Full REp

-

Upload

ahsan-habib-sinha -

Category

Documents

-

view

117 -

download

2

Transcript of Full REp

Internship Report

On

“A Comparative Analysis on Marketing Strategy of Shahjalal Islami Bank with

other Conventional Banks”

Internship ReportOn

“A Comparative Analysis on Marketing Strategy of Shajalal Islami Bank Limited with the

Conventional Bank”

Prepared By

Md.Mustakim Hasnine

ID: UG01-17-08-092

Prepared By

Md.Mustakim Hasnine

ID: UG01-17-08-092

Prepared For

Kamrul Hasan

Lecturer, Faculty of Business

State University of Bangladesh

Prepared For

Kamrul Hasan

Lecturer, Faculty of Business

State University of Bangladesh

DECLARATION

I hereby declare that the report of internship namely titled “A Comparative Analysis on Shahjalal

Islami Bank Limited with the Conventional Bank ” is conducted by me after the completion of 3

(three) months of internship with the Eskaton Branch of Shahjalal Islami Bank Limited.

This is to notify that this report has been prepared for academic purpose as the requirements of

the completion of BBA (Bachelor of Business Administration) program. My supervisor is

Kamrul Hasan, Lecturer, Faculty of Business, State University Bangladesh (SUB). This has not

been prepared for any other purposes.

…………………………….Md. Mustakim Hasnine

State University of Bangladesh

Department of Business Administration

ID No: UG01-17-08-092

CERTIFICATE OF THE SUPERVISOR

It is my pleasure to certify that Md. Mustakim hasnine, ID No: UG01-17-08-092, a student of

Bachelor of Business Administration (BBA), State university of Bangladesh (SUB), Dhanmondi,

and Dhaka has been completed in the practical internship program at the Eskaton branch office

of Shahjalal Islami Bank Limited. I declare that the internship report on“A comparative analysis

on Marketing Strategy of Shahjalal Islami Bank Limited with the Conventional Bank ” is

performed successfully with excellent performance under my supervision period.

I wish him every success in his life.

…………………………….Kamrul Hasan

Lecturer, Faculty of Business

State University of Bangladesh

TO WHOM IT MAY CONCERN

It is our pleasure to certify that Md. Mustakim Hasnine, ID No: UG01-17-08-092, a student of

Bachelor of Business Administration (BBA), State University Bangladesh (SUB), Dhanmondi,

Dhaka has been completed in the practical internship program at the Eskaton branch office of

Shahjalal Islami Bank Limited. We declare that the internship report on “A comparative analysis

on Marketing Strategy of Shahjalal Islami Bank Limited with the Conventional Bank ” is

performed successfully with excellent performance from October 02, 2011 to January 02, 2011.

During this brief period we found him very sincere, energetic and keen to learn. He is disciplined

and well-behaved young gentle man. We observe that he possesses all the qualities to adjust with

every environment.

We wish him every success in his life.

………………………… .……………………..

A.S.M. Hasanul Kabir Md. Aslamul Hoq

AVP & Deputy Manager VP & Manager

Letter of Transmittal I

Acknowledgement II

Executive Summery III

Chapter 01: Introduction 01

1.1 Background of the Study

1.2 Objectives

1.2.1 Broad Objective

1.2.1 Specific Objective

1.3 Methodology

1.3.1 Measurement Techniques (Questionnaire)

1.3.2 Sources of Information (Primary and Secondary)

1.4 Sampling Design

1.4.1 Population

1.4.2 Sampling Area

1.4.3 Sampling Unit

1.4.4 Sampling Size

1.4.5 Sampling Method

TABLE OF CONTENTTABLE OF CONTENT

1.4.6 Sampling Plan

1.5 Scope

1.6 Limitations of the Report

1.7 Schedule of Internship

Chapter 02: Literature Review 07

Chapter 03: An Overview of Shahjalal Islami Bank Limited (SJIBL) 09

3.1 Histories and Background

3.2 Mission

3.3 Vision

3.4 At a glance of SJIBL

3.5 Objectives

3.6 Goals

3.7 Strategies

3.8 Management of SJIBL

3.8.1 Board Committees

3.8.2 Executives Committees

3.8.3 Structural Management

3.9 Branch Expansion

3.9.1 Branch Network

3.10 Office automation

3.11 Features of SJIBL

3.12 Products and Services of SJIBL

3.12.1 Deposit

3.12.2 Investment Scheme

3.12.3 SME Investment Operation

3.12.4 Computer Services

3.12.5 E- Services

3.12.6 Remittances

3.13. Departments of SJIBL

3.13.1 General Banking Department

3.13.2 Foreign Exchange Department

3.13.3 Investment Department

3.14 Activities of SJIBL

3.14.1 Membership of Different Organization

3.14.2 Corporate Banking

3.15 Credit Rating Report of SJIBL

3.16 An Overview of Eskaton Branch

3.16.1 Organ gram of Eskaton Branch

3.17 Financial Highlights of SJIBL

3.17.1 Equity of the Bank

3.17.2 Deposit of the Bank

3.17.3 Investment of the Bank

3.17.4 Foreign Exchange Business

Chapter 04: An Overview of Dutch Bangla Bank Limited (DBBL) 27

4.1 Histories and Background

4.2 Mission

4.3 Vision

4.4 At a glance of DBBL

4.5 Core Objective

4.6 Products and Services of DBBL

4.6.1 Card Products

4.6.2 IT Products

4.6.2.1 Truly Online Banking

4.6.2.2 Electronic and Mobile Banking

4.6.2.3 Wide Range of ATM & POS

4.6.2.4 Internet Banking

4.6.2.5 SMS and Alert Banking

4.6.2.6 Fast Track Service

4.6.3 Retail Banking Product

DBBL Life, Health, Education, Professionals, Marriage Line

Travel, Festival, Dreams Come True, Care, General Line

Home, Full Secured, Recharge and DBBL Future Line

4.6.4 Other Banking Products

4.6.4.1 Deposit

4.6.4.2 Term Deposit

4.6.4.4 Loan Advances

Chapter 05: Banking Industry of Bangladesh 34

5.1 Laws for Private Bank

5.2 Performance of Banking Sectors

5.3 Market Segments

5.4 Current Status of Banking Industries

5.5 Characteristics of Islamic and Conventional Bank

Chapter 06: Data Analysis 40

6.1 Analysis on Strategy of Products and Services of SJIBL

6.1.1 Product Innovation

6.1.2. Product Variation

6.1.3 Product Differentiation

5.2 Analysis on Strategy of Products and Services of DBBL

6.2.1 Product Innovation

6.2.2 Product Variation

6.2.3 Product Differentiation

Chapter 07: Comparative Analysis 42

7.1. Promotional Strategy

7.1.1. Promotional Strategy of SJIBL

7.1.2. Promotional Strategy of SJIBL

7.2 Analysis on Questionnaire

Chapter 08: Recommendations 51

Chapter 09: Conclusion 53

References 0

Appendix 0

22th December 2011

To

Kamrul Hasan

Lecturer, Faculty of Business

State University of Bangladesh

Subject: Submission of the internship report.

Dear sir

I am truly lucky to have you as my instructor in BUS- :

With immense pleasure, I am submitting my internship report on “A Comparative Analysis on

Marketing Strategy of Shahjalal Islami Bank Limited with the Conventional Bank ” which was

assigned me. I have tried to my best to complete the report with the necessary information and

suggested proposal in quite a concise and comprehensive manner as possible.

I hope that the report will meet the expectation.

Sincerely Yours

…………………………….

Md. Mustakim Hasnine

State University of Bangladesh

Department of Business Administration

ID No: UG01-17-08-092

Acknowledgement

Practical experience and situation can give the proper knowledge of different environment. My

report will be the greater example of that.

First, I like to express our gratitude to Almighty Allah to give us the strength to complete this

report.

I am really lucky to my honorable faculty Kamrul Hasan for his whole hearted super vision

during reports period her suggestion were really a great source of spirit to make the report best

one.

I would take this opportunity to thank Mr. Aslamul Hoq, VP & Manager, Mr. A.S.M. Hasanul

Kabir, AVP & Deputy Manager and his whole team of Eskaton Branch for being so much

encouraging and helpful through my internship. I would like to thanks all the officials in the

Eskaton Branch of Shahjalal Islami Bank Limited for three wonderful months’ of work

experience. Special Thanks to Mr. Shahidul Islam (Senior Executive Officer) for providing me

valuable time, co-operation, inspiration, suggestion and supportive information for my report

writing process.

Finally, I would like to thanks my family for their numerous support in both

financially and mentally which helps me lot to finish my entire internship

program and internship report successfully.

Executive Summery

As a bank of 21th century, the SJIBL bank uncompromisingly adopts modern technology at all

levels of its operations to improve efficiency and reduce cost per transaction. This report has

used data both primary and secondary sources. Primary sources like asking question to

employees of the Eskaton branch and customer of SJIBL. As secondary source, I used 2009 to

2010 annual reports, website of SJIBL, and various books and articles about different banks,

investment risk grading manual and investment policies and also more, textbooks including

‘Marketing Research’ by Naresh K. Malhotra, ‘Principles of Marketing’ by Philip Kotlar. In this

report, I described all types of products, investments, and the marketing strategies. Then I

compared the marketing strategies of SJIBL with the conventional bank . Shahjalal Islami Bank

Limited has earned huge reputation across Bangladesh. Despite competition among the banks

operating in Bangladesh, both local and international, the bank has made remarkable progress in

all areas of its activities. Among the Islamic banks SJIBL is the best. The title of the current

study is “A Comparative Analysis on Marketing Strategy of Shahjalal Islami Bank with the

Conventional Bank ”. The Shahjalal Islami Bank Limited of Bangladesh is gradually coming up

as a major bank and making significant contribution to national economy. In this study, different

factors of marketing strategy of SJIBL are analyzed, where some flaws of services in the bank

are identified. This study includes mainly the marketing strategy and the factors where they are

gaining and where they are facing the problems. In addition, in this report I tried to briefly

explain the Bank’s products and services based on their position and gave some

recommendations. I find that the marketing strategy of SJIBL is poor than the conventional bank

DBBL to the someway, in order to improve it should increase their ATM booth as well as

branches throughout Bangladesh. The customers of SJIBL are very much satisfied of customer

care and the interest rate.

1: Introduction

Shahjalal Islami Bank Limited (SJIBL) commenced its commercial operation in accordance with

principle of Islamic Shariah on the 10th May 2001, under the Bank Companies Act, 1991. It is 6th

Islamic Shariah based bank in Bangladesh. The Bank has made a significant progress within a

very short period of its existence and occupied an enviable position among its competitors after

achieving remarkable success in all areas of business operation. The authorized capital of the

Bank is TK. 600 crore and Paid up capital of the Bank stood at TK. 342.51 crore as on June

2010. The total equity (capital and reserves) of the Bank as on June 2010 stood at TK. 647.42

crore. It has 63 branches (now) and total manpower is 1,671 persons.

1.1 Background of the Study

Bank is the heart of the economics and banking is the blood circulation of country’s economic growth.

Banks perform a significant role to serve the needs of the society in different sectors, such as: capital

formation, large scale of production, industrialization, growth of trade and commerce etc. and banks are

contributing a lot of aspect. Now-a- day’s banking sector is modernizing and expanding its hand in

different financial event every day. At the same time the banking process is becoming faster, easier and

is becoming eider. In order to survive in the competitive field of the banking sector all organizations are

looking for better service opportunities to provide their fellow clients. So it has becoming essential for

every person to have some idea on the bank and banking procedure.

Internship program so called work attachment program an essential for every BBA student

because it helps him or her to acquaint with the real life situation. As bank is one of the most

important financial intermediaries. So I have selected Shahjalal Islami Bank Limited, which is

one of the most leading banks of the new bank arena.

1.2 Objectives

The objective of this report is to focus on two broad issues. One is to find and compare the

marketing strategies of Islami Bank (SJIBL) with conventional bank- Dutch Bangla Bank

Limited (DBBL) and the customer response for the marketing activities to those banks.

Underlying these two concerns is the intent to understand the whole banking process, keeping

close attention on their organizational culture and all the practices to learn how they actually do

everyday banking. This would allow me to have a thorough understanding of how a bank works,

as I would engage me in conversation with different personnel handling different departments.

Also, the study would enable me to learn the banking sector of Bangladesh as a whole and how

different product has become the main marketing product for banks, which will greatly assist me

as a business graduate. The other objectives can be enlisted as follows:

1.2.1 Broad Objective

To analyze the current marketing strategy of Shahjalal Islami Bank Limited (SJIBL) compared

with Dutch Bangla Bank Limited (DBBL).

1.2.2Specific Objectives

To study of existing banker and customer relationship of Islami Bank (SJIBL) and

Conventional Bank (DBBL)

To compare with the products and services of SJIBL and DBBL

To have current promotional activities of SJIBL and DBBL

To find out the credit/investment facilities available at SJIBL and DBBL

To find out the modern banking services at SJIBL and DBBL

To effect of interest rates on deposits and credit schemes of SJIBL and DBBL

To find out how rapidly branch expansion in SJIBL and conventional bank (DBBL)

To find the customers value about the service provided by comparative banks

To suggest remedial measurement for the improvement of the whole process of the

SJIBL and other conventional bank in Bangladesh

1.3 Methodology

1.3.1 Measurement Technique (Questionnaire)

According to the Zikmund (2003), the two basic criteria a questionnaire must meet if it is to

achieve the researcher’s purpose are relevance and adequacy. A questionnaire is relevant if no

unnecessary information is collected, and if the information that is needed to solve the business

problem is obtained. The adequacy of the questionnaire is determined by it being reliable and

valid. The questionnaire consisted of 14 questions. Here, questionnaire has developed on the

basis of Likert Scale and the point scale was, SA- defines Strongly Agree, A- defines Agree, N-

defines Neutral, D- defines Disagree and SD- defines Strongly Disagree. The self-administered

questionnaire could be printed or electronic questionnaires. Different categories person gave

their comments and answer the required the providing questions.

1.3.2 Sources of Information (Primary and Secondary)

We cannot make any report without collecting information. So we needed many information and

data for different type of sources to prepare the report. This report are making by using both

primary and secondary sources of data.

Primary sources

Data will be collected from customers and employees. It will do by personal interview and

working experience. I acquired adequate knowledge about marketing research and survey from

our academic classes and that’s why I want to perform the survey by internship. For collecting

primary data, I have taken aid to the respective officer(s). Others are like- Exposure on different

desk of the bank, File study, and Field study.

Secondary sources

Secondary data are type of data that where developed for some other purposes. Secondary data

are collected for their time and cost adventures. These types of data are collected from-

Published Journal, Daily Newspaper, Website of the bank, many types of book, Business

magazines, Annual report and others.

1.4 Sampling Design

1.4.1 Population

According to the Zikmund (2003), it is important to carefully define the target population so that

the proper source, from which the data is to be collected, can be identified. The population of the

research was defined as Bangladeshis who have been staying with the Shahjalal Islami Bank

Limited (SJIBL) and Dutch Bangla Bank Limited (DBBL) in Dhaka City. Various related and

involved directly persons help to make this survey. Clients Both bank is interaction with me and

gives their original and legal information, what their wants from Bank.

1.4.2 Sampling Area

Focus two area is the major option for make the random sampling. The focus on Dhaka's Banks

was deemed appropriate as Dhaka has the greatest number of banks of varying products and

quality services that attend to a diverse set of customer needs. The two banks are at the area of

(SJIBL) Eskaton Branch and (DBBL) Shanti Nagar Branch Dhaka.

1.4.3 Sampling Unit

Two separate private banks in Dhaka were Shahjalal Islami Bank Limited (SJIBL) and Dutch

Bangla Bank Limited (DBBL). Their main difference is an Islamic and another is the

Conventional Bank, but as private bank they can follow more reliable and quality service

provider.

1.4.4 Sampling Size

Simple Random Sampling procedure has been used to draw samples from the population.

Population in this report is the account holders and management of SJIBL, Eskaton Branch and

Conventional Bank (DBBL), Shanti Nagar Branch. The population is fixed and from their

sample size is determined. One of the most important problems in planning a sample survey is

that of determining how large a sample is needed for the estimates to be reliable enough. Due to

resource and time constraints, a sample size of 38 is used in this research. At the time of

selecting the sample here the most considerable things is that the valued customers who are

stayed at least five days in months.

1.4.5 Sampling Method

In case of choosing the sampling method here the first priority is Convenience sampling. This

refers that samples are unrestricted and researchers or field workers have the freedom to choose

whomever they find; thus the name convenience. The convenience sample may consist of

respondents living in an easy accessible locality. Undoubtedly, it is the simplest and least reliable

form of non probability sampling. The primary virtue is its low cost. Considering this method in

mind here, I have tried to focus on those samples which are easy to get access.

1.4.6 Sampling Plan

This is all about how handle the sample. It is almost to do a complete census of most population.

Here, the time of taking sample plan I have spent two days. At the first day I collect data from

the SJIBL and next day I have collected data from the DBBL. In this case I shall collect data

from customers and depositors (Personal interview or survey). It takes complicated time because

participants are not always in mood to talk their banking period and sometimes-different types of

situation have arisen so that I have to wait to make a favorable time. After all, sampling plan has

done properly and able to get desire outcome. Finally I am focusing on marketing strategy

analysis of Shahjalal Islami Bank compared with Dutch Bangla Bank Limited. Personal working

experience and organizational information during my internship time may help to reach the

specific objective.

1.5 ScopeIslami Bank has introduced some modern banking scheme that has got high very hard

competition in this banking sector. So in this research report, I want to deal with the comparison

of marketing strategy of Shahjalal Islami bank compare with Dutch Bangla Bank Limited and

their difficulties in the market demand. As it maintains the pace with competitive business, its

activities, culture, attitude and style leads to learn a lot. It has three divisions- General Banking

Division, Investment Division and Foreign Exchange Division. General Banking Department is

one of the most important departments of Shahjalal Islami Bank Limited. Basically, bank

provides the main services to the customer through this department. The Investment

Division gives loan to the customer and monitor whether he repays regularly or not. As the

Branch did not become AD Branch yet, the Foreign Exchange Division deals their

activities with the help of Foreign Exchange Branch of SJIBL. Beside these they have to

follow initiative marketing policy to increase their banking performances. As they are not

experienced compared to other banks it is facing banking sector.

1.6 Limitations of the Report

Although I have obtained wholehearted co-operation from employee of SJIBL, Eskaton Branch

and Head Office, they could not manage enough time to deal with my report. On the other hand,

as it was the new branch, they were not able to give me much documents and papers. On the way

of my study, I have faced the following problems that may be terms as the limitations of the

study.

Time Limitations

The first obstruct is time itself. Due to the time limit, the scope and dimension of the study has

been curtailed. Shahjalal Islami Bank Limited is a big organization. It is very tough to deal with

this bank within this short time. On the other hand, due to short time I could not become able to

conduct with all the customers who have taken the loan. The respondents are scared with

different places. Due to the short time it was not possible me to do random sampling and conduct

with the respondent by going everywhere. Most of all respondents have less willingness to

answer my questionnaire.

Data Insufficiency

It was very difficult to collect data from such a big organization. My internship was at Eskaton

Branch. But for better interpretation I had to collect some information from the Head office

(Human Resource Department). But because of some divisional and confidential problem, I

could not get enough information. The Eskaton Branch is a new Branch. So for better

interpretation I could not get sufficient data.

Lack of Records

Sufficient books, publications, facts and figures are not available. These constraints narrowed the

scope of accurate analysis. If these limitations were not been there, the report would have been

more useful and attractive.

Strict rules & regulations

SJIBL is very strict with their rules. They never break their rules. So they never disclose required

information on the perspective of my internship.

Depends on particular task

This report only focuses on the Marketing strategy elaborately of Shahjalal Islami Bank Ltd. It

does not cover whole activities about them doing business, such as –

General Banking

Foreign Exchange Activities

1.7 Schedule of Internship

Shahjalal Islami Bank Limited is a large organization and it is very tough to deal with this Bank within this

short time. Due to the short time it is not possible for me to do random sampling and conduct with the

respondent by going everywhere. On the first day the supervisor divided my whole study into three

parts. As a result I could learn the whole Baking system as much as possible. I did all types of work

everyday and every division but deemed that I had a schedule task. The whole work will be completed

within 10 weeks as an internship.

Time Period of the Internship at Eskaton Branch

General Banking Division 4 weeks

Investment / Credit Division 1 weeks

Foreign Exchange Division 5 weeks

02. Literature Review

The introduction of interest-free and equity-based financing by the Islamic banking system is

based on the principles of Islamic economics. The aim of Islamic economics, as observed by

Molla et.al. (1988), is not only the elimination of interest based transactions and the introduction

of the zakat (contribution to poor) system but also the establishment of just and balanced social

order free from all kinds of exploitation. The Islamic banking system is highlighted in the World

Development report (1989, Box 6.3), as under; “Islamic banks offer savers risky open-ended

mutual fund certificates instead of fixed interest deposits. (This is not unlike cooperative banks

and mutual in the west, where deposits earn variable interest and double as equity). Difficulties

arises on the lending side. Arrangements to share profits and losses lead to considerable

problems of monitoring and control, especially in lending to small business”. The Islamic bank

follows the principle of equity based-investment. In the modern financial market an alternate

arrangement for participation of capital and entrepreneurship started with the advent of Islamic

Banking in the 70’s. In a number of studies such as IMF, World Bank and IFC, the Islamic

activities were discussed in detail. Highlighting Islamic bank’s principle Khan (1986, p. 19), in

the IMF staff Paper, observed as; “Indeed it is really apparent that the Islamic model of banking

based on the principle of equity participation bears a striking resemblance to proposals made in

the literature on the reform of banking system in many countries. Islamic banks could make a

useful contribution to economic growth and development particularly in a situation of recession,

stagflation and low-growth level because the crore of their operation is oriented towards

productive investment. About the possibility of introducing an interest-free financing system

through Islamic banking principle Scarf (1983) argues that the establishment Islamic Financial

System based on the principle of Shariah is not only feasible but also profitable.

Although characteristics of risk sharing and variable returns distinguish Islamic banks from

conventional banks in theory, heavy reliance on fixed returns modes describes the actual practice

of Islamic banks.

At the outset of theoretical development, Islamic banks were perceived to conform to one of the

two models: the two-tier mudharabah model and the two-window model: (Iqbal and Mirakhor

1999). The two-tier mudharabah requires that both funds mobilisation and utilisation be on the

basis of mudharabah (Siddiqi 1980, 1982; Chapra 1985; Uzair 1980.Islamic banks are

commercial banks which tend to comply with the religious injunctions of Islam. The guiding

principles for an Islamic bank in particular and financial system, in general is a set of rules and

laws, collectively referred to as Shariah, governing economic, social, political and cultural

aspects of Islamic societies. Interest free Islamic banking, in modern setting, is comparatively

new proposition that began in the seventies when the first of its kind was established in the social

sector in Cairo, named the Nasser Social Bank (Ahmed 1995). Dubai Islamic Bank the first

modern private sector Islamic Bank, was established in 1975 Unlike highly developed financial

markets which have relatively short history, commercial banks have long history of existence

accepting ‘deposits from households and making loans to economic agents requiring capital’

(Allen and Santomero 1998:1463). The conventional finance literature has developed a large

body of literature with regard to various aspects of innovation. In an extensive study of the

available literature on New Service Development (NSD), John and Storey (1998) have included

a wide range of research articles and books on this subject. In addition, most conventional banks

and other financial institutions are having their own innovation and service development

departments. Bowers (1985) finds in a survey that practitioners across the financial industry

believe that service development is vital for future competitive strength. In comparison to the

conventional finance, Islamic finance literature on innovation is lagging behind.

3. An Overview of Shahjalal Islami Bank Limited

3.1 History & Background

Shahjalal Islami Bank Limited (SJIBL) commenced its commercial operation in accordance with

principle of Islamic Shariah on the 10th May 2001 under the Bank Companies Act, 1991. During

last ten years SJIBL has diversified its service coverage by opening new branches at different

strategically important locations across the country offering various service products both

investment & deposit. Islamic Banking, in essence, is not only INTEREST-FREE banking

business, it carries deal wise business product thereby generating real income and thus boosting

GDP of the economy. Board of Directors enjoys high credential in the business arena of the

country, Management Team is strong and supportive equipped with excellent professional

knowledge under leadership of a veteran Banker Mr. Md. Abdur Rahman Sarker.

3.2 Mission of SJIBL

Shahjalal Islami Bank Ltd. aims to become one of the leading Banks in Bangladesh by prudence,

flair and quality of operations in their banking sector. The bank has some mission to achieve the

organizational goals. Some of them are as follows as-

To provide quality services to customers

To set high standards of integrity

To make quality investment

To ensure sustainable growth in business

To ensure maximization of Shareholders' wealth

To extend our customers innovative services acquiring state-of-the-art technology

blended with Islamic principles

To ensure human resource development to meet the challenges of the time

3.3 Vision of SJIBL

To be the unique modern Islami Bank in Bangladesh and to make significant contribution to the

national economy and enhance customers' trust & wealth, quality investment, employees' value

and rapid growth in shareholders' equity.

3.4 AT A GLANCE of SJIBL (as of June, 2011)

Name of the Company Shahjalal Islami Bank Limited

Legal FormA public limited company incorporated in Bangladesh on 1st April 2001 under the companies Act 1994 and listed in Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited.

Commencement of Business 10th May 2001

Head OfficeUday Sanz, Plot No. SE (A), 2/B Gulshan South Avenue, Gulshan - 1, Dhaka-1212.

Telephone No. 88-02-8825457,8828142,8824736,8819385,8818737

Fax No. 88-02-8824009

Website www.shahjalalbank.com.bd

SWIFT SJBL BD DH

E-mail [email protected]

Chairman Alhaj Anwer Hossain Khan

Managing Director Md. Abdur Rahman Sarker

Auditors

M/S. Hoda Vasi Chowdhury & Co. Chartered Accountants Ispahani Bhaban , 14-15 Motijheel C/A , Dhaka-1000 Phone: 88-02-9555915, 9560332

Tax Advisor

M/S K.M Hasan & Co. Chartered Accountants 87, New Eskaton Road, Dhaka. Phone: 88-02-9351457, 9351564

Legal AdvisorHasan & AssociatesChamber of Commerce Building(6th floor), 65-66 Motijheel C/A, Dhaka

No. of Branches 63

No. of ATM Booth 14

No. of SME Centers 06

Off-Shore banking Unit 01

No. of Employees 1,671

Stock Summary:

Authorized Capital Tk. 6,000 million

Paid up Capital Tk. 3425.12 million

Face Value per Share Tk. 10

3.5 Objectives of SJIBL

From time immemorial Banks principally did the functions of moneylenders or "Mohajans" but

the functions and scope of modern banking are now a days, very wide and different. They accept

deposits and lend money like their ancestors, nevertheless, their role as catalytic agent of

economic development encompassing wide range of services is very important. Business

commerce and industries in modern times cannot go without banks. There are people interested

to abide by the injunctions of religions in all sphere of life including economic activities. Human

being is value oriented and social science is not value-neutral. Shahjalal Islami Bank believes in

moral and material development simultaneously. "Interest" or "Usury" has not been appreciated

and accepted by "the Tawrat" of Prophet Moses, "the Bible" of Prophet Jesus and "the Quran" of

Hazrat Muhammad (sm). Efforts are there to do banking without interest Shahjalal Islami Bank

Limited avoids "interest" in all its transactions and provides all available modern banking

services to its clients and wants to contribute in both moral and material development of human

being. No sustainable material well-being is possible without spiritual development of mankind.

Only material well-being should not be the objective of development. Socio-economic justice

and brotherhood can be implemented well in a God-fearing society.

The objectives of SJIBL includes-

To conduct interest-free and welfare oriented banking business based on Islamic Shariah

To implement and materialize the economic and financial principles of Islam in the

banking arena

To contribute in sustainable economic growth

To help in poverty alleviation and employment generations

To remain one of the best banks in Bangladesh in terms of profitability and assets quality

To earn and maintain a 'Strong' CAMEL Rating

To introduce fully automated systems through integration of information technology

To ensure an adequate rate of return on investment

To maintain adequate liquidity to meet maturing obligations and commitments

To play a vital role in human development and employment generation

To develop and retain a quality work force through an effective Human Resources

Management System

To ensure optimum utilization of all available resources

To pursue an effective system of management by ensuring compliance to ethical norms,

transparency and accountability at all levels

3.6. Goals of SJIBL

Shahjalal Islami Bank Ltd. will be the absolute market leader in the number of loans given to

small and medium sized enterprises throughout Bangladesh. It will be a world-class organization

in terms of service quality and establishing relationships that help its customers to develop and

grow successfully. It will be the Bank of choice both for its employees and its customers, the

model bank in this part of the world.

3.7. Strategies of SJIBL

The strategies of Shahjalal Islami Bank include:

To strive for customers best satisfaction & earn their confidence

To manage & operate the Bank in the most effective manner

To identify customers needs & monitor their perception towards meeting those

requirements

To review & updates policies, procedures & practices to enhance the ability to extend

better services to the customers

To train & develop all employees & provide them adequate resources so that the

customers needs are reasonably addressed

To promote organizational efficiency by communicating company plans, polices &

procedures openly to the employees in a timely fashion

To cultivate a congenial working environment

To diversify portfolio both the retail & wholesale markets

3. 8. Management of SJIBL

The Board of Directors consists of eminent personalities from commerce and industry of the

country. Mr. Sajjatuz Jumma, the founder Chairman of the Board of Directors, is a businessman

besides being an eminent personality of the country.

The Bank is manned and managed by highly qualified and efficient professionals. The Managing

Director of the Bank is Mr. Muhammad Ali who has rich experience of managing both the

nationalized and the private sector banks as Managing Director.

3.8.1. Board Committees of SJIBL

Board of Directors who also decides the composition of each committee determines the

responsibilities of each committee.

3.8.2. Executives Committees of SJIBL

All routine matters beyond delegated powers of management are decided by or routed through

the Executives Committee, subject to rectification by the Board of Directors.

3.8.3: Structural Management of SJIBL

Figure 01: Organization Chart of SJIBL Source: Bank of SJIBL

3.9. Branch Expansion

The Bank commenced its business on May 10, 2001 by opening its 1 st branch, i.e. Dhaka Main

Branch at 58, Dilkusha, Dhaka obtaining the license from Bangladesh Bank, the central bank of

Bangladesh. Its Head Office is situated at UdaySanz, Plot No. SE (A), 2/B Gulshan, South

Avenue, Gulshan-1, Dhaka. It opened on 20th June 2010. Its corporate/main office is 10,

Dilkusha Commercial Area, Jiban Bima Bhavan, and Dhaka- 1000. The Bank opened 2 (Two)

branches in 2001, 6 (Six) branches in 2002, 2 (Two) branches in 2003, 2 (Two) branches in

2004, 4 (Four) branches in 2005, 5 (Five) branches in 2006 & 2007. Up to September 31, 2008

SJIBL established 31 branches to all over the country to give a cordial service to their customers.

Now, SJIBL has 63 branches.

3.9.1 Branch Network of SJIBL

Figure 02: Branch Network of SJIBL Source: SJIBL Web Site

3.10. Office Automation

Basic accounting system of the bank branches has been fully computerized to minimize cost and

risk to optimize benefits and increase overall efficiency for improved services. The bank is

capable of generating the relevant financial statements at the end of the day. On-line banking is

introduced by the bank from the commencement of the business. They are using software named

“Ultimus” for their banking operation.

3.11. Features of SJIBL

There are so many reasons behind the better performance of Shahjalal Islami Bank Ltd. than any

other newly established banks:

Shahjalal Islami Bank Ltd. has established a core Research & Planning Division

comprising skilled person from the very inception of the bank

Highly qualified and efficient professionals to manage the bank

The inner environments of the all branches of Shahjalal Islami Bank Ltd. are well

decorated

Banking operations of the all branches of Shahjalal Islami Bank Ltd. have been

computerized to provide the promptly & frequently customers service

The bank has established correspondent relationship with 76 countries of the world

Shahjalal Islami Bank Ltd. provides attractive interest rate that the other financial

institutions

The bank provides loan to the customers @ lower interest with easy & flexible condition

than the other does

The bank frequently arranges customers meeting to achieve their valuable suggestions

Letter of Credit (L/C) commissions and other charges are very lower than the other

conventional banks

Profit earning is not the main aim of the SJIBL. The bank is responsible to maintain the

social duties

The bank is committed to provide the cheque amount within 1 minute of submission the

cheque

3.12. Products and Services of SJIBL

3.12.1. Deposits

Shahjalal Islami Bank Limited accepts deposits on the basis of Mudaraba in the following types

of accounts and pays profit like that of interests in these accounts, except Al Wadia Current

Account. The relationship between banker and customer is not debtor-creditor relationship of

conventional banks. The depositor is a partner in this business with- Shahjalal Islami Bank

Limited.

Customer deposits their fund in the following types of Accounts:

Mudaraba Millionaire Scheme, Mudaraba Double/Triple the Money Scheme, Mudaraba Monthly

Income Scheme, Mudaraba Monthly Deposit Scheme, Mudaraba Hajj Scheme, Mudaraba

Bibaho Scheme (New Product), Mudaraba Cash Waqf Deposit Scheme (New Product), Special

Term Deposit Scheme (New Product), Mudaraba Mohor Deposit Scheme (New Product),

Mudaraba Shikhkha Deposit Scheme (New Product), Mudaraba Housing Deposit Scheme,

Mudaraba Lakhopoti Deposit Scheme, Mudaraba Small Business Deposit Scheme.

3.12.2. Investment Scheme of SJIBL

Doctors Investment Scheme, Education Investment Scheme, Executives Investment Scheme,

Marriage Investment Scheme, Household Durable Scheme, Overseas Investment Scheme,

Housing Investment Scheme, CNG Conversion Investment Scheme, Small Entrepreneurs

Investment Program, Medium Entrepreneurs Investment Program, Rural Investment Program,

Car Investment Scheme, Small Business Investment Scheme

Investments Modes

To provide interest-free Banking Shahjalal Islami Bank has adopted the following modes of

investment:

Musharaka (Equity participation on the basis of sharing profit and loss), Mudaraba (Sharing of

profit and loss in business where one of the partners provides expertise and management and

other partner provides capital remaining inactive), Murabaha (Buying and selling of

commodities goods etc. with profit), Bai-Muajjal (Credit sale with profit), Ijara (Leasing for

rent), HPSM (Hire purchase or Shirkatul Melk), Bai-Salam (purchasing of agricultural products

while in production and providing advance money to the producers), Istisna (purchasing of

industrial products while in production and providing advance money to the producers), Quard.

3.12.3 Small and Medium Enterprise (SME) Investment Operation

Shahjalal Islami Bank Limited (SJIBL) is a modern commercial bank governed by the principles

of Islamic Shariah, which is committed to implement and materialize the economic and financial

principles of Islam in the banking sector. It has undertaken initiatives for investment in SME

sector by introducing a number of SME products in the market gradually with a view to

patronizing the trade, commerce and industrial entities with equity & justice and to make

effective contribution for creating employment opportunities, which will ultimately help the

nation for poverty alleviation from the society.

Objective of Small and Medium Enterprise

The SME Sector has been declared by the Government as a priority sector. In our country, Small

and Medium Enterprises (SMEs) play the pivotal role for employment generation, poverty

alleviation and overall economic growth of the country. It has been observed that fund is the

major constraint of this sector. Therefore, we need to inject more funds into this sector in a much

planned manner to boost-up this sector for the sake of overall economic development of the

country. Our country is labour abundant and SMEs are typically labour intensive. So, the sector

deserves more investment facility for smooth functioning of the existing enterprises and

expansion of the same with a view to retain the workforce active as well as creating more

employment opportunities. Further, investment in SMEs can be very effective in reducing

poverty as well as ensuring long term economic growth.

SME Investment Products:

Prottasha for Small Enterprises

Prottasha for Woman Entrepreneurs

3.12.4. Computer Services

Shahjalal Islami Bank is computerized and provides the following services some of these

services will be introduced soon. Shahjalal Islami Bank Limited introduced different few

schemes, which are very popular:

Online services, Automated Accounting, Integrated System, Any Branch Banking, ATM

Services, POS Services, SMS Push Pull Services, Signature Verification and Other Delivery

Channel Services (to be implemented)

3.12.5. E-services

1. SJIBL VISA Card

2. SMS Service

3. GP Bill Collection

3.12.6. Remittances

1. Western Union

2. Kushiara

3. Swift Service

3.13. Departments of SJIBL

All branches of Shahjalal Islami Bank Limited are divided into three departments:

General Banking Department

Foreign Exchange Department

Investment Department

3.13.1. General Banking Department

General banking department is one of the most important departments of Shahjalal Islami Bank

Limited. Basically, bank provides the main services to the customer through this department. In

general this section of the Shahjalal Islami Bank Limited is divided into five sections.

Accounts Opening Section

Cash Section

Remittance Section

Bills and Clearing Section

Accounts Section

3.13.2. Foreign Exchange Department

Banks play a very important role in effecting foreign exchange transaction of a country. Mainly

transactions with overseas countries are in respect of imports, exports and foreign remittance

come under the purview of foreign exchange department. Banks are the vital sectors by which

such transactions are effected/settled. Central Bank records all sorts of foreign exchange

transactions. The other banks dealing with foreign exchange are to report to Bangladesh Bank

regularly (daily, monthly, quarterly, yearly etc.). The foreign exchange department consists of

three sections. They are:

Import section

Export section

Foreign remittance section

3.13.3. Investment Department

Banking business consists of borrowing and lending. Banks act as an intermediary between

surplus and deficit economic units. Thus a banker is a dealer in money and credit. Banks accept

deposit from large number of customers and then lend a major portion of the accumulated money

to those who wish to borrow. In this process banks secure reasonable return to the savers, make

funds available to the borrowers at a cost and earn a profit after covering the cost of funds.

Banks, besides their role of intermediation between savers and borrowers and providing an

effective payment mechanism, have been allowed to diversify into many new areas of better

paying business activities.

3.14. Activities of SJIBL

2.14.1. Membership of Different Organization / Chamber

1. Bangladesh Institute of Bank Management (BIBM)

2. The Institute of Bankers Bangladesh (IBB)

3. Bangladesh Association of Banks (BAB)

4. Bangladesh Foreign Exchange Dealers' Association (BAFEDA)

5. Central Shariah Board for Islamic Banks of Bangladesh

6. Islamic Banks Consultative Forum (IBCF)

7. International Chamber of Commerce- Bangladesh

8. Society for Worldwide Inter-bank Financial Telecommunication (SWIFT)

3.14.2. Corporate Banking

We provide personalized solutions to all our customers. The Bank distinguishes and identifies

corporate customers need and designs appropriate solutions accordingly. Shahjalal Islami Bank

Limited offers a complete range of financing and operational services to its corporate client

groups combining trade, treasury, investment and transactional banking activities. We offer

accurate solution whether it is project finance, term Investment, import or export deal, working

capital requirement. We are pledged bound to render efficient services to satisfy customer needs.

Our experience in handling Corporate Banking business covers a wide span of businesses and

industries.

We hold leverage on our expertise in the following sectors particularly:

Textile Spinning, Dyeing / Printing, Ready Made Garments, Agro processing industry, Edible

Oil, Consumer and Diversified Industries, Industry (Import Substitute / Export oriented), Food &

Allied products, Paper & Paper Products, Engineering, Steel Mills, Chemical and chemical

products etc, Telecommunications, Information Technology, Real Estate & Housing, Wholesale

trade, Project Finance, Lease Finance, Hire Purchase, International Banking, Transport,

Pharmaceuticals, Export Finance, Import Finance.

3.15. Credit Rating of SJIBL

Long Term Short Term

Entity Rating AA ST- 2

Date of Rating June, 2011

Table 01: Credit Rating Source: SJIBL Website

3.16. An Overview of Eskaton Branch of SJIBL

Eskaton Branch created positive image not only to the SJIBL but also to the customers. There are

some efficient and effective bankers workers in this Branch. The management of the Branch

always tries to provide better service to its customer and behave well with them. As a result they

have got a number of accounts in this branch. As a new branch it is a tremendous victory for the

management. There are mainly three divisions in this Branch. The General Banking Division

deals the day to day transactions. This is highest busy department among all the three

departments. The Investment Division/Credit Division gives loan to the customer and monitor

whether he repays regularly or not. As the Branch did not become AD (Authorized Branch)

Branch yet, the foreign Exchange Division deals their activities with the help of Foreign

Exchange Branch of SJIBL.

3.16.1. Organ gram of Eskaton Branch

Figure 03: Organ gram of Eskaton Branch

3.17. Financial Highlights of the Bank

3.17.1. Equity of the Bank

SL No: Particulars Year 2010

01 Paid-up Capital 342.51

02 Statutory Capital 164.95

03 Retained Earnings 124.80

04 Asset Revaluation Reserve 25.06

(Figures in Crore Taka) Total 657.32

Table 02: Equity of the Bank Source: Annual Report 2010 of SJIBL

Figure 04: Equity Composition

3.17.2 Deposit of the Bank

SL No: Name of the Deposits Taka in Crore Percentage of Total Deposit

01 Al-Wadia Current Deposit 5,236.4 50%

02 Mudaraba Savings Deposit 392.81 4%

03 Mudaraba Term Deposit 3,425.75 32%

04 Bills Payable 75.71 01%

05 Other Deposits 1,352.13 13%

Total 10,482.80 100%

Table 03: Deposit of the Bank Source: Annual Report 2010 of SJIBL

Figure 05: Deposit of the Banks

3.17.3. Investment of the Bank

SL No: Modes of Investment Taka in Million Percentage of Total Investment

01 Murabaha 5,844.81 28.35%

02 Bi-Muajjal 8,882.60 43.08%

03 Hire-purchase &Ijara 3,581.92 17.37%

04 Investment against L/C 19.15 0.09%

05 Bill purchased/Discounted 1,588.00 7.70%

06 Investment against Scheme deposits 17.25 0.08%

07 Quard 29.65 0.14%

08 Others 653.23 3.17%

Total 20,616.61 100%

Table 04: Investment Portfolio Source: Annual Report 2010 of SJIBL

Figure 06: Investment portfolio of 2010 Source: Annual Report 2010 of SJIBL

3.17.4. Foreign Exchange Business

SL No: Particulars Amount in Crore Taka Percentage of Total

01 Import 2,526.26 53%

02 Export 1,914.43 41%

03 Foreign Remittance 293.56 06%

Total 4,734.25 100%

Table 05: Foreign Exchange Business Source: Annual Report 2010 of SJIBL

Figure 07: Composition of Foreign Exchange Business.

4. An Overview of Dutch-Bangla Bank Limited

4.1 History and Background

Dutch-Bangla Bank Limited (the Bank, DBBL) is a scheduled joint venture commercial bank

between local Bangladeshi parties spearheaded by M Sahabuddin Ahmed (Founder & Chairman)

and the Dutch company FMO. DBBL was established under the Bank Companies Act 1991 and

incorporated as a public limited company under the Companies Act 1994 in Bangladesh with the

primary objective to carry on all kinds of banking business in Bangladesh. DBBL commenced

formal operation from June 3, 1996. The Bank is listed with the Dhaka Stock Exchange Limited

and Chittagong Stock Exchange Limited.

4.2 Mission

Dutch-Bangla Bank engineers enterprise and creativity in business and industry with a

commitment to social responsibility. "Profits alone" do not hold a central focus in the Bank's

operation; because "man does not live by bread and butter alone".

4.3 Vision

Dutch-Bangla Bank dreams of better Bangladesh, where arts and letters, sports and athletics,

music’s and entertainment, science and education, health and hygiene, clean and pollution free

environment and above all a society based on morality and ethics make all our lives worth living.

DBBL's essence and ethos rest on a cosmos of creativity and the marvel-magic of a charmed life

that abounds with spirit of life and adventures that contributes towards human development.

4.4 AT A GLANCE of DBBL (as on 02.08.2011)

Type Private ( Non-Government), DSE BUTCH BANGLA

Industry Banking

Founded Dhaka, Bangladesh

Headqurter Dhaka, Bangladesh

Key People M Shahabuddin Ahmed- Founder & Chairman; Financiarings-

maatschappij voor Ontwikklingslanden (FMO)

Products Banking Service, ATM Services, Consumer Banking,

Corporate Banking, Invest Banking

Employees 1600

Website www.dbbl.com.bd

DBBL is most widely recognized for its donations to social causes and its IT investment (largest

ATM network). However it has recently stated that it will stop expansion on its ATM network as

the current numbers have exceeded demand and hence diminishing returns (if any). Although it

is widely believed it is a loss-making/subsidized unit which DBBL rationalizes as quasi CSR.

The bank is often colloquially referred to as "DBBL", "Dutch Bangla" and "Dutch Bangla Bank".

4.5 Core Objective

Dutch-Bangla Bank believes in its uncompromising commitment to fulfill its customer needs and

satisfaction and to become their first choice in banking. Taking cue from its pool esteemed

clientele, Dutch-Bangla Bank intends to pave the way for a new era in banking that upholds and

epitomizes its vaunted marques "Your Trusted Partner"

4.6 Products and Services of DBBL

4.6.1 Card Products

1. DBBL-NEXUS Classic Card (Debit Card)

2. DBBL-NEXUS Maestro card (Debit Card)

3. DBBL-NEXUS VISA Electron card (Debit Card)

4. DBBLNEXUS Silver OD card (Credit Card)

5. DBBL-NEXUS Gold OD card (Credit Card)

4.6.2 IT Products

4.6.2.1 Truly Online Banking

DBBL’s truly Online Banking is a fully automated real-time, any-where, any-way banking

service which covers 24 hours a day and 365 days in a year un-interrupted banking services.

DBBL has selected all the necessary items for truly online banking. The truly online banking is

officially being inaugurated on 3rd January, 2005. In this unique real-time, any-where, any-way

banking program of DBBL, the valued customers and trusted partners will enjoy a full range of

modern banking services at desired speed, absolute accuracy and competitive price.

DBBL are fully aware of the confidentially and security of the customers personal and account’s

information stored into their computer systems. The confidentiality and security of the

customer’s data is achieved by establishing four layers of security at application, network,

database and operating system levels.

4.6.2.2 Electronic and Mobile Banking

“You Dream it, Dutch-Bangla Bank will create it”

Dutch-Bangla Bank offers a complete electronic banking facility for your company around the

clock. Most multi-nationals use this service because it is advanced, secure and affordable. DBBL

creates a custom banking service to suit any business of any size. The services have a wide range

that includes cash flow services, distribution banking and salary accounts. If a company knows

what type of custom and tailored banking service they need, DBBL can provide it instantly and

at minimal cost (usually free of charge).

There are hundreds of companies using this type of services from DBBL and they also include

the largest companies and multi-nationals operating in Bangladesh. DBBL has a world-class

banking system used by many of the world's top banks and the largest electronic banking

infrastructure to provide your company with any type of custom banking services you desire.

For example for your starting point, DBBL has created Employee Banking program which

allows:

Seamless and error free distribution of salaries

Providing employees with timely salary payments

Lower manpower needed

Reduces cash theft and misappropriation

Transactions are properly logged for your easy reference

Highly secure way of distributing money

No cash at hand in the office, all cash finally distributed through the largest ATM

network in Bangladesh

Dutch-Bangla Bank Limited (DBBL) has for the first time introduced its mobile banking service

expanding the banking service from cities to remote areas. Bangladesh Bank Governor Atiur

Rahman yesterday inaugurated the service by depositing Tk 2,000 and withdrawing Tk 1,500

through Banglalink and Citycell mobile networks in Motijheel area.

4.6.2.3 Wide Range of ATM & POS

Now DBBL has 1500 ATM booth as on 09.08.2011and gives 24 hours service with carefully.

ATM services to motivate new customers for opening new account and join with DBBL.

4.6.2.4 Internet Banking

DBBL Internet Banking enables customer to access his/ her personal or business accounts any

time any where from home, office or when travelling. Internet Banking gives customers freedom

to choose his/her own banking hours. It can save time, money and efforts. It’s fast, easy, secure

and best of all.

4.6.2.5 SMS and Alert Banking

It is the new elements of IT products. For SMS and Alert banking-

Customer need to have an account with DBBL

Send an application in the specified format for SMS and Alert banking

DBBL will provide the customer with a pin to carry on the transaction with SMS banking

Three types of Alert banking DNNL provides their customers-

Debit Alert: Whenever a debit transaction is initiated at the account for an amount or higher,

specified by the customer in the application form, a debit alert will be generated and sent to the

customer’s mobile phone.

Credit Alert: Whenever a credit transaction is initiated at the account for an amount or higher,

specified by the customer in the application form, a credit alert will be generated and sent to the

customer’s mobile phone.

Month-end-balance Alert: The customer is sent out a notification of the account balance at end

of every month. The alert intimates to the customer the account number and balance.

4.6.2.6 Fast Track Service

During the Q1 of 2010, Dutch Bangla Bank Ltd. introduced "Fast Track" in the country. Fast

Track is first of its kind in the country that is like a mini branch. Along with the generic ATM

withdrawal service, it lets the customer deposit small amounts of money to DBBL account! The

limit is currently 20,000 BDT. Moreover, the Fast Track also provides account opening service

and loan information. As on 10 October 2010, DBBL has installed 50 numbers of Fast Tracks in

Dhaka, Chittagong and Sylhet cities. Customer can now deposit from the fast track and one is

very close to their house.

Here are some information about “Fast Track” that may be useful for you-

You can withdraw money 24 hours. There are multiple ATM booths in each “Fast Track”

You can deposit money from 9am to 10pm

You can deposit up to 20,000 BDT at “Fast Track”. I appreciate this policy as otherwise

big clients will rush here causing problems to small customers like me

They are open all day except Friday and government holidays. That mean, usually, you

can bank on Saturday too. Hurray!

You can open account from here

You can discuss about SME loan here

You won’t have to pay any fees for depositing money. Their branches charge fee when

you deposit in account from outer zone of account. But it is fully free at “Fast Track”

4.6.3 Retail Banking Products

DBBL Life Line

From the basket of life-line, DBBL is offering a complete series of credit facilities (i. e. health,

education, professional, marriage, travel, festival, dream come true, care, and general line) for

individual service holders, professional and self-employed persons.

DBBL Health Line

Hospitalization or other emergency medical needs and to purchase body fitness equipments

DBBL Education Line

For Higher education purpose and Tuition fees or other Educational expenses/ to purchase of

computer etc

DBBL Professionals Line

Purchase of Professional equipments and for Office renovation/decoration

DBBL Marriage Line

To meet marriage expenses for him/her and Marriages in the family

DBBL Travel Line

For Honeymoon trip, abroad or in the country and For Family trip, abroad or in the country

DBBL Festival Line

To enjoy festive period and Gift for the family/in laws/relatives

DBBL Dreams Come True Line

To purchase TV, Fridge, Furniture, Home Theatre, Motor Cycle, AC etc, to decorate/renovate

own Home/Car

DBBL Care Line

Loan for fulfillment of parents need/dream, To purchase economy car for the family (i.e. to

purchase low cost second hand car)

DBBL General Line

Other legitimate purposes which do not fall under the above mentioned specific lines. To

purchase a new/re-conditioned car and Refinancing of availed car

DBBL Home Line

To purchase a flat, Refinancing of owned house property, Home renovation and Extension /

construction of building

Full Secured Lines

Loans for family expenses and any other valid purposes

Recharge Line

OD facility against security and salary

DBBL Future Line

DBBL Deposit Plus Scheme (DPS), DBBL Periodic Benefit Scheme (PBS), DBBL Bachelor

Dergun Scheme (BDS), DBBL Children Education Savings Scheme (CHESS), DBBL Pension

Plus (PP)

4.6.4 Other Banking Products

4.6.4.1 Deposit

Savings Deposit Account, Current Deposit Account, Short Term Deposit Account, Resident

Foreign Currency Deposit, Foreign Currency Deposit, Convertible Taka Account, Non-

Convertible Taka Account, Exporter's FC Deposit (FBPAR), Current Deposit Account-Bank,

Short Term Deposit Account-Bank

4.6.4.2 Term Deposit

MONTHLY TERM DEPOSIT, TERM DEPOSIT 3 MONTHS, TERM DEPOSIT 6 MONTHS,

TERM DEPOSIT 12 MONTHS, TERM DEPOSIT 12 MONTHS, TERM DEPOSIT 24

MONTHS, TERM DEPOSIT 24 MONTHS 1 Year PAYOUT, TERM DEPOSIT 36 MONTHS,

TERM DEPOSIT 36 MONTHS 6 MONTHS PAYOUT, TERM DEPOSIT 36 MONTHS 1 Year

PAYOUT, TERM DEPOSIT ABOVE 36 MONTHS, MONTHLY TERM DEPOSIT BANKS,

TERM DEPOSIT 3 MONTHS BANKS, TERM DEPOSIT 6 MONTHS BANKS, TERM

DEPOSIT 12 MONTHS BANKS, 1 MONTH TD NFCD, 3 MONTHS TD NFCD, 6 MONTHS

TD NFCD

4.6.4.3 Loan Advances

Life Line (a complete series of personnel credit facility), Loan against Trust Receipt, Transport

Loan, Real Estate Loan (Res. & Comm.), Loan against Accepted Bill, Industrial Term Loan,

Agricultural Term Loan, Lease Finance, Other Term Loan, FMO Local currency Loan for SME,

FMO Foreign currency Loan, Cash Credit (Hypothecation), Small Shop Financing Scheme and

Overdraft.

5. Banking Industry of Bangladesh

The gradual improvement in the overall policy environment has enabled Bangladesh to improve

its economic performance in recent years. A successive government in Bangladesh has been

confronted with the problem of stimulating the economic growth rate in a country where a

substantial segment of the population lives below the subsistence level. Economic policies are

still guided by five year plans. Nevertheless, some progress has been made over the years, such

as self -sufficiency in food grain production, reducing the population growth rate, poverty

alleviation and boosting export income. The GDP growth per annum has been about 5.8 percent

on an average from 2009-2010.

The Banking Industry in Bangladesh is one characterized by strict regulations and monitoring

from the central governing body, the Bangladesh Bank. The chief concern is that currently there

are far too many banks for the market to sustain. As a result, the market will only accommodate

only those banks that can transpire as the most competitive and profitable ones in the future.

5.1 Laws for Private Bank in BangladeshLaws that directly regulate the banking system of Bangladesh are: Bangladesh Bank Order 1972;

Bank Company Act, 1991; Bangladesh Bank (Nationalization) Order 1972; Companies Act 1913

and 1994; Deposit Insurance Order 1984; Bankruptcy Act 1997; Insolvency Act 1920; Financial

Court Act 1990; Foreign Exchange (Regulation) Act 1986; Financial Institutions Act 1993;

Financial Institutions Rules 1994; and Co-operative Societies Ordinance 1984.

Laws that indirectly influence the banking system and for which references are made in the

Banking Company Act 1991 are: Code of Civil Procedure 1898; Code of Criminal Procedure

1898; Evidence Act 1872; General Clauses Act 1897; Limitations Act 1908; Negotiable

Instruments Act 1881; Penal Code 1860; Trust Act 1882; Transfer of Property Act; and

Bangladesh Chartered Accountant Order 1973. [Abul Kalam Azad]

5.2 Performance of Banking Sector

The banking sector of Bangladesh comprises of four categories of scheduled banks. These are

state-owned commercial banks (SCBs), state-owned development finance institutions (DFIs),

private commercial banks (PCBs) and foreign commercial banks (FCBs). The number of banks

remained unchanged at 48 in 2009. These banks had a total number of 7481 branches as of 03-

09-09. The number of bank branches increased from 6886 to 7481 owing to opening of new

branches by the PCBs during the year. Structure of the banking sector with breakdown by type of

banks is shown in following-

Currently, the major financial institutions under the banking system include:

Bangladesh Bank Commercial Banks Islamic Banks Leasing Companies Finance Companies

Of these, there are four nationalized commercial banks (NCB), 8 specialized banks, 10 foreign banks, 23 domestic private banks and 7 Islamic Banks currently operating in Bangladesh.

Figure 08: Different Banks in Bangladesh Source: BB Annual Report 2010-11

All local banks must maintain a 4% Cash Reserve Requirement (CRR), which is non-interest

bearing and a 16% Secondary Liquidity Requirement (SLR). With the liberalization of markets,

competition among the banking products and financial services seems to be growing more

intense each day. In addition, the banking products offered in Bangladesh are fairly

homogeneous in nature due to the tight regulations imposed by the central bank.

Competing through differentiation is increasingly difficult and other banks quickly duplicate any

innovative banking service.

5.3 Market Segment

The banking industry of Bangladesh is mainly divided into two sectors, such as Specialized

Banks (SBs) and Commercial Banks (CBs). The Specialized Banks are those banks that deal

with specific sectors or industry of an economy. For instance, Bangladesh Krishi Bank (BKB)

only deals with the agricultural sector of the economy; Bangladesh Shilpa Bank (BSB) only

deals with the industrial sector of the economy etc.

On the other hand, Commercial Banks are Scheduled Banks that are operating in the country

under the rules and regulations of the Central Bank. Commercial banks in turn can be grouped as

Nationalized Commercial Banks (NCBs); Foreign Commercial Banks (FCBs) and Private

Commercial Banks (PCBs) with three different segments, such as 1st Generation Private

Commercial Banks 2ndGeneration Private Commercial Banks, and 3rd Generation Private

Commercial Banks. The Bangladesh Bank (BB) Order created in 1972, authorized Bangladesh

Bank (BB) as the central bank of the country. Bangladesh Bank Order 1972 and the Banking

Companies Act 1991 mainly guide the commercial banks in Bangladesh. Commercial Banks in

Bangladesh are not allowed to do business other than just banking. Normal activities include

borrowing, raising or taking up of money, lending or advancing of money with or without

security. They are also authorized to issue letters of credit, trade in precious commodities and

buying and selling of foreign goods excluding foreign bank notes. They are also authorized to

trade in bills of exchange, promissory notes, coupons, drafts, debentures, certificates and other

instruments approved by Bangladesh Bank (BB). Banking companies are required to provide

safe vaults and are authorized to collect money and securities. All banks operating in Bangladesh

with different paid-up capital and reserves having a minimum of an aggregate value of Tk. 5

million and conducting their affairs to the satisfaction of the Bangladesh Bank have been

declared as scheduled banks in terms of section 37(2) of Bangladesh Bank Order 1972. Now in

terms of section 13 of Bank Company Act, 1991, the minimum aggregate capital is Tk. 200

million. After liberation, the banks operating in Bangladesh (except those incorporated abroad)

were nationalized. These banks were merged and grouped into six commercial banks. Of the

total six commercial banks, Pubali Bank Ltd. and Uttara Bank Ltd. have subsequently been

transferred to the private sector with effect from January 1985. Moreover at present there are 58

scheduled banks operating all over the country. Out of these, 16 are state-owned (including eight

specialized banks), 33 are private commercial banks (including seven Islami banks) and the

remaining 12 are foreign commercial banks (including one Islami bank).

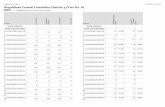

The name of all the banks operating in Bangladesh and their year of incorporation are

given-

NAME OF THE BANK YEAR OF INCORPORATION

NAME OF THE BANK

YEAR OF INCORPORATION

Nationalized Commercial Banks Specialized BanksSonali Bank Ltd. 1972 BKB 1972Janata Bank Ltd. 1972 BSB 1972Agrani Bank Ltd. 1972 BSRS 1972Rupali Bank Ltd. 1972 RAKUB 1987

BASIC 1988Private Commercial Banks

1st Generation PrivateBanks

(1982 – 1988) 2nd Generation PrivateBanks

(1992 – 1996)

Arab Bangladesh Bank Ltd.

1982 Eastern Bank Ltd. 1992

Uttara Bank Ltd. 1983 National Credit & Commerce Bank Ltd.

1993

National Bank Ltd. 1983 Prime Bank Ltd. 1995Islami Bank

Bangladesh Ltd.1983 Dhaka Bank Ltd. 1995

IFIC Bank Ltd. 1983 Southeast Bank Ltd. 1995United Commercial

Bank Ltd.1983 Al-Arafa Islami Bank

Ltd.1995

The City Bank Ltd. 1983 Social InvestmentBank Ltd.

1995

Pubali Bank Ltd. 1984 Dutch-Bangla BankLtd.

1996

Al-Baraka Bank Ltd. 1987Foreign Commercial Banks3rd Generation Private

Banks(1998 – Present)

Bangladesh CommerceBank

1998 Standard CharteredGrind lays Bank

1905

Mercantile Bank Ltd. 1999 Standard CharteredBank

1948

Standard Bank Ltd. 1999 American ExpressBank Ltd.

1996

One Bank Ltd. 1999 State Bank of India 1975Exim Bank Ltd. 1999 Habib Bank Ltd. 1976

Premier Bank Ltd. 1999 Muslim CommercialBank

1994

Mutual Trust Bank Ltd. 1999 National Bank ofPakistan

1994

First Security Bank Ltd. 1999 CITI Bank, N.A. 1995

Bank Asia Ltd. 1999 HSBC 1996The Trust Bank Ltd. 1999 Social Islami Bank 1997Jamuna Bank Ltd. 2001 Credit Agricole

Indosuez1997

Shahjalal Islami BankLtd.

2001 Hanvit Bank 1999

BRAC Bank 2001 Mashreq 2001Table 05: Name of the Banks operating in Bangladesh Source: Bangladesh Bank Ltd

5.4 Current Status of Banking Industry

The Banking Industry of Bangladesh at present is in the growth stage. Almost every year new

private banks are coming up, new branches are opening within two to three months, and new

customers are coming to open an account in different banks. As a result, according to July 30,

2004 there are 4 nationalized commercial banks, 5 specialized banks, 30 local private

commercial banks and 12 foreign commercial banks operating in this country. Moreover, as on

July 30, 2004 there are 27,881,322 numbers of deposit accounts and 7,462,785 numbers of

advance accounts in the banks.

5.5 Characteristics of Islamic and Conventional Bank

Firstly show the main differences for the interest of the readers, the distinguishing features of the

conventional banking and Islamic banking are shown in terms of a box diagram as shown below:

Conventional Banks Islamic Banks

1. The functions and operating modes of conventional banks are based on manmade principles.

1. The functions and operating modes of Islamic banks are based on the principles of Islamic Shariah.

2. The investor is assured of a predetermined rate of interest.

2. In contrast, it promotes risk sharing between provider of capital (investor) and the user of funds (entrepreneur).

3. It aims at maximizing profit without any restriction.

3. It also aims at maximizing profit but subject to Shariah restrictions.

4. It does not deal with Zakat. 4. In the modern Islamic banking system, it has become one of the service-oriented functions of the Islamic banks to collect and distribute Zakat.

5. Leading money and getting it back with interest is the fundamental function of the conventional banks.

5. Participation in partnership business is the fundamental function of the Islamic banks.

6. Its scope of activities is narrower when 6. Its scope of activities is wider when

compared with an Islamic bank. compared with a conventional bank. It is, in effect, a multi-purpose institution.

7. It can charge additional money (compound rate of interest) in case of defaulters.

7. The Islamic banks have no provision to charge any extra money from the defaulters.

8. In it very often, bank’s own interest becomes prominent. It makes no effort to ensure growth with equity.

8. It gives due importance to the public interest. Its ultimate aim is to ensure growth with equity.

9. For interest-based commercial banks, borrowing from the money market is relatively easier.

9. For the Islamic banks, it is comparatively difficult to borrow money from the money market.

10. Since income from the advances is fixed, it gives little importance to developing expertise in project appraisal and evaluations.

10. Since it shares profit and loss, the Islamic banks pay greater attention to developing project appraisal and evaluations.

11. The conventional banks give greater emphasis on credit-worthiness of the clients.

11. The Islamic banks, on the other hand, give greater emphasis on the viability of the projects.

12. The status of a conventional bank, in relation to its clients, is that of creditor and debtors.

12. The status of Islamic bank in relation to its clients is that of partners, investors and trader.

13. A conventional bank has to guarantee all its deposits.

13. Strictly speaking and Islamic bank cannot do that.

6. Data Analysis

6.1 Analysis on Strategy of Product and Services of SJIBL

It can be seen from above that SJIBL introduced more than 40 Islamic banking products &

services. Another distinct edge is that SJIBL facilities cater for all categories of customers

including individual, small businesses, commercial and corporate customers. The marketing

strategies that followed by SJIBL are below:

6.1.1 Product Differentiation

This strategy is taken by SJIBL in both its deposit and financing facilities. Islamic banking

facilities are available at SJIBL. They introduced different deposits and investment scheme under

Islamic mode. So their products are different than Dutch Bangla Bank Limited). The marketer or

the sales executives highlights the Islamic Banking perspectives because most of the customers

are Muslim in our Country. This Islamic Banking made differences with the other

commercial/private banks.

6.1.2 Product Variation

SJIBL has a variety of product under investment and deposit scheme. Above ten deposit scheme

is more difference from DBBL scheme and reliable from the Dutch Bangla Bank Limited. Lead

follows of the variation life standards. The different professional people take these opportunities

for gaining. What types of Halal income Islam can support to the business that way can run in

Bangladesh some Islami Bank. Islam cans Halal to the Business and Haram to the interest. But

give this facility only Islami Bank for doing business.

6.1.3 Product Innovation

This is the important strategy employed by SJIBL is the usage of Islamic terminology is

promoting its products to customers. For example, Arabic words such as Ijraa, Bai- Muajjal and