FINANCIAL TRANSPARENCY REPORT 2018

Transcript of FINANCIAL TRANSPARENCY REPORT 2018

FROM THE

COUNTY

EXECUTIVE

November 18, 2019

Dear St. Louis County residents,

St. Louis County has faced its share of challenges this year. For good reason, many

of us lost trust in county government. So, when I became County Executive, I knew

that our first order of business was restoring trust.

Restoring trust requires being open, honest, and forthright in communicating what we

have done, are doing, and will do. We must both tell the truth in a way our residents

can verify and give our residents the tools to verify that what we say is

true. Transparency empowers all of you to hold your government accountable.

Every November, the County Executive sends the County Council a budget. But all

too often the county government’s financial information is difficult to decipher. So this

year – for the first time – we’re publishing this Financial Transparency Report. This

report makes the County’s finances easier to understand and is part of our broader

effort to increase transparency throughout County government.

Sincerely,

Sam Page

County Executive

This Financial Transparency report will serve as

St. Louis County’s Popular Annual Financial

Report (PAFR) which is an unaudited summary

report of the financial activities of the County

and is prepared primarily from detailed

information contained in the County’s

Comprehensive Annual Financial Report (CAFR).

The CAFR is prepared in accordance with general

accepted accounting principles (GAAP) and

provides detailed information and includes an

audit from an independent accounting firm. The

GAAP presentation also includes the County’s

component units and other information on the

various County funds.

The information in the CAFR can be technical

and complex and as such not as useful to

residents wishing to gain an overview of the

County’s finances. The PAFR has been prepared

to simplify the information in the CAFR, without

the use of technical accounting terms or

excessive detail.

Questions or feedback concerning the

information contained in this report or requests

for additional information may be directed to the

County’s Department of Fiscal Management at

41 South Central Avenue, 8th Floor, Clayton, MO

63105.

The CAFR and PAFR are available online at:

stlouisco.com/fiscalmanagement

ABOUT

THIS

REPORT

PAGE 1

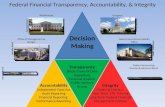

FINANCIAL TRANSPARENCY

REPORT

ST. LOUIS COUNTY

GOVERNMENTA COMPLEX COUNTY

THE CHARTER & BUDGET PROCESS

St. Louis County government’s budget is large and complex, much like the

county itself. St. Louis County has the most people, roads, houses, jobs, work

force, and cities than any other county in Missouri. If a budget is viewed as a

funding plan to carry out an organization’s mission, then it is not surprising that

the county’s budget reflects the size and diversity of the constituency it serves.

Unique among counties, St. Louis County provides countywide services to its

nearly one million residents, local services to more than 300,000 residents in

unincorporated areas, and specialized contractual services to other jurisdictions,

including the 88 municipalities within St. Louis County. Additionally, St. Louis

County owns and operates Spirit of St. Louis Airport as a self-supporting

enterprise.

St. Louis County’s Charter requires the County Executive to submit a balanced

budget to the County Council by November 1st, prior to the start of the County’s

fiscal year in January. The budget must include a complete financial plan for all

county funds and activities, including proposed tax rates, an estimate of all

income and revenue, and all proposed expenditures for current operations, debt

service and a capital program.

PAGE 2

CONTENTS

05

06

07

Get to know St. Louis County, MO

The Fiscal Management Division

The Finances

St. Louis County, MO Quick Facts

St. Louis County Statistics

09

10

11

12

13

14

PAGE 3

The Budget

Revenues

Statement of Activities

Net Position

Debt

Explaining your sales tax

FISCAL

MANAGEMENT

DIVISION

The Fiscal Management Division is

responsible for operating and

supervising the County's accounting

systems, preparing the Comprehensive

Annual Financial Report (CAFR); and

taking an annual inventory of all County

property.

The GFOA awarded a Certificate of

Achievement for Excellence in Financial

Reporting to St. Louis County, Missouri

for its CAFR for the fiscal year ended

December 31, 2017. To receive this

award, a government unit must publish

an easily readable and efficiently

organized CAFR that satisfied both

accounting principles generally

accepted in the United States of

America and applicable legal

requirements.

PAGE 5

QUICK FACTS

ST. LOUIS COUNTY

FOUNDED 1812

DEMOGRAPHICS

GEOGRAPHY

524 square miles

St. Louis County is the 43rd most populous county

in the Nation and the largest county in Missouri

36% of the bi-state region lives in St. Louis

County

PAGE 6

STATISTICS

ST. LOUIS COUNTY

PAGE 7

Employer EmployeesPercentage of Total County

Employment

Washington University in St. Louis 15,818 3.1%

SSM Healthcare 14,926 2.9%

Mercy Healthcare 14,195 2.8%

Boeing Defense, Space & Security 14,000 2.7%

Schnucks Markets Inc. 9,956 1.9%

Special School District of St Louis County 6,272 1.2%

Edward Jones 6,100 1.2%

Enterprise Holdings 5,500 1.1%

Express Scripts Holding Co. 5,323 1.0%

St. Louis County Government 4,216 0.8%

Total 96,306 18.7%

PER CAPITA INCOME

UNEMPLOYMENT

MAJOR EMPLOYERS

2.9%UNEMPLOYMENT RATE

$67,029PER CAPITA

PERSONAL INCOME

$54,830

$50,701$52,528

$54,074

$59,799$58,401

$60,540$62,194

$62,777$67,029

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

U.S. Department of Commerce, Bureau of Economic Analysis

Missouri Economic Research and Information Center, Missouri Department of Economic

Development

5.9

2.9

STLCO’s

BUDGET

General Fund - The General Fund is the general operating fund of the County. It is used to account for all

financial resources except those required to be accounted for in another fund. The General Fund is divided

into four separate departments under the captions General Government, Department of Highways and Traffic,

Department of Health, and Department of Parks and Recreation in order to reflect the County's financial

administration and organization as currently required by ordinance. Certain transactions between the General

Fund departments have been eliminated for presentation in the financial statements.

Public Mass Transit Fund - A Special Revenue Fund used to record the countywide one-half percent

transportation sales tax, the one-half percent Prop A, and the MetroLink light rail Prop M one-quarter percent

sales tax receipts and related expenditures for public mass transportation purposes.

Emergency Communications Fund - A Special Revenue Fund used to record the countywide one-tenth percent

sales tax receipts and related expenditures for a countywide emergency communications system.

Community Children’s Services Fund - A Special Revenue Fund used to record the countywide one-quarter

percent sales tax receipts and related expenditures for support of children services.

Convention and Recreation Trust Fund - A Special Revenue Fund used to record revenue received from a

three and one-half percent hotel/motel tax used to fund the County's share of the debt service payments and

preservation payments of the St. Louis Regional Convention and Sports Complex Authority and debt service

payments for the St. Louis Cardinals Ballpark Site and Ballpark Project.

Debt Service Fund - The Debt Service Fund is used to account for the accumulation of resources for, and the

payment of, long-term debt principal, interest, and related costs.

Capital Projects Fund - The Capital Projects Fund accounts for financial resources used for the acquisition or

construction of major capital facilities, other than those financed by proprietary funds. The Capital Projects

Fund consists of the aggregation of various individual capital projects.

Other Governmental Funds – These funds include Special Revenue Funds, which account for the proceeds of

specific revenue sources that are legally restricted to expenditures for specific purposes.

Enterprise Funds - Enterprise Funds are used to account for operations that are financed and operated in a

manner similar to private business enterprises, where the intent of the governing body is that the costs

(including depreciation) of operations are financed primarily through user charges. An Enterprise Fund has

been established for the Airport. The Airport Fund is defined as a major fund and is used to account for

activities of the County's airport operation financed primarily from fuel sales and facility leases

PAGE 9

REVENUES

$831.8 milin total revenue

$388.3 milSales tax

$118.4 milProperty tax

Nearly 70% of the

County’s $831.8 million in

revenue is generated by

taxes, including property,

sales, utility gross receipts,

and casino taxes

PAGE 10

NET POSITION

STATEMENT OF

The Statement of Net Position presents information on all

of the County’s assets and liabilities, with the difference

between the two reported as net position. These

increases and decreases in net position may serve as a

useful indicator of whether or not the financial position of

the County is improving or worsening.

Governmental

Activities

Business-type

ActivitiesTotal 2018 Total 2017

Assets

Current and other assets 870,085,130 20,966,636 891,051,766 845,281,821

Capital assets, net 1,119,097,703 51,714,140 1,170,811,843 1,163,459,258

Total assets 1,989,182,833 72,680,776 2,061,863,609 2,008,741,079

Deferred Outflows 81,695,422 365,358 82,060,780 95,144,599

Liabilities

Current liabilities 154,166,046 837,209 155,003,255 154,784,829

Noncurrent liabilities 842,699,004 1,363,574 844,062,578 924,907,753

Total liabilities 996,865,050 2,200,783 999,065,833 1,079,692,582

Deferred Inflows 74,760,630 2,243,672 20,117,472 20,117,472

Net Position

Net investment in capital

assets 824,737,774 51,714,140 876,451,914 852,433,219

Restricted 501,948,359 - 501,948,359 452,851,167

Unrestricted (deficit) (327,433,558) 16,887,539 (310,546,019) (301,208,762)

Total net position 999,252,575 68,601,679 1,067,854,254 1,004,075,624

+6.4%from 2017

PAGE 11

REVENUES &

EXPENSES

ACTIVITIES

STATEMENT OF

PAGE 12

The table above quantifies the revenue and expenses of St. Louis County and shows the overall change in net position (revenues

less expenses). Revenues are summarized by source and expenses are shown to reflect the various functions of the County

government. Again, increases and decreases in net position may serve as an indicator of whether or not the financial position of

the County is improving or worsening. The table is divided into three columns: Governmental Activities, Business Activities and

Total Primary Government.

Governmental Activities encompasses all governmental funds through which most governmental functions are financed. These

funds include the General Fund, Public Mass Transit Fund, Emergency Communications Fund, Community Children’s Service Fund,

Convention and Recreation Trust Fund, Debt Service Fund, Capital Projects Fund, and Other Non-Major Funds.

The Business-type Activities are solely related to the County’s operations of Spirit of St. Louis Airport, which is financed primarily

from fuel sales and facility leases.

2017

Revenues

Program revenues:

Charges for services $ 125,303,853 $ 114,415,641 $ 19,843,876 $ 16,314,451 $ 145,147,729 $ 130,730,092

Operating grants and contributions 56,957,076 60,650,512 - 219,821 56,957,076 60,870,333

Capital grants and contributions 39,511,350 31,398,484 1,718,612 937,186 41,229,962 32,335,670

General revenues:

Property taxes 118,357,835 115,986,304 - - 118,357,835 115,986,304

Other taxes 445,158,705 399,706,113 - - 445,158,705 399,706,113

Other revenue 13,885,074 10,495,563 7,732 - 13,892,806 10,495,563

Investment earnings 10,727,950 5,301,323 323,372 143,869 11,051,322 5,445,192

Total revenues 809,901,843 737,953,940 21,893,592 17,615,327 831,795,435 755,569,267

Expenses

General government 131,560,618 125,739,182 - - 131,560,618 125,739,182

Public safety 222,257,843 202,794,822 - - 222,257,843 202,794,822

Human services 49,420,528 61,878,091 - - 49,420,528 61,878,091

Highways and traffic 83,923,176 82,764,065 - - 83,923,176 82,764,065

Health 47,679,526 47,596,313 - - 47,679,526 47,596,313

Parks and recreation 29,264,221 33,418,355 - - 29,264,221 33,418,355

Transportation 159,804,977 146,149,154 - - 159,804,977 146,149,154

Convention and recreation - 100,000 - - - 100,000

Interest and fiscal charges 23,908,677 23,512,083 - - 23,908,677 23,512,083

Spirit of St. Louis Airport - - 21,161,488 17,425,014 21,161,488 17,425,014

Total expenses 747,819,566 723,952,065 21,161,488 17,425,014 768,981,054 741,377,079

Change in net position 62,082,277 14,001,875 732,104 190,313 62,814,381 14,192,188

Beginning net position 936,206,049 922,204,174 67,869,575 67,679,262 1,004,075,624 989,883,436

Prior period adjustment 964,249 - - - - 964,249 -

Beginning net position, as restated 937,170,298 922,204,174 67,869,575 67,679,262 1,005,039,873 989,883,436

Ending net position $ 999,252,575 $ 936,206,049 $ 68,601,679 $ 67,869,575 $ 1,067,854,254 $ 1,004,075,624

2018 2018 2017 2018 2017

Total

Primary Government

Business-type

Activities

Governmental

Activities

0.25%

0.50%0.25%

SALES TAX

EXPLAINING YOUR

7.615%Total sales tax rate in St. Louis

County

2018 sales tax revenue

generated for St. Louis County

$388.3 mil

MO: 4.225%STLCO: 3.39%

9Separate sales taxes to

finance both general

government operations

and specialized functions

QUICK FACTS

Sales tax rate

4.225%

1.00%

0.50%0.10%

0.19%

0.10%

State of Missouri

General

Public Safety

Metro Parks

Transportation

Mass Transit (Prop M)

Children’s Services

Emergency Comm.

Arch/River

0.50% Mass Transit (Prop A)

PAGE 13

NET POSITION

DEBT

2018 2017

General obligation bonds $ 92,215,000 $ 96,850,000

Contractual obligations 62,755,000 69,140,000

Bond payable - Tax increment financing 15,140,000 16,100,000

Note payable - Tax increment financing 103,058,315 80,729,225

Bond payable - Special obligation - Refunding COP - 3,325,000

Bond payable - Special obligation - 2010 issue 149,975,000 156,410,000

Bond payable - Special obligation - 2011 issue 1,120,000 1,275,000

Bond payable - Special obligation - 2012 issue 1,560,000 1,710,000

Bond payable - Special obligation - 2013 issue 42,950,000 43,690,000

Bond payable - Special obligation - 2015 issue 29,205,000 31,290,000

Bond payable - Special obligation - 2016 issue 10,730,000 11,815,000

Bond payable - Special obligation - 2017 issue 31,435,000 32,940,000

Loan payable - Section 108 - 3,000,000

Bond payable - Special obligation - NID 320,000 340,000

Bond payable - Special obligation - Hazelwood 4,810,000 5,110,000

Capital Leases 31,900 -

Unamortized bond premium 10,586,842 11,548,928

Compensated absences 41,343,910 36,958,301

Claims payable 14,942,109 17,714,135

$ 612,178,076 $ 619,945,589

The County’s long term debt obligations, or debt, totaled $612,178,076 in 2018; a net decrease of $7.8M or -1.3% from the prior year’s balance of

$619,945,589.

PAGE 14