Final Project Report on Au Fin. Jaipur

Transcript of Final Project Report on Au Fin. Jaipur

SUMMER TRAINING REPORTOn

AU FINANCIERS (INDIA) PVT.LTD.FINANCIAL STATEMENT ANALYSIS

Submitted in partial fulfillment of the requirements of the two year

Master of Business Administrative (MBA).

Submitted by

Surendra Kumar

Batch: 2009-2011

Sri Balaji College of Engg. & Tech. Jaipur

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

ACKNOWLEDGEMENT

The satisfaction and euphoria that accompanies the successful completion of

any task would be incomplete without mentioning the names of the people

who made it possible, whose constant guidance and encouragement crown

all the efforts with success.

I am deeply indebted to all people who have guided, inspired and helped us

in the successful completion of this project. I owe a debt of gratitude to all of

them, who were so generous with their time and expertise.

I am highly intended and extremely thankful to Mr. Vimal Jain (Company Mentor) & Mss. Sipra Sharma (College Mentor) who as my external guide was a constant source of inspiration and encouragement to me. The strong interest evinced by them has helped me in dealing with the problem; I faced during the course of project work. I express my profound sense of gratitude to them for timely help and co-operation in completing the project. Also I would like to thanks to Mr. Vijender Shekhawat for his continuous

guidance and support.

Last but not the least, I thank everybody of accounts & HR team, who

helped directly or indirectly in completing the project that will go a long way

in my career, the project is really knowledgeable & memorable one.

Surendra Kumar

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

CONTENTS

Serial. No. TITLE PAGE NO.

Chapter-1 PROFILE OF COMPANY

Industry study

• Types of NBFCs

• NBFCs are different from Banks

Company history

• Milestones

Board of Director

Number of People in Company

• No. of Customers

• Target Customer of the Company

Departments

Financial profile of the company

• Actual & Future projection

• Net Worth w/s AUM

Products & Services

Competitors

Other relative information’s

• Brand

• Strength

• Network

• Investor Relation

• Carreers

• Social Responsibility

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Chapter-2 INTRODUCTION

Introduction of the study

Purpose of study

Scope of study

Objective of the study

Methodology

Date collection

Tools

Limitation

Chapter-3 PROJEC OVERVIEW

Introduction of Financial Statement

Meaning and Concept of Financial Analysis

Types of Financial Analysis

Procedure of Financial Statement Analysis

Methods and Devices of Financial Analysis

Limitation of financial Analysis

Overview of Ratio Analysis

Chapter-4 ANALYSIS AND INNTERPRETATION

Comparative Balance Sheet

Comparative Income Statement

Ratio Analysis

Chapter-5 FINDINGS AND SUGGESTIONS

Findings

Suggestions

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Executive Summary

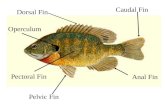

AU Financiers (India) Private Limited is registered with Reserve Bank of India (RBI) as Non-Banking Finance Company (NBFCs). AU Financiers is fast growing company with roots in Rajasthan, and branches spread in Maharashtra and Gujarat and planning to increase our presence to pan India. This company provides financial solution to our customer like Vehicle finance, Small secured loan, life insurance & General Insurance. This company comes under Assets Finance Company (AFC) & Companies extensive network in semi-urban and rural areas of Rajasthan, Maharashtra and Gujarat has brought the benefit of growth to people outside the usual scope of organized finance and allowed us to propagate the motto of inclusive growth.

AU Financiers biggest area of operation is commercial vehicle financing where Company serve the requirements of various categories of the market right from three wheelers to multi-axle trucks. From first time buyers of new vehicles to refinancing of running vehicles and this extensive product portfolio allows this company to cater to a broad cross section of the market.

Company has more than 85 Branches across Rajasthan, Maharashtra & Gujrat. And No. of customers is increasing very fast as on May 2010 Company has 45,721 Customer across these locations and No. of Employers is 685 as on May 2010. Company is performing well because in 2007-08 company’s Net Worth was 24.75 and in 2009-10 were 115.55.

This Project will focus on Managing of Fund. It will include Management of net funds available for investment and external funds purchased from banks. (Owner’s Capital + funds purchased from banks.)

This Project will help us to understand the shortage of the fund, means by doing this we can know that when fund will short and accordingly we can manage fund for further investment activities. By making month wise fund flow statement we can know shortage and excess of the fund.

This project gives the importance of fund management tools and principles.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Industry studyNon-Banking Financial Companies (NBFCs) Non-banking financial companies (NBFCs) are fast emerging as an important segment of Indian financial system. It is a heterogeneous group of institutions (other than commercial and co-operative banks) performing financial intermediation in a variety of ways, like accepting deposits, making loans and advances, leasing, hire purchase etc. They raise fund from the public, directly or indirectly, and lend them to ultimate spenders. They advance loans to the various wholesale and retail traders, small-scale industries and self-employed persons. Thus, they have broadened and diversified the range of products and services offered by a financial sector. Gradually, they are being recognized as complementary to the banking sector due to customer-oriented services, simplified procedures, and attractive rates of return on deposits, flexibility and timeliness in meeting the credit needs of specified sectors.

The working and operations of NBFCs are regulated by the Reserve Bank of India (RBI) with in the framework of the Reserve Bank of India (RBI) Act, 1934.

As per the RBI Act, a 'non-banking financial company' (NBFCs) is defined as:-

(i) A financial institution which is a company.(ii) A non banking institution which is a company and which has as its

principal business the receiving of deposits, under any scheme or arrangement or in any other manner, or lending in any manner.

(iii) Such other non-banking institution or class of such institutions, as the bank may, with the previous approval of the Central Government and by notification in the Official Gazette, specify.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

The types of NBFCs registered with the RBI are:-

Equipment leasing company: - is any financial institution whose principal business is that of leasing equipments or financing of such an activity.

Hire-purchase Company: - is any financial intermediary whose principal business relates to hire purchase transactions or financing of such transactions.

Loan company: - means any financial institution whose principal business is that of providing finance, whether by making loans or advances or otherwise for any activity other than its own (excluding any equipment leasing or hire-purchase finance activity).

Investment Company: - is any financial intermediary whose principal business is that of buying and selling of securities.

Now, these NBFCs have been reclassified into three categories:-

Asset finance Companies (AFC)

AFC are financial institutions whose principal business is of financing

physical assets such as automobiles, tractors, construction equipments

material handling equipments and other machines.

E.g.: Bajaj Auto Finance corp., Fullerton India etc

Investment Companies (IC)

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

ICs generally are involved in the business of shares, stocks, bonds,

debentures issued by government or local authority that are marketable in

nature.

E.g.: Stock Broking Companies, Gilt firms

Loan Companies (LC)

LCs is loan giving companies which operate in the business of providing

loans. These can be housing loans, gold loans etc

E.g.: Mannapuram Gold Finance, HDFC

NBFCs are different from Banks

NBFCs cannot accept demand deposits (Demand deposits are funds

deposited in an institution, that are payable immediately on demand

e.g.: Savings account, Current account etc)

A NBFC cannot issue cheques, to their customers and is not a part of

the payment and settlement system

Deposit insurance facility of Deposit Insurance Credit Guarantee

Corporation (DICGC) is not available for NBFC depositors

They cannot offer interest rates higher than the ceiling rate prescribed

by RBI from time to time. (Currently the ceiling rate is 12.5%)

They cannot offer gifts/incentives or any other additional benefit to

the depositors.

They should have minimum investment grade credit rating, from the

credit rating agencies

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Company Overview

AU financiers (India) Pvt. Ltd.AU Financiers (India) Private Limited, registered with Reserve Bank of India as a Non Banking Finance Company (NBFC) and this company was promoted by Mr. Sanjay Agarwal in the year 1996. Originally the Company was incorporated as ‘L.N. Finco Gems Private Limited’ but in 2005 Company has changed its named into ‘AU Financiers (India) Pvt. Ltd’. The objective was to align the Company name with business line of the Company.

AU Financiers is a fast growing financing company with our roots in Rajasthan, and branches spread in Maharashtra and Gujarat and planning to increase our presence to pan India. Company facilitates access too easy, affordable financing options for small road transport operators and fleet owners. Company extensive network in semi-urban and rural areas of Rajasthan, Maharashtra and Gujarat has brought the benefit of growth to people outside the usual scope of organized finance and allowed us to propagate the motto of inclusive growth.

Its biggest area of operation is commercial vehicle financing where we serve the requirements of various categories of the market right from three wheelers to multi-axle trucks. From first time buyers of new vehicles to refinancing of running vehicles, our extensive product portfolio allows us to cater to a broad cross section of the market.

It also engaged in small secured business loan products for personal and business needs. Our excellent track record of high quality lead generation, high collection ratio and low delinquencies has attracted the attention of high quality stakeholders and today, besides the promoters, our principal investor is Motilal Oswal Private Equity Advisors Private Limited. The support of our investors and our enhanced management bandwidth has given us the impetus to forge ahead in new geographies and expand our product portfolio.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Milestones

The company has disbursed more than Rs.850 crores till January 2010. The company is making continuous efforts to provide financial

assistance not only to the people of Rajasthan but also to the people of Maharashtra and Gujarat.

CRISIL is continuously monitoring our performance. On the basis of performance analysis and sustainable growth shown by the company, company’s rating has been improved to BBB/Stable from BBB/+.

2008- Private Equity Investment from Motilal Oswal Venture Capital Advisors Private Limited.

BOARD OF DIRECTORS

• Mr. Sanjay Agarwal, Promoter & Managing Director• Mr. Uttam Tibrewal, Executive Director• Mr. Krishan Kant Rathi (Director)• Mr. Vishal Kumar Gupta (Investor Director)

The company is being managed by its Board of Directors consisting of 4 board members including investor directors.

Mr. Sanjay Agarwal, Managing Director

He is promoter of the company; he is chartered accountant by profession and is a first generation entrepreneur with 15 years of experience in the finance industry. Having expertise in various fields, he plays key role in financing and financing strategy, corporate planning and risk management. He is also a

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

member of Rajasthan finance companies association.

He believes that: to be successful in life one should have self confidence, integrity and great passion towards his/her works. And it is equally important to assign a right task to the right person as per his/her competency and skills at right time.

Mr. Uttam Tibrewal, Executive Director

He is commerce graduate. He is having 15 years of experience in retail business and has been working in the finance industry for the last 10 years. His expertise expands into the area of retail marketing, building customer relationships and managing operations.

He joined in 2003 and is looking after business development, human resource and developing strategic relationships.

He being born and brought up in business class family; always had a vision to become a successful entrepreneur. His commitment and dedication has turned no stone upturn. He has been able to identify the undetected diversified area with his creative thinking and long term vision towards life.

He believes that: Hard work and integrity is the key to success.

Mr. Krishan Kant Rathi, Director

He is a Chartered Accountant and a Company Secretary by profession and having more than 20 years of experience in the field of finance & accounts. He represents India Business Excellence Fund (“IBEF”) on the board of the company. He is a director in Motilal Oswal Private Equity (“MOPE”). He has also worked as chief financial officer of Future Group and in senior positions at RPG Group and Rajan Raheja Group. He is also the Chairman of the Audit Committee of the company.

Mr. Vishal Kumar Gupta, Investor Director

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

He has a Bachelor of Engineering degree from Aligarh Muslim University and has further done MBA from the University of Chicago. He is a having vast experience of more than 10 years in business planning, joint ventures, mergers & acquisitions, fund raising through private equity and stock markets, corporate governance, treasury management, etc. He represents IBEF on the board of the Company.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

NUMBER OF PEOPLE

The number of employers is increasing year by year at fastest speed, like in 2006-07 the no. of employees was 155 but in 2010 it is 685.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Board of Directors

Managing

Director

Operation, Accounts &

Finance Head

Executive

DirectorBusine

ss Heads

Manager

Zonal Head

Operations, Accounts &

Finance Manager

Operations, Accounts &

Finance Team

Collection & Legal Head

Admin, HR & IT Manag

erManag

er

Admin, HR & IT Team

Executive

FI & Credit Team

Risk & Credit Head

Cluster Head

Team Leader

Collection & Legal Team

Branch Manag

er

Chief Financial Officer

06-07 07-08 08-09 09-10 As on May 100

100

200

300

400

500

600

700

155

253304

603685

No. of Employees

Department wise Employees Strength for May 10

Marketing &

Insurance

Credit & Operations

Accounts & Finance

Collections & Legal

Admin, Hr & IT

SME & Agri

Business

Total Strength

356 113 83 69 52 12 685

No. of Customers

Year Total No. of Customers 2003-04 189 2004-05 2376 2005-06 6182

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

2006-07 12335 2007-08 20239 2008-09 26723 2009-10 41995Apr - 10 43521 May -10 45721

Target Customer of the Company

Rural Semi-Urban areas First time users Tier-2 Cities

DEPARTMENTS

Marketing Department. Accounts Department.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Collection Department. Credit Departments. Human Resources Departments. IT Department. Insurance Department.

FINANCIAL PROFILE OF THE COMPANY

Figures in Crs

Particulars 2009-10

2008-09

2007-08

2006-07

Income from Operations 54.27 22.53 12.88 6.50

Profit Before Tax 18.16 7.74 4.19 1.53

Profit After Tax 11.85 5.18 2.58 .99

Net Worth 115.55 40.37 24.75 2.83

Loan Funds 108.06 60.11 2.01 0.34

Capital Adequacy Ratio (considering off bal sheet items)

31.20%

19.00%

11.14%

6.53%

CAR (without off balance sheet items)

66.18%

80.18%

143.03%

217.85%

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

ACTUAL & FUTURE PROJECTIONS

Particulars 2009-10 2010-11 2011-12

Disbursements 414.49 800 1200

AUM 485.58 925 1400

Net Worth 115.55 150 190

NET WORTH v/s AUM

Particulars Net Worth

AUM

AUM to NW

(in times)

% Increase in NW

2003-04 1.09 4.15 3.81 --

2004-05 2.74 43.01 15.70 151.38%

2005-06 2.84 79.77 28.09 3.65%

2006-07 8.83 136.74 15.49 210.92%

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

2007-08 24.24 210.77 8.70 174.52%

2008-09 40.38 247.65 6.13 66.58%

2009-10 115.55 485.58 4.20 186%

Products & Services

Vehicle Finance Small Secured Business Loans Secured small Landing to existing customers. Insurance

Vehicle Financing:-

Commercial vehicle loans will continue to remain the mainstay for the Company. Company primarily offer our services for financing various types of heavy commercial vehicle, light commercial vehicle, multi-utility offer our services for financing various types of heavy commercial vehicle, light commercial vehicle, multi-utility vehicle, cars, three wheeler loading, three wheeler passenger, tractor etc. of different reputed brands like Mahindra & Mahindra, Tata Motors, Piaggio vehicles, Force Motors, Maruti, Chevrolet, Toyota, etc.

Features:

• Touch & Feel Policy• Takeover/ Top-up Loans• Simple documentation• Quick credit decision• Speedy approval & Disbursement• Loan approval on NIP also i.e. Non Income Proof• Wide repayment options such as Cash/FPDC/RPDC/ECS

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

• Variable guarantor facility i.e. guarantor can be Existing Customer/Family Member/Govt. Employee/Any transporter etc.

Loan against property:-

These are secured loans provided to customers that would meet urgent economic need of the customers. This new business will be built under a new brand called shubharambh. One of the unique aspects of this service is that we also provide loans against Gram Panchayat registered properties which in our knowledge are not provided by any financial institution.

Features:-

• ‘Touch and feel policy’ • Easy & flexible installment repayment• Fast processing• Business establishment support

Small business loans:-

Company renders our financial assistance to promote Small business and income generation activities. Typical tenure for these loans is between three to five years.

Features:-• Loan starting from as little as Rs. 50,000• Flexibility to choose an EMI based loan• Fastest processing in the industry• Providing proper guidance and consultancy to the customer

General Insurance:-

Company creating awareness in the rural areas. The Company has arrangements with multiple insurance companies to offer advisory services for

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

General and Life insurance products. It understands our customer, their basic needs and advises them in the selection of insurance product. It offer products to match our customers personal and business needs and provide them a perfect protection cover. Company advice motor insurance with various plans for private, passengers, and goods carrying vehicles and non motor insurance like Medi-claim Policy, Hospitalization Policy, Personal accident Policy, Travel Policy, Fire and burglary Policy, Marine Policy. Company has also introduced our in-house product ‘Loan Shield Policy’ under the name of Future Generali India Insurance Company Ltd. This product is a cross sell opportunity for the company as it is sold out to the customers when they avail finance. This ensures repayment of the loan taken by the customers in event of any contingency.

Features:

• New insurance policies • Renewal of existing policies• Several options under one roof • Fair & prompt assistance • Hassle free claim settlement • Efficient pre & post advisory services

Life Insurance

Life is full of unexpected surprises; unpredictable events can strike without warning and disrupt the smooth rhythm of life. Therefore, It offer you a peace of Mind by advising various life insurance plans for your unique & specific needs. You must always ensure the financial security of your family and we are here to give you complete financial solutions. Company understands the needs of our clients and meets their requirement with best available product with in well defined time frames and quality assurance.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Life Insurance Plans:

• Protection plans • Investment plans • Child plans• Endowment plans• Retirement/pension Plans• Health plans

Competitors

Mahindra & Mahindra financial services Ltd. Meghma Finance Ltd. Bajaj Auto Finance Ltd. Shriram finance. Baid Finance Ltd. HDFC bank. Hinduja Finance Pvt. Ltd. And Unorganized Sector

BRAND

AU means gold which is precious and worthy across all cultures and times. It symbolizes in service, wealth and happiness. Financiers mean those who finance. As the name of the company suggests, we are the company who finance thorough imperil service to create happiness in the lives our precious and worthy customers. We have launched the new logo of our company which is having manifolds.

Firstly, it is symbolic to Swastik, the most prominent auspicious symbol of the present era. Swastik symbolizes auspiciousness, well being and let good prevail.

Secondly, it is made up with 4 F’s which means- Fast, Fair, Flexible & Friend.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Thirdly, the color associated with it has deep meaning. Blue color is considered to be a corporate color which symbolizes calmness, peace, confidence, intelligence, stability, unity, trust, loyalty, wisdom, faith, tranquility and sincerity.

Red color which a very emotionally intense color is associated with energy, strength, courage, power, determination as well as passion, desire, and love.

STRENGTHS

Relationship based origination model:

We meet every borrower in person before disbursing a loan. The company works on the concept of ‘touch and feel’ which helps to understand background, profile & needs of the customers which are overlooked by the organized sector. Company provides easy finance with hassle (difficulty) free documentation, speedy and transparent process.

Centralized & Independent credit verification:

It highly focused on credit quality of the borrowers. Each file has to go through layered filtration process of the company including credit verification at different levels and final approval from head office. Company assesses the synergy & viability between product, customer profile and product’s proposed use.

Robust collection process:

Company has in house collection team with expert legal advisors who on regular basis follows up with delinquent accounts. Company has layered process which includes telecalling, personal visit, legal actions, repossession of vehicles etc.

The company has a policy of releasing of REPO vehicles which boosts

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

customers confidence is us. The company’s collection efficiency is very strong and has on of the lowest delinquency ratios of in the industry.

Grass root penetration:

Many analysts believe that the rural economy will grow strongly in the coming years. There is strong focus by the Government of strengthen the rural economy. AU Financiers could be a significant beneficiary of this trend. As it diversifies its loan products and offers other forms of secured financing it could augur very well for growth prospects of the Company.

High vintage of team:

AU has a strong, highly motivated and enthusiastic team with rich experience and knowledge of on-the-ground business. The core team has worked with each other for the past several years. The team has been able to establish strong relationships in the marketplace, as well as with various authorities/establishments.

NETWORK

AUFIPL is the first Rajasthan based NBFC which is functioning in many states. AUFIPL continually delivers its promise to provide you quality and hassle-free services through a vast network of virtually connected offices/ branches.

Company branch network continues to expand across the country. As company continually strives to give our customers the best possible service, company is able to offer over 4 products lines. The Company sees geographical expansion as one of its goals, which is aimed on maximizing access for customers. This aim is being implemented as planned. For customer’s comfort and faster loan disbursals, creation of regions and allocation of certain authorities to them have significantly minimized time spent by clients on receiving loans. Therefore, the Company makes a special

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

focus on this aspect. It is worth noting that dynamically developing the Company’s Branches were opened in the largest regions of the state of Rajasthan. And on the same lines the company is expanding its Network in the States of Maharashtra and Gujarat. The Company is presently operating through 84 branches with presence in these three states.

AUFIPL is primarily engaged in originating and underwriting secured loans in semi urban and rural areas. The company is focused to provide variety of financial products to its customers such as Commercial Vehicle loan, Car Loan, Small Secured Business Loans, General and Life-Insurance facility.The Company originates loans under agriculture and priority sector lending as per Reserve Bank of India (“RBI”) s Guidelines.

Network of the Company

2006-07 2007-08 2008-09 2009-10 As on May 10

21

3237

4952

1 26

16 17

0 0 1

1015

22

34

44

75

84

Rajasthan Maharshtra Gujarat Total No. of Branches

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Investor Relation

IFC is a dynamic organization, constantly focusing in creating opportunity to the people to escape poverty and to improve their lives. To achieve this Purpose, IFC offers development-impact solutions though firm-level interventions direct investments, advisory services, and the IFC Asset Management Company; standard-setting; and business enabling environment work. IFC is the financially and legally independent private sector arm of the World Bank Group.

It also coordinates with the other institutions of the World Bank Group for its activities. IFC’s operations are carried out by its departments, most of which are organized by world region or global industry/sector. IFC has over 3,400 staff, of which 51% work in field offices and 49% at headquarters in Washington, D.C.

IFC continues to develop new financial tools that enable companies to manage risk and broaden their access to foreign and domestic capital markets. IFC has launched a broad and targeted set of initiatives to help private enterprises cope with the global financial and economic crisis.

IFC investment in AU financiers will expand borrowing to low-income and underserved customers. Alliance of IFC with AU financiers will enables us to mutually attain the purpose by strengthening the business model of AU Financiers.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

CAREERS

Career with AU Financiers (India) Pvt. Ltd.

AU Financiers is rapidly growing company; there are great opportunities for career advancement.

Company believes our success depends on the exceptional quality and extraordinary efforts of our people who are associated at the grass root level. For this reason, we are committed to hire, develop, motivate and retain the best people in the industry. People who have a great zeal and passion towards work can be a part of our experienced and expertise team.

Why AU Financiers?

A career at AU Financiers means an opportunity for ample learning & growth. The Company Offers a challenging assignment, a world class working environment, professional management, and competitive salaries, along with exceptional rewards.

If volunteers have an appetite for challenges, we have an exciting career for you. Some highlights of facilities for employees at AU Financiers:-

Professional Work Environment

Company has a growing pool of talented professionals, including CAs, MBAs, Lawyers, CSs, and others. This provides a good opportunity to interact and learn from each other.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Professional & Personal Growth

Performance is the key element that matters at AU Financiers. AU Financiers has a transparent policy of recognizing and rewarding deserving people. Company’s performance management systems ensure that the credit goes to those who deserve it. Qualities like leadership, communication skills, negotiating skills and an impressive personality get developed automatically, largely due to the contagiously professional atmosphere and rigorous training programmes at AU Financiers.

Fun at Work Place

AU Financiers ensures that all team members are adequately rewarded for the efforts put in. company regularly organizes trips to various exotic locations in India and abroad for our top performers.

Job Security

At AU Financiers, quality is the key factor in every sphere of activity. That’s why we have a rigorous screening procedure. Once selected, every team member is treated like a family member. Everyone is given a chance to work in different departments in order to get acclimatized. No wonder, many of our team members have been with us for years. Honest and performing team members will always find their jobs secure.

Culture

AU Financiers encourages healthy living. All offices are no-smoking areas. There are no night shifts. Company also organizes yoga sessions to improve the health and well-being of our team members.

Open Communication

The entire top management and the leaders at AU Financiers are always accessible. They are ever-willing to help and hear you out whenever you need

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

them.

Good Compensation

AU Financiers offers a compensation package that is one of the best in the industry. Company believes and asks our team members to write their own cheques. Apart from fixed salaries, we offer aggressive bonus and incentives.

Core values

Company employees are the fixed assets of our company. Recognize and reward individual ability and performance appropriately. Recruit and promote on the basis of merit and performance. Create and maintain a safe and healthy working environment.

Training & Development

Company always strives hard to develop skills, knowledge and competency of our team through developmental assignments, continuous training, and development interventions. Company makes ensure that our employees are given Support, Knowledge, Recognition, Empowerment, and Transformation from time to time. We organize in- house as well as external training programmes for our employees.

‘AU Financiers is a growing finance company which provides conducive environment and platform to grow in person and as a professional.’

SOCIAL RESPONSIBILITY

The company continues to contribute to the economic well being of the communities it interacts with and enhances their social well being. The company during the year continued to involve itself in social welfare activities by contributing to recognized charitable institution, which specifically benefits the economically disadvantaged and socially weaker sections of the society. The Company has regularly contributed to the “Akshay Patra Foundation”.

Akshay Patra Foundation runs “Nutritious food for children in schools” a well

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

known mid-day meal program targeted towards school going children from the under privileged sections of society. In the current year the company donated a Mahindra Vehicle to Akshay Patra foundation”

Company is frontrunner in state of Rajasthan in phasing down old Diesel and Petrol 3 wheelers with new upgraded LPG/CNG based 3 wheelers. Thereby, Company is supporting Govt. of India vision of save energy and environment friendly vehicles on road for better future of our next generation. Company’s 99% of lending is concentrated to vehicle financing and Company’s is focused on financing of vehicles with greater fuel efficiency, lower emission of pollutants and new technology including CNG/LPG. Company’s is looking forward to do “concentrated financing” of vehicles which shall lead to:

1. Saving of fuel with better fuel efficiency with new technology vehicles. 2. Improvement by way of reduction in remission of polluting gases by funding of EURO certification vehicles. 3. Funding of vehicles run on LPG / CNG with little or no atmospheric pollution. Company has been financing following vehicles which leads to lower emission of pollutants and Higher fuel efficiency and with sophisticated technology.

Company also promoting education by reimbursing the cost of education of children of our employees who belong to economically weaker section of the society.

Chapter-2 INTRODUCTION

Introduction of the study

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Purpose of study

Scope of study

Objective of the study

Methodology

Date collection

Tools

Limitation

Introduction of study

Finance is defined as the provision of money when it is required. Every

enterprise needs finance to start and carry out its operation. Finance is the

life blood of an organization. So finance should be managed effectively.

Financial statements are prepared primarily for decision making. Financial

statement analysis refers to the process of determining financial strength and

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

weakness of the firm by properly establishing strategic relationship between

the items of the balance sheet and profit and loss account. There are various

methods and techniques used in analyzing financial statements, such as

comparative statements, trend analysis, common size statement, schedule of

changes in working capital, fund flow and cash flow analysis, cost volume

profit analysis and ratio analysis and other operative data the analysis of

financial statement is used for decision making by various parties.

First task is to analyze and select the information which is requiring taking

decision.

Second task is to arrange the information in a way to highlight significant

relationship.

Final task is the interpretation and drawing of inferences and conclusions.

Purpose of study

The present study is made as a part of the MBA Programme for training in

the form of on the job training with the following activities.

1. To know the financial position of the Au- financier’s (India) Pvt. Ltd.

2. The company has the strength to fulfill its obligation or not

3. Find out strength and weakness of Au-Financier’s (India) Pvt. Ltd.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

4. Performance of Au- financier’s (India) Pvt. Ltd. For granting credit

providing loan and making investment.

5. Growth rate of Au- financier’s (India) Pvt. Ltd.

6. Know the liquidity position of Au-Financier’s (India) Pvt. Ltd.

7. Know the long term solvency of Au-Financier’s (India) Pvt. Ltd.

8. Know the operation efficiency of Au-Financier’s (India) Pvt. Ltd.

9. Know the overall profitability of Au-Financier’s (India) Pvt. Ltd.

Place of Study

All the activities are carried out in the Au-Financier’s (India) Pvt. Ltd.

Scope of Study

The data and information were gathered during training.

The scope is limited to the secondary data only.

The scope is delimited to the year from 1998

Objective of the Study

The role objective of the project is to help the management of the

organization in decision making regarding the subject matter.

Calculation of financial statement and ration is only the clerical task whereas

the interpretation of its needs immense skill intelligence and foresightedness.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

One of the easiest and most popular ways of evaluating performance of the

organization is to compare its present ratios with the past ones called

comparison and through development action plan.

It gives an indication of the direction of change and reflects whether the

organization’s financial position and predominance has improved

deteriorated or remained constant over period of time.

Here much emphasis is given to historical comparison and on forecasting the

immediate future trends

Methodology

The research involved extensive and intensive studies of Au- financier’s

(India) Pvt. Ltd. in this project report a sincere effort has been made to study

the financier statements analysis of the company. During this study, I study

the financial position and performance of the company. At last, I have given

interpretation and conclusion of the study.

Data collection

The whole of my study is based on secondary data of Au- financier’s (India)

Pvt. Ltd. I have not taken any primary data for my study because primary

data would not have been helpful to my study. During the tenure of my

study I have taken help of the following secondary data.

Annual report of Au-Financier’s (India) Pvt. Ltd.

Annual audit report of Au-Financiers (India) Pvt. Ltd..

Balance sheet of Au-Financiers (India) Pvt. Ltd.

Development action plan of Au-Financiers (India) Pvt. Ltd.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Profit and loss account of Au-Financiers (India) Pvt. Ltd.

Tools

There are some of the tools, which are relevant for the study of ration

analysis and performance of Au-Financiers (India) Pvt. Ltd.

Comparative Statements.

Trend Analysis

Common size statements

Funds flow analysis.

Cash flow Analysis

Cost volume profit Analysis

Ratio analysis.

Limitation

It is only based on mathematical interpretation of the figures and ignores the

factors such as management style, motivation of workers leadership etc.

It is affected by the price level changes

It does not give any clue for future.

Chapter No. 3 PROJEC OVERVIEW

Introduction of Financial Statement

Meaning and Concept of Financial Analysis

Types of Financial Analysis

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Procedure of Financial Statement Analysis

Methods and Devices of Financial Analysis

Limitation of financial Analysis

Overview of Ratio Analysis

3.1 –Introduction of Financial Statement: -

Finance is defined as the provision of money when it is

required. Every enterprise needs finance to start and carry out its

operation. Finance is the lifeblood of an organization. So, finance

should be managed effectively.

Financial statements are prepared primarily for decision

making. Financial Statement Analysis refers to the process of

determining financial strength and weakness of the firm by properly

establishing strategic relationship between the items of the balance

sheet and profit and loss account. There are various methods and

techniques used in analyzing financial statements, such as

comparative statements, trend analysis, common size statements,

schedule of changes in working capital, funds flow and cash flow

analysis, cost volume profit analysis and ratio analysis and other

operative data. The analysis of financial statement is used for

decision making by various parties

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

3.2 Meaning and Concept of Financial Analysis:-

The term ‘financial analysis’ , also known as analysis and

interpretation of financial statements’, refers to the process of

determining financial strengths and weakness of the firm by

establishing strategic relationship between the items of the balance

sheet, profit and loss account and opposite data.”Analysing financial

statements,” according to Metcalf and Titard, “is a process of

evaluating the relationship between component parts of a financial

statements to obtain a better understanding of a firm’s position and

performance”. In the words of Myers, “Financial statement analysis is

largely a study of relationship among the various financial factors in a

business as disclosed by a single set-of statement, and a study of the

trend of these factors as shown in a series of statements.”

The purpose of financial analysis is to diagnose the information

contained in financial statements so as to judge the profitability and

financial soundness of the firm. Just like a doctor examines his

patient by recording his body temperature, blood pressure, etc.

before making his conclusion regarding the illness and before giving

his treatment, a financial analyst analysis the financial statements

with various tools of analysis before commenting upon the financial

health or weaknesses of an enterprise. The analysis and

interpretation of financial statements is essential to bring out the

mystery behind the figures in financial statements. Financial

statements analysis is an attempt to determine the significance and

meaning of the financial statement data so that forecast may be

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

made of the future earnings, ability to pay interest and debt maturities

(both current and long-term) and profitability of a sound dividend

policy

The term ‘financial statement analysis’ includes both ‘analysis’,

and ‘interpretation’. A distinction should, therefore, be made between

the two terms. While the term ‘analysis’ is used to mean the

simplification of financial data by methodical classification of the data

given in the financial statements, ‘interpretation’ means, ‘explaining

the meaning and significance of the data so simplified however, both

analysis and interpretation are in terlinked and complimentary to each

other aAnalysis is useless without interpretation and interpretation

without analysis is fifficult or even impossible most of the authors

have used the term analysis only to cover the meaning both analysis

and interpredation as the objective of analysis is ti sutudy the

relationship between various items of financial statements by

interpretation. We have also used the terms Financial statement

Analysis or simply Financial Analysis to cover the meaninng of both

analys is and interpretation.

3.3 - Objective and Importance of Financial Statament Analysis:-

The primary objective of financial statements analysis is to

understatd and diagnoe theimformation contained in financial

statement with a view to judge the profitability financial soundness of

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

the firm and to make forecast about future prospects of the firm. The

purposed of analysis depencds upon the person interested in such

analysis and his object. However the following purposed or objecti es

of finandiaol statements analysis may be stated to bring out

signifiance of such analysis.

1. To assess the earning capacity or profitability of the firm.

2. To assess the operational efficiency and managerial

effectiveness.

3. To assess the short term as wesll as log term solvency of the

firm.

4. To identify the reasons for change in profitability and financial

position of the form.

5. To make inter firem comparisons.

6. To make forecasts about future prospects of the firm

7. To assess the progress of the firm over a perid of time.

8. To help in decision making and control.

9. To guide or determine the dividecnd action

10. To proved important information for granting credit.

Types of Financial Analysis

1. On the basis of material used

2. On the basis of modus operandi,

3. On the bases of entities used,

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

4. On the basis of time horizon.

On the basis of Material Used.

According to material used, financial analysis can be two types.

(a) External Analysis

(b) Internal Analysis

a. External Analysis: This analysis is done by outsiders who do not

have access to the detailed internal accounting records of the

business firm. There outsiders include investors, potential

investors, creditors, potential creditors, credit agencies,

government agencies and general public. For financial analysis

thus save only a limited purpose, however the recent changes in the

government regulations requiring business firms to make available

more detailed information to the public though audited published

accounts have considerably improved the position of the external

analysis.

b. Internal Analysis:- This analysis is done by persons who have

access who have across to the detailed internal accounting records

of the business firm is known as internal analysis such an analysis

can therefore be performed by executives and employees of the

employee of the organization as well as government agencies

which have statutory powers vested in them financial analysis for

managerial purposed is the internal type of analysis that can be

effected de[ending upon the purpose to be achieved

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

On the basis of modus operandic

According to the method of operation followed in the analysis can be two

types

(a) Horizontal Analysis

(b)Vertical Analysis

a. Horizontal Analysis:- If refers to the comparison of financial

data of a company for several years. The figures of this type

analysis are presented horizontally over a number of columns.

The figures of the variously years are compared with standard

or base year. A base year is a year chosen as beginning point. It

is also called ‘Dynamic Analysis’. This analysis makes it

possible to focus attention on items that have changed

significantly during the period under review. Comparative

statements and trend percentages are two tools employed in

horizontal analysis.

b. Vertical Analysis:- It refers to the study of relationship of the

various items in the financial statements of one accounting

period. In this type of analysis the figures from financial

statements of a year are compared with a base year selected

from the same year’s statement. It is also called ‘Static

Analysis’. Common size financial statements and financial

ratios are the two tools employed in vertical analysis. Since

vertical analysis considers data for one time period only, it is

not vary conducive to a proper analysis financial statements.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

However, it may be used along with horizontal analysis to make

it more effective and meaningful.

On the basis of entities involved:

According to the method of operation followed in the analysis can be two

types

(a) Inter –firm or Cross Sectional Analysis

(b) Intra-firm or Time Series Analysis

a. Inter-Firm or Cross Sectional Analysis:- Cross sectional analysis

involves comparison of financial data of a firm with other firms

(competitors) or industry averages for the same time period

b. Intra-firm or Time Series Analysis:- Time series analysis involves

the study of performance of the same firm over a period of time.

On the basis of time horizon.

According to the method of operation followed in the analysis can be

two types

s

(a) Short term Analysis

(b) Long term Analysis.

a. Short term Analysis:- Short term analysis measures the liquidity

position of a firm, i. e. short term paying capacity of a firm or the

firm’s ability to meet the current obligations.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

b. Long term Analysis:- Long term analysis involves the of the firm’s

ability to meet the interest costs and repayment schedules of its long

term obligations. The solvency, stability and profitability are

measured under this type of analysis.

Procedure of Financial Statements Analysis

Broadly speaking there are three steps involved in the analysis of

financial statements. These are

(i) Selection

(ii) Classification

(iii) Interpretation

The first step involves selection of information (data) relevant to the purpose

of analysis of financial statements. The second step involved is the

methodical classification of the data and the third step includes drawing of

inferences and conclusions.

The following procedure is adopted for the analysis and interpretation of

financial statements.

1. The analyst should acquaint himself with principles and postulates of

accounting. He should know the plans and policies of the management

so that he may be able to find out whether these plans are properly

executed or not.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

2. The extent of analysis should be determined so that the sphere of work

may be decided. If the aim is to find out the earning capacity of the

enterprise then analysis of income statement will be undertaken. On

the other hand, if the financial position is to be studied then balance

sheet analysis will be necessary.

3. The financial data given in the statements should be re-organized and

re-arranged. It will involve the grouping of similar data under same

heads, breaking down of individual components of statements

according to nature. The data is reduced to a standard form.

4. A relationship is established among financial statements with the help

of tools and techniques of analysis such as ratios, trends, common

size, finds flow etc.

5. The information is interpreted in a simple and understandable way.

The significance and utility of financial data is explained for helping

decision-taking.

6. The conclusions drawn from interpretation are presented to the

management in the form of reports

Methods or Devices of Financial Analysis

A Number of methods or devices are used to study the relationship

between different statements. The following methods of analysis are

generally used:

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

i. Comparative statement

ii. Trend analysis

iii. Common size statements

iv. Funds flow analysis

v. Cash flow analysis

vi. Ratio analysis

vii. Cost-volume-profit analysis

In this project the Comparative statement and Ratio Analysis is used

to study the financial statements of Au-Financiers (India) Pvt. Ltd.

Comparative Statement:- The comparative financial statements are

statements of the financial position at different periods of time. The

elements of financial position are shown in a comparative form so as to

give an idea of financial position at two or more periods. Any statement

prepared in a comparative form will be covered in comparative

statements. From practical point of view generally two financial

statements.

1. Balance Sheet

2. Income Statement

Comparative balance sheet:- The comparative balance sheet analysis is

the study of the trend of the same items, group of items and computed items,

group of items and computed items in two or more balance sheets of the

same business enterprise on different dates. The changes in periodic balance

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

sheet items reflect the conduct of a business. The changes can be observed

by comparison of th balance she at the beginning and at the end of a period

and these changes can help in forming an opinion about the progress of an

enterprise. The comparative balance sheet has two columns for the data of

original balance sheet. A third column is used to show this increase in

figures. The fourth column may be added for giving percentage of increases

and decreases.

Guidelines for Interpretation of Comparative Balance Sheet

While interpreting comparative balance sheet the interpreter is

expected to study the following aspects.

1. Current Financial Position and Liquidity Position

2. Long term Financial Position

3. Profitability of the Concern

1. For studying the Financial Position and short term Financial Position

of a concern, one sees the working capital in both the years. The

excess of current assets over current liabilities will give the figure of

working capital. The increase in working capital means improvement

in the current financial position of the business. An increase in current

assets accompanied by the increase in current liabilities of the same

amount will not show any improvement in short term financial

position. One should study the increase or decrease in current assts

and current liabilities and this will enable him to analyze the current

financial position.

2. The second aspect which should be studies in current financial

position is the liquidity position of the concern. If liquid assets like

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

cash in hand, cash at bank, bills receivable, debtors, etc. Show an

increase in the second year over the first year, this will improve the

liquidity position of the concern, the increase in inventory can be on

account of accumulation of stocks for want customers, decrease in

demand or inadequate sales promotion efforts. An increase in

inventory may increase working capital of the business but it will not

be good for business.

3. The long term financial position of the concern can be analyzed by

studying the changes in fixed assets, long term liabilities and capital.

The proper financial policy of concern will be to finance fixed assets

by the issue of either long term securities such as debentures, bonds,

loans from financial institutions or issue of fresh share capital, an

increase in fixed assets should be compared to the increase in long

term loans and capital if the increase in fixed assets is more than the

long term securities then parts of fixed assets have not only been

financed from long term sources. A wise policy will be to fiancé fixed

assets by raising long term funds.

4. The new aspects to be studied in a comparative balance sheet

questions is the profitability of the concern. The study of increase or

decrease in retained earning, various resources and surpluses, etc will

enable the interpreter to see whether the profitability has improved or

not. An increase in the balance of profit and loss account and he other

resources created from profits will mean an increase in profitability to

the concern. The decrease in such accounts may mean issue divided,

issue dividend, issue of bonus share or deterioration in profitability of

the concern.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

5. After studying various assets and liabilities and opinion should be

formed about the financial position of the concern. One cannot say if

short term financial position is good the n long term financial position

will also be good or vice versa. A concluding word about the overall

financial position must be given at the end.

Comparative Income Statement:- The income statement gives the results

of the operation of a business. The comparative income statement gives an

idea of the progress of a business over a period of time. The changes in

absolute data in money values and percentages can be determined it analyze

the profitability of the business. .like comparative balance sheet income

statement also has four columns. First two columns give figures of various

items for two years. Third and fourth columns are used to show increase or

decrease in figures in absolute amounts and percentages respectively.

Guidelines for Interpretation of Comparative Income Statement

The analysis and interpretation of income statement will involve are

following steps.

1. The increase or decrease in sales should be compared with the

increase ore decrease in costs of goods sold. An increase in sales will

not always mean an increase in profit. The profitability will improve if

increase in sales is more than increase in costs of goods sold. The

amount of gross profit should be studied in the first step.

2. The second step of analysis should be the operational profits. The

operating expenses such as office and administrative expenses, selling

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

and distribution expenses should be deducted from gross profit to find

out operating profits. An increase in operating profit will result from

the increase in sales position and control of operating expenses. A

decrease in operating profit may be due to an increase in operating

expenses or decease in sales. The change in individual expenses

should also be studied. Some expenses may increase due to the

expansion of business activities while others may go u due to

managerial inefficiency.

3. The increase or decrease in net profit will give an idea about the

overall profitability of the concern. Non operating expenses such as

interest paid, losses from sales of assets, writing off deferred

expenses, payment of tax, etc. Decrease the figure of operational

profit, we get a figure of net profit. Some non operating incomes may

also be there which will increase net profit. An increase in net profit

will gave us an idea about the progress of the concern.

4. An opinion should be formed about profitability of the concern and it

should be given at the end. It should be mentioned whether the overall

profitability of the concern is good or not.

Focus on Financial statement Analysis:

Financial statement analysis involves evaluating different aspects of a

business enterprise, which are of great importance to different users such as

management, investors, creditors, bankers, analyst, investment advisers, etc.

generally, the following analyses are made while making Financial

Statement Analysis.

1. Liquidity or short term solvency analysis.

2. Profitability analysis

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

3. Capital structure or gearing analysis

4. Market strength or investor analysis

5. Growth and stability analysis

Application of Financial Analysis

Following are the application of financial analysis:

1. Assessing Corporate Excellence

2. Judging credit worthiness

3. Forecasting bankruptcy

4. Valuing equity shares

5. Predicting bonds ratings

6. Estimating market risk

Limitations of Financial Statement Analysis

Financial analysis is a powerful mechanism of determining financial

strengths and weakness of a firm. But, the analysis is based on the

information available in the financial statements. Thus, the financial analysis

suffers from serious inherent limitations of financial statements. The

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

financial analysis has also be careful about the impact of price level changes,

windows dressing of financial statements, changes in the accounting policies

of a firm, accounting concepts and conventions, and personal judgment, etc.

the readers are advised to relate the limitations of financial statements as

given in the previous chapter and also the limitations of ratios as a tool of

financial analysis as discussed in Ratio Analysis. Some of the important

limitations of financial analysis are, however, summed up as below.

1. It is only a study of interim reports.

2. Financial analysis is based upon only monetary information and non-

monetary factors are ignored.

3. It does not consider changes in price levels.

4. As the financial statements are prepared on the basis of a going

concern, it does not give exact position. Thus accounting concepts and

conventions cause a serious limitation to financial analysis.

5. Changes in accounting procedure by a firm may often make financial

analysis misleading.

6. Analysis is only a means and not an end in it self. The analyst has to

make interpretation and drawn his own conclusions. Different people

may interpret the same analysis in different ways.

Overview of Ratio Analysis

Introduction:- Ratio analysis is one of the techniques used to analyze the

financial statement. It is one of the most powerful tools of financial analysis.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

It is the process of establishing and interpreting various ratios (quantitative

relationship between figures and group of figures). Through ratio analysis

financial statement can analyze more clearly and decision made from such

analysis.

According to Accountant’s Handbook by Wizon Kell and Bedford, a ratio’is

an expression, of the quantitative relationship between the numbers’.

Nature of Ratio Analysis:- Ratio analysis is a technique of analysis and

interpretation of financial statements. It is the process of establishing and

interpreting various ratios for helping in making certain decision. However,

ratio analysis is not an end in itself. It is only a means of better

understanding of financial strength and weaknesses of affirm. Calculation of

mere ratios does not serve any purpose, unless several appropriate ratio are

analyzed and interpreted. There are a number of ratios which can be

calculated from the information given in the financial statements, but the

analyst select the appropriate data and calculate only a few appropriate ratios

from the same keeping in mind the objective of analysis. The ratios may be

used as a symptom like blood pressure, the pulse rate or the body

temperature and their interpretation depends upon the caliber and

competence of the analyst. The following are the four steps involved in the

ratio analysis:

1. Selection of relevant data from the financial statements depending

upon the objective of the analysis.

2. Calculation of appropriate ratios from the above data.

3. Comparison of the calculated ratios with the ratios of the same firm in

the past, or the ratios developed from projected financial statements or

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

the ratio of some other firms or the comparison with ratios of the

industry to which the firm belongs.

4. Interpretation of the ratios.

Use and significance of Ratio Analysis

Helpful in decision making.

Helpful in financial forecasting and planning.

Helpful in communication.

Helpful in co-ordination.

Helpful in Control.

Helpful in efficiency appraisal

Helpful in evaluation of financial position.

Helpful to investors, financial institution, employee

Limitations of Ratio Analysis:-

The ratio analysis is one of the most powerful tools of financial

management. Though ratios are simple to calculate and easy to understand,

they suffer from some serious limitations.

Limited Use of Single Ratio:- A single ratio, usually, does not convey

much of a sense.

To make a better interpretation a number of ratios have to be calculated

which is likely to confuse the analyst than help him on making any

meaningful conclusion.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

1. Lack of Adequate Standards:- There are no well adapted standards

or rules of thumb for all ratios which can be accepted as norms it

renders interpretation of the ratios difficult.

2. Inherent Limitation of Accounting:- Like financial statements, ratio

also suffer from the inherent weakness of accounting records such as

their historical nature. Ratios of the past are not necessarily true

indicators of the future.

3. Change of Accounting Procedure:- Change in accounting procedure

by a firm often makes ratio analysis misleading. E.g.a change in the

valuation of methods of inventories, from FIFO to LIFO increases the

cost of sales and reduces considerably the value of closing stocks

which makes stock turnover ratio to be lucrative and an unfavorable

gross profit ratio.

4. Window Dressing:- Financial statements can easily be window

dressed to present a better picture of its financial and profitability

position to outsiders. Hence, one has to be very careful in making a

decision from ratios calculated from such financial statements. But it

may be very difficult for an outsider to know about the window

dressing made by a firm.

5. Personal Bias:- Ratio are only means of financial analysis and not an

end in itself. Ratios have to e interpreted and different people may

interpret the same ratio in different ways.

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

6. Incomparable:- Not only industries differ in their nature but also the

firms of the similar business widely differ in their size and accounting

procedures, etc. it makes comparison of difficult and misleading.

Moreover comparisons are made difficult due to differences in

definitions of various financial terms used in the ratio analysis.

7. Absolute Figures Distortive:- Ratios devoid of absolute figures may

prove distortive as ratio analysis is primarily a quantitative analysis

and not a qualitative analysis.

8. Price Level Changes:- While making ratio analysis, no consideration

is made to the changes in price levels and this makes the interpretation

of ratio invalid.

9. Ratios no Substitutes:- Ratio analysis is merely a tool of financial

statements. Hence, ratios become useless if separated from the

statements form which they are computed.

10.Clues not Conclusions:- Ratios provide only clue s to analysts and

not final conclusion. These ratios have to be interpreted by these

experts and there are no standard rules for interpretation.

Classification of Ratios:

The use of ratio analysis is not confined to financial manager only.

There are different parties interested in the ratio analysis for knowing the

financial position of a firm for different purposes. In view of various users of

ratios, there are many types of ratios which can be calculated from the

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

information given in the financial statements. The particular purpose of the

user determines the ratios that might be used for financial analysis.

Various accounting ratios can be classified as followed

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Primary RatioProfit & Loss Account RatioComposite Ratio

Leverage Ratios Activity Ratios

Functional Classification in View of Financial Management or Classification

According to Tests.

Liquidity Ratio:

(A)

1. Current Ratio

2. Liquid Ratio

3. Cash Ratio

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Ratio

Traditional Classification Functional Classification Significance Ratio

Secondary Ratio

Balance Sheet Ratio

Profitability Ratio

Liquidity Ratios

4. Interval Measure

(B)

1. Debtors Turnover Ratio

2. Creditors Turnover Ratio

3. Inventory Turnover Ratio

Long-term solvency and Leverage Ratios:

1. Debt/Equity Ratio

2. Debt to total capital Ratio

3. Invest Coverage

4. Cash Flow/Debt

5. Capital Gearing

Activity Ratios or Asset Management Ratio:

1. Inventory Turnover Ratio

2. Debtors Turnover

3. Fixed Assets Turnover Ratio

4. Total Assets Turnover Ratio

5. Working Capital Turnover Ratio

6. Payables Turnover Ratio

7. Capital Employed Turnover

Profitability Ratio;

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

(A) In relation to Sales

1. Gross Profit Ratio

2. Operating Ratio

3. Operating Profit Ratio

4. Net Profit Ratio

5. Expense Ratio

(B) In relation to investments

1. Return on investments

2. Return on capital

3. Return on Equity capital

4. Return on Total Resources

5. Earnings per share

6. Price-Earning Ratio

Chapter -4

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Analysis and Interpretation

1. Comparative Balance Sheet

2. Comparative Income Statement

3. Ratio Analysis

Analysis and Interpretation

I have studied the financial statement of Au-Financier (India) Pvt. Ltd. by using

comparative statements device. It shows as under.

Interpretation of Comparative balance sheet:

Assets. 31th March 2009

31th March 2010

Increase/Decrease/ Rs. Increase/DecreasePersentage

Current Assets.

Debtors Less than 6 Months

201.03 131.81 (69.23) (34.44)

Debtors More than 6 Months

45.44 6.00 (39.44) (86.80)

Loans & Advances 4,000.03 15,144.80 11,144.76 278.62

Accrued Interest on Loans

31.62 113.10 81.48 257.71

Trade Advances 450.88 566.53 115.65 25.65

Term Deposits 1,850.69 4,201.33 2,350.63 127.01

Cash and other bank balances

3,745.05 2,845.12 (899.93) (24.03)

Advances recoverable 38.83 337.53 298.71 769.33

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

in cash/kindOther current assets 51.86 102.08 50.22 96.83

Current Assets Total 10,415.43 23,448.29 13,032.86 125.13

Fixed Assets.Owen Assets. 191.32 764.46 573.14 299.57

Depreciation 89.44 112.04 22.60 25.27

Net Block = Owen Assets. – DepreciationNet Block 101.88 652.42 550.54 540.38

Investments 317.69 342.37 24.68 7.77

Net Block + Investments

419.57 994.79 575.22 548.15

Total Assets = Total Current Assets. + Total Fixed AssetsTotal Assets 10,835.00 24,443.08 13,608.08 125.59

Current LiabilitiesSundry Creditors 114.37 211.56 97.19 84.98

Other current liabilities/provisions

375.82 612.75 236.93 63.04

EMI Payable Against Securitisation / Assignments

182.77 1,001.67 818.90 448.05

Provisions 151.16 339.67 188.51 124.71

Provisions for NPA 44.92 41.02 (3.91) (8.70)

Provision for Estimated Loss for Securitisation / Assignments

52.50 183.34 130.84 249.23

Other Provisions 53.74 115.31 61.57 114.58

Current Liabilities Total

824.12 2,165.65 1,341.53 162.78

Net Current Assets. = Current Assets – Current LiabilitiesNet Current Assets. 9,591.31 21,282.64 11,691.33 121.89

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Total Capital Employed = Net Block + Investments + Net Current AssetsTotal Capital Employed

10,010.88 22,277.43 12,266.55 122.53

Represented ByEquity Share Capital 1,000.02 1,393.29 393.27 39.33

Share Application Money

146.00 - (146.00) (100.00)

Compulsory Convertible Preference Shares

2,000.00 7,549.99 5,549.99 277.50

Reserves and Surplus 891.50 2,612.23 1,720.73 193.02

Less : intangibles - - - #DIV/0!

DTA 37.86 84.29 46.43 122.63

Tangible Net worth 3,999.66 11,471.22 7,471.56 186.80

Secured LoansTerm Loan 4,740.06 6,337.53 1,597.47 33.70

Cash Credit 1,267.03 4,468.67 3,201.64 252.69

Total 6,007.09 10,806.21 4,799.12 79.89

Unsecured LoansFrom Banks 4.13 - (4.13) (100.00)

Others - - - #DIV/0!

Total 4.13 - (4.13) (100.00)

Deferred Tax Liability

- - - -

Total Liabilities 10,835.00 24,443.08 13,608.08 125.59

Channel Business 15,417.00 13,630.00 (1,787.00) (11.59)

Assigned Portfolio 5,348.00 19,839.87 14,491.87 270.98

Off Balance Sheet Assets

20,765.0 33,469.9 12,704.87 61.18

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Assets Under Management

24,765.03 48,614.67 23,849.63 96.30

The comparative balance sheet reveals that during 2010 there has been an increase in current assets of Rs. 13,032.86 Lacs i. e. 125.13% in the current liabilities have increased by Rs.1,341.53 Lacs i. e. 162.78% so the current financial position has increased.

The liquid Assets that is case in hand, cash in bank shows an decrease in 2010 over 2009 this will not improve the liquidity position of the concern.

The other assets loans & advances have increase by Rs. 11,144.76 Lacs it’s show that company business improved. and long term liabilities increase in form of secured loan then it show that company have good relationship with the banks in India and mostly it shows that the company depends on banks

Reserve and surplus have increased from Rs.891.50/- Lacs to Rs.2,612.23/- Lacs and the profit has increased from Rs.608.82/- Lacs to Rs.1,338.93/- Lacs. i.e. 119.92 %. It shows that the profitability of the Company has improved.

The overall financial position of the Company is satisfactory.

Comparison of income statement

31th March 2009

31th March 2010

Increase/DecreaseRs.

Increase/DecreasePercentage

ExpenditureSalaries and staff expenses

451.38 803.18 351.80 77.94

Admn. and Misc. expenses (incl. raw material)

681.18 1,498.53 817.34 119.99

Operating Expenses 1,132.56 2,301.71 1,169.15 103.23

Provision for NPAs 1.37 (3.91) (5.28) (385.53)

Provision for Credit 52.50 130.84 78.34 149.23

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Loss on Securitisation Provision for Overdue Debtors

8.21 (5.21) (13.41) (163.44)

Loan Written Off 39.40 66.68 27.28 69.23

Debtors Off - 52.27 52.27 5227

Total Provision / Write offs

101.47 240.67 139.20 137.18

Total Expenditure = Operating Expenses + Total Provision/Write offsTotal Expenditure 1234.03 2542.38 1308.35 106.02

IncomeInterest on own books 546.82 1,556.14 1,009.32 184.6

Income under Channel Business

912.67 972.86 60.19 6.595

Income from securitisation

537.84 2,082.89 1,545.05 287.3

Interest on FDR 105.59 191.84 86.25 81.68

Income from Operations

2,102.92 4,803.73 2,700.81 128.4

Other Income 181.54 623.26 441.72 243.3

Total Income 2,284.46 5,426.99 3,142.53 137.6

PBIDT = Total Income – Total ExpenditurePBIDT 1,050.43 2,884.61 1,834.18 174.61

Less:- Depreciation and Impairment of Fixed Assets

30.53 45.81 15.28 50.04

PBIT 1,019.90 2,838.80 1,818.90 178.34

Less:- Interest 185.10 914.06 728.95 393.81

Less:- Prior Period Adjustmenst

(2.15) 0.40 2.55 (118.60)

Less:- Misc. expn. written off

12.75 - (12.75) (100.00)

PBT 824.19 1,924.35 1,100.15 133.48

{ A U F i n a n c i e r s ( I n d i a ) P v t . L t d . }

Less:- Tax 258.66 631.22 372.56 144.03

PAT 565.53 1,293.12 727.59 128.66

Total Expenses = Total Income – Profit After Tax (PAT)

Total Exp. 1,718.93 4,133.87 2,414.94 140.49

Add : Depreciation 30.53 45.81 15.28 50.04

Gross cash accruals = Profit After Tax + Depreciation

Gross cash accruals 608.82 1,338.93 730.12 119.92

Less : Dividends - Pref. (Rs.)

- - - -

- Equity (Rs.)

- - - -

Net cash accruals 608.82 1,338.93 730.12 119.92

Net cash accruals/Total Income(%)

26.65 24.67 (1.98) (7.42)