FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public....

-

Upload

logan-mcbride -

Category

Documents

-

view

215 -

download

0

Transcript of FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public....

FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Advanced (k)

Benchmarking advisor fees and services

17362.1 6/09

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

2009 MFS Fund Distributors, Inc.

Ann Schleck and Co. is not affiliated with MFS. The information presented herein was provided by Ann Schleck and Co., and MFS cannot guarantee its accuracy and/or completeness.

Benching Advisor Fees and Services 2FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Advisor Fees and Services

CONTENTS

I. Retirement Advisor Fee and Service Trends- Database methodology- Fee methods and averages- Retainer versus project-based fees- Investment and fiduciary services

II. Communicating Advisor Fees and Services to Plan Sponsors- Best practices for communicating fees- Annual advisor fee and service review template

III. Fee Benchmarking Tools

FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

ADVISOR FEE & SERVICE TRENDS

Copyright © 2009 Ann Schleck & Co. All rights reserved. 4FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Advisor Fee Trends

FEE BENCHMARKERTM

Database Composition

120 practices, 727 retirement specialists, 5000+ defined contribution (DC) plans

DC assets under advisementBusiness models represented

31%Affiliated

FAs 42%RIAs

27%Fee Only

Consultants

0 to $100M 27%

$101M to $500M 36%

$501M to $1B 15%

Over $1B 22%

Copyright © 2009 Ann Schleck & Co. All rights reserved. 5FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Staffing Norms

TYPICAL RETIREMENT PRACTICE STAFFING LEVELS

Full-Time Retirement Staff

1 to 3 employees 45%

4 to 7 employees 37.5%

8 to 12 employees 12.5%

Over 12 employees 5%

Retirement Staff by Business Model

FT Staff Range Mean

Affiliated FAs 1 to 11 3.9

Independent RIAs 1 to 53 5.8

Fee-only consultants 1 to 65 7.5

Average of 1 full-time retirement specialist for every $169 million in assets under advisement

Copyright © 2009 Ann Schleck & Co. All rights reserved. 6FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Fee Methods

ADVISOR FEE METHODS BY PLAN SIZE

Trends

• Most advisors use a standard fee schedule

• Custom pricing for complex plans• Asset-based for current clients • Flat fee for new clients• Who charges the most?

- Plans under $5M: Fee-based consultants- Plans $25M to $50M: FAs - Plans over $200M: RIAs

Asset-Based Fee Flat Fee Flat Fee +

Asset-Based

Under $10M 82% 13% 5%

$10M 75% 19% 6%

$25M 68% 23% 9%

$50M 66% 23% 10%

$100M 46% 37% 17%

$500M 17% 50% 33%

Percentages may not add up to 100% due to rounding

Copyright © 2009 Ann Schleck & Co. All rights reserved. 7FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Use of Fee Caps

PERCENT OF ADVISORS THAT CAP FEES

Factors Driving Advisor’s Fees

• Plan complexity• Sophistication of the sponsor• Plan committee structure• Plan size• Multiple sites/locations• Frequency of investment reviews• Number of meeting days• Seniority of advisor team

Fee Caps By Plan Size

Percent That Cap Low High

Overall Database 31% $3M $250M

FAs 26% $100M $250M

RIAs 55% $3M $100M

Fee-Based Consultants 19% $20M $250M

Copyright © 2009 Ann Schleck & Co. All rights reserved. 8FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Scope of Services

SERVICES COMMONLY INCLUDED IN THE ANNUAL RETAINER

• Investment policy development• Investment fiduciary to the plan• Fund menu design• Investment monitoring and committee meetings• Fund replacements and fund manager searches• Plan design consulting• Provider fee and service reviews• Provider management and oversight • Education program strategy

SERVICES NOT COMMONLY INCLUDED IN THE ANNUAL RETAINER

• Acting as fiduciary to participants• Asset allocation modeling• Compliance reviews

Copyright © 2009 Ann Schleck & Co. All rights reserved. 9FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Ongoing Investment Reviews

FREQUENCY OF INVESTMENT REVIEWS BY PLAN SIZE

• Vast majority conduct investment reviews quarterly

Investment Fiduciary• 75% are willing to be an investment fiduciary to the plan• Of this 75%, 60% include plan-level fiduciary support as part of retainer• When fiduciary support is charged for separately, common fees are:

- 5 bps- $3,500 per year to $15,000 per year

Plan Size Annually Semiannually Quarterly

$5M 18% 26% 55%

$25M 10% 10% 80%

$50M 8% 8% 84%

$200M 0% 0% 100%

$500M 0% 0% 100%

Copyright © 2009 Ann Schleck & Co. All rights reserved. 10FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Fee Averages

ANNUAL RETAINER AND CONSULTING FEE RANGES

Consulting Fee Examples

Service Fee Range

Vendor search $3,000 to $40,000

Provider fee & service reviews $3,000 to $10,000

Investment policy $2,000 to $10,000

Employee meetings $500 to $3,000per day

Annual Advisor Retainer Fee Averages*

Plan Size Mean/Average Annual Fee Most Common

$5M $17,590 $12,500

$25M $51,512 $50,000 and $62,500

$50M $79,087 $50,000 and $125,000

* For more information on fees for specific plan sizes, refer to Ann Schleck & Co. Fee AlmanacTM or online Fee BenchmarkerTM

FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Communicating fees to plan sponsors

Benching Advisor Fees and Services 12FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Communicating Fees to Plan Sponsors

RECOMMENDATIONS

• Develop a fee philosophy and overall communication approach

• Benchmark your fees and services to industry norms and share the results with plan sponsors

• Proactively disclose your fees on a quarterly invoice, even if no explicit fees are charged

• Conduct a year-end fee and service disclosure summary

• Document your client’s ROI as part of your annual fee disclosure

• Broaden your fee discussion to include plan-level cost savings ideas

Benching Advisor Fees and Services 13FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Annual Fee Disclosure

1. Your fee philosophy and approachFor example…• “We disclose our fees on a proactive and transparent

basis” • “Our goal is to be competitive, but we are not the low-cost

provider”

2. Annual goals and results achieved for the plan

3. Fee education• Types of fees in qualified plans• Key terms and definitions

4. Factors driving fees

5. Cost savings ideas

6. Sponsor’s fiduciary role with fee management

7. Itemization of your fees

8. How fees are charged and paid

POTENTIAL TOPICS TO INCLUDE IN YOUR ANNUAL FEE DISCLOSURE

FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

Fee benchmarking tools

Benching Advisor Fees and Services 15FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

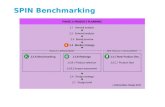

Fee Benchmarking Tools

FEE BENCHMARKERTM LETS ADVISORS COMPARE FEES & SERVICES FOR A SPECIFIC PLAN TO INDUSTRY NORMS

Fee BenchmarkerTM Report…

• Compares fees with similar practices• Quartile rankings• Scope of service comparisons • Commission and fee-for-service

illustrations

To request a report, contact your MFS sales representative

Benching Advisor Fees and Services 16FOR DEALER AND INSTITUTIONAL USE ONLY. Should not be shown, quoted, or distributed to the public.

FOR MORE INFORMATION, PLEASE CONTACT

Name

Phone

17362.1 6/09

Thank you