Ihda illinois smart move

-

Upload

john-poast -

Category

Business

-

view

1.581 -

download

0

description

Transcript of Ihda illinois smart move

The Illinois Smart Move Program

Objectives:

After completion of this presentation participants will be able to:

Explain to homebuyers the benefits of the Smart Move Loan and Smart

Move assistance programs

Explain the Smart Move Down Payment assistance

Explain the three compliance qualifications of the Smart Move program

Explain why targeted areas are beneficial and where a list of targeted

areas can be found.

Explain the three recapture triggers

Explain the five steps of the IHDA loan process

Find guides to assist in submitting IHDA loans

The Illinois Smart Move Program

Illinois Housing Development Authority

“To finance the creation and the preservation of

affordable housing throughout the State to increase the

supply of decent and safe places for people of low or

moderate means to live.”

Illinois Housing Development Authority

Housing Finance Agency

Bank with a public mission

Advocate for affordable housing

Affordable housing expert

Partner

Advantages to IHDA’s Programs

The Illinois Smart Move Program

Safe and reliable products

Reach a different consumer

Affordable interest rates

Easy process

First Mortgage:

30-year; Fixed rate; Affordable interest rate program

Highlights:

Either FHA, Conventional ,USDA and VA insured

Maximum LTV: 96.5 (FHA) ; 97(Conventional) 100 (USDA & VA)

First-time homebuyer or exempt

Minimum credit score of 620

Maximum total debt (back end) ratio of 45 percent

Must contribute 1 percent or $1,000 from buyer’s own funds, whichever is greater

Homeownership counseling required

The Illinois Smart Move Program

Current Rates

4.00% FHA, USDA, VA

4.25% Conventional

Subject to change

First Mortgage plus Down Payment Assistance (DPA):

Characteristics of Down Payment Assistance:

Provides 3 percent of the purchase price, up to $6,000 for households

0 percent, 10-year forgivable loan, recorded as a second mortgage

Mortgage balance is repaid if home is sold or 1st mortgage refinanced within 1st 10 years

The interest rate on the First Mortgage under this package will be slightly higher

than the interest rate on the First Mortgage under package one

The Illinois Smart Move Program

Consists of a Smart Move First Mortgage plus a Smart Move Down Payment

Assistance Loan

Current Rates

4.50% FHA, USDA, VA

4.75% Conventional

Subject to change

Conventional Program:

Job Lost Protection available with MI companies

No Adverse Market Fees

No Pricing Adjustments

Reduced PMI Coverage:

• 18% for LTVs greater than 95% and less than or equal to 97%

• 16% for the LTVs greater than 90% and less than or equal to 95%

• 12% for the LTVs greater than 85% and less than or equal to 90%

• 6% for the LTVs greater than 80% and less than or equal to 85%

Delivery Requirements

• Special Feature Code (“SFC”) Bond Loans– 88

• Special feature code (“SFC”) 460 for my community mortgage code

The Illinois Smart Move Program

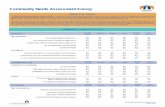

Tax Code Compliance

The Illinois Smart Move Program

Smart Move has three basic compliance qualifications

The Illinois Smart Move Program

1. Borrower(s) must be a first time home buyer or exempt

2. The borrower(s) and relevant parties must have a total

household income that does not exceed the applicable limit

3. The residence being financed must be a qualified dwelling and

the acquisition cost must be within the applicable limit.

Tax Code Compliance Underwriting:

Qualification #1: First-time homebuyer or exempt

The Illinois Smart Move Program

First-time homebuyer:

A person who “has not” had an ownership interest in a

principal residence at any time during the three-year period

prior to the date the mortgage is executed.

Exemptions:

If the residence to be purchased is within a target area.

If the borrower is a veteran, this requirement is waived.

What are targeted areas and why are they beneficial for you?

Targeted Area benefits

Higher income and purchase price limits

Do not have to be a first time home buyer

Good selling point for both originators and realtors

The Illinois Smart Move Program

Targeted Areas: Areas of the state where seventy percent

(70%) or more of the families have an income which is eighty

percent (80%) or less of the median family income, as

established by HUD.

There are thousands of targeted areas within Illinois. For a list by zip code within

each County, visit www.ihda.org.

The Illinois Smart Move Program

This is where you

find, targeted

area look-up

guide, procedural

guides and

forms.

<

Qualification #2: The borrower(s) and relevant parties must have a

total household income that does not exceed the applicable limit.

The Illinois Smart Move Program

The term “borrower” includes:

The borrower and co-borrower(s).

Relevant parties- includes a spouse even if they are not going

on title or are waiving homestead rights. Any adult (over 18)

who will live in the home and their income must also be

included.

How to calculate total household income:

The Illinois Smart Move Program

Calculation: Total household income is the borrower’s and

co-borrower’s and relevant parties’ annualized gross income.

Example: Check Stub dated 2/28/2011*

Gross base Income is $2,000

$2,000 divided by 2 months, result multiplied by 12 = $12,000 Base income

Overtime, Bonuses Commissions generally average with last year and YTD totals

2010 OT $5,000

2011 OT $3,000

Total $8,000 divided by 14, result multiplied by 12=

$6,857

Grand Totals: $12,000 base plus OT $6,857 equals $18,857

* The above is a general example, individual files may require different calculations

Gross Monthly Income Includes:

The Illinois Smart Move Program

Income from all sources!

Gross base pay

Overtime

Part-time employment

Bonuses

Commissions

Child support

Alimony

Investment income

Dividends and interest

Social security

Pension income

Unemployment

Qualification #3: The residence being financed must be a qualified

dwelling and the acquisition cost must be within the applicable limit.

The Illinois Smart Move Program

To be a qualified dwelling,

a) The borrower must acquire a fee simple interest in the real

estate.

b) The home must become the principal place of residence of

the borrower within 60 days after closing on the loan.

c) The residence must be located in Illinois and be designated

for residential use.

The following residences can be Qualified Dwellings:

The Illinois Smart Move Program

1. Single family detached home

2. Townhome

3. Condominium unit

4. Two-unit residential structure

Co-op apartment units are not eligible under the Program

Federal Recapture

The Illinois Smart Move Program

Federal Recapture Tax

The Illinois Smart Move Program

The Smart Move Program uses the proceeds of tax-exempt bonds to

provide financing benefits for first-time homebuyers.

If the home, financed through a Smart Move product, is sold or otherwise

disposed of within nine (9) years of purchase, this benefit may be

"recaptured".

Federal Recapture Tax

The Illinois Smart Move Program

The tax is triggered if all three of the following conditions apply:

1. The home is sold or disposed of within nine (9) years of

being purchased, for reasons other than death; and

2. There is a capital gain on the sale of the home, and

3. The household income for the year in which the home is sold

exceeds federal recapture tax limits.

For an example of a recapture scenario please see the

recapture addendum of this presentation or go to ihda.org

Federal Recapture Tax

The Illinois Smart Move Program

IHDA’s Reimbursement Policy:

IHDA will reimburse buyers for the recapture tax as long as

they can provide documentation showing that the recapture

tax was paid (IRS tax transcripts).

The Reimbursement Policy does not apply to borrowers accessing a

Mortgage Credit Certificate (MCC).

The Illinois Smart Move Program

Smart Move Process

Smart Move Process

1. RESERVATION

2. COMPLIANCE REVIEW

3. CREDIT UNDERWRITING (#’s 2 and 3 can occur simultaneously)

4. CLOSING

5. LOAN SALE & POST CLOSING

The Illinois Smart Move Program

Smart Move Process

Step One: Reservation

Reservations are made online at https://ilrss.ihda.org/ilrss/ IHDA provides a reservation

manual to assist you. A copy is provided as part of this presentation. It is also located

at ihda.org

In order to make a reservation you must have an user id and password

To obtain an user id and password you must contact your system administrator

1. Every lender has an internal administrator at their institution

2. Do you know who’s your administrator?

Once a reservation is made it must close within 60 days. If it doesn’t close within that

time frame, IHDA’s worst case pricing will apply

Rates are subject to change without notice

The Illinois Smart Move Program

Smart Move Process

Step Two: Compliance Review

A compliance file is sent by the lender to IHDA, where we determine if the buyer meets

compliance guidelines (first time homebuyer, income and purchase price limits)

Compliance files can be uploaded through the Mitas system to IHDA for review

IHDA provides compliance checklists to assist you. They are mandatory forms and must

be submitted with every compliance file

It take on average 48-72 business hours to complete the initial review

Lender is notified of review by email

The Illinois Smart Move Program

Smart Move ProcessStep Two: Compliance Review Continued

Smart Move compliance files consists of the same forms that lenders use on a daily

basis. There are documents that are unique to IHDA and are listed below:

Smart Move Buyer and Seller Affidavits

Smart Move Certificate of Income

Recapture notice

Three years of tax returns.

IHDA provides guides on how to complete the above forms. They are included as part of this

presentation and are available at ihda.org.

All IHDA forms are available at ihda.org

All compliance files are sent to the following address

Homeownership Programs

Illinois Housing Development Authority

401 N. Michigan Avenue, Suite 700

Chicago, IL 60611

The Illinois Smart Move Program

Smart Move Process

Step Three: Credit Underwriting

When underwriting Smart Move Loans, you will underwrite according to the program that you

are using (FHA, Conventional, USDA, VA). Please note that IHDA does have two caveats up

and beyond typical underwriting guidelines

Buyers must have a minimum middle fico score of 620

Back end ratio cannot exceed 45%

If you do not have the ability to underwrite loans at your organization, contact US Bank

Help Desk at 1-800-562-5165 for available options

The Illinois Smart Move Program

Smart Move Process

Step Four: Closing

Once you have IHDA and credit approval you can close. Please be aware

of the following.

IHDA offers an optional pre-closing review. Within 24 hours of closing

fax to (312) 832-2195

Copy of the Hud-1

Face pages of the first and second mortgages

The Illinois Smart Move Program

Smart Move Process

Step Five: Loan Sale and Post Closing

Smart Move Loans are sold to US Bank who also acts as the servicer

Purchase files are submitted to both IHDA and US Bank, which

largely mirror each other.

Lender has 10 days from the loan closing date to send the post

closing documents to IHDA.

Loan must have approval from US Bank and IHDA before it is

purchased.

For details on US Bank’s purchase process call their help desk at

1-800-562-5165 or www.mrbp.usbank.com

The Illinois Smart Move Program

Smart Move Process

Step Five: Loan Sale and Post Closing

The Illinois Smart Move Program

Smart Move purchase files consist of the same forms that lenders use on a daily basis. There

are documents that are unique to IHDA and are listed below:

Smart Move Buyer and Seller Affidavits

IHDA Mortgage Rider

IHDA Second Note and welcome letter

IHDA Second Mortgage

IHDA provides checklists for to assist you. They are mandatory forms and must be submitted with

every compliance file

IHDA provides guides and checklists on how to complete the above forms. They are included as

part of this presentation and is available at ihda.org.

All purchase files are sent to the following address

Homeownership Programs

Illinois Housing Development Authority

401 N. Michigan Avenue, Suite 700

Chicago, IL 60611

Step Five: Loan Sale and Post Closing Cont’d

The Illinois Smart Move Program

Below are common errors that occur on IHDA closing submissions

IHDA closing conditions are not met.

Errors on IHDA Mortgage Rider

Rider is recorded with the first mortgage only

Marital Status missing on either the first or second mortgage

By following the IHDA post closing checklist you should eliminate most if not all

errors. Use of the checklist is mandatory.

The Illinois HOME START Program

Closing a Down Payment Assistance Loan (DPA)

DPA loan closes in name of “Illinois Housing Development Authority”

No Truth in Lending (T-I-L) required

Loan can be reflected as subordinate financing on HUD-1 generated for

first mortgage or can have it’s own HUD-1

It is not required to execute an Assignment in

order to sell the second mortgage to U.S. Bank

Home Mortgage.

Lender Compensation:

The Illinois HOME START Program

Origination Fee: Lender can charge 0.5% origination fee to the borrower(s)

Allowable Fees: Lender can charge fair and reasonable fees (up to $1,200)

for services allowed

Service Release Fee: Lender will receive 2.25% of the 1st mortgage amount

as a service release fee for FHA, USDA, & VA loans

For Conventional loans lender will receive 2.25% of the

1st mortgage amount

Resources:

The Illinois Smart Move Program

IHDA Compliance Officers: Linda Benson 312-836-5249

Allison Crane 312-836-8561

IHDA Account Managers: Scott Bush 312-898-3317

Greg Faulkner 312-914-5023

IHDA Toll Free Hotline: 1-877-456-2656

IHDA website: www.ihda.org

U.S. Bank Help Desk: 1-800-562-5165

Objectives Recap:

After completion of this presentation participants will be able to:

Explain to homebuyers the benefits of the Smart Move Loan and Smart

Move assistance programs

Distinguish whether a buyer qualifies for 3% or 5% Smart Move

assistance

Explain the three compliance qualifications of the Smart Move program

Explain why targeted areas are beneficial and where a list of targeted

areas can be found.

Explain the three recapture triggers

Explain the five steps of the IHDA loan process

Find guides to assist in submitting IHDA loans

The Illinois Smart Move Program

The Illinois Smart Move Program

Questions?

The Illinois Smart Move Program