Fed challenge meeting october 8

Transcript of Fed challenge meeting october 8

FED CHALLENGE MEETING

OCTOBER 8, 2012

WEEK 3Review of Leading Economic Indicators

LEADING ECONOMIC INDICATORS

Gross Domestic Product (GDP)* Consumption

(Fixed) Investment Change in Inventories*

Government Consumption Net Exports

Price Deflators of GDP Personal Savings Rate

Car Sales National Association of Purchasing Managers

Employment - Payroll Jobs* Unemployment Rate

Average Hourly Earnings* Real Earnings

Initial Jobless Claims Employment Cost Index (ECI)

Producer Price Index (PPI)* Retail Sales

Industrial Production Capacity Utilization

Housing Starts (/Building Permits) Consumer Price Index (CPI)*

(Business) Productivity and Costs Durable Goods Orders

Business Inventories (and Sales) Wholesale Trade Sales

Personal Income and Consumption Expenditures

Index of Leading Economic Indicators*

Philadelphia Fed Survey New Home Sales

Existing Home Sales Housing Completions

Construction Spending Factory Orders (and Manufacturing Inventories)

International Trade (Exports, Imports, Trade Balance)

Import/Export Price Indexes Current Account

Consumer Confidence Consumer Credit

Beige Book Report Monetary Aggregates

*Discussed in this Presentation

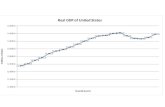

GROSS DOMESTIC PRODUCT (“GDP”) –

MOST IMPORTANT ECONOMIC INDICATOR

Measure of overall income and production

GDP – Market Value (“MV”) of current, final, domestic production for a given time interval

Prepared Quarterly by the Bureau of Economic Analysis (“BEA”)

Volatility = Moderate

Compiled from sources such as:• (i) tax returns;

• (ii) labor and price data; and

• (iii) Census Bureau information.

GROSS DOMESTIC PRODUCT BREAKDOWN

Gross Domestic Product

Gross – Total amount of output, regardless of existing stock of past

outputs

Domestic –Production within national borders,

regardless of foreign ownership with country or domestic ownership

of foreign capital

Value – Amount of money actually paid by

transactions.

Current – Production measured during a set

period of time

Final – Sales of good in intermediate stages

are disregarded. (avoids double

counting)

CAUTIONS OF INTERPRETATION

Not designed to measure economic welfare Some measures of economic welfare not included.

Definitions should be examined closely Appropriate application of definitions.

Real vs. Nominal GDP Price data needs to be dependable

Data comes to BEA from other agencies Some data may be inaccurate / not well-suited for NIPA

METHODS OF MEASURING GDP

Two ways of measuring GDP:

Income Approach

Expenditures Approach

Theoretically equal because every

financial transaction entails expenditure for the

buyer and revenue for the seller.

INCOME APPROACH

Compensation of Employees

Profits

Other forms of Income

Non-Income Items

GDP

Wages / salary / fringe benefits /

payments to Social Security /

unemployment insurance taxes

Corporate tax returns

Non-incorporated businesses /

Rental income / Royalties /

Interest Income

Indirect taxes /

State and Local taxes

EXPENDITURES APPROACH

LIKELY IMPACT ON FINANCIAL MARKETS

Example – Unexpectedly high Quarterly Growth

Interest Rates:

Stock Prices: Ambiguous. E(growth) = increase ∏

E(inflation) = increase I

Exchange Rates: Appreciation of exchange rate

Bond Prices Drop

Interest Rates and

Yields Rise

Inflation –

Fed may

raise Fed

Funds Rate

US HISTORY AND GDP

Traditionally, average growth rate ∈ ( 2.5% , 3% )

Economic growth above this „natural‟ rate cannot be

sustained for too long

Fed Reserve would increase Fed Funds Rate

→ (tight monetary policy)

During Recession Fed decreases Fed Funds Rate

→ (expansionary monetary policy)

CHANGE IN INVENTORIES (“∆ INVENTORY”)

Smallest component of GDP, usually < 1% *Much more important than weight in GDP

Signals changes in Aggregate Demand – future

economic activity

∆Inventory = ∆stock of unsold goods

Published on a quarterly basis

Volatility = high

LIKELY IMPACT ON FINANCIAL MARKETS

Interest Rates : Indicates expectations for inflation

Stock Prices : Ambiguous as shown below

Exchange Rates: No strong effect.

Inventory

Interest Rates

Bullish effect on Stock Price

Interest Rates

Expectations for Recession

Corporate Profits

EMPLOYMENT – PAYROLL JOBS

Most significant monthly economic indicator reported

Provides a signal early each month about the employment conditions in the previous month

Moderately Volatile

Referred to as “the king of kings,” provides for:

(i) Employment;

(ii) Average Workweek;

(iii) Hourly earnings; and

(iv) The unemployment Rate

LIKELY IMPACT ON FINANCIAL MARKETS

Interest Rates: