Ford's New Approach to Supplier Risk Management

Transcript of Ford's New Approach to Supplier Risk Management

Supply Chain Videocast

Ford's New Approach to Supplier Risk Management

Today’s Panel

• Dr. David Simchi-Levi

– Professor of Engineering Systems,

MIT

• Michael Sanders

– Procurement Manager, Ford

What We’ll Cover …

• Introduction

The Risk Exposure Index

• Supplier Segmentation

Automotive Manufacturer

• Wrap-up

3

Risks in Today’s Supply Chains

• Significant increase in supply chain risk

Outsourcing and offshoring

Supply chain is geographically more diverse

Lean manufacturing

Just-in-time (JIT) manufacturing and low inventory levels

4

General Motors truck plant

was shutting down

General Motors truck plant in

Louisiana announced that it

was shutting down

temporarily for lack of

Japanese-made parts because

of the earthquake and tsunami

had struck Japan.

New York Times, 2011

Intel Sales are down

Giant blames Thai flood for

$1B drop in sales goals.

Toyota, Honda, Goodyear,

Canon, Nikon, Sony… have

cut production and lowered

financial forecasts because

of the flooding in Thailand.

The Wall Street Journal, 2011

©Copyright 2012 D. Simchi-Levi

Risks in Today’s Supply Chains

• Significant increase in supply chain risk

Outsourcing and offshoring

Supply chain is geographically more diverse

Lean manufacturing

Just-in-time (JIT) manufacturing and low inventory levels

0

50

100

150

200

250

Quake/Tsunami Floods Tornadoes Floods

Japan Thailand USA Australia

Natural Disasters 2011 Cost ($B)

5

Worldwide Natural Disasters 1980-2011 Source: Munich Re

Hurricane Katrina,

2005

6

Supply Chain Disruption and Stock Performance

• Mattel, the world’s largest toy maker;

• Recalled 18 million toys made in China on August 2007;

• The reason: hazards such as lead paint

$-

$0.50

$1.00

$1.50

$2.00

$2.50 2

00

3Q

3

20

03

Q4

20

04

Q1

20

04

Q2

20

04

Q3

20

04

Q4

20

05

Q1

20

05

Q2

20

05

Q3

20

05

Q4

20

06

Q1

20

06

Q2

20

06

Q3

20

06

Q4

20

07

Q1

20

07

Q2

20

07

Q3

20

07

Q4

20

08

Q1

20

08

Q2

20

08

Q3

20

08

Q4

Hasbro

Mattel

Stock Performance ($1 invested in 2003)

Product Recall

7

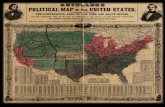

Many Sources of Risks

• Natural disasters

• Geopolitical risks

• Epidemics

• Terrorist attacks

• Environmental risks

• Volatile fuel prices

• Rising Labor costs

• Currency fluctuations

• Counterfeit parts and products

• Port delays

• Market changes

• Suppliers’ performance

• Forecasting accuracy

• Execution problems

Unknown-Unknown

Known-Unknown

Uncontrollable

Controllable

8

Many Sources of Risks

• Natural disasters

• Geopolitical risks

• Epidemics

• Terrorist attacks

• Environmental risks

• Volatile fuel prices

• Rising Labor costs

• Currency fluctuations

• Counterfeit parts and products

• Port delays

• Market changes

• Suppliers’ performance

• Forecasting accuracy

• Execution problems

Unknown-Unknown

Known-Unknown

Uncontrollable

Controllable

9

Many Sources of Risks

• Natural disasters

• Geopolitical risks

• Epidemics

• Terrorist attacks

• Environmental risks

• Volatile fuel prices

• Rising Labor costs

• Currency fluctuations

• Counterfeit parts and products

• Port delays

• Market changes

• Suppliers’ performance

• Forecasting accuracy

• Execution problems

Unknown-Unknown

Known-Unknown

Uncontrollable

Controllable

10

Epidemics

Fuel Prices

Geopolitical

Problems

Currency

Fluctuations

Commodity

Prices

Port

Delays Product Design

Problems

Forecast

Accuracy

Suppliers‘

Performance

The Risk Framework

Expected

Impact

Ability to Control LOW

Unknown-Unknown

HIGH

HIGH

Known-Unknown

LOW

Counterfeits

Government

Regulations

Natural Disasters

Environmental

Risks

11

Epidemics

Fuel Prices

Geopolitical

Problems

Currency

Fluctuations

Commodity

Prices

Port

Delays Product Design

Problems

Forecast

Accuracy

Suppliers‘

Performance

The Risk Framework

Expected

Impact

Ability to Control LOW

Unknown-Unknown

HIGH

HIGH

Known-Unknown

LOW

Counterfeits

Government

Regulations

Natural Disasters

Environmental

Risks

12

Epidemics

Fuel Prices

Geopolitical

Problems

Currency

Fluctuations

Commodity

Prices

Port

Delays Product Design

Problems

Forecast

Accuracy

Suppliers‘

Performance

The Risk Framework

Expected

Impact

Ability to Control LOW

Unknown-Unknown

HIGH

HIGH

Known-Unknown

LOW

Counterfeits

Government

Regulations

Natural Disasters

Environmental

Risks

13

Managing Supply Chain Risk: The Challenge

• Very difficult to predict many sources of risk, especially

the unknown-unknown

• Impact of disruption can be devastating

• Large investment in identifying every possible risk in the

supply chain

• Existing tools and techniques have been inadequate

Mostly ad-hoc, intuition, gut feeling

Exposure to risk may reside in unlikely places

May lead to the wrong actions and waste resources

No ability to prioritize mitigation investment

14

Case Study 1: The Risk Exposure Index

• High tech manufacturing company

• Contract manufacturers in Asia

• Assembly plants in North America

• Many suppliers all over the world

• Sells its products directly and through distributors

15

Case Study 1: The Risk Exposure Index

Tier 1 Tier 2+

US Port

Assembly Plants

Assembly Customers

TL

LTL

Distributors

Contract Manufacturers

US Suppliers

Printed Circuit Board

Chipset Manufacturer

Raw Material Suppliers

16

Stores

Distributors

Distribution

Case Study 1: The Risk Exposure Index

Tier 1 Tier 2+

US Port

Assembly Plants

Assembly Customers

TL

LTL

Distributors

Contract Manufacturers

US Suppliers

Printed Circuit Board

Chipset Manufacturer

Raw Material Suppliers

17

Stores

Distributors

• Time-To-Recovery (TTR): The time it takes to recover to full functionality after a disruption

• Financial Impact (FI): Lost sales during TTR

Distribution

Case Study 1: The Risk Exposure Index

Distribution Tier 1 Tier 2+

US Port

Assembly Plants

Assembly Customers

TL

LTL

Distributors

Contract Manufacturers

US Suppliers

Printed Circuit Board

Chipset Manufacturer

Raw Material Suppliers

18

Stores

Distributors

• Time-To-Recovery (TTR): The time it takes to recover to full functionality after a disruption

• Financial Impact (FI): Lost sales during TTR

$400M

$100M $1.5B

$100M $2.5B

$400M

$300M

Case Study 1: The Risk Exposure Index

Distribution Tier 1 Tier 2+

US Port

Assembly Plants

Assembly Customers

TL

LTL

Distributors

Contract Manufacturers

US Suppliers

Printed Circuit Board

Chipset Manufacturer

Raw Material Suppliers

19

Stores

Distributors

• Time-To-Recovery (TTR): The time it takes to recover to full functionality after a disruption

• Financial Impact (FI): Lost sales during TTR

• The Risk Exposure Index (REI) is the maximum FI over all nodes in the supply chain

$400M

$100M $1.5B

$100M $2.5B

$400M

$300M

The Benefits of using the Risk Exposure Index

• It provides a $ measure of risk--it estimate the cost of

risk;

• It is based on the entire network rather;

• It avoids the need to forecast the unknown-unknown;

• It forces a discussion to understand why TTR for similar

facilities or suppliers is different;

• It forces a process to reduce TTR in various stages of

the supply chain;

• It makes sure you have a good understanding of supply

chain dependencies.

20

What We’ll Cover …

• Introduction

The Risk Exposure Index

• Supplier Segmentation

Automotive Manufacturer

• Wrap-up

21

Forecast

Accuracy

Supply

Risk

Competitive

Position: • Advantage

• Parity

• Disadvantage

Innovation Speed

Possible Decisions:

• Dual Sourcing

• Long Term Contracts

• Maximize Flexibility

• Minimize Lead Time

• Minimize Total Landed

Cost

• Option Contracts

• Portfolio Approach

• Strategic Partnering

Financial

Impact

Price

Risk

Drivers of the Procurement Strategy

22

HIGH

LOW

LOW HIGH Financial Impact

Tota

l S

pen

d

Supplier Segmentation

Reducing Exposure to Supply Risk

23

HIGH

LOW

LOW HIGH Financial Impact

• Inventory

• Long term contracts

Tota

l S

pen

d

Supplier Segmentation

Reducing Exposure to Supply Risk

24

HIGH

LOW

LOW HIGH Financial Impact

• Inventory

• Long term contracts

• Partnerships

• Risk sharing contracts

• Track performance

• Share experience

• Business Continuity

Plans

Tota

l S

pen

d

Supplier Segmentation

Reducing Exposure to Supply Risk

25

HIGH

LOW

LOW HIGH Financial Impact

• Inventory

• Long term contracts

• Partnerships

• Risk sharing contracts

• Track performance

• Share experience

• Business Continuity

Plans

Tota

l S

pen

d

Supplier Segmentation

Reducing Exposure to Supply Risk

26

HIGH

LOW

LOW HIGH Financial Impact

• Inventory

• Long term contracts

• Partnerships

• Risk sharing contracts

• Track performance

• Share experience

• Business Continuity

Plans

• Inventory

• Dual sourcing/sites

• Flexibility

• Standard Components

•Track Performance

Tota

l S

pen

d

Supplier Segmentation

Reducing Exposure to Supply Risk

27

Ford Motor Company

• US manufacturing company

• Global Network with plants all over the world

28

Ford Motor Company

• Global automotive industry

leader based in Dearborn, MI.

• Manufactures and distributes

automobiles in 200 markets

across six continents.

29

Ford Supply Chain

Tier 1 Tier 2 Tier 3+

West Coast

East Coast

North American Assembly Plants

Assembly Dealers

Truck

Train

North American Engine Plants

Transmission Plants

Stamping Plants

APA Suppliers

EU Suppliers

NA Suppliers

Forging Plants

Casting Plants

APA Suppliers

EU Suppliers

NA Suppliers

NA Sheet Steel Suppliers

APA Suppliers

NA Steel Bar Suppliers

EU Suppliers

NA Suppliers

Evonik - CDT PA12

Fuel / Break line suppliers

30

Supplier Segmentation at Ford

• Initial implementation: North America Supply Chain

Exposure index and supplier site costs

• Evaluate on Time to Recover(TTR) for Tier 1 and Tier 2+

suppliers serving North America plants

Two types of TTR:

1. TTR in which the supplier’s production facility is

lost;

2. TTR associated with supplier’s facility and tooling

are lost

Assumed type 1 TTR in this study

• Use Financial Impact information and component price to

identify mitigation strategies

31

The Model—North America Supply Chain

Multi-Tier Network Long Lead times from some suppliers Complex BOM structure Components are shared across multiple

assemblies ~4K Tier 1 suppliers sites ~55K different parts

Two types of TTR information: One in which the supplier’s production facility is lost; second associated with supplier’s facility and tooling are lost.

Tier 2 Tier 1 Assembly Plants Dealers

32

821

465

129

252

94

0

100

200

300

400

500

600

700

800

900

Very Low Low Med High Very High

Financial Impact of Different Supplier’s Sites

Number of Sites

Financial Impact

Another 2K+ sites with negligible Impact 33

20000 40000 60000 80000 100000 120000 140000

Most Important 1000 Supplier Site

Disruption Impact and Total Spend by Supplier Facility

(Number of Vehicles Effected)

To

tal

Sp

en

d b

y S

up

pli

er

Sit

e

Disclaimer: Data shown here is for demonstration only . It does not represent real numbers used in analysis

34

Disruption Impact and Total Spend by Supplier Facility

Financial Impact (Profit)

8192 58192 108192 158192 208192 258192 308192

Most Important 1000 Supplier Sites

To

tal

Sp

en

d b

y S

up

pli

er

Sit

e

Disclaimer: Data shown here is for demonstration only . It does not represent real numbers used in analysis

35

Supplier Segmentation

Financial Impact (Profit)

8192 58192 108192 158192 208192 258192 308192

Most Important 1000 Supplier Sites

To

tal

Sp

en

d b

y S

up

pli

er

Sit

e

Disclaimer: Data shown here is for demonstration only . It does not represent real numbers used in analysis

36

Supplier Segmentation

Financial Impact (Profit)

8192 58192 108192 158192 208192 258192 308192

Most Important 1000 Supplier Sites

To

tal

Sp

en

d b

y S

up

pli

er

Sit

e

• Long Term Contracts

• Track Inventory

• Partnership

• Risk Sharing Contracts

• Track Performance

• Require Multiple Sites

• Inventory

• Dual Sourcing

• New Product Design

Disclaimer: Data shown here is for demonstration only . It does not represent real numbers used in analysis

37

Supplier Segmentation

Financial Impact (Profit)

8192 58192 108192 158192 208192 258192 308192

Most Important 1000 Supplier Sites

To

tal

Sp

en

d b

y S

up

pli

er

Sit

e

• Long Term Contracts

• Track Inventory

• Partnership

• Risk Sharing Contracts

• Track Performance

• Require Multiple Sites

• Inventory

• Dual Sourcing

• New Product Design

Disclaimer: Data shown here is for demonstration only . It does not represent real numbers used in analysis

38

Impact on Automotive Manufacturer

• Optimization model identified at-risk suppliers

Identified the hidden risk of high volume-low

margin components

• Segment suppliers

Some suppliers are required to have alternate

plants in different regions

Implement new product design strategy to

consolidate similar parts & provide suppliers

with economies of scale to set up a second plant

Track daily inventory levels for some suppliers

39

Acknowledgement

• MIT

Prof. David Simchi-Levi

Dr. Yehua Wei (now at Duke)

Dr. William Schmidt (now at Cornel)

• Ford Motor Company

Research and Advanced Engineering

Dr. Oleg Gusikhin, Technical Leader

Dr. Don Zhang, Technical Expert

Purchasing

Keith Combs, Director

Steve Faraci, Manager

Michael Sanders, Manager

IT

Yao Ge, Technical Expert

40

Resources

• Dr. David Simchi-Levi, MIT

– 617-253-6160

• Michael Sanders, Ford

• Dan Gilmore, SCDigest

Copyright SCDigest