Gf bmk2013 en_final

description

Transcript of Gf bmk2013 en_final

Annual Media Conference2012 financial year

Yves Serra, CEO 26 February 2013

2

Georg Fischer Corporation

Highlights 2012: Resilient thanks to global footprint

3% top line growth to CHF 3.6 billion

Operating result reaches CHF 221 million

Proposed dividend unchanged at CHF 15 per share

GF Piping Systems grew with acquisitions and new markets

GF Automotive: Europe subdued, Asia’s importance grows

GF AgieCharmilles: Performance further enhanced

Annual Media Conference / 2012 financial year

Annual Media Conference / 2012 financial year3

Georg Fischer Corporation

Further steps towards a more balanced portfolio

2011 2012

GF Piping Systems GF Piping SystemsGF AgieCharmilles GF AgieCharmilles

GF Automotive GF Automotive

32%

46%

22%36%

23%

41%

Annual Media Conference / 2012 financial year4

Georg Fischer Corporation

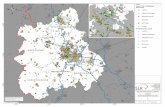

Share of Asia / America significantly increasedCorporate Sales 2012 (2011)

Rest of the world

Asia

Europe

Americas

59%(65%)

14%(10%) 21%

(19%)

6%(6%)

Annual Media Conference / 2012 financial year5

Georg Fischer Corporation

Two divisions with a well-balanced presence

GF Piping Systems GF AutomotiveGF AgieCharmilles

41%(48%)

30%(30%) 23%

(16%)

6%(6%)

9%(8%)

44%(47%)

30%(27%) 17%

(18%)

89%(92%)

11%(8%)

Annual Media Conference / 2012 financial year6

GF Piping Systems

Growth with acquisitions and new markets

Sales at CHF 1.3 billion (+11%),

EBIT reaches CHF 130 million

Acquisitions boost America’s sales (+ CHF 97 million)

Slowdown in Europe, double-digit growth in Asia

Promising new market segments developed

Annual Media Conference / 2012 financial year7

GF Piping Systems

Presence in North America significantly strengthened

Harvel Plastics:- No.1 in industrial pipes in the US

- Plants in Pennsylvania and California

- Annual sales over USD 80 million

IPP: - No.1 in large water infrastructure

piping systems

- Plants in Texas and South Carolina

- Annual sales over USD 50 million 2m diameter pipe extrusionhead from IPP

Annual Media Conference / 2012 financial year8

GF Piping Systems

Promising new market segments developed

Water supply for mines / Seam gas extraction

Hygiene solutions for hospitals and public buildings

Annual Media Conference / 2012 financial year9

GF Automotive

Europe subdued, Asia’s importance grows

Sales at CHF 1.46 billion, -5% to 2011

EBIT reaches CHF 54 million for a 3.7% ROS

Europe: - Premium car market stable

- Clear slowdown in trucks and compact cars

High growth in China

Non-core activities divested (aluminum sand-casting)

New best selling bionic wheel carrier

Annual Media Conference / 2012 financial year10

GF Automotive

Productivity boost through automation in Europe

New iron castings moulding line in Mettmann (D)

Annual Media Conference / 2012 financial year11

GF Automotive

Further expansion in China under way

Iron foundry Kunshan (CN)

Annual Media Conference / 2012 financial year12

GF AgieCharmilles

Performance further enhanced

Sales up 5% to CHF 842 million

EBIT up 22% to CHF 45 million

Customer proximity drives growth in Asia

European sales quite resilient

Focus on less cyclical segments pays off

Major order in Chinafor mobile devices

13

GF AgieCharmilles

Customer proximity drives growth in Asia

Annual Media Conference / 2012 financial year

Top 10 Machine tool consuming countries

Sales Plant TechPoint (new) Center ofCompetence

TaipeiHong Kong

Shenzhen

Yokohama

Bangalore

GF AgieCharmilles presence in Asia

Source: Gardner Report

Annual Media Conference / 2012 financial year14

2008

2012

GF AgieCharmilles

Focus on less cyclical market segments pays off

*ICT= Information and Communication Technology

Semi-C

onductor

Autom

otive

ICT*

Med

ical

Aeronau

tics

CyclicityHigh Low

Consolidated financial statements and financing

Roland Abt, CFO15 Annual Media Conference / 2012 financial year

Annual Media Conference / 2012 financial year16

Georg Fischer Corporation

Income statement

2012 2011 Sales 3 602 3 511 3 %

Gross value added 1 233 1 217 1 %

Personnel expenses -883 -853 4 %

EBITDA 350 364 -4 %

Depreciation, amortization -129 -131 -2 %

EBIT 221 233 -5 %

Financial result -34 -30 13 %

Result of investment properties 1 1 -

Share of results of associates 1 - -

Income taxes -34 -36 -6 %

Net profit from continued operations 155 168 -8 %Loss from discontinued operations -28 0 -

Net profit 127 168 -24 %

thereof own interests 121 160 -24 %

thereof non-controlling interests 6 8 -25 %

million CHF

Annual Media Conference / 2012 financial year17

Georg Fischer Corporation

Sales by divisions

Growth ∆ %

2012 2011 in CHF in LC1)

GF Piping Systems 1 299 1 174 10.6 % 0.6 %

GF Automotive 1 461 1 537 -4.9 % -3.7 %

GF AgieCharmilles 842 800 5.3 % 3.6 %

Corporation 3 602 3 511 2.6 % -0.6 %

million CHF

1) Adjusted for changes in scope of consolidation and stated at previous year’s foreign exchange rates.

Annual Media Conference / 2012 financial year18

Georg Fischer Corporation

EBIT and ROS by divisions

ROS %

2012 2011 in CHF in LC1)

GF Piping Systems 130 137 10.0 % 10.3 %

GF Automotive 54 69 3.7 % 3.5 %

GF AgieCharmilles 45 37 5.3 % 5.0 %

Corporation 221 233 6.1 % 5.9 %

million CHF

1) Adjusted for changes in scope of consolidation and stated at previous year’s foreign exchange rates.

Annual Media Conference / 2012 financial year19

Georg Fischer Corporation

All divisions generate value

0

2

4

6

8

10

12

14

Corporation

12.1%

GF AgieCharmilles

13.4%

GF Automotive

10.3%

GF Piping Systems

13.9%

ROIC

WACC

Weighted average cost of capital (WACC) = 7.6%

Annual Media Conference / 2012 financial year20

Georg Fischer Corporation

Free cash flow

2012 2011

EBITDA 350 370

Changes in net working capital -57 -77

Income taxes / interest paid -66 -72

Other changes 2 29

Cash flow from operating activities 229 250

Additions to property, plant and equipment -132 -147

Cash flow from acquisitions / divestitures -79 0

Other additions / disposals 1 0

Cash flow from investing activities -210 -147

Free cash flow 19 103

million CHF

Annual Media Conference / 2012 financial year21

Georg Fischer Corporation

Net debt and free cash flow

2008 2009 2010 2011 2012-200

-100

0

100

200

300

400

500

600

700

546472

321 294334

-197

94150

103

19

Net debt Free cash flow FCF excl. acquisitionsmillion CHF

Net debt / EBITDA

1.4x 19.7x 0.8x1.0x 1.0x

Annual Media Conference / 2012 financial year22

Georg Fischer Corporation

Key figures

2012 2011

Sales in % 3 6

Sales in % (organic growth) -1 18

Return on Sales (EBIT margin) in % 6.1 6.6

Net profit / (loss) in % of sales 3.5 4.8

Cash flow from operating activities in % of sales 6.4 7.1

ROIC in % 12.1 13.4

Return on Equity in % 10.1 14.3

Equity ratio in % 44 42

Economic Profit 69 82

Earnings per share in CHF 30 39

Earnings per share continued operations in CHF 37 39

Dividend (proposed) per share in CHF 15 15

Number of employees (incl. trainees) 13 412 13 153

million CHF

Annual Media Conference / 2012 financial year23

Outlook

Yves Serra, CEO

Annual Media Conference / 2012 financial year24

Georg Fischer Corporation

Shift towards a better balanced portfolio CHF 3.6 billion CHF 4 ~ 4.5 billion

2012 2015

GF Piping Systems GF Piping SystemsGF AgieCharmilles GF AgieCharmilles

GF Automotive GF Automotive

36%

41%

23%40~45%

20~25%

35~40%

Annual Media Conference / 2012 financial year25

Georg Fischer Corporation

Mid-term profitability objectives confirmed

GF Piping Systems GF Automotive GF AgieCharmilles GF

ROS 11~13% 5~7% 6~8% 8~9%

ROIC 15~18% 13~15% 13~15% >15%

Increase GF Piping Systems share of turnover to 40~45%

Optimize GF Automotive productivity in Europe / Expand in China

Focus GF AgieCharmilles on less cyclical segments

26

Well positioned to profit from relevant trends

Annual Media Conference / 2012 financial year

Annual Media Conference / 2012 financial year27

GF Piping Systems

Water demand growth worldwide

Capitalize on worldwide footprint, further acquire in water infrastructure

Source: Global Energy Network Institute

Annual Media Conference / 2012 financial year28

GF AutomotiveReduction of CO2 emissions

95

130136

2020 target

2012 target

2011actual

EU regulation on CO2 reduction (gCO2/km)

Differentiate through weight reduction leadership

Strut dome

Annual Media Conference / 2012 financial year29

GF AgieCharmilles

New applications driven by precision needs

Leverage leading EDM and high-speed milling expertise

Annual Media Conference / 2012 financial year30

Disclaimer

This document is for presentation purposes only and should not be construed as an offer, invitation or solicitation to subscribe for, purchase or sell any investment. Neither it nor anything it contains shall form the basis of any contract whatsoever.

Opinions expressed herein reflect the current judgement of the management of Georg Fischer. The presentation contains forward-looking statements that involve risks and uncertainties. The actual results of Georg Fischer may differ materially from those anticipated in these forward-looking statements and forecasts as a result of a number of factors.

The management of Georg Fischer does not accept any liability whatsoever with respect to the use of this presentation.