FNV TSX/NYSE...FY 2013 Gold Price ($/ounce) $1,200 $1,272 $1,266 $1,411 Gold Equivalent Ounces...

Transcript of FNV TSX/NYSE...FY 2013 Gold Price ($/ounce) $1,200 $1,272 $1,266 $1,411 Gold Equivalent Ounces...

2014 Results & Investor DayMarch 26, 2015

FNV TSX/NYSE

Cautionary StatementForward-Looking StatementsThis presentation contains “forward looking information” and “forward looking statements” within the meaning of applicable Canadian securities laws and the U.S. Private Securities LitigationReform Act of 1995, respectively, which may include, but are not limited to, statements with respect to future events or future performance, management’s expectations regarding Franco-Nevada’s growth, results of operations, estimated future revenues, requirements for additional capital, mineral reserve and mineral resource estimates, production estimates, production costsand revenue, future demand for and prices of commodities, expected mining sequences, business prospects and opportunities. In addition, statements (including data in tables) relating toreserves and resources and gold equivalent ounces are forward looking statements, as they involve implied assessment, based on certain estimates and assumptions, and no assurance canbe given that the estimates will be realized. Such forward looking statements reflect management’s current beliefs and are based on information currently available to management. Often, butnot always, forward looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budgets”, “scheduled”, “estimates”, “forecasts”, “predicts”, “projects”,“intends”, “targets”, “aims”, “anticipates” or “believes” or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions“may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved. Forward looking statements involve known and unknown risks, uncertainties and other factors, which maycause the actual results, performance or achievements of Franco-Nevada to be materially different from any future results, performance or achievements expressed or implied by the forwardlooking statements. A number of factors could cause actual events or results to differ materially from any forward looking statement, including, without limitation: fluctuations in the prices of theprimary commodities that drive royalty and stream revenue (gold, platinum group metals, copper, nickel, uranium, silver, iron-ore and oil and gas); fluctuations in the value of the Canadian andAustralian dollar, Mexican peso and any other currency in which revenue is generated, relative to the U.S. dollar; changes in national and local government legislation, including permitting andlicensing regimes and taxation policies; regulations and political or economic developments in any of the countries where properties in which Franco-Nevada holds a royalty, stream or otherinterest are located or through which they are held; risks related to the operators of the properties in which Franco-Nevada holds a royalty, stream or other interest, including changes in theownership and control of such operators; influence of macroeconomic developments; business opportunities that become available to, or are pursued by Franco-Nevada; reduced access todebt and equity capital; litigation; title, permit or license disputes related to interests on any of the properties in which Franco-Nevada holds a royalty, stream or other interest; whether or notthe Corporation is determined to have PFIC status; excessive cost escalation as well as development, permitting, infrastructure, operating or technical difficulties on any of the properties inwhich Franco-Nevada holds a royalty, stream or other interest; rate and timing of production differences from resource estimates; risks and hazards associated with the business ofdevelopment and mining on any of the properties in which Franco-Nevada holds a royalty, stream or other interest, including, but not limited to unusual or unexpected geological andmetallurgical conditions, slope failures or cave-ins, flooding and other natural disasters, terrorism, civil unrest or an outbreak of contagious disease; and the integration of acquired assets. Theforward looking statements contained in this presentation are based upon assumptions management believes to be reasonable, including, without limitation: the ongoing operation of theproperties in which Franco-Nevada holds a royalty, stream or other interest by the owners or operators of such properties in a manner consistent with past practice; the accuracy of publicstatements and disclosures made by the owners or operators of such underlying properties; no material adverse change in the market price of the commodities that underlie the asset portfolio;the Corporation’s ongoing income and assets relating to determination of our PFIC status; no adverse development in respect of any significant property in which Franco-Nevada holds aroyalty, stream or other interest; the accuracy of publicly disclosed expectations for the development of underlying properties that are not yet in production; integration of acquired assets; andthe absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. However, there can be no assurance that forward lookingstatements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements and investors are cautioned that forward lookingstatements are not guarantees of future performance. Franco-Nevada cannot assure investors that actual results will be consistent with these forward looking statements. Accordingly,investors should not place undue reliance on forward looking statements due to the inherent uncertainty therein. For additional information with respect to risks, uncertainties andassumptions, please refer to the “Risk Factors” section of our most recent Annual Information Form files with the Canadian securities regulatory authorities on www.sedar.com and containedin our most recent form 40-F filed with the Securities and Exchange Commission (the “SEC”) on www.sec.gov) as well as our most recent Management’s Discussion and Analysis filed with theCanadian securities regulatory authorities on www.sedar.com and with the SEC on www.sec.gov. The forward looking statements herein are made as of the date of this presentation only andFranco-Nevada does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required byapplicable law.

Non-IFRS MeasuresAdjusted Net Income, Adjusted EBITDA and Margin are intended to provide additional information only and do not have any standardized meaning under International Financial ReportingStandards (“IFRS”) and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures are not necessarilyindicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate these measures differently. For a reconciliation of these measures tovarious IFRS measures, please see the end of this presentation or the Company’s most recent Management’s Discussion and Analysis filed with the Canadian securities regulatory authoritieson www.sedar.com and with the SEC on www.sec.gov.This presentation does not constitute an offer to sell or a solicitation of an offer to purchase any security in any jurisdiction

Management Participants

David Harquail President & CEO

Sandip Rana CFO

Paul Brink SVP Business Development

Geoff Waterman COO

Lloyd HongCLO & Corporate Secretary

Kerry SparkesVP, Geology

3

Agenda

Overview of 2014 Results: Sandip Rana

Business Development: Paul Brink

Oil & Gas Update: Geoff Waterman

Associated Gold Ounces & REUs: Kerry Sparkes

Outlook and Q&A: David Harquail

4

Overview of 2014 ResultsSandip Rana – CFO

5

$127.2 $119.4

$180.0

$327.3$347.8

$322.5

$356.9

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$0

$50

$100

$150

$200

$250

$300

$350

$400

2008 2009 2010 2011 2012 2013 2014

Aver

age

Annu

al G

old

Pric

e ($

/oz)

Adju

sted

EBI

TDA

(mill

ions

)Delivering Growth in 2014

1. Please see note 1 on slide 43 2. CAGR: From December 2008 through December 2014

Record Revenues

2014: +10.4%

2014 Gold Price: -10%

CAGR2: +19.6%

Record Adj. EBITDA1

2014: +10.7%

CAGR2: +18.8%

$151.0 $155.1

$227.2

$411.2 $427.0

$400.9

$442.4

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$0$50

$100$150$200$250$300$350$400$450$500

2008 2009 2010 2011 2012 2013 2014

Aver

age

Annu

al G

old

Pric

e ($

/oz)

Reve

nue

(mill

ions

)

6

January Sabodala Stream $135 million

February Fire Creek/Midas Royalties $35 million

March Increased Dividend +11%

April Cerro Moro Royalty $20 million

August Bought Deal Financing $500 million

August Karma Stream $75 million

November Candelaria Stream $648 million

Record Corporate Activity in 2014

>$ 900 million committed in 2014

7

2014 Performance vs Guidance

Exceeded guidance

1. Original March 19, 2014 guidance pre-Candelaria2. See note 4 on slide 43

2013Results

2014 Guidance1

2014 Results without

Candelaria

2014 Results with

Candelaria

GEOs2 241,000 245 – 265,000 273,000 293,000

Oil & Gas Revenue $67 million $60-$70 million $74 million $74 million

8

GEOs1 Realized

GEOs1 realized increased 21.5% year over year

1. Please see note 4 on slide 43

100

150

200

250

300

350

2010 2011 2012 2013 2014

Gol

d Eq

uiva

lent

(000

oun

ces)

GOLD

PGM

other

237.7

293.4

230.3

156.2

241.4

9

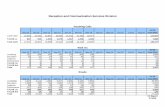

2014 Financial Results($ millions except gold price, GEOs, per share and %) Q4 2014 Q4 2013 FY 2014 FY 2013

Gold Price ($/ounce) $1,200 $1,272 $1,266 $1,411

Gold Equivalent Ounces (GEOs)1 92,774 69,741 293,415 241,402

Revenue $123.0 $100.0 $442.4 $400.9

Adjusted EBITDA2 96.2 77.3 356.9 322.5

Adjusted EBITDA2 Per share $0.62 $0.53 $2.37 $2.20

Net Income (Loss) 1.2 (80.6) 106.7 11.7

Net Income (Loss) per share $0.00 ($0.55) $0.71 $0.08

Adjusted Net Income3 31.6 30.5 137.5 138.3

Adjusted Net Income3 per share $0.20 $0.21 $0.91 $0.94

Margin4 78.2% 77.3% 80.7% 80.4%

1. Please see note 4 on slide 432. Please see note 1 on slide 433. Please see note 2 on slide 434. Please see note 3 on slide 43

Records

10

2014 Q4 Revenue Sources

By Commodity By Geography

88% Precious Metals80% from the Americas

Gold79%

PGMs9%

Other3% Oil & Gas

9%

US18%

Canada30%Latin

America32%

Rest of World20%

11

Adjusted Net Income1: 2013 to 2014

1. Please see note 2 on slide 43

138.3

41.5 2.7 1.6

33.8

12.7

137.5

12

Impairments Recorded

MWS: $26.6 million• This stream was capped as part of agreement to transfer asset

from First Uranium to AngloGold Ashanti• Benefit of blending both AngloGold dumps with First Uranium• More dependable producer in stronger hands

Exploration Assets: $4.5 million• Determined six exploration assets have been impaired• Net number of exploration assets increased over last year

No impact on current revenue and EBITDA

13

A High Margin and Scalable Business

1. Please see note 3 on slide 432. Average based on London PM Fix3. Fixed costs include corporate administration and business development4. Variable costs include costs of stream sales, production taxes and oil & gas operating costs

-200

-100

-

100

200

300

400

500

2010 2011 2012 2013 2014

Mill

ions

$

$925/oz$925/oz

79.2% 79.6% 81.5% 80.4% 80.7%

$1,669/oz $1,411/oz$1,569/oz

$1,225/oz

$1,266/oz

Margin1

Revenue

Au price2

Fixed Costs3

Variable Costs4

14

Business DevelopmentPaul Brink – SVP, Business Development

15

Duketon

Our Business Principles

Long term optionality

MaximizeExploration upside

Security of tenure

Management time on new deals

MinimizeCost exposure

Potential for encroachments

Involvement in operations

Goldstrike Candelaria

16

By-product StreamsCobre Panama - First Quantum

Palmarejo - Coeur Mining

3rd Party RoyaltiesCerro Moro – Yamana Gold

Brucejack – Pretium Resources

Hardrock – Premier Gold Mines

New Investment Opportunities

Since 1985

3

Gold Royalty/Streams to Fund Development

Stibnite Gold – Midas Gold

Kirkland Lake – Kirkland Lake Gold

Karma – True Gold Mining

Royalty/Streams through M&A

Sabodala – Teranga Gold

Fire Creek/Midas – Klondex Mines

Candelaria – Lundin Mining

Since 2008

Since 2011

Since 2013

Expanding growth options

17

Ring of Fire RoyaltiesFranco-Nevada is providing Noront Resources Ltd. with1:

• $22.5 million loan (5 year, 7%, secured on Cliffs’ ROF lands)

• $3.5 million for royalties

Royalties acquired are:

• 3% on Black Thor chromite deposit

• 2% on all Noront ROF properties except Eagle’s Nest

• 2% on certain other Cliffs’ properties

• 8 other 3rd party exploration royalties

Positive attributes to Franco-Nevada:

• Long term interest in a potential new mining camp

• Established world-class chromite resource

• Expect more nickel discoveries similar to Eagle’s Nest

• Additional VMS and/or gold potential

~600 km2

~400 km2

1. Expected to close April 201518

Ring of Fire Royalties

New royalties covering >1,000 km2

Noront properties

* Royalties do not cover the Eagle’s Nest deposit or certain JV ground

*

*

19

Available Capital

Capital Resources

Working Capital1 $ 678 million

Marketable Securities1 62 million

Credit Facility1 (undrawn) 500 million

Cobre Panama commitments (2015) (~325 million)

Other commitments (~75 million)

Total Available Capital $ >800 million

1. As at December 31, 2014

Liquid with NO DEBT

20

Oil & GasGeoff Waterman – COO

21

Oil & Gas Revenue vs Oil Price

* January and February 2015 average WTI price of $48.97

$35.8 $34.9$40.9

$67.0$73.9

$0

$20

$40

$60

$80

$100

$120

$0

$10

$20

$30

$40

$50

$60

$70

$80

2010 2011 2012 2013 2014 2015*

WTI

Oil

Pric

e ($

US/

Barr

el)

Reve

nue

(mill

ions

)

Revenue ($US) WTI Oil Price

Addition of Weyburn NRI

Oil & Gas 2015 revenue guidance: $20 – 30 million• Assumes: $50/bbl WTI and $7.00/bbl price differential• Sensitivity: 10% ∆ in WTI = ~25% ∆ in revenue

10% ∆ in CAD = ~6% ∆ in revenue

22

2015 Expected Revenue Sources (@$50 WTI)

Opportunity to add new O&G royalty assets

Assumes: • Midpoint of GEO guidance (see slide 35)

• $1,200 per ounce gold

• Midpoint of Oil & Gas guidance (previous slide)

Precious Metals93%

Other1% Oil & Gas

6%

23

Associated Gold Ounces & REUsKerry Sparkes – VP, Geology

24

2015 Asset Handbook

Includes:• Update on all our Producing &

Advanced Assets

• Details of ounces associated with each asset

• Details of our REUs estimates

• Oil & Gas reserves

• Other corporate information

Available Today: Website or Hard Copy

25

Gold Reserves Associated with FNV Assets

Seven straight years of increased gold reservesNotes: For a breakdown of Mineral Reserves and Resources by category and additional information relating to Mineral Reserves and Resources, calculated

in accordance with National Instrument 43-101, see pages 20-26 of Franco-Nevada’s 2014 AIF.Refer to slide 42 for “Cautionary Note Regarding Mineral Reserve and Resource Estimates” 26

Gold Resources Associated with FNV Assets

Reserve growth at expense of resources in 2014Notes: For a breakdown of Mineral Reserves and Resources by category and additional information relating to Mineral Reserves and Resources, calculated

in accordance with National Instrument 43-101, see pages 20-26 of Franco-Nevada’s 2014 AIF.Refer to slide 42 for “Cautionary Note Regarding Mineral Reserve and Resource Estimates” 27

New Assets:Candelaria

Karma

Dublin Gulch (Eagle)

Reserve & Resource Growth:Midas/Fire Creek

Hardrock

Cooke 4

Resources converted to Reserves:Stibnite Gold

Tasiast

Reserves converted to Resources:Marigold

Canadian Malartic

Bald Mountain

Reserve & Resource Declines:

Goldstrike

Mesquite

Duketon

South Kalgoorlie

Associated Ounces Notable Changes

28

Royalty Equivalent Units (REUs)

Rationale: • Better representation of value for royalty and stream company

• Reflects economics between NSRs, NPIs and Streams

Limitations:• Requires management guidance regarding:

o Ounces on royalty and stream claims vs public disclosure

o NPI cost economics for different properties

• Reflects life of mine economics and not annual production profiles

Details of REUs in 2015 Asset Handbook

Notes: For further information on REUs as well as how they are calculated, please refer to our 2015 Asset Handbook available on our website 29

REUs Comparison Year over Year

Overall growth in P&P and M&I REUsNotes: For further information on REUs as well as how they are calculated, please refer to our 2015 Asset Handbook available

on our website

0

2

4

6

8

10

12R

EUs

(Mo

z)

P&

PM

&I

Infe

rred

+116% +2%+4%

M&

I

M&

I

Infe

rred

-14%

2011 2012 2014

P&

P

P&

P

P&

P

Infe

rred

Infe

rred

M&

I

+71%

-12%

2013

30

OutlookDavid Harquail, President & CEO

31

Cobre Panama is Advancing

Expect $300-$350 million of funding in 2015

Power plant man camp

Port PP Foundation & conc. warehouse

Botija quarry

32

Cobre Panama Mill and Stockpile Reclaim

Aerial view

Lookingwest

LookingNW

Lookingsouth

33

2015 Expected Changes vs 2014

Candelaria: • 60,000 GEOs

Oil & Gas • Lower oil price

Other upsides:

• Hemlo (stronger NPI)

• Sabodala (full year)

• Goldstrike (less capex)

• Detour (continued ramp up)

Other downsides:• Subika (mine sequence & Ghana power)

• Peculiar Knob (iron ore mine closure)

• Stillwater (lower GEOs)

More upside than downside

34

2015 Guidance

Expected GEOs1: 335,000 – 355,000• 18% increase versus 2014 (assuming midpoint of guidance)

Oil & Gas revenue: $20 to $30 million2

• $49 million decrease versus 2014 (assuming midpoint of guidance)

Begin funding of Cobre Panama:• Estimate $300 - $350 million in 2015

1 Assuming: $1,200/oz Au; $1,200/oz Pt; $750/oz Pd2 Assuming $50/bbl WTI and $7.00/bbl price differential

35

Five Year Outlook (2019)

Expect GEOs1: 385,000 – 415,000• Cobre Panama producing based on First Quantum’s projections

• Candelaria delivering 60,000 GEOs/annum

• Guadalupe production at Palmarejo (decrease from minimum 50,000 oz/year)

• New production from Phoenix, Cerro Moro and Karma

• No expansion at Tasiast or Detour

• No inclusion of non-permitted projects: Rosemont (Az), Perama Hill, Agi Dagi or Brucejack

Oil & Gas revenue: $50 to $60 million2

1 Assuming: $1,200/oz Au; $1,200/oz Pt; $750/oz Pd2 Assuming $75/bbl WTI and $7.00/bbl price differential

36

Other Portfolio PotentialGoldstrike

• TCM ramp-up

• Supplementary ore from South Arturo

Candelaria • Lundin new mine plan

Subika / Ahafo • Mill expansion and underground decisions

Rosemont (HudBay) • Final permits

Lakeshore Gold • New 144 GAP zone discovery

Kirkland Lake Gold • Production growth & exploration

Sabodala • New zones converted into reserves

Brucejack • Permits and production decision

Hardrock • Centerra $300 million investment

Tasiast • Expansion at higher prices

Detour • Expansion at higher prices

Base metal assets • Advancement of Taca Taca and Relincho

Klondex • Exploration at Fire Creek and Midas

Musselwhite • Exploration upside

Other permitting possibilities • Perama Hill, Agi Dagi

37

Progressive DividendDividends

(US$ per share)Dividends & DRIP Paid

(US$ millions)

5% increase to dividend in Q2 2015Eighth consecutive year of dividend increases

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

2008 2009 2010 2011 2012 2013 2014

US$

/ s

hare

0

20

40

60

80

100

120

2008 2009 2010 2011 2012 2013 2014

US$

mill

ions

38

Franco-Nevada since IPORevenue

(US$ millions)Producing Mineral

Assets3Adjusted Net Income1

(US$ per share)

1. Please see note 2 on slide 432. Please see note 5 on slide 433. As at December 31

Market Capitalization3

(US$ billions)Working Capital2

(US$ millions)Dividends

(US$ per share)

39

What Differentiates Franco-Nevada?

OUR BOARD• Highly experienced in resource

investments • Owners with >$200 million invested

OUR BUSINESS MODEL• Focused on exploration upside• No long term debt• Sustainable and progressive dividends

OUR EXECUTIVES• Focused only on FNV, no other boards• Lower G&A than comparables• Active with deals and new innovations

OUR PORTFOLIO• Largest portfolio by number & type

(> 380 royalties, streams, NPIs...)• Most diversified by commodity

(Gold, PGM, O&G)• Most exploration optionality

(~38,000 km2)

SETTING THE BAR

40

Franco-Nevada Provides:

1. At March 23, 2015; FNV and S&P/TSX Global Gold Index converted to USD

Gold exposure at a discount

Growth – organic and acquisitions

Dividends vs. ETF fees

FNV IPO: Dec 2007

Why own a gold ETF?

-100%

-50%

0%

50%

100%

150%

200%

250%

300%

2008 2009 2010 2011 2012 2013 2014 2015

FNV

GOLD

S&P/TSX Global Gold Index

41

Q&A

Cautionary Note Regarding Mineral Reserve and Resource EstimatesThis presentation has been prepared in accordance with the requirements of Canadian securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all mineral resource and reserve estimates included in this presentation have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining and Metallurgy Classification System. NI 43-101 is a rule developed by the Canadian securities regulatory authorities which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 permits a historical estimate made prior to the adoption of NI 43-101 that does not comply with NI 43-101 to be disclosed using the historical terminology if the disclosure: (a) identifies the source and date of the historical estimate; (b) comments on the relevance and reliability of the historical estimate; (c) states whether the historical estimate uses categories other than those prescribed by NI 43-101; and (d) includes any more recent estimates or data available. Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and resource information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by the Corporation in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards. In addition to NI 43-101, a number of resource and reserve estimates have been prepared in accordance with the JORC Code or the SAMREC Code (as such terms are defined in NI 43-101), which differ from the requirements of NI 43-101 and U.S. securities laws. Accordingly, information containing descriptions of the Corporation’s mineral properties set forth herein may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.

42

Notes1. Adjusted EBITDA and Adjusted EBITDA per share are non-IFRS financial measures, which excludes the following from net income and net

income per share: income tax expense/recovery; finance expenses and finance income; foreign exchange gains/losses and other income/expenses; gains/losses on the sale of investments; impairment charges related to royalty, stream and working interests and investments; depletion and depreciation; and non-cash costs of sales. Management believes that Adjusted EBITDA is a valuable indicator of the Company’s ability to generate liquidity from operating cash flow to (i) fund working capital needs; (ii) service working interest capital requirements; (iii) fund acquisitions and commitments; and (iv) fund dividend payments. Management uses Adjusted EBITDA for this purpose and other internal purposes. Management’s internal budgets and forecasts do not reflect potential impairment charges, fair value changes or foreign currency translation gains or losses. Consequently, the presentation of this non-IFRS financial measure enables investors and analysts to better understand the underlying operating performance of our business through the eyes of management. Adjusted EBITDA may be used by investors and analysts for valuation purposes. Management periodically evaluates the components of this non-IFRS financial measure based on an internal assessment of performance metrics that it believes is useful for evaluating the operating performance of our business and a review of the non-IFRS measures used by analysts and other royalty/stream companies. Adjusted EBITDA is intended to provide additional information to investors and analysts, does not have any standardized meaning under IFRS and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Adjusted EBITDA excludes the impact of cash costs of financing activities and taxes, and the effects of changes in operating working capital balances, and therefore is not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate Adjusted EBITDA differently. See the following appendix for non-IFRS reconciliation for 2014 and 2013. Please refer to the relevant Annual MD&A for non-IFRS reconciliation for 2012, 2011 and 2010. Adjusted EBITDA for 2009 and 2008 provided for illustrative purposes only as these years predate IFRS.

2. Adjusted Net Income and Adjusted Net Income per share are non-IFRS financial measures, which excludes the following from net income and net income per share: foreign exchange gains/losses and other income/expenses; gains/losses on the sale of investments; impairment charges related to royalty, stream and working interests and investments; unusual non-recurring items; and the impact of income taxes on these items.

3. Margin is defined by the Company as Adjusted EBITDA divided by revenue.

4. GEOs include our gold, platinum, palladium and other mineral assets. GEOs are estimated on a gross basis for NSR royalties and, in the case of stream ounces, before the payment of the per ounce contractual price paid by the Company. For NPI royalties, GEOs are calculated taking into account the NPI economics. Platinum, palladium and other minerals were converted to GEOs by dividing associated revenue, which includes settlement adjustments, by the average gold price for the period. Commodity prices : $1,266/oz gold (2013 - $1,411/oz); $1,385/oz platinum (2013 - $1,487/oz); $803/oz palladium (2013 - $725/oz) and $19.05/oz silver (2013: $23.86/oz).

5. Working Capital is a Non-IFRS financial measure. The Company defines Working Capital as current assets less current liabilities.

43

Appendix – Non IFRS Measures

Three months ended December 31,

Twelve months ended December 31,

(expressed in millions, except per share amounts) 2014 2013 2014 2013 Net Income (Loss) $ 1.2 $ (80.6) $ 106.7 $ 11.7

Income tax expense 10.2 (17.1) 50.3 22.3 Finance costs 0.4 0.6 1.6 1.9 Finance income (0.9) (1.0) (3.9) (3.5) Depletion and depreciation 48.9 34.4 163.1 129.3 Non-cash costs of sales 2.6 - 6.0 - Impairment of royalty, stream and

working interests 30.9 112.9

31.1

112.9 Impairment of investments 0.4 24.8 0.4 30.7 Foreign exchange (gains)/losses and

other (income)/expenses 2.5 3.3

1.6

17.2

Adjusted EBITDA $ 96.2 $ 77.3 $ 356.9 $ 322.5 Basic Weighted Average Shares Outstanding 156.2 147.1

150.5

146.8

Adjusted EBITDA per share $ 0.62 $ 0.53 $ 2.37 $ 2.20

Three months ended

December 31, Twelve months ended

December 31, (expressed in millions, except per share amounts and Margin)

2014 2013 2014 2013

Net Income (Loss) $ 1.2 $ (80.6) $ 106.7 $ 11.7 Income tax expense 10.2 (17.1) 50.3 22.3 Finance costs 0.4 0.6 1.6 1.9 Finance income (0.9) (1.0) (3.9) (3.5) Depletion and depreciation 48.9 34.4 163.1 129.3 Non-cash costs of sales 2.6 - 6.0 - Impairment of royalty, stream and

working interests 30.9 112.9

31.1

112.9 Impairment of investments 0.4 24.8 0.4 30.7 Foreign exchange (gains)/losses and

other (income)/expenses 2.5 3.3

1.6

17.2

Adjusted EBITDA $ 96.2 $ 77.3 $ 356.9 $ 322.5 Revenue 123.0 100.0 442.4 400.9 Margin 78.2% 77.3% 80.7% 80.4%

44

Appendix – Non IFRS Measures

Three months ended

December 31, Twelve months ended

December 31, (expressed in millions, except per share amounts) 2014 2013 2014 2013 Net Income (Loss) $ 1.2 $ (80.6) $ 106.7 $ 11.7

Foreign exchange (gains)/losses and other (Income)/expenses, net of income tax 1.1 0.5

1.6

2.3

Mark-to-market changes on derivatives, net of income tax 0.1 1.7

(1.1)

9.9

Impairment of royalty, stream and working interests, net of income tax 29.4 83.3

29.5

83.3

Impairment of investments, net of income tax 0.4 25.6 0.4 30.8 Indexation adjustment (0.6) - 0.4 - Credit facility costs written off, net of income tax - - - 0.3

Adjusted Net Income $ 31.6 $ 30.5 $ 137.5 $ 138.3 Basic Weighted Average Shares Outstanding 156.2 147.1 150.5 146.8 Basic EPS $ 0.01 $ (0.55) $ 0.71 $ 0.08

Foreign exchange(gains)/losses and other (income)/expenses, net of income tax 0.01 0.01

0.01

0.02

Mark-to-market changes on derivatives, net of income tax - 0.01

-

0.07

Impairment of royalty, stream and working interests, net of income tax 0.19 0.57

0.20

0.57

Impairment of investments, net of income tax - 0.17 - 0.20 Indexation adjustment (0.01) - (0.01) -

Adjusted Net Income per share $ 0.20 $ 0.21 $ 0.91 $ 0.94

45

Appendix – Income Taxes

Depletion and balances as at December 31, 2014: Applicable statutory tax rates as at December 31, 2014:CANADA Canadian combined income tax rates (Canadian Oil & Gas, Canadian

Mining Assets)• Canadian Oil & Gas: 10% declining balance ($419.7M CAD) • 2015 & thereafter – 24.9%• Canadian Mining: 30% declining balance ($69.9M CAD)• Foreign Assets: generally lesser of income and 30% declining balance, with a minimum of 10% declining balance ($83.0M CAD)

Canadian combined income tax rates (Deposit Structure, Foreign Mining Assets)

• Deposit Structure ($167.7M USD) • 2015 & thereafter - 26.5%

UNITED STATES UNITED STATES• Generally uses cost depletion on a units of production basis ($538.6M USD)

• United States combined income tax rate is 36.3%

AUSTRALIA AUSTRALIA • Generally computed on a units of production basis ($56.7M AUD) • Australian income tax rate is 30.0%

MEXICO MEXICO• Generally claimed at 15% straight line ($485.7M MXN) • Mexican income tax rate is 30.0%

BARBADOS BARBADOS• Deposit Structure ($793.8M USD) Profits < $5M USD - 2.50%

$5M USD < Profits < $10M USD - 2.00%$10M USD < Profits < $15M USD - 1.50%$15M USD < Profits - 0.25%

46

Appendix - Book Value at Dec 31, 2014GOLD – UNITED STATES PRODUCING ADVANCED &

EXPLORATION PGMs PRODUCING ADVANCED &

EXPLORATION Goldstrike $113.1 M $0.0 M Stillwater $158.9 M $0.0 MGold Quarry 58.2 0.0 Pandora 13.7 0.0Marigold 19.7 0.0 OTHER MINERALS Bald Mountain 25.9 7.5 Mt. Keith 13.3 0.0Other 16.7 42.9 Osborne 6.3 0.0

GOLD – CANADA Other 21.0 82.8Detour 14.9 0.0 OIL & GAS Sudbury 167.1 0.0 Weyburn 410.7 0.0Kirkland Lake 46.6 0.0 Midale 19.6 0.0Other 47.7 73.9 Other 48.5 25.4

GOLD –Latin America TOTAL OTHER: $692.0 M $108.2 MCandelaria 637.1 0.0Palmarejo 29.4 0.0 TOTAL: $2,311.6 M $325.2 MCerro San Pedro 3.0 0.0Cobre Panama 0.0 4.2

GOLD – INTERNATIONALSabodala 123.5 0.0Tasiast 2.4 0.0MWS 172.0 0.0Cooke 4 73.3 0.0Subika 42.8 0.0Edikan 24.0 0.0Other 2.2 88.5

TOTAL GOLD: $1,619.6 M $217.0 M

47