Growth of the Meat Trade - USDA...Slide with Chart … and retaliatory tariffs; Vietnam as the...

Transcript of Growth of the Meat Trade - USDA...Slide with Chart … and retaliatory tariffs; Vietnam as the...

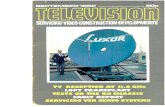

Growth of the Meat Trade

Erin BorrorEconomist, USMEF

USDA Ag Outlook ForumFebruary 21, 2019Washington D.C.

USMEF… and FAS PartnershipUSMEF’s Global Reach

Driving the global meat trade

Pork• China & Vietnam – ASF & tariffs• Europe – ASF & Brexit • Mexico –tariffs • Japan – Japan-U.S. urgency

Beef• China • Global supplies – drought• Economic growth – demand • FTAs

Maximizing carcass values and adding value through the chain, from corn and soybean farmers to processors and exportersProviding customers around the world with

affordable, high quality red meat

Animal disease and tariffs…and demand

Pork trade in the year of the pig• Global pork trade will set new records this year• The degree to which the U.S. benefits will depend largely on tariffs

Four key areas: • China & Vietnam – ASF & tariffs• Europe – ASF & Brexit • Mexico –tariffs • Japan – Japan-U.S. urgency

• Strong demand remains in the rest of world,But will be impacted by above & economy

A 15% drop in China’s & Vietnam’s production means 7% decrease globally…back to 2010-11 levels

0

20,000

40,000

60,000

80,000

100,000

120,000Th

ousa

nd m

etric

tons

Global Pork Production Others

Japan

Mexico

S. Korea

Philippines

Canada

Vietnam

Russia

Brazil

U.S.

EU

China

Source: USDA/FAS fall 2018 & USMEF estimates

U.S. to continue to lead production growth for top exporters

Source: USDA/FAS fall 2018 & USMEF estimates

0

5,000

10,000

15,000

20,000

25,000

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Thou

sand

mt

Pork Production for Top Exporters

European UnionUnited StatesBrazilCanadaMexicoChile

In a scenario where China’s production drops by 15% (-8 million mt), exports to China could increase by +1.5 mmtMaximum increase is about 2.7 mmt –requires surge in U.S. pork

0

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

Met

ric t

ons

Pork/pvm Exports to China/HK

ChileCanadaBrazilU.S.EU28

U.S. is best positioned to fill China’s shortfall but not with a 62% tariff

Source: GTA and USMEF estimates

Driving global pork trade to a record 9-10 million mt … max is 11.5 mmt, +40%

0

2,000,000

4,000,000

6,000,000

8,000,000

10,000,000

12,000,000

Met

ric to

ns

Global Pork & Variety Meat Exports, annual

China

Mexico

Chile

Brazil

Canada

U.S.

EU28

Source: GTA and USMEF estimates

2019f is assuming a 15% drop in China’s production; would be similar to the shift in 2016 trade

+17%+18%

Pork exports mostly flat outside China…Because growth across most markets has offset the loss of Russia & Ukraine buying

0

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

2013 2014 2015 2016 2017 2018e 2019f

Met

ric to

ns

Pork & Variety Meats to Rest of World ex China/HK

MexicoChileBrazilCanadaU.S.EU28

Source: GTA and USMEF estimates

China already the largest importer of pork but growth last year was in the rest of the world

-

500,000

1,000,000

1,500,000

2,000,000

2,500,000

Met

ric to

ns

Pork & variety meat imports from all suppliers

2013 2017 2018e

Source: GTA and USMEF estimates

Russia imports are now minimal

Expect continued growth in the major import markets, but could come down to price if China/global supply shortage materializes later this year

Slide with ChartAs of January, hog prices reflected abundant supplies… and retaliatory tariffs; Vietnam as the exception

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

Japan Korea Vietnam Taiwan China Mexico EU Chile Brazil U.S. Canada

U.S

. $/lb

.

Estimated Carcass Prices

Jan 5yr avg Jan-18 Jan-19

Slide with ChartU.S. futures now waiting for something more tangible? China March 1 Deal?

Slide with ChartExpect continued market volatility

Slide with ChartHog prices rebounding after CNY; spread narrows

$-

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

Ntl Avg Liaoning Henan Sichuan Guangdong Zhejiang

U.S

. $/p

ound

live

China’s Hog Prices in January 2019

5-Jan 12-Jan 19-Jan 26-Jan 2-Feb 9-Feb 16-Feb

+7% yoy

-10% yoy-9% yoy

+2%-6% yoy -4% yoy

First cases in Shandong, Guangxi, and Vietnam this week!

Slide with ChartRecord chicken prices as pork substitute

43.8 40.635.7

10.51 8.93

9.00

3.84.1

4.2

-

10

20

30

40

50

60

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019eKg

per

capi

ta

2019e shows 15% decrease in China’s pork production

China’s per capita consumption

Pork Poultry Beef

ASF in Eastern EuropeEU ASF-infected countries= • 4.4 million mt pork • 50 mil head slaughter • 19% of EU 2017 production • Poland, Hungary & Belgium

are/were major pork exporters• Most major importers have not

recognized regionalization for ASF and impose country-wide import bans after findings

• Remains active in 2019

Brexit and especially a Hard Brexit could impact over 1 million tons of pork trade

-

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

UK pork imports UK pork exports

Met

ric to

ns

UK Pork Trade

2016 2017 2018e

Net UK imports from EU member states of about $2 billion

$2.5 billion

$610 million

Source: GTA and USMEF estimates

U.S. pork industry expansion is built on export potential U.S. must be seen as reliable supplier again

$0

$1

$2

$3

$4

$5

$6

$7

$8

$9

$10

-

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

3,500,000

4,000,000

Billi

on U

SD

Met

ric T

ons

MT USDSource: USDA/FAS & USMEF; fall 2018 forecasts

Pork exports accounted for 22.4% of production and 25.7% when adding variety meats as compared to 22.2% and 26.5% last year.

Jan – Nov export value per head averaged $51.46/head, down $1.72/head or -3%

Down $9.58/ head for the month of Nov

Top 2018 U.S. Export Growth Markets…the silver lining

-10,000

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

Korea S.America

ASEAN Caribb. C.America

Aus/NZ Taiwan Japan Mexico TOTAL

Met

ric To

nsYear-over-Year U.S. Pork Export Growth

Jan - November

Source: USDA/FAS & USMEF

Korea importing record volumes of pork; growing consumption & U.S. share

0

100,000

200,000

300,000

400,000

500,000

600,000

2013 2014 2015 2016 2017 2018

Met

ric to

ns

Korea’s Pork & Variety Meat Imports

MexicoChileCanadaUnited StatesEU-28

Total imports: 600,000 mt, +17%; U.S.: 212,000 mt, +30% U.S. market share increased from 31.6% to 35%

Source: GTA and USMEF estimates

Slide with ChartKorea Meat – centric Home Meal Replacement

Growth did not fully offset the dramatic slowdown to Mexico & China

-150,000

-100,000

-50,000

0

50,000

100,000

150,000

Met

ric To

ns

Year-over-Year U.S. Pork Export Growth Jan – November 2017 and 2018

2017growth 2018growth

Source: USDA/FAS & USMEF

Loss summary: impact of retaliatory duties following U.S. Section 232 (China & Mexico) & 301 tariffs (China)

• U.S. ham primal -19% or -$6.63 per head • U.S. picnic primal -22% or -$3.32 per head • Loss in ham + picnic value = -$9.95 per head• Front & hind feet & picnic hocks = -$1.80 per head• Hams + picnics + feet lost value = -$11.75 per head• $860 million loss when spread across June-Dec harvest

• SOME PACKERS ARE RENDERING CHINA PRODUCTS! • Lost market share & customer efforts to diversify • U.S. as a reliable supplier????

U.S. beef is #1 on a $ basis and global beef trade set a new record in 2018 at >$38 Billion, up 9%

$0

$1

$2

$3

$4

$5

$6

$7

$8

$9

U.S. Australia Brazil India NewZealand

Argentina Canada Uruguay EU28 Mexico Paraguay Nicaragua

Billi

on U

SD

Beef & Variety Meat Export Value, Billion USD

2016 2017 2018e

+7% +43% +12%

-12%

+9%+12%

+15%

+12%+8%

Source: GTA and USMEF estimates

Overall beef export volume up 6% last year

-

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

7,000,000

8,000,000

9,000,000

2013 2014 2015 2016 2017 2018e

Met

ric to

ns

Beef & Variety Meat Export VolumeNicaragua

Belarus

Mexico

Paraguay

Uruguay

Canada

EU 28

Argentina

New Zealand

India

U.S.

Australia

Brazil

Source: GTA and USMEF estimates

Driven largely by China’s buying

-

200,000

400,000

600,000

800,000

1,000,000

1,200,000

Met

ric to

ns

Beef & Variety Meat Imports

2013 2017 2018e+50%

Source: GTA and USMEF estimates

Beef exports to the China region are now double the volume imported into the U.S.

-

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

Met

ric to

ns

Beef & Variety Meat Imports

2016 2017 2018e

+15%

Source: GTA and USMEF estimates

South America dominating China’s imports, accounting for ~70%

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

2011 2012 2013 2014 2015 2016 2017 2018

Met

ric to

ns

China’s Beef Imports

OthersCanadaArgentinaNew ZealandAustraliaUruguayBrazil

Source: Global Trade Atlas, USMEF

+50%

+19%

Grain-fed increases to around 6% or 70,000 mt

Australia shipping more grain-fed to China, even with limited plants approved

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

Japan Korea China EU U.S. HK Taiwan

Met

ric to

ns

Australia’s grain-fed exports to top markets

2016 2017 2018

+8%

+15%+87%

-20% -25% -9% -28%

2018 main markets ~280,000 mt, +13%Source: MLA, USMEF estimates

But weather continues to limit Australia’s herd expansion

Tariff advantages Aus vs. U.S.: Japan 27.5% vs. 38.5%Korea 24% vs. 18.7%China 6% vs. 37%

China accounting for 80% of the increase in beef trade

(200,000)

(100,000)

-

100,000

200,000

300,000

400,000

500,000

Met

ric To

n Gr

owth

The tonnage change in 2018 beef/bvm import volume

2018e import growth

Source: GTA and USMEF estimates

But the growth for U.S. beef has been led by Korea, Japan, Taiwan & ASEAN

-20,000

0

20,000

40,000

60,000

80,000

100,000

Met

ric To

n Gr

owth

Jan-Nov 2017 and 2018 growth year-over-year in U.S. beef/bvm exports

2017growth 2018growth

Source: GTA and USMEF estimates

Underpinned by growing consumption…

Per Capita Consumption

(2016 and 2018est)

U.S. Share of Total Beef Consumption (2016 and 2018est)

Japan 6.7 kg to 7.5 kg 23% to 27%Korea 11.5 kg to 12.5 kg 27% to 33%Taiwan 4.67 kg to 5.35 kg 38% to 42%ChinaHK

4.2 kg to 4.33 kg 2%17% to 18%

Mexico 14 kg to 14.15 kg 9%Canada 18.4 kg to 18.9 kg 15%

Source: USDA/FAS, GTA & USMEF estimates

U.S. beef and variety meat exports set a new record in 2018…growth to continue

$0

$2

$4

$6

$8

$10

$12

-

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

1,800,000

2,000,000

Billi

on U

SD

Met

ric T

ons

MT USDSource: USDA/FAS & USMEF

2018e: 1.35 mmt, +7% $8.3 Billion, +15% >Jan – Nov

beef export value per head averaged $320.72, up $38.38 or +14%. >Beef exports accounted for 11.1% of production and 13.4% when adding variety meatsup from 10.3% and 12.8% last year.

Summary • It will be another wild year, with trade driven by forces out of our control:

disease and tariffs • U.S. maintains supply advantage • U.S. red meat exports will again be record-large, barring our own crisis • Degree to which U.S. is able to supply the world depends on trade policy• All meat producers globally are looking to sell more to China• China’s pork supply “hole” will be partly offset by reduced consumption and

larger imports of pork, poultry, beef, sheep- the big import surge might not happen until late 2019-2020

• Mexico’s domestic pork industry is growing • Japan’s imports will continue to set new records, with growth going to our

competitors until a U.S.-Japan trade agreement happens• Longer-term potential is significant, as U.S. has the production base & natural

resource advantages but must also have partnerships and trade agreements• Opportunities for more branded and value-added products?

EXTRAS

• Growth of Meat Trade 15 minutes

• Over the past 10 years, global exports of beef and pork have increased by more than one-third, supported by economic growth and an expanding middle class. Although demand is growing in most regions, much of the increase in exports is due to surging demand from China. During the same period, Russia drastically reduced imports of beef and pork, increasing competition for markets in Asia. This speaker will discuss expansion in red meat trade, focusing on future opportunities and challenges to growth.

South America’s reliance on ChinaAccounts for >50% of Arg. & Ur. exports

-

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

Brazil Argentina Uruguay Australia U.S. New Zealand

Met

ric to

ns

Exports to China/HK and to the Rest of the World, 2018

China/HK ROW

Source: GTA and USMEF estimates

U.S. and Brazil leading the growth in beef production for top exporters

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018F 2109F

Thou

s m

etric

tons

Beef Production, Top Exporters

Nicaragua

Belarus

Uruguay

New Zealand

Paraguay

Canada

Mexico

Australia

Argentina

India

European Union

Brazil

United States

+2.5%+1.1%

Source: USDA/FAS fall 2018, USMEF estimates

Drives a 10%-15% increase in total U.S. exports vs. 5% baseline forecast

• The increase to China is 1.5 million mt, of which 900k mt can come from the EU

• Drives EU exports to 4.45 million mt, +27% • Canada’s growth could be constrained

• And the hedge against EU ASF … favors U.S. growth • Latin America • Korea, Japan • Southeast Asia • U.S. 2019 export potential scenario… 2.75 million mt, +15% • It’s going to come down to tariffs and prices.

*does not include HS 0504 variety meats

>>Retaliatory tariffs continue to limit U.S. export opportunities in China and Mexico >>The “hole” in China’s supplies might not materialize until later in 2019, with a more significant import surge in 2020

Booming Aussie grain-fed exports…weather continues to limit overall production expansion

• 2018 CY grain-fed exports >280,000 mt, accounting for a quarter of Australia’s total exports and a new record

• Japan: up 8% to 153,000 mt (48% of exports to Japan) • Korea: up 15% to 57,600 mt (34%) • China: up 87% to 49,470 mt (30%)

Source: MLA

Slide with ChartChina’s situation

Transportation of pork in China~ Boyar estimates

Yunnan1100

Sichuan-1150

Chongqing-870

Guizhou-190

Guangxi140

Guangdong-4480

Fujian-630

Jiangxi590

Zhejiang-2070

Jiangsu-1730Anhui

400

Liaoning760

Hebei930

Shandong1360

Henan2410

Hubei1120

Hunan1200

Beijing -580Tianjin -390

Heilongjiang580

Jilin660

Inner Mongolia60

Shanxi-60

Shaanxi40

Ningxia-10

Gansu-70

Qinghai-30

Tibet-30

Sinkiang170

Import >100In Balance: --100~100Export: 100~490Export: 500~990Export: > 1000Unit: 1,000 MT

Hainan-90

In 2017, there were 16 provinces transported pork out of the province, a total of 11.53 million MT.

There were 15 provinces transported pork into the province, a total of 13.54 million.

Slide with ChartChina’s hog prices low goinginto Chinese New Year

Slide with Chart

EU exports continued to grow, without access to Russia and despite ASF

-

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

3,500,000

4,000,000

2013 2014 2015 2016 2017 2018e

Met

ric to

ns

EU pork & pork variety meat exports to top markets

Others

Russia

Taiwan

Australia

United States

Hong Kong

Korea, South

ASEAN

Japan

China

Source: GTA and USMEF estimates

Especially to Asia…they remain key supplier to China and China is by far their biggest market

-

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

1,800,000

2,000,000

China Japan ASEAN Korea,South

Hong Kong UnitedStates

Australia Taiwan Russia Others

Met

ric to

ns

EU pork & pork variety meat exports to top markets

2013 2014 2015 2016 2017 2018e

Source: GTA and USMEF estimates

EU pig prices remain low…waiting for the China buying• With sharp increase in pork

production (Jan-Oct 2018 +2.7%)• Sluggish intra-EU demand and

relatively steady exports

Risks for their production: • ASF, high feed prices, low hog prices• 2019F is for steady production

A bit of a rebound in EU piglet prices

US$48/head

Canada’s exports slow to China & U.S. but growth to Japan, Mexico, elsewhere in Asia

-11%

-11%

+7%

+23%

-1% +31% +20%

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

450,000

China, HongKong

United States Japan Mexico Taiwan S. Korea Philippines Others

Met

ric To

ns

Canada’s pork & variety meat exports

2013 2014 2015 2016 2017 2018e

Source: GTA

2018: 1.15 MMT, -2.5%

China/HK accounted for 24% of Canada export volume, down from 29% in 2016

Mexico’s pork imports record-large again

-

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

1,000,000

2013 2014 2015 2016 2017 2018e

Met

ric to

ns

Exports of pork/pvm to Mexico

EU28ChileCanadaU.S.

U.S. includes HS 0504 variety meats

U.S. market share dropped from 87% to 85%

Mexico’s hog prices have remained strong

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

Jan-

08M

ay-0

8Se

p-08

Jan-

09M

ay-0

9Se

p-09

Jan-

10M

ay-1

0Se

p-10

Jan-

11M

ay-1

1Se

p-11

Jan-

12M

ay-1

2Se

p-12

Jan-

13M

ay-1

3Se

p-13

Jan-

14M

ay-1

4Se

p-14

Jan-

15M

ay-1

5Se

p-15

Jan-

16M

ay-1

6Se

p-16

Jan-

17M

ay-1

7Se

p-17

Jan-

18M

ay-1

8Se

p-18

U.S

. $/l

b

Live Hog Prices in Mexico & U.S.Through Dec 2018

Mexico U.S.

With a strong finish to 2018 as tariffs remained on U.S. pork

Mexico’s efforts to diversify suppliers

0

2,000

4,000

6,000

8,000

10,000

12,000

Met

ric to

ns

Pork exports to Mexico, excluding variety meats

Canada EU

TRQ use: 6,430 mt/ 350,000 mt

Canada

EU

Growth in Mexico’s pork exports…CPTPP

Source: Global Trade Atlas

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

2013 2014 2015 2016 2017 2018e

Met

ric to

ns

Mexico’s Annual Exports, including variety meats

Others

Canada

China

S. Korea

U.S.

Japan

U.S. - Japan trade agreement • Urgency: all is not yet lost, but we are now way behind• Japanese market booming / in transition • Companies looking to invest for future – noting decrease in

Japanese production expected, high labor costs, etc. • Expect continued growth in Japanese red meat consumption and

imports accounting for a larger share of the market • Need assurance that U.S. will be FTA/TAG partner soon • What is the reality for rapid progress / agreement scope? • Exporter priorities conveyed to USTR= level playing field ASAP • Near-term loss estimates: $600 million pork and $550 million beef

… lost opportunities exceed $1 billion each in 10 years• http://www.usmef.org/usmef-assesses-potential-pork-and-beef-

industry-losses-due-to-japans-preferential-trade-agreements/

“Niku Boom” Japan imports record volumes of pork (>$5 billion)

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

2013 2014 2015 2016 2017 2018

Met

ric to

ns

Japan’s Pork & Variety Meat Imports

OthersChileMexicoCanadaEU-28United States

Total imports: 1.16 mil mt, +0.5%; U.S.: 407,000 mt, steady U.S. market share held at 35%

Japan’s imports of U.S. pork

-

50,000

100,000

150,000

200,000

250,000

chilled frozen gsp other processed

Met

ric to

ns

Japan’s U.S. pork imports by category

2010 2011 2012 2013 2014 2015 2016 2017 2018

Tariffs on competitor’s

processed pork phasing to zero

Canadian pork gaining chilled market share

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

450,000

20%

30%

40%

50%

60%

70%

80%

2011 2012 2013 2014 2015 2016 2017 2018f

Met

ric T

ons

Mar

ket S

hare

Japan’s Chilled Pork Imports

TTL Imports Canada U.S.Source: MAFF

Initial tariff reductions on implementation (Dec 30 for CPTPP and Feb 1 for EU) and again at start of JFY, April 1, 2019

4.30%

20.00%

10.00%

9%

2.20%

16.60%

8.30%

4.30%

1.96%

13.30%

6.60%

4.30%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

Chilled/frozen pork Prepared pork Sausages Ham & Bacon

Ad v

alor

em d

uty

Japan’s Tariffs on Pork Imports

U.S. CPTPP & EU Implementation CPTPP & EU April 1, 2019

Zero by 2023

Zero by 2028

Source: USMEF and agreement text

Tariffs are eliminated by 2023 for prepared pork & sausages; and by 2027-2028 for chilled/frozen pork and ham & bacon

Zero by 2027

Zero by 2023

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

Met

ric to

ns

Japan’s imports of ground seasoned pork

Others

Chile

Mexico

Canada

EU-28

UnitedStates

EU market share has increased to 18%

Record-large GSP imports, driven by EU, Mexico, Chile, Canada …FTA partners

Source: MAFF

Korea producing & importing more porkmost imports duty-free

0%

10%

20%

30%

40%

50%

60%

70%

80%

0100200300400500600700800900

1000

Thou

smet

ric to

ns

Korea’s Pork Situation

Dom production Imports U.S. SS rate

Slide with ChartMany variables impacting U.S. hog pricesCrisis = opportunity?

Europe’s cases mostly in wild boar; Romania most active in domestic, backyard & large farms

1,163

109 105 51 10170

2,438

41

1,443

161 138

685

0

500

1,000

1,500

2,000

2,500

3,000

Romania Poland Ukraine Lithuania Belgium Hungary Latvia

case

s

Cases of ASF in European Countries in 2018

Domestic Wild boar

Jan: 22 domestic; 44 wild boar

Jan: 1 domestic; 223 wild boar

Jan: 67 wild Jan: 95 wild Jan: 70 wildJan: 67 wildJan: 2 domestic

Europe’s big exporters

-

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

1,000,000

Germany Spain Denmark Netherlands Poland France UK Ireland Hungary Others

Met

ric to

ns

EU pork & variety meat exports to third countries

2013 2014 2015 2016 2017 2018e

Europe’s big exporters mostly producing more pork, except Germany

0

1,000

2,000

3,000

4,000

5,000

6,000

Germany Spain Denmark Netherlands Poland France UK Ireland Hungary Others

Thou

s met

ric to

ns

EU pork production by top exporters

2013 2014 2015 2016 2017 2018e

Australia cattle on feed set new record• COF to a record 1.13 mil head (Q3 2018) • Dry pastures and strong Asian market

demand for grain-fed beef • 2017-18 feedlot marketings were a record

2.83 mil head• Total slaughter in 2019 estimated at 7.6 mil

head, -3%; (following +9% in 2018) • Production 2019 est. at 2.2 mmt, -4%• Significant female slaughter (+22%) means

smaller breeding herd. • Feed stockpiles depleted and better than

average Northern wet season needed • Wheat A$432/mt, +36% yoy while grain-

fed cattle prices were below year-ago in Q3

Australia’s chilled/frozen beef exports up 12%

• Total 1.125 mmt, +11% or +110,000 mt• But still 20,000 mt below the 5-year

• 2019F: 1.03 mmt, -8% (watch MLA update in late Jan)