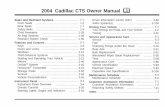

Healthcare Issues Facing Public Employers. ACA Employer Reporting ACA ”Cadillac” Excise Tax 411...

-

Upload

virgil-cameron -

Category

Documents

-

view

215 -

download

0

Transcript of Healthcare Issues Facing Public Employers. ACA Employer Reporting ACA ”Cadillac” Excise Tax 411...

Managing the Storm

Healthcare Issues Facing Public

Employers

ACAEmployer Reporting

ACA

”Cadillac” Excise

Tax

411 Liability

Aging Population

ACA

Shared Responsibilities

Commercial Rollback

Future

Trends?

Managing

Costs and

Plan Design

ThePerfectStorm

WHAT SHOULD YOU BE FAMILIAR WITH?

o Affordable Care Act – On the Radar Screen Employer Shared Responsibility Employer Reporting Requirements

o Cost of the Affordable Care Act Fees and Taxes Predictive Modeling

o 411 Medical Liability

o Future Trends in Healthcare

o Applies to groups with 50 or more Full Time Equivalent Employees (FTE)

Employers with 50 to 99 FTEs - Must make an offer to all qualifying employees starting with the plan year beginning on or after 1/1/2016

Employers with 100 or more FTEs - Must make an offer to all qualifying employees starting with the plan year beginning on or after 1/1/2015

EMPLOYER SHARED RESPONSIBILITY

Starting in 2015 coverage must be offered to 70% of all full-time employees, as well as all part-time, seasonal or variable hour employees averaging 30 or more hours per week (95% in 2016)

Coverage offered must be affordable and provide minimum value to avoid penalties

Part-time, seasonal and variable hour employees hours must be tracked to determine if they qualify as full-time status

EMPLOYER SHARED RESPONSIBILITY

EMPLOYER SHARED RESPONSIBILITY

Admin.

Period

Measurement Period 4

10 Months

Stability Period 312 months

Admin.

Period

Admin.

Period

Measurement Period 2

10 Months

Measurement Period 2

10 months

Stability Period 212 months

Stability Period 112 months

Measurement Period 1

10 Months

Ad

min

istr

ati

on

Peri

od

Tracking Ongoing (Existing) Employees

(Employees who were hired before the start of the first measurement period)

Stability Period 112 months

Measurement Period 110 Months A

dm

in.

Peri

od

Measurement Period 210 Months

Measurement Period 110 Months A

dm

in.

Peri

od

Measurement Period 210 Months

Stability Period 112 months

Ad

min

.P

eri

odMeasurement

Period 110 Months

Measurement Period 210 Months

Stability Period 112 months

January

March

August

Tracking New EmployeesEMPLOYER SHARED RESPONSIBILITY

o Effective for the 2015 calendar year, generally filed by March 31, 2016

o Applies to large employers with 50 or more FTEs.

o Insured Plans Carrier will file 6055 reporting Employer must file 6056 reporting

o Self-Funded Plans Employer must file both 6055 and 6056 reporting

EMPLOYER REPORTING REQUIREMENTS

o 6055 Reporting Information about the entity providing coverage,

who’s enrolled and the months they were enrolled

o 6056 Reporting Information about the employer offering coverage,

who’s enrolled, information about the coverage and the cost of the coverage

EMPLOYER REPORTING REQUIREMENTS

o Determine the risk level?

o Keeping up with changes in the law

o Data versus tracking analysis

o Cost, time and staffing

o Do you have a decision model prepared?

COMPLIANCE ISSUES

COST OF THE AFFORDABLE CARE ACT

o What are the costs involved? Health insurance tax Temporary reinsurance tax PCORI tax Benefit cost of compliance 2018 Excise Tax

o What provisions will affect you?

o Are you in compliance with the law?

COST OF THE AFFORDABLE CARE ACT

o 2018 Excise Tax (All Employers)

40% tax on “excess benefits” that exceed $10,200 a year for individuals or $27,500 for families, multiplied by the health cost adjustment factor and increased by the age and gender excess premium amount.

Annual limits are increased by $1,650 and $3,450, respectively, for employees in high-risk professions (e.g., law enforcement, EMT/paramedics, construction, mining, longshoremen, etc.

COST OF THE AFFORDABLE CARE ACT

o 2018 Excise Tax (All Employers)

Insured Plans - The tax is imposed pro rata on the issuer.

Self-insured group health plan, a health FSA or an HRA - The tax is paid by the entity that administers benefits under the plan (the “plan administrator”).

Self-Administration - The tax is paid by the employer if it acts as plan administrator to a self-insured group health plan, a health FSA or an HRA.

If the employer contributes to an HSA or an Archer MSA, the employer is responsible for payment of the excise tax, as the insurer.

COST OF THE AFFORDABLE CARE ACT Predictive Modeling

COST OF THE AFFORDABLE CARE ACT 2018 Excise Tax

411 MEDICAL LIABILITY

o Iowa Code Chapter 411

Municipalities must provide and finance medical care for Police and Fire members when injured in the performance of their duties

Municipalities must continue to provide medical coverage for such injuries and diseases incurred in the performance of their duties while receiving retirement allowances

Higher costs due to requirement of medical and prescription discounts not being able to be paid through medical insurance?

Solution? (see attached brochure)

FUTURE TRENDS IN HEALTHCARE

Expected trend has averaged 8.1%.

Actual trend (growth) has averaged 5.2%

Cost Trends – United States - All PPO Plans

FUTURE TRENDS IN HEALTHCARE

o Care continues is moving from more costly settings to retail clinics and mobile health

o Replacement Generation…new knees, hips…etc.

o The federal readmission penalties appear to have reduced readmissions by nearly 70,000 in 2012

o 17% of employers now offer a high deductible health plan as the only option for employees

o Higher enrollment due to the ACA will boost benefit spending

o Employers believe health management is helping to slow medical trend

FUTURE TRENDS IN HEALTHCARE

o How do you control Costs?

Cost shifting, incentives for healthy lifestyles

Spousal surcharge

Tobacco surcharge

Tighter utilization management

Wellness, disease management (implementation difficulties in public sector)

Insured to partial self-funding or fully-self-funding

THANK YOU!!

1555 S.E. Delaware AvenueSuite A

Ankeny, Iowa 500211-800-942-4718 or 515-964-5502