S TOCK E STIMATE OF F ILIPINOS O VERSEAS Commission on Filipinos Overseas As of May 24, 2014.

Handbook for Filipinos Overseas

-

Upload

elmer-saba-ereno -

Category

Documents

-

view

225 -

download

0

Transcript of Handbook for Filipinos Overseas

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 1/45

HANDBOOKFOR

FILIPINOS OVERSEAS3rd Edition

A Project of the Commission on Filipinos Overseas of the Department of Foreign Affairs1st - 7th Floors, Citigold Tower, 1345 Quirino Avenue corner South Super Highway, Manila, Philippines

P.O. Box 1388 Manila Philippines

CONTENTS AT A GLANCE

Foreword

Philippines 2000 Beginnings of Philippines 2000 Value/Belief System of Philippines 2000

Components of Philippines 2000 Strategy Filipinos Overseas and Philippines 2000

The Philippine Economy at a Glance Filipinos Overseas

Philippine Congress and the Protection of Filipinos Overseas Migrant Workers and Overseas Filipinos Act of 1995 Inter-Country Adoption Act

Land Ownership by Filipinos Overseas

The Filipina Overseas and Philippines 2000

Off to Another Country Passport Application Travel Tax

Assistance to Filipinos Overseas Assistance-to-Nationals Task Force

The Filipinos Overseas as Citizens Tax Obligations of Filipinos Overseas Remittances from Filipinos Overseas

Donations from Filipinos Overseas LINKAPIL Exports thru Expats

Filipinos Overseas as Entrepreneurs Doing Business in the Philippines: A Checklist

Incentives under the Omnibus Investment Act of 1987 Investment Priorities Plan for 1995 Foreign Investments Act of 1991

Special Investors Resident Visa

Immigration Policies Non-quota Immigrant Student Visa Special Study Permit

Waiver of Exclusion Ground

Programs for Returning Filipino Migrants Lakbay-Aral Bring Home a Friend Balikbayan Program

Balikbayan Plus Card Kabuhayan 2000: Sa Pagbabalik ng Pinoy Retirement Program Pag-IBIG Fund for Filipino Overseas Workers (FILOW) Medicare

Acknowledgments

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 2/45

FOREWORD

The second edition of the Handbook for Filipinos Overseas was released in September 1993. It was also the year President Fidel V. Ramos formally launched the Philippines 2000 after months ofnationwide and multi-sectoral consultation aimed at drafting the blueprint of the country'ssustainable development agenda. The Philippines 2000 banner was eventually unfurled through adevelopment strategy under the Medium Term Philippine Development Plan [MTPDP] for 1993-1998.

After three years, President Ramos opened the curtains of the 10th Congress with a State of theNation Address on July 24, 1995. Three of the six major goals the administration have set its sighton for the next three years will directly impact upon the resolute effort of its people, includingFilipinos overseas, to rise above the present challenges and acquire a new role as nation-builders.These goals are: to adapt to a competitive world economy, to prevent the perpetuation of poverty,and to acquire economic capability and self-reliance. Since the country's relations with othernations and the role of overseas Filipinos would have a significant effect on these goals, theinstituted pillars of the country's foreign policy have been further defined and reinforced to coverthree priority areas: political security, economic diplomacy, and protection of Filipinos overseas.

Filipinos overseas are indeed becoming more involved with the national recovery and developmentefforts. The National Economic Development Authority [NEDA] has recognized the need to look tooverseas Filipinos in the consultation process for the formulation of the Long Philippine TermDevelopment Plan. The involvement is critical in the light of the policy invoked by the President andthe Philippine Congress in effecting measures that would facilitate the re-integration of overseasFilipinos within the mainstream of national development. The Filipino migrants and their familiesare also expected to continue to identify with the country and shall therefore be expected topromote the country's welfare in their area of influence.

By the 21st Century, the Filipino is envisioned to be: mobile, flexible, entrepreneurial, nationalistic,and tolerant.

It is along these thrusts that the Third Edition of the Handbook for Overseas Filipinos is beingcrafted. This publication is intended to provide you with information on a wide range of policies,programs, and activities of the Philippine government, which may affect you, particularly withrespect to your various concerns and interest in the country. It is hoped that awareness of theseissues would create better understanding and appreciation of existing policies, and foster greaterlinkages between you and those in the homeland.

............dahil saan ka man naroon, PILIPINO KA PA RIN.

Sana ay hindi natin malimutan ang kagandahang-asal na likas sa ating pagiging Pilipino.

• Ang pagka-MakaDiyos

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 3/45

Gumagalang at lubos na nananalig sa iisang Makapangyarihang Diyos - AngMapagmahal na Tagapaglikha at Ama nating lahat...

•

Ang pagka-Makatao

Gumagalang at nanalig sa kapwa bilang isang kapatid na may pandama, may lakas at ganda ng loob, may karapatan at hangarin para sa buhay na magana, maayos,mapayapa, at maginhawa.

• Ang pagka-Makakalikasan

Pinangangalagaan ang kalikasan -- hangin, tubig, lupa, kagubatan, at karagatan -- likas

na yaman ng bansang tinubuan...

• Ang pagka-Makabansa

Minamahal ang sarili nating bayang Pilipinas sa pamamagitan ng pagbibigay-buhay salimang simulain ng pambansang tradisyong Pilipino: Ang pagsasarili, pakikisama, pagkakaisa, pagkabayani, at pakikipagkapwa-tao.

Back to Top

Back to Home Back to Labor Index

PHILIPPINES 2000Philippines 2000 is the Filipino people's vision of development by the year 2000. It is at the sametime, a strategy and a movement.

As a VISION, it pictures the Philippines as a God-centered, people-empowered and prosperousnational community by the year 2000 where the least among the Filipinos has the decent minimumof food, clothing, shelter, and dignity. By the year 2000, it sees the country as having properlyaddressed its internal problems as to make it fully capable of handling and benefitting from its

international relations.

As a STRATEGY, it gives emphasis to the pre-conditions that must be established to successfullyrealize the goal of an improved quality of life for each Filipino through the twin strategies ofinternational competitiveness and people empowerment as embodied in the Medium-TermPhilippine Development Plan (MTPDP) for 1993-1998.

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 4/45

As a MOVEMENT, the Philippines 2000 is a call for unity among Filipinos, a call for strategicalliance among key development actors- the government, business/private sector, labor, andNGOs/POs.

Because the phrase "Philippines 2000" has immediately caught public attention, it can also be

considered a "battlecry" to rally all Filipinos to work together towards attaining the country's visionof development.

Back to Top Back to Home Back to Labor Index

Beginnings of Philippines 2000

Prior to its formal launching, Philippines 2000, as a movement, had started to gather momentum inthe form of multi-sectoral consultations that sought to address the problems facing the countrytoday, reinforcing the need for a rallying point and a concrete action program to prepare thePhilippines for entry into the 21st century. The people behind this movement are those from thegovernment, business/private sector, labor and NGOs/POs forming a strategic alliance under theactive leadership of President Fidel V. Ramos.

On January 21, 1993, President Ramos formally launched Philippines 2000 at the Department ofScience and Technology Multi-Sectoral Workshop. Its importance as a key government thrust wasreaffirmed by the President during the 7th EDSA Anniversary celebration last February 25, 1993 with the launching of the Medium-Term Phil ippine Development Plan for 1993-1998 which the

President dubbed as the "roadmap" to attain the vision of Philippines 2000.

The year 2000 was chosen because it represents not just the turn of the century, but moresignificantly, the entry of the Philippines and the whole world into a new millennium. This transitionconnotes change for the better which should inspire commitment and sustained action fromeveryone.

Back to Top Back to Home Back to Labor Index

Value/Belief System of Philippines 2000

Philippines 2000 is based on the vision that sees Filipinos as God-centered, people-empowerednational community, where ordinary Filipinos take control of every aspect of their lives -- theirlivelihood, their politics, and their culture. It draws from the essence of the Filipino personality which views development as both material and moral and which basically affirms and values life(buhay), and human relationships (kapwa, pakikisama, and pagbubuklod).

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 5/45

Back to Top Back to Home Back to Labor Index

Components of Philippines 2000 Strategy

As a strategy, Philippines 2000 is basically made up of two parts. The first is the Medium-TermPhilippine Development Plan (1993-1998) which sets down social and economic developmentpolicies, programs and strategies that should enable the country to realize its goal of an improvedquality of life for all Filipinos by the 21st century. Guided by the twin strategies of PeopleEmpowerment and Global Excellence, the Plan also serves as the road map to attain the vision ofPhilippines 2000.

The second part addresses the conditions that must be present if the socio-economic prescriptionsare to be successfully realized. These conditions are:

[1] political stability and national unity;

[2] opening up the economy and the commitment of the economic and political elite to thecommon good; and [3] a deeply ingrained work ethics among all workers, both in the government and privatesectors.

President Fidel V. Ramos firmly believes that there is a basic ingredient missing in our pastdevelopment efforts. He believes that this missing ingredient has something to do with our need toagree among ourselves, to work as a team, to set aside our differences, and to help one anotherattain peace and prosperity as a nation. Obviously, this dimension is concerned with culture, withmorality, with principles, and with spirituality. Hence, moral regeneration (which should lead us tonational unity) logically proceeds the social and economic development prescriptions in any

development plan.

Back to Top Back to Home Back to Labor Index

Philippines 2000 as a Movement

As a movement, the Philippines 2000 is not characterized by any fixed and permanentorganizational structure. Being simply a movement, it consist of groups and individuals who believein the core values and objectives of Philippines 2000 and at the same time contribute to their

attainment.

Back to Top Back to Home Back to Labor Index

Filipinos Overseas and Philippines 2000

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 6/45

Filipinos, wherever they are, who believe in their hearts that the time to act is now ... that they, too,can contribute, no matter how small or significant ... can respond to the challenge of Philippines2000. They can help propagate the vision of Philippines 2000 by enjoining their families, friends,neighbours to join this movement by organizing their efforts towards a common vision, so thattogether, all Filipinos, no matter where they are, can actively take part in their country's pursuit of

the Medium-Term Philippine Development Plan and the vision of Philippines 2000.

Back to Top Back to Home Back to Labor Index

THE PHILIPPINE ECONOMY AT A GLANCE

For the first time in more than a decade, business activity has picked up considerably, therebysustaining the recovery which started to pick up in 1993.

The recovery of the business sector in 1993 was indicated by the improved earning performance ofPhilippine-based corporations, brisker retail sales on the domestic market, a sharper increase inforeign trade (despite imports still lagging behind exports), and new job openings which haveimproved the prospects of the domestic job market.

The greater inflow of foreign investments in 1993 fuelled the turnaround. This has encouraged agood deal of indigenous capital and contributed to a substantial amount of long-term fixedinvestments in new basic industries and in the production of consumer goods and services.

Back to Top Back to Home Back to Labor Index

Overview • Gross national product (GNP) for the first quarter of 1995 grew by 5.2%, better by 10%

than last year's 4.72%, indicating that the economic growth target of 6% to 6.5% for thisyear is achievable.

• Improvement in all major economic sectors translated in 4.8% growth in gross domesticproduct (GDP), versus the 3.6% recorded in the first quarter of 1994.

•

The industry sector topped the economic scoresheet with a 7.2% rise, while manufacturingrose by 6.6%. • At $3.7B, exports for the first quarter of 1995 were 26.4% higher than last year's $2.9B. In

March alone, exports rose 22.4% to $1.3B. • Export earnings from the country's export processing zone (EPZs) reached $74.3M in the

first four months of 1995, a slight increase of 6% from last year's parallel period.

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 7/45

• The Bangko Sentral's dollar reserves hit a new high of $7.75 billion as of end-July 1994

compared with $5.52 billion a year ago, reflecting a substantial increase in foreigninvestment inflow.

Back to Top

Back to Home Back to Labor Index Policy Reforms in Pursuit of Growth

There are good reasons for taking a more positive and optimistic view of the country's economicprospects as the country moves toward realizing the vision of Philippines 2000.

The main factors that will propel faster economic growth are the structural and economic policyreforms the Ramos administration has initiated and is continuing to implement.

These include:

• Liberalization of investment rules and policy guidelines with the enactment of the 1991

Foreign Investment Act to make the Philippines competitive by attracting moreinternational capital.

• Deregulation of foreign exchange transactions to enable the free movement of capital or

fresh new funds for investment. • Public and private sector efforts to develop a stronger capital market with the listing of new

issues in the stock exchange, and provide incentives for company employees and smallinvestors to become shareholders of large as well as modest-size corporations.

• The decision of the Bangko Sentral's Monetary Board to allow the operation of more

foreign banks in the Philippines. •

Dismantling of monopolies in favor of more competition under a free enterprise or marketeconomy.

• Liberalization of trading policies and regulations and lowering of tariff rates in line with the

decisions and terms of agreement under AFTA and GATT during the last Uruguay Round. • Advent of a more stable political climate and the all-out effort of the government to bring

down the crime rate and restore peace and order. • Solution of the perennial power crisis.

Back to Top Back to Home Back to Labor Index

FILIPINOS OVERSEAS

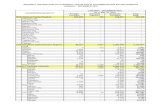

Migration Estimates

Based on stock estimates [N.B.: Estimates: computation based on the registration figures of theCommission on Filipinos Overseas, deployment statistics of the Philippine Overseas Employment Administration, and the data of the Department of Foreign Affairs overseas posts], there are

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 8/45

approximately 6.21 million Filipinos overseas as of December 1994. Of this number, 2.56M areoverseas contract workers, 1.83M are immigrants, and 1.82M are undocumented.

• In 1994 alone, a total of 1,947,399 departures by Filipinos for various countries of

destination has been registered. These departures were made by overseas contract

workers, immigrants, and Filipino tourist. • Of the 1994 out-bound Filipino travellers, 719,602 were contract workers, and 64,537 were

immigrants.

Back to Top Back to Home Back to Labor Index

Recognition of Overseas Filipinos• Proclamation No. 276, signed by former President Corazon C. Aquino in June 1988,

declared December as "Month of Overseas Filipinos". • Executive Order No. 498, signed by former President Corazon C. Aquino in December

1991, institutionalized the granting of Presidential awards for Filipino individuals andprivate organizations overseas.

Back to Top Back to Home Back to Labor Index

PHILIPPPINE CONGRESS AND THE PROTECTION OF FILIPINOS OVERSEAS

Among the laws that have been passed by the Philippine Congress (as of June 1995) to addressthe interests of Filipinos overseas workers and migrants are:

Migrant Workers and Overseas Filipinos Act of 1995

Republic Act No. 8042 was signed by President Fidel V. Ramos into law on June 7, 1995. It seeksto institute measures for overseas employment and establish a higher degree of protection for the welfare of migrant workers, their families, and overseas Filipinos. It affirms the State's policy ofensuring full protection of labor, local and overseas, organized and unorganized.

While recognizing the significant contributions of Filipino migrant labor to the national economythrough foreign remittances, the law explicitly provides that the State does NOT promote overseas

employment as a means to sustain economic growth and achieve national development. Moreover,the State accepts overseas employment as a present-day reality, and requires assurance for theprotection of the dignity and the fundamental human rights and freedoms of the Filipino citizens.

Highlights

In line with the aim of protecting the rights of Filipino migrant labor, the Act provides for thefollowing programs and services:

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 9/45

• Selective deployment of Filipino migrant workers to labor-friendly countries where the

rights of Filipino migrant workers are protected; • Provision of penalties for illegal recruitment;

• Establishment of the P100 million Migrant Workers Loan Guarantee Fund which will be

used to expand the coverage of pre-departure and family assistance loans to Filipinos

migrant workers and their families; • Conduct of travel advisory/information dissemination services and programs on labor and

employment conditions and migration realities which will prepare individuals in makinginformed and intelligent decisions;

• Establishment of the 100 million Emergency Repatriation Fund to facilitate the repatriation

of workers in cases where the principal or the recruiter cannot be identified. • Establishment of Re-Placement and Monitoring Centers for returning migrant workers to

facilitate their reintegration into Philippine society by promoting local employment anddeveloping livelihood programs and projects in coordination with the private sector;

• Establishment of a 24-hour Migrant Workers and Other Overseas Filipino Resource Center

at the Philippine posts where there is a large concentration of Filipinos; •

Establishment of a "Shared Government Information System for Migration"; and • Establishment of the P100 million Legal Assistance Fund which shall be used exclusively

to provide legal services to distressed migrant workers and overseas Filipinos.

Other salient features of the law include the progressive policy of deregulation of recruitmentactivities and the eventual phase-out of the regulatory functions of the POEA, the granting ofincentives to professionals and other highly-skilled Filipinos abroad, overseas Filipinorepresentation in Congress, exemption from travel tax and airport fee, abolition of the repatriationbond, and the creation of a Migrant Workers' Scholarship Fund. Back to Top Back to Home

Back to Labor Index

Inter-country Adoption Act of 1995

Signed into law by President Fidel V. Ramos, Republic Act No. 8043 was enacted to establish therule governing the inter-country adoption of Filipino children.

The law specifically provides for the creation of an Inter-Country Adoption Board which shall act asthe central authority and policy- making body in matters relating to inter-country adoption. TheBoard will carry out the provisions of the newly enacted law, in consultation and coordination withthe Department of Social Welfare and Development (DSWD), the different child-care and

placement agencies, as well as non-governmental organizations engaged in child-care andplacement activities. This body will be chaired by the Social Welfare and Development Secretary,and composed of six (6) other members appointed by the President of the Philippines.

As a matter of policy, inter-country adoption will only be considered after all possibilities foradoption of the child in his home country shall have been exhausted. In allowing aliens to adoptFilipino children to provide every neglected and abandoned child with a family and theopportunities for growth and development, the newly enacted law has adopted stringent measures

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 10/45

to ensure full protection of Filipino children. The maximum number that may be allowed foradoption shall not exceed six hundred (600) a year for the first five (5) years, from the effectivity ofthe law in 1995.

Among the measures guaranteed by this law are:

• A mechanism that will be set by the DFA to monitor and check on the status of Filipino

children sent abroad for trial custody, and the repatriation to the Philippines of a Filipinochild whose adoption has not been approved.

• Under the provisions of this law, persons who knowingly participate in the conduct of illegal

adoption shall be punished with imprisonment ranging from 6 years and one day to 12years and/or a fine of not less than P50,000 pesos, but not more than P200,000.

The Adopted

Only a legally free child (person below 15 years old, unless sooner emancipated by law, and who

has been voluntarily or involuntarily committed to the DSWD) may be subject of inter-countryadoption.

The Adoptor

Any alien or Filipino citizen permanently residing abroad may file an application for inter-countryadoption of a Filipino child, provided that he/she:

[1] At least 27 years old, and at least sixteen years older than the child to be adopted atthe time of the application

unless the adoptor is the parent by nature of the child to be adopted or the spouse of

such parent;

[2] If married, the spouse must jointly file for the adoption; [3] Capable of acting and assuming all rights and responsibilities of parental authorityunder his national laws, and has

undergone appropriate counselling from an accredited counsellor in his/her country; [4] Has not been convicted of a crime involving moral turpitude; [5] Eligible to adopt under his/her national law; [6] In a position to provide the proper care and support, and give the necessary moralvalues and example to his

children, including the child to be adopted; [7] Agrees to uphold the basic rights of the child as embodied under Philippine laws, the

U.N. Convention on the Rights

of the Child, and to abide by the rules and regulations issued to implement theprovisions of this Act; [8] Comes from a country with which the Philippines has diplomatic relations and whosegovernment maintains a similarly

authorized and accredited agency, and that adoption is allowed under his/her country;and [9] Possesses all the qualifications and none of the disqualifications provided in the Act

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 11/45

and in other applicable Philippine Laws.

Persons not eligible to adopt under Article 184 of the Family Code of the Philippines include thefollowing:

[1] The guardian with respect to the ward prior to the approval of the final accounts

rendered upon the termination of their

guardianship relation; [2] Any person who has been convicted of a crime involving moral terpitude; [3] An alien, except:

[a] A former citizen who seeks to adopt a relative by consanguinity; [b] One who seeks to adopt a legitimate child of his or her Filipino spouse; or [c] One who is married to a Filipino citizen and seeks to adopt jointly with his orher spouse a relative by consanguinity of the latter.

Aliens not included in the foregoing exceptions may adopt Filipino children in accordance with theInter-Country Adoption Act.

Back to Top

Back to Home Back to Labor Index

Land Ownership by Filipinos Overseas

There are various considerations in the ownership of private lands in the Philippines by Filipinos who have become naturalized citizens of other countries.

As provided for in Batas Pambansa blg. 185, the transfer (acquisition through voluntary andinvoluntary sale, devise or donation) of such land to Filipinos, who have renounced theircitizenship, must be for residential purposes only.

Conditions and Limitations

[1] The transferee must not use the lands acquired for any purpose other than forhis residence. [2] The transferee is entitled to acquire and own private land up to a maximumarea of one thousand (1,000)

square meters in the case of urban land, or one (1) hectare in the case ofrural land. [3] For married couples, any one or both of them may avail of the said privilege,provided that if both avail of the

same, the area of land acquired shall not exceed the allowed maximum limit. [4] In case the transferee already owns urban or rural lands for residentialpurpose, he may still be entitled to be a

transferee of additional urban or rural lands, provided that the total land areaowned by him will not exceed

the allowed maximum limit. [5] The transferee may acquire not more than two (2) lots, which may be situatedin different municipalities or cities

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 12/45

throughout the Philippines, provided that the total areas of the two (2) shallnot exceed the allowed maximum

limit. [6] A transferee who has already acquired the maximum area of urban land isalready disqualified from acquiring

the rural land, and vice versa.

Registration Requirements

In addition to the requirements provided for in other laws for the registration of titles to lands, thetransferee will have to submit to the Register of Deeds of the province or city, where the property islocated, a sworn statement showing the following information: date and place of birth; names andaddresses of parents, of spouse and children; area, location, and mode of acquisition oflandholding in the Philippines, if any; intention to reside permanently in the Philippines; date he losthis Philippine citizenship; and country which he is presently a citizen.

Penalty

A transferee who violates the provisions of BP Blg. 185 through any misrepresentation in his sworndeclaration, fraudulent acquisition of the landholdings, and failure to reside permanently in the landacquired within two (2) years from the date of acquisition, except when such failure is caused byforce majeure, shall be penalized by:

[1] Forfeiture of such lands and the improvements thereon in favor of the NationalGovernment through escheat

proceedings to be initiated by the Solicitor General or his representatives;

[2] Liability to prosecution under the applicable provision of he revised PenalCode and shall be subject to deportation proceedings;

[3] Will forever be barred from availing of the privilege granted under BatasPambansa Blg. 185.

Back to Top Back to Home Back to Labor Index

THE FILIPINA OVERSEAS AND PHILIPPINES 2000

Section 14, Article 11 of the 1987 Constitution provides that the State recognizes the fundamentalrole of women in nation-building, and ensures the fundamental equality before the law of womenand men. Back to Top Back to Home Back to Labor Index

Government Measures to Advance the Cause of Filipino Women

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 13/45

[1] Department Order 15-89, issued by the Department of Foreign Affairs, requires all Filipinofiancees and spouses of foreign nationals to attend the CFO's guidance and counselling session,as a pre-requisite to the issuance of passports.

In 1994, former Foreign Affairs Secretary Roberto R. Romulo reaffirmed this directive by issuingDFA Order 28-94, to ensure the sustained implementation of guidance and counselling program forpassport applicants going abroad as fiancees/spouses of foreign nationals, and the extension ofsuch service in the provinces as well.

[2] Five-Year Development Plan for Women, detailing the roles and involvement of women innation-building.

[3] The New Family Code, passed through Executive Order No. 227, was adopted to eliminate thediscriminatory provisions to women in the Civil Code of the Philippines. Article 26 of this Code

provides, "where marriage between a Filipino citizen and a foreigner is validly celebrated and adivorce is thereafter validly obtained abroad by the alien spouse capacitating him or her to remarry,the Filipino spouse shall likewise have the capacity to marry under Philippine law".

Back to Top Back to Home Back to Labor Index

Legislative Measures and the Protection of Women's Rights

[1] Creation of the Senate Committee on Women and Family Relations

[2] Passage of Republic Act No. 7192, otherwise known as the "Women in Nation-Building" Act,promotes women as full

and equal partner of men in various facets of development and nation-building [3] Enactment of Republic Act No. 6725, prohibiting discrimination against women with respect tothe terms and

conditions of employment [4] Enactment of Republic Act No. 6955, declaring unlawful the practice of matching Filipino women for marriage to

foreign nationals on a mail-order bride basis and other similar practices

Back to Top

Back to Home Back to Labor Index

Other Services

The Commission on Filipinos Overseas, in coordination with other government and non-government agencies, has intensified its community education program in the various areas of the

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 14/45

country, giving special attention to women, to provide information and address the realities involvedin migration and inter-marriages.

Back to Top

Back to Home

Back to Labor Index

OFF TO ANOTHER COUNTRY Passport Application

Following are the list of requirements for individuals who are applying for passports with theDepartment of Affairs (DFA):

Tourists, Immigrants or Finance(e)s

[1] Birth Certificate

[2] Visa approval or visa checklist, if immigrant or finance/es (For finance/es or spouses offoreign nationals, a certificate

of attendance to the guidance and counselling session, issued by the Commission onFilipinos Overseas (CFO),

must be submitted together with certificate of legal capacity or marriage contract dulystamped or authenticated by

the foreign embassy or consulate concerned.) [3] Two (2) passport pictures (Applicants over 7 years old must wear clothes with collarand sleeves. Middle East

countries do not allow sleeveless dress for women and long hair for men).

Entertainers

[1] Birth certificate [2] Personal appearance and interview

[3] Valid PEC Artists Accreditation Certificate (blue card) [4] Clearance from the Electronic Data Processing Section (EDP), Passport Division

Contract Workers [1] Birth Certificate [2] Photocopy of valid seaman's book

The DFA requires additional documents in the following circumstances: Absence of Birth Certificate

[1] Certificate of non-availability of birth record from the Local Civil Registrar concerned

[2] Voter's affidavit or baptismal certificate or certificate of non-availability of baptismalrecords from the Church

concerned [3] Joint birth affidavit of two (2) disinterested persons who know the circumstances of theapplicant's birth

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 15/45

Late Registration of Birth

[1] Joint birth affidavit of two (2) disinterested persons who know the circumstances of theapplicant's birth [2] Baptismal certificate or voter's affidavit or voter's ID

[3] Authentication of birth certificate at the National Statistics Office (NSO)

Married Woman [1] Photocopy of marriage contract (church certificate is acceptable) [2] If widow, copy of husband's death certificate

Lost Passport

If passport is still valid, Police Report and Affidavit of Loss, duly received by the National Bureau ofInvestigation (NBI), Bureau of Immigration, and the Records Section of the Office of ConsularServices. Fifteen (15) day waiting period is necessary unless waived by competent authorities.

If passport has expired, Affidavit of Loss, duly received by the Records Section of the Office ofConsular Services. If lost abroad, submit travel document.

Adopted Children

[1] Birth certificate before adoption [2] Birth certificate after adoption [3] Court order on adoption [4] DSWD clearance for minors below 18 years old

Discrepancy in Name or Date of Birth

[1] Affidavit of discrepancy

[2] School record (in case of discrepancy in name) [3] Baptismal certificate or voter's affidavit (in case of discrepancy in date of birth)

Minors [below 18 years old] [1] Notarized affidavit of support and consent of both parents; [2] Photocopy of parent's valid passport [3] DSWD clearance is required when the minor is:

[a] unaccompanied by any of the parents [b] travelling with adoptive parents (Filipino or foreign) [c] travelling alone for future adoption by relatives living abroad

Government Employee/Official [1] Travel authority from the Head of Office or Department [2] Copy of approved Leave of Absence to spend vacation abroad [3] If retired, retirement papers

Female Tourists [16-29 years old] [1] Personal appearance and interview

[2] EDP clearance (EDP section, Office of Consular Service) Applicants with Foreign Sounding Names

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 16/45

Applicants with foreign sounding names or with citizenship problems shall be referred to theCitizenship Evaluation Committee (CEC) of the DFA, except:

[1] Filipino women married after the adoption of the 1973 Constitution [2] Passport holders already with EDP/Records verification

Renewal of Passport

For renewal of passport, submit photocopies of the first 3 pages of the old passport forcancellation.

NOTE: Applications may also be lodged by an overseas Filipino with the Philippine Embassy orConsulate. For renewal of passports, applicants are required to submit/present their old passports.Other details may be obtained from the Philippine Embassy/Consulate.

Back to Top Back to Home

Back to Labor Index

Travel Tax

Pursuant to Presidential Decree No. 1183, Filipinos and other nationals travelling outside thecountry are required to pay travel tax before their departure.

Revenues collected are primarily used to conserve the country's dollar resources, provideadequate funds for government programs, and assist in the tax collection process.

Coverage

Persons required to pay the travel tax include:

[1] Citizens of the Philippines [2] Permanent resident aliens [3] Non-resident aliens who have stayed in the Philippines for more than one (1) year

Non-immigrant aliens, who have not stayed in the Philippines for more than one (1) year, are NOTcovered by the Travel Tax.

Exemptions

The following are exempted from paying the travel tax, but are required to get the appropriateexemption certificates from the Philippine Tourism Authority:

[1] Filipino citizens who are residents of foreign countries [2] Filipino overseas contract workers [3] Children who are below two (2) years old

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 17/45

Also exempted are diplomatic representatives, United Nations employees, US military personnel,international carrier crew, foreign service personnel, Philippine government employees, foreignfunded trips, bona fide students on scholarships and personnel of multi-national companies.

Travel tax exemptions/reduced tax certificates can be obtained from the Philippine Tourism

Authority (PTA) upon presentation of the following documents:

[1] Passport [2] Proof of permanent residency abroad [3] Photocopy of Philippine Income Tax return and Proof of paid income tax for precedingyear [4] Certificate of unemployment from the Philippine Embassy or consulate, in the case ofFilipinos who are not employed

Travel Tax Rates [1] P2,700 for first class passage [2] P1,620 for economy class passage

[3] P1,350 reduced rates for children, 2 to 12 years old, on first class passage

[4] P810 reduced rates for children, 2 to 12 years old, on economy class passage [5] P400 reduced rates for dependents of contract workers on first class passage [6] P300 reduced rates for dependents of contract workers on economy class passage

Note: Travel tax exemption will not be granted if the Filipino's immigrant status has lapsed or if hehas stayed in the Philippines for more than one (1) year, whichever comes first.

Back to Top Back to Home Back to Labor Index

ASSISTANCE TO FILIPINOS OVERSEAS

Assistance-to-Nationals Task Force

The Assistance-to-Nationals (ATN) Task Force was created on April 6, 1995 under the mandate ofAdministrative Order No. 182.

The ATN Task Force has the following functions:

[1] Develop and implement an integrated program of government that will address thevarious concerns and problems

resulting from migration;

[2] Develop a mechanism to ensure effective coordination among various agencies ofgovernment to provide solutions

to illegal recruitment and exploitation of highly vulnerable groups of migrants; [3] Develop and implement a continuing information and community education program toensure the effective

dissemination of information related to migration; [4] Establish policies for the effective database management on migration statistics and

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 18/45

assistance-to-nationals cases; [5] Review and develop policies to promote the welfare and interests of Filipino migrants;and [6] Coordinate with the private sector and international organizations, through theappropriate agencies of the government, with the view of establishing a support network

for Filipino nationals.The Inter-agency Committee is jointly headed by of the Department of Foreign Affairs (DFA) andthe Department of Labor and Employment (DOLE).

The other members of the ATN Task Force are the Department of Justice (DOJ), Department ofHealth (DOH), Department of Social Welfare and Development (DSWD), Philippine OverseasEmployment Administration (POEA), Overseas Workers' Welfare Administration (OWWA), NationalBureau of Investigation (NBI), National Commission on the Role of Filipino Women (NCRFW),Commission on Human Rights (CHR), Commission on Filipinos Overseas (CFO) and four (4)private sector representatives. The CFO is the Secretariat for the ATN Task Force.

Five (5) Technical Working Groups have been created to carry out the functions of the ATN TaskForce. These are: Information and Management; Communication and Advocacy; CrisisManagement and Security; Strategic Planning; and Policy, Program and Research.

Back to Top Back to Home Back to Labor Index

THE FILIPINOS OVERSEAS AS CITIZENS

Tax Obligations of Filipinos Overseas

It is the duty of all Filipinos citizens who are residents abroad and currently earning their incomes inforeign countries to file their income tax returns and pay the tax due to the Philippine government.

The non-resident citizen's income tax return (Form 1701-C) may be filed with the PhilippineEmbassy or Consulate nearest his residence or directly to the Commissioner of Internal Revenueat the BIR Bldg., Diliman, Quezon City, Philippines.

Mode of Payment

Payment of taxes may be made through the following modes:

• U.S. dollar or local currencies, which may also be in check or bank draft. The check shall

be drawn in favor of the receiving Philippine foreign posts;

• US dollar checks drawable against the U.S. dollar savings account of the tax payers in thePhilippines or abroad. The check shall be drawn in the name of the Commissioner ofInternal Revenue (Philippines);

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 19/45

• Philippine currency or checks, drawable in banks in the Philippines. The check shall be

drawn in favor of the Commissioner of Internal Revenue (Philippines).

[Personal checks shall not be accepted]

Computation

The Philippine Bureau of Internal Revenue computes taxable income of Filipino citizens overseasbased on their income after the following deductions shall have been made:

• Personal exemption of U.S.$2,000, if the person making the return is a single or a marriedperson legally separated from his or her spouse; or U.S.$4,000, if the person making thereturn is married or head of the family.

• Total amount of the national income tax actually paid to the government of the foreign

country of the residence.

The following shall be imposed and collected as part of the tax: • Surcharge of 25% for each of the following violation:

o Failure to file the return on time;

o Failure to pay the amount of tax on installment due on or before the date due; and

o Filing the return with a person or office other than those mentioned above

• Surcharge of 50% in case of willful neglect to file the return or when a false fraudulent

return is filed • Delinquency interest at the rate of 20% per annum on the unpaid amount from the April 15

due date until fully paid • Compromise penalty as prescribed in Revenue Memorandum Order No. 1-90 for specified

violation of provisions of the Tax Code

Back to Top Back to Home Back to Labor Index

Remittance from Filipinos Overseas

Remittance from Filipinos overseas contribute to the dollar reserves of the country. Data from theBangko Sentral ng Pilipinas show that remittances from Filipinos overseas through the bankingsystem totalled US$2.9 billion in 1994. Ranked as top five (5) countries where overseas remittancecome from are: U.S.A., Saudi Arabia, Hongkong, Japan, and Germany.

Some estimates have been made by other sectors indicating that total remittances, including thosemade through the informal channels, could reach US$4-US6 billion.

Remittance Procedures

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 20/45

Local financial institutions have introduced different modes of remitting money and strengtheningrelationship with other international bank to protect and facilitate the remittance of Filipinosoverseas.

To avoid problems in remitting money, the following procedures are suggested:

[1] Go to any of the Philippine banks' foreign branches, subsidiaries, or correspondentbanks in the locality. Money can be remitted thru any of the following means:

[a] Telegraphic or Telex Transfer [b] Mail Transfer or Mail Payment Order [c] Bank Draft or Bank Transfer

[2] Print clearly and correctly on the remittance application form the following informationregarding the beneficiary:

[a] Full name (Not nickname or alias)

[b] Receiving Bank or branch in the Philippines

[c] Bank account number, if any [d] Complete Philippine address and telephone number, if any

[3] Always keep the remitter's copy of the remittances form to serve as official receipt andsend a photo-copy to the beneficiary as this will be helpful in claiming money from thebank.

Back to Top Back to Home Back to Labor Index

Donations from Overseas Filipinos

General Guidelines

Pursuant to the National Economic and Development Authority (NEDA), the following are thegeneral guidelines affecting the entry of donations from overseas:

[1] Donated items that may be allowed duty-free entry are food, medicines, and otherrelief goods; books and educational materials; essential machineries/equipment; andconsumer goods and other articles subject to certain conditions. Used clothes areconsidered regulated or restricted items. [2] Overseas donations may be allowed duty-free entry upon certification by appropriatePhilippine Government agencies, and if these are consigned to government agencies orDSWD accredited organizations. Certification are required from agencies such as: DSWD,Department of Health, NEDA, and Department of Finance.

The documents required prior to issuance of duty-free certification by governmentagencies concerned are the following:

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 21/45

[a] Letter request from the recipient for duty-free certification; [b] Deed of acceptance and distribution plan of the recipient; [c] Deed of donations duly authenticated by the Philippine Embassies/Consulates;

[d] Pro-forma or commercial invoice and packing list/inventory of donated items;

[e] Shipping documents (bill of lading/airway bill); and

[f] Other documents depending on the nature of donated articles.

NOTE: The request of duty-free certification should be filed before the shipment ofthe donation to allow sufficient time for processing.

[3] Donated goods may only be exempted from import duties, BUT NOT from the paymentof Value Added Tax (VAT) which is 10% of total landed cost as determined by the Bureauof Customs. ONLY BOOK DONATIONS ARE EXEMPTED FROM THE PAYMENT OF

VAT.

[4] The recipient or the donor (depending upon the arrangement made between theparties concerned) shall shoulder the necessary expenses incurred in the processing,handling, and release of the donated shipment from the port of entry.

Specific Procedures • Prior to authentication of the deed of donation, the Philippine Embassy/Consulate (PEC)

shall refer the prospective donor to the CFO, per DFA Memorandum Circular 17-90. Thedonor should provide the following information:

o Detailed packing list/inventory of intended donations; and

o Name, address, and telephone numbers of contact/recipient organizations.

• The CFO shall coordinate with government agencies concerned and designated

beneficiaries to determine if intended donations are eligible for duty-free entry, and if theintended beneficiary is accredited to receive said donations. • The CFO shall inform the PEC and donor on the requirements and obligations relative to

the intended donations. • If the donor agrees to the terms governing the requirements for duty-free donations to the

Philippines, the PEC authenticates the Deed of Donation. • The donor sends the following documents to the recipient organization:

o Deed of donation

o Packing list

o Shipping documents

• The donee/recipient organization submits to government agencies concerned the required

documents to obtain duty-free certification, PRIOR to the shipment of the donation. TheCFO shall assist the donee in coordinating with agencies concerned to secure duty-freeclearance. The donee, however, shall directly undertake/coordinate the processing at theBureau of Customs.

• The CFO shall monitor and evaluate activities relative to disposition/utilization of donations

upon request of the PEC/donor. • The CFO shall send feedback report on the status of donation to PEC/donor.

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 22/45

Back to Top Back to Home Back to Labor Index

LINKAPIL

The "Lingkod sa Kapwa Pilipino" or LINKAPIL is a program developed and implemented by theCommission on Filipinos Overseas (CFO) in an effort to harness the vast potentials of Filipinooverseas. LINKAPIL consists of a mechanism to transfer resources from Filipino overseas to small-scale but high impact projects in the country, particularly in the following sectors: Industry andAgribusiness, Infrastructure, Education and Health.

Operational Framework

[1] Commission on Filipinos OverseasServes as the primary link between Filipino associations overseas and the localbeneficiaries. Identifies and recommends projects for support, as well as conducts

monitoring and evaluation of the project.

[2] Filipino Associations Overseas (as donors)

Coordinate with the CFO in sourcing and providing financial and material resources toidentified local beneficiaries in the Philippines.

[3] Government Instrumentalities

Assist in the identification and formulation of project modules, implement the projects interms of technical assistance and training, as well as facilitate the transfer and release of

material donations.

[4] Non-Government Organizations

Receive donations and/or assistance from Filipinos overseas. Administer the application ordistribution of resources.

[5] Beneficiary

Identifies needs in their locality. As a counterpart effort, contributes free labor and

manpower skills and ascertains the maintenance and viability of the project.

Back to Top Back to Home Back to Labor Index

Exports Thru Expats

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 23/45

The increasing global nature of the markets and the shift of world trading from the Atlantic to thePacific call for a vigorous export strategy to ensure a niche for Philippine goods and services in thePacific Century.

In North America alone, an estimated two million Filipino immigrants comprise one of the biggest

ethnic groups in that region. This figure, which can be translated into a formidable sales force ofthousands, can be organized into a score of business chambers given their strategic locations inthe world's biggest consumer market and with investment capital waiting to be tapped.

The Target: A Network of Filipino Entrepreneurs Abroad

With proper training and encouragement, the entrepreneurial talents of expatriate Filipinos can bedeveloped. Immigrants who have "got it made" can put to good use some of their savings orinvestment money in business opportunities that capitalize on the natural resources of thePhilippines and its highly skilled craftsmen.

They can thereafter be encouraged to form business chambers in their cities so that they can linkup with their Philippine counterparts in the private and the public sector.

The Program

The Exports Thru Expats Training Seminar Series was conceived to motivate Filipino expatriates inpromoting Philippine traditional products and services and in investing in Philippine exportindustries.

The seminars intend to equip qualified and pre-selected expatriates with the basic skills ofentrepreneurship through a comprehensive program of lectures and discussions given by topnotch

resource speakers. Topics include trade and investment policies of the Philippines, export andimport procedures, creative financing schemes, strategic planning (market research andmarketing), and highlights of bilateral trade relations.

Seminar materials allow fingertip access to necessary information on services, product profiles,directories, trade calendars, and lists of projects which require investments.

These workshops will be held periodically in key cities around the world where there areconcentrations of Filipino expatriates and the potential for trade and investment exists.

Overseas Filipinos visiting the Philippines are provided assistance in exploring trade and

investment opportunities specially in export oriented enterprises.

Back to Top Back to Home Back to Labor Index

THE FILIPINOS OVERSEAS AS ENTERPRENEURS

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 24/45

Doing Business in the Philippines

This section provides a general guide for investors intending to do business in the Philippines.

An investor needs only to undertake the applicable combination of activities. Some can be done

simultaneously. Specific requirements may vary depending on several factors like foreign equityparticipation, nature of business, locations, etc.

Getting Started

• General Registration Requirements

Investors setting up business in the country will have to comply with general registrationrequirements, such as:

o with the Securities and Exchange Commission (SEC), if corporation or partnershipo with the Bureau of Trade Regulations and Consumer Protection (BTRCP), if single

proprietorship o with the Board of Investments (BOI), for incentives availment under Executive

Order 226 o with the Export Processing Zone Authority (EPZA), for export firms to be located in

any of the country's export processing zones

• Operational Requirements

Requirements of the Securities and Exchange Commission (SEC), Board of Investments

(BOI), Bureau of Internal Revenue (BIR), and Bureau of Customs (BOC) among others, will have to be complied with by the enterprise while in operation, expansion and/ordiversification.

• Special Permits/Clearances

Special permits such as: Expatriates' Visa from the Bureau of Immigration, and AlienEmployment Permit (AEP) from the Department of Labor and Employment DOLE), arerequired when pursuing projects and activities in the Philippines.

• Special permits and clearances will also be needed for selected export prior to every

shipment. This includes clearances from appropriate agencies, including: Bureau of AnimalIndustry (BAI), Bureau of Plant industry (BPI), Bureau of Food and Drug (BFD), Garmentsand Textile Export Board (GTEB).

Available Front Line Services • One-Stop Action Centers (OSAC)

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 25/45

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 26/45

Under Book I of Executive Order No. 226, otherwise known as the Omnibus Investment Act of1987, an investor may enjoy certain benefits and incentives, provided that he invests in preferredareas of investment found in the current Investment Priorities Plan (IPP).

An enterprise may still be entitled to incentives even if the activity is not listed in the IPP as long

as:

• At least 50% of production is for exports, if Filipino-owned enterprise; and

• At least 70% of production is for exports, if majority foreign-owned (more than 40% foreign

equity)

The BOI, in certain instances as indicated in the IPP, may completely or partially limit theincentives available to export products.

Tax Exemptions and Concessions

BOI-registered enterprises are given a number of incentives in the form of tax exemptions andconcessions. More specifically:

[1] Income tax holiday [2] Tax and duty exemptions on imported capital equipment and its accompanying spareparts [3] Tax credit on domestic capital equipment [4] Tax credit for taxes and duties on raw materials used in the manufacture, processing,and production of export [5] Additional deduction for labor expense [6] Tax and duty-free importation of breeding stocks and genetic materials

[7] Tax credit on domestic breeding stocks and genetic materials

[8] Simplification of customs procedures [9] Unrestricted use of consigned equipment [10] Employment of foreign nationals [11] Tax credit for taxes and duties on raw materials, supplies and semi-manufacturedproducts used in the manufacture

of export products and forming part thereof [12] Access to bonded manufacturing/trading warehouse system

[13] Exemption from wharfage dues and any export tax, duties, import and fees [14] Tax and duty exemption of imported spare parts and supplies

Incentives under the Export Development Act (EDA)

This applies to companies which earn at least 50% of its total revenues from export.

[1] Incentives from the Board of Investments/Exports Processing Zone Authority/SubicBay Metropolitan Authority/Clark

Development Authority if qualified to register with concerned agencies [2] Exemption from P.D. 1853 (advance payment of customs duties) [3] Zero percent duty on imported machinery and equipment and accompanying spare

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 27/45

parts until 1997 [4] Tax credit on imported raw materials for a period of five years [5] Tax credit for increase in current year

[a] Export Revenue [b] First 5% increase entitled to 2.5% credit

[c] Next 5% increase entitled to 5.0% credit

[d] Next 5% increase entitled to 7.5% credit [e] In excess of 15% entitled to 10% credit

[6] Tax credit of 25% on duties of local raw materials, capital equipment and/or spareparts for a period of 3 years, and

extendable for another 3 yearsOther Non-Fiscal Incentives

The Export Processing Zone Authority extends assistance on major manpower training of laborersto firms within the zones. The National Manpower and Youth Council (NMYC) of the Department ofLabor also conducts manpower training programs.

Additional incentives for BOI-registered enterprises locating in less-developed areas (whetherproposed or investing in ventures geared for expansion), include:

[1] Same set of incentives given to pioneer registered enterprises; [2] A 100% deduction from its taxable income representing the necessary and majorinfrastructure it may have

undertaken in the course of its operation; and [3] An additional deduction from taxable income of 100% of the wages corresponding tothe increment in the number of

direct labor for skilled and unskilled workers in the year of availment as against the

previous year.Filing of Investment Application (with incentives)

If an investor wishes to avail of incentives, and the chosen activity is found in the IPP or for export,he can simultaneously file his application for incentives with the BOI and the certificate ofregistration with the SEC or the BTRCP. These offices are located in the following addresses:

• BOARD OF INVESTMENTS (BOI)

Industry and Investments Bldg. 385 Gil Puyat Ave., Makati City Telephone Numbers: 890-1332/897-6682/895-3640

• SECURITIES AND EXCHANGE COMMISSION (SEC)

Main Office: SEC Bldg. EDSA near Ortigas Avenue Greenhills, Mandaluyong Telephone No. 78-09-31 to 39 Extension offices are found in Luzon, Visayas, Mindanao

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 28/45

• BUREAU OF TRADE REGULATION & CONSUMER PROTECTION (BTRCP)

Department of Trade and Industry (DTI) Trade and Industry Bldg. 361 Gil Puyat Ave., Makati City 13 DTI regional offices are found across the country

Locating in the Export Processing Zone

If you will locate in any of the four EPZs in the country, 100% foreign ownership is allowed.However, total production of firms situated inside these zones must be entirely for export. In certaininstances, and subject to the approval of the EPZA, thirty (30) percent of production may be sold inthe domestic market.

Investors locating in any of the four (4) export processing zones in the country must register withthe:

EXPORT PROCESSING ZONE AUTHORITY (EPZA) 4th Floor, Legaspi Towers 300 Vito Cruz St. corner Roxas Blvd. Metro Manila

The four (4) export processing zones in the country are: [1] Bataan Export Processing Zone (BEPZ)

Mariveles, Bataan [2] Baguio City Export Processing Zone (BCEPZ)

Loakan Road, Baguio City

[3] Mactan Export Processing Zone (MEPZ)

Lapu-Lapu City, Mactan Cebu [4] Cavite Export Processing Zone (CEPZ)

Rosario, CaviteAside from these areas, some privately-owned industrial estates have been designated as SpecialExport Processing Zones. This in line with government's industrialization effort to become a world-class investment center in the future.

Back to Top Back to Home Back to Labor Index

Investment Priorities Plan (IPP) for 1995

In line with the vision of the Philippines 2000 under the Medium Term Philippine Development Plan(MTPDP), the main areas of concern of the Department of Trade and Industry (DTI) are in industryand market expansion, countryside development, and consumer welfare.

These concerns are reflected in the goals of the 1995 Investment Priorities Plan (IPP), to wit:

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 29/45

[1] Enhance the global competitiveness of Philippine products and services, thus openingglobal markets; [2] Raise and sustain productivity in the economy, especially in agriculture and fishery; [3] Improve and increase infrastructure and other facilities necessary for the speedymovement of goods and services;

[4] Promote a well-managed environment and the sustainable development of naturalresources; [5] Disperse industry from heavily congested areas; and [6] Alleviate poverty, especially in the countryside.

Pioneer Areas of Investments

Pioneer activities listed in the IPP maybe owned 100% by foreign nationals, subject toconstitutional or statutory limitations.

A Pioneer (P) status is given to activities that:

•

Will engage in the manufacture, processing or production of goods, products, commoditiesor raw materials that have not been or are not being produced in the Philippines on acommercial scale;

• Will use a design, scheme, formula, method, process or system of production or

transformation of any element, substance of raw materials into another raw material orfinished goods with the use of superior technology that is new and untried in thePhilippines;

• Will engage in agricultural, forestry or mining activities and/or services including theindustrial aspects of food processing whenever appropriate;

• Will produce non-conventional fuels or manufacture equipment which utilize non-conventional sources of energy, provided, that the final product will involve substantial useand processing of domestic raw materials.

Pioneer enterprises shall be entitled to a tax holiday (ITH) for a period of six (6) years from the startof commercial operations.

Pioneer enterprises are required to attain Filipino status (60% Filipino) within 30 yearsor suchlonger period as the BOI may determine. Exempted are enterprises whose production is 100%geared for exports.

Priority Investment Areas

1. Export activities 2. Agriculture, food, and forestry-based industries 3. Basic Industries, including: iron and steel (P), cement (P), and mining 4. Engineering industries 5. Infrastructure and services, including: power generation (P/NP), transport operations (NP)

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 30/45

6. Health products and services, including: herbal medicines (P), diagnostic centers (NP) 7. Modernization and rehabilitation programs 8. Environmental conservation and protection, including: forest plantations/farms (NP),

integrated waste management to service domestic industries (P) 9. Research and development activities (Science and Technology Oriented) (P)

Additional Priority Investment Areas are available in the Autonomous Region in Muslim Mindanao(ARMM)

Back to Top Back to Home Back to Labor Index

Foreign Investments Act of 1991

Republic Act No. 7042, otherwise known as the Foreign Investments Act of 1991, aims to promote

foreign investments and prescribes the procedures for registering enterprises doing business in thePhilippines.

Coverage

The Act covers all investment areas or economic activities except banking and other financialinstitutions which are governed and regulated by the General Banking Act and other laws under thesupervision of the Central Bank of the Philippines.

The coverage for restrictions pertains to foreign equity participation only. All other regulationsgoverning foreign investments remain in force.

Qualifications

[1] Any non-Philippine national may do business or invest in a domestic enterprise up toone hundred per cent (100%)

of its capital, provided:[a] The investment is in a domestic market enterprise in areas outside the ForeignInvestment Negative List [b] The investment is an export enterprise whose products and services do not fall within the Lists A and B of the

FINL.

As required by existing law, the country or state of the applicant must also allow Filipinocitizens and corporations to do business therein. [2] Non-Philippine nationals qualified to do business as stated in No. 1 in this Section, but who will engage in more than one investment area, one or more of which is included in theFINL, may be registered under the Act. However, said non-Philippine national shall not beallowed to engage in the investment areas which are in the FINL. [3] Existing enterprises shall be allowed to increase the percentage share on the foreignequity participation beyond current equity holdings only if their existing investment area is

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 31/45

not in the FINL. Similarly, existing enterprises engaged in more than one (1) investmentarea shall be allowed to increase percentage of foreign equity participation if none of theinvestment areas they engaged in is in the FINL.

Existing foreign corporations shall be allowed to increase capital even if their existing

investment is in the FINL.

Transfer of ownership from one foreign company to another shall be allowed even if theenterprise is engaged in an area in the FINL as long as there is no increase in thepercentage share of foreign equity.

Note: Foreign investment Negative List (FINL) is a list of areas of economic activity whoseforeign ownership is limited to a maximum of 40% of the outstanding capital stock, in caseof a corporation, or capital, in case of a partnership.

Allowable Foreign Equity Participation

[1] Export EnterprisesUp to 100%, provided that the products and services of such enterprises do not fall withinLists A and B of the FINL.

[2] Domestic Market Enterprises

Up to 100%, unless such participation is prohibited or limited by existing laws or FINL.

Limitation

Under the Regular Investment Negative List are (3) component lists: A, B and C, which contain

areas of economic activities reserved for Philippine nationals.

[1] List A: foreign ownership is limited by mandate of the constitution and specific laws. Itdefines areas where no foreign

equity is allowed, and those where up to 25%, 30%, 40% foreign equity is allowed. [2] List B: foreign ownership is limited for reasons of security, defense, risk to health andmorals and protection of local

small and medium scale enterprises. It defines areas where foreign equity is allowedup to 40%. [3] List C: Contains investment areas in which existing enterprises already adequatelyserved the needs of the economy

and the consumers and in which foreign investment need not be encouraged further.Areas not in the negative list of the Foreign Investment Act of 1991 can be 100% owned.

Back to Top Back to Home Back to Labor Index

Special Investors Resident Visa

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 32/45

Qualification Requirements

Any alien, except national from South Africa, Northern Korea, and Cambodia and such othercountries that may be classified restricted in the future, and who meet the following qualificationsmay be issued the Special Investors Resident Visa (SIRV), provided:

[1] He has not been convicted of a crime involving moral turpitude; [2] He has not been afflicted with any loathsome, dangerous or contagious disease; [3] He has not been institutionalized for any mental disorder or disability; and [4] He is willing and able to invest US$75,000 in the Philippines.

Privileges

The holder of a Special Investor's Residence Visa shall be entitled to reside in the Philippines foran indefinite period while his investments exist. He is entitled to import used household goods andpersonal effects tax and duty-free as an alien coming to settle in the Philippines for the first time.

The investor's spouse and unmarried children under 21 years of age who are joining him in thePhilippines may also be issued the same visa.

Areas of Investment

Holders of this visa can invest in any project, except: retail trade, rural bank and mass media.Percentage of foreign investment will be limited by the provision of applicable laws, rules, andregulations depending on the area of activity.

Application for Visa

Investors may apply at the Philippine Embassy or Consulate Office in the home country or place ofresident of applicant. If the interested investor is already in the Philippines, he may file theapplication for issuance of SIRV with the One Stop Action Center (OSAC) located at the GroundFloor of the Board of Investments, 385 Gil Puyat Avenue, Makati City, Metro Manila.

Back to Top Back to Home Back to Labor Index

PHILIPPINE IMMIGRATION POLICIES

Among the policies of the Bureau of Immigration (BI) with regards returning Filipino overseas to thePhilippines are the following:

[1] Naturalized citizens of Filipino descent can return for a visit to the Philippines for one(1) year, without acquiring visa.

Extensions may be requested at the BI office. [2] The BI has established an "Express Lane" service to allow its clientele to obtain certain

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 33/45

documents within the same date of filing.

Back to Top Back to Home Back to Labor Index

Non-quota Immigrant

Pursuant to Republic Act 4376, which is being implemented by the BI, a natural born citizen of thePhilippines who has become a naturalized citizen of another country and is returning for permanentresidence in the Philippines with his spouse and minor unmarried children, shall be considered aNon-Quota Immigrant.

The admission of returning former Philippine citizens as a Non-Quota Immigrant is normallygranted at the Philippine Embassies and Consulates.

Those who are already in the Philippines, however, may be permitted to apply for a change of

status. Application, in this case, may be lodged with the BI office at Intramuros, Manila.

Requirements for Change of Status

[1] Birth certificate of applicant [2] Certificate of naturalization in foreign country [3] True copy of marriage contract [4] Birth certificate(s) of unmarried children [5] Affidavit stating that the applicant intends to reside in the Philippines, with supportingdocuments such as: land titles and other evidence of ownership of substantial assets, birthcertificates, and other evidences of relationship to Philippines residents, certificate of

admission to the practice of profession, investment in business enterprise in thePhilippines, and contract employment.

Waiting time for processing is three (3) months or less. Fees to be collected is aboutP1,530 for an individual over 16 years of age.

Procedure in Manila [1] Secure and accomplish the application form for change of status at the BI buildinglocated in the same office. [2] Attach letter request with the supporting documents to the application form, and havethese received at the Board of

Special Inquiry (BSI) in the same office.

[3] Bring the completed application form to the Law Investigation Division (LID) forexamination and verification of

documents. [4] The LID will transmit the application to BSI, which will calendar the hearing in opencourt. The applicant will be

informed, personally or by mail, of the hearing date which shall not be less done three(3) days from notice. No

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 34/45

postponement will be granted. The BSI will hear continuously within a period notexceeding two (2) days.

The applicant may be represented by a counsel of his own choice. He maypresent not more than two (2) witnesses in support of his application. Upon the

termination of the hearing, the BSI will issue a claim stub informing the applicant toreturn after a waiting time of three (3) months. [5] Within three (3) days following the termination of the hearing in open court, the BSI willsubmit to the BID Board of Commissioners a legal memorandum stating the factual andlegal bases for its recommendation to either approve or deny the application.

[6] On the date specified on his claim stub, the applicant surrenders the said stub at theBID, where he will be furnished a copy of the decision on his application.

[7] After payment of the immigration fees, the passport of the applicant will be

appropriately stamped.Back to Top Back to Home Back to Labor Index

Student Visa

An alien admitted into the Philippines under any visa category may apply at the Bureau ofImmigration for change/conversion of admission status from an alien to that of a student underSection 9(f) of the Philippine Immigration Act of 1940, as amended pursuant to E.O. No. 188.

Documentary Requirements

The student shall submit the following documentary requirements to the school's designatedLiaison Officer who will handcarry the documents together with an endorsement letter, signed byschool's registrar and stamped with school's dry seal, to the Bureau of Immigration:

[1] Original copy of Notice of Acceptance, with dry seal; [2] Original copy of the Certificate of Eligibility for Admission issued by the Commission onHigher Education (CHED) for

Medicine and Dentistry; [3] Proof of adequate financial support; [4] Scholastic records duly authenticated by the Philippine Foreign Service Post in thecountry of origin; [5] Police Clearance Certificate issued by the National Police Authorities of the student'scountry of origin or residence

duly authenticated by the Philippine Foreign Service Post having consular jurisdictionover the place, for students

residing in the Philippines for less than one (1) month; [6] AIDS Test clearance issued by accredited hospitals; [7] Quarantine Medical Examination by the National Quarantine Office;

7/28/2019 Handbook for Filipinos Overseas

http://slidepdf.com/reader/full/handbook-for-filipinos-overseas 35/45

[8] Signed personal history statement with recent 2 X 2 photograph; and [9] Xerox copy of the photo, data and stamp of the latest arrival pages of the passport.

Temporary Residence

The alien shall be granted an initial one (1) year authorized stay as a student.

The said stay of one (1) year stay as student may be extended by the Bureau of Immigrationbysemester subject to other specific requirement.

Exemptions

The principals, spouses and unmarried dependent children below 21 years of age of thefollowingcategories as aliens shall not be required to secure student visa and special study permit:

[1] Permanent Foreign Residents (Immigrants); [2] Aliens who have valid admission status under either Sections 9(d) or 9(g) or 47(a)(2) of

the Philippine Immigration Act

of 1940, as amended; [3] Personnel of foreign diplomatic and consular missions; [4] Personnel of duly accredited international organizations based in the Philippines; [5] Aliens who have a valid Special Investor Resident Visa; and [6] Aliens who have a valid Special Resident Retirees Visa.

Back to Top Back to Home Back to Labor Index

Special Study Permit

Under Philippine Immigration Laws, a non-immigrant, having sufficient means for his education andsupport in the Philippines, who is at least 18 years old, and who seeks to enter the countrytemporarily and solely for the purpose of taking up a course of study higher than High School at auniversity, seminary, academy, college or school approved for such alien students by theCommissioner of Immigration, may be issued a Student Visa.

A foreign national who may not otherwise qualify as a student may nonetheless be granted aspecial study permit (SSP) subject to the guidelines on qualification and other requirements.

Qualifications

The following foreign nationals, upon filing of proper application, may be granted an SSP: