Growing Wheatbelt Tourism 2017-2020

Transcript of Growing Wheatbelt Tourism 2017-2020

Page 1 of 60

Growing Wheatbelt Tourism 2017-2020

Page 2 of 60

Document Control

This document has been prepared by the Wheatbelt Development Commission.

Updated 14 September 2017

Version: Version Release Date: Revisions: Purpose:

V1 29 May 2017 WDC Initial Version

V2 8 August 2017 WDC WDC Board Review

V3 14 September 2017 WDC & Industry Industry Review and Public Comment

V4 WDC Incorporate Public Comment

Page 3 of 60

Table of Contents

Glossary ............................................................................................................................... 4

Acronyms ............................................................................................................................. 5

Foreword .............................................................................................................................. 6

1.0 Executive Summary ................................................................................................... 7

2.0 Western Australian Tourism ....................................................................................... 9

3.0 Wheatbelt Tourism ................................................................................................... 10

3.1 Background .......................................................................................................... 10

3.2 Value/Economic Cost Benefit ............................................................................... 12

3.3 Competitive Advantage ......................................................................................... 13

3.4 Comparative Advantage ....................................................................................... 14

4.0 Wheatbelt Tourism Trends ....................................................................................... 16

4.1 Visitation Rates ..................................................................................................... 16

4.2 Expenditure .......................................................................................................... 18

4.3 Employment .......................................................................................................... 19

4.4 Private Capital Investment .................................................................................... 21

5.0 Strategic Alignment – International/ Federal/ State Context and Priorities ............... 23

5.1 Tourism WA’s Five A’s of Success ....................................................................... 24

5.2 Additional WDC A’s of Success ............................................................................ 25

6.0 Current Industry Profile ............................................................................................ 26

6.1 Wheatbelt Tourism Product .................................................................................. 26

6.2 Key Stakeholders .................................................................................................. 28

6.3 Strengths, Weaknesses, Opportunities, Threats................................................... 29

6.4 Key Issues ............................................................................................................ 30

7.0 Wheatbelt Tourism Growth Priorities ....................................................................... 31

7.1 Industry Vision ...................................................................................................... 31

7.2 Target ................................................................................................................... 31

7.3 Growth Strategy Development Process ................................................................ 33

7.4 Recommendations ................................................................................................ 35

8.0 References ............................................................................................................... 45

9.0 Appendices .............................................................................................................. 47

Page 4 of 60

Glossary The World Tourism Organisation (WTO) defines tourism as: ‘the activities of persons travelling to and staying in places outside their usual environment for not more than one consecutive year for leisure, business and other purposes not related to the exercise of an activity remunerated from within the place visited’.

Term Description Domestic Day Trip Visitors

Those who have travelled for a round trip distance of more than 50km or 4 hours to a place and returns to their usual place of residence the same day.

Domestic Overnight Visitor

Australian resident aged 15 years and over who spent at least one night away from home in the region.1

International Overnight Visitor

International visitors aged 15 years and over who spent at least one night in the region.1

Interstate Visitor/Night

A person visiting a State or Territory other than that in which they usually reside. An interstate visitor night is any night spent in a State or Territory other than that in which they usually reside.

Intrastate Visitor/Night

A person visiting a location away from their usual place of residence in the State or Territory in which they reside. An intrastate visitor night is any night spent away from their usual place of residence in the same State or Territory in which they usually reside.

Tourism Expenditure

Expenditure by visitors during a trip, including airfares and other transport costs and any amount spent on trip-related items before, during and after the trip, until they return to their usual place of residence.

Tourism Regions

A tourism region is a geographical region that has been designated by Tourism Research Australia and the Australian Bureau of Statistics as having common cultural or environmental characteristics.

Tourist Someone who is away from home for less than one year continuously, for the purpose of leisure (including holidaying and visiting friends and/or relatives), business, education, employment or other personal reason, other than to be employed by a resident entity in the country or place visited.2

Tourist Attraction

A physical or cultural feature of a particular place that individual travellers or tourists perceive as capable of meeting one or more of their specific leisure-related needs.1

Visitor Nights A measure of the total number of nights spent by overnight visitors on overnight trips.

1 Tourism WA 2 World Tourism Organisation

Page 5 of 60

Acronyms

ABS Australian Bureau of Statistics

ACC Australia’s Coral Coast

AGO Australia’s Golden Outback

CAGR Compound Annual Growth Rate

CBD Central Business District

CRC Community Resource Centre

DPAW Department of Parks and Wildlife

DPIRD Department of Primary Industry and Regional Development

DRD Department of Regional Development

GVA* Gross Value Added

LGA Local Government Authority

LTO Local Tourism Organisation

NEWROC North Eastern Wheatbelt Regional Organisation of Councils

NEWTRAVEL North Eastern Wheatbelt Travel

RAC Royal Automobile Club

RTO Regional Tourism Organisation

SBCD Small Business Development Corporation

SWDC South West Development Commission

WA Western Australia

WAITOC Western Australian Indigenous Tourism Operators Council

WBN Wheatbelt Business Network

WDC Wheatbelt Development Commission

WTO World Tourism Organisation

* Gross Value Added (GVA) is a dollar value for the amount of goods and services that have been produced, less the cost of all inputs and raw materials that are directly attributable to that production.

Page 6 of 60

Foreword The Wheatbelt’s many natural and heritage icons, its proximity to Perth and access via key state and federal road networks delivers annual visitor numbers of nearly 700,000. The industry is important to the Region for two reasons:

1. It presents an opportunity to diversify the economy and drive both revenue and job growth, particularly in high amenity areas; and

2. The underpinning infrastructure that supports tourism also enhances community amenity and liveability. The latter is critical in addressing workforce attraction, a priority for the Wheatbelt.

As the second most visited region in WA after the South West, the Wheatbelt has strong industry assets and activity on which to build. Growth in industry value and jobs will be dependent on addressing capability and capacity issues and driving new market opportunities. This Strategy identifies unique Wheatbelt tourism assets, current growth inhibitors and outlines initiatives which will maximise tourism growth opportunities. It recognises the Wheatbelt’s connection to tourism activity in other regions and acknowledges significant planning undertaken by the Tourism industry organisations of Experience Perth, Australia’s Coral Coast and Australia’s Golden Outback. The Wheatbelt Development Commission thanks key thought leaders and stakeholders for their input into the development of the Strategy and looks forward to ongoing engagement to bring opportunities for growth to fruition. Chair, Wheatbelt Development Commission <<date>>

Page 7 of 60

1.0 Executive Summary The Wheatbelt Tourism Growth Strategy sets a target for the Region’s tourism industry to increase the value of the sector from $245 million in 2015 to $301 million in 2020, and double the number of those employed in the industry from 1,560 in 2014/15 to 3,120 in 2020. This growth will be driven by an increase in visitor overnight stays from 2,265,700 nights in 2014/15 to 2,706,800 nights in 2020. The Wheatbelt Regional Investment Blueprint (2015) outlines the Region’s vision for the future. This Strategy is a direct result of the Blueprint process, which highlights a need to “foster emerging industries that diversify the economy and create new jobs” (Outcome 1.1, pg 79). In relation to the tourism industry, the Blueprint identifies the need for a ‘whole of region tourism strategy to focus investment, build capability and product and market this’ (pg 41). Specifically, the Blueprint recognises the unique Wheatbelt advantages of nature based and heritage tourism. It also recognises that tourism enhances the Region’s amenity and liveability which addresses workforce attraction, a priority for the Wheatbelt. Metropolitan Perth is the main tourism destination in WA. In regional WA, the Wheatbelt is the second highest visited region and receives over 670,000 visitors annually3, contributing to 10% of the State’s tourism economic value4. The Wheatbelt’s unique natural amenity and built heritage is valued as an asset for social, cultural and economic development, particularly in the tourism industry. As a result, growth of the Wheatbelt’s tourism industry over the last 15 years (2001 – 2016) has seen:

• Close to 300,000 visitors annually5,6 to two iconic natural attractions (Wave Rock and the Pinnacles);

• Annual international tourism expenditure quadrupled from $15 million to $61 million7;

• Increased overnight visitors at an average of 9% per year3; and • Tourism-related private investment in excess of $65 million8.

An increase to the length of visitor stay in the Wheatbelt will add value to existing tourism product, increase expenditure in the Region and drive jobs growth for an emerging industry. This Strategy recognises that there is the potential to increase the quality and experience around existing product and broaden the range of products for both domestic and international markets, attracting a greater range of visitor types and increasing their length of stay in the Region. 3 Tourism Western Australia (2014/15), ‘Wheatbelt Development Commission Area: Overnight Visitor Fact Sheet’ 4 Department of Training and Workforce Development (2012), ‘Wheatbelt Workforce Development Plan 2013-2016’, pg. 12 5 Australia’s Golden Outback (2017), ‘Pathways to Wave Rock’ 6 Australia’s Coral Coast (2017), ‘The Pinnacles and Nambung National Park’ 7 Tourism Western Australia, Department of Regional Development (2012), unpublished tourism expenditure data 8 Estimated from Wheatbelt Development Commission’s private investment listings

Page 8 of 60

Through desktop research, analysis and consultations with industry organisations and stakeholders, this strategy has identified a number of initiatives to drive industry growth and jobs over the short and long term. The aim of this strategy is focus on those initiatives that will:

• Enhance access, amenity and activity around four Wheatbelt tourism first-tier icons: o New Norcia o The Pinnacles o Wave Rock o Wildflowers

• Connect and enhance the numerous second-tier tourist attractions such as: o Self-drive trails o Events of international and national significance (aviation, motorsports,

equestrian, water-based etc) o Heritage locations (Avon Valley, Aboriginal Heritage experiences, Museums

etc) • Utilise digital capacity to access and grow markets and enhance visitor experience

to increase the length of stay; and • Drive collaboration, training, and cultural and environmental awareness across

industry to achieve economies of scale and targeted market penetration.

Page 9 of 60

2.0 Western Australian Tourism

Key Highlights:

• The State Government’s goal is to double WA’s tourism economic value to $12B by 2020 • Tourism employment in WA has increased to 7.1% of the State’s total employment • At least 45% of the State’s tourism expenditure is spent in regional WA

Tourism WA’s 2020 Tourism Strategy has set a target to double the State’s tourism economic value from $6 billion in 2010 to $12 billion by 2020. In 2016, 921,400 international visitors (or 11% of Australia’s international visitors) came or travelled within WA, spending $2.35 billion9. In addition to this, the State’s total visitor and expenditure number including international, interstate and intrastate overnight visitors and day trippers equated to 29.8 million visitor nights spending $9.62 billion9. In addition to direct fiscal earnings, growth in the tourism sector also generates:

• Employment opportunities for unskilled, semiskilled and skilled workers. Tourism creates 97,200 jobs in WA, an increase of 3,500 jobs in 2016 which accounted for 7.1% of State employment, overtaking mining (6.9%)10;

• A source of public as well as private income; • Cultural exchange from tourists including language, arts, skills and culture; and • Promotion/publicity of the State to the rest of the world, encouraging future tourist

exchanges.

Tourists in WA also tend to travel regionally, to discover and experience the diverse and dramatic landscapes the State has to offer. In 2016, $4.7 billion or 45% of the State’s total tourism expenditure was spent in Regional WA. The proportion of regional tourism expenditure and visitation (both leisure and business) can be seen in the Figure below.

Figure 1: Proportion of regional tourism expenditure (1a) and visitors (1b) according to Regional Tourism Organisation (RTO) boundaries [Source: Tourism Western Australia, Fast Facts Year Ending September 2016]

9 Tourism Western Australia (2016), Fast Facts Year Ending September 2016 10 Tourism Council WA (2016)

Page 10 of 60

3.0 Wheatbelt Tourism

Key Highlights:

• The Wheatbelt has the second highest number of visitors in WA, outside metropolitan Perth • Wheatbelt tourism contributes 10% of the State’s tourism economic value • The Wheatbelt has four internationally/nationally recognised icons and many locally known

attractions • The tourism industry increases amenity, liveability and economic diversity of the Wheatbelt • Proximity to Perth allows easy access to distinct natural, built and Aboriginal heritage • The diversity of landscape, sporting and heritage attractions across the Wheatbelt provides

options for visitation on a year-round basis, with many sub-regions being more popular at particular times of year.

3.1 Background

Outside metropolitan Perth, the Wheatbelt has the second highest number of visitors after the South West11. The Region welcomes over 670,000 visitors annually, which delivers a turnover estimated to be $245 million per annum, contributing to 10% of the State’s tourism market12. The Wheatbelt has four significant and internationally/nationally known icons:

• Wave Rock; • The Pinnacles; • New Norcia Benedictine Community; and • Wildflowers.

These recognised tourist icons are complemented by numerous second-tier tourist attractions including: adventure tourism activities; self-drive trails accessing natural and historic attractions; significant events; and links to tourism activity in the Goldfields-Esperance, Great Southern, Peel and Mid-West regions.

11 Regional visitations, not including the Perth metropolitan area 12 WA Planning Commission (2009)

Page 11 of 60

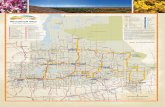

Figure 2: Opportunities for economic growth in the Wheatbelt sub-regions, including tourism; [Source: Wheatbelt Development Commission, Key Economic Features Map]

The Wheatbelt is divided into five sub-regions: Central coast, Central midlands, Central East, Avon and Wheatbelt South. The following map outlines the local governments that make up each sub-region.

Page 12 of 60

Within the Wheatbelt, three Regional Tourism Organisations (RTO’s) operate. Experience Perth includes the Wheatbelt Shires of Beverley, Brookton, Chittering, Gingin, Goomalling, Northam, Toodyay, Victoria Plains (including New Norcia), Wandering and York. Australia’s Coral Coast includes the one Wheatbelt Shire of Dandaragan. Australia’s Golden Outback includes all other 31 Wheatbelt LGA’s outside of those in the Experience Perth and Australia’s Coral Coast regions. The following map highlights the Regional Tourism Organisations that operate in Western Australia:

3.2 Value/Economic Cost Benefit

The Wheatbelt has historically been heavily reliant on the agriculture and mining sectors and as a result, the Region’s commodity economy is highly influenced by seasonal variation, market prices and is susceptible to currency fluctuations. Tourism in the Wheatbelt has the potential to diversify economic growth and development and increase jobs in the Region. Increasing the diversity and resilience of the Wheatbelt’s economy is a key strategic aim outlined in the Wheatbelt Regional Investment Blueprint (2015), Vibrant Economy Vision for “A diversified and adaptive economic base building on the Wheatbelt’s assets and aligned to State, National and International opportunity” (pg. 3).

Page 13 of 60

While tourism has been a small contributor to the Wheatbelt economy, contributing $199.7 million13 in Industry Gross Value Add compared to Agriculture ($1.8 billion or 24.9%) and Mining ($1.4 billion or 20%) in 2014-201514, it can provide a new injection of spending and secondary economic benefits to local regional communities. This can be done through15:

• Supporting increased use of existing infrastructure and amenity; • Increasing the turnover of retail and service businesses that are essential to service

local residents, and in doing so improving business viability in small towns; and • Profiling communities and industry sectors.

3.3 Competitive Advantage

‘Competitive advantage’ is the ability to use resources effectively and generate greater value for visitors than the surrounding competitors. Proximity to Perth A key comparative advantage for the Wheatbelt is its proximity to the Perth Metropolitan area, with the Wheatbelt surrounding Perth on its North and East boundaries. Many of the key attractions for the Region are accessible in a day-trip from Perth, exposing the Region to significant numbers of visitors who do not have the time to travel further afield. The Central Coast, Central Midlands and Avon Sub-regions in particular benefit from this, as well as the western parts of the Wheatbelt South Sub-region. The proximity of the Wheatbelt to Perth also makes it attractive for weekend trips, with much of the Region accessible within 3 hours drive from the Perth CBD. In addition, the Wheatbelt is en-route to outlying regions such as the South West, Mid West, Goldfields-Esperance and Great Southern. All season and diverse cultural, sport and recreational activities The Region has a range of attractions and nature-based recreational activities including: hot air ballooning, skydiving and gliding in the Avon Valley; fishing, surfing, skydiving, kite boarding, snorkelling and scuba diving along the Turquoise Coast; bush walking and mountain bike riding on the Munda Biddi Trail; and 4WD and motor-cross activities across the Region. This diversity makes the overall Region attractive to different visitor markets year-round although the key time for visitors is from Easter to November. Some activities are popular during the winter-spring months (e.g. mountain biking or hiking), and others more popular in summer-autumn months. (e.g. water sports or fishing). This is a significant advantage compared to other regions where specific periods account for the vast majority of visitors, making tourism in the Wheatbelt a viable year-round enterprise. Some Aboriginal culture and heritage interpretive tourism experiences such as Njaki Njaki Tours in the Wheatbelt East, and the Aboriginal Interpretive Centre under construction in

13 Department of Regional Development (2011), ‘Wheatbelt: A Region In Profile 2011’ 14 Wheatbelt Gross Regional Product Statistics (2015) 15 Wheatbelt Regional Investment Blueprint (2015)

Page 14 of 60

the Avon are emerging. The region is also home to numerous museums that interpret historical Wheatbelt life and work. Some tourism activities can take advantage of natural assets such as the night sky. This can increase visitor numbers during traditionally low visitation periods (e.g. the heat of summer) in parts of the Wheatbelt. Value-adding through local knowledge and expertise Within the Wheatbelt, a number of organisations have a strong knowledge base for their focus areas or industries and have been able to leverage this knowledge into successful business ventures. Examples include the Pinnacles Visitor Centre and the Wheatbelt Way drive trail, which have leveraged local expertise into tourism offerings for visitors. Converting local knowledge into a coordinated, professional product provides significant value-add for visitors. There is also considerable potential to further value-add to tourism attractions in the Region, through improved packaging of products that are in proximity to each other, improved marketing, co-ordination between organisations and integration of infrastructure to support increased visitor numbers.

3.4 Comparative Advantage

‘Comparative advantage’ is the natural and heritage resources available to a destination and the Region’s advantage over surrounding competitors as a result. Varied scenic landscapes and diverse natural amenity The Wheatbelt has a number of picturesque scenic landscapes distinctive to this Region. The diverse landscape varies across the sub-regions, from the pristine white beaches and clear turquoise waters of Cervantes and Jurien Bay; the rolling hills and winding streams in the Avon Valley; forests and woodlands in the Dryandra area and Central Midlands; to the more rugged terrain in the Central East along self-drive trails such as the Wheatbelt Way and the Tin Horse Highway. These diverse landscapes, including granite outcrops, salt lakes, wildflowers, unique sculptures and agricultural fields provide visitors with a dynamic, changing experience as they travel through the Region. Built heritage The focus of the built heritage of the Wheatbelt differs significantly to other regions of Western Australia. The Wheatbelt offers opportunities for visitors to observe both past and present working life, with a number of early settler heritage buildings and working farm tours and farm stays providing unique accommodation options throughout the Region. The Wheatbelt’s heritage buildings include the Williams Woolshed, New Norcia Benedictine Community monastic townsite, the historic towns of York (WA’s first inland town) and Toodyay, the Albert Facey homestead in Wickepin and the Avondale Discovery Farm in Beverley. Over 55 museums throughout the Region offer visitors further insight into the history of the Wheatbelt.

Page 15 of 60

Aboriginal heritage There are approximately 800 Aboriginal heritage sites throughout the Wheatbelt16. Some sites, such as the Dorntj Koorliny (‘walking together’) Aboriginal heritage trail along the Avon River have interpretive signs on site, while tour operators such as the Njaki Njaki tours in Merredin provide guided Aboriginal heritage tours and activities for visitors. Aboriginal heritage is largely an understated aspect of the Wheatbelt’s tourism attractions, and could be highlighted across tourism promotions for the Wheatbelt. However, many of these sites are culturally sensitive and there may be no benefit in providing tourism access due to the risk of them being damaged or dealt with in a disrespectful manner. Astronomy The Wheatbelt, with its trade mark clear skies, low light pollution and open spaces, is highly attractive to tourists who come from densely populated urban regions. The Wheatbelt is ideally positioned to capture both domestic and international markets and astronomy tourism in the form of astrophotography or stargazing is a growing tourism niche. Advances in technology and increased media exposure have led to exponential growth in the hobby over the last two decades. Organisations such as Astronomy WA, Stargazers Club WA, Indigo Storm Photography and Astro Photography Australia have increased the exposure of the advantages of the Wheatbelt for stargazing and astrophotography. Internationally/nationally recognised natural icons The Wheatbelt is home to two internationally/nationally recognised natural icons and two of the State’s most popular day trip destinations - Wave Rock and The Pinnacles. These two sites attract approximately 100,00017 and 190,00018 visitors respectively each year and provide significant tourism expenditure and economic growth into nearby Wheatbelt shires and towns. Having iconic destinations in close proximity to Perth gives the Wheatbelt an advantage in attracting day trippers and weekenders and capturing en-route visitors and visitor expenditure. Enhancing activities at these iconic attractions through infrastructure development will encourage visitors to stay more than one night as they have more activities at the one destination. Coordinated marketing that incorporates iconic destinations into broader tours/itineraries will also be beneficial. The Central Coast Sub-region is beginning to show this breadth of activity and collaboration. International standard experiences can now be had at the Pinnacles, Lobster Shack and Jurien Bay Skydive, accommodation and amenity infrastructure is being invested in and collaborative marketing is occurring, attracting the interest of tourism wholesalers.

16 WAPC 2015 17 Australia’s Golden Outback (2017), ‘Pathways to Wave Rock’ 18 Australia’s Coral Coast (2017), ‘The Pinnacles and Nambung National Park’

Page 16 of 60

4.0 Wheatbelt Tourism Trends

Key Highlights:

• 94% of visitors to the Wheatbelt are domestic travellers • This Strategy assumes the majority of domestic travellers are self-drive and/or self-

contained • Domestic visitor numbers fluctuate depending on global economic cycles • The number of overnight visitors in total has increased at an average of 9% per year since

2011 • While domestic tourism expenditure in the Wheatbelt fluctuates from year to year,

international tourism expenditure quadrupled between 2001 and 2012 • Overall, analysis of Wheatbelt tourism trends is difficult due to a lack of destination level,

industry value and employment statistics • Tourism related private investment is estimated to be in excess of $65 million, over the last

five years

4.1 Visitation Rates

There were approximately 676,700 international and domestic visitors in the year 20143, increased from approximately 666,846 visitors in 201319 and 605,700 visitors in 201220. Domestic travellers over this period made up approximately 94% of total visitors, dominating the Wheatbelt’s tourism market. While domestic visitors continue to make up the majority of total visitors, these visitation rates continue to fluctuate according to global economic cycles such as the Global Financial Crisis of 2007-08, whereas international tourist numbers appear more stable.

Figure 3: Estimated visitors to the Wheatbelt (domestic and international); [Source: Tourism WA Visitation Data]

19 Unpublished 2013 visitation data from Tourism WA 20 Tourism WA (2012), ‘International and Domestic Visitor Number 2001 to 2012’

-

100.0

200.0

300.0

400.0

500.0

600.0

700.0

800.0

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Estim

ated

vis

itor n

umbe

r ('0

00s)

Year

Domestic International

Page 17 of 60

For the year ending 2014, the Wheatbelt had a comparatively low proportion of domestic (interstate and intrastate) and international visitors compared to the South West. Approximately 8% of the overnight visitors in WA stayed in the Wheatbelt, compared to 23% of overnight visitors in WA who stayed in the South West. The proportion of total overnight visitors in WA who stayed in the Wheatbelt can be further broken down into:

• 8.9% of the State’s Intrastate overnight visitors; • 3.9% of the State’s Interstate overnight visitors; and • 4.9% of the State’s International overnight visitors.

Of estimated visitor nights, less than 4% of total State nights are spent in the Wheatbelt, however this is proportionate to:

• 4.6% of the State’s Domestic total visitor nights; and • 1.9% of the State’s International total visitor nights.

Table 1: Estimated overnight visitor numbers and nights for the Wheatbelt, comparative to the South West and WA; [Source: Tourism WA (2015) ‘Wheatbelt Development Commission Area Overnight Visitor Fact Sheet YE 2014/15’]

2014/2015 Wheatbelt % South West % Western Australia %

Estimated overnight visitors

Intrastate 586,500 87% 1,739,500 88% 6,542,000 76%

Interstate 48,500 7% 113,000 6% 1,215,000 14%

International 41,200 6% 123,900 6% 827,000 10%

Total 676,700 100% 1,976,400 100% 8,584,000 100%

Estimated visitor nights

Domestic 1,695,500 75% 5,708,000 78% 36,353,000 56%

International 570,200 25% 1,617,000 22% 28,593,000 44%

Total 2,265,700 100% 7,325,000 100% 64,946,000 100%

According to Tourism WA, the Wheatbelt experienced 2,265,700 visitor nights in the 2014/15 financial year9 (refer to Table 1). Of these, 75% of visitor nights were spent by domestic visitors and 34% or 770,338 domestic visitor nights were spent in a caravan park, commercial camping ground or non-commercial camping ground3. As a result, this Strategy assumes the majority of visitors are self-drive and/or self-contained (caravans) with accommodation and meal preparation facilities. While total overnight visitor numbers are comparatively lower than the South West, the Wheatbelt has experienced a comparatively higher increase in the total visitor number growth rate between 2011 and 2015. A visitor number compound annual growth rate (CAGR) of 9.32% over the four year period between 2011 and 2015 indicates a compound growth of approximately 9% per year; in comparison, the South West experienced a CAGR of 6.63% during the same timeframe. This indicates the Wheatbelt had a higher rate of visitor number growth than the South West, despite receiving less overnight visitors in total.

Page 18 of 60

This strategy recognises the need to better quantify the breakdown of the Wheatbelt’s domestic tourism market. This includes the value comparison between overnight visitors and day trippers to the Region. It also includes the breakdown of the type of domestic tourist visiting the Wheatbelt according to social and economic demographics and tourism segments such as business, events, groups, education, visiting friends/relatives or Meetings, Incentives, Conventions and Exhibitions (MICE).

4.2 Expenditure

Total expenditure in the Wheatbelt has experienced continued growth since 2001. During the period of 2001-2012, the average tourism expenditure per year in the Wheatbelt was approximately $202 million. During this time frame, total tourism expenditure was at its highest in 2012 at approximately $239 million (see Table 2), which was made up of:

• $177.9 million from domestic visitors; and • $60.9 million from international visitors.

Table 2: Tourism expenditure in the Wheatbelt for years 2011 and 2012; [Source: Tourism WA and Department of Regional Development (2012)]

Between 2001 and 2012, domestic visitor expenditure made up the majority of total expenditure; however this continues to fluctuate according to global economic cycles. Meanwhile international visitor expenditure quadrupled between 2001 and 2012, generating a greater proportion of the Region’s tourism income each year.

Total Visitors Total Tourism Expenditure

2011 2012 2011 2012 Number % Number % $m % $m %

Domestic 438,700 93 569,300 94 167.4 77 177.9 74

International 34,700 7 36,400 6 49.3 23 60.9 26

Total 473,400 100 605,700 100 216.7 100 238.8 100

Page 19 of 60

Figure 4: Estimated Wheatbelt tourism expenditure showing linear increase in total tourism expenditure and an increased international spend between 2001 and 2012; [Source: Tourism WA and Department of Regional Development (2012)]

4.3 Employment

Employment by Tourism Sectors Since Tourism is a service based industry comprising a number of tangible and intangible components21, Tourism employment sectors are not readily identifiable. As a result, the typology of tourism characteristic activities (direct tourism employment sectors) can be grouped into 5 categories22:

1. Accommodation and Food Services a. Accommodation b. Food and beverage services

2. Retail Trade a. Fuel retailing b. Food retailing c. Other store-based retailing

3. Arts and Recreation Services a. Heritage activities b. Creative and performing arts activities c. Sports and recreation activities d. Gambling activities

4. Transport, Postal and Warehousing a. Road transport b. Rail transport c. Water transport d. Air transport

21 Tourism Western Australia (2006), Inquiry into Australia’s Service Industries 22 Based on the ABS Industrial Classification for Tourism

0.0

50.0

100.0

150.0

200.0

250.0

300.0

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Expe

nditu

re ($

m)

Year

Domestic International Total Linear (Total)

Page 20 of 60

5. Rental, Hiring and Real Estate Services a. Rental and hiring services (except real estate)

Interpretation of the latest ABS census data can be done at an industry level, however specialisation into the above breakdown of direct tourism employment sectors (a,b,c etc.) is not widely available at a Regional level. Therefore, this Strategy acknowledges the following statistics may not be an accurate representation of direct tourism employment, but an indication of the industries as a whole. Between 2006 and 2011, the Wheatbelt experienced growth of employment in Accommodation and Food Services (an increase of 216 jobs; refer to Table 3), and Transport, Postal and Warehousing (and increase of 176 jobs); two sectors that are not specialised to the Region. This increase in total change in employment is primarily due to the prosperity of both sectors at a State-wide whole-of-industry and whole-of-economy level; however the Wheatbelt could take advantage of these employment sectors within its tourism industry as they thrive across the State. In contrast, the Retail Trade and Rental, Hiring and Real Estate Services sectors are declining; however these are driven by a decrease at a whole-of-industry level due to external factors.

Industry Sector National Share (2006-2011)

Industry Mix (2006-2011)

Regional Shift (2006-2011)

Total Change in Employment

(2006-2011) Retail Trade 488.578 -314.885 -263.692 -90

Accommodation and Food Services 237.197 15.806 -37.004 216 Transport, Postal and Warehousing 266.980 132.040 -223.020 176 Rental, Hiring and Real Estate Services 51.056 -39.442 -28.613 -17

Table 3: Shift share analysis (2006-2011) of the Wheatbelt's employment across four tourism-related sectors, compared to State

Employment across Local Government Areas In 2014/15 the estimated percentage of tourism-related employment from total Wheatbelt workforce was 4.4%, or 1,560 jobs23. This has increased from 3% or 1,153 tourism-related jobs in 200124. As shown in Figure 5, the Shire of Northam held the greatest number of tourism-related jobs in the region (240, 4.5%), followed by the Shires of Toodyay (110, 5.1%), Narrogin (110, 4.6%), Gingin (110, 4.6%), Dandaragan (100, 6.2%), York (90, 6%), Chittering (90, 3.5%) and Merredin (80, 5%). A breakdown of employment by LGA can be seen in Appendix 4.

23 Tourism Works (2015), ‘The Western Australian Tourism Works Atlas’ 24 Tourism Task Force (2001), ‘The Tourism Employment Atlas for Australia’

Page 21 of 60

Figure 5: Map showing the distribution of tourism-related jobs across the Wheatbelt Shires; [Source: Tourism Works (2014/15), ‘The Western Australian Tourism Works Atlas’]

4.4 Private Capital Investment

The following tourism-related private capital investments have occurred or are occurring across the Wheatbelt in the past decade. The investment is estimated in excess of $65 million8. Avon Sub-region

• The Grand Hotel, Northam • Dukes Inn, Northam • Fourteen K Brewery, Muchea • Dome Café and Accommodation, Northam (under construction) • Avondale Discovery Farm Housing Development, Beverley • Aboriginal Environmental and Interpretive Centre Northam (under construction)

Central Coast Sub-region

• Jurien Bay Harbour • Ledge Point Caravan Park • Jurien Bay Caravan Park • Cervantes Caravan Park • Skydive Jurien Bay

Page 22 of 60

• Jurien Bay Hotel • Jurien Bay to Cervantes Trail Development • Sandy Cape Campground Upgrade • Lobster Shack Redevelopment, Cervantes

Central East Sub-region

• Merredin Tourist Park - 20 New Chalets Central Midlands Sub-region

• Moora Airport for Recreational Flying Accommodation and Plane Terminal • New Norcia By-pass and lookout, internal visitor infrastructure

Wheatbelt South Sub-region

• Dome Café and Accommodation, Narrogin (under construction) • Dumbleyung Bluebird Festival Development • Wave Rock Airport Terminal, Hyden • Mary’s Farm Cottages at Cambinata Yabbies, Kukerin

Page 23 of 60

5.0 Strategic Alignment – International/ Federal/ State Context and Priorities

This Strategy has been developed to guide the contribution of Regional Development to the State Government’s objective to increase the value of tourism in Western Australia to $12 billion by 2020. The Strategy is available on the Tourism Western Australia website, http://www.tourism.wa.gov.au/About%20Us/Growing_tourism/Strategy/Pages/default.aspx. It provides a regional strategic response to the seven outcome areas developed by Tourism Western Australia, the 2020 State Tourism Strategy and highlights where Regional Development can make the most effective contribution. Seven Outcome Areas

• Brand • Infrastructure • Business travel • Asian markets • Events • Regional travel • Indigenous

Tourism WA Goals

• Tourism enabling infrastructure in regional WA • Australia's best regional events calendar • Improved caravan, camping and self-drive experiences • Extraordinary regional experiences, including nature-based, adventure based and

food and wine Regional Goal

• Increase average estimated visitor nights and maintain the number of overnight visitors

Role of Regional Development The contribution of Regional Development will be in the areas of industry and infrastructure development; however destination marketing will continue to be provided by Tourism WA and the regional tourism associations. The key elements of the regional development contribution will be:

• Infrastructure Development: Support of a network of iconic and core attractors to regional WA. This can link to a variety of nature based experiences and build upon the strategic advantage of the Region in regard to Aboriginal tourism, camping and caravanning, nature based and marine opportunities.

• Events Support: Development of a network of regional events that can leverage visitation and length of stay as a primary objective and related sector investment as a secondary objective, for example food and wine events. This recognises the

Page 24 of 60

important link the 2020 State Tourism Strategy makes to business visitation and the opportunity to link to regional trade delegations.

• Industry Development: Assist regional industry to collaborate and develop

packaged holiday options, targeting national and international market sectors with an emphasis on wholesaling and web based packaging at a regional and inter regional level. Regional Development can assist industry to take up market ready programs especially in regard to Asian visitor market opportunities and better prepare for growth in overseas market visitation through improved tourism packaging.

5.1 Tourism WA’s Five A’s of Success

Tourism WA recommends that tourism business, ideas and strategies be considered within the context of the five A’s of tourism: Attraction, Access, Accommodation, Awareness and Amenities, as they are essential components of successful tourism destinations and businesses. This Strategy is framed around the following definitions for Tourism WA’s five A’s of success:

1. Attraction – what brings visitors to the Region? A tourist attraction is the place of interest that tourists visit when travelling for leisure. Typically an attraction is visited for its cultural value, historical significance and natural or built heritage25. 2. Access – how can visitors get to the Region? Transportation is needed to allow tourists to access their place of interest, from where they live to where they are visiting25. This includes how tourists get to WA and Perth and then how they access the Wheatbelt. In the Wheatbelt, roads serve as the most significant form of access for tourists. 3. Amenities – how do facilities make it easy for the visitor to have a good

experience? Amenities are the services that are required to meet the needs of tourists while they are travelling for leisure. Amenities include but are not limited to public food and beverage outlets, toilets, signage, information bays, visitor centres and telecommunications25. 4. Accommodation – Where visitors can stay? A proliferation of tourist accommodation from basic camping and backpacking to motels, hotels and farm stays are required to successfully cater to all traveller types25. Most Wheatbelt towns are small and unlikely to have large accommodation facilities. For the same reason, there is relatively little four and five star accommodation.

25 Tourism WA (2009), ‘Five A’s of Tourism’

Page 25 of 60

5. Awareness – How do visitors find out about the Region? Awareness in the form of marketing, digital presence and attitude of the local population and local tourism organisations are all necessary when interacting with tourists, to ensure the destination encapsulates a strong positive experience25.

5.2 Additional WDC A’s of Success

In the preparation of this Growth Strategy, the Wheatbelt Development Commission recognised that Wheatbelt Tourism would benefit from two additional A’s for successful destination development. These are: 6. Activities – what can visitors do after they arrive Activities, as opposed to attractions, are interactive ventures or ‘things to do’ that encourage visitors to engage, explore and extend their stay in the Region. Activities include adventure sports, motorsports, water-based activities etc. 7. Ability – Governance capabilities

Ability is the need to connect and build the capacity of tourism groups, operators and local governments across the Region to enhance efficiency and sustainability of governance, business acumen, and to mange seasonal fluctuations in the tourism industry.

The following diagram represents the seven A’s of Wheatbelt Tourism success.

7 A's of Wheatbelt Tourism Success

1. Attractions

2.

Access

3. Amenities

4. Accommodation

5.

Awareness

6. Activities

7. Ability

Page 26 of 60

6.0 Current Industry Profile

Key Highlights:

• Natural, built and heritage products (including Aboriginal heritage) are central to the Wheatbelt tourism industry

• The tourism industry in the Wheatbelt is governed by a complex network of industry operators and organisations

• After the SWOT analysis, key issues are defined according to the seven A’s of Wheatbelt tourism success

Largely oriented around nature-based tourism, recreation and built heritage, the Wheatbelt has a variety of offerings; yet the vastness of the Region (154,862 km2), the extreme change in landscape from the coast to inland and the numerous disconnected micro businesses means it is a challenge to present the Region in a coordinated and clear way.

6.1 Wheatbelt Tourism Product

A vast array of Wheatbelt tourism assets is attached in Appendix 1. These include first-tier icons of New Norcia, The Pinnacles, Wave Rock and Wildflowers Second-tier tourist attractions;

• Trails; • Events; • Museums/discovery centres; • Recreational activities; • Nature hotspots; and • Transport infrastructure.

It is also important to distinguish Wheatbelt tourism products in terms of the feelings they evoke, including authenticity, freedom and friendliness, wide open spaces, uncrowded and great value. Understanding these feelings assist in defining the Region’s visitor appeal. The diagram below is a compilation of words, feelings and descriptions elicited from Wheatbelt tourism industry stakeholders during meetings held for the drafting of this growth strategy.

Page 27 of 60

The seven A’s of successful destination development have been used to analyse the Region’s four first-tier icons listed below. First-tier Icons Attraction Access Activities Amenities Accommodation Awareness Ability

Wave Rock High Medium Medium Low Medium High Medium Pinnacles High High Medium Medium High High Medium

New Norcia Medium High Medium Low Medium Medium Medium Wildflowers High Medium Low Low Low Medium Medium

Wave Rock Maintains international visitor numbers but access and amenity are sub-optimal. Pinnacles Sound amenity infrastructure but lacks connection to surrounding activities. New Norcia A private operator with significant built heritage upkeep that is difficult to support with Government funding. The tourism industry may not necessarily suit New Norcia’s monastery operations. Wildflowers The Wheatbelt is a biodiversity hotspot with unique wildflowers but WA is no longer seen as the international/national wildflower destination. These products are at varying levels of maturity and require specific programs to ensure they remain international/national tourism icons. While these first-tier icons are recognised at an international level, their recognition on a domestic level serves as en-route destinations to other regions in Western Australia; Wave Rock is on the way to Esperance, the Pinnacles are on the way to Kalbarri and Ningaloo, and New Norcia and the Wildflowers are on the way to the Pilbara. The Wheatbelt South is also a major tourism route, on the way to Albany and the South West; however, it does not currently have an established iconic anchor to encourage visitors to stay.

Page 28 of 60

6.2 Key Stakeholders

The tourism industry in the Wheatbelt is a complicated maze of industry operators and organisations. The following diagram reflects the current structure and their interactions of the Wheatbelt tourism industry. Appendix 2 lists these stakeholder organisations.

Page 29 of 60

6.3 Strengths, Weaknesses, Opportunities, Threats

An analysis of the Wheatbelt’s strengths, weaknesses, opportunities and threats (SWOT) is important to gauge the current status of the Region’s tourism industry and what strategies may be best suited for its future growth. The SWOT below was compiled from both desk top research and in consultation with industry stakeholders including Tourism WA, Australia’s Golden Outback, Australia’s Coral Coast, Experience Perth and local regional tourism groups and organisations.

Page 30 of 60

6.4 Key Issues

The Wheatbelt’s key issues and gaps are outlined below, using the seven A’s of successful destination development:

Attraction – what brings visitors to the Region

Access – how can visitors get to the Region

Activities – what can visitors do after they arrive

Amenity- quality of the destination

Key Issues Key Issues Key Issues Key Issues

• Poor infrastructure around some internationally/nationally recognised tourism icons/ assets

• Small operators may be unable to afford to invest in infrastructure and participate in marketing and membership to multiple organisations

• Public transport gaps • High reliance on self-drive • Relatively low presence of

bus tour operators • Poor road and coach access

in some areas

• Product packaging gaps • Disconnection between products

that share location or activity relationships

• Inconsistent and disconnected event promotion

• Some trails are tired and lack interpretation

• Minimal Aboriginal interpretive experiences

• Remote and environmentally sensitive product difficult to protect

• Poorly situated visitor facilities along major routes

• WIFI provision from operators not widespread

• Some remaining telecommunications signal gaps

• Pressures increasing on sensitive environment and cultural heritage

Accommodation – where visitors can stay

Awareness – overall profile and brand for the Region

Ability –governance capabilities

Key Issues Key Issues Key Issues

• Inconsistent quality, variety and supply

• Minimal international standard accommodation

• Lack of catered accommodation for self-drivers not caravanning or camping

• Lack of accommodation at short-notice in peak season with large distances between towns inhibiting easy access to alternatives

• Confusing local, sub-regional and regional branding

• Duplication and uncoordinated digital marketing

• Low number of industry familiarisation tours • Lack of clarity of target markets • Inconsistent and varying levels of digital

professionalism, e.g. website presentation • Limited promotion of events, activities,

accommodation and attractions • Low levels of digital access and capacity in

parts of the Region

• Inconsistent visitor servicing (LGA vs. CRC vs. visitor centres/volunteers)

• Confusing network of governing bodies • Confusing and unclear governance structure • Lack of coordination and communication

between governing bodies • Low level of capacity-building service

provision from State tourism organisations • Lack of reliable statistical data at regional,

sub-regional or LGA levels • Disconnected privately-owned micro operators

Page 31 of 60

7.0 Wheatbelt Tourism Growth Priorities

7.1 Industry Vision

An outward looking, well-integrated Wheatbelt tourism industry that is flexible, harnessing opportunities from existing and emerging markets

7.2 Target

Considering the strength of the Wheatbelt’s existing self-drive, domestic market and the fact that international tourism expenditure has quadrupled over the previous decade and there is now significant private investment in tourism, this Strategy’s growth targets are:

1. To increase the value of industry from $245 million in 2015 to $301 million in 2020

2. To increase the number of jobs from 1,560 to 3,120 in 2020 3. To increase the average estimated visitor nights from 3.3 nights to 4.0

nights and maintain the number of overnight visitors In 2014/15, the Wheatbelt received a total of 676,700 overnight visitors both domestic and international. In the same year, there were a total of 2,265,700 estimated visitor nights. This equates to an average length of stay of 3.3 nights. In 2013, the Wheatbelt received a total of 666,800 visitors, with an expenditure of $245 million26. This equates to an average of $367 expenditure per visitor. Please note, this strategy acknowledges it is comparing two different years of data for average length of stay and average expenditure per visitor. Due to the unavailability of consistent statistical information it assumes a visitor spends approximately $111 per day. This strategy aims to increase the average length of stay from 3.3 nights to 4 nights, whilst maintaining the total number of visitors. This would naturally increase each visitor’s expenditure to $445 per visitor and in turn increases the total visitor expenditure to $301 million per annum by 2020. The table below outlines these target outcomes.

2020 Target Outcome:

• Total of 676,700 overnight visitors maintained • Average length of stay is 4 nights • Average expenditure per visitor increased from $367 to $445 • Total visitor expenditure increased by 23% to $301 million by 2020

26 Tourism Research Australia (2013), International and National Visitor Survey, Tourism Research Australia, Canberra

Page 32 of 60

The 2020 Target Outcome has been designed with the following in mind: • Many iconic nature-based attractions in the Region have fragile environments

and/or are Aboriginal sacred sites with cultural sensitivities; and • Marketing to increase the number of visitors and new markets to the

Wheatbelt is cost prohibitive for small business and small tourism organisations. Until such time that a Wheatbelt-wide tourism organisation can utilise economies of scale for destination marketing, this strategy seeks to solely increase the nights stayed by existing visitors.

Page 33 of 60

7.3 Growth Strategy Development Process

In order to formulate a strategy embedded by local industry knowledge, experience and inspiration, the Wheatbelt Development Commission followed a series of steps including in-depth consultation with industry and stakeholders.

* SWOT is the abbreviation for Strengths, Weaknesses, Opportunities and Threats. It’s a method adopted to assist in analysis. # ISBP is the abbreviation for Issues, Solution, Benefits, Proof. It’s a method adopted to assist in business planning.

Project Conception

Phase Identifying the

need for tourism value add Regional

visitations and overview of

current product

Desktop Research and Analysis

Current industry profile

Review of tourism product

economic research on current and

future trends

SWOT*, ISBP# and Gap Analyses

Identification of gaps in current tourism market

Identification and analysis of

high level strengths and

solutions

Stakeholder Consultation Stakeholder

identification Consultation

with key tourism groups

Feedback from key tourism

groups

Consult with Industry

Organisations Align with industry strategic planning

Feedback on analysis of issues

and solutions

Options Analysis and

Prioritisation Evaluation and prioritisation of

potential tourism product

following feedback from stakeholders

Strategy Development

Outline product and destination

priorities Development of growth strategy

to enable industry plans

and attract investment

Review and Evaluation

Evaluate the degree of impact

this tourism strategy has had

on the Wheatbelt's

tourism sector

Page 34 of 60

The WDC visited the Wheatbelt’s five sub-regions and engaged tourism thought leaders in discussions on the following:

• What does the Wheatbelt do well and not so well? • What is the most common market segment? • What is the best support being received that can help to attract visitors? • What are the actions industry operators can take to enhance tourism? • What are the actions others can take to enhance tourism?

Thought leaders were selected from those who have a high standing in the industry, in the Wheatbelt, are able to think broadly about the industry, had a long history in tourism, worked with operators or had a niche business in tourism. The list of representatives engaged with the initial discussions is listed in Appendix 3.

Page 35 of 60

7.4 Recommendations

In line with the target to increase the average length of a visitor’s stay and to maintain the industry’s flexibility to take advantage of emerging markets, this Strategy outlines numerous recommendations. It is important to note that there are no costs for implementation included in the recommendation tables below. Funding and resources will be required either from the industry itself or external sources in order to implement any of the recommendations. Enabling Infrastructure Key icons in the Wheatbelt continue to attract consistent numbers of international tourists. However, in some cases surrounding amenity is ageing or lacking. This Strategy recognises that in order to remain competitive in a global tourism market, some attractions require upgraded access and facility enhancement. Even though improving attractions on the ground is critical to retaining tourism interest, it is also imperative to improve the infrastructure that supports digital marketing and promotion to markets where online bookings, research prior to arrival and social media interaction are the norm. Recommendations Outcome Priority Timeframe Responsibility

Enha

nce

icon

ac

cess

, am

enity

and

ac

tivity

Wave Rock Infrastructure Project

- Wave Rock entry road, boardwalk, lighting, signage and interpretation

- Hyden to Wave Rock walk trail - Kondinin to Hyden Road upgrade with rest

stops and interpretation - Hyden to Balladonia Road upgrade with

rest stops and interpretation

High Long-term AGO Tourism WA Shire of Kondinin Main Roads WA

New Norcia Bypass Improvements

- Bypass signage installed - Enhanced bus and car parking - New caravan park - Walk and bike trails and interpretation

Med Short-term Main Roads WA New Norcia Benedictine Community

Page 36 of 60

Wheatbelt South Icon Development

- Dryandra signage, access road, camping amenity including glamping, interpretation, nature playground

High Long-term DPAW Shire of Narrogin AGO Australia’s South West SWDC PDC

Coastal Boat Launching Facility

- Central Coast marina site identified and developed

- Ledge Point to Lancelin Road constructed

Low Long-term Shire of Gingin DoT

Wildflower Access - Coach access to wildflower hotspots constructed at Buntine Rock, Petrudor Rock, Mia Moon and Jilbadji.

- Wildflower trails linked to new coastal natural heritage trail

High Short-term Shire of Dalwallinu AGO

Strategic Facilities Upgrade - Road access, parking and ablutions installed at Eastern Wheatbelt rocks including Eaglestone, Bolagi, Elachbutting

Med Mid-term Eastern Wheatbelt LGAs

Exploring Country and Sharing Culture

- Identify reserves in need of improved amenity and Aboriginal culture interpretation

Med Short-term WAITOC DPAW Local Operators

Attract Private Investment - Tourism investment prospectus developed - Potential attraction identified, to be

located between York and Wave Rock

Med Short-term WA Open for Business Tourism WA

Page 37 of 60

Dig

ital P

rese

nce

Digital Streamlining - Overarching digital platform promotes destinations, experiences and events, potentially utilising the new Wheatbelt Way app when launched

- Digital platform promoted on regional entry statement signage

High Short-term NewTravel NEWROC Central Wheatbelt Visitor Centre Heartlands WA

Online Booking System - Self-sustaining digital platform shared across operators and organisations

High Short-term Avon Valley Tourism NewTravel Heartlands WA

Heritage Storytelling - Aboriginal cultural stories digitised - Wheatbelt light show

Med Short-term WAITOC DPAW Local Operators

Signage - Entry statements on all major highways traversing the Region that communicate digital resource access and signify the boundary of the Wheatbelt (e.g., “welcome to the Wheatbelt” when driving in; “thank you for visiting WA’s Wheatbelt” when driving out

- Consistent branding

High Short-term Main Roads WA Heartlands WA

Page 38 of 60

Attract private investment Tourism related private investment is estimated to be in excess of $65 million over the last 5 years. The arrival of corporate organisations such as RAC Cervantes Holiday Park and Dome Café and Accommodation are examples of the potential for further private investment in the Wheatbelt. This trend should be encouraged as it rejuvenates existing infrastructure and creates new tourism assets. Recommendations Outcome Priority Timeframe Responsibility

Priv

ate

Inve

stm

ent Tourism Investment

Prospectus - Wheatbelt tourism investment prospectus

developed Med Short-term WA Open for

Business Tourism WA

Strategic Attractions - Potential attraction identified, to be located between York and Wave Rock

Med Short-term WA Open for Business

Glamping Operator Identification

- Glamping operator matched to a DPAW site through the DPAW-Tourism WA Nature Bank Program

- Private investment

High Short-term DPIRD DPAW Tourism WA

Page 39 of 60

Enhance self-drive trails and their connections The Wheatbelt is home to a number of self-drive trails, both Wheatbelt-based and cross-regional. The Wheatbelt-based self-drive trails showcase the Region’s natural and built heritage and generally involve overnight trips lasting between 2 days to 4 days. As the Wheatbelt is in close proximity to the Perth CBD, visitor travelling time is not more than 4.5 hours per one-way commute and enables short-term/weekend holiday destinations. The recommendations to capitalise on trail assets are as follows: Recommendations Outcome Priority Timeframe Responsibility

Cre

ate

Coastal Natural Heritage Trail

- New coastal trail developed for recreation linking DPAW assets

- Cycle trail between Jurien Bay and Cervantes completed with link to The Pinnacles

High Short-term DPAW Shire of Dandaragan ACC

High in Nature Trail Link - Identified Wheatbelt South icon linked to DPAW’s High in Nature Trail

High Long-term DPAW Shire of Narrogin AGO Australia’s South West SWDC Peel DC

Events Trail - Coordinated events keep visitors for longer

- Event promotion digitised via Heartlands WA online portal

High Short-term Heartlands WA NewTravel

Cross-Regional Trail Links - Wheatbelt linked to other regions (Peel, South West, Great Southern, Goldfields Esperance, Midwest) via trails

High Short-term DPAW Mandurah and Peel Tourism Organisation Australia’s South West AGO

Page 40 of 60

Bike Trails - Recreational mountain bike trails identified and developed

- Mountain bike trail links Wheatbelt with Peel (i.e. Wandering to Dwellingup)

High Short-term DPAW Australia’s South West AGO

Act

ivat

e

Map and Gap Analysis - All Wheatbelt trails are identified, mapped and analysed

- Trails set out according to stopping needs of visitors

High Short-term Heartlands WA DPAW Relevant ROC’s

Adventure Trails Art Trails

- Adventure sports trail identified e.g. sky diving, gliding, ballooning etc.

- Geopark and geocache trails developed - Wheatbelt Science Trail completed - Artbelt Trail implemented (originated by

Dalwallinu Visitor Centre)

High Short-term Various

Rej

uven

ate

Wheatbelt Wildflowers Trails - Seasonality creates a sense of urgency, scarcity and uniqueness to the product

- Coordinated showcasing of wildflowers in Wheatbelt towns

- Granite Loop Wildflower Trail

High Short-term DPAW Wheatbelt LGAs

Wheatbelt Way - Wheatbelt Way app launched - Pilot project (that could be rolled out to

other sub-regional tourism destinations) identified to upskill industry operators in customer service, quality standards and tourism offerings

High Short-term NewTravel

Pioneer Pathway - Direction and interpretive signage renewed

High Short-term NewTravel

Golden Pipeline Heritage Trail

- Direction and interpretive signage renewed

High Short-term NewTravel

Granite Way - Trail linked to geoparks and geocaching High Short-term NewTravel

Food and Wine Trail - Quality food and wine hubs linked High Short-term Heartlands WA Relevant LGA’s

Page 41 of 60

Build industry capacity The overall success of the tourism industry is contingent on the Region’s ability to work together to promote what it has to offer. However, costs of collaboration can be high as the sub-regions are diverse, fragmented and compete with each other. This can deter action despite it being collectively beneficial. While there are numerous groups working to develop tourism, the complexity and incompatibility of the groups have resulted in a lack of regional co-ordination, hampering the development of tourism through poorly communicated agendas and duplication of activities. A lack of consistent and quality data at destination level has further exacerbated the Region’s capacity to grow the tourism industry and underpin future decisions. Improved and transparent methods for data collection as well as increased co-ordination between tourism groups can provide consistent and quality visitor information to inform decisions, streamline developments and ultimately improve the quality of the product offering. This would make tourism in the Region more attractive to prospective visitors and a more economically beneficial industry for the Wheatbelt. Recommendations Outcome Priority Timeframe Responsibility

Hum

an C

apac

ity

Holistic Approach for Wheatbelt Tourism

- Sub-regions work together with the RTO’s to deliver a whole of region approach to tourism development, bring stakeholders together and market Wheatbelt tourism destinations in keeping with State tourism boundaries.

High Med-term NewTravel Merredin VC RoeROC Avon Tourism RTO’s Heartlands WA Thought leaders network

Governance Restructure - Critical mass and sub-regional focus achieved around key tourism zones

High Long-term Tourism WA RTOs Wheatbelt Tourism Groups LGA’s

Page 42 of 60

LGA Visitor Services - State tourism industry delivers workshops to upskill

Med Med-term Wheatbelt LGAs Tourism WA RTOs

Thought Leaders Network - Network of leading industry operators in the Wheatbelt support and grow tourism

Med Med-term RAC Dome WBN Heartlands WA

Mentorships - Tourism mentors for Aboriginal tourism product providers and new tourism businesses.

Med Med-term SBDC WAITOC

Stak

ehol

der E

ngag

emen

t

Stronger Stakeholder Relationships

- Networks and communication between local tourism organisations, RTOs, Tourism WA, DPAW and LGAs developed and strengthened by a Wheatbelt-wide regional leadership organisation

- Tourism WA, Tourism Council and RTOs educated on Wheatbelt tourism

Med Short-term Tourism WA Tourism Council RTOs DPAW LGAs

Local Tourism Buy-In - Pilot project identified to enable both non-tourism and tourism businesses to actively promote local product and understand the value the tourism industry brings to the Region

- Natural marketing system developed through advocacy

- Cross promotion between sub-regions and between local tourism products, services and events providers

Med Med-term WBN Heartlands WA Wheatbelt Tourism Organisations

Page 43 of 60

Info

rmat

ion

Man

agem

ent

Tourism Friendly Toolkit - Audit tool created for tourism friendly communities and rolled out in sub-regions in need

Med Med-term Heartlands WA Wheatbelt LGAs Wheatbelt Tourism Organisations

Statistics - Consistent and quality data at a regional level that accurately reflects overnight and day tripper numbers, visitor expenditure and visitor social and economic demographics

High Short-term Tourism WA ABS Wheatbelt Tourism Organisations

Page 44 of 60

Consolidate and Develop Markets It is important that Wheatbelt tourism operators and organisations remain open to emerging markets and new opportunities into the future. Most tourism operators are small to medium sized businesses and operations with varying degrees of experience and/or professionalism. This Strategy recognises their need to work together to capitalise on new interest in the region from both domestic and or international markets. Recommendations Outcome Priority Timeframe Responsibility

Con

solid

ate

and

Dev

elop

M

arke

ts

Strengthen wholesaler relationships

- Increased number of tourism package offerings

- Increased collaboration and awareness of Wheatbelt products

- Increased average length of visitor stay

Med Short-term Wheatbelt operators RTOs

Upskilling for new markets - Industry operators are supported and upskilled to supply products and services at the required levels for different markets

- Training in cultural awareness for businesses aiming to attract Asian (especially Chinese and Japanese) visitors to ensure a good reputation with wholesalers and Asian travel agents

Med Med-term Industry Operators Tourism WA RTOs

Page 45 of 60

8.0 References Australia’s Coral Coast (2017), ‘The Pinnacles and Nambung National Park’; Available from: www.australiascoralcoast.com Australia’s Golden Outback (2017), ‘Pathways to Wave Rock’; Available from: www.australiasgoldenoutback.com Australian Bureau of Statistics (2006, 2011), Time Series Profile, Wheatbelt Region, Western Australia Australian Bureau of Statistics (2016), Australian National Accounts: Tourism Satellite Account, 2015-16 Department of Regional Development (2011), Wheatbelt: A Region in Profile 2011 Department of Training and Workforce Development (2012), ‘Wheatbelt Workforce Development Plan 2013-2016’, pg. 12 Tourism Research Australia (2013) International and National Visitor Survey; Available from: www.tra.gov.au Tourism Task Force (2001), ‘The Tourism Employment Atlas for Australia’

Tourism WA (2012), State Government Strategy for Tourism in Western Australia 2020: Detailed Strategy Tourism WA (2012), Unpublished International and Domestic Visitor Number 2001 to 2012

Tourism Western Australia & Department of Regional Development (2012), Unpublished Tourism Expenditure Data Tourism Western Australia (2006), ‘Inquiry into Australia’s Service Industries’, House of Representatives Standing Committee on Economics, Finance and Public Administration, Submission 33 Tourism Western Australia (2014/15), ‘Wheatbelt Development Commission Area: Overnight Visitor Fact Sheet’ Tourism Western Australia (2016), ‘Fast Facts Year Ending September 2016’ Tourism Works (2015), ‘The Western Australian Tourism Works Atlas’

Page 46 of 60

Western Australian Planning Commission (2015) ‘Wheatbelt Regional Planning and Infrastructure Framework Part A: Regional Strategic Planning’ Wheatbelt Development Commission (2015), ‘Wheatbelt Blueprint: A Vision for a Vibrant Future’ Wheatbelt Development Commission (2015), Unpublished Gross Regional Product Statistics

Page 47 of 60

9.0 Appendices

Appendix 1: Tourism Product in the Wheatbelt

First-tier Icons Wave Rock Hyden The Pinnacles Cervantes New Norcia Benedictine Community New Norcia Wildflowers in the Wheatbelt

Second-tier Tourist Attractions – Built Form Quality Unique Quirky

• Laurelville B&B York • Bindoon Bakehaus

Bindoon • Duke’s Inn Northam • Gravity Discovery Centre

& Observatory Gingin • Lobster Shack

Cervantes • RAC Holiday Park

Cervantes • Succulent Foods

Kellerberrin • York Olive Oil Company

York • Williams Woolshed

• Barna Mia Nocturnal Animal Sanctuary Dryandra Woodland

• Mogumber Mission Mogumber (not currently in operation)

• Motorcycle Friendly Region Avon Valley

• Wandering Mission Wandering (not currently in operation)

• Westonia Historic Town Site Westonia

• The Prev Kellerberrin

• Christmas 360 shop Toodyay

• Dog Cemetery Corrigin • Springhills Farm Stay

Quindanning • Giant Merino Ram

Wagin • Krystal Rose Jewellery

Doodlakine • Rabbit Proof Fence

Northern Wheatbelt • Rusty the Tin Dog

Dowerin • The Sock Factory York • The Lace Place Hyden • Tin Horse Highway Kulin

Natural Environment Quality Unique

• Wildflowers • Night Sky • Granite Outcrops

• Dryandra Woodlands near Narrogin

• Sand Dunes Lancelin

Biodiversity Hotspots

• Nambung National Park • Lesueur National Park • Moore River National Park • Badgingarra National Park • Drovers Cave National Park • Jurien Bay Marine Park • Kokerbin Nature Reserve • Yorkrakine Rock Nature Reserve • Totadgin Conservation Park • Sandford Rocks Nature Reserve • Williams Nature Reserve

• Korrelocking Nature Reserve • Dumbleyung Nature Reserve • Toolibin Nature Reserve • Lol Gray State Forest • Boyagin Nature Reserve • Wongan Hills Nature Reserve • Watheroo National Park • Avon Valley National Park • Wandoo National Park • Wongan Hills Nature Reserve and Mt

Matilda

Page 48 of 60

Events27 Adventure Culture, Art & Food Motor Sports

• Avon Descent Northam • Lancelin Ocean Classic

Lancelin

• Moondyne Festival Toodyay

• International Food Festival Toodyay

• Indian Ocean Festival Jurien Bay

• Avon Valley Vintage Festival

• Avon Valley Gourmet Food and Wine Festival

• Blazing Swan Kulin • Taste of Chittering • Farmers Markets

• British Car Day Gingin • Flying Fifty Northam • Motorcycle Festival York • King of the Cross

Southern Cross • Quit Targa West Tarmac

Rally • Vintage Car Racing

Carnival Goomalling • Historic Car Day

Bindoon

Agricultural Equestrian

• Dowerin GWN Field Days Dowerin

• Wagin Woolorama Wagin

• Newdegate Machinery Field Days Newdegate

• Agricultural Shows in the Region

• Kulin Bush Races Kulin • Northam Races and

Trots Northam • Narrogin Races and

Trots Narrogin • Kellerberrin Races and

Trots Kellerberrin • York Races York • Toodyay Picnic Races

Toodyay • Mogumber Rodeo

Mogumber • Quindanning Picnic

Races

Self-Drive/Walk Trails28 Heritage Nature Culture, Art & Food

• Golden Pipeline Heritage Trail Mundaring Weir to Kalgoorlie

• Pioneers’ Pathway Toodyay to Merredin

• The Pilgrim Trail Perth to New Norcia

• Marradong Country Self-Drive Trails

• Northern Wheatbelt Wonders

• Turquoise Coast Walk Trail

• Wheatbelt Way • Granite Way • Wildflower Way • Granite Woodlands and

Discovery Trail • Kep Track

• Woodlands and Wheatbelt Trail

• Dryandra Country Art, Food and Wine Trail

• Tin Horse Highway Kulin • Pathways to Wave Rock • Dryandra Mothers Day

Weekend Art Trail

Cross-Regional

• Esperance Escape • Monsignor Hawes

HeritageTrail

27 Not an exhaustive list of events; does not include many local events 28 There are many local walk and cycle trails located in and around towns that are not listed here

Page 49 of 60

Educative Centres Discovery Centres Museums

• Grain Discovery Centre Narembeen

• Gravity Discovery Centre and Observatory Gingin

• Avondale Discovery Farm Beverley

• Pinnacles Desert Discovery Centre Cervantes

• Bluebird Discovery Centre Dumbleyung

• Wheatbelt Heritage Rail Discovery Centre, Minnivale Dowerin (under construction)

• Aeronautical Museum Beverley • Avondale Discovery Farm Beverley • Australian Inland Mission Hospital Museum Lake Grace • Berkshire Valley Folk Museum Moora • Bruce Rock Museum Bruce Rock • Corrigin Pioneer Museum Corrigin • Cunderdin Municipal Museum Cunderdin • Dead Finish Museum Beverley • Dowerin District Museum Dowerin • Goomalling Museum Goomalling • Koorda and Districts Museum Koorda • Mangowine Homestead Nungarin • Merredin Military Museum Merredin • Merredin Railway Museum Merredin • New Norcia Museum New Norcia • Nungarin Heritage, Machinery and Army Museum

Nungarin • Old Newcastle Gaol Museum Toodyay • Old Railway Station Museum Northam • Residency Museum York • Southern Cross & Yilgarn Historical Museum Southern

Cross and Yilgarn • The Lace Place Hyden • Wongan Hills & District Museum Wongan Hills • Wubin Wheatbin Museum Wubin • Wyalkatchem CBH Agricultural Museum Wyalkatchem • York Motor Museum York • York Courthouse Complex York

Transport Major Networks Regional Links

• Great Eastern Highway • Great Northern Highway • Albany Highway • Brookton Highway • Great Southern Highway • Indian Ocean Drive • Brand Highway

• Peel • Perth Hills • Swan Valley/Bullsbrook • Mid West • Goldfields Esperance • Great Southern • South West

Page 50 of 60

Appendix 2: List of Stakeholder Organisations Organisation Name Organisation Type Boundaries and

Regions Responsibilities (relevant to Tourism)

Marketing Tourism Australia www.tourism.australia.com

Australian Government Agency

Nation-wide Responsible for attracting international visitors to Australia, both for leisure and business events