Filling+in+your+VAT+return

-

Upload

kbassignment -

Category

Documents

-

view

217 -

download

0

description

Transcript of Filling+in+your+VAT+return

-

Notice 700/12 Filling in your VAT Return October 2011

Page 1 of 28

Foreword This notice cancels and replaces Notice 700/12 (March 2002). Details of any changes to the previous version can be found in paragraph 1.1 of this notice.

1 Introduction

1.1 What is this notice about? This notice helps you complete the VAT return. It will guide you through the form, box by box. It also contains some special advice for those using VAT accounting schemes and information about submitting your return electronically.

The notice has been restructured and streamlined to make it easier to read. It replaces the March 2002 edition (which was updated in 2004 and 2008).

The significant changes provide new information on:

completion of the return when using a special VAT accounting scheme

using the online VAT return

paying electronically and qualifying for extra time

using an accountant or agent to send your return online

using commercially produced software packages to allow both single and bulk submissions, and

the cleared funds rule for cheque payments by post.

You can access details of any changes to this notice since October 2010 on our internet website hmrc.gov.uk.

This notice and others mentioned are available on our website. Please ensure that you read the notices relevant to your circumstances before you complete your VAT return.

1.2 Online VAT returns Since 1 April 2010 all VAT-registered businesses with a VAT exclusive turnover of 100,000 or more, plus any newly registered businesses (regardless of turnover), must submit their returns online and pay electronically. HMRC plans, from 1 April 2012, to extend this requirement to virtually all VAT-registered businesses. But you dont have to submit your return online or pay electronically if either of the following applies:

-

Notice 700/12 Filling in your VAT Return October 2011

Page 2 of 28

you're subject to an insolvency procedure - but if you have an approved Voluntary Arrangement you may submit online if you want to

HMRC is satisfied that your business is run entirely by practising members of a religious society whose beliefs prevent them from using computers.

You can find out more about Online VAT returns on the HMRC website. The benefits of online VAT returns include:

a safe and secure method of sending your VAT return

an on-screen acknowledgement that we have received your return

an option to receive an electronic reminder when your VAT return is due

automatic calculations to reduce errors when completing the return

in most cases, this gives you up to an extra seven calendar days to submit and pay your return (compared with the due date for paper returns and cheques sent by post) and if you pay by Direct Debit online at least ten extra calendar days to pay.

There are legal conditions that apply to submitting VAT returns online and receiving the extra time for paying electronically. These are on the HMRC website under Legal conditions, Submit a return conditions and Incentives for making an electronic return and paying VAT due by an approved electronic method.

Section 5 of this notice contains more information.

2 Explanation of some common VAT terms This section gives a brief summary of some of the common terms you will come across as you read this notice. But, if you are completing a VAT return for the first time, it might be helpful to look at the VAT guidance.

2.1 Supplies This is the term for the sale of goods or services which you make by way of business. All goods and services that are subject to VAT (at the standard, reduced or zero rate) are called taxable supplies.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 3 of 28

2.2 Output VAT This is the VAT on your sales of goods or services. These sales are known as outputs. Output VAT (or output tax) is the VAT you charge and collect from your customers on goods or services going out of the business if you are registered for VAT.

2.3 Input VAT This is the VAT that you can claim on amounts paid to your suppliers for goods and services that you purchase for your business. These purchases are known as inputs. Input VAT (or input tax) is the VAT that you can reclaim on goods and services coming in to your business if you are registered for VAT. If you make, or intend to make, both taxable and exempt supplies and you incur input VAT that relates to both kinds of supply, you are classified as partly exempt. Your recovery of input VAT in such circumstances is subject to the partial exemption rules (see Notice 706 Partial Exemption).

2.4 Tax due Your VAT return requires you to record the output VAT payable to us and the input VAT you can claim back from us. If the output VAT is greater than the input VAT, you will owe the difference to us. This is a tax due return. If the input VAT you can claim is greater than the output VAT you owe, you will be due a repayment of VAT from us. This is a repayment return.

2.5 VAT period The top of your VAT return will show the inclusive dates that the return covers. For example, if you submit quarterly returns and the end date shown on the return is 31 March 2009, then it will cover the period from 1 January 2009 to 31 March 2009 and be called period 03/09. If it ends on 31 August 2009, your return period will be called 08/09.

2.6 Tax point There are rules for working out the time when a supply of goods or services is treated as taking place. This is called the tax point. You must account for VAT in the VAT period in which the tax point occurs at the rate in force at that time unless you use the Cash Accounting Scheme (see paragraph 4.2). More information on tax points is contained in Notice 700 The VAT Guide.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 4 of 28

2.7 Imports These are goods and related costs that you purchase for your business from suppliers outside the European Community (EC). Any VAT that you pay on these goods can be reclaimed as input VAT, subject to the normal rules (see Notice 702 Imports).

2.8 Acquisitions These are the goods that you purchase from a VAT-registered business in another EC Member State and are dispatched or removed into the UK. You may have to account for VAT in the UK (referred to as acquisition tax), but you can also recover that VAT as input VAT, subject to normal rules. For further information and details of EC Member States see Notice 725 The single market.

2.9 Exports These are goods that you supply to customers outside the EC. Such supplies are normally be zero-rated, see Notice 703 VAT: Export of goods from the United Kingdom.

2.10 Dispatches or removals These are goods that you supply to customers in other EC Member States which are dispatched or removed from the UK. Goods leaving the UK to go to other Member States are not called 'exports', but are referred to as dispatches or removals. The term export is only used for goods leaving the UK to go to countries outside the EC.

3 How to fill in each box on your return The requirements shown here apply to both paper and online VAT returns.

If you are using a special VAT accounting scheme such as the Flat Rate Scheme for small businesses, Cash Accounting, Annual Accounting, Margin Schemes for second hand goods, works of art, antiques and collectors items, Payments on Account, or reverse charge accounting, please read section 4 before filling in your return.

If you use a retail scheme, please see Notice 727 Retail Schemes.

3.1 Common requirements when completing boxes 1 to 9 When completing each box on the return you must:

fill in all boxes clearly in black ink

-

Notice 700/12 Filling in your VAT Return October 2011

Page 5 of 28

write NONE where necessary on paper returns and 0.00 on online returns

not put a dash or leave any box blank

if there are no pence, write 00 in the pence column

not enter more than one amount in any box, and

if you have a negative amount in boxes 1 to 4, put the figure in brackets on a paper return, for example, (1000.00). Insert a minus sign before negative amounts on online returns, for example, -1000.00.

The paper version of the VAT return is designed to be read by machine. Please follow these rules so that the information declared can be easily read.

3.2 Filling in box 1 Box 1 VAT due in the period on sales and other outputs

Include the VAT due on all goods and services you supplied in the period covered by the return. This is your output VAT (or output tax) for the period. VAT may also be due on supplies outside the mainstream of your business. Some examples are:

fuel used for private motoring where VAT is accounted for using a scale charge (see Notice 700/64 Motoring expenses)

the sale of stocks and assets goods you take out of the business for your own private use VAT due under reverse charge accounting and the gold scheme (see

paragraph 4.6) supplies to your staff gifts of goods that cost you more than 50, excluding VAT supplies of goods to customers not registered for VAT in another Member

State including distance sales from the UK to another Member State where supplies are below the distance selling threshold in that Member State

distance sales to the UK which are above the UK distance selling threshold or, if below the threshold but the overseas supplier opts to register for VAT in the UK

commission received for selling something on behalf of someone else VAT shown on self-billed invoices issued by your customer, and supplies of installed or assembled goods in the UK where an overseas

supplier is registered for VAT here (see Notice 725 The single market for more details).

Points to remember when filling in box 1:

deduct any VAT on credit notes issued by you deduct any VAT when you make refunds under the retail export scheme

-

Notice 700/12 Filling in your VAT Return October 2011

Page 6 of 28

include VAT on the full value of the goods where you have taken something in part exchange

leave out any amounts notified to you as assessments by us you can sometimes include VAT underdeclared/overdeclared on previous

returns but see paragraph 6.6 for the special rules that apply, and you must not declare zero-rated exports or supplies to other EC Member

States unless certain conditions are met (see Notice 703 VAT: Exports of goods from the United Kingdom or Notice 725 The single market).

3.3 Filling in box 2 Box 2 The VAT due in the period on acquisitions from other Member States of the European Community (EC).

Show the VAT due on all goods and related costs purchased from VAT registered suppliers in other EC Member States such purchases are referred to as acquisitions. Related costs include any payment which you make to cover your suppliers costs in making the supply, such as packing, transport or insurance for which they are responsible under their contract with you. You must include the VAT due on all your acquisitions for the VAT period in which the tax point occurs. This is the earlier of the date of issue to you of the invoice from your supplier or the 15th day of the month following the one in which the goods were sent to you.

You may also be entitled to reclaim this amount as input VAT and do so by including the relevant figure within the total at box 4 (but see the rules for reclaiming input VAT in Notice 700 The VAT Guide).

Information about trading within the EC is contained in Notice 725 The single market.

3.4 Filling in box 3 Box 3 Total VAT due

Show the total VAT due, that is, boxes 1 and 2 added together. This is referred to as your output VAT (or output tax) for the period.

This figure will be calculated automatically if you are completing your return online.

3.5 Filling in box 4 Box 4 VAT reclaimed in the period on purchases and other inputs

-

Notice 700/12 Filling in your VAT Return October 2011

Page 7 of 28

(including acquisitions from the EC).

Show the total amount of deductible VAT charged on your business purchases. This is referred to as your input VAT (or input tax) for the period. You cannot claim input VAT on your return unless you have a proper VAT invoice to support the claim (but see the rules in Notice 700 The VAT Guide).

You can reclaim:

VAT you have paid under the reverse charge procedure or the gold scheme (see paragraph 4.6)

VAT you can reclaim on acquisitions of goods from VAT registered suppliers in other EC Member States (this must correspond with the amount declared within box 2)

VAT you pay on imports from countries outside the EC (provided you have received the relevant import VAT certificate)

VAT you are claiming back as bad debt relief, see Notice 700/18 Relief from VAT on bad debts

VAT you pay on removals from a warehousing regime or a free zone VAT shown on self-billed invoices issued by you.

Points to remember when filling in box 4

make sure you do not include VAT:

you pay on goods bought wholly for your personal use on business entertainment expenses on second-hand goods that youve bought under one of the VAT second-

hand schemes (see Notice 718 The VAT Margin Scheme and global accounting, Notice 718/1 The VAT Margin Scheme on second-hand cars and other vehicles, Notice 718/2 The VAT Auctioneers Scheme), and

where you receive self-billed invoices. Other points to remember:

deduct VAT on any credit notes issued to you you can sometimes include VAT underdeclared/overdeclared on previous

returns but see paragraph 6.6 for the special rules that apply leave out any amounts notified to you by us as overdeclarations leave out amounts paid on assessments or amounts which we already

owe you, and if you are partly exempt your recovery of input VAT is subject to partial

exemption rules (see Notice 706 Partial exemption).

3.6 Filling in box 5 Box 5 Net VAT to be paid to HMRC or reclaimed

-

Notice 700/12 Filling in your VAT Return October 2011

Page 8 of 28

Take the figures in boxes 3 and 4. Deduct the smaller from the larger and enter the difference in box 5.

This figure will be calculated automatically if you are completing your return online.

If the figure in box 3 is more than the figure in box 4, the difference is the amount you must pay. If the figure in box 3 is less than the figure in box 4 we will credit your account and repay the balance, subject to any enquiries we may need to make.

3.7 Filling in box 6 Box 6 Total value of sales and all other outputs excluding any VAT

Show the total value of all your business sales and other specific outputs but leave out any VAT. Some examples are:

zero-rate, reduced-rate and exempt supplies fuel scale charges (see Notice 700/64 Motoring expenses) exports supplies to other EC Member States (that is any figure entered in box 8) supplies of installed or assembled goods in the UK where the overseas

supplier registers for VAT here distance sales to the UK which are above the UK distance selling

threshold or, if below the threshold but the overseas supplier opts to register for VAT in the UK

reverse charge transactions (see paragraph 4.6 ), and supplies which are outside the scope of UK VAT as described in Notice

741A Place of supply of services, and deposits for which an invoice has been issued. However, you do not include in box 6 any of the following:

money you have personally put into the business loans, dividends, and gifts of money insurance claims, or Stock Exchange dealings (unless you are a financial institution).

3.8 Filling in box 7 Box 7 The total value of purchases and all other inputs excluding any VAT

Show the total value of your purchases and expenses but leave out any VAT.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 9 of 28

You must include the value of:

imports acquisitions from VAT registered suppliers in other EC Member States

(that is any figure entered in box 9) 'reverse charge' transactions (see paragraph 4.6)

However, you do not include the value of any of the following:

wages and salaries PAYE and National Insurance contributions money taken out of the business by you loans, dividends, and gifts of money insurance claims Stock Exchange dealings (unless you are a financial institution) MOT certificates motor vehicle licence duty local authority rates, or income which is outside the scope of VAT because it is not consideration

for a supply.

3.9 Filling in box 8 Box 8 Total value of all supplies of goods and related costs, excluding any VAT, to other EC Member States

-

Notice 700/12 Filling in your VAT Return October 2011

Page 10 of 28

Show the total value of all supplies of goods to other EC Member States and directly related costs, such as freight and insurance, where these form part of the invoice or contract price. This must include the value of any goods dispatched from the UK to a destination in another Member State, even if no actual sale is involved or the sale is being invoiced to a person located outside the EC. Leave out any VAT. See Notice 725 The single market for further information on trading within the EC.

You must include the value of supplies such as:

any goods dispatched from the UK to a destination in another Member State

goods dispatched from the UK for installation or assembly in another Member State

the value of supplies of new means of transport to unregistered customers in another Member State (see Notice 728 New means of transport), and

distance sales to unregistered customers in another Member State where the value of your distance sales have exceeded the distance selling threshold of that Member State.

However, you do not include in box 8 the value of any of the following:

services related to the supply of goods that have been invoiced separately separate supplies of services, such as legal or financial services the goods themselves when you are supplying processing work, or sales made in the UK to unregistered customers in another EC Member

State where the supplies are not distance sales. Remember: Figures entered in this box must also be included in the box 6 total.

3.10 Filling in box 9 Box 9 Total value of all acquisitions of goods and related costs, excluding any VAT, from other EC Member States

Show the total value of all acquisitions of goods from VAT registered suppliers in other EC Member States and directly related costs, such as freight and insurance, where these form part of the invoice or contract price, but leave out any VAT.

You must include the value of supplies such as:

acquisitions made within the return period in which the tax point occurs, and

goods installed or assembled in the UK where those goods have been dispatched from another EC Member State.

However, you do not include in box 9 the value of any of the following:

-

Notice 700/12 Filling in your VAT Return October 2011

Page 11 of 28

the goods themselves when you are supplying processing work. services related to acquisitions that have been invoiced separately separate supplies of services. Remember: Figures entered in this box must also be included in the box 7 total.

4 Filling in the return if you use a VAT Accounting Scheme If you use any of the special VAT accounting schemes there may be different rules for completing some of the boxes on the VAT return (see the guidance at paragraphs 4.1 to 4.6). Other boxes should be completed in the normal way as shown in section 3.

If you trade in other goods and services outside a special scheme you should also include those supplies on your VAT return in the normal way.

4.1 Flat Rate Scheme for small businesses This scheme allows small businesses an alternative to the normal method of accounting for VAT. Under this scheme you can work out your VAT by applying a flat rate percentage to your total turnover (including VAT).

If you use this scheme there are special rules for completing boxes 1, 4, 6 and 7 of the VAT return. These are shown below. All other boxes are completed as normal.

Box 1 VAT due on sales

To calculate the VAT due under the flat rate scheme, you must apply the flat rate percentage for your trade sector to the total of all your supplies, including VAT. This includes your supplies at the standard and reduced rates and any which are zero rated or exempt. You may have other output tax to include in the box such as the sale of capital expenditure goods on which you have claimed input tax separately while using the flat rate scheme.

You should also use this box to record transactions that are subject to the reverse charge (see paragraph 4.6).

Box 4 Total input VAT

If you use the flat rate scheme you do not normally make a separate claim for input VAT, including any VAT on imports or acquisitions, as the flat rate percentage for your trade sector includes an allowance for input VAT.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 12 of 28

However, you can recover VAT on any single purchase of capital goods of 2,000 or more, including VAT, and VAT on stocks and assets on hand at registration. For details, see Notice 733 Flat Rate Scheme for small businesses.

You should also use this box to claim Bad Debt Relief and to account for reverse charge transactions (see paragraph 4.6).

Box 6 Total value of sales

Enter the turnover to which you applied your flat rate percentage, including VAT. You should also include the value, excluding VAT, of any supplies accounted for outside the flat rate scheme, such as the sale of any capital goods on which you have reclaimed input VAT, and reverse charge transactions. Also include any amount you have entered in box 8.

Box 7 Total value of purchases

Usually there will be no figure in this box unless you have bought a capital good costing more than 2,000 (including VAT) and you are claiming the input VAT in box 4. In which case, enter the purchase price, excluding VAT. Also include in box 7 any amount you have entered in box 9 and reverse charge transactions.

Further information about the scheme is available in Notice 733 Flat Rate Scheme for small businesses.

4.2 Cash Accounting Scheme This scheme allows you to account for VAT on the basis of payments you receive and make, rather than on invoices you issue and receive.

If you use this scheme there are special rules for completing boxes 1, 4, 6 and 7 of the VAT return. These are shown below. All other boxes are completed as normal.

Box 1 VAT due on sales

If you use the cash accounting scheme, you must base the figure you put in this box on the payments you have received, not the invoices you have issued.

Box 4 Total input VAT

If you use the cash accounting scheme, you must base your input VAT claim on payments made, not invoices received. However, you cannot use the scheme for acquisitions of goods from other EC Member States, or for imports. You must account for the VAT on such purchases in the normal way and add that amount to your cash accounting figure in this box.

Box 6 Total value of sales

Enter the value of all your sales, excluding VAT, for the period based on the payments you have received, not the invoices issued. Also include in box 6 any amount you have entered in box 8.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 13 of 28

Box 7 Total value of purchases

Enter the value of all your purchases of goods and services for the period, excluding VAT, based on the payments you have made, not the invoices received. Also include in box 7 any amount you have entered in box 9.

Further information about the scheme is available in Notice 731 Cash accounting.

4.3 Annual Accounting Scheme This allows you to complete one VAT return each year and you pay regular instalments of the VAT you expect to owe to avoid a large bill at the end of the year.

If you use this scheme complete all boxes on the VAT return in the normal way for the VAT period.

Box 5 Net VAT to be paid to HMRC or reclaimed by you

Do not deduct any instalments you have paid during the period when calculating the figure to put into this box.

However, the end of the year payment you send with your annual return should be the box 5 figure minus any instalments you have already made for the period.

Further information about the scheme is available in Notice 732 Annual accounting.

4.4 Margin scheme for second-hand goods, works of art, antiques and collectors items VAT is normally due on the full value of the goods you sell. If you trade in second-hand goods, works of art, antiques and collectors items, you may be eligible to use the Margin Scheme. The Margin Scheme allows you to calculate VAT on the difference (or margin) between your buying price and your selling price. If no profit is made (because the purchase price exceeds the selling price) then no VAT is payable.

If you use the Margin Scheme there are special rules for completing boxes 1, 6, and 7 on the VAT return. These are shown below. If you also trade in goods and services outside the Margin Scheme you must account for those supplies on your VAT return in the normal way (described in section 3 above).

Box 1 VAT due on sales

Include the output VAT due on all eligible goods sold in the period covered by the return.

Box 6 Total value of sales

Include the full selling price of all eligible goods sold in the period, less any VAT due on the margin.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 14 of 28

Box 7 Total value of purchases

Include the full purchase price of eligible goods bought in the period.

There is no requirement to include Margin Scheme purchases or sales in boxes 8 and 9 of your VAT return.

Further information about the scheme is available in Notice 718 The VAT Margin Scheme and global accounting, Notice 718/1 The VAT Margin Scheme on second-hand cars and other vehicles, Notice 718/2 The VAT Auctioneers Scheme.

4.5 Payments on account (POA) Every VAT registered business with an annual VAT liability of more than 2.3 million is required to make payments on account (POA).

Once in POA each business must make interim payments at the end of the second and third months of each VAT quarter. These interim payments are payments on account of the quarterly VAT liability. A balancing payment for the quarter, that is the quarterly liability less the payments on account made, is then made with the VAT return.

When you complete your VAT return you should fill in and send your quarterly returns in the normal way. Do not adjust any figures on the return to take account of payments on account which you have made. However, the amount to be paid is the net liability shown on the return less any payments on account that have already been made in respect of that period.

Repayments that may be due will be made under the normal rules. If your return is a repayment return, the payments on account made in the quarter will also be repaid subject to any debt on file.

Further information is available in Notice 700/60 Payments on account.

4.6 Reverse charge accounting Under the reverse charge procedure, the purchaser of the goods or services, rather than the seller, is liable to account for the VAT on the sale. The VAT return should be completed in accordance with the guidance in the following table:

If you use the reverse charge for

....and you are the supplier, fill in

.and you are the customer, fill in

Gold Box 6 (value of the supply) Box 1 (output VAT) Box 4 (input VAT) Box 6 (value of the deemed supply) Box 7 (purchase value)

Services Box 6 (value of the supply) Box 1 (output VAT) Box 4 (input VAT)

-

Notice 700/12 Filling in your VAT Return October 2011

Page 15 of 28

Box 6 (value of the deemed supply) Box 7 (purchase value)

Mobile phones and computer chips

Box 6 (value of the supply) Box 1 (output VAT) Box 4 (input VAT) Box 7 (purchase value)

Further information is available in Notice 701/21 Gold, Notice 735 Reverse charge on mobile phones and computer chips and Notice 741A Place of supply of services.

5 Submitting your return and making payment

5.1 Submitting your return and making payment electronically Since 1 April 2010 all VAT-registered businesses with a VAT exclusive turnover of 100,000 or more, plus any newly registered businesses (regardless of turnover), must submit their returns online and pay electronically. HMRC plans, from 1 April 2012, to extend this requirement to virtually all VAT-registered businesses. But you dont have to submit your return online or pay electronically if either of the following applies:

you are subject to an insolvency procedure - but if you have an approved Voluntary Arrangement you may submit online if you want to

HMRC is satisfied that your business is run entirely by practising members of a religious society whose beliefs prevent them from using computers.

You (or your accountant or other agent) can opt to use either the free HMRC VAT Online service or commercial software. You can benefit from the built-in safeguards which include:

an on screen acknowledgement, and

automatic calculations to reduce errors.

You will also be able to make payment by Direct Debit and you may get additional time in which to submit your return and make payment.

To enrol for this service go to VAT.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 16 of 28

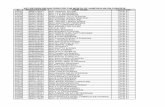

5.2 When to send us your VAT return and payment The table below gives details about the deadlines for submitting your return and paying your VAT. The deadlines will depend on how you submit and pay your return.

If you send us

Then Further information

a paper return and pay by cheque

they must reach us in time for your cheque to clear into our bank account no later than the due date shown on your return, which is normally one month after the end of the VAT period. You need to take account of postal delays, weekends and bank holidays.

If you use the Annual Accounting scheme, your due date is two months (not one month) after the end of the VAT period. Your return and payment must reach us in time for your cheque to clear into our bank account no later than the due date shown on your return.

Cheque payments by post are treated as being received on the date when cleared funds reach our bank account. This means that you must allow enough time for the payment to reach us and to clear into our bank account no later than the due date shown on your return. A cheque takes three bank working days to clear excluding Saturdays, Sundays, and bank holidays.

To allow for possible postal delays we advise you to allow at least three working days for your return and payment to reach us and a further three working days for your cheque to clear to our account.

If you make Payments on Account you must use one of the electronic methods described at paragraphs 5.3.2 to 5.3.6.

a paper return and pay electronically

you can get up to seven extra calendar days for both your return and electronic payment to reach us (unless you use the Annual Accounting scheme or make Payments on Account).

You must ensure that cleared funds are received in our bank account by the seventh calendar day after the due date shown on your return, or you may be liable

If the seventh calendar day falls on a weekend or bank holiday, your return and payment (cleared funds) must reach us before then.

Apart from payments made by CHAPS, it normally takes three bank working days for a payment to clear to our account. Bank working days are Monday to Friday excluding bank holidays. Please check

-

Notice 700/12 Filling in your VAT Return October 2011

Page 17 of 28

to a surcharge for late payment.

You dont get extra time to submit a paper return if the net tax is nil or is a repayment.

For full details of the extra time and electronic payment methods available, go to How to pay VAT.

with your bank or building society to see how long they take to transfer a payment and what their cut off time for initiating a payment is. If your bank or building society takes longer, you will need to initiate your payment earlier.

an electronic return and electronic payment (except Online Direct Debit)

you will normally get an extra seven calendar days for your return (including nil and repayment returns) and any electronic payment to reach us (unless you use the Annual Accounting scheme or make Payments on Account).

When you view your return online, the due date shown on-screen includes the extra seven days. If the due date falls on a weekend or bank holiday your payment (cleared funds) must reach us before then.

If your payment arrives later than this you may be liable to a surcharge for late payment.

If you submit your return online you must pay by an approved electronic method.

For details of the extra time and approved electronic methods, go to How to pay VAT.

An electronic return and pay by Online Direct Debit

you will normally get an extra seven calendar days for your return to reach us (unless you use the Annual Accounting scheme or make Payments on Account).

When you view your return online, the due date shown on-screen includes the extra seven days. It will then be a further three bank working days before the payment is collected from your bank account. Bank working days are Monday to Friday excluding bank holidays.

You must set up your Direct Debit Instruction (DDI) before you submit your next return and at least two bank working days before the return is due when the due date falls on a weekday. If your return due date falls on a weekend or bank holiday you will need to set up your DDI at least three bank working days before the return is due. See paragraph 5.3.1 below for more information about this

-

Notice 700/12 Filling in your VAT Return October 2011

Page 18 of 28

5.3 Paying HMRC We accept payment by a range of methods but recommend electronic payment. Electronic payment is safe and secure and avoids postal costs and delays. If you submit your return online you must pay by an approved electronic method.

HMRC uses two banking suppliers:

Citi for payments made by Bacs Direct Credit, internet/telephone banking and CHAPS see paragraph 5.5 for the correct bank account details.

NatWest (part of the Royal Bank of Scotland Group) for payments made by bank giro see paragraph 5.3.5

To ensure that your payment is received you must use the correct HMRC bank account details and paying-in slips.

However you pay, if the net VAT payable to us is less than 1, you do not need to pay us at all. Do not carry forward amounts of under 1 to your next VAT return.

For full details about the payment options available, see below or go to How to pay VAT.

5.3.1 Direct Debit When you enrol for the VAT Online service you can choose to pay by Direct Debit. HMRC will only collect the amount you have shown as being due on your VAT Return and will never collect any other outstanding amounts by Direct Debit. At all times you are fully protected by the Direct Debit guarantee.

If you are the authorised signatory you can set up the Direct Debit Instruction (DDI) online by accessing the Submit a VAT return/Set up a VAT Direct Debit Instruction link on the home page.

If you are not the authorised signatory you can print out a paper copy from the online service to complete and return by post. We will send you an acknowledgement when we have processed your DDI, which will tell you its effective start date.

You must set up your online DDI before you submit your next return and at least two bank working days before the return is due when the due date falls on a weekday. For example, if your return is due on Tuesday 7 September, two bank working days before this is Friday 3 September. If your return due date falls on a weekend or bank holiday you will need to set up your DDI at least three bank working days before the return is due. For example, if your return is due on Sunday 7 November, three bank working days before this is Wednesday 3 November.

If your return is due in less than two or three bank working days as shown in the examples above then for this return only you will need to pay by a different electronic method.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 19 of 28

Bank working days are Monday to Friday, excluding bank holidays.

You cannot pay by online Direct Debit if you make Payments on Account and submit quarterly returns.

5.3.2 Debit or Credit card over the Internet If you have a debit or credit card issued by a UK card issuer, you can pay your VAT over the internet using the BillPay service. This is a service provided by Santander Corporate Banking (formerly Alliance & Leicester Commercial Bank PLC). To make your payment you will need:

debit or credit card details, and

your VAT registration number.

Please note:

there will be a non-refundable transaction charge for payments by credit card

HMRC does not accept American Express or Diners Club cards, and

you cannot pay surcharges, interest or penalties in this way.

5.3.3 Bacs Direct Credit, Internet or Telephone Banking All banks and building societies that offer payment by Bacs Direct Credit, Internet or Telephone banking can accept VAT payments.

When you pay by this method funds are transferred automatically from your bank or building society account to ours. You tell your bank or building society when to make the payment. Please advise your bank or building society to quote your VAT registration number when making payment.

It normally takes three bank working days for the payment to reach HMRC. Bank working days are Monday to Friday excluding bank holidays. Some bank and building societies can take longer. You should check with your bank or building society to see how long they take to transfer payment and what their cut-off time is for initiating payment. If they take longer you will need to initiate your payment earlier.

5.3.4 CHAPS The CHAPS system enables you to tell your bank or building society to make an immediate payment. You know for certain that payment will reach us on the day the bank makes the payment.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 20 of 28

CHAPS payments are more expensive than other payment methods but may be of benefit if you make very large payments. We receive same day value so long as you initiate payment within the time specified by your bank (usually between 9.00am and 3.00pm). Please advise your bank to quote your VAT registration number when making payment.

5.3.5 Bank Giro If your bank or building society offers the bank giro service, you can make a VAT payment at your own branch by cash or cheque using a bank giro paying-in slip. We treat any payment made by bank giro as electronic.

To use this payment method we need to send you a book of paying-in slips that are pre-printed with your VAT registration number and our bank account details. You can order a book of paying-in slips by emailing [email protected] phoning 01702 366376 or 01702 366314. Please note that it can take up to six weeks for the paying-in slip to be printed and sent to you.

When paying by bank giro please use only an official HMRC paying-in slip. Official paying-in slips contain the correct HMRC bank account information and this will ensure that your payment reaches our account on time.

HMRC now uses NatWest as its giro bank supplier, so please make sure that you are using a paying-in slip that shows the new NatWest account details. You can identify a new paying-in slip as it will have NatWest Bank PLC on it.

Once you have received your book of paying-in slips:

take your official pre-printed paying-in slip and payment to your own bank or building society branch. Other banks may refuse to accept it or charge you for this service.

make your cheque payable to HM REVENUE & CUSTOMS ONLY followed by your VAT registration number.

To allow for possible delays in bank processing (for which HMRC is not responsible) please allow at least three bank working days for your payment to reach us. Bank working days are Monday to Friday excluding bank holidays.

5.3.6 Standing Order You can pay by standing order if you have been accepted for the Annual Accounting Scheme or you make Payments on Account.

A Standing Order authority request form can be found at How to pay VAT, or alternatively you can set up a standing order using your own bank or building societys internet or telephone banking service. To do this you will need to provide your bank or building society with HMRCs bank account details these are shown in paragraph 5.5. If you make a mistake with the sort code or account number there may be a delay before your record is credited or your payment may not be received at all. You may also be liable to a surcharge for late payment.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 21 of 28

5.3.7 By post If you are not required to submit your VAT return online and pay electronically, you can still pay by posting us a cheque. Cheque payments made by post are treated as being received by us on the date when cleared funds reach our bank account not the date when we receive the cheque. This means that you must allow sufficient time for the payment to reach us and clear into our bank account, no later than the due date shown on your paper VAT return. A cheque takes three bank working days to clear. Bank working days are Monday to Friday excluding bank holidays. To allow for possible postal delays (for which HMRC is not responsible) please allow at least three working days for the cheque payment to reach us and a further three days for the payment to clear our bank account.

If your cheque payment does not clear by the due date shown on your paper VAT return, you may be liable to a surcharge for late payment.

If you use this method:

make your cheque payable to HM REVENUE & CUSTOMS ONLY

include your VAT Registration Number after HM REVENUE & CUSTOMS ONLY, and

send your return and cheque to HMRC in the envelope provided.

If you do not have a return envelope, please send your return and payment to:

VAT Controller VAT Central Unit BX5 5AT

If you post your return from abroad please add United Kingdom below the post code.

Where exceptionally you need to use a private courier service to deliver your return please use the following address:

HM Revenue & Customs Alexander House Southend SS99 1AA

5.3.8 Information about the Faster Payments Service HMRC is currently unable to receive or make payments using the Faster Payments Service (FPS) which is offered by some banks; however we will be reviewing the situation and will update our internet website if the position changes.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 22 of 28

5.4 Your payment reference When making payment you must always provide details of your VAT registration number as the payment reference. The VAT registration number is made up of 9 digits, for example, 123 4567 89.

It is important that you show your registration number with no gaps between the characters, for example, 123456789. Without your registration number we will not be able to update your customer account electronically. The delay with updating your account may result in surcharge notices or requests for payment being issued.

5.5 HMRC bank account details If you are paying by Bacs Direct Credit, internet/telephone banking, or by CHAPS you will need to provide your bank with our bank account details as follows:

Account details Sort code 08-32-00 Account Number 11963155 Account Name HMRC VAT

If your bank asks for the address of the bank to which payment is being made please use

Citi Citigroup Centre Canada Square Canary Wharf London E14 5LB

If you are making a payment from an overseas bank account our International Bank Account Number (IBAN) is:

Account details

Swift Bank Identifier Code (BIC) CITIGB2L

International Bank Account Number (IBAN)

GB25CITI0832001 1963155

Account Name HMRC VAT

Please note: Where an IBAN is shown you must give this number as well as the SWIFT BIC.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 23 of 28

6 Frequently asked questions

6.1 What if I cannot complete my return and/or pay the VAT by the due date? If you do not have all the information you need to complete your return or you think that you will be unable to send in your return by the due date, you should contact the VAT Helpline on 0845 010 9000 immediately explaining the circumstances.

If you think you will have problems paying the VAT by the due date you should ring the Business Payment Support Team on 0845 302 1435 immediately. Dont wait until the payment is overdue. Further information can be found on the Business Payment Support Service page.

See Notice 700/50 Default Surcharge and Notice 930 What if I dont pay?.

6.2 What if I submit my return and payment late? We will notify you if we received your return and/or payment late and you may be liable to a surcharge. It is therefore in your own interests to make sure we receive your returns and payments on time.

You can find out more about this in Notice 700/50 Default surcharge.

For further information on how to make a payment, go to How to pay VAT.

6.3 What if I lose my paper return? If you have lost or mislaid the original form do not be tempted to alter another VAT return form or send your VAT declaration in another way. You should contact the VAT Helpline on 0845 010 9000 immediately and ask for a replacement, but please remember that we cannot provide paper versions of any returns that you are required to submit online.

6.4 What if I am unable to send an electronic return due to a system problem? If the system crashes or the website is not available, you should phone our VAT Online Services Helpdesk on 0845 010 8500. They will tell you what you should do. In the meantime you should still make arrangements to pay any VAT due electronically and on time.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 24 of 28

6.5 What if I receive an assessment from HMRC because I have failed to send in a return? You should send us the return immediately, with the correct figures for the VAT period. If you receive such an assessment and it understates your VAT liability and you do not tell us within 30 days, you may be liable to a penalty and interest.

The table below gives information about making payments.

If you then

have not paid the assessment and box 5 of the return shows that you owe us VAT,

you should pay the full amount shown as due, not the amount on the assessment.

have already paid the assessment and the amount shown in box 5 is more than the assessment,

you should send us a payment for the balance with the return.

have paid the assessment and the amount shown in box 5 is less than the assessment,

we will repay or credit you with the overpayment subject to any enquiries we may need to make.

6.6 How can I correct errors on previous returns? You may be able to correct errors in VAT returns for the preceding four years by using boxes 1 and 4 of the return for the period of discovery provided the net error is:

10,000 or less, or

between 10,000 and 50,000 and does not exceed 1% of the total value of your sales (before correction) shown in box 6

Net errors exceeding 50,000 and those above 10,000 that exceed 1% of the box 6 amount must be separately notified.

Further information is contained in Notice 700/45 How to correct VAT errors and make adjustments or claims.

6.7 How do I notify you about changes to my business? If your business circumstances change you must tell HMRC. Such changes will include a new address, company name or trading style, and if you need to cancel your VAT registration. Please notify changes:

-

Notice 700/12 Filling in your VAT Return October 2011

Page 25 of 28

Online for information on how to do this go to the HMRC page Changes to your business details and your VAT registration.

By completing form VAT 484 and sending it to Grimsby National Registration Service the address is on the form. You can download the form from the HMRC website.

For information on how to cancel your VAT registration please see Cancelling your VAT registration on our website.

7 Things to check before you send your return

7.1 Checking your figures If all your outputs are standard-rated, the total in box 1 should be

20% of the total in box 6. (Before 4 January 2011 the standard VAT rate was 17.5%, and from 1 December 2008 to 31 December 2009 it was 15%).

If you have entered a value in box 9, remember to include any acquisition tax due on your intra-EC acquisitions in boxes 2 and 4.

Your box 5 total should be the difference between boxes 3 and 4 this is calculated automatically if you complete your return online.

If the total in box 8 is more than the total in box 6, or the total in box 9 is more than the total in box 7, you may have transposed the box figures in error.

When you complete your online return, please check that you have entered the correct figures before you click on submit, as you cant amend the return online after your have submitted it.

7.2 Other checks Have you completed every box on the return, entering NONE

on paper returns and 0.00 on electronic returns if applicable?

Have you entered any negative figures on a paper return in brackets, for example, (1000.00)? Insert a minus sign before negative amounts on the online return for example -1000.00.

-

Notice 700/12 Filling in your VAT Return October 2011

Page 26 of 28

Have you zero-rated any exports or removals without obtaining valid evidence that the goods have left the UK within the appropriate time limits? See Notice 703 Export of goods from the United Kingdom and Notice 725 The single market.

Have you included any errors you may have found on previous VAT returns? (see paragraph 6.6).

Have you made the necessary adjustments in boxes 1 and 4 for credit notes received and issued by you?

Have you signed and dated the paper return?

If you are sending a cheque, have you signed and dated it correctly, do the words and figures agree and is it made out to HM Revenue & Customs followed by your VAT registration number?

Please do not staple the cheque to the VAT return.

If you are paying by cheque have you enclosed the cheque?

If you are sending a cheque, remember that you must allow enough time for the cheque to clear to our bank account by the due date shown on your paper VAT return see paragraph 5.3.7

Make sure you have not included any correspondence with your VAT return. Correspondence must be sent separately to the appropriate office to ensure it is dealt with promptly. Contact the VAT Helpline on 0845 010 9000 for help on where to send other correspondence.

Have you made arrangements with your bank to make any electronic payment, ensuring cleared funds are in our VAT account by the appropriate date?

Have you provided your bank with our VAT account details? They are: Sort Code: 08-32-00 Account Number: 11963155 Account Name: HMRC VAT see also paragraph 5.5

Have you provided your bank with your VAT-registered name and VAT registration number as the pay reference, without any gap in the nine-digits, for example 123456789 (see paragraph 5.4)?

-

Notice 700/12 Filling in your VAT Return October 2011

Page 27 of 28

Have you notified our National Registration Service of any changes in business circumstances (see paragraph 6.7)? Some changes could affect the account into which any repayment may be paid.

Your rights and obligations Your Charter explains what you can expect from us and what we can expect from you. For more information go to www.hmrc.gov.uk/charter.

Do you have any comments or suggestions? If you have any comments or suggestions to make about this notice, please write to:

HM Revenue & Customs VATAPPS Accounting Policy 1NW Queens Dock Liverpool L74 4AA

Please note this address is not for general enquiries.

For your general enquiries please phone our Helpline 0845 010 9000.

Putting things right If you are not satisfied with our service, please let the person dealing with your affairs know what is wrong. We will work as quickly as possible to put things right and settle your complaint. If you are still unhappy, ask for your complaint to be referred to the Complaints Manager.

For more information about our complaints procedures go to hmrc.gov.uk and under quick links select Complaints.

How we use your information HM Revenue & Customs is a Data Controller under the Data Protection Act 1998. We hold information for the purposes specified in our notification to the Information Commissioner, including the assessment and collection of tax and duties, the payment of benefits and the prevention and detection of crime, and may use this information for any of them.

We may get information about you from others, or we may give information to them. If we do, it will only be as the law permits to:

check the accuracy of information

prevent or detect crime

-

Notice 700/12 Filling in your VAT Return October 2011

Page 28 of 28

protect public funds.

We may check information we receive about you with what is already in our records. This can include information provided by you, as well as by others, such as other government departments or agencies and overseas tax and customs authorities. We will not give information to anyone outside HM Revenue & Customs unless the law permits us to do so. For more information go to hmrc.gov.uk and look for Data Protection Act within the Search facility.

Foreword 1 Introduction 1.1 What is this notice about? 1.2 Online VAT returns 2 Explanation of some common VAT terms 2.1 Supplies 2.2 Output VAT 2.3 Input VAT 2.4 Tax due 2.5 VAT period 2.6 Tax point 2.7 Imports 2.8 Acquisitions 2.9 Exports 2.10 Dispatches or removals 3 How to fill in each box on your return 3.1 Common requirements when completing boxes 1 to 9 3.2 Filling in box 1 3.3 Filling in box 2 3.4 Filling in box 3 3.5 Filling in box 4 3.6 Filling in box 5 3.7 Filling in box 6 3.8 Filling in box 7 3.9 Filling in box 8 3.10 Filling in box 9 4 Filling in the return if you use a VAT Accounting Scheme 4.1 Flat Rate Scheme for small businesses 4.2 Cash Accounting Scheme 4.3 Annual Accounting Scheme 4.4 Margin scheme for second-hand goods, works of art, antiques and collectors' items 4.5 Payments on account (POA) 4.6 Reverse charge accounting 5 Submitting your return and making payment 5.1 Submitting your return and making payment electronically 5.2 When to send us your VAT return and payment 5.3 Paying HMRC 5.3.1 Direct Debit 5.3.2 Debit or Credit card over the Internet 5.3.3 Bacs Direct Credit, Internet or Telephone Banking 5.3.4 CHAPS 5.3.5 Bank Giro 5.3.6 Standing Order 5.3.7 By post 5.3.8 Information about the Faster Payments Service

5.4 Your payment reference 5.5 HMRC bank account details 6 Frequently asked questions 6.1 What if I cannot complete my return and/or pay the VAT by the due date? 6.2 What if I submit my return and payment late? 6.3 What if I lose my paper return? 6.4 What if I am unable to send an electronic return due to a system problem? 6.5 What if I receive an assessment from HMRC because I have failed to send in a return? 6.6 How can I correct errors on previous returns? 6.7 How do I notify you about changes to my business? 7 Things to check before you send your return 7.1 Checking your figures 7.2 Other checks Your rights and obligations Do you have any comments or suggestions? Putting things right How we use your information