CBO: What Accounts for the Slow Growth of the Economy After the Recession?

Financial Pacific - Slow growth but no Recession (third party)

-

Upload

financial-pacific -

Category

Business

-

view

595 -

download

1

description

Transcript of Financial Pacific - Slow growth but no Recession (third party)

UBS Investment Research

US Equity Strategy

Market Navigator — September 2011

Welcome To The Market Navigator This monthly guide provides a summary of the UBS US equity market outlook, aswell as proprietary analytics and other useful information about market returns,corporate profits, valuation, sectors, the economy, and credit.

Slow Growth But No Recession After dropping 13%, the market ended down 5% in August. We believe theeconomy will experience slow growth — not a recession. As such we expectstocks to advance through the end of the year. That said, we expect markets toremain quite volatile with European debt issues our main concern. Whileconsumer and business survey data indicate a lack of confidence in the economy, more direct measures of activity such as retail sales and durable goods ordersremain healthy.

14 Of The Past 9 Since the end of World War II, there have been 14 instances where the S&P 500fell by more than 17%. Only nine of these were accompanied by recessions. Importantly, when recession was avoided, equities advanced an average of 15%during the first four months after reaching a trough and 28% over one year.

Price Target Of 1,350 Represents 15% Upside We are trimming our 2011 and 2012 S&P 500 EPS estimates to $95.00 and$101.00 from $99.35 and $108.00 to reflect UBS’s recently lowered global growthoutlook. Consistent with these changes, we are paring our year-end 2011 S&P 500 price target to 1,350 from 1,425.

Global Equity Research

Americas

Equity Strategy

Investment Strategy

6 September 2011

www.ubs.com/investmentresearch

Jonathan Golub, CFA

+1-212-713 8673

Manish Bangard, CFAStrategist

[email protected]+1-212-713 3036

Daniel MurphyStrategist

[email protected]+1-212-713 3186

Vishal PatelAssociate Strategist

[email protected]+1-212-713 4027

Thomas M. Doerflinger, Ph.D.Strategist

[email protected]+1-212-713 2540

Natalie Garner, CFAStrategist

[email protected]+1-212-713 4915

This report has been prepared by UBS Securities LLC ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 60. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

US Equity Strategy 6 September 2011

UBS 2

UBS Strategy & Economics Teams

U.S. Equity StrategyJonathan Golub Chief Strategist [email protected]

Manish Bangard Strategist [email protected] Chip Miller Small-cap Strategist [email protected]

Daniel Murphy Strategist [email protected] Tom Doerflinger Strategist [email protected]

Vishal Patel Associate v [email protected] Natalie Garner Strategist [email protected]

Maury Harris Chief Economist maury [email protected]

Drew Matus Economist [email protected]

Samuel Coffin Economist [email protected] Paul Donovan Economist [email protected]

Kevin Cummins Economist [email protected] Andrew Cates Economist [email protected]

George Magnus Senior Adv isor [email protected]

Janet Pegg Analyst [email protected] Jonathan Anderson Emg Markets [email protected]

Sunil Kapadia Asset Allocation [email protected]

Mitchell Revsine Strategist [email protected]

Brian Russo Associate [email protected] Jeffrey Palma Chief Strategist [email protected]

Chris Ferrarone Strategist [email protected]

Andrew Kligerman Financials [email protected] Jerry McGuire Associate jerry [email protected]

Nikos Theodosopoulos Technology [email protected]

David Strauss Industrials [email protected] Nicholas Smithie Strategist [email protected]

David Palmer Consumer [email protected] Jennifer Delaney Strategist [email protected]

John Hodulik Telecom [email protected] Stephen Mo Strategist [email protected]

Bill Featherston Energy [email protected]

Ron Barone Energy [email protected] Stephane Deo Europe [email protected]

Justin Lake Health Care [email protected] Amit Kara UK [email protected]

Duncan Wooldridge Asia [email protected]

Nick Nelson Europe [email protected] Scott Haslem Australia [email protected]

Karen Olney Europe [email protected] Tao Wang China [email protected]

Neil Cherry UK [email protected]

George Vasic Canada [email protected] George Bory Credit [email protected]

Shoji Hirakawa Japan [email protected] Michael Schumacher Rates [email protected]

Niall MacLeod Asia x-Japan [email protected] Mansoor Mohi-Uddin Currency [email protected]

David Cassidy Australia [email protected] Bhanu Baweja EM FICC [email protected]

John Tang China [email protected]

Tomas Lajous Mexico [email protected] David Jessop Global Head dav [email protected]

Berry Cox US Head berry [email protected]

Credit, Rates & Currency Strategy

Quantitative Strategy

U.S. Accounting

Global Emerging Markets Strategy

Regional Economics

U.S. Sector Heads

U.S. Derivatives

Regional Strategy

U.S. Economics Global Economics & Strategy

Larry Hatheway Chief Economist

& Strategistlarry [email protected]

Global Equity Strategy

US Equity Strategy 6 September 2011

UBS 3

Table of Contents Outlook

▪ Market Outlook ……….…………………………………….……………………..… 4-5

▪ S&P 500 Targets & Key Calls ...…………….………………………...…………... 6 Equities

▪ Current Environment .…..……………………………………………....…………... 7-10

▪ Past Recessions ……….………....…………………....………..………………...... 113

▪ Revenues & Margins …………....…………………....………..………………...... 12-15

▪ Valuation ..………………..…………….………….……..……………..……...…… 16-22

▪ Market Leadership ……………...…………….……..…….………………..……… 23-26

▪ Earnings Analysis ………………………………………...……...……...…………. 27-31

▪ Index Returns .................................................................................................... 32-34

▪ Correlations & Leading Indicators ……………….………..……………………….. 35

▪ Sector Recommendations .….………………….……………………..……...…… 36-37

▪ Cash, Balance Sheet & Corporate Spending …………..……………………….. 38-41 Economy

▪ ISM ………………..……………………………….…………………………...…….. 42

▪ Inflation & Currencies ………………………………………………………………. 43-45

▪ Employment ………..………………………………………….…………................ 46

▪ Retail Sales, Savings & Wealth …………………….……………………………… 47

▪ Housing ………………………………………………………….…………………… 48

▪ Loan Volumes & Delinquencies …………………………………………………… 49

▪ US Fiscal Imbalances ……………....……...………………………….…………… 50-51 Credit

▪ Yield Curves & Treasuries ………………...……………..…………………...…… 52-54

▪ Bond Spreads …………………………………………………….…….…………… 55

Appendix

▪ S&P 500 Valuation …..……………………..…………..……………..……………. 56

▪ Inter-Sector Valuations .……………………..…………..…………………………. 57

▪ UBS Return Drivers ….……………………..…………..……………..……………. 58-59

All data as of 08/31/2011 unless noted otherwise.

Highlights

• Market Outlook — Pages 4-5

• Current Environment — Pages 7-10

• Valuation — Pages 16-22

• Market Leadership — Pages 23-26

• Sector Recommendations — Pages 36-37

• Inflation & Currencies — Pages 43-45

US Equity Strategy 6 September 2011

UBS 4

Market Outlook

Outlook

Constructive on Stocks. We believe signs point to slow growth — not a recession — and expect stocks to drift higher as worst-case outcomes are avoided and risk appetite improves. While recent survey data indicate a lack of confidence in the economy, more direct measures of activity such as retail sales and durable goods orders are stronger.

14 of the Past 9. By our count, the S&P 500 predicted 14 of the past nine recessions which suggests the market is not a particularly good early indicator of economic downturns. Of the five non-recessionary periods, the market was up an average of 15% during the first four months after the trough and 28% over one year.

Economic Soft Patch Extended. 2Q GDP was revised down from 1.3% to 1.0% and 1Q grew just 0.4%. We believe that debt and budgetary issues in Europe and the U.S. will weigh on 2H11 growth. Chief U.S. Economist Maury Harris recently lowered 3Q11 GDP to 1.5% from 2.5%..

Valuation. At 10.9x forward EPS, stock multiples are well below long term averages. Attractive valuations, improving M&A activity, and large share repurchases should help drive stock prices higher.

Trimming S&P 500 EPS. We are trimming our 2011 and 2012 S&P 500 EPS estimates to $95.00 and $101.00 from $99.35 and $108.00, respectively. This change reflects our economists’ view that the global economy will be weaker, though non-recessionary. More specifically, UBS recently lowered its forecast for 2012 global GDP growth to 3.3% from 3.8%.

Year-end S&P 500 Price Target to 1,350. Consistent with these changes, we are lowering our 2011 year-end price target for the S&P 500 to 1,350 from 1,425. This forecast represents a 15% upside from current levels.

We anticipate a relief rally as the economy avoids recession and risk appetite improves

The market has a less-than-impressive track record in predicting recessions

Debt issues in U.S. and Europe are prolonging the economic soft patch

Valuation is well below long term averages

15% upside to our new 2011 year-end S&P 500 target of 1350

US Equity Strategy 6 September 2011

UBS 5

Market Outlook

Market Leadership

Sector Positioning. Since mid-February, defensives have led the market, however, this leadership has reversed course over the past couple of weeks. Looking to the remainder of 2011, we favor economically sensitive names. More specifically, we expect Tech, Industrials and Financials to do especially well in an up market. We are underweight Staples, Telecom and Utilities.

Small Caps. During the current soft patch, smaller companies have underperformed their larger peers. We expect small-caps to regain their leadership role as they benefit from margins that are much further from peak levels. M&A trends are also a positive.

Large Caps. S&P 500 margins are close to cyclical peaks. As a result, companies exhibiting strong top-line success should remain clear winners in this universe.

Risks

European Sovereign Debt: We believe the greatest risk to U.S. stocks is the potential for a credit disruption emanating from Europe.

Global Growth. Fallout from the debt debate has extended the economic soft patch in the U.S. Separately, monetary tightening across emerging economies has led to heightened growth concerns in a number of markets.

Fiscal Policy. While the fight over raising the debt ceiling is over, the appointment of a super committee to find ways to reduce debt should extend the policy debate.

Monetary Policy. The Fed is constrained by the lower bound on interest rates and the effectiveness of alternative tools, such as quantitative easing, is unclear.

Inflation. Despite the economic slowdown, the most recent headline inflation data came in ahead of expectations, suggesting that inflationary pressures could be less transitory than the Fed, and many investors, believe.

We favor cyclicals including Tech, Industrials and Financials

Small caps should regain their leadership

Government policy is constrained

US Equity Strategy 6 September 2011

UBS 6

S&P 500 Price & Earnings Targets

S&P 500 Price & Earnings Target S&P 500 Price Level Price % Change

Current (as of 09/02/11) 1,174

2011 Year-End Target Price 1,350 15.0%

Operating Earnings EPS Y/Y Growth

2009 Actual 62.25 0.6%

2010 Actual 85.49 37.3%

2011 Estimate 95.00 11.1%

2012 Estimate 101.00 6.3%

Current Year-End

P/E Multiple Price Price

on UBS 2011 EPS 12.4x 15.8x

on Consensus NTM EPS of $107.93 10.9x 12.5x

on Consensus 2012 EPS of $112.56 10.4x 12.0x

on UBS 2012 EPS 11.6x 13.4x Source: Standard & Poor’s and UBS Note: Table updated as of Sep.2, 2011

UBS Key Calls Ticker Company Ticker Company

AAPL Apple Inc. F Ford

BHI Baker Hughes GE General Electric

CAH Cardinal Health GOOG Google

CELG Celgene JOYG Joy Global

C Citigroup PRU Prudential Financial

CNX Consol Energy QCOM Qualcomm

DOW Dow Chemical SNDK SanDisk

DE Deere & Co. Source: UBS Note: All stocks are rated ‘Buy’ by UBS analysts. Updated as of Sep.2, 2011

Our 1,350 target represents a 15% upside from current levels

US Equity Strategy 6 September 2011

UBS 7

Current Environment

S&P 500 vs. Cyclical Outperformance

660

835

1010

1185

1360

Mar-09 Aug-09 Jan-10 Jun-10 Nov-10 Apr-11

60

67

74

81

88

95

Cycl. vs. ►Non-Cycl.

◄ S&P 500

Feb 2011

Source: Standard & Poor’s, Haver, FactSet and UBS Note: Cyclical Outperformance indexed to 100 as of December 31, 2004

Pair-wise Correlations

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

04 05 06 07 08 09 10 11

Source: S&P, FactSet and UBS Note: Data calculated for S&P 500 Industry Groups on a 30-day rolling basis

Cyclicals have underperformed since mid-February

Higher stock correlations pose a challenge for investors

US Equity Strategy 6 September 2011

UBS 8

Current Environment

VIX

90 92 94 96 98 00 02 04 06 08 1010

20

30

40

50

60

31.6

12/31/2010: 17.7506/30/2011: 16.5208/31/2011: 31.62

Source: CBOE, FactSet and UBS

S&P 500 Volatility Skew

12

16

20

24

28

32

1M 3M 6M 9M 12M

6/30/11

08/31/11 ▲

12/31/10 ▼

Source: Bloomberg and UBS Note: All periods reflect annualized numbers

The VIX rose in August due to macro concerns in the US and Europe

Near-term implied volatility has risen more than longer-term

US Equity Strategy 6 September 2011

UBS 9

Current Environment

European CDS

200

400

600

800

1000

1200

1400

1600

Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11

◄ Portugal, Ireland &Greece CDS Basket

Source: Bloomberg and UBS Note: European CDS basket is the 5-day moving average of Portugal, Ireland and Greece CDS.

Euribor–OIS Swap Spread

0

50

100

150

200

250

Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11

bps

Source: Bloomberg and UBS

Pressure on European financial system is increasing

US Equity Strategy 6 September 2011

UBS 10

Current Environment

U.S. Economic Surprise Index

-4

-3

-2

-1

0

1

2

3

06 07 08 09 10 11

> 0 represents Positive Surprise

< 0 represents Negative Surprise

Source: Bloomberg and UBS Global Economics Team

3Q11 GDP Forecasts vs. S&P 500 EPS Estimates

1.5

2.0

2.5

3.0

3.5

4.0

Feb-10 May-10 Aug-10 Nov-10 Feb-11 May-11 Aug-11

24.0

24.5

25.0

25.5

26.0

◄ 3Q11 GDP Est

3Q11 EPS Est ►

% $

Source: Bloomberg, Thomson Financial, FactSet and UBS

Economic surprises have improved as expectations have come down

Consensus 3Q GDP and S&P 500 earnings estimates have fallen

US Equity Strategy 6 September 2011

UBS 11

Past Recessions

Past Market Declines Subsequent Returns

Peak Date Trough Date Return 4 Months 1 Year

S&P 500 Declines of More Than 17% Followed By Recession

Jun-48 Jun-49 -20.3 17.9 42.1Aug-56 Oct-57 -21.6 4.9 31.0Nov-68 May-70 -36.1 21.2 43.7Jan-73 Oct-74 -48.2 25.0 38.0Feb-80 Mar-80 -17.1 23.0 37.1Nov-80 Aug-82 -27.1 36.3 58.3Jul-90 Oct-90 -19.9 24.7 29.1

Mar-00 Oct-02 -49.1 6.8 33.7Oct-07 Mar-09 -56.8 30.5 68.6

Average 15 mths -32.9 21.1 42.4

S&P 500 Declines of More Than 17% Not Followed By Recession

Dec-61 Jun-62 -28.0 4.2 32.7Feb-66 Oct-66 -22.2 18.8 32.9Sep-76 Mar-78 -19.0 8.6 14.0Aug-87 Dec-87 -33.5 14.4 21.4Jul-98 Aug-98 -19.3 28.4 37.9

Average 7 mths -24.4 14.9 27.8

S&P 500 Declines of Less Than 17% Followed By Recession

Jan-53 Sep-53 -14.8 10.9 37.7Aug-59 Oct-60 -13.9 20.2 30.7

Current Fall

Apr-11 Aug-11 -17.9 Source: S&P, Haver and UBS.

EPS Declines in Recessions Quarter EPS EPS Change

Year Peak Trough Peak Trough %

1970 3Q69 4Q70 5.89 5.13 -12.9

1974-75 3Q74 3Q75 9.11 7.65 -16.0

1981-82 4Q81 1Q83 15.36 12.42 -19.1

1990-91 3Q90 4Q91 23.8 20.34 -14.5

2000-01 3Q00 1Q02 56.71 44.19 -22.1

2008-09 4Q07 3Q09 93.41* 60.14* -35.6

Average 5.3 qtrs -20.1 Source: S&P, Thomson Financial, FactSet and UBS Note: 2008-09 EPS of $93.41 and $60.14 adds back $8.85 and $9.30, respectively, to account for extraordinary write-offs taken by the Financials sector.

The market has predicted 14 of the past 9 recessions

In the 5 instances where a 17% market decline was not followed by a recession, stocks rebounded 15% in four months and 28% in one year

The market has predicted 14 of the past 9 recessions

US Equity Strategy 6 September 2011

UBS 12

Revenues & Margins

S&P 500 Revenues vs. Nominal GDP

-24%

-18%

-12%

-6%

0%

6%

12%

18%

00 01 02 03 04 05 06 07 08 09 10 11

-4%

-2%

0%

2%

4%

6%

8%◄ Revenues

GDP ►

Y/Y Y/Y

Sectors MultiplierEnergy 6.8Materials 3.4Technology 2.9Discretionary 2.7Industrials 2.1

Source: BEA, S&P, Compustat, FactSet and UBS Note: Universe excludes Financials. Data as of 2Q11

Operating Margins vs. Capacity Utilization (Mfg)

9%

11%

13%

15%

00 01 02 03 04 05 06 07 08 09 10 11

62

66

70

74

78

82

◄ S&P 500 (ex-Finl.) Operating Margins

Capacity Utilization ►

9.8%

15.0% 14.8%

75.0%

Source: S&P, Compustat, FactSet and UBS Note: Universe excludes Financials. Data as of 2Q11

Revenues for the S&P 500 are driven by nominal GDP but are 3–4x more volatile

Revenues have held up well despite weak GDP

Margins have surpassed last cycle’s peak

US Equity Strategy 6 September 2011

UBS 13

Margins

Operating Margins vs. CRB Raw Industrials

9%

10%

11%

12%

13%

14%

15%

00 01 02 03 04 05 06 07 08 09 10 11

200

300

400

500

600

◄ Margins

CRB Raw Industrials ►

Source: S&P, Compustat, Wall Street Journal, FactSet and UBS Note: Universe excludes Financials. Data as of 2Q11

Unit Labor Cost

50 55 60 65 70 75 80 85 90 95 00 05 10

-3

0

3

6

9

12

2.1Avg: 3.8

Avg: 1.7

Source: Department of Labor, FactSet and UBS

In the last cycle, margins continued to rise despite elevated input costs

Labor costs are on the rise

US Equity Strategy 6 September 2011

UBS 14

Margins

Large-cap vs. Small-cap EBIT Margins

9%

10%

11%

12%

13%

14%

15%

99 00 01 02 03 04 05 06 07 08 09 10 11

2%

3%

4%

5%

6%

7%

8%

9%

10%

◄ Large-cap

Small-cap ►

15.0%

7.2%

14.8% 9.4%

Source: S&P, Compustat, FactSet and UBS Note: Universe excludes Financials. Data as of 2Q11

Large/Small-Cap EBIT Margin Spread

3%

4%

5%

6%

7%

8%

00 01 02 03 04 05 06 07 08 09 10 11

7.8%

Source: S&P, Compustat, FactSet and UBS Note: Universe excludes Financials. Data as of 2Q11

Small-cap margins remain substantially below their large-cap counterparts’

The margin differential points to greater opportunity in the small-cap world

US Equity Strategy 6 September 2011

UBS 15

Current & Peak Operating Margins

Current Last Prior

2Q11E 1Q11A 4Q10A 3Q10A 2Q10A 1Q10A Peak Margin

Cyclicals

Technology 22.3% 22.3% 23.2% 22.0% 21.4% 20.3% 4Q10 23.2%

Software 28.0 27.0 29.2 27.4 26.7 25.0 4Q09 31.9Hardware 17.5 17.4 17.0 16.1 15.1 15.2 4Q09 17.6Semis & Equipment 24.6 26.8 28.3 29.1 28.4 25.5 1Q00 34.9

Industrials 14.5 15.0 15.8 14.0 14.5 12.7 2Q07 16.8

Capital Goods 14.4 15.6 16.2 13.8 14.5 12.9 2Q07 17.0Commercial Svcs 14.1 13.0 14.8 14.5 14.3 13.5 3Q00 17.7Transportation 15.0 12.3 14.3 15.2 14.2 11.6 2Q06 16.5

Cons Discretionary 12.1 11.3 11.3 11.4 11.7 11.3 2Q11 12.1

Autos 9.4 10.1 5.1 10.0 11.1 10.5 2Q09 11.6Durables & Apparel 10.7 9.9 11.1 11.1 10.0 10.7 4Q05 13.7Consumer Svcs 18.3 20.1 17.1 21.0 17.5 19.6 3Q10 21.0Media 21.1 17.7 19.4 18.6 19.4 17.6 2Q03 22.3Retailing 7.6 7.2 8.5 6.7 7.7 7.4 4Q03 9.5

Materials 17.0 17.0 13.5 13.3 14.1 13.7 1Q11 17.0

Energy 16.7 16.0 15.0 14.3 14.9 15.3 3Q08 22.1

Non-Cyclicals

Health Care 13.9 14.4 12.4 13.8 14.0 13.8 2Q00 18.6

Healthcare Svcs 7.3 7.6 6.6 7.0 7.0 7.2 3Q07 7.8Phama & Biotech 29.0 30.3 25.0 29.7 29.7 29.3 2Q03 34.1

Consumer Staples 10.0 9.3 10.0 10.3 10.1 9.7 2Q05 11.8

Food Retailing 5.1 4.8 5.6 4.7 5.1 5.0 2Q05 7.3Food, Bev & Tob 16.7 15.9 15.7 18.5 18.4 16.7 2Q01 19.8Household Prod 16.3 17.7 19.2 20.0 15.8 19.1 4Q03 26.8

Telecom Svcs 17.0 16.9 18.6 17.0 18.4 17.8 3Q00 27.8

Utilities 19.0 19.2 15.6 22.2 19.2 19.3 3Q09 23.7

S&P 500

S&P 500 (ex-Finl.) 15.0 14.7 14.3 14.4 14.3 13.9 2Q11 15.0 Source: Standard & Poor’s, Compustat, Thomson Financial, FactSet and UBS

US Equity Strategy 6 September 2011

UBS 16

Valuation

Dow Jones Industrials — Super Cycle Log Scale

all or

nothing

10 20 30 40 50 60 70 80 90 00 104050

100

200300400500

1,000

2,0003,0004,0005,000

10,000

Source: Dow Jones, FactSet and UBS

S&P 500 E/P vs. Baa Yields (Millennium Regime)

5

6

7

8

9

10

04 05 06 07 08 09 10 11

Earnings Yield ►

▲ Baa Yield

P/E Anchored to Baa Bond Yields

Slower Growth

Recession Fears

g )er(i

pr

gk

pr

E

P 11

1

0

−++=

−=

rprf

Source: Moody’s, Standard & Poor’s, Thomson Financial, FactSet and UBS

Equities experience prolonged booms or periods of anemic returns

These “investment regimes” hold the key to stock prices

The forward consensus P/E is 10.9x. The bond market is implying 18.2x

US Equity Strategy 6 September 2011

UBS 17

Valuation

S&P 500 E/P vs. 10 Yr Treasuries (Great Moderation/The Fed Model)

82 84 86 88 90 92 94 96 984

6

8

10

12

14

16◄ Earnings Yield

10-year Yield ▲

Source: Federal Reserve, Standard & Poor’s, Thomson Financial, FactSet and UBS

S&P 500 E/P vs. 10 Yr Treasuries

00 02 04 06 08 102

4

6

8

10

Earnings Yield ►

10-year Yield ▲

Source: Federal Reserve, Standard & Poor’s, Thomson Financial, FactSet and UBS

During the “Great Moderation”, the “Fed Model” explained returns

However, since 2000, this relationship has broken down

US Equity Strategy 6 September 2011

UBS 18

Valuation

S&P 500 E/P vs. Inflation (Disco Regime)

72 74 76 78 804

6

8

10

12

14

16

Inflation ►

Earnings Yield ▼

Source: Standard & Poor’s, Dept. of Labor, Thomson Financial, FactSet and UBS Note: Earnings Yield based on trailing earnings; CPI (+2%) is lagged by 3 months

The Disco Regime (1981 – Present)

85 90 95 00 05 10

3

6

9

12

15

▲ Inflation

Earnings Yield ►

Source: Standard & Poor’s, Dept. of Labor, Thomson Financial, FactSet and UBS Note: Earnings Yield based on trailing earnings; CPI (+2%) is lagged by 3 months

In the 1970s “Disco Regime”, inflation was the primary driver of stock values

Falling inflation since the late ’70s has made CPI less important to valuations

US Equity Strategy 6 September 2011

UBS 19

Valuation

NTM P/E – Cyclicals vs. Non-Cyclicals

10

11

12

13

14

15

16

Mar-09 Aug-09 Jan-10 Jun-10 Nov-10 Apr-11

◄ Cyclicals

◄ Non-Cyclicals

10.9x

12.6x

Source: Standard & Poor’s, Compustat, Thomson Financial, FactSet and UBS Note: Cyclicals are comprised of Energy, Materials, Industrials, Consumer Discretionary, Financials and Technology while Non-Cyclicals include Consumer Staples, Health Care, Telecom and Utilities

Change in NTM P/E Forward P/E % Chg — Apr 29 to Now

Apr 29 Now Change Price NTM EPS

Cyclicals

Industrials 15.2 11.8 -3.4 -17.0 7.0

Materials 13.8 11.1 -2.7 -13.1 8.1

Energy 12.1 9.6 -2.5 -16.5 4.9

Financials 11.8 9.6 -2.2 -17.5 1.6

Technology 13.2 11.3 -1.9 -9.4 5.9

Discretionary 15.5 13.7 -1.8 -8.5 3.8

Non-Cyclicals

Health Care 12.2 11.1 -1.1 -6.2 3.5

Telecom 16.8 15.5 -1.3 -7.7 0.1

Staples 14.5 13.8 -0.7 -2.4 2.7

Utilities 13.3 13.5 0.2 1.6 0.3 Source: Standard & Poor’s, Compustat, Thomson Financial, FactSet and UBS

Cyclical stocks appear attractively valued vs. more defensive names

The recent shift in multiples is the result of both price and EPS changes

US Equity Strategy 6 September 2011

UBS 20

Inter-Sector Relative Valuations

Relative Valuation – Overvalued/Undervalued

-2.1

-1.0-0.7 -0.7 -0.7

0.3

1.31.5

2.3

2.8

MAT TECH FIN IND EN DISCR HC STPLS TCOM UTIL

P/E

Mu

ltip

le P

oin

ts

Overvalued

Undervalued

Cyclicals Non-Cyclicals

Source: Standard & Poor’s, Compustat, Thomson Financial, FactSet and UBS Note: Analysis performed on a 36-month rolling basis

Energy vs. Materials

-3.7

-2.7

-1.7

-0.7

0.3

1.3

2.3

3.3

97 99 01 03 05 07 09

P/E

Mu

ltip

le P

oin

ts

-4.2

-3.0

-1.7

-0.4

0.8

2.1

3.4

4.6

◄ Energy

Materials ►

Overvalued

Undervalued

Source: First Call, Standard & Poor’s, FactSet and UBS Note: Analysis performed on a 36-month rolling basis

On a relative basis, Utilities & Telecoms look the most overvalued; Materials & Tech the cheapest

Materials appear cheap versus Energy

US Equity Strategy 6 September 2011

UBS 21

Inter-Sector Relative Valuations

Industrials vs. Technology

-2.4

-1.4

-0.4

0.6

1.6

2.6

97 99 01 03 05 07 09

P/E

Mu

ltip

le P

oin

ts

-2.3

-1.4

-0.5

0.4

1.3

2.2

◄ IndustrialsTechnology ►

Overvalued

Undervalued

Source: First Call, Standard & Poor’s, FactSet and UBS Note: Analysis performed on a 36-month rolling basis

Consumer Discretionary vs. Financials

-1.2

-0.2

0.8

1.8

97 99 01 03 05 07 09

P/E

Mu

ltip

le P

oin

ts

-2.0

-0.6

0.8

2.1

◄ Discretionary

Financials ►

Overvalued

Undervalued

Source: First Call, Standard & Poor’s, FactSet and UBS Note: Analysis performed on a 36-month rolling basis

Industrials valuations have come down sharply

Tech trades in line with the broad market

See Appendix for inter-sector valuation methodology

Discretionary is the most overvalued of the cyclical sectors

US Equity Strategy 6 September 2011

UBS 22

Inter-Sector Relative Valuations

Telecommunication Services vs. Utilities

-2.9

-1.9

-0.9

0.1

1.1

2.1

3.1

97 99 01 03 05 07 09

P/E

Mu

ltip

le P

oin

ts

-3.6

-2.3

-1.1

0.2

1.4

2.7

3.9

◄ Telecom

Utilities ►

Overvalued

Undervalued

Source: First Call, Standard & Poor’s, FactSet and UBS Note: Analysis performed on a 36-month rolling basis

Health Care vs. Consumer Staples

-3.0

-2.0

-1.0

0.0

1.0

2.0

97 99 01 03 05 07 09

P/E

Mu

ltip

le P

oin

ts

-2.5

-1.5

-0.6

0.4

1.4

2.4

◄ Health Care Staples ►

Overvalued

Undervalued

Source: First Call, Standard & Poor’s, FactSet and UBS Note: Analysis performed on a 36-month rolling basis

Telecom and Utilities look extremely expensive

While expensive, Health Care and Staples are much more attractively valued than Utilities or Telecom

US Equity Strategy 6 September 2011

UBS 23

Market Leadership

UBS Market Leadership Framework

Valuation

Earnings Fundamentals

Op Leverage

Non-Cyclicals

Cyclicals

I. Early Phase II. Middle Phase III. Late Phase

Volatility Quality

Source: UBS

S&P 500 vs. Cyclical Outperformance

475

675

875

1075

1275

1475

1675

02 03 04 05 06 07 08 09 10

80

90

100

110

120

130

140Middle LateEarly Current

▲ S&P 500

Cycl. vs.Non-Cycl. ►

Source: Standard & Poor’s, Haver, FactSet and UBS Note: Cyclical Outperformance indexed to 100 as of Jan, 1990

Different investment characteristics are rewarded at each stage of the investment cycle

Cyclicals typically outperform in the early stage and during periods of economic strength

US Equity Strategy 6 September 2011

UBS 24

Market Leadership — Return Drivers

Price Volatility & Operating Leverage

-4%

-2%

0%

2%

4%

Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11

◄ Price Vol

◄ Op Levg

3-Month Moving Avg

Source: Standard & Poor’s, Compustat, Thomson Financial, Worldscope, FactSet and UBS

ROE

-4%

-3%

-2%

-1%

0%

1%

2%

3%

Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11

ROE ►

3-Month Moving Avg

Source: Standard & Poor’s, Compustat, Thomson Financial, Worldscope, FactSet and UBS

Similar to 2010’s mid-year slowdown, early-cycle characteristics have rolled over

At the same time, defensive traits are adding value We expect these trends to reverse

US Equity Strategy 6 September 2011

UBS 25

Market Leadership — Return Drivers

Op Lev Return Index vs. Op Margins

94

98

102

106

110

00 02 04 06 08 10

9%

10%

11%

12%

13%

14%

15%

◄ Op. Leverage Return Driver Index

S&P 500 (ex- Finl.)Operating Margins ►

Source: Standard & Poor’s, Compustat, Thomson Financial, Worldscope, FactSet and UBS

Volatility Return Driver in Up S&P 500 Months

-5

0

5

10

15

20

1 7 13 19 25 31 37 43 49 55 61 67 73

Performance in Up SPX Months Avg: 1.9% Max: 17.5% Min:-2.7% Months Outperforming: 56 of 77

Source: Standard & Poor’s, Compustat, Thomson Financial, Worldscope, FactSet and UBS

Operating Leverage is highly correlated with margin upside

More volatile stocks should benefit the most from a market rebound

See Appendix for calculation methodology on UBS Return Drivers

US Equity Strategy 6 September 2011

UBS 26

Market Leadership — Return Drivers

Foreign Sales Return Index

100

105

110

115

120

125

130

135

90 92 94 96 98 00 02 04 06 08 10

1.2% avg alpha per year

Source: Standard & Poor’s, Compustat, Thomson Financial, Worldscope, FactSet and UBS

Foreign Sales – Industry Group Breakdown Foreign Sales Foreign Sales

Exposure Exposure

Cyclicals Non-Cyclicals

Information Tech 55.5 Consumer Staples 26.6Software & Services 44.1 Food & Staples Retail 15.9Hardware 56.1 Food Bev. & Tobacco 40.8Semiconductors 84.9 Household Products 54.6

Energy 48.7 Health Care 18.2Equip. & Services 5.0

Materials 45.5 Pharma/Biotech 47.9

Industrials 37.3 Utilities 5.2Capital Goods 41.4Services 22.6 Telecom 0.1Transportation 16.0

Consumer Cyclicals 24.9 S&P 500 Index 29.7Autos 53.6Durables & Apparel 34.1Consumer Services 43.0Media 20.6Retailing 12.9

Financials 17.0Banks 0.0Diversified Financials 22.7Insurance 17.2Real Estate 12.9

Source: Standard & Poor’s, Compustat, Thomson Financial, Worldscope, FactSet and UBS

Foreign Sales has added considerable alpha over time… …but has detracted value more recently

US Equity Strategy 6 September 2011

UBS 27

Earnings Analysis

2Q11 Earnings Scorecard Earnings Growth Earnings Surprise

Rptd Total YoY (%) Pos Neg Pct (%) Beat Miss

Cyclicals ex-Finls 282 284 24.7 230 48 6.0 212 57

Cons. Discretionary 78 79 10.8 60 18 7.3 64 11

Energy 41 41 41.3 35 5 2.1 29 11

Industrials 59 60 18.2 52 6 3.5 42 14

Materials 30 30 49.7 27 3 3.5 18 9

Technology 74 74 20.4 56 16 10.7 59 12

Non-Cyclicals 132 134 6.9 96 33 3.3 90 30

Cons. Staples 39 41 9.6 30 7 2.6 30 6

Health Care 52 52 5.2 44 8 4.0 37 7

Telecom 8 8 -0.1 3 5 -7.0 4 4

Utilities 33 33 10.8 19 13 11.4 19 13

S&P 500 ex-Finls 414 418 18.3 326 81 5.1 302 87

Financials 81 82 10.8 60 19 6.2 62 15

S&P 500 495 500 17.0 386 100 5.3 364 102 Source: Standard & Poor’s, Compustat, Thomson Financial, FactSet and UBS

2Q11 Revenue Scorecard Revenue Growth Revenue Surprise

Rptd Total YoY (%) Pos Neg Pct (%) Beat Miss

Cyclicals ex-Finls 282 284 18.3 246 36 3.4 188 57

Cons. Discretionary 78 79 11.3 65 13 3.2 53 13

Energy 41 41 38.2 39 2 5.6 30 9

Industrials 59 60 8.4 52 7 1.2 36 15

Materials 30 30 17.8 29 1 2.6 19 7

Technology 74 74 12.8 61 13 2.9 50 13

Non-Cyclicals 132 134 7.8 110 21 1.4 79 33

Cons. Staples 39 41 9.1 33 6 1.8 25 9

Health Care 52 52 6.4 46 6 1.6 35 7

Telecom 8 8 7.9 8 0 0.4 3 3

Utilities 33 33 7.0 23 9 -0.6 16 14

S&P 500 ex-Finls 414 418 14.1 356 57 2.6 267 90

Financials 81 82 7.4 61 18 4.6 55 13

S&P 500 495 500 13.2 417 75 2.9 322 103 Source: Standard & Poor’s, Compustat, Thomson Financial, FactSet and UBS

Stocks beat 2Q expectations by 5%

74% of companies have beaten on the bottom-line

65% of companies (ex-financials) have delivered positive revenue surprises

US Equity Strategy 6 September 2011

UBS 28

Earnings Analysis

S&P 500 Earnings Surprise

7.0

11.5

9.9

8.98.0

5.25.9 6.2

5.1

2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11E

Source: Standard & Poor’s, Compustat, Thomson Financial, FactSet and UBS Note: Universe excludes Financials

S&P 500 Revenue Surprise

0.4

2.3

0.5 0.4

1.4

1.0

2.6

-0.9 -0.1

2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11E

Source: Standard & Poor’s, Compustat, Thomson Financial, FactSet and UBS Note: Universe excludes Financials

EPS has beaten expectations in each of the past 9 quarters

Revenues are coming in much stronger than expected

US Equity Strategy 6 September 2011

UBS 29

Earnings Analysis

Earnings Surprise – Cyclicals vs. Non-cyclicals

10

1514

12

9

6

7 76

4

8

3

56

43

5

3

2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11E

Cyclicals

Non-Cyclicals

Source: Standard & Poor’s, Compustat, Thomson Financial, FactSet and UBS Note: Universe excludes Financials

2011 EPS Revisions since 06/30/11 1.0

0.3 0.1-1.0 -10.2-0.4-0.4

Tech Non-Cycls

Indls Matr ConsDisc

Energy Finls

Source: Standard & Poor’s, Compustat, Thomson Financial, FactSet and UBS

Earnings surprises have been stronger for Cyclicals vs. Non-cyclicals

Earnings revisions have been negative for Financials and the commodity sectors

US Equity Strategy 6 September 2011

UBS 30

Earnings Analysis

2Q11 Price Response to Surprises

Beat Miss Beat Miss

Be

at

0.86 -0.24 0.55

Be

at

0.79 -0.60 0.30

Mis

s

-2.84 -4.64 -3.89M

iss

-1.46 -2.54 -2.04

0.27 -2.24 0.20 -1.29

1Q112Q11

Revenue Surprise

EP

S S

urp

ris

e

Revenue Surprise

EP

S S

urp

ris

e

Source: S&P, Compustat, Thomson Financial, FactSet and UBS. Note: Price action for above table is calculated for all companies reported 2Q results from 1 day before to 1 day after report date. For history shown in table below, price action is calculated from 1 day before to 2 days after report date

Historical Price Response to Surprises Price Action (%)

Beat EPS Beat EPS Miss EPS Miss EPSQuarter Beat Sales Miss Sales Beat Sales Miss Sales

1Q11 0.69 -0.21 -1.42 -2.634Q10 1.61 -0.67 -1.23 -2.893Q10 1.00 -0.70 -2.87 -1.392Q10 1.10 -1.57 -2.64 -3.791Q10 0.62 -0.63 -2.62 -3.53

4Q09 1.16 0.01 -3.07 -3.083Q09 0.87 -0.60 -2.79 -4.632Q09 1.58 -0.12 -1.51 -4.901Q09 4.91 1.68 -1.05 -3.214Q08 4.79 0.67 -2.04 -3.973Q08 2.33 -1.47 -2.15 -4.402Q08 1.91 0.39 -5.19 -5.361Q08 1.73 -0.27 -2.54 -4.074Q07 2.37 -0.09 -0.98 -5.473Q07 1.47 0.27 -0.90 -3.702Q07 1.59 -0.68 -2.77 -3.111Q07 1.69 -0.96 -1.57 -3.384Q06 1.48 0.69 -0.84 -2.603Q06 1.79 -0.28 -1.15 -3.482Q06 1.39 0.41 -4.55 -4.861Q06 1.01 0.85 -2.15 -4.134Q05 1.48 -0.22 -1.28 -3.773Q05 1.39 0.35 -2.44 -2.652Q05 2.01 0.23 -0.71 -2.891Q05 1.64 -0.34 -1.23 -4.834Q04 1.00 -0.62 -2.80 -3.483Q04 1.56 1.37 -0.13 -1.502Q04 1.48 -0.59 -1.47 -4.291Q04 0.98 0.80 -1.82 -3.26

Source: Standard & Poor’s, Compustat, Thomson Financial, FactSet and UBS

Only companies beating on both the top- and bottom-lines are being rewarded

Companies beating on both top- and bottom-lines consistently outperform

US Equity Strategy 6 September 2011

UBS 31

Earnings Analysis

2Q11 Serial Correlation of Revenue Surprises Revenue Surprise

Rptd Total Pct (%) Beat Miss

1Q11 High Rev. Surprise 207 209 3.9 158 33

1Q11 Low Rev. Surprise 207 209 1.8 109 57

Difference 2.1 49 -24

Source: S&P, Compustat, Thomson Financial, FactSet and UBS

Serial Correlation of EPS/Rev Surprises % of Prior Sales % of Overall

Quarter & EPS Beats S&P 500 Difference

1Q11 62% 52% 10%4Q10 63% 50% 13%3Q10 56% 48% 8%2Q10 66% 53% 13%1Q10 69% 60% 9%4Q09 73% 59% 14%3Q09 68% 50% 18%2Q09 54% 37% 17%1Q09 41% 28% 13%4Q08 31% 30% 1%3Q08 46% 39% 7%2Q08 68% 59% 9%1Q08 61% 52% 9%4Q07 67% 57% 10%3Q07 62% 49% 13%2Q07 58% 54% 4%1Q07 64% 54% 10%4Q06 55% 49% 6%3Q06 61% 52% 9%2Q06 60% 49% 11%1Q06 56% 48% 8%4Q05 55% 49% 6%3Q05 47% 43% 4%2Q05 71% 60% 11%1Q05 55% 51% 4%4Q04 64% 58% 6%3Q04 60% 53% 7%2Q04 63% 58% 5%1Q04 76% 69% 7%

Source: Standard & Poor’s, Compustat, Thomson Financial, FactSet and UBS

Revenue surprises are serially correlated

Companies beating on both top- and bottom-lines tend to repeat

US Equity Strategy 6 September 2011

UBS 32

Sector Returns

S&P 500 Sectors Index Aug-11 QTD YTD 1 Yr 3 Yr 5 Yr 7 Yr 10 Yr

Technology (6.0) (4.5) (2.5) 20.5 4.0 4.9 5.7 2.6

Financials (9.6) (12.8) (15.5) 0.0 (12.7) (14.7) (8.2) (4.3)

Energy (9.7) (9.1) 1.3 34.4 (1.0) 5.6 12.3 11.0

Health Care (2.1) (5.9) 7.3 21.2 2.9 2.4 3.7 2.0

Consumer Staples 0.6 (0.9) 6.9 20.1 6.5 7.0 7.7 6.4

Consumer Discret. (5.3) (6.6) 1.2 26.6 9.1 4.4 4.6 3.7

Industrials (6.5) (13.0) (6.0) 17.1 (1.2) 1.3 3.4 2.8

Utilities 2.3 1.4 10.5 15.0 1.0 3.5 8.5 3.9

Materials (6.7) (9.8) (6.5) 19.9 (0.8) 4.7 6.7 7.5

Telecom Svcs. (1.4) (7.0) (0.4) 15.6 3.6 2.6 5.2 0.4

S&P 500 (5.4) (7.4) (1.8) 18.5 0.5 0.8 3.5 2.7

Index Weight 2010 2009 2008 2007 2006 2005 2004

Technology 18.6 10.2 61.7 (43.1) 16.3 8.4 1.0 2.6

Financials 14.2 12.1 17.2 (55.3) (18.6) 19.2 6.5 10.9

Energy 12.4 20.5 13.8 (34.9) 34.4 24.2 31.4 31.5

Health Care 11.8 2.9 19.7 (22.8) 7.2 7.5 6.5 1.7

Consumer Staples 11.3 14.1 14.9 (15.4) 14.2 14.4 3.6 8.2

Consumer Discret. 10.7 27.7 41.3 (33.5) (13.2) 18.6 (6.4) 13.2

Industrials 10.5 26.7 20.9 (39.9) 12.0 13.3 2.3 18.0

Utilities 3.7 5.5 11.9 (29.0) 19.4 21.0 16.8 24.3

Materials 3.6 22.2 48.6 (45.7) 22.5 18.6 4.4 13.2

Telecom Svcs. 3.1 19.0 8.9 (30.5) 11.9 36.8 (5.6) 19.9

S&P 500 100.0 15.1 26.5 (37.0) 5.5 15.8 4.9 10.9

Source: Standard & Poor’s, FactSet and UBS Note: All returns include dividends.

US Equity Strategy 6 September 2011

UBS 33

US Equity Returns

US Equity Indices Index Aug-11 QTD YTD 1 Yr 3 Yr 5 Yr 7 Yr 10 Yr

Dow (4.4) (6.5) 0.3 16.0 0.2 0.4 1.9 1.6

S&P 500 (5.4) (7.4) (1.8) 18.5 0.5 0.8 3.5 2.7

S&P 100 (OEX) (5.2) (6.3) (1.7) 17.7 (0.1) 0.5 2.6 1.6

Nasdaq (6.4) (7.0) (2.8) 22.0 2.9 3.4 5.0 3.6

R. 1000 (5.8) (7.8) (1.9) 19.1 0.8 1.1 4.0 3.2

R. 1000 Value (6.2) (9.4) (4.0) 14.4 (1.4) 0.0 3.0 3.4

R. 1000 Growth (5.3) (6.2) 0.2 24.0 3.1 3.7 4.9 2.7

R. Mid-Cap (6.9) (10.3) (3.0) 21.3 2.9 3.0 7.0 7.2

R. Mid-Cap Value (6.9) (10.2) (4.2) 17.5 2.0 1.4 6.4 7.5

R. Mid-Cap Growth (6.8) (10.3) (1.7) 25.6 3.8 4.3 7.4 5.9

R. 2000 (8.7) (12.0) (6.5) 22.2 0.8 1.5 5.5 5.8

R. 2000 Value (8.8) (11.8) (8.5) 16.9 (0.6) (0.6) 4.3 6.5

R. 2000 Growth (8.6) (12.1) (4.6) 27.5 2.1 3.6 6.6 4.9

Index Value 2010 2009 2008 2007 2006 2005 2004

Dow 11,614 11.0 18.8 (33.8) 6.4 16.3 (0.6) 3.1

S&P 500 1,219 15.1 26.5 (37.0) 5.5 15.8 4.9 10.9

S&P 100 (OEX) 12.5 22.3 (35.3) 6.1 18.5 1.2 6.4

Nasdaq 2,579 16.9 43.9 (40.5) 9.8 9.5 1.4 8.6

R. 1000 16.1 28.4 (37.6) 5.8 15.5 6.3 11.4

R. 1000 Value 15.5 19.7 (36.8) (0.2) 22.2 7.1 16.5

R. 1000 Growth 16.7 37.2 (38.4) 11.8 9.1 5.3 6.3

R. Mid-Cap 25.5 40.5 (41.5) 5.6 15.3 12.7 20.2

R. Mid-Cap Value 24.8 34.2 (38.4) (1.4) 20.2 12.6 23.7

R. Mid-Cap Growth 26.4 46.3 (44.3) 11.4 10.7 12.1 15.5

R. 2000 26.9 27.2 (33.8) (1.6) 18.4 4.6 18.3

R. 2000 Value 24.5 20.6 (28.9) (9.8) 23.5 4.7 22.2

R. 2000 Growth 29.1 34.5 (38.5) 7.0 13.3 4.2 14.3 Source: Dow Jones, NASDAQ, Standard & Poor’s, Russell, FactSet and UBS Note: All returns include dividends except the Dow and NASDAQ.

US Equity Strategy 6 September 2011

UBS 34

Global Equity Returns

Global Equity Indices Country Curr. Aug-11 QTD YTD 1 Yr 3 Yr 5 Yr 7 Yr 10 Yr

EAFE US$ (9.0) (10.4) (5.7) 10.5 (2.5) (1.0) 5.7 5.4

local (8.7) (11.9) (11.4) (1.5) (5.7) (4.5) 2.6 1.0

Euro x-UK US$ (11.4) (15.8) (6.0) 9.3 (4.8) (1.0) 6.5 5.8

local (11.0) (16.0) (13.6) (5.6) (6.2) (4.5) 3.1 0.5

UK US$ (7.3) (7.2) (2.1) 13.2 (1.4) (1.2) 4.9 4.8

local (6.5) (8.5) (5.8) 6.8 2.4 1.9 6.4 3.6

Pac x-Japan US$ (5.4) (5.8) (3.3) 18.3 6.9 8.5 13.5 13.7

local (4.0) (6.1) (7.0) 2.8 1.2 3.0 8.4 8.0

Japan US$ (8.1) (4.9) (9.3) 6.4 (3.4) (4.8) 1.6 2.1

local (9.0) (9.9) (14.5) (3.1) (14.0) (12.6) (3.5) (2.4)

EME US$ (8.9) (9.2) (8.3) 9.4 5.4 8.7 16.0 16.3

local (7.3) (8.1) (9.9) 2.7 4.7 7.2 13.6 14.2

S&P 500 (5.4) (7.4) (1.8) 18.5 0.5 0.8 3.5 2.7

Country Curr. 2010 2009 2008 2007 2006 2005 2004

EAFE US$ 8.2 32.5 (43.1) 11.6 26.9 14.0 20.7

local 5.3 25.4 (39.9) 4.0 16.9 29.5 13.1

Euro x-UK US$ 2.4 33.9 (45.0) 17.5 36.4 11.3 22.4

local 5.1 29.0 (42.7) 6.6 22.5 28.6 13.3

UK US$ 8.8 43.4 (48.3) 8.4 30.7 7.4 19.6

local 12.2 27.7 (28.5) 6.6 14.6 20.1 11.5

Pac x-Japan US$ 17.1 73.0 (50.0) 31.7 33.2 14.8 29.6

local 6.1 45.8 (41.6) 21.6 25.9 20.3 25.3

Japan US$ 15.6 6.4 (29.1) (4.1) 6.3 25.6 16.0

local 0.7 9.3 (42.5) (10.1) 7.3 44.7 10.9

EME US$ 19.2 79.0 (53.2) 39.8 32.6 34.5 26.0

local 14.4 62.8 (45.7) 33.5 28.9 35.8 16.4

S&P 500 15.1 26.5 (37.0) 5.5 15.8 4.9 10.9

Source: Standard & Poor’s, MSCI, FactSet and UBS Note: All returns include dividends.

US Equity Strategy 6 September 2011

UBS 35

Correlations of Stocks and Economic Indicators

Correlations with Major Economic Indicators Indl ISM UBS Econ Nonfarm S&P 500

Prod. ISM Non-Mfg Surp Payrolls Index

Industrial Production 1.00

ISM 0.11 1.00

ISM Non-Mfg 0.02 0.27 1.00

UBS Econ Surprise 0.18 0.25 0.16 1.00

Nonfarm Payrolls 0.52 -0.06 0.03 0.21 1.00

S&P 500 Index 0.08 0.25 0.28 0.47 0.20 1.00 Source: ISM, Federal Reserve, US Dept of Labor, OECD, FactSet and UBS

S&P 500 vs. Economic Surprise Index & ISM Non-Mfg

-30%

-20%

-10%

0%

10%

20%

30%

99 00 01 02 03 04 05 06 07 08 09 10 11

-30%

-20%

-10%

0%

10%

20%

30%

◄ S&P 500

US Econ ▲ Surprise &Non-Mfg ISM

Source: Standard & Poor’s, FactSet and UBS. Note: Rolling 3-month changes

UBS’s proprietary Economic Surprise Index and the ISM Non-Mfg have the highest correlations with stocks of any of the economic indicators

US Equity Strategy 6 September 2011

UBS 36

Sector Recommendations Overweight

Technology

Tech appears attractive for a host of reasons. With a multiple of 11.3x the group trades inline with the market — highly unusual for the sector. Additionally, 2Q earnings beats were the largest of any group and Tech has become the most defensive cyclical sector with 29% of its total assets in cash. This excess capital is driving rapid growth in dividends and buybacks.

Industrials

Industrials have swung from expensive to cheap as prices have dropped 13% since the end of June while forward NTM earnings estimates have continued to rise. Many Capital Goods companies are benefiting from strong spending on agriculture and mining equipment, and Transports, particularly Rails, have solid pricing power. We believe this sector has the most margin upside from current levels due to the group’s later-stage nature.

Financials

Financials underperformed in August due, in part, to investor concerns about the impact of falling asset prices on balance sheets. However, there are a number of tailwinds that should support the group’s performance, including (1) improving loss trends; (2) a turn in C&I and consumer loan volumes; (3) a more favorable backdrop for investment banking activity; (4) increased regulatory clarity; and (5) attractive valuations.

Market Weight

Health Care

Health Care remains our favorite non-cyclical sector due to its solid earnings trends and strong balance sheets. With cash equal to 17% of assets, this group has large reserves that should help drive EPS gains through M&A activity and buybacks. However, we are concerned about high valuations, uncertainty surrounding ‘ObamaCare’, and patent expirations.

Consumer Discretionary

Compared to other economically sensitive areas of the market, Discretionary is expensive and has less potential for dividend and buyback growth due to a high total payout ratio. The group’s relative earnings strength tends to fade as the cycle advances from its early stage.

Tech looks cheap and we expect strong buyback activity

Despite year-to-date underperformance, Financials stand to benefit from a variety of tailwinds

Health Care remains our favorite non-cyclical

US Equity Strategy 6 September 2011

UBS 37

Sector Recommendations Market Weight (continued)

Energy

Falling 10%, Energy was the worst performing sector in August. Since its peak in April, the price of WTI has fallen 22%, and so far in 3Q the average price of oil is 11% below the 2Q level. This decline has curtailed estimate revisions. During 2Q reporting season, Energy companies surpassed top-line expectations by 6% but beat on the bottom-line by just 2% due to margin pressures.

Materials

We expect Materials’ performance to remain closely tied to the outlook for commodity prices, which could continue to be volatile given significant global macro risks. However, the group is currently the cheapest sector based on our valuation work.

Underweight

Consumer Staples

Consumer Staples has outperformed during the current soft patch. However, we expect the sector to struggle versus the broader market as investors rotate toward more cyclical names. From a longer-term perspective, Staples’ secular growth prospects remain solid and much of the group should benefit from significant overseas exposure. High total (dividends and buybacks) payout ratios could constrain the return of capital to shareholders in the future.

Telecom

Telecom is expensive and valuations could be at risk if the economy avoids recession as we expect. Additionally, short term earnings and revenue trends, as measured by surprises and revisions, are weak and longer term the group faces a challenging competitive environment.

Utilities

Up 2%, Utilities was the best performing sector in August. However, it is the most expensive group and analysts expect it to post the lowest earnings growth of any sector over the next two years. Merchant utilities face a challenging pricing environment and environmental costs could have an outsized impact on the industry. Additionally, due to high re-investment needs, the sector has been a net issuer of equity.

Upward estimate revisions have stalled in the Energy sector

We expect Staples to struggle as investors rotate to more cyclical names

Earnings growth and re-investment needs are headwinds for Utilities

US Equity Strategy 6 September 2011

UBS 38

Balance Sheet Strength

Cash as a % of Total Assets

2%

4%

6%

8%

10%

12%

14%

16%

99 00 01 02 03 04 05 06 07 08 09 10 11

▲ Large Cap (S&P 500)

11.0%

Small Cap▼ (S&P 600)

13.5%

Post Recession Build-up

Cash Draw-down

Source: S&P, Compustat, FactSet and UBS Note: Universe excludes Financials. Data as of 2Q11

Net Debt to Equity

35%

45%

55%

65%

75%

85%

95%

99 00 01 02 03 04 05 06 07 08 09 10 11

Source: S&P, Compustat, FactSet and UBS Note: Universe excludes Financials. Data as of 2Q11

Cash balances remain extremely high levels

Balance sheets continue to strengthen

US Equity Strategy 6 September 2011

UBS 39

M&A and Capex

Number of Deals Above $1 Billion

176165

101120

268

244

195

157

9896

143

255

233

180

151

9087

67

110907050301999795Ann.

Source: MergerStat, FactSet and UBS Note: 2011 is estimated based on a run rate of 117 deals as of August 30, 2011

Capex and R&D

5.3%

6.0%

6.8%

7.5%

8.3%

00 01 02 03 04 05 06 07 08 09 10 11

7.0%

7.5%

8.0%

8.5%

9.0%

R&D / Sales(Rolling 12M) ►

◄ Capex/Sales (Rolling 12M) ►

cost cutting

6.3%

7.1%

Source: Standard & Poor’s, CompuStat, FactSet and UBS. Note: Universe excludes Financials. Data as of 2Q11

Deal activity has increased meaningfully off a low base and should continue to rise

Capex spending has picked up while R&D spending remains subdued

Energy and Tech account for the a large part of this rise

US Equity Strategy 6 September 2011

UBS 40

Cash Repatriation

Total Payout Ratio

10

30

50

70

90

110

00 01 02 03 04 05 06 07 08 09 10 11

◄ Dividends+ Buybacks

▲ Dividends 27.7

61.2

45.6

91.6

Source: S&P, Compustat, FactSet and UBS Note: Universe excludes Financials. Data as of 2Q11

Total Payout Potential 2011 Current 10-yr Avg Difference Cash

Earnings Payout Payout b/w Avg and % ofGrowth (%) Ratio (%) Ratio (%) Current Assets

Cyclicals 23.6 56.5 63.1 6.6 12.8

Technology 16.7 48.9 66.6 17.7 28.0Energy 37.7 45.0 51.1 6.1 6.1Materials 40.0 36.4 47.5 11.1 5.9Cons Disc 17.3 91.7 82.0 -9.7 9.7Industrials 19.9 61.1 61.6 0.5 9.2

Non-Cyclicals 5.9 71.3 67.1 -4.2 8.0

Utilities -1.7 46.1 39.7 -6.4 2.2Health Care 7.1 60.4 61.6 1.2 16.9Cons Staples 8.7 88.6 80.6 -8.0 6.3Telecom Svcs 0.9 93.1 74.6 -18.5 3.1

S&P 500 ex-Fin 17.2 61.7 64.7 3.0 11.0 Source: S&P, Compustat, FactSet and UBS Note: Universe excludes Financials

The total payout ratio is rising but well off the prior peak

With more cash, better earnings, and lower payout ratios, cyclicals have better prospects for payout growth

US Equity Strategy 6 September 2011

UBS 41

Cash Repatriation

Dividends & Buybacks ($B)

0

30

60

90

120

150

99 00 01 02 03 04 05 06 07 08 09 10 11

▲ Dividends

Buybacks ►

$B

Source: Standard & Poor’s, Compustat, FactSet and UBS Note: Universe excludes Financials

Buybacks vs. Debt Payments

25

33

5661

58 61

72

3834

14

31

22

-27-19 -18-14

3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11E

Buybacks

Debt Repayments

Debt Payments > Buybacks

Debt Payments < Buybacks Net Debt Issuance

Source: Standard & Poor’s, Compustat, FactSet and UBS Note: Universe excludes Financials

Buybacks have risen sharply but remain far from peak levels

Debt is another source of cash that can be directed to buybacks and investment

US Equity Strategy 6 September 2011

UBS 42

ISM

ISM Manufacturing & Non-Manufacturing

98 00 02 04 06 08 10

35

40

45

50

55

60

>50 is Expansionary

<50 is Contractionary

◄ ISM Mfg

◄ ISM Non-Mfg

50.6

54.6

Source: Institute of Supply Chain Management, FactSet and UBS Note: ISM Mfg represents Aug. 2011

ISM Manufacturing Survey 10 Yr

Aug-11 Jun-11 Jun-11 May-11 Average

Purchasing Managers' Index 50.6 50.9 55.3 53.5 52.2

Production 48.6 52.3 54.5 54.0 55.5

New Orders 49.6 49.2 51.6 51.0 55.3

Backlog of Orders 46.0 45.0 49.0 50.5 49.8

Supplier Deliveries 50.6 50.4 56.3 55.7 54.4

Inventories 52.3 49.3 54.1 48.7 46.0

Customers' Inventories 46.5 44.0 47.0 39.5 44.6

Employment 51.8 53.5 59.9 58.2 49.8

Prices Paid 55.5 59.0 68.0 76.5 63.7

New Export Orders 50.5 54.0 53.5 55.0 54.4

Imports 55.5 53.5 51.0 54.5 53.4 Source: ISM, FactSet and UBS

ISM Manufacturing is consistent with annual GDP growth of 2.8%

US Equity Strategy 6 September 2011

UBS 43

Inflation

CPI – Core vs. Headline

90 92 94 96 98 00 02 04 06 08 10

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

◄ Core3.6%

1.8%

Headline ►

Source: Department of Labor, FactSet and UBS

US Raw Food Costs vs. Consumer Food Costs

90 92 94 96 98 00 02 04 06 08 10

-20

-10

0

10

20

30

4.2%

27.3%

▼ CPI - Food

PPI Raw Foods ►

Source: U.S. Department of Labor, FactSet and UBS

Broad inflation measures are beginning to pick up

In the developed world, intermediate costs limit the impact of commodity inflation on consumer prices

US Equity Strategy 6 September 2011

UBS 44

Inflation

WTI

70 75 80 85 90 95 00 05 10345678

10

20

304050607080

100

88.8

Source: Wall Street Journal, FactSet and UBS

Gold & Copper

Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-111,300

1,400

1,500

1,600

1,700

1,800

4.0

4.1

4.2

4.3

4.4

4.5

4.6$/troy ounce $/lb

◄ Gold Copper ►

5-day average

Source: Wall Street Journal, FactSet and UBS Note: Rolling 5-day average prices

Energy prices have recently fallen on weaker economic data

Precious metal prices have increased while industrial commodity prices remain more subdued

US Equity Strategy 6 September 2011

UBS 45

Inflation & Currencies

5-Year/5-Year Forward Breakeven Inflation Rate

1.5

2.0

2.5

3.0

3.5

99 00 01 02 03 04 05 06 07 08 09 10 11

2.8

2.3

Source: Bloomberg and UBS

USD/EUR

90 92 94 96 98 00 02 04 06 08 10

0.9

1.0

1.1

1.2

1.3

1.4

1.5

1.6

1.44

Source: Wall Street Journal, Bloomberg, FactSet and UBS

Long-term inflation expectations — as implied by the TIPS market — remain in check

The US$ is currently in the middle of its 5-year range

US Equity Strategy 6 September 2011

UBS 46

Employment

Weekly Unemployment Claims

90 92 94 96 98 00 02 04 06 08 10250

300

350

400

450

500

550

600

650

4-week avg. 410k

Source: US Department of Labor, FactSet and UBS

Unemployment Rate

50 55 60 65 70 75 80 85 90 95 00 05 10

3

4

5

6

7

8

9

10

11

9.1%

Source: US Department of Labor, FactSet and UBS Note: Updated for August data.

Weekly claims have stagnated at current levels for the past several months

The unemployment rate rises precipitously during recessions

US Equity Strategy 6 September 2011

UBS 47

Retail Sales, Savings & Wealth

Retail Sales ex-Autos

94 96 98 00 02 04 06 08 10

-8

-6

-4

-2

0

2

4

6

8

8.6

Source: US Census Bureau, FactSet and UBS

Savings Rate & Total Household Net Worth

90 92 94 96 98 00 02 04 06 08 101

2

3

4

5

6

720

30

40

50

6058.1

◄ Savings Rate

Total Household▼ Net Worth (Inverted)

5.3%

Source: Federal Reserve, BEA, FactSet and UBS Note: Household Net Worth is through 1Q11

Retail sales data remains strong

US Equity Strategy 6 September 2011

UBS 48

Housing

Case Shiller (20 Market) Home Values Index

00 01 02 03 04 05 06 07 08 09 10 11

100

120

140

160

180

200

141.3

Source: Standard & Poor’s, FactSet and UBS Note: Data through June 2011

Housing Permits

60 65 70 75 80 85 90 95 00 05 10

500

1,000

1,500

2,000

2,500

601k

Source: US Census Bureau, FactSet and UBS

Home values remain stagnant

Construction activity remains at multi-generational lows

US Equity Strategy 6 September 2011

UBS 49

Loan Volumes & Delinquencies

C&I Loan Volumes

-30

-20

-10

0

10

20

30

40

73 77 81 85 89 93 97 01 05 09

Source: Mortgage Bankers Association, FactSet and UBS

Loan Delinquency (Residential and C&I)

90 92 94 96 98 00 02 04 06 08 10

2

4

6

8

10

12

Residential

C&I

2.2

10.5

As of 2Q11

Source: Federal Reserve, FactSet and UBS

Increasing loan volumes are supportive of further hiring

US Equity Strategy 6 September 2011

UBS 50

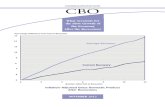

US Fiscal Imbalances

Federal Budget Deficit (US$ Trillions)

0.5

1.4

1.3

1.4

1.1

0.7

0.5 0.50.6

0.6 0.60.7

0.7 0.7

08 09 10 11 12 13 14 15 16 17 18 19 20 21

Source: CBO, Haver and UBS

Federal Budget Breakdown

2011 2021

5% Interest 16%

18% Mandatory 13%

40% Entitlements 46%

14% Discretionary 9%

23% Security 17%

$3.5 Trillion

$5.9 Trillion

Source: Office of Management & Budget and UBS

$8 Trillion in projected deficits over the next 10 years

OMB projects that interest and entitlements will go from 45% of the budget to 62% … almost 80% of tax receipts

US Equity Strategy 6 September 2011

UBS 51

US Fiscal Imbalances

Treasuries Outstanding (By Maturity)

< 1 YearAvg Cpn: 08

27%

> 10 YearsAvg Cpn: 5.2

9%

5-10 YearsAvg Cpn: 3.5

23%

1-5 YearsAvg Cpn: 2.1

41%

Treasuries Outstanding $8.7 Trillion(Bills, Notes, and Bonds)

Source: US Treasury and UBS Note: Data updated through July 2011

Foreign Ownership of Treasuries (US$ Trillions)

2.3 2.4 2.3 2.3 2.4 2.4 2.6 2.7 2.7 2.73.9

4.6

6.41.3 1.3 1.0 1.0 1.2 1.5 1.8 2.0 2.1 2.4

3.1

3.7

4.5

0

2

4

6

8

10

99 00 01 02 03 04 05 06 07 08 09 10 11

Foreign Ow nershipChina 26%Japan 20%Offshore Havens 12%Commodity Exporters 13%Rest of World 29%

11E

Source: US Treasury and UBS Note: Offshore Havens include UK, Luxemburg and Caribbean Banking Centers. Data updated through June 2011

27% of US Treasury debt is up for refinancing in the next 12 months

Is the US Government any different than a sub-prime ARM borrower?

US Equity Strategy 6 September 2011

UBS 52

Yield Curves

US Yield Curves

0

1

2

3

4

5

2009 ► ▲ 2008

2011▲ 2010

3-Mo 2-Yr 5-Yr 10-Yr 30-Yr

08/31/2011 0.01 0.20 0.96 2.22 3.6012/31/2010 0.12 0.59 2.01 3.29 4.3312/31/2009 0.05 1.14 2.68 3.84 4.6412/31/2008 0.08 0.76 1.55 2.21 2.68

Source: Bloomberg, Federal Reserve and UBS

2 – 10 Year Spread

85 90 95 00 05 10

0

1

2

3

2.02

Avg: 1.06

Source: Federal Reserve, Bloomberg, FactSet and UBS

While the yield curve has flattened in recent months, it remains reasonably steep

US Equity Strategy 6 September 2011

UBS 53

Central Bank Policy

Implied Fed Funds Rates (based on Futures)

0.00

0.10

0.20

0.30

0.40

0.50

0.60

9/20/11 11/2/11 12/13/11 1/25/12 3/13/12 4/25/12 6/20/12

▲ Aug 31, 2011

Feb 28, 2011 ►

Source: Bloomberg and UBS

Real Fed Funds

90 92 94 96 98 00 02 04 06 08 10

-2

-1

0

1

2

3

4

-1.64

Avg: 1.20

Source: Federal Reserve, Department of Labor, FactSet and UBS

The Fed is now focused on unconventional measures to provide stimulus

Real rates are now substantially negative

US Equity Strategy 6 September 2011

UBS 54

Treasuries

10-Year Treasury Yields

65 70 75 80 85 90 95 00 05 102

4

6

8

10

12

14

16

2.22

Source: Federal Reserve, Bloomberg, FactSet and UBS

Municipal Bond Spreads

-2.0

-1.5

-1.0

-0.5

0.0

0.5

1.0

1.5

2.0

97 99 01 03 05 07 09 11

Yield (%)10-year US Treasury 2.2

GO BondsNational Avg 2.6 NY 2.9IL 4.1CA 3.6

Source: Federal Reserve, Wall Street Journal, Haver and UBS

Treasury yields remain subdued on growth concerns

Typically, municipal bonds carry lower yields due to their tax-exempt status

US Equity Strategy 6 September 2011

UBS 55

Bond Spreads

Mortgage Spread

90 92 94 96 98 00 02 04 06 08 10

1.0

1.5

2.0

1.31

Avg 1.49

Source: Freddie Mac, Bloomberg, FactSet and UBS

Corporate (Baa) Spread

90 92 94 96 98 00 02 04 06 08 101

2

3

4

5

6

Avg: 2.3

3.12

Source: Moody’s, Bloomberg, FactSet and UBS

Mortgage spreads remain narrow

Corporate spreads have widened recently as a result of falling treasury yields

US Equity Strategy 6 September 2011

UBS 56

Appendix: S&P 500 Valuation Our S&P 500 valuation framework is based upon a traditional discounted cash flow methodology, illustrated in the exhibit below. What differentiates our approach is how we apply it in practice.

Gordon Growth Model

g ERP)RRF(I

PR

gk

PR

E

P 11

1

0

−++=

−=

P0 = current price

E1 = next year’s EPS

PR = payout ratio

k = discount rate or cost of capital

I = inflation rate

RRF = real risk free rate

ERP = equity risk premium

g = long-term growth rate

Source: UBS

Importantly, while our P/E formula remains constant over time, our work suggests that equity markets experience extended stretches over which only one or two key variables dominate overall stock market valuations. We call these prolonged periods “investment regimes” and believe that they hold the key to understanding stock prices.

Investment Regimes

Period Key Factor Valuation Metric Valuation Formula

PE

PE

PE

PE =

1Baa Yield - (Δ Growth)

1I + RRF

=1

Baa Yield2004 - 2008 Cost of Capital Baa Yield

2009 - Present Slower Growth Baa Yield - (Δ Growth)

1980 - 1999 Risk Free Rate 10 year treasury

=1

I + 2%

=

1970 - 1980 Inflation Expectation CPI + 2%

Source: UBS

Notably, over the past couple of years, the market has been discounting slower long-term growth rate. The current relationship between the S&P 500’s 12.4x P/E, the Baa’s 6.0% bond yield, and growth expectations is shown below.

2009 – Present Regime PE

18.9%

8.9% =

Market implied EPS growth slowing by 3.4%

=

=

1Baa Yield - (Δ Growth)

11.3

5.5% - (-3.4%)Baa Yield Δ Growth

Source: UBS

US Equity Strategy 6 September 2011

UBS 57

Appendix: Inter-Sector Valuation The goal of our inter-sector valuation work is to gauge whether each S&P 500 sector is undervalued or overvalued relative to the overall market. Our analysis is based upon the historical valuation relationships between sectors. Importantly, we normalize sector valuations for three dynamics that could potentially provide spurious results, if not accounted for correctly:

Some sectors tend to be more expensive than others on a systematic basis (e.g., Tech consistently trades at a higher P/E than Financials).

The valuation dispersion between sectors is wide in some environments (e.g., the late-90s) and tight in others (e.g., 2008-09). In other words, a multiple point today is not necessarily the same as a multiple point yesterday.

Sector dynamics change over time. For example, Health Care carried a premium multiple throughout the 90’s, but has traded at a discount over the past decade.

Our inter-sector valuation work suggests that relative sector valuations are mean-reverting over medium-term time frames. As such, we view our inter-sector valuation rankings as a good starting point in determining sector recommendations. However, we note that sectors can stay cheap or expensive for multi-year time periods.

Ranking Overview In order to properly normalize inter-sector valuations over time, our analysis focuses on how many standard deviations away each sector’s P/E is from the market’s P/E. (For our fellow math geeks, this is known as cross-sectional standard deviation analysis.) We then put this calculation into a historical context on a sector-by-sector basis.

Step-by-Step Calculations (1) Aggregate P/Es and Standard Deviations. First, we calculate a forward P/E for the S&P 500 and all

ten of its sectors, using consensus EPS estimates over the next twelve months. We also calculate the weighted average standard deviation of the market’s forward P/E.

(2) Calculate Z-Scores. Next, we calculate a Z-Score for each sector. This expresses each sector’s P/E as a number of standard deviations away from the market’s P/E. This is calculated by subtracting the market’s P/E from each sector’s P/E and dividing the result by the weighted average standard deviation of the market’s forward P/E.

(3) Put Current Valuations in Historical Context. A Net Z-Score is then calculated for each sector by comparing current Z-Scores to average Z-Scores over the prior 36 months. We perform our analysis on a rolling 36-month basis to account for secular changes in sector dynamics (e.g., new governmental regulations).

(4) Rank Sectors from Most to Least Expensive. We then rank all ten sectors based upon their Net Z-Scores (i.e., how expensive or cheap each sector’s current Z-Score is in comparison to its historical average). Sectors with negative scores are cheap on a relative basis. Sectors with positive scores are expensive.

(5) Convert Net Z-Scores into Current P/E Multiple Points. To make the visual interpretation of our analysis easier to understand, we covert each sector’s historical Net Z-Scores into current P/E multiple points (cheap or expensive). This is done by multiplying the historical Net Z-Scores by the current weighted average standard deviation of the market’s forward P/E.

US Equity Strategy 6 September 2011

UBS 58

Appendix: UBS Return Drivers We define market leadership by specific stock characteristics, such as Size (large vs. small), Valuation (expensive vs. cheap), Growth, Momentum, and Volatility. We track twelve such characteristics, which we have dubbed “UBS Return Drivers.”

UBS Return Drivers

Size (Capitalization) Foreign Sales

Valuation (Forward P/E) Volatility

Earnings Growth Financial Leverage

Price Momentum Operating Leverage

Earnings Revisions Dividend Yield

Short Interest Return on Equity Source: UBS

Computation Each Return Driver is calculated as a hypothetical long/short portfolio built around a single quantitative decision variable. Our calculations assume monthly rebalancing and no transaction or borrowing costs. For each Return Driver, the computation process has four steps:

(6) Break Stocks into Industry Groups. While our Return Drivers are reported at the sector and index level, our process starts by breaking the S&P 500 into its 24 GICS industry groups.

S&P 500 GICS Sectors and Industry Groups

Source: Standard and Poor’s and UBS

(7) Rank Based on Return Drivers. Within each industry group, stocks are ranked from top to bottom by the Return Driver in question (e.g., largest to smallest market capitalization). The list is then broken into three groups: top-third, middle-third, and bottom-third. Our calculations assume that the top-third of stocks are bought and the bottom-third of stocks are sold.

Ranking and Return Calculation Methodology

Top 1/3Buy (Top 1/3).Stock returns equal-weighted within industry group

Middle 1/3

Bottom 1/3Sell (Bottom 1/3).Stock returns equal-weighted within industry group

Source: UBS

Sectors Industry Groups

Energy Energy

Materials Materials

Industrials Capital Goods; Commercial & Professional Services; Transportation

Consumer Cyclicals Autos; Consumer Durables & Apparel; Consumer Services; Media; Retailing

Consumer Staples Food & Staples Retailing; Food Beverage & Tobacco; Household & Personal Products

Health Care Health Care Equipment & Services; Pharmaceuticals, Biotech & Life Sciences

Financials Banks; Diversified Financials; Insurance; Real Estate

Technology Software & Services; Hardware & Equipment; Semiconductors & Equipment

Telecom Telecommunication Services

Utilities Utilities

US Equity Strategy 6 September 2011

UBS 59

(8) Calculate Returns. Monthly returns are then calculated by subtracting the returns of the bottom-third (sells) from the top-third (buys). The result is then divided by two to put the outperformance in a long-only context. This analysis is done on an equal-weighted basis within each Industry Group.

Return Driver Calculation — Hypothetical Example Foreign Sales Calcualtion — Industry Group Example

Long: Highest Foreign Sales Stocks (Top 1/3) 9.8%Short: Lowest Foreign Sales Stocks (Bottom 1/3) 4.6%Difference 5.2%Divide by 2 ÷ 2Factor Result 2.6%

Source: UBS

(9) Aggregate Results. At the sector level, Returns Drivers are calculated as a weighted average of industry group returns based on S&P 500 index weights. S&P 500 index results are a weighted average of sector results. We also index monthly returns as a time series for further analysis.

GICS Sectors and Industry Groups — S&P 500

S&P 500

Sector Sector

Industry Group Industry Group

Cap-weighted result of Sector Average

Cap-weighted result of Industry Group Average

S&P 500

Sector Sector

Industry Group Industry Group

S&P 500

Sector Sector

Industry Group Industry Group

Cap-weighted result of Sector Average

Cap-weighted result of Industry Group Average

Source: Standard and Poor’s and UBS

(10) Analytics. There are several ways that UBS Return Drivers can be used in investment decision making. We have listed a few below:

Identify Winning Investment Characteristics. UBS Return Drivers identify which specific equity characteristics have outperformed and underperformed during a specific time period. This data is available at the industry group, sector, and index level. Additionally, investors can get a sense for the magnitude of outperformance or underperformance of Return Drivers relative to one another.

Track Historical Trends. In our analysis, we track the performance of each one of our Return Drivers over time. This allows us to identify the types of market environments in which each Return Driver tends to outperform or underperform.

Avoid Crowded Trades. Our work also helps identify over-loved and under-loved investment themes. For each UBS Return Driver, we track the valuation spread between the top-third of companies and the bottom-third of companies over time. As such, we can help identify points when particular portfolio tilts or trades appear to be “crowded” or “priced in.” Alternatively, we can also identify points when upside opportunities appear outsized.

US Equity Strategy 6 September 2011

UBS 60

Analyst Certification

Each research analyst primarily responsible for the content of this research report, in whole or in part, certifies that with respect to each security or issuer that the analyst covered in this report: (1) all of the views expressed accurately reflect his or her personal views about those securities or issuers and were prepared in an independent manner, including with respect to UBS, and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by that research analyst in the research report.

US Equity Strategy 6 September 2011

UBS 61

Required Disclosures

This report has been prepared by UBS Securities LLC, an affiliate of UBS AG. UBS AG, its subsidiaries, branches and affiliates are referred to herein as UBS.

For information on the ways in which UBS manages conflicts and maintains independence of its research product; historical performance information; and certain additional disclosures concerning UBS research recommendations, please visit www.ubs.com/disclosures. The figures contained in performance charts refer to the past; past performance is not a reliable indicator of future results. Additional information will be made available upon request. UBS Securities Co. Limited is licensed to conduct securities investment consultancy businesses by the China Securities Regulatory Commission.

UBS Investment Research: Global Equity Rating Allocations

UBS 12-Month Rating Rating Category Coverage1 IB Services2

Buy Buy 54% 39%Neutral Hold/Neutral 39% 35%Sell Sell 7% 14%

UBS Short-Term Rating Rating Category Coverage3 IB Services4

Buy Buy less than 1% 33%Sell Sell less than 1% 25%

1:Percentage of companies under coverage globally within the 12-month rating category. 2:Percentage of companies within the 12-month rating category for which investment banking (IB) services were provided within the past 12 months. 3:Percentage of companies under coverage globally within the Short-Term rating category. 4:Percentage of companies within the Short-Term rating category for which investment banking (IB) services were provided within the past 12 months. Source: UBS. Rating allocations are as of 30 June 2011. UBS Investment Research: Global Equity Rating Definitions

UBS 12-Month Rating Definition

Buy FSR is > 6% above the MRA. Neutral FSR is between -6% and 6% of the MRA. Sell FSR is > 6% below the MRA.

UBS Short-Term Rating Definition

Buy Buy: Stock price expected to rise within three months from the time the rating was assigned because of a specific catalyst or event.

Sell Sell: Stock price expected to fall within three months from the time the rating was assigned because of a specific catalyst or event.

US Equity Strategy 6 September 2011

UBS 62

KEY DEFINITIONS