IFE, RBV, Porter's

-

Upload

karlen-yrisarry -

Category

Education

-

view

254 -

download

4

Transcript of IFE, RBV, Porter's

IFE Matrix

What is the IFE Matrix?

• Internal Factor Evaluation Matrix

• A summary step in conducting internal

strategic management audit.

• Summarizes and evaluates the major

strengths and weaknesses in the

functional areas of a business.

Components

• Internal Factors – list of all strengths and weaknesses

• Weights – Scale of 0 to 1

• Rating – Scale of 1 to 4

– Strengths – 4-major strength; 3- minor strength

– Weaknesses – 1-major weakness; 2-minor weakness

• Total Weighted Score

Construction of IFE Matrix

• Make a table. In the first column, list

down all the strengths and weaknesses.

• In the second column, assign weights to

each factor ranging from 0.0 (not

important) to 1 (most important).

• The sum of all weights must be equal to

1.

Construction of IFE Matrix

• In the third column, rate each factor

ranging from 1 to 4 (where: 1 = major

weakness, 2 = minor weakness, 3 = minor

strength, 4 = major strength.)

Construction of IFE Matrix

• In the fourth column, calculate weighted

score by multiplying each factor’s score

by its rating.

• Find the total weighted score by adding

the weighted scores for each variable.

Resource-Based View

What is RBV?

• The resource-based view focuses on

internal resources, the firm's strengths

and weaknesses, in contrast to the

positional or environmental models of

competitive advantage which focuses on

opportunities and threats. (Barney, 1991)

The Language of Resources and Capabilities

Resources

Inputs into a firm’s production process

Capability

capacity of an integrated set of resources

to integratively perform a task or activity

Rents

A surplus of revenue over cost.

Strategic Assets/Core Competencies

Resources and capabilities that can earn

rents.

Types of Resources

Tangible Resources – include all plant and

equipment, location, technology, raw

materials and machines

Intangible Resources - include all

employees, training, experience,

intelligence, knowledge, skills, abilities

Organizational Resources - include firm

structure, planning processes, information

systems, trademarks, copyrights, databases.

Resources and capabilities lead to Competitive Advantage when they are:

Valuable allow the firm to exploit opportunities or neutralize threats in its external environment.

Rare possessed by few, if any, current and potential competitors

Costly to imitate when other firms either cannot obtain them at a much higher cost

Non-substitutable the firm must be organized appropriately to obtain the full benefits of the resources in order to realize a competitive advantage

Criteria for Sustainable Competitive Advantage and Strategic Implications

Porter’s Competitive Strategies

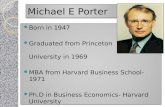

Who is Michael Porter?

• Described a category

scheme consisting of

three general types of

strategies that are

commonly used by

businesses to achieve

and maintain

competitive

advantage.

Three Generic Strategies

1. Cost Leadership

– a firm sets out to become the low cost

producer in its industry.

– Targets a broad market

• Competitive Advatages:

– by reducing production costs and therefore

increasing the amount of profit made on

each sale as the business believes that its

brand can command a premium price or

– by reducing production costs and passing on

the cost saving to customers in the hope that

it will increase sales and market share

Example:

• Southwest Airlines

– The airline industry has typically been an

industry where profits are hard to come by

without charging high ticket prices.

Southwest Airlines challenged this concept by

marketing itself as a cost leader.

Risk:

• other firms may be able to lower their

costs as well. As technology improves,

the competition may be able to leapfrog

the production capabilities, thus

eliminating the competitive advantage.

DIFFERENTIATION

– a firm seeks to be unique in its industry along

some dimensions that are widely valued by

buyers.

– It selects one or more attributes that many

buyers in an industry perceive as important,

and uniquely positions itself to meet those

needs.

Example:

• For the health and wellness section...

• PROCTOR AND GAMBLE

- Differentiation of health and hygiene

products bet Johnson and Johnson with

variants in product and price sufficient

though not leader in this segment

Risk:

• The risks associated with a

differentiation strategy include imitation

by competitors and changes in customer

tastes.

FOCUS

– rests on the choice of a narrow competitive

scope within an industry. The focuser selects

a segment or group of segments in the

industry and tailors its strategy to serving

them to the exclusion of others.

Two Variants

FOCUSED COST LEADERSHIP

• In cost focus a firm seeks a cost

advantage in its target segment

Example:

• VENDING MACHINES

-This strategy allows the firm to offer large

demand at very low prices and still remain

profitable.

FOCUSED DIFFERENTIATION

• differentiation focus a firm seeks

differentiation in its target segment.

Both variants of the focus strategy rest

on differences between a focuser's target

segment and other segments in the

industry.

Example:

• One example is Breezes Resorts, a

company that caters to couples without

children. The firm operates seven

tropical resorts where vacationers are

guaranteed that they will not be annoyed

by loud and disruptive children.

• Focus (Niche) Strategy

– Under a focus strategy a business focuses its

effort on one particular segment of the

market and aims to become well known for

providing products/services for

that segment.

Key Points:

• Cost leadership

– can benefit either by gaining market share

through lowering prices or by maintaining

average prices and therefore increasing

profits.

• DIFFERENTIATION STRATEGY

– win market strategy offering unique features

that are valued by their customers

• FOCUS STRATEGY

– involves achieving cist leadership of

differentiation within niche market in ways

that are not available to more focused

players.

“STUCK IN THE MIDDLE”(Best Cost Strategy)

– attempt to adopt all three strategies; cost

leadership, differentiation and niche (focus).

A business adopting all three strategies is

known as "stuck in the middle". They have no

clear business strategy and are attempting to

be everything to everyone.

STEPS IN CHOOSING THE RIGHT GENERIC STRATEGY

1.) Carry out SWOT Analysis

2.) Use Five Forces Analysis

3.) Compare SWOT Analysis f the viable

strategic options with the results of your

five forces analysis

References (IFE Matrix):

• https://managementmania.com/en/ife-matrix

• http://en.wikipedia.org/wiki/IFE_matrix

• http://www.soopertutorials.com/business/strategic-management/478-how-to-develop-internal-factor-evaluation-matrix-ife-matrix.html

• http://www.zeepedia.com/read.php?ife_matrix_the_internal_factor_evaluation_ife_matrix_internal_audit_strategic_management&b=58&c=12

• http://www.maxi-pedia.com/IFE+EFE+matrix+internal+factor+evaluation

• http://mba-lectures.com/management/strategic-management/1097/ife-matrix-of-coca-cola-company.html

References (RBV):

• http://en.wikipedia.org/wiki/Resource-

based_view

• https://www.boundless.com/managemen

t/strategic-management/internal-

analysis-inputs-to-strategy/resource-

based-view/

• http://www.businessdictionary.com/defi

nition/resource-based-view.html

References (Porter’s):

• http://en.wikipedia.org/wiki/Porter's_generic_strategies

• http://www.mindtools.com/pages/article/newSTR_82.htm

• http://www.slideshare.net/dipalij07/porters-generic-strategies-with-examples

• http://www.slideshare.net/dipalij07/porters-generic-strategies-with-examples

• http://en.wikipedia.org/wiki/Michael_Porter

• https://www.boundless.com/management/strategic-management/internal-analysis-inputs-to-strategy/porter-s-competitive-strategies/