Full Board Meeting - · PDF fileFull Board Meeting Friday January 17 ... • Reed...

Transcript of Full Board Meeting - · PDF fileFull Board Meeting Friday January 17 ... • Reed...

Full Board Meeting Friday January 17, 2014

Museum of Flight 9404 East Marginal Way South

Seattle, WA 98108 Phone: 206-764-5720

9:00 – 10:00: Training Session: Land Use Liability – COMPACT Audit Overview Designed for WCIA Delegates and Alternates Presented by — Mike Connelly of Koegen Edwards LLP

10:15: Full Board Meeting Call to Order/Self Roll Call

Consent Calendar: • Approval of November 2013 Full Board Minutes Page 1

President’s Message

Reports: Director’s Report Page 9 • WAC 200-100 Changes • Stewardship Reports for Members • Negative Member Loss Trend

Managers’ Reports: • Jill Marcell, Treasurer/Deputy Director Page 10 • Reed Hardesty, Claims Manager Page 13 • Eric Larson, Deputy Director – Programs Page 15 • Patti Crane, Member Services Manager Page 18 • Lisa Roberts, Risk Services Manager Page 20

Action Items: • Approve Resolution 230-13 Page 22 • Approve 2014 Liability Coverage Document & Joint Protection Program Page 24 • Approve 2014 Property Joint Protection Program Page 49 • Approve 2014 Auto/Physical Damage Coverage Document

& Joint Protection Program Page 60 • Election of Executive Committee Members Page 74 11:30 – 1:00: Buffet Lunch provided by WCIA

FULL BOARD MEETING November 8, 2013 Embassy Suites – Tukwila, WA

MEMBERS PRESENT: Deb LaCombe, Walla Walla Valley Metropolitan Planning Organization; Mike Frizzell, Chewelah; Tom Richardson, Millwood; Allen Johnson, Arlington; Diana Easton, Elma; Mike Styner, Ocean Shores; Anna Bullock, Sunnyside; Stan Strebel, Pasco; Bob Coons, Port Angeles; Bryan Harrison, Burlington; Duane Leaf, Three Rivers Regional Wastewater Authority; Debbie Stanley, Three Rivers Regional Wastewater Authority; Tina Evenson, George; Anastasiya Warhol, Yarrow Point; Stanly Schwartz, Cheney; Arlene Fisher, Cheney; Kay Kammer, Battle Ground; Mike Evans, MACECOM; Linda Mead, Toppenish; Allan Galbraith, Chelan; Nancy Abell, Marysville; Vicki Look, Shelton and Shelton Metro Parks District; Brian Butterfield, Kelso; Mark McDermott, SERS; Gary Lamb, Renton; Kathy Joyner, Kirkland; Karl Hatton, JeffCom 911; Lucinda Gibbons, SCORE; Robert Grumbach, Medina; Cherie Gibson, Normandy Park and Normandy Park Metro Park District; Alvia Dunnagan, Othello; Jim Haney, Bainbridge Island and Normandy Park; Patrick Curran, Silverlake Water and Sewer District; Eric Robertson, Valley Regional Fire Authority; Stacy Lewis, University Place; Jodi Warren, Snoqualmie and Snoqualmie TBD; Leslie Kuhlman, Richland; Lindsay Blumberg, McCleary; Bob Hartwig, Shoreline; Rod Otterness, Union Gap; Brenda Heineman, Auburn; Jay Burney, Olympia; Connie Cobb, Olympia TBD; Chris Smith, Longview and Water Operating Board; Joel Walinski, Leavenworth; Sam Taylor, Ferndale; Alexandra Sheeks, Woodinville; Scott Hugill, Mountlake Terrace; Nancy Kuehnoel; Greg Corn, Marysville First District; Bracy DiLeonardo, Lacey; Paula Swisher, Brier; Don Morrison, Bonney Lake; Subir Mukerjee, Milton; Peri Gallucci, Chelan; Tony Piasecki, Des Moines and Des Moines TBD; Larry Bellamy, Goldendale; Nancy Adams, Medina; Kandy Bartlett, Mount Vernon; Gene Brazel, Monroe; Ben Warthan, Monroe; Lana Hobson, CRESA; Dave Zabell, Fife; Rob Roscoe, Auburn; Julie Evans, Bothell; Paul Loveless, Steilacoom; Lee Knottnerus, Ridgefield; Joseph Gavinski, Moses Lake; Don Ellis, Northshore Utility District; Pete Rose, Lake Forest Park and Lake Forest Park TBD; Lee Aalund, Lake Forest Park; Michelle Converse, Sumner; Randy Lewis, Westport; Lyman Howard, Sammamish; Angela Belbeck-Summerfield, Mukilteo; Aaron Barber, Auburn; Marianne Ledgerwood, Oak Harbor; Candice Rydalch, Centralia; Elizabeth Mitchell, Woodway; Julie Parker, Thurston PUD; Robert Wyman, Newcastle; Jared Burbidge, Thurston Regional Planning Council (TRPC); Mary Lorna Meade, Issaquah; Sheri Thomas, Puyallup; Chris Boughman, Mukilteo; Cynthia Shaffer, South Sound 911; Scott Patterson, Cowlitz-Wahkiakum Council of Governments; Chelsea Yarwood, Aberdeen; Dennis Osborn, Chehalis; Emily Schuh, Anacortes; William King, Skagit 911; Mitch Lackey, Camas; Noel Treat, Mercer Island; Pat Adams, Snohomish; John Caulfield, Lakewood; Laurie Anderson, Tukwila and Tukwila Metro Parks District, and Richard Conrad, Mercer Island. OTHERS PRESENT: Tiffany Woods, Programs Assistant; Chip McKenna, Sr. Risk Management Rep; Maria Orozco, Member Services Coordinator; Eric Larson, Deputy Director-Programs; Debbi Sellers, Sr. Risk Management Rep; Reed Hardesty, Sr. Claims Adjuster; Doug Martin, Claims Representative; Gordy Van, Sr. Claims Adjuster; Shelley O’Keefe, Claims Assistant; Jason Barney, Sr. Claims Adjuster; Jill Marcell, Deputy Director-Finance/Treasurer; Ann Bennett, Interim Executive Director; Tanya Crites, Sr. Risk Management Rep; Lisa Knapton, Sr. Risk Management Rep; Mark Bucklin, Authority Counsel; Regina Harpster and Arlan Danner, Evergreen Adjustment Services; Patti Crane, Member Services Manager; Tina Smith, Secretary; Lisa Roberts, Risk Services Manager and Danielle Stephens, Claims Office Assistant.

DRAFT 1

FULL BOARD MEETING November 8, 2013 Embassy Suites – Tukwila, WA

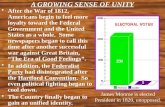

CALL TO ORDER: President Brenda Heineman called the meeting to order at 10:13 a.m. and began with a self roll call. After going over a few housekeeping items she recognized the Executive Committee members and the WCIA staff. CONSENT CALENDAR: Motion P. Rose moved to approve the consent calendar; A. Fisher seconded. The motion passed unanimously. PRESENTATION OF TARGET FUND ANALYSIS: Interim Director Ann Bennett stated for years WCIA has spoken of confidence levels as a measure of funding and the security of WCIA as an organization in its ability to pay claims. There is a national trend to evaluate risks other than claims and determine how an organization’s solvency measures against those risks. The Executive Committee asked the actuaries at PricewaterhouseCoopers (PWC) to conduct a Target Fund Balance Study to evaluate WCIA’s risk. The committee accepted the study and as a result passed Resolution 227-13 to identify a target fund goal and commit to conducting the study every three years. She introduced Kevin Wick and Craig Scukas of PWC to present the study to the Full Board at the request of the committee. Wick serves as a managing director who gives national presentations on this issue, as well as working with the State Risk Manager conducting solvency testing. Scukas serves as a director and has worked with WCIA for over 20 years. Wick stated that the purpose of the evaluation was to determine if WCIA’s current reserve was enough. This is difficult for pools nationwide to determine since they are not regulated. He explained there were typically two distinct models of pooling where capital is available in different forms. One is to maintain a fund balance supporting the risk and the ability to call for cash when the pool is in financial distress. However, more pools are striving to operate under the other model, which does not to use a “cash call,” believing it would be a financial failure or a sign of mismanagement. This latter model operates more like a mutual insurance company. In traditional pooling, surplus does not matter because the organization can call for cash. For the most recent model, capital and surplus are very important as they are is the only things supporting the program’s risk. The amount of capital needed is determined by the company’s business model and risk appetite. The more secure you want to be, the more capital you need; the more risk you have, the more capital you will need. The most familiar risk is the unpaid claims and reserving risk. As an ongoing organization, capital is needed to fund the next year’s business, which is underwriting risk. Additional risk can be investment bonds and their unknown performance. Another consideration could be the failure of reinsurance carriers where an organization would need to have capital to cover claims. Operational risk can be relatively low, but something could occur that would need to be funded by capital. The study evaluated each of these types of risk and determined the right funding level

DRAFT 2

FULL BOARD MEETING November 8, 2013 Embassy Suites – Tukwila, WA

for WCIA. The amount of capital represented in the study is the amount of capital needed for an event. The top of the range accounts for a 1 in 100-year event or possible $95 million loss. The study found there is a 20% chance to have a loss of $20 million in a given year. T. Piasecki asked for clarification on the $95 million loss and Wick stated it would be the total loss in one year, from either claims or investments. Wick continued explaining the study determined a target funding range. The state requires a minimum funding level and the study presented a target range to have some latitude in the surplus to cover a bad year and not affect rates. Maintaining below the range would not allow WCIA to fund surplus appropriately, or maintain the financial security desired by the Executive Committee and management staff. Maintaining a level above the range reflects more capital than necessary. According the study, WCIA is within the range. Wick stated a secure rated insurance carrier should be able to withstand a 1 in 100 or 1 in 150-year event. The Executive Committee agreed with that threshold. If the organization is funded to sustain a 1 in 250-year event, it would be difficult to justify the need for that level of capital given its goals. Though there may have been a perception before the study there was a lot of excess funding available, for an organization that hopes to be around in another 50 years this level of capital is needed to survive. Counsel Mark Bucklin clarified that legally WCIA is the first pooling model, but operationally performs under the second model to avoid calling the members for more money in the case of a catastrophe. DIRECTOR’S REPORT A. Bennett began her report by providing the membership on the status of the new proposed changes to the WAC governing pools. Hearings were conducted and it has now moved to the State Risk Manager’s office for rule making. The proposed changes to the WAC would increase the minimum funding reserve from 70 to 80%. WCIA is supportive of that change but there is active support against it. Other proposed regulations would provide more flexibility to the State Risk Manager as to how to take over a pool that is not solvent, as well as hiring independent actuaries to review a pool’s actuarial work. WCIA will be the first pool to be reviewed. The current insurance market it is very interesting with large capital investments into the insurance industry. Investors are not receiving a good return on their usual investments have found the insurance industry has had positive returns. Many investors are now investing through Insurance Linked Securities and big investors are providing Catastrophe Bonds, or CAT bonds. This large amount of money in the marketplace could change the traditional “hard” and “soft” market. The hope was this would be favorable in terms of keeping rates down. However, there is some indication the traditional markets are taking an opposing stance. Liability reinsurance renewal rates will likely go up by about 6% based on national trends. The property rates will also likely increase since there are very few reinsurance carriers that are willing or capable to cover our $5.6 billion of property. Bennett and Eric Larson recently went to London to meet with 14, Lloyd’s of London underwriters and Bennett complimented Larson on his presentation. Larson was effective in

DRAFT 3

FULL BOARD MEETING November 8, 2013 Embassy Suites – Tukwila, WA

conveying WCIA’s belief in risk management and long-term relationships with our members. Lloyd’s of London holds the same values and appreciates that about our organization. Unfortunately, because the Pacific Northwest has a large amount earthquake risk, they may not be able to increase their coverage. Bennett added the insurance carrier was impressed with the membership and added it was an amazing opportunity to see the global insurance market face to face. Bennett informed the membership of recent coverage conflicts on some claim files. In her dual role as interim director, she may have inside knowledge of some claims. Therefore, she has involved coverage counsel Tim Gosselin and members may receive coverage determination letters from him. She also shared with the membership a noted trend of negative claim losses throughout the last year. There have been many claims that have taken a negative turn on all kind of issues. Currently, the trend is $10 million more than what was paid at the same point last year. WCIA staff is addressing the trend by looking at points where issues can be addressed through training and risk management. There have also been several large first party losses within the $750,000 self-insured retention level of the property program. ACTION ITEM(S):

• Approve the Goals 2014 B. Heineman highlighted some of the new items within the goals. She stated the committee recognized WCIA must sell itself not only to potential new members but also to its current members. The new goals address creating a more detailed plan in that area. Additionally, it is a goal to create a risk reduction grant program that will assist members in reducing their risk levels. There will also be a new program called a Membership Improvement Plan. Though there is the Member Action Plan (MAP) plan, it is a more punitive program that is usually used as a last chance agreement. Motion T. Piasecki moved to approve the 2014 Goals; J. Caulfield seconded. The motion passed unanimously. B. Heinemann introduced Budget Committee Chair Stan Strebel to present the budget. • Approve the 2014 Operating Budget Strebel stressed that one of the best things about WCIA is the ability to be involved in the organization through the various committees. Strebel recognized the members of the Budget Committee: Tony Piasecki, Des Moines; Paul Loveless, Steilacoom; Scott Hugill, Mountlake Terrace; Rob Roscoe, Auburn; Shawn Hunstock, Maple Valley and Jared Burbidge, TRPC. He stated the committee met a few times throughout in the year to review the assessment revenue and most recently to review the operating budget. He stated the 2014 liability rates will increase on average by 3%, thought the actuary had recommended a 7% increase. Having the surplus discussed earlier in the fund analysis, provides for the ability to subsidize these rates for the

DRAFT 4

FULL BOARD MEETING November 8, 2013 Embassy Suites – Tukwila, WA

membership. He commended WCIA for the maintenance of a surplus that allows for these kinds of options. The assessments will generate approximately $24 million; about 23% of that revenue will fund the general operating budget and 77 percent will fund claim reserves, lawsuits and claim payments. The general operating budget will increase by 1.53%, or by approximately $91,000, which he expressed was modest. Establishing the grant program increased the budget by $130,000, but it was offset by discontinued items in budget such as the Target Fund Study and the HR Sentry program. Strebel added there were some normal required expenses in the budget, such as the independent claims audit and technology upgrades. Strebel commended staff in keeping budget increases to a minimum. Strebel felt it was important to recognize that one-third of the $6 million operating budget will go directly back the membership through the upcoming grant program, the pre-defense review program, consulting, and training. The budget will also cover the added benefit of cyber security coverage for up to $1 million, at no additional cost to the membership. This coverage will include event services management, providing assistance with contacting those affected by compromised data. In closing, Strebel stated property rates would increase by about five percent due to loss experience. The auto physical damage program will have no rate increase for the eighth consecutive year, and the fidelity program will see a ten percent rate increase due to loss experience. Mary Lorna Meade of Issaquah asked for more information about the HR Sentry program that was being eliminated. Strebel stated it was an online program, which provided information services regarding human resource issues. Meade further inquired why the program was eliminated and Risk Services Manager Lisa Roberts stated the cost of the group purchase program had increased and become cost prohibitive. Motion S. Strebel moved to approve the adoption of the budget, Resolution 228-13; P. Rose seconded. The motion passed unanimously. • Approve 2014 COMPACT Topic A. Bennett spoke to the 2014 COMPACT topic; staff seeks approval from the membership on the topic to be implemented each year. The COMPACT has a series of expectations established for members to meet throughout the year. Meeting these expectations make the members a good risk to the pool. She acknowledged the members of the Long Range Planning Committee, who were tasked with recently refreshing the COMPACT: Allen Johnson, Arlington; Arlene Fisher, Cheney; Steve Anderson, Bothell; Randy Lewis, Westport; Paul Schmidt, Chelan and David Timmons, Port Townsend. As WCIA has grown, the membership has become more diverse and not every member needs to focus on one topic. Therefore, actuarial Groups 1-4 will be audited on the topic

DRAFT 5

FULL BOARD MEETING November 8, 2013 Embassy Suites – Tukwila, WA

of land use, as well as two additional topics of their choice. Members will have the eight other topics to choose from that apply most to them. Group 5 members, for whom land use does not apply, will have audits on topics that are only applicable to their entity. The idea is to provide flexibility to the membership and receive the most value possible from risk management audit. The committee has also recommended that all pre-interlocal members be subject to a preliminary general risk management audit to assess their risk. • Executive Committee Nominations M. Bucklin stated that pursuant to the Interlocal and Bylaws this was the meeting when nominations for next year’s officers and Executive Committee members are opened. Bucklin officially opened the floor to nominations for the office of president. The only nominee was the current Vice President Jared Burbidge of TRPC. After three calls for additional nominations and hearing none, the nominations for president were closed. He then opened the floor to nominations for the office of vice president. The only nominee was John Caulfield of Lakewood. After three calls for additional nominations and hearing none, the nominations for vice president were closed. Nominations for vacant positions on the committee also open during the fall meeting of the Full Board and remain open until the January meeting. Bucklin opened the floor to nominations for the committee. The current nominees were Woody Edvalson, Bonney Lake; Arlene Fisher, Cheney; Rob Roscoe, Auburn and Stan Strebel, Pasco. Hearing no further nominations, Bucklin declared them suspended until the January meeting. • Appointment of New Executive Director B. Heineman began with background information regarding the appointment of a new executive director. She stated that back in 2002 the Executive Committee asked for a succession plan to prepare for former director Lew Leigh’s eventual retirement. The committee recognized that pool directors were retiring from the marketplace and several transitions yielded negative results due to poor planning. The committee’s plan took shape in 2003 beginning with organizational changes to identify potential in-house successors with Resolution 183-03. In February of 2007, Ann Bennett was identified as a successor by Lew Leigh in anticipation of his retirement in 2012. In 2008, the Full Board adopted a goal to develop a succession planning process that including defining competencies of key pool management staff; legal counsel assisted with the development of internal personnel recruitment and replacement. Reorganization of staff positions were approved for future staff development, and to allow for continued mentoring in accordance with the succession plan. In contemplating the choice of promoting an in-house candidate versus a national search, the Executive Committee took into consideration the succession plan, as well as the competencies required for the director position. The committee evaluated the in-house candidate’s background,

DRAFT 6

FULL BOARD MEETING November 8, 2013 Embassy Suites – Tukwila, WA

experience and her written responses to their specific questions; they also reviewed recommendations from the previous director, the other deputy directors, and legal counsel Mark Bucklin. After conducting a comprehensive interview, the committee decided to suspend a national search and recommend Bennett. Her appointment would make a seamless transfer of management and pool operation skills, maintains momentum of accomplishing goals, supports staff moral and continues institutional memory during a period of change. It is for those reasons the Executive Committee recommended to the Full Board that Ann Bennett be appointed Executive Director of WCIA. Motion A. Fisher moved to approve Ann Bennett as Executive Director; D. Zabell seconded. Discussion Bob Hartwig of Shoreline asked why there was no consideration of an outside search for a candidate, and why the selection committee was completely composed of people who would be under this candidate’s directorship. Heineman stated the committee felt the succession plan in place provided for Bennett as the best option for a successor based on her competencies. Hartwig further asked how the committee knew this candidate was the best one if they did not conduct a national search. Heineman reiterated that the committee was confident in the selection process and Bennett’s skills. A. Fisher added that while recently attending the national Association of Governmental Risk Pools (AGRIP) conference, several attendees approached her asking who would replace Lew Leigh expressing concern that there were very few candidates available. Directors from other states were complimentary of the selection of an internal candidate for the position. Fisher stated this reaffirmed her support of Bennett as the right choice. Hartwig clarified he expressed no animosity toward the selectee, but explained his city policy stated unless there was more than one in-house candidate available, the search must go outside the city. Therefore, he would be voting against the committee’s recommendation. D. Zabell added for clarification that the candidate selection board was not a separate group comprised of employees or the other directors. He stressed it was Executive Committee who conducted the candidate evaluation. Heineman confirmed adding that the director does not control the Executive Committee. Zabell added the committee is comprised of senior city management and staff who recognized it always a consideration to do an outside search. He also added it was important to consider whether to put an agency through that level of turmoil when there was such a high level of confidence in the in-house candidate. D. Timmons added that he initially felt WCIA should look outside the organization to select a candidate, but upon further understanding of the established process, he was supportive of selecting an in-house candidate. He added the availability to find appropriate candidates is not there, stressing it is becoming more important to do advance planning and invest in in-house

DRAFT 7

FULL BOARD MEETING November 8, 2013 Embassy Suites – Tukwila, WA

candidates. He was very impressed by the planning of the organization and supported the appointment. A. Johnson stressed it was a very important to consider that the committee agonized over this decision. Johnson added he had been involved with pooling in four different states during a time when cities could not get insurance regularly. He felt WCIA is the premier pool in the country and he complimented Lew Leigh for leaving the legacy of an insurance pool that is truly unique. He personally knows that when pools in other states have conducted national searches they have ended up with people from the insurance industry who did not understand pooling. He stated while making the best decision for the organization, the committee did consider going outside for a candidate; but Bennett was groomed for the position and the committee was choosing someone who had been raised in the culture of this pool. J. Caulfield echoed the comments of his colleagues on the Executive Committee; he stated there was spirited debate regarding searches with in the state or nationally. Initially, he was on the side of a national search but because of the work that was done by previous board and committee members to prepare for a succession, he was convinced Bennett is right candidate. He encouraged the board members to approve Bennett as Executive Director because she was the right person, at the right time to move the organization forward. B. Heineman called question; the motion passed with one dissenting vote. Heineman also called for a motion to approve the 2014 COMPACT topic that was missed earlier in the agenda. Motion T. Piasecki moved to approve the 2014 COMPACT topic as presented; P. Rose seconded. The motion passed unanimously. Heineman asked newly appointed Executive Director A. Bennett to make a few comments to the board. She expressed her thanks to the board for their acceptance of her as the Executive Director and added she was looking forward to the challenge. Meeting adjourned at 11:22 a.m. Jared Burbidge, Acting President Tina Smith, Authority Secretary Approved on: / /2014

DRAFT 8

Director Report January 17, 2014 Full Board Meeting

WAC 200-100 Changes

As previously reported, the State Risk Manager’s proposed changes to WAC 200-100 have entered the rule making process. Public Hearings were held and the Department of Enterprise Services, who oversees the State Risk Manager, has issued a preliminary decision to make no changes to the proposed rule. The Department prepared an explanatory statement and re-opened the public comment period. In reviewing the previous public comments, it is apparent that WCIA, while not named specifically, was targeted by those opposing the change as somehow influencing the process unfairly for a business advantage. We continue to support the changes that increase minimum confidence levels, determine appropriate asset tests and shorten the time frame for submission of audited financials. Our support of the rules is not motivated by business advantage but rather the desire to ensure the overall financial stability and security of pooling in the State. We have submitted both written and verbal comment supporting the change.

Stewardship Reports for Members

In the 2nd quarter 2013 newsletter, we presented our study of member usage of our Pre-Defense, Consultation and Reimbursement programs over the last five years. Due to the interest we received from the membership about the information, we are now developing a “stewardship report” that will be presented to members during the annual review process. Delegates will see the total dollars spent on their entity in each program. We are also providing comparison data for each member to see their use versus the average usage by their actuarial group. Since those three programs makeup 1/3 of our annual administrative budget we want to make sure all members are taking full advantage.

Negative Member Loss Trend Our year end data revealed that overall claim reserves have doubled over the last three years. The 2010 year-end reserves were $19.6 million compared to 2013 year-end reserves of $38.9 million. This $20 million increase has a direct impact on our amount of undesignated member reserves. The Claims and Risk Management departments have been working on analyzing the loss data and are discussing their findings and possible solutions in their monthly meetings. Unfortunately, we cannot correlate the increase in loss reserves to an increase in the number of claims received. Our overall approach to claim risk makes us susceptible to adverse results but we continue to follow the wishes of the membership by trying cases and attempting to create good case law in the appeals courts. Additionally, many of our large loss cases would not have been covered by many insurers but we have continued to heed your desire for generous coverage.

9

Washington Cities Insurance Authority

Liability , $23,386,887

Property, $6,986,031

Auto Physical Damage, $1,725,841

Boiler & Machinery, $292,382

Crime/Fidelity, $130,181

2013 Assessment Revenue by Coverage

Insurance Premiums, $7,586,819

Claims and Indemnity Payments,

$25,807,426

General Administrative

Expenses, $1,343,993

Claims Management Administration,

$1,168,902

Member Services/Training

Programs, $2,122,471

Pre-Defense Review

Program, $766,654

2013 Expenses Paid

11

$0

$20,000,000

$40,000,000

$60,000,000

$80,000,000

$100,000,000

$120,000,000

$140,000,000

$160,000,000

$180,000,000

$200,000,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Washington Cities Insurance Authority Assets and Reserves History

Designated Claim Reserves/Liabilities (75% Confidence Level)

Total Assets

Undesignated Members' Reserves

2013 figures are staff estimates. Pricewaterhouse calculation not completed.

12

2013 Annual Report - Claims By Reed Hardesty, Claims Manager

• The number of new claims and new lawsuits filed in 2013 was 1758, an 8% increase from

2012. The decreases occurred in Personnel and 1st Party claims. There was a significant increase in Land Use claims and slight increases in General Liability claims. Our in-house Claims Staff handled 73% of the new files with Evergreen Adjustment Service handling 27%.

• The total number of lawsuits received, including those filed on existing claim files was 94, a 10% decrease from last year. Land Use saw the largest increase with Auto and Police having significant decreases.

0

200

400

600

800

1000

1200

2012

2013

0

5

10

15

20

25

30

35

40

45

Auto Personnel Land Use General Police

2012

2013

13

2013 Annual Report - Claims By Reed Hardesty, Claims Manager Page 2

• Indemnity and Legal payments totaled $26,336,696 - a 30% increase from 2012

o Indemnity payments - $17,643,692 (a 39% increase from 2012) o Legal/Expense payments -$8,693,004 (a 5% increase from 2012)

• Of 1710 files closed in 2013, 53% of closed claim files resulted in payments to claimants;

this includes payments to members on 1st party claims. Of lawsuits closed, 51% resulted in payment being made to the plaintiff.

• The pre-defense program remained steady with 244 new requests in 2013. Land Use consultations doubled from last year. Personnel consultations slightly decreased. The program spent $766,653.

• The Department had a busy year in court with 8 trials. The results were 3 defense verdicts, 4

plaintiff verdicts (one lower than our offer) and one settlement during trial. Two plaintiff verdicts were reversed by Judges, one receiving a new trial and one receiving a directed defense verdict, which is now under appeal. The cases were claims of police excessive force, illegal search, K9 excessive force, employer discrimination retaliation, employer gender discrimination, inadequate oversight of public defenders and a car crash. We continue to utilize summary judgment motions to dismiss cases early as a matter of law. The dismissed cases involved applications of recreational immunity, landslides, excess force, and land use decisions.

• We also conducted multiple Claims and Incident Training sessions, Police Chief Orientations and Claims contact trainings.

01020304050607080

2009 2010 2011 2012 2013

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

14

2013 Annual Report - Programs By Eric B. Larson, Deputy Director - Programs

Liability The liability program has a $4 million self-insured retention (SIR). Above the SIR, $1 million in limits is placed with Governmental Entities Mutual, Inc. (GEM) a captive insurance company formed by WCIA and other large public entity insurance pools. Above the SIR and GEM, Ironshore Indemnity provides a $10 million layer followed by the top layer of $5 million by Allied World Assurance Company (AWAC). WCIA has been reinsured with GEM since its formation in 2003 and with Ironshore and AWAC since 2010. Limits to the membership total $20 million subject to certain aggregate limits. It is desirable to establish long-term relationships with the reinsurance carriers. If the insurance industry marketplace hardens, insurance pricing will increase and capacity (availability) may decrease. In that case, carriers may favor their long-term insured’s over short term ones. A chart is attached illustrating the WCIA reinsurance premiums going back to 2004. Reinsurance premiums in 2013 totaled $1,449,359 compared with $1,461,643 for 2012. Premiums increased 6% for the 2014 renewal over 2013 with 3% of the increase attributable to a growth in worker hours. Since 2010, the reinsurance premiums have been quite constant and have ranged between 5.4% and 5.6% of the members total worker hours. Worker hours are used as the exposure basis by the reinsurers. Membership coverage and limits for 2014 will remain the same as 2013. Property In 2013, our appraiser completed the first year of the five-year program to perform on-site appraisals for 80% of the membership’s property values. Overall results were good with the exception of a few severely undervalued buildings from one member. Not counting this member, appraisal values were within 4% of pre-appraisal values. In 2014, appraisals will be performed for WCIA members located in southern King County and Pierce County. The property premium increased from $4,988,715 in 2012 to $5,403,567 (8%) in 2013. The increase was attributable to a 4% rate increase and a 4% increase in property values. For the December 1, 2014 property renewal, premiums decreased to $4,972,249 (-8%) even with a 3% increase in values. Please find attached the property JPP, agenda charts illustrating the 2013 and 2014 property program insurance carrier’s participation and limits. Unlike the liability program’s $4 million SIR, WCIA has a much lower deductible of $750,000 for property. WCIA pools from the member’s individual deductible to $750,000 for all covered perils except flood and earthquake. The self-funded layer in property is smaller than the liability self-funded layer. Flood and earthquake losses, while infrequent, can be quite severe and are not covered in the self-funded layer. Members are subject to the insurance carriers deductibles ranging from $250,000 to $500,000 for these perils.

15

2013 Annual Report - Programs By Eric B. Larson, Deputy Director - Programs Page 2

For 2012 and 2013, property losses in the self-funded layer have totaled $6 million. As a result of the poor experience, rates to the membership are increasing an average of 5%. Auto physical damage losses have been very good and rates will remain the same for 2014. Crime/Fidelity Group purchase crime/fidelity insurance premiums for 2013 totaled $122,377. The crime/fidelity policy has been written by National Union (AIG) since 1995. Considering the large claims through the years, the program is quite a bang for the buck. For 2014, pricing renewed at $130,000 thanks to the long-term relationship with AIG.

16

$0

$200,000

$400,000

$600,000

$800,000

$1,000,000

$1,200,000

$1,400,000

$1,600,000

$1,800,000

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

WCIA Liability Reinsurance Premiums

GEM Additional Layer(s)

First Yr. $20 Million Limits & $4 Million

SIR

First Yr. MunichRe

First Yr. Ironshore &

AWAC

17

2013 Annual Report – Member Services By Patti Crane, Member Services Manager

Congratulations on a phenomenal year of training participation with attendance numbers over 8,500! This record breaking achievement was fueled by increased member contact and a much appreciated addition to Member Services staff. Members met all their training requirements with ease, taking advantage of the opportunity to enhance their educational needs with minimal or zero impact to their budgets. $675,000 Budget Distribution 8,551 Training Attendance Distributions

• Credit for increased training involvement was due to multiple WCIA sessions (303), as well as the enhanced response to WCIA reimbursements for municipal association conferences, schools and institutes.

• Personnel training topics continue to lead expense and training turnout; especially the member requested Anti-Harassment Trainings. Member inquiries also advanced our training curriculums for Performance Management, Supervisor and Workplace Communications trainings. As a result, we increased the number and level training of offerings 25%, while continuing to support annually the Labor Relations Institute and WAPELRA conference registrations.

• Public Safety expenses and participation increased due primarily to our partnership with Criminal Justice Training Commission (CJTC) and Law Enforcement Information Records Association (LEIRA). We promoted CJTC Crisis Intervention Team trainings and reimbursed for attendance to Property & Evidence and Supervisor/Management trainings. CJTC also hosted WCIA trainings on liability exposures related to personnel and police practices. LEIRA support boosted audience numbers to Public Records Act courses for Public Safety. Special attention was also given to 911 Communications reimbursement of Emergency Dispatch certifications.

18

2013 Annual Report By Patti Crane, Member Services Manager Page 2

$214,000 Reimbursements Program Expense Distribution

• Our Reimbursement report reflects the financial support for member participation at 21 municipal association credentialed program events. This effort assists in claim defense and supplements member budgets for staff development.

• Reimbursements grew by 31%, with an 81% participation rate. Each actuarial group and every municipal department has participated. Group 4 had 100% participation! The average amount members received was $1798. Further analysis has helped identify a target group for our 2014 focus.

• This blockbuster accomplishment was due to more advertising, monthly email reminders in the form of the WCIA Schooling Scholarships & Support Calendar and enthusiastic promotion of the reimbursement program by WCIA staff while out in the field. Members also played a major role of leading us to new programs!

19

2013 Annual Report – Risk Services By Lisa Roberts, Risk Services Manager Compact

• The 2013 COMPACT year was an overwhelming success with all members in full compliance. The information gathered was used to assist underwriting in obtaining cyber coverage for WCIA members. Risk Services provided free vulnerability testing, policy development assistance, and on-site IT consultations in support of the Membership to over half the membership. In addition, we formed an IT Committee comprised of member IT subject matter experts. The committee was charged with developing practical strategies to support local government entities. The committee prioritized the SANS 20 Critical Controls, which were then shared during the numerous regional trainings provided. The membership was grateful for the IT Security support, and we will continue to offer these IT Security services into 2014.

• The Full Board in November approved the 2014 COMPACT audit topic of Land Use for members in actuarial Group 1 through 4, and those Group 5 members to whom it applies (COGS and Planning Councils). For Group 5 members with no land use exposures, audit topics in the areas of greatest loss will be provided. Training in the particular COMPACT audit topic will be required and will be presented by the Risk Management Reps in the areas of parks, public works, and fleet. Defense attorneys will provide training in the areas of 911 liability and jail liability.

Risk Management

• Risk Services staff have been busy updating and tailoring audit questionnaires for these particular groups and developing audit-based training programs to assist the membership in identifying areas of need. In addition, they provided anti-harassment trainings, new delegate orientations, field inspections, and risk management guidance.

• We have developed a Stewardship Report for the membership, which will be used by the Reps during the Annual Review, to identify what WCIA programs the members use (i.e., pre-defense, consultation, reimbursements) and ensure members are taking full advantage of the benefits of WCIA membership.

Grant Program

• We are very excited to be launching the WCIA Risk Reduction Grant Program In 2014. A Grant Committee will be formed and t in early 2014 will meet to develop the eligibility criteria, proposal format and approval process. The grant program will offer mitigation grants to reduce liability and property exposures, and staff development grants for education directly related to risk management. Applications will be issued tentatively in April for the 2014 year.

Marketing

• As of January 1, 2014, the cities of Kennewick, Brewster, and several existing members’ TBDs became full members of WCIA. Ferndale and Poulsbo also transitioned from Pre-Interlocal Members into full membership.

20

2013 Annual Report – Risk Services By Lisa Roberts, Risk Services Manager Page 2

• In response to the Executive Committee’s retreat goals, we have contracted with Creative Medial Alliance, a local marketing firm, to assist us in enhancing WCIA’s brand recognition and messaging strategy, to the benefit of the membership. It’s a dynamic process with lots of possibilities!

Consultation Program • The Consultation Program provides a unique opportunity for Members to receive free legal

assistance in the areas of policy review, land use code development, and other general municipal issues. In 2014, 61% of the membership used consultation services.

$- $20,000 $40,000 $60,000 $80,000

$100,000 $120,000

End of Year Consultation Costs - $375,533

0

20

40

60

80

100

120

14

78

5 4

104

39

3

63

30

4 21

End of Year Consultation Count = 365

21

Action Item New Business: Establishment of Risk Reduction Grant Committee Background

Through a recommendation of the Long Range Planning Committee, the Executive Committee set as a 2014 goal the creation of a Risk Reduction Grant Program to assist the membership in reducing liability and property exposures. The WCIA By-Laws allow the Executive Committee to establish “other committees” consisting of volunteers from the membership to address specific areas of pool operation such as budget, long-range planning, investment and risk management/loss control. Currently the Loss Control Committee is tasked with risk management assistance and has a large number of members from which a grant committee could be formed. Establishing a new committee or changing the committee activity requires additional language to the By-Laws, Article III, Section 13, Other Committees which must be approved by the Full Board. Discussion WCIA has always offered members comprehensive risk management as a benefit of membership. In recent years, in response to the financial strains facing our members, we have increased support in our existing Training, Reimbursement, Risk Management Consultation and Pre-Defense programs. Through the awarding of Risk Reduction Grants, WCIA can provide financial assistance to members desirous of improving their risk profiles who have limited funding to accomplish their goals. The Grant Committee’s purpose would be the establishment of grant criteria and applications, the review of completed applications and the awarding of grant funds to members, not to exceed the annual budgeted amount. The committee would meet at least annually. The Grant Committee’s composition would consist of members who have served or are current members of the Loss Control Committee. It would include a chairperson, and its members would be appointed annually by the President. Each member of the sub-committee would agree to recuse themselves from consideration of any grants for which their entity would derive a financial benefit. The Executive Committee approved the creation of the Grant Committee in their December 13, 2012 meeting. Recommendation Approval of Resolution 230-13, that will add language to the By-Laws, Article III, Section 13, Other Committees

22

RESOLUTION 230-13

A Resolution Creating a Risk Reduction Grant Committee

WHEREAS, the By-Laws of the Washington Cities Insurance Authority provide that the Board may establish other standing committees whose members are appointed by the President with at least one member from the Executive Committee serving on the committee as a liaison, and

WHEREAS, the Authority, offers members comprehensive risk management as a benefit of membership and recognizes the financial strains facing our members, and wishes to assist members desirous of improving their risk profiles who have limited funding to accomplish their goals, and

WHEREAS, the Authority can through the annual budget process establish a fixed sum to be dispersed to members for the reduction of risk exposures, known as Risk Reduction Grants and

WHEREAS, a committee can assure the judicious awarding of monies from the Risk Reduction Grant line item through a formal committee mission statement, purpose and responsibilities defined as:

Mission: To develop risk reduction grant award criteria and award grant funds to members pursuant to said criteria.

Responsibilities: To present to the Executive Committee for its approval the formal criteria for risk reduction grant awards and thereafter, review completed risk management grant applications and judiciously award grants not to exceed annual budget amounts, and approve final distribution of funds.

Composition and Activity: To be composed of a chairperson and six (6) representatives from the Authority Board.

Now, therefore, be it resolved, BY THE BOARD OF DIRECTORS OF THE WASHINGTON CITIES INSURANCE AUTHORITY, THAT

The Risk Reduction Grant Committee of WCIA is hereby created with the responsibilities and mission stated above and Article III, Section 13 of the By-Laws of WCIA is hereby amended to add the following language:

Risk Reduction Grant Committee: Reviews and awards risk management grants to Members in amounts not to exceed the total amount budgeted for this purpose in the annual approved operating budget of WCIA and consistent with the written guidelines for risk management grant applications and awards approved by the Executive Committee. The committee shall consist of a chairperson and six representatives from the Board of Directors selected by the President and who serve at the pleasure of the President.

___________________ Date Jared Burbidge, Acting President Washington Cities Insurance Authority

23

Action Item New Business: 2014 Liability Joint Protection Program Background

The Liability Joint Protection Program (LJPP) documents the Authority’s responsibilities regarding coverage, service, cost allocation, and claims process. Additionally the LJPP outlines rules for membership qualification, the treatment of assessments, and coverage termination along with member responsibility for default judgments. Each year, the LJPP identifies the self-insurance and commercial insurance coverage layers, total dollar limits, carriers, and insurance provisions. The LJPP began as a single "declaration page," common to all insurance policies. As operational and coverage issues evolved, it reflects Board resolution of administrative or coverage issues. It summarizes what is more fully discussed in the Coverage Document, which formalizes coverage terms and conditions. The document grows as relevant issues are resolved and memorialized. Discussion

This year's LJPP and Coverage Document maintain a $4 million self-insured retention (SIR). One of the largest in the nation, this layer resolves 98% of the Authority's losses. Within that layer, WCIA controls the "underwriting pen," determining the coverage parameters for liability exposures and the membership it wants to "insure." It also controls the "claims pen," determining the claims resolution and litigation philosophy. WCIA purchases higher limits above the self-insured layer from three commercial reinsurance companies. Currently they are: Governmental Entity Mutual (GEM), a captive insurance company, Ironshore and Allied World Assurance Company (AWAC), both commercial reinsurers. All agree to use our underwriting and defense plans to support us in our insuring obligations. GEM is a "captive" commercial insurance company. It is owned and directed by municipal risk pools nationwide, which amassed operating capital to begin the company, regulated by the Washington D.C. insurance commissioner. The board holds the company "captive" by restricting the amount and types of business it allows the company to do. GEM only insures municipal risk pools, accredited by AGRIP, with other underwriting restrictions. Accordingly, GEM is small in comparison to Ironshore or AWAC's financial prowess, but it is quite useful as a quasi-municipal buffer between its pool members and strict insurance company operation. WCIA purchases $1 million/occurrence from GEM above our $4 million/occurrence self-insured layer, $10 million/occurrence from Ironshore, and $5 million in the final layer from AWAC. The current total limits, all controlled by the JPP is $20 million. All liability coverage uses a "per occurrence" policy form. Significantly, this includes Errors and Omissions and Employment Practice exposures.

24

Action Item New Business: 2014 Liability Joint Protection Program Page 2 This year staff recommends renewal through the same self insured retention and the three reinsurers mentioned above. Each of the carriers has a domestic domicile, using U.S. laws. The insurance industry in general has recovered from economic turmoil, and has adequate financial strength. Staff continues to develop a strong working relationship with each carrier's underwriting and claims staff. In response to increased questioning of the Authority’s right to control claims, new language has been added to Section IV regarding management of claims and settlement rights. The Authority’s rights regarding claim management already exist in the Interlocal, By-Laws, JPP and Coverage Documents. The added language is merely a reinstatement of the right in a clear and concise manner for ease of reference. A new third paragraph has been substituted under Section I, Paragraph A. This new language merely clarifies the previous language regarding the Full Board’s right to determine coverage terms and conditions, and the adoption of the coverage document into the LJPP. Additionally under Section I, Paragraph F, clarifying language has been added regarding costs sharing on legal efforts by members to secure coverage from excess or reinsurers. The changes in the Coverage Document are minor and reflect the current coverage year and new additions to the membership as previously approved by the Executive Committee. Recommendation

Approval of the 2014 Liability Joint Protection Program and 2014 Coverage Document as presented.

25

WCIA 2013 2014 Liability Joint Protection Program Page 2

WASHINGTON CITIES INSURANCE AUTHORITY Liability Joint Protection Program for the

Coverage Year January 1, 2013 2014 to January 1, 20142015 12:01 A.M. Pacific Standard Time

I. AUTHORITY LIABILITY COVERAGE

A. COVERAGE AGREEMENT

The Washington Cities Insurance Authority, (Authority) has been formed to provide its members financial protection from loss, in part, through self-insured and standard insurance coverages as detailed in the Authority's Coverage Document.

Coverage consists of two layers; a self-insured layer, and one or more reinsured layers. The Board of Directors determines the coverage limits in each layer and the relative attachment points among the layers, at the beginning of each coverage year.

The Board also determines the terms and conditions of coverage and herein adopts the continuation of Coverage Document #CT-2013 as the limits, terms and conditions for the self-insured layer of coverage.

The Board of Directors determines the terms and conditions of coverage for the self-insured layer of coverage. Coverage Document #CT-2014, which further defines the aforementioned coverage, is hereby incorporated by reference and adopted herein to this document.

The Board may choose to purchase reinsurance as a layer of coverage, or self-insure that layer. Purchased insurance policies may differ from each other and the self-insured layer in language, exclusions, conditions and underwriters intent. Coverage among the various policies may not be continuous. Annual aggregates may further limit coverage in any of the layers.

Elements of what the Authority intends to pay are defined in the Ultimate Net Loss definition within the Coverage Document. For example, the legal defense expense becomes part of the loss cost and contributes towards (erodes) the self insured and reinsurance limits.

B. EXCLUSIONS

Exclusions of coverage may differ in each of the coverage layers, and are specifically identified by each reinsurance policy or Coverage Document. Policies may differ from each other in the number, language and underwriters intent. For example, previous Board action determined underinsured / uninsured motorist coverage is not provided to members or employees.

C. MEMBERS

Current, risk-sharing, members are identified in the WCIA Coverage Document #CT-20122014. Any non-risk sharing membership does not qualify for the Coverage Document protections.

D. COVERAGE LIMITS

The Authority uses the configuration below of insurance layers to resolve claims and litigation per the terms, conditions and limits of each policy.

Self-Insured Layer: $4 million per occurrence Reinsured Layer-GEM $1 million per occurrence Reinsured Layer- Ironshore Indemnity, Inc.: $10 million per occurrence Reinsured Layer - Allied World Assurance Company, Inc.: $5 million per occurrence. Total Limit: $ 20 million per occurrence, subject to the annual aggregates.

E. AGGREGATES

WCIA and the insurance industry use annual aggregates to create limited coverage for volatile exposures, such as resulting acts of terrorism and broadened pollution coverage, or reduced coverage for an entire line of coverage, such as the employment practice exposure. Aggregates can be used to limit coverage by time periods, insuring limits and can be applied to individual members or an entire pool. Some aggregates apply in

27

WCIA 2013 2014 Liability Joint Protection Program Page 3

addition to the self insured layer, creating higher limits. A partial list of aggregate limits used in this document are:

$4,000,000 per occurrence limit and annual aggregate per Member applying to Terrorism

$5,000,000 per occurrence limit and annual aggregate per Member applying to Airport Errors and Omissions arising out of the operation, ownership, maintenance or use of any airport.

$4,000,000 per occurrence limit and annual aggregate limit per Member applying for the release, discharge or backup of liquids and/or effluents from waste water and/or sanitary sewer lines owned, leased, maintained or operated by a “Member” not arising directly or indirectly out of a “Flood.”

$4,000,000 per occurrence limit and $12,000,000 annual aggregate limit for any and all liability including defense of any and all Members arising directly or indirectly out of a “Flood” including any liability arising directly or indirectly out of the ownership, maintenance, operation or use of levies or any other boundary of lakes, ponds, reservoirs, rivers, streams, harbors and similar bodies of water.

The “Flood’ per occurrence and annual aggregate limit is the most the Authority will pay as a combined total of all ‘Flood” claims, for all Members, occurring during the term of this Coverage Document.

Flood,” as used herein, shall mean ‘surface water”, waves, tide, or tidal water, and the rising (including overflowing or breaching of boundaries) of lakes, ponds, reservoirs, rivers, streams, harbors and similar bodies of water. “Surface water” includes all water which backs up through sewers or drains.

$5,000,000 per occurrence limit and $5,000,000 annual aggregate limit per member for any liability arising out of Land-Use Planning and Land-Use Regulation, zoning, and any other development review process.

Above $5,000,000 per occurrence $15,000,000 annual aggregate Product Liability coverage per Member, $15,000,000 Public Official Liability annual aggregate per Member, $15,000,000 Employment Practice Liability annual aggregate per Member, $15,000,000 annual aggregate per Member Employee Benefits Liability and a $30,000,000 annual aggregate per Member for Law Enforcement Liability arising out of Member owned jails or holding facilities with overnight or greater length of stay for the confinement of inmates.

Other aggregates may apply within the Coverage Document language.

F. FURTHER CONDITIONS AND LIMITATIONS OF COVERAGE

Under no circumstances shall the Authority’s obligation to any member exceed $20 million per occurrence, inclusive of coverage or settlement determination costs, defense costs, and costs incurred by the Authority in obtaining indemnification from reinsurers for the occurrence.

Any member seeking coverage from any insurance company or reinsurer for any occurrence under the Authority’s Coverage Document agrees to pay half (50%) of all costs and expenses incurred in obtaining indemnification and/or defense fromcosts from any insurance company or reinsurers. If requested by a member, the Authority may, in its sole discretion, elect to participate with a member in any legal effort by a member to seek or enforce indemnification and/or defense cost coverage from any insurance company or reinsurer and, if it does so, the Authority will be responsible for payment of 50% of any legal costs and expenses incurred in such effort and the member will be responsible for the remainder of all costs. Subject to the preceding sentence, all any costs incurred by the Authority or individuals acting on its behalf and at its direction in obtaining indemnification for any the occurrence, including but not limited to legal expenses, costs associated with hearings, arbitrations, mediations, negotiations or other proceedings, and any other expenses, shall be part of the total aggregate limits as stated above, and shall reduce any recovery by the member accordingly. Coverage determination costs less than $1,000 per occurrence shall be an administrative cost.

In the event that an occurrence exceeds the combined self insured, and all reinsured layer coverage limits, or if any self insured or reinsured aggregate limit has been exhausted within the coverage term, any remaining obligation will be the sole responsibility of the applicable member and shall not be the responsibility of the Authority nor any other member.

Further coverage limits in the self insured and reinsured layers are limited to budgeted funds. Possible scenarios resulting from frequency of losses or a severity of loss may result in the exhaustion of all Authority funds. Replenishment of the self insured and reinsured layers may be made by special assessment as approved by the Board.

Any occurrence not within the coverage definitions of the self insured or reinsured layer Coverage Document for the coverage years shall be the sole responsibility of the applicable member or employee against whom the claim is made and not the responsibility of the Authority nor any other member.

28

WCIA 2013 2014 Liability Joint Protection Program Page 4

In the event that the Authority is unable for any reason to recover from reinsurers any portion of a liability claim otherwise payable to a member under the terms of the Authority’s Coverage Document, the Authority’s obligation to the member shall be reduced by the amount of such non-recovery. The Authority shall make a reasonable effort to obtain reinsurance recovery, but nothing in this Agreement shall obligate it to instigate judicial or other proceedings, nor to take any particular action to obtain indemnification from reinsurers.

In the event of a reinsurer’s financial failure, or the exhaustion of the self insured layer aggregate, the total liability of the Authority for the policy years shall remain at $4 million per occurrence. Any remaining obligation over the $4 million coverage limit is also the responsibility of the applicable member. The Board may authorize the purchase of new reinsurance or self insure coverage layer.

Liability coverage is subject to the terms, conditions and exclusions stated in the WCIA Coverage Document CT-2009 for the self insured coverage layer and to any reinsurance agreements, as well as all conditions and exclusions for liability coverage in the reinsured layer.

G CLAIMS DEDUCTIBLES

This program assumes no liability deductibles apply to any coverage. Claims deductible levels of $25,000, $50,000, $100,000, $250,000, $500,000 and $1,000,000 are potential coverage options for members that may, at the sole discretion of WCIA, be extended to members with the following characteristics:

1. The actuary must categorize the member in the highest total worker hour group for the projected period.

2. The member must be in compliance with applicable state and/or federal governmental accounting standards, including the establishment of a claims payment internal fund.

3. The member must have staff with authority to implement and administer the risk management function within the entity.

4. The member must have a demonstrated ability, practice and willingness to comply with WCIA Claims handling procedures and reporting requirements.

Members that are given the option to exercise this coverage option, and who do so, must report all claims and incidents, including those within their deductible layer, to the Authority for investigation. The Authority will periodically analyze and review the claims history of the member and distribute claims status reports. No member in good standing with WCIA is required to take an optional deductible level, if offered by WCIA.

The Authority retains control of claims, assignment of defense counsel and settlement authority. The member will be included in the claims decision-making process. For claims decisions that are referred to the Executive Committee, the member involved will be invited to participate in claims settlement discussions in Executive Session.

If the Authority deems that settlement is appropriate, the Authority will issue an authorization for payment to the member. The member is required to promptly pay the claimant upon receipt of the authorization. Any resulting action arising from the member's failure to pay is the sole responsibility of the member.

This claims deductible program is designed to provide the member who assumes significant individual risk with a reduced annual assessment and cash flow benefits. There are no changes to the Interlocal Agreement, By-Laws or Claims Manual concerning claim and litigation control or requirements for members that participate in a claims deductible program.

II. DESCRIPTION OF SERVICES AND COST ALLOCATION

A. AUTHORITY ADMINISTRATION

Administration of the liability claims program is conducted in-house by Authority staff and is an administrative expense. Some field losses are assigned by staff to an outside claims service company for resolution under limited dollar authority. The claims service fees are an administrative expense. The Director, Claims Manager and Adjusters are delegated settlement authority by the Executive Committee.

Defense of litigation is a major coverage element and program expense. It is a loss cost and applies against a member’s loss history and erodes the coverage limit. Selection and assignment of defense counsel is the responsibility of the Executive Director.

29

WCIA 2013 2014 Liability Joint Protection Program Page 5

B. GENERAL COUNSEL LEGAL SERVICES

The Authority General Counsel is appointed by the Board to provide legal assistance concerning Authority operations to the Board, Executive Committee and Executive Director. The Authority Counsel cost is an administrative, not loss-cost, expense.

C. CLAIMS COMMITTEE

The Executive Committee serves as the Claims Committee, approving loss settlements and litigation decisions. It resolves a member’s coverage appeal.

D. CLAIMS COSTS

Administration of the liability claims program is conducted in-house by Authority staff and is an administrative expense. Some losses are assigned by staff to an outside claims service company for resolution. The service company's fees are administrative costs.

Defense of lawsuits are also a part of the program, are considered loss costs, and apply against a member's loss experience and also against coverage limits. Selection and assignment of defense counsel is the sole responsibility of the Executive Director.

III. MEMBER ASSESSMENTS

Each member's assessment with the Authority is due within thirty (30) days of billing. Mid-year (new) membership will be prorated against the remaining coverage year assessment, payable within thirty (30) days.

IV. CLAIMS PROCESS

The Authority retains control of claims, assignment of defense counsel and settlement authority. The claims process is supervised by the Authority and includes development and implementation of claims procedures. Claims reports will be distributed annually to the membership.

Members shall cooperate by promptly reporting all incidents, occurrences, claims and lawsuits which may result in potential liability, by participating fully in any investigation conducted by the Authority or its claims administrator, and by adhering to the claims procedures as set forth in the Authority Claims Manual. The Executive Director may settle any claim up to $100,000. Dollar authority above that level must be brought before the Executive Committee for approval.

V. DEFAULT PENALTY

A member which fails to file a timely Notice of Appearance which results in a Default in favor of Plaintiff shall be subject to any financial penalty or judgment rendered by the courts on behalf of plaintiff, and shall not be payable with Authority funds. Appeals on the enforcement of this Section may be made as outlined in Article VI, Section 2 of the Authority Bylaws (Bylaws).

VI. COVERAGE DETERMINATION

The Executive Director shall be responsible for making coverage determinations within the self-insured layer and reinsured layers regarding claims or litigation filed against the member in which a question of coverage and/or defense obligations exists.

An appeal process has been adopted in the Bylaws, Article VII, Section 2, to allow members to bring before the Executive Committee any coverage decisions which they may contest. Respective requirements of each participating party are detailed in the By-Laws. Failure to follow the stated requirements may result in a waiver of coverage rights.

A Member’s financial participation in the cost of coverage determination is discussed in paragraph F above.

VII. OTHER-INSURANCE

If any member has other valid and collectible insurance or self-insurance, while is available to the member to cover a loss also covered by this Joint Protection Program, the coverage provided by this Joint Protection Program shall be in excess of and shall not contribute with such other insurance.

30

WCIA 2013 2014 Liability Joint Protection Program Page 6

VIII CANCELLATION OR TERMINATION OF MEMBER LIABILITY COVERAGE

Liability coverage provided under the Joint Protection Program may be canceled by an individual member by written notification of its intent to withdraw from participation in the Interlocal Agreement pursuant to Article 20 thereto. Coverage will cease either at the next coverage expiration date after notice, or upon the effective date of the member's withdrawal from the Authority, whichever comes first.

Coverage under this program may be terminated by the Authority by a majority vote of the Board present at the meeting whereby such termination is proposed. Notice of termination shall be provided to the member, in writing, not less than sixty (60) days prior to the effective date of the termination, except that, if the member fails to pay any assessment when due, this coverage may be terminated by providing, in writing, ten (10) days notice.

It is understood that cancellation or termination of coverage under this program shall constitute cancellation of coverage in both the primary and excess layer. Limits, terms and conditions of coverage is restricted to those in force at time of cancellation or termination. Should any premium credit of an individual member be returned to the Authority as a result of the cancellation in any excess insurance policy, it may be retained by the Authority and applied toward any outstanding or anticipated debts of the member to the Authority. Should all the financial obligations of the member be met, 90% of any premium return from the excess insurance carrier for the individual member shall be forwarded to the member.

IX MEMBERSHIP

The Interlocal allows for a broad membership category to include municipal corporations. Current membership types include.

A. CITIES, TOWNS and SPECIAL DISTRICTS

Membership is open to cities, towns and special districts in Washington State, to be reviewed on a case by case basis, subject to current Authority underwriting guidelines.

B. INTERLOCAL ENTITIES

Membership is open to interlocal entities to be reviewed on a case by case basis, and subject to current Authority underwriting guidelines and the following requirements:

1. The Interlocal Entities or Municipal Corporations must provide traditional municipal services with its own staff and Board.

2. A member city must sponsor the Interlocal Entities or Municipal Corporations for WCIA membership.

3. The member city must maintain active participation in the Interlocal Entities or Municipal Corporations and be represented on the Interlocal Entities or Municipal Corporations governing board.

4. The Interlocal Entities or Municipal Corporations must support and attend risk management training sessions.

5. The overall effect of this type of Organization impact on the pool may be reviewed and periodically re-evaluated.

6. The Interlocal Entities or Municipal Corporations must perform to current underwriting standards and COMPACT requirements.

31

WCIA Coverage Document #CT-20143 Page 2

WASHINGTON CITIES INSURANCE AUTHORITY

Self-Insured Coverage Document CT-20132014 January 1, 2013 2014 to January 1, 20142015

12:01 am Pacific Standard Time LIMITS/ULTIMATE NET LOSS: SELF-INSURED LAYER LIMIT: $4,000,000 PER OCCURRENCE REINSURED LAYER GEM: $1,000,000 PER OCCURRENCE REINSURED LAYER Ironshore Indemnity, Inc.: $10,000,000 PER OCCURRENCE REINSURED LAYER Allied World Assurance Company, Inc.: $5,000,000 PER OCCURRENCE TOTAL LIMIT: $20,000,000 PER OCCURRENCE, subject to aggregates and

sub-limits below and in Section I.D, and Section I. E in the WCIA Joint Protection Program.

AGGREGATE LIMITS/SUB-LIMITS:

$4,000,000 per occurrence limit and $4,000,000 annual aggregate limit per Member applying for the release, discharge or backup of liquids and/or effluents from waste water and/or sanitary sewer lines owned, leased, maintained or operated by a “Member” not arising directly or indirectly out of a “Flood.” $4,000,000 per occurrence limit and $12,000,000 annual aggregate limit for any and all liability including defense of any and all Members arising directly or indirectly out of a “Flood” including any liability arising directly or indirectly out of the ownership, maintenance, operation or use of levies or any other boundary of lakes, ponds, reservoirs, rivers, streams, harbors and similar bodies of water. The “Flood’ per occurrence and annual aggregate limit is the most the Authority will pay as a combined total of all ‘Flood” claims, for all Members, occurring during the term of this Coverage Document. Flood,” as used herein, shall mean ‘surface water”, waves, tide, or tidal water, and the rising (including overflowing or breaching of boundaries) of lakes, ponds, reservoirs, rivers, streams, harbors and similar bodies of water. “Surface water” includes all water which backs up through sewers or drains. $4,000,000 per occurrence limit and $4,000,000 annual aggregate per Member applying to Terrorism. $5,000,000 per occurrence limit and $5,000,000 annual aggregate limit per member for Errors or Omissions Coverage arising out of the operations, ownership, maintenance or use of any airport. $5,000,000 per occurrence limit and $5,000,000 annual aggregate limit per member for any liability arising out of Land-Use Planning and Land-Use Regulation, zoning, and any other development review process. Above $5,000,000 per occurrence $15,000,000 annual aggregate Product Liability coverage per Member, $15,000,000 Public Official Liability annual aggregate per Member, $15,000,000 Employment Practice Liability annual aggregate per Member, $15,000,000 annual aggregate per Member Employee Benefits Liability and a $30,000,000 annual aggregate per Member for Law Enforcement Liability arising out of Member owned jails or holding facilities with overnight or greater length of stay for the confinement of inmates.

DESCRIPTION OF COVERAGE: General Liability, Automobile Liability, Stop-Gap Coverage, Errors or Omissions Liability and Employee Benefits Liability.

33

WCIA Coverage Document #CT-20143 Page 3

LIMITS OF LIABILITY FOR ALL COVERAGE.

The Limits/Ultimate Net Loss stated herein and the rules below set the maximum the Authority will pay regardless of the number of:

a. members, b. claims made or lawsuits brought, or c. persons or organizations making claims or bringing lawsuits.

TERRITORY: This coverage applies to General Liability, Automobile Liability, Stop-Gap Coverage, Errors or Omissions Liability and Employee Benefit Liability occurring anywhere in the United States of America, its territories and possessions or Canada.

Members covered by this agreement include the following and new members approved by the Executive Committee during the Coverage Year; members of the Large Deductible Program have their deductible levels listed by their names:

A Regional Coalition for Housing (ARCH) Aberdeen Anacortes Arlington Arlington Transportation Benefit District Auburn Bainbridge Island Bainbridge Island Transportation Benefit District Battle Ground Benton City Benton County Emergency Services (BCES) Bonney Lake Bothell Brewster Brier Burien Burlington Camas Cashmere Centralia Chehalis Chelan Cheney Chewelah Clark Regional Emergency. Services Agency (CRESA) Clarkston Cle Elum Clyde Hill Coupeville Covington Cowlitz-Wahkiakum Council of Governments Des Moines Des Moines Pool Metro Park District Des Moines Transportation Benefit District Eastside Public Safety Communications (EPSCA) eCity Gov Alliance Edgewood Edmonds Edmonds Transportation Benefit District Ellensburg Elma Emergency Services Coordinating Agency (ESCA) Enumclaw Ferndale Fife George Goldendale Grandview Grandview Transportation Benefit District

Grays Harbor Communications Hoquiam Issaquah Jefferson County 911 Kelso Kenmore Kenmore Transportation Benefit District Kennewick Kirkland Kitsap Regional Coordinating Council (KRCC) La Conner Lacey Lake Forest Park Lake Forest Park Transportation Benefit District Lake Stevens Lakewood ($25,000) Leavenworth Leavenworth Transportation Benefit District Long Beach Longview LOTT Clean Water Alliance Mabton MACECOM Maple Valley Maple Valley Transportation Benefit District Marysville Marysville Fire District McCleary Medical Lake Medina Mercer Island Metropolitan Park District of Tacoma ($25,000) Mill Creek Millwood Milton Monroe Moses Lake ($25,000) Mount Vernon Mountlake Terrace Mountlake Terrace Transportation Benefit District Mukilteo Multi Agency Communications Center (MACC 911) Newcastle Normandy Park Normandy Park Metro Park District North Bonneville Northshore Utility District NW Incident Management Team Oak Harbor

34

WCIA Coverage Document #CT-20143 Page 4

Ocean Shores Olympia Olympia Transportation Benefit District Othello Pasco ($100,000) PENCOM Port Angeles ($100,000) Port Townsend Poulsbo Pullman Pullman Metropolitan Park District Pullman-Moscow Regional Airport Board Puyallup ($100,00) Renton ($250,000) Richland Ridgefield Sammamish Shelton Shelton Metro Park District Shoreline Shoreline Transportation Benefit District Silver Lake Water & Sewer District Skagit 911 Snohomish Snohomish Co. Emergency Radio System (SERS) Snohomish Co. Fire District #3 (dba Monroe Fire

District) Snohomish Co. Police Aux. Services Center

(SNOPAC) Snoqualmie Snoqualmie Transportation Benefit District Soap Lake South Correctional Entity Facility PDA (SCORE) South Sound 911 Spokane Valley Stanwood

Stanwood Transportation Benefit District Steilacoom Sumner Sunnyside SW Snohomish Co. Communications Agency

(SNOCOM) Three Rivers Regional Wastewater Authority Thurston 9-1-1 Communications Thurston Public Utilities District Thurston Regional Planning Council (TRPC) Toppenish Tukwila ($25,000) Tukwila Pool Metropolitan Parks District Tumwater Union Gap University Place University Place Transportation Benefit District Valley Communications Valley Regional Fire Authority WA Cities Insurance Authority Walla Walla Walla Walla Joint Community Development Agency Walla Walla Transportation Benefit District Walla Walla Valley Metropolitan Planning Organization Warden Washougal Water Operating Board West Richland Westport WHITCOM 911 William Shore Memorial Pool District Woodinville Woodway Yakima Valley Conference of Governments Yarrow Point Zillah