Ignatius Chithelen & Chris Fling: Analyzing Oil & Gas Companies April 2011

-

Upload

ignatiuschithelen -

Category

Documents

-

view

220 -

download

0

description

Transcript of Ignatius Chithelen & Chris Fling: Analyzing Oil & Gas Companies April 2011

Banyan Tree Capital Management

Analyzing Oil and Gas Exploration and Production Companies

Presentation to undergraduate students at University Of Oklahoma’s Energy Management

Program, attending the Independent Petroleum Association of America’s Oil and Gas Investment Symposium, New York, April 12, 2011

Ignatius Chithelen, Managing Partner, Banyan, New York NY Chris Fling, Principal, Bear Peak Resources, Tulsa OK

Banyan Tree Capital Management 509 Madison Avenue Suite 406

New York NY [email protected]

Banyan Tree Capital Management 2

Focus: Key Issues

• Business economics of Oil and Gas

• Company specific:– Assets– Finances– Management

Banyan Tree Capital Management 3

Business Economics of Commodities

Long term price trends determined by supply and demand

Historical supply, demand, price data helpful

More Important: anticipate future, long term supply, demand and price trends

Typical Investment strategy in commodities: buy after steep, cyclical price declines. Sell near peaks.

Crude Oil: a global market

Banyan Tree Capital Management 4

Banyan Tree Capital Management 5

Banyan Tree Capital Management 6

Global Energy Demand to 2030

Oil, gas, and coal continue to provide about 80 percent of world energy

Energy savings in 2030 about twice the growth in projected energy use

Energy demand is expected to grow about 35 percent by 2030 – led by economic progress in developing nations

Source: Exxon Mobil

Banyan Tree Capital Management 7

Natural Gas – US, Canada market

• Supply: Shale gas major, long term source • Shale supply likely cap prices for years• Prices will rise if serious shale environmental

issues found. Some current major shale operators likely big winners in this scenario

• Demand: some users will switch from oil to gas if gas prices stay relatively low for years

• Demand: export gas as LNG. Outlook uncertain

Banyan Tree Capital Management 8

Banyan Tree Capital Management 9

Banyan Tree Capital Management 10

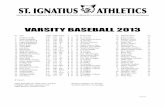

Analyzing companies – 1

• Reserves: oil/gas; potential output; size and life; access to markets

• Finances/Managerial skills: – Expensive reserves? Hence took on big debt load?– Total all in Costs per barrel or per MCFE – Prices received compared to market prices – Hedging took away upside in oil, gas prices?

• Investment decision: Stock cheap on price to future earnings, free cash flow? Potential growth already reflected in stock price?

• Company: SM Energy (SM) – pages 11 to 14

Banyan Tree Capital Management 11

Banyan Tree Capital Management 12

Banyan Tree Capital Management 13

Banyan Tree Capital Management 14

Banyan Tree Capital Management 15

Banyan Tree Capital Management 16

Analyzing Companies - 2

• Reserves: – Maintain current production; grow output– major assets/potential discoveries not widely known on

Wall Street

• Finances/Management:– Debt maturity – short, long– Low or high cost debt. Ability to borrow at low cost. – Ownership, major sale of stock: managers, directors

Companies: Swift Energy(SFY) - pages 17 to 21 SandRidge Energy (SR) – pages 22 to

26

Banyan Tree Capital Management 17

Banyan Tree Capital Management 18

Banyan Tree Capital Management 19

Banyan Tree Capital Management 20

Banyan Tree Capital Management 21

Banyan Tree Capital Management 22

Banyan Tree Capital Management 23

Banyan Tree Capital Management 24

Banyan Tree Capital Management 25

Banyan Tree Capital Management 26

Banyan Tree Capital Management 27

Reading Suggestions for analyzing equity investments

• Peter Lynch --- Beating the Street--- One Up Over Wall Street

• Benjamin Graham– The Intelligent Investor. 1986 Edition with introduction and

appendix by Warren Buffett– Security Analysis. The classic 1951 edition reprinted 2004

• Warren Buffett --- Chairman’s letters BerkshireHathaway.com • Jim Rogers --- Hot Commodities

Banyan Tree Capital Management 28

Ignatius Chithelen, CFA Ignatius is founder of Banyan Tree Capital Management, which runs a long/short mostly US equities fund, based on analysis of the underlying business economics and a value discipline. Banyan was started in August 2000 on the premise that the Internet bubble was going to collapse soon and cheap stocks of old economy companies would do well. Through independent research, seek three types of investments: stable, consistent above average earnings and free cash flow growth arising from volume and/or price increases; strong earnings and free cash flow growth from secular, long term supply demand changes and good, undervalued assets and a catalyst that will unlock the value for shareholders. Short overvalued companies with declining margins and likely losses due to problems with the business and/or products and services; also high debt and weak management. Ignatius’ investing edge is that, due to a nine month study of India’s sugar industry, he understands supply and demand. This, plus his analytical curiosity and experience, gives him some idea which stocks will likely make money and which may lose money. He sticks to areas he knows, tries to avoid big losses by estimating maximum downside from worst case scenarios and views panics as major investment opportunities. Banyan outperformed the long/short hedge indexes, as well as the S&P 500 Index, in the 2007 to 2009 bear market, amidst the worst global economy since 1933. First Eagle (previously SoGen Funds), New York 1995 to 1999: Part of four member investment management team. SoGen $4 billion assets mid 1990’s; currently over $40 billion. Portfolio Manager 1995 to 1997 long only US account. Gain of 77%*, while holding 22% in cash. No use of leverage and no technology stocks. Analyst 1993 to 1999: Identified and analyzed an estimated $300 million of securities, which were bought and sold by SoGen's funds. These included oil & gas stocks in the US and Norway, Titan Cement, a low cost Greek 10 fold gainer and Fast Retailing, which pioneered own label discount apparel retailing in the brand conscious Japan of the early 1990’s, offering a potential 100 plus fold stock price gain. Forbes, New York Reporter 1987-1992. Economic & Political Weekly, Mumbai, Assistant Editor 1983-85 Government of India, Consultant, Sugar Industry 1983 Chartered Financial Analyst, New York, 1992 Columbia University, New York, MS Journalism 1986 Center for Development Studies, India, M Phil 1982. Thesis - published as two research articles - analyzed the pricing, demand/supply and profit and loss cycles, economic history and politics of the sugar industry in India's leading cane growing state. Mumbai University: MA Political Science 1979. BA Philosophy 1977 Quoted in The Financial Times, Barron’s, Bloomberg and Forbes. See: btcapital.biz. Speaker at Wharton, Harvard Club of NY, NYU & other events. Volunteer and assist CitySquash and other inner city educational programs. Enjoy golf and squash. US citizen: 1993. *Estimated gross returns. Past performance is not indicative of future results.

Banyan Tree Capital Management 29

Additional Information

This brochure was the basis of a discussion, for evaluating oil and gas exploration and production companies, with a select group of under graduate students in the Energy Management Program at the University of Oklahoma, attending the Independent Petroleum Association of America’s Oil and Gas Investment Symposium in New York April 12, 2011. Chris Fling, an alumni of the University’s program, is Principal of Bear Peak Resources LLC, an oil and gas exploration and production company.

All information included in this brochure was purely for educational purposes and is not a recommendation of any investment services of Banyan Tree Capital Management, Ignatius Chithelen, Bear Peak Resources and Chris Fling. The specific information on individual companies, taken from recent company presentations, was also purely for education purposes and is not a recommendation to buy or sell any of the stocks. Banyan, Bear Peak, Ignatius and Chris had no investment positions in the companies mentioned at the time of the presentation.

The price charts for the stocks are from BigCharts. The Insider transactions table is from Yahoo Finance.Information in this document is believed to be from reliable sources but cannot be guaranteed as to accuracy.

Ignatius Chithelen CFA Managing PartnerBanyan Tree Capital Management LLC509 Madison Avenue, Suite 406New York NY [email protected]

Chris FlingPrincipalBear Peak Resources LLCP.O.Box 52467Tulsa OK [email protected]