Form 990PF for LOST LIGHT PROJECTS INC DBA INSIDE CLIMATE NEWS

Form “990PF - CNBCfm.cnbc.com/applications/cnbc.com/...1 Total net assets or fund balances at...

Transcript of Form “990PF - CNBCfm.cnbc.com/applications/cnbc.com/...1 Total net assets or fund balances at...

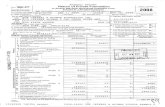

Form “990"PF Return of Private Foundationor Section 4947 a)(1) Nonexempt Charitable Trust

Department of the TreasuryInternal Revenue Serwce

Treate as a Private FoundationNote: The foundatIon may be able to use a copy of thIs return to sat/sfy state

reporting reqmrements

OMB No 1545-0052

2008

For calendar year 2008, or tax year beginning ,2008, and ending ,G Check all that apply. I IlnItIal return rIFInaI return I IAmended return I IAddress change I I Name change

Use the Name of foundatIon A Employer Idontiiicntlon numberIRSIabel- The YLK Charitable Fund 26—1605864

Otherwtlsey Number and street (or P 0 box number It maIl Is not deIIvered to street address) Room/suIte 3 Telephone number (see the Instructlons)prIn

ortype, 8000 Walton Parkway 100 (614) 939-6000ISnesirSEfiglrll‘lsc City or town Slate Z‘P C°de C if exemptIon applIcatIon Is pendlng, check here >

u ' New Albany OH 4 305 4 D 1 ForeIgn organIzatIons, check here >H Check type of organIzatIon ILI Section 501(c)(3) exempt prIvate foundatIon 2 ForeIgn organIzatIons meetIng the 85% test, check

fl SectIon 4947(a)(1) nonexempt charltable trust fl Other taxable private foundatIon E new antd :fiacg imputtatt'o“ t t d >I FaIr market value of all assets at end of year J Accounting method IE Cash U Accrual mm 9 0”" a '0" s a “S was ermma e

(from Part II, column (c), line 16) D Other (s W) Under 590ml" 507(leXA): check here ’ Dp Y _ _ _ _ _ _ _ _ _ _ _ _ _ _ F if the foundation is In a 60-month termInatIon

> $ 2 9 , 95 9 , l4 3 . (Part I, column (d) must be on cash baSIS.) under sectIon 507(b)(l)(B) check here > IT1 [Analysis of Revenue and

Expenses (l’he total of amounts Incolumns (b), (c), and (d) may not neces—sarIIy equal the amounts In column (a)

(a) Revenue andexpenses per books

(b) Net InvestmentIncome

(c) Adjusted netIncome

(d) DIsbursementsfor chantable

purposes(cash baSlS only)

SCANNEDAUG252009

(see the Instructions) )1 ContrIbutIons, grfts, grants, etc, recered (at‘t sch) 4 6 , 657 , 9 98 .2 Ck P If the toundn Is not req to att Sch 8 :5 r “’9qu “fit! ’ fig> ,3 Interest on savmgs and temporary

cash Investments 94, 036. 94, 036.4 DIVIdends and Interest from securItIes 1 6 9 , 1 65 . l 6 9 , 1 65 .5a Gross rents

b Net rental Incomeor (loss)63 Net gaInl(loss) from sale of assets not on MM 10

BAA For Privacy Act and Paperwork Reduction Act No

to\A

E b§£§fs5§lfiinttfifi 4, 433, 660-V 7 Capltal galn net Income (from Part IV, IIne 2)E 8 Net short-term capItal gain

9g 103 ross sal |

11—2 l , 4 l 9 .

12 Wslthroughll 46,254,360. 473,73613 Compensatlon of officers, dIrectors, trustees, etc14 Other employee salarIes and wages15 PenSIon plans, employee benefits

A 16a Legal fees (attach schedule) L—l6a Stmt 101, 165. 101, 165.3' b Accountlng fees (attach sch)I, c Other prof fees (attach sch)

g 5'; 17 Interest 178. 178.E 1R' 18 Taxes (attach schedule) From 1065 K—l ‘ 12 . 12 . »A A 19 Deprecratlon (attach i“ v??? ’ iI ‘lf sch) and depletIon vs: ‘N v 20 Occupancy5 E 21 Travel, conferences, and meetingsa E 22 PrintIng and publIcatIonsD p 23 Other expenses (attach schedule)

5 SeeLIne23Stmt 106,510. 106,124. 386.2 24 Total operating and administratives expenses. Add |Inesl3through23 207,865. 106,314. 101,551.

25 ContrIbutIons, ngts, grants paid N ‘ \ ,, ‘ I « ”26 Total expenses and disbursements.

Add IIne524and25 207,865. 106,314. 101,551.27 Subtract IIne 26 from [me 12: “5' ‘9 ~ 1“ W ( ‘03:”? Vinigcfiiff‘ ’ 1&1:§1’V‘§:I§M “$1M” ,v ’2 a

3 Excess of revenue over expenses ' I ’ 9i" "Steffi; ij; M I k, V , . aand disbursements 4 6, O4 6 , 4 95 . * a x. a g“ m, 3 ‘iqzwmmt :e .z x;

b Net Investment Income (If negatIve, enter -O-) ’ 5f . 3n : I") N"; 3 67 , 4 22 . <«‘ \ w A“ t “55% “a; “V: I I; z a;C Adjusted not Income (It negatIve, enter -0-) : v .V ” U i A , \ figs? 35*”)? ' “M 153251?an at; ‘ ’ (tyeghfii Iv

tice, see the instructions. TEEAO301 01/02/09 Form 990-PF (2008)

Form 990-PF (2008) The YLK Charitable Fund 26-1605864 Page 2Attached schedules and amounts In the description Beginning Of year End Of year

i Balance Sheets column should be for end-of—year amounts only(See instructions) (a) Book Value (b) Book Value (c) Fair Market Value

1 Cash — non-interest-bearing 0 . 195, 121 . 195, 121 .2 Savrngs and temporary cash Investments 5 , 235 , l3 6 . 5 , 2 35 , 136 .

a “‘1‘ ‘ X” s > I a“ < “3 Accounts receivable > f“ ,2 ~ v c “t w fitngsz a a w «wwwv‘t? ‘31\ e c < " s.9

Less allowance for doubtful accounts >4 Pledges receivable ’ _ _ _ _ _ _ _ _ _ _ _ i \ \ , :3 ' ’ 1‘ 2, «133,5 1 " '6 (aw; air/w A v,¥e,§isa?“e§az’ :3" : 1 if;

Less allowance for doubtful accounts >_ _ _ _ _ _ _ _ _ _5 Grants receivable6 Receivables due from officers, directors, trustees, and other

disqualified persons (attach schedule) (see the instructions)7 Other notes and loans receivable (attach sch) ’_ _ _ _ _ _ _ _ _ _ _

Less allowance for doubtful accounts ’ _ _ _ _ _ _ _ _ _ _8 Inventories for sale or use9 Prepaid expenses and deferred charges

10a Investments — U S. and state governmentobligations (attach schedule)

b Investments — corporate stock (attach schedule) L—l Ob Stmt 35 , 2 62 , 5 62 . l 9 , 0 00 , 4 56 .c Investments — corporate bonds (attach schedule) , ~ , s :9», “swim «3\ Ln ; Meme ,

11 Investments —- land, buildings, and ' 4,4 , g t? gags; Rafe 3’3“equrpment ba5is > a a, at \e‘figévgh’gi at» “:wj‘fv; 2“ ’S t’ “9“ of _ gr « V

as

(h-II'I'IUHDD

$2Less accumulated depreciation(attach schedule) ’

12 Investments — mortgage loans _ _ _ — _ _ _ _ _ _13 Investments — other (attach schedule) L-13 Stmt 5 , 353, 67 6 . 5, 528 , 4 3O .14 Land, burldings, and equment basrs >_ _ _ _ _ _ _ _ _ _ _ N . * R ‘ °

Less accumulated deprecration(attach schedule) > _ _ _ _ _ _ _ _ _ _

15 Other assets (describe ’_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ )16 Total assets (to be completed by all filers —

see instructions Also, see page 1, item I) 0 . 4 6, 04 6, 4 95 .17 Accounts payable and accrued expenses 0 .18 Grants payable19 Deferred revenue20 Loans from officers, directors, trustees, & other disqualified persons21 Mortgages and other notes payable (attach schedule)22 Other liabilities (describe >_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _)

mm—d—r—m>—r 23 Total liabilities (add lines 17 through 22) 0 .Foundations that follow SFAS 117, check here > Dand complete lines 24 through 26 and lines 30 and 31.

24 Unrestricted25 Temporarily restricted26 Permanently restricted

Foundations that do not follow SFAS 117, check here >and complete lines 27 through 31.

27 Capital stock, trust princrpal, or current funds 4 6 , 04 6, 4 95 . ‘ i28 Paid-in or capital surplus, or land, burlding, and equrpment fund29 Retained earnings, accumulated income, endowment, or other funds30 Total net assets or fund balances (see the instructions) 4 6, 04 6 , 4 95 .31 Total liabilities and net assets/fund balances

(see the instructions) 0 . 4 6 , 0 4 6 , 4 95 .IPart Ill IAnalysis of Changes in Net Assets or Fund Balances

DOw—Immmzb-tl'l'lz mmnz>r>mUZC'I'I

1 Total net assets or fund balances at beginning of year — Part II, column (a), line 30 (must agree wrthend-of-year figure reported on prior year's return)Enter amount from Part I, line 27aOther increases not included in line 2 (itemize) >Add lines 1,2, and 3Decreases not included in line 2 (itemize) ’ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _Total net assets or fund balances at end of year (line 4 minus line 5) - Part II, column (b), line 30 4 6, O4 6, 4 95 .

BAA TEEAO302 09/17/08 Form 990-PF (2008)

46,046,495.

46,046,495.

mmaww @whWNH

Form.5,Ԥ

990-PF (2008) The YLK Charitable Fund'N’W Capital Gains and Losses for Tax on Investment Income

26-1605864 Page 3

(a) List and describe the kInd(s) of property sold (e 9., real estate,2-story brick warehouse, or common stock, 200 shares MLC Company)

(b) How acquiredP — PurchaseD — Donation

(C) Date acquwed(month, day. year)

(d) Date sold(month, day, year)

1a 4000 shares AAPL D 01/02/08 03/27/08b 1000 shares AAPL D 01/03/08 03/31/08c 1000 shares AAPL D 01/03/08 04/08/08dCall Dec 0863125 100 AAPL I? 11/04/08 12/08/08e See Columns (a) thru (d)

(f) DepreCIatIon allowed(or allowable)

(e) Gross sales price (9) Cost or other baSISplus expense of sale

(h) Gain or (loss)(e) plus (f) minus (9)

a 575,406. 197,981. 377,425.b 145,028. 49,495. 95,533.c 152,639. 49,495. 103,144.d 75,030. 2,099. 72,931.e SeeCqumns(e)thru(h) 3,907,741. -421,184.

Complete onljjor assets showmg gaIn In column (h) and owned by the foundation on 12/31/69 (I) GaIns (Column (h)(i) Fair Market Value

as of 12/31/69(1) Adjusted baSIS

as of 12/31/69(k) Excess of column (I)over column 0), If any

gain mInus column (k), but not lessthan -0-) or Losses (from column (h))

a 37 7 , 4 2 5 .b 95 , 533 .C 1 03 , 1 4 4 .d 72 , 931 .e See Columns (I) thru (l) -421 , 184 .

2 Ca ta] am net tea t I | _l7lf gaIn, also enter In Part I. km 7 ’ip' 9 "meme or (“6 pl a 055) _lf (loss), enter -0- In Part l, line 7 _ 2 227 I 84 9 _

3 Net short-term capital gaIn or (loss) as defined In sectIons 1222(5) and (6)

If gaIn, also enter In Part I, Me 8, column (c) (see the Instructions) lf (loss), enter -0- I»in Part |, Me 8 _ 3

Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income(For optIonaI use by domestIc private foundations subject to the section 4940(a) tax on net Investment Income )

If section 4940(d)(2) applIes, leave this part blank

Was the foundation IIable for the sectIon 4942 tax on the dIstrIbutabIe amount of any year In the base penod"If 'Yes,‘ the foundation does not qualIfy under section 4940(e) Do not complete this part

1 Enter the approprIate amount In each column for each year, see the instructions before making any entrIes

I: Yes DNO

(C)Net value of

noncharItabIe-use assets

(a)Base period years

(b)A t l d t b tCalendar year (or tax year dius ed qua IfyIng Is ri u Ions

(d)DistrIbutIon ratIo

(column (b) dIVIded by column (c))beginning In)

2007 0 .2006200520042003

2 Total of line 1, column (d) 2

3 Average dIstributIon ratIo for the 5-year base period — dIVIde the total on line 2 by 5, or by thenumber of years the foundation has been In eXIstence If less than 5 years 3

4 Enter the net value of noncharitabIe-use assets for 2008 from Part X, line 5 4 38 , 968 , 058 .

5 Multiply line 4 by km 3 5

6 Enter 1% of net Investment Income (1% of Part I, line 27b) 6 3 , 674 .

7 Add IIne55and6 7 3,674.

8 Enter quaIIfyIng distrIbutions from Part XII, We 4 8 101 , 551 .

If Me 8 is equal to or greater than line 7, check the box In Part VI, lIne 1b, and complete that part usmg a 1% tax rate See thePart VI InstructIons

BAA Form 990-PF (2008)

TEEA0303 09/18/08

Form 990-PF(2008) The YLK Charitable Fund 26—1605864v Ij‘J Excise Tax Based on Investment income (Section 4940(a), 49400:), 4940(e), or 4948 — see the instructions)

Page 4

1 a Exempt operatIng foundations described In section 4940(d)(2), check here > [I and enter 'N/A' on line 1 — “32””yfi311Date of ruling letter _ fl _ _ _ _ ~ _(attach copy of ruling letter if necessary — see instructions)

b Domestic foundations that meet the section 4940(e) reqUIrements In Part V, 1 3 , 67 4 .check here ’ and enter 1% of Part |, lIne 27b “ 9 H 1&3: ‘ 3

c All other domestIc foundations enter 2% of Me 27b Exempt foreign organizations enter 4% of Part I, line 12, column (b) :1 N

2 Tax under sectIon 511 (domestic section 4947(a)(1) trusts and taxable i ‘foundatIons only. Others enter -O-) 2 0 .

3 Add lInes1 and2 3 3,674.4 Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -O-) 4 0 .5 Tax based on investment income. Subtract line 4 from line 3 If zero or less, enter -0- 5 3, 674 .6 Credits/Payments « ’I I

a 2008 estimated tax pmts and 2007 overpayment credited to 2008 6 a a; ub Exempt foreIgn organIzatIons — tax Withheld at source 6b t Q a’ w cc Tax paid With applicatlon for extensmn of time to file (Form 8868) 6c 4 3 , 000 . I: ’ ' 6 g: Id Backup Withholding erroneously Withheld 6d *‘ ‘ y ~ ’7 $

7 Total credits and payments Add lines 6a through 6d 7 43 , 000 .8 Enter any penalty for underpayment of estimated tax Check here if Form 2220 Is attached 8 143 .9 Tax due. If the total of lines 5 and 8 is more than line 7, enter amount owed ’ 9

1O Overpayment lf line 7 is more than the total of lines 5 and 8, enter the amount overpaid ’ 10 3 9, l 83 .11 Enter the amount of line 10 to be Credited to 2009 estimated tax > 3 , 6 7 6 . Refunded > 11 35 , 5 07 .

[Bart Statements Regarding Activities

1 3 During the tax year, did the foundation attempt to Influence any national, state, or local legislation or did It A 2" Yes "0partICIpate or intervene In any political campaign? 1a X

b Did It spend more than $100 during the year (either directly or Indirectly) for political purposes(see the instructions for definition)? 1b

If the answer Is 'Yes' to 7a or 7b, attach a detailed descriptIon of the act/Vities and copies of any mater/als publishedor distributed by the foundation In connection With the act/Vities

c Did the foundation file Form 1120-POL for thIs year"d Enter the amount (If any) of tax on polItical expenditures (section 4955) imposed during the year

(1) On the foundation > $ (2) On foundation managers > $e Enter the reimbursement (if any) pald by the foundatIon during the year for political expendIture tax imposed on

foundation managers ’ $2 Has the foundatlon engaged In any actIVItIes that have not preVIously been reported to the IRS7

If 'Yes,’ attach a detailed description of the actIVIties

3 Has the foundation made any changes, not prewously reported to the IRS, in Its governing instrument, articlesof Incorporation, or bylaws, or other Similar Instruments7 If ’Yes, ' attach a conformed copy of the changes

4a Did the foundation have unrelated busmess gross income of $1,000 or more durIng the year7b If 'Yes,‘ has it filed a tax return on Form 990-T for this year7

Was there a IIqUIdation, termination, dissolutlon, or substantial contraction during the year7If ’Yes, ' attach the statement reqwred by General Instruction TAre the requuements of section 508(e) (relatIng to sections 4941 through 4945) satisfied eIther0 By language in the governing instrument, or

5

0 By state legislatlon that effectively amends the governan Instrument so that no mandatory dIrectIons that conflictWith the state law remain In the governing instrument?

7 Did the foundation have at least $5,000 in assets at any time durIng the year7 If 'Yes,'complete Part II, column (0), and Part XV8a Enter the states to which the foundation reports or With which It is registered (see the Instructions)

See States Registered in

b lf the answer Is 'Yes' to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney General(or deSIgnate) of each state as reqUIred by General Instruction G7 If We, 'attach explanation

9 Is the foundation claiming status as a private operating foundation WithIn the meanlng of section 49420)(3) or 4942(1)(5)for calendar year 2008 or the taxable year beginning In 2008 (see instructions for Part XIV)7 If 'Yes, ' complete Part XIV

10 Did any persons become substantial contributors during the tax year7 If 'Yes,’ attach a schedule listing their namesand addresses

p15; t

~A

5 X7 X

fife“ 3,31%"‘ affine: t

’ a :9

8b X

9 X

10 XBAA

TEEAO304 09/18/08

Form 990-PF (2008)

Form 990-PF (2008) The YLK Charitable Fund 26—1605864 Page 5' -' ' Statements Regarding Activities Continued

11 At any time during the year, did the foundation, directly or Indirectly, own a controlled entityWithin the meaning of section 512(b)(3)7 If 'Yes', attach schedule (see instructions) 11 X

12 Did the foundation acqwre a direct or indirect interest in any applicable insurance contract beforeAugust 17, 20087 12 X

13 Did the foundation comply With the public inspection requirements for its annual returns and exemption application7 13 XWebSite address >_N[IA _ _ _ _ _ _ i _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

14 The books are in care of > _P§g_qy_ [_Jg_l_a£1q _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ __ _ Telephone no > _(_61_4_)_ 9:19:§QO_0— _

Located at > .89 90. Hagen. Bessemer; _1_09 yew. e;2a_ny_ _ _ 9r; _ ZIP + 4 > .4; 95:1________ _ _15 Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041 — Check here ; U _

and enter the amount of tax-exempt interest received or accrued during the year ’1 15 l{Padrka l Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the 'Yes' column, unless an exception applies.1a During the year did the foundation (either directly or indirectly)

(1) Engage in the sale or exchange, or leasrng of property With a disqualified person7

(2) Borrow money from, lend money to, or otherWise extend credit to (or accept it from) adisqualified person? Yes

(3) Furnish goods, serVIces, or faCilities to (or accept them from) a disqualified person? Yes(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person7 Yes

(5) Transfer any income or assets to a disqualified person (or make any of either availablefor the benefit or use of a disqualified person)7 D Yes

(6) Agree to pay money or property to a government offICIal7 (Exception. Check 'No' if thefoundation agreed to make a grant to or to employ the offiCIal for a period after terminationof government serVIce, if terminating Within 90 days ) D Yes

b If any answer is 'Yes' to 1a(1)-(6), did any of the acts fail to qualify under the exceptions described inRegulations section 53 4941 (d)-3 or in a current notice regarding disaster aSSIStance (see the instructions)7Organizations relying on a current notice regarding disaster aSSistance check here

c Did the foundation engage in a prior year in any of the acts described in 1a, other than excepted acts,that were not corrected before the first day of the tax year beginning in 20087

2 Taxes on failure to distribute income (section 4942) (does not apply for years the foundation was aprivate operating foundation defined in section 4942(1)(3) or 49420)(5))

a At the end of tax year 2008, did the foundation have any undistributed income (lines 6dand 6e, Part Xlll) for tax year(s) beginning before 20087If 'Yes,‘ list the years ’ 20 , 20 , 20

E] Yes,20

b Are there any years listed in 2a for which the foundation is not applying the prowsions of section 4942(a)(2)(relating to incorrect valuation of assets) to the year's undistributed income? (If applying section 4942(a)(2) toall years listed. answer 'No' and attach statement — see the instructions )

c If the prowsrons of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here’ 20 , 20 , 20 , 20

3a Did the foundation hold more than a 2% direct or indirect interest in any businessenterprise at any time during the year7 D Yes

b it 'Yes,‘ did it have excess busmess holdings in 2008 as a result of (1) any purchase by the foundationor disqualified persons after May 26, 1969; (2) the lapse of the 5-year period (or longer period approvedbgl the Commisswner under section 4943(c)(7)) to dispose of holdings achIred by gift or bequest, or( )the lapse of the 10-, 15-, or 20-year first phase ho ding period? (Use Schedule , Form 4720, todetermine if the foundation had excess busmess holdings In 2008.)

4a Did the foundation invest during the year any amount in a manner that would Jeopardize itscharitable purposes7 .

b Did the foundation make any investment in a prior year (but after December 31, 1969) that couldieopardize its charitable purpose that had not been removed from Jeopardy before the first day ofthe tax year beginning in 20087

No

t, ,1 r f,\ “$351”, :5: ‘3

5*?2b

" 5.. :vwri A.‘22:24“ is: y g?X \ V“t M w‘ a

'9 3;) ‘

, 2w

3 t” 9’“(as int ‘3‘” s

2 3’"

3b

43 X

4b X

BAA

TEEA0305 09/18/08

Form 990-PF (2008)

Form 990-PF (2008)‘ The YLK Charitable FundRéfl’VilsE [Statements Regarding Activities for Which Form 4720 May Be Rguired (continued)

26—1605864

5a During the year did the foundation pay or incur any amount to.(1)

(2)on, directly or indirectly, any voter registration drive7

(3)

(4)

Carry on propaganda, or otherWise attempt to influence legislation (section 4945(e))7

Influence the outcome of any speCIfic public election (see section 4955), or to carry

Prowde a grant to an indiVIdual for travel, study, or other Similar purposes?

Prowde a grant to an organization other than a charitable. etc, organization describedin section 509(a)(l), (2), or (3), or section 4940(d)(2)7 (see instructions)

(5) Prowde for any purpose other than religious, charitable, seientific, literary, oreducational purposes, or for the prevention of cruelty to children or animals7

D Yes No

Yes NoYes No

No

No

El Yes

|:] Yes

b if any answer is 'Yes' to 5a(l)-(5), did any of the transactions fail to qualify under the exceptionsdescribed in Regulations section 53 4945 or in a current notice regarding disaster as5istance(see instructions)7Organizations relying on a current notice regarding disaster a55istance check here

c If the answer is 'Yes' to question 5a(4), does the foundation claim exemption from thetax because it maintained expenditure responSibility for the grant?If 'Yes, ‘ attach the statement reqwred by Regulations section 53 4945-5(d)

6a Did the foundation, during the year, receive any funds, directly or indirectly, to pay premiumson a personal benefit contract7 DYes No M

b Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract?Ifyou answered 'Yes' to 6b, also file Form 8870

7a At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction7b If yes, did the foundation receive any proceeds or have any net income attributable to the transaction?

DYes No

:ch a "e p 7,,wee :<

on?

:.U‘ s

7bsEiajflig

and Contractors1 List all officers, directors, trustees, foundation manaLers and their compensation (see instructions).

f {Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

(a) Name and address(b) Title and average

hours per weekdevoted to posmon

(c) Compensation(If not paid, enter -0-)

(d) Contributions toemployee benefit

plans and deferredcompensation

(e) Expense account,other allowances

zeig§;;£L_We§9ea _________ __One Whitebarn RD. President,DirectorNew Albany OH 43054 1.00 O. O. 0.

39%DLWLEQEEQ___________ __8000 Walton Parkway, Suite 100 Secretary,TreasurerNew Albany OH 43054 1.00 0. 0. 0.

2 Compensation of five highest-paid employees (other than those included on line 1— see instructions). If none, enter 'NONE.‘(a) Name and address of each employee

paid more than $50,000(b) Title and average

hours per weekdevoted to posmon

(c) Compensation (d) Contributions toemployee benefit

plans and deferredcompensation

(e) Expense account,other allowances

Total number of other employees paid over $50,000BAA TEEAO306 09/ 1 8/08

NoneForm 990-PF (2008)

Form 990-PF (2008) The YLK Charitable Fund 26—1605864 Page 7[*Pléi’ffiflwl Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors (continued)

3 Five highest-paid independent contractors for professional services — (see instructions). If none,enter 'NONE.‘

(a) Name and address of each person paid more than $50,000 (b) Type of servrce (c) Compensatmn

_D§!i_s_ 130.13- en_d_ firewall__________________ _ _ Legal450 Lexington Ave.New York NY 10017 101,165.

Total number of others recelvmg over $50,000 for professronal servrces ’ None

Summary of Direct Charitable Activities

List the foundation's four largest direct chantable actIVItIes during the tax year lnclude relevant statistical information such as the number of Eorganizatlons and other beneflCIanes sewed, conferences convened, research papers produced, etc menses

1 _ _ _ _ _ _ _ fl _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

2 _ * _ _ fl _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ Q _ _ _ _ _ _ _ _ _ _ _ _

3 _ _ _ _ _ _ _ _ _ _ w _ _ _ _ ~ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

4 _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

[Radix-B lSummary of Program-Related Investments (see Instructions)

AmountDescribe the two largest program-related Investments made by the foundation during the tax year on lines 1 and 2

Total. Add lines 1 through 3BAA

TEEAO307 09/ 1 8/08

Form 990-PF (2008)

Form 990-PF(2008) The YLK Charitable Fund 26—1605864 Page 8

km” 556:5} Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations,see Instructions.)

1 Fair market value of assets not used (or held for use) directly in carrying out charitable, etc, purposes. I an.a Average monthly fair market value of securities 1 a 30 , l 69 , 8 63 .b Average of monthly cash balances 1b 3 , 923 , 187 .c Fair market value of all other assets (see instructions) 1c 5 , 4 68 , 4 30 .dTotal(add|ines1a,b.andc) 1d 39,561,480.e Reduction claimed for blockage or other factors reported on lines 1a and 1c

(attach detailed explanation) I 1 el2 Acquismon indebtedness applicable to line 1 assets 23 Subtractlinerromlineld 3 39,561,480.

4 Cash deemed held for charitable actIVIties Enter i-1/2% of line 3(for greater amount, see instructions) 4 5 93 , 422 .

5 Net value of noncharitable-use assets. Subtract line 4 from line 3 Enter here and on Part V, line 4 5 38 , 968 , 058 .6 Minimum investment return. Enter 5% of line 5 6 l , 94 8 , 4 0 3 .

Part xt lDistributable Amount (see instructions) (Section 4942(i)(3) and (06) private operating foundationsand certain foreign organizations check here > H and do not complete this part.)

1 Minimum investment return from Part X, line 6 1 l , 948 , 4 03 .2a Tax on investment income for 2008 from Part VI, line 5 2a 3 , 67 4 . V.

b Income tax for 2008 (This does not include the tax from Part VI ) 2bcAdd lines 2a and 2b 2c 3,674.

3 Distributable amount before adjustments Subtract line 2c from line 1 3 l , 944 , 72 9 .4 Recoveries of amounts treated as qualifying distributions 45 Addlines3and4 5 1,944,729.6 Deduction from distributable amount (see instructions) 67 Distributable amount as adjusted Subtract line 6 from line 5 Enter here and on Part Xlll, line 1 7 1 , 944 , 72 9 .

{36%; Qualifying Distributions (see instructions)

1 Amounts paid (including administrative expenses) to accomplish charitable, etc, purposes mya Expenses, contributions, gifts, etc — total from Part I, column (d), line 26 1a 101 , 551 .b Program-related investments — total from Part lX-B 1 b

2 Amounts paid to acqwre assets used (or held for use) directly in carrying out charitable, etc, purposes 2

3 Amounts set aSIde for speCIfic charitable proiects that satisfy the ‘ Ia SUitability test (prior IRS approval reqUired) 3ab Cash distribution test (attach the reqUired schedule) 3b

4 Qualifying distributions Add lines 1a through 3b. Enter here and on Part V, line 8, and Part Xlll, line 4 4 101 , 551 .

Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment incomeEnter 1% of Part |, line 27b (see instructions) 5 3 , 67 4 .

6 Adjusted qualifying distributions. Subtract line 5 from line 4 6 97 , 877 .

Note:qualifies for the section 4940(e) reduction of tax in those years

BAA

TEEA0308 01/02/09

The amount on line 6 Will be used in Part V, column (b), in subsequent years when calculating whether the foundation

Form 990-PF (2008)

Form 990-PF(2008) The YLK Charitable Fund

Part XIII I Undistributed Income (see instructions)

26—1605864 Page9

1 Distributable amount for 2008 from Part Xl,line 7

2 Undistributed income, if any, as of the end of 2007a Enter amount for 2007 onlyb Total for prior years 20_, 20 _, 20 __

3 Excess distributions carryover, if any, to 2008a From 2003

(3)Corpus

(b)Years prior to 2007

(C)2007

(d)2008

1,944,729.

b From 2004c From 2005d From 2006

00000e From 2007f Total of lines 3a through e

4 Qualifying distributions for 2008 from PartX||,|ine4 > $ 101,551.

a Applied to 2007, but not more than line 2a

b Applied to undistributed income of prior years(Election requued — see instructions)

c Treated as distributions out of corpus(Election required — see instructions)

d Applied to 2008 distributable amounte Remaining amount distributed out of corpus

5 Excess distributions carryover applied to 2008(If an amount appears in column (cl), thesame amount must be shown in column (a))

6 Enter the net total of each column asindicated below:

a Corpus Add lines 3f, 4c, and 46 Subtract line 5

b Prior years' undistributed income Subtractline 4b from line 2b

c Enter the amount of prior years' undistribut-ed income for which a notice of defICIencyhas been issued, or on which the section4942(a) tax has been preVIously assessed

d Subtract line 6c from line 6b Taxableamount — see instructions

e Undistributed income for 2007 Subtract line 4a fromline 2a Taxable amount — see instructions

f Undistributed income for 2008 Subtract lines4d and 5 from line i This amount must bedistributed in 2009

7 Amounts treated as distributions out ofcorpus to satisfy reqwrements imposedby section 170(b)(i)(F) or 4942(g)(3)(see instructions)

8 Excess distributions carryover from 2003 notapplied on line 5 or line 7 (see instructions)

9 Excess distributions carryover to 2009.Subtract lines 7 and 8 from line 6a

10 AnaIySis of line 9.a Excess from 2004

101,551.

1,843,178.

b Excess from 2005c Excess from 2006d Excess from 2007

00000e Excess from 2008BAA

TEEAO309 09/ 1 9/08

Form 990-PF (2008)

Form 990-PF (2008) The YLK Charitable Fund 26—1605864 Page 10ifiadthMl Private Operating Foundations (see InstructIons and Part Vll-A, questIon 9) N/A

1a If the foundatIon has received a rulIng or determInatIon letter that It Is a pnvate operatIng foundatIon, and the rulIngIs effectIve for 2008, enter the date of the ruIIng

b Check box to IndIcate whether the foundatIon Is a prIvate operatIng foundatIon descrIbed In sectIon l—l 4942(1)(3) or —| 4942(1)(5)2a Enter the lesser of the adjusted net Tax year PrIor 3 years

:Eflg‘s‘t‘fiqgfiflefi’jfi 'fr‘g'rrfhgafi‘g‘rfgflm (a) 2008 (b) 2007 (c) 2006 (d) 2005 (e) Totaleach year IIsted

b 85% of IIne 2ac QualIfyIng dIstrIbutIons from Part XII,

Me 4 for each year lIstedd Amounts Included In Me 2c not used dIrectly

for actIve conduct of exempt actIVItIese QualIfyIng dIstrIbutIons made dIrectly

for actIve conduct of exempt actIVItIes.Subtract IIne 2d from IIne 2c

3 Complete 3a, b, or c for thealternatIve test reIIed upon

a ‘Assets' alternatIve test -— enter(1) Value of all assets(2) Value of assets qualIfyIng under

sectIon 4942(1)(3)(B)(l)b ‘Endowment‘ alternatIve test — enter 2/3 of

mInImum Investment return shown In Part X,|Ine 6 for each year lIsted

c ‘Support‘ alternatIve test — enter(1) Total support other than gross

Investment Income (Interest,dIVIdends, rents, paymentson securItIes loans (sectIon512(a)(5)), or royaltIes)

(2) Support from general publIc and Sormore exempt organIzatlons as prowdedIn sectIon 4942(J)(3)(B)(III)

(3) Largest amount of support froman exempt organIzatIon

(4) Gross Investment Income

Baékxv I Supplementary Information (Complete this part only if the organization had $5,000 or more inassets at any time durinlthe year — see instructions.)

1 Information Regarding Foundation Managers:a LIst any managers of the foundatIon who have contrIbuted more than 2% of the total contrIbutIons recered by the foundatIon before the

close of any tax year (but only If they have contnbuted more than $5,000) (See sectIon 507(d)(2) )

b LIst any managers of the foundatIon who own 10% or more of the stock of a corporatIon (or an equally large portIon of the ownershIp ofa partnershIp or other entIty) of mm the foundatIon has a 10% or greater Interest

2 Information Regarding Contribution, Grant, Gift, Loan, Scholarship, etc, Programs:Check here ’ If the foundatIon only makes contrIbutIons to preselected chantable organIzatIons and does not accept unsolICItedrequests for funds If the foundatlon makes ng'ts, grants, etc, (see Instructlons) to IndIVIduals or organIzatIons under other condItIons,complete Items 2a, b, c. and d

a The name, address, and telephone number of the person to whom applIcatIons should be addressed.

b The form In thch applIcatIons should be sumetted and InformatIon and materIals they should Include‘

c Any SmelSSlOl’l deadlines

d Any restrIctIons or IImItatIons on awards, such as by geographlcal areas, chantable erIds, kInds of InstItutIons, or other factors

BAA TEEAO310 09/19/08 Form 990-PF (2008)

Form 990-PF (2008) The YLK Charitable Fund 26-1605864 Page 11F’Rae’tWSupplementary Information (continued)

3 Grants and Contributions Paid During the Year or Approved for Future mmentR t If rleclplent IS an IndIVIdual, Foundatlon

ecuplen s ow any relationship to Pur ose of rant orany foundation manager or Status Of Ic):ontrlbu€tJlon Amount

Name and address (home or busmess) Substantial contrlbutor rec'p‘enta Paid during the year

none

Total > 3ab Approved for future payment

Total > 3bBAA TEEA0501 09/19/08 Form 990-PF (2008)

Form 990-PF (2008) The YLK Charitable Fund

{Part XVI-A Analysis of Income-Producing Activities

26-1605864 Page 12

Enter

1abcdef

9234

5ab

AOKDWNO’_|_|

GQOU'II1213

gross amounts unless otherWIse Indicated Unrelated busmess Income Excluded by section 512, 513, or 514

(a) (b) (C) (d) (e)Busmess Amount Exclu- Amount Related or exempt

code SlOn function incomeProgram serVIce revenue. code (see the Instructions)

Fees and contracts from government agenCIesMembership dues and assessmentsInterest on saVIngs and temporary cash investments 1 4 94 , 0 3 6 .DiVidends and Interest from securities l4 1 69 , 1 65 .Net rental Income or (loss) from real estateDebt-financed propertyNot debt-financed propertyNet rental Income or (loss) from personal propertyOther investment Income 1 8 —l 7 , 3 l 4 .Gain or (loss) from sales of assets other than inventory 1 8 2 2 7 , 8 4 9 .Net Income or (loss) from speCIal eventsGross profit or (loss) from sales of inventoryOther revenue

Subtotal. Add columns (b), (d), and (e) 473, 736 .Total. Add line 12, columns (b), (cl), and (e)

(See worksheet In the instructions for line 13 to verify calculations )

Part XVI-B Relationship of Activities to the Accomplishment of Exempt Purposes

Line No.V

NA

TEEA0502 09/19/08

13 473,736.

Explain below how each actIVIty for which Income [5 reported In column (e) of Part XVI-A contributed importantly to theaccomplishment of the foundation's exempt purposes (other than by prowding funds for such purposes) (See the Instructions)

Form BSD-PF (2008)

Form990-PF (2008) The YLK Charltable Fund 26—1605864 Page 13

{Part XVll Ilnformation Regarding Transfers To and Transactions and Relationships With NoncharitableExempt Organizations

1 Did the organization directly or indirectly engage in any of the followmg With any other organization Yes Nodescribed in section 501(c) of the Code (other than section 501(c)(3) organizations) or in section 527,relating to political organizations7

a Transfers from the reporting foundation to a noncharitable exempt organization of(1) Cash 1a (1) X(2) Other assets 1a (2) X

b Other transactions(1) Sales of assets to a noncharitable exempt organization 1b (1) X(2) Purchases of assets from a noncharltable exempt organization 1b (2) X(3) Rental of faCilities, eqUipment, or other assets 1b (3) X(4) Reimbursement arrangements 1b (4) X(5) Loans or loan guarantees 1b (5) X(6) Performance of serVIces or membership or fundraismg solic1tations 1b (6) X

c Sharing of faCilities. eqUipment, mailing lists, other assets, or paid employees 1c X

d If the answer to any of the above is 'Yes,’ complete the followmg schedule Column (b) should always show the fair market value ofthe goods, other assets, or serVIces given by the report: foundation If the foundation received less than fair market value in

transaction or shari arr show in column the value of the other assets or servnces receiveda Line no Amount involved c Name of noncharitable Descri of and shari

described in section 501(c) of the Code (other than section 501(c)(3)) or in section 5277b If 'Yes,‘ complete the followmg schedule

(a) Name of organization (b) Type of organization (c) Description of relationship

2a Is the foundation directly or indirectly affiliated With, or related to, one or more tax-exempt organizationsD Yes No

Under enalties of perjury. I declare that l have exa this return, inc ding accompanying schedules and statements, and to the best of my knowledge andb true, correct, and c plete De ration reparer (other t xpayer or fiductary) is has on all information of which preparer has any knowledge

i X// / 077 ,9 Signature ot‘cfiriMme / \ date Titled) .Preparer s identifyinghlumberI Date Check If (See Signature on page 30 of theS, 1? 2 Preparer's } self-employed VD instructions)

a", Egg Signature Ck 114—44—3021I’ \ I“- gg Firm's name (or yours If ’CORNICK, GARBEWSANDLER, LLP EIN b 13—2 620561

“- self-employed). address. 825 THIRD AVENW TH E‘LandZ'Pcwe NEW YORK, NY 10022—9524 Phoneno 212—557-3900

Form 990-PF (2008)

TEEA0503 01/02/09

Schedule B OMB No 1545-0047

01 ' ! -giosarsri'i‘i-si’vgr) 990 E2 Schedule of Contributors

> Attach to Form 990, 990-EZ and 990-PFDepartment of the Treasury > . ,internal Revenue Same See separate instructions.

Name of the organization Employer Identification number

The YLK Charitable Fund 26—1605864Organization type (check one)Filers of: Section:Form 990 or 990-EZ 501 (c)(_) (enter number) organization

4947(a)(1) nonexempt charitable trust not treated as a private foundation527 political organization

Form 990-PF 501(c)(3) exempt private foundationI 4947(a)(1) nonexempt charitable trust treated as a private foundationI 501(c)(3) taxable private foundation

Check if your organization is covered by the General Rule or a Special Rule (Note: Only a section 501(c)(7), (8), or (10) organization can checkboxes for both the General Rule and a Special Rule See instructions)

General Rule —For organizations filing Form 990, 990-EZ, or 990-PF that received, during the year, $5,000 or more (in money or property) from any onecontributor (Complete Parts 1 and II )

Special Rules —

D For a section 501(c)(3) organization filing Form 990, or Form 990-EZ, that met the 33-1/3% support test of the regulations under sections509(a)(1)/170(b)(1)(A)(VI) and received from any one contributor, during the year, a contribution of the greater of (1) $5,000 or (2) 2% of theamount on Form 990, Part Vlll, line 1h or 2% of the amount on Form 990-EZ. line 1 Complete Parts I and 11

El For a section 501(c)(7), (8), or (10) organization filing Form 990, or Form 990-EZ, that received from any one contributor, during the year,aggregate contributions or bequests of more than $1,000 for use exclusrvely for religious, charitable, SCIentific, literary, or educationalpurposes, or the prevention of cruelty to children or animals Complete Parts I, H, and III

E] For a section 501(c)(7), (8), or (10) organization filin Form 990, or Form 990-EZ, that received from any one contributor, during the year,some contributions for use exclusrvely for religious, c aritable, etc, purposes, but these contributions did not aggregate to more than$1,000 (If this box is checked, enter here the total contributions that were received during the year for an excluswely religious, charitable,etc, purpose. Do not complete any of the Parts unless the General Rule applies to this organization because it received nonexcluswelyreligious, charitable, etc, contributions of $5,000 or more during the year.) > $

Caution: Organizations that are not covered by the General Rule and/or the SpeCIal Rules do not file Schedule B (Form 990, 990-EZ, or990-PF) but they must answer 'No‘ on Part IV, line 2 of their Form 990, or check the box in the heading of their Form 990-EZ, or on line 2 oftheir Form 990-PF, to certify that they do not meet the filing requirements of Schedule 8 (Form 990, 990-EZ, or 990-PF)

BAA For Privacy Act and Paperwork Reduction Act Notice, see the Instructions Schedule B (Form 990, 990—EZ, or 990-PF) (2008)for Form 990. These instructions will be issued separately.

TEEAO701 12/13/08

Schedule B (Form 990, 990-EZ, or 990—PF) (2008) Page 1 of 1 of PartlName of organization Employer identification number

The YLK Charitable Fund 26—1605864

Contributors (see Instructions )

(a) (b) (C) (d)Number Name, address, and ZIP + 4 Aggregate Type of contribution

contributions

1 Elle _C_- Q -_U_- Q -_ 591319221921) _l_n_c ______________ _ _ PersonPayroll

_2§9 .892t_h_ Aesjeiijyjivs; 34:15 94_ ____________ _ _ $_ _ _1_2,_3_7_7L 214:1; Noncash

(Complete Part ll If therejig §_t_ 1.3ng__ §§a_C£1 _ _ _ _ _ _ _ _ _ _ _ _ _ _ _F_L_ _3_:_5 4_0_l_ _ _ _ _ IS a noncash contrrbutron )

(a) (b) (c) (d)Number Name, address, and ZIP + 4 Aggregate Type of contribution

contributions

2 __F:_L13a_n§j_.a_l_ _'I_'1_:_u_sl: _C_olnpaLn_yL I_n_c_: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ PersonPayroll

5; 90. 39.01 $1991: Queries-.3; _________________ _ _ $_ _ _3_4 ,_2_8_0L 1_5_4_- Noncash

(Complete Part II If there_S_1; _T_h9r3a_s_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _V__I_ _09 §O_2_ _ _ _ _ rs a noncash contrrbutron )

(a) (b) (C) (d)Number Name, address, and ZIP + 4 Aggregate Type of contribution

contributions

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ PersonPayroll

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ __$____________ Noncash

(Complete Part ll rf there_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ ‘ _ _ _ _ _ _ _ _ _ _ _ _ _ _ rs a noncash contrrbutron.)

(a) (b) (c) (d)Number Name, address, and ZIP + 4 Aggregate Type of contribution

contributions

_ k _ _ _ _ _ _ _ _ _ _ _ _ _ ~ _ _ _ _ _ fl _ _ v _ _ f _ _ _ _ _ _ _ _ _ _ _ PersonPayroll

P _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ v _ _ _ _ _ _ _ _ _ _ _ _ _ _ $_ _ _ _ _ _ _ _ _ _ _ Noncash

(Complete Part ll If thereF _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ ~ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ * _ _ rs a noncash contribution.)

(a) (b) (C) ((0Number Name, address, and ZIP + 4 Aggregate Type of contribution

contributions

__ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ PersonPayroll

_ _ _ _ _ _ * _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ w _ _ a __$_____________ Noncash

(Complete Part ll If there_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ v _ _ rs a noncash contrrbutron.)

(a) (b) (C) (d)Number Name, address, and ZIP + 4 Aggiegéte Type of contribution

contributions

__ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ * PersonPayroll

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ __$_____________ Noncash

(Complete Part ll rt therep _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ . _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ Is a noncash contrrbutron )

BAA TEEAO702 08/05/08 Schedule B (Form 990, 990-EZ, or 990-PF) (2008)

Schedule B (Form 990. 990-EZ, or 990-PF) (2008) Page 1 of l of Part IIName of organization Employer identification number

The YLK Charitable Fund 26—1605864

* 2 Noncash Property (see Instructions)

(a) _ I (b) I (c) (d)No. from Description of noncash property given FMV (or estimate) Date received

Part I (see instructions)

120, 000 shares of Apple (AAPL)2

$ 23,404,800. 01/03/08

(8 I I (b) I (c) I (d) INo. from Description of noncash property given FMV (or estimate) Date received

Part | (see instructions)

2 , 993.92 shares of Bear Stearns Asset—Backed1 Securities Overseas,LTD.

$ 5,400,074. 01/01/08

in I I (b) I (c) (d) INo. from Description of noncash property given FMV (or estimate) Date received

Part | (see instructions)

10% Capital Limited Partnership Interest1 in Second City Capital Partners I,LP

$ 6,977,770. 01/01/08

(a I I (b) I (C) I (d) INo. from Description of noncash property given FMV (or estimate) Date received

Part I (see instructions)

81, 939 shares of Apple (AAPL)2

$ 10,875,354. 01/30/08

a I I (b) I (c) I (d) INo. from Description of noncash property given FMV (or estimate) Date received

Part | (see instructions)

$

(3 I I (b) I (c) I (d) INo. from Description of noncash property given FMV (or estimate) Date received

Part i (see instructions)

$

BAA Schedule B (Form 990, 990-EZ, or 990-PF) (2008)

TEEAO703 08/05/08

The YLK Charitable Fund 264605864

Form 990-F’F. Page I, Part I, LIne ll

Form 990-PF, Page I, Part I, LIne 23Line 23 Stmt

Other expenses: Rev/Exp Book I Net Inv Inc I Adj Net Inc I Charity DleAgent & Filing fees 386. I I | 386.

Total 106,510. 106,124. 386.

Form 990-PF, Part IV, CapItaI Gains and Losses for Tax on Investment IncomeColumns (a) thru (d)

(a) LIst and describe the klnd(s) of property sold (b) How (c) Date (d) Date(e.g , real estate, 2-story bnck warehouse; or acqurred acqutred soldcommon stock, 200 shares MLC Company) P-Purchase (month, (month,

D-Donatlon clay, year) day, year)

Put JAN 09@85 100 AAPL I? 12/11/08 12/26/08Put DEC 08@85 100 AAPL Expired P 11/04/08 12/23/08Liquidating Dist—Bear Stearn Asset Backed Overseas,LTD D 01/02 /04 Various

Form 990-PF, Part IV, Capital Gains and Losses for Tax on Investment IncomeColumns (e) thru (h)

(e) Gross sales (f) Deprecratlon allowed (9) Cost or other basns (h) Garn or (loss)price (or allowable) plus expense of sale (e) plus (f) minus (9)

59,126. 83,712. —24,586.40,006. 0. 40,006.

2,795,849. 3,824,029. —1,028,180.591,576. 0. 591,576.

Total 3,907,741. —421,184.

The YLK Charitable Fund 26-1605864

Form 990-PF, Part IV, Capital Gains and Losses for Tax on Investment IncomeColumns (i) thru (1)

Complete only for assets showrng gain In column (h) and owned (I) Gains (column (h)by the foundation on 12/31/69 gain minus column (k),

but not less than -0—)(i) Fair Market Value (j) Adjusted baSIS (k) Excess of column (I) or losses (from

as of 12/31/69 as of 12/31/69 over column (I), If any column (h))

— 24 , 58 6 .4 O , 0 O 6 .

-1 , 02 8 , l 8 O .5 91 , 5 7 6 .

Total —421,184.

Form 990-PF, Page 4, Part VII-A, Line 8aStates Registered In

OH — OhioDE — Delaware

Form 990-PF, Page 1, Part 1, Line 16aL-16a Stmt

Line 16a - Legal Fees: Amount Net Adjusted DisbursementsName of Type of Service Paid Investment Net for CharitableProvider Provided Per Books Income Income Purposes

Dav1s, Polk mammal] Incorporatlon L Exemptl l 0 1 , l . l 0 l , l .

Total 101,165. 101,165.

Form 990-PF, Page 2, Part II, Line 10bL-10b Stmt

End of YearLine 10b - Investments - Corporate Stock: Book Fair Market

Value Value

195,939 shares of AAPL 33,109,914. 16,956,561.15,000 shares of JP Morgan 576,603. 467,850.873.8 shares of Bear Stearns Asset Backed Overseas LTD. 1,576,045. 1,576,045.

Total 35,262,562. 19,000,456.

Form 990-PF, Page 2. Part II. Line 13L-13 Stmt

End of YearLine 13 - Investments - Other: Book Fair Market

Value Value

S—CALL JPM 1/09 100 sh JP Morgan —34,619.’ 34,319.

The YLK Charitable Fund 26-1605864

Form 990-PF, Page 2, Part II, Llne 13 ContinuedL-135tmt

EndonearLine 13 - Investments - Other: Book Fair Market

Value Value

S—CALL QAA JAN 09@120 AAPL -3L466. 3,371.S—PUT QAA JAN 09 @ 85 AAPL —29,563. —1l,437.S-PUT QAA JAN 09 @ 85 AAPL —41,129. 39,724.

Second Ciiy Capital Partners l,LP 5,462,453. 5,462,453.

Total 5,353,676. 5,528,430.

The YLK Charltable Fund 264605864

Supporting Statement of:

Form 990—PF, pl/Line 1(a)

Description Amount

The C.O.U.Q. Foundation,Inc.Financial Trust Cogpany,Inc.

12,377,844.34,280,154.

Substantial Contributors1)The C.O.U.Q. Foundation Inc.

250 S. Australian Ave.#1404West Palm Beach,Fl 33401

2)Financial Trust ComBanLInc.6100 Red Hook Quarter—B3St. Thomas,VI 00802

Total 46,657,998.

Copy

Form Application for Extension _of Time To File an

(Rev Aprrl 2008) Exempt orgamzat'on Return OMB No 15451709

> File a separate application for each return.

0 It you are filing for an Automatic 3-Month Extensmn. complete only Part! and check this box >0 if you are filing for an Additional (Not Automatic) 3-Month Extenswn, complete only Part II (on page 2 of this form)

Do not complete Part/l un/essyou have already been granted an automatic 3-month extension on a preViously filed Form 8868[Partl [Automatic 3-Month Extension of Time. Only submit original (no copies needed).

A corporation reqUIred to file Form 990-T and requesting an automatic 6-month extenSion — check this box and complete Part I only > D

All other corporations (including I 120-C filers), partnerships, REM/CS, and trusts must use Form 7004 to request an extenswn of time to fileincome tax returns

Electronic Filing (e-file). Generally, you can electronically file Form 8868 if you want a 3-month automatic extension of time to file one of thereturns noted below (6 months for a corporation required to file Form 990-T) However, you cannot file Form 8868 electronically it (1) you wantthe additional (not automatic) 3—month extenSIon or (2) you file Forms 990-BL, 6069, or 8870, group returns, or a composne or consolidatedForm 990-T Instead, you must submit the fully completed and Signed page 2 (Part 11) of Form 8868 For more details on the electronic filing ofthis form, Vi5it www irs gov/efile and click on e-file for Charities & Nonprofits

Name of Exempt Organization Employer identification numberType orprint _

The YLK Charltable Fund 26—1605864F"? by ‘08 Number. street, and room or swte number It a P 0 box, see instructionsdue date formerge 8000 Walton Parkway, #100Instructions City, town or post office, state. and ZIP code For a toreign address, see instructions

New Albany OH 43054Check type of return to be filed (file a separate application for each return)

Form 990 Form 990-T (corporation) Form 4720Form 990-BL Form 990-T (section 401 (a) or 408(a) trust) Form 5227Form 990-EZ Form 990-T (trust other than above) Form 6069

X Form 990-PF Form 1041 —A Form 8870

0 The books are in the care of ’_P<_eg_gy_ gg_l_a§ci _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Telephone No ’ (614) 939-6000 FAXNo ’ (614) 939-6025° It the organization does not have an office or place of busmess In the United States, check this box > D. If this is for a Group Return, enter the organization's four digit Group Exemption Number (GEN) If this is for the whole group,

check this box > D If it is for part of the group, check this box ’ El and attach a list With the names and Ele of all membersthe exten5ion Will cover

1 | request an automatic 3-month (6 months for a corporation required to file Form 9901) extenSion of timeuntil _Agg _l]_ _ _, 20 _0_9 _ , to file the exempt organization return for the organization named aboveThe extenSion is for the organization's return for’ calendar year 20 _0§ _ or> I tax year beginning , 20 _ _ _ , and ending .20

2 If this tax year is for less than 12 months, check reason D Initial return D Final return [1 Change in accounting period

3a if this application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less anynonrefundable credits See instructions 3a $ 4 3L000 .

b it this application is for Form 990-PF or 990-T, enter any refundable credits and estimated tax paymentsmade Include any prior year overpayment allowed as a credit 3b $ 0 .

c Balance Due. Subtract line 3b from line 3a Include your payment With this form, or, if reqwred,deposn With FTD coupon or, if required, by usmg EFTPS (Electronic Federal Tax Payment System)See instructions 3c $ 43, 000 .

Caution. If you are gomg to make an electronic fund Withdrawal With this Form 8868, see Form 8453-EO and Form 8879-EO forpayment instructions

BAA For Privacy Act and Paperwork Reduction Act Notice, see instructions. Form 8868 (Rev 4-2008)

F |FZO501 04/16/08

![Speech by Chairman Powell on the Federal …fm.cnbc.com/applications/cnbc.com/resources/editorial...Street News and Comment,” Special Dispatch to the [Daily Boston] Globe, on March](https://static.fdocuments.in/doc/165x107/5e525dfe3d292c4261111326/speech-by-chairman-powell-on-the-federal-fmcnbccomapplicationscnbccomresourceseditorial.jpg)