Furobothn(2001) Theory of Firm

-

Upload

heniomillan -

Category

Documents

-

view

225 -

download

0

description

Transcript of Furobothn(2001) Theory of Firm

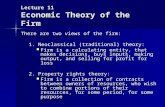

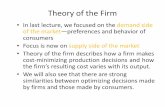

Journal of Economic Behavior & OrganizationVol. 45 (2001) 133–153

The new institutional economics andthe theory of the firm

Eirik G. Furubotn a,b,∗a Private Enterprise Research Center, Texas A&M University, College Station, TX 77841, USA

b University of the Saarland, Saarland, Germany

Received 23 February 1999; received in revised form 1 July 2000; accepted 7 August 2000

Abstract

Concepts of importance in the literature of the New Institutional Economics, such as transactioncosts and bounded rationality, have been used to extend the standard neoclassical model of the firm,but the hybrid models created have failed to provide adequate explanations of enterprise behavior.An alternative, “neoinstitutional,” model of the firm is developed in the paper that differs from thepure neoclassical model and hybrid models in respect to both the nature of the solution it yields andthe process by which it reaches a solution. The neoinstitutional firm cannot be expected to achieveeither the hypothetical allocative efficiency promised by the frictionless neoclassical model, orthe relatively efficient (constrained Pareto optimal) solutions predicted by the largely frictionlesshybrid models. The orthodox marginal rules of neoclassicism can only be used to solve lower-levelproblems that appear within the firm. © 2001 Elsevier Science B.V. All rights reserved.

JEL classification: L20; D81

Keywords: New institutional economics; Bounded rationality

1. Introduction

During the last three decades or so, certain concepts emphasized by “neoinstitutionalist”writers and other critics of contemporary neoclassicism have found their way into main-stream economic discussion. In consequence, it has now become commonplace for theoriststo consider the roles that transaction costs and bounded rationality play in shaping economicbehavior. The approach taken in the literature, however, often tends to follow a rather simpleformula. That is, models are constructed that combine certain elements of the new thinking

∗ Fax: +1-979-845-6636.E-mail address: [email protected] (E.G. Furubotn).

0167-2681/01/$ – see front matter © 2001 Elsevier Science B.V. All rights reserved.PII: S0 1 6 7 -2 6 81 (00 )00171 -2

134 E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153

with conventional neoclassical analysis. 1 In short, there seems to be confidence in somequarters of the profession that significant gains in understanding can be achieved by extend-ing or “generalizing” the standard neoclassical model through the expedient of introducinga few new or supplementary constraints into the analysis (e.g. De Alessi (1983, p. 66),Posner (1993), and Cheung (1998)).

Thus, in the “extended” theory of the firm, there is acceptance of the idea that an en-trepreneur or manager must take account of certain restrictions not present in the frictionlessneoclassical environment (e.g. Stigler (1961) and Stiglitz (1985)). There is also agreementthat, under the changed conditions of the neoinstitutional world, any search for essentialinformation (concerning such things as the quality and price of inputs) will require the useof scarce resources, including cognitive capacity. But, at the same time, there is no feelingthat a fundamental recasting of the optimization problem is needed. Analysis goes forwardin a more or less orthodox manner. It follows, of course, that when the significance ofnewly recognized constraints is viewed in this way, the constraints seem to fit easily intothe standard neoclassical framework.

. . . Information becomes a valued but expensive factor of production and decisions, to beused efficiently like any other. In this sense, bounded rationality is quite rational, and theconcept does not distinguish the New Institutional Economics (NIE) from contemporaryneoclassical economics, save perhaps in terminology. (Scott, 1994, p. 316)

At first blush, this line of argument may appear both plausible and encouraging. We are told,in effect, that progress can be achieved by making a few simple modifications to neoclassicaltheory while retaining its basic structure and familiar technical methods.

It would certainly be convenient if neoclassical theory could be generalized in the mannersuggested above. There are, however, good reasons to reject this optimistic interpretation.The “generalization” approach is based on the use of what may be called “hybrid” models(Furubotn and Richter, 1997, Chapter 10), or models constructed with assumptions drawnfrom the disparate neoclassical and neoinstitutional universes. And it is this procedure thatcreates difficulties. The mixture of what are, in fact, ill-matched assumptions leads to modelstructures that cannot maintain a consistent analytical viewpoint. For example, in the hybridmodels encountered so frequently in the current literature, it is not unusual to find that theindividual decision maker is assumed to be, simultaneously, perfectly informed about somematters while completely ignorant of others (Furubotn and Richter, 1997, p. 227), or thathe must use scarce resources and incur costs to enforce his property rights in real assets butis capable of undertaking a complex optimization process instantly and without any costwhatsoever. Anomalies of this sort abound and cast doubt on the usefulness of solutionsreached by hybrid models. Arguably, then, a closer connection with real-world conditionsis needed.

1 Stiglitz, for example, has used the traditional tools of neoclassical analysis while seeking to overturn orthodoxconclusions about market efficiency. He is quoted as saying: “I took the logic that had led people to be convinced thatmarkets were efficient . . . I changed one assumption — that there was perfect information. I found a general wayto model imperfect information. And when you plugged this in, you found markets to be almost always inefficient”(Uchitelle, 1998, p. 12). What is difficult to see here, however, is why the introduction of imperfect information(and transaction costs) does not have the effect of changing all of the key data in the orthodox neoclassical model.See also Putterman et al. (1998) and Myerson (1999, pp. 1068–1069).

E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153 135

2. The neoinstitutional environment

Observation of actual economic activity suggests that positive transaction costs are ubiq-uitous and unavoidable, and that human decision makers are, by their inherent nature, quitelimited in their ability to acquire, store, retrieve, and process information. Inevitably, thesespecial characteristics influence behavior and generate a distinctive environment — the“neoinstitutional” environment. What seems clear, then, is this. If neoclassical theory is tobe extended so that it is able to explain the behavior that takes place in the more complex“neoinstitutional” environment, extensive reformulation of the standard frictionless theory isessential. As suggested above, it is not sufficient to follow the practice of hybrid models andchange only a few elements of the basic neoclassical structure while leaving most of its otherfeatures intact. The introduction of critical new assumptions concerning positive transactioncosts and bounded rationality has far-reaching consequences. Indeed, when a neoinstitu-tional environment rules, all of the things traditionally accepted as data in the neoclassicalgeneral equilibrium model undergo change simultaneously. That is, given the cognitiverestrictions that constrain each individual and the costly nature of information, a decisionmaker can have only partial knowledge of the full range of options known to the society asa whole. He can no longer be assumed to know everything about existing technological al-ternatives, the characteristics and availability of all productive inputs, the existence and trueproperties of every commodity in the system, etc. Under these conditions, the character ofthe economic problem to be solved is necessarily transformed. The standard technical proce-dures of the orthodox neoclassical case cannot be applied meaningfully when (i) individualknowledge stocks are limited, differ widely from person to person, and tend to change fromone period to the next; and (ii) the very process of decision making has significant costs andmust be based on decision procedures other than “rational choice”. Quite simply, the neoin-stitutional model differs from the pure neoclassical model, and from hybrid models, in re-spect to both the nature of the solution it yields and the process by which it reaches a solution.

Although the neoinstitutional assumptions require that a radical departure be made fromorthodox neoclassicism and in the way modeling is carried out, analysis is not totallydivorced from neoclassical thinking. Thus, in the case of the theory of the firm, certainfamiliar preconceptions come through unchanged. Inter alia, decision makers are assumedto show purposive behavior and, despite uncertainty, a desire to undertake conscious designof the firm’s structure and policies. These individuals control enterprise behavior with aview to securing profits that are as large as possible given uncertainty and the numerousconstraints extant (including the personal limitations of the decision makers themselves).From a motivational standpoint, the drive for profits is important. But, for reasons thatwill be explained more fully below, the neoinstitutional firm cannot be expected to achieveeither the hypothetical allocative efficiency promised by the frictionless neoclassical model,or the relatively efficient (constrained Pareto optimal) solutions predicted by the largelyfrictionless hybrid models. The basic problem here arises from the difficulty of finding such“ideal” configurations for the firm when the array of technological/organizational optionsis very large, information is costly, and the cognitive capacity of decision makers is limited.In other words, given the latter conditions, transaction and deliberation costs will be sogreat as to rule out any exhaustive search for the theoretical optimum. Note, however, thatwhile the firm’s overall structural and organizational solution cannot be determined with

136 E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153

the aid of orthodox technical analysis, it is possible that the neoclassical approach can stillbe employed fruitfully to solve lower-level problems that appear within the firm. When thesecondary problem is not too complex, the less will be the required outlays on transactionand deliberation costs, and the more closely will the assumptions of neoclassical analysisbe approximated (Thaler, 1994, pp. 3–5).

If, as some economists suggest, it is highly desirable to extend the basic neoclassical modelso that it can have applicability to a neoinstitutional world, it would seem essential for theextension to be carried out in a consistent and systematic way. Ideally, all of the implicationsof the new set of assumptions should be accounted for. Thus, in considering the theory of thefirm, the objective of the paper is to explain, in some detail, why a capitalist enterprise faces aspecial type of optimization problem when operating in a neoinstitutional environment, andwhy it must exhibit a behavioral pattern that is significantly different from that describedby the neoclassical model or hybrid models. In this connection, it should also be notedthat while the solutions yielded by neoinstitutional enterprise models have an evolutionarycharacter, the behavior portrayed is somewhat distinct from that of other current evolutionarymodels. 2 In particular, there seems to be no reason to believe that change in society’sexisting knowledge stock must necessarily occur in order for an endogenously generatedtransformation of a system to take place over time, or that natural selection processes willlead to an evolutionary path that can be characterized as “efficient” or optimal.

3. A comparison of models

To facilitate exposition, a simple diagram can be used to contrast the different conceptionsof enterprise behavior offered, respectively, by the neoclassical model, the hybrid model,and the neoinstitutional model. Thus, Fig. 1 is introduced to deal with the familiar problemof how a firm proceeds when attempting to obtain the greatest possible output (q) from agiven outlay (B0). We have:

(A) In the case of the frictionless neoclassical model, it is assumed that the entrepreneuris fully informed about all existing technological options (via the orthodox productionfunction), and that he knows accurately the prices of the inputs (x1, x2). Then, since alloptimization and deliberation costs are taken as zero, the total sum expended on inputs (y)can be equal to the total budgeted outlay (B0), and the entrepreneur is able to determine,instantly and costlessly, the operating position that maximizes output. The firm movesimmediately to this “ideal” equilibrium point (�) — where it will remain until one ofthe givens changes. The possibility of the firm considering innovation as a strategy in itsadjustment process is not given attention in this type of analysis.

(B) The situation of the hybrid model is similar to that of the neoclassical model inthe sense that the entrepreneur is assumed to possess far-reaching cognitive capabilitiesand information. Thus, inter alia, he knows everything about existing technology. What isrecognized, though, is that the firm may face certain difficulties not considered in the pureneoclassical case (Demsetz, 1969). For example, it may be assumed that price dispersion

2 There are, of course, numbers of different models that can be said to fall into the general category ofevolutionary-theoretic constructs. See Nelson (1995).

E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153 137

Fig. 1. Output solutions under different model structures.

holds in factor markets and that the entrepreneur must use time and resources to determinethe most favorable prices at which to acquire needed inputs. As a result of such search costs(S1), the actual expenditure on factors x1 and x2 can be no more than y′. This sum is lessthan the total budgeted outlay, or y′ = B0 −S1. Hence, Fig. 1 indicates that the equilibriumsolution shifts from the neoclassical position at � to point �. The latter solution is interpretedin the literature as a constrained Pareto optimum and, consequently, as efficient (De Alessi,1983, p. 69; Leibenstein, 1985). Since this “ideal” solution emerges from a calculus-basedmaximization procedure, the implication is that the entrepreneur was able to undertake anexhaustive search over all of the myriad technological options extant costlessly, and reacha stable equilibrium end point (�) instantly. Again, innovation is ruled out as an adjustmentprocedure for the firm. This case is characteristic of hybrid models — which seek to movecloser to real-world conditions by introducing supplementary constraints into an otherwiseunchanged orthodox model.

(C) The entrepreneur in the neoinstitutional model is distinct in that he has no capacity forperforming miraculous feats of calculation. Neither does he possess any more than super-ficial general knowledge, initially, of the technological alternatives available for producingthe commodity. These influences on decision making are crucial, of course, and affect thebehavior of the firm. The diagram is unable to represent the full complexity of the neoinsti-tutional case but its essential features can be conveyed by Fig. 1. Thus, assuming that theentrepreneur does not know the production function, he is forced to examine conditions atvarious points in input space and secure detailed information on particular technical pro-cesses. In doing this, he may be guided by what other firms in the industry have done, andby what is currently considered to be “best practice”. In any event, such exploratory activityis costly in terms of both cognitive and material resources. Precisely how far the search for

138 E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153

technical (and price) information should be pushed represents a difficult judgment problemfor the decision maker. More information about alternatives and more careful deliberationmay permit more promising solutions to be discovered. But, then, given a fixed budget, moreresources allocated to the optimization process means that fewer can be directed to actualproduction. For example, the entrepreneur may decide that the monetary value of resourcesdevoted to learning about technical options, plus the monetary value of all other transactionand deliberation costs associated with the firm’s activities, should equal S2. Then, the sumy′′, or (B0 − S2), remains for the purchase of the productive inputs (x1, x2).

In Fig. 1, the relatively few (socially known) technical processes that are studied bythe entrepreneur in detail are indicated by points a, b, c, and �. It is from the alternativesrepresented in this set that he must choose his ultimate operating arrangement. Since thechoice set is rather small, each option it contains can be evaluated carefully and comparedwith the other possibilities without extremely large deliberation costs being incurred. And,given the constraint y′′, it follows that, as far as current technology is concerned, � turnsout to be the best attainable option of which the entrepreneur is aware. It leads to greateroutput than the other options and requires no greater expenditure on inputs than y′′. Note,however, that even though the neoinstitutional model follows a procedure that economizeson transaction and deliberation costs, it does take explicit account of a whole range of costslinked to optimization and production. From this standpoint, it contrasts strikingly with theneoclassical model and the hybrid model — which either ignore all such costs completely,or understate them by focusing on only certain cost elements. The situation explains whyFig. 1 specifies that y = B0 > y′ > y′′, and that, with respect to outputs, � > � > �.

The justification for believing that a firm will be led to a solution such as �, rather thanto an outcome like � or �, rests fundamentally on the understanding that the computationalcomplexity of achieving these classic idealized positions is simply too great. In effect, theinformation that must be acquired and evaluated is so extensive, and the corresponding coststo be incurred so great, as to rule out deliberate action on the part of decision makers tofind conventional optima (�, �). Even the predisposition of decision makers to carry on thesearch for superior productive arrangements period after period will not do much to increasethe possibility of their reaching these classic positions. Moreover, the problem of search anddeliberation is seen to be compounded when it is recognized that an entrepreneur, in seekingan advantageous solution, can consider the possibility of innovation. That is, in addition tothinking about current technology, he can speculate on the desirability of developing andutilizing some novel technological/organizational arrangement of his own design. Then, ofcourse, the set of potential alternatives is open ended, and the idea of finding a definitiveoptimum (comparable to a classic Pareto equilibrium point) has no clear meaning.

To say all this, however, is not to suggest that the conventional marginal calculus andprogramming methods cannot be applied effectively in the solution of certain types ofproblems connected with the firm’s operations. As noted earlier, the orthodox approach canbe utilized to secure efficient treatment for some lower-level problems that arise within thegeneral framework of a firm. Decision making is a costly process and thus the extent to whichresources are used to find desirable arrangements is determined on the basis of perceivedcosts and benefits. When the matter to be resolved is not too complex, so that the extentof the information that must be collected and assessed is well defined and manageable, theassociated costs will be acceptable. Then, the usual marginal costs and returns can indeed be

E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153 139

calculated accurately or approximated. 3 It is also true that, as a practical matter, firms willalways find workable solutions (such as point � in the diagram) and, relative to a structureactually in place, it will be possible to know marginal costs and returns, and to use theinformation in making subsequent adjustments of position. What marginalism cannot do,though, is guide the firm to “ideal” solutions such as � and �.

Despite its simplicity, the analysis based on Fig. 1 is sufficient to show that when firmsoperate in an environment characterized by positive transaction costs and bounded ratio-nality, economic behavior changes significantly from the neoclassical pattern. Specifically,we find that:

1. The neoinstitutional firm, which shapes its policies with the aid of decision rules designedto economize on search and deliberation costs, cannot be expected to achieve the classicefficiency results suggested by the neoclassical model or the hybrid model. Moreover,different firms in the industry will tend to reach different solutions.

2. The neoinstitutional firm does not move instantly and costlessly to a stable equilibriumposition when it finds a workable production arrangement. Rather, the firm tends toundertake a continuing search for superior configurations using a trial and error process.

3. Since the firm is forced to invest time and resources in any adjustment effort attempted,it can consider whether to seek a better production arrangement from among the set ofexisting (socially known) options, or to invest in the development of new knowledge anda novel arrangement.

4. Given the uncertainty surrounding decision making, the individual devising the firm’spolicies has to act as a true entrepreneur rather than as a manager routinely implementingclear-cut marginal rules for allocation.

5. A firm functioning in a neoinstitutional environment may still employ orthodox neo-classical optimization procedures to solve some (secondary) problems it encounters,provided the problems in question are not too complex and do not involve high costs ofsolution.

Finally, it should be emphasized that the findings described in (1)–(5) above emerge,quite logically, as a consequence of the new assumptions concerning transaction costs andbounded rationality that are introduced to extend the basic neoclassical model.

4. The firm’s technological options

In order to examine the neoinstitutional firm in greater depth than was done in Section2 where the simplified diagram shaped discussion, it will be useful, as a first step, to lookmore closely at the subject of technology. According to neoclassical theory, the “state ofthe arts” is a datum and defines a society’s current knowledge of the set of alternativetechnological/organizational arrangements available to produce any given commodity (ash). In a neoinstitutional environment, however, a decision maker interested in producing

3 Precise answers to second-level problems do not necessarily contribute much to the overall efficiency of afirm. Success with secondary matters can even be counterproductive if the secondary solutions reached reinforcea basically ill-conceived structure that has already been established for the firm.

140 E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153

commodity h can never be assumed to have information about more than a small fractionof the total knowledge stock possessed by society. Moreover, mainstream theory arguesthat any technical information the entrepreneur has will necessarily be drawn from thesubset of “efficient” processes (as in Fig. 1). The explanation given for this behavior restson the distinction neoclassical analysis makes between technology (or the production set)and the production function. The idea is that the production set lists all combinations ofinputs and outputs associated with technologically feasible ways of producing a commodity,while the production function represents a subset of the production set that contains the“efficient” or output-maximizing technological/organizational options open. In other words,any specified input combination, as (x0

1 , x02 , . . . , x0

n), is understood to be linked to a numberof distinct technical processes, with each process associated with some given level of output.Entrepreneurs, however, are supposed to be concerned only with the output-maximizingprocesses defined by the production function because the “best” utilization of any particularinput combination is said to be a technical, not an economic, problem.

But, even in a purely neoclassical context, the exclusive focus on the production functionis misleading. If each technical process associated with a given input mix is defined in termsof the way in which the given inputs are utilized, we are forced to consider the likelihood thatdifferent modes of input utilization exert different physical and/or psychological effects onthe inputs. And if such effects do occur, there will normally be some impact of utilizationconditions on factor prices. A competitive firm secures inputs from independent factormarkets, and must pay the going rate established in any market if it is to be able to attractinputs. In the case of labor, for example, there tend to be numbers of distinct marketsdifferentiated on the basis of the relative pleasantness or unpleasantness of the employmentconditions promised. Arduous or hazardous conditions of work, such as occur when “crash”output programs are undertaken, must be rewarded with higher wage rates. Similarly, whenthe operation of machinery is speeded up to increase the rate of output from a given inputcombination (x0

1 , x02 , . . . , x0

n), there is an inevitable tendency for user cost (or else the marketprice of machine services obtained via leased equipment) to rise. In general, then, if givenproductive factors are pressed to the limit in an effort to maximize commodity output overthe flow period defined for the production function, the firm’s operations will be quite costly.

What seems clear is that so-called “efficient” processes that maximize commodity outputper period need not constitute the best choice for the profit oriented firm. If, as is charac-teristic, input prices rise as increased pressure is placed on inputs to yield effectively largerservice flows per period, it will often be preferable for the firm to sacrifice some commodityoutput (and potential revenue) for relatively greater savings on input costs. Forced drafttechnological/organizational arrangements can actually diminish profits. It is useful to pushgiven factors harder only as long as the marginal outlay associated with such action is lessthan the corresponding marginal revenue product. To the extent that larger profits are pre-ferred to smaller profits, the unvarying output maximization required by the neoclassicalproduction function cannot be ideal for the firm. What is best in purely physical terms is notnecessarily best in economic terms. The conclusion to be reached then is that, in principle,the production set rather than the production function is the relevant technological datum forthe firm. And, since many different technical organizations or processes can be associatedwith each combination in input space, it follows that the number of operating arrangementsthat the firm may conceivably use is much larger than the usual neoclassical analysis admits.

E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153 141

Actually, a movement toward reliance on the production set is only one of numerouspossible changes that have the effect of expanding the firm’s array of feasible productionoptions. For example, if it is assumed, quite reasonably, that there are n general typesof productive factors needed for production of the firm’s output (qh) and that each suchfactor can appear in a number of different quality forms (1, 2, . . . , v, in each case) it isclear that there are effectively more “inputs” available for use, and that the firm has moredistinct input combinations capable of generating commodity output. A simple model canbe constructed to show precisely how the few changes noted so far can lead to a great manymore production options than those identified in orthodox neoclassical theory. In the lattercase, society’s knowledge of the various “efficient” ways of producing commodity h isgiven by the production function

qh = f (z∗, x1, x2) (1)

Here, two general inputs exist (x1, x2), and each appears in only one quality. Since eachcombination of these inputs must be used “efficiently,” the technological parameter (z∗)indicates that both inputs will be utilized at the high level of intensity required to generatemaximum outputs. Although Eq. (1) is normally assumed to be continuous, it will now beconvenient to say that Eq. (1) represents a set of N discrete input combinations and theirassociated outputs. The number of alternative operating points (N) is very large but finite.

Next, consider a production model based on two general inputs, but, now, each generalinput exists in two distinct quality forms (x1, x

′1, x2, x

′2). For simplicity, assume further that

production conditions are such that: (i) only two inputs are used in any given process, (ii) twovariant forms of the same general input cannot be employed to secure output, and (iii) pro-duction is not undertaken with combinations of different processes. It is also accepted thatany input mix of the eligible inputs can be utilized in production at one or another of threedifferent levels of intensity zα , α = 1, 2, 3. The respective intensity levels suggest the taut-ness of the production environment and the pressure placed on inputs to yield services. Giventhis structure, there are four subfunctions associated with each intensity level. For example

q(1)h = f (1)(z1, x1, x2)

q(2)h = f (2)(z1, x1, x

′2)

q(3)h = f (3)(z1, x

′1, x2)

q(4)h = f (4)(z1, x

′1, x

′2)

(2)

Arrays similar to Eq. (2) are linked to intensity levels z2 and z3. Consequently, there are 12subfunctions in total.

In general, the number of subfunctions that may appear depends on the number of generalinput types employed (n), the number of quality forms in which each such input exists (v),and the number of intensity levels (α) that can be used in production. The relation is vnα.Further, if it is said that none of the possible subfunctions is continuous, and that eachsubfunction has N distinct input combinations as conceivable operating points, the total(finite) number of alternatives, or processes, relevant for potential production (A) is givenby the formula:

A = (vnα)N, where v ≥ 2, n ≥ 1, α ≥ 1 (3)

142 E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153

While this analysis is based on a series of major simplifying assumptions, it is sufficient toshow how easily the magnitude of A (the firm’s choice set) can become enormously large.Merely by changing the parameters of the model modestly and saying that n = 10, v = 5,and α = 6, we go from the 12 subfunctions of the earlier example to 58,593,750. Since eachof these subfunctions has N relevant points, and since N itself is very large, it is obviousthat the “state of the arts” implies the existence of a vast menu of production alternatives(or processes).

The literature has long recognized that the firm’s choice set can be overwhelming (Simon,1979), but what must be emphasized is that this understanding is entirely consistent with theneoclassical logic. That is, without violating the spirit of neoclassical analysis, or inquiringtoo deeply into the actual complications of technology and the firm’s production process(Nelson and Winter, 1982, pp. 59–65), the model based on Eqs. (2) and (3) emerges. Clearly,the situation would become even more extreme if attempts were made to further reduce thelevel of abstraction and consider the effects of other features of technology and organizationhaving relevance to the firm’s choice of an operating position — as, e.g. the firm’s planninghorizon, its internal property-rights structure, its prevailing corporate culture, etc. In short,technological/organizational complexity is an element that has to be faced by any adequatetheory of the firm.

5. The optimization process

Given a frictionless economy in which all relevant information is available costlessly, anddecision makers are able to deal easily with problems of enormous complexity, the existenceof a multitude of technological/organizational alternatives would present no difficulty to thefirm. It would be possible for an entrepreneur to survey the known situation with respectto technology and prices, and find instantly the optimal (profit-maximizing) arrangementfor conducting business. However, once the idealized world of zero transaction costs andunbounded rationality is abandoned, the (extended) theory of the firm is forced to considerthe role of optimization costs (and their relation to the acquisition and processing of infor-mation about existing technology or innovative activity). Under the new conditions, eachfirm in the system discovers that the general process of learning about existing technologicalopportunities and prices, and of choosing a preferred operating position, becomes a costlyactivity — an activity that involves major expenditures of time, human effort, and materialresources (Conlisk, 1996). In this connection, Göttinger’s remarks on optimization are ofparticular interest.

The calculation of the optimal decision by the agent is generally assumed to be costlessin [the neoclassical] approach. However, certain results in the theory of computationindicate that a useful requirement for a function to be ‘computable’ is that is can berealized by a step-by-step procedure that can be implemented mechanically (Minsky,1967). Since implementation of each step in the procedure requires the services of somehuman or mechanical agent, any computation requires the use of scarce resources: andagents may not perform the computation required for the continuous optimization oftheir criterion functions. Therefore, the optimal decisions of agents in an economy are

E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153 143

determined after the cost of reaching the decision is taken into consideration. (Göttinger,1982, pp. 223–224)

It follows from this understanding, of course, that “rational-choice” procedure, as definedin mainstream theory, cannot be used to discover the optimal configuration for the firm. Eventhe highly simplified model of Section 3 is sufficient to show, via Eq. (3), that the numberof alternative operating points that require consideration is so large as to make “rationalchoice” prohibitively costly. Specifically, the approach is ruled out because it presupposesthat each of the feasible production options known to the society as a whole is also knownto the firm’s entrepreneur, and that he is able to compare each option with each of theother possibilities in order to determine the ideal organizational/technological choice forthe firm. But we find that, in a neoinstitutional environment, quite different behavior mustbe followed by the profit-seeking entrepreneur attempting to enter an industry. Given hisinitial ignorance, he is forced to make significant expenditures of time and resources even tolearn about a small subset of the production alternatives known to society. In effect, he hasto investigate the conditions at different points in the existing production set that he believesmay promise efficient operation, and thus “construct” his own partial map of technology. Bylimiting himself to a modest number of points, he can keep search costs within acceptablebounds, and also ensure that the costs of evaluating the options in the subset (to determinethe most favorable option) will not be excessive. Of course, to accomplish these ends, thedecision maker must forsake “rational choice” and employ relatively crude, cost-savingchoice methods. Deciding on particular choice methods, then, involves, inter alia, a tradeoffbetween: (i) the possible advantages of having more extensive information about technology,and (ii) the benefits that the firm can enjoy by maintaining search and evaluation costs at lowlevels. Similar remarks can be made about the firm’s problem in obtaining data concerningexisting factor and commodity prices.

6. An elementary theory of the neoinstitutional firm

The objective of this section is to describe the behavior of a simple, owner-managed firmthat is operating within a neoinstitutional environment. Thus, only one individual controlsthe firm’s activities, and he is assumed to have exclusive claim on the firm’s residual, andto enjoy other property rights in the organization of the type said to exist in the “classical”capitalist enterprise (Alchian and Demsetz, 1972). To begin discussion, analytic attentionwill be focused on a firm that is seeking to enter a competitive industry characterized bynumerous firms producing a single, standard commodity.

Since the orthodox marginal rules for maximizing profit (De Alessi, 1983, p. 69) are toocostly to follow when transaction costs and bounded rationality hold, a firm concerned witheconomic survival must seek some other guidelines for directing its behavior. Effectively,less exacting methods than those derived from the marginal calculus must be substituted todetermine resource allocation. We know, of course, that alternative decision methods (suchas rules-of-thumb) do exist, and that these expedients are able to economize on optimizationcosts. The alternatives open include random choice, imitation, obeying an authority, andconvention (Pingle, 1992, p. 8; Conlisk, 1996; Leibenstein, 1985, pp. 5–8). An important

144 E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153

implication of the use of such “short-cut” procedures is that firms need not be drivenimmediately to find the very best of all possible operating arrangements. Moreover, despitefree entry and a large number of competing firms, the elusive and costly “ideal solution”of the frictionless model will not be a pressing objective at any stage. In short, a firm mayfunction as a viable member of an industry even though it does not follow conventionalprofit maximization. As Alchian has noted, the pertinent requirement is positive profitsthrough relative efficiency (Alchian, 1950, p. 20). What counts is the position of a firmrelative to its actual competitors — who, themselves, must be operating quite far from any“ideal” position of profit maximization.

Experience in the real world suggests that individuals are willing to undertake invest-ment projects despite the impossibility of forming accurate expectations about future out-comes. Thus, in setting up a production unit initially, and at each subsequent period, theowner-manager of a neoinstitutional firm is assumed to act with some boldness. He facesdifficult problems because he must decide the extent to which he should allocate timeand resources to the task of acquiring economically relevant information and assessing itssignificance for the firm. He may decide, at some stage, that the costs of securing and pro-cessing additional information exceed the potential gain from such action and do nothing.Nevertheless, we can assume that, at the outset, an entrepreneur contemplating entranceinto an industry has limited familiarity with key data, and needs to make expenditures toachieve more precise understanding of some of the opportunities and pitfalls that exist in thissector.

In order to estimate what the firm’s profits will be under different possible configurationsfor his new venture, an entrepreneur must seek knowledge of certain data. Specifically, herequires information on: (i) some of the technological/organizational alternatives for theproduction of the chosen commodity that are currently known to society as a whole, and (ii)some of the prices at which inputs and the commodity in question are selling. Prices in aneoinstitutional world may tend to be sticky (Furubotn and Richter, 1997, pp. 285–287), butprice dispersion can also be anticipated and hence there is a need to know at least some of themarket prices extant. What should be emphasized is that knowledge of current technical andmarket data is essential even if the entrepreneur intends to develop an innovative approach toproduction.

Given information costs, it is inevitable that the entrepreneur’s stock of acquired knowl-edge will be far from complete, yet this fact does not prevent decision making from goingforward. As suggested earlier, the information costs relevant to the firm’s optimization pro-cess are of two basic types. Thus, for example, in the case of technological/organizationaloptions, the entrepreneur must: (i) commit resources and time to select a particular de-cision procedure to guide his activities in gathering information about feasible produc-tive arrangements; and (ii) bear the cost of actually applying the method chosen to thetask of securing data on technological options. Insofar as a relatively inexpensive de-cision method has to be used, the “rational-choice” approach is, of course, ruled out.But the matter of how a particular “less costly” decision method is to be found posessome difficulty. What is required is the use of higher-level decision method, i.e. a rule tochose the rule. But, unfortunately, the selection of the higher-level rule demands a stillhigher-level rule, and the problem of infinite regress is encountered. The general result isthat:

E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153 145

. . . decision-costs act to limit the extent to which rationality can be displaced to higherlevels. There must come a point where, as Knight says, the “rational thing to do is to beirrational” and simply choose a choice method without reason. Otherwise, all resourceswould be used in decision-making. (Pingle, 1992, p. 11)

It should be noted in this connection that while the decision method may have to bechosen arbitrarily, it has great importance because it is used to establish the set of tech-nological/organizational alternatives which (along with price data) will act to limit theentrepreneur’s choice of the ultimate operating arrangement for the firm. The procedurefollowed to obtain needed price information concerning the relevant inputs and the com-modity being produced is the same, mutatis mutandis, as that just described for technology.Once samples of these price data are collected, however, some decision rule (presumablyexhaustive search over the limited entries) must be chosen and applied to determine theparticular price estimates to be introduced into the firm’s production plan. Obviously, allof this information-related activity generates costs, and the costs will be larger or smallerdepending on how much information is collected and how intensively it is assessed.

The entrepreneur, after having accumulated what he regards as a “satisfactory” knowledgestock, is in a position to formulate (at some additional cost) a set of alternative profit projec-tions. A representative profit estimate, relating to one particular technological/organizationalconfiguration for the firm, takes the following form:

Πtz = p̂ ftz(αz, x(1)1b , x

(1)2b , . . . , x

(1)nb )

−n∑

i=1

r̂ib x(1)ib −

n+1∑j=1

Tj − H(1)z − a

(m

[s∑

k=1

Ck

])(4)

Eq. (4) represents one estimate of the amount of profit (Π tz) that the entrepreneur expectsto see when certain quantities of inputs (x(1)

1b , x(1)2b , . . . , x

(1)nb ) are employed with a particular

technical process (t) and a particular form of internal organization for the firm (αz). In otherwords, given the information previously acquired about production options, a specific tech-nological/organizational relation (ftz) is known to exist at this point of possible operation,and its potentialities are being explored. To simplify notation, it is assumed in Eq. (4) thatthe respective inputs are all of the same relatively quality or grade level (b). The commodityprice (p̂) and the input prices (r̂ib, i = 1, 2, . . . , n) have also been established by the earliersearch activity, and these market parameters permit the calculation of total revenue andthe total remuneration going to productive factors per period. Since transaction costs mustbe incurred in acquiring the specified quantities of inputs and in selling output, these costs(∑n+1

j=1Tj

)have to be subtracted from total revenue along with direct factor cost. 4 Another

type of cost is represented by the term H(1)z . It is intended to show the aggregate cost of

administering the particular organizational plan (αz) under which the firm is operating (andincludes such elements as the costs involved in monitoring the inputs).

4 To simplify exposition, it is assumed here that all of the inputs are obtained, and the output sold, throughstraightforward market transactions. We know, however, that with different organization than αz, transactionscould be accomplished by other means (Williamson, 1985, 1996; Masten, 1996).

146 E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153

The last expression in Eq. (4) relates to the outlays made by the entrepreneur in acquiringthe information needed to make decisions. Specifically, a certain set of decision procedures(1, 2, . . . , s) was chosen and applied in order to obtain the information that permitted theformulation of Eq. (4). And we assume that a similar approach was used in formulating m−1other profit projections. These m profit estimates established by the entrepreneur representonly a small sample of the enormous number of operating possibilities available in themultidimensional technological/organizational space, but even securing this level of detailedknowledge has a significant aggregate cost — viz.

(m[∑s

k=1Ck

]). The latter assumes, for

simplicity, that the decision-cost outlay is the same in each of the m cases investigated.The aggregate decision cost just mentioned is a necessary part of the start-up procedureof a decision maker contemplating entry into an industry and, thus, must be consideredin determining the profitability of whatever enterprise configuration is ultimately chosenfrom among the m alternatives. The aggregate decision outlay, however, has the characterof an investment because the benefits of the information accumulated may carry over for anumber of periods into the future. Therefore, depending on the entrepreneur’s calculationof how long his initial arrangements for the firm will prove usable (profitable), the effectivedecision cost allocated to the first period will be greater or smaller, but no more than afraction (a) of the aggregate decision cost

(m[∑s

k=1Ck

]). The last term in Eq. (4) reflects

the fact that the total cost can be spread over a number of periods; and the other m−1 profitprojections will include comparable terms. In short, optimization costs count, and can behighly influential in determining: (i) how much information is collected before decisions aremade, and (ii) what particular production options are actually considered and implemented.

If the entrepreneur has responded to his initial lack of specific knowledge about existingtechnological/organizational options and has made a sizeable outlay to gather information,the total number of alternative profit projections (m) can be moderately large. Nevertheless,at this stage of the optimization process, he should be willing to examine the alternativesexhaustively, i.e. consider each alternative, compare it with all others, and determine themost favorable possibility open. Such an assessment will involve a cost. Therefore, if, e.g.Π tz is found to be the best choice, some fraction (say g) of the assessment cost must besubtracted from Π tz in order to obtain an accurate indication of the residual that is expectedto accrue to the firm. The corrected value of the residual that emerges (Π ′

tz) is important, ofcourse, because unless it is greater than or equal to zero, no action will be taken to initiateproduction with the technological/organizational arrangement associated with Π ′

tz. In otherwords, if none of the m alternatives considered is able to yield what is perceived to bea normal profit, the entrepreneur will be forced to search for more extensive informationabout existing production alternatives, consider innovation, or abandon his plans to enterthis particular industry.

The optimization process just outlined is distinctive because it leaves room for a widevariety of behaviors to be undertaken by decision makers. 5 The precision of the strict

5 It is important to distinguish between the different meanings that can be given to the term “optimization”.In its usual definition, the assumption is that a solution is secured through the use of calculus methods. Thisapproach suggests the existence of a large set of options which must be subjected to an exhaustive search over allpossibilities. Consequently, the choice process is very costly. By contrast, the use of simplified decision rules canreduce the set of options to a small number. Then, even exhaustive search can be undertaken at relative low cost.

E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153 147

neoclassical approach is lost, but this has to be the case given the special conditions ofthe neoinstitutional environment. We know that, in such an environment, the optimizationprocess must be conducted with choice methods that are themselves chosen without the useof strictly rational procedures. Complexity forces decision makers to establish essentiallyarbitrary rules for choosing a suitable configuration for the firm. And, in the case of en-trepreneurs contemplating entry into a competitive industry composed of relatively smallfirms, the first impulse may well be to imitate existing units that appear to be profitable. Inother words, it seems likely that the typical approach will not be to seek novelty and tryinnovative technology but, rather, to adopt an arrangement that represents the “best currentpractice” and seems to be working. In this way, costly investment in the origination andimplementation of fundamentally new production options can be avoided. Nevertheless,even when imitation is the objective, precise duplication of a currently profitable enterpriseis not so easily accomplished. Since profitability depends on a firm’s total technologi-cal/organizational configuration, and not on technical arrangements in the narrow sense,the numerous enterprise characteristics that affect performance have to be considered. Thismeans, however, that mistakes can easily be made because uncertainty exists about the struc-tural details and actual profit positions of existing firms. Indeed, there can be no assurancethat any firm chosen for imitation is the best model possible since the search conducted byan entering firm for a model will not be exhaustive.

In effect, transaction costs and bounded rationality will lead entering firms to selectdifferent models to follow, and “noise” will cause deviations from the patterns chosen forduplication. The general result is that firms following the imitation strategy will tend toscatter within a neighborhood representing technological/organizational options that haveproved profitable under current conditions. Depending on the relative success of their searchand adjustment activities, firms can secure greater or lesser profits. The least well adaptedfirms may be forced to leave the industry as superior units enter, but there is no basisfor believing that the remaining firms have achieved or even approximated classic Paretooptimal solutions. That is, solutions achieved on the assumption of a frictionless system or,in the hybrid case, a largely frictionless system. No entrepreneur is able to compare his actualposition with a hypothetical “ideal” position and make the necessary corrections to reachthe optimum. In practice, he can only obtain understanding of how well his arrangementsare adapted to the going economic conditions by the indirect method of observing his profitposition.

The situation described implies that relatively inefficient and marginally profitable firmscan remain as active members of the industry. These firms, and others in the industry, do facesome significant choice problems, however. In an ongoing system, each firm must decideon a strategy for future action in order to preserve its viability. The basic choices open areas follows:

(i) A firm may decide to keep its existing structure unchanged, shun further experimen-tation, and thus avoid making costly additional investment in information and adjustment.Presumably, such a firm hopes that no major shifts in economic conditions will come aboutin the near future, and that it will be able to maintain an acceptable profit position. If mostindustry members adhere to this strategy, a relatively stable situation can emerge in theindustry, a situation in which industry prices, outputs, and profits are not uniform amongfirms but fall into a broad pattern that can be sustained over some time period.

148 E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153

(ii) Since a decision maker has no definite knowledge that his firm’s present structure iswell adapted to future economic circumstances, or that adjustments in the structure couldnot bring about still larger profits, he may decide to increase his information about the exist-ing knowledge stock possessed by society, and search further through the options present inmulti-dimensional technological/organizational space. In other words, he may replicate thegeneral procedure he followed initially in attempting to achieve the “best current practice”— using the same or different decision rules to explore options. Such investment in re-newed search will be undertaken if the entrepreneur believes that the prospective gainsfrom corrective action are greater than the costs of action. Judgments concerning whetherto take action and on the extent of the investment to be made are, of course, subjectiveand will depend, inter alia, on the willingness of the entrepreneur to assume risk, and onthe urgency of his need to sustain or improve profits. Since search has a cost, and sincethe benefits derivable from incremental pieces of information are impossible to estimateaccurately ex ante (Hirshleifer and Riley, 1979, p. 1395), ambitions for improvement nor-mally have to be tempered. Indeed, to strike a balance between cost and return, the firmmay find it expedient to limit adjustment to secondary characteristics while keeping suchthings as durable capital unchanged. In any event, those firms that are able to move to su-perior technological/organizational configurations will enhance their productivity and tendto squeeze less adroit firms from the industry. It follows, then, that even if no fundamentallynew knowledge is created by society, and firms merely seek to exploit existing possibilitiesmore effectively, entrepreneurs concerned with profits are able to bring about growth in realoutput over time. In orthodox neoclassical terms, the process described here is analogousto one in which firms approach an existing production possibility frontier, rather than moveto a new frontier that has been shifted outward by technological advance.

A question can arise, of course, concerning the definition of “innovation”. At one extreme,innovation can be said to take place if an entrepreneur merely observes and copies thestructure of an existing firm that is operating successfully in the economy. The rationalefor this position is that the entrepreneur has learned something previously unknown tohim and, as a result of this “new knowledge”, has been able to launch a useful productiveenterprise. Or, alternately, it might be argued that firms functioning in a neoinstitutionalenvironment are almost certain to differ among themselves in some respects, and that theunique features indicate the presence of innovative activity. But interpretations of this sortwould seem to drain much of the significance from the term innovation by focusing more onroutine operations than on major creative acts. Although its limits and content may be hardto specify precisely, there is such a thing as society’s accumulated knowledge, and there isreason to distinguish between entrepreneurs who search through technical/organizationaloptions that have been discovered previously, and those who seek basically new and untriedoptions. Moreover, from a practical standpoint, the costs and risks associated with attemptsto find basically new opportunities tend to be much greater than the costs and risks linkedto routine replication or minor variations on existing themes.

(iii) Instead of accepting all of the existing constraints in the system as fixed and un-changeable, an entrepreneur may consider the possibility of taking political action to altersome of the constraints. That is, acting alone or in association with other interested parties,the entrepreneur can endeavor to change the “rules of the game” in directions favorableto himself. Obviously, the profitability of his firm can be ensured (or increased) if the

E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153 149

government revises certain of its policies with respect to such matters as foreign trade, taxa-tion, regulation, industry subsidies, etc. Thus, by diverting time and resources to rent-seekingprojects, the entrepreneur can, conceivably, project himself into a superior position withoutany need to undertake innovation or search for more information about socially knowntechnological/organizational options. In short, investment in lobbying may appear to rep-resent the most “productive” use of the firm’s limited investment funds. Whether this is so,however, depends in good part on the nature of the existing institutional structure and, inparticular, on the manner in which government and the legal arrangements function. Whatthis situation suggests, in turn, is that the theory of the firm is linked, ultimately, to anunderstanding of the theory of the state.

(iv) In initiating production de novo, or in subsequent adjustments of the firm to the neoin-stitutional environment, most decision makers are likely to behave somewhat conservativelyand avoid very bold strategies requiring the discovery and application of fundamentally newknowledge. Nevertheless, it can be expected that a certain number of daring entrepreneurswill appear over time, and these individuals are the ones who will often make large profitsand bring about major economic change. As Alchian has noted: “. . . the greater the un-certainties of the world, the greater is the possibility that profits [will] go to venturesomeand lucky rather than to logical, careful, fact-gathering individuals” (Alchian, 1950, p. 20).This point raises the question of the motivation of investors who seek “novelty”. It is wellknown that when future outcomes are unknowable, as in the case of true innovation, it is notpossible to establish probabilities that permit meaningful maximization of expected profit(Wiseman, 1991, pp. 151–152; De Vany, 1996). And we also know that the neoinstitutionalscene does not provide anything like a comprehensive set of futures markets to guide de-cision making. Presumably, each would be innovator must make his projections of futureevents using his own model of economic reality, and, as Keynes suggested, it may be that:“. . . it is our innate urge to activity which makes the wheels go round, our rational selveschoosing between the alternatives as best we are able, calculating where we can, but oftenfalling back to our motive on whim or sentiment or chance (Keynes, 1936, p. 162). In onefashion or another, people do seem to have faith that, despite Knightian uncertainty, theycan learn and make reasonable investment choices. 6 In the case of the firm’s activities, itis also true, of course, that innovation may involve only modest (and less costly) changes inprocedure — such as the provision of better-serviced goods, more quickly delivered goods,etc. (Blaug, 1998, pp. 6–7). But whether innovation is fundamental and sweeping or minor, ithas the effect of eliminating unadaptive and high-cost producers, and thus of improving thetechnological/organizational forms employed in the industry. The latter tendency is clearlydesirable for economic progress — unless innovation happens to result in the entrenchmentof monopolistic elements and barriers to entry. In general, imperfect competition tends toinsulate firms from market discipline, leads to waste, and may reduce the industry’s thrusttoward continuing (non-trivial) innovation (Marris and Mueller, 1980, p. 57).

The discussion of points (i)–(iv) above suggests that the firm’s dynamic adjustmentproblem reduces, in large part, to one of allocating resources over time among a numberof alternative investment possibilities. And since choice is complicated by the existence

6 Random selection of stocks may produce better returns than those generated on the basis of the advice givenby stockbrokers and fund managers, but the latter individuals are still able to find credulous customers.

150 E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153

of numerous options and Knightian uncertainty, the investment problem has to be solvedwith the aid of simplified decision rules that are themselves not selected by strictly rationalprocedures. Thus, in considering how best to survive and prosper in the neoinstitutional envi-ronment, different entrepreneurs, employing subjective standards, will select different rulesand achieve different results. Given many trials conducted by competing firms, with somefirms following the conservative strategy of imitation and others the venturesome strategyof innovation, a system may show relatively rapid movement toward more growth-effectiveorganization. There can be no assurance, however, that endogenously generated transforma-tion will lead inevitably and quickly to beneficial outcomes. A variety of factors, includingpre-existing institutional arrangements, imperfect competition, perceived search costs, etc.can act to check growth-producing evolution. Certainly, classic Pareto efficiency is not tobe anticipated in a neoinstitutional context.

7. Conclusions

In considering the operation of the “neoinstitutional” firm, it does not seem either nec-essary or desirable to reject completely the explanatory insights provided by neoclassicaleconomics. The frictionless neoclassical model can, in fact, be extended to take account ofbehavior that unfolds in a system exhibiting positive transaction costs and bounded ratio-nality (Simon, 1991). It is true, of course, that when reinterpretation of the orthodox modelis carried out systematically, and the far-reaching consequences of the new assumptionsare understood, the theory of the firm changes profoundly. Some indication of the behaviorto be expected from the neoinstitutional firm has been offered in the preceding sections.It can be observed, however, that the differences that exist between traditional theory andthe new approach are revealed with particular clarity by the way in which the concept ofeconomic efficiency is interpreted in the respective models. Orthodox analysis places heavyemphasis on the idea that a firm operating in an idealized competitive system will be guidedby market forces to what can be termed a classic Pareto optimal equilibrium. Similarly,the hybrid firm is said to move to a constrained Pareto optimal position (Stiglitz, 1985,p. 26). These “efficient” solutions are best thought of as hypothetical because they cannotbe attained in the real world of optimization costs and boundedly rational decision makers.By contrast, the neoinstitutional firm promises more “realistic,” if less encouraging, results.Different neoinstitutional firms will show different productivities, but none can be expectedto achieve the efficiency levels presupposed by the frictionless neoclassical model or thelargely frictionless hybrid model.

From a purely formal standpoint, it is true that all three types of firms considered hereattain constrained optimal solutions — in the sense that each is assumed to move to the mostadvantageous position permitted by the particular set of constraints it faces. Nevertheless,it is possible to draw a distinction between the optimum reached by the neoclassical firm,on the one hand, and that of the neoinstitutional firm, on the other. In a world of completeinformation and unbounded rationality, a decision maker who achieves a Pareto optimumposition knows with certainty that he has wrung the last shred of advantage from the circum-stances that confront him, and that he cannot make any further adjustment that will improvehis situation. Thus, until the data change, he has no incentive to experiment and find a new

E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153 151

solution. With small modification, the hybrid case is analogous. Things are quite different,though, for the neoinstitutional firm. There, the decision maker who is securing some profitdoes not know whether the position he has attained is capable of improvement or not. Thus,while search for a superior solution in any one period may be limited (e.g. by resourcerestrictions), there is incentive for the decision maker to renew the search for promisingalternatives in subsequent periods. Various strategies are open. Consistent with the generalneoclassical logic, he can look for a superior option by exploring the socially known tech-nological/organizational possibilities extant. But, operating in an uncertain world, he mayalso consider devoting resources to innovation, or to rent-seeking activities. What seemsapparent, then, is that the constrained optimal solution of the neoinstitutional case has atransient character. And, lacking the stability of the orthodox Pareto optimum, it is not onlydifferent but appears less significant.

Of course, as Leibenstein has noted, “any decision procedure that does not permit nonop-timal choices denies the essential meaning of the word optimization, that is, the necessarilycomparative element involved” (Leibenstein, 1985, p. 11). Efficiency defined as constrainedmaximization means that every equilibrium reached is “efficient,” and this convention doesnot push discussion in a very useful direction. Hence, it seems necessary to select some inde-pendent standard for assessing outcomes in a neoinstitutional universe. One way to proceedis to interpret an efficiency criterion as a device that establishes a dichotomy and separatesrelatively more desirable activities from less desirable ones. It is plausible to say that, froma one-period or microstatic standpoint, efficient arrangements can be differentiated frominefficient arrangements on the basis of whether a firm is making positive economic profitsor not. The minimum requirement is that a firm must be earning (what are perceived tobe) normal profits so that opportunity costs can be covered. This conception of efficiencyis obviously crude — and sufficiently elastic to permit firms having various levels of pro-ductivity to fall into the category of efficient organizations. Nevertheless, it is capable ofsaying, at any cross-section of time, that, e.g. a firm earning profits is “efficient” relative toone that operates with a soft-budget constraint and is being subsidized by government. Theeffective message conveyed is that when individuals, who are boundedly rational and whopossess only very limited economic information, are required to make allocative decisions,a system can do no better than to ensure that resources flow to those firms that are capableof producing outputs that sell for prices that cover (or more than cover) production andother legitimate costs, and to deny resources to firms that lose money (Furubotn, 1999).The positive profit criterion is strictly a one-period concept and tells us nothing about dy-namic efficiency but, in this respect, it matches the formulation of most New InstitutionalEconomics models.

Decision makers functioning in a neoinstitutional environment have no detailed alloca-tional rules to guide them and, in consequence, are likely to change their behavior fromthe simple pattern indicated by neoclassical analysis. Instead of placing primary emphasison adjusting inputs and outputs while accepting all of the technological and other con-straints as fixed, major attention can be given to the possibility of changing some of theconstraints (North, 1990, pp. 80–81). This approach does not require a careful considera-tion of Lagrangian multipliers as neoclassical theory might suggest. Rather, since irriducibleuncertainty rules, the focus must be on broad changes in the firm’s environment broughtabout by an altered pattern of constraints. In adjusting, entrepreneurs can be conceived as

152 E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153

following some type of investment strategy along the lines noted in points (i)–(iv) of Section5. Of course, by experimenting with what appear to be promising avenues for investment inchange, including legal and institutional change, the hope is to enhance enterprise profitabil-ity. Any given firm may stop searching for improvements and, thus, can reach somethingakin to an equilibrium situation. How long the firm can remain passive, however, dependson the actions of other firms in the industry, and on the intensity of competition. Contend-ing firms using trial and error methods will put pressure on the least productive units andcause some to exit. Yet evolutionary change does not necessarily lead to ever more pro-ductive firms (Ricketts, 1994, pp. 346–348). In principle, the industry can freeze in someconfiguration that maintains an uneasy status quo. In this state, individual units will tendto differ in structure, but insofar as they are earning profits they all meet the loose defini-tion of one-period efficiency noted above. However, as far as the dynamic efficiency of aneconomic system is concerned, little can be said. There seems to be a basis for arguing thatdecentralized organization and competition are more conducive to growth then centralismand monopoly. But, under neoinstitutional conditions, “. . . the very notion of optimizationmay be incoherent in a setting where the range of possibilities is not well defined, evenif the issue of different interests could be resolved in this terminology. . . ” (Nelson, 1995,p. 83). Certainly, theory is carried a long way from the nice regularities of orthodox welfareeconomics.

Acknowledgements

The paper has benefited from comments made by two anonymous referees.

References

Alchian, A., 1950. Uncertainty, evolution, and economic theory. Journal of Political Economy 58, 211–221.Alchian, A., Demsetz, H., 1972. Production, information costs, and economic organization. American Economic

Review 62, 777–795.Blaug, M., 1998. The disease of formalism in economics, or bad games that economists play. Lectiones Jenenses

16, 1–33.Cheung, S., 1998. The transaction costs paradigm. Economic Inquiry 36, 514–521.Conlisk, J., 1996. Why bounded rationality? Journal of Economic Literature 34, 669–700.De Alessi, L., 1983. Property rights, transaction costs, and X-efficiency: an essay in economic theory. American

Economic Review 73, 64–81.Demsetz, H., 1969. Information and efficiency: another viewpoint. Journal of Law and Economics 12, 1–22.De Vany, A., 1996. Information, chance, and evolution: Alchian and the economics of self-organization. Economic

Inquiry 34, 427–443.Furubotn, E., 1999. Economic efficiency in a world of frictions. European Journal of Law and Economics 8,

179–197.Furubotn, E., Richter, R., 1997. Institutions and economic theory. University of Michigan Press, Ann Arbor.Göttinger, H., 1982. Computational Costs and Bounded Rationality. In: Stegmuller, W., Balzer, W., Spohn, W.

(Eds.), Studies in Contemporary Economics. Springer, Berlin, pp. 223–238.Hirshleifer, J., Riley, J., 1979. The analytics of uncertainty and intermediation: an expository survey. Journal of

Economic Literature 17, 1375–1421.Keynes, J., 1936. The General Theory of Employment, Interest, and Money. Macmillan, London.Leibenstein, H., 1985. On relaxing the maximization postulate. Journal of Behavioral Economics 14, 5–19.

E.G. Furubotn / J. of Economic Behavior & Org. 45 (2001) 133–153 153

Marris, R., Mueller, D., 1980. The corporation, competition and the invisible hand. Journal of Economic Literature18, 32–63.

Masten, S. (Ed.), 1996. Case Studies in Contracting and Organization. Oxford University Press, New York.Myerson, R., 1999. Nash equilibrium and the history of economic theory. Journal of Economic Literature 37,

1067–1082.Nelson, R., 1995. Recent evolutionary theorizing about economic change. Journal of Economic Literature 33,

48–90.Nelson, R., Winter, S., 1982. An Evolutionary Theory of Economic Change. Harvard University Press, Cambridge.North, D., 1990. Institutions, Institutional Change, and Economic Performance. Cambridge University Press,

Cambridge.Pingle, M., 1992. Costly optimization: an experiment. Journal of Economic Behavior and Organization 17, 3–30.Posner, R., 1993. The new institutional economics meets law and economics. Journal of Institutional and

Theoretical Economics 149, 73–87.Putterman, L., Roemer, J., Silvestre, J., 1998. Does Egalitarianism have a future? Journal of Economic Literature

36, 861–902.Ricketts, M., 1994. The Economics of Business Enterprise. Harvester Wheatsheaf, London.Scott, K., 1994. Bounded rationality and social norms: concluding comment. Journal of Institutional and

Theoretical Economics 150, 315–319.Simon, H., 1979. Rational decision making in business organizations. American Economic Review 69, 493–513.Simon, H., 1991. Organizations and markets. Journal of Economic Perspectives 5, 25–44.Stigler, G., 1961. The economics of information. Journal of Political Economy 69, 213–225.Stiglitz, J., 1985. Information and economic analysis: a perspective. Economic Journal (Suppl.) 95, 21–41.Thaler, R., 1994. Quasi-rational Economics. Russell Sage Foundation, New York.Uchitelle, L., 1998. The Economics of Intervention, New York Times, Sect. 3, p. 12.Williamson, O., 1985. The Economic Institutions of Capitalism. Free Press, New York.Williamson, O., 1996. The Mechanisms of Governance. Oxford University Press, New York.Wiseman, J., 1991. The black box. Economic Journal 101, 149–155.