IL-700-T, Illinois Withholding Tables Effective January 1, 2016

Transcript of IL-700-T, Illinois Withholding Tables Effective January 1, 2016

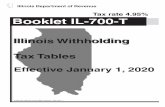

Illinois Withholding Tax Tables

Illinois Department of Revenue

Booklet IL-700-T

Illinois Withholding Tax Tables

Effective January 1, 2018

Tax rate 4.95%

Page 2 (Effective January 1, 2018) Booklet IL-700-T (R-12/17)

Table of Contents

General Information

How to Figure the Amount to Withhold

Withholding Tax Tables

What is the purpose of this booklet? ...................................................................................3Where do I get help? ...........................................................................................................3

How much do I withhold? ....................................................................................................3How do I figure the amount to withhold? .............................................................................3 Using the tax tables in this booklet .................................................................................3 Example using the tax tables in this booklet ..................................................................3What other method may I use to figure the amount of tax that I should withhold? ..............4 Automated payroll method .............................................................................................4 Automated payroll method example ...............................................................................4

Daily Payroll Period ............................................................................................................5Weekly Payroll Period ........................................................................................................6Bi-weekly Payroll Period ...................................................................................................11Semi-monthly Payroll Period ............................................................................................15Monthly Payroll Period ......................................................................................................19

Where to Get Help ..........................................................................................................23

Where to Get Forms, Instructions, and Publications ...................................................23

Where to Get Other Assistance ......................................................................................23

**Please note that there are several income tax changes that affect 2018 withholding.• The tax rate increased per Public Act 100-0022.• The exemption allowance decreased per the sunset of Public Act 97-0652.

For additional information, see FY 2018-03, Withholding Tax Rate and Personal Exemption Amount Changes, and FY2018-XX, What’s New for Illinois Income Tax, for more information.

Booklet IL-700-T (R-12/17) (Effective January 1, 2018) Page 3

General InformationWhat is the purpose of this

booklet?

Where do I get help?

This booklet contains Illinois Income Tax withholding tables. The tables begin on Page 5. It also explains how to figure the amount of Illinois Income Tax that you should withhold using the tables in this booklet.

For answers to questions about your responsibilities as an Illinois withholding agent, see Publication 130, Who is Required to Withhold Illinois Income Tax, and Publication 131, Withholding Income Tax Filing and Payment Requirements. For help with other questions, see “Where to Get Help” on Page 23 of this booklet.

Generally, the rate for withholding Illinois Income Tax is 4.95 percent. For wages and other compensation, subtract any exemptions from the wages paid and multiply the result by 4.95 percent. For details about how much to withhold for other types of payments (i.e., Il-linois Lottery or gambling winnings subject to federal income tax withholding requirements), see Publication 130, Who is Required to Withhold Illinois Income Tax?.

The income tax rate is 4.95 percent and the exemption allowance is $2,000. You may use the tax tables in this booklet to determine how much tax you must withhold. To use the tax tables in this booklet, follow the steps below.

Step 1 Find the table for your payroll period (i.e., how often you pay your employee).Step 2 Read down the column labeled “Wages” and locate the dollar range that contains

the amount of your employee’s wages. Read across the row until you find the dollar amount under the number of allowances your employee claimed on Line 1 of Form IL-W-4. If your employee did not claim any allowances on Line 2 of Form IL-W-4 and did not request that you withhold an additional amount of tax (Line 3 of Form IL-W-4), this is the amount of tax that you must withhold.

Step 3 If your employee claimed allowances on Line 2 of Form IL-W-4, subtract the amount identified at the top of the table from the amount found in Step 2. You must make one subtraction for each allowance your employee claimed on Line 2 of Form IL-W-4.

Step 4 If your employee requested that you withhold an additional amount (Line 3 of Form IL-W-4), add that amount to the amount from Step 2 (or Step 3, if applicable). This is the total amount of tax you must withhold.

You pay Mary $300 every week. She claims three allowances on her Form IL-W-4. Two allowances are claimed on IL-W-4, Line 1, and one allowance is claimed on Form IL-W-4, Line 2. You withhold $10.14 from her pay.

Step 1 Weekly payroll tableStep 2 Locate dollar range and amount to withhold based on allowances claimed .................................................................$ 11.09 Step 3 Subtract $0.95 for the exemption claimed on Line 2 ...............................— 0.95 Tax withheld ...........................................................................................$ 10.14

How to Figure the Amount to Withhold

Example

How much do I withhold?

How do I figure the amount to withhold?

Using the tax tables in this booklet

Wages Number of allowances claimed on Line 1 of Form IL-W-4

at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $0.95 for each allowance least than Withhold this amount of Illinois Income Tax claimed on Line 2 of Form IL-W-4.)

$300 $302 $14.90 $13.00 $11.09 $9.19 $7.28 $5.38 $3.48 $1.57 $302 $304 $15.00 $13.09 $11.19 $9.29 $7.38 $5.48 $3.58 $1.67 $304 $306 $15.10 $13.19 $11.29 $9.39 $7.48 $5.58 $3.67 $1.77

Weekly Payroll Period

Page 4 (Effective January 1, 2018) Booklet IL-700-T (R-12/17)

If you prefer, you may use the automated payroll method to figure the amount of Illinois Income Tax you should withhold.

Tax withheld =

.0495 x (Wages — ((Line 1 allowances x $2,000) + (Line 2 allowances x $1,000))) number of pay periods in a year

To determine how much to withhold using the automated payroll method formula, fol-low these steps:

Step 1 Determine the wages paid for the payroll period.

Step 2 Figure your employee’s exemptions using the allowances claimed on Form IL-W-4. a Multiply the number of allowances your employee claimed on Form IL-W-4, Line 1, by $2,000.b Multiply the number of allowances your employee claimed on Form IL-W-4,

Line 2, by $1,000.c Add your answers from Step 2a and Step 2b.d Divide the result of Step 2c by the number of pay periods from the table. The

result is your employee’s exemptions.

Step 3 Subtract the exemptions from the wages paid. The result is the taxable amount.

Step 4 Multiply the taxable amount by 4.95 percent (.0495). You must withhold this amount.

Step 5 Add any additional amount from Form IL-W-4, Line 3. This is the total amount you withhold.

The example below illustrates how to figure the amount to withhold using the automated payroll method.

You pay Alice $800 every week. She claims four allowances on her Form IL-W-4. Two allowances are claimed on Form IL-W-4, Line 1, and two allowances are claimed on Form IL-W-4, Line 2. You withhold $33.89 from her pay.Step 1 Determine the wages paid $ 800.00Step 2 Figure your employee’s exemptions (based on Form IL-W-4). a 2 x $2,000 = $4,000 (Line 1 x $2,000) b 2 x $1,000 = $2,000 (Line 2 x $1,000) c $4,000 + $2,000 = $6,000 (Step 2a + Step 2b) d $6,000 ÷ 52 pay periods = $115.38Step 3 Subtract the amount exempt from withholding. — 115.38 Taxable amount $ 684.62Step 4 Multiply by the tax rate x .0495 Illinois Income Tax withheld $ 33.89

What other method may I use to figure the amount of tax that I should withhold?

Automated payroll method

Number of pay

periods in a year Weekly payroll 52 Bi-weekly payroll 26 Semi-monthly payroll 24 Monthly payroll 12 Bi-monthly payroll 6 Quarterly payroll 4 Semi-annual payroll 2 Annual payroll 1

Automated payroll method example

Example

Booklet IL-700-T (R-12/17) (Effective January 1, 2018) Page 5

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate

Daily Payroll Period Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $0.14 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$0 $2 $0.05 $2 $4 $0.15 $4 $6 $0.25 $6 $8 $0.35 $0.08 $8 $10 $0.45 $0.17 $10 $12 $0.54 $0.27 $12 $14 $0.64 $0.37 $0.10 $14 $16 $0.74 $0.47 $0.20 $16 $18 $0.84 $0.57 $0.30 $18 $20 $0.94 $0.67 $0.40 $0.13 $20 $22 $1.04 $0.77 $0.50 $0.23 $22 $24 $1.14 $0.87 $0.60 $0.32 $24 $26 $1.24 $0.97 $0.70 $0.42 $0.15 $26 $28 $1.34 $1.07 $0.79 $0.52 $0.25 $28 $30 $1.44 $1.16 $0.89 $0.62 $0.35 $30 $32 $1.53 $1.26 $0.99 $0.72 $0.45 $0.18 $32 $34 $1.63 $1.36 $1.09 $0.82 $0.55 $0.28 $34 $36 $1.73 $1.46 $1.19 $0.92 $0.65 $0.38 $36 $38 $1.83 $1.56 $1.29 $1.02 $0.75 $0.48 $0.20 $38 $40 $1.93 $1.66 $1.39 $1.12 $0.85 $0.57 $0.30 $40 $42 $2.03 $1.76 $1.49 $1.22 $0.94 $0.67 $0.40 $42 $44 $2.13 $1.86 $1.59 $1.31 $1.04 $0.77 $0.50 $0.23 $44 $46 $2.23 $1.96 $1.69 $1.41 $1.14 $0.87 $0.60 $0.33 $46 $48 $2.33 $2.06 $1.78 $1.51 $1.24 $0.97 $0.70 $0.43 $48 $50 $2.43 $2.15 $1.88 $1.61 $1.34 $1.07 $0.80 $0.53 $0.26 $50 $52 $2.52 $2.25 $1.98 $1.71 $1.44 $1.17 $0.90 $0.63 $0.35 $52 $54 $2.62 $2.35 $2.08 $1.81 $1.54 $1.27 $1.00 $0.72 $0.45 $54 $56 $2.72 $2.45 $2.18 $1.91 $1.64 $1.37 $1.10 $0.82 $0.55 $0.28 $56 $58 $2.82 $2.55 $2.28 $2.01 $1.74 $1.47 $1.19 $0.92 $0.65 $0.38 $58 $60 $2.92 $2.65 $2.38 $2.11 $1.84 $1.56 $1.29 $1.02 $0.75 $0.48 $60 $62 $3.02 $2.75 $2.48 $2.21 $1.93 $1.66 $1.39 $1.12 $0.85 $0.58 $0.31 $62 $64 $3.12 $2.85 $2.58 $2.30 $2.03 $1.76 $1.49 $1.22 $0.95 $0.68 $0.41 $64 $66 $3.22 $2.95 $2.68 $2.40 $2.13 $1.86 $1.59 $1.32 $1.05 $0.78 $0.51 $66 $68 $3.32 $3.05 $2.77 $2.50 $2.23 $1.96 $1.69 $1.42 $1.15 $0.88 $0.60 $68 $70 $3.42 $3.14 $2.87 $2.60 $2.33 $2.06 $1.79 $1.52 $1.25 $0.97 $0.70 $70 $72 $3.51 $3.24 $2.97 $2.70 $2.43 $2.16 $1.89 $1.62 $1.34 $1.07 $0.80 $72 $74 $3.61 $3.34 $3.07 $2.80 $2.53 $2.26 $1.99 $1.71 $1.44 $1.17 $0.90 $74 $76 $3.71 $3.44 $3.17 $2.90 $2.63 $2.36 $2.09 $1.81 $1.54 $1.27 $1.00 $76 $78 $3.81 $3.54 $3.27 $3.00 $2.73 $2.46 $2.18 $1.91 $1.64 $1.37 $1.10 $78 $80 $3.91 $3.64 $3.37 $3.10 $2.83 $2.55 $2.28 $2.01 $1.74 $1.47 $1.20 $80 $82 $4.01 $3.74 $3.47 $3.20 $2.92 $2.65 $2.38 $2.11 $1.84 $1.57 $1.30 $82 $84 $4.11 $3.84 $3.57 $3.29 $3.02 $2.75 $2.48 $2.21 $1.94 $1.67 $1.40 $84 $86 $4.21 $3.94 $3.67 $3.39 $3.12 $2.85 $2.58 $2.31 $2.04 $1.77 $1.50 $86 $88 $4.31 $4.04 $3.76 $3.49 $3.22 $2.95 $2.68 $2.41 $2.14 $1.87 $1.59 $88 $90 $4.41 $4.13 $3.86 $3.59 $3.32 $3.05 $2.78 $2.51 $2.24 $1.96 $1.69 $90 $92 $4.50 $4.23 $3.96 $3.69 $3.42 $3.15 $2.88 $2.61 $2.33 $2.06 $1.79 $92 $94 $4.60 $4.33 $4.06 $3.79 $3.52 $3.25 $2.98 $2.70 $2.43 $2.16 $1.89 $94 $96 $4.70 $4.43 $4.16 $3.89 $3.62 $3.35 $3.08 $2.80 $2.53 $2.26 $1.99 $96 $98 $4.80 $4.53 $4.26 $3.99 $3.72 $3.45 $3.17 $2.90 $2.63 $2.36 $2.09 $98 $100 $4.90 $4.63 $4.36 $4.09 $3.82 $3.54 $3.27 $3.00 $2.73 $2.46 $2.19

$100 or more 4.95% of the amount in excess of $100 plus: $4.95 $4.68 $4.41 $4.14 $3.86 $3.59 $3.32 $3.05 $2.78 $2.51 $2.24

Page 6 (Effective January 1, 2018) Booklet IL-700-T (R-12/17)

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate

Weekly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $0.95 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$0 $2 $0.05 $2 $4 $0.15 $4 $6 $0.25 $6 $8 $0.35 $8 $10 $0.45 $10 $12 $0.54 $12 $14 $0.64 $14 $16 $0.74 $16 $18 $0.84 $18 $20 $0.94 $20 $22 $1.04 $22 $24 $1.14 $24 $26 $1.24 $26 $28 $1.34 $28 $30 $1.44 $30 $32 $1.53 $32 $34 $1.63 $34 $36 $1.73 $36 $38 $1.83 $38 $40 $1.93 $40 $42 $2.03 $42 $44 $2.13 $0.22 $44 $46 $2.23 $0.32 $46 $48 $2.33 $0.42 $48 $50 $2.43 $0.52 $50 $52 $2.52 $0.62 $52 $54 $2.62 $0.72 $54 $56 $2.72 $0.82 $56 $58 $2.82 $0.92 $58 $60 $2.92 $1.02 $60 $62 $3.02 $1.12 $62 $64 $3.12 $1.21 $64 $66 $3.22 $1.31 $66 $68 $3.32 $1.41 $68 $70 $3.42 $1.51 $70 $72 $3.51 $1.61 $72 $74 $3.61 $1.71 $74 $76 $3.71 $1.81 $76 $78 $3.81 $1.91 $78 $80 $3.91 $2.01 $80 $82 $4.01 $2.11 $82 $84 $4.11 $2.20 $84 $86 $4.21 $2.30 $0.40 $86 $88 $4.31 $2.40 $0.50 $88 $90 $4.41 $2.50 $0.60 $90 $92 $4.50 $2.60 $0.70 $92 $94 $4.60 $2.70 $0.80 $94 $96 $4.70 $2.80 $0.89 $96 $98 $4.80 $2.90 $0.99 $98 $100 $4.90 $3.00 $1.09

Booklet IL-700-T (R-12/17) (Effective January 1, 2018) Page 7

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate

Weekly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $0.95 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$100 $102 $5.00 $3.10 $1.19 $102 $104 $5.10 $3.19 $1.29 $104 $106 $5.20 $3.29 $1.39 $106 $108 $5.30 $3.39 $1.49 $108 $110 $5.40 $3.49 $1.59 $110 $112 $5.49 $3.59 $1.69 $112 $114 $5.59 $3.69 $1.79 $114 $116 $5.69 $3.79 $1.88 $116 $118 $5.79 $3.89 $1.98 $118 $120 $5.89 $3.99 $2.08 $120 $122 $5.99 $4.09 $2.18 $122 $124 $6.09 $4.18 $2.28 $124 $126 $6.19 $4.28 $2.38 $126 $128 $6.29 $4.38 $2.48 $0.57 $128 $130 $6.39 $4.48 $2.58 $0.67 $130 $132 $6.48 $4.58 $2.68 $0.77 $132 $134 $6.58 $4.68 $2.78 $0.87 $134 $136 $6.68 $4.78 $2.87 $0.97 $136 $138 $6.78 $4.88 $2.97 $1.07 $138 $140 $6.88 $4.98 $3.07 $1.17 $140 $142 $6.98 $5.08 $3.17 $1.27 $142 $144 $7.08 $5.17 $3.27 $1.37 $144 $146 $7.18 $5.27 $3.37 $1.47 $146 $148 $7.28 $5.37 $3.47 $1.56 $148 $150 $7.38 $5.47 $3.57 $1.66 $150 $152 $7.47 $5.57 $3.67 $1.76 $152 $154 $7.57 $5.67 $3.77 $1.86 $154 $156 $7.67 $5.77 $3.86 $1.96 $156 $158 $7.77 $5.87 $3.96 $2.06 $158 $160 $7.87 $5.97 $4.06 $2.16 $160 $162 $7.97 $6.07 $4.16 $2.26 $162 $164 $8.07 $6.16 $4.26 $2.36 $164 $166 $8.17 $6.26 $4.36 $2.46 $166 $168 $8.27 $6.36 $4.46 $2.55 $168 $170 $8.37 $6.46 $4.56 $2.65 $0.75 $170 $172 $8.46 $6.56 $4.66 $2.75 $0.85 $172 $174 $8.56 $6.66 $4.76 $2.85 $0.95 $174 $176 $8.66 $6.76 $4.85 $2.95 $1.05 $176 $178 $8.76 $6.86 $4.95 $3.05 $1.15 $178 $180 $8.86 $6.96 $5.05 $3.15 $1.25 $180 $182 $8.96 $7.06 $5.15 $3.25 $1.34 $182 $184 $9.06 $7.15 $5.25 $3.35 $1.44 $184 $186 $9.16 $7.25 $5.35 $3.45 $1.54 $186 $188 $9.26 $7.35 $5.45 $3.54 $1.64 $188 $190 $9.36 $7.45 $5.55 $3.64 $1.74 $190 $192 $9.45 $7.55 $5.65 $3.74 $1.84 $192 $194 $9.55 $7.65 $5.75 $3.84 $1.94 $194 $196 $9.65 $7.75 $5.84 $3.94 $2.04 $196 $198 $9.75 $7.85 $5.94 $4.04 $2.14 $198 $200 $9.85 $7.95 $6.04 $4.14 $2.24

Page 8 (Effective January 1, 2018) Booklet IL-700-T (R-12/17)

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate

Weekly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $0.95 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$200 $202 $9.95 $8.05 $6.14 $4.24 $2.33 $202 $204 $10.05 $8.14 $6.24 $4.34 $2.43 $204 $206 $10.15 $8.24 $6.34 $4.44 $2.53 $206 $208 $10.25 $8.34 $6.44 $4.53 $2.63 $208 $210 $10.35 $8.44 $6.54 $4.63 $2.73 $210 $212 $10.44 $8.54 $6.64 $4.73 $2.83 $0.93 $212 $214 $10.54 $8.64 $6.74 $4.83 $2.93 $1.02 $214 $216 $10.64 $8.74 $6.83 $4.93 $3.03 $1.12 $216 $218 $10.74 $8.84 $6.93 $5.03 $3.13 $1.22 $218 $220 $10.84 $8.94 $7.03 $5.13 $3.23 $1.32 $220 $222 $10.94 $9.04 $7.13 $5.23 $3.32 $1.42 $222 $224 $11.04 $9.13 $7.23 $5.33 $3.42 $1.52 $224 $226 $11.14 $9.23 $7.33 $5.43 $3.52 $1.62 $226 $228 $11.24 $9.33 $7.43 $5.52 $3.62 $1.72 $228 $230 $11.34 $9.43 $7.53 $5.62 $3.72 $1.82 $230 $232 $11.43 $9.53 $7.63 $5.72 $3.82 $1.92 $232 $234 $11.53 $9.63 $7.73 $5.82 $3.92 $2.01 $234 $236 $11.63 $9.73 $7.82 $5.92 $4.02 $2.11 $236 $238 $11.73 $9.83 $7.92 $6.02 $4.12 $2.21 $238 $240 $11.83 $9.93 $8.02 $6.12 $4.22 $2.31 $240 $242 $11.93 $10.03 $8.12 $6.22 $4.31 $2.41 $242 $244 $12.03 $10.12 $8.22 $6.32 $4.41 $2.51 $244 $246 $12.13 $10.22 $8.32 $6.42 $4.51 $2.61 $246 $248 $12.23 $10.32 $8.42 $6.51 $4.61 $2.71 $248 $250 $12.33 $10.42 $8.52 $6.61 $4.71 $2.81 $250 $252 $12.42 $10.52 $8.62 $6.71 $4.81 $2.91 $252 $254 $12.52 $10.62 $8.72 $6.81 $4.91 $3.00 $1.10 $254 $256 $12.62 $10.72 $8.81 $6.91 $5.01 $3.10 $1.20 $256 $258 $12.72 $10.82 $8.91 $7.01 $5.11 $3.20 $1.30 $258 $260 $12.82 $10.92 $9.01 $7.11 $5.21 $3.30 $1.40 $260 $262 $12.92 $11.02 $9.11 $7.21 $5.30 $3.40 $1.50 $262 $264 $13.02 $11.11 $9.21 $7.31 $5.40 $3.50 $1.60 $264 $266 $13.12 $11.21 $9.31 $7.41 $5.50 $3.60 $1.69 $266 $268 $13.22 $11.31 $9.41 $7.50 $5.60 $3.70 $1.79 $268 $270 $13.32 $11.41 $9.51 $7.60 $5.70 $3.80 $1.89 $270 $272 $13.41 $11.51 $9.61 $7.70 $5.80 $3.90 $1.99 $272 $274 $13.51 $11.61 $9.71 $7.80 $5.90 $3.99 $2.09 $274 $276 $13.61 $11.71 $9.80 $7.90 $6.00 $4.09 $2.19 $276 $278 $13.71 $11.81 $9.90 $8.00 $6.10 $4.19 $2.29 $278 $280 $13.81 $11.91 $10.00 $8.10 $6.20 $4.29 $2.39 $280 $282 $13.91 $12.01 $10.10 $8.20 $6.29 $4.39 $2.49 $282 $284 $14.01 $12.10 $10.20 $8.30 $6.39 $4.49 $2.59 $284 $286 $14.11 $12.20 $10.30 $8.40 $6.49 $4.59 $2.68 $286 $288 $14.21 $12.30 $10.40 $8.49 $6.59 $4.69 $2.78 $288 $290 $14.31 $12.40 $10.50 $8.59 $6.69 $4.79 $2.88 $290 $292 $14.40 $12.50 $10.60 $8.69 $6.79 $4.89 $2.98 $292 $294 $14.50 $12.60 $10.70 $8.79 $6.89 $4.98 $3.08 $1.18 $294 $296 $14.60 $12.70 $10.79 $8.89 $6.99 $5.08 $3.18 $1.28 $296 $298 $14.70 $12.80 $10.89 $8.99 $7.09 $5.18 $3.28 $1.37 $298 $300 $14.80 $12.90 $10.99 $9.09 $7.19 $5.28 $3.38 $1.47

Booklet IL-700-T (R-12/17) (Effective January 1, 2018) Page 9

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate

Weekly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $0.95 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$300 $302 $14.90 $13.00 $11.09 $9.19 $7.28 $5.38 $3.48 $1.57 $302 $304 $15.00 $13.09 $11.19 $9.29 $7.38 $5.48 $3.58 $1.67 $304 $306 $15.10 $13.19 $11.29 $9.39 $7.48 $5.58 $3.67 $1.77 $306 $308 $15.20 $13.29 $11.39 $9.48 $7.58 $5.68 $3.77 $1.87 $308 $310 $15.30 $13.39 $11.49 $9.58 $7.68 $5.78 $3.87 $1.97 $310 $312 $15.39 $13.49 $11.59 $9.68 $7.78 $5.88 $3.97 $2.07 $312 $314 $15.49 $13.59 $11.69 $9.78 $7.88 $5.97 $4.07 $2.17 $314 $316 $15.59 $13.69 $11.78 $9.88 $7.98 $6.07 $4.17 $2.27 $316 $318 $15.69 $13.79 $11.88 $9.98 $8.08 $6.17 $4.27 $2.36 $318 $320 $15.79 $13.89 $11.98 $10.08 $8.18 $6.27 $4.37 $2.46 $320 $322 $15.89 $13.99 $12.08 $10.18 $8.27 $6.37 $4.47 $2.56 $322 $324 $15.99 $14.08 $12.18 $10.28 $8.37 $6.47 $4.57 $2.66 $324 $326 $16.09 $14.18 $12.28 $10.38 $8.47 $6.57 $4.66 $2.76 $326 $328 $16.19 $14.28 $12.38 $10.47 $8.57 $6.67 $4.76 $2.86 $328 $330 $16.29 $14.38 $12.48 $10.57 $8.67 $6.77 $4.86 $2.96 $330 $332 $16.38 $14.48 $12.58 $10.67 $8.77 $6.87 $4.96 $3.06 $332 $334 $16.48 $14.58 $12.68 $10.77 $8.87 $6.96 $5.06 $3.16 $334 $336 $16.58 $14.68 $12.77 $10.87 $8.97 $7.06 $5.16 $3.26 $1.35 $336 $338 $16.68 $14.78 $12.87 $10.97 $9.07 $7.16 $5.26 $3.35 $1.45 $338 $340 $16.78 $14.88 $12.97 $11.07 $9.17 $7.26 $5.36 $3.45 $1.55 $340 $342 $16.88 $14.98 $13.07 $11.17 $9.26 $7.36 $5.46 $3.55 $1.65 $342 $344 $16.98 $15.07 $13.17 $11.27 $9.36 $7.46 $5.56 $3.65 $1.75 $344 $346 $17.08 $15.17 $13.27 $11.37 $9.46 $7.56 $5.65 $3.75 $1.85 $346 $348 $17.18 $15.27 $13.37 $11.46 $9.56 $7.66 $5.75 $3.85 $1.95 $348 $350 $17.28 $15.37 $13.47 $11.56 $9.66 $7.76 $5.85 $3.95 $2.04 $350 $352 $17.37 $15.47 $13.57 $11.66 $9.76 $7.86 $5.95 $4.05 $2.14 $352 $354 $17.47 $15.57 $13.67 $11.76 $9.86 $7.95 $6.05 $4.15 $2.24 $354 $356 $17.57 $15.67 $13.76 $11.86 $9.96 $8.05 $6.15 $4.25 $2.34 $356 $358 $17.67 $15.77 $13.86 $11.96 $10.06 $8.15 $6.25 $4.34 $2.44 $358 $360 $17.77 $15.87 $13.96 $12.06 $10.16 $8.25 $6.35 $4.44 $2.54 $360 $362 $17.87 $15.97 $14.06 $12.16 $10.25 $8.35 $6.45 $4.54 $2.64 $362 $364 $17.97 $16.06 $14.16 $12.26 $10.35 $8.45 $6.55 $4.64 $2.74 $364 $366 $18.07 $16.16 $14.26 $12.36 $10.45 $8.55 $6.64 $4.74 $2.84 $366 $368 $18.17 $16.26 $14.36 $12.45 $10.55 $8.65 $6.74 $4.84 $2.94 $368 $370 $18.27 $16.36 $14.46 $12.55 $10.65 $8.75 $6.84 $4.94 $3.03 $370 $372 $18.36 $16.46 $14.56 $12.65 $10.75 $8.85 $6.94 $5.04 $3.13 $372 $374 $18.46 $16.56 $14.66 $12.75 $10.85 $8.94 $7.04 $5.14 $3.23 $374 $376 $18.56 $16.66 $14.75 $12.85 $10.95 $9.04 $7.14 $5.24 $3.33 $376 $378 $18.66 $16.76 $14.85 $12.95 $11.05 $9.14 $7.24 $5.33 $3.43 $1.53 $378 $380 $18.76 $16.86 $14.95 $13.05 $11.15 $9.24 $7.34 $5.43 $3.53 $1.63 $380 $382 $18.86 $16.96 $15.05 $13.15 $11.24 $9.34 $7.44 $5.53 $3.63 $1.72 $382 $384 $18.96 $17.05 $15.15 $13.25 $11.34 $9.44 $7.54 $5.63 $3.73 $1.82 $384 $386 $19.06 $17.15 $15.25 $13.35 $11.44 $9.54 $7.63 $5.73 $3.83 $1.92 $386 $388 $19.16 $17.25 $15.35 $13.44 $11.54 $9.64 $7.73 $5.83 $3.93 $2.02 $388 $390 $19.26 $17.35 $15.45 $13.54 $11.64 $9.74 $7.83 $5.93 $4.02 $2.12 $390 $392 $19.35 $17.45 $15.55 $13.64 $11.74 $9.84 $7.93 $6.03 $4.12 $2.22 $392 $394 $19.45 $17.55 $15.65 $13.74 $11.84 $9.93 $8.03 $6.13 $4.22 $2.32 $394 $396 $19.55 $17.65 $15.74 $13.84 $11.94 $10.03 $8.13 $6.23 $4.32 $2.42 $396 $398 $19.65 $17.75 $15.84 $13.94 $12.04 $10.13 $8.23 $6.32 $4.42 $2.52 $398 $400 $19.75 $17.85 $15.94 $14.04 $12.14 $10.23 $8.33 $6.42 $4.52 $2.62

Page 10 (Effective January 1, 2018) Booklet IL-700-T (R-12/17)

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate

Weekly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $0.95 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$400 $402 $19.85 $17.95 $16.04 $14.14 $12.23 $10.33 $8.43 $6.52 $4.62 $2.71 $402 $404 $19.95 $18.04 $16.14 $14.24 $12.33 $10.43 $8.53 $6.62 $4.72 $2.81 $404 $406 $20.05 $18.14 $16.24 $14.34 $12.43 $10.53 $8.62 $6.72 $4.82 $2.91 $406 $408 $20.15 $18.24 $16.34 $14.43 $12.53 $10.63 $8.72 $6.82 $4.92 $3.01 $408 $410 $20.25 $18.34 $16.44 $14.53 $12.63 $10.73 $8.82 $6.92 $5.01 $3.11 $410 $412 $20.34 $18.44 $16.54 $14.63 $12.73 $10.83 $8.92 $7.02 $5.11 $3.21 $412 $414 $20.44 $18.54 $16.64 $14.73 $12.83 $10.92 $9.02 $7.12 $5.21 $3.31 $414 $416 $20.54 $18.64 $16.73 $14.83 $12.93 $11.02 $9.12 $7.22 $5.31 $3.41 $416 $418 $20.64 $18.74 $16.83 $14.93 $13.03 $11.12 $9.22 $7.31 $5.41 $3.51 $418 $420 $20.74 $18.84 $16.93 $15.03 $13.13 $11.22 $9.32 $7.41 $5.51 $3.61 $1.70 $420 $422 $20.84 $18.94 $17.03 $15.13 $13.22 $11.32 $9.42 $7.51 $5.61 $3.70 $1.80 $422 $424 $20.94 $19.03 $17.13 $15.23 $13.32 $11.42 $9.52 $7.61 $5.71 $3.80 $1.90 $424 $426 $21.04 $19.13 $17.23 $15.33 $13.42 $11.52 $9.61 $7.71 $5.81 $3.90 $2.00 $426 $428 $21.14 $19.23 $17.33 $15.42 $13.52 $11.62 $9.71 $7.81 $5.91 $4.00 $2.10 $428 $430 $21.24 $19.33 $17.43 $15.52 $13.62 $11.72 $9.81 $7.91 $6.00 $4.10 $2.20 $430 $432 $21.33 $19.43 $17.53 $15.62 $13.72 $11.82 $9.91 $8.01 $6.10 $4.20 $2.30 $432 $434 $21.43 $19.53 $17.63 $15.72 $13.82 $11.91 $10.01 $8.11 $6.20 $4.30 $2.40 $434 $436 $21.53 $19.63 $17.72 $15.82 $13.92 $12.01 $10.11 $8.21 $6.30 $4.40 $2.49 $436 $438 $21.63 $19.73 $17.82 $15.92 $14.02 $12.11 $10.21 $8.30 $6.40 $4.50 $2.59 $438 $440 $21.73 $19.83 $17.92 $16.02 $14.12 $12.21 $10.31 $8.40 $6.50 $4.60 $2.69 $440 $442 $21.83 $19.93 $18.02 $16.12 $14.21 $12.31 $10.41 $8.50 $6.60 $4.69 $2.79 $442 $444 $21.93 $20.02 $18.12 $16.22 $14.31 $12.41 $10.51 $8.60 $6.70 $4.79 $2.89 $444 $446 $22.03 $20.12 $18.22 $16.32 $14.41 $12.51 $10.60 $8.70 $6.80 $4.89 $2.99 $446 $448 $22.13 $20.22 $18.32 $16.41 $14.51 $12.61 $10.70 $8.80 $6.90 $4.99 $3.09 $448 $450 $22.23 $20.32 $18.42 $16.51 $14.61 $12.71 $10.80 $8.90 $6.99 $5.09 $3.19 $450 $452 $22.32 $20.42 $18.52 $16.61 $14.71 $12.81 $10.90 $9.00 $7.09 $5.19 $3.29 $452 $454 $22.42 $20.52 $18.62 $16.71 $14.81 $12.90 $11.00 $9.10 $7.19 $5.29 $3.39 $454 $456 $22.52 $20.62 $18.71 $16.81 $14.91 $13.00 $11.10 $9.20 $7.29 $5.39 $3.48 $456 $458 $22.62 $20.72 $18.81 $16.91 $15.01 $13.10 $11.20 $9.29 $7.39 $5.49 $3.58 $458 $460 $22.72 $20.82 $18.91 $17.01 $15.11 $13.20 $11.30 $9.39 $7.49 $5.59 $3.68 $460 $462 $22.82 $20.92 $19.01 $17.11 $15.20 $13.30 $11.40 $9.49 $7.59 $5.68 $3.78 $462 $464 $22.92 $21.01 $19.11 $17.21 $15.30 $13.40 $11.50 $9.59 $7.69 $5.78 $3.88 $464 $466 $23.02 $21.11 $19.21 $17.31 $15.40 $13.50 $11.59 $9.69 $7.79 $5.88 $3.98 $466 $468 $23.12 $21.21 $19.31 $17.40 $15.50 $13.60 $11.69 $9.79 $7.89 $5.98 $4.08 $468 $470 $23.22 $21.31 $19.41 $17.50 $15.60 $13.70 $11.79 $9.89 $7.98 $6.08 $4.18 $470 $472 $23.31 $21.41 $19.51 $17.60 $15.70 $13.80 $11.89 $9.99 $8.08 $6.18 $4.28 $472 $474 $23.41 $21.51 $19.61 $17.70 $15.80 $13.89 $11.99 $10.09 $8.18 $6.28 $4.38 $474 $476 $23.51 $21.61 $19.70 $17.80 $15.90 $13.99 $12.09 $10.19 $8.28 $6.38 $4.47 $476 $478 $23.61 $21.71 $19.80 $17.90 $16.00 $14.09 $12.19 $10.28 $8.38 $6.48 $4.57 $478 $480 $23.71 $21.81 $19.90 $18.00 $16.10 $14.19 $12.29 $10.38 $8.48 $6.58 $4.67 $480 $482 $23.81 $21.91 $20.00 $18.10 $16.19 $14.29 $12.39 $10.48 $8.58 $6.67 $4.77 $482 $484 $23.91 $22.00 $20.10 $18.20 $16.29 $14.39 $12.49 $10.58 $8.68 $6.77 $4.87 $484 $486 $24.01 $22.10 $20.20 $18.30 $16.39 $14.49 $12.58 $10.68 $8.78 $6.87 $4.97 $486 $488 $24.11 $22.20 $20.30 $18.39 $16.49 $14.59 $12.68 $10.78 $8.88 $6.97 $5.07 $488 $490 $24.21 $22.30 $20.40 $18.49 $16.59 $14.69 $12.78 $10.88 $8.97 $7.07 $5.17 $490 $492 $24.30 $22.40 $20.50 $18.59 $16.69 $14.79 $12.88 $10.98 $9.07 $7.17 $5.27 $492 $494 $24.40 $22.50 $20.60 $18.69 $16.79 $14.88 $12.98 $11.08 $9.17 $7.27 $5.37 $494 $496 $24.50 $22.60 $20.69 $18.79 $16.89 $14.98 $13.08 $11.18 $9.27 $7.37 $5.46 $496 $498 $24.60 $22.70 $20.79 $18.89 $16.99 $15.08 $13.18 $11.27 $9.37 $7.47 $5.56 $498 $500 $24.70 $22.80 $20.89 $18.99 $17.09 $15.18 $13.28 $11.37 $9.47 $7.57 $5.66

$500 or more 4.95% of the amount in excess of $500 plus: $24.75 $22.85 $20.94 $19.04 $17.13 $15.23 $13.33 $11.42 $9.52 $7.62 $5.71

Booklet IL-700-T (R-12/17) (Effective January 1, 2018) Page 11

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate

Bi-weekly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $1.90 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.) $0 $5 $0.12 $5 $10 $0.37 $10 $15 $0.62 $15 $20 $0.87 $20 $25 $1.11 $25 $30 $1.36 $30 $35 $1.61 $35 $40 $1.86 $40 $45 $2.10 $45 $50 $2.35 $50 $55 $2.60 $55 $60 $2.85 $60 $65 $3.09 $65 $70 $3.34 $70 $75 $3.59 $75 $80 $3.84 $80 $85 $4.08 $85 $90 $4.33 $0.52 $90 $95 $4.58 $0.77 $95 $100 $4.83 $1.02 $100 $105 $5.07 $1.27 $105 $110 $5.32 $1.51 $110 $115 $5.57 $1.76 $115 $120 $5.82 $2.01 $120 $125 $6.06 $2.26 $125 $130 $6.31 $2.50 $130 $135 $6.56 $2.75 $135 $140 $6.81 $3.00 $140 $145 $7.05 $3.25 $145 $150 $7.30 $3.49 $150 $155 $7.55 $3.74 $155 $160 $7.80 $3.99 $160 $165 $8.04 $4.24 $165 $170 $8.29 $4.48 $0.68 $170 $175 $8.54 $4.73 $0.92 $175 $180 $8.79 $4.98 $1.17 $180 $185 $9.03 $5.23 $1.42 $185 $190 $9.28 $5.47 $1.67 $190 $195 $9.53 $5.72 $1.91 $195 $200 $9.78 $5.97 $2.16 $200 $205 $10.02 $6.22 $2.41 $205 $210 $10.27 $6.46 $2.66 $210 $215 $10.52 $6.71 $2.90 $215 $220 $10.77 $6.96 $3.15 $220 $225 $11.01 $7.21 $3.40 $225 $230 $11.26 $7.45 $3.65 $230 $235 $11.51 $7.70 $3.89 $235 $240 $11.76 $7.95 $4.14 $240 $245 $12.00 $8.20 $4.39 $245 $250 $12.25 $8.44 $4.64

Page 12 (Effective January 1, 2018) Booklet IL-700-T (R-12/17)

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate

Bi-weekly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10

(Subtract $1.90 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$250 $255 $12.50 $8.69 $4.88 $1.08 $255 $260 $12.75 $8.94 $5.13 $1.32 $260 $265 $12.99 $9.19 $5.38 $1.57 $265 $270 $13.24 $9.43 $5.63 $1.82 $270 $275 $13.49 $9.68 $5.87 $2.07 $275 $280 $13.74 $9.93 $6.12 $2.31 $280 $285 $13.98 $10.18 $6.37 $2.56 $285 $290 $14.23 $10.42 $6.62 $2.81 $290 $295 $14.48 $10.67 $6.86 $3.06 $295 $300 $14.73 $10.92 $7.11 $3.30 $300 $305 $14.97 $11.17 $7.36 $3.55 $305 $310 $15.22 $11.41 $7.61 $3.80 $310 $315 $15.47 $11.66 $7.85 $4.05 $315 $320 $15.72 $11.91 $8.10 $4.29 $320 $325 $15.96 $12.16 $8.35 $4.54 $325 $330 $16.21 $12.40 $8.60 $4.79 $330 $335 $16.46 $12.65 $8.84 $5.04 $335 $340 $16.71 $12.90 $9.09 $5.28 $1.48 $340 $345 $16.95 $13.15 $9.34 $5.53 $1.72 $345 $350 $17.20 $13.39 $9.59 $5.78 $1.97 $350 $355 $17.45 $13.64 $9.83 $6.03 $2.22 $355 $360 $17.70 $13.89 $10.08 $6.27 $2.47 $360 $365 $17.94 $14.14 $10.33 $6.52 $2.71 $365 $370 $18.19 $14.38 $10.58 $6.77 $2.96 $370 $375 $18.44 $14.63 $10.82 $7.02 $3.21 $375 $380 $18.69 $14.88 $11.07 $7.26 $3.46 $380 $385 $18.93 $15.13 $11.32 $7.51 $3.70 $385 $390 $19.18 $15.37 $11.57 $7.76 $3.95 $390 $395 $19.43 $15.62 $11.81 $8.01 $4.20 $395 $400 $19.68 $15.87 $12.06 $8.25 $4.45 $400 $405 $19.92 $16.12 $12.31 $8.50 $4.69 $405 $410 $20.17 $16.36 $12.56 $8.75 $4.94 $410 $415 $20.42 $16.61 $12.80 $9.00 $5.19 $415 $420 $20.67 $16.86 $13.05 $9.24 $5.44 $420 $425 $20.91 $17.11 $13.30 $9.49 $5.68 $1.88 $425 $430 $21.16 $17.35 $13.55 $9.74 $5.93 $2.12 $430 $435 $21.41 $17.60 $13.79 $9.99 $6.18 $2.37 $435 $440 $21.66 $17.85 $14.04 $10.23 $6.43 $2.62 $440 $445 $21.90 $18.10 $14.29 $10.48 $6.67 $2.87 $445 $450 $22.15 $18.34 $14.54 $10.73 $6.92 $3.11 $450 $455 $22.40 $18.59 $14.78 $10.98 $7.17 $3.36 $455 $460 $22.65 $18.84 $15.03 $11.22 $7.42 $3.61 $460 $465 $22.89 $19.09 $15.28 $11.47 $7.66 $3.86 $465 $470 $23.14 $19.33 $15.53 $11.72 $7.91 $4.10 $470 $475 $23.39 $19.58 $15.77 $11.97 $8.16 $4.35 $475 $480 $23.64 $19.83 $16.02 $12.21 $8.41 $4.60 $480 $485 $23.88 $20.08 $16.27 $12.46 $8.65 $4.85 $485 $490 $24.13 $20.32 $16.52 $12.71 $8.90 $5.09 $490 $495 $24.38 $20.57 $16.76 $12.96 $9.15 $5.34 $495 $500 $24.63 $20.82 $17.01 $13.20 $9.40 $5.59

Booklet IL-700-T (R-12/17) (Effective January 1, 2018) Page 13

Illinois Income Tax Withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate

Bi-weekly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $1.90 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$500 $505 $24.87 $21.07 $17.26 $13.45 $9.64 $5.84 $2.03 $505 $510 $25.12 $21.31 $17.51 $13.70 $9.89 $6.08 $2.28 $510 $515 $25.37 $21.56 $17.75 $13.95 $10.14 $6.33 $2.52 $515 $520 $25.62 $21.81 $18.00 $14.19 $10.39 $6.58 $2.77 $520 $525 $25.86 $22.06 $18.25 $14.44 $10.63 $6.83 $3.02 $525 $530 $26.11 $22.30 $18.50 $14.69 $10.88 $7.07 $3.27 $530 $535 $26.36 $22.55 $18.74 $14.94 $11.13 $7.32 $3.51 $535 $540 $26.61 $22.80 $18.99 $15.18 $11.38 $7.57 $3.76 $540 $545 $26.85 $23.05 $19.24 $15.43 $11.62 $7.82 $4.01 $545 $550 $27.10 $23.29 $19.49 $15.68 $11.87 $8.06 $4.26 $550 $555 $27.35 $23.54 $19.73 $15.93 $12.12 $8.31 $4.50 $555 $560 $27.60 $23.79 $19.98 $16.17 $12.37 $8.56 $4.75 $560 $565 $27.84 $24.04 $20.23 $16.42 $12.61 $8.81 $5.00 $565 $570 $28.09 $24.28 $20.48 $16.67 $12.86 $9.05 $5.25 $570 $575 $28.34 $24.53 $20.72 $16.92 $13.11 $9.30 $5.49 $575 $580 $28.59 $24.78 $20.97 $17.16 $13.36 $9.55 $5.74 $580 $585 $28.83 $25.03 $21.22 $17.41 $13.60 $9.80 $5.99 $585 $590 $29.08 $25.27 $21.47 $17.66 $13.85 $10.04 $6.24 $2.43 $590 $595 $29.33 $25.52 $21.71 $17.91 $14.10 $10.29 $6.48 $2.67 $595 $600 $29.58 $25.77 $21.96 $18.15 $14.35 $10.54 $6.73 $2.92 $600 $605 $29.82 $26.02 $22.21 $18.40 $14.59 $10.79 $6.98 $3.17 $605 $610 $30.07 $26.26 $22.46 $18.65 $14.84 $11.03 $7.23 $3.42 $610 $615 $30.32 $26.51 $22.70 $18.90 $15.09 $11.28 $7.47 $3.66 $615 $620 $30.57 $26.76 $22.95 $19.14 $15.34 $11.53 $7.72 $3.91 $620 $625 $30.81 $27.01 $23.20 $19.39 $15.58 $11.78 $7.97 $4.16 $625 $630 $31.06 $27.25 $23.45 $19.64 $15.83 $12.02 $8.22 $4.41 $630 $635 $31.31 $27.50 $23.69 $19.89 $16.08 $12.27 $8.46 $4.65 $635 $640 $31.56 $27.75 $23.94 $20.13 $16.33 $12.52 $8.71 $4.90 $640 $645 $31.80 $28.00 $24.19 $20.38 $16.57 $12.77 $8.96 $5.15 $645 $650 $32.05 $28.24 $24.44 $20.63 $16.82 $13.01 $9.21 $5.40 $650 $655 $32.30 $28.49 $24.68 $20.88 $17.07 $13.26 $9.45 $5.64 $655 $660 $32.55 $28.74 $24.93 $21.12 $17.32 $13.51 $9.70 $5.89 $660 $665 $32.79 $28.99 $25.18 $21.37 $17.56 $13.76 $9.95 $6.14 $665 $670 $33.04 $29.23 $25.43 $21.62 $17.81 $14.00 $10.20 $6.39 $670 $675 $33.29 $29.48 $25.67 $21.87 $18.06 $14.25 $10.44 $6.63 $2.83 $675 $680 $33.54 $29.73 $25.92 $22.11 $18.31 $14.50 $10.69 $6.88 $3.07 $680 $685 $33.78 $29.98 $26.17 $22.36 $18.55 $14.75 $10.94 $7.13 $3.32 $685 $690 $34.03 $30.22 $26.42 $22.61 $18.80 $14.99 $11.19 $7.38 $3.57 $690 $695 $34.28 $30.47 $26.66 $22.86 $19.05 $15.24 $11.43 $7.62 $3.82 $695 $700 $34.53 $30.72 $26.91 $23.10 $19.30 $15.49 $11.68 $7.87 $4.06 $700 $705 $34.77 $30.97 $27.16 $23.35 $19.54 $15.74 $11.93 $8.12 $4.31 $705 $710 $35.02 $31.21 $27.41 $23.60 $19.79 $15.98 $12.18 $8.37 $4.56 $710 $715 $35.27 $31.46 $27.65 $23.85 $20.04 $16.23 $12.42 $8.61 $4.81 $715 $720 $35.52 $31.71 $27.90 $24.09 $20.29 $16.48 $12.67 $8.86 $5.05 $720 $725 $35.76 $31.96 $28.15 $24.34 $20.53 $16.73 $12.92 $9.11 $5.30 $725 $730 $36.01 $32.20 $28.40 $24.59 $20.78 $16.97 $13.17 $9.36 $5.55 $730 $735 $36.26 $32.45 $28.64 $24.84 $21.03 $17.22 $13.41 $9.60 $5.80 $735 $740 $36.51 $32.70 $28.89 $25.08 $21.28 $17.47 $13.66 $9.85 $6.04 $740 $745 $36.75 $32.95 $29.14 $25.33 $21.52 $17.72 $13.91 $10.10 $6.29 $745 $750 $37.00 $33.19 $29.39 $25.58 $21.77 $17.96 $14.16 $10.35 $6.54

Page 14 (Effective January 1, 2018) Booklet IL-700-T (R-12/17)

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate.

Bi-weekly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $1.90 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.) $750 $755 $37.25 $33.44 $29.63 $25.83 $22.02 $18.21 $14.40 $10.59 $6.79 $755 $760 $37.50 $33.69 $29.88 $26.07 $22.27 $18.46 $14.65 $10.84 $7.03 $3.23 $760 $765 $37.74 $33.94 $30.13 $26.32 $22.51 $18.71 $14.90 $11.09 $7.28 $3.47 $765 $770 $37.99 $34.18 $30.38 $26.57 $22.76 $18.95 $15.15 $11.34 $7.53 $3.72 $770 $775 $38.24 $34.43 $30.62 $26.82 $23.01 $19.20 $15.39 $11.58 $7.78 $3.97 $775 $780 $38.49 $34.68 $30.87 $27.06 $23.26 $19.45 $15.64 $11.83 $8.02 $4.22 $780 $785 $38.73 $34.93 $31.12 $27.31 $23.50 $19.70 $15.89 $12.08 $8.27 $4.46 $785 $790 $38.98 $35.17 $31.37 $27.56 $23.75 $19.94 $16.14 $12.33 $8.52 $4.71 $790 $795 $39.23 $35.42 $31.61 $27.81 $24.00 $20.19 $16.38 $12.57 $8.77 $4.96 $795 $800 $39.48 $35.67 $31.86 $28.05 $24.25 $20.44 $16.63 $12.82 $9.01 $5.21 $800 $805 $39.72 $35.92 $32.11 $28.30 $24.49 $20.69 $16.88 $13.07 $9.26 $5.45 $805 $810 $39.97 $36.16 $32.36 $28.55 $24.74 $20.93 $17.13 $13.32 $9.51 $5.70 $810 $815 $40.22 $36.41 $32.60 $28.80 $24.99 $21.18 $17.37 $13.56 $9.76 $5.95 $815 $820 $40.47 $36.66 $32.85 $29.04 $25.24 $21.43 $17.62 $13.81 $10.00 $6.20 $820 $825 $40.71 $36.91 $33.10 $29.29 $25.48 $21.68 $17.87 $14.06 $10.25 $6.44 $825 $830 $40.96 $37.15 $33.35 $29.54 $25.73 $21.92 $18.12 $14.31 $10.50 $6.69 $830 $835 $41.21 $37.40 $33.59 $29.79 $25.98 $22.17 $18.36 $14.55 $10.75 $6.94 $835 $840 $41.46 $37.65 $33.84 $30.03 $26.23 $22.42 $18.61 $14.80 $10.99 $7.19 $3.38 $840 $845 $41.70 $37.90 $34.09 $30.28 $26.47 $22.67 $18.86 $15.05 $11.24 $7.43 $3.63 $845 $850 $41.95 $38.14 $34.34 $30.53 $26.72 $22.91 $19.11 $15.30 $11.49 $7.68 $3.87 $850 $855 $42.20 $38.39 $34.58 $30.78 $26.97 $23.16 $19.35 $15.54 $11.74 $7.93 $4.12 $855 $860 $42.45 $38.64 $34.83 $31.02 $27.22 $23.41 $19.60 $15.79 $11.98 $8.18 $4.37 $860 $865 $42.69 $38.89 $35.08 $31.27 $27.46 $23.66 $19.85 $16.04 $12.23 $8.42 $4.62 $865 $870 $42.94 $39.13 $35.33 $31.52 $27.71 $23.90 $20.10 $16.29 $12.48 $8.67 $4.86 $870 $875 $43.19 $39.38 $35.57 $31.77 $27.96 $24.15 $20.34 $16.53 $12.73 $8.92 $5.11 $875 $880 $43.44 $39.63 $35.82 $32.01 $28.21 $24.40 $20.59 $16.78 $12.97 $9.17 $5.36 $880 $885 $43.68 $39.88 $36.07 $32.26 $28.45 $24.65 $20.84 $17.03 $13.22 $9.41 $5.61 $885 $890 $43.93 $40.12 $36.32 $32.51 $28.70 $24.89 $21.09 $17.28 $13.47 $9.66 $5.85 $890 $895 $44.18 $40.37 $36.56 $32.76 $28.95 $25.14 $21.33 $17.52 $13.72 $9.91 $6.10 $895 $900 $44.43 $40.62 $36.81 $33.00 $29.20 $25.39 $21.58 $17.77 $13.96 $10.16 $6.35 $900 $905 $44.67 $40.87 $37.06 $33.25 $29.44 $25.64 $21.83 $18.02 $14.21 $10.40 $6.60 $905 $910 $44.92 $41.11 $37.31 $33.50 $29.69 $25.88 $22.08 $18.27 $14.46 $10.65 $6.84 $910 $915 $45.17 $41.36 $37.55 $33.75 $29.94 $26.13 $22.32 $18.51 $14.71 $10.90 $7.09 $915 $920 $45.42 $41.61 $37.80 $33.99 $30.19 $26.38 $22.57 $18.76 $14.95 $11.15 $7.34 $920 $925 $45.66 $41.86 $38.05 $34.24 $30.43 $26.63 $22.82 $19.01 $15.20 $11.39 $7.59 $925 $930 $45.91 $42.10 $38.30 $34.49 $30.68 $26.87 $23.07 $19.26 $15.45 $11.64 $7.83 $930 $935 $46.16 $42.35 $38.54 $34.74 $30.93 $27.12 $23.31 $19.50 $15.70 $11.89 $8.08 $935 $940 $46.41 $42.60 $38.79 $34.98 $31.18 $27.37 $23.56 $19.75 $15.94 $12.14 $8.33 $940 $945 $46.65 $42.85 $39.04 $35.23 $31.42 $27.62 $23.81 $20.00 $16.19 $12.38 $8.58 $945 $950 $46.90 $43.09 $39.29 $35.48 $31.67 $27.86 $24.06 $20.25 $16.44 $12.63 $8.82 $950 $955 $47.15 $43.34 $39.53 $35.73 $31.92 $28.11 $24.30 $20.49 $16.69 $12.88 $9.07 $955 $960 $47.40 $43.59 $39.78 $35.97 $32.17 $28.36 $24.55 $20.74 $16.93 $13.13 $9.32 $960 $965 $47.64 $43.84 $40.03 $36.22 $32.41 $28.61 $24.80 $20.99 $17.18 $13.37 $9.57 $965 $970 $47.89 $44.08 $40.28 $36.47 $32.66 $28.85 $25.05 $21.24 $17.43 $13.62 $9.81 $970 $975 $48.14 $44.33 $40.52 $36.72 $32.91 $29.10 $25.29 $21.48 $17.68 $13.87 $10.06 $975 $980 $48.39 $44.58 $40.77 $36.96 $33.16 $29.35 $25.54 $21.73 $17.92 $14.12 $10.31 $980 $985 $48.63 $44.83 $41.02 $37.21 $33.40 $29.60 $25.79 $21.98 $18.17 $14.36 $10.56 $985 $990 $48.88 $45.07 $41.27 $37.46 $33.65 $29.84 $26.04 $22.23 $18.42 $14.61 $10.80 $990 $995 $49.13 $45.32 $41.51 $37.71 $33.90 $30.09 $26.28 $22.47 $18.67 $14.86 $11.05 $995 $1,000 $49.38 $45.57 $41.76 $37.95 $34.15 $30.34 $26.53 $22.72 $18.91 $15.11 $11.30 $1,000 or more 4.95% of the amount in excess of $1000 plus: $49.50 $45.69 $41.88 $38.08 $34.27 $30.46 $26.65 $22.85 $19.04 $15.23 $11.42

Booklet IL-700-T (R-12/17) (Effective January 1, 2018) Page 15

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate.

Semi-monthly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $2.06 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.) $0 $5 $0.12 $5 $10 $0.37 $10 $15 $0.62 $15 $20 $0.87 $20 $25 $1.11 $25 $30 $1.36 $30 $35 $1.61 $35 $40 $1.86 $40 $45 $2.10 $45 $50 $2.35 $50 $55 $2.60 $55 $60 $2.85 $60 $65 $3.09 $65 $70 $3.34 $70 $75 $3.59 $75 $80 $3.84 $80 $85 $4.08 $85 $90 $4.33 $90 $95 $4.58 $0.45 $95 $100 $4.83 $0.70 $100 $105 $5.07 $0.95 $105 $110 $5.32 $1.20 $110 $115 $5.57 $1.44 $115 $120 $5.82 $1.69 $120 $125 $6.06 $1.94 $125 $130 $6.31 $2.19 $130 $135 $6.56 $2.43 $135 $140 $6.81 $2.68 $140 $145 $7.05 $2.93 $145 $150 $7.30 $3.18 $150 $155 $7.55 $3.42 $155 $160 $7.80 $3.67 $160 $165 $8.04 $3.92 $165 $170 $8.29 $4.17 $170 $175 $8.54 $4.41 $175 $180 $8.79 $4.66 $180 $185 $9.03 $4.91 $185 $190 $9.28 $5.16 $1.03 $190 $195 $9.53 $5.40 $1.28 $195 $200 $9.78 $5.65 $1.53 $200 $205 $10.02 $5.90 $1.77 $205 $210 $10.27 $6.15 $2.02 $210 $215 $10.52 $6.39 $2.27 $215 $220 $10.77 $6.64 $2.52 $220 $225 $11.01 $6.89 $2.76 $225 $230 $11.26 $7.14 $3.01 $230 $235 $11.51 $7.38 $3.26 $235 $240 $11.76 $7.63 $3.51 $240 $245 $12.00 $7.88 $3.75 $245 $250 $12.25 $8.13 $4.00

Page 16 (Effective January 1, 2018) Booklet IL-700-T (R-12/17)

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate.

Semi-monthly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $2.06 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$250 $255 $12.50 $8.37 $4.25 $0.12 $255 $260 $12.75 $8.62 $4.50 $0.37 $260 $265 $12.99 $8.87 $4.74 $0.62 $265 $270 $13.24 $9.12 $4.99 $0.87 $270 $275 $13.49 $9.36 $5.24 $1.11 $275 $280 $13.74 $9.61 $5.49 $1.36 $280 $285 $13.98 $9.86 $5.73 $1.61 $285 $290 $14.23 $10.11 $5.98 $1.86 $290 $295 $14.48 $10.35 $6.23 $2.10 $295 $300 $14.73 $10.60 $6.48 $2.35 $300 $305 $14.97 $10.85 $6.72 $2.60 $305 $310 $15.22 $11.10 $6.97 $2.85 $310 $315 $15.47 $11.34 $7.22 $3.09 $315 $320 $15.72 $11.59 $7.47 $3.34 $320 $325 $15.96 $11.84 $7.71 $3.59 $325 $330 $16.21 $12.09 $7.96 $3.84 $330 $335 $16.46 $12.33 $8.21 $4.08 $335 $340 $16.71 $12.58 $8.46 $4.33 $0.21 $340 $345 $16.95 $12.83 $8.70 $4.58 $0.45 $345 $350 $17.20 $13.08 $8.95 $4.83 $0.70 $350 $355 $17.45 $13.32 $9.20 $5.07 $0.95 $355 $360 $17.70 $13.57 $9.45 $5.32 $1.20 $360 $365 $17.94 $13.82 $9.69 $5.57 $1.44 $365 $370 $18.19 $14.07 $9.94 $5.82 $1.69 $370 $375 $18.44 $14.31 $10.19 $6.06 $1.94 $375 $380 $18.69 $14.56 $10.44 $6.31 $2.19 $380 $385 $18.93 $14.81 $10.68 $6.56 $2.43$385 $390 $19.18 $15.06 $10.93 $6.81 $2.68 $390 $395 $19.43 $15.30 $11.18 $7.05 $2.93 $395 $400 $19.68 $15.55 $11.43 $7.30 $3.18 $400 $405 $19.92 $15.80 $11.67 $7.55 $3.42 $405 $410 $20.17 $16.05 $11.92 $7.80 $3.67 $410 $415 $20.42 $16.29 $12.17 $8.04 $3.92 $415 $420 $20.67 $16.54 $12.42 $8.29 $4.17 $0.04 $420 $425 $20.91 $16.79 $12.66 $8.54 $4.41 $0.29 $425 $430 $21.16 $17.04 $12.91 $8.79 $4.66 $0.54 $430 $435 $21.41 $17.28 $13.16 $9.03 $4.91 $0.78 $435 $440 $21.66 $17.53 $13.41 $9.28 $5.16 $1.03 $440 $445 $21.90 $17.78 $13.65 $9.53 $5.40 $1.28 $445 $450 $22.15 $18.03 $13.90 $9.78 $5.65 $1.53 $450 $455 $22.40 $18.27 $14.15 $10.02 $5.90 $1.77 $455 $460 $22.65 $18.52 $14.40 $10.27 $6.15 $2.02 $460 $465 $22.89 $18.77 $14.64 $10.52 $6.39 $2.27 $465 $470 $23.14 $19.02 $14.89 $10.77 $6.64 $2.52 $470 $475 $23.39 $19.26 $15.14 $11.01 $6.89 $2.76 $475 $480 $23.64 $19.51 $15.39 $11.26 $7.14 $3.01 $480 $485 $23.88 $19.76 $15.63 $11.51 $7.38 $3.26 $485 $490 $24.13 $20.01 $15.88 $11.76 $7.63 $3.51 $490 $495 $24.38 $20.25 $16.13 $12.00 $7.88 $3.75 $495 $500 $24.63 $20.50 $16.38 $12.25 $8.13 $4.00

Booklet IL-700-T (R-12/17) (Effective January 1, 2018) Page 17

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate.

Semi-monthly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $2.06 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$500 $505 $24.87 $20.75 $16.62 $12.50 $8.37 $4.25 $0.12 $505 $510 $25.12 $21.00 $16.87 $12.75 $8.62 $4.50 $0.37 $510 $515 $25.37 $21.24 $17.12 $12.99 $8.87 $4.74 $0.62 $515 $520 $25.62 $21.49 $17.37 $13.24 $9.12 $4.99 $0.87 $520 $525 $25.86 $21.74 $17.61 $13.49 $9.36 $5.24 $1.11 $525 $530 $26.11 $21.99 $17.86 $13.74 $9.61 $5.49 $1.36 $530 $535 $26.36 $22.23 $18.11 $13.98 $9.86 $5.73 $1.61 $535 $540 $26.61 $22.48 $18.36 $14.23 $10.11 $5.98 $1.86 $540 $545 $26.85 $22.73 $18.60 $14.48 $10.35 $6.23 $2.10 $545 $550 $27.10 $22.98 $18.85 $14.73 $10.60 $6.48 $2.35 $550 $555 $27.35 $23.22 $19.10 $14.97 $10.85 $6.72 $2.60 $555 $560 $27.60 $23.47 $19.35 $15.22 $11.10 $6.97 $2.85 $560 $565 $27.84 $23.72 $19.59 $15.47 $11.34 $7.22 $3.09 $565 $570 $28.09 $23.97 $19.84 $15.72 $11.59 $7.47 $3.34 $570 $575 $28.34 $24.21 $20.09 $15.96 $11.84 $7.71 $3.59 $575 $580 $28.59 $24.46 $20.34 $16.21 $12.09 $7.96 $3.84 $580 $585 $28.83 $24.71 $20.58 $16.46 $12.33 $8.21 $4.08 $585 $590 $29.08 $24.96 $20.83 $16.71 $12.58 $8.46 $4.33 $0.21 $590 $595 $29.33 $25.20 $21.08 $16.95 $12.83 $8.70 $4.58 $0.45 $595 $600 $29.58 $25.45 $21.33 $17.20 $13.08 $8.95 $4.83 $0.70 $600 $605 $29.82 $25.70 $21.57 $17.45 $13.32 $9.20 $5.07 $0.95 $605 $610 $30.07 $25.95 $21.82 $17.70 $13.57 $9.45 $5.32 $1.20 $610 $615 $30.32 $26.19 $22.07 $17.94 $13.82 $9.69 $5.57 $1.44 $615 $620 $30.57 $26.44 $22.32 $18.19 $14.07 $9.94 $5.82 $1.69 $620 $625 $30.81 $26.69 $22.56 $18.44 $14.31 $10.19 $6.06 $1.94 $625 $630 $31.06 $26.94 $22.81 $18.69 $14.56 $10.44 $6.31 $2.19 $630 $635 $31.31 $27.18 $23.06 $18.93 $14.81 $10.68 $6.56 $2.43 $635 $640 $31.56 $27.43 $23.31 $19.18 $15.06 $10.93 $6.81 $2.68 $640 $645 $31.80 $27.68 $23.55 $19.43 $15.30 $11.18 $7.05 $2.93 $645 $650 $32.05 $27.93 $23.80 $19.68 $15.55 $11.43 $7.30 $3.18 $650 $655 $32.30 $28.17 $24.05 $19.92 $15.80 $11.67 $7.55 $3.42 $655 $660 $32.55 $28.42 $24.30 $20.17 $16.05 $11.92 $7.80 $3.67 $660 $665 $32.79 $28.67 $24.54 $20.42 $16.29 $12.17 $8.04 $3.92 $665 $670 $33.04 $28.92 $24.79 $20.67 $16.54 $12.42 $8.29 $4.17 $0.04 $670 $675 $33.29 $29.16 $25.04 $20.91 $16.79 $12.66 $8.54 $4.41 $0.29 $675 $680 $33.54 $29.41 $25.29 $21.16 $17.04 $12.91 $8.79 $4.66 $0.54 $680 $685 $33.78 $29.66 $25.53 $21.41 $17.28 $13.16 $9.03 $4.91 $0.78 $685 $690 $34.03 $29.91 $25.78 $21.66 $17.53 $13.41 $9.28 $5.16 $1.03 $690 $695 $34.28 $30.15 $26.03 $21.90 $17.78 $13.65 $9.53 $5.40 $1.28 $695 $700 $34.53 $30.40 $26.28 $22.15 $18.03 $13.90 $9.78 $5.65 $1.53 $700 $705 $34.77 $30.65 $26.52 $22.40 $18.27 $14.15 $10.02 $5.90 $1.77 $705 $710 $35.02 $30.90 $26.77 $22.65 $18.52 $14.40 $10.27 $6.15 $2.02 $710 $715 $35.27 $31.14 $27.02 $22.89 $18.77 $14.64 $10.52 $6.39 $2.27 $715 $720 $35.52 $31.39 $27.27 $23.14 $19.02 $14.89 $10.77 $6.64 $2.52 $720 $725 $35.76 $31.64 $27.51 $23.39 $19.26 $15.14 $11.01 $6.89 $2.76 $725 $730 $36.01 $31.89 $27.76 $23.64 $19.51 $15.39 $11.26 $7.14 $3.01 $730 $735 $36.26 $32.13 $28.01 $23.88 $19.76 $15.63 $11.51 $7.38 $3.26 $735 $740 $36.51 $32.38 $28.26 $24.13 $20.01 $15.88 $11.76 $7.63 $3.51 $740 $745 $36.75 $32.63 $28.50 $24.38 $20.25 $16.13 $12.00 $7.88 $3.75 $745 $750 $37.00 $32.88 $28.75 $24.63 $20.50 $16.38 $12.25 $8.13 $4.00

Page 18 (Effective January 1, 2018) Booklet IL-700-T (R-12/17)

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate.

Semi-monthly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $2.06 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$750 $755 $37.25 $33.12 $29.00 $24.87 $20.75 $16.62 $12.50 $8.37 $4.25 $0.12 $755 $760 $37.50 $33.37 $29.25 $25.12 $21.00 $16.87 $12.75 $8.62 $4.50 $0.37 $760 $765 $37.74 $33.62 $29.49 $25.37 $21.24 $17.12 $12.99 $8.87 $4.74 $0.62 $765 $770 $37.99 $33.87 $29.74 $25.62 $21.49 $17.37 $13.24 $9.12 $4.99 $0.87 $770 $775 $38.24 $34.11 $29.99 $25.86 $21.74 $17.61 $13.49 $9.36 $5.24 $1.11 $775 $780 $38.49 $34.36 $30.24 $26.11 $21.99 $17.86 $13.74 $9.61 $5.49 $1.36 $780 $785 $38.73 $34.61 $30.48 $26.36 $22.23 $18.11 $13.98 $9.86 $5.73 $1.61 $785 $790 $38.98 $34.86 $30.73 $26.61 $22.48 $18.36 $14.23 $10.11 $5.98 $1.86 $790 $795 $39.23 $35.10 $30.98 $26.85 $22.73 $18.60 $14.48 $10.35 $6.23 $2.10 $795 $800 $39.48 $35.35 $31.23 $27.10 $22.98 $18.85 $14.73 $10.60 $6.48 $2.35 $800 $805 $39.72 $35.60 $31.47 $27.35 $23.22 $19.10 $14.97 $10.85 $6.72 $2.60 $805 $810 $39.97 $35.85 $31.72 $27.60 $23.47 $19.35 $15.22 $11.10 $6.97 $2.85 $810 $815 $40.22 $36.09 $31.97 $27.84 $23.72 $19.59 $15.47 $11.34 $7.22 $3.09 $815 $820 $40.47 $36.34 $32.22 $28.09 $23.97 $19.84 $15.72 $11.59 $7.47 $3.34 $820 $825 $40.71 $36.59 $32.46 $28.34 $24.21 $20.09 $15.96 $11.84 $7.71 $3.59 $825 $830 $40.96 $36.84 $32.71 $28.59 $24.46 $20.34 $16.21 $12.09 $7.96 $3.84 $830 $835 $41.21 $37.08 $32.96 $28.83 $24.71 $20.58 $16.46 $12.33 $8.21 $4.08 $835 $840 $41.46 $37.33 $33.21 $29.08 $24.96 $20.83 $16.71 $12.58 $8.46 $4.33 $0.21 $840 $845 $41.70 $37.58 $33.45 $29.33 $25.20 $21.08 $16.95 $12.83 $8.70 $4.58 $0.45 $845 $850 $41.95 $37.83 $33.70 $29.58 $25.45 $21.33 $17.20 $13.08 $8.95 $4.83 $0.70 $850 $855 $42.20 $38.07 $33.95 $29.82 $25.70 $21.57 $17.45 $13.32 $9.20 $5.07 $0.95 $855 $860 $42.45 $38.32 $34.20 $30.07 $25.95 $21.82 $17.70 $13.57 $9.45 $5.32 $1.20 $860 $865 $42.69 $38.57 $34.44 $30.32 $26.19 $22.07 $17.94 $13.82 $9.69 $5.57 $1.44 $865 $870 $42.94 $38.82 $34.69 $30.57 $26.44 $22.32 $18.19 $14.07 $9.94 $5.82 $1.69 $870 $875 $43.19 $39.06 $34.94 $30.81 $26.69 $22.56 $18.44 $14.31 $10.19 $6.06 $1.94 $875 $880 $43.44 $39.31 $35.19 $31.06 $26.94 $22.81 $18.69 $14.56 $10.44 $6.31 $2.19 $880 $885 $43.68 $39.56 $35.43 $31.31 $27.18 $23.06 $18.93 $14.81 $10.68 $6.56 $2.43 $885 $890 $43.93 $39.81 $35.68 $31.56 $27.43 $23.31 $19.18 $15.06 $10.93 $6.81 $2.68 $890 $895 $44.18 $40.05 $35.93 $31.80 $27.68 $23.55 $19.43 $15.30 $11.18 $7.05 $2.93 $895 $900 $44.43 $40.30 $36.18 $32.05 $27.93 $23.80 $19.68 $15.55 $11.43 $7.30 $3.18 $900 $905 $44.67 $40.55 $36.42 $32.30 $28.17 $24.05 $19.92 $15.80 $11.67 $7.55 $3.42 $905 $910 $44.92 $40.80 $36.67 $32.55 $28.42 $24.30 $20.17 $16.05 $11.92 $7.80 $3.67 $910 $915 $45.17 $41.04 $36.92 $32.79 $28.67 $24.54 $20.42 $16.29 $12.17 $8.04 $3.92 $915 $920 $45.42 $41.29 $37.17 $33.04 $28.92 $24.79 $20.67 $16.54 $12.42 $8.29 $4.17 $920 $925 $45.66 $41.54 $37.41 $33.29 $29.16 $25.04 $20.91 $16.79 $12.66 $8.54 $4.41 $925 $930 $45.91 $41.79 $37.66 $33.54 $29.41 $25.29 $21.16 $17.04 $12.91 $8.79 $4.66 $930 $935 $46.16 $42.03 $37.91 $33.78 $29.66 $25.53 $21.41 $17.28 $13.16 $9.03 $4.91 $935 $940 $46.41 $42.28 $38.16 $34.03 $29.91 $25.78 $21.66 $17.53 $13.41 $9.28 $5.16 $940 $945 $46.65 $42.53 $38.40 $34.28 $30.15 $26.03 $21.90 $17.78 $13.65 $9.53 $5.40 $945 $950 $46.90 $42.78 $38.65 $34.53 $30.40 $26.28 $22.15 $18.03 $13.90 $9.78 $5.65 $950 $955 $47.15 $43.02 $38.90 $34.77 $30.65 $26.52 $22.40 $18.27 $14.15 $10.02 $5.90 $955 $960 $47.40 $43.27 $39.15 $35.02 $30.90 $26.77 $22.65 $18.52 $14.40 $10.27 $6.15 $960 $965 $47.64 $43.52 $39.39 $35.27 $31.14 $27.02 $22.89 $18.77 $14.64 $10.52 $6.39 $965 $970 $47.89 $43.77 $39.64 $35.52 $31.39 $27.27 $23.14 $19.02 $14.89 $10.77 $6.64 $970 $975 $48.14 $44.01 $39.89 $35.76 $31.64 $27.51 $23.39 $19.26 $15.14 $11.01 $6.89 $975 $980 $48.39 $44.26 $40.14 $36.01 $31.89 $27.76 $23.64 $19.51 $15.39 $11.26 $7.14 $980 $985 $48.63 $44.51 $40.38 $36.26 $32.13 $28.01 $23.88 $19.76 $15.63 $11.51 $7.38 $985 $990 $48.88 $44.76 $40.63 $36.51 $32.38 $28.26 $24.13 $20.01 $15.88 $11.76 $7.63 $990 $995 $49.13 $45.00 $40.88 $36.75 $32.63 $28.50 $24.38 $20.25 $16.13 $12.00 $7.88 $995 $1,000 $49.38 $45.25 $41.13 $37.00 $32.88 $28.75 $24.63 $20.50 $16.38 $12.25 $8.13

$1,000 or more 4.95% of the amount in excess of $1000 plus: $49.50 $45.38 $41.25 $37.13 $33.00 $28.87 $24.75 $20.63 $16.50 $12.38 $8.25

Booklet IL-700-T (R-12/17) (Effective January 1, 2018) Page 19

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate.

Monthly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $4.12 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.) $0 $10 $0.25 $10 $20 $0.74 $20 $30 $1.24 $30 $40 $1.73 $40 $50 $2.23 $50 $60 $2.72 $60 $70 $3.22 $70 $80 $3.71 $80 $90 $4.21 $90 $100 $4.70 $100 $110 $5.20 $110 $120 $5.69 $120 $130 $6.19 $130 $140 $6.68 $140 $150 $7.18 $150 $160 $7.67 $160 $170 $8.17 $170 $180 $8.66 $0.41 $180 $190 $9.16 $0.91 $190 $200 $9.65 $1.40 $200 $210 $10.15 $1.90 $210 $220 $10.64 $2.39 $220 $230 $11.14 $2.89 $230 $240 $11.63 $3.38 $240 $250 $12.13 $3.88 $250 $260 $12.62 $4.37 $260 $270 $13.12 $4.87 $270 $280 $13.61 $5.36 $280 $290 $14.11 $5.86 $290 $300 $14.60 $6.35 $300 $310 $15.10 $6.85 $310 $320 $15.59 $7.34 $320 $330 $16.09 $7.84 $330 $340 $16.58 $8.33 $0.08 $340 $350 $17.08 $8.83 $0.58 $350 $360 $17.57 $9.32 $1.07 $360 $370 $18.07 $9.82 $1.57 $370 $380 $18.56 $10.31 $2.06 $380 $390 $19.06 $10.81 $2.56 $390 $400 $19.55 $11.30 $3.05 $400 $410 $20.05 $11.80 $3.55 $410 $420 $20.54 $12.29 $4.04 $420 $430 $21.04 $12.79 $4.54 $430 $440 $21.53 $13.28 $5.03 $440 $450 $22.03 $13.78 $5.53 $450 $460 $22.52 $14.27 $6.02 $460 $470 $23.02 $14.77 $6.52 $470 $480 $23.51 $15.26 $7.01 $480 $490 $24.01 $15.76 $7.51 $490 $500 $24.50 $16.25 $8.00

Page 20 (Effective January 1, 2018) Booklet IL-700-T (R-12/17)

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate.

Monthly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $4.12 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$500 $510 $25.00 $16.75 $8.50 $0.25 $510 $520 $25.49 $17.24 $8.99 $0.74 $520 $530 $25.99 $17.74 $9.49 $1.24 $530 $540 $26.48 $18.23 $9.98 $1.73 $540 $550 $26.98 $18.73 $10.48 $2.23 $550 $560 $27.47 $19.22 $10.97 $2.72 $560 $570 $27.97 $19.72 $11.47 $3.22 $570 $580 $28.46 $20.21 $11.96 $3.71 $580 $590 $28.96 $20.71 $12.46 $4.21 $590 $600 $29.45 $21.20 $12.95 $4.70 $600 $610 $29.95 $21.70 $13.45 $5.20 $610 $620 $30.44 $22.19 $13.94 $5.69 $620 $630 $30.94 $22.69 $14.44 $6.19 $630 $640 $31.43 $23.18 $14.93 $6.68 $640 $650 $31.93 $23.68 $15.43 $7.18 $650 $660 $32.42 $24.17 $15.92 $7.67 $660 $670 $32.92 $24.67 $16.42 $8.17 $670 $680 $33.41 $25.16 $16.91 $8.66 $0.41 $680 $690 $33.91 $25.66 $17.41 $9.16 $0.91 $690 $700 $34.40 $26.15 $17.90 $9.65 $1.40 $700 $710 $34.90 $26.65 $18.40 $10.15 $1.90 $710 $720 $35.39 $27.14 $18.89 $10.64 $2.39 $720 $730 $35.89 $27.64 $19.39 $11.14 $2.89 $730 $740 $36.38 $28.13 $19.88 $11.63 $3.38 $740 $750 $36.88 $28.63 $20.38 $12.13 $3.88 $750 $760 $37.37 $29.12 $20.87 $12.62 $4.37 $760 $770 $37.87 $29.62 $21.37 $13.12 $4.87 $770 $780 $38.36 $30.11 $21.86 $13.61 $5.36 $780 $790 $38.86 $30.61 $22.36 $14.11 $5.86 $790 $800 $39.35 $31.10 $22.85 $14.60 $6.35 $800 $810 $39.85 $31.60 $23.35 $15.10 $6.85 $810 $820 $40.34 $32.09 $23.84 $15.59 $7.34 $820 $830 $40.84 $32.59 $24.34 $16.09 $7.84 $830 $840 $41.33 $33.08 $24.83 $16.58 $8.33 $0.08 $840 $850 $41.83 $33.58 $25.33 $17.08 $8.83 $0.58 $850 $860 $42.32 $34.07 $25.82 $17.57 $9.32 $1.07 $860 $870 $42.82 $34.57 $26.32 $18.07 $9.82 $1.57 $870 $880 $43.31 $35.06 $26.81 $18.56 $10.31 $2.06 $880 $890 $43.81 $35.56 $27.31 $19.06 $10.81 $2.56 $890 $900 $44.30 $36.05 $27.80 $19.55 $11.30 $3.05 $900 $910 $44.80 $36.55 $28.30 $20.05 $11.80 $3.55 $910 $920 $45.29 $37.04 $28.79 $20.54 $12.29 $4.04 $920 $930 $45.79 $37.54 $29.29 $21.04 $12.79 $4.54 $930 $940 $46.28 $38.03 $29.78 $21.53 $13.28 $5.03 $940 $950 $46.78 $38.53 $30.28 $22.03 $13.78 $5.53 $950 $960 $47.27 $39.02 $30.77 $22.52 $14.27 $6.02 $960 $970 $47.77 $39.52 $31.27 $23.02 $14.77 $6.52 $970 $980 $48.26 $40.01 $31.76 $23.51 $15.26 $7.01 $980 $990 $48.76 $40.51 $32.26 $24.01 $15.76 $7.51 $990 $1,000 $49.25 $41.00 $32.75 $24.50 $16.25 $8.00

Booklet IL-700-T (R-12/17) (Effective January 1, 2018) Page 21

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate.

Monthly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $4.12 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$1,000 $1,010 $49.75 $41.50 $33.25 $25.00 $16.75 $8.50 $0.25 $1,010 $1,020 $50.24 $41.99 $33.74 $25.49 $17.24 $8.99 $0.74 $1,020 $1,030 $50.74 $42.49 $34.24 $25.99 $17.74 $9.49 $1.24 $1,030 $1,040 $51.23 $42.98 $34.73 $26.48 $18.23 $9.98 $1.73 $1,040 $1,050 $51.73 $43.48 $35.23 $26.98 $18.73 $10.48 $2.23 $1,050 $1,060 $52.22 $43.97 $35.72 $27.47 $19.22 $10.97 $2.72 $1,060 $1,070 $52.72 $44.47 $36.22 $27.97 $19.72 $11.47 $3.22 $1,070 $1,080 $53.21 $44.96 $36.71 $28.46 $20.21 $11.96 $3.71 $1,080 $1,090 $53.71 $45.46 $37.21 $28.96 $20.71 $12.46 $4.21 $1,090 $1,100 $54.20 $45.95 $37.70 $29.45 $21.20 $12.95 $4.70 $1,100 $1,110 $54.70 $46.45 $38.20 $29.95 $21.70 $13.45 $5.20 $1,110 $1,120 $55.19 $46.94 $38.69 $30.44 $22.19 $13.94 $5.69 $1,120 $1,130 $55.69 $47.44 $39.19 $30.94 $22.69 $14.44 $6.19 $1,130 $1,140 $56.18 $47.93 $39.68 $31.43 $23.18 $14.93 $6.68 $1,140 $1,150 $56.68 $48.43 $40.18 $31.93 $23.68 $15.43 $7.18 $1,150 $1,160 $57.17 $48.92 $40.67 $32.42 $24.17 $15.92 $7.67 $1,160 $1,170 $57.67 $49.42 $41.17 $32.92 $24.67 $16.42 $8.17 $1,170 $1,180 $58.16 $49.91 $41.66 $33.41 $25.16 $16.91 $8.66 $0.41 $1,180 $1,190 $58.66 $50.41 $42.16 $33.91 $25.66 $17.41 $9.16 $0.91 $1,190 $1,200 $59.15 $50.90 $42.65 $34.40 $26.15 $17.90 $9.65 $1.40 $1,200 $1,210 $59.65 $51.40 $43.15 $34.90 $26.65 $18.40 $10.15 $1.90 $1,210 $1,220 $60.14 $51.89 $43.64 $35.39 $27.14 $18.89 $10.64 $2.39 $1,220 $1,230 $60.64 $52.39 $44.14 $35.89 $27.64 $19.39 $11.14 $2.89 $1,230 $1,240 $61.13 $52.88 $44.63 $36.38 $28.13 $19.88 $11.63 $3.38 $1,240 $1,250 $61.63 $53.38 $45.13 $36.88 $28.63 $20.38 $12.13 $3.88 $1,250 $1,260 $62.12 $53.87 $45.62 $37.37 $29.12 $20.87 $12.62 $4.37 $1,260 $1,270 $62.62 $54.37 $46.12 $37.87 $29.62 $21.37 $13.12 $4.87 $1,270 $1,280 $63.11 $54.86 $46.61 $38.36 $30.11 $21.86 $13.61 $5.36 $1,280 $1,290 $63.61 $55.36 $47.11 $38.86 $30.61 $22.36 $14.11 $5.86 $1,290 $1,300 $64.10 $55.85 $47.60 $39.35 $31.10 $22.85 $14.60 $6.35 $1,300 $1,310 $64.60 $56.35 $48.10 $39.85 $31.60 $23.35 $15.10 $6.85 $1,310 $1,320 $65.09 $56.84 $48.59 $40.34 $32.09 $23.84 $15.59 $7.34 $1,320 $1,330 $65.59 $57.34 $49.09 $40.84 $32.59 $24.34 $16.09 $7.84 $1,330 $1,340 $66.08 $57.83 $49.58 $41.33 $33.08 $24.83 $16.58 $8.33 $0.08 $1,340 $1,350 $66.58 $58.33 $50.08 $41.83 $33.58 $25.33 $17.08 $8.83 $0.58 $1,350 $1,360 $67.07 $58.82 $50.57 $42.32 $34.07 $25.82 $17.57 $9.32 $1.07 $1,360 $1,370 $67.57 $59.32 $51.07 $42.82 $34.57 $26.32 $18.07 $9.82 $1.57 $1,370 $1,380 $68.06 $59.81 $51.56 $43.31 $35.06 $26.81 $18.56 $10.31 $2.06 $1,380 $1,390 $68.56 $60.31 $52.06 $43.81 $35.56 $27.31 $19.06 $10.81 $2.56 $1,390 $1,400 $69.05 $60.80 $52.55 $44.30 $36.05 $27.80 $19.55 $11.30 $3.05 $1,400 $1,410 $69.55 $61.30 $53.05 $44.80 $36.55 $28.30 $20.05 $11.80 $3.55 $1,410 $1,420 $70.04 $61.79 $53.54 $45.29 $37.04 $28.79 $20.54 $12.29 $4.04 $1,420 $1,430 $70.54 $62.29 $54.04 $45.79 $37.54 $29.29 $21.04 $12.79 $4.54 $1,430 $1,440 $71.03 $62.78 $54.53 $46.28 $38.03 $29.78 $21.53 $13.28 $5.03 $1,440 $1,450 $71.53 $63.28 $55.03 $46.78 $38.53 $30.28 $22.03 $13.78 $5.53 $1,450 $1,460 $72.02 $63.77 $55.52 $47.27 $39.02 $30.77 $22.52 $14.27 $6.02 $1,460 $1,470 $72.52 $64.27 $56.02 $47.77 $39.52 $31.27 $23.02 $14.77 $6.52 $1,470 $1,480 $73.01 $64.76 $56.51 $48.26 $40.01 $31.76 $23.51 $15.26 $7.01 $1,480 $1,490 $73.51 $65.26 $57.01 $48.76 $40.51 $32.26 $24.01 $15.76 $7.51 $1,490 $1,500 $74.00 $65.75 $57.50 $49.25 $41.00 $32.75 $24.50 $16.25 $8.00

Page 22 (Effective January 1, 2018) Booklet IL-700-T (R-12/17)

Illinois Income Tax withholding at 4.95 percent (.0495)Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate.

Monthly Payroll Period

Wages Number of allowances claimed on Line 1 of Form IL-W-4 at but less 0 1 2 3 4 5 6 7 8 9 10 (Subtract $4.12 for each allowance least than Withhold this amount of Illinois Income Tax —— claimed on Line 2 of Form IL-W-4.)

$1,500 $1,510 $74.50 $66.25 $58.00 $49.75 $41.50 $33.25 $25.00 $16.75 $8.50 $0.25 $1,510 $1,520 $74.99 $66.74 $58.49 $50.24 $41.99 $33.74 $25.49 $17.24 $8.99 $0.74 $1,520 $1,530 $75.49 $67.24 $58.99 $50.74 $42.49 $34.24 $25.99 $17.74 $9.49 $1.24 $1,530 $1,540 $75.98 $67.73 $59.48 $51.23 $42.98 $34.73 $26.48 $18.23 $9.98 $1.73 $1,540 $1,550 $76.48 $68.23 $59.98 $51.73 $43.48 $35.23 $26.98 $18.73 $10.48 $2.23 $1,550 $1,560 $76.97 $68.72 $60.47 $52.22 $43.97 $35.72 $27.47 $19.22 $10.97 $2.72 $1,560 $1,570 $77.47 $69.22 $60.97 $52.72 $44.47 $36.22 $27.97 $19.72 $11.47 $3.22 $1,570 $1,580 $77.96 $69.71 $61.46 $53.21 $44.96 $36.71 $28.46 $20.21 $11.96 $3.71 $1,580 $1,590 $78.46 $70.21 $61.96 $53.71 $45.46 $37.21 $28.96 $20.71 $12.46 $4.21 $1,590 $1,600 $78.95 $70.70 $62.45 $54.20 $45.95 $37.70 $29.45 $21.20 $12.95 $4.70 $1,600 $1,610 $79.45 $71.20 $62.95 $54.70 $46.45 $38.20 $29.95 $21.70 $13.45 $5.20 $1,610 $1,620 $79.94 $71.69 $63.44 $55.19 $46.94 $38.69 $30.44 $22.19 $13.94 $5.69 $1,620 $1,630 $80.44 $72.19 $63.94 $55.69 $47.44 $39.19 $30.94 $22.69 $14.44 $6.19 $1,630 $1,640 $80.93 $72.68 $64.43 $56.18 $47.93 $39.68 $31.43 $23.18 $14.93 $6.68 $1,640 $1,650 $81.43 $73.18 $64.93 $56.68 $48.43 $40.18 $31.93 $23.68 $15.43 $7.18 $1,650 $1,660 $81.92 $73.67 $65.42 $57.17 $48.92 $40.67 $32.42 $24.17 $15.92 $7.67 $1,660 $1,670 $82.42 $74.17 $65.92 $57.67 $49.42 $41.17 $32.92 $24.67 $16.42 $8.17 $1,670 $1,680 $82.91 $74.66 $66.41 $58.16 $49.91 $41.66 $33.41 $25.16 $16.91 $8.66 $0.41 $1,680 $1,690 $83.41 $75.16 $66.91 $58.66 $50.41 $42.16 $33.91 $25.66 $17.41 $9.16 $0.91 $1,690 $1,700 $83.90 $75.65 $67.40 $59.15 $50.90 $42.65 $34.40 $26.15 $17.90 $9.65 $1.40 $1,700 $1,710 $84.40 $76.15 $67.90 $59.65 $51.40 $43.15 $34.90 $26.65 $18.40 $10.15 $1.90 $1,710 $1,720 $84.89 $76.64 $68.39 $60.14 $51.89 $43.64 $35.39 $27.14 $18.89 $10.64 $2.39 $1,720 $1,730 $85.39 $77.14 $68.89 $60.64 $52.39 $44.14 $35.89 $27.64 $19.39 $11.14 $2.89 $1,730 $1,740 $85.88 $77.63 $69.38 $61.13 $52.88 $44.63 $36.38 $28.13 $19.88 $11.63 $3.38 $1,740 $1,750 $86.38 $78.13 $69.88 $61.63 $53.38 $45.13 $36.88 $28.63 $20.38 $12.13 $3.88 $1,750 $1,760 $86.87 $78.62 $70.37 $62.12 $53.87 $45.62 $37.37 $29.12 $20.87 $12.62 $4.37 $1,760 $1,770 $87.37 $79.12 $70.87 $62.62 $54.37 $46.12 $37.87 $29.62 $21.37 $13.12 $4.87 $1,770 $1,780 $87.86 $79.61 $71.36 $63.11 $54.86 $46.61 $38.36 $30.11 $21.86 $13.61 $5.36 $1,780 $1,790 $88.36 $80.11 $71.86 $63.61 $55.36 $47.11 $38.86 $30.61 $22.36 $14.11 $5.86 $1,790 $1,800 $88.85 $80.60 $72.35 $64.10 $55.85 $47.60 $39.35 $31.10 $22.85 $14.60 $6.35 $1,800 $1,810 $89.35 $81.10 $72.85 $64.60 $56.35 $48.10 $39.85 $31.60 $23.35 $15.10 $6.85 $1,810 $1,820 $89.84 $81.59 $73.34 $65.09 $56.84 $48.59 $40.34 $32.09 $23.84 $15.59 $7.34 $1,820 $1,830 $90.34 $82.09 $73.84 $65.59 $57.34 $49.09 $40.84 $32.59 $24.34 $16.09 $7.84 $1,830 $1,840 $90.83 $82.58 $74.33 $66.08 $57.83 $49.58 $41.33 $33.08 $24.83 $16.58 $8.33 $1,840 $1,850 $91.33 $83.08 $74.83 $66.58 $58.33 $50.08 $41.83 $33.58 $25.33 $17.08 $8.83 $1,850 $1,860 $91.82 $83.57 $75.32 $67.07 $58.82 $50.57 $42.32 $34.07 $25.82 $17.57 $9.32 $1,860 $1,870 $92.32 $84.07 $75.82 $67.57 $59.32 $51.07 $42.82 $34.57 $26.32 $18.07 $9.82 $1,870 $1,880 $92.81 $84.56 $76.31 $68.06 $59.81 $51.56 $43.31 $35.06 $26.81 $18.56 $10.31 $1,880 $1,890 $93.31 $85.06 $76.81 $68.56 $60.31 $52.06 $43.81 $35.56 $27.31 $19.06 $10.81 $1,890 $1,900 $93.80 $85.55 $77.30 $69.05 $60.80 $52.55 $44.30 $36.05 $27.80 $19.55 $11.30 $1,900 $1,910 $94.30 $86.05 $77.80 $69.55 $61.30 $53.05 $44.80 $36.55 $28.30 $20.05 $11.80 $1,910 $1,920 $94.79 $86.54 $78.29 $70.04 $61.79 $53.54 $45.29 $37.04 $28.79 $20.54 $12.29 $1,920 $1,930 $95.29 $87.04 $78.79 $70.54 $62.29 $54.04 $45.79 $37.54 $29.29 $21.04 $12.79 $1,930 $1,940 $95.78 $87.53 $79.28 $71.03 $62.78 $54.53 $46.28 $38.03 $29.78 $21.53 $13.28 $1,940 $1,950 $96.28 $88.03 $79.78 $71.53 $63.28 $55.03 $46.78 $38.53 $30.28 $22.03 $13.78 $1,950 $1,960 $96.77 $88.52 $80.27 $72.02 $63.77 $55.52 $47.27 $39.02 $30.77 $22.52 $14.27 $1,960 $1,970 $97.27 $89.02 $80.77 $72.52 $64.27 $56.02 $47.77 $39.52 $31.27 $23.02 $14.77 $1,970 $1,980 $97.76 $89.51 $81.26 $73.01 $64.76 $56.51 $48.26 $40.01 $31.76 $23.51 $15.26 $1,980 $1,990 $98.26 $90.01 $81.76 $73.51 $65.26 $57.01 $48.76 $40.51 $32.26 $24.01 $15.76 $1,990 $2,000 $98.75 $90.50 $82.25 $74.00 $65.75 $57.50 $49.25 $41.00 $32.75 $24.50 $16.25 $2,000 or more 4.95% of the amount in excess of $2000 plus: $99.00 $90.75 $82.50 $74.25 $66.00 $57.75 $49.50 $41.25 $33.00 $24.75 $16.50

Booklet IL-700-T (R-12/17) (Effective January 1, 2018) Page 23

Where to Get Help

If you need help completing your return, you may visit or call one of our Illinois Department of Revenue offices Monday through Friday. We can accommodate and assist the disabled. WILLARD ICE BUILDING JAMES R THOMPSON CENTER 101 W JEFFERSON STREET 100 W RANDOLPH STREET SPRINGFIELD IL 62702 CONCOURSE LEVEL CHICAGO IL 60601-3274 Office hours: 8:00 a.m. to 5:00 p.m. Office hours: 8:30 a.m. to 5:00 p.m. Our taxpayer assistance numbers are 1 800 732-8866 or 217 782-3336. Our TDD (telecommunications device for the deaf) number is 1 800 544-5304. If you prefer, you may visit our web site at tax.Illinois.gov or write us at the address below.

If you have questions or need more information about a previous refund or other tax matters, send us your inquiry in writing on a separate sheet of paper. Your written inquiry must include your name and address, your FEIN, the tax type, the tax year in question, and a description of the error or question. Send inquiries to

ILLINOIS DEPARTMENT OF REVENUE PO BOX 19044 SPRINGFIELD IL 62794-9044

If you need additional forms, instructions, or publications, you may visit our website at tax.Illinois.gov; call our 24-hour Forms Order Line at 1 800 356-6302; write to Illinois Department of Revenue, P.O. Box 19044, Springfield, IL 62794-9044; or visit any taxpayer assistance office listed above or regional offices listed below.

Illinois Regional Offices

The Internal Revenue Service (IRS) produces many publications to help answer your questions and fill out your federal tax return. You may call the IRS at 1 800 829-3676 or visit their web site at www.irs.gov.

Where to Get Other Assistance

Printed by authority of the State of Illinois - web only

Fairview Heights15 Executive DriveSuite 2 Fairview Heights, IL 62208-1331

Rockford200 S. Wyman StreetRockford, IL 61101-1237

Marion2309 West MainSuite 114Marion, IL 62959-1196

Des PlainesMaine North Regional Building9511 Harrison StreetDes Plaines, IL 60016-1563