Fertilizers Sector in Pakistan - · PDF fileFertilizers Sector | Capacities Urea Urea Market...

Transcript of Fertilizers Sector in Pakistan - · PDF fileFertilizers Sector | Capacities Urea Urea Market...

Fertilizers Sector in Pakistan

- Cultivating Economy

October 2015

Significance of Fertilizers

Fertilizers is the most significant and expensive agricultural input

Agriculture (Agri)

accounted for 21% of

GDP in FY15

Agri is important for Food Security

and reducing poverty | political

interests

Crop yield (30% - 50%) is dependent upon balanced use of fertilizers; One kg of fertilizers

nutrients produces

8 kgs of cereals (Wheat, Maize and rice)

2.5 kgs of cotton

114 kgs of stripped sugarcane

Increased Agri production

and higher crop yield is

essential for food security

Nutrient deficiency in soil of Pakistan is met through fertilizers

Nitrogen Deficiency: 100% of soil

Phosphorus Deficiency: 80% - 90% of soil

Potassium Deficiency: 30% of soil

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea | Performance

DAP | Performance

Risk Profile

Outlook

1

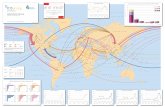

Fertilizers Sector | Competitive AnalysisS

uppli

ers Gas Distribution Companies

SNGPL

Mari Petroleum

SSGC

Natural Gas Government regulated prices

and supplies | Controlled

Sector Allocation

Substitutes(Not

feasible)

Coal

High Bargain

Power

Man

ufa

cture

r

Nine companies

demonstrated capacity of

9.4mln Tons per annum

93% of Industry’s Capacity owned by

three strong groups

• Fauji’s 41%, Fatima 28%, Engro 24%

• Retains ability to pass on cost hikes,

however, constraint with few

limitations

Industry

Structure

Oligopoly

Cust

om

ers

Dealers

~ 10,000

Farmers

Companies select dealers and train

them | Dealers buy on cash in advance

Farmers buy from dealers against

credit | SBP’s Agricultural Credit

9MFY15 PKR 326bln (65% of annual

target of PKR 500bln)

Low Bargain

Power

Substitutes

No

Co

ntr

oll

ed

by G

oP

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea | Performance

DAP | Performance

Risk Profile

Outlook

2

2

3

Fertilizers Sector | Capacities

Urea

Urea

Market

share

CAN DAP NPOthers

(SSP)

Fauji (FFC) 2,500 36% - - - - 2,500

FFBL 700 10% - 670 - - 1,370

Sub-Total 3,200 46% - 670 - - 3,870

Engro Engro Fertilizer 2,275 33% - - 2,275

Fatima 500 7% 420 - 360 - 1,280

Pakarab 92 1% 450 - 350 - 892

DH Fertilizers 446 6% - - - - 446

Sub-Total 1,038 15% 870 - 710 - 2,618

Agritech 433 6% - - - 81 514

Others - - - - 162 162

6,946 100% 870 670 710 243 9,440 Grand Total

Fertilizer Industry Demonstrated Capacities (thousand MT p.a.)

Fauji's

Fatima

Nitrogenous Fertilizers Phosphatic | Complex Fertilizers

Grand

Total

Company's

Name

Group's

Name

1 & 2 - RYK | 3-Ghotki Sona

Port Qasim Karachi Sona

Base Plant & Enven - Dharki Engro

Rahim Yar Khan SarSabz

Multan SarSabz

Sheikhupura Bubber Sher

Urea-Mianwali | SSP-Hazara Tara

Jaranwala Punjab None

Plant LocationBrand

Name

Urea

67%

CAN

6%

DAP

20%

NP

5%Others

2%

5,631 480 1,655 470 193 8,430 Demand CY14

Fertilizer Mix byDemand

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea | Performance

DAP | Performance

Risk Profile

Outlook

2

Fertilizers Sector | Capacities

Dec-10

6.9mln MT

Jun-11

• Engro

• 1.3mln MT

Jul-11

• Fatima 1.3mln

MT

Sep15

Capacity

• 9.4mln MT

Capacity Expansion in latest 5 years – Majorly Nitrogenous Fertilizer

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea | Performance

DAP | Performance

Risk Profile

Outlook

Despite Capacity Expansion, enabling excess supply over demand, the Industry continued to

import urea due to shortage of vital raw material – Natural Gas.

2

Raw Material | Gas Supply SituationScarce resource in Pakistan

(Quantity in mmcfd) FY12 FY13 FY14

Allocated Gas to Fertilizer Manufacturers 822 822 822

Gas Supplied – Actual 595 521 597

Less Temporary Gas (Guddu Power Plant) (60)

595 521 537

Shortfall (adj by Guddu)227 301 225 (285)

%age shortfall 28% 37% 27%(35%)

Sector (Priority) Allocation %

Domestic (1) 20%

Power (2) 30%

Fertilizer (3) 18%

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea | Performance

DAP | Performance

Risk Profile

Outlook

Gas Network Urea

Capacity (000'Tons)

Capacity utilization

CY13 CY14 9MCY15

Mari Petroleum* 4,300 94% 95% 101%

Sui Northern Gas (SNGPL) 1,946 28% 32% 31%

Sui Southern Gas (SSGC) 700 32% 30% 38%

Total 6,946 70% 71% 75%

*Engro's new plant Enven swapped to Mari from SNGPL since Jul13

2

4

5a

UREA Performance

Country’s largest selling Nitrogenous Fertilizer

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea |Performance

DAP | Performance

Risk Profile

Outlook

Urea Industry Supply deficit continued to be met through imports

5.1 4.2

4.8 4.9 3.6 3.9

1.0

1.4 1.0 0.8

0.4 0.6

6.3

5.2

5.9 5.7

4.1 3.9

(1.0)

-

1.0

2.0

3.0

4.0

5.0

6.0

7.0

(1.0)

-

1.0

2.0

3.0

4.0

5.0

6.0

7.0

CY11 CY12 CY13 CY14 9M14 9M15

Mil

lio

n T

on

s

Mil

lio

n T

on

s

Urea Demand Supply Dynamics

Production Imports Stocks Ajd. Consumption

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea |Performance

DAP | Performance

Risk Profile

Outlook

5b

Urea | Pricing Trend

-

100

200

300

400

500

600

700

800

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

Gas

Pri

ce (

PK

R/m

mb

tu)

Ure

a P

rice (

PK

R/

To

n)

Aug-11 Jan-12 Jul-12 Jan-13 Jun-13 Jan-14 Jul-14 Jan-15 Jul-15 Sep-15 Oct-15

Margins/Ton 28,403 24,235 22,465 22,339 24,579 23,580 23,341 23,701 23,701 24,550 21,010

Basic Gas Cost/Ton 4,517 5,149 4,974 5,115 5,115 5,280 5,280 5,280 5,280 7,600 7,600

GIDC Cost/Ton - 4,596 4,781 4,945 4,945 7,400 7,639 7,639 7,639 7,650 7,650

Gas Price / mmbtu

(weighted Average)161 348 348 359 359 453 461 461 461 545 545

Urea Price and Margins

GIDC:20%

pass through

31%pass through | Cumulative 62%

pass through

Concessionary Feedstock (Fertilizers Policy, 2001) fixed at USD 0.7/mmbtu | GIDC

differential (PKR 300/mmbtu) abolished | Stay Order from High Court

GIDC Benefit for New Urea plants cost saving of PKR 6,900 per ton (PKR 345/bag)

46%pass through

46%pass through

| reversed

Govt promised to revert gas

price

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea |Performance

DAP | Performance

Risk Profile

Outlook

25c

6

2

2

2

0%

10%

20%

30%

40%

50%

60%

-

100

200

300

400

500

600

700

800

Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Sep-15

Cu

shio

n %

per

Ton

US

D P

er T

on

Urea Retail Price

Parity with Import Price Domestic Price Imported Price

Urea Price Declining Parity with Import Price

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea |Performance

DAP | Performance

Risk Profile

Outlook

5c and 5d

DAP Performance

Country’s largest selling Phosphate Fertilizer

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea | Performance

DAP |Performance

Risk Profile

Outlook

DAP Industry – Subsidy announced after 5yrs

0.6 0.6 0.7 0.7

0.3 0.4

0.6 0.6

0.8 0.9

0.2 0.2

1.1 1.2

1.6 1.7

0.4 0.5

(1.0)

(0.5)

-

0.5

1.0

1.5

2.0

(0.4)

(0.2)

-

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

CY11 CY12 CY13 CY14 9M14 9M15

Mil

lio

n T

on

s

Mil

lio

n T

on

sDAP Demand Supply Dynamics

Production Imports Stocks Ajd. Consumption

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea | Performance

DAP |Performance

Risk Profile

Outlook

5b

DAP Price Fluctuating Parity with Import Price | Thin margins for importers

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea | Performance

DAP |Performance

Risk Profile

Outlook

5c and 5d

-2%

0%

2%

4%

6%

8%

10%

12%

14%

16%

-

100

200

300

400

500

600

700

800

900

Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Sep-15

Cu

shio

n %

per

To

n

US

D P

er T

on

DAP Retail Price

Parity with Import Price Domestic Price Imported Price

Fertilizer Industry | Risk profile

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea | Performance

DAP | Performance

RiskProfile

Outlook

┼ The industry’s financial risk profile is improving; debt raised for recent capacity expansion

shall be completely paid off in 2018 (mainly Fatima and Engro). Providing fiscal space to

grow further.

┼ Established Demand of fertilizers backed by vital need of agricultural output

┼ No substitute of the products

┼ Key players associated with Mari Network (62% of Industry’s capacity) have been

receiving regular/ uninterrupted gas supplies. In addition, one key provided with additional

gas, though temporary, have enabled robust cashflows consecutively for two years.

─ Permanent resolution of gas to small players is vital for their survival.

─ Limitations imposed through government intervention to pass on Gas Cost hikes may

further impede industry’s margins. Nevertheless, the players have requisite cushion to

absorb such shocks.

─ Any drop in international urea price will further constraint urea price raise to pass on cost

hikes

Fertilizer Industry

Positive Outlook

SignificanceCompetitive

AnalysisCapacities

Raw Material | Gas Supply

Situation

Urea | Performance

DAP | Performance

Risk Profile

Outlook

Bibliography

1. Pakistan Economic Survey 2014-15, issued by Finance Division Government of Pakistan – Chapter 2_Agriculture,

Page_23.

2. PACRA’s in-house research and database

3. Pakistan Economic Survey 2014-15, issued by Finance Division Government of Pakistan – Chapter 2_Agriculture,

Section (v)_Agricultural Credit, Page_35-36.

4. Pakistan Energy Year Book 2014, Issued by Ministry of Petroleum and Natural Resources. Part 1_Energy Situation,

Table 1.7_Eenergy and Non-Energy Uses of Gas in Fertilizer Sector, Page_8.

5. National Fertilizer Development Centre (NFDC) Monthly Report

a. Annexure 11_ Fertilizer Production by Product and Manufacturer

b. Annexure 5_ Plant wise Production Sales and Stock position

c. Section 9_Fertilizer Prices, Table 7_Average Fertilizer Retail Prices

d. Section 9_Fertilizer Prices, Table 8_International Prices

6. Oil and Gas Regulatory Authority, Notified Gas Prices_Consumer Gas Prices

(http://www.ogra.org.pk/cats_disp.php?cat=90)

DISCLAIMERPACRA has used due care in preparation of this document. Our information has been obtained from sources

we consider to be reliable but its accuracy or completeness is not guaranteed. The information in this

document may be copied or otherwise reproduced, in whole or in part, provided the source is duly

acknowledged. The presentation should not be relied upon as professional advice.

Analysts

Amara S. Gondal

Jhangeer Hanif

Haider Imran

Mahina Majid

Rai Aman Zafar

Contact Number: +92 42 3586 9504

Thank You