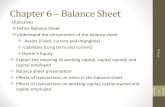

HCL Balance Sheet

Transcript of HCL Balance Sheet

-

8/3/2019 HCL Balance Sheet

1/6

HCL Balance sheet

Jun ' 11 Jun ' 10 Jun ' 09 Jun ' 08 Jun ' 07

Sources of funds

Owner's fundEquity share capital 137.74 135.76 134.05 133.27 132.74

Share application money 1.00 2.01 0.47 1.71 -

Preference share capital - - - - -

Reserves & surplus 5,720.41 4,798.09 3,353.72 3,079.85 3,292.28

Loan funds

Secured loans 1,029.87 1,030.51 123.81 25.24 40.77

Unsecured loans 0.29 366.88 389.92 0.09 0.12

Total 6,889.31 6,333.25 4,001.97 3,240.16 3,465.91

Uses of fundsFixed assets

Gross block 2,880.57 2,293.37 1,957.86 1,599.61 1,332.67

Less : revaluation reserve - - - - -

Less : accumulated depreciation 1,584.64 1,349.54 1,100.88 874.32 662.58

Net block 1,295.93 943.83 856.98 725.29 670.09

Capital work-in-progress 568.73 477.20 417.56 419.03 212.86

Investments 2,653.27 2,233.20 562.75 1,797.34 1,988.86

Net current assets

Current assets, loans & advances 4,552.64 4,836.63 4,760.07 2,850.89 2,027.86Less : current liabilities & provisions 2,181.26 2,157.61 2,595.39 2,552.39 1,433.76

Total net current assets 2,371.38 2,679.02 2,164.68 298.50 594.10

Miscellaneous expenses not written - - - - -

Total 6,889.31 6,333.25 4,001.97 3,240.16 3,465.91

Notes:

Book value of unquoted investments 2,558.34 2,233.20 562.75 1,797.34 1,988.86

Market value of quoted investments - - - - -

Contingent liabilities 2,677.49 2,505.21 3,317.46 469.36 418.65

Number of equity sharesoutstanding (Lacs) 6886.89 6787.84 6702.57 6663.40 6636.83

-

8/3/2019 HCL Balance Sheet

2/6

HCL Profit loss account

Jun ' 11 Jun ' 10 Jun ' 09 Jun ' 08 Jun ' 07

Income

Operating income 6,794.48 5,078.76 4,675.09 4,615.39 3,768.62Expenses

Material consumed 165.31 85.47 - - -

Manufacturing expenses 579.27 521.70 592.67 746.92 577.24

Personnel expenses 3,125.87 2,137.82 1,874.10 1,621.35 1,322.59

Selling expenses 23.27 19.85 14.83 29.68 17.82

Adminstrative expenses 1,309.46 900.27 803.82 990.48 913.89

Expenses capitalised - - - - -

Cost of sales 5,203.18 3,665.11 3,285.42 3,388.43 2,831.54

Operating profit 1,591.30 1,413.65 1,389.67 1,226.96 937.08Other recurring income 161.25 155.26 158.67 62.85 16.07

Adjusted PBDIT 1,752.55 1,568.91 1,548.34 1,289.81 953.15

Financial expenses 101.39 101.36 35.35 24.93 20.60

Depreciation 291.37 274.03 251.89 217.87 178.21

Other write offs - - - - -

Adjusted PBT 1,359.79 1,193.52 1,261.10 1,047.01 754.34

Tax charges 91.60 100.01 196.61 94.60 75.87

Adjusted PAT 1,268.19 1,093.51 1,064.49 952.41 678.47

Non recurring items -69.91 -40.70 -67.18 -171.76 423.35Other non cash adjustments - 3.43 - - -

Reported net profit 1,198.28 1,056.24 997.31 780.65 1,101.82

Earnigs before appropriation 3,449.42 2,977.21 2,570.04 2,351.09 2,287.81

Equity dividend 514.49 270.20 469.61 598.58 525.59

Preference dividend - - - - -

Dividend tax 84.39 45.40 79.73 101.72 81.60

Retained earnings 2,850.54 2,661.61 2,020.70 1,650.79 1,680.62

-

8/3/2019 HCL Balance Sheet

3/6

HCL Cash flow

Jun ' 11 Jun ' 10 Jun ' 09 Jun ' 08 Jun ' 07

Profit before tax 1,289.88 1,152.82 1,193.92 875.25 1,177.69

Net cashflow-operating activity 1,519.39 739.26 587.94 1,056.84 997.93Net cash used in investing activity -535.03 -1,399.11 306.83 -148.53 -341.46

Netcash used in fin. activity -882.56 583.38 -215.82 -602.26 -381.57

Net inc/dec in cash and equivlnt 102.86 -79.16 678.95 305.94 274.72

Cash and equivalnt begin of year 64.84 144.00 686.88 380.94 106.22

Cash and equivalnt end of year 167.70 64.84 1,365.83 686.88 380.94

-

8/3/2019 HCL Balance Sheet

4/6

DLF Profit loss account

Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07

Income

Operating income 2,916.082,307.082,827.905,496.961,101.66Expenses

Material consumed - - - 6.06 8.72

Manufacturing expenses 848.68 889.25 778.34 2,141.29237.75

Personnel expenses 89.90 90.50 71.12 103.78 44.82

Selling expenses 53.71 56.92 59.28 45.70 63.42

Adminstrative expenses 143.99 225.45 156.39 128.16 88.51

Expenses capitalised - - - - -

Cost of sales 1,136.271,262.131,065.142,424.98443.22

Operating profit 1,779.811,044.951,762.763,071.98658.44Other recurring income 1,130.06896.76 1,006.72560.74 327.67

Adjusted PBDIT 2,909.871,941.722,769.483,632.72986.11

Financial expenses 1,286.70847.24 809.86 447.65 356.25

Depreciation 129.77 126.05 114.08 25.68 9.44

Other write offs 50.40 41.47 37.86 41.79 -

Adjusted PBT 1,443.00926.96 1,807.693,117.59620.42

Tax charges 309.05 175.71 261.00 543.52 214.56

Adjusted PAT 1,133.95751.24 1,546.682,574.07405.86

Non recurring items 105.45 11.80 -2.15 0.16 -0.19

Other non cash adjustments 30.16 2.01 33.05 0.36 1.24

Reported net profit 1,269.56765.06 1,577.582,574.59406.91

Earnigs before appropriation4,033.493,441.303,312.542,843.86930.67

Equity dividend 339.51 339.48 339.44 681.93 340.97

Preference dividend - - - - -

Dividend tax - 11.38 28.91 115.89 57.95

Retained earnings 3,693.973,090.442,944.192,046.03531.76

Stock market predictions by Satish Gupta

-

8/3/2019 HCL Balance Sheet

5/6

Balance sheet

Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07

Sources of funds

Owner's fundEquity share capital 339.51 339.48 339.44 340.96 305.88

Share application money - - - - -

Preference share capital - - - - -

Reserves & surplus 13,470.98 12,490.53 12,035.39 10,928.19 346.92

Loan funds

Secured loans 14,700.70 11,590.19 7,979.97 4,945.91 6,242.81

Unsecured loans 358.85 1,047.67 1,635.00 3,440.49 526.48

Total 28,870.03 25,467.86 21,989.79 19,655.55 7,422.10

Uses of fundsFixed assets

Gross block 2,143.37 2,002.85 1,968.40 1,533.72 365.58

Less : revaluation reserve - - - - -

Less : accumulated depreciation 400.27 273.84 152.87 59.34 37.01

Net block 1,743.10 1,729.02 1,815.52 1,474.37 328.57

Capital work-in-progress 2,199.25 1,718.51 1,657.73 1,781.79 665.03

Investments 7,037.24 6,558.88 2,956.32 1,839.83 769.17

Net current assets

Current assets, loans & advances 24,251.81 18,944.48 18,718.62 18,345.94 9,442.25Less : current liabilities & provisions 6,361.36 3,483.03 3,158.40 3,786.38 3,782.93

Total net current assets 17,890.45 15,461.45 15,560.22 14,559.56 5,659.32

Miscellaneous expenses not written - - - - -

Total 28,870.03 25,467.86 21,989.79 19,655.55 7,422.10

Notes:

Book value of unquoted investments 7,037.24 6,558.88 2,956.32 1,808.92 758.98

Market value of quoted investments - - - 30.92 10.19

Contingent liabilities 10,141.63 7,423.38 4,875.99 3,047.92 3,818.81

Number of equity sharesoutstanding (Lacs) 16975.72 16973.91 16972.09 17048.33 15294.21

-

8/3/2019 HCL Balance Sheet

6/6

Cash flow

Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07

Profit before tax 1,555.21 943.09 1,808.77 3,117.92 620.33

Net cashflow-operating activity 1,515.13 395.24 1,365.86 -1,505.81 -2,626.83Net cash used in investing activity -1,949.99 -2,420.00 -1,151.17 -6,482.00 -628.34

Netcash used in fin. activity 419.00 1,434.95 -437.54 8,945.90 3,233.37

Net inc/dec in cash and equivlnt -15.86 -589.80 -222.85 958.09 -21.80

Cash and equivalnt begin of year 169.60 759.40 982.25 24.16 46.05

Cash and equivalnt end of year 153.74 169.60 759.40 982.25 24.25