HDFC Equity Savings Fundfiles.hdfcfund.com/s3fs-public/Others/2019-08/HDFC Equity Savings...

Transcript of HDFC Equity Savings Fundfiles.hdfcfund.com/s3fs-public/Others/2019-08/HDFC Equity Savings...

1

HDFC Equity Savings Fund(An open ended scheme investing in equity, arbitrage and debt)

2August 2019

Riskometer

This product is suitable for investors who are seeking*:

• Capital appreciation while generating income over medium tolong term

• Provide capital appreciation and income distribution to theinvestors by using equity and equity related instruments,arbitrage opportunities, and investments in debt and moneymarket instruments

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

# In view of individual nature of tax consequences. Each unit holder is advised to consult his/her own professional tax advisors.

Tax efficient

returns #

UnhedgedEquity

Arbitrage

Debt10% to 35%

15% to 40%

25% to 75%

The best of three asset classes

Key advantages of HDFC Equity Savings Fund

• Volatility lower than Equity Funds

• Potential returns* higher than Debt Funds

• Tax efficiency of Equity Funds

2*HDFC Mutual Fund/AMC is not guaranteeing return on investments made in the Scheme

A Fund with an optimal mix of equity, debt and arbitrage opportunities

UnhedgedEquity

Arbitrage

Debt

15% to 40%

25% to 75%

10% to 35%

HDFC Equity Savings Fund – The best of three asset classes

Why HDFC Equity Savings Scheme?

• Long Term Growth – Controlled equity allocation to take advantage of the long term potential of

equities (15-40%)

• Regular Income – Debt securities (10-35%) and arbitrage opportunities (25-75%) reduce volatility

and aid regular income

• Low Fund Volatility – Fixed Income exposure and hedged equity exposure (arbitrage) reduces

fund volatility inherent to directional equity exposure (refer Slide 9)

• Efficient Taxation – Better tax efficiency than debt funds #

• Diversified Asset Allocation – Regular balancing between asset classes based on market

conditions and outlook

4

HDFC Mutual Fund/AMC is not guaranteeing return on investments made in the scheme.# In view of individual nature of tax consequences, each unit holder is advised to consult his/her own professional tax advisors

3

HDFC Equity Savings Fund – Investment strategy

• Equity Strategy

– Maintains an effectively diversified portfolio

– Follows a multi cap strategy, flexibility to invest across large cap, midcap and small cap stocks

• Fixed Income Strategy

– The fixed income portion is invested in corporate bonds and bank perpetual bonds and GILTS

– The maturity profile of debt portion depends on interest rate outlook. Modified duration as on July, 2019

is 1.43 years

• Equity Arbitrage Strategy

– Hedged equity allocation to gain from spread between future and spot prices

5

The current investment strategy is subject to change depending on the market conditions. For complete details on investment strategy,

refer SID/KIM of the scheme.

For complete portfolio details visit www.hdfcfund.com 4

Fund Positioning Risk Quotient

• Aims to provide returns while managing risks

efficiently.

• Equity Taxation # – Better tax efficiency than debt

funds

• HDFC Equity Savings Fund is less volatile than hybrid

equity funds since it has a limited exposure to

unhedged equity (max up to 40%)

• Suitable for conservative investors.

Pro

du

ct R

etu

rn

Product Risk# Provided the scheme meets the criteria as an equity oriented scheme as per prevalent Income tax laws. HDFC Mutual Fund/AMC is not guaranteeingreturn on investments made in the scheme. In view of individual nature of tax consequences. Each unit holder is advised to consult his/her ownprofessional tax advisors.

6 5

Debt Funds

Hybrid Debt Funds

Equity Savings Funds

Hybrid Equity Funds

Equity Funds

Performance Scenario Analysis of Hybrid Portfolio Strategy

The scenarios of hybrid portfolio of equity, arbitrage and fixed income provided in the table above does not in any manner offer any assured returns and is subject to

market risks. The above scenario analysis does not take fund expenses into account. The rates of return shown are assumed figures and not to be construed as actual

returns and/or guaranteed returns. HDFC Mutual Fund/AMC is not guaranteeing returns on investments made in the Scheme. The information provided herein is used to

explain the concept and is given for illustrative purposes only. The same is not sufficient and shouldn’t be used for the development or implementation of an investment

strategy. It should not be construed as an investment advice to any party. Past performance may or may not be sustained in future.

7

Scenario Analysis Assumed Un-hedged Equity Portion returns (35% weight)

25% 20% 15% 10% 5% 0% -5% -10% -15% -20% -25%

Assumed Hedged +

Fixed Income returns (65%

weight)

9% 14.6% 12.9% 11.1% 9.4% 7.6% 5.9% 4.1% 2.4% 0.6% -1.2% -2.9%

8% 14.0% 12.2% 10.4% 8.7% 7.0% 5.2% 3.5% 1.7% -0.1% -1.8% -3.6%

7% 13.3% 11.6% 9.8% 8.1% 6.3% 4.6% 2.8% 1.1% -0.7% -2.5% -4.2%

How to read the table?

Lets take an example of the cell shaded in red

Arbitrage & Fixed Income: 8% return * 65% exposure = 5.2% contribution; Equity: 15% return * 35% exposure = 5.2% contribution

Performance of the Hybrid Portfolio Strategy = 10.4% return

6

7

Fund Facts( As on July 31, 2019)

For complete portfolio details refer www.hdfcfund.com

Gross Equity Exposure 65.9%

Hedged Equity Exposure (Arbitrage) 28.9%

Unhedged Equity Exposure 37.0%

Monthly Average AUM (Rs in crores) 5137

Total Number of stocks in the Portfolio

48

Top 10 Holdings (%) 29.1

Large Cap (%) 33.1

Mid Cap (%) 1.7

Small Cap (%) 2.4

Equity (Unhedged)

Average Maturity 1.78 years

Macaulay Duration* 1.55 years

Modified Duration* 1.43 years

Yield to Maturity* 8.17%

Debt

* Computed on the invested amount for debt portfolio.

Low Fund Volatility

8

Monthly Returns of the Scheme and NIFTY50 depicts that HDFC Equity Savings Fund has

been less volatile as compared to NIFTY50

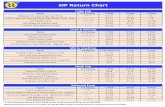

Year Scheme/Benchmark Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov DecStd.

Deviation

2016

Scheme -2.54 -3.56 6.21 1.96 1.28 2.11 4.33 2.69 0.87 1.95 -0.67 -0.48 2.73

Benchmark -1.12 -2.03 3.80 0.91 1.61 1.10 1.89 1.05 -0.03 0.59 -0.79 0.06 1.54

NIFTY50 TRI -5.12 -7.10 10.98 1.49 4.01 1.96 4.74 1.71 -1.93 0.27 -4.46 -0.49 4.91

2017

Scheme 3.05 1.93 2.43 1.48 0.56 0.53 1.92 -0.37 0.14 2.05 0.41 1.27 1.03

Benchmark 1.66 1.24 1.44 0.63 1.38 0.28 2.22 -0.10 -0.13 1.88 -0.06 1.12 0.82

NIFTY50 TRI 4.46 3.83 3.47 1.52 3.25 -0.66 6.12 -1.48 -1.29 5.49 -1.01 3.18 2.73

2018

Scheme 0.80 -1.70 -1.04 1.29 -0.33 -0.63 1.89 1.59 -1.94 -0.66 0.68 0.61 1.28

Benchmark 1.53 -1.24 -0.48 1.87 0.33 0.24 2.22 1.21 -1.69 -0.95 1.90 0.38 1.33

NIFTY50 TRI 4.47 -4.69 -3.80 5.62 0.18 0.03 6.03 3.01 -6.83 -4.58 4.74 -0.13 4.49

Monthly Returns are as on the end of the respective month and have been shown since Jan’16 as there was a change in the fundamental attributes of the

scheme viz; from HDFC Multiple Yield Fund, open ended Income Scheme to HDFC Equity Savings Fund. For complete performance details, please refer

slide 15-18.

Scheme performance may not strictly be comparable with that of NIFTY 50 in view of hybrid nature of the scheme where the investments are made in

equity (hedged and unhedged) and debt instruments.

Benchmark - 40% NIFTY 50 Arbitrage Index, 30% CRISIL Short Term Bond Fund Index and 30% NIFTY 50 (Total Returns Index)

3 Year Rolling Returns (15th Dec 2015* – 31st July 2019)

Particulars %

Minimum 7.31

Maximum 12.56

Average 10.88

Std.Deviation 1.04

Number of Observations 156 %

Less than 7% 0 0%

Greater than 7% 156 100%

The fund has given average returns of 10.88% based on 3 year rolling basis with very

low volatility.

The fund has delivered greater than 7% return in 100% observations based on 3

rolling basis.

Return Profile

* Returns have been shown since 15th Dec’15 as there was a change in the fundamental attributes of the scheme viz; from HDFC Multiple Yield Fund,

open ended Income Scheme to HDFC Equity Savings Fund. For complete performance details, please refer slide 15-18.9

Current Sectoral Rationale

10

Sector Rationale

Corporate Banks

A sharp surge is likely in the profits of corporate banks due to a steep decline in loan-loss provisions driven by(1) peaking of NPLs and slippages in 4QFY18; NPLs have declined moderately in 9MFY19 and slippages fallen sharplyover the same period,(2) high provision coverage ratio at end-9MFY19, which would result in a decline in loan-loss provisions from FY2020and(3) possible recovery on loans already written off on successful resolution of a few large cases in the NCLT.

Utilities Earnings are expected to grow over the next 3 years and on valuation basis utilities are substantially cheaper than themarket. Post regulatory changes undertaken recently, the net impact appears to be positive. Operating issues such ascoal shortage have been mostly sorted out.

Energy

For upstream companies, based on the government’s budgetary estimates for oil subsidies in the FY2019RE andFY2020BE budgets, a meaningful subsidy burden for the upstream oil companies in FY2019 and FY2020 is unlikely.Valuations are extremely attractive.For gas transportation and marketing companies, the near term drivers are higher gas transportation tariffs which isexpected to be announced shortly.For refining companies, while margins are weak in the near term, triggers from regulatory changes expected in CY2020 could boost earnings. Marketing margins are trending well for the OMCs.

ITOur holdings in this sector are companies which have the potential to outperform the sector in terms of revenuegrowth, possible improvement in margins in the next 3 years and are available at attractive valuations.

Retail Banking While the fund is underweight NBFCs, we have positions in large well established retail banks that are expected tocontinue their strong growth.

Stocks/sectors referred above are not recommended by HDFC Mutual Fund/AMC. The Fund may or may not have any present or future positions in these sectors. The above should

not be construed as an investment advice or a research report or a recommendation by HDFC Mutual Fund/HDFC AMC to buy or sell the stock or any other security covered under the

respective sector/s. The above has been prepared on the basis of information which is already available in publicly accessible media. The recipient should understand that the

information provided above may not contain all the material aspects relevant for making an investment decision. For complete portfolio details refer www.hdfcfund.com.

Suitability

The fund is suitable for conservative and risk averse investors looking for

moderate participation in equity markets

The fund is an ideal alternative to traditional saving options

Investors having an investment horizon of 2-3 years

11

Equity Taxation

• For the purpose of determining the tax payable, the amount of distributed income be increased to such amount as would, after reduction of tax from such increased amount, be equal to the

income distributed by the Mutual Fund. The impact of the same has not been reflected above.

Display of two rates with “/ “ in between means rates “with” / “without” surcharge.

$ - Surcharge at 15%, is applicable where income of Individual, HUF, AOP, BOI, Artificial juridical person being unit holders exceeds Rs. 1 crore and surcharge at 10% is to be levied in case of

Individual, HUF, AOP, BOI, Artificial juridical person being unit holders where income of such unit holders exceeds Rs. 50 lakhs but does not exceed Rs. 1 crore.

@ - Surcharge at the rate of 7% is levied for domestic corporate unit holders where the income exceeds Rs 1 crore but is less than Rs 10 crores and at the rate of 12%, where income exceeds

Rs 10 crores.

^^^ - If total turnover or Gross receipts during the Financial year 2016-17 does not exceed Rs. 250 crores.

Health and Education cess shall be applicable @ 4% on aggregate of base income tax plus surcharge.

DISCLAIMER: The information given here is as of 29th Nov 2018 and is neither a complete disclosure of every material fact of Income-tax Act 1961 nor does it constitute tax or legal advice. In

view of the individual nature of the tax consequences, each investor is advised to consult his/her own professional tax advisor. For further details, kindly refer to the Tax Reckoner 2018 - 19

available under section “Investor Corner” on www.hdfcfund.com

For Resident Individuals/HUF$

Taxes Applicable Equity Oriented FundsLiquid Funds/

Debt Funds

Dividend Distribution Tax* 11.648% 29.12%

Short Term Capital Gains 17.94%/17.16% 35.88%/34.32%

Long Term Capital Gains 11.96%/11.44% 23.92%/22.88%

For Domestic Companies@

Taxes Applicable Equity Oriented FundsLiquid Funds/

Debt Funds

Dividend Distribution Tax* 11.648% 34.944%

Short Term Capital Gains 17.472%/16.692%34.944%/33.384%

^^^ 29.120%/27.820%

Long Term Capital Gains 11.648%/11.128% 22.256%/23.296%

12

Asset Allocation Pattern-Normal

14

Under normal circumstances, the asset allocation of the scheme’s portfolio will be as follows:

Types of InstrumentsMinimum

(% of Total Assets)

Maximum

(% of Total

Assets)

Risk Profile

Equity & Equity related instruments 65 90 Medium to High

Of which net long equity and equity related

instruments*15 40 High

Of which Derivatives including index futures,

stock futures, index options and stock options,

etc.

25 75 Medium to High

Other Derivative opportunities 0 20 Medium to High

Debt securities (including securitized debt) &

Money Market instruments 10 35 Low to Medium

Units issued by REITs and InvITs 0 10 Medium to High

Non-convertible preference shares 0 10 Low to Medium

* This net long equity exposure is aimed to gain from potential capital appreciation and thus is a directional equity exposure which will not be hedged.The Scheme may invest in the schemes of Mutual Funds in accordance with the applicable extant SEBI (Mutual Funds) Regulations as amended from time to time.

13

Asset Allocation Pattern-Defensive

15

Under defensive circumstances, the asset allocation of the scheme’s portfolio will be as follows:

Types of InstrumentsMinimum

(% of Total Assets)

Maximum

(% of Total

Assets)

Risk Profile

Equity & Equity related instruments 15 65 Medium to High

Of which net long equity and equity related

instruments*15 40 High

Of which Derivatives including index futures,

stock futures, index options and stock options,

etc.

0 50 Medium to High

Other Derivative opportunities 0 20 Medium to High

Debt securities (including securitized debt) &

Money Market instruments 35 85 Low to Medium

Units issued by REITs and InvITs 0 10 Medium to High

Non-convertible preference shares 0 10 Low to Medium

* This net long equity exposure is aimed to gain from potential capital appreciation and thus is a directional equity exposure which will not be hedged.The Scheme may invest in the schemes of Mutual Funds in accordance with the applicable extant SEBI (Mutual Funds) Regulations as amended from time to time.

14

Scheme Performance as on 31st July 2019

15

^^Effective December 16, 2015, certain changes, including changes to fundamental attributes, were effected in the erstwhile HDFC Multiple Yield Fund, (an open endedincome scheme) which was renamed as HDFC Equity Savings Fund, an open ended equity scheme. On account of these changes, the performance during the period(s) fromSeptember 17, 2004 to December 15, 2015 is not comparable.Returns greater than 1 year period are compounded annualized (CAGR). N.A. Not Available. # 40% NIFTY 50 Arbitrage Index, 30% CRISIL Short Term Bond Fund Index and 30%NIFTY 50 (Total Returns Index); ## NIFTY 50 Total Returns Index. Scheme performance may not strictly be comparable with that of its Additional Benchmark, since a portion ofscheme’s investments are made in debt instruments. Performance of dividend option under the schemes for the investors would be net of distribution tax as applicable. Forperformance of other schemes managed by Vinay Kulkarni (Equities), Krishan Kumar Daga (Equities) and Anil Bamboli (Debt), refer subsequent slides. Different plans viz.Regular Plan and Direct Plan have a different expense structure. The expenses of the Direct Plan under the Scheme will be lower to the extent of the distribution expenses /commission charged in the Regular Plan. Past performance may or may not be sustained in the future. Load is not taken into consideration for computation of performance.

Value of Rs 10,000 invested

Period^^Scheme

Returns (%)

Benchmark Returns (%)

#

Additional Benchmark Returns (%)

##

Scheme Benchmark

(Rs)#

Additional Benchmark

(Rs)##

Last 1 year 3.03 5.46 -0.85 10,303 10,546 9915

Last 3 years 7.97 7.61 10.17 12,593 12,468 13,379

Last 5 years 7.96 7.83 8.91 14,670 14,580 15,324

Since inception 9.09 NA 14.75 36,465 NA 77,457

Scheme

Managing scheme since

1 year 3 yearCAGR (in %)

5 year CAGR (in %)

Vinay Kulkarni manages 4 schemes (including HDFC Equity Savings Fund)

HDFC Tax Saver 21/Nov/2006-5.08 6.88 7.08

NIFTY 500 TRI1 -5.15 8.57 9.12

HDFC Focused 30 Fund 21/Nov/2006 -4.8 4.97 6.69

NIFTY 500 TRI1 -5.15 8.57 9.12

HDFC Growth Opportunities Fund 18/Feb/1994 -4.42 5.94 5.52

NIFTY Large Midcap 250 TRI1 -7.66 8.38 10.42

Past performance may or may not be sustained in the future. Returns greater than 1 year period are compounded annualised (CAGR). The above returns are of Regular plan -growthoption. Load is not taken into consideration for computation of performance. 1. Benchmark. On account of difference in the type of the Scheme, asset allocation, investment strategy,inception dates, the performance of these schemes are strictly not comparable. Returns as on 31st July 2019. Different plans viz. Regular Plan and Direct Plan have a different expensestructure. The expenses of the Direct Plan under the Scheme will be lower to the extent of the distribution expenses/ commission charged in the Regular Plan. TRI – Total ReturnsIndex.

Other Schemes managed by Vinay Kulkarni, co-fund manager of HDFC Equity

Savings Fund

16

17

Scheme Managing scheme

since

1 year 3 yearCAGR (in %)

5 year CAGR (in %)

Krishan Kumar Daga manages 13 schemes (including HDFC Equity Savings Fund) (Schemes which have completed more than 1 year)

Performance of Top 3 schemes managed by Krishan Kumar Daga (excluding HDFC Equity Savings Fund)

HDFC Arbitrage Fund 19/Oct/15 6.17 5.93 6.39

NIFTY 50 Arbitrage Index 1 6.8 5.42 6.17

HDFC SENSEX ETF 19/Oct/15 0.93 11.47 NA

S&P BSE SENSEX TRI 1 0.93 11.49 NA

HDFC Charity Fund for Cancer Cure - Arbitrage Plan 27/Mar/17 6.30 NA NA

NIFTY 50 Arbitrage Index 1 6.80 NA NAPerformance of Bottom 3 schemes managed by Krishan Kumar Daga (excluding HDFC Equity Savings Fund)

HDFC DAF - III - 1304D August 2016 $ 12/Sep/16 5.69 NA NA

NIFTY 50 Hybrid Short Duration Debt 40:60 Index1 5.37 NA NA

HDFC DAF - III - 1267D October 2016 $ 25/Oct/16 5.73 NA NA

NIFTY 50 Hybrid Short Duration Debt 40:60 Index1 5.37 NA NA

HDFC DAF - III - 1224D November 2016 $ 07/Dec/16 5.72 NA NA

NIFTY 50 Hybrid Short Duration Debt 25:75 Index1 6.87 NA NAPast performance may or may not be sustained in the future. Returns greater than 1 year period are compounded annualized (CAGR). The above returns are of Regular plan -growth option. $ The scheme is co-managed by Anil Bamboli and Krishan Kumar Daga. 1 Benchmark. Top 3 and bottom 3 schemes managed by the Fund Manager have been derivedon the basis of since inception returns. In case the benchmark is not available on the Scheme’s inception date, the returns for the concerned scheme is considered from the date thebenchmark is available. On account of difference in the type of the Scheme, asset allocation, investment strategy, inception dates, the performance of these schemes is strictly notcomparable. Returns as on 31

stJuly 2019. Different plans viz. Regular Plan and Direct Plan have a different expense structure. The expenses of the Direct Plan under the Scheme will

be lower to the extent of the distribution expenses/ commission charged in the Regular Plan. Load is not taken into consideration for computation of performance.

Other Schemes managed by Krishan Kumar Daga, co-fund manager of

HDFC Equity Savings Fund

Scheme

Managing scheme since

1 year 3 yearCAGR (in %)

5 year CAGR (in %)

Anil Bamboli manages 32 schemes (including HDFC Equity Savings Fund) (Schemes which have completed more than 1 year)

Performance of Top 3 schemes managed by Anil Bamboli (excluding HDFC Equity Savings Fund)

HDFC FMP 1111D September 2016 (1) 15/Sep/2016 7.86 NA NA

CRISIL Composite Bond Fund Index1 12.76 NA NA

HDFC FMP 1218D December 2016 (1) 12/Jan/2017 8.82 NA NA

CRISIL Composite Bond Fund Index1 12.76 NA NA

HDFC FMP 1302D September 2016 (1) 28/Sep/2016 7.31 NA NA

CRISIL Composite Bond Fund Index1 12.76 NA NAPerformance of Bottom 3 schemes managed by Anil Bamboli (excluding HDFC Equity Savings Fund)

HDFC FMP 1146D April 2018 (1) (40) 10/May/18 6.07 NA NA

CRISIL Composite Bond Fund Index1 12.76 NA NA

HDFC DAF - III - 1267D October 2016 $ 25/Oct/16 5.73 NA NA

NIFTY 50 Hybrid Short Duration Debt 40:60 Index1 5.37 NA NA

HDFC DAF - III - 1224D November 2016 $ 07/Dec/16 5.72 NA NA

NIFTY 50 Hybrid Short Duration Debt 25:75 Index1 6.87 NA NAPast performance may or may not be sustained in the future. Returns greater than 1 year period are compounded annualized (CAGR). The above returns are of Regular plan -growthoption. $ The scheme is co-managed by Anil Bamboli and Krishan Kumar Daga. 1 Benchmark. Top 3 and bottom 3 schemes managed by the Fund Manager have been derived on thebasis of since inception returns. In case the benchmark is not available on the Scheme’s inception date, the returns for the concerned scheme is considered from the date thebenchmark is available. On account of difference in the type of the Scheme, asset allocation, investment strategy, inception dates, the performance of these schemes is strictly notcomparable. Returns as on 31st July 2019. Different plans viz. Regular Plan and Direct Plan have a different expense structure. The expenses of the Direct Plan under the Scheme willbe lower to the extent of the distribution expenses/ commission charged in the Regular Plan. Load is not taken into consideration for computation of performance.

18

Other Schemes managed by Anil Bamboli, co-fund manager of HDFC

Equity Savings Fund

Product FeaturesName HDFC Equity Savings Fund

Type of Scheme An open ended scheme investing in equity, arbitrage and debt

Inception Date

(Date of allotment)September 17, 2004

Investment ObjectiveTo provide capital appreciation by investing in Equity & equity related instruments, Arbitrage opportunities, andDebt & money market instruments. There is no assurance that the investment objective of the scheme will berealized.

Fund Manager(s) $ Vinay Kulkarni & Krishan Kumar Daga (Equities), Anil Bamboli (Debt)

Investment Plans• Direct Plan

• Regular Plan

Investment Option Under Each Plan: Growth & Dividend. The Dividend Option offers Dividend Payout and Reinvestment facility

Minimum Application Amount

(Under Each Plan /Option)

Purchase: Rs. 5,000 and any amount thereafter

Additional Purchase: Rs. 1,000 and any amount thereafter

Load Structure

Entry Load: Not Applicable

• Upfront commission shall be paid directly by the investor to the ARN Holder (AMFI registered Distributor)based on the investors’ assessment of various factors including the service rendered by the ARN Holder.

Exit Load:• In respect of each purchase / switch-in of Units, up to 15% of the units may be redeemed without any exit

load from the date of allotment.• Any redemption in excess of the above limit shall be subject to the following exit load:

• Exit load of 1.00% is payable if Units are redeemed / switched-out within 1 year from the date of allotment of units.

• No Exit Load is payable if Units are redeemed / switched-out after 1 year from the date of allotment.

In case of systematic transactions such as SIP, GSIP, STP, Flex SIP, Flex STP, Swing STP, Flexindex; exit load, if any,prevailing on the date of registration/enrolment shall be levied.

Benchmark 40% NIFTY 50 Arbitrage Index, 30% CRISIL Short Term Bond Fund Index and 30% NIFTY 50 (Total Returns Index)

For further details, refer Scheme Information Document and Key Information Memorandum and addenda thereto available on www.hdfcfund.com and at Investor Service Centres of HDFC Mutual Fund. $ Dedicated fund manager for overseas investments Mr. Amar Kalkundrikar

20 19

Disclaimer

This presentation dated 29th August 2019, has been prepared by HDFC Asset Management Company Limited (HDFC AMC)based on internal data, publicly available information and other sources believed to be reliable. Any calculations made areapproximations, meant as guidelines only, which you must confirm before relying on them. The information contained inthis document is for general purposes only. The current investment strategies are subject to change depending on marketconditions. The document is given in summary form and does not purport to be complete. The views / informationprovided do not have regard to specific investment objectives, financial situation and the particular needs of any specificperson who may receive this information. The information/ data herein alone are not sufficient and should not be usedfor the development or implementation of an investment strategy. The statements contained herein may includestatements of future expectations and other forward-looking statements that are based on our current views and involveknown and unknown risks and uncertainties that could cause actual results, performance or events to differ materiallyfrom those expressed or implied in such statements. Stocks/Sectors referred above are illustrative and not recommendedby HDFC Mutual Fund / AMC. The Fund may or may not have any present or future positions in these sectors. The abovehas been prepared on the basis of information which is already available in publicly accessible media. The above shouldnot be construed as an investment advice or a research report or a recommendation by HDFC Mutual Fund/HDFC AMC tobuy or sell the stock or any other security covered under the respective sector/s. Past performance may or may not besustained in future. HDFC Mutual Fund/AMC is not guaranteeing return on investments made in the scheme. NeitherHDFC AMC and HDFC Mutual Fund nor any person connected with them, accepts any liability arising from the use of thisdocument. The recipient(s) before acting on any information herein should make his/her/their own investigation and seekappropriate professional advice and shall alone be fully responsible / liable for any decision taken on the basis ofinformation contained herein. For complete portfolio/details refer to our website www.hdfcfund.com

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

2021