023fd4f4990s.foundationcenter.org/990pf_pdf_archive/431/... · Gross sales pri ce for all b assets...

Transcript of 023fd4f4990s.foundationcenter.org/990pf_pdf_archive/431/... · Gross sales pri ce for all b assets...

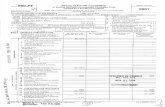

Form 990-PFDepartment of the Treasu ry

Return of Private Foundationor Section 4947(a)(1) Nonexempt Charitable Trust

Treated as a Private Foundation

OMB No 1545-0052

1"ternw r enue service I Note: The organization maybe able to use a copy of this return to satisfy state reporting requirements. I 2005For calendar year 2005 , or tax year beginning I--I , and endingn Ph M, ..u Chet a nnh, F---1 Ind , el .#..,n I 1 Rnel return I I Amenrferl return F-X I ArlA rote r •hanno I 1 Name rhanne

Use the IRS Name of organization A Employer identification number

label.Otherwise, IEBLING FOUNDATION FOR WORTHY STUDENTS 43-1722158

print Number and st reet (or P O box number if mail is not delivered to street address) Floorn/su,te B Telephone numberor type. J.S.•BANK N.A. , P.O. BOX 387 (314)418-2643

See SpecificInstructions City or town, state, and ZIP code C if exemp tion application is pending, check here -►Q

.T . LOUIS MO 63166 0 1. Foreign organizations, check here ►

H Check type of organization Section 501(c)(3) exempt private foundation 2 checkh andatonesrneeUpn uor8s96 test, ►El

Q Section 4947(a)(1) nonexempt cha ritable trust Q Other taxable private foundation E If rivate foundation status was terminatedI Fair market value of all assets at end of year J Accounting method: EXI Cash O Accrual

punder section 507(b)(1)(A), check here .►0

(from Part 11, col. (c), line 16) 0 Other (specify) F If the foundation is in a 60-month termination► $ 9 6 0 5 8 8 . (Part 1, column (60 must be on cash basis.) under section 507(b)(1 (B), check here- ►0

Analysis of Revenue and Expenses (a) Revenue and (b) Net investment (c) Adjusted net ( d) Disbursements(The total of amounts In columns (b), (c), and (d) may notnecessari ly equal the amounts In column (4) expenses per books income income for charitable purges(cash basis ony)

1 Contributions, grits, grants, etc., received2 Check [] aftIoundaEaoknotre lI baaxhSch. B

Interest on savings and temporary3 cash Investments

-

4 Dividends and interest from securities - - 42,188. 42,188.

5a Gross rents .b Net rental income or Coss)

6a Net gain or Coss) from sale of assets not on line 10 <25.,J.0.5 •

q

AT ;r�T

EGross sales pri ce for all

b assets on line sa-

-

7 Capital gain net Income (from Part IV, line 2) 0.

cc 8 Net short-term capital gain9 Income modifications

Gross sales less retu rn s10a and allowances

b Less Cost of goods--

C WOO

aI.Ad lines rou h.

16,483. 4 2 18 8.[sa " d, sh atm 13,300. 9 975. 3325

1 Ot eremployea.salari as .... .. . ..15 e 1 ns*p6igbene s ...

yl ... .. . ........ . . ... .C b Accounting fees STMT 2 550. 550.

.

0.W c Other professional fees . ...... .... .....> 17 InterestW

.18 Taxes STMT 3 711. 0. 0.19 Depreciation and depletion ... .... ..20 Occupancy

4 21 Travel, conferences, and meetings22 Printing and publications ... .... ..23 Other expenses ....24 Total operating and administrative

expenses . Add lines 13 through 23 .. - 14 5 61 10 5 2 5 .

.

5 .0 25 Contributions, gifts, grants paid 42 750 0

26 Total expenses and disbursements.Add lines 24 and 25 5 7 311 10 5 2 5. 5.

27 Subtract line 26 from line 12:a Excess of revenue over expenses and disbursements <40 82 8

b Net Investment Income pfnegative, ewe. -o-) 31,663.

c Adjusted net Income (Inegawa enter-o-)- N/A

LHA For Privacy Act and Paperwork Reduction Act Notice, see the Instructions . Form 990-PF (2005)yyy���0051o1.osoe

115380331 748475 PF-446680FF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

L FnrmQQn-PF (•90051 T.TFRT.TNG FntiNDATTON FOR WORTHY STUDENTS 43-1 7221 SR Paae2

andan ts In ft VbonB l Sh Beg inning of year End of yearjt a ance eets c olumn sho uld beformdd1w arr ounra* V lB(a) Book Value ook a(b) u e (c) Fair Market Value

1 Cash - non-interest-bearing 130. 144. 144.2 Savings and temporary cash investments 14,763. 50, 992. 56,992.3 Accounts receivable ►

Less allowance for doubtful accounts ►4 Pledges receivable ►

Less* allowance for doubtful accounts ►5 Grants receivable6 Receivables due from officers, directors, trustees, and other

disqualified persons7 OCia notes and loara nzavabk ►

Less* allowance for doubtful accounts ►, 8 Inventories for sale or use . . .

9 Prepaid expenses and deferred charges10a Investments - U S. and state government obligations STMT 4 105,934. 31, 303. 30,084.

b Investments - corporate stock _. STMT 5 408,341. 436,726. 427,011.c Investments - corporate bonds _ ..... STMT 6 481,819. 450, 994. 452,357.

11 Imestments- bndbuBdnps,andequipment buk ►

►Less ao inu d depreciation

12 Investments - mortgage loans ... . ... .. . .13 Investments - other14 Land, buildings, and equipment basis ►

Less: amunvAtd depreciation

15 Other assets (describe ► )

16 Total assets to be completed by all filers 1, 010,987. 970, 159. 960 588 .17 Accounts payable and accrued expenses . .18 Grants payable ..

m 19 Deferred revenue . .20 Loans from officers, directors, trustees , and other disqualified persons

21 Mortgages and other notes payable . .... ..J 22 Other liabilities (describe ►

23 Total liabil ities (add lines 17 through 22) 0. 0.

Organizations that follow SFAS 117, check here ► 0and complete lines 24 through 26 and lines 30 and 31.

24 Unrestricted . . . . ........ ........... ... ... .......0 25 Temporarily restricted . .. . ......................... ......... ..co 26 Permanently restricted ...... . ........... ......... .c EX--1Organizations that do not follow SFAS 117, check here 0-

and complete lines 27 through 31.° 27 Capital stock, trust principal, or current funds ..... , ... ... 1, 010,987. 970, 159 .y 28 Paid-in or capital surplus, or land, bldg , and equipment fund 0. 0 .

29 Retained earnings, accumulated income, endowment, or other funds. 0. 0 .

Z 30 Total net assets or fund balances .. ... ........... . .. 1, 010,987. 970, 159i

31 Total liabilities and net assets nd balances 1, 010,987.1 970, 159.1mj# Analysis of Changes in Net Assets or Fund Balances

1 Total net assets or fund balances at beginning of year- Part II, column (a), line 30(must agree with end-of-year figure reported on prior year's return)

2 Enter amount from Part I, line 27a . .. .. ..... . ... ..... . ...... . ..... ..3 Other increases not included in line 2 (itemize) ►4 Add lines 1, 2, and 35 Decreases not included in line 2 (itemize) ►8 Total net assets or fund balances at end of year (line 4 minus line 5) - Part II, column (b), line 30

523511of-05-08

1,010,987.<40,828. >

0.970,159.

0.970,159.

Form 990-PF (2005)

215380331 748475 PF-44668OFF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

Form 990-PF (2005) L I EBL ING FOUNDATION FOR WORTHY STUDENTS 43-1722158 Page 3Part fV Capital Gains and Losses for Tax on Investment Income

(a) List and desc ri be the kin d ( s) of property sold (e g , real estate ,2-story b ri ck warehouse , or common stock , 200 shs MLC Co )

( b How acquired- Purchase

D - Donation( t) Date acquired(mo , day, yr)

(d) Date sold(mo , day, yr )

1a SEE ATTACHED SCHEDULEbtde

(e) Gross sales p ri ce ( f) Depreciation alowed(or allowable)

( g) Cost or other basisplus expense of sale

(h) Gain or (loss)(e) plus ( f) minus (g)

a <25,705.:bcde

Complete on ly for assets showing gain in column (h) and owned by the foundation on 12/31/69 ( I) Gains ( Col (h) gain minus

(I) F.M V. as of 12/31/69(j) Adjusted basisas of 12/31/69

( k) Excess of col. (i)over col (I), if any

col ( k), but not less than -0-) orLosses (from col. (h))

a <25,705.:bcde

2 Capital gain net income or capital lossIf oss also enter in Part I, li ne 7

(net ) Ifloss ) enter -0- in Part I line 72 <2 5 , 7 05 .

3

,,

Net short-term capital gain or ( loss) as defined in sections 1222 (5) and (6).If gain, also enter in Part I , line 8, column (c)If (loss), enter -0- in Part I , line 8 3 N/A

,ftft,M ] Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)

If section 4940(d)(2) applies, leave this part blank.

Was the organization liable for the section 4942 tax on the distributable amount of any year in the base period9 EXI Yes O NoIf 'Yes' the organization does not quality under section 4940(e). Do not complete this part.1 Enter the approp ri ate amount in each column for each year, see instructions befo re making any ent ri es.

Base period yearsCalendar year or tax year beginning In)

(b)Adjusted qualifying dist ri butions (°)Net value of noncharitable-use assets Distribution ratio(col. (b) divided by col (c))

20042003200220012000

2 Total of line 1, column (d) ...... . .... ........... 23 Average distribution ratio for the 5-year base period - divide the total on line 2 by 5, or by the number of years

the foundation has been in existence if less than 5 years ....... ...... ..... 3

4 Enter the net value of noncharitable-use assets for 2005 from Part X, line 5 .. .. . .. ......... .. . .. .. 4

5 Multiply line 4 by line 3 ......... ... ... ..... ..... ... .... .... .. 5

6 Enter 1% of net Investment income (1% of Part I, line 27b) . . .... .... .... ........... .... .. .. 6

7 Add lines 5 and 6 . .. . . .. . ... . .......... ...... ..... 7

8 Enter qualifying distributions from Part XII, line 4 . ........ . ... ......... ... . . 8

If line 8 Is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1% tax rate.See the Part VI Instructions.

523sx1A1.05.06 Form 990-PF (2005)

15380331 748475 PF-446680FF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

Form 990-PF ( 2005 ) L I EBL ING FOUNDAT ION FOR WORTHY STUDENTS 43-1722158 Page 4Fart VI Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948 - see instructions)la Exempt operating foundations described in section 4940(d)(2), check here ► L_J and enter 'N/A" on line 1.

Date of ruling letter ( a tt ach copy of ruling le tt er if necessa ry-see Instructions)

b Domestic organizations that meet the section 4940(e) requirements in Part V, check here ► and enter 1% 1 633.

of Part I, line 27bc All other domestic organizations enter 2% of line 27b. Exempt foreign organizations enter 4% of Part I, line 12, col (b)

2 Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -0-) 2 0.

3 Add lines 1 and 2 3 633.

4 Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-) . . . 4 0.

5 Tax based on Investment Income . Subtract line 4 from line 3 If zero or less, enter -0- 5 633.

6 Credds/Paymentsa 2005 estimated tax payments and 2004 overpayment credited to 2005 6a 680..

b Exempt foreign organizations - tax withheld at source - 6b

c Tax paid with application for extension of time to file (Form 8868) . . . 6c

d Backup withholding erroneously withheld - .. .... 6117 Total credits and payments Add lines 6a through 6d .....8 Enter any penalty for underpayment of estimated tax. Check here 0 if Form 2220 is attached _ ......

9 Tax due . If the total of lines 5 and 8 is more than line 7, enter amount owed ►

10 Overpayment . If line 7 is more than the total of lines 5 and 8 , enter the amount overpaid ►11 Enter the amount of line 10 to be* Credited to 2006 estimated tax ► 4'7 .1 Refunded ►

1 a During the tax year, did the organization attempt to influence any national, state, or local legislation or did it participate or intervene in

any political campaign? ... .... la. ... ..... ... .. .. .b Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see instructions for definition)? . lb

If the answer is "Yes" to 1 a or 1 b, attach a detailed description of the activities and copies of any matenals published or

distributed by the organization in connection with the activities.

c Did the organization file Form 1120-POL for this year? 1C

d Enter the amount (d any) of tax on political expenditures (section 4955) imposed during the year:

(1) On the organization ► $ 0 • (2) On organization managers. ► $ 0.

e Enter the reimbursement (it any) paid by the organization during the year for political expenditure tax imposed on organization

managers. ► $ 0.2 Has the organization engaged in any activities that have not previously been reported to the IRS? 2

If "Yes," attach a detailed description of the activities.3 Has the organization made any changes, not previously reported to the IRS, in its governing instrument, articles of incorporation, or

bylaws, or other similar instruments? If "Yes," attach a conformed copy of the changes . ......... ..... ..... . . -. 3

4a Did the organization have unrelated business gross income of $1,000 or more during the year? ..................... ... . ...... ... 4a

b If Yes' has it filed a tax return on Form 990-T for this year? .............................. .... . 4b

5 Was there a liquidation , termination, dissolution , or substantial contraction during the year? .................... ....... ...... . ......

If "Yes," attach the statement required by General Instruction T.

6 A re the requirements of section 508(e ) ( relating to sections 4941 through 4945) satisfied either.

• By language In the gove rn ing Instrument, or• By state legislation that effective ly amends the gove rn ing instrument so that no mandato ry directions that conflict wit h the state law

remain in the gove rn ing instrument? ....... ..... . . .. . ........ ....... ......... .7 Did the organization have at least $5,000 in assets at any time du ring the year?.... . ..... ............. ... ...... .

If "Yes," complete Part Il, col. (c), and Part XV.8a Enter the states to which the foundation reports or with which it is registered (see instructions) ►

MOb If the answer is "Yes' to line 7, has the organization fu rn ished a copy of Form 990-PF to the Atto rn ey General (or designate)

of each state as required by General Instruction G? If 'No, " attach explanation . ..... ................ .... .......

9 Is the organization claiming status as a private operating foundation within the meaning of section 4942(j)(3) or 4942(j)(5) for calendar

year 2005 or the taxable year beginning in 2005 ( see instructions for Part XIV)? If "Yes,' complete Part X/V. ... .....

10 Did any pe rs ons become substantial cont ributo rs du ring the tax year? if -Yes.- atmcn a schedule listi ng their names and addresses .11 Did the organization comply wit h the public inspection re quirements for its annual retu rns and exemption application? ,,.,,,.

Web site address ► N/A12 The books are in care of ► U.S. BANK N.A. Telephone no.)',_( 3

Located at ► P . O . BOX 387, ST. LOUS I , MO zIP+413 Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041 - Check here

8b I X

47.0.

s NoXX

X

X

XX

X

g X10 X11 X

4)418-2643►63166

. ....... ►oN/A

Form 990-PF (2005)

680.

67 X

415380331 748475 PF-446680FF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

I Form 990-PF (2005) LIEBLING FOUNDATION FOR WORTHY STUDENTS 43-1722158 Page5

Part VII-B Statements Regarding Activities for Which Form 4720 May Be RequiredFile Form 4720 if any item is checked in the "Yesu column , unless an exception applies. Yes No

1 a During the year did the organization (e it her directly or indirectly)(1) Engage in the sale or exchange , or leasing of property with a disqualified pe rson? - O Yes 0 No

(2) Borrow money from, lend money to, or otherwise extend cred it to (or accept d from)

a disqual if ied person? LI Yes No

(3) Furnish goods , se rv ices , or facilities to ( or accept them from ) a disqual if ied persons Yes OX No

(4) Pay compensation to, or pay or reimburse the expenses of, a disqual if ied person? EX Yes No(5) Transfer any income or assets to a disqual if ied pe rson ( or make any of e it her ava il able

for the benefit or use of a disqual if ied person )? -- [] Yes 0 No

(6) Agree to pay money or property to a government official? (Exception . Check "No'

if the organization agreed to make a grant to or to employ the official for a pe riod aftertermination of government se rvice , if terminating within 90 days ) . .. . =Yes [] No

b If any answer is 'Yes' to 1a ( 1)-(6), did any of the acts fail to qual ify under the exceptions desc ri bed in Regulations

section 53 4941(d )-3 or in a current notice regarding disaster assistance (see page 20 of the instructions)?Organizations relying on a current notice regarding disaster assistance check here ....... ►0

c Did the organization engage in a p ri or year in any of the acts desc ribed in 1 a, other than excepted acts , that were not corrected

before the fi rst day of the tax year beginning in 2005? -- .... .Taxes on failure to dist ribute income (section 4942 ) (does not apply for years the organization was a private operating foundation

defined in section 4942(j )( 3) or 4942 (j)(5))-a At the end of tax year 2005 , did the organization have any undist ri buted income (lines 6d and 6e, Part XIII) for tax year (s) beginning

before 2005') . . ....... . 0 Yes 0 No

If 'Yes,' list the years ►b Are there any years listed in 2a for which the organization is not applying the provisions of section 4942(a)(2) (relating to incorrect

valuation of assets) to the year's undistributed income? (If applying section 4942(a)(2) to all years listed, answer'No' and attach

statement - see instructions.) ... . .. . .......c If the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here

N/A

3a Did the organization hold more than a 2% direct or indirect interest in any business enterp rise at any timedu ri ng the year? . . • ...... ..... LI Yes 0 No

b If Yes ; did it have excess business holdings in 2005 as a result of (1) any purchase by the organization or disqualified persons afterMay 26 , 1969 ; (2) the lapse of the 5-year pe riod ( or longer pe riod approved by the Commissioner under section 4943 (c)(7)) to disposeof holdings acquired by gift or bequest; or (3) the lapse of the 10-, 15-, or 20-year fi rst phase holding pe ri od? (Use Schedule C,Form 4720, to determine if the organization had excess business holdings in 2005.) N/A

4a Did the organization invest du ri ng the year any amount in a manner that would jeopardize its cha ri table purposes? .. ... .. .b Did the organization make any investment in a p rior year (but after December 31,1969 ) that could jeopardize its charitable purpose that

had not been removed from jeopa rdy before the first day of the tax year beginning in 2005? . ..........5a Du ring the year did the organization pay or incur any amount to:

(1) Carry on propaganda , or otherwise attempt to influence legislation (section 4945(e))? . ...... . .. ...... ...... . 0 Yes [] No(2) Influence the outcome of any specifi c public election (see section 4955 ); or to carry on , directly or indirectly,

any voter registration drive? ..... LI Yes 0 No

(3) Provide a grant to an ind ividual for travel, study , or other similar purposes? ........ ... - .. .. 0 Yes 0 No(4) Provide a grant to an organization other than a chartable , etc., organization desc ri bed in section

509(a )( 1), (2), or ( 3), or section 4940(d)(2)? ................. . . ... .. ... . . ........ 0 Yes 0 No

(5) Provide for any purpose other than religious , charitable, scienti fic, litera ry, or educational purposes, or forthe prevention of crue lty to children or animals? ........... - O Yes 0 No

b If any answer is Yes' to 5a(1 )-( 5), did any of the transactions fail to quality under the exceptions desc ribed in Regulationssection 53.4945 or in a current notice regarding disaster assistance (see instructions )? .... ..Organizations relying on a current notice regarding disaster assistance check here .... . . 0

c If the answer is Yes' to question 5a (4). does the organization claim exemption from the tax because it maintainedexpend iture responsibility for the grant? . ... .... ....... . . ....... NIA El Yes El NoIf 'Yes,' a ttach the statement required by Regula tions section 53 . 4945-5(a).

6a Did the organization , du ri ng the year, rece ive any funds , directly or indirectly , to pay premiums ona personal benefit contract? ... ... ..... ....... . . . - ........... 0 Yes 0 No

X

X

X

X

X

b Did the organization , du ring the year , pay premiums, directly or indirectly, on a personal benefit contract? . ..... 6b XIf you answered 'Yes' to 6b, also file Form 8870.

Form 990-PF (2005)

52354101-05-M

515380331 748475 PF-44668OFF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

LIEBLING FOUNDATION FOR WORTHY STUDENTS 43-1722158

dill PaidInformation

Employees, andContractorors, Trustees , Foundation Managers, Highly Page 6

1 List all officers . directors. tnisteec . foundation managers and their compensation.

(a) Name and address(b) Title , and average

per week devotedhou rsto position

(c) Compensation( It not paid ,enter -0-)

(d?Conmbunaum°"a �°aifi

congaaaom

(e) Expenseaccount, otherallowances

U.S. BANK N.A. TRUSTEEP.O. BOX 387ST. LOUIS, MO 63166 0.00 13,300. 0. 0.

2 1;emnpn5atInn 01 fwn hiohest-nald emniovees iotner roan inose inciuaea on une i i. ai none. enter ' NUNt.-

(a) Name and address of each employee paid more than $50,000(b1 Title and averagehours per week

devoted toposition(c) Compensation

(d) contributortssro(d

cwyewbon

(e)Expenseaccount, otherallowances

NONE

Total number of other employees paid over $50 ,000 ..... ... ►1 03 Five highest-paid independent contractors for professional services . If none, enter " NONE."

(a) Name and address of each pe rs on paid more than $50,000 (b) Type of se rvice (c) CompensationNONE

Total number of othe rs receiving over $50,000 for professional services. 0I fWt A I Summary of Direct Charitable ActivitiesList the foundation's four largest direct charitable activities during the tax year. Include relevant statistical information such as thenumber of organizations and other beneficiaries served, conferences convened, research papers produced, etc. Expenses

� CD

2 GS

3

4

ENSATION OF OFFICERS, DIRECTORS, TRUSTEES, ETC.ED TO BE FOR CHARITABLE PURPOSES

S & CONTRIBUTIONS MADE DURING THE YEAREE PART XV 3 FOR DETAILS

3,325.

42,750.

o Form 990-PF (2005)6

15380331 748475 PF-44668OFF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

Form 990-PF (2005) LIEBLING FOUNDATION FOR WORTHY STUDENTS 43-1722158 Pagel

Irt Summary of Program-Related Investments

Describe the two largest program- related investments made by the foundation during the tax year on lines 1 and 2 Amount

t N/A

2

All other program- related investments See instructions3

Total . Add lines 1 through 3 ► 0.

art X Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations, see instructions.)

1 Fair market value of assets not used (or held for use) directly in carrying out charitable, etc , purposesa Average monthly fair market value of securitiesb Average of monthly cash balancesc Fair market value of all other assetsd Total (add lines la, b, and c) -

971,596.

11d 1 971,596.a Reduction claimed for blockage or other factors reported on lines la and

1c (attach detailed explanation) le 02 Acquisition indebtedness applicable to line 1 assets 2 0.3 Subtract line 2 from line 1d 3 971, 596 .4 Cash deemed held for charitable activities Enter 1 1/2% of line 3 (for greater amount, see instructions) - 4 14, 574 .5 Net value of noncharitabte -use assets . Subtract line 4 from line 3. Enter here and on Part V, line 4 5 957, 022 .6 Minimum Investment return . Enter 5% of line 5 6 47, 851 .

ENEF).7 Distributable Amount (see instructions) (Section 4942(j)(3) and (1)(5) private operating foundations and certain

foreign organizations check here ► 0 and do not complete this part )

1 Minimum investment return from Part X, line 6 1 47, 851 .2a Tax on investment income for 2005 from Part VI. line 5 . . . ..... .... 2a 633. .b Income tax for 2005. (This does not include the tax from Part VI.) ........... .. 2bc Add lines 2a and 2b 2c 633 .

3 Distributable amount before adjustments Subtract line 2c from line 1 .... ..... 3 47, 218 .4 Recoveries of amounts treated as qualifying distributions . ..... ........ ...... .. . . . ......... 4 0 .5 Addlines3and4 ....... . . .. . ... . .. ..... . .............. ... 5 47 218.6 Deduction from distributable amount (see instructions) ... .... ........ . ............ .......... ........ . ... 6 0 .7 Distributable amount as adjusted . Subtract line 6 from line 5. Enter here and on Part XIII, line 1 7 47, 218 .

iP,atf XI Qualifying Distributions (see instructions)

I Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes:a Expenses, contributions, gifts, etc. - total from Part I, column (d), line 26 .. la 46,075.b Program-related investments - total from Part IX-B 1b 0.

2 Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc , purposes.. 23 Amounts set aside for specific charitable projects that satisfy the:a Suitability test (prior IRS approval required).......... . ...... ....... 3ab Cash distribution test (attach the required schedule) .......... . . . . .. .. 3b

4 Qualifying distributions . Add lines la through 3b. Enter here and on Part V, line 8. and Part XIII, line 4. . . .......... 4 46,075.5 Organizations that qualify under section 4940(e) for the reduced rate of tax on net investment

income. Enter 1% of Part I, line 27b ......... 5 0.6 Adjusted qualifying distributions . Subtract line 5 from line 4 ........ ..... . ... ........ 6 46,075.

Note: The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundation qualifies for the section4940(e) reduction of tax in those Years.

Form 990-PF (2005)

52356101 -05-06

715380331 748475 PF-446680FF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

Form 990-PF (2005) L I EBL ING FOUNDATION FOR WORTHY STUDENTS 43-1722158 Page 8

i III Undistributed Income (see instructions)

(a) (b) (c) (d)Corpus Years p ri or to 2004 2004 2005

1 Distributable amount for 2005 from Part XI,line 7 47,218.

2 Undistributed income, if any, as of the end of 2004

a Enter amount for 2004 only 21,753.b Total for prior years

0.3 Excess distributions carryover, q any, to 2005:

a From 2000b From 2001c From 2002d From 2003e From 2004f Total of lines 3a through e 0

4 Qualifying distributions for 2005 fromPart Xli, line 4: '$ 46,075.

a Applied to 2004, but not more than line 2a 21,753.b Applied to undistributed income of prioryears (Election required - see instructions) 0

c Treated as distributions out of corpus(Election required - see instructions) 0.

d Applied to 2005 distributable amount 24,322.e Remaining amount distributed out of corpus 0

5 Excess distributions carryover applied to 2005 0. 0Of an amount appears in column (d), the same amountmust be shown in column (a) )

6 Enter the net total of each column asIndicated below:

a Corpus Add lines 3f, 4c, and 4e. Subtract line 5 0

b Prior years' undistributed income Subtractline 4b from line 2b ... .... 0

c Enter the amount of prior years'undistributed income for which a notice ofdeficiency has been issued, or on whichthe section 4942(a) tax has been previouslyassessed 0,....

d Subtract line 6c from line 6b. Taxable.........amount - see instructions 0............

a Undistributed income for 2004. Subtract line4a from line 2a. Taxable amount - see instr.. 0

f Undistributed income for 2005. Subtractlines 4d and 5 from line 1. This amount must ,be distributed in 2006 . 22,896.. _ ....... .

7 Amounts treated as distributions out ofcorpus to satisfy requirements imposed bysection 170(b)(1)(E) or 4942(8)(3) . 0 -

8 Excess distributions carryover from 2000not applied on line 5 or line 7 0

9 Excess distributions carryover to 2006. .Subtract lines 7 and 8 from line 6a . 0

10 Analysis of line 9:a Excess from 2001 ...b Excess from 2002..c Excess from 2003d Excess from 2004.e Excess from 2005.

Form 990-PF (2005)52357101-05-06

815380331 748475 PF-446680FF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

Form990-PF 2005 LIEBLING FOUNDATION FOR WORTHY STUDENTS 43-1722158 Page9

Part)UV.1 Private Operating Foundations (see instructions and Part VII-A, question 9) N/A

1 a if the foundation has received a ru li ng or determination le tter that it is a p rivate operating

foundation , and the ruling is effective for 2005, enter the date of the ruling lo. 1b Check box to indicate whether the organization is a private operatm foundation described in section 0 4942(j)(3) or 49 42(j)(5)

2 a Enter the lesser of the adjusted net Tax year P ri or 3 yea rs

income from Part I or the minimum ( a) 2005 ( b) 2004 ( c) 2003 ( d) 2002 ( e) Total

investment return from Part X foreach year listed

b 85% of line 2ac Qualifying distributions from Part XII,

line 4 for each year listedd Amounts included in line 2c notused directly for active conduct ofexempt activities . .

e Qualifying distributions made directlyfor active conduct of exempt activitiesSubtract line 2d from line 2cComplete 3a, b, or c for thealternative test relied upon.

a 'Assets' alternative test - enter:(1) Value of all assets ...

(2) Value of assets qualifyingunder section 4942(j)(3)(B)(i)

b 'Endowment' alternative test - enter2/3 of minimum investment returnshown in Part X, line 6 for each yearlisted

c 'Support' alternative test - enter:(1) Total support other than gross

investment income (interest,dividends, rents, payments onsecurities loans (section512(a)(5)), or royalties)

(2) Support from general publicand 5 or more exemptorganizations as provided insection 4942(j)(3)(B)(uQ

(3) Largest amount of support froman exempt organization _ .......

C1f Supplementa ry Information (Complete this part only if the organization had or more in assetsat any time during the year-see page 26 of the instructions.)

1 Information Regarding Foundation Managers:a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before the close of any taxyear (but only if they have contributed more than $5,000) (See section 507(d)(2).)

NONEb List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership of a partnership or

other entity) of which the foundation has a 10% or greater interest.

NONE2 Information Regarding Contri bution , Grant, Gift, Loan , Scholarship , etc., Programs:

Check here 01, 0 if the organization only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. Ifthe organization makes gifts, grants, etc. (see instructions) to individuals or organizations under other conditions, complete gems 2a, b, c, and d.

a The name , address , and telephone number of the pe rs on to whom applications should be addressed-U.S. BANK N.A.P.O. BOX 308, ST. JOSEPH, MO 64501

b The form in which applications should be submitted and information and mate rials they should include.SEE ATTACHED

c Any submission deadlines:NONE

d Any rest ri ctions or limitations on awards , such as by geographical areas , cha ritable fields , kinds of institutions, or other facto rs :SCHOLARSHIPS ARE AWARDED TO WORTHY STUDENTS OF THE ST. JOSEPH MO SCHOOLDISTRICT.52358101 -06.06 Form 990-PF (2005)

9:5380331 748475 PF-44668OFF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

Form 990-PF (2005) L I EBLon

TION FOR WORTHY STUDENTS 43-1722158 Page10

3 Grants and Cont ributions Paid Du ring the Year or Approved for Future Payment

Recipient If recipient is an individual,show any relationship to Foundation Purpose of grant or

Name and address ( home or business ) any foundation manageror substantial cont ri butor

status ofrecipient

cont ri bution Amount

a Paid during the year

SCHOLARSHIPS [SEE ATTACHELIST FOR RECIPIENTS] ONE /A CHOLARSHIPS 42,750.

Total ... ► 3a. . .. . . ... .... . . . ..... 42,750.b Approved for future payment

NONE

Total .. ► 3b 1 0.. . . .... . ... . . . . . .523MIRI- 05-M Form 990-PF (2005)

1015380331 748475 PF-446680FF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

Form 990-PF (2005) LIEBLING FOUNDATION FOR WORTHY STUDENTS 43-1722158 Pagell

Part XVt-A Analysis of Income-Producing Activities

Enter gross amounts unless otherwise indicated

1 Program service revenue

UIIWIdW(a)

Businesscode

° UU 111CZZ, "'I""'°

(b)Amount

txau

�9,,.

see

aeo o seuon » z D» oro14

(d)Amount

(e)

Related or exemptfunction income

abtdefg Fees and contracts from government agencies

2 Membership dues and assessments3 Interest on savings and temporary cash

investments ...4 Dividends and interest from securities .. .. 14 42,188.5 Net rental income or (loss) from real estate*

a Debt-financed property . . .. .b Not debt-financed property

6 Net rental income or (loss) from personalproperty

7 Other investment income8 Gain or (loss) from sales of assets other

than inventory 18 .<25, 7059 Net income or (loss) from special events . . .. .

10 Gross profit or (loss) from sales of inventory11 Other revenue.

abtde

12 Subtotal. Add columns (b), (d), and (e) 0. 16,483. 0.

13 Total. Add line 12, columns (b), (d), and (e) ... ... ... . . . . 13 16,483.(See worksheet in line 13 instructions to verify calculations.)

/Q» . Relationship of Activities to the Accomplishment of Exempt Purposes

1115380331 748475 PF-44668OFF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

'01-05-06 Form 990-PF (2005)

Form 990-PF (2005) LIEBLING FOUNDATION FOR WORTHY STUDENTS 43-1722158 Page 12Part XNII Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Organizations1 Did the organization directly or indirectly engage in any of the following with any other organization desc ri bed in section 501 (c) of Yes No

the Code ( other than section 501(c)(3) organizations ) or in section 527, relating to political organizationsa Transfers from the repo rt ing organization to a noncharitable exempt organization of

(1) Cash . la(l) X(2) Otherassets 1a 2 X

b Other transactions(1) Sales of assets to a nonchantable exempt organization Mill X(2) Purchases of assets from a nonchantable exempt organizati on lb(2) X(3) Rental of facil it ies , equipment, or other assets . . UP) X(4) Reimbursement arrangements lb(4) X(5) Loans or loan guarantees lb(5) X(6) Pe rformance of services or membership or fundraising solic itations .. . .. 1b 6 X

c Sha ri ng of facilities , equipment , mailing lists, other assets, or paid employees 1e Xd If the answer to any of the above is 'Yes," complete the following schedule . Column ( b) should always show the fair market value of the goods, other assets,

or se rvices given by the repo rting organization . If the organization received less than fair market value in any transaction or sha ri ng arrangement, show in

(a) Name of organization (b) Type of organization ( c) Desc ri ption of relationship

N/A

Under penal ury , 1 at I have examined this return, including accompanying schedules and statements , and to the best of my knowledge and belief, it Is true, correct,and complet l then than er fidudary) Is on all Information of which preparer has any knowledge.

Signa

C

signatu re°L

a a Rndsnan (or yoursa nsdlcrr ulo pt .

ad0ass, and ZIP Code

52362101-05-06

15380331 748475 PF-446680FF 2C

2a Is the organization directly or indirectly affiliated with , or re lated to , one or more tax-exempt organizations desc ri bedin section 501(c ) of the Code ( other than section 501 (c)(3)) or in section 527? .... .. ... .......... . ..... . .. ... .. LI Yes ® No

IN If'Vne 4 rmmnlata the fnllnwinn erhathda

LIEBLING FOUNDATION FOR WORTHY STUDENTS 43-1722158

FORM 990-PF GAIN OR (LOSS) FROM SALE OF ASSETS STATEMENT 1

(A)DESCRIPTION OF PROPERTY

SEE ATTACHED SCHEDULE

MANNER DATEACQUIRED ACQUIRED DATE SOLD

PURCHASED

(B) (C) (D) (E) (F)GROSS COST OR EXPENSE OF

SALES PRICE OTHER BASIS SALE DEPREC. GAIN OR LOSS

0. 0. 0. 0. <25,705.>

CAPITAL GAINS DIVIDENDS FROM PART IV 0.

TOTAL TO FORM 990-PF, PART I, LINE 6A <25,705.>

FORM 990-PF ACCOUNTING FEES STATEMENT 2

(A) (B) (C) (D)EXPENSES NET INVEST- ADJUSTED CHARITABLE

DESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES

ACCOUNTING FEES 550. 550. 0.

TO FORM 990-PF, PG 1, LN 16B 550. 550. 0.

FORM 990-PF TAXES STATEMENT 3

(A) (B) (C) (D)EXPENSES NET INVEST- ADJUSTED CHARITABLE

DESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES

SECTION 4940 EXCISE TAX 711. 0. 0.

TO FORM 990-PF, PG 1, LN 18 711. 0. 0.

13 STATEMENT(S) 1, 2, 315380331 748475 PF-44668OFF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

LIEBLING FOUNDATION FOR WORTHY STUDENTS 43-1722158

FORM 990-PF U.S. AND STATE/CITY GOVERNMENT OBLIGATIONS STATEMENT 4

U.S. OTHERDESCRIPTION GOV'T GOV'T

SEE ASSET STATEMENT ATTACHED X

TOTAL U.S. GOVERNMENT OBLIGATIONS

TOTAL STATE AND MUNICIPAL GOVERNMENT OBLIGATIONS

TOTAL TO FORM 990-PF, PART II, LINE 10A

BOOK VALUE

31,303.

31,303.

31,303.

FAIR MARKETVALUE

30,084.

30,084.

30,084.

FORM 990-PF CORPORATE STOCK STATEMENT 5

FAIR MARKETDESCRIPTION BOOK VALUE VALUE

SEE ASSET STATEMENT ATTACHED 436,726. 427,011.

TOTAL TO FORM 990-PF, PART II, LINE 10B 436,726. 427,011.

FORM 990-PF CORPORATE BONDS STATEMENT 6

DESCRIPTION

SEE ASSET STATEMENT ATTACHED

TOTAL TO FORM 990-PF, PART II, LINE 10C

FAIR MARKETBOOK VALUE VALUE

450,994 . 452,357.

450,994 . 452,357.

14 STATEMENT(S) 4, 5, 615380331 748475 PF-446680FF 2005.05000 LIEBLING FOUNDATION FOR WOR PF-44661

S C H E D U L E D

ACCT# 44668OFF (THE LIEBLING FDN FOR WORTHY STUDENTS) YR END 12/31/05 TAXPAYER ID 43-1722158 TX 0 270TAX OFFICER# 270 JIM NELSON

DATE SHR/PY DESCRIPTION

1/28/05 850.000 SOLD FIRST AMER PRIME OBLIG FUND CL Y

2/23/05 1110 . 410 SOLD FIRST AMER PRIME OBLIG FUND CL Y

3/22/05 1117 . 250 SOLD FIRST AMER PRIME OBLIG FUND CL Y

4/20/05 1105. 310 SOLD FIRST AMER PRIME OBLIG FUND Cl. YACQUIRED 9117/04 THROUGH 10/15/04

** * -6 64 . 310 GAIN/LOSS ST: 0.00** * 41 .500 GAIN/L058 ST: 0.00

****** 121.690 GAIN /LOSS ST: 0.00****** 40.000 GAIN /LOSS ST: 0.00****** 112.800 GAIN /LOSS ST: 0.00****** 57.000 GAIN/LOSS ST: 0.00****** 28.130 GAIN /LOSS ST: 0.00*** * 39.880 GAIN/LOSS ST: 0.00

5/12105 170.000 SOLD FIRST AMER PRIME OBLIG FUND CL Y5'13105 31.000 SOLD - I 1 RST . AMER PRIME OBL IG FUND C{. Y

5/20/05 1106 . 410 SOLD FIRST AMER PRIME OBLIG FUND CL YACQUIRED 10/15/04 THROUGH 11/03/04

****** 624.220 GAIN /LOSS ST: 0.00****** 195.000 GAIN /LOSS ST: 0.00** * 32.500 GAIN/:LOSS ST: 0.00** * 139 .500 GAIN/LOSS ST: 0.00** * 16.190 GAIN/LOSS ST: 0.00

99 .000 GAIN/LOSS ST: 0.005/31/05 1450 . 000 SOLD FIRST AMER PRIME OBLIG FUND CL Y

ACQUIRED 11/03/04 THROUGH 11/29/04****** 9.900 GAIN /LOSS ST: 0.00****** 127.600 GAIN /LOSS ST: 0.00****** 15.000 GAIN /LOSS ST: 0.00** * 1297.500 GAIN/LOSS ST: 0.00

6/13/05 128 .000 SOLD FIRST Al PRIME OBLIG FUND Cl. Y6114/05 1000.000 SOLD FIRST AKER PRIME OBLIG FUND CL Y

ACQUIRED 11/29/04 THROUGH 12/02/04****** 24.500 GAIN/LOSS ST: 0.00****** 716.500 GAIN /LOSS ST: 0.00****** 259.000 GAIN /LOSS ST: 0.00

6/16/05 1500. 000 SOLD FIRST AKER PRIME OBLIG FUND CL YACQUIRED 32/02 /04 THROUGH 12/15/04

** * 479 . 010 GAIN/LOSS ST: 0.00** * 119 .000 GAFN/LOSS ST: 0.00** * 41 .010 GAIN/LOSS ST: 0.00

****** 36.000 GAIN /LOSS ST: 0.00

ACQUIRED S01.D/RECD SALE PRICE BASIS

PAGE 1

NET -S.. T.

9/17/04 1/28/05 850 . 00 850 . 00 0.00 0.00

9/17/04 2/23/05 1110.41 1110 .41 0.00 0.00

9/17/04 3/22/05 1117.25 1117 .25 0.00 ... 0.00

VARIOUS +4/70/o 110 .31 1105. 31

9/17/04 $6431 664.31

930/04 121.69 121.6910/ 1/04 40.00 40.0010/ 6/04 112.80 112.8010/ 8/04 57.00 57.0010/12/04 28 . 13 28.1310/15/04 39 6 88 39.88

10/15/04 f/12/05. • 170,00 17,0 .0010/15/04 1 l :: ;: •:.;•.; :::> 1.x:00 ::•:; :; ..::' .:31::i�b .:::> ::;>:

VARIOUS 5/20/05 1106 . 41 1106.41

10/15/04 624.22 624.2210/25/04 195 . 00 195.0010/29/04 32 . 50 32.50111 1/04 139 . 50 139,5011/ 2/04 1.6119 16.13Ill 3/04 99,00 99.00VARIOUS 5/31/05 1450 . 00 1450.00

11/ 3/04 9.90 9.9011/15/04 127 . 60 127.6011/26 /04 15.00 15.0011/29/04 129 50 1297.50

11/29/04 6/ 3/05 128.00 128.00VARIOUS 6/14/05 1000.00 1000.00

11/29/04 24 . 50 24.5012/ 1/04 716.50 716.5012/ 2/04 259.00 259.00

VARIOUS 6/16/0 1500►O0 15500.00

12/ 2/04 479. 01 47901121 3/04 119 , 00 119.0012/13/04 36 . 00 36.00

ab

00 o'.00

0.00 0.00

0.00 0.00•

0.00.... ...•,... «00

L 00 :.x.00

- - --------- -------------------

S C H E D U L E D

ACCT# 44668OFF ( THE LIEBLING FDN FOR WORTHY STUDENTS) YR END 12/31/05 TAXPAYER ID 43-1722158 TX 0 270 PAGE 2TAX OFFICER# 270 JIM NELSON

DATE

6/22/05

6/24/05

6/27/057/13/05

7/21/05

7/26/05

SHR/PY DESCRIPTION ACQUIRED SOLD/RECD SALE PRICE BASIS MET -S. T. NET 1:'.T.

824.980 GAIN/LOSS ST: 0.00 12115/04 824698 824,98 .

1119.130 SOLD FIRST AMER PRIME OBLIG FUND CL Y 12/15/04 6/22/05 1119.13 1119.13 0.00 0.00

1363.710 SOLD FIRST AMER PRIME OBLIG FUND CL Y VARIOUS 6/24/05 1363.71 1363.71 0.00 0.00ACQUIRED 12/15/04 THROUGH 12/16/04

792.240 GAIN/LOSS 51: 0.00 12/15/04 792.24 792.24571.47.0 GAIN/toss ST: 0.00 12116/134 . . 571.47 571.47 :. '.

1000.000 SOLD FIRST AMER PRIME OBLIG FUND CL Y 12/16/04, 6/27/05 1000.00 1000•100 0.00 IJ.00

2000.000 SOLD FIRST AMER PRIME OBLIG FUND CL Y VARIOUS 7/13/05 2000.00 2000.00 0.00 ..0.00ACQUIRED 12/16/04 THROUGH 1/04/05

745.580 GAIN/LOSS ST: 0.00 12/16/04 745.58 745.5815.000 GAIN/LOSS ST: 0.00 12/17/04 15.00 15.0041.500 GAIN/LOSS ST: 0.00 12/20/04 41.50 41.50

225.-000 GAIN/LOSS ST: 0.00 12/23/04 225.00 225.0070.000 GAIN/{.05S ST: 0.00 12/28/04 70.00 70,00 ••

615.000 GAIN/LOSS ST: 0.00 12/30/04 615600-

615,007 027.300 GAIN/LOSS ST: 0.00 1/ 3105 • • • . . • 27-b 2 ,3

.260.620 GAIN/LOSS S`r: 0.00 1/ 4/135 260.62 260.62

1000.000 SOLD FIRST AMER PRIME OBLIG FUND CL Y 1/4/05 7/21/05 1000.00 1000.00 0.00 0.00

39325.390 SOLD FIRST AME PRIME OBLIG FUND CL Y VARIOUS 7/26/05 39325.39 39325.39 0.00 0.00�ACQUIRED 6/30/05

510.120 GAYNAOSS ST: 0.00 1/ 4/05 510.12 510. 22109.540 GArNJt.4DSS ST: 0.00 1/ 5/05 209.54 109.5497.130 GAMILOSS ST: 0.00 1/10/05 97.13 97.13

127.4600T

0.00 1/18 /05/

:' ::.: ' '. • •:89 ' '

12763 :...... ..:.:.:::;::'.:: •::• •:.;;: > :::: `':::::5: •305.890 GANYLOSS S , 0.00 1/20 05115.000 GAINAOSS ST: 0.00 1/24/05 115.00 115.0088.000 GAINAOSS ST: 0.00 1/25/05 88.00 88.0035.100 GAINAOSS ST: 0.00 1/31/05 35.10 35.10

1316.500 GAINAOSS ST: 0.00 2/ 1/05 1316.50 1316.50136.690 GAIN/LOSS ST: 0.00 2/ 2/05 136.69 136.69

2308.860 GAINILOSS ST: 0.00 2/151,05 2308.86 2308.86850.000 GAINAOSS ST: 0.00 3/24/05 8�p 4600 850.00 • •774.380 GAI-NAOSS ST: 0.00 2/25/05 774.38 774.38 •••1837.000 GAHAOSS ST: 0.00 3/ 1/05 1837.00 1837.00 •142.530 GAINAOSS ST, 0.00 3/ 2/05 • 142653 142.53133.000 GAINAOSS ST: 0.00 3/ 8/05 133.00 133.00227.540 GAIN/LOSS ST: 0.00 3/10/05 227.54 227.5442.000 GAIN/LOSS ST: 0.00 3/14/05 42.00 42.00127.600 GAIN/LOSS ST: 0.00 3/15/05 127.60 127.6025.000 GAIN/LOSS ST: 0.00 3/18/05 25.00 25.0041.500 GArNJtOSS ST: 0.00 3/21/05 4150 .41.5020.000 0.00 3/24/05 20600 20.00•

259.180 GAIN/LOSS ST: 0.00 3/29105 259.18 253,1863.500 GAINILOSS ST: 0.00 3/31 /,05 63.50 63,50

521.100 GAI-NILOSS ST: 0.00 4/ 1 1-05 521.10 521,10 :......:

S C H E D U L E DACCT# 44668OFF (THE LIEBLING FDN FOR WORTHY STUDENTS) YR END 12/31/05 TAXPAYER ID 43-1722158 TX 0 270TAX OFFICER# 270 JIM NELSON

DATEMG�k�kAr�R�k

8/ 2/05

8/ 3/05

8/ 4/05

8/ 9/05

8/10/05

8/12/058/15/058/17/95

SHR/PV

186.84069.00031.500

1600.000203.00035.100145.500158.880127.60015.000

1450.000724.5001612.70031.500133.00016.000

.217.5401696.35025.00041.50020.000

20570.120

50094.040

9493.3802409.800166.54069.00031.500127.600

37796.220

2000.000

DESCRIPTION

00GA IN/LOSS ST: 0.GAIN/LOSS

ST 0 00GA :IN/LOSS .GA IN/LOSS

ST 0 00GA :IN/LOSS .GAI N/LOSS ST:

ST:'

0.00GA STtrNltOSSGArN/tOSS ST: 0.00GAIN/LOSS ST:

0 00GAI N/LOSS .GAI N/LOSS ST: 0.00GAI N/LOSS ST: 0.00GAI N/LOSS

ST 000GAI :N/LOSS .GArNILOSS ST:

0GArNJLOSS ST: 0.0GAI NILOSS

ST 00GAINILOSS * 0.GAIN/LOSS

000GAI N/LOSS ST: .

SOLD FIRST AMER PRIME OBLIG FUND CL YACQUIRED 6/30/05 THROUGH 7/20/05

GAIN /LOSS ST: 0.00GAIN/LOSS ST: 0.00GAIN/LOSS ST: 0.00GAIN/LOSS ST: 0.00GAIN/LOSS ST: 0.00GAIN/LOSS ST: 0.00GAIN /LOSS ST: 0.00

SOLD FIRST AMER PRIME OBLIG FUND CL Y15000.000 SOLD FIRST AMER PRIME OBLIG FUND CL Y

ACQUIRED 7120/05 THROUGH 7/28/059013.070 GAIN/LOSS ST: 0.00203.000 GAIN/LOSS ST: 0.00

5783.930 GAIN/LOSS ST: 0.001000.000 SOLD FIRST AMER PRIME OBLIG FUND CL Y2000.000 SOLD FIRST AMER PRIME OBLIG FUND CL Y1000.000 SOLD FIRST AMER PRIME OBLIG FUND CL Y191.140 SOLD FIRST AMER PRIME OBLIG FUND CL Y

2000.000 SOLD FIRST AMER PRIME OBLIG FUND Cl.. Y

ACQUIRED SOLD/RELY SALE PRICE

4/ 4/05 286.844/ 8/05 69.004/11/05 31.50

VARIOUS

6/30/057/ 1/057/ 5/057/ 8/057/11 /1057/15/057/20/057/20/05

VARIOUS7/20/057125/057728/05

7/28/05

7/28/057/28/05

7/28/057128/05

1600.00203.0035.10

#45.50158,881370601450 b'OO724. g01612.7031.50133.0016.00

717,5412 00.541.5020.00

20570.12

8/2/05 50094.04

9493.382409.801.66.5.4

• 499.0031.50#37660

37796.228/3/05 2000.00

8/4/05 15000.009013607203.005783693

8/9/05 1000.00

8/10/05 2000.00

8/12/05 1000.00

8/19/0 191.148/17/0p 2000.00

BASIS

,186.84 .69.0031.50

1600.00203.0035.10

1.49.50158.88127.60..IS d 00

1724loo

0'1612. 031.50133.0016.00

217.541696.3525.00

20.000020570.12

50094.04

9493.382409.80166.5459.0031.50127.60

37796.22

2000.00

15000.009013.07203.005783.931000.00

2000.00

1000.00

191.142000.00

NET SOT.

PAGE 3

0.00 0.00

0.00 0.000.00 0.00

0.00 0.00

0.00 0.000.00 . 0.00x!•..00 0.00'0►00 0•.00.

S C H E D U L E D

ACCT# 44668OFF (THE LIEBLING FDN FOR WORTHY STUDENTS) YR END 12/31/05 TAXPAYER ID 43-1722158 TX 0 270TAX OFFICER# 270 JIM NELSON

PAGE 4

DATE SHRIPV DESCRIPTION ACQUIRED SOLD1REU SALE PRICE BASIS NET S1T. .HET.1.FT.•.

8/22/05 10050 . 600 SOLD FIRST AMER PRIME OBLIG FUND CL Y 7/28/05 8/22/05 10050 . 60 10050 . 60 0.00 0.00••

8/30/05 11057 . 340 SOLD FIRST AMER PRIME OBLIG FUND CL Y 7/28/05 8/30/05 11057.34 11057 . 34 0.00 0.00

9/ 2/05 701 . 790 SOLD FIRST AMER PRIME OBLIG FUND CL Y 7 /28/05 9/2/05 701.79 701 . 79 0.00 0.00

91 6/05 2835.500 SOLD FIRST AKER PRIME OBLIG FUND CL Y 7/28/05 9f6105 2835 + 50 2835 . 50 • 0.00 . ;.0 0O.

9113/05 19906.290 SOLD FIRST AMER PRIME OBLIG FUND C{. Y 7/28105 9/ 3/t5 '19906,29 19906,29 0.600' 0..00

9/14/05 1500 . 000 SOLD FIRST AMER PRIME OBLIG FUND CL Y 7/28/05 9/14/05 1500.00 1500 . 00 0.00 0.00

9/19/05 1000 . 000 SOLD FIRST AMER PRIME OBLIG FUND CL Y 7 /28/05 9/19/05 1000.00 1000.00 0.00 0.00

9/20/05 1958 . 500 SOLD FIRST AMER PRIME OBLIG FUND CL Y 7/28/05 9/20/05 1958 . 50 1958 . 50 0.00 0.00

9/21/05 2111 . 710 SOLO FIRST AMER PRIME OBLIG FUND C#. Y 7/28 /05 9121105 2111 . 71 2111,71 0.00 .04-00%,

9/23/05 1000.000 SOLO FIRST 4M PRIME OBLIG FUND CL. Y 7/28 /05 ,9/ /A5...::.. 1000.00 OOO . OO :rr':;.: •: • : l,Q9/26/05 700 . 320 SOLD FIRST' AMER PRIME OBLIG FUND CL Y 7/28/05 9/26/05 100.32' 700.32 0 . 00 0.00

9/27/05 1500 . 000 SOLD FIRST AMER PRIME OBLIG FUND CL Y 7/28/05 9/27/05 1500.00 1500 . 00 0.00 0.00

9/30/05 936 . 500 SOLD FIRST AMER PRIME OBLIG FUND CL Y 7/28/05 9/30/05 936 . 50 936.50 0.00 0.00

10/18 /05 886 . 000 SOLD FIRST AMER PRIME OBLIG FUND CL Y 7/28/05 10/18/05 , . 886.00 886 . 00 000 • • • X3.00

10/20/05 1090 . 360 SOLD FIRST AMER PRIME OBLIG FUND Cl.. Y 7/28 /05 10/20/0$ 1090 0 36 1090.36 0. 00' -OM.

11/17/05 1000 . 000 SOLD FIRST AMER PRIME OBLIG FUND CL Y 7 /28/05 11/17/05 1000.00 1000 . 00 0.00 0.00

11/22/05 1078 . 100 SOLD FIRST AMER PRIME OBLIG FUND CL Y 7/28/05 11/22 /05 1078.10 1078 . 10 0.00 0.00

12/13 /05 170 . 000 SOLD FIRST AMER PRIME OBLIG FUND CL Y 7/28/05 12/13/05 170.00 170.00 0.00 0.00

12121105 1087 .560 SOLD FIRST AMER PRIME OBLIG FUND Cl. Y 7128 /05 12/21/05 1087.56 1087 . 56 a., 00 0.00

7/20/05 50000 .000 SOLD F H L B DEB 5 . 720% 7/20/05 7/29/98 7/20/05 50000 . 00 49631.00 0.00 369.0050,000 PAR VALUE AT 100 % . . . •. . . ...

8/25/05 25000 . 000 SOLD F H L B DEB 6 . 075% 8 /25/05 8/18/98 8 /25/05 25000 . 00 25000 . 00 0.00 0.0025,000 PAR VALUE AT 100 %

6/30/05 30000 . 000 SOLD KEY BK N A 4.100% 6/30/05 8/29 /02 6/30/05 30000.00 30825 . 00 0.00 -825.0030,000 PAR VALUE AT 100 % . .

7/28105 300.000 SOLD COMCAST CORP SPECIAL CL A VARIOUS 7/25/05 8906,68 10871.84 0.00 -1965.22'ACQUIRED 9/07/9 THROUGH 5/26/00

4300 T****** 45.000 GAIN/LOSS LI : -294.79 9/ 7 /99 1335.99 1630.78

S C H E D U L E DACCT# 446680FF (THE LIEBLING FDN FOR WORTHY STUDENTS) YR END 12/31/05 TAXPAYER ID 43-1722158 TX 0 270 PAGE 5TAX OFFICER# 270 J IM NELSON

DATE SHR/PY DESCRIPTION ACQUIRED SOLD/R£CO SALE PRICE BASIS NET S►T. NEB: L.T.*** * 130.000 GAIN/tOSS.IT -851.59 20/ 7/99 ;:.::.:•::;:.;;>:•..38 9,6,4 4111'd 3''`:•; .; . > . , .> ; .;.

****** 125.000 GAIN/LOSS LT: -818.84 5/26/00 3711.09 4529.93

7/28/05 200.000 SOLD COMVERSE TECHNOLOGY INC VARIOUS 7/25/05 4893.79 18322.50 0.00 -13428.71ACQUIRED 8/07/00 THROUGH 9/13/00

200 SHARES AT $24.52** * 120.000 GAIN/i.OSS L : -8381.23 81 7/00 .'. ::. 2936+ 27 11317.50

.,7****** 80.000 GAIN/3.055 LT. 5047.48 l97 bR 7005 007128105 1500.000 SOLO CORNING INC 'k 'VARIOUS 7/25/05 36698888 18179.00 �l..00 . 8,519.88

ACQUIRED 5126/00 THROUGH 5/01/03 .1,500 $17.85

****** 180.000 LT: -6871.13 5/26/00 3203.87 10075.00****** 320.000 GAIN/LOSS LT: 3071.76 11/ 1/01 5695.76 2624.00****** 1000.000 GAIN/LOSS LT: 12319.25 5/ 1/03 17799.25 5480.00

7/28/05 250.000 SOLD E H C CORP MASS VARIOUS 7/25/05 3559.855 8498.83 0800 -4938.97ACQUIRED 9/07/9 THROUGH 10/07/99

** ** 90.000;

350 SHARES AT 1.4.29GAINILOSS L : -1778.03 9/ 7/99 1281,555 3059458

**+ * 160.000 GAIN/LOSS LT: -3160.94 101 7199 2278630 5439 4247/28/05 140.000 SOLD ELI LILLY & CO VARIOUS 7/25/05 7712.27 10338.05 0.00 -2625.78

ACQUIRED 9/07/99 THROUGH 10/07/99140 T I55.14

A O****** 80.000L

G SSIN/L -1667.59 9/ 7/99 4407.01 6074.60** * 60.000 GAIN/LOSS LT: -958.19 10/ 7/99 3305.26 4263.45

8/30/05 200.000 SOLD HOME DEPOT INC VARIOUS 8125/05 7975.66 8978.24 X800 -1002,PACQUIRED 9/07/99 THROUGH 10/07/99 .zOO

INR O S 39-93****** 103.000 S LT :GA /L -516.33 9/ 7/99 4107.46 4623.79****** 97.000 GAIN/LOSS LT: -486.25 10/ 7/99 3868.20 4354.457/28/05 320.000 SOLD SUN MICROSYSTEMS INC 10/7/99 7/25/05 1210.82 7675.00 0.00 -6464.18

320 SHARES AT $3.834

7128/05 300.000 SOLD T ROHE PRICI GROUP INC 8/7/00 7/25/0# 19985,16 12506,21; 0600 1441.g g.

300 SHARES AT 66.677128/05 195.000 SOLD TIME WARNER INC VARIOUS 7/25/05 3236886 8636.43 0.600 9.437.-

ACQUIRED 10/07/99 THROUGH 5/26/00195 T I16.65

IN****** 112.500L

GA /LOSS -3115.14 10/ 7/99 1867.42 4982.56****** 82.500 GAIN/LOSS LT: -2284.43 5/26/00 1369.44 3653.877/26/05 1435.403 SOLD FIRST AMER SMHID CAP CORE FD CL Y 1/4101 7/255/05 12674.61 27682.07 0400 . ^15007,.46

1,435.403 SHARES AT $8.8312/13/05 2609.603 RECD FIDELITY ADV DIVERSIFIED INTL CL A 1219/05 0.00 0.00 0800 1852 83

CAPITAL GAINS DISTRIBUTION

-------------- -S C H E D U L E D

ACCT# 44668OFF (THE LIEBLING FDN FOR WORTHY STUDENTS) YR END 12 /31/05 TAXPAYER ID 43-1722158 TX 0 270TAX OFFICER# 270 JIM NELSON

DATE SHR/PY DESCRIPTION ACQUIRED SOLD/RECD SALE PRICE BASIS

12/16/05 1619.870 RECD FIRST AMER REAL ESTATE SECS FD CL Y 12/15/05 0.00 0.00CAPITAL GAINS DISTRIBUTION

12/16/05 905.797 RECD FIRST AMER SMALL CAP SELECT FD CL Y 12 /15/05 0 . 00 0.00CAPITAL GAINS DISTRIBUTION

12113105 2609 .603 RECD FIDELITY ADV DIVERSIFIED INTL CL A 1219/0f# 0.00 11,00CAPITAL GAINS DISTRIBUTION

12/16105 1619.870 RECD FIRST AMER REAL ESTATE SECS FD CL Y 12/15/05 0.00 0100CAPITAL GAINS DISTRIBUTION

12/16/05 905.797 RECD FIRST AMER SMALL CAP SELECT FD CL Y 12/ 15/05 0.00 0.00CAPITAL GAINS DISTRIBUTION

PAGE 6

NET••5•.J. • NE.t•1,.•T.

0.00 2834.29

0.00 1975.55

62.6b 30 :0.00

931.13 0.00=a mmg w

2-121.49scasssw

28627,01

ASSET STATEMENT

SHARES OR 0 CURRENT NNUA LPAR VALUE DESCRIPTION UNIT TOTAL TO UNIT TOTAL YIELD INCONE

CASH EQUIVALENTS

50,992.37 FIRST AMER PRIME OBLIG FUND CL Y 1. 00 50 .992 5.31'% 1.00 50 . 992 3,78% 1.930TOTAL 50,992 5 . 31%. 50,992 3 . 78% 1,930

FIXED INCOME ASSETS

US GOVERNMENT ISSUES

30,000 . 00 F N M A DEB 5.250 % 6/15/06 100.28 30 . 084 3.13% 104.34 31.303 5,24% 1.575

25,000.0050,000.0050,000.0025,000.0025,000.0050,000.0040,000.0025,000.0050,000.0025,000.0025,000.0030,000.0030,000.00

2,798.51

TOTAL 30,084 3.13% 31,303 5.24% 1,575

CORPORATE ISSUES

FIRST CHICAGO N B D 6.125% 2/15/06 100.14 25,036 2.61% 99.84 24,961 6.12% 1,531BEAR STEARNS COS INC 7.000% 3/01/07 102.30 51,148 5.33% 99.66 49,828 6.84% 3,500CITICORP 7.000% 7/01/07 103.04 51,519 5.36% 99.78 49,888 6.79% 3,500CHASE MANHATTAN CORP 6.375% 2/15/08 102.76 25,690 2.67% 98.87 24,718 6.20% 1,594GEN MTRS ACCEP CORP 6.125% 11/15/08 83.60 20,900 2.18% 99.95 24,988 7.33% 1,531FIRST UN NATL BK N C 5.800% 12/01/08 102.63 51,318 5.34% 102.32 51,160 5.65% 2,900HOUSEHOLD FIN CORP 5.875% 2/01/09 102.20 40,879 4.26% 101.02 40,406 5.75% 2,350ATLANTIC RICHFIELD C 5.900% 4/15/09 103.78 25,945 2.70% 98.86 24,715 5.69% 1,475CHASE MAN CORP NEW 7.125% 6/15/09 106.65 53,325 5.55% 99.90 49,952 6.68%

3,AMERICAN GEN FIN 3.875% 10/01/09 95.78 23,945 2.49% 99.35 24,838 4.05% 963SUNTRUST BKS 4.250% 10/15/09 97.54 24,386 2.54% 101.75 25,438 4.36% 1,063GEN ELEC CAP CRP 4.250% 12/01/10 97.61 29,283 3.05% 99.48 29,845 4.35% 1,275WAL MART STORES 4.125% 2/15/11 96.62 28,985 3,02%, 100.86 30.259 4.27% 1,238TOTAL

FIXED INCOME FUNDS

VANGUARD G N M A FUND INV*36

TOTAL

TOTAL FIXED INCOME ASSETS

452,357 47.10% 450,994 5.86% 26,488

10.30 28,825 3.00'% 10.72 30,000 4.63% 1,335

28,825 3.00% 30,000 4.63% 1,335

511,266 53.23% 512,297 5.75% 29,398

ACCOUNT STATEMENT

ASSET STATEMENT

SHARES ORPAR VALUE DESCRIPTION

EQUITY ASSETS

COMMON STOCKS

MATERIALS100.00 ALCOA INC100.00 DOW CHEM CO100.00 MEADWESTVACO CORP

TOTAL

INDUSTRIALS400.00 GENERAL ELEC CO375.00 HONEYWELL INTERNATIONAL INC100.00 3M CO

TOTAL

ENERGY300.00 EXXON MOBIL CORP150.00 SCHLUMBERGER LTD

TOTAL

CONSUMER DISCRETIONARY200.00 COMCAST CORP CL A200.00 GANNETT INC200.00 OMNICOM GROUP INC200.00 PENNEY J C COMPANY INC

TOTAL

CONSUMER STAPLES160.00 COCA COLA CO175.00 LAUDER ESTEE COS INC CL A210.00 WAL MART STORES INC

TOTAL

HEALTH CARE

UNIT TOTAL UNIT TOTALCU

29.57 2,957 0.31% 22.68 2,268 2.03% 6043.82 4,382 0.46% 44.93 4,493 3.06%

13428.03 2.803 0.29% 23.01 2,301 3.28% 9210,142 1.06% 9,062 2.82% 286

35.05 14,020 1.46% 37.41 14,965 2.85% 40037.25 13,969 1.45% 45.54 17,077 2.21% 30977.50 7.750 0.81% 78.77 7.877 2.17% 168

35,739 3.72% 39,918 2.45% 877

56.17 16,851 1.75%97.15 14,573, 1.52%

31,424 3.27%

39.39 11,818 2.07%78.79 11 ,819 0.86%

23,637 1.51%

348

474

25.92 5,184 0.54%60.57 12,114 1.26%85.13 17,026

11.77Z

55.60 11. 20

45,444 4.73%

40.31 6,450 0.67%33.48

8289 %1,046.80

. 2

22,137 2.30%

31.10 6 ,220 0.00%74.23 14 ,846 1.92%V.40 16,83

0.90'%

49,383 1.17%

54.74 8,759 2.78%43.62 7,634 1.19%48.79 10.246 1.28%

26,638 1.69%

0232100532

179126375

ACCOUNT STATEMENT

ASSET STATEMENT

SHARES ORPAR VALUE

170.00 AMGEN INC700.00 PFIZER INC

TOTAL

DESCRIPTION UNIT TOTAL TOTAL UNIT TOTAL YIELD INCOME

78.86 13,406 1. 40% 59 .19 10 ,062 0.00%23.32 16,324 1.70X 37.43 26,202 4.12'% 672

29,730 3.10% 36,264 2.26% 672FINANCIALS

200.00 ALLSTATE CORP200.00 AMERICAN INTL GROUP INC200.00 BANK OF AMERICA CORP300.00 FIFTH THIRD BANCORP200.00 MARSHALL & ILSLEY CORP130.00 MORGAN STANLEY230.00 P N C FINANCIAL SERVICES GROUP INC100.00 WELLS FARGO & CO

TOTAL

UTILITIES100.00 AMEREN CORP100.00 GREAT PLAINS ENERGY INCORPORATED

TOTAL

TELECOMMUNICATION SERVICES200.00 AT&T INC200.00 VERIZON COMMUNICATIONS INC

TOTAL

INFORMATION TECHNOLOGY400.00 CISCO SYS INC200.00 DELL INC200.00 INTEL CORP200.00 MICROSOFT CORP

TOTAL

TOTAL COMMON STOCK

54.07 10,814 1.13%68.23 13,646 1.42%46.15 9,230 0.96%37.72 11,316 1.18%43.04 8,608 0.90%56.74 7,376 0.77%61.83 14,221 1.48%62.83 6. 283 0.65%

81,494 8.49%

55.45 11,090 2.37% 25683.36 16,673 0. 88%

12043.23 8,646 4.33%41.80 12,540 4.03%

1 644.61 8,921 2.23%947.47 6,171 1.90% 140

57.02 13,116 3.23%46058.68 5,868 3.31X

83,025 2 .74% 2,232

51.24 5,124 0 . 53% 40 . 59 4,059 4.96%27.96 2 , 796 0 . 29% 25 .77 2,577 5. 94'% 166

7,920 0.82% 6,636 5.30% 420

24.49 4,898 0.51%30.12 6,024 0.63%

10,922 1.14%

9.34 1,868 5.43% 26638.96 7,792 5.38% 324

9,660 5 . 40% 590

17.12 6,848 0.71%29.95 5 , 990 0.62%24.96 4,992 0.52%26.15 5, 230 0.54%

23,060 2.40%

298,011 31.03%

26.48 10, 594 0.00% 036.17 7,234 0.00% 020.86 4,172 1.28% 6427.52 5,504 1.38% 72

27,504 0 .59% 136311,726 2.21% 6,595

EQUITY FUNDS

ACCOUNT STATEMENT

ASSET STATEMENT

SHARES ORPAR VALUE

2,609.601,619.87

905.80

DESCRIPTION

FIDELITY ADV DIVERSIFIED INTL CL AFIRST AMER REAL ESTATE SECS FD CL YFIRST AMER SMALL CAP SELECT FD CL Y

TOTAL

TOTAL EQUITY ASSETS

TOTAL MARKET VALUE

UNIT TOTAL TOTAL

21.10 55 , 063 5.73%20.11 32, 576 3.39%13.84 12.536 1.31%

100,174 10.43%

398,185 41

960,444 100.00%

106,336

1.06 6,780106,192-

960,588=====c=aaaaa

PRINCIPAL CASH

TOTAL PRINCIPAL INVESTMENTS

INCOME CASH

TOTAL ACCOUNT

UNIT TOTAL --YIELD INCOME

19.16 50 ,000 0.68% 37618.52 30, 000 3 . 08% 1,00416.56 15 .000 0.00% 0

95,000 1 .38% 1,380406,726 2.00% 7,975970,015 4.09% 39,303

106.336

1,076,351106,192-

970,159 39,303=m=aa=aaaa :s ssss sS=5��

ACCOUNT STATEMENT

Thomas M. Paul Memorial Trust

A.B. and A.F. McGlothlan Trust

Liebling Foundation for Worthy Students

APPLICATION FOR GRANT IN AID

PERSONAL INFORMATION:

Name: Soc.Sec.#:First Middle Last

Home Address: Phone #:

Date of Birth: Sex: Marital Status

Father/S tepfather/Male Guardian (circle one) Name:

Address (if different from Home Address, above):

Occupation: Employer.

Mother/Stepmother/Female Guardian (circle one) Name:

Address (if different from Home Address, above):

Occupation:

Parents' Status:

Married Separated:

Female parent deceased

Employer.

Single Divorced

Male parent deceased:

EDUCATIONAL AND ACTIVTI'Y INFORMATION

Name and address ofhigh schools and colleges attended and dates:

School Address Dates: From To

Number of students in high school graduating class: Applicants class rank:

Give GPA based on point system. Expected graduation date:

ACT or SAT score Percentile Rank

List academic honors and distinctions:

List, in the order of their importance to you, the major school, church and community activitiesin which you are now participating or have participated. Provide information about the nature ofyour involvement and indicate any leadership positions you may have held.

List places and types of employment in which you have engaged.

COLLEGE INFORMATION

College Preferences:

College Name Applied Accepted1.

2.

3.

Anticipated college major:

In what vocation are you interested:Why?

FiNANc .INFoRmAnw

Estimated expenses for the coming year at the college of your choice:PLEASE ITEMIZE:a. Tuition S

b. Board Sc. Room Sd. Fees, dues, etc. S

e. Books & supplies Sf. Clothing, travel Sg. Miscellaneous S

Total $

Estimated Resources for student during coming academic year:

Parents assistance $

Students assets $

Student' s expected earnings $

Gifts from friends and relatives $

Scholarships or grants already awarded $

Any other source $

Total $

Will you need continued financial assistance for the remainder of your college career?

Have you applied for any scholarships or other grants?If so, name them:

List names and addresses of three references (not related to you). Include at least one highschool administrator or teacher.

Name Address

Did you or will you file a federal income tax for last year?_

If yes, a copy of it must be attached to this application.

Did or will any other person claim you as a dependent on theirfederal income tax for last year?

If yes, a copy of it must be attached to this application.

Please include a recent photograph with this application. Also, it is necessary that you include acopy of your most current transcript. If these are not available, please explain:

In your own handwriting, and in whatever detail you believe is necessary, please describe youreducational plans, your career goals and your need for scholarship aid. Include any additionalinformation you believe will be of value to the selection committee.

I affirm on my honor that all of the above information is accurate, complete and correct.

Date Signature of applicant

U S BANK ADMIN PG 1

TRANSACTIONS FROM 01/01/05 TO 12/31/05 - ALL PORTFOLIO 03/31/06 15 17

446680FF THE-LIEBLING FDN FOR WORTHY STUDENTS PRIN CASH INCOME CASH

01/27 CASH DISBURSEMENT 850 00-

PAID TO CENTRAL MO STATE UNIVERSITY

FOR MALLORY WILLIAMS

SCHOLARSHIPS AWARDED

T/A CHECK # 576067

PAID FOR NO ONE

2004 -05 FULL TERM GRANT FOR MALLORY WILLIAMS

BATCH NO. VB000913 TRANS NO 04

DISBURSEMENT CODE: 461

06/13 CASH DISBURSEMENT 1,000.00-

PAID TO UTAH STATE UNIVERSITY

FOR AMANDA MILLER

SCHOLARSHIPS AWARDED

T/A CHECK # 809024

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR AMANDA MILLER

BATCH NO. VB000722 TRANS NO. 11

DISBURSEMENT CODE: 461

06/14 CASH DISBURSEMENT 1,000.00-

PAID TO UNIVERSITY OF KANSAS

FOR KRYSTIN HARRIS

SCHOLARSHIPS AWARDED

T/A CHECK # 811812

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR KRYSTIN HARRIS

BATCH NO. VB000833 TRANS NO. 155

DISBURSEMENT CODE- 461

06/15 CASH DISBURSEMENT 1,500.00-

PAID TO UNIVERSITY OF MO-ROLLA

FOR BRIAN HUFFMAN

SCHOLARSHIPS AWARDED

T/A CHECK # 815024

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR BRIAN HUFFMAN

BATCH NO. VB000900 TRANS NO. 29

DISBURSEMENT CODE: 461

06/23 CASH DISBURSEMENT 1,000.00-

PAID TO UTAH STATE UNIVERSITY

FOR MILLIE MILLER

SCHOLARSHIPS AWARDED

T/A CHECK # 826887

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR MILLIE MILLER

BATCH NO. VB001431 TRANS NO. 02

DISBURSEMENT CODE: 461

06/24 CASH DISBURSEMENT 1,000.00-

PAID TO UNIVERSITY OF MO-COLUMBIA

FOR CORY CARPENTER

SCHOLARSHIPS AWARDED

T/A CHECK # 828529

PAID FOR NO ONE

U S. BANK ADMIN PG 2

TRANSACTIONS FROM 01/01/05 TO 12/31/05 - ALL PORTFOLIO 03/31/06 15 17

44668OFF THE"LIEBLING FDN FOR WORTHY STUDENTS PRIN. CASH INCOME CASH

2005-06 FULL TERM GRANT FOR CORY CARPENTER

BATCH NO. VB001515 TRANS NO. 59

DISBURSEMENT CODE: 461

07/12 CASH DISBURSEMENT 1,000 00-

PAID TO SOUTHWEST BAPTIST UNIVERSITY

FOR JESSICA ELDER

SCHOLARSHIPS AWARDED

T/A CHECK # 857087

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR JESSICA ELDER

BATCH NO. VB000549 TRANS NO 10

DISBURSEMENT CODE- 461

07/12 CASH DISBURSEMENT 1,000.00-

PAID TO PARK UNIVERSITY

FOR ATHENA SCHWOPE

SCHOLARSHIPS AWARDED

T/A CHECK # 857089

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR ATHENA SCHWOPE

BATCH NO VB000549 TRANS NO. 16

DISBURSEMENT CODE: 461

07/19 CASH DISBURSEMENT 1,500.00-

PAID TO INDIANA BIBLE COLLEGE

FOR HANNAH ARBUCKLE

SCHOLARSHIPS AWARDED

T/A CHECK # 867937

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR HANNAH ARBUCKLE

BATCH NO. VB000998 TRANS NO. 06

DISBURSEMENT CODE: 461

07/20 CASH DISBURSEMENT 1,000.00-

PAID TO MO WESTERN STATE COLLEGE

FOR MARIA RODRIGUEZ

SCHOLARSHIPS AWARDED

T/A CHECK # 870672

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR MARIA RODRIGUEZ

BATCH NO. VB001095 TRANS NO. 15

DISBURSEMENT CODE. 461

07/25 CASH DISBURSEMENT 1,000.00-

PAID TO CENTRAL MO STATE UNIVERSITY

FOR REBECCA THOMPSON

SCHOLARSHIPS AWARDED

T/A CHECK # 876204

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR REBECCA THOMPSON

BATCH NO. VB001355 TRANS NO 33

DISBURSEMENT CODE: 461

07/25 CASH DISBURSEMENT 1,000.00-

PAID TO UNIVERSITY OF MO-KANSAS CITY

U S BANK ADMIN PG 3

TRANSACTIONS FROM 01/01/05 TO 12/31/05 - ALL PORTFOLIO 03/31/06 15 17

44668OFF THE^LIEBLING FDN FOR WORTHY STUDENTS PRIN CASH INCOME CASH

FOR ANDREW BUNGE

SCHOLARSHIPS AWARDED

T/A CHECK It 876656

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR ANDREW BUNGE

BATCH NO VB001421 TRANS NO 14

DISBURSEMENT CODE 461

08/01 CASH DISBURSEMENT 1,000 00-

PAID TO MISSOURI SOUTHERN STATE UNIVERSITY

FOR MICHAEL ANDERSON

SCHOLARSHIPS AWARDED

T/A CHECK # 888131

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR MICHAEL ANDERSON

BATCH NO. VB000031 TRANS NO. 88

DISBURSEMENT CODE- 461

08/02 CASH DISBURSEMENT 1,000.00-

PAID TO NORTHWEST MO STATE UNIVERSITY

FOR SARA NEVILLE

SCHOLARSHIPS AWARDED

T/A CHECK # 890078

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR SARA NEVILLE

BATCH NO VB000101 TRANS NO. 09

DISBURSEMENT CODE: 461

08/02 CASH DISBURSEMENT 1,000.00-

PAID TO NORTHWEST MO STATE UNIVERSITY

FOR PEGGY CORRELL

SCHOLARSHIPS AWARDED

T/A CHECK # 890085

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR PEGGY CORRELL

BATCH NO. VB000110 TRANS NO. 104

DISBURSEMENT CODE. 461

08/08 CASH DISBURSEMENT 1,000.00-

PAID TO MO WESTERN STATE COLLEGE

FOR KRISTEL CRAWFORD

SCHOLARSHIPS AWARDED

T/A CHECK # 899864

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR KRISTEL CRAWFORD

BATCH NO. VB000487 TRANS NO. 81

DISBURSEMENT CODE- 461

08/09 CASH DISBURSEMENT 1,000.00-

PAID TO MO WESTERN STATE COLLEGE

FOR BRYNDE MACE

SCHOLARSHIPS AWARDED

T/A CHECK # 901659

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR BRYNDE MACE

BATCH NO. VB000555 TRANS NO. 56

U S BANK ADMIN PG 4

TRANSACTIONS FROM 01/01/05 TO 12/31/05 - ALL PORTFOLIO 03/31/06 15 17

44668OFF THE-LIEBLING FDN FOR WORTHY STUDENTS PRIN. CASH INCOME CASH

DISBURSEMENT CODE 461

08/09 CASH DISBURSEMENT 1,000.00-

PAID TO MO WESTERN STATE COLLEGE

FOR JENESSA HENDERSON

SCHOLARSHIPS AWARDED

T/A CHECK # 901665

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR JENESSA HENDERSON

BATCH NO. VB000577 TRANS NO 42

DISBURSEMENT CODE 461

08/11 CASH DISBURSEMENT 1,000 00-

PAID TO UNIVERSITY OF NEBRASKA-LINCOLN

FOR BRETT HOOK

SCHOLARSHIPS AWARDED

T/A CHECK # 905667

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR BRETT HOOK

BATCH NO. VB000738 TRANS NO 96

DISBURSEMENT CODE 461

08/12 CASH DISBURSEMENT 1,000.00-

PAID TO MO WESTERN STATE COLLEGE

FOR TRACI FORTUNE

SCHOLARSHIPS AWARDED

T/A CHECK # 907212

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR TRACI FORTUNE

BATCH NO. VB000823 TRANS NO 02

DISBURSEMENT CODE. 461

08/12 CASH DISBURSEMENT 1,500.00-

PAID TO NORTHWEST MO STATE UNIVERSITY

FOR ANGELA SMITH

SCHOLARSHIPS AWARDED

T/A CHECK it 907213

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR ANGELA SMITH

BATCH NO. VB000831 TRANS NO. 21

DISBURSEMENT CODE: 461

08/16 CASH DISBURSEMENT 1,500 00-

PAID TO NORTHWEST MO STATE UNIVERSITY

FOR ASHLEY BALLY

SCHOLARSHIPS AWARDED

T/A CHECK It 911457

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR ASHLEY BALLY

BATCH NO. VB001025 TRANS NO. 74

DISBURSEMENT CODE 461

08/16 CASH DISBURSEMENT 500.00-

PAID TO MO WESTERN STATE COLLEGE

FOR ROSELEE STEHLE

SCHOLARSHIPS AWARDED

U S BANK ADMIN PG 5

TRANSACTIONS FROM 01/01/05 TO 12/31/05 - ALL PORTFOLIO 03/31/06 15.17

44668OFF THE-LIEBLING FDN FOR WORTHY STUDENTS PRIN CASH INCOME CASH

T/A CHECK # 911461

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR ROSELEE STEHLE

BATCH NO VB001045 TRANS NO 13

DISBURSEMENT CODE. 461

08/29 CASH DISBURSEMENT 1,000.00-

PAID TO NORTHWEST STATE UNIVERSITY

FOR GENTRY CAW

SCHOLARSHIPS AWARDED

T/A CHECK # 929026

PAID FOR NO ONE

2005 -06 FULL TERM GRANT FOR GENTRY CAW

BATCH NO. VB001791 TRANS NO 48

DISBURSEMENT CODE- 461

08/29 CASH DISBURSEMENT 1,000.00-

PAID TO CENTRAL MO STATE UNIVERSITY

FOR DUSTIN HELSEL

SCHOLARSHIPS AWARDED

T/A CHECK # 929030

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR DUSTIN HELSEL

BATCH NO VB001802 TRANS NO. 33

DISBURSEMENT CODE. 461

08/31 CASH DISBURSEMENT 1,000.00-

PAID TO NORTHWEST MO STATE UNIVERSITY

FOR CARRISSA PHILLIPPE

SCHOLARSHIPS AWARDED

T/A CHECK # 932761

PAID FOR NO ONE

2005 -06 FULL TERM GRANT FOR CARRISSA PHILLIPPE

BATCH NO. VB001958 TRANS NO. 10

DISBURSEMENT CODE- 461

09/02 CASH DISBURSEMENT 1,000.00-

PAID TO MO WESTERN STATE UNIVERSITY

FOR BRANDON WILLIAMS

SCHOLARSHIPS AWARDED

T/A CHECK # 937982

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR BRANDON WILLIAMS

BATCH NO. VB000102 TRANS NO. 10

DISBURSEMENT CODE. 461

09/02 CASH DISBURSEMENT 1,000.00-

PAID TO MO WESTERN STATE UNIVERSITY

FOR JEREMY SIMMONS

SCHOLARSHIPS AWARDED

T/A CHECK # 937983

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR JEREMY SIMMONS

BATCH NO. VB000102 TRANS NO. 22

DISBURSEMENT CODE: 461

U.S BANK ADMIN PG 6

TRANSACTIONS FROM 01/01/05 TO 12/31/05 - ALL PORTFOLIO 03/31/06 15 17

44668OFF THE-LIEBLING FDN FOR WORTHY STUDENTS PRIN CASH INCOME CASH

09/02 CASH DISBURSEMENT 1,000 00-

PAID TO NORTHWEST MO STATE UNIVERSITY

FOR MARIA CHAVEZ

SCHOLARSHIPS AWARDED

T/A CHECK # 937717

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR MARIA CHAVEZ

BATCH NO. VB000114 TRANS NO 43

DISBURSEMENT CODE- 461

09/02 CASH DISBURSEMENT 1,000.00-

PAID TO MO WESTERN STATE UNIVERSITY

FOR MICHAEL ZIPP

SCHOLARSHIPS AWARDED

T/A CHECK # 937992

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR MICHAEL ZIPP

BATCH NO. VB000114 TRANS NO 49

DISBURSEMENT CODE: 461

09/13 CASH DISBURSEMENT 500.00-

PAID TO MO WESTERN STATE UNIVERSITY

FOR JEREMY SIMMONS

SCHOLARSHIPS AWARDED

T/A CHECK # 955285

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR JEREMY SIMMONS

BATCH NO. VB000627 TRANS NO 80

DISBURSEMENT CODE 461

09/13 CASH DISBURSEMENT 1,000.00-

PAID TO MO WESTERN STATE UNIVERSITY

FOR DANIEL MOSS

SCHOLARSHIPS AWARDED

T/A CHECK # 955293

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR DANIEL MOSS

BATCH NO. VB000638 TRANS NO. 12

DISBURSEMENT CODE: 461

09/16 CASH DISBURSEMENT 1,000.00-

PAID TO MO WESTERN STATE UNIVERSITY

FOR ASHLEY MAYHEW

SCHOLARSHIPS AWARDED

T/A CHECK # 961935

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR ASHLEY MAYHEW

BATCH NO. VB000887 TRANS NO. 38

DISBURSEMENT CODE- 461

09/19 CASH DISBURSEMENT 1,000.00-

PAID TO MO WESTERN STATE UNIVERSITY

FOR CALEB GENTRY

SCHOLARSHIPS AWARDED

T/A CHECK # 963966

PAID FOR NO ONE

U.S BANK ADMIN PG 7

TRANSACTIONS FROM 01/01/05 TO 12/31/05 - ALL PORTFOLIO 03/31/06 15 17

446680FF THE-LIEBLING FDN FOR WORTHY STUDENTS PRIN. CASH INCOME CASH

2005-06 FULL TERM GRANT FOR CALEB GENTRY

BATCH NO. VB000984 TRANS NO 07

DISBURSEMENT CODE- 461

09/19 CASH DISBURSEMENT 1,000 00-

PAID TO UNIVERSITY OF CHICAGO

FOR BRADLEY GRIER

SCHOLARSHIPS AWARDED

T/A CHECK # 963967

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR BRADLEY GRIER

BATCH NO. VB000984 TRANS NO. 58

DISBURSEMENT CODE- 461

09/20 CASH DISBURSEMENT 1,000.00-

PAID TO UNIVERSITY OF MO-KANSAS CITY

FOR ELIZABETH RHODES

SCHOLARSHIPS AWARDED

T/A CHECK # 967318

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR ELIZABETH RHODES

BATCH NO. VB001130 TRANS NO 19

DISBURSEMENT CODE: 461

09/22 CASH DISBURSEMENT 1,000.00-

PAID TO MO WESTERN STATE UNIVERSITY

FOR ASHLIE MARTINEZ

SCHOLARSHIPS AWARDED

T/A CHECK # 970509

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR ASHLIE MARTINEZ

BATCH NO. VB001236 TRANS NO. 13

DISBURSEMENT CODE: 461

09/23 CASH DISBURSEMENT 1,000.00-

PAID TO HILLYARD TECHNICAL SCHOOL

FOR EMILY SUPPLE

SCHOLARSHIPS AWARDED

T/A CHECK # 972104

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR EMILY SUPPLE

BATCH NO. VB001341 TRANS NO. 38

DISBURSEMENT CODE: 461

09/26 CASH DISBURSEMENT 1,500.00-

PAID TO UNIVERSITY OF CENTRAL ARKANSAS

FOR KATHERINE GUYER

SCHOLARSHIPS AWARDED

T/A CHECK # 975848

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR KATHERINE GUYER

BATCH NO. VB001473 TRANS NO. 12

DISBURSEMENT CODE. 461

09/29 CASH DISBURSEMENT 1,000.00-

PAID TO MISSOURI STATE UNIVERSITY

U S BANK ADMIN PG 8

TRANSACTIONS FROM 01/01/05 TO 12/31/05 - ALL PORTFOLIO 03/31/06 15 17

44668OFF THE-LIEBLING FDN FOR WORTHY STUDENTS PRIN. CASH INCOME CASH

FOR SARAH UELIGGER

SCHOLARSHIPS AWARDED

T/A CHECK # 981944

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR SARAH UELIGGER

REVERSED BY TRX 1 BATCH AL000488 ON 10/27/05

REVERSAL POSTED BY 129

BATCH NO. VB001755 TRANS NO 22

DISBURSEMENT CODE- 461

10/14 CASH DISBURSEMENT 1,000.00-

PAID TO CENTRAL MO STATE UNIVERSITY

FOR MALLORY WILLIAMS

SCHOLARSHIPS AWARDED

T/A CHECK # 1006154

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR MALLORY WILLLIAMS

BATCH NO VB000746 TRANS NO 36

DISBURSEMENT CODE- 461

10/17 CASH DISBURSEMENT 1,000 00-

PAID TO HILLYARD VOCATIONAL SCHOOL

FOR RIKKI WILSON

SCHOLARSHIPS AWARDED

T/A CHECK # 1008119

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR RIKKI WILSON

BATCH NO. VB000845 TRANS NO 35

DISBURSEMENT CODE. 461

10/27 CASH DISBURSEMENT 1,000.00-

PAID TO MISSOURI STATE UNIVERSITY

FOR SARAH UELIGGER

SCHOLARSHIPS AWARDED

T/A CHECK # 1024975

PAID FOR NO ONE

2005 -06 FULL TERM GRANT FOR SARAH UELIGGER

BATCH NO. VB001575 TRANS NO. 119

DISBURSEMENT CODE 461

10/27 REVERSAL 1,000.00

PAID TO MISSOURI STATE UNIVERSITY

FOR SARAH UELIGGER

SCHOLARSHIPS AWARDED

T/A CHECK # 981944

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR SARAH UELIGGER

REVERSAL OF TRX 22 BATCH VB001755 FROM 9/29/05

REVERSAL POSTED BY 129

BATCH NO. AL000488 TRANS NO. 01

DISBURSEMENT CODE. 461

11/16 CASH DISBURSEMENT 1,000.00-

PAID TO WILLIAM JEWELL COLLEGE

FOR SUMMER NELSON

SCHOLARSHIPS AWARDED

U S BANK ADMIN PG 9

TRANSACTIONS FROM 01/01/05 TO 12/31/05 - ALL PORTFOLIO 03/31/06 15 17

446680FF THE"LIEBLING FDN FOR WORTHY STUDENTS PRIN CASH INCOME CASH

T/A CHECK 8 1053813

PAID FOR NO ONE

2005-06 FULL TERM GRANT FOR SUMMER NELSON

BATCH NO. VB000917 TRANS NO 50

DISBURSEMENT CODE 461