Indonesia

-

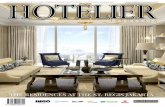

Upload

safril-salle -

Category

Documents

-

view

200 -

download

0

Transcript of Indonesia

-

OVERVIEWOFINDONESIASENERGYSECTORANDRECENTDEVELOPMENTINTHECOALSECTOR

MINISTRY OF ENERGY AND MINERAL RESOURCESDIRECTORATE GENERAL OF MINERAL AND COAL

JOINT WORKING GROUP ON COAL INDONESIA INDIA

-

2MAIN TOPICS

NATIONAL ENERGY POLICY

CURRENT CONDITION

COAL POTENCY COAL PRODUCTION

STRATEGIC COAL POLICY

OPPORTUNITY

CONCLUDING REMARKS

-

3 NATIONAL ENERGY POLICY

-

INDONESIAN NATIONAL ENERGY POLICY

Vision : Guaranteeing the sustainable energy supply to support national interest

Mission :To guarantee a domestic energy supplyTo increase the added values of energy sourcesTo manage energy sources in an ethical and sustainable mannerTo provide an affordable energy for low income people and develop domestic capacities in the field of energy management

Measures :Energy IntensificationEnergy DiversificationEnergy Conservation

-

INDONESIAN ENERGI MIX YEAR 2025

Oil 20 %

Gas 30 %

Coal 33 %

Renewable Energy 17 %

Bio-fuel 5 %

Geothermal 5 %

Biomass, Nuclear, Hydro,Solar - 5 %

Coal Liquefaction 2 %

-

NATIONAL COAL POLICY

INDONESIAN NATIONAL COAL POLICY (NCP)

Supply Policy Utilization Policy Development Policy

- Diversification- Price- Lignite- Coal Briquette- Coal Bed Methane

- R & D- Training- Organization- Data/Information- Coal technology Center

Basic Constitution of 1945 Regional Autonomy PolicyNational Energy Policy

- Investment Climate- Intensification of

Exploration & Production- Conservation- Environment

Management Policy

-

NATIONALCOALPOLICY

PURPOSED OF THE POLICY

SECURING THE AVAILABILITY AND SUPPLY OF COAL FOR DOMESTIC USE IN THE LONG RUN

COAL EXPLOITATION SHALL PROVIDE DIRECT AND INDIRECT BENEFITS TO THE STATE AND THE COMMUNITY

COAL UTILIZATION SHALL BE FOCUSED ON FULFILLING THE DOMESTIC DEMAND FOR CLEAN ENERGY AT AFFORDABLE PRICE

COAL DEVELOPMENT SHALL EMPHASIZED ON UTILIZATION OF ALL GRADE OF COAL THROUGH BEST AVAILABLE TECHNOLOGY

-

8 CURRENT CONDITION

-

9` Nowadays, coal resources of Indonesia is more than 105 billion tones and coal reserves is about 21 billion tones or equivalent to 80 billion Barrel Oil Equivalent (BOE).

` In the year 1998 Indonesian coal production was only 61.3 million tones, then increased spectacularly to 240 million tones during ten years period. Last year, the production of coal continued to climb up to 275 million tones.

` Approximately 75% of national coal production is exported to various countries, while domestic market needs 30% only. There are 50 Coal Contract of Works (PKP2B) companies that are currently in production stage, other producers are coal Mining Holders (IUP) which its permits were issued by local governments/regency.

` The New Mining Law No 4/2009 has emphasized the government commitment to optimize the benefit of mining activities for the country and community.

` At present, the government is performing a number of stages as the follow-up of the law implementation, such as; government regulation, socialization with stakeholders, etc.

CURRENT CONDITION

-

10

COAL POTENCY

-

INDONESIA COAL POTENCY

-

PROGRESS OF PROGRESS OF COAL COAL RESOURCE & RESERVERESOURCE & RESERVE

b

i

l

l

i

o

n

t

o

n

e

s

Source:GeologicalAgency,2010

2004 2005 2006 2007 2008 2009 2010

0

20

40

60

80

100

120

Reserve 7.00 7.01 9.48 18.71 20.96 21.13 21.131

Resource 60.51 61.37 65.4 93.4 104.76 104.94 105.187

2004 2005 2006 2007 2008 2009 2010

-

WORLDS COAL RESERVECURRENT CONDITION

-

TOTAL RESOURCES105.187 Billion Ton

TOTAL RESERVES21.131 Billion Ton

Very High ( > 7100 kal/gr ) Medium ( 5100 - 6100 kal/gr )High ( 6100 - 7100 kal/gr ) Low ( < 5100 kal/gr )

DISTRIBUTION OF INDONESIA COAL

Source:GeologicalAgency,2010

-

Source: Geological Agency, 2010

COAL RESOURCE AND RESERVE BASED ON CALORIFIC VALUE

Quality ResourcesMilliontons) Reserve(Milliontons)

ClassCalorificValue(cal/gram)

Total % Probable Proven Total %

Low 7,100 1,013.19 0.96% 73.29 109.18 182.47 0.87%

Total 105,187.44 100.00% 15,602.41 5,529.43 21,131.85 100.00%

LowCalorie7,100cal/gram

-

16

COAL PRODUCTION

-

STATUS OF COAL CONTRACT OF WORKS (OCTOBER 2011)

17

Note:Coalcompanies,includingCCoW,PTBA(BUMN),andIUPCoalproductionfromCCoWis7580%oftotalnationalproduction

-

Realization Projection

REALIZATION OF COAL PRODUCTION, DOMESTIC, AND EXPORT( 2005 2010 )

REALIZATION OF COAL PRODUCTION, DOMESTIC, AND EXPORT( 2005 2010 )

18

Domestic Export Production

m

i

l

l

i

o

n

t

o

n

e

s

-

CoalTerminalandCapacity(MaxvesselCapacityinDWT)

KALIMANTAN

SULAWESI

IRIAN JAYA

SUMATRA

JAVA

Tarahan 40.000 Pulau Baai 35.000 Kertapati 10.000 Teluk Bayur 35.000

Tanjung Redep* 5.000 Tanjung Bara 200.000 B l o r o* 8.000Loa Tebu* 8.000

Balikpapan 60.000 Tanah Merah 20.000

North Pulau Laut 150.000 IBT 70.000Sembilang* 7.500Air Tawar* 7.500Banjarmasin* 10.000South Pulau Laut 200.000 S a t u i* 5.000Kelanis* 10.000

* River Terminal

-

COMPARISONOFCOALPRODUCTIONEXPORT

-

21

STRATEGIC COAL POLICY

-

STRATEGIC COAL POLICY

1. To increase the role of coal in the framework of national energy development.

2. To maintain the security of Indonesia long-term coal supply-demand

3. To develop all types of coal

-

STRATEGIC COAL POLICY

1. To increase the role of coal in the framework of national energy development.

- Blueprint of National Energy Management - National Energy Policy that by 2025

the use of coal in national energy mix will be 33%

2. To maintain the security of Indonesia long-term coal supply-demand

- Coal DMO- Coal Production Control Coal Pricing

3. ........

-

COAL POLICY

3. To develop all types of coal

Monitoring, supervision, country revenue Clean coal technology manpower development Utilization /processing of low rank coal Coal briquette Coal bed methane

-

DOMESTIC MARKET OBLIGATION POLICY &COAL EXPORT CONTROL

Coal mining companies can export coal production, when domestic coal demand have been fulfilled (article 11-12 of CCoW).

IUP Operation and Production Holders have to prioritize domestic needs (article 84 Government Regulation No. 23/2010).

Government set out policy to prioritize coal for domestic needs(article 5 Law Nr. 4/2009)

-

PROJECTION OF COAL DOMESTIC CONSUMPTION >(2011-2014)

0

20

40

60

80

100

120

m

i

l

l

i

o

n

t

o

n

e

s

Briquette 0 0.6 0.9 1.3

Fertilizer 0.9 1.1 1.2 1.3

Paper Pulp 0.6 0.7 0.8 0.8

Textile 2 2.3 2.3 2.3

Metallurgy 0.4 0.5 0.5 0.5

Cement 8.9 9.4 10.1 11.2

Electricity 66.3 71.5 79.1 87.7

2011 2012 2013 2014

7987

95

104

> Coal domestic consumption is determined on the basis of coal user demand projection

-

PROJECTION OF COAL PRODUCTION, DOMESTIC, AND EXPORT > (2011-2014)

0

50

100

150

200

250

300

350

400

m

i

l

l

i

o

n

t

o

n

e

s

Domestic 79 87 95 104

Export 248 245 242 238

Production 327 332 337 342

2011 2012 2013 2014

> Coal Production Growth is projected 1.5% annually

-

COAL PRICE REFERENCE

1. Starting in 2007, coal price has kept on rising. In early 2008 domestic coal supply scarce which was caused by the increase of world coal price.

2. The inexistence of Coal Price Index results in a great variety and disparity between Indonesian and World Coal Price

3. Ministerial Regulation No. 17/2010 concerning Procedure to Set Mineral and Coal Price Index

-

Note:calculatedin6322kkal/kgGAR

COAL PRICE POLICY

-

GAS FUELChemical Feedstock

DIRECT USEPOWER PLANT

INDUSTRY

LIQUEFACTION

GASIFICATION

OIL FUEL

Clean Coal Technology

UPGRADING COOKING COAL

LOW RANK COAL

COKES

ACTIVE CARBON

COALCOAL

CWM

CONVERTION

CONNECTIONCHAINOFCOALADDEDVALUE

-

No. CompanyName Location Product ProductCapacity Operational Progress1 PendopoCoal

GasificationPrabumulih,SouthSumatera

CoalGasification EstCommercial:2016

FeasiblityStudy

2 PendopoCoalUpGrading

Prabumulih,SouthSumatera

UpgradingCoal

5,000,000ton/years

EstCommercial:2013

FeasibilityStudy

3 WhiteEnergyandGunungBayanResources

Tabang,EastKalimantan

BinderlessCoalBriquetting

3,500ton/day Est.Commercial:20112012

TrialProduction

COAL ADDED VALUE PLAN

-

INVESTMENT OPPORTUNITIES

*) MEMR proposed Coal liquefaction and gasification business (south Kalimantan, East Kalimantan, Central Kalimantan, Jambi, Bengkulu, South Sumatra, West Sumatra, Riau, NAD) as a one of business sector to obtain income tax facilities in certain field and business.

32

o Mining infrastructure developments (mainly in Kalimantan and Sumatra)o New application of mining through bidding process in new areas of mining

(IUP and IUPK)o Added Value of Mineral (to development of processing and refining)o Cooperation in underground coal mining developmento Utilization of law rank coal (LRC) Coal liquafaction Coal gasification Mine-mouth power plant

-

33

CONCLUDING REMARKS

-

CONCLUDING REMARKS

In line with the Government Policy in Energy Sector, National Coal Policy is prepared for the purposed of coal resources management, enterprises, utilization and development policy.

To fulfill domestic energy and securing coal export needs, the Government is now promoting the development and utilization of low rank coal (LRC) for mine mouth power plant, upgrading brown coal and coal liquefaction.

In general, coal supply both for export and domestic consumption can be fulfilled from national production and existing coal resources.

For the time being Indonesia still needs big investment to develop the potency on low rank coal and encourages all private investment.

34

-

www.djmbp.esdm.go.id

-

1 ECof Sumatera

2 ECof Jawa

ECof Bali Nusa Tenggara3 ECof Kalimantan

ECof Papua Maluku 4 ECof Sulawesi Maluku Utara

Economic CentreMega Economic Centre Proposed KEK Location Proposed KEK Location as a FTZ

DenpasarDenpasar

MataramMataram

JakartaJakarta

MedanMedan

PekanbaruPekanbaru

JambiJambi

LampungLampung

SemarangSemarang

BanjarmasinBanjarmasin

PalangkarayaPalangkaraya

PontianakPontianak

MakassarMakassar

ManadoManado

KendariKendari

GorontaloGorontaloManokwariManokwari

JayapuraJayapura

1

2

3 4

SerangSerang

MamujuMamuju

IMTIMT--GTGT

BIMPBIMP--EAGAEAGA

SurabayaSurabaya

MeraukeMerauke

KupangKupang

SamarindaSamarindaSofifiSofifi

WamenaWamena

SorongSorong

AmbonAmbon

PaluPalu

Banda AcehBanda Aceh

PadangPadang

BengkuluBengkulu

JogjakartaJogjakarta

PalembangPalembang

Tj. PinangTj. Pinang

Pkl. PinangPkl. Pinang

6PriorityEconomicCorridors:Commoditybases/featuredregionalsectors

6

6

5

5

36

Note : KEK : Koridor Ekonomi Khusus/Special Economic Corridor, FTZ : Free Trade Zone, EC : Economic CorridorSource : Kementerian Koordinator Bidang Perekonomian dan Kementerian PPN/BAPPENAS

ACCELERATION AND EXPANSION OF NATIONAL ECONOMIC DEVELOPMENT PROGRAMS

-

Centre of resources production and processing and as national energy source"

Added Value for Mineral and Coal Sector Coal : Developing petrochemical industry by constructing syngas

pipeline; Coal Gasification and Coal Upgrading in Pendopo. Mineral: Constructing Processing Facility for gold and silver in

SouthTapanuli ; constructing concentrate factory and mining infrastructure for Zinc dan Lead in Dairi Regency

Necessary Key Infrastructure 1.Infrastructure on Electricity related to mineral and coal

Steam mine-mouth power plant in PLTU Banjarsari (Lahat, Sumsel);PLTU Sumsel di Muara Enim, PLTU Tj. Enim, PLTU Tarahan(Lampung Selatan) and PLTU Peranap (Indragiri Hulu, Riau).Electricity installment for gold and silver processing in SouthTapanuli, Sumut;

2.Infrastructure on Coal Rail way and port

- Construction of new railway Tj. Enim Srengsem (Lampung)- Improving capacity of railway Tj. Enim Lampung and Tj. Enim -Kertapati- Rail wayMuara Enim Tj. Carat- Construction of Tj. Carat Port (Lampung)

Construction of Kuala Tanjung Dock

-

Boosting national industry and service"

Infrastructure:1.Coal Generated ElectricityDevelopment of Steam Power Plant 10.000 MW Stage I and II

10000 MW stage1PLTU 10000 MW stage IIPLTA & PLTP 10000 WW stage IIOIL REFINERY

-

Centre of resources production and processing and as national energy source

Added Value on Energy and Mineral Sector1. Coal:

Acceleration of Operation-Production stage in Central Kalimantan Coal Mining in Samarinda, Balikpapan and Kutai Kartanegara Coal Processing inTanjung Redep, Bulungan and Batu Licin Construction of coal upgrading plant in haul road km 68 Coal Liquefaction Project in Kalimantan Timur

Necessary Key Infrastructure:Necessary Key Infrastructure:1.1.Infrastructure on CoalInfrastructure on Coal

Railway in PRailway in Puurrukukcahu cahu -- BangkuangBangkuang Expansion of coal freight port in Kelanis, Central Kalimantan Expansion of coal freight port in Kelanis, Central Kalimantan Construction of Construction of overland conveyer from mine to coal freight portoverland conveyer from mine to coal freight port

and and crushing plantcrushing plant2.2.Infrastructure on ElectricityInfrastructure on Electricity

Construction steam and gas power plant Bangkanai (1x120MW)Construction steam and gas power plant Bangkanai (1x120MW) Construction of mine mouth power plant in Tabalong (2x30MW)Construction of mine mouth power plant in Tabalong (2x30MW) Total Infrastructure on Electricity: Power Plant (2.160MW), Total Infrastructure on Electricity: Power Plant (2.160MW),

TraTrannsmission (5.346kms), Substation (1.720MVA), Distribution smission (5.346kms), Substation (1.720MVA), Distribution JTM (10.810kms), Distribution JTR (9.907kms), Distribution JTM (10.810kms), Distribution JTR (9.907kms), Distribution Station (898MVA)Station (898MVA)

-

Research and Development on Low Rank Coal Utilization

New Delhi, 24 November 2011

Agency of R & D for Energy and Mineral Resources Ministry of Energy and Mineral Resources

-

SustainableDevelopment

Role of Energy and Mineral Resources

Source of State Revenue

Domestic Fuels

Feed Stocks

Multiplier Effects

EconomicDevelopment

E

N

E

R

G

Y

A

N

D

M

I

N

E

R

A

L

R

E

S

O

U

R

C

E

S

S

E

C

T

O

R

-

Targeted Primary Energy Mix

Base on:President Regulation No. 5/ 2006President instruction No. 2/2006

Natural Gas,

28.57%Oil 51.66%

Geothermal, 1.32%

Hydro, 3.11%

2005

Coal, 15.34%

2025

others, 5%

Bio-fuels, 5% Geothermal, 5%

Coal Liquid 2%

Coal 33%

Natural Gas , 30%

Oil, 20 %

AlternativesA

lternatives17%

-

BBGChemical Feedstock

DIRECT USEDIRECT USEPOWER PLANT

INDUSTRY

CONVERSIONCONVERSION

LIQUEFACTION

GASIFICATION

BBM

CLEAN COAL TECHNOLOGYCLEAN COAL TECHNOLOGY

UPGRADINGUPGRADING HIGH RANK COAL

LOW RANK COAL

COKE

ACTIVATED CARBON

COALCOAL

CWM

COAL UTILIZATION

-

Coal Centre in Palimanan

FACILITIES :1. Bio briquette2. Pilot Plant Activated Carbon3. Pilot Plant UBC4. Pilot Plant Foundry COke5. Pilot Plant Gasification6. Pilot Plant Aquabat/CS/CWM7. Pilot Plant Cyclone 8. Pilot plant Gasifikasi Cap. 1MW (*)10.Mess for Operator11.Laboratorium 12.Office/ Administation Room

In process construction(*)

-

COALUPGRADING

-

UpgradingDefinition:

CoalUpgrading :process to increase thequalityof lowrank coal (lignite and or subbituminus) to becomesimilarwithqualityofbituminuscoalBenefits:

Increasetheaddedvalue Increasecombustionefficiency Stabilizethequalityofcoalforindustry Reducetransportationcost Reduceemission:CO2,SOX,NOX &partikulat

-

UBC (Upgraded Brown Coal)

Mixed Oil(Kerosene + LSWR)

Raw coalCoal Preparation

Slurry Mixing

Recovered Oil

Coal Oil Separation 130C, 100 kPa

Oil Recovery/Drying 180C, 100 kPa

Cake

Fine UBC

Briqueting

Slurry Dewatering 140-150C, 0.3 MPa

Waste Water M

MM

M X

UBC Pilot Plant, Palimanan

- Upgrading coal of 3,500-5,000 kcal/kg to 6,000-6,900 kcal/kgby moisture reduction from 25-50% to

-

Bench Scale, Takasago (Japan), 100 kg/batch

Pilot Plant, Palimanan , Cirebon, 5 ton/day

Function: Test facilities to get engineering

data for commercial plant Research, to develop UBC process Operator training for UBC

commercial plant

Results: low rank coal with calorific value of 6,200 kcal/kg

Demonstration Plant9

DEVELOPMENT OF UBC PLANT

-

UBC Product

-

BinderlessCoalBriquetting(BCB)

yLocation Desa Gunung Sari, Kec. Tabang, Kab. KutaiKartanegara,Prop.KaltimyWhiteEnergywithPTKaltimSupacoalyCapacity:1millionton/yearyInvestasment:US$65millionyNobinderyNochemicalreactionyNooilfuel

-

BCB Product

Coal Upgrading Post Conference Workshop, Singapore 29 April 2011

-

Coal Drying Briquetting (CDB)

Reducing moisture by evaporation using rotary drying integrated with briquette machine

Developed by tekMIRA on bench scale, ready to scale up to pilot plant

-

Coal Upgrading Briquette (CUB)

The technology will provide higher heating value by reducing high moisture by drying the coal and to keep the dried productby briquetting

Developed by Enertech, cooperation with Alstom USA (Flash Dryer), Zemag Germany (Rotary Dryer) and Sahut Conreur France (Briquette Machine)

-

COAL SLURRY = AQUABAT

-

Aquabat

Aquabat

Fluid

Handling=heavy

oil

Nospontaneouscombustion,

nodust

Fueloilsubstitution

-

AquabatMakingLowrankcoal

Upgrading

Mixing:+water+aditives

Bituminus

Aquabat

-

18

CS Activities in Indonesiay 1992-1996, CS preparation using low rank coal

and bituminous coaly 1996-2000, CS preparation and combustion

test using bituminous coaly 2003-now, CS preparation and combustion test

using upgraded coal by UBC processy 2006-now, R&D of CWM joint cooperation with

JGC (Japan) to develop HWT-csy 2008-now, study market on CS utilizationy Start 2010, build demo plant of CS in Karawang

-

19

FOUNDRY COKES

-

Carbonization Process

CarbonizationHeating without Air

Coke ; 900-1,050C Semi coke ; 700-900C Char ; 500-700C

Steps : - Softening- Swelling- Stiffening

20

-

(New and Renewable Energy -Including synthetic oil & IGCC)

Foundry CokeFoundry Cokeo Demand of coke as reductor increased as steel industry in Indonesia is

booming o Coking coal not available in Indonesia, meanwhile price of international coking

coal is increasing o Opportunity to develop coke making using low rank coal from Indonesia as

blended coal

No Company Product Capacity Ton Location

1 PT Krakatau Posco Plate, Slab 3.000.000 Banten2 PT. Meratus Jaya Iron & Steel Iron Spons 315.000 Kalsel3 PT. Mandan Steel Billet 1.000.000 Kalsel 4 PT. Semeru Surya Steel Pig Iron 100 .000 Kalsel 5 PT. Delta Prima Steel IronSpons 100.000 Kalsel 6 PT. Jogja Magasa Iron Pig Iron 1.000.000 Jogja 7 PT. Indo Ferro Pig Iron 1.000.000 Cilegon

-

Status of Foundry CokeStatus of Foundry Cokea. R & D with Japan to increase the strength

of foundry cokeb. Process development in making artificial

coking coal c. Development of coal blending to make

coke (low rank coal+ coking coal)

-

ACTIVATED CARBON

-

Demand of activated carbon is increasing

- Until now, no activated carbon plant from coal has been

built in Indonesia

- Domestic consumption is 66.000 ton per year

ActivatedCarbon

-

SUBBITUMINOUSCarbonizatiion

400-600CSemicoke

Activation 900-1000CSteam

Rotarykiln:capacity1ton/day

MakingofActivatedCarbon

Activatedcarbon

-

CharacteristicofActivatedCarbonNo Parameter Unit Quality of activated carbon (granule)

1 Moisture % 4-62 Ash % 3 -183 Iodine number mg/g 500-8004 Methylene blue mg/g 40-80

5 Apparent density g/ml 0,53

6 HGI % 50

Quality standard of activated carbon

Size Granule/powder

Iodine number 500 -1200 mg iodine/gr

Methylene blue >100 mg methylene blue/gr

Moisture < 5% for granule< 8% for powder

Ash 5-10%

HGI 80

-

COAL GASIFICATION

-

Application of Coal Gasification Application of Coal Gasification

COALGAS

Small-Medium Scale Industry

Diesel OilSubstitution

Syngas Production

Agro Industry Metal Industry Mineral Industry

Gaseous Fuel Chemical Industry Fertilizer Synthetic Oil SNG

Hybrid Diesel(PLN)

Conversion of coal in a reactor into gaseous product (esp. CO and H2) either without or with reactant (air, oxygen, steam, carbon dioxide or mixture of them). CO and H2 can be processed into CH4 (SNG)

Coal GasificationCoal Gasification

28

- Gas low calorie(

-

1 kg LRC 3 Nm3 gasComposition :

- CO : 24 34 %- H2 : 13 15 %- CH4 : 1,6 2,4 %- N2 : 47 51 %- CO2 : 4 6 %

Price of gas : US$ 3,5/MMBTU Batubara Comparison of electricity cost

- 100% diesel = Rp. 1.650/kWh- 100% gas from coal= Rp. 300/kWh

Added Value : Rp. 1.350/kWh or Rp. 25 trillion/year PLTD PLN

Gas for Diesel Substitution in Diesel Power Plant

-

Applicationof Gasifier(TeaDryer)

Saving fuel>50%

-

Coal Liquefaction

-

HH

Coal Liquefaction Technology

Decomposition and Hydrogenation

Gasification and shift reaction

CO + H2F/T

SynthesisCxHy

Coal

Oil

Oil or Chemicals

Indirect liquefaction

Direct liquefaction

-

y FischerTropschsynthesis(SASOLPROCESS) IndirectProcess CommerciallyAvailable

y CleanCoalTechnology(CCT) PilotplantinChina Commercialplantwithsmallcapacity5,000bbl/day

y BrownCoalLiquefaction(BCL) DirectProcessdevelopbyJapan PilotplantinVictoriaAustralia F/SinthreelocationsinIndonesia(Banko,BerauandMulia)

Coal Liquefaction Technologies

-

Concluding RemarksIndonesia will more relying on coal to fulfill domestic energy demand.

Indonesia is interested in developing technology for coal utilization especially low rank coal

Appropriate beneficiation and utilization technologies could increase value added and energy efficiency also decrease CO2 emission

Indonesia needs strategic partner for JointResearch and Development to develop the Coal Resources

-

36

http://www.tekmira.esdm.go.id

-

TECHNOLOGY PRODUCT KIND OF TECHNOLOGY Technology Owner PLANT DESIGNUpgrading High rank coal UBC, K-Fuel, Fleissner,

HWD/SD, SynCoal, CDB, BCB, LFC, HWD

Indonesia, Foreign

Indonesia

Coal Liquefaction Oil from coal BCL, NEDOL, HTI, shenhua, Sasol, CCT

Foreign Indonesia

Gasification Gas and syngas

Dual fuel and Tigar Indonesia, Foreign

Indonesia

Coal slurry (CS) Slurry/Heavy Oil

CWM, aquabat, JCF Indonesia, Foreign

Indonesia

Foundry Coke Coke Coke Indonesia IndonesiaActivated Carbon Activated

CarbonActivated Carbon Indonesia Indonesia

TECHNOLOGY OF COAL UTILIZATION

-

Distribution of Coal Resources

0,450,00

0,030,00 1,76

1,940,730,04

2,110,009

0,20,02 47,089,54

0,010,00 0,008

0,00 0,00080,00

0,520,00 1,640,08

12,263,60

37,95,90

0,230,0006

0,020,00

0,020,00

0,120,00

CoalResourcesCoalReserves(openpit)

105,19

21,13

0,100,00

0,0020,00

Source : Geological Agency, 2010

-

Application of New Coal Technology to support Indonesian Energy Policy

Coal Fired Power Plant Coal Upgrading

Coal Liquefaction Other use of coal (Formed coke, Activated carbon)

Characteristics of New Coal Technology9Suitable for Indonesian Low Rank Coals9Low cost at high efficiency9Environmentally Friendly

Coal Utilization Technology to be considered

Coal Gasification

-

Result Analysis of CDB Product

Coal 1 Coal 2

Parameter Raw Coal CDBProduct

Raw Coal CDB Product

TM, % 60.20 11.2 46 7.1

CV, kcal/g (ar)

2,113 5,300 3,238 5,684

-

41

Objectives of the CS ProjectImmediate ObjectivesTo obtain an HWT-cs demonstration plant of 10,000

tons/year capacity to show the itself and CS combustion to candidate user in Indonesia.

Long Term Objectives- To increase the value of Indonesian low rank coal- To prevent the secure and stability of energy supply- To substitute for heavy oil

-

MoU between ARDEMR, PT Pupuk Sriwijaya, Ishikawajima-Harima Heavy Industries Co. Ltd (IHI) and Sojitz Co. concerning Study on Integration of Lignite Gasifier into Fertilizer Plant (Oct. 18, 2006)

Study on Integration of Lignite Gasifier into Fertilizer Plant using TIGAR (Twin IHI Gasifier) Technology has been carried out and the Final Report (Feasibility Study) completed in June 2007

The Final Report concluded that: - It was feasible to integrate lignite gasifier into existing fertilizer plant- To construct a prototype plant in PT Pupuk Kujang, Cikampek

to obtain detail engineering and economic data

The Draft of Cooperation Agreement on TIGAR Prototype Plant is being prepared, including: Utility list, Schedule of project, Scope of work for EPC and operation, project cost, and Commitment of contribution

IHI will change/delay schedule of syngas commercialization for flexibility of site condition of commercial plant, ensuring quality & safety and understanding impact of lignite characteristics

Tigar Gasification Technology

-

Advantages of Tigar Gasification Technology

1. Low Temperature

Insensitive to content of coal moisture and ash or suitable for lignite

3. Coarse and dry coal feed

Reduce Grinding Cost and high energy density

2. Employ Steam as Oxidizer

High Concentration of H2 suitable for ammonia plant

4. Separation between combustion and reduction Zone

Low Cost of CO2 Capture

-

Ministry of Energy and Mineral ResourcesMinistry of Energy and Mineral ResourcesDirectorate General of ElectricityDirectorate General of Electricity

Republic of IndonesiaRepublic of Indonesia

NewDelhi,NovemberNewDelhi,November 2424,,20112011

CoalFiredPowerPlant(CFPP)CoalFiredPowerPlant(CFPP)InvestmentOpportunityinIndonesiaInvestmentOpportunityinIndonesia

PresentedPresented atatThe 2The 2ndnd Joint Working Group on Coal Indonesia Joint Working Group on Coal Indonesia IndiaIndia

CFPP Suralaya (1 x 625 MW)

CFPP Indramayu (3 x 330 MW)

CFPP Pacitan (2 x 315 MW) CFPP Tarahan (2 x 100 MW) CFPP 3 Bangka (2 x 30 MW)

CFPP Kendari (2 x 10 MW)

CFPP Amurang (2 x 25 MW)

CFPP Barru (2 x 50 MW)

CFPP Tidore (2 x 7 MW)

CFPP Ende (2 x 7 MW)

CFPP Lontar (3 x 315 MW)

CFPP Rembang (3 x 315 MW)

CFPP Tj. Balai Karimun (2 x 7 MW)CFPP Labuan (2 x 300 MW)

-

Indonesia Power Sector Infrastructure (Current Status) Power Generation Current Condition Necessity for Private Power Participation Private Sector Participation Scheme CFPP Investment Opportunity on EPC Contract CFPP Investment Opportunity on IPP Project CFPP Investment Opportunity on PPP Project The Government Facilities Provided Type of Power Generation Procurement Power Generation Development Planning Target of Energy Mix for Power Generation Conclusion

TABLEOFCONTENTTABLEOFCONTENT

-

SUMATERA : Generation:5.711 MW 275kV:1.027 kms 150kV:9.398 kms 70kV:456 kmsMV :73.700 kms LV :92.262 kms

JAMALI : Generation:25.606MW 500kV:5.099 kms 150kV:13.505 kms 70kV:3.757 kmsMV :133.670 kms LV :219.084 kms

NusaTenggara: Generation:335 MW 150kV:83 kmsMV :7.676 kms LV :7.501 kms

KALIMANTAN: Generation:1.376 MW 150kV:1.824 kms 70kV:123kmsMV :23.907kms LV : 22.537kms

SULAWESI : Generation:1.498MW 150kV:3.000 kms 70kV:552 kms MV :24.361 kms LV : 25.404 kms

MALUKU : Generation:216 MWMV :4.585 kms LV :2.364 kms

PAPUA : Generation:211MWMV :2.074 kms LV :3.558 kms

:existingtransmission

:plantransmission

:GenerationTOTAL TOTAL GENERATION INSTALL CAPACITY : GENERATION INSTALL CAPACITY : 335.313 MW5.313 MW TRANSMISSION LENGHTTRANSMISSION LENGHT::-- 500 KV : 5.500 KV : 5.099099 kmskms-- 275 KV : 275 KV : 1.027 1.027 kms kms -- 150 KV : 2150 KV : 27.810 7.810 kmskms-- 70 KV : 4.70 KV : 4.888888 kmskms

DISTRIBUTION LENGHT:DISTRIBUTION LENGHT:-- MMV (Medium Voltage)V (Medium Voltage) : 2: 270.214 70.214 kmskms-- LVLV (Low Voltage)(Low Voltage) : 3: 372.709 72.709 kmskms

INDONESIAPOWERSECTORINFRASTRUCTUREINDONESIAPOWERSECTORINFRASTRUCTURE(CurrentStatus)(CurrentStatus)

-

Oil share in electricity production is still high, because: DPP that should be operated in peak load period, is operating in

base load period to fulfill the demand (mostly happened in Outside Java-Bali system)

Several CCPP and GTPP in the Java-Bali system are operating utilizing oil as primary energy because of lack of gas supply.

Totalinstalledcapacityisabout35,313 MW,whichconsistofthoseownedbyPLNs(27,849 MW),IPPs(6,331

MW)andPPUs(1,133 MW).

POWERGENERATIONCURRENTCONDITIONPOWERGENERATIONCURRENTCONDITIONPower Generation by Owner

Power Generation by Type

Electricity Productionby Energy Mix

PowergenerationisstilldominatedbyCFPP,thenfollowedbyCCPP,DPP,HEPP,GTPP,GeoPP,MHPP,GEPPandWTPP.

Note:CFPP : CoalFiredPowerPlantCCPP : CombineCyclePowerPlant

HEPP : HydroElectricPowerPlantGTPP : GasTurbinePowerPlantGeoPP : GeothermalPowerPlant

MHPP : MiniHydroPowerPlantGEPP : GasEnginePowerPlantWTPP : WindTurbinePowerPlant

IPP:IndependentPowerProducerPPU:PrivatePowerUtility

-

Growth rate of demand for electricity is still high (9.5% p.a up to 2029).

Electrification ratio is still low (67.2% in 2010). Lack of electricity supply in some

areas/regions.

NEED A HUGE OF ADDITIONAL CAPACITY (estimated of 7,800 MW p.a during 20 years), investment required approx. USD 11.4 billion p.a)

BUT

PLNs investment capability is limited (around 20%) The Government budget for infrastructure is very limited.

THEREFORE Privates sector participation are required:

Engineering, Procurement and Construction (EPC) Independent Power Producer (IPP) Project Public Private Partnership (PPP) Project

0

100

200

300

400

500

600

700

800TWh

JamaliOutsideJamaliINDONESIA

Electricity Demand (based on draft RUKN 2010-2029)

020406080100120140160180GW

Additional Power Generation(based on draft RUKN 2010-2029)

Infrastructure JAMALI Outside JAMALI Total

Generation 121,217 79,607 200,824Transmission Line and Substation

9,180 5,844 15,024

Distribution Line 6,546 4,728 11,275

Total 136,944 90,179 227,122

Investment Requirement(based on draft RUKN 2010-2029)

Million USD

Note: RUKN : National Electricity General PlanFTP-1 : Fast Track Program 10,000 MW Phase IFTP-2 : Fast Track Program 10,000 MW Phase II

NECESSITYFORPRIVATEPOWERPARTICIPATIONNECESSITYFORPRIVATEPOWERPARTICIPATION

-

EPC ContractThe owner of project is PLN. Engineering, Procurement, and Construction (EPC) of project will be offered to private sector through bidding. In this model PLN provides 15% financing and private provides 85%. Example: Fast Track 10,000 MW Phase I and some projects in Fast Track 10,000 MW Phase II.

IPP ProjectThe owner and implementer of EPC is private. 100% financing source of the project comes from private and it is passed through to electricity selling price. Example: most of IPP projects and some projects in Fast Track 10,000 MW Phase II.

PPP ProjectThe project is collaboration between SOEs and private enterprises. The government could provide either the government support or the government guarantee. If private as the initiator of the project, the government will provide some compensation. Example: CFPP Central Java 2 x 1,000 MW.

PRIVATESECTORPARTICIPATIONSCHEMEPRIVATESECTORPARTICIPATIONSCHEME

-

CFPPINVESTMENTOPPORTUNITYONEPCCONTRACTCFPPINVESTMENTOPPORTUNITYONEPCCONTRACT(UnderFastTrack10,000MWProgramPhaseII)(UnderFastTrack10,000MWProgramPhaseII)

CFPP Indramayu Capacity : 1 x 1,000 MW Status : F/S COD : 2017

CFPP Lombok Capacity : 2 x 25 MW Status : F/S COD : 2015

Total : 1,100 MW

CFPP Sampit Capacity : 2 x 25 MW Status : F/S COD : 2014

-

CFPPINVESTMENTOPPORTUNITYONIPPPROJECTCFPPINVESTMENTOPPORTUNITYONIPPPROJECT(UnderFastTrack10,000MWProgramPhaseII)(UnderFastTrack10,000MWProgramPhaseII)

CFPP Tj. Balai Karimun Capacity : 2 x 10 MW Status : F/S COD : 2014

CFPP Tj. Pinang Capacity : 2 x 15 MW Status : F/S COD : 2015

CFPP Sumbawa Capacity : 2 x 10 MW Status : F/S COD : 2014/2015

Sub Total : 70 MW

-

CFPPINVESTMENTOPPORTUNITYONPPPPROJECTCFPPINVESTMENTOPPORTUNITYONPPPPROJECT

CFPP Sulawesi Utara Capacity : 2 x 55 MW Status on PPP Book: Potential COD : 2017/2018

CFPP Kalimantan Timur Capacity : 2 x 100 MW Status on PPP Book: Potential COD : 2017/2018

CFPP Jambi Capacity : 2 x 400 MW Status on PPP Book: Priority COD : 2018/2019

CFPP Sumatera Selatan - 9 Capacity : 2 x 600 MW Status on PPP Book: Potential COD : 2017/2018

CFPP Sumatera Selatan - 10 Capacity : 1 x 600 MW Status on PPP Book: Potential COD : 2017/2018

PotentialCompliance with the National Medium Term Development Plan (RPJM) / Regional and Strategic Plan of the Ministry / Agency / Local GovernmentLocation of the project suitable with the Regional Spatial General Plan (RTRW)There are linkages between Infrastructure sector and inter-region Estimation of cost recovery potential and there is a preliminarystudy

PriorityThe project listed on the potential cooperation plans / projectsproposed by in charge of cooperation projects for unsolicited projects according to Presidential Decree No. 67/2005technically feasible, legally and financially based on a preliminary studyRisk identification and allocation have been performedStudies on modalities / forms of cooperation that will be used have been carried outGovernment support has been identified (if needed)

Ready to OfferInterest potential of businesses to participateFairness of the tender schedule and readiness of the tender teamCompleteness of the tender documentsThere has been the availability and / or approval in support principle of the government (if needed)

Total : 2,910 MW

-

Fast Track 10,000 MW Phase II Project The government guarantees the feasibility of PLN business in accordance to the

provisions of legislation. Provide facilities such as exemption from import duty and other facilities regulated by

the Ministry of Finance.

PPP Project The government provide the government support or the government guarantee. If private as the initiator of the project, the government will provide some compensation:

1. Additional value (max 10% of the initiator tender assessment); or

2. Right to match by the initiator against the best offer in accordance with the results of the assessment in the tender process

3. Purchase of a joint project initiatives including intellectual property rights attached to them by the minister / head of institution / district head or by the winning bidder

THEGOVERNMENTFACILITIESPROVIDEDTHEGOVERNMENTFACILITIESPROVIDED

-

TenderTender Direct Direct SelectionSelectionDirect Direct

AppointmentAppointment

Electric power purchase from electric power generator using renewable energy among others, mini/micro hydro, geothermal, biomass, wind and solar; marginal gas, mine-mouth coal and other local energy sources;

Purchase of excess of electric power; Local electric power system in the crisis condition of

electric power supply ; or. Addition of electric power generator capacity in the central

electric power generator which has been in operation in the same location by Cooperative, Region Owned Enterprise, Private Business Entity, Self-Supporting Community, and individual acting as Holder of Electric Power Business License for Public Interest.

- In the frame of energy diversification of electric power generation to non petroleum fuel.

- More than one developer proposing for direct selection to the system of Electricity Business Authority/Electricity Business License Holder (PKUK/PIUKU).

- The volume of capacity being offered by the developers are exceeding the needs for additional capacity of PKUK or PIUKU local system.

Basically, entire power purchase plan by PLN conducted through Tender, except fulfill condition of Direct Selection and/or Direct Appointment

TYPEOFPOWERGENERATIONPROCUREMENTTYPEOFPOWERGENERATIONPROCUREMENT

-

*Source: Draft RUPTL PLN 2011-2020

Total power generation that will be developed from 2011-2020 is about of 55 GW or in average 5.5 GW p.a (CFPP will be developed about of 36 GW up to 2020 or 65% from total power generation)

PLN will develop about of 57% of the total capacity and the rest (43%) will be developed by IPP/private Diesel Power Plant will still be developed, but only dedicated to isolated/remote area.

POWERGENERATIONDEVELOPMENTPLANNINGPOWERGENERATIONDEVELOPMENTPLANNING

-

2011 2020

TARGETOFENERGYMIXFORPOWERGENERATION

Coal46%

Gas26%

Geothermal2%

Oil19%

Hydro7%

Electricity efficiency effort is conducted through diversification of primary energy in power generation (supply side) by optimizing utilization of gas, replacement of HSD to MFO, increasing coal utilization, and developing renewable power generation

Oil utilization is dedicated to isolated/remote areas with a higher priority for renewable energy resources

Gas and coal are given priority to reduce dependence on oil in power generation.

Coal64%

Gas17%

Geothermal12%

Oil1%

Hydro6%

*Source: Draft RUPTL PLN 2011-2020

First semester Planning

-

Indonesia electricity demand is still high thus need a huge additional capacity of generation, transmission and distribution.

The government encourages participation of private sector to cooperate with PLN through EPC project, IPP project and PPP project.

The government is committed to maintain the PLNs financial viability in order to meet its obligations to other parties.

For the next 10 years, the electricity supply in Indonesia is still relying on CFPP, it is because the availability of coal abundant as primary energy and cost of production is relatively cheap compare others power generation, but still taking into account of environmental sounds.

CONCLUSIONCONCLUSION

-

REPUBLIC OF INDONESIAMINISTRY OF ENERGY AND MINERAL RESOURCES

EDUCATION AND TRAINING AGENCY FOR ENERGY AND MINERAL RESOURCES (ETA-EMR)

HUMAN RESOURCES DEVELOPMENT IN COAL TECHNOLOGY:

Training Program Cooperation on Coal Mining and Utilization Technology

Presented on The 2nd Indonesia-India

Join Working Group MeetingNew Delhi, 24 - 25 November 2011

-

OUTLINEOUTLINE

I. INTRODUCTIONIndonesian Coal

II. HUMAN CAPACITY BULDING2.1 Human Resources Development2.2 ETAEMR Profile

III. TRAINING COOPERATION PROGRAMProposed Program

IV. CONCLUSION

-

I.I. INDONESIAN COALINDONESIAN COAL

Indonesia's coal industry has grown progressively in the last five years.

Total coal production has reached a significant amount of 275 million tonnes (Mt) in 2010 and is estimated to be 300 million tons within five years later.

Coal industry has a significant contribution to the economy of Indonesia and the government gets 35% of national income from oil, gas, and coal industries.

-

y In the last few years, issue of global warming caused by the effects of coal dust and pollutant emissions has become an international concern.

y Clean Coal Technology, such as coal conversion, offer a solution to global warming issue.

y Human resources development is essential to the development of coal technologies and achieving global competitiveness.

-

IIII. . HUMAN CAPACITY BUILDINGHUMAN CAPACITY BUILDING

Human capacity building can be done through improving specific technical competencies associated with the job, knowledge, skills, and atitudes. This results in a need for education and training institutions which are capable of generating expertise sustainable.

2.1 Human Resource Development

2.2 ETAEMR-Profile- Education and Training Center for Mineral and Coal

(ETCMC)

-

EDUCATION AND TRAINING AGENCY (ETA EMR)

to provide the competent human resources in order to support policy of energy and mineral

resources sectors

(Education and Training Center)

ETC for Electricity and

Renwble energy

Secretariate of the Agency

Underground Mining

Training Unit

ETC for Mineral and Coal

Institute of EMR

ETC for Oil and Gas

ETC for Geology

COMPETENT HUMAN RESOURCES OF EMR SECTOR

2.2 2.2 ETETAEMR AEMR PROFILEPROFILE

-

2.22.2.. Education and Training Center for Mineral andEducation and Training Center for Mineral and Coal Coal (ETCMC)(ETCMC)

ETCMC is one of the education and training centers under Education and Training Agency for Energy and Mineral Resources, The Ministry of Energy and Mineral Resources.

The main task of the ETCMC is to develop and implement education and training in the field of mineral and coal. The aim of education and training is to improve the quality/competence of Government official as well as mining industry manpower.

-

III. TRAINING III. TRAINING COOPERATONCOOPERATON PROGRAMPROGRAM

Training Cooperation Program aims to cooperate in the development of skills and knowledge in creating a productive human resources in the future, in order to promote the development of the nation Indonesia- India.

In the spirit of progress the two countries, Indonesia proposed a cooperation program of Mining Technology and Coal Utilization Technology.

This program offers cooperation in the field of coal technology, where each country has the experience and expertise.

-

PropoProposedsed ProgramPrograma.Coal Mining Technology Special program for improvement of production and productivity of Opencast

and Underground Coal Mines; Safety awareness and safety practices are included in operations and mining

methods; Transition from Open Cast coal production to Underground coal production.b. Coal Utilization Technology Utilization of coal through clean coal technology for environmental protection; Coal Liquefaction; Upgraded Brown Coal (UBC); Coal Bed Metane.c. Coal Sector Management Training Best management practise of coal mining; Efficiency of coal use and transportation; Coal management; Environmental protection.

-

IV. CONCLUSIONIV. CONCLUSION Training cooperation between India and Indonesia are

considered to be an integral part of a reciprocal relationship between the two countries and an important means to promote the exchange of ideas, experiences, knowledge, technical advances, skills and expertise in various sectors of coal.

Cooperation Program Training Coal Mining Technology is to increase the stability of coal production and safety management in coal mines through knowledge transfer.

The proposed training program cooperation aimed at improving manpowers' understanding and implementing the mining technology and coal utilization technology

-

CurrentStatusonDeepseatedCoalResourcesinIndonesia

GeologicalAgencyMinistryofEnergyandMineralResources

-

IndonesianCoalBasins

Maincoalbasins:SouthSumatera,Kutai&BaritoBasin

-

CoalDistributionMap

-

*)BasedonSNI(IndonesianNationalStandard)

IndonesianCoalResources&Reserve,2010*

0,450,00

0,030,00 1,76

1,940,730,04

2,110,009

0,20,02 47,089,54

0,010,00 0,008

0,00 0,00080,00

0,520,00 1,640,08

12,263,60

37,95,90

0,230,0006

0,020,00

0,020,00

0,120,00

CoalResources2010(billiontons)

CoalReserve2010(billiontons)

105,19

21,13

0,100,00

0,0020,00

-

LowCalorieCoal( 5.100cal/gr,billiontons)

MediumCalorieCoal(5.1006.100cal/gr,billiontons)

21,21

69,72

18,9932,041,400,04

0,0009

0,0020,01

0,00

2,2237,3611,790,94 0,002

0,220,010,00

0,000,090,0090,03

HighCalorieCoal(6.1007.100kal/gr,milyarton)13,21

VeryHighCalorieCoal( 7.100kal/gr,milyarton)1.01

IndonesianCoalResourcesBasedonCalorificValue,2011

-

NationalEnergyProjectionsetstheuseofcoaltoreached32.7%in2025

Environmentalissues,includingminewaste,coalcombustion,andlanduseconflicts(theopenpit)

Coalwillbeanexcellentenergyresourcesforthefuture,thereforethetechnologymustbeimproveto: Cleancoaltechnology,suchascoaltogasorcoaltoliquid

technology

Betterunderstandingofundergroundminingtechnology,consideringverylargepotentialforundergroundcoal

ThereshouldbesynergybetweentheuseofCMM/CBMandtheundergroundcoalmining.

FutureChallengesandOpportunities

-

Coalresourcesbelow100metersdepth Possibilityofexploitation:UndergroundCoalMiningCoalbedMethane(CBM)/CoalMineMethane(CMM)CoalGasificationCoaltoLiquid

GeologicalAgencyhavedonesomestudyondeepseatedcoalresourcesinSumateraandKalimantanStudyonundergroundcoalresourcesStudyonCoalbedMethane(CBM)

Mostlycalculatedbyextrapolation,howeversomeareashavebeendeeplyexplored(upto400mdepth)

DeepseatedCoalResources(1/2)

-

Someoftheparametersdeterminedintheareaofdeepseatedcoalare:CoalthicknessDippingofcoalseamCalorificvalueofcoalProximateUltimateOrganicPetrographyCBM/CMMparameters:gascontent,methanecontent,adsorptionisotherm,etc

Studycase:SouthSumateraEastKalimantanSouthKalimantan

DeepseatedCoalResources(2/2)

-

StudyCase:SouthSumatera,Map

-

Area Number ofSeamsMaximumdepthofCoalResourcesCalculation

(SLm)

Bayat 6 400~750LubukMahang 6 350~650SungaiLilin 2 100~150KotaTengah 6 250~500MusiRawas 3 100~250Nibung 4 600

Babattoman 4 450Babat 5 350~500

MuaraLakitan 6 350~450SungaiPinang 5 450

Sekayu 5 250~500SigoyangBenuang 7 200~300BenakatMinyak 4 400

Banjarsari 2 100~180Arahan 5 300~600

AirSerelo 1 150Kungkilan 8 350Bunian 4 200~350

TanjungLubuk 2 200~300Pagardewa 6 100~200

20Areas 91

StudyCase:SouthSumatera,StudyArea

-

SouthSumateraPotencyforOpenPitandUndergroundCoalMining

No LocationsOpenPit

300metersTOTAL

(Mil.Ton)

1 AirSerelo 75,92 0 75,92

2 Arahan 2.116,99 763,09 2.880,09

3 Babat 2.482,61 1.258,07 3.740,68

4 Babattoman 163,21 133,03 296,25

5 Banjarsari 335,32 0 335,32

6 Bayat 1.957,05 1.212,17 3.169,22

7 BenakatMinyak 735,85 521,27 1.257,11

8 Bunian 30,91 54,34 85,26

9 KotaTengah 1.093,45 528,29 1.621,74

10 Kungkilan 217,55 913,11 1.130,66

11 LubukMahang 1.029,79 862,99 1.892,78

12 MuaraLakitan 273,92 124,19 398,11

13 MusiRawas 751,04 0,27 751,30

14 Nibung 1.153,67 389,42 1.543,09

15 Pagardewa 329,18 0 329,18

16 Sekayu 5.001,65 3.087,64 8.089,29

17 SigoyangBenuang 8.929,97 356,55 9.286,52

18 SungaiLilin 472,40 0 472,40

19 SungaiPinang 2.698,15 769,63 3.467,77

20 TanjungLubuk 230,18 42,22 272,40

TOTAL (MillionTons) 30.078,82 11.016,27 41.095,10

-

AreaGeologicalAgencyResult

(MillionTons)JointStudyGA&NEDO

(MillionTons)

Batulicin 76.651BuanaJaya 242.35 371.790

EmbalutWest 116.618Langap 102.178LoaLepu 322.310

LoaJananSouth 98.498LongIram 30.42 64.726LongLees 1,403.21 1,358.491LongNah 424.28 605.817

MarahHaloq 543.9 626.964MarangKayu 43.2 204.961MuaraWahau 4,385.0 9,781.294

Pelakan 295.366SenyiurRitan 1,333.36 6,008.768

Tapin 198.15 291.233

15 Areas 8.603,87 20,325.6

StudyCase:East&SouthKalimantan,StudyArea

-

StudyCase:EastKalimantan

-

Area

HypotheticResources(MillionTons)

Total(MillionTons)

100 200m 200 300m 300 400m 400 500m 100 500m

Bontang 66.592 60.862 55.704 51.063 234.221

Santan 37.123 33.411 30.069 25.809 126.410

LongLees 360.11 281.734 139.703 77.869 859.416

LongNah 201.371 70.178 68.058 66.15 405.757

MuaraHaloq 306.597 214.618 150.233 105.163 776.611

Marangkayu 33.229 32.044 31.361 31.361 127.995

Wahau 1,019.867 1,009.669 999.572 989.576 4,018.684

S.Krasi 32.737 31.442 31.523 30.145 125.847

Total 2,057.6 1,733.9 1,506.2 1,377.1 6,674.9

EastKalimantanPotencyforUndergroundCoalMine

-

StudyCase:SouthKalimantan

-

No AreaHypotheticResources(milliontons)

WarukinFormation100 300m

TanjungFormation100 300m

Total100 300m

1 Tanjung 22.34 73.26 95.6

2 Amuntai 24.87 24.87

3 Rantau 123.33 27.9 151.24

4 Banjarbaru 1.35 1.35

5 Sebamban 22.87 137.8 160.7

6 SatuiKintap 96.9 96.9

Total 193.42 337.29 530.7

SouthKalimantanPotencyforUndergroundCoalMine

-

ResourcesExplorationonDeepseatedCoal SuitableCoalforCoaltoLiquidandCoalGasification

CoalMineMethane/CoalbedMethane

PossibleJointStudyWithIndia

-

ThankYou!

CenterforGeologicalResources

GeologicalAgencyMinistryofEnergyandMineralResources

RepublicofIndonesiawww.bgl.esdm.go.id

-

INDONESIAN COAL INDUSTRY( Current Progress on Business Exchange )

November 24 - 25 , 2011New Delhi, India

By :INDONESIAN COAL MINING ASSOCIATION ( APBI ICMA )

1

Presented at : Program of Indonesia India Meeting

-

2OUTLINES

-

1. INTRODUCTION1. INTRODUCTION

3

-

41. Currently about 7 billion people living in the world. About 2 billion people constrained access to electricity power. IEA projects indicated 1.2 billion people will be without electricity in 2030.

2. The world need much more energy particularly electricity. Coal is the cornerstone of global electricity producing over 8200 TWh ( about 41% of the worlds power ).

3. Coal is the worlds fastest growing fuel for measurable reasons ; abundance, security, affordability, versatility andamenability to clean coal technology.

4. Eliminating of energy poverty, social and economic development and poverty eradication are the first order priorities of developing countries.

5. Among fossil fuel, coal is the most economically competitive with the lowest price on a heat equivalency basis compared to order primary energy sources.

1.1. THE VALUE OF COAL IN THE GLOBAL PERSPECTIVE

-

Source : OECD/IEA ( International Energy Agency ) 2010

1.2. Hard Coal Producer in the world , 2009

5

-

61.3. Composition of Primary Energy Consumption in Major Countries ( 2007 )

Source:1.IEA,WorldEnergyOutlook2009 &EnergyBalancesofOECDCountries(2009Edition)2.HandbookofEnergy&EconomicStatistics ofIndonesia2009

-

71.4. Electricity Production from Coal 2008

Source : IEA, Electricity Information, Paris 2010 and Hand Book of Energy & Economic Statistics of Indonesia

-

2. Indonesian Coal Industry

8

-

9M

i

l

l

i

o

n

t

o

n

n

e

s

2.1. INDONESIAN COAL PRODUCTION, EXPORT AND DOMESTIC SALES ( 2000 - 2010 )

-

10

CountryofDestination 2008 2009e

India 22,464 38,901

China 15,568 38,463

OthersAsia 26,206 34,576

Japan 43,811 33,614

Korea,Republicof 28,195 33,398

Others 27,740 21,611

Taiwan 25,960 18,369

Hongkong 12,651 10,715

TOTAL 202,595 229,647

2.2.IndonesianExportsofCoalbyMayorCountriesofDestination,2008 2009NetWeight:000tonnes

Source : Coal Information 2010

-

11

2.3. Distribution of Indonesias coal exports in selected countries in Asia , 2009e

Source : Coal Information 2010

-

Mining Authorization : 3,796 Companies Coal Contract of Work ( CCoW ) : 77 Companies Stated Owned : 1 Company

12

2.4. INDONESIAN COAL MINING PLAYERS, 2011

Source : Indonesian Coal Book 2010/2011

-

3. Government Policy on Coal

13

-

14

1 LegalAspect LawNo.11/1967 LawNo.4/20092 Authority CentralGovernment(StrategicMineral&Vital)

ProvincialGovernment(Centralgroupminerals)RegencyProvicy,CentralGovernment

3 Typeofmininglicensing COW(KK)CCOW(PKP2B)KP(CentralGovernmentMiningPermit)SIPD(ProvincialMiningPermit)WPR

IUP(MiningLicensing)IUPKhusus

WPR4 TreatmenttotheInvestor Discriminative(unequaltreatment) Equaltreatment5 LicensingApproval DirectAppointment Throughbidding&Offering

6 MinimumDomesticShare Non Minimum20%7 ConcessionArea(Coal)

ExplorationExploitation

Upto1millionHaUpto250.000Ha

50.000Ha15.000Ha

8 LicensingTenor COW/CCOW30YearsExtension2xYearsKP:10YearsSIPD:10Years

IUP/IUPK20YearsExtension2X10Years

9 TaxationNonTaxRegimeRoyalty(Coal)CorporateTax(Coal)

CCOW:13.5%CCOW:1Generation45%

IUP/IUPK:4 7%IUP/IUPK:25%

10 PenaltyforIllegalMining Softpenalty Hardpenalty11 DomesticMarketObligation(DMO) Notregulated Regulated12 IndonesianCoalPriceReference

(ICPR)Notregulated Regulated

3.1.TransformationinMiningLaw

-

15

3.2. SHIFTING PARADIGM ON DEVELOPMENT PRIORITY TARGET FOR COAL INDUSTRY

DevelopmentTarget Until1999 From2000

IncreasingGovernmentearning +++ ++DomesticEnergySecurityofSupply + +++RegionalDevelopment(Infrastructure) +++ ++Employment +++ +++CommunityDevelopment ++ +++EnvironmentSustainabilityAspect ++ +++EconomicSustainabilityDevelopment + +++TechnologyTransfer +++ ++HumanRightEnforcement + +++LocalPeopleEmpowering ++ +++CollaborationWithLocalGovernment ++ +++ForeignInvestmentEncouragement +++ ++

-

3.3. National Energy Mix 2010

Source : Indonesian Ministry of Energy Mineral and ResourcesDirectorate General of New Renewable Energy and Energy Conservation

National Energy supply is still dependent on fossil fuels of about 95.21%

16

-

17

3.4. GOI grand policy on coal (Presidentials Regulation No.5/2006)

ROAD MAP INDONESIAN ENERGY MIX 2006 - 2025

BaU Scenario

TE : 2,8 Billion BOE (100%)COAL : 923 Million BOE ( 33%) = 301 Million Ton of Coal *

TE : 5 Billion BOE (100%)COAL : 1.7 Billion BOE (34,6%)

= 564 Million Ton of Coal *

TE : 993 Million BOE (100%)COAL : 152 Million BOE (15,34%)

= 50 Million Ton of Coal *

*) Using conversion factor : Lignite 1 MT = 3,0649 BOE

-

3.5.Indonesiandomesticcoalusersbyindustrialsectorin2011(BasedonMinisterialDecreeofEnergyandMineralResourcesNo.2360K/30/MEM/2010)

No CompanyTONASE

(Milliontonnes) % GCV(GAR)1 PLTU

A.PTPLN(Persero) 55.82 70.69 4.000 5.200B.IPP 8.97 11.36 4.000 5.200C.PTFREEPORTINDONESIA 0.83 1.05 5.650 6.150D.PTNEWMONTNUSATENGGARA 0.47 0.60 5.200E.PTPUSAKAJAYAPALUPOWER 0.19 0.24 5.000

2 METALURGIA.PTINCO 0.14 0.18 5.900B.PTANTAMTbk. 0.20 0.25 6.000

3 SEMEN.PUPUK.PULPDANTEKSTILA.SEMEN 8.86 11.22 4.100 6.300B.PUPUK 0.92 1.16 4.000 5.000C.PULP 0.60 0.76 4.500 5.000D.TEKSTILDANPRODUKTEKSTIL 1.97 2.49 5.000 6.500

TOTAL 78.97 100

18

-

19

3.6. INDONESIAN COAL PRICE REFERENCE ( ICPR )

INDONESIAN COAL FLOOR PRICE REFERENCE DETERMINATED BY GOI AND WILL BE ADJUSTED MONTHLY.

ICPR/HBA IS THE AVERAGE COAL PRICE IS CALCULATED BASED ON THE FOUR PRICE INDEX ( ICI-1, PLATTS-1, NEW CASTLE EXPORT INDEX / NEX, NEW CASTLE GLOBAL COAL INDEX / GC ) FOR THE SAME CALORIFICVALUE.

ICPR MEANS FLOOR PRICE OF COAL FOB MOTHER VESSEL ( BARGE, TRANSSHIPMENT, AND INSURANCE COSTS MAY BE ADJUSTED ACCORDINGLY ).

BY GOI APPROVAL CERTAIN TYPES OF COAL MAY BE OFFERED BELOW ICPR.

-

4. Indonesian Supply Capability for International Market

20

-

21

4.1. COAL RESOURCES STATUS INDONESIA( 2009 )

Total resources : 104,842 M ton

Source : Indonesian Geological Agency

-

22

4.2.COALRESOURCESTATUSINDONESIA 2009Basedoncalorificvalue(adb)

Source : Indonesian Geological Agency

-

Reserves : 21,13 b. tLignite : 29 %Subituminous : 60 %Bituminous : 11 %

11.23 b.tSUMATRA

Resources : 104,842 b. tLignite : 20 %Subituminous : 66 %Bituminous : 14 %

52.53 b.t

b.t : billion tons

0.01 b.t

51.92 b.t

0.23 b.t 0.002 b.t 0.15 b.t

9.90 b.t

Source: Badan Geology/Geological Agency,2009

4.3. INDONESIAN COAL MAP RESOURCES AND RESERVES

4.3. INDONESIAN COAL MAP RESOURCES AND RESERVES

Source: Badan Geology/Geological Agency,2009

23

-

DISTRIBUTION OF INDONESIAN COAL RESOURCES REPORTED IN 2007

8%

48%

1 %

10%

32%SUMATRA

JAVA

KALIMANTAN

BALI

SULAWESIMALUKU

PAPUA

Distribution of Coal Resources Potential

4.4. DISTRIBUTION OF COAL RESOURCESIN INDONESIA

24

Source: Badan Geology/Geological Agency,2009

-

25

4.5. Indonesian Supply Capability for International Market will be depended on :

Intensification of coal exploration.

Further infrastructure development (namely Inland hauling road, railway, seaport , coal blending terminal ).

The application of underground mining method .

Future Government policy on energy particularly on export of coal.

-

5. Investment Opportunities and Challenges in Coal Sector

26

-

5.1. Investment Opportunities in Coal Sector

Take over small & medium scale coal block ( 20-100 million US $ ). Coal terminal / Blending facility ( 200 300 million US$ ). Upgrading LRC ( Low rank coal ) and Cooking coal

processing ( 200 500 million US $ ). Coal conversion ( gasification and liquefaction ) ( > 1 billion US $ ). Mine mouth power generation ( 300 700 US $ ). Other downstream coal industry ( activated carbon, chemical

feedstock, fertilizer , etc ). Inland transportation ( railway, tool road ) ( > 1 billion US $ ). Seagoing transportation ( barge, mother vessel,

floating coal terminal ).

27

-

5.2. Fiscal Incentive for Infrastructure Project

5 % Tax cutting for corporate Tax. Net revenue deductable up to 30% of Investment

cost, applied in 6 ( six ) years for 5 ( five ) % per year. Accelerated depreciation and Amortization. Exemption or deduction of Regional Tax. Exemption or deduction of Regional Retribution Fee. Losses compensation costs over for 5 to 10 years.

28

-

5.3. Challenges in Coal Sector

High cost for exploration. Land acquisition and overlapping land utilization

between mining and plantation or forestry. Complicated government Bureaucratic system. Some regulation are not in harmony with the mine

law ( due to lack of national consensus on extractiveindustry development ).

29

-

5.4. Migration facility for foreign investment and foreign workers

Granting a limited stay permit for 2 years . Granting permanent residence permit may be granted after living in

Indonesia for 2 years. Granting re-entry permit for multiple trips to the license holder is

limited by the validity period of one year provided for a maximum period of 12 months.

Granting re-entry permit for multiple trips to the license holder is limited by the validity period of two years is given for a maximum period of 24 months.

Re-entry permits for some time travel for holders of permanent licenses granted for a maximum period of 24 months.

30

-

5.5. Exemption of import duty for imported goods and raw materials for investment

Exemption of import duty on the importation of two-year period starting from the entry into force of the decision to import taxexemption (can be extended in accordance with the period of industrial development as stated in the investment approval).

When using the domestic production of at least 30% of the total value of machinery, on the import of goods and materials may be granted exemption from import duty for purposes of additional production or production for 4 years based on installed capacity, with a period of importation for 4 years from the entry into force of the releasedecision import duties .

31

-

6. Closing Remark

32

-

33

6.1. CLOSING REMARKS

Indonesian coal production and export level may be guaranteed for the next five years, amid significant increasing of domestic utilizations, due to :- sufficient coal reserves.- existing infrastructures are still able to

support production capacity up to 600 million ton per year.

- domestic consumption level will be far behind production capacity.

-

34

6.2. CLOSING REMARKS( continued )

Infrastructure development and solving some overlapping regulation in the coal mining in accordance with Master Plan : Acceleration and Expansion of Indonesia Economic Development 2011 2025, will be very supportive for increased coal production in the future so that the potential of Indonesia in meeting the global needs of the world will be achieved.

-

THANK YOU

35

-

CERTIFICATIONNo. QUAL/1999/13307

THE INTERNATIONALCERTIFICATION NETWORK

IQNET REGISTRATIONNo. 1999/13307

PTBA COAL MINING IN SUPPORTING INFRASTRUCTURE

PROJECT IN SOUTH SUMATERA

,New Delhi November 2011

BukitAsam

-

GEOLOGICALAGENCY,2009

52,44 B T

51,92 B T

0,014 B T

0,23 B T

0,002 B T 0,15 B T

TOTALCOALRESOURCE105,187 BILLION TONS

TOTALCOALRESERVE21,131 BILLION TONS

-

320%

66%

13%

1%

COAL QUALITY

Low Calorie Medium Calorie High Calorie Very High Calorie Low Calorie (< 5100 cal/gr, adb)Medium Calorie (5100 6100 cal/gr, adb)

Very High Calorie (> 7100 cal/gr, adb)High Calorie (6100 7100 cal/gr, adb)

Source : Badan Geologi, Indonesia -Thailand 2011

Coal Resources : 105 Billion ton Coal Reserve : 21 Bilion ton

-

431

86 96

103 113

-

20

40

60

80

100

120

2005 2010 2015 2020 2025

Million ton

Power Plant Upgrading Brown CoalCement Industry Coal liquefaction

Metalurgiand Pulp Small Industries

Source : Directorate Mineral and Coal

-

Geothermal;1,32%

HydroPower;3,11%

NaturalGas;28,57%

Coal;15,34%

CrudeOil;51,66%

EnergyMix2007

NaturalGas;30%

Coal;33%

CrudeOil;20% BioFuel;5%

Geothermal;5%

Biomass,Nuclear,Hydro,Solar

,Wind;5%LiquefiedCoal;

2%

Other;17%

EnergyMix2025

-

6GOI POLICY IN ECONOMIC DEVELOPMENT

MP3EI : Masterplan for the Acceleration and Expansion of Economic

Development of Indonesia 2011-2025 (MP3EI). Focus in Six Economic Corridors : Sumatera, Jawa, Kalimantan,

Sulawesi, Bali-Nusa Tenggara, and Maluku-Papua. MP3EI is to drive Indonesian Economy in High Growth, Equitable,

Justice, and Sustainable. The implementation of MP3EI is coordinated by a Committee chaired

by the President.

-

11 KE Sumatera

22 KE Jawa

KE Bali Nusa Tenggara3 KE Kalimantan

KE Papua Maluku 4 KE Sulawesi

Pusat ekonomiPusat ekonomi mega Usulan lokasi KEK Usulan lokasi KEK yang merupakan FTZ

DenpasarDenpasar

MataramMataram

JakartaJakarta

MedanMedan

PekanbaruPekanbaru

JambiJambi

LampungLampung

SemarangSemarang

BanjarmasinBanjarmasin

PalangkarayaPalangkaraya

PontianakPontianak

MakassarMakassar

ManadoManado

KendariKendari

GorontaloGorontaloManokwariManokwari

JayapuraJayapura

1

2

3 4

SerangSerang

MamujuMamuju

IMTIMT--GTGT

BIMPBIMP--EAGAEAGA

SurabayaSurabaya

MeraukeMerauke

KupangKupang

SamarindaSamarindaSofifiSofifi

WamenaWamena

SorongSorong

AmbonAmbon

PaluPalu

Banda AcehBanda Aceh

PadangPadang

BengkuluBengkulu

JogjakartaJogjakarta

PalembangPalembang

Tj. PinangTj. Pinang

Pkl. PinangPkl. Pinang

INDONESIA SIX ECONOMIC CORRIDORS

6

6

5

5

-

Established in 1981, PTBA is the only State Owned Coal Mining Company in Indonesia ;

Coal Mining : Tanjung Enim (South Sumatera), Ombilin (West Sumatera) Peranap (Riau Sumatera) Sanga sanga (East Kalimantan)

Numbers of Employee = 3.255 people ; Coal resources is 7.2 billion ton Mineable Reserve is 1.7 billion ton

-

Palembang

Padang

SamarindaPekan Baru

ExistingRailway

IPCMINEResources :0.045 billiontonsMineable:0.01 billionton

PERANAP/CERENTIMINERecources :0.79 billiontonsMineable :0.37billiontons

KERTAPATIPIERStockpile :50.000tonsTroughput :2.5 MTABargeMax. :8,000DWT

TELUKBAYURPORTStockpile :90,000tonsTroughput :2.5million MTAVesselMax. :40,000DWT

OMBILINMINEResources :0.10billiontonsMineable :0.02billiontons

TARAHANPORTStockpile :560,000tonsTroughput :12 MTAVesselMax :80,000DWT

TANJUNGENIMMINEResources :6.36 billiontonsMineable :1.59 billiontons *)

*) include mineable reserve in disputed area Lahat (0.22 billion tons).

Tanjung Enim

MINING BUSINESS LICENSES (IUP) Tanjung Enim Mine : 66,414 Ha Ombilin Mine : 3,950 HaPeranap/Cerenti Mine : 17,100 HaIPC Mine : 3,238 HaTOTAL : 90,702 Ha

Total Resources : 7.29 billion tonsTotal Mineable Reserves : 1.99 billion tons

9

Sales and Production (today) : 12 MTA Sales and Production plan 2017: 50 MTA

Tarahan

-

10

SPEC BITUMINOUS SUB BITUMINOUS LIGNITETM ( %) AR < 18 18 -30 > 35

CV (Kkal/kg) ADB > 6,400 4,900 6,400 < 4,900

CV (Kkal/kg) AR 5,800 7.950 4,400 5.800 < 4,400

0.20 bn tons

3.58 bn tons

0.68 bn tons

1.25 bn tons

0.06 bn tons

3.51 bn tons

-

RESOURCES MINEABLE RESERVES

Tanjung Enim 80%

Tanjung Enim 87%

Total Resources : 7,29 Billion TonTotal Mineable Reserves : 1.99 Billion ton(By Competent Person Verification International Mining Consultant, Desember 2008)

-

PTBA AS A PUBLIC COMPANY :

12

Established in 1981 ; Become Public company in 2002 ; Price per share whwen IPO in 2002 :Rp 600,-

Price per share today : Rp 18.000, Rp 19.000,- Share composition in 31 of December 2010 :

-

BUCKET WHEEL EXCAVATOR In Tanjung Enim Mine

-

14

PTBA coal is transported by railway : 10 MTA to Tarahan Port in Lampung 2 MTA to Kertapati Port at Musi River

-

15

In million tons

Existing Railway Capacity in Sumatera

PTBA PTKA agreed to upgrade railway capaity 22,7 ton per annum in 2014

-

2005 2006 2007 2008 2009 2010

Domestic 7.289 6.753 6.896 8.321 8.068 8.228

Export 2.492 3.165 3.955 4.477 4.416 4.723

TotalSales 9.781 9.918 10.851 12.798 12.485 12.951

2.0004.0006.0008.00010.00012.00014.000

M

T

-

17

PALEMBANG

PrabumulihMuara Enim

Baturaja

TARAHAN PORT

STOCKPILE

KERTAPATI

Lahat

Tanjung Carat

TAMBANG TANJUNG

ENIM

KERTAPATI PIER

NEW PORT

Existing Railway Capacity:Menjadi22.7jtt/th Parties :PTBAdan PTKA TE Tarahan : 416.6KmTEKertapati :167.6Km Perkiraanselesai:2014

NewRailway(SubidiaryCompany)Capasity:25.0jtt/thnMitra :PTBA;TranspacificRailway

Infrastructure;ChinaRailwayEng. Jarak :307Km Perkiraanselesai:2014

NewRailway CooperationwithADANI Capasity :35.0jtt/thnMitra :PTBA Adani Jarak :270 Km PerkiraanSelesai:2015

CoalGasificationinTgEnim SaatinimasihdilakukanStudi

Kelayakan

CBMinTgEnim SaatiniPelaksanaan

KegiatanPemboran

-

EXISTINGRAILWAYPROJECT(TANJUNGENIM TARAHANPORT&

KERTAPATIPIER)

NEWRAILWAYPROJECT(TANJUNGENIM ANEWPORTINLAMPUNG

PROVINCE)

NEWRAILWAYPROJECT(TANJUNGENIM T.CARATSOUTHSUMATERA

PROVINCE)

Parties ExistingSouthSumateraRailwayownedandoperatedbyPTKA,whichis astateownedrailwaycompany.

PTBA 10% RajawaliAsiaResources 80% ChinaRailwayEngineering 10%

Adani 98% SouthSumatraProvince2% PTBAasthecoalSuplier

Status Toacceleratetransportationvolumegrowth,inOctober2009PTBAandPTKAsignedanew CoalTransportationAgreement(CTA)for20yearscontractinordertoachieve railway capacityof 22.7milliontons / annumin2014.

EPCcontract(USD1.3billion)andO&Mcontract

(USD3.5billion)signedinMarch2010 Alignmentdesignapprovalhasbeenobtained

fromRegencies(July2011)

HOA oftheCTA(Coal TransportationAgreement)hasbeensigned betweenPTBA,Adani,andSouthSumatraPemprop

FeasibilityStudyofCoalRailwayTransportationandthePorthavebeencompleted

Capacity 22.7 milliontonsperannumin2014(increasedgradually)

25.0milliontonsperannum (increasedgradually)

35.0milliontonsperannum (increasedgradually)

Target 2011 :13.6milliontons2012 :15.6milliontons2013 :18.5 milliontons2014 2029 : 22.7milliontons

1st year:7.5milliontons2nd year:15.0milliontons3rd year:20.0milliontons4th year:25.0milliontons

1st year:7.5milliontons2nd year:10.0milliontons3rd year:20.0milliontons4th year:25.0milliontons5th year:35.0milliontons

CommercialOperation

2015 2015

-

BANJARSARI MINE MOUTH POWER PLANT PROJECT (2x110 MW)

POWERPLANTTGENIM POWERPLANTTARAHAN

Location TanjungEnimmineTanjungEnimMine Tarahan Port

Parties PTBA(59.75%),PJB(29.15%),NII(11.10%) PTBA100% PTBA100%

Status FinancingfromBNI EPCcontractorbyCNEEC AmendmentPPASignedinJuly2011 EPC 91,4% EPC(landpreparation)

Capacity2x110MW 3x10MW 2x8MW

CoalConsumption 1.4milliontonsperannum,suppliedbyPTBA

ComercalOperation

2014 2011 2013

-

UPGRADINGEXISTINGINFRASTRUKTUR COALBEDMETHANE

Location Tarahan Port TanjungEnimmine

Parties PTBAPTBA(27.5%), Pertamina (27.5%), Arrow/DartEnergy(45%).

Status

DetailEngineeringDesign ProductionSharingContractbetweenconsortiumandgovernmentsignedin August2009.

JointOperationAgreementsignedinFebruary2011. Currentstatus:detailExploration.

Capacity Existing :1Port 80.000DWT NewPort:[email protected]

50MMSCF/day(millioncubicfeetperday)

Comercialoperation 20132013

-

COOPERATION BETWEEN PTBA AND ADANI (1):

Bukit Asam has a cooperation with Adani in increasing capacity of coal transportation by developing Railway from Tanjung Enim to Tanjung Carat (270 km) and the Coal Port at Tanjung Carat in South Sumatera as follows :

The cooperation is initiated by Head of Agreement among three parties :1. Adani : Investor / Developer 2. Bukit Asam : Coal Suplier ;3. Sumatera Selatan Govt.: Regulator ;

HoA was signed on 25 August 2010 in Jakarta (the amandment signed on 25 Januari 2011 in New Delhi) ;

Capacity of coal transported : 35 MTA (700 milion ton in 20 years) Project complete : 2015 (prediction) Status :

Adani today is completing the FS dan Permit Lincences ; Bukit Asam is preparing Coal Mining ;

The HoA will continue with : The Coal Transportation Agreement ; Coal Sales Agreement .

-

MINING ESTIMATION RESOURCES

1. South Banko Coal Field 379 MT

2. Lahat Coal Fields 2,484 MT

3. Suban Jeriji Field 502 MT

T o t a l 3,365 MT

Mining Reserves with asumption 25% from Geological resources areapproximately 841 Million Tonnes

Coal Resources Prepared By PTBA

COOPERATION BETWEEN PTBA AND ADANI (2) :

-

LP 3 X = 374751.260Y = 9590760.217

ALTERNATIF LOKASI TLS PT ADANI SUMSEL

LP 2X = 348943.252Y = 9585615.026

LP 1X = 376315.385Y = 9567873.513

AlternativeTrainLoadingStationLocationPlan

COOPERATION BETWEEN PTBA AND ADANI (3) :

-

The development of the infrastructure of coal is very useful : For PTBA is to increase capacity of production and sales ; For Adani, it will develop the company to be larger and more

experinced company ; For the Government of Indonesia as well as South Sumatera :

the opportunity to sell more coal which is increasing the economical scale ;

For the Government of India : the opportunity to buy more coal from Indonesia ;

For both the Government of Indonesia and Government of India : it will increase a better relationship between two countries.

CONCLUSION

-

BukitAsam

-

INDONESIA

Review of Rail and Port Project

1

Nov 24, 2011

-

Rail Project Background

Project conceptualization - August 2008

Site visit and preliminary studies Internal Team - Dec 2008

Proposal submitted to Governor, Sumsel - Chairmans visit in January 2009

Milestones Achieved

HoA - August 2010

Incorporation of SPV, BKPM approval, and Permit from Governor for IUJP coal

transport

Finalization of Rail Alignment

Feasibility study completed by Aurecon Autralia based on the technical studies by

HR Wallingford - UK, EMS- Tech - Canada, PT Diagram and others

Rail and Port Project Journey so far

-

Rail Project Background

Activities under progress

Dept of Transport Route agreement

Discussions with PTBA

40 MMTPA can be considered

Quality shall be around ICI 4 grade

Mining units have been identified as South Bangko (157 MMT), and

Suban Jeriji (502 MMT)

Price shall be as per HBA / HPB

Waterfall guarantee can be considered

Rail and Port Project Journey so far (Contd)

-

Probable timeline of Project Execution

Rail Project Schedule

Schedule of Construction

2011 12 : Definitive Agreement with PTBA, Completion of EIA, and Land acquittal after detailed agreement

2012 13 : Earthwork, Bridges & Roads ( 20% of work total work). 2013 14 : Earthwork, Bridges, structures, Track ( 65% of total work)

Possibility of multimodal shipment from Teluk Betung 2014 15 : Track, Signaling to be completed ( 15% of total work)

Rolling Stock to be acquired in phases

Schedule of Production

2015 -- 16 : 7.5 MTPA 2016 -- 17 : 12.5 MTPA 2017 --18 : 20 MTPA 2018 -- 19 : 25 MTPA 2019 -- 20 : 35 MTPA 2020 -- 21 : 40 MTPA

-

Rail and Port Project

(1) Rail Project

(4) Stockpile & Material Handling

5

(5) Capital & Operating Cost

(2) Port Development

(3) Access Channel

(6) Next Steps

Contents

-

Rail Project Technical Parameters

-

Rail Project Technical Parameters

-

Rail Project Technical Parameters

The proposed rail alignment divides into 4 distinct sections.

A.Hilly terrain near Muara Enim, i.e., Train Loading Station to Station 5 (72.310 Kms.),

B.Flat ground between Station 5 to Station 3 (Teluk Betung) (82.64 Kms), and

C.Flat and swampy terrain, i.e., from Station 3 to Unloading Station (84.263 Kms)

D.Unloading Loop (4.364 Kms)

D Unloading Loop

-

Rail Project Technical Parameters

Land Characteristics Length (in mtrs.) %

Plantation 80,663 33.68%

Productive Forest Land 64,674 27.01%

Marshy Land 60,535 25.28%

Protected Forest 21,519 8.99%

Misc. 12,080 5.04%

Total 239,471

Land Utilization pattern along the proposed Rail alignment

-

Port Project Technical Parameters

Area Distance (*) Bore Hole Drilling Pattern Soil Penetration Test (SPT)Depth of Boreholes 30 mtrs.

Marshy Land 90 kms. @ 1 for every 10 km distance 9.00 @ 8 for every 10 km

distance 72

Normal Land 60 kms. @ 1 for every 15 km distance 4.00 @ 1 for every 5 km distance 12

Hard Land 90 kms. @ 1 for every 20 km distance 4.50 @ 1 for every 10 km

distance 9say 18 93

Width of Waterbody

(Span in mtrs)

Number of Water

Bodies Pattern of Borehole drilling Pattern of SPT

0-30 31 bore holes at one end of the

water body 31 SPT at one end of the

water body 3

31-50 } 71 bore holes at one end of the

water body 71 SPT at each end of the

water body 1451-100 }

more than 100 mtr. 10