Green Scissors 2011

-

Upload

amitjain310 -

Category

Documents

-

view

229 -

download

0

Transcript of Green Scissors 2011

-

8/4/2019 Green Scissors 2011

1/28

green scissorsCutting Wasteful and Environmentally Harmful Spending

2011

IDEAS THAT EMPOWER PEOPLE

-

8/4/2019 Green Scissors 2011

2/28

Green Scissors 2011

Written by Autumn Hanna, Taxpayers for Common

Sense; Eli Lehrer, The Heartland Institute; BenjaminSchreiber, Friends of the Earth; Tyson Slocum,Public Citizen

Additional contributions by Deborah Bailin andMatthew Glans, The Heartland Institute; MichelleChan, Eric Homan and Kate McMahon, Friendsof the Earth; Joseph Babler, Cody Clarke, JenCox, Steve Ellis, Topher Freer-Lancaster, JoshSewell, Michael Surrusco and Erich Zimmermann,Taxpayers for Common Sense

Design by Lisa Matthes, Friends of the Earth

This report is available online atwww.greenscissors.com

For more information, contact:

Autumn Hanna, Taxpayers for Common Sense(202) 546-5800 [email protected]

Eli Lehrer, The Heartland Institute(202) 525-5719 [email protected]

Benjamin Schreiber, Friends of the Earth(202) 222-0752 [email protected]

Tyson Slocum, Public Citizen(202) 454-5191 [email protected]

The authors would like to extend their sincere

thanks to the foundations and individuals whosenancial support made the Green Scissors 2011report possible. Thanks also to colleagues andadvocates across the country working to endwasteful and harmful spending.

Green Scissors is a registered trademark ofFriends of the Earth.

http://www.greenscissors.com/mailto:%[email protected]:%[email protected]:%[email protected]:%[email protected]:%[email protected]:%[email protected]:%[email protected]:%[email protected]://www.greenscissors.com/ -

8/4/2019 Green Scissors 2011

3/28

-

8/4/2019 Green Scissors 2011

4/284 Green Scissors 2011

Green Scissors strives to make environmental andfscal responsibility a priority in Washington.For more than 16 years, Green Scissors has ex-

posed subsidies and programs that both harm the en- vironment and waste taxpayer dollars. Te campaignhas built a strong case that the ederal government canprotect our natural resources, reduce the growth o gov-ernment spending, and make a signifcant dent in thenational debt. Building on last years detailed cut lists,Green Scissors 2011 identifes more than $380 billion in

wasteul government subsidies that are damaging to theenvironment and harming taxpayers.

Wasteul government spending comes in many di-erent orms. Te most obvious are direct spending ondiscretionary programs and mandatory programs suchas commodity crop payments. Slightly less transparent

are tax expenditures, privileges written into the tax code,or below market giveaways o government resources liketimber and hardrock minerals. Even more opaque ispreerential government fnancing or harmul projectsthrough bonding loans, long term contracting authorityand loan guarantees, and risk reduction through govern-ment insurance and liability caps.

Some subsidies are dicult to calculate but have enor-

mous costs to taxpayers. For example, the Oil PollutionAct o 1990 caps industry liability or oshore drillingaccidents at a paltry $75 million, but they can cost tax-payers billions o dollars. Te cleanup o the DeepwaterHorizon spill has already topped $6.8 billion.1Anotherexample is the cost o lost oil and gas revenues due to

1 http://edition.cnn.com/2011/BUSINESS/07/26/bp.prots.dudley/index.html

I n T R o D U C T I o n

http://edition.cnn.com/2011/BUSINESS/07/26/bp.profits.dudley/index.htmlhttp://edition.cnn.com/2011/BUSINESS/07/26/bp.profits.dudley/index.htmlhttp://edition.cnn.com/2011/BUSINESS/07/26/bp.profits.dudley/index.htmlhttp://edition.cnn.com/2011/BUSINESS/07/26/bp.profits.dudley/index.html -

8/4/2019 Green Scissors 2011

5/28Green Scissors 2011 5

low royalty rates and industry underreporting. Despitethe diculty in determining the exact loss or calculatingthe fnal price tag, these types o subsidies need to be

eliminated as well.

With the ederal government acing a $1.65 trilliondefcit and $14.6 trillion debt, Green Scissors agenda ismore critical than ever. Te nations defcit and debt havenot gone unnoticed by the president, Congress or thepublic, many o whom have called or fscal restraint in

Washington. In act, members o both parties are look-ing or ways to solve our nations budget crisis. Otenprograms targeted at conserving our natural resourcesare the frst on the chopping block, but Green Scissorsshows us a way to help the environment by spending less.

Tis years Green Scissors report oers lawmak-ers and the public a starting place or spending reduc-tions, including cuts to discretionary, mandatory and taxspending that also increase environmental protection.Perhaps even more importantly, Green Scissors 2011 o-ers a roadmap or how Congress can bridge the gap be-tween ideologically diverse perspectives to begin mov-ing towards defcit reduction in a productive ashion.Green Scissors 2011 represents the interests o our variedgroups: Friends o the Earth, Public Citizen, axpayers

or Common Sense and Te Heartland Institute. Whileall our groups have dierent missions, histories, goalsand ideas about the role o government, we all agree that

we can begin to overcome our nations budgetary and en-vironmental woes by tackling spending that is not onlywasteul, but environmentally harmul.

o get our nations spending in check we will need toend wasteul programs and policies. Tey not only costus up ront, but also create additional fnancial liabilitiesdown the road and threaten our nations ragile land, airand water. In addition, we need to ensure that we receive

a air return on government assets. From the more thana century old 1872 Mining Law that gives away pre-cious metals like gold and copper on ederal landsor ree, to $53 billion in lost oil and gas revenues romroyalty ree leases in ederal waters granted in the late1990s, to the $6 billion per year ethanol tax credit, thereare dozens o reorms that can return hundreds o bil-lions to taxpayers while helping to address our nationstop environmental priorities.

Te list o cuts is long, and tackling them will requiretaking on rich, powerul corporations and special inter-est groups. Te president and Congress must get tough

with the special interests that are raiding our treasuryand jeopardizing our valuable natural resources. Reorm

will also require cutting through traditional dogmas andworking with non-traditional partners. We know it isnot going to be easy. America needs real leadership.

Green Scissors 2011 builds on our previous reports butalso oers new and expanded cuts. As with past reports,unless otherwise noted, the data is compiled rom gov-ernment sources.

A green roadmap for trimming the budgetGreen Scissors 2011 tackles environmentally harm-

ul spending in our major areas: energy, agriculture,transportation, and land and water. In each section, weprovide an overview o the topic, a summary chart othe spending cuts, and more detailed inormation onselected cuts. While billions o additional savings thatcould be achieved by cutting environmentally harmulspending have not been included in this report, GreenScissors 2011 oers important steps toward reormingour nations budgetary ills while also protecting our en-

vironment.

-

8/4/2019 Green Scissors 2011

6/286 Green Scissors 2011

F

or more than a century taxpayers have subsidizedthe nations energy sector. Each year we spend bil-lions to promote both mature energy technologies

as well as new, unproven, risky ones. Many o these tech-nologies are destructive to public health and the envi-ronment, and billions o taxpayer dollars could be savedby cutting subsidies to them. Continuing to ask taxpay-ers to subsidize these technologies o the past or to anteup money or new harmul technologies is fscally andenvironmentally reckless.

Subsidies or the coal and oil and gas industries haveexisted since the beginning o the 20th century. oday,generous tax credits, royalty relie, taxpayer-backed in-surance, and preerential fnancing through loan guar-antees and bonds all provide energy companies with

lucrative subsidies at the taxpayers and environmentsexpense.

Companies selling newer technologies see the largesshanded to purveyors o older orms o energy and wantto eed at the trough. Yet some new technologies thatdo environmental harm are being sold as green, andalmost all subsidies deepen the ederal defcit. Likewise,some companies developing new energy sources andtechnologies say that they will need billions o dollarsin subsidies to make them eective even while competi-tors develop similar new technologies without any help.Our current system o energy subsidies reects the spe-cial interest politics in Washington rather than any realdedication to the public interest. Te nations current en-ergy policy not only promises these polluting industriessubsidies in 2012, but implies that they will receive themor years to come.

New ways o locking us into dirty energy continue toemerge. In his State o the Union address, the presidentproposed a Clean Energy Standard that would man-date use o energy rom sources such as nuclear reac-tors, biomass, natural gas and the inappropriately namedclean coal. Tis proposed mandate could increase elec-tricity prices or consumers by requiring more expensive

choices and, depending on how it is crated, lead to sig-nifcant environmental harm.

We must shit course in 2011 and recognize that thepitalls o our current system should not be allowed tocontinue through variations on ailed energy policies othe past.

Cvti i u

For nearly 100 years we have given generous govern-

ment subsidies to the incredibly lucrative ossil uels in-dustry. Te lions share o these subsidies comes in theorm o tax breaks that cost the government tens o bil-lions o dollars annually. Tis tax spending is particularlyadvantageous or the industry because most o it is per-manent law and does not require regular review romCongress. Tus, it can be counted on year ater year.

Despite a recent push to move away rom oil con-sumption due to the proound environmental, national

e n e R G Y

Fireboats try to put out the re at the site of the DeepwaterHorizon explosion that left 11 dead and led to the worst oil spill inU.S. history.

-

8/4/2019 Green Scissors 2011

7/28Green Scissors 2011 7

security and fscal consequences o oil usage, there hasbeen little change in the ederal money going to theseindustries. Te oil and gas industry simply does not needthe government handouts coming its way; its bottom line

benefts rom high prices at the pump. Less than a yearater leaving the Gul Coast awash in oil rom the Deep-

water Horizon catastrophe, BP saw its second quarterprofts rise to $5.3 billion. In the frst hal o 2011 BPhas already garnered $10.8 billion in profts.2 Five o thetop oil companies have already pocketed $70.1 billion inprofts or the frst hal o 2011, signifcantly exceedingtheir profts over the same time period last year.

Another conventional ossil uel, coal, also continuesto be the darling o Washington, despite its serious en-

vironmental consequences. Te coal industry benefts

rom billions in ederal subsidies, even as it makes sub-stantial profts. Subsidies to the coal industry began in1932, when the ederal government frst began allow-ing companies to deduct a portion o their income tohelp recover initial capital investments (the percentagedepletion allowance). Since then, coal companies haveenjoyed billions more in subsidies, including some hand-

2 http://www.bp.com/extendedgenericarticle.do?categoryId=2012968&contentId=7069912

outs or simply ollowing basic worker saety regulations,while earning billions in profts. Over the last decade,revenues at the largest domestic coal companies trendedupwards, while profts have mostly ollowed. Peabody

Energy, the largest private sector coal company, earnedrecord breaking profts in 2008 and has already posted$461.3 million in profts in 2011, up 36 percent rom thefrst six months o 2010.3 Consol Energy recorded near-record income o $540 million in 2009, and this year,frst quarter profts nearly doubled rom 2010 to reach

$192 million.456

axpayers also subsidize conventional ossil uelsprojects through a host o national, international andregional development banks that use ederal dollars toinvest overseas in harmul projects like coal plants. On

3 http://phx.corporate-ir.net/phoenix.zhtml?c=129849&p=irol-newsArticle&ID=1586385&highlight=

4 http://phx.corporate-ir.net/phoenix.zhtml?c=66439&p=irol-newsArticle&ID=1555936&highlight=

5 Government Accountability Oce, High Risk Series Update,GAO-11-270, February 2011.

6 Government Accountability Oce, Oil and Gas Royalties:A Comparison of the Share of Revenue Received from Oiland Gas Production by the Federal Government and OtherResource Owners; GAO-07-676R, May 1, 2007.

Ryty cctiFederal taxpayers should receive the revenue they are due from resources extracted from public

lands. Year after year, the nations oil and gas royalty collection system receives serious criticism fromoversight entities like the Government Accountability Oce. Just this year, the Government Account-ability Oce, the non-partisan investigative arm of Congress, added royalty collection to its annualhigh risk list, giving it a high risk for waste tag.5 It found in 2008 that reported revenues from oiland gas production had gone down for 93 of the 104 total resource owners. Examining the programfurther, the Government Accountability Oce found that over the last two years the Department

of the Interior the agency charged with assuring the publics revenues are collected has madecontinual blunders with the collection of company-reported data and oered unreliable sales datathat do not reect market prices for oil and gas. Even when the royalty system is working properly

taxpayers are getting less than their fair share. That is because, according to a 2007 GovernmentAccountability Oce report, U.S. royalty rates for oil and gas production are among the lowest inthe world, as well as lower than those of the states.6

http://www.bp.com/extendedgenericarticle.do?categoryId=2012968&contentId=7069912http://www.bp.com/extendedgenericarticle.do?categoryId=2012968&contentId=7069912http://phx.corporate-ir.net/phoenix.zhtml?c=129849&p=irol-newsArticle&ID=1586385&highlight=http://phx.corporate-ir.net/phoenix.zhtml?c=129849&p=irol-newsArticle&ID=1586385&highlight=http://phx.corporate-ir.net/phoenix.zhtml?c=66439&p=irol-newsArticle&ID=1555936&highlight=http://phx.corporate-ir.net/phoenix.zhtml?c=66439&p=irol-newsArticle&ID=1555936&highlight=http://phx.corporate-ir.net/phoenix.zhtml?c=66439&p=irol-newsArticle&ID=1555936&highlight=http://phx.corporate-ir.net/phoenix.zhtml?c=66439&p=irol-newsArticle&ID=1555936&highlight=http://phx.corporate-ir.net/phoenix.zhtml?c=129849&p=irol-newsArticle&ID=1586385&highlight=http://phx.corporate-ir.net/phoenix.zhtml?c=129849&p=irol-newsArticle&ID=1586385&highlight=http://www.bp.com/extendedgenericarticle.do?categoryId=2012968&contentId=7069912http://www.bp.com/extendedgenericarticle.do?categoryId=2012968&contentId=7069912 -

8/4/2019 Green Scissors 2011

8/288 Green Scissors 2011

the national level, the Overseas Private Investment Cor-poration and the Export-Import Bank o the UnitedStates are examples o government-supported agenciesthat subsidize U.S. companies to invest in risky oreignmarkets by providing them direct and low-cost fnanc-ing and insurance. While intended to help Americansmall businesses compete in the global marketplace,these agencies actually provide subsidies to large, veryproftable private companies like ExxonMobil.

Tese public fnancing agencies continue to subsi-dize environmentally harmul coal, oil and gas projects.In fscal year 2010, the Export-Import Bank provided arecord-breaking $4.5 billion in fnancing or these os-

sil uels. Te Export-Import Banks ossil uel binge iscontinuing in 2011, including $805 million to fnancethe largest greenhouse gas-emitting project in its history,a 4,800 megawatt coal plant that will spew 30.5 milliontons o carbon dioxide as well as enormous amounts oparticulate emissions into the atmosphere each year.7

7 http://www.exim.gov/about/reports/ar/2010/exim_2010annualreport_full.pdf

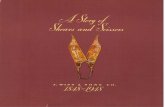

Similarly, the World Bank and regional developmentbanks, which also receive U.S. taxpayer support, continueto be some o the largest and most consistent unders oossil uel projects around the world. In act in 2010, the

World Bank provided a record-breaking $4.4 billion incoal fnancing, representing a 356 percent increase over2009.8 Tis included unding or a South Arican coalplant that local and international advocacy groups say

will not increase access to energy or many but will in-crease pollution.

Te U.S. is the largest and most inuential sharehold-er o the World Bank. For the frst time since 1988, the

World Bank has asked or a signifcant uptick in und-

ing, ormally known as a General Capital Increase, to in-crease its lending capacity or middle income countries.Consequently, the Obama administration has requested$586 million over fve years, which amounts to $117.4million a year, or the United States contribution to

8 World Bank Group Energy Sector Financing Update,prepared by Heike Mainhardt-Gibbs for the Bank InformationCenter, November 2010 http://www.bicusa.org/en/

Article.12280.aspx

Destruction of land adjacent to a coal plant run by South African utility Eskom, which received a loan from the World Bank in 2010 tobuild one of the worlds largest coal plants. Photo credit: groundWork/Friends of the Earth South Africa, courtesy of the Bateleurs.

http://www.exim.gov/about/reports/ar/2010/exim_2010annualreport_full.pdfhttp://www.exim.gov/about/reports/ar/2010/exim_2010annualreport_full.pdfhttp://www.bicusa.org/en/Article.12280.aspxhttp://www.bicusa.org/en/Article.12280.aspxhttp://www.bicusa.org/en/Article.12280.aspxhttp://www.bicusa.org/en/Article.12280.aspxhttp://www.exim.gov/about/reports/ar/2010/exim_2010annualreport_full.pdfhttp://www.exim.gov/about/reports/ar/2010/exim_2010annualreport_full.pdf -

8/4/2019 Green Scissors 2011

9/28Green Scissors 2011 9

the General Capital Increase.9 Given the World Banksrecord o unding polluting projects, no money or theGeneral Capital Increase should be authorized or ap-

propriated or fscal year 2012.

Subsidizing coal makes little economic or environ-mental sense. Te Obama administration has commit-

9 U.S. Department of the Treasury International ProgramsJustication for Appropriations FY 2012 Budget Request

ted to phase out ossil uel subsidies and has targeted taxspending; making these frst cuts would be an importantstep. Te president and Congress must also eliminate

ederal fnancing or coal projects. Te list below includessome key cuts to current coal industry subsidies, savingtaxpayers more than $61 billion over the next fve years.

sctd cvti i u uidi Ptti cut 2012-2016 ($)

Last In, First Out Accounting(a) 29,661,000,000

Domestic Manufacturing Tax Deduction for Oil and Gas Companies 6,679,000,000

Intangible Drilling Costs 6,268,000,000

Percentage Depletion Allowance for Oil and Gas Wells 4,657,000,000

Oil Royalty Relief 4,033,000,000

Deductions for Foreign Tax Dual Capacity (b) 3,896,000,000

Domestic Manufacturing Deduction for Hard Minerals 921,000,000

Expansion of Amortization for Certain Pollution Control Facilities 851,000,000

Amortization of Geological and Geophysical Expenditures 797,000,000

Gas Royalty Relief 787,000,000

Natural Gas Distribution Lines 600,000,000

World Bank Capital Increase 587,000,000Percentage Depletion Allowance for Coal and Hard Mineral Fossil Fuels 557,000,000

Capital Gains Treatment for Royalties from Coal 264,000,000

Expensing of Exploration and Development for Minerals 240,000,000

Ultra-Deepwater and Unconventional Natural Gas and Other Petroleum Research Fund 190,000,000

Passive Loss Exemption 99,000,000

Liberalize the Denition of Independent Producer 84,000,000

Exemption from Bond Arbitrage Rules for Natural Gas 43,000,000

Expensing of Tertiary Injectants 38,000,000

Certain Income and Gains Relating to Industrial Source Carbon Dioxide Treated asQualifying Income for Publicly Traded Partnerships 18,000,000

Natural Gas Gathering Lines 5,000,000

Liability Limitations for Oshore Drilling (c) *

Tt 61,275,000,000

a. This number represents the full elimination of Last In, First Out Accounting for all industries.

b. This number represents the proposal in President Obamas scal year 2012 budget and is illustrative of the savings that could beachieved through reform of this provision; the number represents savings from all industries.

c. Cost to taxpayers is unavailable.

-

8/4/2019 Green Scissors 2011

10/2810 Green Scissors 2011

nucr rgy

For more than 60 years, taxpayers have providedthe nuclear industry with a suite o subsidies orresearch and development costs, tax preerenc-

es, liability insurance and loan guarantees. Even withthese subsidies, no new reactors have been built sincethe 1970s, and all proposed reactors are dependent ongovernment fnancing. Furthermore, more than 50 yearsater the frst commercial reactors went online, Ameri-can political leaders still have not agreed on a long-termsolution or dealing with nuclear waste.

Since the 1940s the nuclear industry has received tens

o billions o dollars in ederal subsidies. Most recently,the Department o Energy provided $18.5 billion inloan guarantees or new reactor construction. Te De-partment o Energy Inspector General has reported thatthese guarantees result in signifcant risk to the gov-ernment and, thereore, the American taxpayer.10 Build-ing new reactors not only sticks taxpayers with the im-

10 http://energy.gov/sites/prod/les/igprod/documents/IG-0777.pdf

sm mdur rctr

Since support for renewed construction of large nuclear power reactors for electricity generation hassimply not materialized, the nuclear industry and many in Congress are pushing for small modular

reactors. Small modular reactors only exist in concept, but already unsubstantiated claims are be-ing made that they will solve a host of cost, design, siting and nuclear waste problems presented bylarge reactors.

Congress and the administration are already lining up to throw money at these so-called mini-nukes.A group of bipartisan senators introduced the Nuclear Power 2021 Act, which would have the Depart-

ment of Energy pay for up to 50 percent of the cost of designing and licensing two small modularreactors. These costs are typically borne by the industry.

The Department of Energy is pursuing its own plan to promote small modular reactors. The agencyhas requested almost $100 million for small modular reactor research and design and licensing for

scal year 2012. The Department of Energy wants to provide government support for small modularreactors by oering to buy the power itself so that small modular reactors can have a secure market.The government should not subsidize this technology.

http://energy.gov/sites/prod/files/igprod/documents/IG-0777.pdfhttp://energy.gov/sites/prod/files/igprod/documents/IG-0777.pdfhttp://energy.gov/sites/prod/files/igprod/documents/IG-0777.pdfhttp://energy.gov/sites/prod/files/igprod/documents/IG-0777.pdf -

8/4/2019 Green Scissors 2011

11/28Green Scissors 2011 11

mediate cost o construction, it also implies continuedliability insurance costs (via the Price-Anderson Act),continued nuclear security concerns and nuclear waste

disposal problems.

Many now want to increase these loan guarantees. Te administration and some backers on Capitol Hillhave made it clear that they will do whatever it takes tooer billions in loan guarantees to the nuclear indus-try. President Obamas last two budgets have requestedalmost tripling loan guarantees or new reactors, rom

the current $18.5 billion to $54 billion. Despite thepresidents request, Congress has not given any new loanguarantee authority the last two years.

Congress should not give billions more in handoutsto this mature industry, which should be able to attractits own private investment. Te chart below highlightssome recommended cuts to nuclear industry subsidiesover the next fve years, resulting in a total savings totaxpayers o almost $50 billion.

sctd ucr uidi Ptti cut 2012-2016 ($)Loan Guarantees for Nuclear and Uranium Enrichment (d) 22,500,000,000

Nuclear Waste Fund Liability Payments 16,200,000,000

Mixed Oxide Fissile Materials Dispositions Construction 2,405,000,000

Fusion Energy 2,404,000,000

Standby Support for Certain Nuclear Plant Delays 2,000,000,000

Non-Defense Environmental Cleanup 1,095,000,000

Fuel Cycle Research and Development 775,000,000

Reactor Concepts Research and Development 625,000,000

Nuclear Energy Enabling Technologies 485,000,000

Modication to Special Rules for Nuclear Decommissioning Costs 471,000,000Credit for Production of Advanced Nuclear 349,000,000

Treatment of Certain Income of Electric Cooperatives 190,000,000

Demonstration Hydrogen Production 100,000,000

Decommissioning Pilot Program 16,000,000

Price-Anderson Act (e) *

Tt 49,615,000,000

d. The nuclear and uranium enrichment portion of the Title XVII loan guarantee program also appears as part of the Loan GuaranteeProgram in the alternative energy section on page 15, though it is not included in the total for the alternative energy section.

e. Estimates of this subsidy vary widely.

-

8/4/2019 Green Scissors 2011

12/2812 Green Scissors 2011

atrtiv rgy

Alternative energy can mean developing totallynew energy sources or using existing energysources in dierent ways. Alternative energy

sources take various orms that oten require signifcantsubsidies beore being viable. While some alternativeenergy sources pollute less than conventional sources,others touted as environmentally riendly are, in reality,environmentally damaging.

Ethanol

Corn ethanol is the granddaddy o wasteul alterna-

tive uels. Due to ederal mandates, nearly all gasolinesold at retail contains at least some ethanol. It is the mostcommon biouel in the U.S. Its environmental benefts,however, are dubious: widespread ethanol production hasconverted otherwise wild land into agricultural land andused enormous amounts o water. Te industrial arm-ing and manuacturing technologies needed or ethanolproduction contribute to ertilizer runo, pollution, andcarbon and particulate emissions. Cellulosic ethanol,

which is ethanol derived rom wood, grass and othernon-edible parts o plants, has environmental problems

similar to corn ethanol.Despite its demonstrated environmental downsides,

ethanol production is subsidized through a number oederal policies in the name o clean energy, the mostsignifcant o which are the Volumetric Ethanol Excise

ax Credit and the Renewable Fuels Standard.

Te Volumetric Ethanol Excise ax Credit is thelargest direct subsidy to corn ethanol. Te tax creditsorigins go back more than 30 years, in response to U.S.oil shortages that resulted rom the OPEC oil embargo.

It exempts the ethanol portion o gasoline blends romgasoline excise taxes and establishes a tax credit orethanol use. Tis massive subsidy does not go to amilycorn armers or even agro-businesses or ethanol produc-ers. Instead, the benefts go almost entirely to oil com-panies that blend the ethanol with traditional uel. Cur-rently worth 45 cents per gallon o ethanol that is thenblended with gasoline, in 2011 eliminating the Volu-metric Ethanol Excise ax Credit would have yielded

$5.7 billion that Congress could have used to und otherprograms or reduce other taxes.11

Congress should save taxpayers billions by immedi-

ately ending the tax credit, which costs taxpayers morethan $15 million a day. I Congress does not take proac-tive measures to end this harmul subsidy immediately,it should at the very least do nothing and let the Volu-metric Ethanol Excise ax Credit simply expire when itis set to at the end o 2011.

11 Government Accountability Oce, Opportunities to ReducePotential Duplication in Government Programs, Save TaxDollars, and Enhance Revenue, GAO-11-441T, March 3, 2011

-

8/4/2019 Green Scissors 2011

13/28Green Scissors 2011 13

In addition to the tax credits or ethanol, the Re-newable Fuels Standard mandates the use o an in-creasing amount o biouels each year, regardless o

actual demand or economic and environmental im-pact. By the year 2022, the Renewable Fuels Standard

will mandate the use o 36 billion gallons o biou-els. Fiteen billion gallons o that is expected to comerom corn ethanol. Tis mandate, in addition to the taxcredit, urther subsidizes biouel production by ensur-ing a market or biouel producers, regardless o thefnancial or environmental costs o producing it.

Congress should eliminate the Renewable FuelsStandard mandate and let corn ethanol and other bio-uels compete in the market. Once the primary drivero ethanol consumption in the U.S., the VolumetricEthanol Excise ax Credit no longer encourages bio-uel consumption because the Renewable Fuels Stan-dard now mandates the purchase o ethanol by uelblenders at a greater volume than the market demands.

Te Volumetric Ethanol Excise ax Credit serves onlyas another orm o corporate welare or some o themost proftable companies in the world.

Combined, the Renewable Fuels Standard and Vol-umetric Ethanol Excise ax Credit will subsidize eth-

anol at approximately $56 billion rom 2011 to 2015,including both direct (tax credits) and indirect (marketprice support) subsidies.12 Congress could save taxpay-ers money and help the environment by eliminatingboth the Volumetric Ethanol Excise ax Credit andthe Renewable Fuels Standard mandate or corn etha-nol.

New coal technologies

By providing subsidies or carbon capture and seques-tration, taxpayers continue to oot the bill in a never end-ing quest or clean coal. Carbon capture and sequestra-tion is an unproven, expensive and potentially dangeroustechnology that, even i it works, does nothing to alle-

viate the environmental, health and social consequenc-es resulting rom the mining and burning o coal. Teironically named FutureGen is the most recent taxpayer-

12 Doug Koplow, A Boon to Bad Biofuels, Earth Track, April 2009

unded boondoggle or clean coal, with a projected cost

o $2.4 billion.13 1415

In addition to the quest or clean coal, taxpayers are

yet again also being asked to provide subsidies or theproduction o synthetic uels like liquid coal. Existingossil uel subsidies have been expanded to include liquidcoal and tar sands, and earmarks or research and devel-opment have been tacked onto appropriations bills. Ad-

13 http://www.netl.doe.gov/publications/press/2009/7749.html14 http://trib.com/news/state-and-regional/article_e20aadb8-

9c18-568e-8f39-ea0a9b78c414.html15 James T. Bartis, Frank Camm, David S. Ortiz, Producing Liquid

Fuels from Coal, Rand Corporation, 2008

Mdici bw

An old, expensive technology has its hand outagain to the federal government. Medicine BowFuel & Power LLC, a wholly owned subsidiary ofDKRW Advanced Fuels LLC, has applied for a De-

partment of Energy loan guarantee for reportedlyas much as two-thirds of the cost of the $2.7 billionliquid coal plant and coal mine it hopes to build inMedicine Bow, Wyoming.14 The government got

behind liquid coal, as well as other synthetic fuels,

back in the 70s and 80s, but it was a nancialboondoggle. Thats because the technology toturn coal into liquid fuel is extremely expensive andonly deepens our dependence on environmentallydamaging fossil fuels. It also has all of the envi-ronmental impacts of coal mining and requires atleast two gallons of water for every gallon of fuelproduced, according to The RAND Corporation.15

Even if the plant is able to utilize carbon capture

and sequestration, the Environmental ProtectionAgency found that liquid coal plants would release3.7 percent more greenhouse gases than conven-

tional fuels, as well as signicant amounts of par-ticulate emissions.

http://www.netl.doe.gov/publications/press/2009/7749.htmlhttp://trib.com/news/state-and-regional/article_e20aadb8-9c18-568e-8f39-ea0a9b78c414.htmlhttp://trib.com/news/state-and-regional/article_e20aadb8-9c18-568e-8f39-ea0a9b78c414.htmlhttp://trib.com/news/state-and-regional/article_e20aadb8-9c18-568e-8f39-ea0a9b78c414.htmlhttp://trib.com/news/state-and-regional/article_e20aadb8-9c18-568e-8f39-ea0a9b78c414.htmlhttp://www.netl.doe.gov/publications/press/2009/7749.html -

8/4/2019 Green Scissors 2011

14/2814 Green Scissors 2011

ditionally, each year liquid coal proponents push or theinclusion o long term contracts in the National DeenseAuthorization Act, through which taxpayers would be

locked into purchasing uneconomical, high carbon liq-uid coal or decades or more. Recent appropriations billshave even included unding to construct liquid coal a-cilities on military bases.

Natural gas

One recent attempt to secure subsidies or unconven-tional ossil uels involves the natural gas industry. A billintroduced in the 112th Congress known as the NA

GAS Act would provide signifcant subsidies or naturalgas at all levels o production rom manuacturingand inrastructure to consumer tax credits carrying an

estimated $5 billion price tag. It includes a tax credit orup to 80 percent o the marginal cost o buying a natu-ral gas vehicle (up to $64,000 or the heaviest trucks); a50-cent-per-gallon uel tax credit; an inrastructure taxcredit o 50 percent o the cost o a ueling station, upto $100,000; and a manuacturing tax credit or the pro-duction o natural gas vehicles. Tese natural gas subsi-dies could have a signifcant impact on the environmentand taxpayers alike.

advncd Rsrch Projcts agncy-enrgy

The Advanced Research Projects Agency-Energy, authorizedin 2007 and rst funded in 2009, is a giant government-runresearch and development agency charged with doing (to

quote its own mission statement) creative out-of-the-boxtransformational energy research. Although dwarfed bysuch science behemoths as the National Science Founda-tion, NASA, and the National Institutes of Health, AdvancedResearch Projects Agency-Energy is the largest governmententity devoted entirely to applied research that (to quoteits own mission statement again) bridgesthe gap betweenbasic...research and development/industrial innovation.With one major exception (the unsuccessful synfuels eortof the 1970s and 1980s), this type of applied civilian energy

research has historically been done almost entirely at private rms.

Many of the projects that Advanced Research Projects Agency-Energy supports are bad for the environment. SomeAdvanced Research Projects Agency-Energy backed clean coal, biofuels and biotech technologies show littlepromise for reducing pollution but could potentially be signicant prot centers for private rms if any investorswere convinced of their merits. Some of the more environmentally promising and successful Advanced ResearchProjects Agency-Energy projects, such as eorts to make buildings more energy ecient, provide taxpayer subsidiesto develop things that the private sector was already using on a large scale. Although Advanced Research Projects

Agency-Energy supports some positive eorts, much of this program harms the environment or fails to add real value.

-

8/4/2019 Green Scissors 2011

15/28Green Scissors 2011 15

sctd trtiv rgy uidi Ptti cut 2012-2016 ($)

Loan Guarantee Program (f) 51,000,000,000

Volumetric Ethanol Excise Tax Credit 38,843,000,000

Volumetric Biodiesel Excise Tax Credit and Renewable Biodiesel Tax Credit 5,586,000,000

Biorenery Assistance 3,345,000,000

Election to Expense 50 Percent of Qualied Property Used to Rene Liquid Fuels (OilShale and Tar Sands Reneries)

2,700,000,000

Fossil Energy Research and Development Program 2,380,000,000

Biological and Environmental Research Biological Systems Science 1,880,000,000

Department of Energy Biomass and Biorenery Research and Development 1,700,000,000

Open Loop Biomass 1,600,000,000

Tax Credit and Deduction for Clean-Fuel Burning Vehicles 1,590,000,000

FutureGen 2.0 1,300,000,000

Biomass Crop Assistance Program 1,212,000,000

Industrial CarbonCapture and Sequestration Tax Credit 971,000,000

Credit for Investment in Clean Coal Facilities 900,000,000

Credit for Alternative Fuel Mixtures 880,000,000

Excess of Percentage Over Cost Depletion, Other Fuels 700,000,000

Bioenergy Program for Advanced Biofuels 446,000,000

Expensing of Exploration and Development Costs, Other Fuels 400,000,000

Production Tax Credit for Cellulosic Ethanol 369,000,000

Re-Powering Assistance 175,000,000

Biomass Research and Development 134,000,000

Municipal Solid Waste 100,000,000

Department of Energy Fuel Technologies Program 95,000,000

Alternative Fuel Vehicle Refueling Property 10,000,000

Biodiesel Fuel Education Program 1,000,000

Advanced Research Projects Agency-Energy (g) 3,250,000,000

Tt (h) 95,817,000,000

f. $22.5 billion from this program has been earmarked for nuclear energy and appears in the chart on page 11. Only the part of this

program not earmarked for nuclear energy is included in the total in this chart.g. Since not all of this spending funds environmentally harmful projects, this program is excluded from the overall total for this chart.

h. This total does not include Advanced Research Projects Agency-Energy or loan guarantee money that has been earmarked fornuclear reactors.

-

8/4/2019 Green Scissors 2011

16/2816 Green Scissors 2011

W

ashington wastes billions o taxpayer dollarsannually on agriculture policies that no lon-ger address the economic or environmental

realities o 21st century agriculture. Many o these poli-cies were created in the 1930s as temporary assistancemeasures to combat conditions o the Great Depression.Nearly 80 years later, many continue despite not address-ing the needs o the majority o Americas armers, ruralcommunities, consumers or taxpayers. Billions o dollarsare unneled each year to an increasingly small numbero large arming operations, while the majority o arm-ers and rural residents receive little assistance. axpayersubsidies also distort arm policies to contribute to over-production and cultivation o marginal lands, wasting

taxpayer dollars and harming the environment. As Con-gress ramps up or a potential Farm Bill in 2012, thecuts on the next page, along with a reormed sustainableagriculture policy that more eectively and eciently al-locates ederal resources, should be implemented, sav-ing taxpayers billions and helping restore environmentalbalance to our armlands.

Cmmdity crp

A majority o government subsidies are providedto a handul o commodity crops, and the majority othese subsidies ow only to corporate arms. Corn, cot-ton, wheat, rice and soybeans rack up 90 percent o thecommodity crop subsidies, while ruit, vegetable and nutproducers are let picking the scraps. Tese subsidies endup as windall profts or the wealthiest and largest agro-corporations, crowd out unding or agriculture-relatedconservation programs and do little or rural develop-ment or the struggling amily arm. Because o highcommodity prices, the counter-cyclical payments intended to support armers when prices are low are

virtually non-existent. Te vast majority o the subsidiesare or so-called direct payments, which are based onhistorical plantings and largely line the pockets o bigagriculture without any strings attached. According tothe Department o Agriculture, Fixed direct paymentsare not tied to current production or prices and do not

a G R I C U l T U R e

-

8/4/2019 Green Scissors 2011

17/28Green Scissors 2011 17

require any commodity production on the land.16 Re-ducing commodity crop subsidies by 80 percent couldsave taxpayers more than $20 billion over the next fve

years.

Mrkt acc Prgrm

Te Market Access Program should be cut entirely.For more than two decades, taxpayers have spent $3.4billion subsidizing overseas ad campaigns that beneftproftable multinational corporations like McDonalds,Nabisco, Fruit o the Loom and Mars. Cutting this

wasteul program could save taxpayers $1 billion.

Crp iurc

Crop insurance is quickly becoming the most expen-sive type o agricultural subsidy, nearly outstripping thecost o all other arm subsidy programs combined. Whilecalled insurance, it doesnt operate like any orm o in-surance most Americans have bought. In most places,ederal taxpayers pay 100 percent o the premiums orthe arms basic catastrophic coverage while providing

subsidies or additional coverage resulting in an average16 U.S. Department of Agriculture, http://www.ers.usda.gov/

brieng/farmpolicy/directpayments.htm

o 60 percent o the premium cost or private crop insur-ance being covered by taxpayers.

Te crop insurance program is dominated by corn,cotton, soybeans and wheat, which account or about80 percent o the subsidies provided by the program,

with corn taking the lions share. Te larger the arm, thelarger the potential payout; the Congressional ResearchService estimates that the biggest agricultural producers(over $1 million in sales) account or about 30 percento the subsidy. Unlike other agriculture subsidies, thereare ew strings attached, so crop insurance will covermarginal land, which is oten more environmentallysensitive. By guaranteeing some return, it provides anincentive to plant where odds o success are slim, but thelikelihood o environmental harm is great. In addition,in 2008 the Agriculture Department lowered crop insur-ance costs or genetically engineered corn, particularlyherbicide tolerant varieties such as Monsantos Round-up Ready corn. Such varieties encourage more intensiveherbicide use; as weeds become resistant, they can trig-ger a dangerous cycle o ever increasing chemical use.

Excluding taxpayer-paid premiums, claims under thecrop insurance program have exceeded premiums every

year since 1994. In a time o record defcits and near

record commodity prices, taxpayers can ill aord yet an-other program that promotes degradation o the envi-ronment while privatizing profts and socializing risks.

sctd gricutur idutry uidi Ptti cut 2012-2016 ($)

Major Commodity Cropsi

Corn 7,945,000,000

Wheat and Wheat Products 4,280,000,000

Upland Cotton 2,467,000,000

Soybeans 2,174,000,000Rice 1,627,000,000

Crop Insurance Disaster Aid 30,000,000,000

Concentrated Animal Farming Operations Environmental Quality Improvement Program 7,040,000,000

Market Access Program 1,004,000,000

Foreign Market Development Program 118,000,000

Tt 56,655,000,000

i. The following major commodity crop numbers represent an 80 percent reduction from current subsidy levels.

http://www.ers.usda.gov/briefing/farmpolicy/directpayments.htmhttp://www.ers.usda.gov/briefing/farmpolicy/directpayments.htmhttp://www.ers.usda.gov/briefing/farmpolicy/directpayments.htmhttp://www.ers.usda.gov/briefing/farmpolicy/directpayments.htm -

8/4/2019 Green Scissors 2011

18/2818 Green Scissors 2011

T

he nations transportation program aces signif-cant challenges. Authorizing legislation undingour roads, rails and airways has long been expired

and the relevant agencies have operated or years undershort-term extensions. Proposals to reauthorize the sur-ace transportation program appear unlikely to move inthe near uture, and the Federal Aviation Administrationreauthorization is blocked by policy and unding dis-agreements between the House o Representatives andSenate. Te Federal Aviation Administration recentlyurloughed 4,000 workers, put hundreds o constructionprojects on hold and stopped collecting aviation taxesbecause Congress ailed to pass a short-term extensiono the program.

ransportation unding is lagging. Te Highwayrust Fund the account into which our gas taxes aredeposited is collecting ar less than current spendinglevels, which has required Congress to transer millionso dollars into the Highway rust Fund to keep it sol-

vent. Meanwhile we have an ever increasing backlog omaintenance. It is imperative, then, that we do the most

with every transportation dollar. o do more with lessmeans some programs and projects need to be eliminat-ed while others should be reduced in scope.

eti air srvic

Te Essential Air Service was created in response tothe Airline Deregulation Act o 1978 due to concernthat airlines, now ree to choose which routes they wouldy, might stop servicing smaller airports. Te EssentialAir Service provides a subsidy to airlines that operateights rom non-hub airports that are 90 miles or morerom the nearest large or medium hub airport.

Te Essential Air Service is a policy relic, created inthe atermath o airline deregulation and prior to trilliondollar budget defcits. Subsidizing ights or a handulo passengers at a cost to taxpayers o hundreds o dollars

per ight makes no sense or taxpayers or the environ-ment. For example, the 50 minute ight rom Lebanon,New Hampshire to Boston receives a subsidy o $287per passenger when its only a little over an hour driveto another large airport, Manchester-Boston RegionalAirport.17 Some routes cost taxpayers thousands o dol-lars per passenger. Recent reorms would have changed

17 Per passenger subsidy rates based on 2010 contract subsidyamounts and number of enplanements per Essential AirService airport provided from the Congressional ResearchService and the Federal Aviation Administration.

T R a n s P o R T a T I o n

sctd trprtti prgrm d prjct Ptti cut 2012-2016 ($)

General Revenue Transfers to Highway Trust Fund 72,000,000,000

I-710 Tunnel Project (California) 11,800,000,000

Airport Improvement Program Grants to General Aviation-Dominated Airports 10,900,000,000

Columbia River Crossing 3,600,000,000

I-73 Project (South Carolina) 2,400,000,000

Outer Bridge Portion of Ohio River Bridges Project (Indiana & Kentucky) 1,526,000,000

Knik Arm Crossing (Alaska) 1,500,000,000

Essential Air Service Program 815,000,000

Hartford-New Britain Busway (Connecticut) 573,000,000

Juneau Access Road (Alaska) 500,000,000

St. Croix River Crossing Project/Stillwater Bridge (Minnesota & Wisconsin) 407,000,000

Gravina Island Access (Alaska) 304,000,000

Charlottesville Bypass (Virginia) 197,000,000

Tt 106,522,000,000

-

8/4/2019 Green Scissors 2011

19/28Green Scissors 2011 19

the eligibility to exclude airports within 90 miles o ahub (up rom 70 miles), but the Secretary o ransporta-tion used a hardship waiver to keep the subsidies ow-

ing to ten airports that would have been eected by thechange. Te reorms did eliminate subsidies to three air-ports, however, because the subsidy per passenger is nowcapped at $1,000. Tese subsidies encourage air travel on

inecient smaller planes as well the continued opera-tion o commercial airports in places where the marketdoes not support them. Exceptions may be acceptable in

Alaska, where roads are scarce and distances great, butthat is the only place where the Essential Air Serviceshould remain in eect.

Hyrid tx crditIn many ways hybrid cars are an environmental success story. Now prevalent on the streets of America, such cars, whichmate conventional internal combustion engines to battery power, produce less air pollution than conventionally powered cars, reduce oil usage, and have generated signicant prots for the companies that produce them. When hybridsrst came to market more than a decade ago, all buyersreceived special tax credits that were intended to over-come the initially high cost dierential between hybridvehicles and conventional cars and trucks. Althoughthe credit ocially lapsed on January 1, 2011, some in

Congress want to put it back into place.

This is a misguided idea. The structure of the hybrid tax

credit over the past few years has incentivized the saleof inecient hybrids at the expense of the most fuel

ecient models. The hybrid car tax credit applied toonly the rst 60,000 cars sold by any automaker. Therst companies to come to market with practical, fuel

ecient, desirable hybrids Toyota, Honda and Ford all exhausted the credit well before it ocially expired,leaving their cars no longer eligible for the credit. (Manycut their prices in response.) This left companies thatwere slow to develop this technology like GM, Nis-

san and Chrysler or that sold less attractive products,with a relative advantage because their products werestill eligible for the tax credits. These late developers also happen to be producing less fuel ecient vehicles than theircounterparts, creating a situation where taxpayers subsidize and incentivize the purchase of less ecient hybrid vehiclesAdditionally, luxury car makers like BMW and Porsche, which sell fewer cars, benet from the credit for a much longertime. Buyers of such rareed automobiles are neither particularly price sensitive nor deserving of special governmenhandouts. The result is that large numbers of the hybrid credits claimed on 2010 tax returns were for hybrid luxurycars and SUVs that, although more fuel ecient than their non-hybrid counterparts, are hardly paragons of eciency

-

8/4/2019 Green Scissors 2011

20/2820 Green Scissors 2011

Puic d

The ederal government owns more than 650 mil-lion acres o land. Tese publicly owned lands in-clude national parks, orests, historical sites and

wildlie reuges that provide opportunities or recreation,tourism and conservation. Many public lands, however,are also given over to purely commercial uses such asgrazing, mining, drilling and timber harvesting. Otenthese industries do not pay or the resources they removeor the inrastructure they need or resource extraction.At the same time, they negatively impact water, air andecosystems. I Congress is serious about improving theenvironment and cutting the defcit, it should require in-

dustries using our public lands to pay air value or theseresources.

Hardrock mining

One o the oldest and most egregious o ederal sub-

sidies, the 1872 Mining Law, governs hardrock miningon ederal lands. It provides a stark example o taxpayergiveaways o ederally owned resources. First enactedunder President Ulysses S. Grant, the 1872 Mining Law

was intended to promote western settlement. Now, 139 years later, this anachronistic law remains unchanged,providing an enormous subsidy to the biggest miningoperators in the world like UK-based Rio into. Underthe 1872 law, mining companies pay no royalties or theminerals they remove rom ederal lands and can pur-chase ederal land or $5 per acre (a weak annual mora-

torium on purchases has been put in place, but there isno permanent fx). axpayers receive nothing or the ap-proximately $1 billion worth o minerals mining compa-nies extract annually rom ederal lands. By comparison,the oil, gas and surace coal industries pay royalty rateso at least 12.5 percent, which are still among the lowestin the world.

Timber

Te harvest o timber rom ederal lands not only robstaxpayers o precious revenue, in many cases it is actually

a money loser or taxpayers. axpayers pay millions odollars in subsidies to allow timber companies access toour ederal lands. For decades, commercial timber saleson public lands have lost money because the ees paid tothe government by the companies buying the timber donot even cover the costs associated with preparing andadministering the sales. Tats right: American citizenspay corporations to log our public lands. In response topressure rom Congress, the Department o Agriculturecreated the Timber Sale Program Information Report-ing System, which documented the costs to taxpayers o

orest product sales. While the system had aws, it stillshowed that timber programs cost taxpayers millions odollars each year. Perhaps that is why the Department oAgriculture has moved to a new system that has elimi-nated any timber sale program reporting and adoptedaccounting practices that make it impossible to evaluatethe cost.

Te ongass rainorest in Alaska, the worlds largestremaining temperate rainorest, is a prime example o

l a n D a n D W a T e R

-

8/4/2019 Green Scissors 2011

21/28Green Scissors 2011 21

this awed policy. Te U.S. Forest Service continues tolog this pristine wilderness area despite the act that tax-payers pay more or the construction and maintenance

o roads and other inrastructure needed to extract thetimber than they receive rom timber royalties. Loggingcompanies would be required to pay these costs them-selves i they were to log on private lands. Logging innational orests has eliminated many old growth or-ests and damaged habitat or numerous species such assalmon, grizzly bear and wol. Soil erosion and sedimen-tation caused by logging and road building is the mostsignifcant threat to fsh and other aquatic organisms inour national orests. Erosion can also reduce the produc-tive capacity o these lands, limiting regeneration o trees

and other plants. Te government should require the re-ceipts or commodity timber sales in national orests toat least cover all o the expenses involved with preparingthe sales, as well as the cost o restoring landscapes and

watersheds.

Grazing

Te Forest Service and Bureau o Land Manage-ment public land grazing program is highly subsidizedand benefts only two percent o the nations livestock

operators. According to the Government AccountabilityOce in 2004, grazing programs cost taxpayers roughly$136 million to operate but only earned $21 million.18Below-cost grazing ees encourage overgrazing and,along with other problematic eatures o the existingederal program, have resulted in extensive and severeenvironmental damage to public lands and riparian ar-eas, resulting in reduced ecologic resiliency and ability toadapt to a warming western climate. Federal grazing eesare lower than the ees charged by almost every state.In fscal year 2007, ederal grazing ees ell to $1.35 peracre, the lowest amount allowed by law. o put that inperspective, the frst uniorm ederal grazing ee that wasestablished in 1934 was set at $1.23 per acre. Te equiva-lent, in 2010 dollars, is $19.81 per acre. It is time ortaxpayers to be airly compensated or allowing grazingon ederal lands.

18 Government Accountability Oce, Federal Expenditures andReceipts Vary, Depending on the Agency and the Purpose ofthe Fee Charged, GAO-05-869, September 2005

Livestock

Te Department o Agricultures Wildlie Services

program spends millions o taxpayer dollars annually tokill as many as 100,000 wild predators, largely at the be-quest o ranchers through its predator control program.Much o this killing is done on ederal lands.

Last year Wildlie Services spent $13 million tokill tens o thousands o wild animals. Lethal controlmethods that the program employs have led to dozenso human injuries and deaths and the degradation oecosystems that rely on healthy predator populations tounction. Te only benefciaries are ranchers who shouldbe responsible or protecting their own cattle. axpayers

should not be ooting the bill or this program.

Wtr

Too oten the nations management o waterwaysand ood plains yields specious short-term eco-nomic gains and longer-term economic and envi-

ronmental losses. Reorming these programs with smartcuts and policy shits would save taxpayers billions andprotect the countrys natural resources.National Flood Insurance Program

Te National Flood Insurance Program, which pro- vides government-backed ood coverage to privatehomes all around the country, is a disaster or citizens andthe environment. Although intended to both fnanciallybreak even and promote water resources conservationand protection when Congress created it in 1968, theprogram has done neither. Te ood program has soldmillions o Americans coverage against ooding at ratesnot commensurate with their risk and ar below those

in the private market. Te result is to encourage moreintensive development in ood prone, environmentallysensitive areas. As a result o its shoddy underwritingpractices, the National Flood Insurance Program owesthe Department o reasury almost $18 billion. Tis en-tire debt, nearly all experts agree, will eventually have tobe paid by all taxpayers instead o just the individuals

who beneftted. Ending the program immediately, how-ever, would not necessarily solve its problems. Because

-

8/4/2019 Green Scissors 2011

22/2822 Green Scissors 2011

the program relies on premiums charged to policyhold-ers to pay interest on its debt and recent claims, theCongressional Budget Oce says that such a termina-

tion would actually cost $2 billion. Te National FloodInsurance Program shouldnt be eliminated tomorrow,but it can and must be phased out over time.

Army Corps of Engineers

Te Army Corps o Engineers has been a lever pulledby lawmakers to bring money to their home districts ornearly two centuries. Te agency constructs water re-source projects dealing with navigation, ood and stormdamage reduction, and environmental restoration. Yet in

many cases these projects serve little to no national inter-est, are not economically justifed, have serious negativeenvironmental impacts and are based more on politicalpower than national priority.

oo oten Corps projects are both economically andenvironmentally wasteul. Over the last several years,Corps projects have been challenged by the NationalAcademy o Science, Government Accountability O-fce and even the U.S. Army Inspector General. With aocus on structural solutions like dams and levees, and aparochial bias that oten inhibits regional or watershed

planning, the Corps oten ignores alternatives less costlyor taxpayers and the environment. Ater Hurricane Ka-trina, the nation saw a glaring example o Corps ailuresin ood control and how Corps projects led to increaseddevelopment in high risk areas.

While there are many questionable Corps projects, aew deserve special attention. Tese projects are not theproduct o a system designed to identiy the greatest na-tional needs but instead o political calculations in Con-gress. Projects that were started or sustained throughearmarking continue on to this day. With Washingtonocused on prioritizing every taxpayer dollar, now is thetime to end the Corps involvement in projects that areeconomically unjustifed and environmentally harmul.

Uppr Miiippi Rivr nvigti lckPrjct $2,095,000,000

Despite continued decreases in barge trac, cost-overruns and a history o wildly exaggerated economicassumptions, the Army Corps o Engineers seeks to

spend billions constructing new and enlarged navi-gation locks as part o the Mississippi River-Illinois

Waterway Navigation Expansion Project. Mainly just

a fx or occasional barge transportation delays thatoccur at river locks during high trac times, cheaperand less harmul alternatives such as scheduling, trad-able lockage ees and helper boats should be pursuedat a raction o the projects current cost.

Idutri C lck Rpcmt $1,300,000,000

Despite declining barge trac, the Corps continuespursuing construction o a new longer, wider, deeperlock on the Inner Harbor Navigation Canal (Indus-

trial Canal) in New Orleans. Te Corps would spendmore than $1.3 billion building just one lock whileignoring major storm damage reduction needs in theadjacent area.

Grd Priri ar Dmtrti prjct $450,000,000

Te Grand Prairie Irrigation Project in Arkansas isthe Corps attempt to move into the irrigation busi-ness in urther support o already highly subsidizedrice plantations. Te $450 million total price tag istoo steep a price to pay or this project, which willseverely deplete wetlands, while cheaper, more eec-tive alternatives to water management exist.

Dwr Rivr Dpig $348,000,000

At nearly $350 million, the Delaware River Deepen-ing project is extremely damaging to taxpayers andthe environment. In spite o opposition rom the stateo New Jersey and the state o Delaware, and majorcriticism rom the Government Accountability Oceand other independent analysts, the Corps continuesto pursue this project, which will degrade the Dela-

ware Bay and River or the beneft o a handul opetroleum companies.

st. Jh byu/nw Mdrid fdwy $159,000,000

Any notion that the St. Johns Bayou/New MadridFloodway project was a good idea was washed away

when the Corps responded to record ooding threat-ening Cairo, Illinois, by blasting the Birds Point levee

-

8/4/2019 Green Scissors 2011

23/28Green Scissors 2011 23

Id Wtrwy Trut fud

In an eort to stretch federal dollars further and ensure there is a real non-federal interest in a particular project,virtually all Corps projects include a non-federal cost-sharing partner. These cost-sharing rules are, unsurpris-ingly, frequently under attack. Despite Washingtons new-found focus on decits and debt reduction, the inlandwaterways industry has been ramping up eorts to further weaken its cost-sharing responsibility in the Inland

Waterways Trust Fund. The Inland Waterways Trust Fund was created in 1978 to provide a self-sustaining fundingsource, generated by a tax on fuel used for inland waterways shipping, to pay for construction and maintenanceon much of the nations most used waterways. Years of overspending and decreased usage of the nations locksand rivers, however, has left the Inland Waterways Trust Fund eectively bankrupt. Rather than propose viablesolutions to shore up funding, special interests are seeking to further roll back their cost-sharing responsibilitiesby increasing taxpayer subsidies for inland waterways navigation to a level that far exceeds all other forms oftransportation, including highways, rail and air travel. These special interests have cleverly proposed increas-ing the tax they pay by a few pennies but at the same time increasing inland waterways construction spendingand eliminating cost-sharing in a wide variety of areas that will increase taxpayer costs by $200 million per year.

Inland waterways users must begin shouldering more of the costs for constructing and operating the inland wa-terways systems that make their business possible. Congress must oppose eorts to further weaken the inland

waterways industrys cost-share requirement and immediately authorize collection of lock user fees. Currently,inland waterways users pay for only 9-10 percent of the total costs of operating the system. The initial target ofa fee system would be double the user contribution. Such an additional fee system could be designed to encour-age scheduling of lock usage, which would have the immediate eect of reducing or eliminating congestion andincreasing eciency, and would provide revenues for system investments. Rolling back cost-sharing will not onlycost taxpayers more to construct the same project, it will also siphon o needed funds from other priorities andallow projects to go forward that do not have adequate justication.

-

8/4/2019 Green Scissors 2011

24/2824 Green Scissors 2011

on May 2, 2011, sending the Mississippi River cas-cading down the 130,000 acre natural oodway. TeNew Madrid Floodway is one o the last remaining

natural oodways on the river, yet or years the Corpshas sought to build levees and pumping stations tocut it o rom the river. Tis ood protection project

would actually increase ooding risks while inducingdevelopment in the oodway, costing taxpayers mil-lions more in damages the next time the oodway isoperated.

frt Wrth-Ctr City prjct $435,000,000

Te Fort Worth-Central Cityproject is just one por-tion o a larger project known as the rinity River

Vision, the total cost o which has increased to nearly$1 billion. Te project is a Corps ood control e-ort to reroute the rinity River in Fort Worth, exasthrough construction o a new dam, a 1.5 mile longbypass channel and numerous ood gates in orderto create an urban waterront community to thetune o $435 million. Tis is a wasteully speculativedevelopment and the Corps should better utilize itsood control dollars.

D fdwy exti, Triity Rivr prjct $459,000,000

Neighboring the Fort Worth-Central City project,the Dallas Floodway Extension, rinity River projectis another Corps ood control project on the rin-ity River. Under this project, the Corps seeks to ex-tend existing levees while cutting a 600-oot-wideswath (swale) through the Great rinity Forest. Teprojects principal economic justifcation is increasedood control or downtown Dallas. Yet, most o thesebenefts could be obtained or a raction o the projectcost by simply raising one o the existing Dallas leveesand conducting a voluntary buyout in ood proneneighborhoods. Tis would provide the most eectiveood protection or the area, with dramatically lessimpact on the oodplain.

fdr ch rpihmt $350,000,000

Beach replenishment projects are one o the mostegregious examples o public dollars subsidizingprivate benefts. Beach nourishment is intended toaddress the problem o beach erosion and protect

a prgrm tht mk :

Ct brrir Rurc actIn 1982, President Reagan signed the Coastal Bar-rier Resources Act. This government initiative, laterexpanded in 1990 and 2000, enabled states andlocalities to identify undeveloped areas on coastalbarrier islands and have them included in whats

now called the John H. Chaee Coastal Barrier Re-sources System. Within Coastal Barrier ResourcesSystem units, the federal government does notpurchase land, does not limit development anddoes not dictate conservation, but it does with-

draw a wide range of federal development sub-sidies ranging from ood insurance to interstatehighway funds. The underlying concept was that

the federal government should not subsidize devel-opment in high risk, environmentally sensitive areaslike barrier islands. As President Reagan observed,the Coastal Barrier Resources System meets theneeds of the environment with less government,not more.

The Fish and Wildlife Service, which oversees theCoastal Barrier Resources System, estimated that

the program saved taxpayers more than $1.3 billionbetween the time of its creation in 1980 and 2003.(Total savings have grown since then as hurricaneshave ravaged many Coastal Barrier Resources Sys-tem areas that would otherwise have been devel-oped.) The Coastal Barrier Resources System is alsoa conservation success story: collectively, the 3.1million of acres of land preserved under the Sys-

tem are larger than all but one National Park in thelower 48 states. Coastal barriers can also serve asimportant wildlife habitat and a buer to shieldinland areas against severe storms. Many develop-

ers and realtors have fought the system by pushingfor legislation that would modify boundaries and

shift valuable parcels out of the system in order toobtain federal development subsidies. Rather thangiving in to their pressure, Congress should resist

it and, instead, work to withdraw government de-velopment subsidies from a broader range of highrisk, environmentally sensitive areas.

-

8/4/2019 Green Scissors 2011

25/28Green Scissors 2011 25

property rom storms. However, many experts notethat this process only provides a temporary solution tomaintaining the width o a beach and promotes more

intensive development in high risk, environmentallysensitive areas. axpayers thus pay millions every yearto pump sand onto beaches, sand that inevitably andalmost immediately washes back out to sea.

Id Wtrwy Ur brd $1,700,000

Te Inland Waterways Users Board is a ully taxpayer-unded advisory board that works against the interestso taxpayers. Te Users Board is charged with making

recommendations on the priorities or ederal spend-ing on inland waterways. Consisting solely o repre-sentatives o barge industry companies and Corps o

Engineers personnel, however, the Users Board ails totake into account the interests o any other non-bargeindustry users o the nations waterways or generaltaxpayers. Te Users Board is an anachronistic entityand is no longer needed. Eliminating the Users Boardwill save more than $1.7 million in administrativecosts over the next fve years and untold billions insavings rom not having a taxpayer-unded advocateor many wasteul and overly complicated projects.

sctd d d wtr uidi Ptti cut 2012-2016 ($)

Special Tax Treatment for Timber Gain 2,200,000,000

Upper Mississippi River Navigation Locks Project (Iowa, Illinois, Missouri) 2,095,000,000

Forest Products (Within Integrated Resource Restoration) 1,645,000,000

Inner Harbor Navigation Canal (Industrial Canal) Lock Replacement (Louisiana) 1,300,000,000

Expensing of Timber Growing Costs 1,200,000,000

Amortization and Expensing of Reforestation Expenditures 1,200,000,000

Increased Inland Waterways Subsidy (Over Five Years) 1,000,000,000

1872 Mining Law Reform (Royalty Payment 12%) 866,000,000

Percentage Depletion Allowance 500,000,000

Dallas Floodway Extension, Trinity River Project (Texas) 459,000,000

Grand Prairie Area Demonstration Project (Arkansas) 450,000,000

Fort Worth Central City Project (Texas) 435,000,000

Federal Beach Replenishment 350,000,000

Delaware River Deepening Project (Pennsylvania, New Jersey, Delaware) 348,000,000

Expensing and Exploration Nonfuel Minerals 300,000,000

Money Losing Timber Sales 276,000,000

Special Rules for Mining Reclamation Reserves 200,000,000

St. Johns Bayou Basin/New Madrid Floodway Project (Missouri) 159,000,000

Forest Service Salvage Fund 140,000,000

Livestock Protection Program 65,000,000

Bureau of Land Management Public Domain Forestry 49,000,000

Fair Value Grazing Fees 41,000,000

Timber Purchaser Election Road Construction 10,000,000

Inland Waterways Users Board 2,000,000

Tt 15,290,000,000

-

8/4/2019 Green Scissors 2011

26/2826 Green Scissors 2011

A

lthough the nations budget debate shited intocrisis mode in July and is ar rom over, therehave been some signs o light in the budgetary

abyss. In 2011, lawmakers have taken action on a ewo the important issues targeted by the Green Scissorscoalition. Tese recent signs o progress show that theinterests o taxpayers and the environment can trumpthose o well-unded special interest and business groupsin Washington. Hardly any o the changes go ar enoughbut all should serve as a starting point or Congress asit moves orward on repealing environmentally harmuland wasteul spending. Much more needs to be done tomake these needed reorms a reality. Tere is no time to

waste.

Te ollowing list provides a glimpse at some o thecoalitions 2011 successes.

st vt t imituidy r cr th

Te contention that tax spending is not actuallyspending came under a microscope when a bipartisanbill to end one o the most egregious tax preerences, the

Volumetric Ethanol Excise ax Credit, was brought tothe Senate oor thanks to the tireless work o bipartisanSenate champions. In a sign that things really are chang-ing in Washington, the Senate overwhelmingly voted toend a subsidy that just a ew months earlier had beenextended yet again. In the end, 73 senators took on thepowerul corn lobby and supported fscal responsibilityand the environment by voting to end a wasteul subsidythat has been on the books or over 30 years.

Unortunately, the Volumetric Ethanol Excise axCredit continues to cost taxpayers billions. While the

amendment to end the tax credit passed the Senate,the underlying bill stalled. As a result, it remains onthe books. But the signal has been sent. Te VolumetricEthanol Excise ax Credit is set to expire at the end othe year without a congressional extension. Te vote in

July suggests that, ater three decades, we might fnallybe getting this subsidy o the books.

Hu ri i gricuturwt

Stop subsidizing Brazilian cotton farmers

Advocates or common sense agriculture spendinggained a recent victory when the House o Representa-tives voted to deny unding or the Brazil Cotton Insti-tute. Bizarrely, American taxpayers are being orced to

subsidize Brazilian cotton arming in order to protectsubsidies or U.S. cotton armers. Brazil challenged U.S.cotton subsidies at the World rade Organization and

won the right to enact punitive taris until the subsidiesare reormed. Instead o tackling the underlying issue,the Department o Agriculture and U.S. rade Repre-sentative decided to bribe Brazil with this payo.

Earlier this summer the House o Representativespassed bipartisan legislation that would cancel the near-

s I G n s o f P R o G R e s s

-

8/4/2019 Green Scissors 2011

27/28Green Scissors 2011 27

ly $150 million bribe to stop Brazil rom enorcing theWorld rade Organization ruling that U.S. cotton sub-sidies are trade distorting. Te amendment passed the

House o Representatives as part o the Agriculture, Ru-ral Development, Food and Drug Administration, andRelated Agencies Appropriations Act, but to date hasnot passed the Senate or been signed by the president.

Eliminate funding for livestock protection

program

An amendment was oered during the House Agri-culture Appropriations debate to cut a $13 million cor-porate welare program under which the ederal govern-

ment kills predators that could harm livestock. Whilethe program certainly helps some ranchers, protectinglivestock should be a private responsibility. Althoughranchers were able to deeat this amendment in theHouse o Representatives, the amendments introduc-tion shows there are still bipartisan groups o lawmakers

willing to fght to end this program. Tis cut has longbeen a Green Scissors priority. Te program should end.

Cut funding for Market Access Program

Te Market Access Program provides subsidies totrade associations and other groups to advertise and buildmarkets or American goods overseas. Tis corporate

welare is clearly a waste o taxpayer money. Te Houseo Representatives ailed to pass an amendment endingthe program in June, but the act that it was brought upor debate demonstrates an appetite to end it.

Cap agriculture subsidies

An amendment to the Agriculture Appropria-tions bill to cap the amount o arm support subsi-

dies to any one entity at $125,000 shows that somepolicymakers have a desire to go in the right direction.

Limit eligibility for commodity payments

In another stab at stopping wasteul agriculture pro-grams, the House o Representatives considered anamendment to tighten existing rules (riddled with loop-holes) that limit commodity payments to operations

with an adjusted gross income o less than $1,250,000

in on-arm and o-arm income. Under the amendmentonly arms with adjusted gross incomes o less than$250,000 will be eligible. Te amendment ailed, but it

was a sign that there is bipartisan support or reorm othis broken system.

Prohibit funds to be used for ethanol blender

pumps

Te House o Representatives overwhelmingly sup-ported an amendment to stop the Department o Ag-riculture rom providing yet another subsidy or theethanol industry or blender pumps and ethanol stor-age tanks (the industry already receives a tax credit, a

mandate or ethanol use and a protective tari ). Waste-ul subsidies to ethanol are a drain on taxpayers and alsoharm the environment; there is no reason to give the in-dustry even more handouts.

oi d g uidi tht

Members o both parties have agreed that all optionsor reining in waste need to be on the table. Although

there are disagreements on the details, lawmakers o allstripes have identifed oil and gas subsidies as a potentialtarget. Billions o dollars in savings cannot be ignored.

Tere have been signs that even subsidies as entrenchedas those or the oil and gas industry could be in danger.

Hu vt t cut diurc uidi

Te House o Representatives, which had previouslymoved to increase ood insurance subsidies and add newcoverage to the program, voted overwhelmingly to re-duce and, over time, phase out the large taxpayer sub-sidies provided to people who purchase homes in oodprone areas. While the proposal took some small stepstowards expanding the program, on balance it reducedthe subsidies provided or development in ood proneareas.

-

8/4/2019 Green Scissors 2011

28/28

Green Scissors 2011 is produced by Friends of the Earth, Public Citizen, Taxpayers for Common Sense and The Heart-land Institute to highlight and end wasteful and environmentally harmful federal spending. This diverse coalition of

environmental, taxpayer, free market and consumer groups has come together to show how the government cansave billions of tax dollars and improve our environment.

Green Scissors relies on government resources, primarily the Joint Committee on Taxation, the Government Account-ability Oce and the Oce of Management and Budget for subsidy values illustrated in the charts. For tax provisions,the newest estimates from the Joint Committee on Taxation are used where available. In most cases calculationsare based on savings over a ve-year window or over the life of the project. Due to the diculty of collecting com-

prehensive and detailed cost breakouts for many of the suggested cuts, these numbers are representations of nalsavings. This guide is meant to be the beginning of a conversation on how to identify and cut various programs andtax breaks to benet taxpayers, consumers and the environment.