FINANCE - cb.hbsp. · PDF fileHBSP.HARVARD.EDU 3 Clarkson Lumber Co. The owner of Clarkson...

Transcript of FINANCE - cb.hbsp. · PDF fileHBSP.HARVARD.EDU 3 Clarkson Lumber Co. The owner of Clarkson...

C O U R S E M A T E R I A L S

2013

Articles

Books & Chapters

Cases

Course Modules

Online Courses

Simulations

FINANCEUPDATEDEDITION

Harvard Business Publishing serves the finest learning institutions worldwide with a comprehensive catalog of case studies, journal articles, books, and eLearning programs, including online courses and simulations.

In addition to material from Harvard Business School and Harvard Business Review, we also offer course material from these renowned institutions and publications:

� ABCC at Nanyang Tech University

� Babson College

� Berrett-Koehler Publishers

� Business Enterprise Trust

� Business Expert Press

� Business Horizons

� California Management Review

� Darden School of Business

� Design Management Institute

� European School of Management and Technology (ESMT)

� Harvard Medical School/Global Health Delivery

� HEC Montréal Centre for Case Studies

� IESE Business School

� Indian Institute of Management Bangalore

� INSEAD

� International Institute for Management Development (IMD)

� Ivey School of Business

� John F. Kennedy School of Government

� Kellogg School of Management

� MIT Sloan Management Review

� North American Case Research Association

� Perseus Books

� Princeton University Press

� Rotman Magazine

� Social Enterprise Knowledge Network

� Stanford Graduate School of Business

� Thunderbird School of Global Management

� Tsinghua University

� University of Hong Kong

Customer service is available 8 am to 6 pm ET, Monday through Friday. Phone: 1-800-545-7685 (1-617-783-7600 outside the U.S. and Canada)

Tech support is available 8 am to 8 pm ET, Monday through Friday. Phone: 1-800-810-8858 (1-617-783-7700 outside the U.S. and Canada)

Email: [email protected] Web: hbsp.harvard.edu

CASES

Cases, slices of business life, focus on actual problems and decisions facing a company. Students are challenged to put themselves in the protagonist’s place and suggest business strategies, tactics, and solutions.

New Cases

Airport Express Metro Line: Infrastructure Project Financing and Implementation through Public-Private PartnershipThe city of Delhi, India, wants to link the railway station with the international airport metro system in preparation for hosting the XIX Commonwealth Games. Rapid transit projects in the past have relied on funding through public-private partnerships but funding from the usual sources is not available for this project. TN Ivey School of Business #W11529

Al Hilal Bank: Setting an ExampleAl Hilal is a respected and fast-growing Islamic bank that has shown a profit in a very short period of time. The CEO of the bank prepares to address a group of international banking executives interested in understanding the reasons for the bank’s success and the challenges it expects to face in the future. TN Ivey School of Business #W11779

China Life: Microinsurance for the PoorA Chinese life insurance company considers a plan to sell microinsurance in rural areas. While the potential market size is enormous, China’s rural poor have very little disposable income and know very little about the benefits of insurance. Harvard Business School #212030

Gemini ElectronicsA small U.S.-based electronics company that recently went public wants to expand its business and compete with Korean and Japanese electronics companies. A junior partner at PricewaterhouseCoopers is asked to conduct a financial review so that the firm can better understand its financial condition before implementing a new strategy. TN Ivey School of Business #W11710

Hayman Capital ManagementThe founder and portfolio manager for a hedge fund disagrees with budget projections from the Japanese government. Japan has the world’s highest debt burden as a percentage of GDP or government revenue, and the portfolio manager believes interest rates will increase, the currency will be devalued, and the country’s debt will need restructuring. Harvard Business School #212091

Jiuding Capital: Private-Equity Firm with Chinese CharacteristicsA Chinese private-equity firm specializes in equity investments in late-stage, pre-IPO companies. The firm achieves very large returns using an investment practice based on large-scale industrial production methods. There are concerns that the model may not be sustainable in the rapidly changing landscape for private equity in China. TN Tsinghua University #TU0027

L’Occitane en ProvenceA cosmetics company considers the best time and the most suitable market for an initial public offering. The firm could list on Euronext in Paris, close to the firm’s headquarters or on an exchange in the U.S. or Asia where most of the firm’s growth is expected. Harvard Business School #212051

H B S P . H A R VA R D . E D U 1 TN Teaching Note Available

2 F I N A N C E • 2 0 1 3 *Reviews available to Premium Educators

Quadriserv and the Short-Selling MarketQuadriserv created an electronic marketplace for borrowing and lending equity securities. Participation by established brokerage firms is critical for success and the founder must decide whether to offer concessions to attract large brokerages or build momentum with hedge funds and other clients. TN Harvard Business School #212021

Saskferco Products Inc.Crown Investment Corporation of Saskatchewan and its partners decide to sell a fertilizer plant that they jointly own. They perform a valuation analysis by analyzing free cash flow and comparable companies and transactions while considering qualitative factors that affect value. They must also consider the possible selling strategies for a large business. TN Ivey School of Business #W11500

Strong Tie Ltd.The CEO of a manufacturer of structural ties used in the building industry questions his company’s recent performance while facing intense international competition. He hires an outside consultant to analyze financial statements, determine financial ratios, and ultimately provide recommendations for the future. TN Ivey School of Business #W11712

Popular Cases

Airbus A3XX: Developing the World’s Largest Commercial Jet (A) The supervisory board at Airbus Industries is about to approve a $13 billion investment for the development of a new super jumbo jet known as the A3XX. The company already has 20 orders for the new jet and the board must decide if there is sufficient long-term demand to justify the investment. TN Harvard Business School #201028

American Home Products Corp. American Home Products is a company with growing cash reserves and virtually no debt. The CEO is proud of the balance sheet and believes strongly in avoiding any kind of loan. The case requires students to analyze the company’s debt policy and capital structure and make recommendations to the CEO. TN Harvard Business School #283065

Arundel Partners: The Sequel Project Arundel Partners considers buying the sequel rights for a portfolio of feature films from one or more major U.S. film studios. The firm must determine how much to pay and how to structure each contract. Students examine cash flow estimates for a list of major films released in the U.S. and estimate the value of sequel rights. TN Harvard Business School #292140

Butler Lumber Co. Butler Lumber Co. needs increased bank financing to support current rapid sales growth coupled with low profitability. Students must determine the reasons for the rising bank borrowing, estimate the amount of borrowing needed, and assess the attractiveness of the loan from the bank. TN Harvard Business School #292013

“ There is no better case than Butler Lumber for its focus on sustainable growth.” — Case review from Harvard Business Publishing for Educators web site*

H B S P . H A R VA R D . E D U 3

Clarkson Lumber Co. The owner of Clarkson Lumber Co., a rapidly growing retail lumber company, considers the financial implications of continued rapid growth. Despite good profits, the company experiences cash shortages and must borrow to cover expenses. Students are required to analyze the company’s financing requirements. TN Harvard Business School #297028

Cost of Capital at Ameritrade Ameritrade Holding Corp. is planning large marketing and technology investments to improve the company’s competitive position. To determine whether the strategy can generate sufficient cash flows, the CEO needs an estimate of the project’s cost of capital. However, there is considerable disagreement about the correct cost of capital investment. TN Harvard Business School #201046

Dell’s Working CapitalDell Computer Corp. manufactures and sells personal computers directly to customers. The company uses a build-to-order that which enables the firm to have a much smaller investment in working capital than its competition. The company has been able to grow quickly and finance the growth internally. TN Harvard Business School #201029

Marriott Corp.: The Cost of Capital (Abridged) Investment projects at Marriott Corp. are selected by discounting the cash flows by the appropriate hurdle rate for the division. The company is also considering using hurdle rates to determine incentive compensation. The case requires students to use the capital asset pricing model (CAPM) to calculate the cost of capital for each of the company’s divisions. TN Harvard Business School #289047

Ocean Carriers Ocean Carriers, a shipping company, evaluates a proposal to lease a ship for a three-year period. One of Ocean Carriers’ customers is eager to finalize the contract for the new ship since no existing ship in the fleet is able to meet the customer’s requirements. TN Harvard Business School #202027

“ Ocean Carriers makes a fine choice for a first ‘real’ case to follow the simple exercises that usually begin the DCF analysis learning process.” — Case review from Harvard Business Publishing for Educators web site*

Æ Find more cases at hbsp.harvard.edu

BRIEF CASES

Rigorous and compact, Harvard Business School Brief Cases present realistic management challenges for students to discuss.

Blaine Kitchenware, Inc.: Capital Structure In response to an unsolicited takeover, a kitchen appliance maker contemplates using excess liquidity and additional borrowing for a stock repurchase. The company must determine the effects of increasing leverage on the cost of capital, firm value, and share price. TN #4040

Ceres Gardening Company: Funding Growth in Organic Products An aggressive player in the organic gardening industry offers steep discounts and vendor financing to its retailers in an effort to increase market penetration. Students analyze the company’s financial statements and make projections. TN #4017

TN Teaching Note Available

4 F I N A N C E • 2 0 1 3 *Reviews available to Premium Educators

Flash Memory, Inc. A small firm in the computer and electronic device memory market must invest heavily in new product development to stay competitive. The CFO prepares plans for investing and financing over the next three years and considers alternatives for additional funding in light of increased working capital requirements. TN #4230

“ The combination of analytical and strategic challenges in the case proved a great capstone to what my course truly focuses on: the cogent expression in words of what the financial numbers signify.” — Case review from Harvard Business Publishing for Educators web site*

Groupe Ariel S.A.: Parity Conditions and Cross-Border Valuation Groupe Ariel evaluates a proposal from its Mexican subsidiary to purchase and install cost-saving equipment at a manufacturing facility. Ariel corporate policy requires a discounted cash flow (DCF) analysis and an estimate for the net present value (NPV) for capital expenditures in foreign markets. TN #4194

Hansson Private Label, Inc.: Evaluating an Investment in Expansion A manufacturer of private-label personal care products must decide whether to fund an unprecedented expansion of manufacturing capacity. This case requires students to complete a fundamental analysis of the project, including the development of cash flow projections and net present value (NPV) calculations. TN #4021

Harmonic Hearing Co.Two employees from a small manufacturer of hearing aids consider purchasing the company from the founder. While the decision to purchase Harmonic is easy for them, arranging financing proves more difficult. Two financing alternatives are presented: one is virtually all debt-financed, the other all equity. The financing structure will significantly affect future products and firm performance. TN #4271

Jones Electrical Distribution Despite several years of rapid sales growth and good profits, Jones Electrical Distribution experiences short-term cash shortages. The company is unable to take discounts on accounts payable and increasingly relies on loans from the bank to cover expenses. The owner weighs the options for managing sales growth against the need for additional financing. TN #4179

Mercury Athletic: Valuing the Opportunity The head of business development at Active Gear Advantage, a midsize athletic footwear company, considers the opportunity to acquire Mercury Athletic and double the size of his business. Students gain exposure to basic discounted cash flow (DCF) valuation using the weighted average cost of capital (WACC). TN #4050

Midland Energy Resources, Inc.: Cost of Capital The senior vice president of project finance for a global oil and gas company must determine the weighted average cost of capital (WACC) for the company as a whole and for each of its divisions. Students become familiar with WACC, the capital asset pricing model (CAPM), and associated data and formulas. TN #4129

Monmouth, Inc. A leading producer of engines and massive compressors for the natural gas industry considers whether to acquire a tool company. Students must choose an approach for valuing the company and consider how the offer should be structured and implemented. TN #4226

H B S P . H A R VA R D . E D U 5

New Heritage Doll Company The New Heritage Doll Company, a midsize, privately owned domestic firm, evaluates two investment alternatives. The case explores basic issues in capital budgeting and requires students to analyze financial information from competing capital budgeting projects and choose a single investment project. TN #4212

NEW! Pacific Grove Spice CompanyA manufacturer, marketer, and distributor of spices and seasonings utilizes debt to fund the necessary growth in assets to support sales. The bank is concerned about the total amount of interest-bearing debt on the firm’s balance sheet and has asked the company to provide a plan to reduce it. TN #4366

Valuation of AirThread ConnectionsA senior associate in the business development group at American Cable Communications must prepare a preliminary valuation for acquiring AirThread Connections, a regional cellular provider. This case can be used as a capstone valuation exercise for first-year MBA students in an introductory finance course. TN #4263

Æ Find more cases at hbsp.harvard.edu

ARTICLES

Articles from Harvard Business Review and other renowned journals provide up-to-the- minute ideas from the best business thinkers.

New Articles

Flexible Footprints: Reconfiguring MNCs for New Value OpportunitiesPowerful technological, regulatory, and economic forces compel senior executives of multinational corporations to reevaluate and reconfigure value chains in the search for competitive advantage. Releasing and redeploying assets to pursue new opportunities is an often misunderstood and challenging task. California Management Review #CMR504

How to Make Finance WorkA performance review of the U.S. financial sector shows mixed results. While many large corporations have benefited from ready access to capital, the rest of the economy has not been served as well. This article suggests reforms in the financial sector that could improve the health and competitiveness of the U.S. economy. Harvard Business Review #R1203H

Misguided Policy? Following Venture Capital into Clean TechnologyThe Clean Technology policy of the Obama administration provided large loan guarantees to a few venture capital-financed firms. Other government policies such as SBIR grants, university research and development support, and certain deregulatory actions and procurement decisions may be more successful at encouraging innovation. California Management Review #CMR505

TN Teaching Note Available

Popular Articles

Are You Paying Too Much for That Acquisition? The purchase price of an acquisition is almost always higher than the intrinsic value of the company based on the price of the company’s stock before an announcement. This article describes a systematic approach to calculating the optimum price that requires a careful analysis of the “synergy value,” the value that results from improvements following the acquisition. Harvard Business Review #99402

How Venture Capital Works An analysis of present-day venture capitalists dispels many myths about how they operate. In the past, venture capitalists were legendary for taking risks. In reality, venture capitalists are expected to earn consistently superior returns on investments in inherently risky businesses. They succeed by structuring deals to minimize risk and maximize returns. Harvard Business Review #98611

Investment Opportunities as Real Options: Getting Started on the Numbers This article presents a framework for bridging the gap between the practicalities of real-world capital projects and the higher mathematics associated with formal option-pricing theory. This step-by-step approach maps out the exact relationship between a project’s characteristics and five variables that determine the value of a simple call option on a share of stock. Harvard Business Review #98404

Making the Deal Real: How GE Capital Integrates Acquisitions Thousands of companies every year acquire other companies or are acquired themselves. Yet statistics show that nearly half of all mergers fail. One company that has been very successful in the acquisition and integration process is GE Capital. Consultants from GE Capital offer four lessons for successful integration following an acquisition. Harvard Business Review #98101

Stock or Cash? The Trade-offs for Buyers and Sellers in Mergers and Acquisitions In 1988, fewer than 2% of large acquisition deals were paid for entirely in stock. By 1998, that number had risen to 50%. This article provides two simple tools for choosing between cash and stock as payment in mergers and acquisitions. The author believes the choice should never be made without full and careful consideration of the potential consequences. Harvard Business Review #99611

Using APV: A Better Tool for Valuing Operations For the past 25 years, using a discounted cash flow (DCF) methodology and the weighted average cost of capital (WACC) has been the commonly accepted practice for valuing assets. This article suggests a more versatile and reliable alternative: using the adjusted present value (APV). Harvard Business Review #97306

What’s It Worth?: A General Manager’s Guide to Valuation The resource allocation decisions that companies make depend on calculating what the decision is worth. Over the years, valuation tools have become increasingly sophisticated. This article provides an overview of three valuation tools and explains how they work and when to use them. Harvard Business Review #97305

Æ Find more articles at hbsp.harvard.edu

6 F I N A N C E • 2 0 1 3 *Reviews available to Premium Educators

SIMULATIONS

Online simulations present real-world management challenges for students and encourage classroom interaction and discussion. Results are available immediately for a comprehensive debrief session. All simulations include a detailed Teaching Note.

Finance Simulation: Capital Budgeting In this single-player simulation, students assume the role of a member of the capital committee at a high-end doll manufacturing company. Students review 27 different proposals over five simulated years to decide which projects to fund across the company’s three divisions. Ultimately, students must develop a capital budgeting strategy and choose projects with the greatest impact on the firm’s profitability. Seat Time: 60–90 minutes. TN #3357

“ I prefer this simulation to the case approach because students can learn by doing and because it provides instant feedback to learn from.” — Simulation review from Harvard Business Publishing for Educators web site*

Finance Simulation: Blackstone/Celanese This team-based simulation, based on the landmark acquisition of Celanese AG by the Blackstone Group in 2003, teaches principles of private-equity finance. Students play the role of either Blackstone or Celanese and conduct due diligence, establish deal terms, respond to bids and counterbids, and consider the interests of other stakeholders. Seat Time: 120 minutes. TN #3712

Finance Simulation: M&A in Wine Country Students play the role of CEO at one of three wine producers: Starshine, Bel Vino, or International Beverage. They must determine value targets and reservation prices and negotiate deal terms before deciding to accept or reject final offers. This team-based simulation teaches core principles of valuation, M&A strategy, and negotiation. Seat Time: 90 minutes. TN #3289

“ Gets students working on the nuts and bolts of strategy decisions and figuring out their financial impact. I like very much that students can see in real time the effect of their ideas on stock prices and company valuation.” — Simulation review from Harvard Business Publishing for Educators web site*

NEW! Working Capital Simulation: Managing GrowthIn this single-player simulation, students act as the CEO of a small business that distributes nutraceuticals. They must choose to invest in growth opportunities while also considering working capital requirements and improvements to cash flow. A successful strategy requires an understanding of the relationships among the income statement, balance sheet, and statement of cash flows. Seat Time: 60 minutes. TN #4302

Æ Find more simulations at hbsp.harvard.edu/list/simulations

H B S P . H A R VA R D . E D U 7 TN Teaching Note Available

COURSE MODULES

Course Modules offer a road map to the best teaching materials, with recommendations on how to organize them. Each module suggests 4–6 items plus some alternate suggestions. Popular modules in Finance have all been recently updated and include the following:

Capital Structure Net Present Value and Capital Budgeting Company Valuation Real Options Corporate Restructuring Risk Management Mergers and Acquisitions Risk, Return, and Cost of Capital

Æ Find more Course Modules in Finance at hbsp.harvard.edu/list/course-module

VIDEO SHORTS

These free, short videos are all under 10 minutes long and illustrate a case’s central learning objective. Intended solely for use in the classroom, the streaming video is available to registered Premium Educators at hbsp.harvard.edu. Current titles in Finance include:

Beacon Lakes #805023 Real Property Negotiation Game: Cable & Wireless America #08004 Lender Case, Porus Bank #209031 Jedi Bank #396327 Savannah West #381081Millegan Creek Apartments #395118

Æ Find more Video Shorts in Finance at hbsp.harvard.edu/list/videoshorts

BOOKS & CHAPTERS

Individual chapters may be integrated into course materials, while books may serve as primary class texts.

Anticipating Correlations: A New Paradigm for Risk ManagementEffective risk management tools provide much-needed help to prepare for unpredictable changes in financial markets. These chapters provide guidance in creating a better way to forecast correlations among large systems of assets. Princeton University Press. Available only in chapters. #PRN009–#PRN020

Ben Bernanke’s Fed: The Federal Reserve after Greenspan Ben Bernanke is considered by many to be the world’s most powerful economist. This book offers an in-depth study of the policies, strategies, and actions of Bernanke as chairman of the U.S. Federal Reserve and explores how the Federal Reserve analyzes and manages the U.S. economy. Harvard Business Review Press. Available in chapters. #2584

Financial Intelligence: A Manager’s Guide to Knowing What the Numbers Really Mean Understanding how to read a balance sheet, recognizing a liquidity ratio, and calculating return on investment are important skills for managing the financial side of a company. In an accessible, jargon-free style, this book provides a solid foundation in the core concepts of finance along with practical strategies for improving company performance. Harvard Business Review Press. Available in chapters. #7642

8 F I N A N C E • 2 0 1 3 *Reviews available to Premium Educators

H B S P . H A R VA R D . E D U 9

Investors and Markets: Portfolio Choices, Asset Prices, and Investment AdviceMaking good portfolio choices requires an understanding of the determinants of asset pricing. Written by Nobel Prize-winning economist William F. Sharpe, this book presents a nonmathematical method of analyzing asset prices that accounts for the real behavior of investors. Princeton University Press. Available only in chapters. #PRN002–#PRN008

Æ Find more books and chapters at hbsp.harvard.edu/list/book-chaptersONLINEURSES

ONLINE COURSES

Available in Sections Online Courses introduce complex subjects and can be used in advanced undergraduate business courses, as prematriculation requirements for MBAs, or assigned as homework over a semester or year. Online courses are available as complete courses or in sections.

Finance This course introduces core concepts in Finance ranging from ratio analysis to valuation and from pro forma estimating to capital structure. The story line provides a meaningful and engaging context in which students learn the material. Seat Time: 13–15 hours. TN

Complete Course #208719 Introductory Section #6000

Mathematics for ManagementFollowing the story line of several family-owned businesses, students learn how to apply math concepts to solve problems, analyze data, and predict outcomes. Seat Time: 12–20 hours. TN

Complete Course #3350 Algebra Section #6004Calculus Section #6006 Statistics Section #6007Probability Section #6008 Finance Section #6009

Quantitative MethodsSet in a Hawaiian resort, this course teaches statistics and regression analysis from a management perspective. Students develop statistical models for making better business decisions. Seat Time: 20–50 hours. TN

Complete Course #504702 Regression Section #6012

“ The Quantitative Methods Online Course is a perfect support for teaching Quantitative Analysis.” — Case review from Harvard Business Publishing for Educators web site*

Spreadsheet ModelingThis course shows students how to use Microsoft Excel 2007 as both a reporting tool and a modeling tool for solving business problems. It is appropriate for beginning and advanced users of Excel. Seat Time: 10–20 hours. TN

Complete Course #3252 Introductory Section #6010Advanced Section #6011

Æ Find more Online Courses at hbsp.harvard.edu/list/online-coursesVIDEO SHORTS

TN Teaching Note Available

© 2012 Harvard Business School Publishing.

Harvard Business Publishing is an affiliate of Harvard Business School.

Product #M11384 MC174810612

EDUCATORS Get updates from us at Twitter@HarvardBizEdu

GENERAL PUBLIC

ACADEMIC DISCOUNT

SAVE YOUR STUDENTS UP TO 60% WITH YOUR ACADEMIC DISCOUNT

■■■ Register as a Premium Educator at hbsp.harvard.edu

■■■ Design a coursepack with content from our collection.

■■■ Make the coursepack available to students.

■■■ Students receive your academic discount and save up to 60% on course materials.

HERE’S HOW TO SHARE THE DISCOUNT:

BUILD A COURSEPACK NOW: hbsp.harvard.edu

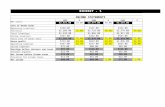

Simulations $37.50 $12.50

Online Courses $38.00–$129.00 $19.00–$64.50

Online Course Sections $16.00–$69.00 $8.00–$34.50

Online Tutorials $12.00 $6.00

Multimedia Cases $20.00 $7.00

Similar discounts apply to all teaching materials at hbsp.harvard.edu. Prices subject to change without notice.

NEW! Add material from outside the Harvard Business Publishing catalog and personal material to a coursepack.