Income Verification and Budgeting 1. Introduction This training session will provide details about...

-

Upload

elijah-armstrong -

Category

Documents

-

view

217 -

download

0

Transcript of Income Verification and Budgeting 1. Introduction This training session will provide details about...

Income Verification and Budgeting

1

Income Verification and Budgeting

Introduction

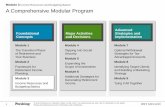

This training session will provide details about Income Verification and Income Budgeting Methods.

Policies apply to both Family Medical and E&D Medical programs. We will identify when there are differences between the program rules.

2

Income Verification and Budgeting

Agenda

• Lesson 1: Introduction to MAGI• Lesson 2: Tiered Verifications• Lesson 3: Non-MAGI• Lesson 4: Income Budgeting Policy Updates• Lesson 5: Reasonable Compatibility• Lesson 6: Earned Income• Lesson 7: Unearned Income • Lesson 8: Self-Employment• Lesson 9: Prior Medical

3

4

Income Verification and Budgeting

Lesson 1: Introduction to MAGI

Forget everything you know about determining family medical households and income. The introduction of MAGI medical determinations changes every aspect of how eligibility is determined. For example, with MAGI:•Individual Budgeting Unit•Who Can Apply•Income•Expenses

5

Income Verification and Budgeting

Lesson 1: Introduction to MAGI

What medical determinations use MAGI?

6

Income Verification and Budgeting

Lesson 1: Introduction to MAGI

With the MAGI rules, who can apply is based on tax dependency instead of relationships.

With MAGI, an individual may apply on behalf of his or her tax dependents regardless of relationships.

7

Income Verification and Budgeting

Lesson 1: Introduction to MAGI

Under MAGI, determinations are no longer based on a single household assistance plan. Each applicant receives an individual determination using an individually determined household and income amount.

8

Income Verification and Budgeting

Lesson 1: Introduction to MAGI

Countable income for MAGI is based on tax rules. In most situations, if income is taxable it is counted in the eligibility determination; if the income is not taxable it is exempt (with a few exceptions).

There is also new policy on what information must be verified for income and what information can be accepted from interfaces.

In a MAGI determination there are no expense deductions for earned income or for dependent care costs. These expenses are built into the FPL % for Kansas.

Income Verification and Budgeting

Lesson 1: Introduction to MAGI > Summary

That completes Lesson 1. In this lesson, we reviewed:

•MAGI•Non-MAGI

Next, we will discuss Tiered Verifications.

9

Income Verification and Budgeting

Agenda

• Lesson 1: Introduction to MAGI

• Lesson 2: Tiered Verifications

• Lesson 3: Non-MAGI

• Lesson 4: Income Budgeting Policy Updates

• Lesson 5: Reasonable Compatibility

• Lesson 6: Earned Income

• Lesson 7: Unearned Income

• Lesson 8: Self-Employment

• Lesson 9: Prior Medical

10

Income Verification and Budgeting

Verification of information needed to determine eligibility is based on a tiered verification approach. There are four tiers of verification. There is a hierarchy among the tiers meaning that Tier 1 should always be used when available; Tier 2 should be used when Tier 1 is not available and so on.

11

Lesson 2: Tiered Verifications

12

Income Verification and BudgetingLesson 2: Tiered Verifications

13

Income Verification and Budgeting

Lesson 2: Tiered Verifications

All verifications must be used and/or requested based on the tiered structure outlined in this training session.

14

Income Verification and Budgeting

Lesson 2: Tiered Verifications

Tiers provide a formal policy and hierarchy to be used when verification is needed.

Federal Law requires that we use information available to us through interfaces or other means prior to contacting the applicant. For example, if wage verification can be obtained through an interface, such as The Work Number, it is not permissible to request verification from the applicant.

15

Income Verification and Budgeting

Lesson 2: Tiered Verifications

Each tier is defined

16

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Tier 1

Tier 1 - Payer Interfaces: They are automated and are not verified manually by a user. Tier 1 verifications come directly from the source. Examples of Tier 1 verifications include:

•Citizenship and/or Identity verification through the Federal Hub•Unemployment Compensation that is verified through an unemployment interface•Social Security income that is verified through interfaces from the Social Security Administration•KPERS payments verified through a state interface.

17

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Tier 1

If Tier 1 Verification is available, DO NOT proceed to Tier 2, 3, or 4.

18

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Tier 2

Tier 2 verifications are automated and are not verified manually by a user. Tier 2 verifications come from interfaces, but do not come directly from the payer. Examples of Tier 2 verifications include:

•Wages verified through the Kansas Department of Labor (KDOL). KDOL wages were formerly known as BASI wages •Wages verified through the Work Number. •Electronic Verification of Vital Events (EVVE)•KSWebIZ

19

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Tier 2

If Tier 2 Verification is available, DO NOT proceed to Tier 3 or 4.

20

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Tier 2

Tiers 1 and 2 are automated. They seem similar, but the key difference is the ‘Source.’ UC can be verified in Tier 1 because the source that is paying provides verification.

Tier 2 verifications are like a third party that gathers information from the ‘Source’. For example, The Work Number is not the ‘Source’ that pays the applicant’s wages but it can provide wage verification.

21

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Tier 3

Tier 3 verifications are not automated. Tier 3 verification occurs when a worker reviews case information, completes research, and makes collateral contacts to verify the required information.

22

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Tier 3

For example, if an applicant reports two jobs the system may not be able to verify the income from both jobs. It is possible that the Work Number shows only one job, but KDOL shows two jobs. This may prevent the system from automatically using Tier 2 verifications and require the worker to review the KDOL wages and confirm that they verify the income reported by the applicant.

23

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Tier 3 > Examples

Examples of Tier 3 verifications include:

•Reviewing the images for verification submitted with the application •Interface data from Tier 1 or Tier 2 that requires a worker to resolve a discrepancy prior to using as verification•Collateral contact or information from another agency •Collateral contact from the employer or source of income. Contacting an employer is acceptable but we are not always able to contact employers. We have the option to contact the employer, but it is not a requirement.

24

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Tier 3

If Tier 3 Verification is available, DO NOT proceed to Tier 4.

25

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Tier 4

Tier 4 verifications are not automated and are used as a last resort when Tiers 1 – 3 are not sufficient. Tier 4 verification occurs when information cannot be verified through an interface or through contacts other than the applicant. On occasion, the applicant may be contacted by phone but more commonly a letter will be sent when Tier 4 verification is required

26

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Tier 4 > Examples

Tier 4 verification examples include:•Tax Returns•Pay Stubs•Birth Certificates•Immunizations•Hard copy verifications

27

It is FEDERAL LAW that we request consumer information only as a last resort.

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Federal Law

Income Verification and Budgeting

Lesson 2: Tiered Verifications > Summary

That completes Lesson 2 We have now:

• Defined Tier 1—Tier 4 Verifications• Learned that Federal Law mandates us

to request information from a consumer as a last resort.

Next, we will discuss Non-MAGI.

28

Income Verification and Budgeting

Agenda

• Lesson 1: Introduction to MAGI• Lesson 2: Tiered Verifications• Lesson 3: Non-MAGI• Lesson 4: Income Budgeting Policy Updates• Lesson 5: Reasonable Compatibility• Lesson 6: Earned Income• Lesson 7: Unearned Income • Lesson 8: Self-Employment• Lesson 9: Prior Medical

29

Income Verification and Budgeting Lesson 3: Non-MAGI

30

The Tiered Verifications discussed in Lesson 1 apply to both the MAGI and Non-MAGI populations.

There are also additional rules that apply to the Non-MAGI, or Elderly and Disabled, groups.

Income Verification and Budgeting Lesson 3: Non-MAGI > 2 groups

31

Reminder: These are the Non-MAGI groups

The Non-MAGI group breaks down into 2 more groups

Long Term Care, which includes institutional, HCBS, and PACE as well as Working Healthy programs will continue to follow the existing income/resource verification & budgeting methodologies.

Income will be verified via one of the payer interfaces (SSA, KDOL – Unemployment, KPERS). All other reported income and resources will require verification from the applicant/recipient just as we do now.

32

Income Verification and Budgeting

Lesson 3: Non-MAGI > LTC and Working Healthy

Income Verification and Budgeting Lesson 3: Non-MAGI > Medically Needy and MSP

33

The Medically Needy and Medicare Savings Program (MSP), while still considered as non-MAGI programs, will follow the new MAGI verification/budgeting methodology.

Income will be verified using the above-mentioned Tiered approach, but continue to have their own requirements for which income types are countable/exempt, and what income is verified with hard copy documents or other sources.

Resources will be verified by the applicant/recipient just are they are now, except for prior medical months.

In a combination situation, where there are both MSP and LTC or WH, the more restrictive LTC/WH rules will be applied to all programs.

34

Income Verification and Budgeting Lesson 3: Non-MAGI > Combination Cases

Income Verification and Budgeting

Lesson 3: Summary

That completes Lesson 3. In this lesson we reviewed:

• Non-MAGI has two groups: oLTC and Working Healthy oMedially Needy and MSP

• LTC and Working Healthy still require the same hard copy verifications as they have in the past.

• Medically Needy and MSP follow the MAGI verification rules.

Income Budgeting Policies will be covered next.

35

Income Verification and Budgeting

Agenda

• Lesson 1: Introduction to MAGI

• Lesson 2: Tiered Verifications

• Lesson 3: MAGI vs. Non-MAGI

• Lesson 4: Income Budgeting Policy Updates

• Lesson 5: Reasonable Compatibility

• Lesson 6: Earned Income

• Lesson 7: Unearned Income

• Lesson 8: Self-Employment

• Lesson 9: Prior Medical

36

Income Verification and Budgeting

Lesson 4: Income Budgeting Policy Updates

37

Understanding Income Budgeting policy is essential to correctly determining medical eligibility. This training provides the detailed information necessary to correctly budget earned, unearned and self employment income. Income changes, the budgeting method and Reasonable Compatibility will also be covered in this module.

Income is prospectively budgeted based on what the household expects to receive beginning in the month of application. Prospective income is that which the household reasonably expects to receive going forward from the month of application.

38

Lesson 4: Income Budgeting Policy Updates > Prospective Budgeting

Income Verification and Budgeting

Income Verification and Budgeting

Lesson 4: Income Budgeting Policy Updates > Irregular Budgeting

39

When income is irregular (Example: change in employment, loss of job or unemployment stops) the income is budgeted based on the situation that exists at the end of the month. Then the income that will be continuing into the future is projected.

When there has been a loss of income, the lost income will not be included in budgeting for a current determination.

Income Verification and BudgetingLesson 4: Income Budgeting Policy Updates > What Happened Last

40

A key principle to use when budgeting income is asking the question “what happened last in the month?” What is current at this “Point in Time” is considered what happened last. Let’s review some examples.

Applicant reports a job loss and unemployment started in the month of application.

What happened last in the month? •The Unemployment – a monthly amount will be budgeted and used for the determination. •Since the job is not going to continue in the future, it is not budgeted.

41

Income Verification and Budgeting

Lesson 4: Income Budgeting Policy Updates > Example 1

Income Verification and Budgeting

Lesson 4: Income Budgeting Policy Updates > Example 2

42

Applicant reports being hired for a new job. Current income is $0 and they are expected to start the new job in 6 weeks.

What happened last in the month?

•At this ‘point in time’ the income is $0. The job has not actually started, therefore, it cannot be used in the determination.

Income Verification and Budgeting

Applicant applies on the 5th and calls on the 15th to report they started working.

What happened last in the month? •At this ‘point in time’ the applicant has begun working, so their wages are prospectively budgeted.

43

Lesson 4: Income Budgeting Policy Updates > Example 3

Income Verification and Budgeting

Lesson 4: Income Budgeting Policy Updates > Example 4

44

Applicant applies on the 25th and reports just losing their job. They’ve received paychecks all month and will get their last check in the first week of the following month.

What happened last in the month?

•At this ‘point in time’ they are not employed. The income is $0.

Income Verification and BudgetingLesson 4: Income Budgeting Policy Updates > What Happened Last

45

Always ask “What Happened Last in the

month” when budgeting income.

Income Verification and Budgeting

Lesson 4: Income Budgeting Policy Updates > Summary

In Lesson 4 we learned:• Income is budgeted Prospectively

based on what the household expects to receive.

• When income is irregular, the income is budgeted based on what happened last in the month that is being determined.

We will cover Reasonable Compatibility in our next lesson.

46

Income Verification and Budgeting

Agenda

• Lesson 1: Introduction to MAGI• Lesson 2: Tiered Verifications• Lesson 3: MAGI vs. Non-MAGI• Lesson 4: Income Budgeting Policy Updates • Lesson 5: Reasonable Compatibility• Lesson 6: Earned Income• Lesson 7: Unearned Income • Lesson 8: Self-Employment• Lesson 9: Prior Medical

47

Income Verification and Budgeting

Lesson 5: Reasonable Compatibility

48

If the applicant’s statement of income is deemed reasonably compatible further verification cannot be requested. Income amounts from both the consumer and the sources are converted into monthly amounts and then compared with the reasonable compatibility test.

The Reasonable Compatibility income test is used for all medical programs with the exception of Long Term Care and Working Healthy.

49

Income Verification and Budgeting

Lesson 5: Reasonable Compatibility

Income Verification and Budgeting

Lesson 5: Reasonable Compatibility > Defined

50

Income is considered reasonably compatible if:

•The amount reported by the consumer is greater than the amount received from the data source,

OR•The amount reported by the customer is within 20% of the amount received from the data source.

Income Verification and Budgeting

Lesson 5: Reasonable Compatibility > Example 1

51

The amount reported by the consumer is greater than the amount received from the data source.

•Example: If the applicant reports $1,000.00 in wages but no jobs are found through interfaces, $1,000.00 will be counted.

Income Verification and Budgeting

Lesson 5: Reasonable Compatibility > Example 2

52

The amount reported by the customer is within 20% of the amount received from the data source.

•Example: If the applicant reports making $800.00 per month but the interfaces report $1,000.00 per month, $800.00 will be counted because it is within 20% of what was found in the interfaces.

Income Verification and Budgeting

Lesson 5: Reasonable Compatibility > Example 3

53

The amount reported by the customer is within 20% of the amount received from the data source.

•Example: If the applicant reports making $600.00 per month but the interfaces report $1,000.00 per month, the amounts are not reasonably compatible because there is a variance of 40% between the applicant’s statement and the interface findings. Further research will be required in this example.

Reasonable Compatibility is also applicable for other sources like pay checks or employer letters.

When using interface data, the system will determine if the income is reasonably compatible with what the client has reported.

When using other sources like paychecks, staff will use a special Excel worksheet to determine the reasonable compatibility.

54

Income Verification and Budgeting

Lesson 5: Reasonable Compatibility

Income Verification and Budgeting

Lesson 5: Reasonable Compatibility > RC Calculator

55

Up to 4 different income types can be entered on the Calculator at one time. Staff enter the amount reported by the applicant and then the amount verified. The Calculator will provide an answer on whether or not the income is reasonably compatible by displaying a Red No or Green Yes.

Income Verification and Budgeting

Lesson 5: Reasonable Compatibility > Summary

In this lesson, we discussed:

• Income is reasonably compatible when the reported amount is greater than the verified amount, or the reported amount is within 20% of the verified amount.

• When using interface data, the system will calculate whether or not the income is reasonably compatible.

• When using another source of data, such as pay stubs staff enter the information into the Excel tool: Reasonable Compatibility Calculator.

Now, we’ll review Earned Income.56

Income Verification and Budgeting

Agenda

• Lesson 1: Introduction to MAGI

• Lesson 2: Tier Verifications

• Lesson 3: MAGI vs. Non-MAGI

• Lesson 4: Income Budgeting Policy Updates

• Lesson 5: Reasonable Compatibility

• Lesson 6: Earned Income

• Lesson 7: Unearned Income

• Lesson 8: Self-Employment

• Lesson 9: Prior Medical

57

Income Verification and Budgeting

Lesson 6: Earned Income > Verification

58

Unless otherwise stated, all income MUST be verified for MAGI and Non-MAGI determinations. The Tier Verification policy discussed in Lesson 1 is used to verify income.

Income Verification and Budgeting

Lesson 6: Earned Income > Verification > Tier 2

59

Earned income does not have a Tier 1, payer source level of verification. Therefore, verification of earned income begins at Tier 2. Use the following steps to verify earned income when determining current eligibility.

This type of verification requires no action on the part of the worker as checking these external sources has already been completed automatically by the system. This automatic verification can occur with the following interfaces:

1.The WORK#

2.KDOL wage records (BASI)

60

Income Verification and Budgeting

Lesson 6: Earned Income > Verification > Tier 2

Income Verification and Budgeting

61

The WORK# - Income details from the past 4 months will be returned if it is available. The average of this income will then be evaluated against reported income to identify if the income is reasonably compatible.

KDOL wage records (BASI) - The most recent quarter of wages will be identified and then divided by 3 to get to an average monthly amount. This will then be evaluated against reported income to identify if the income is reasonably compatible.

Lesson 6: Earned Income > Verification > Tier 2

Income Verification and Budgeting

If the reported income amount is reasonably compatible with either the income found in The Work # or KDOL wages, the reported amount is automatically verified and will be used in the determination.

Reasonable compatibility isn’t required for both interfaces. Income is found to be reasonably compatible if found in only one interface.

If the reported amount is NOT reasonably compatible, proceed to Tier 3 verification.

62

Lesson 6: Earned Income > Verification > Tier 2

Income Verification and Budgeting

63

If income is not reasonably compatible with Tier 2, staff will conduct research in the following order. Research includes:

•Hard-copy Wage Verification•The Work Number and/or BASI •DCF Income Records•Employer Contact

Lesson 6: Earned Income > Verification > Tier 3

Income Verification and Budgeting

64

Existing Hard-copy Wage Verification: The case file should be reviewed to determine if hard copy verification of income has been submitted. Examples of hard copy wage verification include paystubs or a statement from an employer.

o If at least 30 days of wages verification is provided, a prospective amount shall be determined and used in place of reported income.

o If partial verification is provided, a prospective amount shall be determined. Use whichever is greater: converted monthly amount of paystubs, or monthly amount reported by the applicant.

Lesson 6: Earned Income > Verification > Tier 3

Income Verification and Budgeting

65

The Work Number/BASI: While The Work Number and/or BASI were not able to establish reasonable compatibility in Tier 2, the income details may be able to verify reported income. Staff shall access these interfaces and compare the results with what was reported.

Lesson 6: Earned Income > Verification > Tier 3

Work Number Example: If a consumer has more than one job, the Work Number may not be able to verify the wages for only one of the reported jobs making the income fail the initial reasonable compatibility test. The wage information found for the one job could still be used as Tier 3 verification.

If partial verification is provided, a prospective amount shall be determined. Use the greater of the reported amount and the prospective amount.

66

Income Verification and Budgeting

Lesson 6: Earned Income > Verification > Tier 3

Income Verification and Budgeting

67

DCF Income Records: if the most recent DCF application was received within 3 months prior to the month the medical application was received, the DCF records can be used as verification.

Use the monthly income amount that is being budgeted on the DCF case for the income type.

Lesson 6: Earned Income > Verification > Tier 3

Income Verification and Budgeting

68

Employer Contact: staff may contact the applicant’s employer in rare cases. If verification is obtained, a prospective amount will be used in replacement of the self attestation.

NOTE: This is not required. A worker may proceed to Tier 4 without contacting the employer but should use this method of verification when available.

Lesson 6: Earned Income > Verification > Tier 3

The applicant shall be contacted only as a last resort when all other Tiers have failed to verify income. Applicants shall be directed to provide verification of the last 30 days of earnings and given at least 10 days to provide the information.

Remember, it is FEDERAL LAW that we request consumer information as a last resort.

69

Income Verification and Budgeting

Lesson 6: Earned Income > Verification > Tier 4

Income Verification and Budgeting

70

• If full verification is provided (30 days worth of income or more), a prospective amount shall be used to determine coverage.

• If partial verification is provided (Less than 30 days worth of income), a prospective amount shall be determined. Used the greater amount between reported amount and prospective amount.

• If no income verification is provided, the consumer shall be denied for failure to provide.

Lesson 6: Earned Income > Verification > Tier 4

Income Verification and Budgeting

Lesson 6: Earned Income > Summary

In this lesson, we discussed:

• Using the Tiers to verify earned income. • Tier 2 verifications - The Work Number

and BASI• Hard copy verification, reviewing

interfaces, and DCF income records as alternatives to verify income.

Now, we’ll review Unearned Income.

71

Income Verification and Budgeting

Agenda

• Lesson 1: Introduction to MAGI• Lesson 2: Tiered Verifications• Lesson 3: MAGI vs. Non-MAGI• Lesson 4: Income Budgeting Policy Updates• Lesson 5: Reasonable Compatibility• Lesson 6: Earned Income• Lesson 7: Unearned Income • Lesson 8: Self-Employment• Lesson 9: Prior Medical

72

Income Verification and Budgeting

73

Unearned income types vary greatly. Depending on the type of unearned income reported it is possible to verify unearned income in any of the four verification Tiers. The guidelines on the following slide will help you identify how to verify these varying types of income.

Lesson 7: Unearned Income >

Income Verification and Budgeting

74

The following payer interfaces are accessed automatically by KEES to obtain information about unearned income:•SSA•KPERS•KDOL – Unemployment Compensation

The amount verified from the payer interface will be used, regardless of the amount reported by the applicant.

Lesson 7: Unearned Income > Tier 1 Payer Interfaces

Income Verification and Budgeting

75

There are no Tier 2 sources of verification for unearned income. Therefore, if the income is not available in Tier 1, the worker will conduct research on the case file to determine if hard copy documentation has been submitted by the applicant.

Lesson 7: Unearned Income > Tier 3 Verification

Income Verification and Budgeting

For MAGI, self attestation is used to verify unearned income not verifiable in Tiers 1-3 with the following exceptions:

•SSA

•KPERS

•Unemployment

•Annuity Income

•Trust Income

•Contract sales

•Insurance Payments

•Oil Royalties & Mineral Rights

•Railroad retirement

These types of unearned income MUST be verified.

76

Lesson 7: Unearned Income > Tier 4 Verification > MAGI Contact

77

Income Verification and Budgeting

Lesson 7: Unearned Income > MAGI vs. Non-MAGI

Income Verification and Budgeting

Lesson 7: Unearned Income > Summary

78

In this lesson, we discussed:

• Unearned income could be verified with any of the four Tiers

• For MAGI – self attestation is accepted for all but 6 types of unearned income.

• For non-MAGI, self-attestation is not accepted.

In the next lesson, we’ll discuss Self-employment Income.

Income Verification and Budgeting

Agenda

• Lesson 1: Introduction to MAGI• Lesson 2: Tiered Verifications• Lesson 3: MAGI vs. Non-MAGI• Lesson 4: Income Budgeting Policy Updates• Lesson 5: Reasonable Compatibility• Lesson 6: Earned Income• Lesson 7: Unearned Income • Lesson 8: Self-Employment• Lesson 9: Prior Medical

79

Income Verification and Budgeting

IRS tax rules are used to budget self-employment income.

When a tax return has been filed - the countable amount of self-employment income is taken directly from the form.

When a tax return has not been filed, or isn’t representative – the countable amount of self-employment income is obtained from the applicant through the use of a Self-employment Worksheet.

80

Lesson 8: Self-Employment > IRS tax rules

Income Verification and Budgeting

81

Use the following guidelines to verify Self Employment income:•The most current tax return that has been filed should be used.•Tax Returns must include all personal schedules and attachments to be considered complete.•If it is after April 15th and the applicant has not filed a tax return, the previous year’s return may be used if they have filed an extension with the IRS.

NOTE: We do not need a copy of the extension.

Lesson 8: Self-Employment > Tax Return

Income Verification and Budgeting

82

Lesson 8: Self-Employment > Tax Return

Use the line identified below as the amount of self-employment income that is budgeted.

Income Verification and Budgeting

83

When a loss is reported on the tax form, it is to be treated as $0.00 income for the eligibility determination. A loss from a business cannot be deducted from another source of income, even if the other source is another form of self employment.

Lesson 8: Self-Employment > Tax Return

Income Verification and Budgeting

84

Lesson 8: Self-Employment > Schedule C

Income Verification and Budgeting

85

Lesson 8: Self-Employment > Schedule F

Income Verification and Budgeting

86

Lesson 8: Self-Employment > Schedule E

Income Verification and Budgeting

87

When a tax return is not available or not representative of the existing self-employment income, rather than ask the applicant for copies of their ledgers, a standard worksheet will be used. Staff will send the applicant a self-employment worksheet. The worksheet asks the specific questions necessary to be able to comply with IRS tax policies.

Lesson 8: Self-Employment > SE Worksheet

Income Verification and Budgeting

88

Lesson 8: Self-Employment > SE Worksheet

This form is mailed by the worker. The first page is always mailed. Staff then choose the remaining pages to include depending on the type of self-employment income.

Income Verification and Budgeting

89

Lesson 8: Self-Employment > SE Worksheet

Income Verification and Budgeting

90

Lesson 8: Self-Employment > SE Worksheet

Income Verification and Budgeting

91

Lesson 8: Self-Employment > SE Worksheet

Income Verification and Budgeting

92

The Self-employment worksheet will be required to be completed and returned by the consumer. Failing to provide the completed worksheet will result in a denial.

Lesson 8: Self-Employment > SE Worksheet

Income Verification and Budgeting

93

The Self-employment worksheet can be used in the following circumstances:

•The tax return is no longer representative of the self-employment income. The reason for the discrepancy must also be clearly documented by the applicant and is only allowed when there is a definitive change in the amount of business. In this case, the tax return AND the self-employment worksheet are required to verify the applicant statement.

•It is a new business and a tax return has not been filed.

•It is an existing business, but the applicant has not (or will not) file a tax return.

Lesson 8: Self-Employment > SE Worksheet

Income Verification and Budgeting

Lesson 8: Self-Employment > Summary

In this lesson, we discussed: • Self-employment income is budgeted

using IRS rules. • A tax return is the primary source of

verification. • If a tax return has not been filed or isn’t

representative of current income, the applicant is expected to complete a self-employment worksheet that lists the income and expenses.

Our last lesson will address Prior Medical.

94

Income Verification and Budgeting

Agenda

• Lesson 1: Introduction to MAGI

• Lesson 2: Tier Verifications

• Lesson 3: MAGI vs. Non-MAGI

• Lesson 4: Income Budgeting Policy Updates

• Lesson 5: Reasonable Compatibility

• Lesson 6: Earned Income

• Lesson 7: Unearned Income

• Lesson 8: Self-Employment

• Lesson 9: Prior Medical

95

Income Verification and Budgeting

96

Income budgeting for prior medical determinations is changing. Before deciding if actual income is required, the applicant is asked to identify if they had different circumstances in the prior months.

Note: This policy applies to all of the family medical programs and to the Working Healthy (WH), Medically Needy (MN) and Medicare Savings Programs (MSP – QMB, LMB, ELMB).

It does not apply to the long term care programs – Institutional (nursing homes, hospitals, psychiatric facilities, etc.), Home and Community Based Services (HCBS), Money Follows the Person (MFP), and Program of All-Inclusive Care for the Elderly (PACE).

Lesson 9: Prior Medical

Income Verification and Budgeting

97

The application asks the consumer to answer a series of questions if they want prior medical assistance. They are asked to identify if there have been any changes in:

•Income

•Household

•Assets

If the questions have been left blank staff must contact the applicant to obtain the answers.

Lesson 9: Prior Medical > Reporting Changes

Income Verification and Budgeting

98

There are two separate paths for determining prior

medical income:

Lesson 9: Prior Medical

Income Verification and Budgeting

99

Use the following guidelines when budgeting prior medical income to identify if a change has occurred:

•Have there been any changes in the household during the last three months? (People moving in or out) Examples include but are not limited to:

o A financially responsible case person has moved in our out it is necessary to request actual income

o Any applicant moves in or out of the household

Lesson 9: Prior Medical > Changes in the Household

Income Verification and Budgeting

100

• Have there been any changes in the household income during the last three months? Examples include but are not limited to:

o A job change has been reported in the last 3 months

o A loss of income has occurred in the last 3 monthso A new source of income has begun in the last 3

months

Lesson : Prior Medical > Changes in Income

Income Verification and Budgeting

101

• Have there been any changes in the household assets during the last three months? Examples include but are not limited to:

o An asset is sold o Applicant bought a car o Reduction in bank account balance o Closed a bank account

Lesson 9: Prior Medical > Changes in Assets

Income Verification and Budgeting

Consumers are asked to explain the changes that have occurred. Staff will evaluate the explanation provided by the consumer. Some changes reported by the consumer may not be changes at all. In these situations, the eligibility will be treated as if no change has been reported.

102

Lesson 9: Prior Medical

Income Verification and Budgeting

103

Simply reporting a change in the prior period does not mean verification and budgeting of actual income will always be required.

The reported change must be in the rate of pay (ie: received a raise or pay cut) or the regularly scheduled hours of work (ie: weekly hours were increased or decreased).

Missing a few days of work due to sickness or working some occasional extra hours or overtime does not trigger this change policy. The change must fundamentally alter the expected income to be received.

Lesson 9: Prior Medical > Types of Changes

Income Verification and Budgeting

104

Lesson 10: Prior Medical > Example 1

A 32 year old mother with 4 minor children applies on 10/22/2013 for family medical assistance, including prior medical. She reports her only income is from her job at WalMart (30 hours/week at $10/hour, paid every Friday.) She also reports that there has been no change in income in the prior 3 months.

Her current reported income is verified through The Work Number. Her converted monthly income of $1,290 ($10/hr x 30 hrs/wk x 4.3 = $1,290) is budgeted prospectively for 10/2013 on forward, and for each month of the 3 month prior period (7/2013 thru 9/2013).

01/13 02/13 03/13 04/13 05/13 06/13 07/13 08/13 09/13 10/13 11/13 12/13$1,290 $1,290 $1,290 $1,290 $1,290 $1,290

Income Verification and Budgeting

105

A 73 year old single woman applies on 11/15/2013 for Medically Needy (MN) and Medicare Savings Program (MSP) coverage, including prior medical. Her reported income is Social Security of $1,083/month and $50/week she earns by cleaning the church she attends. She also reports that there has been no change in income in the prior 3 months.

Her reported SSA income is verified through the SSA interface and her current earned income is verified through the Work Number. Her monthly SSA income of $1,083 and converted monthly earned income of $215 ($50/wk X 4.3 = $215) is budgeted prospectively for 11/2013 on forward, and for each month of the 3 month prior period.

Lesson 10: Prior Medical > Example 2

01/13 02/13 03/13 04/13 05/13 06/13 07/13 08/13 09/13 10/13 11/13 12/13$1,083$215

$1,083$215

$1,083$215

$1,083$215

$1,083$215

Income Verification and Budgeting

106

A single mother with 2 minor children applies on 11/19/2013 for family medical assistance, including prior medical. Her only reported income is from a full-time job at Target (40 hours/week at $10.00/hour, paid twice a month). She reports that there has been a change in income in the prior 3 months – she received a .25 cent/hour pay raise sometime in 08/2013.

Her current reported income is verified through the Work Number. Her converted monthly income of $1,720 ($10.00/hr X 40 hrs/wk X 2.15 X 2 = $1,720) is budgeted prospectively for 10/2013 on forward. Since a change in income has been reported in the prior 3 months, actual income must be verified and budgeted for each of those months.

Paystubs were provided verifying actual earnings for the prior period:

08/03/2013: $936 09/03/2013: $880 10/03/2013: $88008/18/2013: $780 09/18/2013: $800 10/18/2013: $960------------------------- ------------------------- ------------------------- $1,716 $1,680 $1,840

Lesson 10: Prior Medical > Example 3

01/13 02/13 03/13 04/13 05/13 06/13 07/13 08/13 09/13 10/13 11/13 12/13$1,716 $1,680 $1,840 $1,720 $1,720

Income Verification and Budgeting

107

A single father with 3 minor children applies on 10/1/2013 for family medical assistance, including prior medical. His only reported income is a full-time job as a mechanic at the local garage (40 hours/week at $18/hour, paid every other Tuesday). He reports that there has been a change in income in the prior 3 months – he changed jobs (including missing 2 weeks of work), but his scheduled hours per week and rate of pay were the same in his old job.

His current reported income is verified through the Department of Labor interface (reasonably compatible). His converted monthly income of $3,096 ($18/hr x 40 hrs/wk x 2 x 2.15 = $3,096) is budgeted prospectively for 10/2013 on forward. Even though he reports a change in income in the prior 3 months, since it is not a change in either rate of pay or scheduled hours of work, it is not considered a change for budgeting purposes. Since there is no change, the amount of his verified current reported income will also be budgeted for each of the prior 3 months.

Lesson 10: Prior Medical > Example 4

01/13 02/13 03/13 04/13 05/13 06/13 07/13 08/13 09/13 10/13 11/13 12/13$3,096 $3,096 $3,096 $3,096 $3,096 $3,096

Income Verification and Budgeting

Lesson 10: Prior Medical > Summary

In this lesson, we discussed:

• The method of budgeting prior medical is dependent upon whether the applicant has had changes in the prior three months.

• If no changes are reported, use the information budgeted for the current month and apply it to the prior months.

• If there are changes, request actual income for all three prior months.

108

Income Verification and Budgeting

Wrap up

That concludes the Income Verification and Budgeting Webinar.

In this course, you learned about: •MAGI•Tier Verifications•MAGI vs. Non-MAGI•Income Budgeting Policy Updates•Reasonable Opportunity•Earned Income•Unearned Income•Self-Employment•Prior Medical

109

110

Income Verification and BudgetingQuestions

Webinar is being Recorded

• A recording of this webinar will be available for those who could not attend the webinar.

• A link to the recording will be distributed to the RRAs and Regional Trainers to share with staff.

111