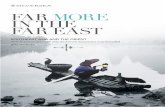

Far East Energy 2012 Corporate Presentation

-

Upload

company-spotlight -

Category

Business

-

view

553 -

download

2

description

Transcript of Far East Energy 2012 Corporate Presentation

Copyright © 2012 Far East Energy Corp., All rights reserved.

Far East Energy Corporation

March 29, 2012

2012-4

Corporate Presentation

Copyright © 2012 Far East Energy Corp., All rights reserved.

Cautionary Statements

2

• Statements contained in this presentation that state the intentions, hopes, estimates, beliefs, anticipations, expectations or predictions of the future of Far East Energy Corporation and its management are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. It is important to note that any such forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties. Actual results

could differ materially from those projected in such forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include: the preliminary nature of well data, including permeability and gas content. There can be no

assurance as to the volume of gas that is ultimately produced or sold from our wells; the fracture stimulation program may not be successful in increasing gas volumes; due to limitations under Chinese law, we may have only limited rights to enforce the gas sales agreement between Shanxi

Province Guoxin Energy Development Group Limited and China United Coalbed Methane Corporation, Ltd., to which we are an express beneficiary; additional wells may not be drilled, or if drilled may not be timely; additional pipelines and gathering systems needed to transport our gas may not

be constructed, or if constructed may not be timely, or their routes may differ from those anticipated; the pipeline and local distribution/compressed natural gas companies may decline to purchase or take our gas, or we may not be able to enforce our rights under definitive agreements with

pipelines; conflicts with coal mining operations or coordination of our exploration and production activities with mining activities could adversely impact or add significant costs to our operations; the Chinese Ministry of Commerce (“MOC”) may not approve the extension of our production sharing

contracts (“PSCs”) on a timely basis or at all, or, if so, on commercially advantageous terms; the MOC’s failure to approve the extension of the Shouyang PSC by March 1, 2012 could limit the Company’s ability to borrow additional amounts under the credit facility; the MOC’s failure to approve

the extension of the Shouyang PSC by May 30, 2012 could result in the early termination of the credit facility and require immediate repayment of all outstanding amounts thereunder; the Company’s inability to comply with certain quarterly financial covenants, satisfy certain continuing

representations, or remedy a material adverse effect to the business of the Company or to certain other conditions could result in early termination of the credit facility and require immediate repayment of all outstanding amounts thereunder; the total amounts we may borrow from Standard

Chartered Bank may be different than anticipated; the MOC may require certain changes to the terms and conditions of our PSCs in conjunction with their approval of any extension of our PSCs, including a reduction in acreage; our lack of operating history; limited and potentially inadequate

management of our cash resources; risk and uncertainties associated with exploration, development and production of coalbed methane; proved reserves may not be reported in a timely manner or at all and, if reported, may be smaller than anticipated; our inability to extract or sell all or a

substantial portion of our estimated Contingent Resources; we may not satisfy requirements for listing our securities on a securities exchange; expropriation and other risks associated with foreign operations; disruptions in capital markets affecting fundraising; matters affecting the energy

industry generally; lack of availability of oil and gas field goods and services; environmental risks; drilling and production risks; changes in laws or regulations affecting our operations, as well as other risks described in our Annual Report on Form 10-K, quarterly reports on Form 10-Q and

subsequent filings with the Securities and Exchange Commission. Statements contained in this presentation speak only as of the date hereof. We assume no obligation to update any of these statements.

• Definition of Technical Terms:

Certain technical terms used in this presentation associated with descriptions of the potential for oil and gas properties are not consistent with the definition of “Proved Reserves” in the SEC rules and thus the SEC guidelines prohibit us from including such terms in filings with the SEC. Such

terms used herein are defined as follows:

– Original Gas-in-Place: This term refers to discovered and undiscovered Gas-In-Place, which is the quantity of hydrocarbons which is estimated, on a given date, to be contained in known accumulations, plus those quantities already produced therefrom, plus those estimated

quantities in accumulations yet to be discovered.

– Recoverable CBM Resources: Recoverable CBM resources refer to a calculation based on geologic and/or engineering data similar to that used in estimates of proved reserves; but technical, contractual, economic, or regulatory uncertainties preclude such resources from being

classified as proved reserves. Recoverable CBM resources may also be estimated assuming future economic conditions different from those prevailing at the time of the estimate.

– Contingent Resources: Those quantities of CBM estimated, as of a given date, to be potentially recoverable from known accumulations by application of development projects, but which are not currently considered to be commercially recoverable due to one or more contingencies.

– Estimated Ultimate Recovery: The sum of resources remaining as of a given date and the cumulative production as of that date.

• Note to Investors:

• This presentation contains information about adjacent properties on which we have no right to explore. U.S. investors are cautioned that petroleum/mineral deposits on adjacent properties are not necessarily indicative of such deposits on our properties. This presentation also includes various estimates and comparisons contained in studies and reports. Actual results are likely to vary from the results in the studies and reports.

• Additional Information Regarding Estimates of Reserves:

• NPV10 and the standardized measure of discounted future net cash flows do not purport to be, nor should they be interpreted to present, the fair value of the coalbed methane reserves of the Shouyang project. An estimate of fair value would take into account, among other things, the recovery of reserves not presently classified as proved, the value of unproved properties, and consideration of expected future economic and operating conditions.

• Estimated future production of Proved Reserves and estimated future production and development costs of Proved Reserves are based on current costs and economic conditions. Future income tax expenses are computed using the appropriate year-end statutory tax rates applied to the future pre-tax net cash flows from proved coalbed methane reserves, less the tax basis of Far East Energy. All wellhead prices are held flat over the forecast period for all reserve categories. The estimated future net cash flows are then discounted at a rate of 10%.

• NPV10 for Proved Reserves may be considered a non-GAAP financial measure as defined by the SEC and is derived from the standardized measure of discounted future net cash flows for proved reserves, which is the most directly comparable US GAAP financial measure. NPV10 is computed on the same basis as the standardized measure of discounted future net cash flows for proved reserves but without deducting future income taxes. As of December 31, 2011, our discounted future income taxes were $2.8 million and our standardized measure of after-tax discounted future net cash flows for Proved Reserves was $62.6 million. We believe NPV10 is a useful measure for investors for evaluating the relative monetary significance of our coalbed methane properties. We further believe investors may utilize our NPV10 as a basis for comparison of the relative size and value of our Proved Reserves to other companies because many factors that are unique to each individual company impact the amount of future income taxes to be paid. Our management uses this measure when assessing the potential return on investment related to our coalbed methane properties and acquisitions. However NPV10 is not a substitute for the standardized measure of discounted future net cash flows. Our Pre-Tax PV10 and the standardized measure of discounted future net cash flows do not purport to present the fair value of our proved coalbed methane gas reserves.

• NPV10 for Probable and Possible Reserve amounts above represent the present value of estimated future revenues to be generated from the production of Probable or Possible Reserves, calculated net of estimated lease operating expenses, production taxes and future development costs, using costs as of the date of estimation without future escalation and using 12-month average prices, without giving effect to non-property related expenses such as general and administrative expenses, debt service and depreciation, depletion and amortization, or future income taxes and discounted using an annual discount rate of 10%. With respect to NMPV10 amounts for Probable or Possible Reserves, there do not exist any directly comparable US GAAP measures, and such amounts do not purport to present the fair value of our Probable and Possible Reserves.

• It is not intended that NPV10 or the FASB’s standardized measure of discounted future net cash flows for Proved Reserves represent the fair market value of Far East Energy’s Proved, Probable or Possible Reserves. Far East Energy cautions that the disclosures contained in this presentation related to the value of Far East Energy’s coalbed methane reserves are based on estimates of Proved, Probable or Possible reserve quantities and future production schedules which are inherently imprecise and subject to revision, and the 10% discount rate is arbitrary. In addition, costs and prices as of the measurement date are used in the determinations, and no value may be assigned to Probable or Possible Reserves. Estimates of economically recoverable coalbed methane reserves and of future net revenues are based upon a number of variable factors and assumptions, all of which are to some degree subjective and may vary considerably from actual results. Therefore, actual production, revenues, development and operating expenditures may not occur as estimated. The reserve data are estimates only, are subject to many uncertainties and are based on data gained from production histories and on assumptions as to geologic formations and other matters. Actual quantities of coalbed methane may differ materially from the amounts estimated.

Copyright © 2012 Far East Energy Corp., All rights reserved.

Far East Energy Profile

• Coalbed methane development company operating under three production sharing contracts

(PSCs) in Shanxi and Yunnan Provinces (see SEC filings for current status)

– Total 1.1 million acres (~4450 km2)(d)

– Estimated 21.3-29.2 Tcf (603-827 Bcm) of gross original gas-in-place (OGIP)(b)

– Shouyang coals exhibit both high permeability and high gas content, properties that are

consistent with the most commercially successful CBM basins worldwide

• Exceptional infrastructure and market access

– 20 year gas pipeline sales agreement in place in Shouyang

– Approximately $6.45 to $7.34/Mcf(c) wellhead price

• Strong management and board

– Solid experience in CBM and with Chinese energy industry and policy makers

• Funding in place

– Bank note payable issued in November 2011 securing the funding needs for current drilling

program without issuance of equity

3

a. 1.1 million gross acres includes acres subject to the Qinnan PSC. Note that the exploration period of the Qinnan PSC has not been extended and remains subject to approval by

Chinese authorities, we can not be optimistic at this time. The Qinnan PSC covers approximately 528,620 gross acres (2,139 km2).

b. OGIP estimates (P10 -P90) for Qinnan from ConocoPhillips; for Yunnan from Yunnan Provincial Coal Geological Bureau; for Shouyang from July 2011 report by Netherland, Sewell &

Associates, Inc. (NSAI), and does not take into account recently relinquished acreage.

c. Inclusive of current and announced estimated government subsidies, and subject to annual review and exchange rate fluctuations.

d. Estimates based on recent extensions and modification agreements for Shouyang and Yunnan PSC. The extensions of the Shouyang and Yunnan PSCs have been executed and are

pending Chinese government approval from MofCom.

Copyright © 2012 Far East Energy Corp., All rights reserved.

• Beneficiary of CHINA’S ECONOMIC GROWTH/robust energy demand

– Gas demand far exceeds supply with demand expected to triple over next 10 years. PRC

focusing on CBM as desirable alternative to LNG imports

• Far East Energy’s blocks have enormous gas-in-place, and discovery of HIGH

PERMEABILITY in Shouyang makes acreage unique in China and potentially world class

– Netherland Sewell and ARI have verified high gas content/high permeability and project high

production rates

– Shouyang Block could support 4,000 to 5,000 vertical wells on 80-acre spacing

• SALES AGREEMENT WITH PIPELINE PROVIDES CAPACITY to move large volumes

which is ESSENTIAL FOR LARGE-SCALE DEVELOPMENT. Believed to be first of its kind

for foreign operators. At $6.45 to $7.34/Mcf and assuming ARI projected production levels,

economics are compelling

• Second competing pipeline to Shouyang is now completed, creating likely competition and

potentially adding up to 50 MMcf/d of off-take capacity (Total possible off-take of 90 MMcf/d

from both pipelines)

• Critical desorption pressure (CDP) reached in portions of the Shouyang 1-H pilot area. At stage

where high permeability reservoirs often begin to exhibit significant production increases

• Multi-year drilling program planning– ramping up to an annual pace of 200 wells per year and up

to 500 wells per year in outer years

4

Investment Highlights (Trades on OTC:BB as FEEC)

Copyright © 2012 Far East Energy Corp., All rights reserved.

Far East Energy’s

Production Sharing Contract Areas

Shouyang contract area

1656.3 km2

(409,282 ac)

5

Note that the exploration period of the Qinnan PSC has not

been extended and remains subject to approval by Chinese

authorities. If the Qinnan PSC is not extended, Far East

Energy will hold rights to approximately 528,620 gross acres

(2,139 km2).

Estimates are based on recent

extension and modification

agreement which has been

executed and is now pending

Chinese government approval.

Qinnan contract area

2317.4 km²

(572,642 ac)

Yunnan contract area

483 km2

(119,338 ac)

Estimates are based on recent extension

and modification agreement which has

been executed and is now pending

Chinese government approval.

Copyright © 2012 Far East Energy Corp., All rights reserved.

Why Coalbed Methane in China?

Enormous energy demand/enormous

environmental problems

DEMAND:

World’s largest

consumer of energy

DIRTY ENERGY:

73% of energy supply from coal

ENVIRONMENTAL CONCERNS: 20 out of 30 of the world’s most polluted cities in the world;

Number 1 in CO2 emissions

Number 1 in methane emissions

(21X heat trapping of CO2)

China coal has among the highest gas

content in the world, but over 5,000

miners/year die in methane explosions

Why China?

Slide Sources: Business Week, EIA, World Bank, EPA, China Daily, Trading Markets

CBM addresses both concerns

SUPPLY:

China has the largest CBM resources

in the world (1305 Tcf gas-in-place)

CLEAN CBM:

CBM (gas) burns substantially cleaner than coal

China targets 27X increase in gas

consumption in energy mix

CBM production eliminates mine venting and reduces

emission of methane to atmosphere

Degasification in advance of

mining coal saves lives

Why Coalbed Methane?

6

Copyright © 2012 Far East Energy Corp., All rights reserved.

• China aims for 2.5x increase in CBM

production in next 5 years

• China also wants to triple the use of gas by 2020

• Chinese government officials have stated an

intent to double the subsidy for CBM

production to 0.4 RMB/m3 which would move

the price paid for Far East Energy gas from U.S.

$6.45 per Mcf to $7.34 per Mcf, a significant

premium over the Henry Hub U.S. gas price of

$2.98 per Mcf as of December 30, 2011 7

China’s Current Energy Targets

Copyright © 2012 Far East Energy Corp., All rights reserved.

A Chinese Coalbed Methane Breakthrough

To Supply Growing Demand

• Far East Energy’s discovery is a breakthrough

for China’s CBM industry

– Shouyang’s primary coal seams exhibit both

high permeability (80 to 120 millidarcies)

and high gas content

– Coal seams with similar properties in San

Juan and Black Warrior basins initiated

dramatic CBM production growth in U.S.

– Established operators in China are

accelerating major development plans

• Coalbed methane may hold some of the

greatest potential for increasing Chinese

domestic gas supplies

– Demand fundamentals drove flurry of

acquisitions of Australian CBM in 2008

– Domestic sources obviously desirable,

fueling interests by majors in China CBM

8

China

Australia

Copyright © 2012 Far East Energy Corp., All rights reserved.

Resource Comparison

Preliminary technical data suggests that the

Company’s North Shouyang acreage compares very well

to premier U.S. CBM plays

San Juan Black

Warrior

N. Shouyang

Acreage

Coal Gas Content (Scf/ton)(b) 400-500 350-500 400-600(a)

Coal Thickness: Typical net coal (feet)(b) 40

(12 m)

5

(1.5 m)

10-15

(3-4.5 m)

Pressure (psi)(b) 1500

(10.3 MPa)

400

(2.8 MPa)

400

(2.8 MPa)

Permeability (mD)(b) 25 75 100(d)

Recovery Factor(c) 80% 65% 50-70%

Note: Actual results are likely to vary from the following preliminary estimates, which are based on various assumptions

Notes:

a. Based on recent gas content test results from several pilot development test wells.

b. Source: Data on U.S. Basins from John P. Seidle, Sproule Associates, Inc., Coalbed Methane. of North America.

c. Source: Gas Research Institute and March 2008 ARI report.

d. Permeability in Shouyang Pilot area ranges from 80-120 mD, according to the ARI Report of March 21, 2008.

9

Copyright © 2012 Far East Energy Corp., All rights reserved.

Netherland, Sewell & Associates, Inc. (NSAI)

Reports on OGIP for Shouyang PSC*

Gross OGIP (Tcf / Bcm)

As of June 30, 2011

Coal Seam

Low Estimate Best Estimate High Estimate

Tcf Bcm Tcf Bcm Tcf Bcm

No. 3 0.900 25.47 1.487 42.08 2.100 59.43

No. 9 0.860 24.34 1.047 29.63 1.216 34.41

No. 15 4.964 140.48 6.056 171.38 7.053 199.60

Total 6.724 190.29 8.590 243.10 10.369 293.44

*The NSAI report s on OGIP estimates, which contains further information and qualifications, can be found on Far East Energy’s website at: www.fareastenergy.com. Note that some

numbers may not total exactly, due to rounding. Estimates are based on original acreage held by the Shouyang PSC. The extension of the exploration period of the Shouyang PSC has

been executed and is now pending Chinese government approval.

10

Copyright © 2012 Far East Energy Corp., All rights reserved. 11

Netherland, Sewell & Associates, Inc. (NSAI)

Contingent Resource Report* for Shouyang PSC

* The contingent resources report is posted to the FEEC website, www.fareastenergy.com. The NPV10 amounts are shown before consideration of any income taxes.

Contingent resources are those quantities of CBM estimated, as of a given date, to be potentially recoverable from known

accumulations by application of development projects, but which are not currently considered to be commercially recoverable

due to one or more contingencies.

RESTATED BASED ON PSC MODIFICATION

As of June 30, 2011

Shouyang Block Low Best High

Net Contingent Resources, Bcf

(Bcm)

100.4 Bcf

(2.8 Bcm)

319.6 Bcf

(9.1 Bcm)

461.8 Bcf

(13.1 Bcm)

Net Cash Flow (NPV10) $259,689,000 $1,057,426,000 $1,689,875,000

(Relinquished 16% of acreage in Shouyang for a 10% reduction in NPV10 of contingent resources)

Copyright © 2012 Far East Energy Corp., All rights reserved. 12

Shouyang US SEC Reserves – RISC As of December 31, 2011

Category

Gross

Reserves

Net

Reserves Future Net Revenue

$million

MMscf MMscf 10% Discount

Proved Developed 14,160 13,505 34.5 Proved Undeveloped 45,469 41,094 30.9 Total Proved 59,629 54,599 65.4 Probable Developed 3,653 3,608 14.9 Probable Undeveloped 511,300 375,994 649.0 Total Probable 514,953 379,603 663.9 Possible Developed 8,845 8,783 29.0 Possible Undeveloped 156,420 105,654 349.9 Total Possible 165,265 114,436 378.9 Total Proved, Probable

and Possible Reserves 739,847 548,638 1,108.2

Totals may differ due to rounding.

Gas volumes are expressed in units of million standard cubic feet at reference conditions of 60 deg F and 14.696 psia

Copyright © 2012 Far East Energy Corp., All rights reserved.

• Flowing in newly constructed pipeline with 40 million cubic feet

per day (40 MMcf/d) of capacity

20 year gas sales contract with Shanxi

Provincial Guoxin Energy

Development Group (SPG)

• Price includes enacted and announced government subsidies

• Wellhead price approximately 2.5x that of U.S. Henry Hub gas(b)

Wellhead price of

1.45 to 1.65 RMB/m3,

or approximately $6.45 to $7.34/Mcf(a)

• Pipeline must “take” all gas produced up to 300,000 m3/d

(10.6 MMcf/d), or pay for available volumes not taken Favorable “take-or-pay” contract terms

• Setting stage for strong competitive bidding for selling gas into

second pipeline built to the area

Ability to renegotiate contract for

volumes in excess of 10.6 MMcf/d

• Presents possibility of even higher prices as two lines may

compete for Far East Energy’s gas

Second pipeline built to

Shouyang is complete

First Pipeline Sales Agreement

for Foreign CBM Operator in China

Notes: a. Inclusive of existing government subsidies (0.2 RMB/m3 from central government plus 0.05 RMB/m3 from Shanxi provincial government) plus estimated 0.2 RMB m3

government subsidy (announced but not yet implemented), and subject to annual review and exchange rate fluctuations.

b. Henry Hub average natural gas price of $2.98/Mcf at December 30, 2011 close.

13

Copyright © 2012 Far East Energy Corp., All rights reserved.

Extension Agreement for

Shouyang Block CBM PSC Signed • Agreement signed November 15, 2011, by FEEB and CUCBM extending

exploration period of Shouyang Block PSC (currently pending Ministry of

Finance approval)

• 84.5% of acreage retained (1656.3 km2 or approximately 409,281 acres)

• Relinquished approximately 306.5 km2 (approximately 75,738 acres)

• Portions of relinquished acreage are considered by management to be marginal

or non-prospective

• Approximately 100 km2 (24,710 acres) is currently pending reserves

certification by Chinese authorities (includes 1H pilot area as well as several

nearby PDT wells)

– Pending Chinese reserves area constitutes basis of a potential Overall Development

Plan (ODP)

– Of this pending reserves area, FEEB is entitled to100% of reserves of approximately

65 km2 (16,062 acres) and includes all wells in the 1H pilot area

– Of this pending reserves area, CUCBM is entitled to100% of reserves of

approximately 35 km2 (8,649 acres)

14

Copyright © 2012 Far East Energy Corp., All rights reserved.

Gas Gathering System

Compressor Stations

15

Copyright © 2012 Far East Energy Corp., All rights reserved. 16

Shouyang PSC Exploration Agreement Acreage Diagram

84.5% of acreage retained A. Approximately 65 km2 with FEEB entitled to100% of reserves

B. 35 km2 with CUCBM entitled to100% of reserves

C. 1656.3 km2 (includes area A)

D. Of the 306.5 km2 relinquished, 104 km2 was either a no coal or thin coal zone

A D

C

B R CUCBM to drill well for FEEB to replace P8

Copyright © 2012 Far East Energy Corp., All rights reserved.

Operations Update

17

• 16 new wells completed in July-August 2011 completion cycle

• 3 wells completed in November-December 2011 completion cycle;

7 deferred to March 2012 due to freezing conditions

• De-watering continuing on 1H Pilot Area wells

• Currently drilling one well per month over the winter; continued focus on pattern

drilling in 1H Pilot Area

Drilling and Completion

•Located in east central Shouyang Block

•Thickness of #15 coal seam: 3.85m (12.63 ft)

•Top of the #15 coal seam: 1070 m (3510 ft)

•Current Production Rate: 40 Mcf/d (1132m3/d)

•Has produced over 100 Mcf/d at 40 psi surface flowing pressure; 220 M fluid over #15 coal seam

•Initial test results indicate gas content of 660 scf/ton

•Demonstrates further permeability continuity across the Shouyang Block

SY-P18

•Located in southeast Shouyang Block

•Thickness of #15 coal seam: 6.4m (21 ft)

•Approximate Vertical Depth:1372m (4501 ft)

•Current Production Rate: 77 Mcf /d (2180m3/d)

•Test results indicate gas content of 935 scf/ton

•Saturation: 95%

SYS-05

Copyright © 2012 Far East Energy Corp., All rights reserved.

Shouyang Block

Appraisal Wells

18

2H/2V

60 mD

Prod Test

20-40 mD

Prod Test

10-20 mD

Prod Test

80-100 mD

Prod Test

Located midway between

northern and southern

boundaries of block and is

approximately 20km south of

1H pilot area

50-70 mD

140 mD

Prod Test

50 mD

Prod Test

120 mD

Prod Test

180mD

Prod Test

20 mD

IFO Test

30 mD

Prod Test

300 mD

Prod Test

50 mD

Approximately

12 km due east

of 1H pilot area

Approximately

22 km southeast

of 1H pilot area

Approximately

26 km southeast

of 1H pilot area

Approximately

18 km west of

1H pilot area

+200 mD

10 mD

Gas Content:

529 scf/ton

300+ mD

Gas Content:

479 scf/ton

R CUCBM to drill well

for FEEB to replace P8.

Location TBD.

SYS-05

Approximately 14 km south and

22 km east of SYS02 and 35 km

south of 1H pilot area

Depth 1372m

Gas Content: 935 scf/ton

Saturation: 95%

Depth: 1070 m

Gas Content: 660 scf/ton

Copyright © 2012 Far East Energy Corp., All rights reserved.

Shouyang Results of

Appraisal Wells

19

Located midway between

northern and southern

boundaries of block and is

approximately 20km south of

1H pilot area

Approximately 26 km

southeast

of 1H pilot area

Approximately 14 km

south and 22 km east of

SYS02 and 35 km south of

1H pilot area

Approximately

18 km west of

1H pilot area Approximately

12 km due east of

1H pilot area

Approx. Depth: 662 m

Perm: 200 mD

Prelim Gas Content: 520 scf/ton

SYS-02

Approx. Depth: 1274m

Perm: 300+ mD

Gas Content: 479 scf/ton

Average Thickness: 4m

1H Pilot Area

Perm: 80-100 mD

Average Depth: approx. 600 m

Average Gas Content: 400-600 scf/ton

Average Thickness: 3-4.5 m

SYS-05

Approx. Depth:1372m

Gas Content: 935 scf/ton

Saturation: 95%

Approximately 22 km

southeast

of 1H pilot area

SY-P12

Approx. Depth: 970 m

Perm: 10 mD

Prelim Gas Content: 529 scf/ton

SY-P18: Promising Area

Approx. Depth: 1070 m

Prelim Gas Content: 660 scf/ton

Reached Production Rate over

100 Mcfpd

R CUCBM to drill well for FEEB to replace P8. Location TBD.

SY-P20

Approx. Depth: 1054m

Gas Content: 561 scf/ton

SY-P17

Approx. Depth: 1196 m

Gas Content: 583 scf/ton

Copyright © 2012 Far East Energy Corp., All rights reserved.

Shouyang Block Permeability*

Well Area

Permeability

Range

(mD)

Number of Wells

In this Range

1H Pilot Area 80-100 1H Pilot Area Wells

PDTW 200-300 3

PDTW 100-199 3

PDTW 50-99 4

PDTW 10-49 6

20

*Results of Pilot Development Test Wells (PDTW) to determine the extent of high permeability in Shouyang Block

Copyright © 2012 Far East Energy Corp., All rights reserved.

Projected Drilling

Program at Shouyang

Wells

Drilled, Drilling

and/or Completed

2010 (actual) 26

2011 (actual spud) 33

2012 (estimated 12 mos.) 200-250

2013 (estimated) 300-400

2014 (estimated) 500

21

• FEEC is currently considering various financial sources to secure project

finance to fund costs not covered by gas sales.

• The revenue from additional wells could provide substantial offset to well costs.

Subject to approval by CUCBM

Copyright © 2012 Far East Energy Corp., All rights reserved.

Bank Financing of 2012

Shouyang Development Costs

22

Gross Loan Amount: $25 Million

Proceeds Net of Issuance Costs: $23.5 Million

Tenor: 9 months with potential additional 3 month

Interest Rate: LIBOR plus 9.5%

Common Stock Dilution: NONE

Amount Drawn at Closing: $17.87 Million

Use of Proceeds: Operational costs related to first half of 2012

and finance and related expenses

Bank: Standard Chartered PLC (Leading international bank, operated over 150 years

and earned over 90% of income and profit from Asia,

Africa and the Middle East)

Copyright © 2012 Far East Energy Corp., All rights reserved.

Key Validation Points

23

• China’s economy robust; energy demand enormous; gas consumption expected to rise

• Far East Energy well-positioned to benefit from China’s demand for clean burning gas

– In-Country (a competitive advantage over LNG), with enormous resource base of

1.1 million acres and 21.3-29.2 Tcf (603-827 Bcm) of estimated gas-in-place (see SEC filings for current

status)*

– Discovery of breakthrough area of high permeability, high gas content is unique in China with potential

to generate optimal economics akin to world’s best CBM plays

– Netherland Sewell, ARI verified high permeability, high gas content and projected very attractive

economic rates of production

• Excellent access to market through national trunk and provincial pipelines

• 20 year gas sales contract already secured at $6.45 to $7.34/Mcf. Believed to be first foreign

CBM operator to secure pipeline access essential for large-scale development

• Netherland Sewell Contingent Resource Report of June 30, 2011, as restated for PSC extension,

NPV10 “Best” case $1.1 billion , “High” case $1.7 billion and “Low” case $260 million

• Initial independent reserves report by RISC (in accordance with SEC guidelines) showing

NPV10 of $65.4 million-Proved, $663.9 million-Probable, and $378.9 million-Possible

*Does not take into account acreage relinquished under modification agreement to PSCs pending MofCom approval.

Copyright © 2012 Far East Energy Corp., All rights reserved.

APPENDIX

24

Copyright © 2012 Far East Energy Corp., All rights reserved.

Third Party Review

Shouyang Block #15 Coal Seam

25

Advanced Resources International, Inc. (ARI) 2008 Netherland, Sewell & Associates, Inc. (NSAI) 2007

Study stated Shouyang Block #15 coal

seam has high permeability,

approximately 100 millidarcies (md)

Gas content measurements:

400-600 scf/ton

Higher gas rates of 1 to 2 MMcfpd

(28-57 Mcmpd) are possible in future

horizontal wells

Most likely and mean recovery estimate of

1.1 Bcf and 1.8 Bcf

(31.2 and 51 MMcm), respectively, per

horizontal well

Initial permeability:

80 and 120 millidarcies (md)

Gas content estimate:

500 scf/ton dry ash free

Forecast peak daily production

rate estimates

•Vertical well 80 acre spacing: 300-500 Mcfpd (8496-14,160 m3pd)

•Horizontal well 400 acre spacing: 2.3-5 MMcfpd (65-142 Mcmpd)

Forecast gas recovery rate estimates

(20 year, P50)

• Vertical well 40-160 acre spacing: 0.5-1.2 Bcf/well

(14.2-34 MMcm/well)

• Horizontal well 250 & 550 acre spacing: 3.4-5.3 Bcf/well

(96.3-150.1 MMcm/well)

Note: Actual results are likely to vary from the foregoing preliminary estimates, which are based on various assumptions. The third party reports, which contain further information and qualifications,

may be found on Far East Energy’s website (www.fareastenergy.com). ARI is a research and consulting firm that provides services related to coalbed methane, gas shale, tight sands, enhanced oil

recovery and carbon sequestration (www.adv-res.com). NSAI is an independent engineering firm that provides engineering studies of reservoirs for oil and gas companies worldwide

(www.netherlandsewell.com).

Copyright © 2012 Far East Energy Corp., All rights reserved.

Financial Highlights

26

As of December 31, 2011

Outstanding Shares 342,209,884

Outstanding Warrants 21,994,982

Outstanding Options 10,823,833

OTC.BB

FEEC

Market Cap @ 12/31/2011

$71.9 MM

Daily Volume (3 month average @ 12/31/2011)

1,366,579

Copyright © 2012 Far East Energy Corp., All rights reserved.

Vision and Commitment

Our vision is zero harm to

people and the

environment while creating

value for our shareholders

as well as for China

No lost-time accidents in

6+ years and no major

environmental incidents

Good corporate citizens of

China, utilizing very high

levels of Chinese content

in personnel, services, and

equipment

Employ numerous safety

precautions

Comply with International

laws and regulations

concerning the

environment, occupational

safety and health in China

27

Copyright © 2012 Far East Energy Corp., All rights reserved.

FEEC Management and

Operations Team

28

Michael R. McElwrath CEO, President and Director

Former U.S. Assistant Secretary of Energy, Director

National Institute Petroleum & Energy Research

(30+ years)

Bruce N. Huff Chief Financial Officer

Former President, Director and

Chief Financial Officer

of Harken Energy

(35+ years)

Dr. Zhendong “Alex”

Yang Sr. Vice President - Geology

Pioneer in China Coalbed

Methane, Chief Geologist with

Amoco, Arco, BP CBM projects

(40+ years)

Robert “Bob” Hockert China Country Manager

CBM Drilling & Production

Manager; District Manager for

Halliburton – Russia

(20+ years)

Rebecca B. “Beckie” Le President and CFO – FEEB

Sr. VP Government Relations

Amerada Hess, Price

Waterhouse, Consolidated

Edison (15+ years)

David J. Minor Executive Director of

Operations

Former President and General

Manager of Walter Black

Warrior Basin, LLC

(30+ years)

Copyright © 2012 Far East Energy Corp., All rights reserved.

FEEC Board of Directors

William A. Anderson

Former Founder, Director, President or CFO of publicly and

privately held banking, energy and technology companies

C. P. Chiang

Former China Country Manager of

Burlington Resources;

40 yrs with Exxon, British Gas, Tenneco, etc.

Michael R. McElwrath

Former U.S. Assistant Secretary of Energy;

Director National Institute

Petroleum & Energy Research

(30+ years energy industry)

John C. Mihm

Retired Senior Vice President of ConocoPhillips

China background dates to 1983

Lucian L. Morrison

Founder and Director of numerous trust and investment companies;

former Chairman and CEO of Wing Corp.

(exploration and production company)

Thomas E. Williams

Retired President of Mauer Technology and VP, R&BD of Noble

Technology Services Division (both Noble Corporation subsidiaries)

Donald A. Juckett

Chairman, retired U.S. Department of Energy;

Director, Office of Natural Gas; Director, DC Office of

American Association of Petroleum Geologists;

Established U.S.-China Oil & Gas Industry Forum

29

Copyright © 2012 Far East Energy Corp., All rights reserved.

Production Sharing Contract Briefs

30

• FEEC has 100% interest in H-1 proved

reserves area, including development costs and

all production

• 70/30% split in other areas

• CUCBM pays 30% development costs in areas

outside H-1

• FEEC recovers all exploration costs and

CUCBM recovers all pre-contract costs

(US$2.8M) out of production, including H-1

• ConocoPhillips 3.5% ORRI out of FEEC share

• Parties recover development costs out of

production with 9% interest

• Parties pay up to 3% PRC royalty(b)

• 60/40 split with CUCBM

• FEEC pays 100% exploration costs/60%

development costs

• CUCBM pays 40% development costs

• FEEC recovers all exploration costs out of

production

• Parties recover development costs out of

production with 9% interest

• Parties pay up to 3% PRC royalty(b)

Shanxi Province Qinnan PSC is similar to Shouyang before the most recent amendment,

however force majeure relating to transfer from CUCBM to PetroChina is pending

Yunnan Province PSC(a) Shanxi Province Shouyang PSC(a)

(a) The exploration period for the Yunnan PSC and Shouyang PSC expired on 6/30/2011, however an extension has been agreed for Shouyang and

Yunnan and are awaiting final government approval.

(b) PRC royalty is zero until 50 million cubic feet per day of gas production, and up to 3% after reaching 500 MMcf/d; however, FEEC understands that

the royalty regime is changing to a tax regime

Copyright © 2012 Far East Energy Corp., All rights reserved.

Shanxi Province

Gas Pipeline Network

Shouyang Block

20 year gas sales agreement signed with SPG

(Pipeline arrived to Shouyang PSC in July 2010)

Shanxi International (second competing pipeline complete)

2

1

Shouyang Block Pipeline

Opportunities

1

2

31

Copyright © 2012 Far East Energy Corp., All rights reserved.

Acreage Comparison

San Juan Basin (Fruitland Coal)

Source: Map: Energy Information Administration (November, 2007); Shouyang Block Overlay: Jay Smith, Viking Engineering, L.C. This map is not an indication that the Shouyang Block will be as successful as the San Juan Basin.

32

Copyright © 2012 Far East Energy Corp., All rights reserved.

Acreage Comparison

Black Warrior Basin

Source: Map: Energy Information Administration (November, 2007); Shouyang Block Overlay: Jay Smith, Viking Engineering, L.C. This map is not an indication that the Shouyang Block will be as successful as the Black Warrior Basin

Shouyang

Block

Acreage

Size

33

Copyright © 2012 Far East Energy Corp., All rights reserved.

Far East Energy Corporation

Website

www.fareastenergy.com

Investor Relations Contacts

Michael R. McElwrath – CEO and President

Bruce N. Huff – Chief Financial Officer

Catherine Gay – Assistant to CEO

281.606.1600

Corporate Headquarters

363 N. Sam Houston Parkway E., Suite 380

Houston, Texas 77060

Telephone: 832.598.0470

34