Inland Revenue Act, No. 24 of 2017 Capital allowances and ... · Balancing Allowances (Loss)...

Transcript of Inland Revenue Act, No. 24 of 2017 Capital allowances and ... · Balancing Allowances (Loss)...

Business Taxation

BUSINESS INCOME

By

Mahesh Ranawaka Arachchi Deputy Commissioner -IRD

Specific Deduction

Inland Revenue Act No. 24 of 2017

• Interest Expenses- Section 12

• Allowance for trading stocks - Section 13

• Repairs and improvements – Section 14

• R & D expenses and agricultural start up expenses - Section 15

• Capital allowances and balancing allowances - Section 16

• Losses on realization of business assets and liabilities - Section 17

• Deductible amount of financial cost - Section 18

• Business or investment losses – Section 19

Mahesh Ranawaka Arachchi

Interest Expenses – Section 12

The interest incurred by a person during the year under debt

obligation of the person shell be deemed to be incurred in the

production of income to the extend that-

a) The borrowed money was used to acquire an asset that is used

during the year in the production of income; or

b) The debt obligation was incurred in the production of income

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

Allowance for Trading Stock – Section 13

“Trading stock” means assets owned by a person that are sold or intended

to be sold in the ordinary course of a business of the person, work in

progress on such assets, inventories of materials to be incorporated into

such assets and consumable stores

Section195

• The definition of ‚capital asset" and ‚depreciable asset" excludes

Trading stock. However it depends on facts of the case.

• Calculation of trading stock as sub section 2 of section 13

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

Allowance for Trading Stock

Inland Revenue Act No. 24 of 2017

The allowance shall be calculated as –

Opening value of trading stock of the business for the Y/A = ******

Plus: Expenses incurred during the on trading stock of the business = ****

******

Less: Closing value of trading stock of the business for the year. = ( ***)

Allowance for trading stock = ******

Mahesh Ranawaka Arachchi

Allowance for Trading Stock

Inland Revenue Act No. 24 of 2017

Closing valve of trading stock shall be lower of –

a. The cost of the trading stock at the end of the year

b. The market value of the trading stock at the end of the year

According to this comparison, cost of the trading stock shall be

reset

Mahesh Ranawaka Arachchi

Example : Allowance for Trading Stock

Inland Revenue Act No. 24 of 2017

Book profit of company has Rs. 60,950,000 for the year ended 31.03.2019.

Value of stocks as at 31.03.2018 and 31.03.2019 were Rs. 70,200,000 and Rs. 102,500,000 respectively. Its cost of purchase of stocks during the year of assessment 2018/2019 was Rs. 255,200,000. The company has charged a sum of Rs. 240,100,000 as cost of sales in the income statement for the year ended 31.03.2019.

Make relevant adjustments to the tax computation based on the above information for the year of assessment 2018/2019.

Mahesh Ranawaka Arachchi

Research and Development Expenses and

Agricultural Start up Expenses – Section 15

Research and Development expenses and Agricultural start up

expenses meeting the requirements of subsection (1) of section 11

may be deducted irrespective of whether they are of a capital nature

or not.

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

(a) opening up any land for cultivation or for animal husbandry;

(b) cultivating land referred to in paragraph (a) with plants;

(c) the purchase of livestock or poultry to be reared on land

referred to in paragraph (a); or

(d) maintaining tanks or ponds or the clearing or preparation of any

inland waters for the rearing of fish and the purchase of fish to be

reared in such tank, pond or inland waters, as the case may be;

Definition ‚Agricultural start up expenses” means expenses incurred by the person in –

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

(a) Carrying on any scientific, industrial, agricultural or any other

research for the upgrading of the person’s business through

any institution in Sri Lanka (or for any innovation or research

relating to high value agricultural products, by the person or

through any research institution in Sri Lanka); or

(b) The process of developing the person’s business and improving

business products or process,

which shall be beneficial to Sri Lanka, but shall exclude

expenses incurred that are otherwise included in the cost of

an asset under this Act.

Definition ‚Agricultural start up expenses” means expenses incurred by the person in –

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

A person is entitled to claim capital allowances

if such person is the owner of the depreciable asset; and

uses them at the end of a year of assessment in the

production of the person’s income from a business;

Inland Revenue Act No. 24 of 2017

Capital Allowance and Balancing

Allowance - Section 16

Mahesh Ranawaka Arachchi

Capital Allowance Owned and Used - Temporary disuse

Example:

One of the printing machines of Company “A” is broken down and the Company has had

substantial problem of getting it repaired because they had to order parts from the European

manufacturer.

Hence the Company “A” had to wait 14 months. Despite the 14 months during which the

printing machine was not in use, Company A was actively pursuing its repair and did succeed

in having the machine put back into operation.

Company “A” may continue to claim capital allowances during the time it took to have the

printing machine repaired.

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

Capital Allowance Owned and Used

Example:

Company A runs a hotel. It commissioned Company Z to construct a new hotel in Colombo.

The contract price is Rs. 20,000,000 and the construction period is two and a half years.

Company A is required to pay the contract price in instalments as follows,

- deposit - 10%,

- after the foundations are laid - 20%

- after lock-up - 40% -

- on completion - 30%.

Is it eligible to claimed the Capital allowances

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

Capital Allowance

• Shall be calculated

- According to the straight line method

- According to the second, fourth or sixth schedules

• Full capital allowances will be granted for the year of acquisition

• Capital allowance will not be granted for the year of disposal

• Shall not be deferred to a later year of assessment

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

No Capital Allowance Shall be granted in respect of a road vehicle other than

- a commercial vehicle,

- a bus or minibus,

- a goods vehicle;

- or a heavy general purpose or specialised truck or trailer;

Definition of “Commercial Vehicle” mean,

- a road vehicle designed to carry loads of more than half a ton or more than 13 passengers; or

- a vehicle used in a transportation or vehicle rental business.

Capital Allowance

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

Class

Depreciable Assets Number of Years

1 computers and data handling equipment together with peripheral devices

5

2 buses and minibuses, goods vehicles; construction and earthmoving equipment, heavy general purpose or specialised trucks, trailers and trailer-mounted containers; plant and machinery used in manufacturing

5

3 railroad cars, locomotives, and equipment; vessels, barges, tugs, and similar water transportation equipment; aircraft; specialised public utility plant, equipment, and machinery; office furniture, fixtures, and equipment; any depreciable asset not included in another class

5

4 buildings, structures and similar works of a permanent nature 20

5 intangible assets, excluding goodwill The actual useful life of the intangible asset, or where the intangible asset has an indefinite useful life, 20.

Calculation of Capital Allowance

Formula for calculating capital allowance

A/B

A - The depreciation basis of asset at the end of

the year of assessment

B - Number of years (provided in the fourth schedule)

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

Allowance Depreciation basis of

Depreciable Asset

• The depreciation basis of the asset at the end of the previous year of

assessment and (could be the cost or WDV)

• Amounts added to the depreciation basis of the asset during the year of

assessment including the excess expense of repair and improvements

referred to in section 14 for which a deduction shall not be allowed as a

result of the limitation.

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

Repairs and Improvements – Section 14

Expenses for the repair or improvement of depreciable assets shall

be deducted irrespective of whether they are of a capital nature or

not

Mahesh Ranawaka Arachchi

Definition

“Depreciable asset” –

a. means an asset to the extent to which it is employed in the production of income from a business and which is likely to lose value because of wear and tear, or the passing of time; but

a. excludes goodwill, an interest in land, a membership interest in an entity and trading stock;

Section 195

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

Inland Revenue Act No. 24 of 2017

Limitation for Deduction

Assets categorized under

Buildings, structures and similar depreciable assets (Class 4)

- 5%

for all other cases - 20%

of the WDV of the asset at the end of previous year.

Excess expense for which a deduction is not allowed shall be added

to the depreciation basis of the asset.

Mahesh Ranawaka Arachchi

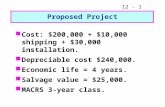

Company runs a manufacturing business.

During the following years of assessments it incurs expenditure as follows:

- 2018/2019 : bought machine B for Rs. 2,000,000

- 2019/2020 : repairs and improvements to machine B Rs. 400,000

- 2020/2021 : repairs and improvements to machine B Rs. 200,000

Since the machine B is under class 3 , the deduction for repairs and

improvements is limited to 20% of the depreciation basis of the machine B at

the end of the previous Y/A

Inland Revenue Act No. 24 of 2017

Example :Repair & Improvements and

Capital Allowances

Mahesh Ranawaka Arachchi

23

2018/2019 2019/2020 2020/2021

WDV of Machine B at the beginning of the Y/A (Depreciation basis)

1,600,000

1,200,000 + 80,000

Repair Exp. 400,000 200,000

Allowable 1,600,000*20% = 320,000

1,200,000*20%= 240,000

Allowed 320,000 200,000

Not allowed 80,000 Nil

Capital allowance 2,000,000/5 = 400,000

1,600,000/4= 400,000

1,280,000/3= 426,666

WDV of Machine B at the end of the Y/A (Depreciation basis)

1,600,000 1,200,000 853,334

Inland Revenue Act No. 24 of 2017

An Assessable Charged is included

or Balancing Allowance is granted

Where a depreciable asset of a person is realised, when calculating

the person’s income;

(a) an assessable charge is included (profit) or

(b) a balancing allowance is granted (loss)

Mahesh Ranawaka Arachchi

An Assessable Charged is included Example:

Company A runs a property rental business and owns a building of apartments

for rental. At the start of year 1, the balance in Company A's class 4 is Rs.

30,000,000, i.e. the balance at the end of the previous year less the depreciation

allowance granted for that year.

Company A is expecting to sell off a large number of the apartments in the

building except for a few select apartments. As a result, during year 1 it receives

Rs. 50,000,000 as proceeds from the sales.

Calculate the assessable charged or Balancing allowance for Y/A 2018/19

Mahesh Ranawaka Arachchi

Balancing Allowances (Loss)

Balancing allowances are –

made in respect of depreciable assets

(a) (i) realised during a year of assessment; and

(ii) in respect of which capital allowances have

been granted in that year or an earlier year; and

(b) Calculated in accordance with the provisions of the second,

fourth schedule to this act.

Mahesh Ranawaka Arachchi

An Assessable Charged is included or

Balancing Allowance is granted

Example:

Company “R “sells office furniture at the price of Rs. 700,000 and at the time of disposal

the written down value of the asset is Rs. 1,000,000.

With respect to the office furniture, Company “R” will be granted a deduction in the

amount by which the written down value of the asset exceeds the proceeds of sale, i.e.

Rs. 300,000.

Sale proceed = Rs. 700,000

WDV = Rs. 1,000,000

Balancing allowance (Loss) = Rs. 300,000

Rs. 300,000 is allowed as a deduction when calculating company R’s business income Mahesh Ranawaka Arachchi

Capital Allowance for Leasing Assets Where an asset is leased under the finance lease, the lessor shall be

treated as transferring ownership of the asset to the lessee.

Accordingly, the lessee is entitled to deduct capital allowance in

relation to the assets obtained under finance leasing.

Substance Vs. From

- No. 10 of 2016 -From

- No. 24 of 2017 - Substance

Mahesh Ranawaka Arachchi

An Assessable Charged is included or

Balancing Allowance is granted Example:

Company “R “sells office furniture at the price of Rs. 700,000 and at the time of disposal the

written down value of the asset is Rs. 1,000,000.

With respect to the office furniture, Company “R” will be granted a deduction in the amount

by which the written down value of the asset exceeds the proceeds of sale, i.e. Rs. 300,000.

Sale proceed = Rs. 700,000

WDV = Rs. 1,000,000

Balancing allowance (Loss) = Rs. 300,000

Rs. 300,000 is allowed as a deduction when calculating company R’s business income

Mahesh Ranawaka Arachchi

Investment incentive as Second

Schedule

A person who invests in Sri Lanka (other than the expansion of

an existing business) during a year of assessment shall be

granted enhanced capital allowances, in addition to the capital

allowances computed under the Fourth Schedule.

Mahesh Ranawaka Arachchi

Enhanced Capital Allowance as 2ND

schedule

Condition Limitation Capital allowance %

1. Used in a part of Sri Lanka other than the Northern Province

On depreciable assets other than intangible assets - USD 3 million -USD 100 million

100%

2. Used in a part of Sri Lanka other than the Northern Province

On depreciable assets other than intangible assets - exceeds USD 100 million

150%

3. Used in the Northern Province

On depreciable assets other than intangible assets - exceeds USD 3 million

200%

4. State-owned company that are used in a part of Sri Lanka

On assets or shares - exceeds USD 250 million

150%

Condition for claiming the

Enhanced Capital Allowance

Capital allowances arising above paragraphs of above table with

respect to a particular year of assessment cannot be accumulated

with another paragraph and shall be taken in that year and shall be

deferred to a later year of assessment.

Mahesh Ranawaka Arachchi

Temporary Concession as Sixth

Schedule

A person who invests in Sri Lanka (other than expansion of existing

business) on depreciable assets mentioned in the following table

during a year of assessment shall be granted enhanced capital

allowances computed in accordance with this paragraph, in

addition to the capital allowances computed under the Forth

Schedule.

Mahesh Ranawaka Arachchi

Enhanced Capital Allowance as 6TH

Schedule

Condition Limitation Depreciable assets

Capital allowance %

1. in a part of Sri Lanka other than the Northern Province

Class 1 and class 4 assets and plant or machinery that are used to improve business processes or productivity and fixed to the business premises.

up to USD 03 million

100%

2. in the Northern Province 200%

Temporary Concession as Sixth

schedule - Conditions

• Claiming of capital allowances cannot be deferred to a

later year of assessment.

• Deduction of capital allowances under this Schedule shall

expire three years after it becomes effective.

Mahesh Ranawaka Arachchi

Losses on Realization of Business

Assets and Liabilities – Section 17

In calculating the person’s income from business, loss from the realization of asset and

liabilities shall be deducted.

Assets

Capital assets of a business used in the production of income from business.

Liability

Debt obligation incurred in borrowing money – money used or asset purchased

Other liability - the liability was incurred in the production of income from the

business.

Mahesh Ranawaka Arachchi

Definition

“Capital asset”–

(a) means each of the following assets:

(i) land or buildings;

(ii) a membership interest in a company, partnership or trust;

(iii) a security or other financial asset;

(iv) an option, right or other interest in an asset referred to in the foregoing paragraphs; but

(b) excludes trading stock or a depreciable asset;

Section 195

Mahesh Ranawaka Arachchi

Deductible amount of Financial

Cost – Section 18

The amount of financial costs deducted in calculating an entity’s

income for a year of assessment shall not exceed the amount of

financial costs attributable to financial instruments within the limit.

This rule does not apply to Financial Institutions from conducting a

business or investment and individuals (entity excludes individual).

Mahesh Ranawaka Arachchi

“Financial instrument” means

(a) (i) a debt claim or debt obligation;

(ii) a derivative instrument;

(iii) a foreign currency instrument; and

(iv) any other instrument prescribed by regulations or, in the absence of

regulations, treated as a financial instrument by generally accepted accounting

principles; but

(b) except to the extent as may be prescribed by regulations, excludes a membership

interest in an entity.

Section 198

Definition

Mahesh Ranawaka Arachchi

Limitation for Financial cost

Formula:

A x B

Where:

‘A’ - total of the issued share capital and reserves of the

entity

‘B’ - (a) in the case of a manufacturing entity, the number 3;

(b) in the case of an entity other than a manufacturing

entity, the number 4.

Mahesh Ranawaka Arachchi

Limitation for Financial Cost

For Manufacturing Entities

Allowable Finance Cost attributable to financial instruments =

Cost of Financial Instruments X [(Issued Share Capital and reserves) X 3]

Total amount of Financial Instruments

For Other Entities

Allowable Finance Cost attributable to financial instruments =

Cost of Financial Instruments X [(Issued Share Capital and reserves) X 4]

Total amount of Financial Instruments

Mahesh Ranawaka Arachchi

Limitation for Financial cost

Example:

Company B is a garment factory and incurs interest expense (for what)

amounting to Rs. 4,500,000 during the year of assessment 2018/2019.

Balance Sheet of the company as at 31.03.2019 revealed as follows.

Stated Capital Rs. 6,000,000

Revenue Reserves Rs. 4,000,000

Long Term Loans Rs.40,000,000

Calculate the allowable interest expense according to thin capitalization

rule. Mahesh Ranawaka Arachchi

Business or Investment Losses – Section 19

In calculating the income of a person from a business following

shall be deducted:–

(a) an unrelieved loss of the person for the year from any other

business; and

(b) an unrelieved loss of the person for any of the previous six

years of assessment from the business or any other

business.

Mahesh Ranawaka Arachchi

The person may choose the income calculation or calculations in which an

unrelieved loss or part of the loss is deducted.

Notwithstanding the provisions of subsections (1) and (2), where a person

makes a loss and if the loss were a profit it would be taxed at a reduced rate,

the loss shall be deducted only in calculating income taxed at the same reduced

rate,

If the loss were a profit and the profit would be exempt, the loss shall be

deducted only in calculating exempt amounts.

Business or Investment Losses Conditions

Mahesh Ranawaka Arachchi

Deduction Criteria

Income Source Eligible Loss Loss Income

Business income Unrelieved business Loss of • any other business • previous six years

Reduced rate Exempt

Same reduced rate, Lower reduced rate, Exempt Exempt

Investment Income Unrelieved business Loss

Investment Loss

Business or Investment Losses – Section 19

“Loss” means

of a person for a year of assessment from a business or investment shall be

calculated as the excess of amounts deducted in accordance with this Act

(other than under this section or subsection (5) of section 25) in calculating

the person’s income from the business or investment over amounts included

in calculating that income; and

“Unrelieved loss” means

the amount of a loss that has not been deducted in calculating a person’s

income under this section or subsection (5) of section 25.

Definition

Mahesh Ranawaka Arachchi

Example: How to sett the Investment and Business Losses

Business or Investment Losses

Business - 40% Business - 28%

Business - 14%

Exempted Income

Investment Income

Profit 1,000,000 5,000,000 (1,000,000) 2,000,000 2,000,000

Loss B/F During Y/A Total

(2,000,000) 0

(2,000,000)

(2,000,000) 0 (2,000,000)

(1,000,000) (1,000,000) (2,000,000)

(4,000,000) 0 (4,000,000)

(3,000,000) 0 (3,000,000)

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

Example: Solution -01 for how to sett the Investment and Business Losses

Business or Investment Losses

Business - 40%

Business - 28%

Business - 14%

Exempted Income Investment Income

Profit 1,000,000 5,000,000 (1,000,000) 2,000,000 2,000,000

Loss B/F During Y/A Total Up front Loss deduction Remaining Loss Adjustment Total Loss deducted C/F losses

(2,000,000) 0

(2,000,000)

1,000,000 1,000,000

0 1,000,000 1,000,000

(2,000,000) 0 (2,000,000)

2,000,000

0 0

2,000,000 0

(1,000,000) (1,000,000) (2,000,000)

0

2,000,000 0 0

2,000,000

(4,000,000) 0 (4,000,000)

2,000,000 2,000,000

0 2,000,000 2,000,000

(3,000,000) 0 (3,000,000)

2,000,000 1,000,000

0 2,000,000 1,000,000

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

Example: Solution -02 for how to sett the Investment and Business Losses

Business or Investment Losses

Business - 40%

Business - 28%

Business - 14%

Exempted Income Investment Income

Profit 1,000,000 5,000,000 (1,000,000) 2,000,000 2,000,000

Loss B/F During Y/A Total Up front Loss deduction Remaining Loss Adjustment Total Loss deducted C/F losses

(2,000,000) 0

(2,000,000)

1,000,000 1,000,000

(1,000,000) 1,000,000

0

(2,000,000) 0 (2,000,000)

2,000,000

0 1,000,000 3,000,000

0

(1,000,000) (1,000,000) (2,000,000)

0

2,000,000 0 0

2,000,000

(4,000,000) 0 (4,000,000)

2,000,000 2,000,000

0 2,000,000 2,000,000

(3,000,000) 0 (3,000,000)

2,000,000 1,000,000

0 2,000,000 1,000,000

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

Example: Solution -03 for how to sett the Investment and Business Losses

Business or Investment Losses

Business - 40%

Business - 28%

Business - 14%

Exempted Income Investment Income

Profit 1,000,000 5,000,000 (1,000,000) 2,000,000 4,000,000

Loss B/F During Y/A Total Up front Loss deduction Remaining Loss Adjustment Total Loss deducted C/F losses

(2,000,000) 0

(2,000,000)

1,000,000 1,000,000

(1,000,000) 1,000,000

0

(2,000,000) 0 (2,000,000)

2,000,000

0 1,000,000 3,000,000

0

(1,000,000) (1,000,000) (2,000,000)

0

2,000,000 (1,000,000)

0 1,000,000

(4,000,000) 0 (4,000,000)

2,000,000 2,000,000

0 2,000,000 2,000,000

(3,000,000) 0 (3,000,000)

3,000,000

0 1,000,000 4,000,000

0

Inland Revenue Act No. 24 of 2017

Mahesh Ranawaka Arachchi

Applicability of Specific Deductions

51

Section Expense Business Investment

12 Interest √ √

13 Trading stocks √

-

14 Repairs and improvements √

-

15 R & D and agricultural start up √

-

16 Capital allowances √

-

17 Losses on realisation of business assets and liabilities

√ -

18 Deductible amount of financial cost √ √

19 Business or investment losses √ √

Reversal

Where a person deducts an expense in calculating the person’s income and the person later recovers

the expense, the person shall, at the time of recovery, include the amount recovered in calculating

the person’s income.

Disclaimer or Write off

The person may, at the time of disclaimer or write off, deduct the amount disclaimed or written off

in calculating the person’s income.

a person can disclaim the entitlement to receive an amount or write off a debt claim as bad if the

person has taken reasonable steps in pursuing payment and the person reasonably believes that the

entitlement or debt claim will not be satisfied.

Reversal of amount including bad

debts

Mahesh Ranawaka Arachchi

Limitation for Financial cost

Example:

Company which has a book profit of Rs. 20,100,000 for the year ended 31.03.2019, has made following transactions. - Made the provision for doubtful debts account for the year ended 31.03.2019 Rs.2,200,000. Out of which a sum of Rs. 800,000 represents specific provision and the balance of Rs. 1,000,000 is general provision. - It has written off a total sum of Rs. 800,000 out of the general provision made To Trade debts of Rs. 500,000 To Staff loans of Rs. 300,000 Make the relevant tax adjustments for the year of assessment 2018/2019.

Mahesh Ranawaka Arachchi