Houston Marine Insurance Seminar “Overview of Excess Casualty and Other Lines” September 23,...

-

Upload

ferris-scott -

Category

Documents

-

view

22 -

download

1

description

Transcript of Houston Marine Insurance Seminar “Overview of Excess Casualty and Other Lines” September 23,...

Houston Marine Insurance Seminar

“Overview of Excess Casualty and Other Lines”

September 23, 2002

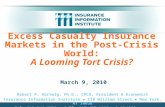

-21.05%

-26.12%

-13.04%-13.84%

-7.10%-7.66%

-30

-25

-20

-15

-10

-5

0

Nasdaq S&P 500 Dow Jones

2001

6 Mos. 2002

U. S. Equity Markets 2001-02

P/C Insurer Financial Strength 2001

6 companies ratings were raised

209 companies ratings were lowered

24 companies became insolvent - all of which were rated below S&P “BBB”

Source: Standards & Poor’s, March 27, 2002

0%

5%

10%

15%

20%

25%

19

70

19

72

19

74

19

76

19

78

19

80

19

82

19

84

19

86

19

88

19

90

19

92

19

94

19

96

19

98

20

00

20

02

Growth in U.S. P&C NPW ( All Lines)

Source: A.M. Best, Insurance Information Institute*Estimate based on III 2002 Earlybird Survey

2000: 5.1%2001 Estimate: 10.3%*2002 Forecast: 15.1%*

Underwriting Gain (Loss) 1975 - 2001

*2001 estimate based on first 9 months including assumptions for WTC losses.Source: A.M. Best, Insurance Information Institute

($40)

($30)

($20)

($10)

$0

$10

1975

1977

1979

1981

1983

1985

1987

1989

1991

1993

1995

1997

1999

2001

*

World’s costliest property catastrophe insurance losses, 1970 to 2001

Insured Loss ($millions) Date Event Country

1 40-60 BN* 11/9/01 Terrorist attack on WTC, Pentagon United States 2 20,185 23/8/92 Hurricane Andrew United States, Bahamas3 16,720 17/1/94 Northridge Earthquake United States4 7,338 27/9/91 Typhoon Mireille Japan5 6,221 25/1/90 Winterstorm Daria France, GB, B6 6,164 25/12/99 Winterstorm Lothar France, CH7 5,990 15/9/89 Hurricane Hugo Puerto Rico, United States8 4,674 15/10/87 Storms and floods Europe9 4,323 25/2/90 Winterstorm Vivian Western/Central Europe10 4,293 22/9/99 Typhoon Bart Japan11 3,833 20/9/98 Hurricane Georges United States, Caribbean12 3,150 5/6/01 Tropical Storm Allison United States13 2,994 6/7/88 Piper Alpha oil platform explosion Great Britain14 2,872 17/1/95 Great Hanshin earthquake, Kobe Japan15 2,551 27/12/99 Winterstorm Martin France, Spain, CH16 2,508 10/9/99 Hurricane Floyd, flooding United States17 2,440 1/10/95 Hurricane Opal United States, Mexico18 2,144 10/3/93 Blizzard, tornadoes United States19 2,019 11/9/92 Hurricane Iniki United States20 @2,000 Aug ‘02 European Floods

Source: Swiss Re, Sigma. At 2001 prices•WTC property losses alone estimated at $19BN.

Energy Property Losses

$110M

$950M

$440M

$1.35BN

$300M

$0

$200M

$400M

$600M

$800M

$1BN

$1.2BN

$1.4BN

'98 '99 '00 '01 '02*

* 02 Loss Exceeding $50M include: Gas, plant fire, Kuwait $150M Refinery fire, Japan $ 75M Power station flood, Washington State $ 70M

Percent of Awards Greater Than $1 Million By Liability Type

0

10

20

30

40

50

60

70

ProductsLiability

BusinessNegligence

MedicalMalpractice

PremisesLiability

VehicularLiability*

1994-1996

1999-2000

* Includes Personal AutoSource: Current Award Trends in Personal Injury 2001 Jury Verdict Research

Impact of Loss Cost Trends on Excess Casualty

Attachment points have not kept pace with loss cost trends Frequency - More claims now penetrating excess layer Severity

More severity losses Excess layer receives the bulk of severity increases

Higher attachment points would offset, in part, the effect of new losses trending into the excess layer

Workers Compensation Post 9/11/01• “Employee concentration” issues long existed, but 9/11 made the potential real with catastrophic results.

• 9/11 brought new analytic, catastrophic modeling into common use:

Aggregation analysis: identifying substantial numbers of employees at a single location or in a single area Geo-coding: quantifying high-risk geographic zones exposures across multiple lines of insurance

• Heightened emphasis on material risk information, including review of insured’s disaster and business continuity plans.

Vehicular Liability Jury Awards (including Personal Auto)

%Change 1994 2000 2005? 1994-2000

Top Award $20,625,000 $46,000,000 ? 123% Mean Award $187,152 $268,648 ? 44%

Underwriters are pricing risks today for possible events which will not be adjudicated until 2005.

• The U.S. Department of Transportation estimates the average costs of an auto fatality in the year 2000 was $977,000. The average cost of a critical injury was $1,100,000.

• U.S. Department of Transportation, National Highway Traffic Safety Administration (NHTSA), May 2002.

Asbestos, MTBE & Mold

Asbestos Unparalleled loss estimates 300,000 court cases in U.S, and rising Unveiling of “unimpaired cases” premise

MTBE Energy insurance sector liability concerns

Mold Unchartered territory Congressional intervention

Average Settlement Values

0

5M

10M

15M

20M

25M

All Cases Accounting Cases Non AccountingCases

'96-'00

2001

Restatements Filed 1997 - 2001

116

158

216233

270

0

50

100

150

200

250

300

1997 1998 1999 2000 2001

Energy Industry and Insurance

• Events in both industries have impacted the risk financing strategies of energy companies.

• Energy sector consolidation and downwards credit rating trends influencing risk assessment by insurers.

• P&C hard market dynamics adding pressure on enterprise risk spend.

Looking Ahead• Collective responsibility to ensure marketplace viability.

• Reinforcement of long-term relationships.

• Adjust perception of opportunistic enticements.

• Importance of insurer credit-worthiness.

• Value of insurance companies track record.

• Listening and understanding what is important to each other - insurers, reinsurers, brokers and insureds.