FAO/FIJI Sugar Conference...Regional Threshold vs. actual 2010/2011 (tonnes wse) 0 100000 200000...

Transcript of FAO/FIJI Sugar Conference...Regional Threshold vs. actual 2010/2011 (tonnes wse) 0 100000 200000...

-

FIJI/FAO – 2012 Asia Pacific Sugar Conference

ACP perspectives on the Implementation of EPA-

EBA Sugar Arrangements

-

Key Issues

• ACP (EPA-EBA) Sugar Structure • Transitional Phase –Sugar Protocol to EPAs • Sugar in EPAs • Performance to-date • Accompanying Measures Support Programme • Projections beyond 2015 • EU Refiners Concerns • EPA/EBA Suppliers considerations • Conclusions

-

3

ACP Sugar Structure

ACP Ministerial Committee on Sugar

ACP Ambassadorial Committee on Sugar

ACP Brussels Sugar Working Group

ACP (EPA-EBA) London Group of Experts

ACP Council of Ministers

ACP (EPA-EBA) Sugar

Industries

-

4

ACP Objectives

• To represent the interests of all ACP sugar supplying countries under the various regional EPAs and EBA initiative to the EU;

• To make representation to the EC and the EU on the EPA implementation issues;

• To develop strategies for discussion with the EC and other EU bodies e.g. EP and MS with a view to influencing issues related to a potential further reform to the EU Sugar Regime, post-2015, AMSP, ACP Research,etc. 4

-

5

Contd.

Monitor EU legislation and policy developments in the areas relevant to sugar

Ensure a permanent link with the European institutions and other international organizations

Provide strategic advice & coordination of lobbying activities and adoption of common positions on sugar.

5

-

Sugar in Post 2013 CAP Reform

ACP submission calls for:

• fair, stable and remunerative EU market prices;

• a guaranteed priority of access;

• long-term predictability with continued preference assured by adequate border measures and robust mechanisms for market management; and,

• a balanced market.

-

Exchange of Information

• Set up an Alert System

• Joint ACP-EC Forum

– Regular Information Exchange

– Close liaison with regional EPA Implementation Committees

– Exchange of production and export data with the Commission

– Frequency of meetings

7

-

What were the benefits of the Sugar Protocol?

1. A guaranteed (and negotiated) price

2. Specific quantities (and transferability) of sugar exports for each country

3. Indefinite period of duration

4. Exemption from the safeguard mechanism

5. Legal strength of the Protocol

6. Negotiating strength of Protocol group

Benefits of trading framework (legitimate expectations from longstanding arrangements)

7. Duty-free access to EU market

8. EU guaranteed prices above world levels

-

Transition Phase Implementation & ACP Market Opportunities

9

From fixed preferential to variable preferential EU access

To establish sustainable sugar (& ethanol)

industries

“ACP Market Opportunities”

Domestic / Regional / EU / World Market in Sugar & Ethanol

-

10

Transition Phase Expectations

Increased Access (Threshold to 2015, DFQF thereafter) Access at lower, but still well above world market, prices Maintenance of a true preference “The ACP will continue to have preferential access over all others. We have offered nothing to Latin American countries in the Mercosur negotiations; instead we have said to them that we reserve sugar for the ACPs. This is the political commitment of the EU. We want to preserve access for ACP sugar, and that goes for the bilateral and multilateral negotiations.” Karl-Friedrich Falkenberg, Deputy Director General, DG Trade, 10th ACP Special Ministerial Conference on Sugar,1st May 2007. Rapid deployment of adjustment assistance funds A boost for economic development

-

11

To support Transition (i.e. economic development), Preference must have value

the EU market must: Provide a stable & remunerative price

Be predictable, to cover the investment cycle

Coherence of trade, development and agricultural policy

Transition & ACP Market Opportunities

-

12

Sugar in the EPAs

Transition in 2 steps: 1. 1 Jan 2008 - 30 Sept 2009: Sugar Protocol continues until 30 Sept 2009 Additional access for ACPs (230 000 t)

2. 1 Oct 2009 - 30 Sept 2015: Free access with a double-trigger volume

safeguard

-

13 13

Sugar in EPAs (contd.)

Duty introduced to ACP non-LDCs if: a) 3.5 million tonnes total imports are reached and

b) imports from non-LDCs exceed

1.38 million tonnes in 2009/10 1.45 million in 2010/11 1.6 million tonnes from ACPs non-LDCs from 2011-2012 until 2014/2015

-

The seven ACP regions

• Caribbean Forum of Caribbean States (CARIFORUM)

• Economic Community of Central African States (CEMAC)

• Economic Community of West African States (ECOWAS)

• Eastern and Southern Africa (ESA)

• East African Community (EAC)

• Southern African Development Community (SADC)

• Pacific Islands Forum (PIF)

-

EPA 2009-2015 : Regional Safeguard Threshold (RST) Metric Tons (wse)

15

2009/2010 2010/2011 2011/2012

CARIFORUM 454,356.6 477,749.0 527,875.6

CEMAC 10,186.1 10,186.1 10,186.1

ECOWAS 10,186.1 10,186.1 10,186.1

ESA 544,711.6 572,755.9 632,850.9

EAC 12,907.9 13,572.4 14,996.5

SADC 166,081.2 174,631.9 192,954.5

PACIFIC 181,570.5 190,918.6 210,950.3

Total 1,380,000.0 1,450,000.0 1,600,000.0

-

Regional Safeguard Advantages

• Answers the request from SP countries of a minimum access - although on a regional basis

• Coherence with EPA overall regional approach

• Takes into account the different production cycles

• Gives additional flexibility compared with the Sugar Protocol country allocation

16

-

ACP(ALL) Overall Threshold vs. Actual (ACP Non LDC +ACPLDC)

(tonnes wse)

0

500000

1000000

1500000

2000000

2500000

3000000

3500000

4000000

2009/2010 2010/2011 2011/2012

TH

Actual

-

Lower Threshold Vs. ACP-Non LDCs

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1800000

2009/2010 2010/2011 2011/2012

TH

ACTUAL

-

Regional Threshold vs. actual 2009/2010 (tonnes wse)

0

100000

200000

300000

400000

500000

600000

700000

SADC EAC ESA PACIFIC CARIFORUM

TH

09/10

-

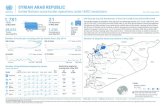

Regional Threshold vs. actual 2010/2011 (tonnes wse)

0

100000

200000

300000

400000

500000

600000

700000

SADC EAC ESA PACIFIC CARIFORUM

TH

10/11

-

Regional Threshold vs. actual 2011/2012 (tonnes wse)

0

100000

200000

300000

400000

500000

600000

700000

SADC EAC ESA PACIFIC CARIFORUM

TH

11/12

-

EPA – EBA import licence applications

EBA (LDC) licences ACP non-LDC licences

0

100

200

300

400

500

1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52

'00

0 t

on

ne

s

Week No.

EBA (LDC)

2010-11 2011-12

0

200

400

600

800

1000

1200

1400

1600

1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52

'000 tonnes

Week No.

ACP (NON-LDC)

2010-11 2011-12

-

EPA – EBA import licence applications

All ACPs EPA-EBA (incl. non-ACP LDCs)

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52

'000 tonnes

Week No.

ACP (ALL)

2010-11 2011-12

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52

'000 tonnes

Week No.

EPA-EBA

2010-11 2011-12

-

EU Accompanying Measures Support Programme (AMSP)

AMSP assistance based along the three main axes:

• Enhancing the competitiveness of the sugar sector, where this is sustainable;

• Promoting the diversification of sugar dependent areas, and

• Addressing broader adaptation needs.

• MIP I All SP countries (2006-2010) - €667.34m

• MIP II All SP countries(2011-2013) - €573.98 m

-

AMSP Overall Contract & Paid as %tage of total allocation as at Feb 2012

Year % Contracted %Paid

2006 95.93 91.99

2007 96.25 91.11

2008 84.76 64.18

2009 64.81 53.45

2010 58.97 18.73

2011 0 0

-

The near term outlook for imports

• In the near term, increased supplies could come from a number of sources:

There is potential for ACP/LDCs to increase their supplies. However, local demand is growing quickly and can be volatile, which could constrain surpluses.

Additional sugar will enter under the FTA’s although the timing of this is unclear.

The question is: will this be enough?

Source: LMC International

-

In Asia-Pacific, growing production in

Laos could boost supplies to the EU by

100,000 tonnes by 2015 Projected surpluses in Asia-Pacific

Cambodia will also produce

sugar, but this will be a swap

tonne rather than surplus sugar.

Source - LMC International Source: LMC International

-

Availability in Southern Africa is set to rise by 200,000 tonnes by 2015

Projected surpluses in key African suppliers

Swaziland, Mozambique and

Zimbabwe could increase their

supplies over the next few years.

Source: LMC

-

Some recovery of production in the Caribbean could add a further 50,000 tonnes (BUT high risk that this will not materialise)

Projected surpluses in key Caribbean suppliers

-

The near term outlook for imports

• Increased supplies from the ACP/LDCs and FTAs should improve the supply situation. BUT…

• The market balance will be tight and some swaps will still be required to prevent stocks from falling.

• If anything goes wrong (weather problems/political events in ACP/LDCs), exceptional measures are likely to be required again.

• Much depends on uncertainties surrounding consumption growth, the timing of FTA agreements and ACP/LDC production.

Source: LMC International

-

Some ACP/LDCs are more exposed to the EU than others…

Exposure to the EU market (average 2008-2010)

Kenya, Cote d’Ivoire, Tanzania, Sudan, Dom Rep and Cambodia all supply less than 20%

Source: LMC International

-

Key conclusions for LDC/ACP suppliers

• Post 2015, LDC/ACP suppliers are likely to face a more volatile trading environment in the EU.

• If quotas are retained, the LDC/ACP will continue to earn a preference on sales to the EU market.

• In the absence of quotas, this preference could fall to zero as long as world prices are supported above 18-22 cents/lb.

• However, if world prices are low, prices in the EU should remain above world market values.

In this way, the EU will continue to give the LDC/ACP some protection from the volatility of the world market. Source: LMC International

-

EPA-EBA suppliers consideration

• EPA/EBA suppliers need a viable EU refining industry to provide a dedicated entry to the EU market and to maintain a plurality of potential buyers for EPA/EBA sugar.

-

EU Refiners Concerns

• Insufficient supplies - EU refinery capacity utilisation of only some 60%.

• Additional imports are allocated through a licence auction process in which the licence-seeker must bid the import-duty level.

• Bidding is not reserved for refiners, nor is it for raw sugar only.

• Successful bidders, of which there are many, are each allocated a proportion of their bid. Thus, quantities obtained by refiners are small and uneconomical.

-

Emergency Measures

• Reduced ACP/EBA imports 2010/11 supply problems addressed Out-of-Quota Reclassification: 500k mt Exceptional (duty-free) imports: 500k mt Variable duty imports: 356k mt Total ‘new supply’: 1.4m mt 2011/12 • Out-of-Quota Reclassification: 450k mt + 250k mt =

700k mt (two tranches) • Variable duty imports: 354k mt (six import tenders held

so far)

-

Conclusions • Represent the interests of all ACP sugar supplying countries under the

various regional EPAs and EBA initiative to the EU; • Make representation to the Commission and other bodies within the EU

on the implementation issues pertaining to preferential sugar imports; • Develop strategies for discussion with the Commission and other EU

bodies e.g. Parliament and Member States with a view to influencing issues related to a potential further reform to the EU Sugar Regime, post-2015.

• Ensure the transition period is managed to avoid the collapse of the EU sugar market as this would be counter-productive and adversely affect the value of ACP access.

• Active participation in the information exchange with the aim to maximize ACP exports to the EU within the agreed safeguard limits.

• Develop modalities for relationship between the EPA Committees at the regional level with the All-ACP level institution given that the upper ceiling of the safeguard threshold was applicable at the All-ACP level.

36

-

Conclusions (contd)

Possible Risks • Any reduction in price will negate the rationale behind the heavy

investment being made and the valuable accompanying measures provided by the EU. It will also adversely affect the capacity of the ACP Sugar Suppliers to fulfil their supplies requirements necessary for a balanced and stable EU Sugar Market.

• Award of import quotas in the context of new FTAs can easily destabilise the EU market which has an inelastic demand structure. Continued widening of supply sources can only risk damaging the interests of all cane and beet sugar suppliers.

• EPAs and the EBA suppliers cannot achieve their developmental role without a fair and remunerative price. Guaranteed access, stable prices, adequate and effective border measures are necessary for investment in this very capital-intensive industry, notably because the crop has a minimum seven-year production cycle.

![[XLS]reports.mca.gov.inreports.mca.gov.in/Reports/MasterDataExcels/company... · Web view3800000 3800000 700000 530340 100000 100000 5000000 1200000 600000 509600 30000000 9377400](https://static.fdocuments.in/doc/165x107/5ad0382a7f8b9a71028d9ead/xls-view3800000-3800000-700000-530340-100000-100000-5000000-1200000-600000-509600.jpg)