Forms 990 and 990=PF - Internal Revenue Service · A Number of Forms 990 and 990-PF in the...

Transcript of Forms 990 and 990=PF - Internal Revenue Service · A Number of Forms 990 and 990-PF in the...

n( ,,), M

nliD

M r-1 171

Forms 990and 990=P FReturns of Organizationsand Private FoundationsExempt from Income Taxfor 197 3Filed during 1974

June 1976

Department of the TreasuryInternal Revenue Servic e

Office of Assistant Commissioner (Planning and Research) /Statistics Divisio n

Document 6167

Contents

Introduction :

General . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Scope of the Study . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5&6

Filing Requirements :

Form 990 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Form 990-PF . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Description of the Sample and Processing the Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6&7

Notes to the Tables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Form 990 Tables

Page

Table Reference

I Page I Exemption Code Paragraph of Internal Revenue Code Under Whic hExemption Was Claimed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Method Used to Record Address Information and Presence or Absence ofEmployer Indentification Number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1

2 Page 1

Part 1, lines

3 1-84 75 86 9-11,13-15

7 lOx 6

8 139 17-19,25

Part H, fines

10 1-8

11 9-19

12 32,37,41

13 41x Part 1 ,lines 12, 15

Schedule A

14 Part I

15 Part V,lines 1-7

16 Part V,lines 8-15x lines 4, 5

17

Entries in "Receipts" Section (Part 1) . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . I IDistribution by Size of Total Receipts (Part 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12Distribution by Size of Gross Receipts for Filing Requirements (Part 1) . . . . . . . 12Entries for Specified "Expenses and Disbursements" and "Assets an d

Liabilities" (Part I) . . . . . . . . . ..

. . . . 13Entry for Expenses Attributable to Gross Contributions by Size of Receipts ofGross Contributions . . . . . . . . . . . . . . . . . .

.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Distribution by Size of Total Assets (Part 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14Entries for Miscellaneous Items from Page I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 4

Entries for Specified "Receipts from Other Sources" (Part 11) : Returns withGross Receipts of $10,000 or More . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Entries for Specified "Expenses and Disbursements" (Part 11) : Returns wit hGross Receipts of $10,000 or More . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

_~ column D~ : Returns withEntries for Specified "Balance Sheet" Items (Part 11~,Gross Receipts of $10,000 or More . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Agreement between Items in Parts I and 11 on Changes in Net Worth, by Sizeof Total Net Worth, End of Year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Number of Officers, Directors, and Trustees Receiving Compensation(Schedule A, Part 1) Listed: Section 501 (c) (3) Returns With Schedule AAttached . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Reason Checked for Non-Private Foundation Status (Schedule A, Part V) :Section 501 (c) (3) Returns With Schedule A Attached . . . . . . . . . . . . . . . . . . . . 18

Entries in "Support Schedule," by Major Reasons for Non-Private Foundatio nStatus (Schedule A, Part V) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

Attachments to Form 990 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

I

Contents (Cont'd )

Table Reference

Form 990-PF Tables

Page

18 Entries in Year in Which Exemption Letter Issued by Fair Market Value of Assets . . . . 22 & 23upper right ,page I

Part 1, lines

19 1,3-12 Entries for Specified "Receipts" (Part 1) by Column in Which Entered . . . . . 2420 1-12 Line Showing Highest Dollar Amount in Each Column in "Receipts" (Part 1) 2521 13 Distribution by Size of Total Receipts by Size of Fair Market Value of Assets 2622 14-22 x cols . Entries for Specified "Expenditures" (Part 1) by Column in Which Entered 27

A-D23 1 x 23, col .D Entry for Receipts from Gross Contribution-s, Gifts, Grants, Etc . by Size of

Expenditures for Contributions, Gifts, Grants . . . . . . . . . . . . . . . . . . . . . . . . . . 2824 22 x 24, Entry for Other Expenses by Size of Total Expenditures . . . . . . . . . . . . . . . . . . . 28

Col . D

Part 111, lines

25 10, 11, 13, 17, Entries for Specified "Balance Sheet" Items (Part 111) . . . . . . . . . . . . . . . . . . . . 2918,2 1

Part V, lines

26 A, B, C, E, F, Entries for "Statements with Respect to Certain Activities" (Part V) . . . . . . . . . 30H (2), J (1) ,J (2), M (1 )

27 N (1) a- Entries for "Statements with Respect to Certain Activities" (Part V) . . . . . . . . . 31N(I) e

Part V11, line s

28 1-3 Entries for Specified Items for "Capital Gains and Losses for Tax o nInvestment Income" (Part VII) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

Part V111, lin e

29 Ix Part 1, Entry for Dividends by Size of Adjusted Net Income . . . . . . . . . . . . . . . . . . . . . . 32line 5

Part IX, lines

30 ld, 4 Entries for Specified Items (Part IX) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3231 6, 7 x Date of Organization (relative to May 26, 1969) by Size of Minimu m

Part VIII, Investment Return for 1973 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33line 2

2

Contents (Cont'd )

Table Reference

Form 99&-PF Tables

Part X, line

32 4 x Part VIII, Distribution by Size of Distributable Amount as Adjusted by Size of Total

Page

line 7 Qualifying Distributions in 1973 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Part X1, lin e

33 10 Distribution by Size of Undistributed Income for 1973 (Part XI) . . . . . . . . . . . . 35

Part X11, lines

34 2a, 2c Entries in "Private Operating Foundation" Section by Year of Activity(Part XII) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Appendix

Page

A Number of Forms 990 and 990-PF in the Population and Sample, an dWeighting Factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

B Relative Sampling Variability of Estimated Number of Returns . . . . . . . . . . . 38Copy of the Form 990 and Schedule A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39-42Copy of the F orm 990 Checksheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43-55Copy of the Form 990-PF . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57-64Copy of the Form 990-PF Checksheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65-80

3

Introduction

Generd

This report presents data from Forms 990 and 990-PF, filed in 1974 for 1973 . Form 990 is the "Return ofOrganization Exempt from Income Tax Under Section501 (c) of the Internal Revenue Code (except Private.Foundation)", and Form 990-PF is the "Return ofPrivate Foundation Exempt from Income Tax UnderSection 501 (c) (3) of the Internal Revenue Code" .This report was initiated to provide information toInternal Revenue Service officials about how exemptorganizations in general and private foundations inparticular report their business and other activities thatmay affect their exempt status .

This is the twenty-first report in a series of studies oftax and information returns initiated in 1954 . Thesestudies have assisted Treasury and IRS officials inplanning and redesigning tax forms by providing infor-mation on how taxpayers fill out -their returns. TheReporting Characteristics Studies are also useful sup-plements. to the Statistics of Income publications .These studies have beer. scheduled to cover, over aperiod of years, as many different kinds of returns aspossible. Usually, the Tax Forms Coordinntinor CoM_

mittee recommends the return in a particular yearwhose study is expected to be most helpful at thattime. Consequently, a newly revised form may beselected for restudy rather than a form not previ

.ously

studied orone not studied for some time .

The choice of the Forms 990 and 990-PF for thisstudy reflected interest in the area of exempt organiza-tions in connection with the establishment by Congressof the new Office of the Assistant Commissioner (Em-ployee Plans and Exempt Organizations) . The tableestimates in this report reflect taxpayer entries whethercorrectly or incorrectly reported . As shown below inthe list of studies that have been completed or arescheduled to date, Forms 990 and 990-PF are beingstudied for the first time . The list includes :

Income Year or Calendar Quarter Form

1954 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10401955 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1040A1956 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11201957 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10651958 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1040A1958 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1120S1959 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104OW

Income Year or Calendar Quarter--Continued Form

1960 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1040with Schedule C or F

1961 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1040with Schedules B and D

1962 (filed for 2nd Quarter) . . . . . . . . . . . . . . . . . . 9411962 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . W-21963 (filed for 2nd Quarter) . . . . . . . . . . . . . . . . . . 7201964 (filed for 4th Quarter) . . . . . . . . . . . . . . . . . . . 9421964 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9431965 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10411966 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1040

and Schedules B, C, D and F1968 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11201969 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1040

and Schedules1971 (filed for 2nd Quarter) . . . . . . . . . . . . . . . . . . 9411972 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7061973 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 990/990--PF19741 . . . . . . . . . . . . . .. . . . . . . . . . . . . 1040 & Schedules

I Scheduled for release in 1976

Scope of the Study

The present study is limited to all returns filed in1974 on Forms 990 (1973 Revision), with gross re-ceipts (Part I, line 8) of $5,000 or more, and 990-PF(1973 Revision) . Form 990 type organizations with

gross receipts not more than $5,000 were excluded asthey are not required to file . The sample is composedof those returns filed from January 1, 1974, throughDecember 31, 1974 . Of the 361,000 Forms 990 filed,165,000 or 46 percent, were on the current year (1973)form with gross receipts of $5,000 or more, and wereincluded in the study . The remaining 54 percent or196,000 returns were on prior year forms or had grossreceipts below $5,000 . Similarly, the Forms 990-PFfiled consisted of 34,200 returns, of which 24,400 or 71percent were on current year forms and were includedin the study . The -other 29 percent were excluded be-cause they were prior year forms .

Prior year forms (which include some taxpayerserroneously filing for the current year on prior yearforms) are normally%excluded from tabulation in re-porting characteristics studies, since the purpose ofthe studies is to reveal how taxpayers used the partic-ular form involved . The -tabulation below shows thetotal number of Forms 990 and 990-PF filed and sub-jected to sampling as well as subsequent exclusionsfrom the study (based on sample determinations) .

5

Form 990 Form 090-PF

All returns filed I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 361,063 34,192

Returns included in the study . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 165,026 24,4olReturns excluded -from tht study . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 196,037 9,791

Prior year form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100,912

Gross receipts less than $5,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95,125

9,79 1

Total number is based on counts from service center "batch transmittals" and therefore exceeds the NationalComputer Center count of returns posted to the Exempt Organization Master Ale (EOMF) .

Filing Requirements

Form 990:

The 1973 return was required of -organizations (in-cluding foreign organizations), and cooperative ho,spi-tal service organizations described in section 501 (e)exempt from tax under 501 (a) of the Code except :

1 . A church, and interchurch organization of localunits of a church, a convention or associationof churches, or an integrated auxiliary of achurch ;

2 . A -subordinate organization (other than aprivate foundation) covered by a group exemp--tion letter issued -to a church central or parentorganization, Ifor years 1970 through 1973 only,-

9. A stock bonus, pension or profit~sharing trustwhich qualified undersection . 401 ; and

10. A religious or apostolic organization describedin section 501 (d) .

Section 501 (c) (3) organizations (,other than pr*ivate

foundations filing Form 990-PF) were also to com-plete separate Schedule A (Form 990)-"Organiza-tions Exempt Under 501 (c) (3), Supplementary Infor-mation ."

An organization claiming an exempt status undersection 501 (a) prior to the establishment of such ex-empt status was required to file Form 990, if its appli-cation for exemption was pending with the InternalRevenue Service .

3 . An exclusively religious activity of any religiousorder;

4. An organization whose gross receipts were nor-mally not more than $5,000 ;

5 . A mission society sponsored by or affiliated withone or -more churches or church denominations,more -than one-half of the activities of whichsociety were conducted in, or directed at per-sons in, foreign countries ;

6. A State institution, the income of which wasexcluded from gross income under section115(a) ;

7 . An organization described in section 501 (c) (1)as a corporation organized under an Act ofCongress if : a) such a corporation was an in-strumentality of the United States, and b) sucha corporabon was exempt from Federal incometaxes (under such Acts as amended and sup-plemented) ;

8. A private foundation exempt under section501 (c) (3) and described in section 509(a) (Re-quired to file Form 990-1317) ;

Form 990-PF:

T,he 1973 return was required of all organizations,including such foreign organizations as had obtainedrulings, that were exempt from income tax under sec-tion 501 (c) (3) of the Code and -had the status of"private foundation" within the racaning of section509(a) . An organization acknowledging itself to be aprivate foundation and claiming exempt status undersection 501 (c) (3) prior to -the establishment of suchexempt status was required to file this -return if itsapplication for exemption was pending with the In-ternal Revenue Service .

Description of the Sample and Processing the Dat a

All Forms 990 and 990-PF received between Jan-uary I and December 31, 1974, were subjected tosampling . The selection of tax returns for the samplewas made on the basis of a combination of randomlyselected digits in the 12th and 134h positions of theDocument Locator Num.-ber at an intended samplingrate of 2 percent for Forms 990 and 20 percent forForms 990-PF. This procedure resulted in a sampleof 7,072 Forms 990 from a population of 361,063, and6,348 Forms 990-PF from a population of 34,192 .

6

Prior year and Form 990 returns with gross receiptsless than $5,000 were subsequently excluded . As inprevious studies in this series, extensive consistencytesting identified errors in abstracting and keypunch-ing. These errors were corrected by reference to thechecksheets and/or to the original tax return if neces-sary. However, taxpayers and/or -tax return preparersoften omitted lines that -they considered unimportant .In addition, some taxpayers and/or preparers mis-understood the instructions and omitted required sec-tions, such as Part Il of the Form 990 which was re-quired for returns with gross receipts greater than$10,000 . These situations have been reported as found .These reporting characteristics are reflected in thetabulated data and should be considered in the analysisand use of the data.

Frequencies in the tables of this report are estimatesformed from weighted sample counts for the popula-tions as defined for the study (see "Scope of Study,"above) . Appendix Table A shows population counts,sample counts, and weighting factors used for thestudy .

Since the estimates in the study are based on sampledata, they can be expected to differ more or less fromcounts from the entire population due to samplingvariability. Measures of this difference for various esti-mate levels are shown in tippenudix TU-101lee B . Relative

sampling variabilities are shown at the I-sigma level,in the form of the coefficient of variation, as a per-centage, for estimates of the number of Forms 990and 990-PF returns respectively . The coefficient ofvariation provides the computed upper and lower per-centage limits within which approximately 2 out of 3estimates derived from similarly selected sampleswould be expected to fall . The-se limits may also beapplied to the corresponding percentage estimateswhen the percentages are based on the population .

Copies of the 1973 forms and checksheets used toabstract data are provided in the Appendix .

Notes to the table s

(1) Less than 0.05 percent

Estimates based on less than 20 sample returns andsubject to excessive sampling variability .

Details in each table may not add to totals due to round-ing .

Form 990 returns filed for 1973 with gross receipts lessthan $5,000 are not included in these tables as they arenot required to file .

7

Form 990 Tables

1973 Form 990 Returns Filed During 1974 '

Table 1 - tbcomption Code Paxagxaph of Internal Revenue Code Under Which ExemptionWas Claimed

TAll figures are estimates based on samples )

Item

All returns filed .. . . . . . . . . . . . . . . . . . . . . . . . . . . .

No entry for exemption Code paimgraph . . . . . . . . . . . . .

Entry for exemption Code paragraph . . . . . . . . . . . . . . . .

501(c)(01) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(c)(02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(c)(03), Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule A attached . . . . . . . . ! . . . . . . . . . . . . . . . . . .Schedule A not attached . . . . . . . . . . . . . . . . . . . . . . .

501 (c) (04) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(c)(05) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(c)(06) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 . . . . .

501(c)(07), Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Entry for initiation fee (line 22a) . . . . . . . . . . .No entry for initiation fee . . . . . . . . . . . . . . . . . . .

501(c)(08) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(c)(09) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501 (c) 0 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501 (c) (11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(c)(12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(c)(13) . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(c')(14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(c)(15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(c)(16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(c)(17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(c)(18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501 (c) 0 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number

165,026

39,468

125,558

102

2,298

47,23 1

38,5508,68 1

16,441

15,931

13,276

10, 31L

4,2896,025

8,221

2,859

3,01 3

153 *

1,583

970 *

1,174

613 *

102

613 *

664 *

Percent

100 . 0

23 .9

76 . 1

0 . 1

.1 . 4

28 . 6

23 . 45-- 3

10 . 0

9 .7

8 .0

6 . 2

2 . 6. 6

5 . 0

1 .7

1 . 8

0 . 1

1 . 0

o . 6

0 . 7

0 . 4

0 . 1

0 .4

0 . 4

Estimates based on less than 20 sample returns and subject to excessivesampling variability .

10

1973 Form 990 Returns Filed During 1974-

Table 2 - Method Used to Record Address Information and Presenceor Absence of Employer Identification Numbe r

(All figures are estimates based on samples )

Item

All returns filed . . . . . . . . . . . . . . . . . . . . . . . . . .

IRS preprinted label used, Total . . . . . . . . . . . . . . . .

Label changed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Label unchanged . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

IRS preprinted label not used . . . . . . . . . . . . . . . . . . .

Method used to record address information :

IRS preprinted label . . . . . . . . . . . . . . . . . . . . . . . . . .Typed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Handwritten . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Stamped or other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Employer Identification Number :

Entry . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .No entry . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number

165,02 6

71,382

8,42562,957

93,644

71,38254,17538,193-1-t-27 6

155,68 29,344

Table 3 - Entries in "Receipts- Section (Part I)

(All figures are estimates based on samples )

Item

All .returns filed . . . . . . . . . . . . . . . . . . . . . . . . . . . It

Gross sales and receipts (line 1) . . . . . . . . . . . . . . . . .

Cost of goods sold (line 2) . . . . . . . . . . . . . . . . . . . . . . .

Cost or other basis (line 3) . . . . . . . . . . . . . . . . . . . . . .

Gross income (line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gross dues and assessments (line 5) . . . . . . . . . . . . . . .

Gross contributions (line 6) . . . . . . . . . . . . . . . . . . . . . .

Total (line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gross receipts for-filing reqi rements test s(line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Numberwith entry

165,026

129,897

34,210

17,514

lo6,358

108,707

77,662

151,646

107,788

Percent

100 . 0

43 . 3

5 .138 . 2

76 .

43 .332 .823 . 1

0 . 8

94.35 . 7

Percentwith en r7y

100 .0

78 .7

20 .7

10 .6

64 .4

65 . 9

47 . 1

91 . 9

65 .3

III

1973 Form 990 Returns Filed During 1974Table 4 - Distribution by Size of Total Receipts (Part I )

(All figures are estimates based on samples )

Total receipts (PA-rt I, line 7 )

All returns filed . . . . . . . . . . . . . . . . . . . . . . . . . .

Zero or no entry . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$1 under $5,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$5,000 under $10,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$10,000 under $25,000 . . . . . . . e . . . . . . . . . . . . . . . . . . .

$25,000 under $100,000 . . . . . . . . . . . . . . . . . . . . . . . . . .

$100,000 under $500,000 . . . . . . . . . . . . . . . . . . . . . . . .

$500,000 under $1,000,000 . . . . . . . . . . . . . . . . . . . . . . .

$1,000,000 and over . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number

165,026

13,380

21,088

29,2o6

34,465

36,763

20,832

4,391

4,901

Percent

100 . 0

8 . 1

12 . 8

17 .7

20 .9

22 .3

12 .6

2 .7

3 . 0

Table 5 - Distribution by Size of Gross Receipts for FilingRequirements (Part I)

(All figures are estimates based on samples )

Gross receipts (Part I, line 8 )

All returns filed . . . . . . . . . . . . . . . . . . . . . . . . . . .

Zero or no entry I/. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$1 under $10,000 1/ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$10,000 and over, Total . . . . . . . . . . . . . . . . . . . . . . . . . .

$10,000 under $25,000 . . . . . . . . . . . . . . . . . . . . . . . . . .

$25,000 under $100,000 . . . . . . . . . . . . . . . . . . . . . . . . .

$100,000 under $500,000 . . . . . . . . . . . . . . . . . . . . . . . .

$500,000 under $10,000,000 . . . . . . . . . . . . . . . . . . . . .

$10,000,000 and over . . . . . . . ... . . . . . . . . . . . . . . . . . .

Number

165,026

57,238

23,845

8,1,94 3

28,543

30,330

17,054

7,71 0

3o6

Percent

100 . 0

34.7

14 . 4

-50-- 9

17 .3

18 .4

10. 3

4. 7

0 . 2

1/ Not required to complete Part II or attach a contribution schedule .

Estimate based on less than 20 sample returns and subject to excessive

sampling variability .12

1973 Form 990 Returns Filed During 1974

Table 6 - Entries for Specified "Expenses and Disbursements" and "Assetsand Liabilities" (Part I )

(All figures are estimates b4sed on samples )

Item

All returns filed . . . . . . o . . . . . . . . . . . 0 . . . . . . .

Expenses .attributable to gross income (line 9) . .

Expenses attributable to gross contributions,gifts and grants (line 10) . . . . . . . . . . . . . . . . . . . .

Disbursements for purposes for which theorganization is exempt (line 11) . . . . . . . . . . . . . . . .

Total assets (line 13) . . . . . . . . . . . . . . . . . . . . . . . . . .

Total liabilities (line 14) . . . . . . . . . . . . . . . . . . . . .

Net worth (line 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Numberwith entry

165,026

79,960

19,148

112,587

153,486

75,109

144,959

Percentwith entry

100 . 0

48 . 5

11 .6

68. 2

93.0

45.5

87 . 8

Table 7 - Entry for Expenses Attributable to Gross Contributions (Part I,line 10) by Size of Receipts of Gross Contributions (Part I, line 6)

(All figures are estimates based on samples )

All returns filed . . . . . . . . .

~ero or no entry . . . . . . . . . . . . . . .

$1 under $5,000 . . . . . . . . . . . . . . . .

$5,000 under $10,000 . . . . . . . . . . .

$10,000 under $25,000 . . . . . . . . . .

$25,000 under $100,000 . . . . . . . . .

$100,000 and over . . . . . . . . . . . . . .

Returns with entry fo rExpenses attributable to

gross contributionsReceipts of gross contributions Number Percent (Part -line 10)

(Part I, line 6) As percentNumber of size

class (3-'l )(1) (2) (3) (4)

165,026 19,148 11 . 6

87,364 52 .9 3,013 3 .4

33,053 20.0 5,565 16 . 8

9,621 5 .8 2,145 22 . 3

11,179 6 .8 2,757 24. 7

12,254 7 .4 2,706 22 . 1

11,555 7 .0 2,962 25 . 6

13

1973 Form 990 Returns Filed During 1974

Table 8 - Distribution by Size of Total Assets (Part I )

(All figures are estimates based on samples )

Total assets (Part I, line 13 )

All returns filed . . . . . . . . . . . . . . . . . . . . . . . . . .

Zero or no entry . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$1 under $5,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$5,000 under $10,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$10,000 under $25,000 . . . . . . . . . . . . . . . . . . . . . . . . . . .

$25,000 under $100,000 . . . . . . . . . . . . . . . . . . . . . . . . . .

$100,000 under $500,000 . . . . . . . . . . . . . . . . . . . . . . . . .

$500,000 under $1,000,000 . . . . . . . . . . . . . . . . . . . . . . .

$1,000,000 under $10,000,000 . . . . . . . . . . . . . . . . . . . .

$10,000,000 and over . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number

165 ;026

11,489

46,567

16,492

20,373

30,636

24,71 3

4,340

8,833

1,583

Table 9 - Entries for Miscellaneous Items from Page 1

(All figures are estimates based on samples )

ItemNumber

with entry

Percent

100 . 0

7 .0

28 .2

10 .0

12 .3

18 .6

15 .0

2 . 6

Percent

rny

All returns filed . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total gross receipts are normally less than

$5,000 (dheckbox, -upper right) . . . . . . . . . . . . . . . . . . .

Have any changes not previously reported to IRS

been made in your governing instrument? (line 17)

Is this a group return? (line 18) . . . . . . . . . . . . . . . .

Have you filed a Form 990-T? (line 19) . . . . . . . . . . .

Indication of who is in charge of the book s

(line 25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Location of books (line 25) . . . . . . . . . . . . . . . . . . . . . .

Name and telephone number of person to becontacted (line 25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Signature of preparer . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 Includes only returns with "Yes" box checked .

i r,5, n2r,

93J-~,593

4,391-1/

12,564/

6,842y,

155,478

155,427

137,045

32,627

with en

3C)Q Q

ffr, . 7.11 - I

5. 4

1 . 0

2 .7

7 .6

4 . 2

94 .2

94. 2

83 . 0

19 . 8

14

1973 Form 990 Returns Filed During 1974

Table 10 Entries for Specified "Receipts from Other Sources" (Part Ij) :Returns with'Gross Receipts of $10,000 or More

(All figures are estimates based on samples )

Income itemNumber

with entryPercent

with entry

All returns filed with Gross receipts of$10,000 or more (Part I, line 8) . . . . .

.. .

. . . .

Gross sales or receipts from all businessactivities (line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest (line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Dividends (line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gross rents (line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gross amount received from sale of assets(line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other income (line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total gross sales and receipts -- sum of line s1 to 7 (line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

83,943

35,027

46,26o

10,365

13,327

:8,476

25,58 1

63,621

100 . 0

41 .7

55 .1

12 .3

15 . 9

101 1

30 . 5

75 . 8

15

1973 Form 990 Returns Filed During 1974Table 11 - Entries for Specified "Expenses and Disbursements" (Part II) :

Returns With Gross Receipts of $10,000 or More

(All figures are estimates based on samples )

Expense itemNumber

with entryPercent

All returns filed with Gross receipts of$10,000 or more (Part I, line 8) . . . . . . . . . . .

Contributions, gifts, and grants (line 9 ,column c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Disbursements to or for members (line 10 ,column c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Compensation of officers, directors, trustees(line 11, column c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other salaries and wages (line 12, column c) . . . . .

Interest (line 13, column c) . . . . . . . . . . . . . . . . . . . . .

Taxes (line 14, column c) . . . . . . . . . . . . . . . . . . . . . . . .

Rent (line 15, column c) . . . . . . . . . . . . . . . . . . . . . . . . .

Depreciation (and depletion) (line 16, column 0 .

Other expenses (line 18, column c) . . . . . . . . . . . . . . .

Total (line 19, column c) . . . . . . . . . . . . . . . . . . . . . . . .

83,943

19,913

11,131

16,288

30,891

11,131

27,113

19,096

14,603

48,354

60,966

with en ;VY

100 . 0

23 . 7

13 . 3

19 .4

36 .8

13 .3

32-3

22 .7

17 .4

57 .6

72 . 6

Table 12 - Entries for Specified "Balance Sheet" Items (Part II, column D) :Returns with Gross Receipts of $10,000 or More

(All figures are estimates based on samples )

ItemNumber

with entryPercent

All returns filed with Gross receipts of$10,000 or more (Part I, line 8) . . . . . . . . . . . .

Total assets (line 32) . . . . . . . . . . . . . . . . . . . . . . . . . .

Agrees with Total assets (Part I, line 13) . . . .Does not agree with Total assets (Part I) . . . . .

Total liabilities (line 37) . . . . . . . . . . . . . . . . . . . . .

Net worth (line 41) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

83,943

68,727

6.5,5613,166

41,767

60,353

with ent17

100 .0

81 .9

78 .13 . 8

49 .8

71 . 9

16

1973 Form 990 Returns Filed During 197 4

Table 13 - Ageeement Between Items in Parts I and II on Changes in Net Worthby Size of Total Net Worth, End of Yea r

(All figures are estimates based on samples )

Total net worth (end of year)(Part I, line 15)

(2) 1 (3) (4) 1 (5 )

Does Excess of receipts overexpenses and disbursement s(Part I, line .12) agree with

Total change in Net worth (end ofyear minus beginning )(Part II, lin 41 )

Does not No line 12Agrees a lor 41 entr

Number

All returns filed . . . . . . . . . . . . . 0 165,026

Zero or no entry . . . . . . . . . . . . . . . . . . . . 19,964

$1 under $5,000 . . . . . . . . . . . . . . . . . . . . . 47,639

$5,000 under $10,000 . . . . . . . . . . . . . . . 15,8294

$10,000 under 925,000 . . . . . . . . . . . . . . 20,424

$25,000 under $100,000 . . . . . . . . . . . . . . 29,462

$100,000 under $500,000 . . . . . . . . . . . . . 21,292

$500,000 and over . . . . . . . . . . . . . . . . . . . 1 10,416

87,210 46,107 31,7Q9

663* 7,863 11,438

25,224 1 11,897 10,51 8

9,701

12,714

18,382

13,990

6,536

3,881

5057

8,374

5,668

3,267

2,247

2,553

2,7o6

1,634

61 3

Percent

All returns filed . . . . . . . . . . . . . . 1 100- 0

Zero or no entry . . . . . . . . . . . . . . . . . . . . 12 .1

$1 under $5,000 . . . . . . . . . . . . . . . . . . . . . 28 .9

$5,000 under $10,000 . . . . . . . . . . . . . . . . 9 .6

$10,000 under $25,000 . . . . . . . . . . . . . . . 12-4

$25,000 under $100,000 . . . . . . . . . . . . . . 17 .8

$100,000 under $500,000 . . . . . . . . . . . . 1 12 .9

$500,000 and over . . . . . . . . . . . . . . . . . .

.

6 .3

100 . 0

100 .0

100 .0

100 .0

100 .0

100 .0

100 .0

100 .0

3 .3

52 .9

61 .3

62 .2

62 .4

65 .7

62 .7

39 .4

25 . 0

24 .5

25 .3

28 .4

26 . 6

31 .4

57 .3

22 .1

14 .2

12 .5

7 . 7

5 .9

Estimates based on less than 20 sample returns and subject to excessivesampling variability .

17

1973 Form 990 Returns . Filed During 1974

Table 14 - Number of Officers, Directors, and Trustees ReceivingCompensation (Schedule A, Part I) Listed: Section

501(c)(j) Returns With Schedule A Attached

(All figures are estimates based on samples)

Number of persons listed (Part 1) Number Percent

Section 501(c)(3) returns filed withSchedule A attached . . . . . . . . . . . . . . . . . . . . . . . .

.. .

None . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

One . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Two or three . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Four or more . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Table 15 - Reason Checked for Non-private Foundation Status (Schedule A,Part V) : Section 501(c)(3) Returns With Schedule A Attached

_18,_55 0

24,816

7,097

3,880

2,757

100 . 0

64 .4

18 .4

10 . 1

7 . 2

(All figures are estimates based on samples)

Reason for status Number Percen t

Section 501(c)(3) returns filed withSchedule A Attached . . . . . . . . . . . . . . . . . . . . . . . . .

Entry for Reason for non-private foundationstatus . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 . Church, school or hospital ; section 1 .70(b)or (v) . . . . . . . . . . . . . . .

2 . Medical research organization in

conjunction with hospital ; section 170(b)(1)(A)(iii) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3- Organization for benefit of college oruniversity of gove rnmental unit ; section170(b)(1)(A)(iv) . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 . Normally receives substantial support fromgovernmental unit or general public ;section 170(b)(1)(A)(vi) . . . . . . . . . . . . . . . . . . .

5 . Normally receives no more than one-thirdof support from gross investment incomeand more than one-third from contributions,etc . ; section 509(a)(2) . . . . . . . . . . . . . . . . . . . .

6 . Organization for above purposes or for501(c)(4),(5), or (6) ; not controlled inspecific ways ; section 509(a)(3) . . . . . . . . . . .

38,550

37~1 72

6,383

306 -

715 *

14,19 5

11,13 1

4,442

100 . 0

96 . 4

16 . 6

0 . 8

1 . 9

36 . 8

28 . 9

11 . 5

7 . Makes tests for public safety ; section

509(a)(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

No entry for Reason for non-private foundationstatus . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,378 3 . 6

Estimates based on less than 20 sample returns and subject to excessivesampling variability .

18

Table 16 - Entries in "Support Schedule," (Schedule A, Part V) by Major Reasons for Non-Private Foundation status (Schedule A, Part V)

(All figures are estimates based on samples )

Item for support

Normally receives subsfrom gove=ent unit

Reason for status (Schedule A, Part V)

Number

Total returns filed with specificreason . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gifts, rants, and contributions received(line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Membership fees received (line 9) . . . . . . . . . .

Gross receipts from admissions (line 10) . . .

Gross income from interest, dividends,

rents and royalties (line 11) . . . . . . . . . . . . . .

Net income from unrelated businessactivities (line 12) . . . . . . . . . . . . . . . . . . . . . . .

Tax revenue (line 13) . . . . . . . . . . . . . . . . . . . . . .

Value of services furnisDed by government

without charge (line 14) . . . . . . . . . . . . . . . . . . .

Other income (line 15) . . . . . . . . . . . . . . . . . . . . .

14,19 5

11,28 4

3,778

6,842

6,995

3o6 *

255 *

562

3,268 23 . 0

1/ See "Reasons number 4 and 5,11 Table 16 .

2/ Percent of appropriate total number

* Estimates based on less than 20 sample returns and subject to excessive sampling variability .

tantial. part of support Normally receives no more than 1/3 support

or general-public 1/ from gross investment and more than 1/3

Percent

100 . 0

79 .5

26 .6

48 . 2

49 . 3

2 . 2

1 . 8

4.0

from contributions,etc . I/ -NumberT37

Percent

T4_T_

11,13 1

7,097

5,412

6,58 7

6,893

562 *

51 *

153

2,298

100 .0 W

5. 0

19

1973 Form 990 Returns Filed During -1974

Table 17 - Attachments to Form 990

(All figures are estimates based on samples )

item

All returns filed . . . . . . . . . . . . . . . . . . . . . . . . . ,

Statement explaining how individuals receivingdisbursements from you, in furtherance of yourexempt programs, are qualifying recipients(Schedule A, Part IV, line .5) . . . . . . . . . . . . . . . . . .

Taxpayer's schedule attached as substitute forfinancial statement (Part II) . . . . . . . . . . . . . . . . . .

Statement explainimg how business activity notreported on Form 990-T contributed to exemptpurpose (Part II, line 1) . . . . . . . . . . . . . . . . . . . . . . .

List showing name of and amount contributed byeach person whose total gifts exceeded a certaamount (Schbdule,A, Part V, line 19b) . . . . . . . . . .

All Section 501(c)(3) returns filed . . . . . . . .

Schedule A attached . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

All returns filed with Gross receipts of$10,.000 or more (Part I, line 8),,. .. . . . . . . . . . .

Contribution schedule attached . . . . . . . . . . . . . . . . . 0

Number

165,026

5,872

19,045

2,247

3,72 7

41, 2 31

38,550

83,943

10,416

Percent

100 . 0

3 . 6

11 . 5

1 .4

2 . 3

100 . 0

81-0- 6

100 . 0

12 . 4

20

Form 990-PF Tables

21

Table 18 - Year in Which Ebcemption Letter Issued by Fair Market Value of Assets

(All figures are estimates based on samples )

Fair market value of assets Total

(1)

No entryfor year o fexemption

letter

M

Total withentry for

year issuedLU to - (81

DO

1970or

laterJW

1965 1969

Number

All returns filed . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Zero or no entry . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$1 under $5,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$5,000 under $10,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$10,000 under $25,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$25,000 under $100,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$100,000 under $500,000 . . . . . . . . . . . . . . . . . . . . . . . . . . .

$500,000 and over . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24 .40 1

5,530

3,o62

1,191

2,312

4,183

4,587

3,536

1,153

555

92 *

54 *

65

162

151

74

z3,248

4,975

2,970

1,137

2,247

4,021

4,436

3,46 2

(more)

22

-~L,~O 8

1,o96

792

220

419

593

608

380

6 ~86 7

1,562

1,12 7

464

879

1,342

1,00 3

490

Year issue d

-196o - 1964

M

4,474

996

501

205

52 3

895

841

513

1950 - 1959

(7 )

5,36 8

91 1

415

156

340

922

1,461

1,163

Priorto

1950

2 .43 1

41 0

135

'-4W

86 *

52 3

916

Table 18 - Year in Which Exemption Letter Issued by Fair Market Value of Assets (Cont'd)

(All figures are estimates based on samples )

Fair market value of assets

Percent ofasset clas swith entryfor, year

(1)

Total withentry for

year issued

(3) to (7 )(2)

1970 or later 1965 - 1969

ToPercent

All ret=s filed . . . . . . . . . . . . . . . . .

Zero or no entry . . . . . . . . . . . . . . . . . . . . . . .

$1 under $5,000 . . . .. . . . . . . . . . . . . . . . . . . . .

$5,000 under $10,000 . . . . . . : . . . . . . . . . . . .

$10,000 under $25,000 . . . . . . . . . . . . . . . . . .

$25,000 under $100,600 . . . . . . . . . . . . . . . . .

$100,000 under $500,000 . . . . . . . . . . . . . . . .

$500,000 and over . . . . . . . . . . . . . . . . . . . . . .

* Estimates based on less than 20 sample returns and subject to excessive sampling variability .

23

95 . 3

90 .0

97 .0

95.5

97 .2

96 .1

96 .7

97 .9

100 . 0

100 .0

100 .0

100 .0

100 .0

100 .0

100 .0

100 .0

1',7

D

7

22 .0

26 .7

19-3

18 .7

14.8

1 13 .7

11 .0

99---5-

31 .4

37 .9

40 .8

39 .1

33 .4

22 .6

14.2

Year issued

196o - 196 4

F5)

12_! 2

20 .0

16 .9

18 .0

23 .3

22 .3

19 .0

14 .8

1950 - 1959

a)

23 . 1

18 .3

14 .0

13 .7

15 .1

22 .9

32 .9

33 .6

Prior to 1950

M

58 . 2

4.5

8 . 1

3 .8

6 . 7

11 . 8

26 .5

1973 Form 990-PF Returns Filed During 1974

Table 19 - Entries for Specified "Receipts" (Part I) by Column in Which Entered

(All figures are estimates based on samples )

Receipts and Computation of Computation ofexpenditures net investment adjusted net

per books income income

Item (co A) (column B) (column C )Number Percent Number Percent Number Percentwith with with with with withentry entry entry entry entry entry

(3) (4) (5) (6 )

All returns filed . . . . . . . . . 24,401 100 .0 24,401 100 .0 24,401 100 . 0

Entry in column for at leas tone of lines 1 - 12 . . . . . . . . . . . . 22,4o6 91 .8 19,678 8o .6 19,268 79 .0

Gross contributions, gifts ,grants, etc . (line 1) . . . . . . . . . . 10,624 43-5 XX XX XX XX

Gross dues and assessment s(line 3) . . . . . . . . . . . . . . . . . . . . . . . 485 2 .0 XX XX XX XX

interest (1-ine- 177Pc~~ 70 .7 16 .035 69 .4 16,585 68 . o

Dividends (line 5) . . . . . . . . . . . . . 13,524 55-4 13,524 55-4 13,206 54-1 .

Gross rents androyaltie s(line 6) . . . . . . . . . . . . . . . . . . . . . . . 2,107 8 .6 1,984 8 .1 2,032 8 . 3

Net gain (loss) from sale ofassets (line 7) . . . . . . . . . . . . . . . . 7,643 31 .3 XX XX XX XX

Net capital gain (line 8) . . . . . . XX XX 4,970 20-4 XX XX

Net short term capital gain(line 9) . . . . . . . . . . . . . . . . . . . . . . . XX XX XX XX 879 3 . 6

Income modifications (line 10) . XX XX XX XX 437 1 . 8

Gross profit from any businessactivities (line 11) . . . . . . . . . . . 426 1 .7 XX XX 345 1- 4

Other income (line 12) . . . . . . . . . 2,054 8-4 XX XX 1,391 5 . 7

XX : Entry not required on'return 24

1973 Form 990--PF Returns Filed During 1974

Table 20 - Line Showing Highest Dollar Amount in Each Column in "Receipts" (Part I)

(All figures are estimates based on samples )

Line number

Line showing hi est dollarReceipts andexpenditure s

per books(column A)_

Ul )

24,401

Number

All returns filed . . . . . . . .

1 Gross contributions, gifts,grants, etc . . . . . . . . . .

.. . . . . .

4 Interest . . . . . . . . . . . . . . . . . . . .

5 Dividends . . . . . . . . . . . . . . . . . . .

6 Gross rents and royalties . . .

7 Net gain (loss) from saleof assets . . . . . . . . . . . . . . . . . . .

8 Net capital gain . . . . . . . . . . . .

11 or 12 Gross profit fromany business activities orother income . . . . . . . . . . . . . . . .

Other lines . . . . . . . . . . . . . . . . . . . .

No entries on lines 1 - 1 2in column . . . . . . . . . . . . . . . . . . . . . .

XX : Entry not required on return

7,966

6,419

5,250

593

Computation ofnet investment

income(column B )

ffl

24,40 1

XX

10,058

6,985

733

1 .6c)8

XX

383

97 *

1,995

XX

1,870

XX

32 *

4,723

Estimates based on less than 20 sample returns and subject to excessivesampling variability .

amount for :Computation ofadjusted net

income(column C)

M

24,40 1

XX

lo,16o

7,745

792

YY

XX

334

237

5,133

25

Table 21 , Distribution by Size of Total Receipts (Part I) by Size of Fair Market Value of Asset s

(All figures are estimates based on samples )

Total receipts (Part I . line 13, column A )Zero or 1 $1 1 $5,000 1 $25,000

Fair market value of assets ITotal I- no entry I under I under I and

Di U2 30Number

All returns filed . . . . . . . . . . . . . . . . . . . .

Zero or no entry . . . . . . 0 . . . . . . . . . . . . . . . . . . .

$1 under $10,000 . . . . . . . . . . . . . . . . . . . . . . . . .. .

$10,000 under $100,000 . . . . . . . . . . . . . . . . . . . .

$100,000 and over .*. . . . . . . . . . . . . . . . . . . . . . . .

Z4,401

5,530

4t253,

6,495

8,123

-?-~8

1 .1086,

805

11 8

29 1~

$5 .000 825.oob over

-9-L54

2,409

2,593

3,930

624

Percent

All returns filed . . . . . . . . . . . . . . . . . .

Zero or no entry . . . . . . . . . . . . . . . . . . . . . . . . . .

$1 under $10,000 . . . . . . . . . . . . . . . . . . . . . . . . . .

$10,000 under $100,000 . . . . . . . . . . . . . . . . . . . .

9100,000 and over . . . . . . . . . . . . . . . . . . . . . . . . .

100 . 0

100 .0

100 .0

100 .0

100 .0

8 . 4

19 .6

18. ~""q -

1 . 8

0 .4

39 . 2

43 .6

61 .0

6o . 5

7 .7

(4) 1

6,036

1,223

630

1,682

2,501

24. 7

22 .1

14.8

25.9

30 .8

M

6,77 1

81 2

2~5

4,969

14-7

5 .3

11 .8

61 . 2

Estimate based on less than 20 sample returns and subject to excessive sampling variability .

26

Table 22 - Entries for Specified "Expenditures" (Part I) by Column in Which Entered

(All figures are estimates based on samples )

Receipts and expenditures Comp.utatiQx_k Q.f not in-. Computation of adjusted Disbursements for exempt-per books 'Column A) vestment

.income (colum B) net income (colum C) -purpose (Column M

Item Number 'Percent Number Percent Number Percent Number Percentwithn entry with* . entry with entry wi,th entry with entrv with - 'entry with entry with em-1;rv

(1) (3) (4).(5) '(6 ~ (7) (8 )

All returns filed . . . . . . . . . . . . . . . . . . . 24,401 100 .0 24 .01 .100 .0 24.401 100 .0 2h .401 100 . 0

Entry in column for at least one oflines 14 - 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,458 87-9 16,057 65-8 16,030 65 .7 12,214 50- 1

Compensation of officers (line 14) . . . . . . . 4,829 19 .8 4,241' 17 .4 4,215 17-3 2,571 10- 5

Other salaries and wages (line 15) . . . . . . . 2,081 8-5 986, 4.0 1,o94 4-5 1,633 6 . 7

Other employee benefits (line 16) . . . . . . . . 76o 3 .1 302- 1 .2 318 1 .3 625 2 . 6

Investment, legal and other professiona lservices (line 17) . . . . . . . . . . . . . . . . . . . . . . . 10,079 41 .3 7,72c., 31 .7 7,654 31-4 5,,255- 21- 5

Interest (line 18) . . . . . . . . . . . . . . . . . . . . . . . 2,312 9 .5 1,628 6 .7 1,719 7-0 803 3- 3

Taxes (line 19) . . . . . . . . . . . ... . . . . . . . . . . . . . 16,154 66 .2 5,309 21 .8 5,406 22 .2 4,156 17 . 0

Depreciation, amortization anddepletion (line 20) . . . . . . . . . . . . . . . . . . . . . . 1,628 6 .7 1,132 4.6 1,267 5.2 XX XX

Rent (line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,692 6 .9 1,035 4.2 1,040 4.3 1,083 4- 4

Other expenses (line 22) . . . . . . . . . . . . . . . . . 17,323 71 .0 10,866 44-5 11,184 45 .8 9,691 39 .7

I-A

W

tD

"Un

;0M

MMCL

XX : Entry not required on return 27

1973 Form 990-PF Returns Filed During 197 4

Table 23 - Entry for Receipts from Gross Contributions, Gifts, Grants, etc.(Part I, line 1) by Size of Expenditures for Contributions, Gifts,

Grants (Part I, line 23, column D)

(All figures are estimates based on samples )

Returns with entry forReceipts from gross

contributions, gifts ,

Expenditures for contributions, Number Percent grants (Pa I, line 1 )

gifts, grants As percent

(Part I, line 23, Golumn D) Number of siz e

-clas s

(1) (2) T3 )

All returns filed . . . . . . . . . 24,401 100 .0 lo,624

Zero or no entry . . . . . . . . . . . . . . . 5,170 21 .2 2,199 42 . 5

$1 under $5,000 . . . . . . . . . . . . . . . . 7,438 30 .5 2,814 37 . 8

$5,000 under $10,000 . . . . . . . . . . . 2,889 11 .8 1,315 45 . 5

$10,000 under $25,000 . . . . . . . . . . 3,266 13 .4 1,525 46 . 7

$25,000 under $100,000 . . . . . . . . . 39563 14.6 1,763 49 . 5

$100,000 under $500,000 . . . . . . . . 1,552 6.4 749 48- 3

$500,000 and over, .% . . . . . . . . . . . . 523 2 .1 259 49- 5

Table 24 - Entry for Other Expenses (Part I, line 22') by Size ofTotal Expenditures (Part I, line 24, tolumn D )

(All figures are estimates based on samples )

Returns with entry forOther expenses

(Part I, line 22 )

Total expenditures Number Percent As percent

(Part I, line 24, column D) Number of sizeclass 011 )

(1) (2) (3) (4 )

All returns filed . . . . . . . . . . 24.4ol 100 .0 17AL59 71 . 6

Zero or no entry . . . . . . . . . . . . . . . . 3,374 13 .8 1,310 38 . 8

$1 under $5,000 . . . . . . . . . . . . . . . . . 8,220 33 .7 5,676 69 . 1

$5,000 under $10,000 . . . . . . . . . . . . 3,o62 12 .5 2,399 78- 3

$10,000 under $25,000 . . . . . . . . . . . 3,433 14.0 2,716 79 . 1

$25,000 under $100,000 . . . . . . . . . . 3,887 16 .o 3,213 82 . 7

$100,000 under $500,000 . . . . . . . . . 1,827 7 .5 1,590 87 . 0

$500,000 and over . . . . . . . . . . . . . . . 598 2-5 555 92 . 8

28

1973 Form 990-PF Returns Filed During 1974

Table 25 - Entries for specified "Balance sheet" Items (Part III )

. (All figures are estimates based on samples )

Balance sheet itemNumber

with entryPercent

ry

All returns filed . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Depreciable assets :

Held for investment purposes less accumulateddepreciation (line 10b, column B) . . . . . . . . . . . . . .

Held for charitable purposes less accumulateddepreciation (line 10d, column B) . . . . . . . . . . . . . .

Land :

Held for investment purposes (line 11a ,column D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . oo

Held for charitable purposes (line 11b ,column D) . . . o . . . . . . . . . . . . . . . . . o . . . . . o . . . . . . . . . . .

Total assets (line 13, column D) . . . . . . . . . . . . . . .. . . .

Other liabilities (line 17, column D) . . . . . . . . . . . . .

Total liabilities (line 18, column D) . . . . . . . . . . . . .

Total net worth (fund balances)(line ..21, column D)

24,40 1

878

1,267

1,245

qo6

22,13 1

2,447

4,484

20,908

with en

100 . 0

5 . 1

3 . 6

5 . 2

3 .7

90 .7

10 .0

18 .4

85 . 7

29

1973 Form 990-PF Returns Filed During 1974

Table 26 - Entries for "Statements with Respect to Certain Activities" (Part v)

(All figures are estimates based on samples )

How did the taxpayer answerthe following questions? Yes

TNo I No entry

"i U2 ~ --TNumber

Have you :

Attempted to influence National, State, oror local legislation? (line A) . . . . . . . . .

.. . I

Engaged in activities not reported to theIRS? (line B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 *

Made changes in governing instrument thatwere not reported? (line C) . . . . . . . . . . . . . . . 377

Had substantial contraction (in assets) ?(line E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,116

Filed Form 990-AR? (line F) . . . . . . . . . . . . . . . 20,455

Furnished a copy of the Form 990-AR tothe Attorney General of state(s) ?(line H(2)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Engaged in specified acts (of self-dealing) with disqualified persons ?(line J(1)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If engaged, were all such actsexcepted acts? (line J(2)) . . . . . . . . . . . . . .

-rI Lvested to Jeopardize exempt purpose?r(line M(1)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22 *

20,61 1

3,024

2,598

27 *

23,888

23,824

23,452

22,374

2,841

1,849

49 1

572

572

91 1

1,105

1,94 1

21',377 Z/

113 31 3

23,128 1,246

1/ Based on 24,4Q1 returns filed .

2/ 21,377 returns had either "no" checked or no entry .

Estimates based on less than 20 sample returns and subject to excessivesampling variability .

30 .

1973 Form 990-PF Returns Filed During 197 4

Table 27 - Entries for "Statements, with Respect to CertainActivities" (Part V )

(All figures are estimates based on samples )

How did the taxpayer answerthe followin~t~ions?.

(1)Yes

nse

Number,L/

During the year did you pay or incur aliability to pay for any of the following(line N(1)) :

Total number of "yes" entries forlines (a) to .(e) . . . . . . . . . . . . . . . . . . . . . .

Carry on propaganda? (line a) . . . . . . . . . . . . .

Influence outcome of election? (line b) . . .

Grant to individual for travel or study?(line c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Grant to organization other than acharitable one? (line d) . . . . . . . . . . . . . . . . . .

For any purpose other than religious,charitable, etc .? (line e) . . . . . . . . . . . . . . . .

1/ 3ased on 24,401 returns filed .

1,579

?7 *

11 *

1,277

237

27 *

23,511

23,56o

22 ,

22,250

23,236

23,204

Ty

863

830

874

928

1,17 0

Estimates based on less than 20 sample returns and uubject to excessivesampling variability .

Table 28 - Entries for Specified Items for "Capital Gains and Lossesfor Tax on Investment Income" (Part VII )

(All figures are estimates based on samples )

Item

All returns filed . . . . . . . . . . . . . . . . . . . . . . . . . .

Gain or loss (line 1, column i) . . . . . . . . . . . . . . . . .

Fair market value as of 12/31/69(line 1,column-j

Adjusted basis as of 12/31/69 (line 1, column k)

Excess of fair market value over adjusted basis(line 1, column 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Losses and gains (line 1, column m) . . . . . . . . . . . . .

Net capital gain (line 2) . . . . . . . . . . . . . . . . . . . . . . .

Net short term capital gain (line 3) . . . . . . . . . . . .

Taxpayer's respo

Number

with entry

24,40 1

5,945

2,549

2,409

1,924

3,789

8,080

1,752

No en

M

806

Percentwith ent

100 . 0

24.4

10 . 4

9 . 9

7 . 9

15 . 5

33- 1

7 .2

rY

31

1973 Form 990-PF Returns Filed During 1974

Table 29 - Entry for Dividends (Part I, line 5) by SizeAdjusted Net Income (Part VIII, ~ine 1 )

(All fieures are estimates based on samples)

of

Returns with entryfox'Dividends

Adjusted net income (Part I, line 5)(Part VIII, line-1) Number Percent As percent

Numbar of siz eclass (341 )

(1) (2) (3) (4 )

All returns filed . . . . . . . . . 24,401- 100 .0 13,701 56 . 1

Zero or no entry . . . . . . . . . . . . . . . 6,7.oo 27-5 1,493 22 . 3

$1 under $5,000 . . . . . . . . . . . . . . . . 10,085 41 .3 5,746 57 . 0

$5,000 under $10,000 . . . . . . . . . . . 2,124 8 .7 1,639 77 . 2

$10,000 under $25,000 . . . . . . . . . . . 2,194 9 .0 1,81o 82 . 5

$25,000 under $100,000 . . . . . . . . . 2,o8o 8 .5 1;,875 90 . 1

$100,000 under $500,000 . . . . . . . . 916 3 .8 846 92,4

$500,000 and.over . . . . . . . . . . . . . . 302 . 1 .2 292 96 . 7

Table 30 - Entries for Specified Items (Part IX)

(All figures are estimates based on samples )

Item

All returns filed . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total fair market value of assets not useddirectly in carrying out exempt purpose (line 1d )

Cash deemed held for charitable activitie s(line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Numberwith entry

24,40 1

18,030

16,919

Percentwith ent17

100 . 0

73 . 9

69 . 3

32

Table 31 - Date of Organization (relative to May 26, 1969) by Size of Minimum Investment Return for 1973

(All figures are estimates based on samples )

Minimum investment income .

(Part VIII, line 2 )

All returns filed . . . . . .

Zero or no entry . . . . . . . . . . . .

.$I under $5,000 . . . . . . . . . . . . .

$5,000 under $10,000 . . . . . . . .

$10,000 under $25,000 . . . . . . .

$25,000 under $100,000 . . . . . .

$100,000 and over . . . . . . . . . . .

I

Totalor-ganizea after May 26, 1969

or operating foundation(Part IX,

(2 )

24,40 1

7,422

9,600

2,119

2,o86

1,957

1,217

2,33 L

700

1,143

146

15 6

12 4

65 *

Non-operating foundationorganized May 26, 1969 orearlier (Part IX, line 11

Number

Estimates based on less than 20 sample returns and subject to excessive sampling variability .

33

D~

340

8,408

1,962

1,930

1,833

1,147

7!MCL

GrQ

line 6No entry on lines 6 or 7

6,382

49

w

5 ;aM.-I-C

Table 32 - Distribution by Size of Distributable Amount as Adjusted (Part VIII, line 7)by Size of Total Qualifying

D '

istributions in 1973 (Part X, line 4 .) .1/

(All figures are estimates based on samples )

Total qualifying distributions in 1973( Paxt X . line

Total Zero orno entry

2~

Distributable rt VIII,_li ne 71$ 1

under $5,000(3)

$5,000under 910.000

(4 )Number

All returns filed . . . .. . . . . . . . . . . . . . .

Zero or no entry . . . . . . . . . . . . . . . . . . . . . . . . .

$1 under $5,000 . . . . . . . . . . . . . . . . . . . . . . . . . .

$5,000 under $10,000 . . . . . . . . . . . . . . . . . . . . .

$10,000 under $25,000 . . . . . . . . . . . . . . . . . . . .

$25,000 under $100,000 . . . . . . . . . . . . . . . . . . .

$100,000 and over . . . . . . . . . . . . . . . . . . . . . . . . .

24,40 1

3,676

7,735

3,105

3,444

3,886

2,555

6,01 5

2,85 2

1,277

485

485

517

399

10t24 1

695

6,075

1,531

1 , 1'2 1

695

124

Percen t

All returns filed . . . . . . . . . . . . . . . . . . .

Zero or no entry . . . . . . . . . . . . . . . . . . . . . . . . .

$1 under $5,000 . . . . . . . . . . . . . . . . . . . . . . . . .

$5,000 under $10,000 . . . . . . . . . . . . . . . . . . . . .

i

$10,000 under $25,000 . . . . . . . . . . . . . . . . . . . .

$25,000 under $100,000 . . . . . . . . . . . . . .

$100,000 and over . . . . . . . . . . . . . . . . . . . . . . . . 1

100 . 0

15-1

31e7

12-7

14-1

15-9

10-5

24 . 7

11-- 7

5 . 2

2 . 0

2 . 0

2 . 1

1-7

. 0

2 .9

24 . 9

6-3

4. 6

2,9

0-5

4 3

302

873

545

36 1

8 7

0 .2

1 . 2

3.6

2.2

1-5

0-4

$10,000under $25,000

(5 )

2,355

49 *

76 *

194

1,110

722

204

9 .7

0 .2

0-3

0 .8

4-5

3-0

o .8

$25,000and over

M

3 679

I-&W1~4w

-M2,3

3 7

22

183

1,591

1,741 '

14 . 7

0 . 2

M

0 . 1

0 .8

6-5

7- 1

1/ 11,572 returns had an entry for "Total qualifying distributions applied to 1970, 1971, 1972 and .1973 in line 9, Part XI (Corpus oolumn)-.

Estimates based on less than 20 sample returns and subject to excessive sampling variabili .ty .

42

2,211

OrQ

14Pb

.34

1973 Form 990-PF Returns Filed During 1974

Table 33 - Distribution by'Size of Undistributed Income for 1973 (Part XI)

(All figures are estimates based on samples )

Undistributed income for 1973(Part XI, line 10)

All returns filed . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Zero or no entry . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$1 under $5,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$5,000 under $10,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$10,000 under $25,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$25,000 under $100,000 . . . . . . . . . . . . . . . . . . . . . . . . . . .

$100,000 and over . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number

24,40 1

20,11 5

2,566

469

507

437

307

Table 34 - Entries in "Private Operating Foundation" Sectionby Year of Activity (Part XII )

(All figures are estimates based on samples )

Item

Adjusted net income (line 2a) . . . . . . .

Qualifying distributions (line 2c) . .

Percent

100 . 0

82 . 4

10 . 5

1 . 9

2 . 1

1 . 8

1 . 3

ear1970

(1) 1 (2) 1 (3) 1 (4) 1 (5 ~

.24,401

24,401

Percent

Adjusted net income (line 2a) . .. . . . . .

Qualifying distributions (line 2c) .,

100 . 0

100 .0

I1,687

1,8oo

6 .9

7 .4

Number

1,622

1,639

6 . 6

6 .7

V-1,542

1,558

6 .3

6 . 4

4

1,401

1,41 2

5 .7

5 . 8

1/ 2,549 returns had an entry for "Date of ruling or determination letter that itis an 'operating' foundation," effective for 1973 (Part XII, line 1 )

35

Appendix

37

Table A - Number of Forms 990 and 990-PF in the Population and Sample, andWeighting Factors

Form PopulationSampleCount

WeightingFactor

All retu-vms . . . . . . . . 395,255 13,420

Form 990 . . . . . . . . . . . . . 361,o63 7,072 51 .o6

Form 990-PF . . . . . . . . . . 34,192 6,348 5 .38

Table B - Relative Sampling Variability of Estimated Number of Return s

Fo

Estimated Numberof Returns

Under 100100

250500

1,0001,5002,0002,5003,0004,000

10,00020,00030,00035,00040,000

100,000200,000250,000300,000350,000

rM 990

Relative SamplingVariability M L

70 .744 .731 .622 .418 .315 .814 .112 .911 . 2

7 .15 .04.13 .83 .52 .21 .61 .41 .31 .2

Form 990

Estimated Numberof Returns

Under 10102550

100150200250300500

1,0002,0003,0005,0007,500

10,00015,00020,00025,00030,000

-PF

Relative SamplingVariability. (-%)- _2/

63 .240 .028 .320 .016 .314.112 . 7

8 .96 .34.53 .72 .82 .32 .01 .61 .41 .31 . 2

Any cell total less than 100 should be used with extreme caution .

2/ Any cell total less than 1,000 should be used with extreme caution .

(Relative sampling variability is presented on a one-standard deviation basis )

38

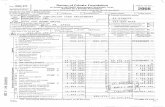

9For- anization Exempt From Income Tax 1@73lReturn of O rTR

gDepartment suryInternal Revenue Service under section 501(c) of the Internal Revenue Code (Except Private Foundation )

For the calendar year 1973, or fiscal year beginning 1973, and ending 19Name of organization If gross receipts are normally no t

Mease type,more than $5,000 . (See gener I ihstruction Milli check here . . 8

print or Address (number and street) -Em-ployer identification numbe r

attach label. (See instruction P )See instruction

P.City or town, State, and ZIP code Date of exemption lette r

Enter the name and address used on your return for 1972 (if the same as above, write "Same") . If none filed, give reason . If exemption application i spending, check this bloc k

Enter exemption Code paragrap h

501 (c) (SUM= All Organizations Complete Part I it line 8 is $10,000 or less, complete only Part 1 . Do not complete Part II .

Receipts (Revenues )I Gross sales and receipts from all sources, other than shown on lines 5 and 6 . . . . . . . .2 Cost of goods sold . . . . . . . . . . . . . . . . . . . . VNE/00000/0 V////,3 Cost or other basis and sales expenses of assets sold . . . . . . . . . .4 Gross Income-line I less sum of lines 2 and 3 . . . . . . . . . . . . . . . . .

.5 Gross dues and assessments from members and affiliates . . . . . . . . . . . . .6 Gross contributions, gifts . grants and similar amounts received (see instructions) . . . . . . .7 Total-add lines 4, 5 and 6 . . . . . . . . . . . . . . . . . . . . . .

8 Gross receipts for filing requirements tests-add lines 1, 5 and 6 . . . . .Expenses and Disbursement s

9 Expenses attributable to gross income . . . . . . . . . . . . . . 00110 Expenses attributable to amount on line 6 . . . . . . . . . . . .11 Disbursements for purposes for which exempt . . . . . . . . . . .12 Excess of receipts over expenses and disbursements-line 7 less sum of lines 9, 10 and 11-Increas e

or (Decrease) in net wortn (see instructions) . . . . . . . . . . . . . . . . . .Assets and Liabilities Beginning of year End of yea r

13 Total assets . . . . . . . . . . . . . . . . . . . . . .

14 Total liabilities . . . . . . . . . . . . . . . . . . . .15 Net worth . . . . . . . . . . . . . . . . . . . . . . .

16 Have you engaged in any activities- which have not previously been reported to the Internal Revenue Service? Yes N o. . . . . . . . . . .It "Yes," attach a detailed description of such activities . . . . . . . ..

17 Have any changes not previously reported to the Internal Revenue Service been made in your governing instrument ,articles of incorporation, or bylaws, or other instruments of similar import? If "Yes," attach a copy of the changes .

18 Is this a group return filed on behalf of affiliated organizations covered by a group exemption letter? (See instruction G . )19 Have you filed a tax return on Form 990-T, "Exempt Organization Business Income Tax Return," for this year ?20 Was there a substantial contraction during the year? (See instruction 0.) It "Yes," attach a schedule for the dispo -

sition(s) for the year(s) showing type of asset disposed of, the date(s) disposed, the cost or other basis, the fai rmarket value on date of disposition and the names and addresses of the recipients of the assets distributed .

21 Membership organizations enter amount allocated for political purposes . . . . . . . . . .

22 Clubs exempt under section 501(c)(7) enter amount of :Part I . . . . . . . . . . .(a) Initiation fees and capital contributions included in line 5 ,

(b) Gross receipts from general public from use of club facilities included in line 1, Part 11 (or line 1 ,. . . . . . . . . .. .Part 1, if only Part I is completed) (See instructions) . . . - . .

23 Organizations exempt under section 501(c)(12) enter amount of:(a) The total amount of gross income received from members or shareholders . . . . . . .(b) The total amount of gross income received from other sources . (Do not net amounts due or pai d

to other sources against amounts due or received from them .) . . . . . . . . . . . .

24 Enter your principal activity codes from last page of instructions . . . . . . . . . I

25 The books are in care of 10, ----------------------------------------------------------------- Located at Do ----------- .. . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ------- -

Name and telephone number of person to be contacted during business hours 0, ~ ------------------------------------------------------------ -

Under penalties of periury . I deelare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it i strue. correct, and complete . Declaration of preparer (other than taxpayer) is based on all information of which he has any knowledge.

t .liraiureof officeg o i trust c a Tore

------ S -------------------------------- - -------------------or _r No--------- 62 te---------- ignature of individual or firm preparing return iirejar _ ;s_aiddrm- ----------------- ---- So l

39

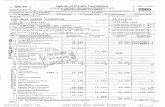

Form 990 (1973) Page 2

UIEM Organizations with Gross Receipts of More Than $10,000-Complek Part 1 1Receipts from Other Sources (fine 1, Part 1)

1 Gross sales or receipts from all business activities (state nature) . (Attach a statement explaining how each

business activity qot reported on Form 990-T contributed importantly to your exempt purpose. See

instruction J . )

-------------------------------------------------------------------------------------------------------------------------- --------------- -

---------------------------------------------------------------------------------------------------------------------------

2 Interest

---------------------- -

3 Dividends

4 Gross rent s

5 Gross royalties

6 Gross amount received from sale of assets, excluding inventory items (attach schedule) - - - - - - - --------------------- -

7 Other income (attach schedule-Do not include contributions, gifts, grants, etc.) . . . . . . . . .