EXPERTISE. STRENGTH....

Transcript of EXPERTISE. STRENGTH....

EXPERTISE. STRENGTH. COMMITMENT.

Headquarters Office 150 Northwest Point Blvd., 3rd Floor Elk Grove Village, IL 60007 Main: 847.472.6700 Toll-Free: 800.897.2551 Underwriting Fax: 847.700.8240 Claims Fax: 847.228.3920 www.atlas-fin.com

Agency Guidelines

TABLE OF CONTENTS

INTRODUCTION 1 What We Do & Agent Opportunities 2 The Atlas Footprint 3-4 Our Vision, Mission & Values 5 The Atlas Executive Team

UNDERWRITING 6 Target Markets 7 8 9 10-11 12 13 14 15-16

Underwriting Guidelines Taxi & Car Service Limousines Paratransit Business Auto Other Public Auto General Liability

New York Livery (Taxi & Car Service Outside of the 5 Boroughs of NYC) New York City (5 Boroughs TLC Registered)

17 Submissions & Application Procedures 18 Safe Driver Criteria 19 New York Driver Guidelines 20 Payment Plan Options 21 Agent of Record Bulletin 22 Policy Renewal Procedures

QUOTE FORMS 23 Quick Quote Application 24-26 Public Auto Supplemental Application 27 Vehicle Schedule Form

MARKETING 28 Marketing Services We Offer 29 Physical Damage Enhancements Flyer Sample 30-33 Insured-Focused Advertising Brochure Sample 34 Safety Window Clings Samples 35 Paratransit Safety Sticker Sample 36 Taxi-Limo Safety Poster Sample 37 Paratransit Safety Poster Sample 38 Loss Prevention Materials Order Form 39 Accident Kit/ID Holder Sample

CLAIMS 40-44 Loss Prevention 45 Claims

INTRODUCTION

1

WHAT WE DO

If you are in the Passenger Transportation business or own a business that operates other light commercial vehicles, Atlas is the commercial automobile insurance specialist for you. As leaders in providing coverage to the Passenger Transportation industry, we have the expertise needed to understand Passenger Transportation guidelines in various locations throughout the country.

At Atlas, we focus on building mutually beneficial partnerships with our retail agents. We're ready to help you acquire additional clients and retain them year after year. As an Atlas agent, you can expect our underwriters to work with you to provide the right insurance solutions to address specific risks for your clients. In today’s increasingly dynamic world, it is becoming more important than ever for policyholders to have insurance that’s in-sync with their evolving risks. We know that customers look to their trusted agents to help them sort through their options for managing risks. With our expansive reach utilizing our commercial lines products, responsive claims services, and tailored risk management solutions for a broad range of businesses and industries, we’re ready to work with you to help your customers find the protection they need now. We appreciate your business and continued loyalty; we remain committed to being your preferred casualty insurer.

AGENT OPPORTUNITIES

2

THE ATLAS FOOTPRINT

Revised 2013-07-01

3

VISION

To be the preferred specialty commercial transportation insurer in any geographic areas where our value proposition delivers benefit to all stakeholders.

To develop and deliver superior specialty insurance products that are correctly priced to meet our customers’ needs and deliver consistent underwriting profit for the insurance companies we own. These products will be distributed to the insured through independent retail agents utilizing Atlas’ efficient operating platform. We will achieve our Vision and Mission through the design, sophisticated pricing and efficient delivery of specialty transportation insurance products. Our understanding of the markets we serve will remain current through interaction with our retail producers. Analysis of the substantial data available through our operating companies will drive product and pricing decisions. We will focus on our key strengths and expand our geographic footprint and products only to the extent that these activities support our Vision and Mission. We will target niche markets that support adequate pricing and will be best able to adapt to changing market needs ahead of our competitors due to our scale and strategic commitment.

MISSION

4

VALUES

Integrity: We value honesty. We hold ourselves and each other accountable for meeting all commitments.

Trust: As a team we rely on and trust one another. We encourage transparency and two-way communication to ensure understanding.

Teamwork: We proactively collaborate with each other and with stakeholders to achieve mutually beneficial goals. We believe everyone has an important contribution to make.

Discipline: We are committed to the disciplined execution of our business - delivering predictable operational and financial performance. Using fact based decision making, we refuse to knowingly sacrifice underwriting profit to increase volume.

Excellence: We have a strong work ethic and positive attitude which drives us to continually improve performance and exceed expectations.

Meritocracy: We are committed to rewarding and promoting our team members on the basis of each individual's contribution and future potential within our team.

Innovation: We develop and implement innovative ways to anticipate customer needs, grasp local market opportunities, create global value, and exceed the expectations of all stakeholders.

Community: We strive to keep a balance between taking care of business and taking care of our families, friends and the communities in which we live and work.

5

THE ATLAS EXECUTIVE TEAM

Back Row: Leslie DiMaggio, Vice President Operations & IT; Bruce Giles, Vice President Product Development & Underwriting; Scott Wollney, President & CEO; Joe Shugrue, Vice President Claims

Front Row: Paul Romano, Vice President & CFO; Zenovia Love, Assistant Vice President Human Resources

UNDERWRITING

6

TARGET MARKETS

Taxi Metered vehicles that can pick up street hails. Car Service: Demand-response units operating in local metropolitan and rural areas. Focus is on writing owner-operator business. Includes New York black car service.

Limousine: Prearranged transportation in luxury vehicles, vans, and minibuses. It is anticipated that their vehicles will be stationary at venues during a portion of their trips.

Paratransit: Social service and non-emergency medical transportation in the local area.

Business Auto: Vehicles used by small businesses in their daily operations. May have some personal usage as well.

Other Public Auto: Classes such as charter buses and airport buses, where we have an opportunity to write these risks successfully.

7

TAXI & CAR SERVICE Lines of Business: Automobile Liability, Physical Damage, and General Liability Liability Coverage/Limits: • Up to $1,000,000 CSL. • Higher limits are available at the Underwriter’s discretion.

Physical Damage:

• Minimum $500 deductible for comp/collision. • Minimum stated value: $3,000 • Units older than 10 years requires Underwriting approval. A current mechanics statement and photograph

may be required at your Underwriter’s discretion. Vehicles: • Sedans and minivans with capacity up to 7 passengers, excluding the driver. Eligible Operations: • For-Hire transportation of passengers. Insured must be dispatched from or a member of a radio group of

association, or possess a medallion. • Demand-Response units with less than 24-hour prearranged pickup reservations. • New venture individuals and partnerships are acceptable with résumé or letter of experience indicating how

many years he/she has experience operating a similar vehicle type. • In jurisdictions where owner-operators receive a discount, refer to the state-specific filing for eligibility and

credit allowed. • Double shifts are eligible with proof of a current formal maintenance program. Ineligible Operations: • “Gypsy Cabs” • New venture corporations, unless there is previous insurance history which is favorable, and that can be

substantiated. • Triple shifts.

8

LIMOUSINES Lines of Business: Automobile Liability, Physical Damage, and General Liability (through ACIC) Liability Coverage/Limits: • Up to $1,500,000 CSL. • Higher limits are available at the Underwriter’s discretion. Physical Damage: • Minimum $500 deductible for comp/collision (coverage written through GLINY is fire, theft, and collision

only) • Minimum stated value or ACV: $10,000 • Stated values greater than $250,000 must be reinsured. • Terminal exposures greater than $1,000,000 in total values will be reinsured. • Units older than 10 years requires Underwriting approval. A current mechanics statement and photograph

may be required at your Underwriter’s discretion. Vehicles: • Luxury sedans and stretches, vans and minibuses. • Vehicles with seating capacity greater than 8 passengers, excluding the driver, may be rated as a Charter

Bus. • Classic vehicles, stretches greater than 150 inches long, and vehicles with unique modifications will be

considered at the Underwriter’s discretion. Eligible Operations: • Pickups arranged at least 24 hours in advance. • Vehicles used for special events (weddings, proms, funerals), business functions, airport trips, and local

“nights on the town.” • New ventures are acceptable with résumé or letter of experience indicating how many years he/she has

experience operating a similar vehicle type. • Radius of operation within 100 miles Ineligible Operations: • Risks that operate as demand-response units. • Risks with fare boxes or meters.

9

PARATRANSIT Lines of Business: Automobile Liability, Physical Damage, and General Liability

Liability Coverage/Limits: • Up to $1,000,000 CSL. • Higher limits are available at the Underwriter’s discretion.

Physical Damage: • Minimum $500 deductible for comp/collision. • Minimum stated value: $10,000 • Stated values greater than $250,000 must be reinsured. • Terminal exposures greater than $1,000,000 in total values will be reinsured. • Units older than 10 years requires Underwriting approval. A current mechanics statement and photograph

may be required at your Underwriter’s discretion.

Vehicles: • Sedans and vans with seating capacity up to 14 passengers. • Units may be equipped with wheelchair ramps or lifts. • Vehicles must have proper tie-downs for wheelchairs while in transport. • Vehicles must display written procedures for loading and unloading passengers in wheelchairs. • Surcharges may apply for vehicles with wheelchair access.

Eligible Operations: • For-Hire transportation of patients on a contract or demand-response basis • Medicars & Ambulettes • Vehicles owned and operated by social service organizations, or medical facilities, used to transport their

clients/patients. • Eligibility for rating under this classification requires a minimum 85% revenue from these types of

operations. Not more than 15% can come from a taxi exposure. Contracts and/or financials may be requested for verification.

Ineligible Operations: • Ambulances or emergency vehicles equipped with lights and sirens. • Risks that provide any medical, paramedical or first-aid service. • Risks that transport oxygen. Ineligible Operations: • Insured must conform to all laws regarding having matrons/aides on vehicles. • Patients must be belted in and strapped securely.

10

BUSINESS AUTO Lines of Business: Automobile Liability and Physical Damage Liability Coverage/Limits: • Up to $1,000,000 CSL. • Higher limits are available at the Underwriter’s discretion. • Maximum vehicle age is 20 years (liability coverage). • Units older than 15 years will require a current mechanic’s statement and a current photo. Physical Damage: • Minimum $500 deductible for comp/collision. • Minimum stated value: $5,000 • Stated values greater than $250,000 must be reinsured. • Terminal exposures greater than $1,000,000 in total values will be reinsured. • Units older than 15 years are not eligible for physical damage coverage. Vehicles: • PPTs, pickup trucks, vans, and trucks with GVW less than 45,000 pounds. Eligible Operations: • Vehicles used in the pursuit of the insured’s business. • Vehicles which are registered to the business if it is a corporation, or to an individual is it is a sole

proprietorship or partnership. • PPTs must be registered in a business or corporate name. • Local or intermediate radius only (ISO definition). • New ventures are acceptable with résumé or letter of experience indicating how many years he/she has

experience operating a similar vehicle type. • Targeted business types:

o Contracting/Construction o Landscaping (Incidental Snowplowing Only) o Manufacturing o Residential or Commercial Repair Services o Retail Sales/Delivery o Professional Services o Wholesale/Distribution

11

BUSINESS AUTO Ineligible Operations

Ineligible Operations: • Pizza/Food Delivery • Fuel Oil Dealers • Freight Forwarders • Driving Schools • Septic Waste Removal • Garages/Dealers • Specialized or Timed Delivery • Armored Cars • Farm Vehicles • Snowplows • Catering Vehicles with Food Cooked/Sold from Vehicle • Junk, Metal, or Scrap Iron Dealer • Tree Removal • Tow Trucks • Sanitation/Garbage Haulers – Residential or Commercial Pickup • Newspaper Delivery • Real Estate Agents • PPTs without any Business Purpose • Sand & Gravel • Excavation, Mining, or Quarrying • Security Guard Operations • Salvaged Vehicles (exceptions made at underwriter’s discrection) • Vehicles qualifying under the regional trucking program or one of the public auto programs. • Vehicles modified with special equipment, such as cranes, cherry pickers, and buckets.

12

OTHER PUBLIC AUTO

Lines of Business: Automobile Liability, Physical Damage, and General Liability Liability Coverage/Limits: • Up to $1,000,000 CSL. • Higher limits are available at the Underwriter’s discretion. Physical Damage: • Minimum $500 deductible for comp/collision. • Minimum stated value: $10,000 • Stated values greater than $250,000 must be reinsured. • Terminal exposures greater than $1,000,000 in total values will be reinsured. • Units older than 10 years requires Underwriting approval. A current mechanics statement and photograph

may be required at your Underwriter’s discretion. Vehicles: • Vans, minibuses, and motor coaches up to 32 passengers (exceptions made at underwriters discretion) Eligible Operations: • Local or intermediate charter buses (not a route bus) • Airport vehicles. • Local sightseeing tour vehicles. • Shuttle buses.

Ineligible Operations: • Church vehicles. • Commuter vans, or “Dollar Vans” in New York. • School buses. • Inter-city buses. • Transportation of athletes and entertainers.

13

GENERAL LIABILITY

Limits of Liability: • Up to $1,000,000 CSL per occurrence/$2,000,000 general aggregate. • $2,000,000 CSL products/completed operations aggregate. • $1,000,000 CSL personal and advertising injury. • $100,000 damage to rented premises. • $5,000 medical expense. • Limits greater than those above are available at your Underwriter’s discretion. Classes of Business: • We will write General Liability only in conjunction with an Automobile Liability policy as support for the

following: o Taxi & Car Services o Limousine o Paratransit o Other Public Auto (refer to management as applicable)

We will not write General Liability in conjunction with our Business Auto Program.

14

NEW YORK LIVERY (TAXI & CAR SERVICE OUTSIDE THE 5 BOROUGHS OF NYC)

Lines of Business: Automobile Liability & Physical Damage* (comp & collision) Liability Coverage/Limits: • 25,000/50,000/10,000 to 100,000/300,000/10,000 • Up to 1,000,000 available through ACIC at underwriters’ discretion

Physical Damage*:

• Minimum $500 Deductible for comp/collision • Minimum stated value: $3,000 • A unit older than 10 years requires underwriting approval. A current mechanics statement and

photograph may be required at your underwriters’ discretion. Vehicles:

• Mid and full size Sedans and minivans with capacity up to 7 passengers, excluding the driver • Vehicles older than 12 years old including model year require underwriter approval • Vehicles 8 passenger and up may be rated as charter bus

Driver Classifications*:

• Owner Operator- An individual owner of a vehicle operated by the individual owner or spouse • Named Driver- A vehicle operated by an individual named in the Declarations who is not the owner of

the vehicle (applies to GLINY only) • All Other-Any class that does not meet the definitions above

Eligible Operations:

• For-Hire transportation of passengers • Demand-response units with less than 24-hour prearranged pickup reservations • New venture individuals and partnerships are acceptable with resume or letter of experience • Vehicles must be owned by and registered to the named insured (leases and other circumstances due

to financial assistance accepted at the underwriters discretion and surcharge may apply) • Double Shifts accepted

Ineligible Operations:

• New venture corporations unless there is previous insurance history which is favorable, and that can be substantiated

• Triple Shifts (exceptions made at underwriters’ discretion) *Physical damage coverage written through ACIC only

15

NEW YORK CITY (5 BOROUGHS TLC REGISTERED)

Lines of Business: Automobile Liability & Physical Damage (Fire, theft, and collision) Liability Coverage/Limits:

• 100,000/300,000/10,000 (as required by the NYC TLC) • PIP 50,000 statutory + 150,000 additional (as required by NYC TLC)

Physical Damage:

• 1,000 deductible (lower (to 750)/higher (to 5,000) deductibles available at the Underwriters discretion)

• Coverage is for Fire, Theft, and Collision ONLY • Vehicle can be no more than 4 model years old including current model year • Coverage is based on ACV • Vehicle subject to CARCO inspection requirement at the underwriters’ discretion

Vehicles:

• Four Door Sedans & SUV’s with seating of 8 or less • Black Car registered base/rating: must be no more than 5 model years old including current

model year and payment must be received by at least 90% voucher • Minivans accepted for Black Car ONLY • Luxury rating (100/300): must be no more than 8 model years old including current model year • Car Service rating: must be no more than 10 model years old including current model year (older

accepted at underwriters’ discretion)

Driver Classifications: • Owner Operator- An individual owner of a vehicle operated by the individual owner or spouse • Named Driver- A vehicle operated by an individual named in the Declarations who is not the

owner of the vehicle • Corporate Scheduled driver-The vehicle is owned by a corporate entity and operated by a

scheduled driver (corporations written for black car only) • All Other-Any class that does not meet the definitions above

16

NEW YORK CITY (5 BOROUGHS TLC REGISTERED) –

Continued

Eligible Operations:

• For-Hire transportation of passengers • Vehicles must be registered to a valid TLC Base (base letter with seal required for newly

registering insureds) • Vehicles must be owned by and registered to the named insured (leases and other circumstances

due to financial assistance accepted at the underwriters discretion) • Double Shifts accepted with valid driver/TLC information

Ineligible Operations:

• “Gypsy Cabs” • Triple Shifts (exceptions made at underwriters’ discretion) • Medallion Yellow Taxis (SHL green cars accepted and classified at underwriters discretion)

NYC TLC Luxury Limousine Program (see Limousine guidelines for regular limousine operations)

• Limits: 500,000/1,000,000/50,000 (higher limits available at underwriters’ discretion and based on seating capacity)

• UM will be written to reflect statutory requirements • PIP will be written as 50,000 statutory + 150,000 additional (as required by NYC TLC) • Must be a luxury type vehicle and can be no more than 3 model years old (exceptions made at

underwriters’ discretion) • Must be registered with a valid Luxury TLC Base • 1,000 deductible (lower (to 500)/higher (to 5,000) deductibles available at the Underwriters

discretion) • Coverage is for Fire, Theft, and Collision ONLY • Coverage is based on ACV • Vehicle subject to CARCO inspection requirement at the underwriters’ discretion • Driver classifications S/A/A

17

SUBMISSIONS & APPLICATIONS

Submissions & Applications: In order to properly evaluate a risk, we must receive a complete submission. The information submitted should be truthful, and include an accurate representation of the exposures presented by the individual risk. All submissions must include the following in order for us to provide a quotation:

1. Completed Application: ACORD 125, or Global Application for Global Business, along with the appropriate state and line of business ACORD applications. The application must include the insured’s FEIN (if a corporation) or SSN (if an individual). We must also have the MC/Docket Number (if applicable).

2. Supplemental Application: Fully completed for the class or line of business to be quoted.

3. MVRs: MVRs run within 30 days of application for all operators with access to vehicles. This will include any family members who drive vehicles during non-business hours. For larger driver schedules (more than 50 drivers), we will accept a sample of abstracts equal to no less than 25% of the driver pool. The remainder of the MVRs must be submitted upon binding. Any quotes given will be subject to receipt of favorable MVRs, and can be withdrawn or cancelled if the information provided is unacceptable.

4. Loss Runs: Any account with prior insurance history must submit loss runs. Loss runs must be currently valued (within 60 days of application), and represent the expiring year, and at least three prior years.

5. Résumé or Letter of Experience: New ventures must submit either a résumé or letter of experience which indicates the number of years the owner and principal operator (if different) have in the industry.

6. Additional Pertinent Underwriting Information: Based on the unique characteristics of the risk being presented, the underwriter may require additional information. This may include, but is not limited to, copies of contracts, radio base letters, proof of residency, and financial information.

18

SAFE DRIVER CRITERIA (Applicable to all states outside of New York)

Driver information must be submitted to and evaluated by Atlas Financial Holdings, Inc., prior to binding coverage and/or hiring a driver. Complete driver information consists of the operator’s full name, date of birth, driver’s license number, and state where license was issued. If the MVR is not provided at the time of the submission, agent is to submit the MVR to determine acceptability. For risks with over 50 drivers, a 25% sample of MVR’s may be accepted prior to quoting, but the remaining MVR’s must be evaluated within 5 days of binding.

Motor Vehicle Reports/Driving Records The following should be used as a guideline only and should not replace sound underwriting judgment.

1. Operators must be in possession of a valid driver’s license issued from the state in which the named insured operates. 2. Operators must possess the proper license classifications and endorsements relative to the line of business and/or vehicles they operate

(i.e. Chauffeur’s license and CDL’s for capacities greater than 15 passengers). 3. Operators should have 3 years documented professional driving experience. Without 3 years’ experience, we impose a minimum driving

age of 23. Drivers 70 years or older will be asked to provide a U.S. Department of Transportation Medical Examination Report documenting acceptable physical condition for the job duties.

4. Operators should not have more than six (6) points in the past three (3) years or four (4) points in the past twelve (12) months. Points will be assessed as follows:

Violation and Point Schedule

• Licensed less than 3 years Not Acceptable • At-Fault accident in past 12 months 4 points • Each additional At-Fault accident 3 points • Speeding 1-14 mph above limit 2 points • Speeding 15-30 mph above limit 3 points • Minor violations 2 points • Equipment violations/defective equipment 2 points • Seat belt violations 1/2 point • Major violations 6 points • Driving too fast for conditions 2 points • Speeding more than 10 mph over posted limit in a school zone 3 points

5. Automatic Unacceptable Drivers: ● Vehicular homicide, manslaughter, or assault while operating a motor vehicle ● Lending operator, chauffeur, or motor vehicle registration to another ● DUI/DWI in the past 5 years ● Speeding greater than 30 mph above limit ● Negligent/reckless driving ● Fleeing and eluding ● Hit-and-Run Violations ● Felony involving a motor vehicle

6. Minor Violations Include: ● Disregarding traffic control devices ● Lane violations

7. Major Violations Include, but are Not Limited to: ● Driving during a suspension or revocation ● Racing ● Careless operation of a motor vehicle

8. Suspensions due to not making child support payments must be cleared up by the driver. They are not moving violations and should not be assessed points, but the driver should not be approved until he has cleared up his suspension with the DMV.

Points for violations not specifically listed above will be applied at the Underwriter’s discretion. The company retains the right to refuse any operator and/or affiliate, should they qualify under the above criteria, but other circumstances may render them unacceptable (such as administrative actions, criminal convictions, or a history as a habitual violator).

Atlas Financial Holdings, Inc., and The Atlas Group of Companies, do not discriminate based on age, gender, race, religion, national origin, or any other factor that does not affect the safe operation of a motor vehicle. Only the driver’s ability to safely operate a motor vehicle is considered in determining the acceptability of an individual driver.

19

NEW YORK DRIVER GUIDELINES Drivers’ Guidelines

a. Operators should have 3 years documented professional driving experience. Without 3 years’ experience, we impose a minimum driving age of 23. Drivers 70 years or older will be asked to provide a U.S. Department of Transportation Medical Examination Report documenting acceptable physical condition for the job duties.

b. Drivers should hold a valid operator’s license; c. Drivers should hold a valid chauffer’s license (if applicable); d. One year of prior for-hire driving experience may be required.

Unqualified Risks (Exceptions to be made by Underwriting Only)

a. DWI/DUI within the last five years; b. A currently suspended driver’s license; c. Citation for leaving the scene of an accident within the last 60 months; d. Vehicular homicide and/or use of a vehicle in the commission of a crime; e. Speeding 25+ miles/hour over the speed limit within the last 40 months; f. Three (3) speeding violations within the last 36 months; g. Failure to stop for school bus citation within the last five years; h. Any accident involving/resulting in a pedestrian knockdown; i. Reckless driving within the past 60 months; j. Operating a motor vehicle without valid registration/without insurance in effect within the past

48 months; k. Operating any motor vehicle without a valid driver’s license within the past 48 months; l. Any felony conviction. m. Two at-fault accidents within the past 36 months.

20

PAYMENT PLAN OPTIONS

There are several direct bill payment plan options available to meet your clients’ needs. Please contact your Underwriter for availability by company and line of business.

• 20% Down and 10 Equal Payments with $5 Fee per Installment The first installment is due at day 30, and the remaining installments are due in 30-day increments.

• 20% Down and 9 Equal Payments with $5 Fee per Installment The first installment is due at day 20, and the remaining installments are due in 30-day increments.

• 25% Down and 9 Equal Payments with $5 Fee per Installment

The first installment is due at day 30 and the remaining installments are due in 30-day increments. • Long-Term Payment Plan Options

Atlas has implemented a payment plan option that is available for all policies written for terms 15 months and greater, up to 23 months. The plan allows for a down payment of 15%, with the remaining premium due being dispersed in equal monthly payments. The number of installments available is dependent upon the length of the policy period. For these options, there is a $5 installment fee that applies to each payment, including the down payment.

• Full Payment

Full payment is due at the inception date. No installment fee applies with full payment.

• Other payment options are available such as agency bill and premium financing.

21

AGENT OF RECORD

New Business: • We will recognize any contracted agency that sends in a complete submission. • The same quotation will be given to all agents who have made a complete submission. • The account will be bound for the first agent who receives a deposit from the insured. • In the event an Atlas customer’s policy cancels for any reason, the policy must have lapsed for 30 days or

more before a submission will be accepted from a different agent. • We reserve the right to make all final judgments and evaluations in the application of this procedure. Renewal Business: • We will accept an AOR letter for a renewal policy, provided that the AOR is received at least 10 days prior to

the expiration of the policy to be renewed and is accompanied by a completed renewal application. • The current agent will be notified that an AOR has been received, with five days lead time before a quote is

released to the new agent. If a rescinding AOR is received prior to the release of a renewal quote, the new agent will not receive a copy of the renewal quote.

• The same renewal quote will be given to both the incumbent agent and to any other agent who has submitted an AOR and a completed renewal submission.

• We reserve the right to make all final judgments and evaluations in the application of this procedure.

In-Force Business: • We will not generally recognize Agent of Record letters that are submitted to be effective during the term of

an existing policy. The Underwriting Manager may make exceptions where warranted. • If the insured insists on recognizing a new agency during the policy term, the current agency will be offered 10

days to obtain a rescinding letter from the insured. The current agent may waive this 10-day notice in writing. • Policies will not be cancelled and rewritten for the sake of an AOR alone. • No commissions are payable to the new agent until renewal of the policy; additional premiums, however, will

be the responsibility of the new agent. The incumbent agent is due any commissions, even on endorsements, throughout the remainder of the policy term.

• We reserve the right to make all final judgments and evaluations in the application of this procedure.

Newly-Contracted Agents • An agent must be contracted for more than one year before submitting an AOR.

Note: With regard to business in-force or renewing with a terminated agent, we will give notice to the current agent.

22

POLICY RENEWAL PROCEDURES

Upon receipt of a renewal quote, it is the agent’s responsibility to do the following: • Present the renewal quote to the client, as this is only sent to the agent. • Submit a bind request to the Underwriter, along with all required applications and/or requested

information. • Collect the down payment from the client and remit it to the carrier. Either the agent or the client

can make a payment online or they may remit a check to the appropriate lockbox.

o Please note: Unless otherwise specified, the client’s policy will be renewed with the same payment terms as their expiring policy. If the client is requesting different payment terms, please notify the underwriter at the time of binding.

• Once the policy is received via email from the carrier, the agent should distribute policy copies to

the client.

QUOTE FORMS

23

24

25

26

27

MARKETING

28

MARKETING

For You and Your Customers: Marketing assistance is available, should you need it. We can help design electronic and print advertising materials to help you build your client base. Co-branded marketing may also be available. To make it easier for you, we can also provide you with customized quote forms that would include your logo and contact information. A variety of promotional and safety items are also available for you to provide to your insureds, which currently includes the following items:

• Safety window clings to remind passengers to buckle up and exit curbside • Safety stickers designed for paratransit vehicles, reminding passengers not to smoke, and to buckle up • Safety posters that you can have printed locally in various sizes for use in the insureds’ workplace

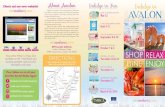

PHYSICAL DAMAGE ENHANCEMENTS FLYER SAMPLE

& INSURED-FOCUSED BROCHURE

SAMPLE

29

30

31

32

33

SAFETY ITEMS SAMPLES

34

SAFETY WINDOW CLING SAMPLES

4” X 4” clear window cling designed for window placement.

4.75” X 5.5” clear window cling designed for window placement.

35

PARATRANSIT SAFETY STICKER SAMPLE

5” X 7” vinyl sticker design for placement facing passengers on seatbacks.

36

TAXI-LIMO SAFETY POSTER SAMPLES

37

PARATRANSIT SAFETY POSTER SAMPLES

38

39

ACCIDENT KIT / ID HOLDER SAMPLE

LOSS PREVENTION

40

BACKING ACCIDENTS General Discussion: Backing accidents are one of the most common types of accidents in everyday driving. While they are common in occurrence, they are also very preventable. Being committed to backing safely is one of your key responsibilities as a defensive driver. Prior to backing your vehicle, remember the following:

• Whenever possible, plan ahead to avoid backing. • Keep your mirrors clean and properly adjusted as this will help in correctly judging distance. • Park your vehicle so you can pull forward when starting rather than having to back up. • Avoid blindside backing by backing from the driver’s side. • Park in a location away from moving traffic or other parked vehicles to try and avoid difficult

maneuvering. • Walk around the back of your vehicle and make sure there is plenty of clearance in order to back

safely. • Get in your vehicle and begin backing immediately after checking behind your vehicle. Any delay

can increase the chances of someone or something getting in behind your vehicle. • Back slowly to maintain better control of your vehicle. • Use your mirrors and look out the driver’s window to watch clearance on both sides of your

vehicle. • If you see vehicles or pedestrians approaching, judge their speed and distance before continuing

your backing maneuver. When in doubt, let them pass before continuing. • If your vehicle has a backup alarm, make sure it is functioning properly. If not, you could activate

your flashers and/or tap your horn to alert other motorists or pedestrians.

As stated earlier, backing accidents are among the most frequently occurring types of accidents. Remembering to follow these important guidelines can go a long way toward preventing a backing accident. While backing accidents may not be as severe as other types of accidents, avoiding them will still save money and time.

41

INTERSECTION ACCIDENTS General Discussion: With vehicles crossing paths at the same time and abrupt changes in speed and direction, the areas in and around intersections are often prone to crashes. Despite better markings and technological advances, intersections continue to pose significant hazards to drivers. In addition, the nature of some of these accidents (such as a T-bone or a sudden stop rear-end) increases the likelihood of injury.

To avoid accidents in intersections, remember the following:

• Scan far enough ahead to be able to react to a developing situation or hazard. • Do not force other drivers to brake or swerve because of your maneuver. • Assume that other drivers will not see you and try to avoid your vehicle while making a

maneuver into or across their path of travel. • Approach an intersection with the assumption that traffic on the intersecting street may not

observe the traffic control device and be prepared to avoid them. • Look left-right-left (just like you were taught so long ago!). • Always come to a complete stop at red lights and stop signs. • Remain behind white stop lines to allow clearance for vehicles turning from the intersecting

street. • Allow enough time for the rear of your vehicle to clear the entire road when crossing an

uncontrolled intersection as drivers on the intersecting street may otherwise be distracted and not see you. Use extra caution when crossing these types of intersections at night or in inclement weather when visibility may be reduced.

Following these points can help you avoid a potentially serious accident. While many of these points may seem like common sense or basic in nature, they are often overlooked because many times they were not followed and nothing bad happened. A defensive driver must remain disciplined and not allow bad habits to settle in.

42

LANE CHANGE AND MERGING ACCIDENTS General Discussion: Lane change and merging accidents are common occurrences, particularly on metropolitan area highways. Unfortunately, these incidents also often involve bodily injury claims. They primarily result from following other vehicles too closely or being inattentive to traffic conditions. Blind spots are also a contributing factor, so driving defensively is an effective countermeasure. To avoid lane change and merging accidents, remember the following:

• Keep your mirrors clean and properly adjusted. • Adjust your speed with the flow of traffic. • Maintain a safe following distance from the vehicle ahead. • Avoid changing lanes frequently. • Do not change lanes at railroad crossings, around curves, or in intersections. • Be alert of traffic around you, particularly vehicles entering the highway. • Flash your brake lights to warn vehicles behind you of trouble ahead. • Always signal your intention to change lanes or when merging into traffic. • Check mirrors before initiating a lane change maneuver. • While passing, watch for vehicles that may be entering the roadway and cause the vehicle you

are passing to try and move into your lane. • Use extra caution when approaching construction zones, especially when lane closures are

involved. • When driving in passing zones on two-lane roads:

o Be aware of vehicles passing other vehicles from the opposite direction. o Assume vehicles coming from the opposite direction will not see you or slow down for

you to complete your passing maneuver. o Don’t get into a race if the vehicle you are trying to pass speeds up. Just let it go.

• Remember that many states require drivers to move over and/or slow down if law enforcement or emergency vehicles are stopped on the side of a road.

As stated earlier, lane change and merging accidents can be costly and often involve injuries. A defensive driver must always try to maintain sufficient space around the vehicle to help avoid these types of accidents. Getting in the proper lane well in advance and minimizing the number of times a lane change is necessary will go a long way toward preventing accidents of this nature.

43

REAR-END ACCIDENTS

General Discussion: Employing space management techniques helps enable a defensive driver to stay accident-free. Utilizing space management means keeping the areas around your vehicle (the front, both sides, and the rear) free of other vehicles to allow for better, easier, and safer maneuvering. While rear-end accidents may not occur with as great of frequency as some other types of accidents, their cost is often considerably higher because they often result in bodily injuries. To avoid rear-end accidents, remember the following:

• Keep at least two (2) or three (3) seconds following distance under normal traffic conditions (at least four (4) at highway speeds).

• Add additional time for poor weather, road, and traffic conditions. As your speed increases and/or as driving conditions change, add one (1) or more seconds on to the distance from the vehicle ahead of you.

• Adjust your speed with the flow of traffic and avoid tailgating the vehicle in front of you or changing lanes frequently.

• Give the right-of-way instead of taking it. • Leave room ahead, behind, and alongside your vehicle for better maneuvering. This includes

when pulling up behind stopped vehicles, such as at a red light. A good rule of thumb is that if you cannot see where the rear tires of the vehicle in front of you are touching the pavement, then you have stopped too close to that vehicle. A vehicle that rear-ends you could then push you into the vehicle in front of you.

• Do not assume the vehicle in front of you is going to try and beat the yellow light (so you can too!). That driver may stop suddenly.

• Use extra caution in construction zones, especially when lane closures are involved. Vehicles ahead can come to an abrupt stop!

• Give your full attention to driving and avoid distracting activities such as eating or talking or texting on a cell phone.

As stated earlier, rear-end accidents are generally costly in nature and often involve injuries. A defensive driver must always maintain a safe following and stopping distance from vehicles ahead. This will allow greater reaction time to changing situations and more margin for error.

44

TURNING ACCIDENTS

General Discussion: Turning accidents, especially while turning right, are a common occurrence. Some of the challenges that contribute to turning accidents are entering and exiting parking lots and shopping centers along busy streets. Streets and driveways with limited sight distance or visual obstructions where they intersect with other streets can also be particularly hazardous. To avoid turning collisions, remember the following:

• Be aware of where your next turn needs to be made and properly position your vehicle well in advance.

• Signal your intention to turn. • When turning right, be aware of the space alongside your vehicle. Another motorist may try to

squeeze by on your right. • When turning left, do not begin turning until you have enough time for the rear of your vehicle to

clear oncoming lanes without forcing other drivers to slow down or swerve. Also, do not assume oncoming drivers see you as they may be distracted.

• Be sure to turn from the proper lane (for example, if there is a center turn lane, do not turn left from the travel lane).

• Pay attention to markings whenever there are multiple turn lanes at an intersection so that you do not leave one lane and encroach into the other and possibly strike a vehicle next to you.

• Avoid making U-turns unless at intersections or locations where such turns are allowed. • Quickly scan your surroundings to identify bicyclists and pedestrians who may enter crosswalks,

even when doing so against the signal. As stated earlier, turning accidents are a common occurrence. A professional driver must be aware of what is occupying the space around his or her vehicle. Doing so will increase the likelihood of completing these maneuvers safely and without incident.

CLAIMS

45

CLAIMS

Our Claims team is dedicated to getting your clients back on the road fast and efficiently.

There are many ways you can report your claims to Atlas:

• Email: [email protected] • Phone: 800.897.2551 • Online: http://www.atlas-fin.com/Customers/Claims.aspx • QR code: Located on the back of the insurance ID card • Fax: 847.224.3920

You can also locate adjuster, towing, total loss and litigation contacts by doing the following: By using the direct link: http://www.atlas-fin.com/Customers/Claims/ClaimsContactLocator.aspx Or you can:

• Go to www.atlas-fin.com • Go to the “Customer” tab • Click on “Claims” • Click on the “Claims Contact Locator”

Contact Information: Deborah L. Velez Manager Claims Atlas Financial Holdings, Inc. 150 Northwest Point Boulevard, 3rd Floor Elk Grove Village, IL 60007

Industry Leading Insurance for Taxi, Limousine, Paratransit and Airport Transit

• Loss prevention services available • Joint Underwriting & Claims visits at agent or

account request • Significant Account claims program

• 24/7 Claims assistance • Prompt claims payments • Adjusters with state-specific expertise

Direct: 847.472.6061 Cell: 847.721.3846 Fax: 847.952.4852 Main: 847.472.6700