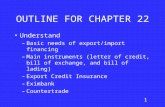

Import Financing

-

Upload

abhishek-dutta -

Category

Documents

-

view

5 -

download

0

description

Transcript of Import Financing

-

5/21/2018 Import Financing

1/24

Import Financing

Nalind Saxena

-

5/21/2018 Import Financing

2/24

Roadmap FEMA regulations relating to import

Buyers credit and suppliers credit

External Commercial borrowings

-

5/21/2018 Import Financing

3/24

ImportsRegulatory checklist DGFTForeign Trade Policy

Normal banking practices & UCP guidelines forletters of credit

Compliance with IT Act where applicable

Compliance with R&D cess Act for import ofdrawings and designs

Compliance with KYC norms A-I form to be used for imports in excess of USD

500

EC Copy of Import Licenses for items in negative

list

-

5/21/2018 Import Financing

4/24

FEMA Obligations Forex can be used either for the purpose furnished by buyer or for any purpose for

which forex can be purchased- Sec 10 (6) of FEMA

AD can open LCs, make remittances etc for all permissible imports

Evidence of Import of goods to be obtained when Fx used for import

Modes of paymentremittances from India or credit to account of overseas

supplier in India

Remittances against Imports to be normally completed within 180 days from date

of shipment

Import of books to be allowed - no time restriction provided interest if any is asapplicable under Trade credit

Delegation to ADs to allow delayed remittancesfinancial difficulties, disputes

etc.

Interest on delayed import bills, usance bills, overdue interest upto three years in

terms of interest applicable to trade credits

-

5/21/2018 Import Financing

5/24

Definition Deferred payment arrangements, including suppliers and

buyers credit, providing for payments beyond a period of six

months from date of shipment up to a period of less than

three years, are treated as trade credits for which the

procedural guidelines laid down in the Master Circular for

External Commercial Borrowings and Trade Credits may be

followed.(Imports)

Trade Credits (TC) refer to credits extended for imports

directly by the overseas supplier, bank and financial

institution for maturity of less than three years. (ECBs and

TCs)

-

5/21/2018 Import Financing

6/24

Advance Remittances AD can allow upto USD 100,000 without guarantee

Discretion to allow upto USD 5 million without guaranteetrack record and own guidelines

For PSUs waiving guarantee beyond USD 100,000 requiresapproval from MoF.

Advance remittance for diamond imports from specifiedmining companies without limits subject to: Recognition of importer by Gem and Jewellery EPC

Good track record of realisation and requirement in sale contract

No conflict diamonds

KYC, due diligence, commercial judgment of AD

Half yearly statement to RBI of advance remittances withoutguarantee in excess of USD 5,000,000

-

5/21/2018 Import Financing

7/24

Adv RemittancesAircraft AD can permit remittances upto USD 50 mio

for import of aircraft waiving requirement of

guarantee subject to: KYC, due diligence, commercial judgment

Payment in terms of sale contract and direct to

manufacturer

Documentary evidence of import within specifiedtime - undertaking

Approval of DGCA

Ensure refund in case of non import

-

5/21/2018 Import Financing

8/24

Service imports Advance Remittance: No ceiling for amounts with

guarantee

May permit USD 500,000 without guarantee in case

of service contracts Obligation to ensure fulfillment of contract

BPOs may be allowed to make remittances towardsthe cost of equipment for their overseas sites for

setting up International Call Centres subject to: Approval of Ministry of IT for setting up ICC Remittance in terms of contract direct to overseas supplier

Evidence of importcertificate from CEO/ Auditor

-

5/21/2018 Import Financing

9/24

Trade Credit Suppliers credit and buyers credit upto 3 years

SC and BC 3 years and aboveECB

AD can approve TC upto 20 million per import For non CG for maturity upto one year from date of shipment For CG for maturity upto 3 years from date of shipment

No rollover and extension beyond the periods

No TCs beyond USD 20 million without prior approval of RBI

All in cost ceiling currently at LIBOR + 200 bps ( all

inclusive ADs can issue guarantees/ LoCs etc for facilitating

TCs

Reporting to RBI

-

5/21/2018 Import Financing

10/24

Direct receipt of import bills Should be received through AD normally

Exceptions Value of import does not exceed USD 300,000

Bills received by WOS of foreign cos.

Bills received by Status holders, 100% EOUs, SEZ units, PSU

All limited companies

Specified sectorDiamonds upto USD 300,000 with

documentary evidence of import Direct receipt by AD from overseas supplierAD satisfied of

financial standing etc., report on overseas supplier for imports

exceeding USD 300,000

-

5/21/2018 Import Financing

11/24

Documentary Evidence of import

Physical imports in excess of USD 100,000 EC copy of BE for HC, EC copy for Warehousing in case of EOUs

Customs assessment certificate or postal appraisal certificate for postalimports

If remittance on DA basis insist on D/E of import before remittance

Alternate documents Certificate from CEO/auditor of company if amount less than USD

1,000,000

Listed company with net worth over Rs 100 cr/ PSU etc

Academic bodies like IIT/ IISc etc Non physical importsCA certificate

Issue of acknowledgement, instructions for preservation,reporting in BEF etc.

-

5/21/2018 Import Financing

12/24

Import of gold, precious metals etc

Direct import of gold allowed by EOUs, SEZunits etc and nominated agencies

Total trade credit not to exceed 90 days fromdate of shipment

AD to ensure KYC/AML

Credentials of supplier to be checked

Large unusual transactions to be watched

Import by nominated agencies etc. onconsignment basis or unfixed price basis

-

5/21/2018 Import Financing

13/24

Import Factoring

Financial service that enables purchase of goodsfrom overseas supplier on short term credit of upto180 days on open account terms without the need for

opening a letter of credit (LC). Import factoring works on a two factor platform

Supplier approaches Export factor in his country torequest a credit line on India buyer

Export factor applies to import factor for evaluation ofcredit risk, collection and due date payment

Both factors are generally members of FCI

-

5/21/2018 Import Financing

14/24

Merchanting Trade

Goods involved permitted to be imported

All regulation for export and import except

GR and BE to be followed Entire transaction to be completed within 6

months

Forex outlay not to exceed 3 months

Payment received on export leg in time

No trade credit can be availed at any stage

-

5/21/2018 Import Financing

15/24

External Commercial borrowings

(ECB)

Commercial loans in the form of bank loans, buyerscredit, suppliers credit, securitized instrumentsavailed of from non-resident lenders with minimumaverage maturity of 3 years

FCCBs, FCEBs need to follow ECB guidelines

Preference shares, debentures and such capitalmarket instruments with debt characteristics need toadhere to ECB Guidelines to the extent applicable

Companies in real sectorindustrial andinfrastructure and specified service sectors can raiseECB under Automatic route

-

5/21/2018 Import Financing

16/24

ECBAutomatic route Eligible borrowers :

Corporates - includes software, hotels and hospitals, but excludesfinancial intermediaries. Individuals and trusts not eligible

Units in SEZ for own use only

NGOs in microfinance with a borrowing relationship with AD and fitand proper status certified by AD

IFCs upto 50% of owned funds

Recognised lenders:

Internationally recognised sources like international banks, capitalmarkets, multilateral financial institutions, export credit agencies,suppliers of equipment, foreign equity holders (subject to conditions)

Overseas organisations lending to NGOs in MF and individuallenders require due diligence certificate from their overseas bank

http://localhost/var/www/apps/conversion/tmp/scratch_3/Import%20Financing.ppthttp://localhost/var/www/apps/conversion/tmp/scratch_3/Import%20Financing.ppt -

5/21/2018 Import Financing

17/24

ECBInfrastructure Finance cos

NBFCs engaged in financing infrastructure and

classified as such by RBI vide DNBS.PD. CC No.

168 / 03.02.089 /2009-10 dated Feb 12, 2010 can

avail ECB under Automatic route upto 50% of

owned funds

Compliance with terms of circular dated Feb 12, 2010

Hedging of risk in full Total outstanding ECBs not to exceed 50% of owned

funds

-

5/21/2018 Import Financing

18/24

Maturity & Amount Corporates other than in service sector USD 500 mio per

financial year

Corporates in hotels, software and hospitals USD 100 mio per

financial year NGOs in Microfinance USD 5 mio per fin year

Of the eligible amount a maximum amount of USD 20 miocan have average maturity of 3 years to 5 years

All ECBs above USD 20 mio must have average maturity of5 years and above

All in cost ceilings as prescribed from time to time

-

5/21/2018 Import Financing

19/24

End use Investment [such as import of capital goods, new projects, modernization /expansion of

existing production units in the real sector - industrial sector including small and

medium enterprises (SME), infrastructure sector and specific service sectors, namely

hotel, hospital and software - in India.

Overseas investments in JVs WOS

Acquisition of shares in disinvestment of PSUs Payment for 3G license etc.

For onlending to SHGs etc by NGOs in MF

Premature buyback of FCCBs as and when permitted

DONTs

No onlending, investment in capital market or acquisition of company part of whole permitted out of ECB funds

No investment in real estate

No working capital, refinancing Rupee loans, general corporate purpose etc permitted

No issue of guarantees by AD

-

5/21/2018 Import Financing

20/24

ECBssecurity

Choice of security left to borrower

AD delegated powers to convey no objection

to borrowers under FEMA for creation ofcharge on immovable assets, financialsecurities, personal guarantees etc. subject to:

ECB compliant with Guidelines

Requirement of the security in the loan agreement Loan registered with RBI

NOC to include conditions specified by RBI

-

5/21/2018 Import Financing

21/24

ECBsMisc provisions Parking of ECB proceedsabroad in specified assets or

banks or remitted to India to be retained as Rupee deposit tillactual requirement

Prepayment can be permitted by AD upto USD 500 miosubject to compliance of min average maturity

Refinancing of existing ECB with another provided lower allin cost and maintenance of original maturity

Buyback of FCCBs

Servicing ECB

Note to obtain LRN before drawdown

-

5/21/2018 Import Financing

22/24

ECBsApproval route

Eligible borrowers: Financial institutions dealing exclusively in infrastructure or

exports

Banks and FIs participating in steel and textile restructuringpackage approved by GOI

NBFCs in infrastructure beyond Auto Route

FCCBs by HFCs

SPVs set up for infrastructure financing and notified

Multi state co-op societies in mfg

SEZ developers for infrastructure as defined

Corporates who have violated norms or are under EDinvestigation etc

Cases falling outside purview of Auto Route

-

5/21/2018 Import Financing

23/24

ECBs- Approval Route Recognised lenderon similar lines as Auto Route

Maturity and AmountAmounts in excess of USD 500 mioin a financial year can be considered under Approval Route.Maturity restrictions apply

Costsame as auto route Guarantee for ECB for SME only considered under Approval

Route

Prepayment in excess of USD 500 mio

Buyback of FCCBs outside Auto route Cases considered by Empowered Committee

Reporting and dissemination of informationform 83, ECBand ECB 2

-

5/21/2018 Import Financing

24/24

Structured Obligations Rupee denominated structured obligations can be

credit enhanced by international banks, FIs, JVpartners etc. under approval route

Credit enhancement permissible for domestic debtraised in the capital markets by Indian companiesengaged exclusively in infrastructure andinfrastructure financing companies classified as such

by RBI: Credit enhancement by multilateral regional financial institutions

and Govt owned FIs

Minimum average maturity of 7 years

Guarantee fee / all in cost2%

![Welcome [] · Zülküf Küçüközer TriangleCanvas.java import javax.microedition.lcdui.Graphics; import javax.microedition.lcdui.game.*; import javax.microedition.m3g.*;](https://static.fdocuments.in/doc/165x107/5d31f91d88c9937a3b8ccf67/welcome-zuelkuef-kuecuekoezer-trianglecanvasjava-import-javaxmicroeditionlcduigraphics.jpg)