Fidelity Retirement Funds Making the Right Investments Dr. Eskandar Tooma.

-

Upload

curtis-perkins -

Category

Documents

-

view

217 -

download

0

Transcript of Fidelity Retirement Funds Making the Right Investments Dr. Eskandar Tooma.

Fidelity Retirement Funds

Making the Right Investments

Dr. Eskandar Tooma

Outline

Introduction and Objective of Lecture Fidelity Retirement Plan Investor lifecycle Risk Tolerance :Questionnaire Risk-return relationship Table of returns How to choose funds? Benchmarking-

investment funds Using the software

Selection of the new Fidelity Funds A range of fund options covering all

asset classes, e.g. equities, bonds and cash

A range of fund options covering the entire risk reward spectrum, low risk and high risk alternatives

‘Self select’ fund options ‘Lifestyle’ options

Objective of Lecture

Assist Faculty and Staff in allocating their funds among 10 Fidelity Investment Funds

Things to look for before investing in funds

Investor Lifecycle: Where am i? Risk Tolerance: How risky can I get?

Portfolio Mix: How much in each asset class?

Investor Life-Cycle: Where am I?

Investor Life-CycleAccumulation phase

Long-term: Retirement Children College Needs

Short-term: House Car

Consolidation phase

Long-term: Retirement

Short-term: Vacations Children College Needs

Spending phaseGifting phase

Long-term: Estate planning

Short-term: Lifestyle needs gifts

Networth

Age

Risk Tolerance: How risky can I get?

Risk Tolerance

The degree of uncertainty that an investor can handle in regards to a negative change in the value of their portfolio.

An investor's risk tolerance varies according to age, income requirements, financial goals, etc.For example, a 70-year-old retired widow

would generally have a lower risk tolerance than a single 30-year-old executive.

Risk ToleranceQuestionnaire

Risk Preferences for Investors

Risk and Return Fundamentals We don’t know how much a stock will be worth

in the future.

It is difficult to make such predictions with any

degree of certainty.

As a result, investors often use history as a

basis for predicting the future.

Risk Defined Risk is variability of returns associated with a

given asset

Assets (real or financial) which have a greater

chance of loss are considered more risky than

those with a lower chance of loss.

Return Defined Return represents the total gain or loss on an investment.

The most basic way to calculate return is as follows:

kt = Pt - Pt-1 + Ct

Pt-1

kt is the actual, required or expected return during period t,

Pt is the current price,

Pt-1 is the price during the previous time period,

Ct is any cash flow accruing from the investment

Return Defined

Risk-Reward Concept Most Investors are risk averse In theory the higher the risk, the more you

should receive for holding the investment, and the lower the risk, the less you should receive

For investment securities, we can create a chart with the different types of securities and their associated risk/reward profile.

Investment Risk Pyramid

Portfolio Construction: Fidelity Retirement Funds

A Guide To Portfolio Construction

Step 1: Determining the Appropriate Asset Allocation for You

Step 2: Achieving the Portfolio Designed in Step 1you simply need to divide your capital between the appropriate asset classes.

Step 3: Re-assessing Portfolio Weightings Step 4: Rebalancing Strategically

Always remember the importance of diversification

AggressiveGrowth Portfolio

ConservativePortfolio

GrowthPortfolio

BalancedPortfolio

pick your

mix

modelfind the

AggressiveGrowth Portfolio

ConservativePortfolio

BalancedPortfolio

GrowthPortfolio

Average Annual Return (1951–2002)

Best Annual Return

Worst Annual Return

# of Up Years

# of Down Years

7.38 %

22.04 %

-1.15 %

49

3

9.49 %

25.52 %

-10.92 %

42

10

10.81 %

35.80 %

-17.35 %

40

12

11.85 %

44.08 %

-22.02 %

39

13

30%50%

85%70%

20%25%

10% 5%

40%

15%

50%

Source: Ibbotson Associates 12/1951-12/2002

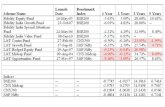

Choosing your investment funds – Self-Select OptionsFidelity Fund Name

Risk Objective

Defensive Fund

Low Growth

Euro Stoxx 50 Medium Growth

America Medium Growth

European Growth

Medium/High Growth

Pacific High Growth

Global Growth Medium Growth

Emerging Markets

Very High Growth

International Bond

Low/Medium Protection

US$ Bond Low Protection

US$ Cash Very Low Protection

INFLATION RISKINFLATION RISK INVESTMENT RISKINVESTMENT RISK

High V HighMedium-High Medium Low-Medium Low Very Low

Fidelity Funds – risk reward spectrum

US Dollar Cash

US Dollar Bond

FPS Defensive

International Bond

America FPS

Global Growth

Euros Stoxx 50

Pacific Emerging Markets

European Growth

Understanding Funds Terminology Benchmark Index Funds Growth % Fund annualized growth Index annualized growth

Choosing your investment funds – Self-Select OptionsFidelity Fund Name

Risk Funds Growth Since Launch

Index Growth since Launch

Defensive Fund

Low 4.4% 4.8%

Euro Stoxx 50 Medium 3.8% 4.5%

America Medium 10.9% 11.7%

European Growth

Medium/High 13.2% 10.7%

Pacific High 4.6% 2.5%

Global Growth Medium 6.6% 5.3%

Emerging Markets

Very High 2.9% 6.3%

International Bond

Low/Medium 5.8% 8%

US$ Bond Low 6.3% 7.7%

US$ Cash Very Low 3.5% N/A