Futures Markets Historical Considerations Japan 1600's US 1850's CA Winnipeg Market in property...

-

Upload

marylou-lewis -

Category

Documents

-

view

218 -

download

4

Transcript of Futures Markets Historical Considerations Japan 1600's US 1850's CA Winnipeg Market in property...

Futures Markets

Historical Considerations• Japan 1600's

• US 1850's

• CA Winnipeg

Market in property rightsexchange of PR separated from exchange of commodity

Markets for a variety of commoditiesGrains/oilseeds/livestock/sugarMetals, lumber, oil, Financial instruments

Markets are dynamicNew products, (lean hog)

Economic FunctionInstitution

price discovery

transfer of risk - attractive vs. forward contract

Why/how did FM develop?Time lag

Long distances – slow transport

Production/salePrice Uncertainty

prices could change rapidly

little market informationConvenienceTrade ownership rights ahead of arrival of commodityPre-determined price

Why Futures Markets exist

Meeting place:• Many traders with similar interests (liquidity)

• Trading rules; enforcement

dispute settlement

Advantages compared to forward contract

Forward - specifications particularFutures: - standardized

perfect substitutability of contracts

Efficiency gain – lower transactions costs

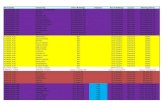

Market Activity2000 2010

Volume of Trade 580 Million 3.1 Billion

Value of Trade $12 Trillion $ 39 Trillion

# of Contracts 266 2466

# New Contract Filings 50 776

Electronic Trading 9% 78%

8% Agr. Commodities79% Financials13% Other

Commodity Futures Trading Commission. Performance and Accountability Report., 2010. Washington.

Over the Counter Market (OTC)

Financial “Swaps” traded by US Commercial Banks since 1981Poorly regulated

Commodity Futures Trading Commission. Performance and Accountability Report., 2010. Washington.

CFTC estimates this market at $217 Trillion for 2010

2008 market meltdown

2010: Congress passed the Dodd-Frank Act

bring this market under tighter regulation and oversight as is the case for futures and options markets

Futures: Standardized Contract

Contract completely specifies

1 – The good: quantity & quality2 – Time of expiry delivery month3 – Location delivery points4 – Price premia and discounts

Specifying the Good - US #2 Corn

Federal Grain Inspection Service (USDA)

Test Weight 56 lbsMoisture 13 %Heat Damage (kernels) 0.2 %Broken corn 3.0% & foreign matter

Futures: Standardized ContractCBOT Futures Contract Specifications

FHKNQUVXZ = Jan, Mar, May, Jul, Aug, Sep, Oct, Nov, Dec

Months Tick Size Trading Unit Daily Limit Rough Rice FHKNUX 1/2 cent/cwt 2,000 cwt 50 cents/cwt Corn HKNUZ 1/4 cent/bu 5,000 bu 20 cents/bu Oats HKNUZ 1/4 cent/bu 5,000 bu 20 cents/bu Soybean Meal

FHKNQUVZ 10 cents/ton 100 tons (2,000 lbs/ton)

$20/ton

Soybeans FHKNQUX 1/4 cent/bu 5,000 bu 50 cents/bu Canola FHKNUX C$.10/tonne 20 tonnes $30/tonne Hard Red Spring Wheat

HKNUZ 1/4 cent/bu 5,000 bu. $.30/bu

Alberta Barley

HKNVZ C$.10/tonne 20 tonnes $30/tonne

Who is involved in trading ?

Clearing house: delivery arrangements - notices to parties

contract enforcement

contract integrity

Members - seat on the exchange - floor traders

Brokers IndividualsUsersProducersSpeculatorsExchange: oversight of trading activity

trading rulescounterparty to all contracts

Commodity Futures Trading Commission CFTC“system” oversight

Trading Mechanics (e.g. corn)

SELL 1 October contract (short)

Right & obligation to SELL 5,000 @ $6 in October

BUY 1 October contract (long)

Right & obligation to BUY 5,000 @ $6 in October

SELL 1 contract: Market order; limit order, stop loss

Trading Mechanics (e.g. corn)

SELL 1 contract:

Margin and leverage: 5 - 25% value of contract

5000 bu @ $6.00 = $ 30,00010% margin = $ 3000

Price change + 10 cents/buMargin account “marked to market”

Margin = $3000 - $500 = $2500

“paper loss” = $500

Margin call - deposit $ to bring margin to “maintenance margin”

BUY 1 contract: “offsets” the SELL contract“crystalize” the loss

HOLD 1 contract and deliver at expiry @ $6.00

Source: http://www.tfc-charts.w2d.com/marketquotes/ZC.html

Dec 11 Open Interest: 1.3 Billion Bu US Corn output (2011) - 12 Billion Bu.Mar 12 Open Interest 2.5 Billion Bu

Contango

Backwardation

Evolution of Trading Volume Sept 11 Corn (CBOT) Contract Expiry

Evolution of Open InterestDec 11 Corn (CBOT)