Hope Dread Disappointment and Elation From Anticipation

Transcript of Hope Dread Disappointment and Elation From Anticipation

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

1/40

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

2/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

on the website of www.megamillions.com many people were still willing to pay a few dollars to play

it. With a few dollars, they bought hope, which allowed them to dream about what they would do with

hundreds of millions of dollars. Dreaming about winning in the days between buying a ticket and

learning the outcome of the lottery drawing may have brought more pleasure to the players than using

a few dollars to buy a snack or a cup of coffee.

Lottery buyers in the Mega Millions lottery experience more utility by anticipating a higher

expected payoff from the lottery, because anticipating a favorable result is in itself a pleasurable

outcome. This type of behavior is consistent with the theory of utility from anticipation, which is

based on the assumption that people not only derive utility when experiencing an outcome but also

from anticipating the outcome (Akerlof and Dickens 1982, Loewenstein 1987, Elster and Lowenstein

1992).

However, anticipating a higher expected payoff may also result in more disappointment when a

player does not win the lottery. Adopting the old saying, Blessed is he who expects nothing, for he

shall never be disappointed is consistent with lowering anticipated expected payoff. The notion that a

DM can subjectively change her anticipation level for an uncertain payoff has been studied

extensively in psychology and behavioral science (Taylor and Shepperd 1998, Van Dijk et al. 2003,

Carroll et al 2006). In all of these studies, scholars confirmed that people tend to lower their

expectations or predictions for a self-relevant event as the event draws near. Van Dijk et al (2003)

hypothesize that people lower their expectations to protect themselves from suffering a major

disappointment when the uncertainty of a proximate self-relevant event is resolved.

Thus there are two competing cognitive strategies that a decision maker (DM) might employ to

increase her experienced utility: savoring a higher anticipated payoff before the uncertainty of the

payoff is resolved or anticipating a less desirable payoff to avoid disappointment when the lottery is

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

3/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

resolved. These two competing strategies have been verified in experimental studies by Loewenstein

and Linville (1986).

In this paper, we propose a decision making model to capture the tradeoff between these two

conflicting strategies that influence the DMs total experienced utility from an uncertain outcome paid

in the future. Besides the behavioral findings reviewed above, our research is also closely related to

the concept of disappointment (Bell 1985, Loomes and Sugden 1986, Jia et al. 2001). In these

disappointment models, a DM anticipates that she will experience either elation or disappointment

when the lottery is resolved and paid, depending on whether the realized outcome is superior or

inferior to her reference point. The reference point against which the outcome is compared to form

elation and disappointment is assumed to be either the mathematical expectation of the lottery (Bell

1985, Jia et al. 2001) or the expected utility of the lottery (Loomes and Sugden 1986). However, these

models do not apply to a decision maker who subjectively chooses to lower her expectation to avoid

disappointment, as the expectations in these disappointment models are based on objective

probabilities.

Our model is a special case of a model proposed by Gollier and Muermann (2010), hereafter the

GM model, where a DM forms her expectation of the anticipated outcome based on her subjective

probabilities. Before the uncertainty of the outcome is resolved, she can savor the anticipation; after

the uncertainty is resolved, she experiences either elation or disappointment by comparing the realized

payoff with a reference point determined by her subjective expectation. The GM model assumes that

the DM chooses an optimal subjective belief to balance the tradeoff between savoring higher

expectation and avoiding higher disappointment. This assumption in the GM model is related to the

line of research on optimal beliefs in expected utility introduced by Brunnermeier and Parker (2005)

and Brunnermeier et al. (2007). We allow for any possible anticipated payoff level in the decision

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

4/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

making process rather than assume the DM is capable of determining the optimal anticipation to

maximize her utility. Savoring anticipation and avoiding disappointment may be only two of many

considerations that influence how people form their beliefs about the future.

Our model asserts a different process of forming an anticipated outcome to savor than GM,

which results in different implications. For example, we show that in a portfolio choice problem our

model is consistent with the empirical finding that optimism will lead to more investment in the risky

asset relative to the risk free asset (Manju and Robinson 2007, Balasuriya 2010, Nosic and Weber

2010). In contrast, the GM model conflicts with these empirical findings. This conflict is addressed by

an extension of the GM model proposed by Jouini et al (2013). However, neither GM nor Jouini et al

(2013) propose preference conditions for their models. In contrast, we also develop an axiomatic basis

for our model with preference assumptions that can be evaluated for their reasonableness.

We refer to the anticipated expected payoff based on a DMs subjective probabilities as the

anticipation level. By changing her subjective probabilities over outcomes, the DM could change her

anticipation level for a lottery. This anticipation level influences two types of utility derived from a

lottery: utility of anticipation and anticipated experienced utility. Utility of anticipation is the

pleasure or pain that the DM consumes before the lottery is resolved, where anticipation can be

interpreted as a psychological state (Caplin and Leahy, 2001). Anticipated experienced utility is

determined based on the DMs prediction of how disappointed or elated she will feel when the lottery

is resolved. By incorporating these two types of utility into a unified framework, our model captures

four different emotions we may observe in a risky decision context: hope, dread, elation, and

disappointment.

While elation and disappointment have been modeled in disappointment theory (Bell 1985,

Loomes and Sugden 1986, Jia et al 2001, Delqui and Cillo 2006), there are few studies that embed

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

5/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

hope and dread in a decision model. One exception is Chew and Ho (1994) who did model hope as

the preference for the late resolution of the uncertainty in a recursive utility framework. Caplin and

Leahy (2001) proposed a very general model that incorporates the utility derived from anticipatory

feelings such as anxiety, hope, and suspense in the decision making process. However, they did

not allow the anticipatory feelings to influence the decision makers reference point, thus emotions of

disappointment and elation are not captured by their model. We model hope as the anticipation of a

gain and dread as the anticipation of a loss consistent with Lowenstein (1987).

The rest of the paper is organized as follows. In section 2, we introduce a general model and

show that a special case of this model is a Risk-Value model (Jia and Dyer 1996). We then make

additional assumptions about the components of this general model and obtain a model similar to GM,

which also contains Bells (1985) disappointment model as a special case. In section 3, we propose

preference conditions to axiomatize the models discussed in section 2, while section 4 discusses the

risk attitudes captured by our model that cannot be described by Expected Utility (EU) model and

shows that our model can be used to interpret the coexistence of gambling and insurance purchasing

without violating either stochastic dominance or transitivity; other existing models for the utility of

gambling violate at least one of these conditions. In section 5, we apply our model to portfolio choice

and the selection of the optimal advertising level to demonstrate the variety of factors that might affect

preference that our model can accommodate. Section 6 concludes the paper. All the proofs are

provided in the appendix.

2. The model

In this paper, we useto denote a lottery of payoffs and to denote an anticipation level. The

bounded sets of payoffs and anticipation are denoted by and respectively. In general,

the anticipation level depends on the lottery, which can be denoted by . Thus, is a function of

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

6/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

consistent with Caplin and Leahy (2001).However, when it is clear which lottery is associated with

the anticipation level we will drop the subscript and simply use .

We consider two periods in our model. In the first period, the DM chooses the anticipation level

of the lotterywith monetary payoffs that is under consideration. She derives utility from before

the lottery is resolved by savoring it. In the second period, the lottery is resolved and she experiences

either elation or disappointment induced by comparing the received outcome of the lottery with a

reference point determined by . Thus, the DMs evaluation of a lottery in the first period is based

on a two attribute vector (, ). The total ex ante utility derived from this lotterywith an associated

anticipation is evaluated by the DM according to the following model with ()> 0

, = () +() () (1)

The total ex ante utility , in this model is decomposed into two parts, the utility of

anticipation()and the anticipated experienced utility (). Since the utility function is

unique up to an affine transformation, we can rescale it such that (0,0)= 0, (0)= 0, and (0)=

0. This rescaling leads to zero total ex ante utility for the DM when she both anticipates and receives a

zero outcome. The function ()is a trade-off factor between the two components of the total ex ante

utility. For a lottery, if the DM anticipates > 0, this positive anticipation creates hope for the

DM; if the DM anticipates < 0, this negative anticipation creates dread. Since this anticipation is

the outcome the DM anticipates before the lottery is resolved, the reference point used by the DM

to form elation and disappointment should be influenced by this anticipation level. Specifically, we

assume the reference point depends on the anticipation level through a function (). For any

realized outcome , the DM experiences () and will be elated when > () and

disappointedwhen < ().

We do not address the psychological mechanisms that may form anticipation. Instead, we allow

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

7/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

the DM to form anticipation in many possible ways. If the DM forms her anticipation level by using

her subjective probability over the possible future outcomes, then the anticipation level can be

interpreted as the certainty equivalent of the lottery in a manner consistent with the interpretation

of anticipation in the GM model. We also assume that this anticipation is bounded by the minimum

possible outcome and the maximum possible outcome of a lottery, minand maxrespectively,

which is consistent with the argument by Jouini et al. (2013). If the DMs anticipation level for is

the mathematical expectation of the lottery, = , and she also chooses the anticipation level as

the reference point when determining the elation and disappointment, i.e., ()= , our model is

reduced to , = + . If we also assume () = (), our model

(1) is reduced to a Risk-Value model (Jia and Dyer 1996). In this sense, our model (1) can be

considered a General Risk-Value model where the risk is measured by the anticipated experienced

utility from elation and disappointment, and value is measured by the utility of anticipation.

Although model (1) can be obtained by assuming some weak preference conditions as we show

in the next section, it is not a simple model to study and it is more general than other models

considered in the literature. A more parsimonious model that captures the tradeoff between

anticipation and disappointment can be obtained by assuming a constant tradeoff factor ()= 1and

a linear reference point function ()= for some constant 0,1.

, = () + (2)

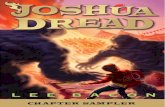

In Figure 1, we show that both of model (1) and (2) are special case of the GM model. The GM

model and its extension proposed by Jouini et al (2013) assume that the DM always adopts her

optimal belief: the anticipation level that maximizes the total ex ante utility derived from the lottery

. In contrast, we do not assume that the DM is capable of optimizing her anticipation when facing a

lottery . In this way, the anticipation level in our model may reflect the DMs optimistic or

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

8/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

pessimistic attitude toward the future as we discuss in subsequent sections.

For model (2), if both and are linear and the DMs anticipation equals the mathematical

expectation of the lottery = , this model reduces to the disappointment model proposed by Bell

(1985). In another special case, if the DMs preferences are not affected by anticipation, elation, or

disappointment, we have = 0and ()becomes a constant. In this case, model (2) reduces to the

expected utility model. In Figure 1, we illustrate the relationships between our models (1) and (2) and

other preference models in the literature.

Figure 1. The relationship of models (1) and (2) with some existing models

3. The preference conditions

In this section, we discuss the preference conditions that imply models (1) and (2) in section 2.

We assume that there is a risky preference over the two attribute space , which is represented

, = ()+ () ()

General Risk Value Model (1)

, = ()+ Anticipation Disappointment Tradeoff Model (2)

, = + Risk Value Model (Jia and Dyer 1996)

, =Expected Utility Model

, =+ Disappointment Model (Bell 1985)

Gollier and Muermanns model (2010)

= max()+ ,

When = , = ,and()=

When () =,() = 1

When(, )= ()()and no max operation is applied to

determine a

When = 0() = 0

When = , = 1,()= and

()= ; 0; < 0

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

9/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

by a von Neumann and Morgenstern utility function (,). Since the anticipation level can be

interpreted as a psychological state which reflects DMs beliefs, this setup is consistent with the

premise that people not only have preferences over payoffs but also over their beliefs about payoffs as

proposed by Akerlof and Dickens (1982) and with the assumption that the DM could have a

preference order over the psychological states as proposed by Caplin and Leahy (2001). The set of

simple lotteries defined overis denoted by and different lotteries on the payoff space are denoted

by, , and so on. Given these definitions, the preference condition leading to model (1) can be

stated as follows.

Assumption 1. (Shifted Utility Independence) For any, and any, , ,

, implies that there exists a quantity (, ) such that + (, ), +

(, ), .

This assumption states that for lotteries resolved and paid in the second period, a DMs

preference order over these lotteries is the same under different levels of anticipation if the lotteries

payoffs are adjusted by a constant amount that depends on the two distinct anticipation levels. For

instance, consider a gambler choosing between betting on a pair of horse races where she anticipates

winning $100 for each bet. She may have the same risky preference over the two races if instead she

anticipates winning $150 if all the possible payoffs are increased by an amount that depends on both

$150 and $100. In a simple special case, for example, this increase could be $50=$150-$100 if

preferences are linear in dollars. When the outcomes are dollars, the higher anticipation may be

completely compensated by the increased payoff levels in the lotteries, and any possible

disappointment and elation from each original lottery is kept the same in the transformed lottery.

In general, there may also exist situations where the required adjustment quantity for the lotteries

does not match the exact difference between the two levels of anticipation. However since the

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

10/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

adjustment is affected by the two different anticipation levels, we expect it to be a function of both

and , i.e., (, )in Assumption 1. Figure 2 provides a graphical depiction of Assumption 1.

Figure 2. Assumption 1: Shifted Utility Independence

When (, )= 0 for any , , Assumption 1 is equivalent to the assumption that is

utility independent of (Keeney and Raiffa, 1976). Utility independence implies that, for example,

the utility function over when anticipation is is an affine transformation of the utility of when

anticipation is , e.g. (, )= ()+()(,) (Keeney and Raiffa 1976). Similarly,

Assumption 1 implies that (, )= () + ()( +(,),), since the preference order over

, is strategically equivalent to the preference order over + (,), . Assumption 1 leads to

the additive representation of model (1) when = 0and ()is defined to be () (, 0)

(0,0). Therefore, we conclude that a utility function (,)representing risky preference over

can be decomposed into model (1) under Assumption 1.

Theorem 1. Assumption 1 holds if and only if the utility function (,)can be decomposed

into (1)with (0)= 0, (0)= 0,and(0)= 0.

As discussed in section 2, model (2) can be obtained as a special case of model (1) by assuming

()= 1and ()= for some 0,1. To state the preference assumptions for model (2), we

denote (, ); (, )as a binary lottery that results in either (, )or (, )with even chances.

,

(, )

(, )

1 ,

(, )

(, )

1

+ (, ),

(+ (, ), )

(+ (, ), )

1

+ (, ),

(+ (, ), )

(+ (, ), )

1

If

Then

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

11/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

Assumption 2. (Shifted Additive Independence) For any and ,there exists

(, ) 0 such that(, ); (, )( (, ), ); ( + (, ), ).

This assumption describes a situation that may happen if a DM is uncertain about her

anticipation level. Caplin and Leahy (2001) adopted a similar assumption in their anticipatory feeling

model. In our paper, we can consider a DM who has an even chance to obtain lottery or on day

2 and the lottery she receives will be resolved and paid two weeks later. In this case, the DM will form

her anticipation level for each lottery and begin to savor it when she learns which lottery she will

receive on day 2. But, on day 1, the DM is uncertain about her anticipation level. If the DM also

forecasts that her anticipation levels will be and forand respectively, the lottery she evaluates

on day 1 is , ; , . If we assume there exist and such that , (, )and

, (, ), the lottery faced by the DM can be written as (, ); (, ), which is the lottery

discussed in Assumption 2.

Specifically, Assumption 2 assumes that the DM faces two such lotteries (, ); (, )and

(, ); (, ). Since and , (, ) is a lower payoff associated with a higher level of

anticipation and (, ) is a higher payoff associated with a lower level of anticipation. Thus, the

lottery produces either a large disappointment or a large elation. The second lottery (, ); (, )

yields either a lower payoff associated with lower anticipation or higher payoff associated with higher

anticipation, which produces neither high disappointment nor high elation. Put another way, the level

of anticipation and the outcome received are negatively correlated for lottery 1 and positively

correlated for lottery 2.

If the DM is correlation seeking in the sense defined by Eeckhoudt et al. (2007) in the payoff-

anticipation space, she may feel like playing it safe: (, ); (, )(, ); (, ). This situation

happens when the utility function has the property of (,)/ 0 , the condition for

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

12/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

disappointment aversion (Gollier and Muermann, 2010). As a result, if the attractiveness of the second

lottery can be reduced by some amount, it is possible that the DM is indifferent between the two

lotteries. This can be achieved by spreading out the outcomes of the preferred lottery on the payoff

attribute while holding the mean constant (i.e., a mean preserving spread). More formally, there may

exist (, )such that (, ); (, )( (, ), ); ( + (, ), )as illustrated in Figure 3.

This preference condition was proposed by He et al (2013) to axiomatize a habit formation and

satiation utility function for intertemporal choice.

Using Assumption 2, we conclude that the trade-off factor in model (1) is equal to 1. To obtain a

linear reference point function ()= so that model (1) reduces to model (2), we also need the

following technical assumption.

Figure 3. Assumption 2: Shifted Additive Independence

Assumption 3. (Linear Shifting Quantity) For any , there is a unique(, )which

depends on the difference betweenand, namely(, )= ( )0 , ,satisfying the

condition in Assumption 2.

Under Assumptions 2 and 3, we can conclude that the utility function (,) can be

decomposed into model (2) as formally stated in Theorem 2.

Theorem 2. Assumptions 2 and 3 hold if and only if the utility function(,) can be

decomposed into(2) with 0,1, (0)= 0, (0)= 0.

(,)

(,)

+ (, )

(, )

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

13/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

4. Risk Attitude

4.1 Optimism, pessimism, and risk attitude

When facing an uncertain outcome, a DMs attitude toward the future outcome may be classified

into two categories, optimistic or pessimistic. When a DMs anticipation level increases, we say that

she has become more optimistic which also means that she has become less pessimistic, and vice

versa. Intuitively an optimistic DM believes better outcomes are more likely to occur and therefore

may take more risks than a DM who is pessimistic. This positive relationship between optimism and

risk seeking behavior has been modeled and tested in the literature (Misina 2005, Anderson and

Galinsky 2006, Dillenberger and Rozen 2011). However, there may be situations where pessimistic

people are more risk seeking; for instance, desperate people may take more risky actions (Lybbert and

Barrett, 2011). In another study, Mansour et al (2008) found that pessimism is positively correlated

with risk tolerance, implying that more pessimistic people are more risk seeking. In this paper, we call

these two types of interaction between anticipation and risk attitude increased risk seeking behavior

due to optimism (pessimism), respectively, and show that our model (2) can be used to describe both.

Following convention, we define the risk attitude by comparing the expected utility of a lottery

with the utility of its expectation. From this section on we denote the anticipation level as to

emphasize that the anticipation level is associated with a particular lottery, . If E, >

(=,

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

14/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

In the economics literature (e.g. Bnabou and Tirole 2002, Epstein and Kopylov, 2007),

optimism (pessimism) is defined by assigning higher subjective probabilities over better (worse)

outcomes. If the DMs anticipation is interpreted as the certainty equivalent for the lottery based on

her subjective probabilities as in GM, then the optimism and pessimism defined here are consistent

with the concepts commonly used in the literature.

In Proposition 1, we use , , and to denote the derivatives of , , and, respectively. Theproposition states that, in our model, more optimism about a lottery (a higher level of anticipation)

could either increase or decrease the risk premium of that lottery. So, our model is consistent with

increased risk seeking behavior due to optimism (pessimism).

Proposition 1. Under the assumptions of model (2), for a given lottery when the DM

anticipates, the risk premium()fordepends on in the following ways:

i. If () 0, then() 0. The DM exhibits increased risk seekingbehavior due to optimism .

ii.If ( ) 0, then ( ) 0. The DM exhibits increased risk seekingbehavior due to pessimism.

When the risk premium ( )is positive, the DM is risk averse and case idescribes a situation

where more optimism leads to less risk aversion. Since being less risk averse implies that the DM is

getting closer to risk seeking behavior, we refer to this as increased risk seeking behavior due to

optimism. When () is negative, the DM is risk seeking and case i describes a situation where

more optimism leads to more risk seeking as | increases. The results of case ii can be

interpreted in a similar way.

This proposition states that whether a DM exhibits increased risk seeking behavior due to

optimism or pessimism is determined by the comparison between the marginal utility of anticipation

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

15/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

and the marginal anticipated experienced utility. When ( ) , the utility from the

increase in anticipation derived by the DM is larger than the utility loss from the increase in

disappointment, and thus the DMs increased risk seeking behavior is due to optimism.

Case iin Proposition 1 may be common for the Mega-millions lottery players discussed in the

introduction. The lottery ticket buyers derive more utility from a higher anticipation than they lose

from disutility due to the potential disappointment. This is consistent with the observation that many

people purchase a lottery ticket as a way to acquire hope. Proposition 1 predicts that for DMs that

gamble and buy lottery tickets, high levels of optimism are associated with more risk seeking

behavior. This also explains why lottery companies spend money on advertisements that depict people

winning the lottery to increase the anticipation level of the public such that they might become more

risk seeking and buy more chances to win.

Similarly, in case iiof Proposition 1 a DM worries more about the possible disappointment. If

she is more pessimistic, her anticipation will be lower. Therefore, she will be less worried about the

possible utility loss from a larger disappointment associated with higher anticipation. This is

consistent with the empirical finding that a negative emotional state may cause people to become

more risk seeking (Zhao 2006, Chuang and Lin 2007), because they value the chance of elation from

receiving a better than anticipated lottery outcome that would improve their negative emotional state.

Case iicannot be explained by the EU model because shifting probability mass from the bad outcome

to the good outcome will increase the expected utility of a lottery. Thus, more optimistic always

implies less risk averse behavior in the EU model.

4.2 Wealth effect on risk attitude

By allowing the DM to choose the level of anticipation, our model can also capture how the

DMs anticipation mediates the wealth effect on her risk attitude. For any anticipation level chosen

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

16/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

by the DM for lotteryat wealth level , there is a unique certainty equivalent that solves the

equation ( + , + )= + , + . For a given , this certainty equivalent is a

function of . In this subsection, we use ()/to denote the derivative of with respect to

wealth to emphasize this point. However, we also use the notation to indicate this function for

simplicity when no derivative of the function is taken. Under model (2), the equation that defines the

certainty equivalent above can be written as

( + ) + + ( + )= ( + ) + + ( + ) (3)

We can investigate how the certainty equivalent is affected by the wealth level at different levels of

anticipation by taking the derivative with respect to on both sides of (3), and solving for ()/

.

()/

= (+ ) ( + ) + (1 ) + ( + ) + ( + )

( + ) + (1 )

+ ( + )

Under the standard assumptions that > 0and > 0, the sign of ()/is determined by

the numerator. Thus, we have the following proposition about the sign of ()/.

Proposition 2. When = 1, ()0, we have:()/ ()0if and only if

(); when 0,1),we have:

i. If

0,

0,

0,

and

(1 ) + implies

()/ 0.

ii.If 0, 0, 0, and (1 ) + implies()/ 0.iii.If 0, 0, 0, and(1 ) + implies()/ 0.iv.If 0, 0, 0, and(1 ) + implies()/ 0.Moreover, if we replace 0 with 0 and () with (), the sign of

()/is unchanged.

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

17/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

When = 1 , the DM uses the anticipation as the reference point to predict the level of

disappointment and the sign of ()/ is determined by the sign of . If we assume

0 , a relatively optimistic DM who anticipates becomes more risk averse with an

increase in wealth, ()/ 0 ; and a relatively pessimistic DM who anticipates

becomes less risk averse with an increase in wealth, ()/ 0.

When 1, the sign of ()/not only depends on the sign of but also depends

on the sign of (1 ) + , as summarized by Proposition 2. These four cases

demonstrate that our model has the descriptive power to capture many different ways that optimism

and pessimism can mediate the wealth effect on risk aversion. For instance, in case ii of Proposition 2,

and(1 ) + implies (risk seeking). So, in this case, a DM who is

relatively pessimistic ( ) and risk seeking ( ) will become more risk seeking at a

higher level of wealth ()/ 0. Among these four cases, cases i and iii are of special

interest, as they describe two seemingly conflicting empirical observations that people with lower

levels of wealth can be either more risk averse or more risk seeking (Caballero 2010, Vieider et al

2012).

For case i, it is straightforward to show that implies both

and . By combining these two inequalities, we obtain (1 ).

Recognizing that case ican be obtained from , we can conclude that a DM with an

anticipation level lower than the certainty equivalent of the lottery and exhibiting risk averse

behavior will become more risk averse when her wealth level decreases, i.e., ()/

0. This is consistent with the observation that people with lower levels of wealth are often more

risk averse than people with higher levels of wealth and are therefore less likely to participate in high

risk/return investment activities, resulting in the poverty trap (Mosley and Verschoor, 2005, Yesuf

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

18/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

and Bluffstone 2009).

Similarly, if the condition is satisfied then using the result of case iii, we can

conclude that a DM with an anticipation level higher than the certainty equivalent and

exhibiting risk seeking behavior will become more risk seeking when her wealth level is

decreased, i.e., ()/ 0. The result of this case matches the observation that DMs with

lower levels of wealth may be more involved in gambling than DMs with higher wealth levels

(Lesieur 1992). When gambling, people may anticipate favorable results; in our terms, gamblers are

optimistic about the payoff of a lottery, i.e., . Thus, the certainty equivalent of a lottery for a

high wealth gambler is smaller than that for a low wealth gambler, which results in relatively less

gambling for high wealth DMs. Bosch-Domenech and Benach (2005) found that people with lower

levels of wealth are more risk seeking than people with higher levels of wealth when facing lotteries

with large absolute payoffs. This empirical finding may also be explained by case iii, since a lottery

with large payoffs is more likely to induce a high anticipation leading to more risk seeking behavior

for people with lower levels of wealth.

4.3 Utility of Gambling

In this subsection, we discuss a widely recognized puzzle in decision theory which is the

coexistence of gambling and insurance purchasing, implying that people are simultaneously risk

seeking and risk averse (Friedman and Savage 1948). This puzzling problem can be traced back to the

work of von Neumann and Morgenstern who believed that gambling behavior is inconsistent with

expected utility theory (von Neumann and Morgenstern 1944, p. 28 and Bleichrodt and Schmidt

2002). Only a few studies have axiomatized the utility of gambling (e.g. Diecidue, et al. 2004), and

typically the utility of gambling is modeled by appending an extra utility term to the standard

expected utility model or by applying different utility functions to non-degenerate and degenerate

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

19/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

lotteries (Fishburn 1980, Conlisk 1993 Schmidt 1998, Diecidue et al. 2004). A common weakness of

these studies is that they do not provide a psychological explanation for why people would use

different utility functions to evaluate risky lotteries and certain outcomes.

Insurance purchasing behavior is consistent with a risk averse expected utility function, which is

a special case of our model. Gambling behavior is consistent with the increased risk seeking behavior

due to optimismcaptured by our model as discussed in subsection 4.1. When people gamble, the high

anticipation associated with taking the wager can make them become more risk seeking (less risk

averse) such that their risk attitude switches from risk aversion to risk seeking.

To illustrate this, we consider a special case of model (2) with = 0, but a similar result can be

obtained for 0. Suppose a simple lottery ticket which induces a large payoff with small

probability and a zero payoff with probability 1 is available for purchase at its expected payoff

. According to our model, a DM that anticipates the nonzero payoff will buy the lottery when the

following condition holds

() + () + (1 )(0)> () + ()

which is equivalent to

() ()> () () (4)

The left hand side of (4) is the utility difference from anticipation and the right hand side is the utility

difference from anticipated experienced utility. The DM may gamble because the utility difference

() () may not be very large. However, when is large and is small, the difference

() () could be very large. In other words, anticipating a large prize from a lottery may

produce much more marginal utility than anticipating the certain payoff of the expectation of the

lottery; () () () ()= () () + (1 )(0) . Therefore, in our

model, the behavior of gambling is interpreted as a product of the high anticipation level which

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

20/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

outweighs the dread the DM might derive from the risk of losing.

Beyond providing intuition, our model also avoids violating stochastic dominance and

transitivity which is not true for most models capable of explaining this phenomenon (Fishburn 1980,

Schmidt 1998, Diecidue et al 2004). Bleichrodt and Schmidt (2002) propose a context dependent

model that does not violate stochastic dominance, but it does violate another desirable property:

transitivity of preference (Luce 2000, MacCrimmon 1968). Stochastic dominance or transitivity is

violated by these models in part because they apply different utility functions to represent the unique

preference order on a set including both risky and riskless alternatives (see Bleichrodt and Schmidt

2002, Table 1). In our model, under the appropriate assumptions, the violation of both stochastic

dominance and transitivity can be avoided.

By definition (Bleichrodt and Schmidt 2002, Diecidue et al. 2004), a preference order satisfies

stochastic dominance if for any degenerate or non-degenerate lottery , any two certain outcomes

, , and any (0,1, if , then + (1 ) + (1 ) . Under model (2), the

preference relation is represented by () + ( ) () + ( ) . Since both

functions ()and ()are monotonically increasing, we know . Compounding lotterywith

will have a total ex ante utility greater than or equal to that from compounding lottery with in

many cases, but it will depend on how a DM forms her anticipation for the compound lotteries. In

Assumption 4, we describe a situation where the larger the payoff compounded with a lottery, the

higher the anticipation formed by the DM. This assumption implies that when an outcome of a lottery

is improved the anticipation level should not decrease, which seems to be reasonable.

Assumption 4. (Consistent Compounding) A DM is said to be consistently compounding in

anticipation if for any and , her anticipation levels for the compound lotteries +

(1 )and + (1 )satisfy the condition() () .

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

21/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

Proposition 3 states that under Assumption 4, the preference in our model satisfies stochastic

dominance when is small enough, i.e., the DM is not very sensitive to the potential disappointment.

Proposition 3. Under Assumption 4, there exists , such that when 0, , +(1), () + (1 ), () for any and any .

A smaller indicates that the gambler is not sensitive to disappointment, which may be true in

practice. A gambler may be driven by the hope created by a large anticipated outcome. If the effect of

disappointment is also strong (large ), the utility of anticipation could be reduced by the

disappointment, which would further reduce the motivation for gambling. Since we observe many

people repeating gambling activities, we may infer that is small for these DMs.

Finally, by introducing the anticipation level in the choice set, our model can avoid the problem

of intransitivity encountered by Bleichrodt and Schmidt (2002). This is apparent since the total ex

ante utility (,) is a representation of a transitive preference order defined on the two attribute

space .

5. Decision making models

5.1. Portfolio selection decision

The portfolio choice problem we study involves the following choices. A decision maker has

initial wealth denoted by . She selects to invest in the risky asset which has a random

gross return . Her remaining wealth is invested in a risk free asset which has a gross return .

The objective is to select an optimal to maximize her utility from holding both the risky and risk

free assets.

In the GM model, for any given level of the allocation to the risky asset, the DM selects her

anticipation level so that her total ex ante utility is maximized. Thus, this optimal anticipation level is

a function of the allocation to the risky asset. Then, under the assumption of optimal anticipation, the

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

22/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

DM optimizes the allocation to the risky asset to maximize her total ex ante utility. By solving a

problem set up in this way, GM obtained the result that optimism is negatively related to allocation to

the risky asset, which seems to be counterintuitive. They acknowledged that their result is somewhat

surprising and that it conflicts with the results predicted by optimal expectations models

(Brumnermeier and Parker 2005, Gollier 2005). Empirical studies have also confirmed that more

optimistic investors tend to hold more risky assets (Manju and Robinson 2007, Balasuriya 2010,

Nosic and Weber 2010). In the extended GM model (Jouini et al. 2013), the feasible domain of the

anticipation level is modified to show that the GM model can be consistent with empirical studies on

the relationship between optimism and investment in the risky asset. In this paper, we provide an

alternative explanation and propose that the surprising result in the GM model may occur because of

the optimal anticipation assumption.

We acknowledge that a DM may adjust her chosen anticipation level for a lottery when she tries

to increase her total ex ante utility, but this may not be a general rule that applies to all situations. The

belief of a DM, which we model as the anticipation level, may be influenced by the context of the

decision. For instance, in a bear market, no matter how optimistic an investor may be, she may not be

able to form an optimistic anticipation level for money invested in stocks. Moreover, as we discussed

above, the GM model assumes that a DM can forecast how the allocation decision will influence the

total ex ante utility through the optimal anticipation. In our development we relax this demanding

requirement that the DM will be able to optimize her anticipation level intentionally when facing such

a portfolio selection problem.

We allow the anticipation level to be influenced by contextual factors and set up the portfolio

decision model as follows. Influenced by the economic environment, the DM forms anticipation

for the random risky return, which is bounded by the minimum and maximum possible outcomes of

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

23/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

, i.e, min, max . Then, her anticipated total wealth is given by ( ) + = +

( ). The utility of anticipation is ( + ( ))and the anticipated experienced utility is

( ) + ( ) + = (1 ) + ( ). Utilizing

these components in (2), the DM optimizes the allocation of her wealth to risky asset by solving the

following problem

max ()= ( + ( )) + (1 ) + ( ) (5)

If we assume that both and are concave functions, () is also a concave function of as

the sum of concave functions is still concave. Under these assumptions we can obtain the following

result.

Proposition 4. The optimal investment in the risky asset in (5) is > (=, < 0)if and only if

()( )() >(=, 0; otherwise the investor would not choose to invest in the risky

asset. In this case, we can rewrite the optimal investment condition in Proposition 4 as > 0if and

only if()

()>

. Since the risk premium of the risky asset, , is positive and

0,1, when the anticipated return is low, i.e. when < ,

is always negative. In

this case,()

()>

always holds as and are both positive. Recall that the

anticipation level can be interpreted as a certainty equivalent of the lottery based on subjective

probabilities. Thus, under the assumption of concave , < when the subjective probabilities

become close to the objective probabilities. The above results imply that if the DM has beliefs that are

close to the objective probabilities, she will always invest in the risky asset.

If the anticipated return is relatively high, e.g. > ,

is always smaller than one. If

the marginal utility ratio ()

() is always larger than one, then > 0 and the DM always

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

24/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

invests in the risky asset. In this case, the inequality > can be explained as the result of

optimistic beliefs that deviate significantly from objective probabilities. Thus, this result implies that

when a DM is very optimistic, she will invest in the risky asset only if the marginal utility she derives

from anticipation is large enough to counter the potential disappointment.

Now, we treat the anticipated return as a parameter and analyze how it influences the optimal

investment level which we will denote as ( ).

Proposition 5. There exists a such that

0 if and only if ( + (

)) .

This proposition states that when the marginal utility from anticipation is large enough at the

optimal investment level, i.e., ( + ( ))> , the DM will invest more given a higher

anticipation level. This is a very intuitive result. The DM will only increase the investment in a risky

asset when the marginal utility she derives from anticipation is large enough to offset the utility loss

from the potential disappointment.

Besides being consistent with the empirical finding that more optimistic DMs will invest more in

the risky asset, our model can also be employed to explain the equity premium puzzle, which can be

described as follows: In order to explain the much higher available returns of risky assets (stocks)

compared to riskless assets (bonds), investors must have extremely high levels of risk aversion. GM

noted that the literature on optimal expectations (Brunnermeier and Parker 2005, Gollier 2005)

assumes the DM always optimizes her beliefs and selects a risker portfolio, reinforcing the equity

premium puzzle, while their model implies that optimism of a DM is negatively related to the

investment in a risky asset, reducing the equity premium puzzle. However, empirical studies suggest

that a more optimistic DM will invest more in the risky asset (Manju and Robinson 2007, Balasuriya

2010, Nosic and Weber 2010). Thus, although the GM model is consistent with the equity premium

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

25/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

puzzle, it conflicts with both our intuition and the empirical finding that optimism should induce more

risk taking behavior and more investment in the risky asset.

Our model can explain the equity premium puzzle without conflicting with the finding that

optimism leads to increased investment in the risky asset. As shown by Proposition 4, our model can

be used to represent preferences with either ( )/ 0or ( )/ 0 depending on

the functional form used to model utility from anticipation. To be consistent with the empirical

finding on the relationship between optimism and risk taking, we should assume preferences exhibit

( )/ 0. To explain the equity premium puzzle, we propose that if DMs in the financial

market are generally pessimistic, i.e., anticipate a lower level of , our model implies a decrease in

the demand for the risky asset, which increases the equity premium. Finally, we should emphasize that

this descriptive flexibility comes from the relaxation of the optimal anticipation (belief) assumed by

other models in the literature (Brunnermeier and Parker 2005, Gollier 2005, Gollier and Muermann

2010).

5.2. Optimal advertising decision

In this section, we explore the optimal advertising level for a marketer facing a consumer who

trades off the utility of anticipation and the utility from anticipated disappointment consistent with

model (2). We will model the consumers decision to purchase or not to purchase a single unit of a

product. Further, we assume that the customer will not know the quality of the product until after it is

purchased and model the predicted quality as a simple lottery defined on a bounded payoff set

of quality measures for the product. However, we assume that the consumer has some

knowledge about the probability distribution of this uncertain quality level. Before purchasing the

product, the consumer anticipates the quality of the product min , max . Under the

assumption of model (2), the total ex ante utility derived from purchasing one unit of this product is

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

26/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

given by ( ) +( )while the total ex ante utility from not purchasing the product is 0.

Following the convention in the economics literature (e.g. Shogren 1994), we assume the

consumer has additive utility over wealth and her consumption of the product, i.e., (, )= () +(). The consumers willingness to pay (( )) is determined by solving equation (6)

( ) + + ( ( ) )= () (6)

where ()is the utility function over her wealth.

For this problem, we can show that the maximum willingness to pay is obtained at an interior

level of the anticipation in the domain min , maxunder some standard assumptions.

Proposition 6. Under some standard assumptions, > 0, 0, 0, 0 ,

min min > 0 and max max < 0, there exists an

interior optimal anticipation min ,maxsuch that ( )is maximized.

This proposition states that if a consumer derives utility from both anticipation and the

anticipated experienced utility, the optimal level to anticipate should be neither too high nor too low.

Now, we consider a seller who is attempting to sell a new product to a group of consumers, each

with a concave willingness to pay function ( )due to the tradeoff between high anticipation and

high disappointment. To model the heterogeneity of the consumers in the market, we assume the

willingness to pay of each customer is given by ( )= ( ) + , where is a mean zero

random variable with cumulative density function that captures the uniqueness of a consumers

preferences. If the seller sets the price of the product at , the consumer will buy the product if

( ) + . Therefore, the response function is given by (, )= 1 ( ),

which depends on both the price and anticipation . Further, the seller can influence the

anticipated quality of the product through her advertising effort, , measured in dollars. We assume

that the consumers anticipated quality of the product is positively related to the advertising effort

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

27/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

and is given by the linear relationship = + , where 0, with = (max )/,

which is the effort level that will cause the consumer to anticipate the highest possible quality. In this

linear relationship, is the base anticipation level of the consumer when no advertising effort is

exerted; and is the increase in anticipation produced by one marginal unit of advertising effort. This

assumption of a positive relationship between the anticipated quality of the product and the

advertising effort has been documented by Deighton (1984). Kirmani and Wright (1989) also verified

that the perceived advertising expense has a positive relationship with consumers expectation of

product quality in a laboratory setting.

Goering (1985) and others have argued that increasing the expected quality of a product can

increase the demand for the product and that advertising is a way to increase the consumers quality

expectation and therefore product sales (Simon and Arndt 1980, Bagwell 2005, Erdem et al. 2008).

However, as we show in Proposition 7, the response function in our context is maximized at an

appropriate level of advertising effort < , because a high anticipation level of product quality

produced by advertising effort can also induce high anticipated disappointment, decreasing the

consumers willingness to pay. In other words, advertising can raise a consumers expectation so high

that she would prefer not to purchase the product for fear of being disappointed with its actual quality.

Proposition 7. For fixed price , the response function is maximized at an advertising effort

level = , when < (>), (, )> (

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

28/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

attains its maximum at = , we know that the optimal advertising effort to maximize the

total profit is < , so that (+ )=( ) (+ )

>0. Therefore,

we have the following proposition.

Proposition 8. For fixed price , the profit is maximized at an advertising effort level that is

lower than the effort level maximizing the willingness to pay, < .

This result implies that sellers of a product should not always seek to increase consumers

willingness to pay. When willingness to pay is above (+ ) , the marginal cost of the

advertising effect the unit cost in our model outweighs the marginal contribution to the profit

produced by the increase in willingness to pay, which further reduces the total profit. Again,

increasing the anticipated quality level of a product via advertising can reduce sales when customers

grow concerned that their high expectations cannot be satisfied and choose to abstain from a purchase.

6. Conclusion

In this paper, we propose preference conditions for a decision making model which incorporates

both the utility of anticipation hope and dread and the anticipated experienced utility elation and

disappointment in a decision making process. This model captures optimism and pessimism by

allowing the DM to choose to anticipate any outcome of a lottery being evaluated. The level of

anticipation serves two roles in our model: it is the source of the utility of anticipation in the period

before the lottery is resolved as well as the reference point used to form elation and disappointment

after the lottery is resolved.

We show that our model can account for how optimism could influence both the DMs risk

attitude as well as the wealth effect on that risk attitude. This optimism can explain the coexistence of

gambling and the purchasing of insurance without violating stochastic dominance and transitivity.

Finally, we discuss the applications of this model in both finance and marketing contexts. In a simple

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

29/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

setting with one risky and one risk-free asset, we show that our model can capture the widely

observed behavior that an investors optimism is positively correlated with her investment level in the

risky asset. It also provides an explanation for the equity premium puzzle that is consistent with this

empirical finding. In a marketing context, we show that using advertising to increase the customers

anticipation level of product quality with the intent to increase her willingness to pay does not always

increase the demand for a product. This result conflicts with the intuition that product demand is

increasing with advertising, and should be studied in more detail with controlled experiments.

Notes:

1.See Yahoo news: http://news.yahoo.com/blogs/sideshow/mega-millions-hits-record-640-million-jackpot-160916556.html

2.We also assume the second order condition is satisfied: () 0.References:

Aczl, J. 2006. Lectures on Functional Equations and Their Applications. Dover Publication. Mineola,

New York. 31-32.

Akerlof, G. A., W. T. Dickens. 1982. The Economic Consequences of Cognitive Dissonance.

American Economic Review. 72(3) 307319.

Anderson, C., A. D. Galinsky. 2006. Power, Optimism, and Risk-taking. European Journal of Social

Psychology. 36(4) 511-536.

Bagwell, K., 2005. The Economic Analysis of Advertising. Discussion Papers 0506-01, Columbia

University, Department of Economics.

Balasuriya, J., Y. G. Muradoglu, P. Ayton. 2010. Optimism and Portfolio Choice. SSRN working

paper: http://ssrn.com/abstract=1568908or http://dx.doi.org/10.2139/ssrn.1568908

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

30/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

Bnabou, R., J. Tirole, 2002. Self-Confidence and Personal Motivation. The Quarterly Journal of

Economics. 117(3) 871-915.

Bell, D. E. 1985 Disappointment in Decision Making Under Uncertainty, Operations Research. 33(1)

1-27.

Bosch-Domenech, A., J.S. Benach, 2005. Ready to Take Risks? Experimental Evidence on Risk

Aversion and Attraction. Working paper: http://www.crei.cat/research/opuscles/op16ang.pdf

Bleichrodt, H., U. Schmidt. 2002 A Context-Dependent Model of the Gambling Effect. Management

Science. 48(6) 802-812

Brunnermeier, M. K., J. A. Parker. 2005 Optimal expectations. American Economic Review 95(4)

1092-1118.

Brunnermeier, M. K., C. Gollier. J. A. Parker. 2007 Optimal beliefs, asset prices, and the preference

for skewed returns.American Economic Review.97(2) 159-165.

Caballero, G.A. 2010. Risk Preferences Under Extreme Poverty: A Field Experiment. SSRN working

paper. http://ssrn.com/abstract=1720983

Carroll, P. J., K. Sweeny, J. A. Shepperd. 2006. Forsaking Optimism.Review of General Psychology.

10(1) 56-73.

Caplin, A., J. Leahy. 2001. Psychological Expected Utility Theory and Anticipatory Feelings. The

Quarterly Journal of Economics, 116(1) 55-79.

Conlisk, J. 1993. The Utility of Gambling.Journal of Risk and Uncertainty. 6(3) 255-275.

Chew, S. H., J. L. Ho. 1994. Hope: An Empirical Study of Attitude Toward the Timing of Uncertainty

Resolution.Journal of Risk and Uncertainty. 8(3) 267-88.

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

31/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

Chuang, S. C., H. M. Lin. 2007. The Effect of Induced Positive and Negative Emotion and Openness-

to-Feeling in Students Consumer Decision Making.Journal of Business and Psychology. 22(1)

65-78.

Deighton, J. 1984. The Interaction of Advertising and Evidence.Journal of Consumer Research. 11(3)

763-770.

Delqui, P., A. Cillo 2006 Disappointment Without Prior Expectation: a Unifying Perspective on

Decision under Risk.Journal of Risk and Uncertainty. 33(3) 197-215.

Diecidue, E. U. Schmidt. P.P. Wakker. 2004. The Utility of Gambling Reconsidered. The Journal of

Risk and Uncertainty. 29(3)241-259.

Dillenberger, D., K. Rozen, 2011. History-Dependent Risk Attitude. PIER Working Paper No. 11-004.

Erdem, T., M. Keane. B.H. Sun. 2008. The Impact of Advertising on Consumer Price Sensitivity in

Experience Goods Markets. Quantitative Marketing and Economics, 6(2) 139-176.

Epstein, L. G., I. Kopylov, 2007. Cold feet. Theoretical Economics2(3) 231259

Eeckhoudt, L., B. Rey, H. Schlesinger. 2007. A Good Sign for Multi-variate Risk Taking.

Management Science. 53(1) 117124.

Fishburn, P. C. 1980. A Simple Model of the Utility of Gambling. Psychometrika45 435-448.

Friedman, M., L. J. Savage. 1948. The Utility Analysis of Choices Involving Risk. Journal of

Political Economy.56 279304.

Goering, P. A. 1985. Effects of Product Trial on Consumer Expectations, Demand, and Prices.

Journal of Consumer Research. 12(1) 74-82.

Gollier, C., A. Muermann. 2010. Optimal Choice and Beliefs with Ex Ante Savoring and Ex Post

Disappointment.Management Science. 56(8) 1272-1284.

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

32/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

He, Y., J. S. Dyer, J. C. Butler. 2013 On the Axiomatization of Satiation and Habit Formation Utility

Function. Operations Research, forthcoming

Jia, J., J. S. Dyer, J. Butler 2001 Generalized Disappointment Models. Journal of Risk and

Uncertainty. 22(1) 59-78

Jouini, E., P. Karehnke, C. Napp. 2013. On Portfolio Choice with Savoring and Disappointment.

Management Science, forthcoming. Available at SSRN: http://ssrn.com/abstract=2291836

Kirmani, A., P. Wright. 1989. Money talks: Perceived advertising expense and expected product

quality.Journal of Consumer Research. 16, 344353.

Loewenstein, G. 1987. Anticipation and the Valuation of Delayed Consumption. The Economic

Journal. 97(387) 666-684.

Loewenstein, G., & Linville, P. (1986). Expectation formation and the timing of outcomes: A

cognitive strategy for balancing the conflicting incentives for savoring success and avoiding

disappointment. Unpublished manuscript

Loomes, G., R. Sugden. 1986. Disappointment and Dynamic Consistency in Choice under

Uncertainty.Review of Economic Studies.53(2) 271-282.

Lybbert, T. J., C. B. Barrett, 2011. Risk-Taking Behavior In The Presence Of Nonconvex Asset

Dynamics.Economic Inquiry, Western Economic Association International. 49(4) 982-988.

Lesieur, H. R., 1992 Compulsive Gambling. Society29(4) 43-50.

Manju, P., D. T. Robinson, 2007. Optimism and Economic Choice, Journal of Financial Economics.

86(1) 71-99.

Mansour, B. S., E. Jouini, J. M. Marin, C. Napp, C. Robert. 2008. Are Risk Averse Agents More

Optimistic? A Bayesian Estimation Approach.Journal of Applied Econometrics. 32(6) 843860.

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

33/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

Mosley, P., A. Verschoor, 2005 Risk Attitudes and the Vicious Circle of Poverty.European Journal

of Development Research. 17(1) 59-88.

Misina, M. 2005. Risk Perceptions and Attitudes. Bank of Canada Working Papers 05-17.

http://www.bankofcanada.ca/2005/06/publications/research/working-paper-2005-17/

Nosic, A., M. Weber. 2010. How Risky Do I Invest: The Role of Risk Attitudes, Risk Perceptions,

and Overconfidence.Decision Analysis, 7(3) 282-301.

Schmidt, U. 1998. A Measurement of the Certainty Effect. Journal of Mathematical Psychology. 42

32-47.

Shogren, J. F., S.Y. Shin, D. J. Hayes, J. B. Kliebenstein. 1994. Resolving Differences in Willingness

to Pay and Willingness to Accept. The American Economic Review. 84(1) 255-270.

Simon, J. L., & Arndt, J. 1980. The Shape of The Advertising Response Function.Journal Of

Advertising Research, 20(4), 11.

Taylor, K. M., J. A. Shepperd. 1998. Bracing for the Worst: Severity Testing, and Feedback Timing

as Moderators of the Optimistic Bias.Personality Social Psychology Bulletin. 24(9) 915926.

van Dijk, W.W., M. Zeelenberg, J. van Der Pligt. 2003 Blessed are Those Who Expect Nothing:

Lowering Expectations as a Way of Avoiding Disappointment.Journal of Economic Psychology.

24(4) 505-516.

Vieider, F. M., T. Chmura. P. Martinsson. 2012. Risk Attitudes, Development, and Growth:

Macroeconomic Evidence From experiments in 30 Countries, Discussion Papers,

http://EconPapers.repec.org/RePEc:zbw:wzbrad:spii2012401

Yesuf, M., R. A. Bluffstone, 2009 Poverty, Risk Aversion, and Path Dependence in Low-Income

Countries: Experimental Evidence from Ethiopia. American Journal of Agricultural Economics.

91(4) 1022-1037.

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

34/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

Zhao, J. 2006. The Effects of Induced Positive and Negative Emotions on Risky Decision Making.

Talk presented at the 28th Annual Psychological Society of Ireland Student Congress, Maynooth,

Ireland. http://www.princeton.edu/~jiayingz/pdfs/BAThesis06.pdf

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

35/40

Appendix for Hope, Dread, Disappointment, and Elation from

Anticipation in Decision Making

Ying He

, James S. Dyer

, John C. Butler

Department of Information, Risk, and Operations Management

Department of Finance

McCombs School of Business, The University of Texas at Austin, Austin, Texas 78712

[email protected],[email protected],[email protected] 1. Assumptions 1 holds if and only if the utility function (,)can be decomposed into

, = () +() () (1)

with (0)= 0, (0)= 0,and(0)= 0.

Proof: Sufficiency: by Assumption 1, we have (, )= () + ()( + (, ), )=() + ()( + (, ) (0,0) + (0,0), ) , since (, ) and ( +(,),) are

strategically equivalent to each other. Let = 0 and define () (, 0) (0,0), (): =() , and (): = ( + (0,0), 0) in (, )= () + ()( + (, ) (0,0) +(0,0), ), we have (1). By definition of (), we have (0)= 0. Since utility function is unique up

to affine transformation, we can rescale the utility function (, )such that ((0,0), 0)= 0and(0)= 0. Thus, we have (0)= 0and (0)= 0.

Necessity: for any, and any , if , , , from model (1) we have,

, = () + () () () + () () = ,

which implies () () . For any , since , ()> 0 , this

inequality is equivalent to

() + ()+ () () () () + ()+ () () ()

Define (, )= () (), so we have + (, ), + (, ),

Theorem 2. Assumptions 2 and 3 hold if and only if the utility function (,)can be decomposed

into

, = () + (2)

with 0,1, (0)= 0, (0)= 0.

Proof: Sufficiency: Assumption 2 implies (, ) + (, )= ( (, ), ) +

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

36/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

( + (, ), ). Let = 0, = 0and rescale (, ) such that (0,0)= 0, we have (, )=( (, 0), 0) + ((, 0), ) . Define () (, 0) , () ((, 0), ) , and () ( (), 0), we have (, )= () + ().

Now, we prove ()is linear. According to Assumption 2, for any and , wehave (, ); (, )( (, ), ); ( + (, ), ) . Expressing this condition in term of(, ), we have

(, ) + (, )= ( (, ), ) + ( + (, ), )Let = + (, ), the above equation is equivalent to

(, ) (, )= ( (, ), ) ( (, ), )Similarly, we have for

(, ) (, )= ( (, ), ) ( (, ), )( (, ), ) ( (, ), )= ( (, ) (, ), ) ( (, ) (, ), )Thus, we have

(, ) (, )= ( (, ), ) ( (, ), )

= ( (, ) (, ), ) ( (, ) (, ), )According to Assumption 3, this (, ) is unique which is a function depends on the difference

between and , namely (, )= ( ) is unique. Thus, from the uniqueness of this (, ),we have

( ) = ( ) + ( )By setting = 0 in above equation, we have () () = ( ) . Let = , we

have () + ()= ( + ), which is a Cauchy functional equation (Aczl 2006). The solution tothis equation is ()= for . Because Assumption 3 states that ( )0, for , we have 0,1. Since we defined () (, 0)= (), we have ()= . Finally,from (0,0)= 0, () ((, 0), ), and () ( (), 0), it is easy to conclude

that (0)= 0and (0)= 0.Necessity: given (, )= () + ( ), we have

(, ) + (, )= () + ( ) + () + ( )

= () + ( + ( ) ) + () + ( + ( ) )

= ( + ( ), ) + ( + ( ), )

Define (, ): = ( ) , since 0,1 , we know there exits (, )= ( )

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

37/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

0, such that Assumption 2 holds. This also proves (, )0, in Assumption 3.Finally, to prove the uniqueness of (, )stated in Assumption 3, suppose there exists another

(, )= + (, )such that (, ) + (, )= ( (, ), ) + ( + (, ), )=

( (, ), ) + ( + + (, ), )Let (, )= , we have

( (, ), ) ( (, ), )= ( + + (, ), ) ( + (, ), )

= ( + + (, ) (, ), ) ( + (, ) (, ), )

= ( + , ) (, )= (, ) ( ,)Since , are arbitrary, , are also arbitrary. Denote utility function (, )by(). The

last equation above is equivalent to

( + ) ()= () ( )for any

, . Taking

derivative with respect to , we have() ( ) = 0. Then, taking derivative with respect to, we have( ) = 0, which implies()= (, )is a linear function in . This violates thelaw of diminishing marginal utility. Thus, the (, )is unique.

Proposition 1. Under the assumptions of model (2), for a given lotterywhen the DM anticipates

, the risk premium( )fordepends on in the following ways:

i. If ( ) 0, then( ) 0. The DM exhibits increased risk seekingbehavior due to optimism .

ii.If ( ) 0, then ( ) 0. The DM exhibits increased risk seekingbehavior due to pessimism.

Proof: According to the definition ( ) = | , ( ) 0( 0) if and only if|

0( 0). By definition and model (2),

| ,

| =

, = ( ) + , we have | + (1 )| = ( ) + . Thus, we

have:

| + (1 ) (1 )| |

= ( )

It is easy to verify that|

0( 0)if and only if () 0( 0).

Proposition 2. When

= 1,

(

)0,we have:

()/ (

)0

if and only if

(

)

;

when 0,1),we have:

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

38/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

i. If 0, 0, 0, and(1 ) + implies()/ 0.ii. If 0, 0, 0, and (1 ) + implies()/ 0.iii.If 0, 0, 0, and(1 ) + implies()/ 0.iv. If 0, 0, 0, and(1 ) + implies()/ 0.Moreover, if we replace 0 with 0 and () with (), the sign of()/is unchanged.

Proof: From (3) in the text, we know

() =

()() ()()()()

When

= 1, since

> 0, the sign of

()

is determined by the comparison between

and

.

When 0,1). We only show case ihere. The other cases can be obtained by following the sameidea. When 0, 0, 0 , from 0 , by Jensens inequality, we can conclude

+ ( + ) + ( + ) . From 0 , (1 ) +

implies + (1 ) (1 ) + (1 ). Thus, we have

+ ( + ) + ( + )

+ ( + ) + ( + ) 0

Moreover, from 0 and , we have (+ ) ( + ) . Therefore, we can

conclude the numerator of the above equation is positive. Since we also assume > 0and > 0,we conclude that ()/ 0in this case.

Proposition 3. Under Assumption 4, there exists , such that when 0, , +(1

), () + (1 ), () for any and any .

Proof: Since the lotteryis the common part for both compounding lotteries considered here,we simply denote the anticipation by ()indicating that the anticipation depends on , which is the

certain payoff compounded with. Stochastic dominance requires that when :

+ (1 ),()= () + () + (1 ) ()

() + () + (1 ) () = + (1 ), ()

Under the assumption of consistent compounding in anticipation, we have

() ()

for any , namely ()= ()/ > 0, stochastic dominance is satisfied by our model when

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

39/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

+ (1 ),()/ > 0, which is equivalent to the condition

()() + ()1 () (1 ) () ()> 0

Without loss of generality, we assume that marginal utility is bounded, i.e., ,.Then, let solves the following equation

()() +1 ()=(1 )()

= ()() +

+ (1 )()> 0

when () > 0, () > 0, and () > 0.

Then, we have for any 0, ,

()

() +

()1

()>

()

() +1

()=(1 )()>(1 ) () ()

which implies that the stochastic dominance holds.

Proposition 4. The optimal investment in the risky asset in (5) is > (=,< 0)if and only if()( )() >(=, (=, (=,< 0), which leads to the result.

Proposition 5. There exist a such that

0if and only if( + ( )) .

Proof : When no derivative of ( ) is taken, we keep using for simplicity. By

differentiating the first order condition for (5) with respect to , we can solve for

as follows

= () ()()() ()

()()

()

where we define two functions ()= (1 ) + ( )and ()= +( ) to simplify the expression above. Under the assumption that < 0and < 0, the

denominator of the right hand side is negative. Therefore, a negative numerator is equivalent to a

-

8/12/2019 Hope Dread Disappointment and Elation From Anticipation

40/40

He, Dyer, and Butler:Hope, Dread, Disappointment, and Elation from Anticipation in Decision MakingThe University of Texas at Austin

positive

. A negative numerator is equivalent to the condition:

( )() +()< () + ( )()

Define = ( )() +() ( )() , wecan get the result in the proposition.

Proposition 6. Under some standard assumptions, > 0, 0, 0, 0, min min > 0and max max< 0, there exists an interior optimalanticipation min ,maxsuch that ( )is maximized.

Proof: Note that the consumers willingness to pay is a function of her anticipation for this one

unit of the product. Differentiating both sides of (6) with respect to ,( ) + + ( ( ) )= () (6)

we find ( )=

. When > 0, min min > 0, and

max max< 0 , we have min> 0 and max< 0 . If we

take the derivative of (6) with respect to twice, we can solve for

( )=

( )

Under the assumption of 0, 0, and 0, we can verify that ( ) 0. Thus, wecan conclude the result stated in the proposition.

Proposition 7. For fixed price , the response function is maximized at an advertising effort level

=