Industry squares up to multiple opportunities

-

Upload

wendy-atkins -

Category

Documents

-

view

214 -

download

1

Transcript of Industry squares up to multiple opportunities

The public sector continued to dominate the industry in 2006, with numerous rollouts and trials taking place worldwide in areas such as passenger control, airport security and government access control, as well as in driving licence and national ID projects. The biggest story was the push towards ePassports, which continued to gather pace. US visa waiver countries focused on achieving the US-imposed deadlines which required them to have an ePassport programme in place by 26 October 2006. By the deadline, only two countries – Andorra and Brunei – had failed to implement the technology. By the end of the year, an estimated 50 countries were believed to have started producing – or planned to rollout – ePassport technology. Meanwhile, Iceland became one of the first European countries to integrate both face and fingerprint biometrics into its new ePassports.

In North America, the year started with an announcement by the USA’s Transportation Security Administration (TSA) that it intended to launch a nationwide, biometric-based registered traveller programme. British Airways also

revealed an agreement with the Clear Registered Traveller programme to launch a biometric-based registered traveller scheme in terminal 7 of John F Kennedy International Airport in New York.

Other countries made progress with their own registered traveller schemes. The Greater Toronto Airports Authority signed a deal with Verified Identity Pass Canada to develop a Clear Registered Travel ler programme which uses fingerprint and iris technologies. In the UK, the Iris Recognition Immigration System (IRIS) was launched at Heathrow Airport’s Terminal 1. Already in place in Terminals 2 and 4 of the airport (and now many other airports in the UK), the system is part of the UK’s e-Borders programme – a partnership between the Home Office, border control, law enforcement and intelligence agencies.

In the middle of the year, plans were announced to trial a registered traveller scheme between the UK, Hong Kong and Dubai to allow pre-enrolled passengers to be fast tracked through immigration controls at both the country of embarkation and that of disembarkation.

And towards the end of the year, Heathrow’s Terminal 3 began a pilot of a registered traveller scheme known as miSense.

Taking the registered traveller concept further, European Commission vice president Franco Frattini indicated in the second half of the year that it was to study the feasibility of introducing a Europe-wide registered traveller scheme using biometrics. Something which could be a great advantage for travellers, but politically (and technically) challenging.

Rollout of border management solutions were not restricted to the Western world. Also in the second half of the year, Indonesia’s Minister of Law and Human Rights officially opened the country’s SAPHIRE programme, which uses iris recognition technology, at Jakarta Soekarno-Hatta International Airport.

T h e Tr a n s p o r t a t i o n Wo r k e r Identif ication Credential (TWIC) continued to move forward with approval of proposed regulations for a biometric-based ID credential for port workers.

In the UK, the proposed national ID scheme continued to be passed back and forth between the House of Commons and the House of Lords, with the government being criticised for its forecast costings of the scheme and public opinion remaining sharply divided. However, the government finally got its legislation passed and the scheme continues to receive strong backing from the Labour government. Procurement should begin in the first half of 2007.

Beyond the government sector, the technology began to gain traction in the consumer and business markets, with biometric devices being implemented in the financial sector as well as in portable devices, such as laptops, mobile phones and PDAs.

Public awarenessAlthough the industry continued to raise its profile among the general public, it was at the centre of the controversy when it was revealed that the introduction of biometric passports could lead to double-digit increases in the price of a passport. Furthermore, the price of travel visas for non-EU nationals was also forecast to rise by more than two thirds as a consequence of capturing biometric identifiers as part of the visa issuance process.

Biometric Technology Today • January 2007

SURVEY

8

Industry squares up to multiple opportunitiesby Wendy Atkins

In a year that saw at least one mega-merger, major deployments and continued technical innovation, the biometrics industry certainly kept commentators and analysts on their toes. The industry had much to be upbeat about, having captured investor interest and scooped some major deals. But attempts to spoof systems continued, and there was an ongoing PR battle to demonstrate to stakeholders that the technology could indeed be effectively applied both to improve security and aid convenience in a number of market areas. We look back on what 2006 offered the industry, consumers and investors, and examine prospects for the industry in 2007 and beyond.

TechnologyWork continued across the various biometric technologies to make them more robust, accurate and cheaper.

One of the big improvements of the year was seen in vein technology, which continued its move towards the mainstream with deployments announced in a Japanese public library as well as in a handful of banks, including Sumitomo Mitsui Banking Corporation (SMBC).

Elsewhere, the emergence of robust facial recognition technology emerged, with the combination of skin and facial recognition proving to be a potent combination. For example, Identix’s G6 system combines traditional 2D face recognition with skin texture analysis to deliver higher accuracy rates. The skin analysis element looks for uniqueness in texture and randomly formed features on the skin surface. This requires high resolution images, but the system delivered impressive (in fact perfect) performance in tests performed by

the UK’s National Physical Laboratory (NPL) and Deloitte, but at the cost of time.

3D face also performed well in the NPL/Deloitte trials with A4 Vision’s system able to distinguish between identical twins in identification mode, even though the twins were able to authenticate as each other. Enrolment issues were encountered with a few people with beards.

Vein recognitionDuring 2006, vein recognition made significant headway, moving from what could be described as an ‘alternative’ or ‘other’ biometric to being regarded a mainstream technology. IBG expects it to play a larger role in the access control market, eventually comprising more than 10% of this market.

“2007 will see a combination of technical innovation and market deployments for vein pattern recognition,” says Lee. “R&D will continue during 2007, with efforts being made to make the technology more compact, more accurate and more efficient overall. But I do see a significant shift away from R&D towards marketing the products.” The technology has traditionally been deployed in the banking sector and, although some insiders believe it could gain traction in Europe during 2007, the Far Eastern market is still considered the strongest because virtually all major vein pattern recognition manufacturers are located in Japan and Korea. “They understand the market well – particularly in the financial sector,” says Lee.

PaymentsThe banking sector is beginning to open its eyes to the technology. For now, however, most activity will take place in back office situations. As one banking insider commented, consumers still have concerns about privacy – and banks need to resolve this before there will be a wide deployment in this sector.” Industry analyst firm Celent agrees (see graph 3), while Victor Lee comments: “Here the driver is efficiency. When talking of online payments, security is the key driver.”

Mergers and acquisitionsIt was a busy year in the boardroom. Viisage completed its acquisition of SecuriMetrics and also announced plans to take over Iridian. The announcement that Identix and Viisage were to merge in a US$770 million deal captured the attention of the industry, and resulted in the creation of a biometrics powerhouse

Biometric Technology Today • January 20079

SURVEY

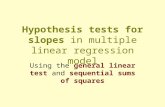

Graph 1: Biometric Market by Technology, 2007Copyright@2006-2007 International Biometric Group

Graph 2: Annual Biometric Industry Revenues, 2007-2012 ($m USD)Copyright@2006-2007 International Biometric Group

branded L-1 Identity Solutions, which has a broad technology range including multi-modal finger, face, skin and imaging ID solutions.

Pay By Touch snapped up its rival, BioPay, in an US$82 million stock and cash deal, which was seen as a major step by the industry towards becoming more mainstream.

CrossMatch continued its rapid growth by building on its 2005 acquisition of Smith Heimann Biometrics (SHB) with the purchase of C-VIS in June 2006.

In another major development, Gemplus International and Axalto, two big hitters from the smart cards industry, finally completed a merger with the creation of Gemalto in the middle of the year. The new operation, which has significant biometric expertise, has operations in more than 50 countries and around 11,000 employees.

“The investment community paid a lot more attention to the industry in 2006,” says Victor Lee, senior consultant with International Biometric Group (IBG). “We saw more companies go public and financial results improved during the year.”

Funding was relatively strong, with several finance deals announced. Keystroke dynamics company BioPassword secured US$8 million in Series B financing (and even more in the last month – see this month’s Business Watch). Meanwhile, bioMETRX secured US$1.65 million in new funding and voice-based verification solution provider Biometric Security secured £3 million (US$5.5 million) investment capital.

CompetitionThe expiry of several key patents provided new market opportunities for firms interested in getting a foothold in the industry. Following on from the 2005 expiry of US Patent number 4,641,349 for iris recognition, February 2006 saw the expiry of the worldwide patent –WO 86/05018 for

iris recognition. Theoretically, this should open the market up to greater competition and consequently rapid growth.

“There were certain places in Asia Pacific where the patent didn’t actually apply,” says Sapna Capoor, industry analyst with Frost & Sullivan. “So we’ve already started to see a select number of vendors who focus on iris recognition in that region.”

Capoor believes there will be increased competition, particularly from Asian manufacturers, in the year ahead. However, any new market entrants will have to compete with Iridian (now part of L-1 Identity Solutions), which has dominated the market for some time and has developed a strong reputation and position in the market with numerous installations worldwide.

Industry groupsIt was also a year that saw the proliferation of industry groups and the emergence of even more acronyms. The European Biometrics Forum (EBF) established the International Biometric Advisory Council (IBAC) to provide advice and expert opinion to the EBF, its members and partners on issues facing the biometrics industry. And the final quarter saw the launch of the British Biometric Industry Association (BBIA), which aims to promote the industry in the UK.

Where now?Having finished 2006 on a relative high, the industry is anticipating another year of growth which will pave the way for further advances over the next five years.

As always, a number of buzzwords will dominate the industry (see box 1) and these perhaps give an indication of where insiders believe the market is headed during the year.

While the government sector will continue to take the lion’s share of industry revenue, there will also be further positive developments in the corporate and consumer segments.

According to US-based consultancy IBG’s newly released Biometrics Market and Industry Report 2007-2012, global biometric revenues are projected to grow from US$3.01billion in 2007 to US$7.41billion in 2012, driven by government ID management programmes and private sector initiatives such as consumer ID (see graphs 1 & 2).

It also forecasts that fingerprint technology will gain 38.1% of the non-AFIS biometrics market in 2007, followed by face recognition at 19.0% and iris recognition at 7.7%.

The company says annual ir is recognition revenues are projected to reach $400m by 2010, while Asia and North America will be the largest global markets for biometric products and services.

“The government sector will take a smaller share of the pie in the future, although it will still be growing,” says Lee. “But this isn’t really bad news. All it means is that other markets will take a bigger slice.”

There will also be greater penetration into new market sectors. “Security of personal devices will be an increasingly important market area in 2007,” says Capoor. “As the

Biometric Technology Today • January 200710

SURVEY

Your buzzwords for 2007

• Efficiency• Fast capture• Form factor• Identification• Identity Management• Multi-modal• Privacy• Security• Standards• Trusted traveller

Graph 3: Adoption of biometrics in the banking sector

price of the technology falls, we’ll certainly see more deployments for personal use in wireless devices such as mobile phones. This will gain momentum in Europe and North America in 2007, and will in turn increase end-users’ confidence in using their cell phones to store data such as bank details.”

Whether or not consumers will be prepared to pay for biometric technology in their portable devices is debatable. “Early adopters within the consumer and end-user community would be prepared to pay the additional amount,” says Capoor. But as the technology moves into the mainstream, driven by a fall in the price of devices such as fingerprint scanners, one would expect biometrics to become part and parcel of an enhanced device.”

More opportunitiesAs biometrics penetrate more markets, the industry is preparing itself for even more trials of the technology. “Public sector activities will continue to be strong,” says Lee. “The ePassport round will continue to grow as more countries try to fit in with ICAO MRTD standards.”

The technology will continue to be tested for frequent traveller schemes. For example, Heathrow Airport is to begin a voluntary trial of fingerprint biometrics in Terminal 1 in May 2007 and subsequently in the new Terminal 5 building in March 2008. This will allow domestic and international passengers to mingle in a common user lounge, something which is currently

not desirable due to the potential for immigration fraud.

Beware the red herrings…Although civil ID programmes will continue to provide a high proportion of the industry’s revenue, it would be wrong to think that success in this market is guaranteed. “I do want to caution that it won’t be the saviour of biometric technologies,” says Lee. “It’s an important aspect of the biometrics market, but over-reliance on it is dangerous – and some people in the biometrics industry rely too heavily on it…There’s only so much that can be done in the public sector. They’re usually huge projects and only a few firms can win them. But even then, a lot of budgets are allocated to related functions, such as systems integration and support functions. They may not be the core functions.”

StandardsStandards work will continue. “Work will continue in the area of interoperability, but there will also be more industry standards,” says Capoor. “We’re increasingly finding standards that may not necessarily stipulate the use of biometrics, but biometrics may be the most suitable way of addressing an industry’s enhanced security requirements.

For example, Sarbannes Oxley and directives for the use of two-factor

authentication don’t specify that biometrics should be used, but these technologies can deliver the required levels of security and robustness.”

BoardroomIn the boardroom, investors are expected to maintain their interest in all things biometric, with more venture capital funding being made available. Industry consolidation also seems inevitable, with strategic mergers taking place throughout the sector. “Two types of acquisition are likely in 2007,” says Capoor. “We’ll see biometric vendors merging to broaden and expand their portfolios. But we’ll also see mergers taking place between players at different levels of the value chain.”

While there are many opportunities for the industry, it still faces some significant threats (see SWOT analyses in box 2).

During 2007, the industry will also have to combat the problem of spoofing, which will require a multi-pronged attack. Technologists need to address the technology problems associated with spoofing, while PR and marketing people fight a communications battle to ensure stakeholders get a clear message about the technology.

IBG has launched Spoof 2007 in an attempt to address some of the challenges. “There is lots of interesting information out there about how biometric devices can be tricked by an impostor,” says Lee. “But the amount of information about how ‘spoofable’ a device is hasn’t yet been calculated This is something IBG will do to get a better understanding of the different biometric technologies during the year.”

ConclusionIt is clear that 2007 will be a fascinating

time for the biometrics industry. Those biometric players that have been skilled enough to find themselves involved with large government projects will reap some long-awaited rewards, while other less successful players will hopefully have been able to avoid being sucked in too far at the expense of letting other opportunities slip.

As always technologies anmd standards will continue to develop, but in many cases it is now the human interface and the architecture within which the biometric technology now operates which is letting the overall system down.

Biometric Technology Today • January 2007

SURVEY

11

Strengths

• Perceived to be high security;• Provides convenience;• Augments existing technologies (ie

it provides the perfect add-on as organisations move from two-factor to three-factor authentication);

• Industry is explaining itself better;• Uniqueness of biometrics;• Convenient technology;• Cost of deployment falling.

Weaknesses

• Tied to something so intrinsic, that if it were compromised it could be a serious problem;

• Return on Investment (ROI) not always easy to achieve;

• Accuracy levels are not always considered high enough.

Opportunities

• Well positioned to take advantage of the investment community’s interest in the market;

• Virtually every consumer device could be protected by a biometric;

• Government sector still offers many opportunities

• Commercial market offers bright future.

Threats

• As it becomes increasingly well known, it will have to explain itself better;

• Companies need to deal with the fact that firms that have traditionally been partners, are rapidly also becoming competitors;

• Privacy and spoofing concerns still need to be addressed;

• Lower cost of alternatives.

SWOT Analysis