Financial Performance of Kist Bank

-

Upload

deepesh-sharma -

Category

Documents

-

view

218 -

download

4

Transcript of Financial Performance of Kist Bank

FINANCIAL PERFORMANCE OF KIST BANK

In partial fulfillment of the requirement for the degree ofBachelor in Business Administration (BBA)

March 2014 Kathmandu, Nepal

Table of Contents

CHAPTER 1

1. Introduction

1.1 Background of the study

1.2 Background of the Company

1.3 Statement of Problem

1.4 Objective of Study

1.5 Significance of the Study

1.6 Limitation of Study

1.7 Organization of Study

1.0 Introduction

1.1 Background of study

The bank is an institution established by law, which deals with money and credit is called

banking. In other words, it is obvious that an institution which deals with money, receiving it on

deposits from customers, honoring customers drawings against such deposits and demand,

collecting cheques from customers, and lending or investing surplus deposits until they are

required for repayment.

The financial institutions or banks are the crucial ways not only for financing activities but also

provides all types of activities related to finance. Financial performance of financial institutions

is well advanced in its measurement within the field of finance and management. The core aim

of the study is to analyze the financial data of Kist bank ltd..

A sound banking system is important because of the key role it plays in the economy

intermediation, maturity transformation, facilitating payment flows, credit allocation and

maintaining financial discipline among the borrowers In any economy whether highly developed

financial market or less well developed financial markets, bank remain at the centre of

economic and financial activity and stand apart from other institution as primary providers of

payment services and a fulcrum for monetary policy implementation.

Financial analysis is an integral aspect of operating a successful business. Analysis of firm’s

income statement and balance sheet can provide valuable data that executives and managers can

use to make informed business decision. A bank should be certain that its financial statements

are accurate. Data gleaned from inaccurate financial statement will yield financial analysis that

may not be helpful in making proper decision. A greater awareness of financial statements and

their interrelationship can lead to improved profitability or cash flow.

1.2 Background of the Company

“ Kist bank stands for the customers’ convenience, support and providing Power to Succeed.”

Kist Bank, established in 2003, with a vision of becoming the best Bank on operational

excellence and superior financial performance, has the authorized Capital of NPR 10 billion;

issued capital of NPR 2 billion and Paid-Up Capital NPR 2 billion.

60% of the paid-up capital is held by the promoters and remaining 40% by the general public.

The share of the Bank is listed at Nepal Stock Exchange Limited (NEPSE), the only Stock

Exchange in the country, as 'A' category company...The Bank has a seven member Board of

Directors with the representation of three Directors from the promoters' group, two Directors

from general public and one as Professional Director.

Kist Bank stands for customers' convenience and support. The Bank is driven by values of

efficiency in operations, integrity and a strong focus on catering the needs of every customer by

offering high quality and cost effective products and services.

The Bank has wider range of products and services, which covers Business Banking,

Institutional Banking, Small and Medium Enterprises Banking, Consumer Banking, Micro-

financing, Transaction Banking. The Bank has also been providing Cards, Remittance, Internet

Banking, Mobile Banking (both through four wheeler vehicle and cell phone), etc services.

The Bank has 365 days banking and provides evening banking services from all branches.

Deposit and Withdrawal services are available from all branches at free of cost.

The Bank is equipped with a robust system for Risks Management. The professional

management team, along with dedicated employees, is always looking forward to serving the

customers, understanding their needs and designing the tailored-made products and services,

who are equipped with a state-of-art technology and IT infrastructures.

Mission

Our mission is to become the leading bank by providing the best quality financial products and

services to our customers, enhancing our shareholders’ value, contributing to the economic

prosperity of the country and creating excellent opportunity for our employees.

Vision

Our vision is to become the best bank based on operational excellence and superior financial

performance.

Board of directors

Mr. Ram Prasad Dahal

Chairman

Mr. Bishnu Gopal Shrestha

Director

Mr. Pushpa Bahadur Pradhan

Director

Mr. Dakshya Poudyal "Subhash"

Director

Ms. Kusum Lama

Director

Mr. Parmeshwor Lal Pradhan

Director MR. Rishi Ram Gautam

Professional Director

Management team

Mr. Kumar Lamsal

(Chief Executive Officer)

Mr. Bal Kumar Pandey

(Chief Legal & Compliance Officer)

Mr. Bhesh Raj Khatiwada

( Chief Credit Officer)

Mr. Ashok Sherchan

(Deputy Chief Executive Officer)

Mr. Bam Dev Dahal

(Chief Operating Officer)

Mr. Mukunda Subedi

(Head - Central Finance)

Mr. Tara Manandhar

(Chief Business Officer)

Mr. Rishi Ram Neupane

(Head - IT Department)

Mr. Pradeep Khanal

(Head-Deposit Marketing/ Branch Co-ordination)

Mr. Ranjan Pandey

(Manager-Central Credit Risk Assessment)

Mr. Surendra Chand

(Head-Central Credit Administration)

Share capital

The Authorized Capital of the Bank is Rupees 10 billion and the Issued & Paid-Up Capital is

Rupees 2 billion. 60 percent of the Paid-Up Capital is held by the promoter and remaining 40%

is held by the general public. The Bank is listed at Nepal Stock Exchange Limited (NEPSE).

Authorized Capital

The authorized capital of the Bank is Rupees 10,000,000,000.00 (Rupees Ten billion Only)

divided into 100 million equity shares of Rupees 100.00 each.

Issued Capital

The issued capital of the Bank is Rupees 2,000,000,000.00 (Rupees Two billion Only) divided

into 20 million equity share of Rupees 100.00 each.

Paid-Up Capital

The Paid up capital of the Bank is Rupees 2,000,000,000.00 (Rupees Two billion Only) divided

into 20 million equity share of Rupees 100.00 each.

Year Total Paid up capital

Commencement of

business30 Million

2005 IPO of Rupees 20 million totaling Paid-Up Capital Rupees 50 million

20061:1 right share issue of Rupees 50 million totaling Paid-Up Capital to

Rupees 100 million

20071:1 right share issue of Rupees 100 million totaling Paid-Up Capital to

Rupees 200 million

Early 20081:3 right share issue of Rupees 600 million totaling Paid-Up Capital to

Rupees 800 million

By the end of 20081:1.5 right share issue of Rupees 1.2 billion totaling to Paid-Up Capital

to Rupees 2 billion

Share capital structure of the Bank

Grou

pShare Holders

No. of

Share

Share Capital

in %

Paid Up

Capital

Payment in

%

A Promoter 12,000,000 601,200,000,000.0

0100

BGeneral Public (Including

Staff) 8,000,000 40

800,000,000.00100

Total: 20,000,000 1002,000,000,000.0

0100

BRANCHES

The Bank has been providing its service to its customers through its own office building at

Anamnagar in the capital, as well as in other different parts of country. We are available with 51

branches spread throughout the country with the eagerness to serve the customers.

ATM SERVICES

Kist is providing self service banking (SSB) to its esteem customers through Kist SSB Card

using own ATM Switching software. Till date we have 78 ATM outlets. Our customer can

transact from our terminal free of cost. In additional to this customers can use any other SCT

member banks' terminal paying charges.

Our customers can now have access to 24 hours banking service through our 78 ATM locations

among which 46 ATMs are inside the valley and the rest 32 are outside the valley.

PRODUCTS AND SERVICES

Personal Banking

Savings Account Fixed Deposit Account NaraNari Nikshep-2 Call Deposit

Current Account

Coporate Banking

Term Loan Chelibeti Laghu Udyamshil Karja Kist Microfinance Wholesale Loan Salary Solutions Bank Guarantee Business

Transaction Banking

Ncell Pre-paid Top-Up Card Transaction Limits NCell Pro Payment Kist Mobile Wallet E-Banking

SWOT ANALYSIS

This free sample SWOT analysis shows strengths, weaknesses, opportunities and threats. We

cover over 40,000 companies and industries. This sample SWOT analysis for Kist Bank can

provide a competitive advantage.

Strengths

-high profitability and revenue

-existing distribution and sales networks

-barriers of market entry

-domestic market

Weaknesses

-small business units

-future competition

Opportunities

-venture capital

-income level is at a constant increase

-global markets

-growth rates and profitability

-new markets

Threats

-growing competition and lower profitability

-increasing rates of interest

-rising cost of raw materials

-government regulations

-increase in labor costs

-price changes

-tax changes

-external business risks

-global economy

1.3 Statement of Problem

The present study has tried to analyze and evaluate the financial performance of bank taking a

case of Kist Bank ltd.. Furthermore the study has tried to answer the following research

questions:

What is financial position of Kist bank ltd. in market?

How far the bank has been able to meet the shareholders expectation?

How viable the bank is in long term?

1.4 Objective of study

Each activity of human being is driven to world the following objective

To evaluate liquidity, leverage, and profitability ratios of Kist bank limited.

To study the cash flow statement of banks.

To ma ke nece ss a ry s ugges t i ons and r e comm enda t i ons fo r e f f ec t i ve

f i nanc i a l performance in future.

1.5 Significance of the Study

The topic under study will help different parties since the significance of banking business for a

national development is obvious. The study has multidimensional significance:

Holding of Share

Shareholders are the owners of the company. Time and again, they may have to take decisions

whether they have to continue with the holdings of the company's share or sell them out. The

financial statement analysis is important as it provides meaningful information to the

shareholders in taking such decisions.

Decisions and Plans

The management of the company is responsible for taking decisions and formulating plans and

policies for the future. They, therefore, always need to evaluate its performance and effectiveness

of their action to realize the company's goal in the past. For that purpose, financial statement

analysis is important to the company's management.

Extension of Credit

The creditors are the providers of loan capital to the company. Therefore they may have to take

decisions as to whether they have to extend their loans to the company and demand for higher

interest rates. The financial statement analysis provides important information to them for their

purpose.

Investment Decision

The prospective investors are those who have surplus capital to invest in some profitable

opportunities. Therefore, they often have to decide whether to invest their capital in the

company's share. The financial statement analysis is important to them because they can obtain

useful information for their investment decision making purpose.

1.7 Limitations of study

The major limitations of this research are related with the ratio analysis of

financial p e r f o r m a n c e o f K i s t b a n k l i m i t e d . Use and Limitations of

Financial statement analysis (using Ratios) attention should be given to the following

issues when using financial ratios: A reference point is needed. To be meaningful, most

ratios must be compared to historical values of the same firm, the firm's forecasts, or

ratios of similar firms. Most ratios by themselves are not highly meaningful. They should

be viewed as indicators, with several of them combined to paint a picture of the firm's

situation. Year-end values may not be representative. Certain account balances that are

used to calculate ratios may increase or decrease at the end of the accounting period

because of seasonal factors. Such changes may distort the value of the ratio. Average

values should be used when they are available. Ratios are subject to the limitations of

accounting methods. Different accounting choices may result in significantly different

ratio values. V a r i o u s limitations have been faced while preparing this report which is

expressed below:

This study is conducted mainly based on secondary type of data i.e. annual

reports and textbooks factors.

Study conducted only on the basis of five years data.

Limited interaction with concerned heads due to busy schedule

This study only explains about ratio and cash flow statements.

1.8 Organization of study

This study has been divided in to five chapters

Chapter1:- Introduction

Chapter2:-Research Methodology

Chapter3:- Presentation and Analysis Of data

Chapter4:- Summary, Conclusion and Recommendation

INTRODUCTION

Thi s cha p te r cove r s t he gene ra l bac kg round o f t he gene ra l pe r fo rm ance

ana l y s i s , introduction of the organization, statement of problem, objective and limitations of

the study and organization of the research study Kist Bank Ltd.

RESEARCH METHODOLOGY

This chapter focuses the research design, sample data analysis tools and their using

techniques.

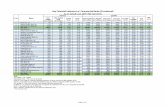

PRESENTATION AND ANALYSIS OF DATA

This chapter concern with measurement of financial performance using ratio

analysis tools and their trend analysis.

SUMMARY, CONCLUSION AND RECOMMENDATION

This chapter gives summarization, conclusion and recommendation of the study