Global Data Watch: Developed Markets...sgp twn tha-4.0-3.0-2.0-1.0 0.0 1.0 2.0 3.0-6.0 -4.5 -3.0...

Transcript of Global Data Watch: Developed Markets...sgp twn tha-4.0-3.0-2.0-1.0 0.0 1.0 2.0 3.0-6.0 -4.5 -3.0...

Global Data Watch: Developed Markets

Economic ResearchSeptember 24, 2010

• FOMC moves toward QE and signals firm commitment to reflation

• The ECB is resistant to additional QE while BoJ and BoE are likely to act

• Global growth rotation is proceeding apace; Europe slows as US stabilizes

• High inflation allows India to accept currency appreciation

• Next RBA rate hike moved up to October

Whip-up Inflation NowOn one level, this week’s FOMC meeting merely met expectations, as the com-mittee did not engage in further asset purchases while signaling a heightenedreadiness to ease. We maintain that the Fed will resume large-scale asset pur-chases (LSAP) of Treasuries, most likely at its November meeting. However,the committee went further than signaling that it might take out insuranceagainst downside risks to growth. For the first time, the FOMC statement ex-pressed a view that underlying inflation is running below its mandate, and thatthe Fed is committed to moving it higher.

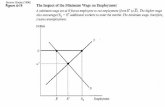

The statement linked the inflation outlook to two key variables—slack and in-flation expectations—whose movements will now guide its path through QE2.Although there is a divide within the committee on the role high unemploy-ment plays in the inflation process, US experience shows that the level of slackhas been a key determinant of cyclical swings in inflation. This message hasbeen reinforced by recent US and global performance. The strong correlationbetween output gaps and inflation movements across the globe this year is par-ticularly notable. As evidence reinforces this relationship, the policy prescrip-tion is clear: The FOMC needs to deliver sustained growth well above trend ifit is going to avoid the threat that inflation drifts further from its objective.

There is less debate about the importance of aligning inflation expectations withFed objectives. However, expectations are hard to measure. The FOMC statementreiterated the view that expectations remain stable, but the slide in breakevenspreads since early this year and the recent fall in one-year consumer expectationshave likely contributed to the Fed’s willingness to consider action at this point.

Given the considerable skepticism about the effectiveness of monetary policyonce the lower policy rate bound has been reached, it is encouraging to see thatfinancial markets are moving in a manner consistent with the Fed’s policy shift—which began with Chairman Bernanke’s August 27 speech. Over the past

Bruce Kasman

David Hensley

Joseph Lupton

usa

emu

jpn gbr

swe

norche

canbra

chl

permex

cze

hun

polzaf

tur

rus

chnidn

kor phl

sgptwn

tha

-4.0-3.0-2.0-1.00.01.02.03.0

-6.0 -4.5 -3.0 -1.5 0.0 1.5 3.0

Global slack and inflation

%-pt, chg in core(oya) ytd

%, Output gap 2Q10

-2

0

2

4

685 90 95 00 05 10

-4

-3

-2

-1

0

1

%-pt, dev from avg

US unemployment and core inflation%pt, 8qtr chg in oya

Core inflation, chg

Unemp rate

ContentsEconomic Research noteThe Fed talks and financial markets listen 10US jobless recoveries: what we now know and still don’t know 12Ireland faces huge medium-term fiscal challenges 14

Global Economic Outlook Summary 4Global Central Bank Watch 6The J.P. Morgan View: Markets 7

Data WatchesUnited States 16Euro area 24Japan 30Canada 34United Kingdom 36Sweden/Norway 40Australia and New Zealand 42

Regional Data Calendars 46

Sample

2

Economic ResearchGlobal Data Watch: Developed MarketsSeptember 24, 2010

JPMorgan Chase Bank NA, New YorkBruce Kasman

David Hensley

Joseph Lupton

month, real interest rates and the dollar have moved lowerwhile inflation expectations and risky asset values havemoved higher (see the research note “The Fed talks and fi-nancial markets listen” in this GDW).

More hands on deckThe shift taking place at the Fed was mirrored by moremodest movements at other large central banks. By year-end it is possible that both the Bank of England and Bankof Japan will engage in further QE. The official statementfrom the BoJ on the recent unsterilized currency interven-tion gave an impression that it is easing only reluctantly.However, board member Miyao suggested this week thatthe BoJ appears to be ready for further easing through theoutright purchase of JGBs. While it is premature to assumethat the BoJ has decided to increase JGB purchases fromthe current yearly JPY21.6 trillion, the FOMC statementhas increased the odds of BoJ action.

The release of the August MPC minutes this week showsthat some BoE members are edging toward more QE asgrowth momentum slows. However, concerns about thecontinued high level of inflation make it a close callwhether a consensus will form around our view of a £25billion extension of QE in November.

Notably absent from the group moving toward QE is theECB. In part, this reflects the ECB’s forecast that underlyinginflation will move higher over the next year despite modestgrowth and a depressed utilization rate. However, relative tothe Fed, the ECB also views the benefits of QE as more lim-ited and the risks as higher. Regarding risks, the central bankworries about anchoring inflation expectations in an environ-ment in which budget deficits are very wide and the region isstruggling to impose an appropriate medium-term frame-work for fiscal discipline. In addition, the ECB worries thatfurther stimulus will prevent the very balance sheet adjust-ments that are necessary to return to health. It is thus not sur-prising to observe the divergence in movements of financialmarket measures of inflation expectations in recent weeks.

Growth rotations are on trackA rotation in regional growth continues to be an importantglobal theme. Recent weeks have brought hopeful signs thatgrowth in the United States and China is stabilizing after asharp downshift in 2Q. At the same time, the Euro area wasexpected to slow this quarter after having accelerated intomidyear. This week’s report of a steep drop in the SeptemberEuro area PMI was a confirming sign. It does not appear that3Q growth fell materially below our 2% forecast, as the PMIhad been elevated relative to our expectations. In addition,the continued resilience of national business sentiment—which is a broader gauge of business health—suggests thatdownside risks are limited. To this point, it will be importantto watch the German consumer. The surge in the retail com-ponent of the IFO survey offers hope that household spend-ing growth will be more robust in this expansion.

A challenge to growth in the Euro area comes from stress inthe periphery. This is coinciding with the beginning of thebudgetary round for 2011. All Euro area countries havemulti-year fiscal adjustment plans, and as budgets get re-leased in the coming weeks, most of the region simply willconfirm the objectives that have already been set. The keyinformation in the budgets will be the details about how theobjectives will be met. However, the situations in Portugaland Ireland are different. Portugal is under pressure to ar-rest some slippage in meeting this year’s objective, whileIreland is under pressure to front-load some of the adjust-ment that was planned for future years.

Elsewhere, we are on guard for a growth downshift in Japan.Current-quarter activity received a temporary boost from fis-cal stimulus and unusually warm weather. We look forgrowth to stall as these effects wear off and the tightening indomestic financial conditions (yen, Nikkei) takes hold. Themost important guidance in next week’s reports will comefrom the forward-looking business surveys (SeptemberShoko Chukin and manufacturing PMI, quarterly Tankan)and the August IP report, which will include manufacturers’production plans for September and October.

India leading Asian policy normalizationEM Asian policymakers are still running very loose policydespite an impressive rebound in growth that already haslifted resource utilization back above average and produceda rise in core inflation. This stance is reflected in the rela-tively meager rise in both policy interest rates and trade-weighted exchange rates across the region. Over the pastyear, for example, EM Asian policy interest rates have in-creased 26bp, while the region’s real TWI is up 6%.

1.80

2.10

2.40

2.70

3.00

3.30

3.60

% p.a.; US is Fed breakeven measure, EMU based on swaps5yr/5yr forward inflation expectations

2008 2009 2010

US

EMU

Jackson Hole

Sample

Economic ResearchGlobal Data Watch: Developed MarketsSeptember 24, 2010

3

JPMorgan Chase Bank NA, New YorkBruce Kasman

David Hensley

Joseph Lupton

EditorSandy Batten

The region’s two biggest economies, China and India,bracket the range of regional policy tightening. Chinese offi-cials have not raised interest rates since late 2007. Mean-while, they have maintained a tight grip on the currency, not-withstanding this month’s 3% rise versus the dollar. US frus-tration with this policy spilled over this week in the form ofdraft legislation that would allow US companies to petitionfor higher duties on imports from China to compensate forthe effect of the weak yuan. The House of Representatives isexpected to vote on this legislation next week.

Reluctant to allow their currencies to appreciate versus theyuan, policymakers elsewhere in the region have beenholding back on raising interest rates, while interveningheavily in the FX markets. The notable exception to thistrend has been India. In the year-to-date the RBI has raisedits policy rate 125bp. Moreover, because of tight bank li-quidity, the overnight call rate has jumped from the bottomof the policy corridor to the top, implying an effectivetightening of 275bp. As it has raised rates, the RBI has re-frained from FX intervention. Thus, India’s real TWI hasincreased about 10% over the past year, versus about a 4%gain in the rest of EM Asia, including China.

India’s more aggressive policy action is motivated by highinflation. Although the inflation rate has eased modestlyover the last two months, it remains in a range of 8% to9%. Barring a more significant decline in inflation, we ex-pect Indian officials to continue tightening, although at aless rapid pace. As such, India will continue to lead theprocess of policy normalization in the region.

Shifting timetables for RBA, RBNZ actionThe RBA sent a strong message this week that a furtherrate hike is imminent. The Governor said that the taskahead “is likely to be on managing a fairly robust up-swing.” Above-trend growth is the likely outcome for theAustralian economy in 2011, which will push the limits onresource usage and thus feed inflation. As the central bank

gains confidence that the global backdrop is stabilizing, it islikely to determine that delaying further policy tightening until2011 would be a mistake. We have therefore brought forwardour forecast for the next RBA hike to October. In contrast, weare pushing out an expected December rate hike in NewZealand to March of next year. The surprise weakness in theGDP numbers this week, falling inflation expectations, andthe damping impact of the recent earthquake in Canterbury oneconomic activity mean there is no urgency for the RBNZ tostep away from its accommodative policy.

CEEMEA central banks to stay on holdAlthough several CEEMEA central banks sent more hawk-ish messages this week, we maintain our call that rate nor-malization will not get under way in the region until 2Q11.MPC minutes in Poland showed that a motion for a 50bprate hike was put forward at the August meeting, while oneMPC member in the Czech Republic voted to raise rates25bp this week. Turkey’s central bank raised reserve re-quirements on TRY and FX deposits to restrain loangrowth. Nonetheless, the combination of uncertainty overthe Euro area growth outlook, low inflation, and continuedupward pressure on FX rates argues against preemptiverate hikes. Indeed, in South Africa, continued currencystrength raises the likelihood of another rate cut in Novem-ber. The Bank of Israel is the odd one out. It is already inthe midst of a tightening cycle, and we expect another 25bprate hike next week.

Latin governments push for fiscal restraintIn Latin America, the current budget season is drawing at-tention to a shift away from stimulative fiscal policies. InMexico, the opposition is seeking to reduce the VAT, but thegovernment intends to keep the current lid on fiscal policy inplace in 2011, lowering the deficit to just over 2% of GDP.In Argentina, opposition proposals to raise pensions andlower export taxes are unlikely to advance. In Brazil, mar-kets are anticipating that a cabinet led by ex-Finance Minis-ter Palocci will deliver a moderate improvement in the pri-mary balance, although reining in lending by BNDES, themain development bank, will be a challenge. Chile’s govern-ment is reviewing the definition of the structural fiscal rule,which will imply a reining in of stimulus even as earthquakereconstruction proceeds, bringing the structural deficit from3% of GDP to 1% by the end of its mandate. Colombia’snew administration is eager to adopt a structural fiscal rulelike Chile’s. The challenge is to have Congress approve thereform without watering it down.

80

85

90

95

100

105

110

35

40

45

50

55

60

65

IndexGerman IFO and composite PMI

Index

00 02 04 06 08 10

IFO

PMI

Sample

4

Economic ResearchGlobal Data Watch: Developed MarketsSeptember 24, 2010

JPMorgan Chase Bank, New YorkDavid Hensley

Carlton Strong

Joseph Lupton

Global economic outlook summary

Note: For some emerging economies, 2010-2011 quarterly forecasts are not available and/or seasonally adjusted GDP data are estimated by J.P. Morgan. New GDP weights used tocalculate the regional and global aggregates shown in the table were introduced in the September 3, 2010 issue. The change in composition adds to the weight given to EM countries andas a result increases global GDP growth by 0.4%-point on average.Bold denotes changes from last edition of Global Data Watch, with arrows showing the direction of changes. Underline indicates beginning of J.P. Morgan forecasts.

2009 2010 2011 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 2Q10 4Q10 2Q11 4Q11The AmericasUnited States -2.6 2.6 2.4 3.7 1.6 1.5 2.0 2.5 2.5 3.0 1.8 0.9 1.2 1.1Canada -2.5 3.1 2.2 5.8 2.0 2.2 2.0 2.3 2.0 2.4 1.4 1.9 ↓ 2.1 2.1Latin America -2.4 5.7 ↑ 4.1 ↑ 4.9 ↓ 8.9 ↓ 1.0 ↓ 2.7 ↓ 4.4 ↑ 6.0 ↑ 3.5 6.6 ↑ 7.1 7.3 7.3

Argentina -2.0 8.5 5.5 ↑ 13.4 ↑ 12.6 ↓ 0.0 ↓ 2.0 ↓ 6.0 ↑ 8.0 ↑ 8.0 10.6 ↑ 10.5 ↑ 11.0 12.0Brazil -0.2 7.5 4.5 11.3 5.1 2.3 3.2 5.7 4.7 5.0 5.1 5.0 5.1 5.1Chile -1.5 5.5 ↑ 6.0 -6.0 18.4 11.0 ↓ 6.0 ↓ 4.0 ↑ 4.0 ↑ 4.0 1.2 3.8 3.6 ↓ 3.4 ↓

Colombia 0.8 4.5 4.1 3.3 ↓ 3.9 ↓ 3.7 4.0 4.0 4.1 5.0 2.1 2.8 3.3 4.0Ecuador 0.4 2.0 3.0 1.3 3.5 4.0 4.5 3.0 2.5 2.5 3.3 3.9 4.1 3.9Mexico -6.5 4.5 3.5 -2.5 13.5 -3.6 3.1 2.9 9.2 -0.1 4.0 5.1 4.5 4.0Peru 0.9 8.2 6.0 8.0 12.7 4.8 3.5 5.8 6.7 7.2 1.2 2.6 2.2 2.7Venezuela -3.3 -2.2 1.0 -2.0 5.2 3.0 -5.0 2.0 1.0 1.5 31.9 31.6 34.7 35.1

Asia/PacificJapan -5.2 3.0 1.1 5.0 1.5 2.5 -0.5 0.5 1.5 1.8 -0.9 -0.7 0.1 -0.1Australia 1.2 3.1 3.2 2.7 4.9 2.4 2.8 3.1 4.0 3.0 3.1 3.3 3.8 3.4New Zealand -1.7 2.0 ↓ 2.8 ↓ 2.2 ↓ 0.7 ↓ 2.5 ↓ 2.5 ↓ 2.6 ↓ 3.1 ↓ 4.2 ↑ 1.8 4.9 5.6 3.2Asia ex Japan 5.6 8.7 7.0 10.5 7.4 5.5 6.4 7.4 7.3 7.5 4.5 4.1 ↓ 3.9 ↓ 3.9

China 9.1 9.8 8.6 10.8 7.2 7.5 8.1 9.1 8.9 9.1 2.9 2.8 2.7 2.6Hong Kong -2.8 6.6 4.1 8.7 5.7 3.0 3.5 4.2 4.3 4.7 2.6 2.5 2.2 2.4India 7.4 8.3 8.5 9.2 8.5 8.0 8.9 8.0 8.5 8.6 13.7 11.0 10.1 10.2Indonesia 4.5 6.0 5.4 3.0 7.5 4.5 5.0 5.3 5.2 5.0 4.4 6.8 6.6 4.8Korea 0.2 6.1 4.0 8.8 5.8 2.5 3.8 4.0 4.0 4.5 2.6 2.9 ↓ 3.4 ↓ 3.4 ↑

Malaysia -1.2 7.2 4.6 4.8 7.2 3.0 3.5 4.9 4.9 4.5 1.6 1.1 1.3 2.4Philippines 1.1 7.0 3.9 11.9 7.7 0.8 1.6 4.9 4.9 4.9 4.2 1.8 1.5 3.5Singapore -1.3 14.8 4.2 45.7 24.0 -11.5 -2.0 8.7 6.6 7.4 3.1 3.0 1.4 1.6Taiwan -1.9 9.9 4.1 10.9 7.2 1.5 2.3 4.2 4.6 5.5 1.1 2.0 1.8 1.7Thailand -2.2 8.5 5.0 13.9 0.6 2.8 2.8 6.0 5.5 4.0 3.2 1.1 1.5 1.8

Africa/Middle EastIsrael 0.8 3.5 4.5 3.8 4.6 3.0 3.0 4.0 5.0 5.5 2.8 2.6 3.0 2.8South Africa -1.8 2.9 3.1 4.6 3.2 3.1 3.2 3.1 3.1 3.4 4.5 4.5 4.7 5.9

EuropeEuro area -4.0 1.7 1.5 1.3 3.9 2.0 1.0 1.0 1.0 1.8 1.5 1.7 1.1 1.0

Germany -4.7 3.3 2.4 1.9 9.0 3.0 2.0 2.0 1.5 2.0 1.0 1.2 0.6 0.7France -2.5 1.6 1.5 ↑ 0.7 2.8 ↑ 2.0 1.5 1.0 1.0 1.5 1.8 1.3 0.7 1.1Italy -5.1 1.2 ↑ 1.3 1.7 ↑ 1.8 ↑ 2.0 1.0 1.0 1.0 1.5 1.6 1.7 1.4 1.5

Norway -1.2 1.5 2.3 0.7 1.9 3.0 2.5 2.0 2.0 2.5 2.6 2.1 1.3 1.3Sweden -5.1 4.5 3.1 6.0 8.0 4.5 3.0 2.3 2.3 2.8 1.0 1.5 1.6 1.8Switzerland -1.9 2.9 2.0 4.2 3.5 2.5 2.0 1.5 1.5 2.3 1.0 0.4 0.1 0.7United Kingdom -4.9 1.7 2.2 1.3 4.9 2.5 1.5 1.0 2.5 3.0 3.5 2.6 1.9 2.1Emerging Europe -5.3 3.9 4.2 2.7 3.8 2.4 3.8 3.9 4.2 4.6 5.7 6.4 6.5 5.6

Bulgaria -5.0 -0.5 4.0 … … … … … … … … … … …Czech Republic -4.1 2.0 3.2 1.5 3.8 2.5 2.3 2.5 3.0 5.0 1.2 2.8 2.7 2.6Hungary -6.3 1.0 2.8 2.4 0.0 2.0 2.0 2.0 3.0 3.5 5.4 4.4 3.4 3.6Poland 1.7 ↓ 3.5 3.8 2.8 4.5 3.5 3.5 3.0 3.5 4.0 2.3 2.6 2.7 2.9Romania -7.1 -2.0 1.5 … … … … … … … 4.4 8.0 7.2 4.0Russia -7.9 4.3 4.7 3.3 4.3 2.5 5.0 5.0 5.0 5.0 5.9 7.6 8.4 7.1Turkey -4.7 6.4 4.7 … … … … … … … 9.2 7.5 7.0 6.2

Global -2.2 3.6 2.9 4.2 3.9 2.5 2.3 2.8 3.1 ↑ 3.3 2.5 2.3 2.3 2.2Developed markets -3.5 2.3 1.9 3.0 2.8 2.0 1.4 1.6 1.9 2.4 1.5 1.2 1.2 1.1Emerging markets 1.3 6.9 5.7 7.7 7.1 3.8 ↓ 5.0 ↓ 6.0 ↑ 6.4 ↑ 5.9 5.2 5.3 5.2 ↓ 5.1

Memo:Global — PPP weighted -0.8 4.5 3.8 5.2 4.6 ↓ 3.1 3.2 3.8 ↑ 4.0 4.2 3.2 3.0 3.0 2.9

% over a year agoConsumer prices

% over previous period, saar Real GDP

% over a year ago Real GDP

Sample

Economic ResearchGlobal Data Watch: Developed MarketsSeptember 24, 2010

5

JPMorgan Chase Bank, New YorkDavid Hensley

Carlton Strong

Joseph Lupton

G-3 economic outlook detailPercent change over previous period; seasonally adjusted annual rate unless noted

Note: More forecast details for the G-3 and other countries can be found on J.P. Morgan’s Morgan Markets client web site.

2009 2010 2011 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4QUnited StatesReal GDP -2.6 2.6 2.4 3.7 1.6 1.5 2.0 2.5 2.5 3.0 4.0 Private consumption -1.2 1.5 2.1 1.9 2.0 1.8 1.8 2.0 2.3 2.5 3.3 Equipment investment -15.3 14.5 8.9 20.5 24.9 10.0 7.0 7.0 8.0 8.0 10.0 Non-residential construction -20.4 -14.4 1.7 -17.8 0.4 -6.0 -3.0 0.0 7.0 9.0 10.0 Residential construction -22.9 -2.1 6.4 -12.3 27.1 -20.0 -5.0 10.0 15.0 20.0 20.0 Inventory change ($ bn saar) -113.1 51.3 59.7 44.1 63.2 48.7 49.0 59.3 59.6 60.2 59.8 Government spending 1.6 0.9 0.0 -1.6 4.3 0.9 0.8 -0.8 -1.0 -1.0 0.4 Exports of goods and services -9.5 11.8 7.2 11.4 9.2 8.0 7.0 6.0 7.0 8.0 8.0 Imports of goods and services -13.8 11.9 6.2 11.2 32.4 3.0 4.0 4.0 6.0 6.0 6.0 Domestic final sales contribution -3.1 1.7 2.3 1.4 4.4 1.4 1.7 2.0 2.5 2.8 3.8 Inventories contribution -0.6 1.3 0.1 2.6 0.6 -0.5 0.0 0.3 0.0 0.0 0.0 Net trade contribution 1.0 -0.3 0.0 -0.3 -3.4 0.6 0.3 0.2 0.0 0.2 0.2Consumer prices (%oya) -0.3 1.6 1.0 2.4 1.8 1.3 0.9 0.8 1.2 1.1 1.1 Excluding food and energy (%oya) 1.7 1.0 0.7 1.3 1.0 0.9 0.7 0.8 0.7 0.6 0.7Federal budget balance (% of GDP, FY) -10.0 -9.6 -8.0Personal saving rate (%) 5.9 5.9 6.1 5.5 6.1 6.0 6.1 6.0 6.0 6.2 6.2Unemployment rate (%) 9.3 9.7 9.8 9.7 9.7 9.6 9.8 9.9 9.8 9.7 9.6Industrial production, manufacturing -11.1 5.7 3.3 6.2 8.5 3.5 2.0 2.0 3.0 4.5 5.0Euro areaReal GDP -4.0 1.7 1.5 1.3 3.9 2.0 1.0 1.0 1.0 1.8 2.0 Private consumption -1.1 0.7 1.0 0.6 1.9 0.3 0.5 1.0 1.0 1.5 2.0 Capital investment -11.3 -0.5 3.4 -1.6 7.5 3.0 3.0 3.0 3.0 3.5 4.0 Government consumption 2.5 1.0 -0.1 0.9 1.9 1.0 0.0 -0.5 -0.5 -0.5 -0.5 Exports of goods and services -12.9 9.9 7.0 9.8 18.6 8.0 7.0 6.0 6.0 5.0 5.0 Imports of goods and services -11.6 10.2 6.3 17.2 18.6 6.0 5.0 6.0 6.0 5.0 5.0 Domestic final sales contribution -2.6 0.5 1.2 0.3 2.9 0.9 0.9 1.1 1.1 1.4 1.8 Inventories contribution -0.7 1.2 -0.1 3.7 0.8 0.2 -0.8 -0.1 -0.1 0.3 0.1 Net trade contribution -0.8 0.0 0.3 -2.6 0.1 0.9 0.9 0.1 0.1 0.1 0.1Consumer prices (HICP, %oya) 0.3 1.5 1.1 1.1 1.5 1.7 1.7 1.4 1.1 0.9 1.0 ex unprocessed food and energy 1.3 0.9 0.8 0.9 0.8 1.0 1.0 0.9 0.9 0.7 0.7General govt. budget balance (% of GDP, FY) -6.3 -6.8 -5.5Unemployment rate (%) 9.4 10.0 9.9 9.9 10.0 10.0 10.0 10.0 9.9 9.8 9.7Industrial production -14.9 6.5 1.9 9.8 10.1 2.0 1.0 1.0 1.0 2.0 3.0JapanReal GDP -5.2 3.0 1.1 5.0 1.5 2.5 -0.5 0.5 1.5 1.8 2.0 Private consumption -1.0 2.1 0.6 2.2 0.0 4.5 -2.5 0.5 1.2 0.8 1.5 Business investment -19.1 1.6 4.0 3.2 6.2 4.0 3.0 3.0 4.0 6.0 5.0 Residential construction -13.9 -9.6 2.1 1.2 -5.1 -5.0 0.0 5.0 5.0 5.0 5.0 Public investment 8.0 -4.3 -10.4 -3.5 -10.3 -10.0 -10.0 -10.0 -10.0 -12.0 -12.0 Government consumption 1.5 1.6 0.9 2.2 1.1 1.0 0.8 0.8 0.8 1.0 1.0 Exports of goods and services -24.1 25.6 6.3 31.0 25.8 10.0 2.5 3.0 5.0 8.0 8.0 Imports of goods and services -16.8 10.8 5.7 12.6 17.4 10.0 3.5 3.5 4.0 6.0 7.0 Domestic final sales contribution -3.4 1.3 0.7 2.0 0.5 2.8 -1.3 0.6 1.1 1.1 1.4 Inventories contribution 0.2 -0.6 -0.1 0.2 -0.8 -0.8 0.8 -0.2 0.0 0.0 0.0 Net trade contribution -2.0 2.2 0.4 2.8 1.9 0.5 0.0 0.1 0.4 0.6 0.5Consumer prices (%oya) -1.4 -1.0 -0.1 -1.2 -0.9 -1.1 -0.7 -0.5 0.1 0.2 -0.1General govt. net lending (% of GDP, CY) -7.2 -7.6 -8.5Unemployment rate (%) 5.1 4.9 4.5 4.9 5.2 4.9 4.7 4.6 4.6 4.5 4.4Industrial production -21.8 17.8 2.8 30.9 6.2 2.5 -1.0 1.0 4.0 7.0 7.0

Memo: Global industrial production -8.9 9.3 4.6 11.9 9.9 2.9 3.6 3.1 5.0 5.7 7.1 %oya 10.0 11.3 8.8 7.1 5.0 3.9 4.3 5.2

2010 2011

Sample

6

Economic ResearchGlobal Data Watch: Developed MarketsSeptember 24, 2010

JPMorgan Chase Bank N.A., New YorkDavid Hensley

Michael Mulhall

Joseph Lupton

Central Bank WatchChange from Forecast

Official interest rate Current Aug '07 (bp) Last change Next meeting next change Sep 10 Dec 10 Mar 11 Jun 11 Sep 11

Global GDP-weighted average 1.76 -319 1.77 1.82 1.87 1.94 1.98 excluding US GDP-weighted average 2.40 -241 2.40 2.47 2.54 2.64 2.70Developed GDP-weighted average 0.61 -358 0.61 0.63 0.65 0.67 0.69Emerging GDP-weighted average 4.99 -211 5.00 5.14 5.29 5.51 5.59 Latin America GDP-weighted average 7.22 -218 7.22 7.31 7.80 8.38 8.42 CEEMEA GDP-weighted average 4.07 -295 4.08 4.10 4.11 4.17 4.36 EM Asia GDP-weighted average 4.54 -171 4.55 4.76 4.84 5.00 5.05

The Americas GDP-weighted average 1.28 -453 1.28 1.31 1.40 1.51 1.54United States Federal funds rate 0.125 -512.5 16 Dec 08 (-87.5bp) 3 Nov 10 On hold 0.125 0.125 0.125 0.125 0.125Canada Overnight funding rate 1.00 -325 8 Sep 10 (+25bp) 19 Oct 10 19 Oct 10 (+25bp) 1.00 1.25 1.50 1.75 2.00Brazil SELIC overnight rate 10.75 -125 21 Jul 10 (+50bp) 20 Oct 10 Jan 11 (+25bp) 10.75 10.75 11.50 12.50 12.50Mexico Repo rate 4.50 -270 17 Jul 09 (-25bp) 15 Oct 10 On hold 4.50 4.50 4.50 4.50 4.50Chile Discount rate 2.50 -250 16 Sep 10 (+50bp) 14 Oct 10 16 Sep 10 (+50bp) 2.50 3.25 4.00 4.50 4.50Colombia Repo rate 3.00 -600 30 Apr 10 (-50bp) 29 Oct 10 1Q 11 (+50bp) 3.00 3.00 4.00 5.00 5.50Peru Reference rate 3.00 -150 9 Sep 10 (+50bp) 7 Oct 10 4Q 10 (+50bp) 3.00 4.00 4.50 4.50 4.50

Europe/Africa GDP-weighted average 1.44 -322 1.44 1.45 1.46 1.47 1.52Euro area Refi rate 1.00 -300 7 May 09 (-25bp) 7 Oct 10 On hold 1.00 1.00 1.00 1.00 1.00United Kingdom Repo rate 0.50 -500 5 Mar 09 (-50bp) 7 Oct 10 On hold 0.50 0.50 0.50 0.50 0.50Sweden Repo rate 0.75 -275 2 Sep 10 (+25bp) 26 Oct 10 26 Oct 10 (+25bp) 0.75 1.25 1.25 1.25 1.50Norway Deposit rate 2.00 -250 5 May 10 (+25bp) 27 Oct 10 3Q 11 (+25bp) 2.00 2.00 2.00 2.00 2.25Czech Republic 2-week repo rate 0.75 -200 6 May 10 (-25bp) 4 Nov 10 2Q 11 (+25bp) 0.75 0.75 0.75 1.00 1.25Hungary 2-week deposit rate 5.25 -250 26 Apr 10 (-25bp) 27 Sep 10 3Q 11 (+25bp) 5.25 5.25 5.25 5.25 5.50Israel Base rate 1.75 -225 26 Jul 10 (+25bp) 27 Sep 10 27 Sep 10 (+25bp) 2.00 2.25 2.50 2.75 3.25Poland 7-day intervention rate 3.50 -100 24 Jun 09 (-25bp) 29 Sep 10 2Q 11 (+25bp) 3.50 3.50 3.50 3.75 4.00Romania Base rate 6.25 -75 4 May 10 (-25bp) 29 Sep 10 3Q 11 (+25bp) 6.25 6.25 6.25 6.25 6.50Russia 1-week deposit rate 2.75 -25 31 May 10 (-50bp) Sep 10 3Q 11 (+25bp) 2.75 2.75 2.75 2.75 3.00South Africa Repo rate 6.00 -350 9 Sep 10 (-50bp) 18 Nov 10 On hold 6.00 6.00 6.00 6.00 6.00Switzerland 3-month Swiss Libor 0.25 -225 12 Mar 09 (-25bp) 4Q 10 Jun 11 (+25bp) 0.25 0.25 0.25 0.50 0.75Turkey 1-week repo rate 7.00 -1050 - 14 Oct 10 4Q 11 (+50bp) 7.00 7.00 7.00 7.00 7.00

Asia/Pacific GDP-weighted average 2.92 -128 2.92 3.06 3.12 3.23 3.27Australia Cash rate 4.50 -175 4 May 10 (+25bp) 5 Oct 10 5 Oct 10 (+25bp) 4.50 4.75 5.00 5.25 5.50New Zealand Cash rate 3.00 -500 29 Jul 10 (+25bp) 27 Oct 10 10 Mar 11 (+25bp) 3.00 3.00 3.25 3.50 3.75Japan Overnight call rate 0.10 -43 19 Dec 08 (-20bp) 5 Oct 10 On hold 0.10 0.10 0.10 0.10 0.10Hong Kong Discount window base 0.50 -625 17 Dec 08 (-100bp) 4 Nov 10 On hold 0.50 0.50 0.50 0.50 0.50China 1-year working capital 5.31 -126 22 Dec 08 (-27bp) 3Q 10 4Q 10 (+27bp) 5.31 5.58 5.58 5.85 5.85Korea Base rate 2.25 -225 9 Jul 10 (+25bp) 14 Oct 10 4Q 10 (+25bp) 2.25 2.50 2.75 2.75 2.75Indonesia BI rate 6.50 -200 5 Aug 09 (-25bp) 5 Oct 10 2Q 11 (+25bp) 6.50 6.50 6.50 6.75 6.75India Repo rate 6.00 -175 16 Sep 10 (+25bp) 2 Nov 10 4Q 10 (+25bp) 6.00 6.25 6.50 6.50 6.75Malaysia Overnight policy rate 2.75 -75 8 Jul 10 (+25bp) 12 Nov 10 On hold 2.75 2.75 2.75 2.75 2.75Philippines Reverse repo rate 4.00 -350 9 Jul 09 (-25bp) 7 Oct 10 1Q 11 (+25bp) 4.00 4.00 4.25 4.75 5.00Thailand 1-day repo rate 1.75 -150 26 Aug 10 (+25bp) 20 Oct 10 20 Oct 10 (+25bp) 1.75 2.00 2.00 2.00 2.00Taiwan Official discount rate 1.375 -175 24 Jun 10 (+12.5bp) 30 Sep 10 30 Sep 10 (+12.5bp) 1.50 1.50 1.50 1.50 1.625Bold denotes move since last GDW and forecast changes. Underline denotes policy meeting during upcoming week.

Sample

Economic ResearchGlobal Data WatchSeptember 24, 2010

7

JPMorgan Chase Bank, LondonJan Loeys

J.P. Morgan View: Markets

Central banks areboosting confidence• Economics –– Activity data are tracking our forecast of

growth close to potential.

• Asset allocation –– QE boosts investor confidence.Add risk.

• Fixed Income –– QE on the horizon supports core bondmarkets, but look for Australia and Canada to decouple.

• Equities –– Negative pre-announcements point to aworse EPS outcome in Q3 relative to Q2, but seemlargely priced in. Short covering has further to go.

• Credit –– Medium-term strategy remains long credit,favoring EM over DM, corporate over state, and USover Europe.

• FX –– Add to USD shorts.

• Commodities –– Much stronger than expected demandfor crude oil leads us to raise price forecasts, from $75 to$81 average for Q4. Go long crude oil.

In a week where economic data were OK, but not great andjust confirming stabilization, the important event was aclear enough statement from the Fed that it would do whatit can with its balance sheet to reflate the economy. To-gether with the Bank of England and Bank of Japan, theyare telling us that low growth is not acceptable, deflationrisks are rising, and they stand ready to move to a sec-ond phase of asset purchases to reflate the globaleconomy and asset markets.

Investors are becoming more hopeful, but remain scep-tical on what central banks can achieve, taking a “showme that it works” attitude before joining the reflation trade.Recent global activity data are telling us that downside riskof a double dip has been curtailed, but that there is as yetno reason to see upside risk (Chart 1). The majority of in-vestors believe that the developed economies have entereda 7-year famine of weak growth, high unemployment, andhigh fiscal deficits. And most believe that emerging econo-mies will escape much of this malaise. We have expressedsimilar views but are more open on how long this malaisewill last and how bad it will be. This is because policymakers and governments are under massive pressure to endthe malaise and reflate the world economy.

Hyperactive policy makers have the tools that can help turnthe world economy around, but the risk is that such ac-

tions will do more bad than good. Negative impacts couldcome from overstimulating the world, and thus quicklyturning deflation into inflation risks. This is one reason theECB remains more conservative. A second danger is thathyperaction turn into beggar-they-neighbour policies,aimed at helping your own country at the cost of others,and likely the overall world economy. You increase yoursize of the pie, but the pie itself will shrink. These measureinclude currency intervention and trade restrictions. Thegood news is that, so far, most counties are staying awayfrom destructive protectionism. Asia, however, continues toprotect itself against currency appreciation, with Japan hav-ing joined in recently. There is a danger this becomes a cur-rency war, but Europe and the US are so far not taking thebait. If anything, Asian currency intervention has had thegrowth-positive impact of importing US easy monetarypolicy. We conclude that trade, monetary, and currencypolicies are in aggregate a boost to growth.

Will these policies succeed in stimulating growth andthus risk assets? Much of the slower growth we are seeingis due not only to delevering, but also to broad macro andmicro uncertainty that are holding companies and house-holds back from responding to easy money. The clear moveby three major central banks to commit their balance sheetsto reflation should make economic agents on the marginless uncertain and thus more willing to invest and spend.This is the reason to raise allocations to riskier assets.

Fixed incomeBond markets are priced for significant further easing, andcentral banks brought that easing closer this week, pushingyields lower across the globe. The BoE’s minutes showed acommittee edging towards more QE. And more impor-tantly, the FOMC adopted a very explicit easing bias,pledging to take action if inflation stays subdued. In-stead of a big bang announcement of a huge target for bondpurchases, QE2 seems set to take a more flexible course,with the Fed setting a modest target for the first fewmonths, and waiting for the data to see if more is needed.Ultra-loose monetary policy remains supportive of bondmarkets, and we stay bullish and in flatteners.

More easing in the US, UK and perhaps Japan raisesthe prospect of a more pronounced decoupling withbond markets in the smaller developed economies,which have recovered more smartly from the global reces-sion. Indeed, hawkish comments by RBA GovernorStevens this week prompted the market to fully price an-other rate hike by year end. We favour flatteners on theAustralian money market curve. Similarly, we expect the

Sample

8

Economic ResearchJ.P. Morgan View: MarketsSeptember 24, 2010

JPMorgan Chase Bank, LondonNikolaos Panigirtzoglou

Bank of Canada gradually to move policy away from itsemergency setting, even in the face of somewhat slowergrowth, and stay short in Canada vs the US.

European peripherals underperformed this week, led onceagain by Ireland and Portugal. Peripheral bonds have threepotential supports. The first and most important is a narrow-ing of fiscal deficits, but this will take time, and Portugal forone appears to be falling behind its targets. The second is theprospect of support from the EU and IMF. Yet even thoughGreece has secured funding for the next three years, its 2-year yields are still at 9%, indicating that the market remainssceptical that EU/IMF support removes default risk. Thethird is the potential for more aggressive ECB buying,though the central bank’s purchases have now been below€400m for ten weeks in a row. Thus we stay neutral overallon peripherals, even at these wide spreads, while looking forshort-dated Greek paper to continue its recent rally, andfor Spanish spreads to drift wider into supply.

EquitiesEquities rose for a fourth straight week on dovish centralbank comments and slightly better economic data. Our USEconomic Activity Surprise Index (EASI), which tends tocorrelate well with equities and tracks data surprises over a6-week rolling window, has risen to zero after spendingalmost three months in negative territory (see chart).

Equity fund flows continued to be positive for a thirdstraight week driven once again by ETFs. In contrast,non-exchange traded equity mutual fund flows remainnegative. As explained last week, this suggests that it wasmostly hedge funds rather than retail investors behind thismonth’s rally. The still low level of their 21-day rollingequity beta suggests that Macro hedge funds are still farfrom fully covering their shorts in equities (see chart).

Equity prices have been above the important technicallevel of 200-day moving averages for two straightweeks, longer than the one week in early August. Thelonger equity prices stay above the 200-day moving aver-age, the more likely it becomes that momentum driven in-vestors will chase the equity rally.

The Q3 reporting season is set to kick off in two weeks.Pre-announcements and guidance has been so far morenegative compared to Q2. Negative pre-announcementsare running at 59% of total, compared with 50% for the Q2reporting season and 55% for Q1. Negative pre-announce-ments and guidance were concentrated in Cyclical sectors,especially the Technology sector. We are thus reluctant to

chase the recent rally in Technology stocks and prefer tofocus our sectoral exposure on Banks.

Overall, negative earnings pre-announcements point to aworse EPS outcome in Q3 relative to Q2, but this islargely priced in. Bottom-up projections for Q3S&P500 EPS show a large 4% drop from Q2, a magnitudeonly seen during past financial crises or recessions.

Across regions, we continue to focus our exposure on EM.Indeed, EM equities resumed their outperformance inSeptember. Our EM vs DM equity allocation modelfavours an EM overweight, as both 2-month return momen-tum and relative IP growth (i.e. the difference between theoya rates in EM IP vs DM IP) are supportive.

CreditCorporates bonds are up on the week in price terms, butspreads have lagged the equity rally due to the rapid fall ingovernment yields. Unlike equities, credit does not benefitfrom a short base, with most managers being overweight.Near term, this benefits equities over credit, despite ourpreference for credit in a low-growth world.

Our medium strategy is to be long credit, but to be selec-tive, favoring sectors and regions least vulnerable to a lowgrowth environment. This means favoring EM over DM,corporate over sovereign, and US over Europe.

Foreign ExchangeIn view of the Fed’s imminent re-launch of large-scaleasset purchases, we published several forecast changes inweek. EUR/USD still looks to be in a range, though wemove the mid-point from 1.25, where we set it during thelast round of forecast revisions in May, to 1.30. As the majorreserve currency alternative to the dollar, the euro wouldbenefit unambiguously from Fed QE were it not for

2.8

3.0

3.2

3.4

3.6

3.8

Jan 10 Mar 10 May 10 Jul 10 Sep 10

2011 global GDP growth forecasts: J.P. Morgan versus consensus%

J.P. Morgan

Consensus

Sample

Economic ResearchGlobal Data WatchSeptember 24, 2010

9

JPMorgan Chase Bank, LondonJan Loeys

Europe’s growth slowdown in Q4, an event which couldrevive sovereign stress. This upgrade to EUR/USD’s fore-cast also lifts the GBP/USD range from a previous low 1.40sto high 1.40s. The outlook for EUR/GBP is unchanged,however. We still expect the cross to reach 0.87 by end-2010and 0.88 by Q1 2011.

Commodity currency forecasts are raised through year-end. We had expected these currencies to slump in Q42010 as the global economy downshifted, but Asia hasstabilised more quickly than expected and Chinese data areshowing some signs of reacceleration. AUD, NZD andCAD should, therefore, range around current levels in Q4before trending higher in 2011 on the back of further raterises. The USD/JPY forecast for a new all-time low at 79by December 2010 is unchanged, even in the face of in-tervention risks.

The signal from the Fed that further QE is required is notjust the message that inflationary pressures remain weakbut that US growth momentum is stalling. Though a furthersuppression in US yields and added monetary stimulus bythe Fed should be broadly negative for USD versus all ma-jor currencies, stalling growth is likely to see some dispar-ity between the performance of high beta currencies suchas NZD which are likely to under-perform and defensivecurrencies such as CHF and JPY which should continue tooutperform. This week we are moving to a more defensivestance are adding further short USD exposure (vs. CHF)whilst extending CHF longs (vs. NZD, GBP and EUR).

With the Fed having now shown its hand, we expect thatthe BoE will be the next central bank to pull the trigger onQEII in the months ahead. A triumvirate of spending cuts,housing market slowdown and further monetary stimulusprovide the perfect storm for sustained GBP downside.Add GBP shorts vs. European currencies where fundamen-tal divergences are starkest (NOK, CHF).

CommoditiesRecent data show a much stronger than expected in-crease in demand for crude oil in Q3 2010, driven almostentirely by emerging markets and in particular China. Thiscoincides with the view from our economists that whiledemand growth is likely to remain at subdued levels, theglobal manufacturing downshift is now over and withChina’s economy projected to expand by 8.6% next year,we expect demand to remain strong. These two develop-ments coupled with probable further weakness in the dollarfollowing on from an expected second round of QE, lead us

to revise up our oil price forecast from an average price of$75 in Q4 to $81. As such, we move from neutral to out-right long crude oil.

We have been underweight base metals for over a monthnow as we expected a dramatic slowdown in global indus-trial growth to translate into a slowdown in demand for rawmaterials like metals. This slower demand growth has notmaterialised and with the manufacturing slowdown nowover and Chinese demand growth stabilising at healthy lev-els, we see a more balanced supply and demand picture. Asa result, we turn neutral base metals.

It is tempting to jump on the current rally in gold as mo-mentum and flows are clearly supportive. However, goldsupply appears healthy and industrial and consumer de-mand has weakened this year while buying by ETFs hasincreased to account for almost 30% of global demand,raising the tail risk that a change in investor attitudes couldcause a significant correction in gold prices. As such, weprefer not to chase this rally, and we remain neutral gold.

Ten-year Government bond yieldsCurrent Dec 10 Mar 11 Jun 11 Sep 11

United States 2.61 2.25 2.25 2.25 2.25Euro area 2.34 2.15 2.20 2.30 2.30United Kingdom 3.04 3.00 3.00 3.10 3.25Japan 1.00 0.80 0.80 0.90 0.95GBI-EM 6.33 7.90

CurrentUS high grade (bp over UST) 165Euro high grade (bp over Euro gov) 170USD high yield (bp vs. UST) 669Euro high yield (bp over Euro gov) 629EMBIG (bp vs. UST) 306EM Corporates (bp vs. UST) 351

Current Dec 10 Mar 11 Jun 11 Sep 11EUR/USD 1.35 1.30 1.30 1.30 1.30USD/JPY 84.4 79 81 83 85GBP/USD 1.58 1.49 1.48 1.48 1.49

Current 10Q4 11Q1 11Q2 11Q3WTI ($/bbl) 76 75 75 77 80Gold ($/oz) 1297 1275 1250 1250 1250Copper($/m ton) 7883 6750 6750 7000 6800Corn ($/Bu) 5.22 5.25 5.30 5.15 5.10

12.7%12.5%

Credit marketsYTD Return

10.3%

10.7%5.2%

Commodities - quarterly average

Foreign exchange

Source: J.P. Morgan, Bloomberg, Datastream

11.7%

Sample

10

Economic ResearchThe Fed talks and financial markets listenSeptember 24, 2010

JPMorgan Chase Bank NA, New YorkBruce Kasman

Robert Mellman

The Fed talks and financialmarkets listen• Bernanke’s Jackson Hole speech communicated Fed

concerns over low inflation and willingness to use LSAP

• These two themes were reinforced in this week’sFOMC statement

• Markets have responded: inflation expectations areup, the dollar is down, and risk assets have rallied

Tuesday’s FOMC meeting reinforced the message that theFed is moving toward additional large-scale asset pur-chases (LSAP). The first hint of a shift in policy came fromthe decision to reinvest the paydown of MBS into Treasur-ies announced at the August 10 meeting. This was followedby Chairman Bernanke’s discussion of the efficacy of alter-native policies to support growth, focusing on asset pur-chases, in his August 27 Jackson Hole speech. This week’sdownbeat growth assessment and statement that the com-mittee is “prepared to provide additional accommodation ifneeded” signals that the Fed is now likely to embark onTreasury purchases before year-end.

The goal of Fed balance sheet policy since the financialcrisis began has been to influence the prices of the assets itpurchases. To this end, a decision to purchase longer-termTreasury securities would be geared toward portfolio bal-ance effects that lower longer-term interest rates (see “US:The Fed exits the exit,” GDW, August 13). However, theFed also operates through words and actions that communi-cate its broader policy objectives and path of future actions.In this regard, it has sent an important complementary sig-nal about its objectives in recent weeks. The Committeehas publicly stated for the first time that inflation has fallento unacceptably low levels.

This message was first relayed in the Jackson Hole speech,in which the Chairman said “inflation has declined to a levelthat is slightly below that which FOMC participants view asmost conducive to a healthy economy in the long run.” Itwas reiterated in this week’s statement with a commitmentby the FOMC “to return inflation, over time, to levels consis-tent with its mandate.” A stated goal of raising the level ofUS inflation implies that the Fed is moving much more ag-gressively than just acting against downside risks to growth.Although FOMC members employ different frameworks inforecasting inflation, the likely Committee consensus wouldsee sustained above-trend growth and a significant fall in theunemployment rate as necessary to achieve this goal.

Economic Research Note

More bang for buck after Jackson HoleThere has been considerable skepticism about the effective-ness of monetary policy tools as the Fed reached the lowerbound on policy rates. Despite this skepticism, it is impres-sive to see the size and breadth of the Fed’s impact on fi-nancial markets as it has talked about LSAP and its infla-tion objectives in recent weeks. To be sure, Fed policy isnot the only influence, and these market shifts have alsoreflected incoming economic data that, while generallylackluster, have reduced the risks of a double-dip back intorecession. However, market movements appear to be di-rectly responding to the signal from the Fed.

82838485868788

Jan Mar May Jul Sep

Index, 2000=100Value of dollar, real broad effective exchange rate

Jackson Hole speech

Key US financial market variables%, except as noted

May 3 August 9 Aug 26 LatestEuro fiscal Pre-FOMC Pre-Jackson Hole

10-year Treasury 3.72 2.86 2.50 2.60

S&P 500 index 1202 1128 1047 1145

Dollar, real broad 83.9 83.8 85.1 83.1

Corp. credit spreads (bp):

High grade 114 136 143 140

High yield 587 673 709 672

5yr-5yr breakeven, Fed 3.13 2.49 2.22 2.70

Real 10-year yield 1.30 1.01 0.93 0.74

2.2

2.5

2.8

3.1

3.4

Jan Mar May Jul Sep0.7

0.9

1.1

1.3

1.5

1.7

%, Fed measureUS interest rates

% 5-year - 5-year forward breakeven

10-year TIPS yield (real)

Jackson Hole

Sample

Economic ResearchSeptember 24, 2010

11

JPMorgan Chase Bank NA, New YorkBruce Kasman

Robert Mellman

For purposes of tracking financial markets, it is useful todistinguish between three separate periods.

Stage One: Increasing prospects of weaker growth andlower inflation. The weeks and months after May 3 werefollowed by a period of troubling news out of Europe, acoincident marked downshift in many US economic indica-tors including employment, and increased concerns aboutthe economy possibly slipping back into recession. FromMay until the August 10 FOMC meeting, the financial mar-kets priced in increasing prospects of economic weaknessand reduced inflation. Treasury yields declined, equityprices declined, credit spreads widened, and inflation ex-pectations as measured by TIPS spreads moved signifi-cantly lower (see table on previous page).

Stage Two: Trends continue past August 10 FOMCmeeting. Although the August 10 Fed decision to reinvestMBS prepayments was a surprise, the Fed’s commentaryabout this move suggested that it should not necessarily beviewed as a shift toward an easing bias. Several Fed offi-cial including the Chairman have explained that the deci-sion was necessary just to keep the Fed on hold, as allow-ing prepayments to reduce the size of the Fed’s balancesheet would be a passive policy tightening. In addition,there was no change in the description of the inflation out-look in the statement. As a result, the August 10 FOMCmeeting did not have any discernible influence on financialmarket performance. Through most of August, Treasuryyields declined further, equity prices dropped, creditspreads widened, and market-measured inflation expecta-tions continued to trend lower.

Stage 3: Jackson Hole is a turning point. Nearly half ofChairman Bernanke’s August 27 speech at the JacksonHole conference was devoted to “Policy options for furthereasing.” While the Chairman did not provide much speci-ficity about the path of policy, he explicitly expressed theCommittee’s concern about inflation and recommendedLSAP as the preferred policy tool. Financial markets re-versed course immediately following this speech. BetweenAugust 26 and the September 21 FOMC meeting, Treasuryyields rose, equity prices rose, the dollar declined in value,credit spreads narrowed, and inflation expectations in-creased significantly. These changes are broadly consistentwith the view that the market was now expecting LSAPfrom the Fed that would, at a minimum, cushion downsiderisks to growth.

To be sure, other influences have contributed to swings infinancial market variables since late August. The tone ofthe incoming economic data has been somewhat better. Andsome investors may be looking for the early November elec-tion to result in a Congress that is friendlier to business andto the financial markets. But the economic data have notbeen strong, and inflation news has been subdued. It doesseem that the Fed’s commitment to reflation and its willing-ness to embark on another round of LSAP has been an im-portant influence on financial markets since late August.

Against this backdrop, the statement following the TuesdayFOMC meeting largely reinforced the shift made at Jack-son Hole with details adding support for those who thinkthat the Fed will start to buy Treasuries in size later thisyear. The immediate financial market response to theFOMC statement was not dramatic. But by the end of theweek the latest readings on market-based inflation expecta-tions, the dollar, and equity prices were continuing to re-spond to a Fed that views inflation as undesirably low andis increasingly likely to resort to another LSAP program.

0.0

0.5

1.0

1.5

2.0

2.5

3.0

%ch saarCore PCE price index, with forecast for August

2008 2009 2010

Over year ago

Over 3 months

-2

0

2

4

685 90 95 00 05 10

-4

-3

-2

-1

0

1

%-pt, dev from avg

US unemployment and core inflation rates

%-pt, 8qtr chg in oya

Core inflation, chgUnemployment rate

Sample

12

Economic ResearchUS jobless recoveries: what we now know andstill don’t knowSeptember 24, 2010

JPMorgan Chase Bank, New YorkMichael Feroli

US jobless recoveries: what wenow know and still don’t know• The labor market recovery from the 2007-2009 reces-

sion bears similarities to the past two recoveries

• One hypothesis for this is structural change that hasmade businesses more cautious

One year ago, as the current recovery was just getting un-der way, we published a note that surveyed theories of job-less recoveries in order to gauge the prospects for the labormarket in the year ahead. At that time, there were twobroad sets of explanations for the jobless recoveries thatfollowed the 1991 and 2001 recessions. One set focused onthe shallowness of those recessions, which created only amodest bounce-back in growth and labor market activity.The other set of explanations looked to structural changesthat may have taken place in the economy in the 1980s orsince that may have changed the shape of business cycles.

Defining jobless recoveriesThe current recovery certainly wasn’t shallow, yet by somemeasures it is shaping up to be a jobless recovery. Probablythe simplest measure of a jobless recovery is net change injobs since the end of the recession. Currently, private non-farm employment, total nonfarm employment, and thehousehold survey measure of civilian employment all standbelow where they were at the end of the recession in June2009. By this straightforward standard, the US is experi-encing its third consecutive jobless recovery.

A recurrent concern is that the term “jobless recovery” maysimply mean a slow-growth recovery, with no labor marketfeature that is particularly unusual. In order to mitigate thisconcern, we look at job growth relative to GDP growth(second chart) in order to control for the strength of the re-covery. When looked at in this way, the behavior of thelabor market in recoveries still exhibits a sharp break in themid-1980s. Prior to then, employment grew at about halfthe rate of GDP in the first year of recovery. Since then,employment has contracted in the first year even as GDPhas grown. Of course, there is a complex web of interac-tions between overall economic growth and job growth, buteven controlling for GDP growth, there seems to be a shiftin labor market behavior in the 1980s that persists in thecurrent recovery.

Economic Research Note

98

100

102

104

106

108

-10 -5 0 5 10 15 20Months from trough

Private nonfarm payrolls around recession troughTrough employ ment = 100

1982

1975

1991

2001

2009

-40-20

020406080

%

First year of recovery employment growth rate as % of GDP growth rate

'49 '58 '70 '82 '01'54 '61 '75 '91 '09

Another way of comparing the current labor market recov-ery to previous jobless recoveries is to look at the grossflows in the labor market. (Gross flow data are availablefor only the last two decades, but a widely used methodintroduced by Rob Shimer at the University of Chicago es-timates implied flow data from the household survey.) Thethird chart plots the probability an employee is separatedfrom his job (a proxy for firing) and the probability an un-employed person finds employment (a proxy for hiring).

Relative to recoveries prior to the mid-1980s, there is noth-ing unusual about the job separation probabilities in the job-less recoveries, or in the current recovery for that matter,indicating that businesses have not stepped up firing in thepast three recoveries. In contrast, the job finding probabilityhas been significantly lower in the past three recoveries rela-

2.02.53.03.54.04.55.0

72 77 82 87 92 97 02 07

102030405060

%, both scales

Probability of finding or losing a jobProbability employ ed

person loses jobProbability unemploy ed

person finds a jobSample

Economic ResearchGlobal Data WatchSeptember 24, 2010

13

JPMorgan Chase Bank, New YorkMichael Feroli

0.70.80.91.01.11.21.31.4

1 3 5 7 9 11 13 15 17 19 21 23 25

Index , trough=1Job finding probability

Range of 6 prior post-WWII recoveries

2001

Months after trough

19912009

0.7

0.8

0.9

1.0

1.1

1 3 5 7 9 11 13 15 17 19 21 23 25

Index , trough=1Job separation probability in recoveries

1991

Range of 6 prior post-WWII recoveries

Months after trough

20012009

tive to prior post-war recoveries. For whatever reason, firmsappear much more reluctant to hire in jobless recoveries, andthe current recovery fits right into this pattern.

Explaining jobless recoveriesGiven that the current recovery seems to fit most definitionsand share most characteristics of jobless recoveries, the shal-low recession explanation of jobless recoveries is much lesspersuasive. Why then has every recovery since the mid-1980s produced no job growth in the first year of the expan-sion, even controlling for the vigor of the overall economy?And why has hiring been relatively weak even as layoffshave followed the path of previous recoveries?

Of course there are idiosyncracies in each recession—theS&L issues in the 1990s, the Iraq War uncertainties in the2000s, the deleveraging process today—and so the appar-ent trend toward jobless recoveries could be merely a stringof bad luck. While this is possible, the consistent experi-ence of job-full recoveries before the mid-1980s and job-less ones since then is striking. In last year’s note, we dis-cussed the various explanations put forward by academiceconomists. To recap, the explanations were few, weregenerally not compelling, and become even less compellingwhen forced to also explain the current jobless recovery.

Structural changes in the US economy surely did take placein the mid-1980s. The “Great Moderation” in the volatilityof economic activity—which seems to have survived theGreat Recession—is often dated to the mid-1980s. Associ-ated with that is a shift in inventory behavior such thatfirms’ stockbuilding is less procyclical. More generally,firms are often reported to have become more cost-con-scious in that period, whether it was just-in-time inventorymanagement, EVA, lean manufacturing, etc. The problemeconomists have with this explanation is that it seems toimply that before the 1980s, firms were leaving profits onthe table by not cutting costs to the fullest extent possible.

While economists assume a profit maximization motive forfirms, the starting point in the study of corporate finance isthe observation of a separation between ownership andcontrol: the profit-maximizing objective of shareholdersmay conflict with the empire-building or other objectivesof executives. The mid-1980s ushered in an era of morecontested markets for corporate control. While the hostiletakeover tactics of that decade have subsided, corporatefinance theorists are in general agreement that the legacy ofthat period is fundamentally changed governance struc-tures: private equity, LBOs, MBOs, heightened merger ac-tivity, increased incentive compensation for executives, and

other mechanisms have emerged since the 1980s as meansto align the interests of ownership and management. Thereorienting of executive focus from empire-building toprofits may have created more reluctant hiring early in re-coveries. Of course, this explanation is conjectural.

If jobless recoveries are an enduring feature of economicrecoveries, the implications are not entirely bleak. While it’sobviously nice to experience robust job growth coming outof recession, the two prior jobless recoveries eventually—within two or three years—became job-creating. They alsobecame long expansions. While the last expansion did notend well (to put it mildly), that owed more to household fi-nancial imbalances than to business sector fatigue.

1

2

3

4

5

6

Five-year rolling standard deviation of output growthThe Great Moderation

60 65 70 75 80 85 90 95 00 05 10

Sample

14

Economic ResearchIreland faces huge medium term fiscalchallengesSeptember 24, 2010

JPMorgan Chase Bank, LondonDavid Mackie

Ireland faces huge medium-term fiscal challenges• Deficit reduction plan assumes buoyant growth

• Softer growth would require more fiscal tightening

• Cumulative move in Irish deficit could end up beingalmost as large as that in Greece

The increased market pressure on Ireland in recent weekshas little to do with how the Irish economy and the fiscaladjustment are progressing this year. According to thehigh-frequency data, the Stability Program looks to be ontrack. Real GDP growth has been very volatile in recentquarters, but the growth assumption in the Stability Pro-gram still looks achievable. Meanwhile, the budgetary ob-jective for this year, excluding measures to support thebanks, looks likely to be met. Instead, the market stress re-flects concerns about the fiscal cost of bailing out the banksand the likelihood that more fiscal adjustment will beneeded over time, and that it may need to be more front-loaded. This would add downside risks to growth to aneconomy that has already experienced the deepest reces-sion in the region.

The Irish fiscal adjustmentThe fiscal adjustment outlined in the Irish Stability Program,published last December, is striking in three respects. First,although the cumulative fiscal tightening in the program—amove in the cyclically adjusted primary position of 7.6%-ptsof GDP—is large, it is spread over a long time: five years intotal. Second, the fiscal consolidation is heavily backloaded:only just over a quarter of the total adjustment takes place in2010 and 2011. And third, the growth assumptions seemvery optimistic: even as the fiscal tightening intensifies, realGDP gains averaging 4.3% are anticipated in 2012-14.

The fiscal cost of supporting the banks is increasing the gen-eral government deficit and the level of debt. As banks trans-fer assets to the National Asset Management Agency(NAMA), losses have to be realized, and this requires thebanks to increase their capital positions. The government issupporting this process, injecting capital by way of promis-sory notes. It now looks likely that the fiscal deficit this yearwill be around 25% of GDP, and the level of debt will bejust over 91% of GDP. Each of these is 13.6%-pts above theestimates contained in the Stability Program. The Irish gov-ernment is stressing that the “underlying” deficit this year isstill tracking the original Stability Program target of 11.6%

Economic Research Note The Irish Stability Program% of GDP for fiscal data, %oya for GDP and CPI

2009 2010 2011 2012 2013 2014Fiscal balance -11.7 -11.6 -10.0 -7.2 -4.9 -2.9Interest expense 2.1 2.9 3.4 3.8 3.9 3.9Primary balance -9.6 -8.7 -6.6 -3.4 -1.0 1.0Cyclically adjusted fiscal balance -9.3 -9.4 -8.5 -6.8 -5.2 -3.5Cyclically adjusted primary balance -7.2 -6.5 -5.1 -3.0 -1.3 0.4Government debt 64.5 77.9 82.9 83.9 83.3 80.8Real GDP -7.5 -1.3 3.3 4.5 4.3 4.0Nominal GDP -9.5 -2.2 5.6 6.7 6.5 6.1Output gap -7.0 -6.9 -3.7 -1.1 0.6 1.5Unemployment rate 11.8 13.2 12.6 11.8 10.8 9.5CPI -2.1 -0.8 1.6 1.8 2.0 1.9Source: Irish Ministry of Finance. Published December 2009.

IMF projections for Ireland

2010 2011 2012 2013 2014General government deficit -11.9 -11.1 -8.6 -7.3 -5.9General government debt 86.2 94.7 96.9 97.5 97.7Real GDP -0.6 2.3 2.5 2.9 3.2CPI -1.8 -0.5 0.8 1.7 1.9

% of GDP for general government deficit and debt, %oya for real GDP and CPI

Based on the Article IV Consultation, July 2010. The projections for the deficit this year do not include all the additional support for banks.

Government projections for deficit reduction% of GDP

Debt at end of adjustment

Overall deficit Primary deficitSpain 8.2 9.5 69.2Greece 11.0 14.4 149.1Portugal 7.4 8.5 84.8Ireland 8.9 10.7 94.4

Changes from 2009-2014

The Irish deficit excludes banking support measures. For Spain and Portugal, the table assumes that the deficit in 2014 is the same as in 2013.

Updated Irish government projections

2010 2011 2012 2013 2014General government deficit -25.2 -10.0 -7.2 -4.9 -2.9General government debt 91.5 96.5 97.5 96.9 94.4Real GDP 1.0 3.3 4.5 4.3 4.0CPI -1.0 1.6 1.8 2.0 1.9

% of GDP for general government deficit and debt, %oya for real GDP and CPI

Based on the Stability Program published in December 2009 and information made available since then.

The headline fiscal deficit in 2009 and 2010 % of GDP

2009 2010"Underlying" deficit -11.8 -11.6Bank support 2.5 13.6

Anglo Irish 2.5 11.7Irish Nationwide 0.0 1.7Educ. bldg. society 0.0 0.2

"Headline" deficit -14.3 -25.2The underlying deficit for 2009 has been revised by 0.1%-pt since the Stability Program was published. There is still some uncertainty about whether the support for the Educational building society will be fully reflected in the deficit.

Sample

Economic ResearchGlobal Data Watch: Developed MarketsSeptember 24, 2010

15

JPMorgan Chase Bank, LondonDavid Mackie

of GDP, and indeed it is. However, the wider-than-expecteddeficit, and higher-than-expected debt, do reflect the fiscalcost of the banking crisis, which will ultimately be borne byIrish taxpayers. So, the cumulative gain in Irish debt is goingto be huge, from a level of around 25% of GDP in 2007 to apeak of around 97% in 2013. We would attribute around athird of this to the direct cost of the banking crisis.

Looking beyond this year, the medium-term issues aroundthe Irish fiscal consolidation remain. Excluding the impact ofthe direct banking support, this year’s primary deficit in Ire-land will be around 8.7% of GDP. This is clearly an unsus-tainable position. Economic theory and empirical analysissuggest that there should be a positive relationship betweenthe primary position and the level of debt: that is, as the levelof debt goes up, the primary surplus has to increase in orderto maintain the confidence of financial markets regardingsolvency. Our analysis suggests that with Irish governmentdebt peaking at around 97% of GDP, the primary surplus hasto be at least 1% of GDP, and may need to be higher due toincreased risk premia as debt moves to an exceptionally highlevel (see “Euro area sovereigns: the long journey back tosolvency,” GDW, July 9, 2010).

The Irish Stability Program does anticipate a primary surplusof 1% of GDP, but not until 2014. Relative to the adjust-ments elsewhere on the periphery of the Euro area, the Irishconsolidation for the period 2010-04 is backloaded. More-over, it is conditioned on a set of very buoyant growth ex-pectations and a projected inflation rate of more than 2%oya(for the GDP deflator). Real GDP growth is expected toaverage 4.3%oya from 2012 to 2014, and nominal GDPgrowth is expected to average 6.4%oya.

It is hard to see how Ireland can achieve such buoyant realgrowth. Taking the magnitude of the fiscal adjustment in theStability Program, and assuming a fiscal multiplier of 1.0,the underlying real growth rate from 2012 to 2014 would bearound 6%. This would be quite an achievement. During the2002-07 upswing, GDP growth averaged 5.4%, which wasclearly an unsustainable pace of growth, boosted by an ex-cessive expansion in the construction and financial sectors.In its Article IV Consultation, published in July, the IMFsuggested that, at the peak of the last cycle, the level of GDPwas 5%-7%-pts above potential. In addition to the headwindfrom the unwinding of imbalances, some of the output lost inthe recession was likely structural and the reversal of immi-gration trends points to lower growth potential in the future.It seems likely that Irish growth will be subdued for years tocome. The IMF projects a more moderate pace of growththan the Irish government: an average real growth rate of2.9% from 2012 to 2014.

Moreover, in the first eight months of the year, the coreCPI has fallen 2.6%oya, and in the first half, the GDP de-flator fell by almost as much. Ireland could easily fall into asustained deflation, which would mean lower nominalgrowth than the Stability Program assumes. To the extentthat real and nominal GDP fall short of the projections inthe Stability Program, additional fiscal tightening will beneeded. If the IMF growth and inflation projections turnout to be correct, then the cumulative fiscal tightening willneed to be almost 30% greater than in the Stability Programin order to achieve the same primary position in 2014. Thiswould make the required cumulative move in the Irish pri-mary position similar in size to what is needed in Greece.

The consequences of market pressureAs we saw with Greece earlier in the year, market pressurecan add significantly to the funding difficulties of sover-eigns and banks. However, in contrast to earlier in the year,the region is now well placed to provide liquidity support.The European Stabilization Mechanism set up in May,which comprises the European Financial StabilizationMechanism (€60 billion) and the European Financial Sta-bility Facility (€440 billion), can provide liquidity supportto sovereigns. In addition, the ECB can provide unlimitedliquidity support to banks.

While liquidity support would be available to the Irish sov-ereign if needed, it would likely involve an accelerated pro-gram of fiscal consolidation as part of the conditionality ofthe program. Alone among the peripheral sovereigns, Ire-land has not added any measures this year to those con-tained in the Stability Program. It is striking that Greece,which is in receipt of multilateral liquidity support, is en-gaging in a fiscal tightening this year that is over threetimes larger than the tightening in Ireland. Severe marketpressure and an accelerated fiscal consolidation would addsignificant downside risks to Irish economic growth. More-over, these would come on top of the severe recession thathas only just ended.

-10

-5

0

5

60

70

80

90

100

110

120

% of nominal GDP, both scalesIrish household debt and financial position

2003 2004 2005 2006 2007 2008 2009

Net lending/borrowing

Debt to GDP ratio

Sample

16

Economic ResearchUnited StatesSeptember 24, 2010

JPMorgan Chase Bank NA, New YorkRobert Mellman

United States• August durables report points to continued solid

growth in capital goods spending this quarter

• Home sales remain severely depressed in August;homebuilders see more of the same this month

• FOMC statement emphasizes that inflation is undesir-ably low, hints that LSAP is increasingly likely

Recent reports on durable goods orders and on home salesand housing starts helped to fill in the picture of economicperformance in August. The details of the durables reportwere stronger than expected and provide some assurancethat capital spending is continuing to expand at a solid clipthis quarter. But the news on housing remains gloomy.New and existing home sales remained severely depressedin August, and respondents to the September homebuilderssurvey report unchanged sales in September. Housing startsdid bounce 10.5% samr from extremely low levels in Au-gust, but with most of the improvement coming from multi-family activity. Industry sources indicate that the decline inhomeownership is starting to lift rental occupancy rates,and developers are beginning to increase supply.

The statement following the FOMC meeting reiterated twothemes from Chairman Bernanke’s Jackson Hole address:that inflation is undesirably low and that the Fed is preparedto embark on another program of large-scale asset purchases.Fed communication in advance of action has been influenc-ing financial markets in a substantial way, helping to raisemarket-based inflation expectations, drive down the value ofthe dollar, and support risk markets including equities evenin advance of Fed action. (See the research note “The Fedtalks and financial markets listen” in this GDW.)

The upcoming calendar includes August reports on incomeand consumption and on construction (both Friday). Earlyreports on September activity (also on Friday) are expectedto be mixed. Based partly on regional manufacturing surveysin hand, the ISM manufacturing survey (Friday) is expectedto decline 2.3 points to 54.0. Early industry guidance pointsto an increase in new car and light truck sales to 11.9 millionsaar this month from 11.4 million in August.

Durable growth for capital goodsIncoming durable goods orders declined 1.3%, but onlybecause of a 40.2% decline in orders for civilian aircraftand a 4.4% decline in orders for motor vehicles and partsthat reversed large increases in July. New orders excludingtransportation rebounded 2.0% in August and reinforced

other upbeat manufacturing indicators for August includingthe 56.3 reading for the ISM manufacturing survey and the0.5% increase in nonauto manufacturing production.

The most encouraging part of the durables report for growthprospects is the 1.6% increase in core capital goods ship-ments, accompanied by an upward revision to the July fig-ure (to 0.1% from -1.0%). More timely data still show thatthe trend in core capital goods shipments is slowing, from17.4% saar in 2Q10 to about 10% in the current quarter.But these shipments, key source data for the estimate ofspending on equipment and software in the GDP accounts,are tracking considerably stronger than seemed likely be-fore this report was released. The much more volatile serieson core capital orders rebounded 4.1% in August, but thisfollowed an even larger decline in July. Core capital goodsshipments have slowed to only about 2% saar growth so farin the quarter, hinting at a further moderation in growth ofshipments and equipment spending next quarter.

Housing slump drags on and on and onA good part of this past week’s economic calendar was de-voted to updates on housing including home sales, houseprices, and housing starts.

-60-45-30-15

0153045

%ch saar over 3 monthsCore capital goods shipments and new orders

2009 2010

New orders

Shipments

0.2

0.4

0.6

0.8

1.0

1.2

3.54.04.55.05.56.06.57.0

Mn units, saar, both scalesNew home sales and existing home sales

2006 2007 2008 2009 2010

New homes Existing homes

Sample

Economic ResearchGlobal Data Watch: Developed MarketsSeptember 24, 2010

17

JPMorgan Chase Bank NA, New YorkRobert Mellman

Home sales still severely depressed: Declining mortgagerates have not done much to revive home sales, and bothnew and existing home sales for August were at severelydepressed levels.

Existing home sales did manage to rebound 7.6% in August,but this seemingly encouraging report followed a 27.0% de-cline the month before. The August level of existing homesales, 4.13 million at an annual rate, was 17.8% below thedepressed average pace in 2008-2009 and was 22.9% belowthe average pace in the first half of this year that had re-flected some benefit from the homebuyer tax credit. Indeed,August home sales were the second lowest (next to July) ofany month in the history of this series dating back to 1999.And single-family existing home sales were the second low-est (next to July) for any month since 1995.

New home sales, which are based on contracts signedrather than closings, provide more timely information. Andnew home sales for August were also severely depressed.Sales of 288,000 at an annual rate were unchanged fromJuly and not much above May’s 282,000 reading that hadbeen the lowest in a series dating back to 1963.

More timely readings on housing demand were also down-beat. The September homebuilders survey was unchanged at13, the lowest reading since March 2009. And mortgage pur-chase applications fell for the second consecutive week. Theaverage level of purchase applications so far this month is upfrom the low June-July levels, but not by much.

2H sag in house prices: The FHFA measure of nationalhouse prices has recently followed patterns of demand thatwere influenced by the homebuyer tax credit. The FHFAmeasure rose 1.5% in the three months through May whensales were being pulled forward by the tax credit, andprices declined a downwardly revised 1.2% in June and0.5% in July when sales were depressed following the ex-piration of the tax credit. Through the first seven months ofthe year, the FHFA measure of house prices is down 0.9%,consistent with the forecast of a modest decline in houseprices over the whole year. The more closely followedCase-Shiller house price measure (released Tuesday) in-creased 1.4% in the first half of the year. But the forecastlooks for the falloff in demand following the expiration ofthe tax credit to lead to declines in this index starting inJuly and for a 4Q10 reading that is -2.1%oya.

Mixed news on starts: August housing starts surprised byrebounding 10.5% in August, with details of the reportshowing very different recent trends in the single-familyand the multifamily segments of the markets. Single-family

-30

-20

-10

0

10

20

%ch saar over 6 monthsTwo measures of house prices

2005 2006 2007 2008 2009 2010

Case-Shiller 20-city indexFHFA purchase-only

index

0.30

0.35

0.40

0.45

0.50

0.55

0.60

0.05

0.10

0.15

0.20

0.25

Mn units, saar, both scalesHousing starts

2009 2010

Multifamily

Single family

starts, accounting for almost 80% of the total, increased4.3% in August, but this gain recaptures only a small partof the cumulative 25.4% decline between April and July.The August gain looks like an outlier in a still-weakeningtrend. Single-family permits fell 1.2%, the fifth consecutivemonthly decline, and are at a level below starts. And, asnoted, the homebuilders survey indicates that industry par-ticipants remain exceedingly gloomy about sales prospects.

Multifamily starts, in contrast, are on an improving trendfrom an extremely low level at the beginning of the year.Multifamily starts increased 36.0% in July and another32.2% in August to a level nearly double the average pacein 4Q09-1Q10. Moreover, industry analysts look for fur-ther gains ahead from levels that are still considered to beextremely low. The REIS survey shows modest declines inapartment vacancy rates and modest increases in rentsthrough the first half of the year, and industry sources indi-cate that these trends are continuing this quarter. (Resultsare different from readings on rents and vacancy rates inofficial data in part because the REIS sample tends, on av-erage, to be at the higher end.) To be sure, gains in multi-family housing from these levels will not do much to boostGDP since new multifamily construction comprises a mi-nuscule share, less than 0.2%, of the overall economy.

Sample

18

Economic ResearchUnited StatesSeptember 24, 2010

JPMorgan Chase Bank, New YorkMichael Feroli

Daniel Silver

Data releases and forecastsWeek of September 27 - October 1

Tue S&P/Case-Shiller home price indexSep 28 %oya, unless noted9:00am Apr May Jun Jul

20-city composite 3.8 4.6 4.2 2.9 %m/m, sa 0.6 0.5 0.3 -0.4 10-city composite 4.6 5.4 5.0We expect the Case-Shiller 20-city home price index todecline 0.4% in July (+2.9%oya). House prices werelifted earlier in the year when home buying was stimu-lated by the homebuyer tax credit, but have come downsince its expiration. The Case-Shiller index is calculatedas a three-month moving average and will thereforeincorporate data from May, June, and July in the forth-coming release. Data that have been reported alreadyindicate that house prices have dropped in June andJuly. The LoanPerformance home price index, which isalso a three-month moving average, declined in Julywhen including distressed sales (the Case-Shiller datawill also incorporate distressed sales, assuming thatthey meet the sample’s other requirements). The FHFAhouse price index, which is a monthly index, showedhouse prices declining in both June and July.

Tue Consumer confidenceSep 28 Sa10:00am Jun Jul Aug Sep

Conference Bd index 54.3 51.0 53.5 54.0Present situation 26.8 26.4 24.9 Jobs plentiful 4.3 4.4 3.8 Jobs hard to get 43.5 45.1 45.7 Plentiful less hard-to-get -39.2 -40.7 -41.9Expectations 72.7 67.5 72.5We expect the Conference Board measure of consumerconfidence to edge up 0.5pt to 54.0 in September. Thepreliminary September consumer sentiment measurereported by the University of Michigan dropped 2.3ptsto 66.6 and the two indexes generally move in the samedirection each month. That being said, the ConferenceBoard survey has two questions specifically on the jobmarket while the Michigan survey has none. Since the

recent data on jobless claims have been relatively en-couraging compared to August, we think the Confer-ence Board index should improve despite the declinealready reported in the University of Michigan survey.

Thu Jobless claimsSep 30 000s, sa8:30am New claims (wr.) Continuing claims Insured

Wkly 4-wk avg Wkly 4-wk avg Jobless,%

Jul 17¹ 468 457 4568 4549 3.6Jul 24 460 453 4570 4583 3.6Jul 31 482 459 4491 4528 3.5Aug 7 488 475 4515 4536 3.6Aug 14¹ 504 484 4479 4514 3.5Aug 21 478 488 4479 4491 3.5Aug 28 478 487 4573 4512 3.6Sep 4 457 479 4537 4517 3.6Sep 11 453 467 4489 4520 3.5Sep 18¹ 465 463Sep 25 460 4591. Payroll survey weekWe forecast initial jobless claims to decline 5,000 to460,000 for the week ending September 25. In the priorweek, initial claims increased 12,000 to 465,000, whichis in line with the four-week moving average for thatweek, but above the weekly levels in the previous twoweeks. We think claims should return to the lower lev-els in the forthcoming report.Continuing claims fell 48,000 to 4.489 million for theweek ending September 11. There was a significantupward revision to the prior week’s data from 4.485million to 4.537 million. The weekly data have beenvolatile, but the four-week moving average was basi-cally unchanged at 4.520 million. Continuing claimshave been declining very gradually throughout the year.The insured unemployment rate for the same weekedged down from 3.6% to 3.5%, on the low end of therange seen throughout the year.

-20-15-10

-505

10152025

%oy a

Case-Shiller monthly home price indices

10-city composite

20-city composite

88 93 98 03 08

0

50

100

150

Index , sa

Conference Board consumer confidence