Foreign Exchange & International Operations DepartmentThe world’s biggest rogue traders in recent...

Transcript of Foreign Exchange & International Operations DepartmentThe world’s biggest rogue traders in recent...

-

Foreign Exchange & International

Operations Department

Patrick El Hajj CFA

Money Market Chief Dealer

-

Role of the Central Bank

1-Currency issuance : the Central Bank prints and issues notes and coins for the government usually backed by holdings of government bonds ( Gold and Foreign currency in the case of Lebanon).

2-Banker to the banks : It provides a payments system for the transactions between banks and liquidity.

3-Banker to the government.

4-Banking supervision : The Central Bank regulates the banking system to seek to maintain financial stability .

-

5-Maintain financial stability (provides emergency liquidity assistance to financial institutions that might otherwise collapse, damaging the economy as a whole. Ex: LCB case).

6- Monetary policy function: increasing and decreasing the money supply by using 3 tools : Interest rate, open market operations and reserve requirement ratio.

7-Reserve Management: The Central Bank manages the portfolio of foreign exchange reserves of the country and may buy or sell them to influence the exchange rate ( Intervention ).

-

One of the major roles of the central banks is to control inflation and stimulate growth. Central bankers should always keep in eye on major economic indicators such as inflation , growth , unemployment GDP , Trade balance etc….

-

Top Economic indicators

1. Gross domestic product (GDP) : it is the market value of all officially recognized final goods and services produced within a country in a given period of time .

(Released 30 days after the quarter ends)

2. US Initial Jobless Claims SA :

Weekly initial jobless claims are the actual number of

people who have filed for unemployment benefits for

the first time. (Released weekly)

-

3. Nonfarm payroll – Unemployment Indicator :

A measure of the total number of persons employed in

nonagricultural sectors of the economy.

(Released 1st Friday of the month)

4. Consumer Price Index – CPI – Inflation Indicator

It is a price measures for tracking the price of a market

basket of goods and services purchased by individuals.

The weights of the components are based on consumer

spending patterns.

(Released 15 days after the end of the month)

-

5.Producer Price Index- PPI- Inflation Indicator

Measures prices received by producers at the first

commercial sale.

(Released 17 days after the end of the month)

6. Industrial Production

Industrial production is the measure of physical output in

factories, mines and utilities. Activity in manufacturing

accounts for about 85% of total industrial production with

the remainder of output from utilities and services.

(Released 16 days after the end of the month)

-

7. Retail sales

The report details the dollar value of purchases made at

retail stores. (Example: Auto dealers, department stores,

etc…).

(Released 14 days after the end of the month)

8. Trade Balance

Surplus and deficits in trade reflect the competitiveness

of a nation’s economy, which in turn indicates demand

for a country’s currency. It’s released about 40 days after

the end of month .

(Released 40 days after the end of month)

-

9. Purchasing Manager Index – PMI

Is an economic indicator derived from monthly surveys of

private sector companies.

An index reading of 50.0 means that the variable is

unchanged, a number over 50.0 indicates an

improvement while anything below 50.0 suggests a

decline. The further away from 50.0 the index is, the

stronger the change over the month.

(Released first business day after the end of month)

10. Open Market Committee decision

The Federal OMC is the Federal Reserve committee

that makes key decisions about interest rates and the

growth of the United States money supply.

-

Economic Indicators - USA

-

Economic Indicators - Euro zone

-

Its very hard for a country to survive without financial

assistance if it is borrowing at very high yields ( above 7 % )

-

Dealing Room

-

Definition of Reserves

Our main role in the Dealing room is to manage the USD 37 Billion foreign reserve of the Central Bank.

These are assets of the central bank held in different reserve currencies, mostly the US dollar, and to a lesser extent the euro, the UK pound, the Japanese yen and other foreign currencies.

http://en.wikipedia.org/wiki/Assethttp://en.wikipedia.org/wiki/Central_bankhttp://en.wikipedia.org/wiki/Reserve_currencyhttp://en.wikipedia.org/wiki/United_States_dollarhttp://en.wikipedia.org/wiki/Eurohttp://en.wikipedia.org/wiki/Pound_sterlinghttp://en.wikipedia.org/wiki/Japanese_yen

-

Foreign Reserve Composition

Net reserve (BDL ownership )

Deposits of Local Banks ( RR) -Liabilities

Local banks covering their reserve requirement ( 15 %) .

Deposits of international Banks -Liabilities

Arab and International Banks and central banks placing time

deposits with BDL.

Other liabilities

Local and international banks buy Certificate of Deposits issued

by BDL.

-

Time Deposit

Each Day The department of Foreign Exchange and

International Operations release new rates on time

deposit based on the Libor for the USD and Euribor for

the Euro .

LIBOR stands for the London Inter-Bank Offered Rate

( the most popular benchmark ).

Euribor stands for the EURO Inter-Bank Offered Rate.

-

Borrowing cost : Rates paid for Local and Foreign banks

-

BDL Foreign Reserve Currency Composition

U.S. Dollar

EURO

Pound Sterling

Japanese Yen

Swiss Francs

Other Arab Currencies

-

International Reserve Assets

-

Reserve Currency Allocation

-

Gold Reserves

According to Bloomberg data Lebanon is ranked 2nd in the MENA region after KSA and 15th globally

-

2012 MENA Gold Reserves (mil troy OZ)

10.382

9.2225.583

4.624

2.539

2.431

0.83

0.709

0.41

0.399

0.15

Saudi ArabiaLebanonAlgeriaLibyaKuwaitEgyptSyriaMoroccoJordanQatarBahrain

-

Why do Countries Hold Reserves?

Exchange rate targeting : Ex: Lebanon and Switzerland. The Central Bank of Lebanon has set a range for the LBP 1501-1514 . Whereas the Swiss National Bank has set a floor for the EUR/CHF at 1.20. They both intervene on regular basis to defend those prices.

Exchange rate stability : Central banks could intervene to reduce the volatility in the FX market. €/$ ATR 100 to 200 points).

Store of national wealth. Sovereign rating :The higher the FX reserve the better the

sovereign rating of a country the lower the borrowing cost.

Used to avoid financial crises : The Central Bank can use its reserve in time of crisis to pump liquidity into the market.

-

Exchange rate Systems

Fixed exchange rate systems determine a preset

exchange rate and defend it .

Advantage : Exchange rate stability.

Disadvantage : Lost control of monetary policy .

Economic shocks hit the real economy, rather than

the exchange rate.

Pegged exchange rate systems tie the exchange rate to

another major currency, but allow it to float within a

range.

Advantage : good for trade, it gives confidence to

investors.

Disadvantage : Shocks hit the real economy.

-

Exchange rate Systems

Flexible exchange rate systems allow exchange rate to

float freely according to supply and demand.

Advantage : currency absorbs economic shocks,

government retains control of monetary policy.

Disadvantage : volatility adds risk to trade.

-

6 September 2011 : The SNB set a floor on the

Eur /CHF at 1.20

CHF appreciation became a burden on the Swiss export industry. The Swiss National Bank intervened in the market selling CHF in order to weaken the

threat posed by a strong Franc

-

USD/LBP AT 1501-1514 SINCE 1999

USD/LBP Closing Prices

Year DECEMBER

1980 3.6475

1981 4.6100

1982 3.8100

1983 5.4900

1984 8.8900

1985 18.10

1986 87.00

1987 455.00

1988 530.00

1989 505.00

1990 842.00

1991 879.00

1992 1838.00

1993 1711.00

1994 1647.00

1995 1596.00

1996 1552.00

1997 1527.00

1998 1508.00

1999 1507.50

2000/2012 1507.5

-

Where do we invest our fund ?

A certain amount is kept in our accounts with our

correspondents and the rest is managed on a daily basis.

We invest our funds with investment grade banks (rated AA

and above) and Central Banks. The investments are made

for different time period going from one day up to 3 years

depending on our liquidity needs.

We buy treasury bills, notes and bonds.

Our policy is to stay very liquid in order to be able to

intervene in the FX market ( USD/LBP) supporting the

Lebanese pound whenever need it.

-

Eligible Assets

BDL Investment :

• Time deposits

• Certificate of Deposits

• Treasury Bills (less than 1 yr)

• Treasury Notes ( 2 to 10 yrs)

• Treasury Bonds (20 & 30 yrs)

All our investments are made on Reuters dealing 3000 and

Bloomberg , which are systems that links all the treasury

desks around the world together.

-

US SOVEREIGN SECURITIES

-

European Sovereign Securities

-

US Treasury Bill Description

-

US Treasury Note Description

-

Reuters Dealing and Bloomberg terminal

-

Rogue traders

If you put a rogue trader behind a Bloomberg terminal or

Reuters dealing and leave it without supervision, you can

be bankrupt in a matter of days

A rogue trader is an authorized employee making

unauthorized trades on behalf of their employer.

http://en.wikipedia.org/wiki/Employeehttp://en.wikipedia.org/wiki/Employer

-

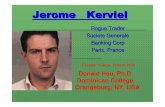

The world’s biggest rogue traders in recent history

Number 1: Jerome Kerviel Societe General Paris loss $ 7.2 billion

In 2008 , SocGen's "rogue

trader" Kerviel lost the French

bank approximately $7.2 billion

through arbitrage of equity

derivatives from unauthorized

trades.

-

Number 2: Yasuo Hamanaka, Sumitomo corporation Tokyo

-Loss $ 2.6 billion

In 1996 Yasuo hamanaka who was once nick-named ” Mr. Copper” because of his aggressive trading style in the copper market, caused Sumitomo to lose $ 2.6 Billion from his unauthorized copper trades on the London Metal Exchange.

As a result of his rogue trade, Mr. Copper was sentenced to eight years in prison in 1998. He was released in July 2005, a year before his sentence was supposed to end.

-

Number 3 : Kweku Adoboli UBS London Loss $ 2.3 billion

In September 2011, UBS revealed an unexpected $ 2.3 billion loss believed to be caused by a rogue trader in the banks London office. Kweku Adoboli,31 yrs old.

Shortly after the massive

trading loss was discovered, the Swiss Bank’s CEO Oswald Grubel resigned from his post.

-

Number 4: Nick Leeson - Barings Bank GBP 827 Million

Nick Leeson. He was employed by Barings Bank as a trader in the early 1990′s. As a trader he was responsible for bankrupting Barings Bank in 1995, a 233 year old bank , known as the Queen of England bank, with losses of $1.3 billion.

He was sentenced for 6.5 years and to jail in Singapore.

He now lives in Ireland and is a professional speaker.

-

Dealer at BDL are supervised by the Middle office , The Head of Treasury , The Back office and the Auditing Unit

Dealer Middle

Office

Head

of

Treasury

Back

Office

Auditing

Unit

-

The Foreign Exchange Operation

In the Forex market, we have the spot , forward ,swap

and option market . We only deal in the spot market. The

spot market represents currency exchange rates for the

immediate delivery of currency. FX market daily volume

around $ 4 trillion , the biggest market in the world ( $ 1.5

trillion in the spot market).

In the front office we are responsible for buying and

selling the USD against the Lebanese pound and other

foreign currencies whenever needed.

In the FX there is always BID and ASK.

-

BID (offer to buy )- The amount that a dealer is willing to pay for a base currency.

ASK ( offer to sell)-The amount that a dealer is willing to receive for the base currency

• Bid ASK

$/LBP 1501 1514

BDL sells USD at 1514 and I buy at 1501 )

The spread between the Bid and Ask Price represents the Dealer’s income. The Ask is always higher than the Bid .

• Bid Ask

EUR/USD 1.3303 1.3306

-

We trade the 6 Majors

+ Arab currencies

The Euro (EUR/USD ) the Fiber

The Japanese Yen( USD/JPY) the Yen

The British Pound ( GBP/USD) also known as Sterling or

Cable

The Swiss Franc (USD/CHF) The Swissy/Chief

The Australian Dollar ( AUD/USD) the Aussie

The Canadian Dollar ( USD/CAD) the Looney

-

Base Currency Versus Quoted or Variable

Currency

The exchange rate is the price at which one unit of the base currency can be bought or sold, in terms of a number of units of the quoted currency.

XXX/YYY

XXX is the base currency

YYY is the quoted currency

EUR/USD 1.2240 means that 1 Euro equals1.2240 USD

USD/JPY 110.08 means that 1 USD equals 110.08 JPY

-

EUR/USD Daily Graph

-

EUR/USD Monthly Graph

-

Currency Performance

-

Gold Performance

-

Gold Performance

-

Crude Oil Performance

-

The End