Grand Bahama stays the course

Transcript of Grand Bahama stays the course

581

Ship repair work at Grand Bahama Shipyard

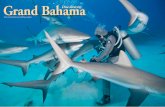

Grand Bahamastays the courseDespite the global economic meltdown, Freeportcontinues to attract large investment projects.BY STEVE COTTERILL

Of all the Bahamian islands outside of New Providence,Grand Bahama has proved to be one of the most

popular among investors. Natural attributes commonplacethroughout the archipelago–clear blue waters and beautifulbeaches–underpin massive investments in tourism, but the islandhas other features that make it uniquely desirable as a destinationfor manufacturing and industry.

A deep-water harbour, a strong telecommunications infrastructureand advanced transportation systems, along with tax incentives forbusinesses, are just a few of Grand Bahama’s attractions. As a result,industry has traditionally bolstered the island’s economy. The hub islocated in the port area of Freeport, which provides employmentand a stable stream of revenue quite apart from tourism.

During boom periods Freeport enjoyed rapid growth, withmultinational conglomerates and local entrepreneurs cashing in onfree and easy trade with the US and Europe, laying a foundation forfuture growth. But current circumstances are different, and sincethe global economic downturn began in the third quarter of 2008,

COURTESY

GRANDBAHAMASH

IPYARD

582 583

boom times have come to an end–not only in Grand Bahama butthroughout the entire island chain. Most notably, many largeconstruction projects have been halted as banks severed credit linesand financiers lost confidence.

Freeport has escaped the worst of this downturn as a cluster ofcompanies based around the harbour area offer hope for the future.Acquisitions and new developments in this area include some of thelargest investments made in The Bahamas in the 18 months leadingup to the summer of 2008.

Shipyard dry dockOne of the biggest investments was the installation of a third drydock at Grand Bahama Shipyard Ltd. This 300m-long, 54m-widesteel hull, constructed in Europe, has a lifting capacity of 50,000tonnes. It took six weeks to be transported from Le Havre to GrandBahama–at a total investment of around $60 million. “We lost one weekbecause we had to tow the dock north to avoid a hurricane,” says

Carl-Gustaf Rotkirch,chairman and chief executiveofficer at the shipyard. “But itwas still an extremelysuccessful crossing.”

With the new dock facility,Rotkirch is confident theinvestment will be recoupedin five to 10 years. “When weput together last year’sbudget, we had to reevaluateour expected revenue, as weknew 2009 would not be asgood as we had plannedbecause of the overalldownturn,” he says. Withbusiness split fairly evenlybetween commercial andcruise vessels, the shipyard issomewhat insulated from theworst of the economicdownturn. “The cruisebusiness is very stable

because the liners need to bemaintained according to a verystrict schedule, but commercialvessels–merchant and cargo ships,tankers, container ships and bulkcarriers–have been hit hard by theeconomic downturn.”

Even with the slowdown,shareholders must have beenconfident in the prospects of theshipyard and by extension the widershipping industry to plough so muchmoney into the expansion. Thethinking behind the investment isbased on long-term planning withinthe cruise industry.

“The yard is jointly owned by thecruise lines–Carnival and Royal

Grand Bahama Shipyard’s dry docks

CO

UR

TESY

GR

AN

DB

AH

AM

ASH

IPY

AR

D

Carl-Gustaf Rotkirch, chairman andCEO, Grand Bahama Shipyard

CO

UR

TESY

GR

AN

DB

AH

AM

ASH

IPY

AR

D

585584

Caribbean–and the Grand Bahama Port Authority,” says Rotkirch.“For a long time the cruise lines have been looking to develop therange of services here so that we can do full vessel conversions andmajor refurbishments. For such activities the vessels have to bedocked for a much longer time–a month or more compared to ourusual turnaround of a couple of weeks. The third dock means we donot have to disrupt our usual stream of work to do the bigger jobs.”It also means the cruise lines have guaranteed docking space fortheir planned upgrades.

All of this is good news for the local economy. During the busyJanuary to April season, the shipyard will increase its employees byabout 300–up to around 1,150. Including revenue brought to theisland through subcontractors and crew members on shore leave, itis estimated that Grand Bahama Shipyard contributes around $40million to the local economy each year. The introduction of thethird dock will boost this figure, underscoring the stakeholders’commitment to the shipyard and the island.

Bigger boats, better profitsAnother boat repair yard in the port area has made a more modestinvestment but one that the owners hope will contribute a similarboost to annual revenue. Bradford Marine Bahamas is part-waythrough a new $800,000 dock at its Grand Bahama site that willallow much larger vessels to moor. “It will definitely be a shortrecoup on investment,” says Dan Romence, general manager atBradford. “We have already had several bigger boats calling on usthat wouldn’t have been able to before, and of course having theextra dock increases our capacity.”

The boatyard offers maintenance and repair services for bothcommercial and private boats. The new dock will allow boats wellover 200 ft in length to dock for repairs or simply to moor. “Thedockage here is cheaper, and it is easier to get things done than atthe more expensive marinas,” says Romence. “It’s a working yard, sowe tend to get boats that are in their maintenance phase.”

Construction on the new dock was complete at press time, and allthe landscaping and utility installation was expected to be finished

by the end of 2009. Once up and running, Romence expects thenew facility to provide work for an additional 10 to 12 persons. “Weare also looking to expand our subcontractor base, with newbuildings where we can host specialized contractors with specifictrades–speciality electronics, custom welding, pipeline welding,among others–so that we can offer a full range of services. We arenot out to conquer the entire world, just the part that we know wecan do well.”

Black goldProbably the largestdollar investment on theisland is being made byFirst Reserve Corporation and Dutch-based oil storage operator RoyalVopak. The two industry giants acquired the Freeport-basedBahamas Oil Refining Company International Ltd (BORCO) in2008 in a deal worth a reported $900 million. The facility is thelargest oil storage terminal in the region, with a 20-million-barrelcapacity and the capability to blend, trans-ship and bunker fuel oil,crude oil and other petroleum products. The equity value of the new

CO

UR

TESY

VO

PAK

CO

UR

TESY

GR

AN

DB

AH

AM

APO

RT

AU

THO

RIT

Y

BORCO circa 1970 and todayas Vopak Terminal Bahamas

… it is estimated that Grand Bahama Shipyard contributesaround $40 million to the local economy each year.

586

The terminal is expected to become an international hub forcrude oil and petroleum products for major oil companies.

company amounts to $550 million, with an 80/20 per cent split betweenaffiliates of First Reserve Fund XI, LP and Royal Vopak, respectively.

Under the new ownership, the terminal is expected to become aninternational hub for crude oil and petroleum products for major oilcompanies and will be positioned as a best-in-class storage andtrading platform for the entire region, while providing economicdevelopment and jobs for The Bahamas.

No sooner was the deal inked than the new owners announcedtheir commitment to invest $300-$600 million in upgrading thefacilities. “We view this as a unique opportunity to transform an assetinto a profit centre of sustainable business,” says Thomas Sikorski,

managing director of UK-based First Reserve. “Wehave endeavoured todevelop an investmentplan where we mightrenovate and fix existingcapacity of the facility anddevelop an expansion planon the available accessland of additionalinvestment and storage.

Our goal is to transform the objectives of the company to a moreactive, thriving long-term business with long-term contracts withcustomers, a renewed investment in the jetties and a focus ondelivery value to those global customers.”

The first phase of this redevelopment was already underway in2009 with the demolition of the existing refinery, repairing oftankage and the planned expansion. The overhaul will increasebarrel storage capacity from 20 million to 25-30 million within thenext two to three years.

The project will also include work on the deep-water jetties andthe development of further service options. The owners areconfident the capital investment will bring profits as well as addedvalue. “Vopak will leverage its global customer portfolio to increasethe storage activities at this strategic location,” says John PaulBroeders, chairman of the Vopak executive board. “With the high

Vopak oil storage

STEV

EC

OTT

ERIL

L/©

DU

PUC

H

588

interest expressed by future clients and theintention to invest in improvements andexpansion, this terminal is expected to becomeprofitable within the first couple of years.”

Sikorski echoes this confidence and hasreaffirmed his company’s vision for the GrandBahama facility. “This significant capitalinvestment demonstrates First Reserve’s long-term commitment to the employees and willserve as a catalyst for increased developmentand production in The Bahamas.”

PharmaceuticalfuturesRight next to the Vopak facilityis PharmaChem–one of theworld’s primary producers ofactive pharmaceuticalingredients (APIs) andregistered intermediates for thedrugs used in the global fightagainst AIDS/HIV.

Since buying the Freeportplant in 1996, Pietro Stefanutti,president and founder ofPharmaChem Technologies(Grand Bahama) Ltd, hasinvested around $50 million increating a state-of-the-art planton the 62-acre site. It currentlyproduces tenofovir disoproxil

fumarate–the active ingredient in AIDS/HIV drugs Atripla®,Truvada® and Viread®.

As awareness of these drugs has increased, so has demand, withproduction at the plant multiplying tenfold over the last five years.“We currently employ 80 people full time, and we have 20-25contractors who are here full-time involved in maintenance, securityand so on,” says Randy Thompson, administrator and businessservice manager at PharmaChem. “Ninety-seven per cent of ouremployees are Bahamians.”

CO

UR

TESY

PHA

RM

AC

HEM

Production of AIDS/HIV drugs hasincreased tenfold at PharmaChem.

CO

UR

TESY

PHA

RM

AC

HEM

John Paul Broeders,chairman of the executiveboard, Vopak

CO

UR

TESY

VO

PAK

Oceanfront livingin Grand Bahama

Luxury furnished and unfurnished 2-bedroom condominiums with a fullrange of amenities including private beach with panoramic view of theAtlantic Ocean, pool with clubhouse, tennis court and an 18-slip marina.

PO Box F-44053, Jolly Roger Dr, Freeport, Grand BahamaTel: (242) 373-2673 • Fax: (242) 373-3802

E-mail: [email protected] • www.bellchannelclub.comViewing by appointment

90%SOLD

590

With an eye on further expansion, in November 2007 PharmaChemwas acquired by Groupe Novasep–a world leader in the pharmaceuticalindustry with global sales of €350 million ($486 million)–withStefanutti becoming chairman of the supervisory board. The move isdesigned to increase the plant’s visibility and open the door into newfields such as research and development and the manufacture ofother APIs.

“As a matter of priority wehave invested to keep up withdemand,” says Thompson. “Nowwe think we are ready to take itto the next level. We have thetechnical facilities, but we donot yet have the staff, which iswhy we are in the process ofassembling a research anddevelopment team. But it is aslow process because this is sucha specialized industry. We need atleast three [people with] PhDsand four or five BA chemists,both expat and Bahamian.”

Further investment is thenplanned to bring a second plantonstream. The pharmaceuticalindustry, after all, is one sectorwhere investment is constantly

GO

RD

ON

LOM

ER/©

DU

PUC

H

Pietro Stefanutti, left, president and founder, PharmaChem Technologies (Grand Bahama)Ltd, and Randy Thompson, administrator and business service manager

PharmaChem production plant

CO

UR

TESY

PHA

RM

AC

HEM

592

“The opening of Fenestration & Glass Services is especiallywelcome, as it provides much needed job growth forGrand Bahama.”

justified. “As I know from personal experience, as we age we needmore medicines,” says Stefanutti. “Our commitment is to contributeand improve the health of the world’s population.”

Windows of opportunityAnother manufacturing facility in Freeport is also attempting toprotect the world’s population, not from disease or disability but fromhurricanes–a subject very close to the hearts of Grand Bahamians whosuffered the ravages of storms Frances and Jeanne in 2004.

Fenestration & Glass Services (FGS) Ltd manufactures hurricaneimpact windows, doors and related components in its 64,000-sq-ft

warehouse andmanufacturing plant,located on a three-acresite. At the opening of thefacility last year, PrimeMinister Hubert Ingrahamcommented: “The openingof Fenestration & GlassServices is especiallywelcome, as it providesmuch needed job growthfor Grand Bahama. Thisnew enterprise is good forGrand Bahama on otherfronts as well. Firstly, itintroduces a green, energy-efficient product–insulatedwindows and doors; andsecondly, to the extentthat the products areemployed in theconstruction sector inGrand Bahama, it will

reduce cooling requirements and hence electricity usage and demandfor increased oil imports, especially during the hot summer months.”

Operations at Fenestration & Glass Services Ltd

STEV

EC

OTT

ERIL

L/©

DU

PUC

H

100 WEST MIDDLE RD, RIVIERA BEACH, FL 33404WEST PALM BEACH•TEL (561) 848-3738•FAX (561) 848-3772

MIAMI•TEL (305) [email protected]

www.easternfreight.com

• COMPLETE SHIPPING• BONDED TRUCKING• CONSOLIDATION• WAREHOUSING• RAIL SERVICE• CRATING• NVOCC TO THE BAHAMAS• LICENSED CUSTOMS BROKERS

LICENSED BY

ICC and FMC

We are computerized,facsimilized and personalized

EASTERN FREIGHTFORWARDERS

FREEPORTTRANSFER LIMITEDCOMPLETE CUSTOMS BROKERAGEAND TRUCKING SERVICES

AGENTS FOR ALL MAJOR VAN LINESAND CARRIERS WORLDWIDE

FOREST AVE & PEACH TREE ST • PO BOX F-42520, FREEPORT, GBTEL (242) 352-7821• FAX (242) 352-5263

CABLE: FREETRANEMAIL: [email protected]

LAT I

NAM

ERICAN AND CARIBB

EAN

MO

VERS ASSOCIATIO

N

•Storage and warehousing•Trans-shipment•Import and export services•Air freight agents•Household goods removals and shipping•Consolidated containerized freight service:West Palm Beach/Freeport & UK/Freeport

•Forklift rentals

594

Fenestration has beenaround for more than 25years and has manufacturingplants and distributioncentres in China, SouthAmerica, the US and Europe.Swift thinking and heavyinvestment in research anddevelopment have kept themanufacturer ahead of thefield. In 1992 this becameparticularly poignant whenMiami-Dade Countyreviewed building codesfollowing Hurricane Andrew.

“The new hurricane impactguidelines were thought upby scientists and bureaucratsand not the people whoactually have to make theglass,” says Fenestrationmanaging director and ownerPhil Popple. “The industry got two years’ notice, and at the timethere wasn’t an off-shelf product that was anywhere near passing thetest. So everyone was rushing to develop a viable product. We werethe first to invent an impact glass that complied with the new codes.Now there are other products on the market that pass the test, butat least we can say we were the first.” In fact Miami-Dade nowconsults with Fenestration on any changes it intends to make toglass-related building codes.

With such a large percentage of its trade being conducted withthe US and particularly Florida, Grand Bahama was a natural choicefor the company to position its $22 million manufacturing site.Popple also says that the favourable tax environment was a majorincentive. “We import a lot of raw materials, and a lot of it comesfrom China. With increasing tariffs in the US and Europe, it wasbecoming more and more difficult to operate there.

“A big advantage being here is the lack of tariffs or import duty.We can bring in the raw materials, process them and then takeadvantage of the trade agreements with the European Union,

Phil Popple, managing director,Fenestration & Glass Services

STEV

EC

OTT

ERIL

L/©

DU

PUC

H

“Each year so many deserving animals are

tragically put to sleep—seemingly beyond

help, seemingly beyond hope. One of them

would have been AMIGO… .”

His life has ended,but his mission lives on…

‘AMIGO’commemorativestamp basedon a painting byAlton R. Lowe

AMIGO’S FUNDwww.amigosfund.org

596

Commonwealth countries and the US and export our finishedproduct. Being here means we don’t have to worry about taxpercentages as part of our bottom line.”

Currently the facility employs around 35 people, but Popple ishoping that the market will soon regain buoyancy and theproduction line will be running full-capacity, engaging 135 workers.

“I work in seven-year cycles of feast and famine. When things gettough, it weeds out all the undesirables–the cheap traders thatflourish when supply can’t meet demand but who produce inferiorproducts at silly prices. When the economy picks up again there willonly be a few quality companies left, and we will be able to competeat the prices we need to charge to make it viable.”

With investments such as these, as well as ongoing projects suchas the continued expansion of the container port, Grand Bahama isstill proving attractive to investors. When the Hawksbill CreekAgreement was drawn up in 1955, the Grand Bahama PortAuthority set out a long-term vision for the development of the cityof Freeport. Today such a focus on longevity and sustainability is stillprevalent, and despite the current economic adversity, investors arestill basically confident in the future growth of The Bahamas’ keyindustrial hub.

Fenestration & Glass Services Ltd

STEV

EC

OTT

ERIL

L/©

DU

PUC

H