GLOBALIZATION The Aftermarket’s Economic Opportunity The Japanese and Korean Aftermarket The...

-

Upload

felix-oconnor -

Category

Documents

-

view

212 -

download

0

Transcript of GLOBALIZATION The Aftermarket’s Economic Opportunity The Japanese and Korean Aftermarket The...

GLOBALIZATIONThe Aftermarket’s Economic Opportunity

The Japanese and Korean AftermarketThe following is an excerpt from a presentation by AAIA CEO Kathleen Schmatz. For the purposes of

this course, comments have been added to the notes pages by your instructor

Japanese Vehicle Registrationsby type of vehicle, 2004

Total Japanese Vehicle Registrations: 74,214,416

55,212,594 (74%)

19,001,822 (26%)

Cars Trucks and Buses

Source: Auto Strategies International

Japan

• Japan has world’s 3rd largest car park, aging UIO – 4.75 yrs. (1996) vs. 6.5 yrs. (2006), and strong personal incomes.

• Japan is America ’s fifth largest parts export market -- $1.5 billion in 2005.

• Cumulative 1996-2005 parts trade deficit with Japan nearly $400 billion.

Regulatory Barriers to Japanese Aftermarket

• Japan imposes no tariffs on vehicles or parts; regulatory barriers instead protect aftermarket.

• Most high-value repairs of “critical parts” must be inspected.

• Critical parts inspections = Regulated Garages = OEM-controlled.

• OE’s control 80% of aftermarket parts and service sales. Independents’ bays are mostly limited to TBA work.

• Japanese motorists pay 3 – 4 times more than U.S. consumers for comparable parts/service.

Some Bright Spots About Japan

• 1995 U.S.-Japan Agreement improved the onerous and costly “shaken” vehicle inspection system, based on a repair and inspect regime, rather than inspect and repair. Independent garages could be designated inspectors/repairers.

• Japanese consumers really love their Coke, with per capita consumption of about 150 bottles per year.

• “Shaken” was so dreaded, the Japanese would have given up their Cokes rather than face it. In fact, as year 5 inspection dates approached, many traded cars rather than face inspection.

• Now, Japanese motorists are keeping their cars longer and finding other ways to spend their money, maybe on more Cokes.

Some Bright Spots About Japan (cont.)

• Thanks to Tenneco’s leadership, the Agreement removed shocks and struts from the “critical parts” list.

• Consumers can use independent shops for those repairs, thus opening new channels for competitive aftermarket parts.

• 2002 Japan External Trade Organization (JETRO) Report documented staunch Japanese consumer opposition to the heavily regulated and non-competitive aftermarket.

U.S.-Japan Auto Trade Balance(as of 2005) (in thousands of dollars)

Total Amount of U.S.-Japan Auto Trade: 17,539,134

$1,388,863, (8%)

$16,150,271, (92%)

Imports from Japan Exports to Japan

Source: U.S. International Trade Commission

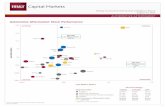

U.S.-Japan Auto Trade Balance (net) by Product, as of 2005, (thousands of US dollars)

Other Components

Chemicals and Lubricants

Tools and Equipment

Glass and Mirror Components

Radio and Electronic Components

Lighting and Electrical Components

Air Conditioning Components

Brake Components

Body Parts

Tires and Wheels

Engine Components

Undercar and Drivetrain

-$7,000,000 -$4,000,000 -$1,000,000 $2,000,000

Source: U.S. International Trade Commission

Korea

• Growth in the Korean car park and middle class favor aftermarket sales.

• Korea generally has followed export-oriented Japan trade model.

• Newly launched U.S.-Korea FTA must address longstanding Korean non-tariff automotive barriers.

• Item: Koreans purchasing imported vehicles subjected to tax audits.