Financial Planning in Start-Up Companies

Transcript of Financial Planning in Start-Up Companies

FINANCIAL PLANNING IN START-UP COMPANIES

Presentation for Venture Cup

29.1.2003

Janne Jutila

Nokia Early Stage Technology Fund

Overview

• Key elements in founding a company

• How financial plan too often looks like?

• Key issues in financial planning• When looking for initial financing• When operational – seed, growth and profitability

phase• One financial planning framework• Link into risk management• Two common pitfalls

• Introduction to venturing and private equity investment in Nokia

Key Elements for Starting a Company

New Co

Business Idea

Team Capital

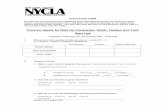

Usually Start-up Financing Plans Start Like This…

1H/2002 2H/2002

Sales Volume 0,6 1,4

Unit Price 150 150

Estimated price erosion

Sales 90 210

Material per Unit 40 40

Labor per Unit 30 25

Direct Costs 42 91

Retrofit % 7% 5%

Warranty % 3% 3%

Retrofit and Warranty 9 17

Other direct cost ( sales 15 %) 14 32

Total Direct Cost 65 139

SALES MARGIN 26 71

SALES MARGIN % 28% 34%

1H/02Total Sales 90Total Direct Costs 65Sales volume 1

TOTAL SALES MARGIN 26TOTAL SALES MARGIN % 28%

FIXED COSTS

Production FPO % of Sales 3%Production FPO 3Prod. line Depreciation 0

GROSS MARGIN 23

Travel 20Development costs in R&D 96Marketing 96Others 36Fixed costs Sub total 248

OPERATING PROFIT -225

CAPITAL CHARGE 4

PROFIT 1 -22996583 349209 523814 12448340,193 0,184 0,175 0,1665,0% 5,0% 5,0% 5,0%

18 684 64 175 91 450 206 4620,06783 0,0644385 0,0644385 0,0612166

0,005 0,005 0,005 0,0057 034 24 249 36 373 82 4290,0% 0,0% 0,0% 0,0%1,5% 1,2% 1,0% 1,2%

280 770 914 2 4782803 9626 13717 30969

10 117 34 645 51 005 115 8768 567 29 530 40 445 90 58746% 46% 44% 44%

2H/04 1H/05 2H/05 1H/0657 874 208 253 296 760 669 39839 790 144 119 207 294 469 016168130 628580 942870 2240706

… And Continue With Famous Hockey Stick

-200

-100

0

100

200

300

400

500

600

700

2003 2004 2005 2006 2007 2008

Sales

Cumulativecash-flow

Hardly any investment

Amazing growth

Even more amazing profitability

Two year hockey-stick

Sales and profitability forecast for NewCo

Key Issues When Looking For Initial Financing

• Realistic income assumptions (sales volume, pricing, margins)

• Timing usually most critical

• Cost budgeting top down rather than bottom up• Example from building a house• Timing of cost increases critical

• How far into future?

• Right level of detail

• Link to business plan• Milestones

• Working capital needs

• Sensitivity analysis tied to business case• Business case scenarios rather than financial scenarios

When Operational – Seed Phase

• Nature of financial planning – operational goals, cost accounting

• Do we know the true cost of pilot projects /first customers?

• Project planning and budgeting• Documentation• Building processes• Realistic timing

• Initial sales – delays, setbacks

• Light tools for planning

• Outsourcing

Growth / Profitability Phase

• What is the growth / profitability trade-off• Links to all aspects of business plan• Influences risk level and drives value creation• Strategy choice that is driven by financial planning

• Development of internal processes and systems• ERP and financial planning tools

• Dedicated financial staff• Controller, treasurer, CFO• Clear roles and responsibilities

Financial Planning Framework

Planning and budgeting

• Monthly/quarterly income statement & balance sheet

• Comparison to budget

• Reporting to board, management, employees

•Complemented with business update

Follow-up and reporting

• Rolling planning cycle•Monthly/quarterly basis for two years•Firm budget for next two quarters

• All functions of the firm – sales, production etc.

• Financing plan updated and agreed by board for budget period

• Clear, documented policies and responsibilities

Venture capitalists are generally good in taking bad news but not good at all in

taking surprises

Link to Risk Management

Type of risk Impact of risk

Likelihood

Actions to reduce or manage risk

Business risks

Operational risks

Financial risks

Legal risks

Two Common Pitfalls

• Securing financing takes often long

•Speed in progress is a good indicator of interest•Multiple discussions in different stages•High cost

• Financing round takes a lot of management time

•How to move forward operationally during negotiations?•Flexibility•Decision making

• VC’s are masters in complicated contracts

•Special terminology and clauses•Legal overhead

• Complexity grows each financing round

•Adding to time and transaction cost

• Different risk / reward –position may influence decision making if things go south

Time Consumption Separation of risk and reward

A comprehensive set of vehicles for venturing in place

Future link withcore business

Existing core

Main businessdriver

Expanding CoreBusiness

ROI &Strategic Option

ROI

Non-corePossiblyHighly likely

Strategic New Businesses

External VC Fund(NVO/NVP)

Internal Venture Fund(NVO/NEST)

Corporate Venturing(NVO/NGB)

Venturing in BUs(NMP, NET, NRC, etc.)

Technology & BusinessSpace Exploration(NRC, NVO/I&F)

Nokia Early Stage Technology Fund

Financing Criteria• Primarily Nokia originated deal flow• € 40 M fund – seed and first round financing• Highly attractive business potential• NEST Investment typically between € 1 - € 3 million• Possibility to syndicate with internal/external partners

Additional• Portfolio companies are independent legal entities• Transparent market based valuations on transfers

and exits• No business guarantees from business units

Exit Options• Nokia, trade sale to industrial or financial players,

public markets

Nokia Venture Partners

• Nokia Venture Partners is an independent Venture Capital fund

• Nokia Venture Partner invests in EXTERNAL companies • The target companies have exceptional technology,

good management and potential to become a major international player in its own field

• The target companies must operate in Mobile and IP Technologies areas

• Nokia Venture Partners have 650m$ under management

• Value-add investors: Nokia, Goldman Sachs, BMC Software, CDB WebTech and others

• Typical initial investment is 3-6m$ • Current portfolio: 25 companies and 10 exits

Thank You and all the best luck!

Nokia Early Stage Technology Fund

Nokia Venture Partners