Fin Planning

Transcript of Fin Planning

-

7/23/2019 Fin Planning

1/35

Financial PLANNING

CS T. Anil KumarFCS

-

7/23/2019 Fin Planning

2/35

Agenda

Introduction

Financial Planning

SMART Goals

Risk vs Returns

Power of Compounding

Inflation

Investment Veicles

Investment Strategies

-

7/23/2019 Fin Planning

3/35

Importance of learning about

money & planning!

Enables us to take informed

decisions about money

-

7/23/2019 Fin Planning

4/35

Introduction

Planning of finances is essential for everyone.

One must restrain from overspending

Planning helps us to plan, save and achieve

our financial goals

If people start planning from student days,they have longer time to plan.

Power of compounding helps the most over

longer periods of time

-

7/23/2019 Fin Planning

5/35

our monthly budget " Income

Pocket Money Part time assignment

Prize

Stipend

Cash gifts, if any

# " E$penses

College Fees

Party

Gift

EMI if any Lnch

!ra"elling e#penses

$thers

%" #alance '#( ' Sa"ings%&'( of Income)

-

7/23/2019 Fin Planning

6/35

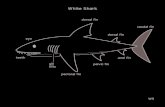

)*+ I -I%I/ P/I0 &

+he financial planning process.

Identifygoals &risk

Appetite2ReviewPeriodically6

Implementthe plan5

Prepare aplan to bridgethe gaps4

Identifyaps!

atherfinancial"ata

#

-

7/23/2019 Fin Planning

7/35

Gathering financial data

*hat is the sorce of income and +hat is its natre

Monthly Salary -siness Income

.o+ mch are yor monthly e#penses

/no+ing salary 0 e#penses act as first step for planning

E"en 1asic needs cannot 1e met, e"en if is a handsome salary 1t

lack of planning2

Net worth & Planning

*here+e are

*here +e

+ant to 1e

-

7/23/2019 Fin Planning

8/35

Identify Goals

3efine in"estment o14ecti"e or financial goals

Goals can 1e

5 short term %pto 6 years),

5 medim term %6 to 7 years) or

5 long term %p+ards of 7 years)

Each goal mst ha"e a target amont and a target date

Goals +ithot amonts and dates are likely to 1e missed8

G$ALS mst 1e SMA9! Goals

-

7/23/2019 Fin Planning

9/35

-

7/23/2019 Fin Planning

10/35

Identify gaps or isses

Are there any e#penses +hich ha"e to 1e met on a priority, de to

+hich plan may ha"e to 1e changed

Are there any lia1ilities +hich are already e#isting or +orse still,

may crop p sddenly1

-

7/23/2019 Fin Planning

11/35

Prepare the plan

2nderstand the risk taking ability

Income& E#penditreand Assets & Lia1ilitiesplay a veryimportant role in an individual3s risk taking ability

.igh incomedoes not necessarily mean high risk appetite if the

person also has large amount of liabilities

Lo+ incomeused 4udiciously to build assets, can increase risk

appetite

*ealth5 net worth

:et +orth5 assets;liabilities

-

7/23/2019 Fin Planning

12/35

Implement the plan

Preparing plan is relati"ely simple, implementing it reglarly is

the real challenge

*here is the money in"ested ; in +hich asset class ;

determines the potential retrns the in"estor can e#pect

A"oiding risky in"estments may lead to compromising ofgoals

-

7/23/2019 Fin Planning

13/35

+o um 2p6666

-

7/23/2019 Fin Planning

14/35

*ow to chieve 0oals

rrange goals in order of their time to reach short term, followed bymediumterm and lastly long term(

Plan investments for each goal.

hort term goals cannot be achieved by investing in risky avenueswhich by definition are long term in nature

/ong term goals cannot be funded by investing in short termavenues as they may not generate enough returns

-

7/23/2019 Fin Planning

15/35

teps for #udget Planning

Calclate yor

income

7etermine

your

bill for

essentials

7etermine

your bill for

non'essentials

+otal

debtsCalclate

yor

sa"ings

-

7/23/2019 Fin Planning

16/35

9IS/ A:3 9E!=9:

' 8isk and investing go hand in hand-8isk increases as the e$pected potential return

increases.'Even 9no'risk: products such as savings accounts

and government bonds carry the risk of earning less

than the inflation rate

/ow risk ' %ash, bank, -7s, 0old 8eturns ;.< ' =>(?edium 8isk @ 0OI #onds, %ompanies bonds ='AB>(

ggressive Investments @ ECuity & ?utual -unds8eturns DA>(

It is crcial to manage yor risk

-

7/23/2019 Fin Planning

17/35

+ime value of ?oney & Inflation

BA

BAA

8s A,BBBF5

today

8s. ;GF5

tomorrow

Inflation

Inflation

10 %

Infation erodes purchasing powero money

*hat 9s2 >?@ yo can 1y today might

not 1e enogh for prchasing the same

after > year2

Means prchasing po+er of 9pee hasgone do+n2

-

7/23/2019 Fin Planning

18/35

Po+er of Componding

-)hat happens to 8s. ABB invested H AB> for fi$ed rate

of interest

-loatingrate

mount #asedon floating rate(

A AAB.BB AB> AAB.BB

AA.BB G> AAG.GB

; A;;.AB A> A;;. AJ.= AJB.BJ

-

7/23/2019 Fin Planning

19/35

Componding

--ormula for calculating annual compound interest is

)here, 5 final amount P 5 principal amount initial investment( r 5 annual nominal interest rate as a decimal(

it should not be in percentage(

n 5 time

-

7/23/2019 Fin Planning

20/35

Choosing the right in"estment

option

ny investor should look for"

afety

/iCuidity

8eturns

-

7/23/2019 Fin Planning

21/35

Asset Allocation-Investors need to have varying percentages of

investments.

/O)

?E7I2?

*I0*

in 9s2

-unds AB,BBB

Investments

tocks ;,

-

7/23/2019 Fin Planning

22/35

Investment options

hort term avings bank account

?oney market funds F liCuid funds

/ong term ECuity shares

PP-

#onds and debentures

-

7/23/2019 Fin Planning

23/35

avings & investment related products

avings may be' -inancial ssets ' on -inancial ssets

$inancial Assets

%ash Instrments"ebt Instrments'(ity Instrments

)on

$inancial Assets%ommodity*'+ ,raded $nds

Real 'state-llions*old./ilver. "iamond

-

7/23/2019 Fin Planning

24/35

avings & investment related products

%ash Instruments

%ash in hand%ash in #ank

2seful for emergencies/ooses value because of inflation

;'J months of average monthly e$penses

to be kept in cash instruments.

-

7/23/2019 Fin Planning

25/35

sset llocation trategyssets have different

risk @return characteristics

investments allocated based on risk'return characteristicsare known as 9sset allocation:

sset allocation strategy *O2/7 %OI7E8our time frameour risk toleranceour personal circumstances

-

7/23/2019 Fin Planning

26/35

avings & investment related products

7ebt Instruments' mall avings chemes

' Public Provident -unds' ational aving %ertificates' Post Office ?onthly Income

chemes' enior %itiKen avings chemes

' Post Office term deposit' Post Office avings accounts' Post Office 8ecurring 7eposits' Lisan Mikas Patra

#onds & 7ebentures' +a$ aving #onds'Infrastructure

#onds,

-

7/23/2019 Fin Planning

27/35

avings & investment related products

ECuity -unds

' Investing in the ECuity capital of the %ompany' Public Offer

' Purchasing through secondary market.

7ividend or capital appreciation.

-

7/23/2019 Fin Planning

28/35

Third richest man in the world after Carlos Slim & Bill Gateshain! a networth "#$ Billion $ is %arren Buet.

'e (ou!ht his )rst share at the a!e of ** & he re!retted

that he started too late.'e (ou!ht a small farm at the a!e of *+ with sain!s fromdelierin! news,a,ers.

'e dries his own car & neer traels in a ,riate -et.

'e owns " Com,anies writes one letter to the C/0s & does

not hold meetin!s.

-

7/23/2019 Fin Planning

29/35

avings & investment related products

?utual -unds

' +he money pooled in by the investors in mutual fund is managed by sset

?anagement %ompanies & invested

in money markets, eCuity, debts etc.

+he returns earned are distributed as

as dividend or added to the capital.

avings & investment related

-

7/23/2019 Fin Planning

30/35

avings & investment related

products6..

Insurance

' preads risk' preads the losses

+o be discussed openly and no sentiments to be attached.

ew Pension ystem, BBGvailable to all Indians between A= and withdrawn

-

7/23/2019 Fin Planning

31/35

/oans or Investments

/oans & %redit cards have a very highcost.

/oans taken are deductible under

Income +a$ @ *ousing /oan & Principal.tudents /oans are also deductible.

-

7/23/2019 Fin Planning

32/35

%redit cards

%redit cards allows e$tra float on their money.

on Payment of dues within < days leads to

interest H ;> per month.

)arren #uffet

9 tay away from credit cards bank loans( and invest in yourself& rememberN

a( money does not create man but it is the man who

created money.

b( live your life as simple as you are.

c( 7on3t do what others say, 4ust listen to them but dowhat you feel good.

-

7/23/2019 Fin Planning

33/35

+a$ Planning

ection =B % @ 8ebate upto 8s. A,BB,BBB

Investments like insurance

premia, housing loan, PP- etc

/ong term capital gain on eCuities are not ta$able

=B %%- Infrastructure #onds are also e$empt.

-

7/23/2019 Fin Planning

34/35

8egulators

ecurities & E$change #oard of India

8eserve #ank of India

Insurance regulatory 7evelopment uthority

%ompetition %ommission of India

-

7/23/2019 Fin Planning

35/35

THANK YOU!

Any questions I would be glad to answer

your valuable time & patient hearin