Gems & Jewellery

Transcript of Gems & Jewellery

2

Industry Overview

India is one of the largest exporters of Gems and Jewellery. The industry plays a vital role in the

Indian economy for its role as a major contributor to the total foreign exchange reserves of the

country. It contributes around 7 per cent of the country’s GDP and 15 per cent to India’s total

merchandise exports. It also employs over 4.64 million workers and is expected to employ 8.23

million by 2022. One of the fastest growing sectors, it is extremely export oriented and labour

intensive.

Based on its potential for growth and value addition, the Government of India has declared the

Gems and Jewellery sector as a focus area for export promotion. The Government has recently

undertaken various measures to promote investments and to upgrade technology and skills to

promote ‘Brand India’ in the international market.

India is deemed to be the hub of the global jewellery market because of its low costs and

availability of high-skilled labour. India is the world’s largest cutting and polishing center for

diamonds, with the cutting and polishing industry being well supported by government policies.

Moreover, India exports 75 per cent of the world’s polished diamonds, as per statistics from the

Gems and Jewellery Export promotion Council (GJEPC). India's Gems and Jewellery sector has

been contributing in a big way to the country's foreign exchange earnings (FEEs). The

Government of India has viewed the sector as a thrust area for export promotion. The Indian

government presently allows 100 per cent Foreign Direct Investment (FDI) in the sector through

the automatic route.

The overall net exports of Gems and Jewellery registered an annual growth of 9.1% to reach $ 35.6

bn during 2016-17. Exports of cut and polished diamonds, gold jewellery and silver jewellery

registered a growth of 10.2%, 1.9% and 35.9%, respectively during 2016-17. Exports of gold coins

and medallions from India stood at $ 1.9 bn, while exports of silver jewellery stood at $ 3.3 bn

during April 2017-February 2018

India is also a major importer of gems and jewellery. The imports of gems and jewellery increased

at a CAGR of 7.8% from $ 11.63 bn in 2004-05 to $ 28.8 bn in 2016-17. The imports during April

2017-February 2018 stood at $ 28.3 bn.

3

US, Hong Kong and UAE are the major exporters, who accounted for 75% of the total gems and

jewellery exports from India during 2016-17. Other big importers of Indian jewellery include

Russia, Singapore, Latin America and China.

The Indian Government has permitted 100% Foreign Direct Investment (FDI) in the sector under

the automatic route.

Industry Sub-sectors

Gems and Jewellery comprises of the following sub-sectors:

Diamonds

Gemstones

Pearl

Gold, Silver and Platinum Jewellery

India being the largest manufacturer of cut and polished diamonds globally, its global diamond

market share is 60% and 90% in value terms and volume terms, respectively. The country where

gold jewellery forms around 80% of the total jewellery market, stood as the biggest buyer of gold

globally in 2016-17.

Diamonds Gemstones Pearl

Gold, Silver & Platinum

4

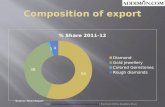

Export

Gems & Jewellery

▪ Gems and jewellery industry plays a vital

role as it is one of the largest exporters

and contributes a major chunk to the

total foreign reserves of the country. The

net exports rose from US$ 15.66 billion

in FY2004-05 to US$ 32.71 billion in FY

2017-18, at a CAGR of 5.83 per cent over

FY05-18.

▪ In FY18, Hong Kong, UAE and US

accounted for 33 per cent, 25 per cent and 23 per cent respectively, accounted as major

export destinations of gems and jewellery.

▪ The net exports of gems and jewellery stood at US$ 22.42 billion between Apr-Dec 2018.

It is forecasted to grow at 5 per cent in FY19.

▪ Exports of gold coins and medallions stood at US$ 258.35 million and silver jewellery

exports stood at US$ 578.95 million between Apr-Dec 2018.

Cut and Polished Diamonds

▪ India is the world’s largest center for cut

and polished diamonds in the world and

exports 75 per cent of the world’s

polished diamonds.

▪ In FY18, India exported US$ 23.73

billion worth of cut and polished

diamonds, at a CAGR of 5.97 per cent.

0

10

20

30

40

50

Net Export Value of Gems & Jewellary

(USD Billion)

0

5

10

15

20

25

30

Export of Cut & Polished Diamonds (USD Billions)

5

Import

Gems & Jewellery

▪ India is a major importer of gems and

jewellery as well.

▪ India’s total gems and jewellery imports

rose from US$ 11.63 billion in FY05 to

US$ 31.52 billion in FY18, thereby

registering a compound annual growth

rate (CAGR) of 7.97 per cent.

▪ India’s imports of gems and jewellery

stood at US$ 20.19 billion in Apr-Dec

2018.

Export & Import of Gold Jewellery

▪ India is one of the largest golds

jewellery exporters of the world and it

exports to around 160 countries.

▪ In FY18, India’s gold jewellery exports

stood at US$ 9,673.23 million and

imports stood at US$ 279.01 million.

▪ India’s gold jewellery exports stood at

US$ 8.77 billion and imports stood at

US$ 230.74 million in Apr-Dec 2018.

▪ Mostly high-end jewellery or machine-

made jewellery is imported usually

from Middle East or South East Asia.

0

5

10

15

20

25

30

35

40

45

Import of Gems & Jewellery (USD Billions)

0

2000

4000

6000

8000

10000

12000

14000

FY 11 FY 12 FY 13 FY 14 FY 15 FY 16 FY 17 FY 18 FY 19

Import & Export of Gold Jewellery (USD Millions)

Import Export

6

Growth Drivers

Population Demographics

✓ India’s middle-class population is expected to increase to 1,250 million in

2048 from 270 million in 2018.

✓ India’s rich population is expected to increase to 310 million in 2048 from

30 million in 2018.

Rising Gold Demands

✓ Rapidly increasing middle class population has led to increase in demand

of gold.

✓ India’s demand for gold reached 771.22 tonnes in 2017 and 523.93 tonnes

between January-September 2018

Government Initiatives

✓ Gold Monetisation Scheme to reduce the country’s reliance on gold imports

to meet the domestic demand.

✓ Proposed jewellery park in Navi Mumbai at 25 acre land and allotted

25,000 sq. ft land for jewellery park in West Bengal.

✓ Proposed policy to help increase the gold supply from local refineries to 80

per cent in the next few years from current 40 per cent.

Growing Organized Retail Format

✓ Gold and Jewellery retail market are shifting from unorganized to

organized format

✓ Indian retail market to reach $ 1 trillion by 2021

7

Industry Trends

• Changing preferences of young people from gold to coloured

gemstone, platinum and palladium jewellery

Increasing demand for precious gem stones

• Women are buying diamond jewellery for occasions other than

marriage

Multiple occasions for purchase

• Bridal diamond jewellery is the foundation of industry, but product

popular with millennials is helping to spur growth

Changing demographics impacting demand

• Also known as synthetic diamonds, artificial diamonds, cultivated

diamonds or cultured diamonds. It's demand is increasing rapidly.

Growth of lab created diamonds

• Emergence of new manufacturing techniques

Focus on technology

• stricter quality norms and hallmarking

Focus on Quality

8

Challenges in Gems & Jewellery Sector

❖ Overdependence on Imports

Indian gems and jewellery industry is almost completely dependent on imported raw

materials such as gold, diamond and other precious and semi-precious stones, with India

importing almost 90% of its requirements. Limited recycling and inefficient mining of gold

are the main reasons for low domestic supply of gold.

❖ Changing Taste & Technology

The industry is highly affected by changing consumer tastes and preferences. In times of

such rapid changes, it has to face the challenge head on and must be attentive to and

receptive towards important trends, developments and new risks.

❖ Lower Value Addition

As per industry experts, consumer behaviour in India is a major factor for lower value

addition as Indians prefer pure gold jewellery in which there is a limited scope for value

addition due to less artistic work and innovation in designs. Gemstones studded jewellery

which would naturally add more value to the product is not as sought after. Limited

domestic brands, limited gold recycling and inefficient mining are other reasons for a low

GVA. To increase value addition, gemstone studded gold jewellery and more value-added

products may be promoted.

Overdependence

on Imports

Changing Taste

& Technology

Lower Value

Addition

Exchange Rate

Fluctuation

Labor related

issues

9

❖ Exchange Rate Fluctuation

In the last few years the rupee has been highly volatile against the dollar. As gems and

jewellery industry involves import export, the changing exchange rate is not favorable in

this trade.

❖ Labor related Issues

Like other industries, the gems and jewellery industry is also facing many challenges

related to labour. These are mainly shortage of skilled labour, poor working conditions

and pay. Manual methods of cutting, polishing, manufacturing and designing of gems and

jewellery are steadily being substituted with high-end automation using machines and

software. Use of laser machines, operating computers and understanding modern

techniques require systematic and practical training.

Government Initiatives

❖ FDI Policy

100% Foreign Direct Investment (FDI) through automatic route is allowed in the sector.

Gold Monetization Scheme

The Gold Monetization Scheme (GMS) in the form of Gold Deposit Scheme (DPS) and Gold

Metal Loan (GML), launched in November 2015, allows individuals, trusts and mutual funds

to deposit gold with banks in return for interest. This is helping reduce dependence on gold

imports and alleviate pressure on trade balance.

Sovereign Gold Bond Scheme

The Government also launched the Sovereign Gold Bond Scheme, under which gold bonds

denominated in grams of gold are issued to individuals by the Reserve Bank of India (RBI) in

consultation with Ministry of Finance.

10

Special Notified Zone

With a view to develop India into an international diamond training hub, a Special Notified

Zone (SNZ) was opened at Bharat Diamond Bourse in Mumbai on December 20, 2015. The

creation of SNZs has ensured the regular availability of direct supply of rough diamond in the

country itself and within easy access, not only save time and effort of travel by diamond

manufacturers, who move to different centers to procure rough diamonds, but has also

minimized middlemen commissions and eventually costs.

Jewellery Park

A Jewellery park is being developed at Mumbai to encourage the local handmade workers and

factories in Zaveri Bazar, Dahisar areas of Mumbai to relocate them in the park and develop

their trade. This will help in improving living standard of the workers and small-scale

manufacturers and improve the work environment in which the workers currently operate.

12

Road Ahead

In the coming years, growth in Gems and Jewellery sector would be largely contributed by the

development of large retailers/brands. Established brands are guiding the organised market

and are opening opportunities to grow. Increasing penetration of organised players provides

variety in terms of products and designs. Online sales are expected to account for 1-2 per cent

of the fine jewellery segment by 2021-22. Also, the relaxation of restrictions of gold import is

likely to provide a fillip to the industry. The improvement in availability along with the

reintroduction of low-cost gold metal loans and likely stabilization of gold prices at lower

levels is expected to drive volume growth for jewellers over short to medium term. The

demand for jewellery is expected to be significantly supported by the recent positive

developments in the industry.

13

918, Gala Empire,

Opp. Doordarshan

Tower, Drive in Road,

Thaltej,

Ahmedabad- 380059

079-4892 9056

www.virtue-ventures.com