Gold Company Review Exploration, Development & Production · Underground mining grades at Morning...

Transcript of Gold Company Review Exploration, Development & Production · Underground mining grades at Morning...

Gold Company ReviewExploration, Development & ProductionMarch Quarter 2010

Resource Capital Research

Resource Capital Research

Suite 1306 183 Kent Street Sydney, NSW 2000

Tel: +612 9252 9405 Fax: +612 9251 2859 Email: [email protected]: www.rcresearch.com.au

Resource Capital Research ACN 111 622 489

Gold Company ReviewMarch Quarter 2010

Resource Analyst (Gold): Dr Tony Parry

Resource Analyst: John WilsonResource Analyst: Dr Trent Allen

This report is subject to copyright and may not be redistributed without written permission from RCR. The information contained in this report is for use by US, Canadian andAustralian residents only. Copies are available for purchasefrom RCR.

30 March 2010

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 2

Contents Contents.............................................................................................................................2 Overview and Investment Comment .......................................................................................3 RCR March Quarter 2010 Featured Company Summary .............................................................4 Comparative Charts..............................................................................................................6 Financial Data .....................................................................................................................7 Company Statistics...............................................................................................................7 Reserves, Resources and Historic Mineralisation .......................................................................8 Valuation and Performance Data ............................................................................................8 Exploration, Development and Production Companies

[A1 Minerals Limited…………………………………………….……….…………………………………………………………...] Allied Gold Limited *...................................................................................................9 [Ampella Mining Limited………………………………………………………………………………………………………………] [Azumah Resources Limited………………………………………..…………………………………………………………..…] Beacon Minerals Limited............................................................................................ 11 Catalpa Resources Limited......................................................................................... 13 Eleckra Mines Limited ............................................................................................... 15 Kingsgate Consolidated Limited * ............................................................................... 17 Morning Star Gold NL................................................................................................ 19 Nevsun Resources Limited ......................................................................................... 21 Norseman Gold Plc * ................................................................................................ 23 North Queensland Metals Limited ............................................................................... 25 [Perseus Mining Limited………………………………………………………………………………………………………………] Vantage Goldfields Limited ........................................................................................ 27 [West Wits Limited………………………………………………………………………………………………………………………] YTC Resources Limited.............................................................................................. 29

[Gold Market Fundamentals……………………………………….……………………………………………………………………………] Selected Charts and Gold Sector Statistics............................................................................. 31 Report Contributors............................................................................................................33 Disclosure and Disclaimer.................................................................................................... 34

* Indicates companies with detailed financial projections and valuation available.

[This is the Abridged Version of the March Quarter RCR Gold Company Review. The comprehensive version of the Gold Company Review which includes all company reports and a review of gold market fundamentals (58 pages) can be purchased for A$2,200. The comprehensive versions of the RCR March quarter uranium and iron ore reports can also be purchased for the same price. Contents and purchase details can be found at www.rcresearch.com.au]

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 3

Overview and Investment Comment

Gold Price outlook After a speculative surge in November and December 2009, which saw gold peak at an all time high of US$1,215.70/oz, it appears that the US dollar has returned to the ascendancy as the main driver of the gold price in the short to medium term. RCR expects the gold price to trend downwards and spend most of the remainder of 2010 in the range US$1,050/oz to US$1,100/oz. Our forecast for that period is an average price of US$1,075/oz. The spot price of gold is currently US$1,107.00/oz (March 30) which is down 9% from the December 2009 all time high. Over the past three months the gold price has firmed slightly from US$1,096.80/oz (up 0.9%), and has generally traded either side of the US$1,100/oz mark. We are moderately bearish on the outlook for gold in the medium term because we consider that the current uptrend for the US dollar could continue, particularly when taking into account the status of most of the currencies the greenback is measured against. We consider that gold’s supply-demand fundamentals also tip the balance towards further gold price weakening. Key measures of safe haven demand for gold, such as inflows into Exchange Traded Funds (ETF’s) have been weak in the last half of 2009 and actually have flipped over into net outflows in the first two months of 2010. Jewellery demand remains subdued and producer net de-hedging is likely to trend towards net hedging during 2010. Gold Equities Gold shares produced spectacular outperformance in the March quarter of 2009, at the height of the GFC, but since then have generally underperformed. In the last 12 months equity markets have recovered strongly (the Morgan Stanley World Index is up 51%), but the Australian gold index is up only 8%, the Canadian gold index is down 2% and the South African index down 23%. All have underperformed the US dollar gold price (up 21%), due to strengthening producer country currencies. Junior and emerging companies have, however, outshone their big brothers, as is evidenced by an average 159% twelve month share price rise for juniors featured in this Review.

Current * 1 month 3 month 6 month 1 year

Gold Price US$/oz na -1% 1% 12% 21%

USA S&P 500 Gold Index na 2% 6% 15% 11%Canada S&P/TSX Gold Index na -4% -5% -7% -2%Australia S&P/ASX200 Gold Index na 8% -5% 9% 8%South Africa FTSE/JSE Gold Index na 2% -6% -7% -23%FTSE Gold Index FTSE Gold Index na 2% -3% 0% 17%

World Markets (all sectors) Morgan Stanley World Index na 6% 2% 7% 51%

*Table data as at 29 March 2010 Source: Bloomberg, RCR

Gold’s all time high on 2 December 2009 was US$1,215.70/ounce. The anticipated range for the remainder of 2010 is US$1,050 to US$1,100. The last three months has seen little direction for gold. We see near term risk on the downside due to US dollar firming… …and weaker supply-demand fundamentals for gold. Over the last twelve months major gold equities have underperformed strongly recovering broader equity markets, and also the gold price, due to strengthening producer country currencies… …but the junior companies have performed strongly.

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 4

RCR March Quarter 2010 Featured Company Summary AUSTRALIACompany Code CommentA1 Minerals Limited AAM Production

A1 has joined the gold producer ranks with first pour at its low capex ~A$12m Brightstar project near Laverton(1.7moz resource). After getting through teething problems in commissioning, we expect the market to focuson potental expansion to >50kozpa within two years.

Allied Gold Limited ALD ProductionExpanding mid tier producer ALD plans to more than triple gold output from its 7.8moz Au resource by early2013, to +300kozpa. This should see both oxide and sulphide operations at Simberi (PNG) and a restart ofthe 120kozpa Gold Ridge (Solomon Is).

Ampella Mining Limited AMX Mid ExplorationAn intial 1.2moz Au resource at Konkerea (Burkina Faso) may have set the scene for a year of strong resultsfor Ampella, as it spends A$15m exploring 110km strike on the Batie West Shear. Drill results are pending atthe Tonior Prospect (surface grades to ~21.5oz Au).

Azumah Resources Limited AZM ScopingAn initial 350koz Au resource at the Julie Prospect has pushed AZM's resource inventory at the Wa GoldProject (Ghana) to 1.104moz Au. Strong newsflow is expected from a second 40,000m drilling program,ahead of a Feasibility Study in late 2010.

Beacon Minerals Limited BCN Advanced ExplorationBCN now has the funding to push ahead strongly in 2010 with drilling of targets at its Barlee Gold Project inWA. It has set an initial 0.5moz target for what looks like high grade shallow mineralisation. This could lead toa PFS for production commencing within 12 months.

Catalpa Resources Limited CAH Production & New Plant ConstructionLess than two years ago CAH was a hopeful capitalised at A$15m. Now it is about to become a ~130kozpagold producer, is in the ASX300 index, and is capitalised at >A$250m. As its Edna May mine commissions inMay, we expect further re-rating towards our A$2.07 base case valuation.

Eleckra Mines Limited EKM Advanced ExplorationEKM's Yamarna belt (WA) exploration has produced a new high grade discovery and probably more withthree major new anomalies to be drilled 2Q10. This increases our expectation of a >1moz resource (0.75mozcurrent), with improved grades, and a share valuation of ~A$0.20.

Kingsgate Consolidated Limited KCN Production, Advanced ExplorationWe are forecasting 141koz FY10 gold output (US$295/oz opex), rising to 193koz in FY12 with plantexpansion. Discoveries of major regional mineralised zones support our view that KCN is sitting in a >10mozThai Au province, which could drive KCN towards A$11/share.

Morning Star Gold NL MCO ProductionUnderground mining grades at Morning Star averaged 22.95g/t in 4Q09, well in excess of current resourcegrades and in line with historic production (~900koz at 26g/t). Milling to produce 15-25kozpa Au via gravitycould commence in Jun '10.

Norseman Gold Plc NGX Production, Advanced ExplorationNGX's credibility and profitability have suffered with recent grade and production shortfalls. However, it is still confident it can get back on track and boost production to ~110koz in FY11 (after ~65koz FY10). If so, shares look very undervalued based on our A$1.45/share NAV.

North Queensland Metals Limited NQM Production, Advanced ExplorationDividend-paying NQM is firming up strategies for additional ore to feed the under-utilised Pajingo mill (60% NQM), to boost Pajingo production by 75% to >100kozpa in 12 months. The clarity should lead to a re-rating of NQM as a growth stock - towards our A$0.47/share NAV.

Perseus Mining Limited PRU Definitive Feasibility StudyA start to construction of the Central Ashanti Gold Project (Ghana) is imminent, with environmental permitspending. Production from the 2.1moz Reserve could commence in 3Q11, with a predicted +300kozpa Aucoming from the CAGP and Tengrela (Ivory Coast).

Vantage Goldfields Limited VGO Production, Advanced ExplorationProposed market debutant VGO plans to expand two mines in South Africa’s rich Barberton goldfields from~20kozpa (CY10) to ~80kozpa (CY13) equity production. Current project resource base is 4.38moz.Proposed A$0.40/share IPO price is below our valuation range.

West Wits Mining Limited WWI Advanced ExplorationWWI will outsource initial ore treatment to neighbour Mintails, aiming for shared ~20kozpa gold production in4Q10 from near-surface deposits on the Witwatersrand Basin. Cash flow will fund exploration for >4moz Auand >15mlb U reef targets.

YTC Resources Limited YTC Pre-Feasibility StudyYTC is on track to start gold and base metal production in early 2011 from the Hera Project (NSW). Aresource upgrade and DFS are expected in April 2010. A near-term value driver could be exploration drillingbetween Hera and the historic Nymagee Copper Mine.

Company Summary

CANADACompany Code Comment

Nevsun Resources Limited NSU ConstructionMining at the US$260m Bisha gold and base metal project, Eritrea, could start in late 2010. Forecast goldproduction is an impressive 900koz Au before year 3, costing US$230/oz including credits. Estimated projectNPV is US$5.11/share at current metal prices.

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 5

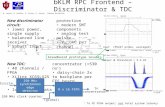

Explorers’ Development Cycle: Conceptual market capitalisation versus development stage; March Q 2010

Exploration DiscoveryResource expansion; Economic assessment

Project approvals; Funding Construction Commis'g

High risk/ High return

Declining exploration risk

AUS ATN BCN CHZ SAU SGZ

CAN

AUSAMX

AVQ TGX TMX YTC

CAN

AUSKGL MLI

NAV RRL RED

CAN

AUSALD AVO

BCD CTO KCN HEG MLI

MUN MCO NGX NQM

Production

AUS ADU AGD ALK AND AZM CHN CRC EKM GDR KALKOR IGR PRU YTC

AUS CAH KRM WWI

CAN ATW NSU

Share Price

CAN SAC XRC FRG

CAN FIU IAU UME

AUSAAM

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 6

Comparative Charts

Percentage share price rise in last 12 months(as at 30 March 2010)

Note: Vantage Goldfields is not yet listed and Norseman Gold data is from listing on the ASX in June 2009.

-100

0

100

200

300

400

500

600

Allied Gold Limited

North QueenslandMetals Limited

West Wits MiningLimited

YTC Resources Limited

A1 Minerals Limited

Norseman Gold Plc

Catalpa ResourcesLimited

KingsgateConsolidated Limited

Nevsun ResourcesLimited

Morning Star Gold NL

Perseus Mining Limited

Azumah ResourcesLimited

Eleckra Mines Limited

Beacon MineralsLimited

Ampella Mining Limited

Vantage GoldfieldsLimited

Percentage Share Price Movement

Exploration Budget FY2009 and FY2010(local currency - A$m or C$m)

0 10 20 30 40 50

Vantage Goldfields Limited

Morning Star Gold NL

Eleckra Mines Limited

A1 Minerals Limited

Azumah Resources Limited

Beacon Minerals Limited

North Queensland Metals Limited

YTC Resources Limited

West Wits Mining Limited

Ampella Mining Limited

Catalpa Resources Limited

Allied Gold Limited

Norseman Gold Plc

Perseus Mining Limited

Kingsgate Consolidated Limited

Exploration Budget A$m and C$m

FY2009

FY2010

The average share price rise in the last 12 months for the 15 listed companies

covered is 159%, compared to +8% for the Australian Gold Index, -2% for the Canadian Gold Index, and +21% for US

dollar gold price.

Exploration budgets vary widely. Current or imminent emerging

producers such as Vantage, Morning Star and A1 have more of a production

focus.

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 7

Financial Data

COMPANY Aust

Can

ada

USA

Euro

pe

othe

r

List

ed

optio

ns

Share Price (LC$/share)3

2 FullyDiluted

MarketCap Book Enterprise

ExchangesCode Status1 Yr End 52 week Current Shares Opt+W2 Other2 Shares (undiluted) Cash Debt Value Value30 March 2010 Hi Low (m) (m) (m) (m) (LC$m)3 (LC$m)3 (LC$m)3 (LC$m)3 (LC$m)3

AUSTRALIA (A$)

A1 Minerals Limited AAM P June ASX No 0.42 0.11 0.24 197 17 0 214 47 2.5 0.0 28 47 Allied Gold Limited ALD P June ASX TSX AIM No 0.55 0.25 0.33 1036 77 0 1113 342 155.7 0.0 319 342 Ampella Mining Limited AMX E June ASX AMXO 1.39 0.17 1.23 163 28 0 191 201 17.8 0.0 23 201 Azumah Resources Limited AZM E June ASX No 0.39 0.09 0.37 177 16 0 193 65 8.0 0.0 10 65 Beacon Minerals Limited BCN E June ASX BCNO, BCNOA 0.04 0.00 0.03 735 314 0 1048 21 4.6 0.0 7 21 Catalpa Resources Limited CAH I June ASX CAHO 1.96 0.76 1.51 161 15 0 214 242 25.4 65.0 -12 307 Eleckra Mines Limited EKM E June ASX EKMO 0.21 0.02 0.09 196 76 0 272 18 2.7 0.0 8 18 Kingsgate Consolidated Limited KCN P June ASX No 10.30 4.93 8.63 98 5 0 102 845 35.2 0.0 275 845 Morning Star Gold NL MCO I June ASX MCOOB 0.49 0.11 0.33 173 79 0 252 56 2.5 0.0 5 56 Norseman Gold Plc NGX P June ASX AIM No 1.35 0.45 0.79 173 4 0 176 136 16.2 2.0 74 138 North Queensland Metals Limited NQM P June ASX No 0.36 0.20 0.24 199 1 0 200 48 11.2 0.0 49 48 Perseus Mining Limited PRU I June ASX TSX FRNK No 2.14 0.63 1.99 345 10 0 355 684 159.4 94.4 179 778 Vantage Goldfields Limited VGO P Dec ASX * No na na 0.40 224 36 0 260 89 11.0 0.0 27 89 West Wits Mining Limited WWI I June ASX No 0.15 0.07 0.09 122 19 0 141 11 4.1 0.0 27 11 YTC Resources Limited YTC E June ASX No 0.35 0.10 0.21 164 5 0 169 34 10.5 0.0 30 34

* VGO ASX listing subject to IPO

Total: Australia 466.9 161.5 1049 3002

CANADA (C$)

Nevsun Resources Limited NSU E Dec TSX AMEX No 3.66 1.17 3.10 193 8 0 200 597 117.9 20.0 238 617

Total: Canada 117.9 20.0 238 617

Total: Global (US$)4 535 165 1175 3300

(1) P: Producer; E: Explorer; I: Imminent - includes companies with bankable feasibility studies and likely to be in production within 3 years; IHC: Investment Holding Company(2) Fully Diluted (shares, options + warrants (opt. + w), convertible notes (Conv. N), other obligations)(3) L.C. - Local Currency unit (4) AUD/USD: 0.90; CAN/USD: 0.97

Exchanges

Company Statistics

COMPANY

(A) Exploration (L.C.$m)7 (B) Corporate (L.C.$m)7Drilling ('000 m)Code Land (A)/(A+B) %30 March 2010 ('000 ha)6 Dec-09 Mar-10 2009 2010 Dec-09 Mar-10 2009 2010 Dec-09 Mar-10 2009 2010 Mar-10 2009 2010

AUSTRALIA (A$)

A1 Minerals Limited AAM 15 3.5 3.5 17.0 11.5 0.6 0.8 1.7 2.5 0.4 0.4 0.7 1.4 69.6 69.7 63.6Allied Gold Limited ALD 40 5.0 5.0 20.0 20.0 0.7 1.0 7.9 4.7 1.2 1.2 7.5 4.8 45.5 51.1 49.3Ampella Mining Limited AMX 225 5.0 5.0 9.8 20.0 1.5 1.0 3.7 5.5 0.3 0.3 0.9 1.1 80.0 81.1 82.8Azumah Resources Limited AZM 345 8.0 6.0 10.0 28.0 0.7 0.6 2.0 2.2 0.3 0.3 0.7 1.1 70.6 73.4 66.3Beacon Minerals Limited BCN 30 7.5 12.0 7.9 29.7 0.4 1.2 1.7 3.2 0.3 0.3 1.2 1.0 82.8 58.9 75.3Catalpa Resources Limited CAH 88 7.0 8.0 16.0 31.0 1.7 1.0 5.4 4.3 2.7 1.0 2.7 4.9 50.0 66.7 46.8Eleckra Mines Limited EKM 450 3.5 2.0 18.5 22.0 0.7 0.5 1.1 2.2 0.2 0.3 0.7 1.0 64.3 60.7 68.6Kingsgate Consolidated Limited KCN 130 57.0 52.0 216.0 223.0 4.0 4.0 30.4 16.0 2.0 2.0 8.5 9.7 66.7 78.2 62.3Morning Star Gold NL MCO 24 0.5 0.5 2.4 2.0 0.5 0.2 1.6 1.4 0.3 0.3 0.8 1.0 44.4 66.0 58.4Norseman Gold Plc NGX 161 5.0 5.0 20.0 20.0 2.2 1.5 6.8 6.7 0.8 0.8 2.7 3.2 65.2 71.6 67.7North Queensland Metals Limited NQM 151 5.0 5.0 13.1 20.0 0.8 1.0 2.3 3.4 0.8 0.8 3.3 3.0 57.1 41.5 53.0Perseus Mining Limited PRU 347 10.0 10.0 56.4 49.7 6.0 4.0 22.2 17.4 0.5 0.5 2.0 2.2 88.9 91.6 89.0Vantage Goldfields Limited VGO 16 3.5 3.5 15.5 14.0 0.3 0.3 1.0 1.0 0.2 0.3 0.7 1.8 45.5 57.8 35.7West Wits Mining Limited WWI 10 0.0 1.0 16.2 2.5 0.3 0.8 5.6 2.4 0.4 0.4 1.3 1.5 69.6 81.3 62.0YTC Resources Limited YTC 185 10.0 10.0 14.0 40.0 3.1 1.1 1.1 4.7 0.3 0.3 1.4 1.2 81.5 45.3 80.1

Total: Australia 130.5 128.5 452.8 533.4 23.5 18.9 94.6 77.6

CANADA (C$)

Nevsun Resources Limited NSU 13 0.0 2.2 6.6 0.0 0.1 0.1 0.6 0.8 2.1 1.0 4.9 4.0 12.5 10.4 16.7

Total: Canada 0.0 2.2 6.6 0.0 0.1 0.1 0.6 0.8

Total: Global (US$)4 21 17 85 70

(6) To convert hectares to acres, multiply by 2.47; eg 100 thousand hectares ('000 ha) = 247 thousand acres ('000 ac)(7) L.C. - Local Currency unit

(A) Exploration (L.C.$m)7 (B) Corporate (L.C.$m)7Drilling ('000 m)

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 8

Reserves, Resources and Historic Mineralisation COMPANY

Code Status1 Silver Other Silver Other Silver Other30 March 2010 koz t moz koz t moz koz t moz moz t

AUSTRALIA

A1 Minerals Limited AAM P 150 4.7 1,736 54.0 0 0.0 1,736 54.0 Allied Gold Limited ALD P 1,988 61.8 7,805 242.8 10.2 0 0.0 7,805 242.8 Ampella Mining Limited AMX E 0 0.0 1,194 37.1 0 0.0 1,194 37.1 Azumah Resources Limited AZM E 0 0.0 1,104 34.4 0 0.0 1,104 34.4 Beacon Minerals Limited BCN E 0 0.0 59 1.8 0 0.0 59 1.8 Catalpa Resources Limited CAH I 1,023 31.8 1,908 59.4 0 0.0 1,908 59.4 Eleckra Mines Limited EKM E 0 0.0 749 23.3 6.2mlb U3O8 0 0.0 749 23.3 Kingsgate Consolidated Limited KCN P 1,470 45.7 3,100 96.4 24.10 0 0.0 3,100 96.4 Morning Star Gold NL MCO I 0 0.0 910 28.3 0 0.0 910 28.3 Norseman Gold Plc NGX P 400 12.4 3,700 115.1 0 0.0 3,700 115.1 North Queensland Metals Limited NQM P 57 1.8 60kt cu-equiv. 448 13.9 0 0.0 448 13.9 Perseus Mining Limited PRU I 1,890 58.8 6,270 195.0 0 0.0 6,270 195.0 Vantage Goldfields Limited VGO P 407 12.7 3,465 107.8 0 0.0 3,465 107.8 West Wits Mining Limited WWI I 59 1.8 353 11.0 0 0.0 353 11.0 YTC Resources Limited YTC E 0 0.0 283 8.8 49.2mlb Sn 0 0.0 283 8.8

Average: Australia

CANADA

Nevsun Resources Limited NSU E 1,295 40.3 280ktCu,700ktZn 1,866 58.1 0 0.0 280KtCu,700ktZn 1,866 58.1

Total/Total Average 8,739 271.8 34,952 1,087.1 34.3 0 0.0 34,952 1087.1

(1) P: Producer; E: Explorer; I: Imminent - includes companies with bankable feasibility studies and likely to be in production within 2 years; IHC: Investment Holding Company(2) Reserves, resources and mineralised material published by the relevant company. The applicable mineral resource codes are by country: Australian: JORC, Canadian: NI 43-101, South Africa: SAMREC

* Mineral resource estimates are inclusive of the mineral reserve.

(All Au Mineralisation)

Total Gold (Au)

Gold (Au) Gold (Au) Gold (Au)

Reserves (Equity)2 Resources (Equity)2 Historical/Mineralised Material (Equity)2

Valuation and Performance Data COMPANY EV-Cash EV-Cash EV-Cash

Code P/Book P/Net Cash /Reserves /Res'v+resources /Total Au30 March 2010 (x) (x) US$/unit US$/unit US$/unit 1 month 3 month 6 month 12 month Hi Lo

AUSTRALIA

A1 Minerals Limited AAM 1.7 18.8 268.2 23.2 23.2 -23 -38 23 45 43 118Allied Gold Limited ALD 1.1 2.2 84.3 21.5 21.5 18 2 -29 -25 40 32Ampella Mining Limited AMX 8.9 11.3 na 137.8 137.8 34 98 124 547 12 645Azumah Resources Limited AZM 6.8 8.2 na 46.9 46.9 64 42 155 236 5 316Beacon Minerals Limited BCN 2.9 4.5 na 242.8 242.8 0 33 22 387 20 600Catalpa Resources Limited CAH -21.0 -6.1 247.7 132.8 132.8 13 10 -5 71 23 98Eleckra Mines Limited EKM 2.3 6.8 na 18.9 18.9 11 -10 38 321 55 327Kingsgate Consolidated Limited KCN 3.1 24.0 495.9 235.2 235.2 0 -1 8 72 16 75Morning Star Gold NL MCO 11.7 22.2 na 53.2 53.2 -3 -24 3 183 34 195Norseman Gold Plc NGX 1.8 9.6 274.7 29.7 29.7 -4 -18 -2 na 41 76North Queensland Metals Limited NQM 1.0 4.3 573.9 73.3 73.3 7 -14 -2 1 33 20Perseus Mining Limited PRU 3.8 10.5 294.7 88.8 88.8 13 14 63 206 7 216Vantage Goldfields Limited VGO 3.3 8.1 173.3 20.4 20.4 na na na na na naWest Wits Mining Limited WWI 0.4 2.7 105.0 17.6 17.6 0 -14 -25 20 38 38YTC Resources Limited YTC 1.1 3.3 na 76.3 76.3 2 -13 -2 40 40 110

Average: Australia 279.7 81.2 81.2

CANADA

Nevsun Resources Limited NSU 2.5 6.1 373.8 240.6 240.6 24 28 38 125 15 165

Average: Canada 373.8 240.6 240.6

Total/Total Average 289.1 91.2 91.2 10 6 27 159 28 202

(%)

Share Price Performance Current Share Price

% off 12 month

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 9

Allied Gold Limited *

0.55

Debt (A$m) -Mar 10FEnterprise value (A$m)

Avg monthly volume (m)Cash (A$m) - Mar 10FPrice/Cash (x) Drilling - RAB (m)Price/Book (x) Listed company options: Land holding ('000 ha)

$11M exploration budget for 2008.

Experienced board and management.

Resources (includes proven and probable reserves)

Mineralised Material (est., non compliant with JORC)* Note: contained silver is 10.17moz grading 2.77g/t

Contacts DirectorsMr Mark CarusoChairman, CEO S HarveyTel: 61 (7) 32525911 M HouseMilton, QLD, Australia A Lowrie

G SteemsonF Terranova

0.0%

27,000

2.23

0

28

Exploration and Evaluation (A$m)

Feasibility

5,690177.0

35,000

24.32.4

EqtyMt

35.6na

nonenone

1.191.8219.6

na

Porphyry

(JORC)Au

156.6100%100%

41.6

Big Tabar Island100%Tatau Island Au, Ag100% Ag,Pb,Zn

100%Simberi 100%

Simberi 100%Project

Gold RidgeAu, Ag

Gold Ridge Meas+ind+inf

100%

M Caruso (Chair, CEO)

Total

0.0%

08

www.alliedgold.com.au

0.07,805

37.87,805194.4

0.0

0

Project

OptionOwnership/

0

Simberi

Meas+ind+inf

Total

Simberi*

Au, Ag

Probable

Convertible notes (m) 0

Key Projects

Metal

Dividends (A¢/share)

Reserves

Drilling - RC/Diamond (m)40

5

0.0%-26.1P/CF (x)

EV/EBITDA (x)Yield (%)

013.5

013.6 3.8

Gold Ridge

c/off

22.0

17.43

Proven, probable 100%100%

Au

28

13

Equity

20,000

Ore

020,000

Company Comment

Code for reporting mineral resources - Australian:ClassificationGold

34.115.7

Reserves and Resources/Mineralised Material

40

0.0%

88.29

8

2.48.9

7.01.0-1.4-2.4

-9.5

-13.7

EPS (norm) (A¢/share)Net Profit (norm) (A$m) -8.2

CFPS (A¢/share) -1.20

PER (x)

57.45

-22.74.4

0

-68.700.0%

Exchanges: ASX:ALD, TSX:ALD, AIM:AGLD

Capital Profile

52 week range (A$/share)Share price (A$)

to0.330.25

ALD.AUGold, SilverPapua New Guinea, Solomon Islands, MexicoProduction

30 March 2010

1036Options and warrants (m) 77

1113Fully diluted^ (m)

Number of shares (m)

0.0Market capitalisation (undiluted) (A$m)

336.7

336.7

Location

Major shareholders: M&G Investments (19.4%),

Rapidly growing, recently established mid-tier goldproducer and explorer, focused on 100% owned projects inPNG and the Solomon Islands.

Combined reserves of 2moz Au, resources of 7.8moz Augrading 1.25g/t, with potential for expansion

Simberi Gold Project (PNG): forecast open cut production70koz-80koz Au in 2010 from surface oxide, opexA$810/oz with near-term target A$560/oz.

Growth strategy is to develop Simberi oxide expansion andsulphide project, and re-open Gold Ridge Project (SolomonIs): potential 320kozpa Au production by 2013.

Cash Mar 10F of A$155.7m after 4Q09 lisings on TSX andAIM; can progress near-term development strategy withoutfurther finance; debt free and unhedged.

NAV at conservative long-term US$850/oz Au isA$0.78/share, strong upside from current A$0.33/share.

13

2.2

Investment Points

1.1No

Baker Steel (10.7%), RCF (5.1%)

155.7

CILPNGProduction

PNGPNG

Solomon Is.nana

nonena

PorphyryAnalyst: Dr Trent AllenEpitherm Mid Expl

ProcessRoute

1.25

[email protected] Mexico

Early ExplnoneMapimi

A$ 0.33

10.4

2011F

34.8

Expanding mid tier producer ALD plans to more than triple gold outputfrom its 7.8moz Au resource by early 2013, to +300kozpa. This shouldsee both oxide and sulphide operations at Simberi (PNG) and a restartof the 120kozpa Gold Ridge (Solomon Is).

Allied Gold Limited

103.4

JVPartner Type

Au, Ag

PorphyrynoneAu

Target

Porphyry

PorphyryPNG

noneCIL

0.50.51.74 2,115

5,6902,11565.8

1,98861.8

1.13

0

1,988

843g/t t

843

Au

26.2g/t

8.7

Early ExplMid Expl

ProjectStatus

0.0

1,145

30,000

koz

40

2012FYEAR END: June

-6.7231.8

EBIT (A$m)72.6Equity Production (koz) 62.9

7.4

32.9-8.2 134.8

2.1

Production and Financial Forecasts

2009a 2010F2008a

242.7

94.4

3.6

koz

1,145

ALD - Allied Gold Limited

0.20

0.25

0.30

0.35

0.40

0.45

0.50

0.55

0.60

Mar

-09

May

-09

Jun-

09

Jul-0

9

Aug

-09

Sep

-09

Oct

-09

Nov

-09

Jan-

10

Feb-

10

Mar

-10

Shar

e Pr

ice

($/S

hare

)

Source: Bloomberg

Introduction: ALD listed on the ASX in Dec ’03 and the TSX and AIM in Nov ‘09. It is focused on goldproduction and exploration in Papua New Guinea and the Solomon Islands. Gold production: Allied owns the Simberi Gold Mine (PNG) in the Tabar Islands, 60km from LihirIsland. The 275km2 project area was acquired in 2003 and gold was poured in Feb ‘08. The currentmining reserve is 843koz Au grading 1.19g/t, included in a resource of 5.69moz Au (Mar ’10). Expectedproduction in CY2010 is 75-80koz Au. In 4Q09, output was 17.7koz Au (up 24% on 3Q09), at a headgrade of 1.26g/t Au. Open cut mining was 653.2kt (up 23%) for 482.9kt processed, sustaining a 2mtpa-2.2mtpa nameplate capacity at the CIL plant, which recovered 88.5% Au. A debottlenecking operation isin progress that should increase capacity to 2.2mtpa-2.4mtpa by 2H10. Operating cost in 4Q09 wasA$810/oz (down 11% on 3Q09) including mining A$171/oz and processing A$402/oz. Fixed costs are40% of current total, i.e. opportunities for economies of scale. Target cash costs are <US$450/oz.Forecast output in 1Q10 is 14.5koz Au after heavy rainfall and a local landowner protest (now mediated).Expansion plans: An A$30-35m expansion of the Simberi oxide operation (incl. 2.5MW SAG mill andadded CIL tank) is planned for 2H10, increasing throughput capacity to 3mtpa for Au production of100kozpa. There is potential to mine sulphide ore, initially from Pigiput Deposit, which has sulphideresources of 2.36moz Au – a Pre Feasibility Study for a 100kozpa Au, +US$100m expansion isexpected in mid-2010. With sulphide mining in early 2013, Simberi production could be 200kozpa Au. Gold Ridge Project (Solomon Islands): This 130km2 project was gained by a C$145m takeover ofAustralian Solomons Gold (TSX:SGA) in late 2009. It produced 210koz Au in 1998-99 but closed in 2000due to (then) political unrest. ALD has greenlit a restart in early 2011 at a cost of ~US$110m. Productionof 120kozpa Au at opex US$511/oz (LOM) from the 1.15moz Au mining reserve is expected in FY2012. Exploration: Near-mine drilling has proved successful: for example, M&I resources at Pigiput andPigibo deposits (Simberi) increased by 170% in Mar ‘10. Exploration of the adjacent Big Tabar andTatau islands by former JV partner Barrick (spend +A$10m) identified Cu-Au porphyry targets. As part ofits expansion, ALD will buy out the JV for A$5.5m. Gold Ridge exploration should commence in 2Q10. Investment comment: ALD already has a track record of successful production at Simberi. Productionslowdowns in late 4Q09 and bottlenecks at the plant are being remediated but the share price is yet tofully recover, providing a good opportunity for investors that understand the potential of ALD’s expansionplans. At a long term gold price of US$850/oz, Allied Gold’s NAV (5% disc) with an expanded 100kozpaSimberi oxide operation is A$85m or A$0.22/share; however, with Simberi sulphide and Gold Ridge(less 30% for pre-production) adding +200-220kozpa Au, NAV is A$711m or A$0.78/share (fully diluted).

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 10

Allied Gold Limited (ASX:ALD): financial forecasts and valuation

A SSUM P T ION S 2008a 2009a 2010F 2011F 2012F F IN A N C IA L R A T IOS 2008a 2009a 2010F 2011F 2012FA$/US$ 0.90 0 .74 0.73 0.76 0.78Gold Price (US$/oz) 834 8 8 6 1,010 912 899 Net debt/equity (%) 4% - 4 % -44% -37% -31%Gold Price Realised (US$/oz) 132 797 1,061 1,005 977 Net debt/ net debt + equity (%) 4% - 5% -77% -58% -46%

Current rat io (x) 0.3 5.0 22.1 11.7 7.6EBIT/ interest (x) -22 na 26 15686 60786

EQUIT Y P R OD UC T ION Debt/operat ing cashf low (%) na 2 8 % 1% 0% 0%Simberi/Gold Ridge Product ion (koz) 33 73 63 103 232 Explorat ion/total overhead (%) 0% 0% 0% 0% 0%

EV/EBITDA (x) -68.7 57.5 17.4 8.3 2.2ALD Equity Product ion Gold (koz) 33 73 63 103 232 M arket cap/net cash (x) -25.7 2 3 .2 2.3 2.7 3.2Cash Costs (US$/oz)** 271 4 9 0 710 624 435 M arket cap/book (x) 3.3 1.3 1.1 1.0 0.7 ** Cash Cost is direct operat ing cost before royalt ies and by product credits

P R OF IT A N D LOSS (A $ m) F IN A N C IA L SEN SIT IVIT IESRevenues 5 79 76 125 285Operat ing costs (direct) -10 - 59 -51 -77 -126 % Change in EPS for a 10% increase in:Depreciat ion/amort izat ion -2 - 14 -9 -6 -16Explorat ion Expensed 0 0 0 0 0 AUD/USD -42% -58% -33%Corporate -4 - 8 -5 -5 -5 Gold Price 46% 60% 43%Other (incl. Royalt ies) 4 - 6 -2 -2 -2EB IT - 7 - 8 10 3 5 13 5Interest 0 0 0 0 0 % Change in NPV for a 10% increase in forecast minelifeOp erat ing p ro f it / lo ss - 10 - 8 10 3 5 13 5 commodity assumptions for:Tax 0 0 -3 -10 -40 B ase + 10 %M inorit ies 0 0 0 0 0 A $/ share A $/ share %N et p ro f it / lo ss - 10 - 8 7 2 4 9 4 Gold Price US$850/oz 0.78 0.83 6%Net abnormals/extaordinaries 0 0 0 0 0Net prof it / loss (reported) -10 - 8 7 24 94

B A LA N C E SH EET (A $ m) VA LUA T ION (A $ m) Q1 10 C ash and d ep o sit s 0 2 1 14 7 12 4 10 6Total current assets 10 16 9 161 156 163 A ssump t io ns B ase " W hat if " PP&E 13 0 12 9 14 4 19 0 3 0 3 Long Term Gold Price :US$/oz 8 50 1,100Total non-current assets 145 14 1 156 202 315 Long Term AUUS 0 .8 0 0.91Total assets 155 3 0 9 317 358 478 Pro ject sTotal current liabilit ies 30 3 3 7 13 22 Simberi Oxide 100% NPV@5% A$21/oz 8 5 117 Reclamation reserves 0 0 0 0 0 Based on reserves only Lo ng t erm d eb t 3 4 - 2 - 2 - 2 Exp ansio ns, new minesTotal non-current liabilit ies 24 13 1 1 1 Simberi Sulphide 100% NPV@5% A$53/oz 4 15 480Total liabilit ies 55 4 6 8 14 22 Gold Ridge 100% 2 11 272Eq uit y 10 1 2 6 3 3 0 9 3 4 4 4 55

T o t al d eb t 13 6 0 0 0 A sset sNet debt 13 -15 -147 -124 -106 Cash and deposits (1Q10) 156 156Average shares (fully diluted) (m) 394 4 75 935 1117 1117 Rehabilitat ion Fund 0 0

Other 0 0F LOW OF F UN D S (A $ m) Liab il i t iesEB IT D A - 5 6 19 4 1 151 Debt 0 0Cash f low from operat ing act ivit ies Corporate - 3 1 -31 Operat ing surplus -5 11 25 47 157 Reclaimat ion Reserve 0 0 Corporate -4 - 8 -5 -5 -5 N et A sset s 8 3 5 9 9 4 Net borrowing cost -2 - 1 -2 -3 -1 Net tax paid 0 - 4 -3 -3 -24 Fully Diluted Shares (m) 1117 1117 Net explorat ion paid -13 - 8 -5 -8 -8 N et asset s/ share ( A $/ share) 0 .78 0 .9 2 Other non cash items 24 3 1 -7 0 -7N et cash f ro m o p erat ing act ivit ies 0 2 2 3 2 8 112Cash f low from invest ing act ivit ies Valuat ion/Reserve oz :US$/oz 3 3 6 455 Capital expenditure -91 - 3 4 -10 -33 -121 Valuat ion/Reserve & Resource oz :US$/oz 8 6 116 Asset Sales & Other 38 10 -15 -18 -8N et cash f ro m invest ing act ivit ies - 53 - 2 4 - 2 4 - 51 - 12 9Cash f low from f inancing act ivit ies Net proceeds from issue of shares 27 0 0 0 0 Dividends paid 0 0 0 0 0 Net proceeds from borrowings 14 2 3 17 0 0N et cash f ro m f inancing act ivit ies 4 1 2 3 17 0 0Net change in cash -12 2 0 -4 -23 -18

P R OD UC T ION ST A T IST IC SSimb eri/ Go ld R id g e 10 0 %Ore Treated (mt) 417 1,654 1,932 2,936 5,852 Head Grade (g/ t) 2.51 1.64 1.15 1.23 1.43Recovery (%) 98 83 88 89 86Recovered grade (g/ t) 2.46 1.36 1.01 1.10 1.23Gold Produced (koz) 33 73 63 103 232Eq uit y Pro d uct io n ( ko z) 3 3 73 6 3 10 3 2 3 2C ash C o st s ( U S$/ o z) 510 6 51 8 0 3 74 4 54 6Product ion Costs (A$/t) 44.91 38.79 36.02 34.39 27.89 EB IT ( A $m) 4 .7 2 1.3 2 1.3 3 4 .3 12 5.4

Location, location ...The Pacif ic Rim is prospective for w orld class gold deposits. ALD's Simberi Mine is in the Tabar Islands, 60km W of the 40moz Au Lihir resource. Many deposits, including Simberi and Gold Ridge lie on major crustal structures.

Year YearYEAR END: June

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 11

Beacon Minerals Limited

0.04

Debt (A$m) - Mar 10FEnterprise value (A$m)

Avg monthly volume (m)Cash (A$m) - Mar 10FPrice/Cash (x) Cash (A$m)Price/Book (x) Listed Company options: Net asset backing (Ac/share)

*Gold prospective tenements, held and under application.

Reserves

ResourcesInferredInferred

Total

Contacts DirectorsMr Darryl Harris(Managing Director)Tel: 61 (0) 8 9476 9200West Perth, WA, Australia

Project

0.0

10.051.28.0

Funding from JV partners (A$m)

1.0

0

1.74 4.003.150.27

Tenement costs ($k per year) -

1.0

Corporate (A$m)

Cash backing (Ac/share) 0.8

0.40Exploration and evaluation (A$m)

A$ 0.03

#NAME?

Production and Financial Forecasts

2011FMar-10F 2009aDec-09a 2010Fto

30 March 2010

BCN.AUGoldAustralia (WA)

Beacon Minerals Limited

BCN now has the funding to push ahead strongly in 2010 with drilling oftargets at its Barlee Gold Project in WA. It has set an initial 0.5moztarget for what looks like high grade shallow mineralisation. This couldlead to a PFS for production commencing within 12 months.

0 0

1.041.2259

2,275

-

0

0.3732.7

0.00

30 30

5,600

Advanced ExplorationExchanges: ASX:BCN

Capital ProfileShare price (A$)

Market capitalisation (undiluted) (A$m)

Major shareholders: Geocrystal Ltd (2.7%), Forty Traders Ltd.(2.0%),

20.6

Convertible notes (m)1048.1

0.0Options and warrants (m)

0.030.0052 week range (A$/share)

Number of shares (m) 734.6313.5

731.4

Drilling - Other/Diamond (m)Land holding ('000 ha) *

Drilling - RAB (m)Shares on issue (pr end) (m shares)

3,5403,951

83Exploration/(Expl.+ Corporate) (%) 60Funding duration at current burn (years)

Capital raisings (A$m)

30

0.0

30

8,000

Ownit Brisbane Service Co pty Ltd (0.8%).

961.7732.7

0.0

t

18,406

koz

11,326

Company Comment

0.9

328

Fully diluted (m)

20.6

ProcessTarget

0.10.8

30- -

357.0

1.69

0.5

BCN's total focus is gold exploration in WA. Explorationbudget accelerating to ~A$4mpa (A$1.7m FY09).

Barlee project (~300km2) - strategic positioning in under-explored greenstone belt N of Southern Cross.

BCN sees production potential from a number of satellitedeposits to reach an initial 0.5moz resource target .

Other mines in this belt include Davyhurst, Copperheadand Youanmi.

Drilling to date indicates attractive characteristics -relatively shallow, high grade oxide ore.

Initial JORC Resource [email protected]/t Halley's E & Phil.

BCN can now fund a more aggressive drilling campaignafter capital raising 4Q09.

50,000m drilling planned for CY2010 ( ~20,000m CY09).

85

4.6

75

-

4,000

1.200.251.20

Gold Au Eq

4.5

Investment Points

2.9BCNO, BCNOA

P Lloyd (Non Exec Chair) Ownership/

Code for reporting mineral resources - Australian:

0.384

100%100%/80% none

OptionAu

none

JV

Mineralised Material (est., non compliant with JORC)

Metal PartnerBarlee Gold Project

AuClassification Project Cut Offg/t g/t

porphyryRoute

intrusives na

6.0

Typena

Early Expl.

0.9-0.1

Cu,Au,Ag

4.6

Reserves and Resources/Mineralised Material

Key Projects

59.2

AuMt

0.10.6 0.3

Mid. Expl. Aus (WA)

02.29

3.4

(JORC)

EquityOre Au

Analyst: Dr Tony Parry

www.beaconminerals.com

M Egan (Non-Exec Dir)D Harris (MD) Project

Greenvale

Status

0.0

0.0

2.00.3

64.0

Location

Aus (QLD)

2.66.70 0.50

koz

0.0

0.6

40,50018,000

0.0

74.0

1.0

8.128.04

0.2990.09

Barlee - Halleys EastBarlee - Phil

80%80%

6.70 0.503.70 0.50

BCN - Beacon Minerals Limited

0.00

0.01

0.01

0.02

0.02

0.03

0.03

0.04

0.04

Mar

-09

May

-09

Jun-

09

Jul-0

9

Aug

-09

Sep

-09

Oct

-09

Nov

-09

Dec

-09

Feb-

10

Mar

-10

Shar

e Pr

ice

($/S

hare

)

Source: Bloomberg

Overview: Beacon listed on the ASX in October 2006. During 2009 it divested various non core assets including most of its early stage exploration ground in Queensland (precious and base metals) and its interests in various mineral projects in Kyrgyzstan. It is now effectively a single project company, totally focused on its Barlee gold prospect in WA. Barlee Gold Project (80%/100%): This project is in the North Yilgarn greenstone belt, located in the Archean Southern Cross Province, 200km north of the town of Southern Cross, which itself is approximately midway between Perth and the major mining centre of Kalgoorlie. BCN was attracted to this region for three reasons. Firstly, it is relatively un-explored, with only ~10km2 of the total >300km2

having had any drilling (including BCN’s drilling). Secondly, the historical drilling was relatively shallow with only ~5% of all historical holes drilled to >100m. Thirdly, the Barlee prospect is strategically located in the greenstone belt north of Southern Cross surrounded by significant previous operations including Copperhead (1.2moz extracted), Davyhurst (0.8moz extracted) and Youanmi (0.4moz extracted). BCN holds interests in 3 contiguous exploration licences with a total area of ~300km2. It holds 80% of the central EL(77/1297) where all BCN’s drilling has been to date, and 100% of the other two EL’s. Exploration to Date: Aeromag work has identified >20 priority structural targets associated with north east trending regional shear zones. Since 2007 BCN has completed ~43,000m of RC and RAB drillingcovering a handful of the targets and a small percentage of the project area. This has yielded numerous high grade intercepts and an indication of multiple open ended mineralised zones (see map on following page). The mineralisation identified to date by BCN is relatively shallow oxide material. Initial Resource: In Dec ‘09 BCN confirmed its first JORC resource at the Halleys East and Phil – a modest tonnage (384kt) at a high grade of 6.0g/t for 74koz contained. Further drilling in Nov/Dec 2009 produced more high grade intercepts from known targets and confirmed new mineralised zones. Of note was an intercept of 14m @ 45.31g/t from 86m at Halleys E, not included in the Dec JORC resource. Drilling in 2010: BCN is planning to undertake a total of 50,000m of RC and RAB this year. The first program (10,000m RAB, 5,000m RC) commenced in February – testing the W extension of Halleys E, open extensions of Phil (S and N) and a number of newly discovered mineralised zones. Corporate: BCN raised a total of A$8.03m in 4Q09 through a non-renounceable 1:1 rights issue priced at A$0.22/share, including placement of 100% of the shortfall. This enabled the company to extinguish A$1.5m of shareholder loans (it is now debt free) and to confidently accelerate exploration expenditure. A further A$2.45m is likely to be raised from 245.5m A$0.01 options which expire in August 2010. Investment Comment: 2010 is going to be a big year for BCN. We can expect a series of JORC resource statements from the aggressive drilling programs on the Barlee Project. If the higher grades (>4g/t) are maintained, and if BCN shows it can establish mineable resources approaching 0.5moz from fairly ‘poddy’ mineralisation, then shareholders are likely to be further rewarded.

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 12

The Barlee Gold Project is 200km N of Southern Cross (WA), in the North Yilgarn greenstone belt Although this belt has produced a number of significant gold deposits (e.g. Copperhead - 1.2moz; Davyhurst –

0.8mz; and Yuoanmi – 0.4moz), BCN’s ground is relatively under-explored.

BCN has identified multiple shallow, relatively high grade, mineralised zones on NE trending shears in its drilling programs to date. An initial JORC Inferred resource of 74koz at 6.0g/t grades at Halleys East and

Phil. Further recent drilling produced an intercept of 14m @45.31g/t at Halleys East.

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 13

Catalpa Resources Limited

1.96Gold Price (US$/oz)

Revenue (A$m) 182.3

Debt (A$m) - Mar 10F *Enterprise value (A$m)

Avg monthly volume (m)Cash (A$m) - Mar 10F *Price/Cash (x)Price/Book (x) ASX-listed options: * A$7m of A$65m loan held in a cash retention account, net debt is A$58m.

Cracow **Total

Cracow **

* Resources includes reservesMineralised Material (est., non compliant with JORC)

Contacts Directors Key ProjectsMr Bruce McFadzean P Maloney (Non Exec Chair) Ownership/Managing Director ProjectTel: 61 (8) 9321 3088 Edna May

M Pollock (Non Exec Dir) Cracow B Sullivan (Non Exec Dir)G Freestone (Non Exec Dir)

4.7

47.1

950

169.8120.5

2.84.8

naNCM

Analyst: Dr Tony Parry

47.6

3.2

AuAu

160.8

57.8

10.0

Status

1,530

1,185

4.0

2,488

Project

Aus (WA)

48.8

7%3.7

77.4

7%3.1

86.3

10.05.3

54.533.332.1

5

28.2

4.5

30 March 2010

25.49.5

Investment Points

Citicorp Nominees PL (7.2%), National Nominees Ltd (4.5%)

306.2

Fully diluted (m)

Major shareholders: HSBC Custody Nominees (14.4%), ANZ Noms. (7.9%),

Our FY11 gold production forecast is 126koz.

100kozpa Cracow JV (30% CAH) is now contributing.

Construction of A$92m 100kozpa Edna May plant on track,on budget, for first production May '10.

Total group resource 1.91moz, reserves 1.02moz.

Strong forward sales (~55% for 5 yrs) at A$1,557/oz.

A$20m capital raising and debt restructure further de-risksthe company and will accelerate exploration.

CAH targeting growth towards 170kozpa - potential highgrade Edna May deeps (u/g ore) and regional targets.

Our med-term share price expectation is A$2.00/sharerunning up to Edna May commissioning. (NAV is A$350m,A$2.07/share).

Prospective P/E ratio for FY11 is only ~ 5x.

4.0

55.0Meas+Ind+Inf

Ore

JV

CAHO

1303.1 8.20

1.00Meas+Ind+Inf

1,02336.9

0.00.0 0.0

1,908

0.4

na30%

Key Assumptions:

Code for reporting mineral resources - Australian:

Reserves and Resources/Mineralised Material

868

Au Eqty

100% 47.9

30% Aus(QLD)

Route Location

OperatingCIL

TypePartnerIRG/reef

epithermal

A$ 1.50

Process

52.4

2.8

160.8

Target

Forecasts: Gold price: (long term from FY13) = US$850/oz; A$/US$=0.80 (long term).

27.0 8681.09 0.4

** Cracow data from NCM release 17.8.09

Au

24.8

AuAu

Company Comment

0

www.catalparesources.com.auPerth, WA, Australia

100%

Total

Resources *

8

Shares on Issue (EOP)*

100%

Proved & Probable

J Rowe (Non Exec)B McFadzean (MD) MetalOption

Meas+Ind+Inf

65.0

Classification

P/CF (x)

EV/EBITDA (x)Yield (%)

na

Gold

1171.8

Reserves

-0.07

54.5

-21.0

Greenfinch

EPS (norm) (A¢/share)

Proved & ProbableGreenfinchEdna May Proved & Probable

Edna May

Exchange: ASX:CAH

Capital Profile

31.00

-2.6

00

na

-0.2

0

32.9

4.0

176.88.5

55.784.0

Net Profit (norm) (A$m)241.2176.3

Market capitalisation (undiluted) (A$m)

CAH.AU

Production and Financial Forecasts

2013F

Catalpa Resources Limited

GoldAustralia (WA)Production & New Plant Construction

52 week range (A$/share) toShare price (A$)

EBIT (A$m)

0.00.10.0

15.5Convertible notes (m)Options and warrants (m)

160.8Number of shares (m)

-2.6

YEAR END: June1.500.761

2010F

886

2011F2009a

1,047 1,002

CFPS (A¢/share)Dividends (A¢/share)PER (x) na

Less than two years ago CAH was a hopeful capitalised at A$15m. Now itis about to become a ~130kozpa gold producer, is in the ASX300 index,and is capitalised at >A$250m. As its Edna May mine commissions inMay, we expect further re-rating towards our A$2.07 base case valuation.

Equity Production (koz) 128.2

2012F

125.925.3973

867.27.20 69231

862.7na

3.3160.8

g/t

(JORC)Cut Off

32.6160.8

ProjectMt koz

21.1

100%

Equity

30%100% 2.5

0.71.07 0.5

248130

82825.8

1,530

ConstructionCIL

koz

72.7

3.2

g/t t

0.41.02

CAH - Catalpa Resources Limited

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

1.80

2.00

Apr

-09

May

-09

Jun-

09

Jul-0

9

Aug

-09

Sep

-09

Oct

-09

Nov

-09

Jan-

10

Feb-

10

Mar

-10

Shar

e Pr

ice

($/S

hare

)

Source: Bloomberg

Overview: CAH was listed on the ASX in Aug ’02, and is on track to re-commence production at EdnaMay in 2Q10 at a rate of ~100kozpa. It also has a 30% JV interest in the 100kozpa Cracow JV (QLD). The Cracow Joint Venture: Situated in S QLD, Cracow is a high grade underground mining field based on an epithermal system that has yielded over 1.1moz since 1932. Newcrest Mining (ASX:NCM) is the operator (70%). Based on high % of resource conversion to reserves and recent discoveries of new shoots(e.g. Kilkenny) it is likely that the mine will have a life well in excess of 10 years. Cracow Performance: In 4Q09 the JV produced 24.1koz. Grades were a bit down (6.97g/t) but cash costs were in line (A$532/oz). We are forecasting FY10 output of 104koz for Cracow with treatment of 452kt of ore grading 7.8g/t. Cash costs US$453/oz (A$115/t of ore treated). Our assessed NAV of theCracow JV is A$161m (@5% discount rate), assuming (conservatively) a 6.5 year Cracow mine life. Edna May Status: CAH reports that the A$92m Edna May Project construction is on schedule and within budget, for the expected first pour in May ’10, 70% debt funded utilising an A$65m Macquarie Bank finance facility (A$7m currently in a cash retention account) and ~30% equity funded. In FY11 we have assumed 2.7mt of ore processed to produce 95.4koz at ave. A$630/oz opex. Base case valuation (NPV @ 5%DR) is A$272m assuming 60% resource conversion to reserves (42mt LOM, 13 year life). Margins are boosted by the spectacular forward sales book of ~70% of first five years gold forward sold at A$1,557/oz.Exploration Emphasis: CAH will accelerate exploration to upgrade existing resources and bring in new resources (e.g. Golden Point gneiss) with A$11m of the A$20m raising allocated to exploration. Corporate Developments: CAH has recently announced a debt restructure and an A$20m equity raising. The debt restructure involves converting mezzanine to senior debt. Meanwhile, CAH has raised A$10m through a share placement @A$1.32 (bringing in two new investment funds) and will raise a further A$10m from an underwritten 1:19 renounceable rights issue @$1.25/share. The A$20m will be utilised for start-up working capital and resource exploration at Edna May and regional targets. Catalpa’s Growth Targets: CAH sees potential to fuel strong growth to ~170kozpa organically through the significant higher-grade underground potential at Edna May, and from the regional exploration potential of the relatively unexplored Westonia greenstone belt, where numerous targets await drilling. Investment Comment: Catalpa’s spectacular growth in the last 12 months now sees it in the ASX300 index, less than three months from first pour at Edna May. The current modest capital raising further de-risks the project start-up and underlines the importance of on-going resource definition and exploration.Our base case NPV is A$2.07share (US$850 long term gold, A$/US$ 0.80). Using spot gold (US$1,110/oz, A$/US$=0.92, long term) gives a valuation of A$2.68/share. We expect that the shares will regain momentum after the rights issue towards a post-commissioning target of A$2.00/share.

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 14

CATALPA RESOURCES LIMITED VALUATIONPro forma as at June 2010 post renouceable entitlement issue.

ValuationEquity Resource RCR Target with

Gold Resource Valuation Price SpotEquity (moz) US$/oz A$m ^ Prices *

Projects+ Edna May Gold Project NPV** 100% 1.66 150 272 386+ Cracow JV NPV ** 30% 0.25 238 48.3 64.8+ Regional & U/G Exploration 100% 10.0 15.0

Sub Total 330.3 465.8

+ Cash (est Jun '09) 26.9 26.9+ Tax Losses 9.4 9.4+ Discounted Value of Forward Sales (5% nominal) 81.0 54.0- Debt (est. Jun '09) 65.0 65.0- Corporate Overhaeds (NPV @ 5%) 32.9 32.9

Sub Total 19.4 -7.6

CAH NET ASSET VALUE 143 349.7 458.2

Capital Structure^^Shares (Jun '10) (m) 160.8 160.8Fully Diluted Shares (Jun '10) (m) 176.3 176.3

CAH NET ASSET VALUE PER SHARE :A$/share 2.18 2.85CAH NET ASSET VALUE DILUTED :A$/share fully diluted 2.07 2.68

^^ Capital structure assumes 1:19 entitlement issue is completed.^Target valuation based on RCR long term gold price forecast of US$850/ounce (from 2Q12), A$/US$ = 0.80. * Spot price valuation is based on current spot price of US$1,110/oz, A$/US$ = 0.92 as long term prices.** Edna May and Cracow project valuations based on after tax nominal NPV @ 5% discount rate.

Of the A$20m to be raised, A$11m is allocated to exploration, underlining the importance of further resource definition and resource exploration drilling. Recent drilling of the Golden Point gneiss (see

below) is very encouraging for defining additional resources SE of the current proposed pit shell.

Source: Catalpa Resources Ltd

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 15

Eleckra Mines Limited

0.21

Debt (A$m) - Mar 10FEnterprise value (A$m)

Avg monthly volume (m)Cash (A$m) - Mar 10FPrice/Cash (x) Cash (A$m)Price/Book (x) Company options: Net asset backing (Ac/share)

*Gold and uranium prospective tenements, held and under application. ** FY11 shares assumes nominal A$4m equity raised.

Reserves

Contacts DirectorsMr Ian Murray(Executive Chairman)Tel: 61 (0) 8 9486 4144West Perth, WA, Australia

1.6

9,50024,000

0.0

749

6.22.7

0.0

1000.017

23.31.001.78

U3O8

Aus (WA)

Location

Aus (WA)Aus (WA)

0.0

Status

Yamarna - Gold regional

100%

100%K Hart (Non-Exec Dir)R Davis (Non-Exec Dir)I Murray (Exec Chairman)

Project

Analyst: Dr Tony Parry

www.eleckramines.com.au

0 0

g/t g/t

(JORC)

EquityOre Au

1.4

Adv. Expl. Aus (WA)

Adv. Expl.

6.2

04.00

1.8

Alk. Leach

2.7

Reserves and Resources/Mineralised Material

Key Projects

749

AuMt

0.83.1

0

Type

Early Expl.

heap leach

ox/sulpMid Expl.

ox/sulpRoute

1.4

Gold

Early Expl.

ox/sulp nana

CalcreteCalcretenone

none

JVOption

AuMetal Partner

Ownership/

Lake Rason + Lake Wells

Yamarna - Attila 100% noneAu none

100%

Golden Sands 100%Yamarna: Thatcher Soak

3.5

U3O8

100%

16.1100%

13.1

EquityProject

InferredUranium Resources Mt

Project Aukoz

0.0

mlb

0.0

Yamarna - Attila-Alaric Inf., Ind. & Meas.

Mineralised Material (est., non compliant with JORC)

Code for reporting mineral resources - Australian:

6.8

Investment Points

2.3EKMO

0.9

Company Comment

5.0

79

2.7

69

-

1,000

1.200.250.45

2.4

0.40.6

450- -

Au,U noneU

5

Fully diluted (m)

18.4

U

EKM's focus is gold and uranium in WA. Explorationbudget increasing to ~A$2mpa, mostly directed to gold.

Strategic position (~5,000km2) in remote under-exploredYamarna greenstone belt in Yilgarn Craton.

Yamarna (Attila-Alaric) gold resource 749koz Au nearsurface - many untested targets along 17km strike.

New high grade discovery Central Bore - 520m new open-ended high grade mineralised zone.

Additional larger Byzantium, Hann and Central Boreanomalous zones near Central Bore recently discovered,drilling 2Q10.

Initial resource statement for Central Bore 3Q10.

If Byzantium, Hann and Central Bore anomalies reproduceCentral Bore success, EKM will be re-rated.

As resource approaches 1moz and grades improve, our sixmonth target range is A$0.16/share - A$0.22/share.

Aus (WA)

233.9195.8

0.0

t koz

na

Eqty mlbppm%

ProjectProcessTarget

2.67

U3O8 Cut Off U3O8

kt

3.9

2.36Capital raisings (A$m)

450

0.0

450

1,000 8,000

2.66Geiger Counter Fund (4.0%), Asarco Expl. Co. Inc.(2.6%).

14,000

Exploration/(Expl.+ Corporate) (%) 77Funding duration at current burn (years)

192.8

Drilling - Other/Diamond (m)Land holding ('000 ha) *

Drilling - RAB (m)Shares on issue (pr end) (m shares) **

2,0001,500

Options and warrants (m)

0.090.0252 week range (A$/share)

Number of shares (m) 195.8

Market capitalisation (undiluted) (A$m)

Major shareholders: Directors (7.3%), Perth Select Seafood (5.1%),

18.4

Convertible notes (m)271.8

0.0

Advanced ExplorationExchanges: ASX:EKM

Capital ProfileShare price (A$)

1.3195.8

0.32

450 450

15,5003,000

-

170.4

1.010.7161

toDec-09a 2010F

64

30 March 2010

EKM.AU

76.0

Gold, UraniumAustralia (WA)

Production and Financial Forecasts

2011FMar-10F 2009a

Eleckra Mines Limited

EKM's Yamarna belt (WA) exploration has recently produced one newhigh grade discovery and three major new anomalies to be drilled 2Q10.This increases our expectation of a >1moz resource (0.75moz current),with improved grades, and a share valuation of ~A$0.20.

1.10 3.102.210.74Exploration and evaluation (A$m)

A$ 0.09

YEAR END: June

Funding from JV partners (A$m)

0.22

4.0

0

Tenement costs ($k per year) -

4.0

Corporate (A$m)

Cash backing (Ac/share) 1.6

Classification

Resources

Thatcher Soak

Cut Off Au Eq

EKM - Eleckra Mines Limited

0.00

0.02

0.04

0.06

0.08

0.10

0.12

0.14

0.16

Apr

-09

May

-09

Jul-0

9

Aug-

09

Oct

-09

Nov

-09

Dec

-09

Jan-

10

Feb-

10

Shar

e Pr

ice

($/S

hare

)

Source: Bloomberg

Overview: EKM listed on the ASX July ‘06. Its focus is the under-explored Yamarna Greenstone Beltwhere it has established a 749koz gold resource, and a 6.2mlb shallow calcrete U3O8 resource. Yamarna Project (WA): (3,000km2, gold) EKM has defined an initial gold resource along the Yamarna shear zone - a regional scale mineralised trend considered prospective for multi-million ounce discoveries. EKM’s 749koz (1.78g/t) resource defined to date occurs in the Attila-Alaric zone along a 17km strike length. The deposit is open at depth and along strike. EKM is targeting total resources of 1moz – 1.5moz Au before commencing a PFS. Recent 7,000m RC campaign 3Q09 focused on two areas, with significant success: 1. Yarmana Deeps: EKM has identified 10 target areas with potential deeper high grade shoots (>10g/t). The first target – Alaric 2 – was subject of a 2,132m 15 hole program in 3Q09, and produced good high grade intercepts. Second target Khan North also produced good intercepts. 2. Central Bore (“CB”): (3.7km E of Attila) – A new high grade quartz vein discovery parallel to Attila-Alaric, strike length of 520m, open along strike and at depth. The 2009 RC drilling program (3,900m, 39 holes) confirmed that CB is a likely source of higher grade ore. New Anomalies: Soil geochem surveys have recently resulted in the discovery of three large gold anomalies - Byzantium Prospect – 1 km long, only 500m from CB, the Hann Prospect – a strong 2.8km anomaly (surface grades up to 2.1g/t) only 1.1km from Atilla, and Central Bore East (0.6km long). These new anomalies are stronger anomalous zones than the original CB zone. Next Steps: Immediate drilling priorities for 2Q10 are the new Byzantium, Hann and Central Boreanomalies (7,000m RC campaign starting April). Second 14,000m campaign will follow 2H10. We expect that EKM will announce an initial JORC resource for CB in 3Q10, after the next round of drilling. Subject to drilling results and resource size, PFS could start early 2011. PFS likely to focus on open pit and possibly underground mining of high grade shoots, heap leach of oxide ore, trucking of primary ore. Golden Sands (WA): (1,500km2, gold) EKM holds largely unexplored exploration tenements north of the AngloGold Ashanti/Independence Group Tropicana gold project (5moz resource). Thatcher Soak (WA): (500km2, uranium) EKM holds Eastern portion of the Thatcher Soak calcrete uranium prospect, (total 20mlb resource - Uranex NL (ASX:UNX) 14mlb and EKM 6.2mlb). Based on UNX recent transaction, we think a deal with UNX would value Thatcher Soak at around ~A$1.00/lb. Investment Comment: The higher grade Central Bore zone discovery has been a real revelation for EKM and a potential significant boost to the economics of this project. If the three new parallel anomalies near Central Bore come up anything like Central Bore, then this will dramatically increase the perceived value and economic viability of EKM’s ground. A higher grade >1moz target will look more assured. Putting a deal value of A$1.00/lb on Thatcher Soak, plus A$3m for other exploration ground, gives a target range between A$0.16/share (A$20/oz valuation) and A$0.22/share (A$30/oz valuation)assuming a 1moz target. Upper level of this range is more likely as a six month share price target.

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 16

The newly discovered anomalies at Byzantium and Hann are between the existing Attila resource and the newly discovered Central Bore 520m higher grade zone. They are both bigger and stronger anomalies than

was Central Bore, which bodes well for follow up drilling in 2Q10.

After completing share placements to raise A$2.7m EKM can aggressively increase its drilling campaigns in 2010 with a doubling of planned drill metres – mainly focused on the new anomalies.

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 17

Kingsgate Consolidated Limited *

10.30

Debt (A$m) - Mar 10FEnterprise value (A$m)

Avg monthly volume (m)Cash (A$m) - Mar 10FPrice/Cash (x) Drilling - RAB (m)Price/Book (x) Listed company options: Land holding ('000 ha)

** 2010F Net Profit does not include unrealised forex. losses (A$8m 2H09) treated as abnormals.

$11M exploration budget for 2008.

Experienced board and management.

Resources (includes proved and probable reserves) *

Mineralised Material (est., non compliant with JORC)* Note: Contained silver is 24.14moz, resource grade is 9.0g/t Ag Reserves and Resources as at 30 June 2009

Contacts DirectorsMr Gavin ThomasMD, Chief Executive Officer G Thomas (MD)Tel: 61 (2) 8256 4800 P McAleer (Non Exec Dir)Sydney, NSW, Australia C Carracher (Non Exec Dir)

3.5%8.22

80,000

130

Exploration and Evaluation (A$m)

Production

71022.3

60

155,000

95.894.6

Au none

Eqty

100% 1.9037.1

5.4g/t

1.70

0.901.2032.0

(JORC)Au

17.4100%

www.kingsgate.com.au

StockpilesTotal

Chatree

R Smyth-Kirk (Chairman)

Total

Chokdee 100%

62.5

3,100

1.9

81.7

1.7

0.0

3,100

0.50.91

Reserves

Chatree North Meas+ind+inf

0.5

g/t

100%100%Stockpiles Meas+ind+inf

Code for reporting mineral resources - Australian:Classification

Chatree

Gold

Meas+ind+inf

100%Chatree 100%Project

Chatree NorthAu

TotalTotal

OptionOwnership/

86,000

Convertible notes (m) 0.0

130140,000

1286,000

16

130

30

18.0P/CF (x)

EV/EBITDA (x)Yield (%)

16

130,000Drilling - RC/Diamond (m)

8.64.0% 4.0%6.6

3.5%

359.2 12.5

Reserves and Resources/Mineralised Material

7.36

25.3 11.27.7

Company Comment

135,000

Chatree North

c/off

3.2Total 100%100%

AuMt

CFPS (A¢/share)

6.30

t

16

EquityOre

88,000

Project

130

81.8 78.177.481.2

18.270.0%

EPS (norm) (A¢/share)Net Profit (norm) (A$m)**

34.332.5

Dividends (A¢/share)48.2

0PER (x)

Capital Profile

52 week range (A$/share)Share price (A$)

to8.674.93

Number of shares (m)

0.0Market capitalisation (undiluted) (A$m)

KCN.AUGold, SilverThailandProduction, Advanced Exploration

30 March 2010

97.9

Exchanges: ASX:KCN

Options and warrants (m) 4.5

102Fully diluted^ (m)

849.2

849.2

Major shareholders: Blackrock Inv. Mgt (10.90%),

Thailand-based KCN is an unhedged mid tier goldproducer in a strong growth phase.

Production forecast 141koz in FY10, then to ~193koz FY12( with A$120m plant expansion to 5.0mtpa).

Efficient low cost operation, forecast FY10 net profitA$80m (82cps), cash opex US$295/oz.

Plant expansion go ahead is imminent.

Highly grade sensitive - every 0.1g/t increase in long termreserve grade adds A$1/share to NPV.

Regional exploration success suggests potential >10mozgold province (current resource 3.1moz).

Near-mine discovery at Suwan, and regional Chokdee bothare major (>20km2) mineralised systems.

Profit growth, resource grade upside and exciting regionaldiscoveries could drive stock towards A$11/share in themedium term.

.

Unhedged no debt A$8m cash NPV$5 53/share (US$850

10

24.1

Investment Points

3.1No

UBS Nominees Pty Ltd (4.9%), Directors (6.3%).

35.2

60

7102,33072.5

601.71,47045.6

88,000

Location

as aboveThailandProductionThailand

Analyst: Dr Tony Parry

na

Process

0.5

Route

1.18

Target

91.9

2012F

105.4

We are forecasting 141koz FY10 gold output (US$295/oz opex), rising to193koz in FY12 with plant expansion. Discoveries of major regionalmineralised zones support our view that KCN is sitting in a >10moz ThaiAu province, which could drive KCN towards A$11/share.

159.9 193.5

Key Projects

MetalJV

Partner Typenone

AuThailand

noneCIL 2.4mtpa

0.5

0.50.51.16

1.28

0.0

1,240

1,470

2,330

1,240

0.0

38.4

Mid Expl.

ProjectStatus

1.20

69.4

180

30

0.5 180

Au

35

2009a 2013FYEAR END: June

34.9168.2

EBIT (A$m)141.0Equity Production (koz)

104.2

93.089.5 76.9

112.3

Production and Financial Forecasts

2010F

96.5

69.9

131.2

0.5

koz

60

140,000

koz

130

100.5

2011F

A$ 8.67Kingsgate Consolidated Limited

8.12

10.78.3

30

KCN - Kingsgate Consolidated Limited

0.00

2.00

4.00

6.00

8.00

10.00

12.00

Mar

-09

May

-09

Jun-

09

Jul-0

9

Aug

-09

Sep

-09

Oct

-09

Nov

-09

Dec

-09

Feb-

10

Mar

-10

Shar

e Pr

ice

($/S

hare

)

Source: Bloomberg

Overview: KCN re-listed on the ASX in 1988, focused on gold mining and exploration in Thailand.KCN’s Chatree mine has been in production since 2001 and recently produced its 1 millionth ounce. It isa stand-out low cost, efficient SE Asian gold mining operation, benefitting from a low tax regime. Chatree Performance: 4Q09 production was an impressive 40koz with grades back up to 2.0g/t (1.5g/t3Q09). Cash costs (incl. royalties) were US$312/oz (US$239/oz pre royalties) confirming KCN currentlyis in the lowest quartile of global gold producers. Financial Performance: First half FY10 profit (beforeunrealised forex losses) was A$41.2m (42.3cps), interim dividend 15cps, in line with our forecast. Outlook: We are forecasting a similar second half profit (A$40m) partly affected by commencement oftax payments, with head grades of ~1.9g/t (giving 71.5koz for the half, 141koz for FY10). Forecast netearnings of A$0.82/share will more than double FY09 result. FY11 profit will contract slightly with gradesof 1.76g/t forecast (production 160koz). The proposed plant expansion to 5.0mtpa is being delayed asKCN seeks confirmation of Thai Government financial incentives. We expect a decision soon. We haveassumed that expansion will proceed at a capital cost of A$120m (50% debt funded, balance funded bycashflow), start up in 2Q11. This will bring production up to around 194kozpa in FY12, forecast net profit95cps. Production is expected to reduce to 168 koz FY13 as grades revert towards reserve grades.Chatree N Resource Base: Reserves of 1.47moz and resources 3.1moz (grade of 1.2g/t) are likely toincrease substantially in next 24 months with on-going drilling at Chatree N and below old Chatree pitsproducing promising results and possibly higher grades. A 0.1g/t increase in reserve grade (orUS$100/oz increase in the gold price) increases our NPV by ~A$1/share. The Chatree Gold Province: KCN holds 1300km2 surrounding Chatree. The discovery of a new 20km2

(Chatree-sized) mineralised zone at Suwan ~6-10km N of Chatree is a major development – a likelysatellite ore body and a major boost to the resources. Further drilling will be keenly watched. Chokdee~30km N of Chatree, is a major new discovery, could rival total Chatree resources of 5moz to date andsupport a new stand-alone plant. All this points to the Chatree as a world scale >10moz province. Investment Comment: Our NPV is A$7.97share, (5% DR, US$850/oz long term Au, A$/US$=0.80,65% resource conversion) or A$9.64/share at current spot Au price of US$1,100/oz, AS$/US$=0.91. Wesee plenty of upside for KCN - a possible A$1–A$2/share uplift effect on valuation due to possible liftingof longer term resource grades (indicated by current drilling) and the exciting Suwan and Chokdeediscoveries could have a greater impact – see the graph on the next page. KCN is a stand-out low costdividend-paying Asian producer now coming into the range of institutional funds (Blackrock now holds10.9%) as it approaches A$1bn market cap.

Resource Capital Research

March Quarter 2010 Disclaimer and disclosure attached. Copyright© 2010 by Resource Capital Research Pty Ltd. All rights reserved. 18

Kingsgate Consolidated Limited

ASSUMPTIONS 2009a 2010F 2011F 2012F 2013F FINANCIAL RATIOS 2009a 2010F 2011F 2012F 2013FA$/US$ 0.75 0.88 0.84 0.80 0.80Gold Price (US$/oz) 886 1,047 1,002 973 950 Net debt/equity (%) -3% -2% -3% -13% -19%Gold Price Realised (US$/oz) 875 1,063 1,016 979 956 Net debt/ net debt + equity (%) -3% -2% -3% -15% -24%

Current ratio (x) 3.3 3.2 3.8 7.9 10.2EBIT/interest (x) 19 68 33 44 46

EQUITY PRODUCTION Debt/operating cashflow (%) 12% 13% 32% 21% 18%Chatree Production (koz) 93 141 160 194 168 Exploration/total overhead (%) 3% 9% 17% 17% 13%

EV/EBITDA (x) 18.8 8.3 7.6 6.5 8.4KCN Equity Production Gold (koz) 93 141 160 194 168 Market cap/net cash (x) 31.7 43.8 35.6 7.7 5.2Cash Costs (US$/oz)** 479 295 332 374 440 Market cap/book (x) 3.6 2.9 2.4 1.9 1.7 ** Cash Cost is direct operating cost before royalties and by product credits

PROFIT AND LOSS (A$m) FINANCIAL SENSITIVITIESRevenues 117 180 203 254 221Operating costs (direct) -60 -40 -63 -91 -92 % Change in EPS for a 10% increase in:Depreciation/amortization -12 -15 -24 -29 -26Exploration Expensed 0 -1 -2 -2 -1 AUD/USD -22% -26% -32%Corporate -8 -10 -8 -8 -8 Gold Price 24% 28% 35%Other (incl. Royalties) -2 -25 -15 -19 -16EBIT 35 90 92 105 77Interest 2 1 3 2 2 % Change in NPV for a 10% increase in forecast minelifeOperating profit/loss 33 88 89 103 75 commodity assumptions for:Tax -1 -6 -11 -7 -5 Base + 10%Minorities 0 0 0 0 0 A$/share A$/share %Net profit/loss 33 82 78 96 70 Gold Price US$850/oz 7.97 8.52 7%Net abnormals/extaordinaries 0 -8 0 0 0Net profit/loss (reported) 33 74 78 96 70

BALANCE SHEET (A$m) VALUATION (A$m) Q1 10 Cash and deposits 30 35 64 143 187Total current assets 58 45 74 153 197 Assumptions Base "What if" PP&E 200 261 312 290 272 Long Term Gold Price :US$/oz 850 1,110Total non-current assets 213 291 357 352 345 Long Term AUUS 0.80 0.91Total assets 271 335 431 504 542 ProjectsTotal current liabilities 17 14 19 18 16 Chatree and Chatree North 100% NPV@5% A$145/oz 429 507 Reclamation reserves 0 0 0 0 0 Based on reserves only Long term debt 0 13 37 27 17 Resources and ExplorationTotal non-current liabilities 8 21 46 36 26 Chatree and Chatree North 100% NPV@5% A$76/oz 235 303Total liabilities 26 35 65 53 42 Regional Exploration 100% 100 125Equity 245 300 366 451 501

OtherTotal debt 2 15 40 30 20 AssetsNet debt -28 -20 -24 -114 -168 Cash and deposits - Mar 10F 35 35Average shares (fully diluted) (m) 102 103 103 103 103 Rehabilitation Fund 0 0

Other - tax benefits 51 51FLOW OF FUNDS (A$m) LiabilitiesEBITDA 46 105 115 135 103 Debt - Mar 10F 0 0Cash flow from operating activities Corporate Overheads -56 -56 Operating surplus 34 131 139 156 117 Reclaimation Reserve 0 0 Corporate -8 -10 -8 -8 -8 Net Assets 793 965 Net borrowing cost -2 -2 -4 -7 -10 Net tax paid -7 -9 -10 -7 -5 Fully Diluted Shares (m) 103 103 Net exploration paid -30 -16 -16 -16 -12 Net assets/share (A$/share) 7.97 9.64 Other non cash items 32 18 25 25 27Net cash from operating activities 18 113 125 144 110Cash flow from investing activities Valuation/Reserve oz :US$/oz 215 597 Capital expenditure -12 -75 -74 -8 -8 Valuation/Reserve & Resource oz :US$/oz 205 283 Asset Sales & Other -36 -22 -16 -16 -12Net cash from investing activities -48 -97 -90 -24 -20Cash flow from financing activities Net proceeds from issue of shares 16 0 0 0 0 Dividends paid 0 -25 -29 -29 -34 Net proceeds from borrowings 0 15 25 -10 -10Net cash from financing activities 16 -10 -5 -39 -44Net change in cash -14 7 30 80 45

PRODUCTION STATISTICSChatree 100%Ore Treated (kt) 2,405 2,642 3,450 5,000 5,000 Head Grade (g/t) 1.20 1.82 1.76 1.34 1.16Recovery (%) 90 91 90 90 90Recovered grade (g/t) 0.96 1.66 1.44 1.20 1.05Gold Produced (koz) 74 141 160 194 168Equity Production (koz) 74 141 160 194 168Cash Costs (US$/oz) 479 295 332 374 440Production Costs (A$/t) 19.08 17.80 18.35 18.17 18.50 EBIT (A$m) 35.0 62.3 62.3 108.4 74.9

Exploration Success = Share UpsideA ~3moz additional resource target for Suwan and Chokdee would push the

shares towards a target price of ~A$11-A$14/share.

Year YearYEAR END: June

VALUATION SENSITIVITY TO EXPLORATION SUCCESS

8.00

10.00

12.00

14.00

16.00

18.00

20.00

0 1.0 2.0 3.0 4.0 5.0

Future Resource Increase (moz)

Net

Ass

et V

alue

(A$/

shar

e -

fully

dil.

)

Additional Resources @ A$100/oz Additional Resources @ A$200/oz

BASE CASE

2-3 Year Target based on Chokdee and Suwan exploration success