Gap Financing Options Private and PLUS Loans · Private Loan: Lender or Loan Servicer ParentPLUS:...

Transcript of Gap Financing Options Private and PLUS Loans · Private Loan: Lender or Loan Servicer ParentPLUS:...

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE-GRANTING INSTITUTIONS ONLY. | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTIONConfidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE-GRANTING INSTITUTIONS ONLY. | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Nanette White, Sallie Mae, Director, Business Development

GAP FINANCING OPTIONS: PRIVATE & PLUS LOANSWHAT YOU NEED TO KNOW IN 2015

Updated April 2015

2

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Note: Nonfederal loans include loans to students from states and institutions, in addition to private loans issued by financial institutions.SOURCE: College Board Trends in Student Aid 2014

Federal and Private Student Loan Growth

3

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Federal Student Aid Programs : A 10 Year View

SOURCE: College Board Trends in Student Aid 2014

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE-GRANTING INSTITUTIONS ONLY. | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

4

Understanding the Differences between Private and Federal PLUS Loan Programs

5

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

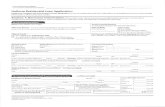

Federal Direct Loan Program Rates and Fees

Loans First Disbursed10/1/13 – 6/30/14 7/1/14 – 9/30/14 10/1/14 – 6/30/15

Undergraduate Stafford (subsidized & unsubsidized)

Interest Rate: 3.86% 4.66% 4.66%

Fee: 1.072% 1.072% 1.073%

Graduate Stafford (unsubsidized)

Interest Rate: 5.41% 6.21% 6.21%

Fee: 1.072% 1.072% 1.073%

Parent and Graduate PLUS

Interest Rate: 6.41% 7.21% 7.21%

Fee: 4.288% 4.288% 4.292%

► Federal Loan interest rates based on the 10-year Treasury Note reset annually effective July 1

► Federal Loan fees reset annually effective October 1 based on Sequestration

Sources are provided in Important Information section

6

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Application and Responsibility

► Who can apply for the loan?

► Who is responsible for the loan?

Parent PLUS: Parent

Grad PLUS: Graduate/Professional Student

Private Loan: Student or Student with Cosigner

Parent PLUS: Parent

Grad PLUS: Graduate/Professional Student

Private Loan: Student and Cosigner

*Many private lenders offer a cosigner release program. Sources are provided in the Important Information Section

7

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Enrollment, Eligibility and FAFSA Requirements

EnrollmentRequirement

ProgramEligibility

FAFSARequirement

Parent PLUS At least half time Degree Seeking YES

Grad PLUS At least half time Degree Seeking YES

Private Loan Varies by lender –less than half

time is available

Varies by lender –many lenders offer loans to non-degree

seeking students

Varies by lender –most do not

require; unless it is the policy of the

school

Sources are provided in the Important Information section

8

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Interest Rates for Academic Year 2015-16

Fixed Rate Variable Rate

Parent PLUS 7.21%(APR: 7.31% to 8.15%)

N/A

Grad PLUS 7.21%(APR: 7.73% to 8.15%)

N/A

Private LoanUndergraduate

Varies by lender4.75% to 12.99%

(APR: 4.75% to 12.99%)

Varies by lender2.25% to 10.42%

(APR: 2.25% to 10.42%)

Graduate Varies by lender5.75% to 12.99%

(APR: 4.75% to 12.99%)

Varies by lender2.25% to 10.42%

(APR: 2.25% to 10.42%)

► Effective for loans that first disburse July 1, 2014

Sources are provided in Important Information section

9

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Parent PLUS: 0.25% Auto Debit Only

Grad PLUS: 0.25% Auto Debit Only

Private Loan: Most lenders offer 0.25% Auto DebitAdditional benefits vary by lender

Fees and Discounts

► Fees:

► Discounts:

Parent PLUS: 4.292% Origination Fee

Grad PLUS: 4.292% Origination Fee

Private Loan: Varies by lender – most offer 0%

Sources are provided in the Important Information section.

10

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Repayment Terms

In-School Deferment

Standard Repayment Term

Parent PLUS Immediate repayment after final disbursement; may request in-school deferment while the student on whose behalf a parent borrowed is enrolled in

school at least half time and for 6 months after enrollment

10 years

Grad PLUS Immediate repayment after final disbursement; but automatically deferredwhile the student borrower is enrolled at

least half time and for 6 months after enrollment, unless requested otherwise

10 years

Private Loan Most programs offer deferred payments while in school with an additional grace

period; interest payments while in school are also offered by most lenders

Varies by lender –typically 5-15 year terms are offered

Sources are provided in the Important Information section.

11

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Loan Forgiveness, Death/Disability Coverage, Servicing

► Is Loan Forgiveness Available?

► Is there Death & Disability Coverage?

► Who Services the Loan?

Parent PLUS: YES

Grad PLUS: YES

Private Loan: NO

Parent PLUS: U.S. Dept of Education contracted servicers

Grad PLUS: U.S. Dept of Education contracted servicers

Private Loan: Lender or Loan Servicer

Parent PLUS: YES

Grad PLUS: YES

Private Loan: Varies by lender – many offer this feature

Sources are provided in the Important Information section.

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE-GRANTING INSTITUTIONS ONLY. | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

12

Encouraging Responsible Borrowing

13

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

► Families should consider their financial situation and the student’s future earning potential in his/her chosen field

► How much is too much?– Only borrow what they think they can afford to pay back later

– Guidance from the College Board® suggests that a new graduate’s monthly student loan payments should be no more than 10% to 15% of his or her starting monthly salary.

To help estimate future income potential, students can visit the US Department of Labor at www.bls.gov/oco/

How Much Should They Borrow?

14

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

► Due to accrued and capitalized interest, the amount families will have to repay is more than the amount borrowed

► The total interest a borrower pays depends on:– Interest Rate

– Origination or Disbursement Fees

– Repayment Term

– Postponement of Payments

– Benefits

– Interest Capitalization

How Much Will It Cost?

15

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

► Fixed Interest Rates– Interest rate is determined at time of loan approval and does not

change for the life of the loan

– The interest rate is based on credit worthiness as well as the market rates

► Variable Interest Rates– Interest rate is determined at time of loan approval and will

fluctuate over time

– The interest rate is based on two components: a market index that is publicly available plus a credit-based margin (determined by lender)

Starting rate on a variable rate loan is usually lower than the rate on a fixed rate loan.

Understanding Fixed and Variable Interest Rates

16

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

► Index:– Index rate will vary over time based on economic conditions

– Common indices used for student loans:• LIBOR (London Interbank Offered Rate)

• WSJ Prime Rate (Wall Street Journal Prime Rate)

► Margin:– Margin is set by lender

– Is locked in at the time of credit approval based on the applicants creditworthiness

► Consumer concerns with variable interest rates:– Fear of interest rates rising

– Lack of predictability

How Variable Interest Rates Work

17

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

History of Libor Rate

SOURCE:http://www.moneycafe.com/personal-finance/1-month-libor/

18

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

History of Prime Rate

SOURCE:http://www.moneycafe.com/personal-finance/prime-rate/

19

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

► No payments: Payments are deferred while in school

► Paying the interest: Monthly interest payments are made while in school

Impact of In-School Payments

Repayment Options While In-School

In-School Plan

In-School Monthly Payment

Post-School Payment

Post-School Payment Terms

(months)

Total Amount Paid

No Payment $0 $141.90 144 $20,405.41

Pay Interest $56.88 $156.68 84 $15,651.13

Example is for a $10,500 loan with variable rate ranging from 6.5% to 7.5% for a freshmen borrower, the interest rate may change as the index changes

20

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

► Term: Amount of time allotted to pay back the loan after the student graduates

Impact of Longer Terms

Repayment Terms After Graduation

Loan Amount

Repayment Term

Monthly Payment

Total InterestPaid

Total Amount Paid

$10,00010 years

(120 months)$121 $4,560 $14,560

$10,00015 years

(180 months)$96 $7,203 $17,203

Examples are based on a $10,000 loan with two disbursements and an interest rate of 8%.

21

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Federal Loan Repayment Plans

Repayment Plans After Graduation

Sources are provided in the Important Information section.

Parent PLUS: Standard, Graduated, Income Sensitive (FFELP only), Extended, Consolidation

Grad PLUS: Standard, Graduated, Income Sensitive (FFELP only), Income Based, Income Contingent, Extended, Pay as You Earn, Consolidation

Private Loan: Varies by Lender

PlanInitial Monthly

PaymentLong-term Monthly

PaymentTotal Interest

PaidYears in

Repayment

Standard $292.00 292.00 $6,855.00 10

Graduated $165.00 $494.00 $8,589.00 10

Extended - Fixed n/a n/a n/a n/a

Extended- Graduated n/a n/a n/a n/a

Income Based $281.00 $292.00 $6,939.54 10.1

Income Contingent $221.00 $273.00 $9,209.00 12.8

Income Sensitive $105.00 $292.14 $8,080.10 11

Pay as You Earn $187.00 $292.00 $8,966.06 11.8

Consolidation $178.03 $178.03 $14,793.40 20

22

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Gap Financing Options for Parents to Consider

PLUS Loan for Parents Private Student Loans

Variable Interest Rate N/A 2.25% - 10.42% APR

Fixed Interest Rate7.21% for Academic Year 2014-15

Note: AY 2015-16 rates will be announced on or after June 1, 2015.

4.75% -12.99% APR

Origination Fees 4.292% through September 30, 2015 Varies by lender - most offer 0%

Responsibility to Pay Parent Student and cosigner (if applicable)

Cosigner RequirementsNo, the parent will need to pass a credit check and if they fail, may qualify with a

creditworthy endorser

No, but students with little or no credit history may have difficulty qualifying for a loan without

a cosigner. Having a cosigner can also help the student qualify and obtain a better rate.

Cosigner Release N/A

Yes. Many lenders provide a cosigner release option where the student can apply to release

the cosigner after they graduate, make a specified number or on-time payments and

meet underwriting requirements.

Enrollment Status At least half timeVaries by lender but offer loans to borrowers

who are less than half time

Standard Repayment Term 10 – 25 years Varies by lender – typically 5-15 year terms

Benefits0.25 percentage point interest rate

reduction for automatic debit enrollment3

Most lenders offer a 0.25 percentage point interest rate reduction for automatic debit

enrollment. Additional benefits vary by lender.

Sources are provided in the Important Information section.

23

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Top three reasons parents choose private student loans

Parents did not want the loan in their name (61%)

Better interest rates, especially with good credit (23%)

More choices and features

(13%)

Why Parents Choose Private Student Loans

Features of private student loans that parents prefer

More repayment flexibility

More convenient application process

Easier account management

SOURCE: Sallie Mae customer research studies 2012/2013.

24

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Gap Financing Options for Graduate Students to Consider

PLUS Loan for Grad Students Private Student Loans

Variable Interest Rate N/A 2.25% - 10.42% APR

Fixed Interest Rate7.21% for Academic Year 2014-15

Note: AY 2015-16 rates will be announced on or after June 1, 2015.

4.75% - 12.99% APR

Origination Fees 4.292% through September 30, 2015 Varies by lender - most offer 0%

Responsibility to Pay Student Student and cosigner (if applicable)

Cosigner RequirementsNo, the student will need to pass a credit check and if they fail, may qualify with a

creditworthy endorser

No, but students with little or no credit history may have difficulty qualifying for a loan without

a cosigner. Having a cosigner can also help the student qualify and obtain a better rate.

Cosigner Release N/A

Yes. Many lenders provide a cosigner release option where the student can apply to release

the cosigner after they graduate, make a specified number or on-time payments and

meet underwriting requirements.

Enrollment Status At least half timeVaries by lender but offer loans to borrowers

who are less than half time

Standard Repayment Term 10 – 25 years Varies by lender – typically 5-15 year terms

Benefits0.25 percentage point interest rate

reduction for automatic debit enrollment

Most lenders offer a 0.25 percentage point interest rate reduction for automatic debit

enrollment. Additional benefits vary by lender.

Sources are provided in the Important Information section.

25

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Why Some Graduate Students Don’t Choose PLUS Loans

SOURCE: Sallie Mae customer research studies 2012/2013.

Interest ratetoo high (17%)

Alternatives offer more choices and features

(15%)

High fees (12%)

Payments too high (10%)

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE-GRANTING INSTITUTIONS ONLY. | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

26

What You Can Do to Help Educate Families

27

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

► Prepare youself and your staff to discuss gap financing options that include both Private and PLUS– Understand the different loan programs– Understand the factors that impact the total loan cost

• Interest rates• Repayment option selected (in school and after graduation)

– Understand the associated fees, such as origination and disbursement fees

► Consider adding language to award letter or website to encourage families to be better informed of their choices

When applying for a private loan, you will be presented with an interest rate based on your (or your cosigner’s) creditworthiness. You are encouraged to apply (there’s no cost or obligation) and compare the rates on the private loans to the rate offered on the PLUS loan and choose which is right for you.

► If you offer students and families a lender list, make sure the information is up-to-date and the links are accurate

Next Steps

28

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

29

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

Sources:Federal student loan information gathered on April 8, 2015 from http://studentaid.ed.gov and http://www.direct.ed.gov/check those pages for the most up-to -date information about federal student loans. Rates, fees, and availability of federal student loans are subject to change by the Federal Government.

Private Student Loan information based on an April 8, 2015 review of national school-certified private loan programs offered by publicly-traded companies or subsidiaries thereof. Private student loans that have variable rates may go up or down based on the changes of an underlying interest rate index.

EXPLORE FEDERAL LOANS AND COMPARE TO ENSURE YOU UNDERSTAND THE TERMS AND FEATURES. PRIVATE STUDENT LOANS THAT HAVE VARIABLE RATES CAN GO UP AFTER CONSUMMATION. FEDERAL STUDENT LOANS ARE REQUIRED BY LAW TO PROVE A RANGE OF FLEXIBLE REPAYMENT OPTIONS, INCLUDING, BUT NOT LIMITED TO, GRADUATED AND EXTENDED REPAYMENT PLANS, AND LOAN FORGIVENESS AND DEFERMENT BENEFITS, WHICH OTHER STUDENT LOANS ARE NOT REQUIRED TO PROVIDE. FEDERAL LOANS GENERALLY HAVE ORIGINATION FEES, BUT ARE AVAILABLE TO STUDENTS REGARDLESS OF INCOME.

©2015 Sallie Mae Bank. All rights reserved. Sallie Mae and the Sallie Mae logo are service marks or registered service marks of Sallie Mae Bank or its subsidiaries. SLM Corporation and its subsidiaries, including Sallie Mae Bank, are not sponsored by or agencies of the United States of America.

Important Information

30

Confidential and proprietary information © 2015 Sallie Mae Bank. All rights reserved. FOR DEGREE GRANTING INSTITUTIONS ONLY | FOR SCHOOL USE ONLY – NOT FOR DISTRIBUTION

The information contained in this presentation is not comprehensive, is subject to constant change, and

therefore should serve only as general, background information for further investigation and study related to the subject matter and the specific factual circumstances being

considered of evaluated. Nothing in this presentation constitutes or is designed to constitute legal advise.

MKT10854